Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … ons/p542/202401/a/xml/cycle06/source (Init. & Date) _______

Page 1 of 27 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Publication 542

(Rev. January 2024)

Cat. No. 15072O

Corporations

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (Tiếng Việt)

Contents

Future Developments ....................... 2

Photographs of Missing Children .............. 2

Introduction .............................. 2

Businesses Taxed as Corporations ............ 2

Property Exchanged for Stock ................ 3

Capital Contributions ....................... 4

Filing and Paying Income Taxes ............... 5

Income Tax Return ....................... 5

Penalties .............................. 5

Estimated Tax .......................... 6

U.S. Real Property Interest ................. 7

Estimated Tax Worksheet .................... 7

Accounting Methods ....................... 8

Accounting Periods ........................ 8

Recordkeeping ............................ 9

Income, Deductions, and Special Provisions ..... 9

Costs of Going Into Business ................ 9

Related Persons ......................... 9

Corporate Preference Items ................ 10

Dividends-Received Deduction ............. 10

Extraordinary Dividends .................. 11

Below-Market Loans ..................... 11

Charitable Contributions .................. 12

Capital Losses ......................... 13

Net Operating Losses .................... 14

At-Risk Limits .......................... 14

Passive Activity Limits .................... 15

Figuring Tax ............................. 15

Tax Rates ............................ 15

Base Erosion Minimum Tax ................ 15

Corporate Alternative Minimum Tax (CAMT) .... 15

Credits ............................... 15

Recapture Taxes ........................ 15

Accumulated Earnings Tax .................. 15

Distributions to Shareholders ............... 16

Money or Property Distributions ............. 16

Distributions of Stock or Stock Rights ......... 16

Constructive Distributions ................. 17

Reporting Dividends and Other Distributions .... 17

How To Get Tax Help ....................... 19

Other Useful Forms for Corporations .......... 23

Index .................................. 27

Feb 9, 2024

Page 2 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Future Developments

For the latest information about developments related to

Pub. 542, such as legislation enacted after it was

published, go to IRS.gov/Pub542. For changes that may

affect the current tax year, see the Instructions for Form

1120 or the applicable instructions for the corporation’s

tax return.

What's New

New corporate alternative minimum tax. For tax years

beginning after 2022, the Inflation Reduction Act of 2022

amended section 55 of the Internal Revenue Code to im-

pose a new corporate alternative minimum tax (CAMT)

based on the adjusted financial statement income (AFSI)

of an applicable corporation. See Corporate Alternative

Minimum Tax (CAMT), later.

Form 1120-W now historical. Form 1120-W, Estimated

Tax for Corporations, and the Instructions for Form

1120-W are now historical. The 2022 revisions were the

last revisions of both the form and its instructions. Prior

versions are available on IRS.gov.

Photographs of Missing

Children

The Internal Revenue Service is a proud partner with the

National Center for Missing & Exploited Children®

(NCMEC). Photographs of missing children selected by

the Center may appear in instructions on pages that would

otherwise be blank. You can help bring these children

home by looking at the photographs and calling

800-THE-LOST (800-843-5678) if you recognize a child.

Introduction

This publication discusses the general tax laws that apply

to ordinary domestic corporations. It provides supplemen-

tal federal income tax information for corporations. It also

supplements the information provided in the Instructions

for Form 1120, U.S. Corporation Income Tax Return. How-

ever, the information given does not cover every situation

and is not intended to replace the law or change its mean-

ing.

Comments and suggestions. We welcome your com-

ments about this publication and suggestions for future

editions.

You can send us comments through IRS.gov/

FormComments. Or, you can write to:

Internal Revenue Service

Tax Forms and Publications

1111 Constitution Ave. NW, IR-6526

Washington, DC 20224

Although we can’t respond individually to each com-

ment received, we do appreciate your feedback and will

consider your comments and suggestions as we revise

our tax forms, instructions, and publications. Do not send

tax questions, tax returns, or payments to the above ad-

dress.

Getting answers to your tax questions. If you have

a tax question not answered by this publication or the How

To Get Tax Help section at the end of this publication, go

to the IRS Interactive Tax Assistant page at IRS.gov/

Help/ITA where you can find topics by using the search

feature or viewing the categories listed.

Getting tax forms, instructions, and publications.

Go to IRS.gov/Forms to download current and prior-year

forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instruc-

tions, and publications; call 800-829-3676 to order

prior-year forms and instructions. The IRS will process

your order for forms and publications as soon as possible.

Do not resubmit requests you’ve already sent us. You can

get forms and publications faster online.

Additional forms. A list of other forms and statements

that a corporation may need to file is included at the end

of this publication. Also, see the instructions for the corpo-

ration’s tax return for additional forms and statements that

may be required.

Useful Items

You may want to see:

Publication

510 Excise Taxes (Including Fuel Tax Credits and

Refunds)

538 Accounting Periods and Methods

544 Sales and Other Dispositions of Assets

550 Investment Income and Expenses

925 Passive Activity and At-Risk Rules

946 How To Depreciate Property

Businesses Taxed as

Corporations

The rules used to determine whether a business is taxed

as a corporation changed for businesses formed after

1996.

Business formed before 1997. A business formed be-

fore 1997 and taxed as a corporation under the old rules

will generally continue to be taxed as a corporation.

510

538

544

550

925

946

2 Publication 542 (1-2024)

Page 3 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Business formed after 1996. The following businesses

formed after 1996 are taxed as corporations.

•

A business formed under a federal or state law that re-

fers to it as a corporation, body corporate, or body po-

litic.

•

A business formed under a state law that refers to it as

a joint-stock company or joint-stock association.

•

An insurance company.

•

Certain banks.

•

A business wholly owned by a state or local govern-

ment.

•

A business specifically required to be taxed as a cor-

poration by the Internal Revenue Code (for example,

certain publicly traded partnerships).

•

Certain foreign businesses.

•

Any other business that elects to be taxed as a corpo-

ration.

Limited liability company (LLC). An LLC may be clas-

sified for federal income tax purposes as either a partner-

ship, a corporation, or an entity disregarded as an entity

separate from its owner by applying the rules in Treasury

Regulations section 301.7701-3. An LLC can elect to be

treated as an association taxable as a corporation by filing

Form 8832, Entity Classification Election. See the Instruc-

tions for Form 8832. For more information about LLCs,

see Pub. 3402, Taxation of Limited Liability Companies.

S corporations. Some corporations may meet the quali-

fications for electing to be S corporations. For information

on S corporations, see the Instructions for Form 1120-S.

Personal service corporations. A corporation is a per-

sonal service corporation if it meets all of the following re-

quirements.

1. Its principal activity during the “testing period” is per-

forming personal services (defined later). Generally,

the testing period for any tax year is the prior tax year.

If the corporation has just been formed, the testing pe-

riod begins on the first day of its tax year and ends on

the earlier of:

a. The last day of its tax year, or

b. The last day of the calendar year in which its tax

year begins.

2. Its employee-owners substantially perform the serv-

ices in (1) above. This requirement is met if more than

20% of the corporation's compensation cost for its ac-

tivities of performing personal services during the

testing period is for personal services performed by

employee-owners.

3. Its employee-owners own more than 10% of the fair

market value of its outstanding stock on the last day of

the testing period.

Personal services. Personal services include any ac-

tivity performed in the fields of accounting, actuarial sci-

ence, architecture, consulting, engineering, health (includ-

ing veterinary services), law, and the performing arts.

