Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 1 of 11

ACCOUNTING SYSTEM REQUIREMENTS

for

PROFESSIONAL CONSULTANTS

The Office of Inspector General, Florida Department of Transportation, has prepared

this “Primer” to illustrate and explain some required elements and capabilities of an

acceptable Job Cost Accounting System. This Primer is primarily, but not exclusively,

for the benefit of new Professional Services providers. In our illustrations we have given

titles to the various forms and records; it is the information content of the records which

is important, not the titles. Many Consultants utilize commercial accounting software

packages to establish their accounting systems; all default titles are acceptable so long

as the information requirements are met.

Background and Authority

Professional Consultants seeking to provide services to the Florida Department of

Transportation must be prequalified annually in accordance with Florida Administrative

Code (FAC), Chapter 14-75. Regardless of whether the Request for Qualification

Package for Professional Consultants is the initial submission or an annual renewal, the

package must include evidence the Consultant maintains an accounting system

adequate to separate and accumulate direct and indirect costs and to support billings to

the Department and other clients.

Most Consultants provide this assurance by submitting, as part of the qualification

package, an audit prepared by an independent Certified Public Accountant containing

certain specific and general statements and schedules (FAC 14-75.0022(c)1.).

Consultants who do not have a current CPA audit, because they have not been in

operation for a complete fiscal year or have recently reorganized, may submit estimates

based on partial years or the best available unaudited information (FAC 14-

75.0022(c)2.). The Department’s Office of Inspector General will either review the

CPA’s statements or, absent an audit, will undertake a review of the Consultant’s

accounting system.

All accounting systems must be capable of separating direct and indirect costs and

segregating all costs associated with individual contracts entered with the Department.

Unless the Consultant bills clients on a fee-for-service basis and maintains a published

fee schedule, the association of costs with specific contracts requires the existence and

operation of a “Job Cost Accounting System.” Professional Consultants billing clients

based on labor-by-the-hour must maintain and operate a Job Cost Accounting System.

References

All Consultants and Certified Public Accountants preparing statements to be used by

the Department should be familiar with FAC 14-75.0022 and the Department’s

Reimbursement Rate Audit Guidelines, 2005, which are incorporated by reference into

the Rule. Section 1 of the Reimbursement Rate Audit Guidelines contains specific

Departmental requirements in addition to the general guidelines contained in the

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 2 of 11

American Association of State Highway and Transportation Officials (AASHTO),

Uniform Audit and Accounting Guide, which is reprinted as Section 3 of the Guidelines.

Section 1 of the Guidelines includes Parts relating to “Accounting Systems and

Procedures,” a separate Part discussing “New Consultants / Provisional Rates,” a Part

explaining audit requirements, including the Department’s “Direct Expense Rate” and a

Part discussing “Minor Projects / Self-Certifications.” This Primer will explain many of

these requirements but cannot substitute for a direct familiarity with the materials in the

Reimbursement Rate Audit Guidelines, 2005.

The following flowchart illustrates the flow of information and the records which must be

maintained for the operating costs normally incurred by a professional services provider.

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 3 of 11

Time and Labor

The largest single cost element for a professional services provider will normally be

labor. Tracking time, converting time charged to labor costs, and accounting for these

costs are, therefore, major areas of concern for the Department. Establishment and

maintenance of acceptable timesheets is required documentation for your accounting

system. The following example incorporates the essential elements:

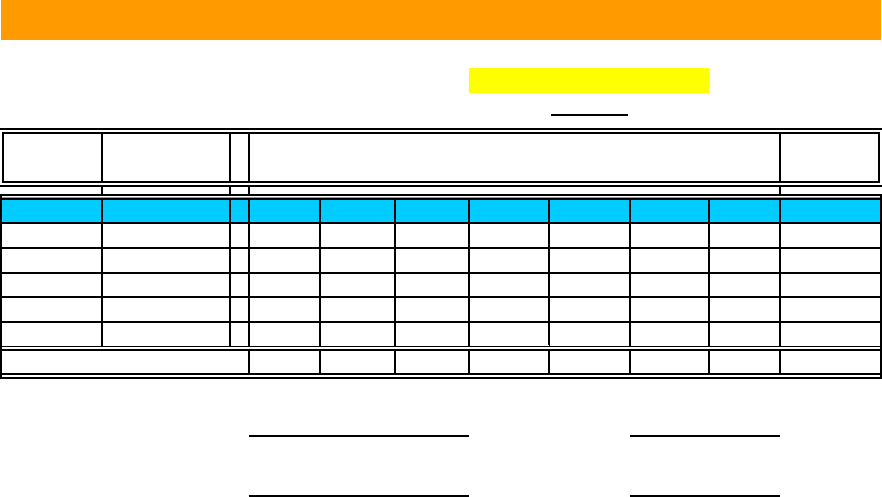

COST

CENTER

PROJECT

NUMBER

SAT. SUN. MON TUE WED THU FRI

TOTAL

HOURS

01 10111 0 0 2 2 3 6 2 15

01 10112 0 1 3 3 0 2 3 12

01 99005 4 0 3 0 0 0 3 10

01 99015 0 0 0 3 5 0 0 8

0

0

HOURS:

418 8 8 88 45

Employee

Signature:

Date:

Supervisors

Signature:

Date:

TIMESHEET

EMPLOYEE NAME:

WEEK ENDING:

Bobby Baker

8/1/2002

SMITH CONSTRUCTION, INC.

The illustration reflects a weekly pay period; the timesheets adopted for use in your

business should correspond to the pay period you use. Timesheets must provide for

the reporting of time worked directly on each individual project or contract and time not

chargeable to any specific project or job. The “Project Number” column of this sample

timesheet shows Bobby Baker, a “Home Office” employee (Cost Center 01), charged

time to two direct jobs and two indirect “projects” for the pay period. This capability of

separating direct costs from indirect costs is critical to the establishment and functioning

of the required Job Cost Accounting System. Totals are shown by day and for each

project, with a cross-checking grand total for the pay period. Finally, the sample

timesheet provides for the dated signature of both the employee and the approving

supervisor. Please note that although the timesheet shows 45 hours of labor were

provided, the timesheet itself makes no effort to identify which hours or functions were

responsible for the 5 hours of overtime; assignment or allocation of overtime hours will

be discussed in later sections of this Primer.

Every pay period the timesheet for each individual must be posted to the accounting

system. The costs associated with the hours posted must be retrievable and displayed

in two separate reports: a Payroll Distribution Report, which, in our illustrations,

provides the direct and indirect labor split to the General Ledger, and a Labor

Distribution Report, which provides labor charges for individual projects or jobs needed

to build Job Cost Reports.

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 4 of 11

The Personnel Register illustrated below contains a listing of employees together with

their wage rates and withholding information.

EMPLOYEE

COST

CENTER

WAGE

TYPE

LABOR

RATE

PREMIUM

RATE

W - 4

EXEMPT

Baker, Bobby 01 Hourly 10.00$ 5.00$ 2

Campos, Van 01 Hourly 11.00$ 5.50$ 2

Thrasher, John 01 Salary 500.00$ 2

Whigham, Wynn 01 Hourly 10.00$ 5.00$ 2

PERSONNEL REGISTER

Most firms use a Personnel Register which contains each employee’s service dates,

insurance coverages, and other information relating to their status as an employee, in

addition to their name, rate of pay, exemptions from the W-4, and status as an hourly or

salaried employee. Firms using this type of Personnel Register, combine the

information with information from the timesheet to produce a separate Payroll

Distribution Report that shows hours, pay rate, gross wages, net pay, withholdings for

all employees for the pay period, and the firm’s employment tax consequences

associated with the employee’s labor. Some firms use a simplified Payroll Register

which combines the Personnel Register and the Payroll Distribution Report. In the

flowchart on page 2, we characterize all types of such records as “Payroll Records.”

The Personnel Register above shows four employees and their applicable wage rates.

Information from timesheets for each employee, such as the timesheet for Bobby Baker

shown on page 3, is combined with the Personnel Register information to produce the

pay period Payroll Distribution Report shown on the next page. The Payroll Distribution

Report shows the cost consequences of a single payroll cycle. Immediately below the

pay period report is a cumulative Payroll Summary for the year.

For purposes of illustration, the Payroll Distribution Report shown categorizes the

timesheet information into direct labor and indirect labor and shows different General

Ledger account numbers for these accounts. The account numbering shown in our

illustrations reflect conventional numbering designations: 1000 accounts for assets,

2000 accounts for liabilities, 3000 accounts for capital, 4000 accounts for revenue, 5000

accounts for direct costs or “Cost of Goods Sold,” and 6000 accounts for indirect

expenses. Use of this or any other numbering plan is not required but can be very

helpful in organizing the cost and financial information of a business entity.