Employee-owners. A person is an employee-owner of

a personal service corporation if both of the following ap-

ply.

1. That person is an employee of the corporation or per-

forms personal services for, or on behalf of, the corpo-

ration (even if that person is an independent contrac-

tor for other purposes) on any day of the testing

period.

2. That person owns any stock in the corporation at any

time during the testing period.

Other rules. For other rules that apply to personal

service corporations, see Accounting Periods, later.

Closely held corporations. A corporation is closely held

if all of the following apply.

1. It is not a personal service corporation.

2. At any time during the last half of the tax year, more

than 50% of the value of its outstanding stock is, di-

rectly or indirectly, owned by or for five or fewer indi-

viduals. “Individual” includes certain trusts and private

foundations.

For rules for determining stock ownership, see section 544

of the Internal Revenue Code.

Other rules. For the at-risk rules that apply to closely

held corporations, see At-Risk Limits, later.

Property Exchanged for Stock

If you transfer property (or money and property) to a cor-

poration in exchange for stock in that corporation (other

than nonqualified preferred stock), and immediately after-

ward you are in control of the corporation, the exchange is

usually not taxable. This rule applies both to individuals

and to groups who transfer property to a corporation. It

also applies whether the corporation is being formed or is

already operating. It does not apply in the following situa-

tions.

•

The corporation is an investment company.

•

You transfer the property in a bankruptcy or similar

proceeding in exchange for stock used to pay cred-

itors.

•

The stock is received in exchange for the corporation's

debt (other than a security) or for interest on the cor-

poration's debt (including a security) that accrued

while you held the debt.

See Property Exchanged for Stock in chapter 2 of Pub.

544 for more information.

Publication 542 (1-2024) 3

Page 4 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Both the corporation and any person involved in a

nontaxable exchange of property for stock must

attach to their income tax returns for the year of

the exchange, the complete statement of all facts perti-

nent to the exchange required by Treasury Regulations

section 1.351-3.

Control of a corporation. To be in control of a corpora-

tion, you or your group of transferors must own, immedi-

ately after the exchange, at least 80% of the total com-

bined voting power of all classes of stock entitled to vote

and at least 80% of the outstanding shares of each class

of nonvoting stock.

Loss on exchange. If you have a loss from an exchange

and own, directly or indirectly, more than 50% of the cor-

poration's stock, you cannot deduct the loss. For more in-

formation, see Nondeductible Loss under Sales and Ex-

changes Between Related Persons in chapter 2 of Pub.

544.

Basis of stock or other property received. The basis

of the stock you receive is generally the adjusted basis of

the property you transfer. Increase this amount by any

amount treated as a dividend, plus any gain recognized

on the exchange. Decrease this amount by any cash you

received, the fair market value of any other property you

received, and any loss recognized on the exchange. Also

decrease this amount by the amount of any liability the

corporation or another party to the exchange assumed

from you, unless payment of the liability gives rise to a de-

duction when paid.

Further decreases may be required when the corpora-

tion or another party to the exchange assumes from you a

liability that gives rise to a deduction when paid, if the ba-

sis of the stock would otherwise be higher than its fair

market value on the date of the exchange. This rule does

not apply if the entity assuming the liability acquired either

substantially all of the assets or the trade or business with

which the liability is associated.

The basis of any other property you receive is its fair

market value on the date of the trade.

Basis of property transferred. A corporation that re-

ceives property from you in exchange for its stock gener-

ally has the same basis you had in the property, increased

by any gain you recognized on the exchange. However,

the increase for the gain recognized may be limited. For

more information, see section 362 of the Internal Revenue

Code.

If property is transferred to a corporation subject to sec-

tion 362(e)(2) of the Internal Revenue Code, the transferor

and the acquiring corporation may elect, under section

362(e)(2)(C), to reduce the transferor's basis in the stock

received instead of reducing the acquiring corporation's

basis in the property transferred. Once made, the election

is irrevocable. For more information, see section 362(e)(2)

and Treasury Regulations section 1.362-4. If an election is

made, a statement must be filed in accordance with Treas-

ury Regulations section 1.362-4(d)(3).

CAUTION

!

Capital Contributions

This section explains the tax treatment of contributions

from shareholders and nonshareholders.

Paid-in capital. Generally, contributions to the capital of

a corporation, whether or not by shareholders, are paid-in

capital. These contributions are not taxable to the corpo-

ration. However, after December 22, 2017, the following

nonshareholder contributions to the capital of a corpora-

tion are not considered nontaxable paid-in capital.

•

Any contribution in aid of construction or any other

contribution as a customer or potential customer.

•

Any contribution by any civic group.

•

Any contribution by any governmental entity. However,

see the special rule below.

For contributions made after December 31, 2020, a

special rule applies to contributions to the capital of water

and sewerage disposal utilities. Under the special rule,

any amount of money or property received after Decem-

ber 31, 2020, as a contribution in aid of construction or a

contribution to the capital of a regulated public utility that

provides water or sewerage disposal services is eligible

for exclusion from income under section 118 of the Inter-

nal Revenue Code.

Basis. The corporation's basis of property contributed to

capital by a shareholder is the same as the basis the

shareholder had in the property, increased by any gain the

shareholder recognized on the exchange. However, the in-

crease for the gain recognized may be limited. For more

information, see Basis of property transferred above and

section 362 of the Internal Revenue Code.

The basis of property contributed to capital by a person

other than a shareholder is zero.

If a corporation receives a cash contribution from a per-

son other than a shareholder, the corporation must reduce

the basis of any property acquired with the contribution

during the 12-month period beginning on the day it re-

ceived the contribution by the amount of the contribution.

If the amount contributed is more than the cost of the

property acquired, then reduce, but not below zero, the

basis of the other properties held by the corporation on

the last day of the 12-month period in the following order.

1. Depreciable property.

2. Amortizable property.

3. Property subject to cost depletion but not to percent-

age depletion.

4. All other remaining properties.

Reduce the basis of property in each category to zero

before going on to the next category.

There may be more than one piece of property in each

category. Base the reduction of the basis of each property

on the following ratio.

4 Publication 542 (1-2024)

Page 5 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Basis of each piece of property

Bases of all properties (within that category)

If the corporation wishes to make this adjustment in some

other way, it must get IRS approval. The corporation files a

request for approval with its income tax return for the tax

year in which it receives the contribution.

Filing and Paying Income

Taxes

The federal income tax is a pay-as-you-go tax. A corpora-

tion must generally make estimated tax payments as it

earns or receives income during its tax year. After the end

of the year, the corporation must file an income tax return.

This section will help you determine when and how to pay

and file corporate income taxes.

For certain corporations affected by federally de-

clared disasters such as hurricanes, the due

dates for filing returns, paying taxes, and perform-

ing other time-sensitive acts may be extended. The IRS

may also forgive the interest and penalties on any under-

paid tax for the length of any extension. For more informa-

tion, visit

IRS.gov/DisasterTaxRelief.

Income Tax Return

This section will help you determine when and how to re-

port a corporation's income tax.

Who must file. Unless exempt under section 501 of the

Internal Revenue Code, all domestic corporations in exis-

tence for any part of a tax year (including corporations in

bankruptcy) must file an income tax return whether or not

they have taxable income.

Which form to file. A domestic entity electing to be clas-

sified as an association taxable as a corporation must

generally file Form 1120, U.S. Corporation Income Tax Re-

turn, to report its income, gains, losses, deductions, cred-

its, and to figure its income tax liability. Certain organiza-

tions and entities must, or may elect to, file special returns.

For more information, see Special Returns for Certain Or-

ganizations in the Instructions for Form 1120.

Electronic filing. Corporations can generally electroni-

cally file (e-file) Form 1120 and certain related forms,

schedules, and attachments. However, for returns filed on

or after January 1, 2024, corporations that file 10 or more

returns are required to efile. However, these corporations

can request a waiver of the electronic filing requirements.

For more information on electronic filing, see the Instruc-

tions for Form 1120, or the applicable instructions for your

income tax return.

When to file. Generally, a corporation must file its in-

come tax return by the 15th day of the 4th month after the

end of its tax year. A new corporation filing a short-period

TIP

return must generally file by the 15th day of the 4th month

after the short period ends. A corporation that has dis-

solved must generally file by the 15th day of the 4th month

after the date it dissolved.

However, a corporation with a fiscal tax year ending

June 30 must file by the 15th day of the 3rd month after

the end of its tax year. A corporation with a short tax year

ending anytime in June will be treated as if the short pe-

riod ended June 30 and must file by the 15th day of the

3rd month after the end of its tax year.

If the due date falls on a Saturday, Sunday, or legal holi-

day, the due date is extended to the next business day.

Extension of time to file. File Form 7004, Application

for Automatic Extension of Time To File Certain Business

Income Tax, Information, and Other Returns, to request an

extension of time to file a corporation’s income tax return.

The IRS will grant the extension if the corporation com-

pletes the form properly, files it, and pays any tax due by

the original due date for the return.

Form 7004 does not extend the time for paying the tax

due on the return. Interest, and possibly penalties, will be

charged on any part of the final tax due not shown as a

balance due on Form 7004. The interest is figured from

the original due date of the return to the date of payment.

For more information, see the Instructions for Form

7004.

How to pay your taxes. A corporation must pay its tax

due in full no later than the due date for filing its tax return

(not including extensions).

Electronic Federal Tax Payment System (EFTPS).

Corporations must generally use EFTPS to make deposits

of all tax liabilities (including social security, Medicare,

withheld income, excise, and corporate income taxes). For

more information on EFTPS and enrollment, visit

www.eftps.gov.

Penalties

Generally, if the corporation receives a notice

about interest and penalties after it files its return,

send the IRS an explanation and we will deter-

mine if the corporation meets reasonable-cause criteria.

Do not attach an explanation when the corporation's re-

turn is filed. See the instructions for your income tax re-

turn.

Late filing of return. A corporation that does not file its

tax return by the due date, including extensions, may be

penalized 5% of the unpaid tax for each month or part of a

month the return is late, up to a maximum of 25% of the

unpaid tax. If the corporation is charged a penalty for late

payment of tax (discussed next) for the same period of

time, the penalty for late filing is reduced by the amount of

the penalty for late payment. A minimum penalty applies

for a return that is over 60 days late. The minimum penalty

amount may be adjusted for inflation. See the Instructions

for Form 1120 (or the instructions for your applicable re-

turn) for the minimum penalty amount for the current tax

year. The penalty will not be imposed if the corporation

CAUTION

!

Publication 542 (1-2024) 5

Page 6 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

can show the failure to file on time was due to a reasona-

ble cause.

Note. If the corporation is charged a penalty for late

payment of tax (discussed next) for the same period of

time, the penalty for late filing is reduced by the amount of

the penalty for late payment.

Late payment of tax. A corporation that does not pay

the tax when due may be penalized half of 1% of the un-

paid tax for each month or part of a month the tax is not

paid, up to a maximum of 25% of the unpaid tax. The pen-

alty will not be imposed if the corporation can show that

the failure to pay on time was due to a reasonable cause.

Trust fund recovery penalty. If federal income, social

security, or Medicare taxes that a corporation must with-

hold from employee wages are not withheld or are not de-

posited or paid to the U.S. Treasury, the trust fund recov-

ery penalty may apply. The penalty is the full amount of

the unpaid trust fund tax. This penalty may apply to you if

these unpaid taxes cannot be immediately collected from

the business.

The trust fund recovery penalty may be imposed on all

persons who are determined by the IRS to be responsible

for collecting, accounting for, and paying these taxes, and

who acted willfully in not doing so.

A responsible person can be an officer or employee of

a corporation, an accountant, or a volunteer director/

trustee. A responsible person may also include one who

signs checks for the corporation or otherwise has authority

to cause the spending of business funds.

“Willfully” means voluntarily, consciously, and intention-

ally. A responsible person acts willfully if the person knows

the required actions are not taking place or recklessly dis-

regards obvious and known risks to the government’s right

to receive trust fund taxes.

For more information on withholding and paying these

taxes, see Pub. 15 (Circular E), Employer's Tax Guide.

Other penalties. Other penalties can be imposed for

negligence, substantial understatement of tax, reportable

transaction understatements, and fraud. See sections

6662, 6662A, and 6663 of the Internal Revenue Code.

Estimated Tax

Generally, a corporation must make installment payments

if it expects its estimated tax for the year to be $500 or

more. If the corporation does not pay the installments

when they are due, it could be subject to an underpay-

ment penalty. This section will explain how to avoid this

penalty.

When to pay estimated tax. Installment payments are

due by the 15th day of the 4th, 6th, 9th, and 12th months

of the corporation's tax year.

Example 1. Your corporation's tax year ends Decem-

ber 31. Installment payments are due on April 15, June

15, September 15, and December 15.

Example 2. Your corporation's tax year ends June 30.

Installment payments are due on October 15, December

15, March 15, and June 15.

If any due date falls on a Saturday, Sunday, or legal hol-

iday, the installment is due on the next business day.

How to figure each required installment. The Estima-

ted Tax Worksheet, later, can be used to figure each re-

quired installment. Form 1120-W, Estimated Tax for Cor-

porations, is now historical. Prior versions are available on

IRS.gov

You generally use one of the following two methods to

figure each required installment. You should use the

method that yields the smallest installment payments. In

these discussions, “return” generally refers to the corpora-

tion's original return. However, an amended return is con-

sidered the original return if it is filed by the due date (in-

cluding extensions) of the original return.

Method 1. Each required installment is 25% of the in-

come tax the corporation will show on its return for the cur-

rent year.

Method 2. Each required installment is 25% of the in-

come tax shown on the corporation's return for the previ-

ous year.

To use Method 2:

1. The corporation must have filed a return for the previ-

ous year,

2. The return must have been for a full 12 months, and

3. The return must have shown a positive tax liability (not

zero).

Also, if the corporation is a large corporation, it can use

Method 2 to figure the first installment only.

Large corporations. A large corporation is a corporation

that had, or whose predecessor had, taxable income of $1

million or more for any of the 3 tax years immediately pre-

ceding the current tax year, or if less, the number of years

the corporation has been in existence. For this purpose,

taxable income is modified to exclude net operating loss

and capital loss carrybacks or carryovers.

Annualized income installment method and/or adjus-

ted seasonal installment method. If the corporation's

income is expected to vary during the year because, for

example, it operates its business on a seasonal basis, it

may be able to lower the amount of one or more required

installments by using the annualized income installment

method and/or the adjusted seasonal installment method.

For example, a ski shop, which receives most of its in-

come during the winter months, may be able to benefit

from using one or both of these methods in figuring one or

more of its required installments. See sections 6655(e)(2)

and 6655(e)(3) of the Internal Revenue Code.