The Payroll Distribution Report is the first opportunity to observe that Overtime Premium

pay is a compensation account but it is NOT a labor account. Overtime Premium pay

can be accumulated as direct or indirect operating costs (5010 or 6010). Each firm

must decide how their accounting system will accumulate overtime premium costs;

several options are discussed on page 9, later in this Primer.

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 5 of 11

ACCT.

DESCRIPTION

HRS RATE

PAY PERIOD

HRS RATE PAY PERIOD HRS RATE PAY PERIOD HRS RATE PAY PERIOD HRS RATE PAY PERIOD

5001

Direct Labor

27 10.00$ 270.00$ 40 11.00$ 440.00$ 27 11.63$ 313.95$ 21 10.00$ 210.00$ 115 1,233.95$

6001

Indirect Labor

18 10.00$ 180.00$

0 11.00$ -$ 16 11.63$ 186.05$ 13 10.00$ 130.00$ 47 496.05$

Total Labor

45 10.00$ 450.00$ 40 11.00$ 440.00$ 43 11.63$ 500.00$ 34 10.00$ 340.00$ 162 1,730.00$

5010

OT Premium Pay-Direct

15.00$ -$ -$ -$ 15.00$

6010

OT Premium Pay-Indirect

10.00$ -$ -$ -$ 10.00$

GROSS PAY

475.00$ 440.00$ 500.00$ 340.00$ 1,745.00$

Withholdings

2201

Federal Tax

68.16$ 63.14$ 71.75$ 48.79$ 251.84$

2202

Medicare

6.89$ 6.38$ 7.25$ 4.93$ 25.45$

2203

Social Security

29.45$ 27.28$ 31.00$ 21.08$ 108.81$

TAXES WITHHELD

104.50$ 96.80$ 110.00$ 74.80$ 386.10$

NET PAY

370.50$ 343.20$ 390.00$ 265.20$ 1,358.90$

Employer Taxes &

Contributions:

6202

Medicare

6.89$ 6.38$ 7.25$ 4.93$ 25.45$

6203

Social Security

29.45$ 27.28$ 31.00$ 21.08$ 108.81$

6204

Federal Unemployment

3.80$ 3.52$ 4.00$ 2.72$ 14.04$

6205

FL - Unemployment

12.83$ 11.88$ 13.50$ 9.18$ 47.39$

TOTAL EMPLOYER TAXES

52.96$ 49.06$ 55.75$ 37.91$ 195.68$

PAYROLL DISTRIBUTION REPORT

Smith Construction, Inc.

Pay Period Ended August 1, 2002

TOTALS - 8/1/2002Bobby Baker Van Campos John Thrasher Wynn Whigham

ACCT.

DESCRIPTION

HRS RATE PAY PERIOD HRS RATE PAY PERIOD HRS RATE PAY PERIOD HRS RATE PAY PERIOD HRS RATE PAY PERIOD

5001

Direct Labor

908 10.00$ 9,080.00$ 1040 11.00$ 11,440.00$ 960 12.17$ 11,678.83$ 650 10.00$ 6,500.00$ 3558 38,698.83$

6001

Indirect Labor

332 10.00$ 3,320.00$ 220 11.00$ 2,420.00$ 273 12.17$ 3,321.17$ 318 10.00$ 3,180.00$ 1143 12,241.17$

Total Labor

1240 10.00$ 12,400.00$ 1260 11.00$ 13,860.00$ 1233 12.17$ 15,000.00$ 968 10.00$ 9,680.00$ 4701 50,940.00$

5010

OT Premium Pay-Direct

276.00$ 427.00$ -$ 40.00$ 743.00$

6010

OT Premium Pay-Indirect

200.00$ 330.00$ -$ -$ 530.00$

GROSS PAY

12,876.00$ 14,617.00$ 15,000.00$ 9,720.00$ 52,213.00$

Withholdings:

2201

Federal Tax

1,847.71$ 2,097.54$ 2,152.50$ 1,394.82$ 7,492.57$

2202

Medicare

186.70$ 211.95$ 217.50$ 140.94$ 757.09$

2203

Social Security

798.31$ 906.25$ 930.00$ 602.64$ 3,237.21$

TAXES WITHHELD

2,832.72$ 3,215.74$ 3,300.00$ 2,138.40$ 11,486.86$

NET PAY

10,043.28$ 11,401.26$ 11,700.00$ 7,581.60$

40,726.14$

Employer Taxes &

Contributions:

6202

Medicare

186.70$ 211.95$ 217.50$ 140.94$ 757.09$

6203

Social Security

798.31$ 906.25$ 930.00$ 602.64$ 3,237.21$

6204

Federal Unemployment

103.01$ 116.94$ 120.00$ 77.76$ 417.70$

6205

FL - Unemployment

347.65$ 394.66$ 405.00$ 262.44$ 1,409.75$

TOTAL EMPLOYER TAXES

1,435.67$ 1,629.80$ 1,672.50$ 1,083.78$ 5,821.75$

Smith Construction, Inc.

2002 YTD - 8/1/2002

PAYROLL SUMMARY

TOTALS - 8/1/2002Bobby Baker Van Campos John Thrasher Wynn Whigham

Regardless of the payroll system used, the job cost accounting system absolutely must

accumulate and report each employee’s time and labor costs by individual project or

job. The sample Labor Distribution Report on the next page demonstrates this

requirement. Where the Payroll Distribution Report and the Payroll Summary

differentiate direct and indirect labor, the Labor Distribution Report shows hours of

labor, and labor costs, incurred for each individual job or project.

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 6 of 11

EMPLOYEE

COST

CENTER

JOB

HOURS

CHARGED

LABOR

RATE

LABOR

COST

Baker, Bobby 01 10111 15 10.00$ 150.00$

10112 12 10.00$ 120.00$

99005 10 10.00$ 100.00$

99015 8 10.00$ 80.00$

45 450.00$

Campos, Van 01

10111 15 11.00$ 165.00$

10112 9 11.00$ 99.00$

10116 16 11.00$ 176.00$

40 440.00$

Thrasher, John 01

10111 15 $500/wk 174.42$

10115 12 $500/wk 139.53$

90064 16 $500/wk 186.05$

43 500.00$

Whigham, Wynn 01

10111 10 10.00$ 100.00$

10116 11 10.00$ 110.00$

99005 13 10.00$ 130.00$

34 340.00$

LABOR DISTRIBUTION REPORT

Smith Construction, Inc.

The time shown on the individual’s timesheet and the associated labor costs charged to

each project or job become line items on the Labor Distribution Report. Line item and

total pay period hours should trace to the signed timesheet and the total labor costs

should trace to Total Labor on the Payroll Distribution Report, for both direct and indirect

labor. In our illustrations, records for Bobby Baker are highlighted in yellow and records

for Project 10111 are highlighted in blue to facilitate tracing the data through the system.

It is important that the Labor Distribution Report show both time and dollar cost since

each line item is a building block needed to construct the direct labor component of the

Job Cost Reports. Separate line item reports for each employee are included in the

Labor Distribution Report. Total time and labor costs charged to each project or job

during the pay period are shown in the Labor Distribution Summary Report on page 7.

The sample Labor Distribution Report and Labor Distribution Summary Report show

that all four employees charged time to Job 10111, and their combined time charged to

this project totaled 55 hours at a combined labor cost of $589.42.

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 7 of 11

COST

CENTER

JOB

TOTAL

HOURS

TOTAL

LABOR

01 10111 55 589.42$

01 10112 21 219.00$

01 10113 0 -$

01 10114 0 -$

01 10115 12 139.53$

01 10116 27 286.00$

Total Direct Labor:

115 1,233.95$

01 99005 23 230.00$

01 99015 8 80.00$

01 90064 16 186.05$

Total Indirect Labor:

47 496.05$

Total Labor (Pay Period):

160 1,730.00$

Smith Construction, Inc.

LABOR DISTRIBUTION SUMMARY REPORT

The time and cost information reported in the Labor Distribution Report also appears as

current period labor cost information in the Job Cost Report, illustrated below.

However, the Job Cost Report additionally shows the cost of Overtime Premium

compensation and other direct expense costs. In addition, the Job Cost Report shows

“Project to Date” totals as well as the information for the current pay period. Again, the

system must be capable of reporting both accumulated hours and accumulated cost in

dollars. The sample Job Cost Report shows that since Project 10111’s inception, 1,291

hours of direct labor have been charged at an associated cost of $13,615.91. Also note

this amount includes only the direct labor component of total job costs.

Smith Construction, Inc.