Refiguring required installments. If after the corpora-

tion figures and deposits its estimated tax it finds that its

tax liability for the year will be more or less than originally

estimated, it may have to refigure its required installments

to see if an underpayment penalty may apply. An

6 Publication 542 (1-2024)

Page 7 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

immediate catch-up payment should be made to reduce

any penalty resulting from the underpayment of any earlier

installments.

Underpayment penalty. If the corporation does not pay

a required installment of estimated tax by its due date, it

may be subject to a penalty. The penalty is figured sepa-

rately for each installment due date. Therefore, the corpo-

ration may owe a penalty for an earlier due date, even if it

paid enough tax later to make up the underpayment. This

is true even if the corporation is due a refund when its re-

turn is filed.

Form 2220. Use Form 2220, Underpayment of Esti-

mated Tax by Corporations, to determine if a corporation

is subject to the penalty for underpayment of estimated

tax and to figure the amount of the penalty.

If the corporation is charged a penalty, the amount of

the penalty depends on the following three factors.

1. The amount of the underpayment.

2. The period during which the underpayment was due

and unpaid.

3. The interest rate for underpayments published quar-

terly by the IRS in the Internal Revenue Bulletin.

A corporation generally does not have to file Form 2220

with its income tax return because the IRS will figure any

penalty and bill the corporation. However, even if the cor-

poration does not owe a penalty, complete and attach the

form to the corporation's tax return if any of the following

apply.

1. The annualized income installment method was used

to figure any required installment.

2. The adjusted seasonal installment method was used

to figure any required installment.

3. The corporation is a large corporation figuring its first

required installment based on the prior year's tax.

How to pay estimated tax. A corporation is generally re-

quired to use EFTPS to pay its taxes. See Electronic Fed-

eral Tax Payment System (EFTPS), earlier.

Quick refund of overpayments. A corporation that has

overpaid its estimated tax for the tax year may be able to

apply for a quick refund. Use Form 4466, Corporation Ap-

plication for Quick Refund of Overpayment of Estimated

Tax, to apply for a quick refund of an overpayment of esti-

mated tax. A corporation can apply for a quick refund if the

overpayment is:

•

At least 10% of its expected tax liability, and

•

At least $500.

Use Form 4466 to figure the corporation's expected tax li-

ability and the overpayment of estimated tax.

File Form 4466 after the end of the corporation’s tax

year, but before the corporation files its income tax return.

Do not file Form 4466 before the end of the corporation's

tax year. An extension of time to file the corporation's in-

come tax return will not extend the time for filing Form

4466. The IRS will act on the form within 45 days from the

date you file it.

U.S. Real Property Interest

If a domestic corporation acquires a U.S. real property in-

terest from a foreign person or firm, the corporation may

have to withhold tax on the amount it pays for the property.

The amount paid includes cash, the fair market value of

other property, and any assumed liability. If a domestic

corporation distributes a U.S. real property interest to a

foreign person or firm, it may have to withhold tax on the

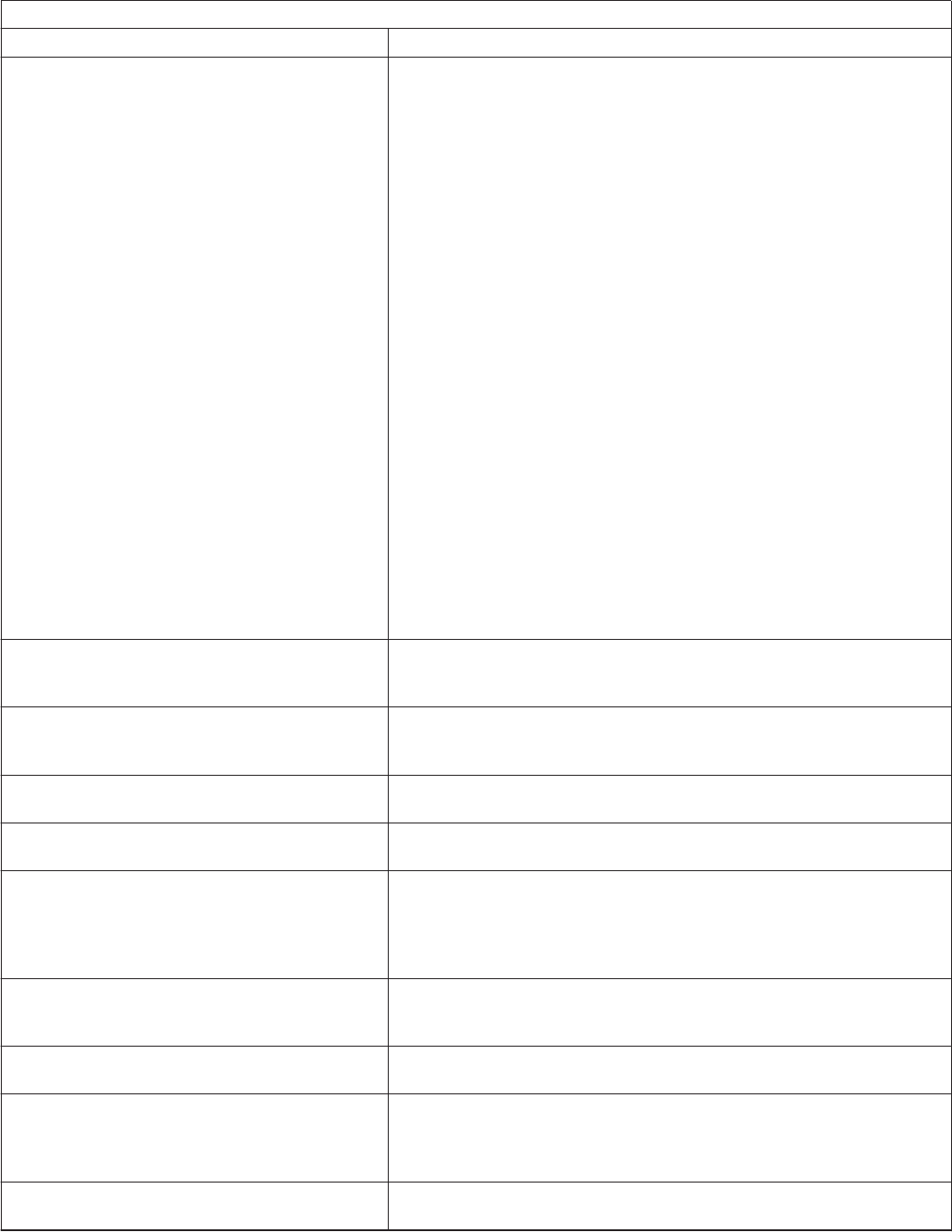

Estimated Tax Worksheet Keep for Your Records

Note. This worksheet may be used as a guide in figuring the required estimated tax installments.

1. Enter the expected taxable income .............................................................

1.

2. Multiply line 1 by the maximum tax rate that is in effect for the applicable tax year. For example, in 2023 the maximum

rate is 21%. ............................................................................. 2.

3. Tax credits. For information on tax credits the corporation can take, see the instructions for Form 1120, Schedule J,

Part I, lines 5a through 5e, or the instructions for the applicable lines and schedule of the corporation’s income tax

return .................................................................................. 3.

4. Subtract line 3 from line 2 ....................................................................

4.

5. Other taxes. For information on other taxes the corporation may owe, see the instructions for Form 1120, Schedule J,

or the instructions for the applicable lines and schedule of the corporation's income tax return .................. 5.

6. Total tax. Add lines 4 and 5 ..................................................................

6.

7. Enter any credit for federal tax paid on fuels and other refundable credits. For information on other refundable credits,

see the instructions for Form 1120, Schedule J, or the instructions for the applicable line of the corporation’s income tax

return .................................................................................. 7.

8. Subtract line 7 from line 6. If the result is less than $500, the corporation is not required to make estimated tax

payments ............................................................................... 8.

9. Enter the tax shown on the corporation’s prior year’s tax return. If the tax is zero or the tax year was for less than 12

months, skip this line and enter the amount from line 8 on line 10 ....................................... 9.

10. Enter the smaller of line 8 or line 9. If the corporation is required to skip line 9, enter the amount from line 8 ........

10.

11. Required installments. Enter 25% of line 10. If the corporation uses the annualized income installment method, or

adjusted seasonal installment method, or is a large corporation, an additional computation may be needed .......

11.

Publication 542 (1-2024) 7

Page 8 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

fair market value of the property. A corporation that fails to

withhold may be liable for the tax and any penalties and

interest that apply. For more information, see section 1445

of the Internal Revenue Code; Pub. 515, Withholding of

Tax on Nonresident Aliens and Foreign Entities; Form

8288, U.S. Withholding Tax Return for Dispositions by For-

eign Persons of U.S. Real Property Interests; and Form

8288-A, Statement of Withholding on Dispositions by For-

eign Persons of U.S. Real Property Interests.

Accounting Methods

An accounting method is a set of rules used to determine

when and how income and expenses are reported. Taxa-

ble income should be determined using the method of ac-

counting regularly used in keeping the corporation's books

and records. In all cases, the method used must clearly

show taxable income.

Generally, permissible methods include:

•

Cash,

•

Accrual, or

•

Any other method authorized by the Internal Revenue

Code.

Accrual method. Generally, a corporation, other than a

qualified personal service corporation (as defined in sec-

tion 448(d)(2) of the Internal Revenue Code), must use an

accrual method of accounting if it is not a small business

taxpayer (as defined in section 448(c) of the Internal Rev-

enue Code). A corporation engaged in farming operations

must also use an accrual method, unless it qualifies as a

small business taxpayer.

Under an accrual method of accounting, you generally

report income in the year it is earned and deduct or capi-

talize expenses in the year incurred. The purpose of an

accrual method of accounting is to match income and ex-

penses in the correct year.

See Pub. 538 for additional information and special

rules.

Expenses. Generally, an accrual basis taxpayer can

deduct accrued expenses in the tax year when:

1. All events that determine the liability have occurred,

2. The amount of the liability can be figured with reason-

able accuracy, and

3. Economic performance takes place with respect to

the expense.

There are exceptions to the economic performance rule

for certain items, including recurring expenses. See sec-

tion 461(h) of the Internal Revenue Code and the related

regulations for the rules for determining when economic

performance takes place.

Percentage of completion method. Long-term con-

tracts (except for certain real property construction con-

tracts) must generally be accounted for using the percent-

age of completion method described in section 460 of the

Internal Revenue Code.

Mark-to-market accounting method. Generally, deal-

ers in securities must use the mark-to-market accounting

method described in section 475 of the Internal Revenue

Code. Under this method, any security held by a dealer as

inventory must be included in inventory at its fair market

value. Any security not held as inventory at the close of

the tax year is treated as sold at its fair market value on

the last business day of the tax year. Any gain or loss must

be taken into account in determining gross income. The

gain or loss taken into account is treated as ordinary gain

or loss.

Dealers in commodities and traders in securities and

commodities can elect to use the mark-to-market account-

ing method.

Change in accounting method. A corporation can

change its method of accounting used to report taxable in-

come (for income as a whole or for the treatment of any

material item). The corporation must file Form 3115, Appli-

cation for Change in Accounting Method. See the Instruc-

tions for Form 3115 and Pub. 538 for more information

and exceptions.

Section 481(a) adjustment. If the corporation's taxa-

ble income for the current tax year is figured under a

method of accounting different from the method used in

the preceding tax year, the corporation may have to make

an adjustment under section 481(a) of the Internal Reve-

nue Code to prevent amounts of income or expense from

being duplicated or omitted. The section 481(a) adjust-

ment period is generally 1 year for a net negative adjust-

ment and 4 years for a net positive adjustment. However,

exceptions to the general section 481(a) adjustment pe-

riod may apply. Also, in some cases, a corporation can

elect to modify the section 481(a) adjustment period. The

corporation may have to complete the appropriate lines of

Form 3115 to make an election. See the Instructions for

Form 3115 for more information and exceptions.

Accounting Periods

A corporation must figure its taxable income on the basis

of a tax year. A tax year is the annual accounting period a

corporation uses to keep its records and report its income

and expenses. Generally, a corporation can use either a

calendar year or a fiscal year as its tax year. Unless spe-

cial rules apply, a corporation generally adopts a tax year

by filing its first federal income tax return using that tax

year. For more information, see Pub. 538.

Personal service corporation. A personal service cor-

poration must use a calendar year as its tax year unless:

•

It elects to use a 52-53-week tax year that ends with

reference to the calendar year or tax year elected un-

der section 444 of the Internal Revenue Code;

8 Publication 542 (1-2024)

Page 9 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

•

It can establish a business purpose for a different tax

year and obtains approval of the IRS (see the

Instructions for Form 1128 and Pub. 538); or

•

It elects under section 444 to have a tax year other

than a calendar year. Use Form 8716, Election To

Have a Tax Year Other Than a Required Tax Year, to

make the election.

If a personal service corporation makes a section 444

election, its deduction for certain amounts paid to em-

ployee-owners may be limited. See Schedule H (Form

1120), Section 280H Limitations for a Personal Service

Corporation (PSC), to figure the maximum deduction.

Change of tax year. Generally, a corporation must get

the consent of the IRS before changing its tax year by fil-

ing Form 1128, Application To Adopt, Change, or Retain a

Tax Year. However, under certain conditions, a corporation

can change its tax year without getting the consent. For

more information, see Form 1128 and Pub. 538.

Recordkeeping

A corporation should keep its records for as long as they

may be needed for the administration of any provision of

the Internal Revenue Code. Usually records that support

items of income, deductions, or credits on the return must

be kept for 3 years from the date the return is due or filed,

whichever is later. Keep records that verify the corpora-

tion's basis in property for as long as they are needed to

figure the basis of the original or replacement property.

The corporation should keep copies of all filed returns.

They help in preparing future and amended returns and in

the calculation of earnings and profits.

Income, Deductions, and

Special Provisions

Rules on income and deductions that apply to individuals

also apply, for the most part, to corporations. However, the

following special provisions apply only to corporations.

Costs of Going Into Business

When you go into business, treat all eligible costs you in-

cur to get your business started as capital expenses.

However, a corporation can elect to deduct a limited

amount of start-up or organizational costs. Any costs not

deducted can be amortized.

Start-up costs are costs for creating an active trade or

business or investigating the creation or acquisition of an

active trade or business. Organizational costs are the di-

rect costs of creating the corporation.

For more information on deducting or amortizing

start-up and organizational costs, see the instructions for

your income tax return.

Related Persons

A corporation that uses an accrual method of accounting

cannot deduct business expenses and interest owed to a

related person who uses the cash method of accounting

until the corporation makes the payment and the corre-

sponding amount is includible in the related person's

gross income. Determine the relationship as of the end of

the tax year for which the expense or interest would other-

wise be deductible. If a deduction is denied, the rule will

continue to apply even if the corporation's relationship with

the person ends before the expense or interest is includi-

ble in the gross income of that person. These rules also

deny the deduction of losses on the sale or exchange of

property between related persons.