Period Ending: 8/1/200

2

Job Number: 10111

Job Description: I-14 Overpass

HOURS COSTS HOURS COSTS

Baker, Bobby 5001 15 150.00$

265 2,650.00$

Campos, Van 5001 15 165.00$ 198 2,178.00$

Thrasher, John 5001 15 174.42$ 312 3,627.91$

Whigham, Wynn 5001 10 100.00$ 516 5,160.00$

55 589.42$ 1291 13,615.91$

Overtime Premium 5010 8.33$ 186.14$

Travel 5101 125.00$ 1,525.00$

Supplies 5111 75.00$ 312.50$

Reproduction 5121 35.00$ 120.00$

243.33$ 2,143.64$

TOTAL JOB COST: 832.75$ 15,759.55$

Total Direct Expenses:

LABOR COSTS ACCOUNT

CURRENT PERIOD

JOB COST REPORT

PROJECT TO DATE

DIRECT EXPENSES ACCOUNT CURRENT PROJECT TO DATE

Total Direct Labor:

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 8 of 11

Direct Expenses

The sample Job Cost Report also shows that “Travel” expenses, “Supplies,” and

“Reproduction” costs have been charged directly to Project 10111, as well as the

overtime premium compensation paid to Bobby Baker and the others. Expenses

incurred which are attributable to a specific project are direct expenses. As illustrated in

the flowchart on page 2, information for the Job Cost Report must come from both the

payroll cycle and other expenditures in order to include both direct labor and direct

expenses and to fully include all project specific costs. The Department expects work

completed under our contracts will be reflected as a project, over time perhaps many

different projects, within your Job Cost Accounting System.

The purpose of an Accounting System Review is to confirm that the job cost accounting

system is able to segregate direct and indirect costs and is able to produce reports,

similar to the sample Job Cost Report, for each or any of the contracts. This is what the

Department means when we require that the accounting system be capable of

“supporting billings to the Department and other clients.” All charges shown in Job Cost

Reports must be traceable both to source documentation, such as timesheets for labor

costs or evidence of receipt, billing, and payment for direct expenses, and to General

Ledger accounts. Consultants engaged in a contract with the Department are subject to

an audit of the costs associated with that contract; therefore, the job cost accounting

system must be capable of generating a Job Cost Report showing total hours and all

associated direct costs for any specific contract.

The Job Cost Summary Report below is similar to an Income Statement or a Profit and

Loss Statement covering all jobs and indirect operations for the firm. To satisfy the

Department’s requirements, it is only necessary for the system to generate a report of

total operating costs with totals for both the current period and the project to date. This

summary report must include, at a minimum, all direct jobs and costs charged.

Period Ending:

8/1/200

2

LABOR OT

COSTS PREMIUM

5001 5010

01

10111 I-14 Overpass

589.42$ 8.33$ 235.00$ 832.75$ 13,615.91$ 186.14$ 1,957.50$

15,759.55$

01

10112 Centerview Drive

219.00$ 6.67$ 116.00$ 358.00$ 4,786.23$ 56.87$ 914.00$

5,757.10$

01

10113 US 60, Winchester

-$ -$ -$ -$ 27,564.49$ 462.36$ 3,641.25$

31,668.10$

01

10114 Iron Works Pike

-$ -$ -$ -$ 785.71$ -$ 37.50$

823.21$

01

10115 US 68, Forbes Road

139.53$ -$ 87.00$ 226.53$ 139.53$ -$ 87.00$

226.53$

01

10116 West High Street

286.00$ -$ 54.26$ 340.26$ 1,254.63$ 6.14$ 343.68$

1,598.31$

1,233.95$ 15.00$ 492.26$ 1,757.54$ 48,146.50$ 711.51$ 6,980.93$

55,832.80$

01

99005 General Admin

230.00$ 5.56$ 192.84$ 428.40$ 9,571.60$ 789.54$ 19,187.38$

29,548.52$

01

99010 Training

-$ -$ -$ -$ 960.00$ -$ 1,287.50$

2,247.50$

01

99015 Bid & Proposal

80.00$ 4.44$ 87.50$ 171.94$ 3,785.12$ 326.40$ 4,673.94$

8,785.46$

01

99060 Holiday

-$ -$ -$ -$ 920.00$ -$ -$

920.00$

01

99062 Sick

-$ -$ -$ -$ 2,076.00$ -$ -$

2,076.00$

01

99064 Vacation

186.05$ -$ -$ 186.05$ 4,683.81$ -$ -$

4,683.81$

496.05$ 10.00$ 280.34$ 786.39$ 21,996.53$ 1,115.94$ 25,148.82$

48,261.29$

1,730.00$ 25.00$ 772.60$ 2,543.93$ 70,143.03$ 1,827.45$ 32,129.75$

104,094.09$

6001 6010 YEAR TO DATE - 2002

Total Indirect Costs

TOTAL COSTS

JOB COST SUMMARY REPORT

Smith Construction, Inc.