Related persons. For purposes of this rule, the following

persons are related to a corporation.

1. Another corporation that is a member of the same

controlled group (as defined in section 267(f) of the

Internal Revenue Code).

2. An individual who owns, directly or indirectly, more

than 50% of the value of the outstanding stock of the

corporation.

3. A trust fiduciary, if the trust or the grantor of the trust

owns, directly or indirectly, more than 50% of the

value of the outstanding stock of the corporation.

4. An S corporation, if the same persons own more than

50% in value of the outstanding stock of each corpo-

ration.

5. A partnership, if the same persons own more than

50% in value of the outstanding stock of the corpora-

tion and more than 50% of the capital or profits inter-

est in the partnership.

6. Any employee-owner, if the corporation is a personal

service corporation (see Personal service corpora-

tion, earlier), regardless of the amount of stock owned

by the employee-owner.

Ownership of stock. To determine whether an indi-

vidual directly or indirectly owns any of the outstanding

stock of a corporation, the following apply.

1. Stock owned, directly or indirectly, by or for a corpora-

tion, partnership, estate, or trust, is treated as being

owned proportionately by or for its shareholders, part-

ners, or beneficiaries.

2. An individual is treated as owning the stock owned,

directly or indirectly, by or for the individual's family.

Family includes only brothers and sisters (including

half brothers and half sisters), a spouse, ancestors,

and lineal descendants.

3. Any individual owning (other than by applying (2)

above) stock in a corporation, is treated as also own-

ing the stock owned directly or indirectly by that indi-

vidual's partner.

4. To apply (1), (2), or (3) above, stock constructively

owned by a person under (1) is treated as actually

Publication 542 (1-2024) 9

Page 10 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

owned by that person. But stock constructively owned

by an individual under (2) or (3) is not treated as ac-

tually owned by the individual for applying either (2) or

(3) to make another person the constructive owner of

that stock.

Reallocation of income and deductions. Where it is

necessary to clearly show income or prevent tax evasion,

the IRS can reallocate gross income, deductions, credits,

or allowances between two or more organizations, trades,

or businesses owned or controlled directly, or indirectly, by

the same interests.

Complete liquidations. The disallowance of losses from

the sale or exchange of property between related persons

does not apply to liquidating distributions.

More information. For more information about the rela-

ted person rules, see Pub. 544.

Corporate Preference Items

A corporation must make special adjustments to certain

items before it takes them into account in determining its

taxable income. These items are known as “corporate

preference items” and they include the following.

•

Gain on the disposition of section 1250 property.

For more information, see Section 1250 Property un-

der Depreciation Recapture in chapter 3 of Pub. 544.

•

Percentage depletion for iron ore and coal (in-

cluding lignite).

•

Amortization of pollution control facilities. For

more information, see section 291(a)(4) of the Internal

Revenue Code.

•

Mineral exploration and development costs.

For more information on corporate preference items, see

section 291 of the Internal Revenue Code.

Dividends-Received Deduction

A corporation can deduct a percentage of certain divi-

dends received during its tax year. This section discusses

the general rules that apply. The deduction is figured on

Form 1120, Schedule C, or the applicable schedule of

your income tax return. For more information, see the In-

structions for Form 1120, or the instructions for your appli-

cable income tax return.

Dividends from foreign corporations. Generally, 100%

of the foreign-source portion of dividends (and items trea-

ted as dividends) from 10%-owned foreign corporations

may be deducted. The stock with respect to which such

dividends are received must meet a special 365-day hold-

ing period and does not include certain “hybrid” dividend

payments. See Form 1120, Schedule C (or the applicable

schedule of your income tax return), for details regarding

this deduction. Also see the Instructions for Form 1120 or

the instructions for your applicable income tax return.

Note. This deduction is not subject to the limit on de-

duction for dividends related to dividends from domestic

corporations, discussed below.

Dividends from domestic corporations. A corporation

can deduct, within certain limits, 50% of the dividends re-

ceived if the corporation receiving the dividend owns less

than 20% of the corporation distributing the dividend. If

the corporation owns 20% or more of the distributing cor-

poration's stock, it can, subject to certain limits, deduct

65% of the dividends received.

Ownership. For these rules, ownership is based on

the amount of voting power and value of the paying corpo-

ration's stock (other than certain preferred stock) that the

receiving corporation owns.

Small business investment companies. Small busi-

ness investment companies can deduct 100% of the divi-

dends received from taxable domestic corporations.

Dividends from regulated investment companies.

Regulated investment company dividends received are

subject to certain limits. Capital gain dividends received

from a regulated investment company do not qualify for

the deduction. For more information, see section 854 of

the Internal Revenue Code.

No deduction allowed for certain dividends. Corpora-

tions cannot take a deduction for dividends received from

the following entities.

1. A real estate investment trust (REIT).

2. A corporation exempt from tax under section 501 or

521 of the Internal Revenue Code either for the tax

year of the distribution or the preceding tax year.

3. A corporation whose stock was held less than 46 days

during the 91-day period beginning 45 days before the

stock became ex-dividend with respect to the divi-

dend. “Ex-dividend” means the holder has no rights to

the dividend.

4. A corporation whose dividends were received on any

share of preferred stock that are attributable to peri-

ods totaling more than 366 days if such stock was

held for less than 91 days during the 181-day period

that began 90 days before the ex-dividend date.

5. Any corporation, if your corporation is under an obli-

gation (pursuant to a short sale or otherwise) to make

related payments with respect to positions in substan-

tially similar or related property.

Dividends on deposits. Dividends on deposits or with-

drawable accounts in domestic building and loan associa-

tions, mutual savings banks, cooperative banks, and simi-

lar organizations are interest, not dividends. They do not

qualify for this deduction.

Limit on deduction for dividends. The total deduction

for dividends received or accrued is generally limited (in

the following order) to:

10 Publication 542 (1-2024)

Page 11 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

1. 65% of the difference between taxable income and

the 100% deduction allowed for dividends received

from affiliated corporations, or by a small business in-

vestment company, for dividends received or accrued

from 20%-owned corporations; then

2. 50% of the difference between taxable income (re-

duced by total dividends received from 20%-owned

corporations) and the 100% deduction allowed for div-

idends received from affiliated corporations, or by a

small business investment company, for dividends re-

ceived or accrued from less-than-20%-owned corpo-

rations (reducing taxable income by the total divi-

dends received from 20%-owned corporations).

Figuring the limit. In figuring the limit, determine taxa-

ble income without the following items.

1. The net operating loss deduction.

2. The deduction under section 199A for income attribut-

able to domestic production activities of specified ag-

ricultural or horticultural cooperatives.

3. The deduction allowed by sections 243(a)(1) and

245(a) of the Internal Revenue Code.

4. The deduction allowed by section 250 of the Internal

Revenue Code.

5. Any adjustment due to the nontaxable part of an ex-

traordinary dividend (see Extraordinary Dividends,

later).

6. Any capital loss carryback to the tax year.

Effect of net operating loss. If a corporation has a

net operating loss (NOL) for a tax year, the limit of 65% (or

50%) of taxable income does not apply. To determine

whether a corporation has an NOL, figure the divi-

dends-received deduction without the 65% (or 50%) of

taxable income limit.

Example 1. A corporation loses $75,000 from opera-

tions. It receives $100,000 in dividends from a

20%-owned corporation. Its taxable income is $25,000

($100,000 – $75,000) before the deduction for dividends

received. If it claims the full dividends-received deduction

of $65,000 ($100,000 × 65%) and combines it with an op-

erations loss of $75,000, it will have an NOL of ($40,000).

Therefore, the 65% of taxable income limit does not apply.

The corporation can deduct the full $65,000.

Example 2. Assume the same facts as in Example 1,

except that the corporation only loses $30,000 from oper-

ations. Its taxable income is $70,000 before the deduction

for dividends received. After claiming the dividends-re-

ceived deduction of $65,000 ($100,000 × 65%), its taxa-

ble income is $5,000. Because the corporation will not

have an NOL after applying a full dividends-received de-

duction, its allowable dividends-received deduction is limi-

ted to 65% of its taxable income, or $45,500 ($70,000 ×

65%).

Extraordinary Dividends

If a corporation receives an extraordinary dividend on

stock held 2 years or less before the dividend announce-

ment date, it must generally reduce its basis in the stock

by the nontaxed part of the dividend. The nontaxed part is

any dividends-received deduction allowable for the divi-

dends.

Extraordinary dividend. An extraordinary dividend is

any dividend on stock that equals or exceeds a certain

percentage of the corporation's adjusted basis in the

stock. The percentages are:

1. 5% for stock preferred as to dividends, or

2. 10% for other stock.

Treat all dividends received that have ex-dividend dates

within an 85-consecutive-day period as one dividend.

Treat all dividends received that have ex-dividend dates

within a 365-consecutive-day period as extraordinary divi-

dends if the total of the dividends exceeds 20% of the cor-

poration's adjusted basis in the stock.

Disqualified preferred stock. Any dividend on disquali-

fied preferred stock is treated as an extraordinary dividend

regardless of the period of time the corporation held the

stock.

Disqualified preferred stock is any stock preferred as to

dividends if any of the following apply.

1. The stock when issued has a dividend rate that de-

clines (or can reasonably be expected to decline) in

the future.

2. The issue price of the stock exceeds its liquidation

rights or stated redemption price.

3. The stock is otherwise structured to avoid the rules for

extraordinary dividends and to enable corporate

shareholders to reduce tax through a combination of

dividends-received deductions and loss on the dispo-

sition of the stock.

More information. For more information on extraordinary

dividends, see section 1059 of the Internal Revenue

Code.

Below-Market Loans

If a corporation receives a below-market loan and uses

the proceeds for its trade or business, it may be able to

deduct the forgone interest as well as any interest the cor-

poration actually paid or accrued.

A below-market loan is a loan on which no interest is

charged or on which interest is charged at a rate below the

applicable federal rate. A below-market loan is generally

treated as an arm's-length transaction in which the bor-

rower is considered as having received both the following.

•

A loan in exchange for a note that requires payment of

interest at the applicable federal rate.

•

An additional payment in an amount equal to the for-

gone interest.

Publication 542 (1-2024) 11

Page 12 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

The borrower treats the additional payment as a gift, divi-

dend, contribution to capital, payment of compensation, or

other payment, depending on the substance of the trans-

action.

Foregone interest. For any period, forgone interest is

equal to:

1. The interest that would be payable for that period if in-

terest accrued on the loan at the applicable federal

rate and was payable annually on December 31, mi-

nus

2. Any interest actually payable on the loan for the pe-

riod.

More information. For more information on below-mar-

ket loans, including information on demand loans, gift

loans, and term loans, see section 7872 of the Internal

Revenue Code, the related regulations, and chapter 1 of

Pub. 550, Investment Income and Expenses.

Charitable Contributions

A corporation can claim a limited deduction for charitable

contributions made in cash or other property. The contri-

bution is deductible if made to, or for the use of, a qualified

organization. For more information on qualified organiza-

tions, see Pub. 526, Charitable Contributions. Also, see

Tax-Exempt Organization Search at IRS.gov/Charities, the

online search tool for finding information on organizations

eligible to receive tax-deductible contributions.

Note. You cannot take a deduction if any of the net

earnings of an organization receiving contributions benefit

any private shareholder or individual.

Cash method corporation. A corporation using the

cash method of accounting deducts contributions in the

tax year paid.

Accrual method corporation. A corporation using an

accrual method of accounting can choose to deduct un-

paid contributions for the tax year the board of directors

authorizes them if it pays them by the due date for filing

the corporation’s tax return (not including extensions).

Make the choice by reporting the contribution on the cor-

poration's return for the tax year. Attach a declaration stat-

ing that the board of directors adopted the resolution dur-

ing the tax year. The declaration must include the date the

resolution was adopted.

Limitations on deduction. A corporation cannot deduct

charitable contributions that exceed 10% of its taxable in-

come for the tax year. Figure taxable income for this pur-

pose without the following.

1. The deduction for charitable contributions.

2. The dividends-received deduction.

3. The deduction allowed under section 249 of the Inter-

nal Revenue Code for bond premium.

4. Any deduction for income attributable to domestic

production activities of specified agricultural or horti-

cultural cooperatives.

5. Any net operating loss carryback to the tax year.

6. Any capital loss carryback to the tax year.

Carryover of excess contributions. You can carry

over, within certain limits, to each of the subsequent 5

years any charitable contributions made during the current

year that exceed the 10% limit. You lose any excess not

used within that period. Do not deduct a carryover of ex-

cess contributions in the carryover year until after you de-

duct contributions made in that year (subject to the 10%

limit). You cannot deduct a carryover of excess contribu-

tions to the extent it increases a net operating loss carry-

over.

Farmers, ranchers, or Native Corporations. Corpora-

tions that are farmers, ranchers, or Native Corporations,

see section 170(b)(2) of the Internal Revenue Code for

special rules that may affect the deduction limit.

Cash contributions. A corporation must maintain a re-

cord of any contribution of cash, check, or other monetary

contribution, regardless of the amount. The record can be

a bank record, receipt, letter, or other written communica-

tion from the donee indicating the name of the organiza-

tion, the date of the contribution, and the amount of the

contribution. Keep the record of the contribution with the

other corporate records. Do not attach the records to the

corporation's return. For more information on cash contri-

butions, see Pub. 526.

Gifts of $250 or more. Generally, no deduction is al-

lowed for any contribution of $250 or more unless the cor-

poration gets a written acknowledgement from the donee

organization. The acknowledgement should show the

amount of cash contributed, a description of the property

contributed (but not its value), and either gives a descrip-

tion and a good faith estimate of the value of any goods or

services provided in return for the contribution or states

that no goods or services were provided in return for the

contribution. The acknowledgement must be obtained by

the due date (including extensions) of the return, or, if ear-

lier, the date the return was filed. Keep the acknowledge-

ment with other corporate records. Do not attach the ac-

knowledgement to the return.

Contributions of property other than cash. If a corpo-

ration (other than a closely held or a personal service cor-

poration) claims a deduction of more than $500 for contri-

butions of property other than cash, a schedule describing

the property and the method used to determine its fair

market value must be attached to the corporation's return.

In addition, the corporation should keep a record of:

•

The approximate date and manner of acquisition of

the donated property, and

•

The cost or other basis of the donated property held

by the donor for less than 12 months prior to contribu-

tion.

12 Publication 542 (1-2024)

Page 13 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Closely held and personal service corporations must

complete and attach Form 8283, Noncash Charitable

Contributions, to their returns if they claim a deduction of

more than $500 for noncash contributions. For all other

corporations, if the deduction claimed for donated prop-

erty exceeds $5,000, complete Form 8283 and attach it to

the corporation's return.