CURRENT PERIOD PROJECT TO DATE

Total Direct Costs

COST

CTR

JOB DESCRIPTION

EXPENSES EXPENSES

TOTAL

COSTS

TOTAL

COSTS

LABOR

COSTS

OT

PREMIUM

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 9 of 11

Accounting for Overtime

Please notice on the Personnel Register and the Labor Distribution Report that

employee John Thrasher is shown to be a salaried, rather than an hourly, employee.

When salaried employees like John work overtime, their rate of pay changes. In

negotiating contracts with the Department the actual hourly rate for salaried employees

must be presented as the actual “labor rate.” In John’s case, his rate of pay for a

standard 40 hour workweek is $12.50 per hour, for a total of $500 per week. When

John worked 43 hours he was still paid $500 for the week. His actual rate of pay during

the 43 hour week shown was $500 / 43 hours = $11.63 per hour. A Consultant’s job

cost accounting system is required to record and display the actual hourly rate, as

shown in the sample Payroll Distribution Report on page 5. This treatment reflects use

of the Effective Rate Method of accounting for uncompensated overtime. This method

is one of two (2) options presented in Section 1, Part IV.C.4. of the Reimbursement

Rate Audit Guidelines, 2005.

Hourly employees are commonly paid a premium rate for time worked in excess of 40

hours per week. When hourly employees work overtime the gross wages in excess of

their base hourly rate must be charged to an “Overtime Premium” account. The amount

of the “Overtime Premium” pay is equal to the “1/2” premium portion of “time-and-a-half”

for overtime; the base labor hours, the “1,” are charged to jobs or projects the same as

“regular” hours. Each professional services provider must establish a policy for the

allocation of Overtime Premium costs to the appropriate projects or jobs. The method

may be weighted average time charged for the pay period, which is the method used in

our illustrations, average by number of jobs charged, or any other basis which assures

reasonable distribution of these charges to all jobs worked during the pay period.

Consultants may also elect to charge Overtime Premium costs as an indirect expense,

included in the Overhead rate. A written policy is required to assure consistency in the

accounting treatment of these costs.

As an example, the timesheet and Payroll Distribution Report for Bobby Baker show he

worked 45 hours during the pay period. The Personnel Register and the Payroll

Distribution Report show Bobby’s labor rate is $10/hour and the time-and-a-half for

overtime premium rate is $5/hour. Although the gross wages are $475, only $450 can

be charged as direct or indirect labor since Overtime Premium pay is not treated in the

same way as the base rate for labor. The remaining $25 (5 hours at the $5.00

“premium rate”) must be charged as “Overtime Premium” in accord with the established

policy.

In our illustration we have charged the premium costs in the ratio shown on the

timesheet. That is, on the Payroll Distribution Report Bobby Baker is shown to have

worked 27 hours of direct labor and 18 hours of indirect labor, therefore the $25 is

charged 60% to direct and 40% to indirect costs. The $15 direct cost is divided

between 10111 and 10112 based on ratios observed in the Labor Distribution Report,

but actual “premium” charges only appear in the Job Cost Reports. The Job Cost

Report for 10111 shows an overtime premium charge of $8.33, representing 15/27 of

the $15 direct cost.

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 10 of 11

The accounting system must be capable of maintaining a record both of hours worked

and wages paid and must be capable of segregating and charging Overtime Premium

amounts as direct or indirect costs in accord with the established policy. When the

amounts of overtime premium costs a firm expects to incur are small, it is very common

to charge all overtime premium costs to an indirect account and include the cost in the

overhead reimbursement rate calculation.

General Ledger Accounts

The accounting system must be capable of producing Job Cost Reports reflecting all the

direct costs incurred in performing each project or job, including expenses as well as

direct labor. The system must have a mechanism for designating the cost center and

the project or job number for all direct expenses associated with each specific project.

However, in preparing financial statements and reimbursement rate audit reports,

Certified Public Accountants commonly deal with General Ledger account balances

rather than referring to the full series of Job Cost Reports. Subsidiary job cost records

must, therefore, be regularly reconciled to direct charge General Ledger accounts.

If all charges to a particular cost account, such as Travel or Reproduction and Copies,

are posted to a single General Ledger Account, it will be difficult to produce financial

reports which segregate direct and indirect costs. If there is but one General Ledger

account for “Supplies” the CPA will not be able to separately report the cost of indirect

supplies consumed in operating an office from the $312.50 in supplies which have been

direct charged to Job Number 10111, as shown in the sample Job Cost Report. It is

necessary that a 5000 series account have been established for direct “supplies” as well

as a 6000 series account for indirect “Supplies Expense.” Direct and indirect General

Ledger accounts must be established for all cost elements which may be subject to both

direct and indirect charges, including labor. The Reimbursement Rate Audit Guidelines,

2005, Section 1, Part II requires establishment of a General Ledger in which direct and

indirect costs are separately accumulated.

Rates Used In Contract Negotiation

The annual CPA Rate Audit report you submit to renew qualification to provide services

is used to establish reimbursement rates for Overhead, Facilities Capital Cost of Money,

and Direct Expenses. After completing review of your accounting system and cost

projections, the OIG will establish provisional rates which will be used until your first

CPA audit is reviewed. The “Overhead” rate is computed comparing the indirect costs

of operations against the direct labor base. These indirect costs include a combination

of the costs of employee benefits and taxes, commonly referred to as “Fringe Benefits,”

and “General Overhead” costs which cannot be directly attributed to a particular project.

If a professional services provider maintains both a Home Office and a Field Office, the

Department has prescribed rules for the allocation of Overhead costs between the

offices.

Florida Department of Transportation – Procurement Office

Primer on Accounting System Requirements Page 11 of 11

For illustration purposes, and ignoring the differences in the accumulation periods, if the

costs reflected in the Job Cost Summary Report on page 8 represented the best

available information for a single year of operation, the Home Office Combined

Overhead Rate would be 100.24%. This rate is determined by comparing total indirect

expenses of $48,261.29 to the direct labor base of $48,146.50. The illustration shows

operation of a single Home Office; if the Consultant had also operated a Field Office, a

separate rate would be required for both, each based on an allocation of the total

indirect expenses and the amount of direct labor charged to the separate cost centers.

If the overhead rate determined above were applied to an invoice for $1,000 of direct

labor in a contract with the Department, the reimbursement for direct labor and

overhead would be $2,002.40.

The Facilities Capital Cost of Money rate (FCCM) is determined from the “Average Net

Book Value” of the Consultant’s capital assets and rates covering six month periods

established and published by the U.S. Office of Management and Budget. There will be

a single FCCM rate for the Professional Consultant as a whole, based on combined

direct labor from all offices. Annual CPA reports submitted to the Department should

include a statement of the Consultant’s average net book value of capital assets (capital

assets minus accumulated depreciation) to facilitate establishment of the FCCM rate.

The FCCM rate provides an estimate and reimbursement of “opportunity costs”

foregone in investing capital in the business, rather than a reimbursement of interest.

The Direct Expenses rate is calculated comparing total qualifying direct costs charged

and reported to specific jobs against the same direct labor base used for the Overhead

rate. Again, if the information reflected in the Job Cost Summary Report above

represented the annual report, the Consultant’s Direct Expenses rate would be 15.98%.

This rate is determined by comparing total direct expenses and Overtime Premium of

$7,692.44 to the direct labor base of $48,146.50.

For purposes of computing the Direct Expense rate to be applied by the Department in

contract negotiations, qualified direct expenses DO NOT include the cost of payments

made to subcontractors. In contracts with the Department the costs associated with

subcontracts will continue to be negotiated and approved in advance, and subcontractor

costs appearing in the Professional Consultant’s accounting records are deemed “pass

through” costs, separately invoiced by and reimbursed to the Consultant. Direct

expenses attributable to a Home Office or a Field Office are to be reported from the

accounting system and may not be allocated between the offices.

Please refer to the

Reimbursement Rate Audit Guidelines, 2005, Section 1, Part IV.C 6. for more

information on accounting for and reporting direct expenses.

Any questions relating to the material covered in this “Primer” should be directed to

Jeffrey Owens at (850) 414-4539, e-mail [email protected].