A corporation must obtain a qualified appraisal for all

deductions of property claimed in excess of $5,000. A

qualified appraisal is not required for the donation of cash,

publicly traded securities, inventory, and any qualified ve-

hicles sold by a donee organization without any significant

intervening use or material improvement. The appraisal

should be maintained with other corporate records and

only attached to the corporation's return when the deduc-

tion claimed exceeds $500,000 ($20,000 for donated art

work).

See Form 8283 for more information.

Qualified conservation contributions. If a corpora-

tion makes a qualified conservation contribution, the cor-

poration must provide information regarding the legal in-

terest being donated, the fair market value of the

underlying property before and after the donation, and a

description of the conservation purpose for which the

property will be used. For more information, see section

170(h) of the Internal Revenue Code.

Contributions of used vehicles. A corporation is al-

lowed a deduction for the contribution of used motor vehi-

cles, boats, and airplanes. The deduction is limited, and

other special rules apply. For more information, see Pub.

526.

Reduction for contributions of certain property.

For a charitable contribution of property, the corporation

must reduce the contribution by the sum of:

•

The ordinary income and short-term capital gain that

would have resulted if the property were sold at its fair

market value; and

•

For certain contributions, the long-term capital gain

that would have resulted if the property were sold at its

fair market value.

The reduction for the long-term capital gain applies to:

•

Contributions of tangible personal property for use by

an exempt organization for a purpose or function unre-

lated to the basis for its exemption;

•

Contributions of any property to or for the use of cer-

tain private foundations except for stock for which mar-

ket quotations are readily available; and

•

Contributions of any patent, certain copyrights, trade-

mark, trade name, trade secret, know-how, software

(that is a section 197 intangible), or similar property, or

applications or registrations of such property.

Larger deduction. A corporation (other than an S cor-

poration) may be able to claim a deduction equal to the

lesser of (a) the basis of the donated inventory or property

plus half of the inventory’s or property's appreciation (gain

if the donated inventory or property was sold at fair market

value on the date of the donation), or (b) two times basis

of the donated inventory or property. This deduction may

be allowed for certain contributions of the following.

•

Certain inventory and other property made to a donee

organization and used solely for the care of the ill, the

needy, and infants. Special rules apply to qualified

contributions of “apparently wholesome food” (see

section 170(e)(3)(C) of the Internal Revenue Code).

•

Scientific property constructed by the corporation

(other than an S corporation, personal holding com-

pany, or personal service corporation) and donated no

later than 2 years after substantial completion of the

construction. The property must be donated to a quali-

fied organization and its original use must be by the

donee for research, experimentation, or research

training within the United States in the area of physical

or biological science.

Contributions to organizations conducting lobbying

activities. Contributions made to an organization that

conducts lobbying activities are not deductible if:

•

The lobbying activities relate to matters of direct finan-

cial interest to the donor's trade or business, and

•

The principal purpose of the contribution was to avoid

federal income tax by obtaining a deduction for activi-

ties that would have been nondeductible under the

lobbying expense rules if conducted directly by the do-

nor.

More information. For more information on charitable

contributions, including substantiation and recordkeeping

requirements, see section 170 of the Internal Revenue

Code, the related regulations, and Pub. 526.

Capital Losses

A corporation can deduct capital losses only up to the

amount of its capital gains. In other words, if a corporation

has an excess capital loss, it cannot deduct the loss in the

current tax year. Instead, it carries the loss to other tax

years and deducts it from any net capital gains that occur

in those years.

A capital loss is carried to other years in the following

order.

1. 3 years prior to the loss year.

2. 2 years prior to the loss year.

3. 1 year prior to the loss year.

4. Any loss remaining is carried forward for 5 years.

When you carry a net capital loss to another tax year, treat

it as a short-term loss. It does not retain its original identity

as long term or short term.

Example. A calendar year corporation has a net

short-term capital gain of $3,000 and a net long-term capi-

tal loss of $9,000. The short-term gain offsets some of the

long-term loss, leaving a net capital loss of $6,000. The

corporation treats this $6,000 as a short-term loss when

carried back or forward.

Publication 542 (1-2024) 13

Page 14 of 27 Fileid: … ons/p542/202401/a/xml/cycle06/source 9:40 - 9-Feb-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

The corporation carries the $6,000 short-term loss

back 3 years. In year 1, the corporation had a net

short-term capital gain of $8,000 and a net long-term capi-

tal gain of $5,000. It subtracts the $6,000 short-term loss

first from the net short-term gain. This results in a net capi-

tal gain for year 1 of $7,000. This consists of a net

short-term capital gain of $2,000 ($8,000 − $6,000) and a

net long-term capital gain of $5,000.

S corporation status. A corporation may not carry a

capital loss from, or to, a year for which it is an S corpora-

tion.

Rules for carryover and carryback. When carrying a

capital loss from 1 year to another, the following rules ap-

ply.

•

When figuring the current year's net capital loss, you

cannot combine it with a capital loss carried from an-

other year. In other words, you can carry capital losses

only to years that would otherwise have a total net

capital gain.

•

If you carry capital losses from 2 or more years to the

same year, deduct the loss from the earliest year first.

•

You cannot use a capital loss carried from another

year to produce or increase a net operating loss in the

year to which you carry it back.

Refunds. When you carry back a capital loss to an earlier

tax year, refigure your tax for that year. If your corrected

tax is less than the tax you originally owed, use either

Form 1139, Corporate Application for Tentative Refund, or

Form 1120X, Amended U.S. Corporation Income Tax Re-

turn, to apply for a refund.

Form 1139. A corporation can get a refund faster by

using Form 1139. It cannot file Form 1139 before filing the

return for the corporation's capital loss year, but it must file

Form 1139 no later than 1 year after the year it sustains

the capital loss.

Form 1120X. If the corporation does not file Form

1139, it must file Form 1120X to apply for a refund. The

corporation must file the Form 1120X within 3 years of the

due date, including extensions, for filing the return for the

year in which it sustains the capital loss.

Net Operating Losses

A corporation generally figures and deducts a net operat-

ing loss (NOL) the same way an individual, estate, or trust

does. For more information on these general rules, includ-

ing the sequencing rule for when the corporation carries

two of more NOLs to the same year, see Pub. 536, Net

Operating Losses (NOLs) for Individuals, Estates, and

Trusts.

A corporation's NOL generally differs from individual,

estate, and trust NOLs in the following ways.

1. A corporation can take different deductions when fig-

uring an NOL.

2. A corporation must make different modifications to its

taxable income in the carryback or carryforward year

when figuring how much of the NOL is used and how

much is carried over to the next year.

3. A corporation uses different forms when claiming an

NOL deduction.

4. A corporation is not subject to section 461, which lim-

its the amount of losses from the trades or businesses

of noncorporate taxpayers.

For more information, including how to figure the NOL

deduction for the current tax year and any carryback or

carryforward, see the Instructions for Form 1139, and the

instructions for the corporation's tax return.

At-Risk Limits

The at-risk rules limit your losses from most activities to

your amount at risk in the activity. The at-risk limits apply

to certain closely held corporations (other than S corpora-

tions).

The amount at risk generally equals:

•

The money and the adjusted basis of property contrib-

uted by the taxpayer to the activity, and

•

The money borrowed for the activity.

Closely held corporation. For the at-risk rules, a corpo-

ration is a closely held corporation if, at any time during

the last half of the tax year, more than 50% in value of its