Are you looking

to grow your

ecommerce

bookkeeping

practice?

If so, you’re in

the right place.

Onboarding new clients properly is one

of the highest ROI activities you can

undertake to improve your bottom line

and prepare your company for growth.

In this guide, and with our

accompanying

checklist and bonus resources, we

take a deep dive into what you need

to implement for a delightful and

comprehensive client onboarding

experience.

In this document:

Why is it important to

standardize your onboarding

process?

What needs to happen before

onboarding?

How long does onboarding take?

The onboarding checklist

Pre-onboarding

Onboarding

Post-onboarding

Bonus sections

$

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Why is it important to

standardize your onboarding

process?

Having a consistent and standardized onboarding

process is critical if you want new client relationships to

be handled seamlessly without needing to do everything

yourself. It gives your team a predictable pathway to

take on new customers, and provides your clients with a

high level of visibility over what’s needed at each stage.

But it’s more than that. Documenting your processes

(starting with onboarding) helps you to predictably

achieve higher prot margins, allows for better capacity

planning of sta resources, and makes your practice

more valuable if you decide to sell in the future.

Long story short: Investing in a comprehensive onboarding process is

a savvy business strategy, and we’ve compiled it all on a silver platter in

this guide to make your job easier.

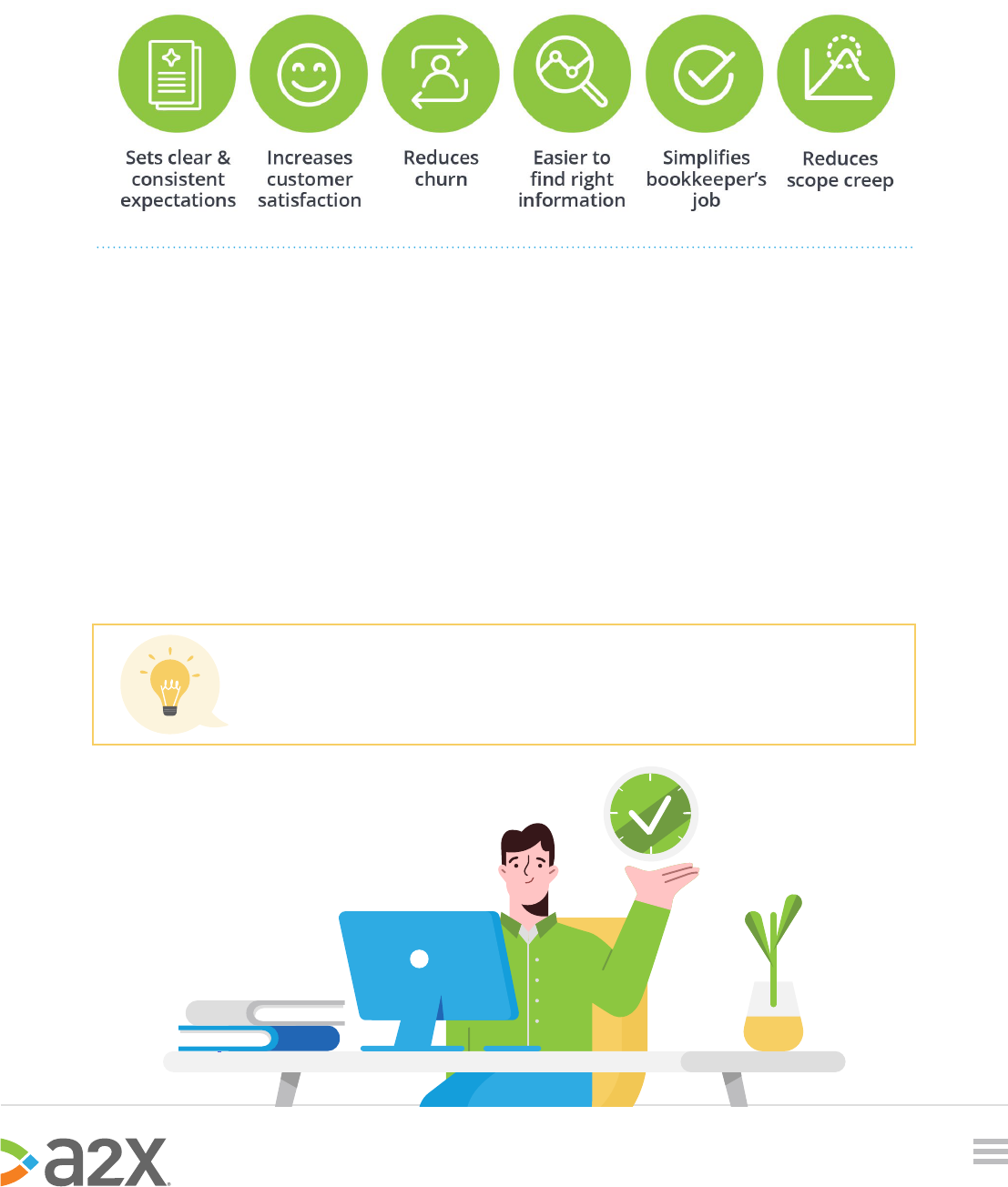

Other benets of having a robust

onboarding process:

• Happier, more loyal customers

that are more likely to provide

referrals.

• Prevents unpleasant surprises

that could be avoided by asking

the right questions upfront.

• More visibility over the customer’s

nancial position, opportunities

and challenges from the outset.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Standardizing your processes is a key element

of preparing your business for growth. Another

important component is having a consistent set of

apps and tools that you use across all clients.

If your team needs to learn new software every

time a customer comes onboard, it will be much

more dicult to grow and do an excellent job on a

consistent basis.

With this in mind, part of the reason for onboarding

is to prepare new clients for working in a way that

ts with how you operate by nding alignment on

the systems and structure that will be used to

serve them.

Whilst you’re still able to adapt your systems and

tools to meet the needs of a specic client, it means

that you don’t need to reinvent the wheel for each

new account.

Contract management

& automated practice AR

Automated ecommerce

payout reconciliation

Practice management

Cloud accounting software

Client communication

Internal communication

Document collection

Expense management

Cloud storage

Workow automation

Time tracking

Paying bills

Regional payroll

Here’s an example of what your standardized

tech stack might look like. This varies from one

practice to the next, depending on the specic

oerings and needs of customers.

This is a good lens to look through when

considering your processes. You can tweak what

you provide on dierent projects, but you don’t

need to create a new recipe for every client.

Standardized processes tools

scalable success

Example ecommerce

bookkeeping tech stack

+

=

Analogy: when you visit a restaurant,

you’re able to order items from the

menu. You can still customize what you

want (e.g: no olives on the pizza), but the

kitchen sta have a standard recipe to

deliver what’s on the menu.

(USA)

(Canada)

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

The satisfaction of your customers largely depends on if they feel that their expectations

have been met. The better you can set realistic expectations and clearly articulate the

journey throughout the onboarding process, the happier clients will be.

Set realistic expectations upfront

Here are some questions to consider when thinking about the

expectations you should be setting:

• What does the onboarding process involve and how long will it take?

• At each stage of the onboarding process, what is the next step, what’s required

from your team, and what’s required from the client?

• Are there any commitments that the client needs to make for you to do a good

job (e.g: quick replies to requests)?

• What are the consequences or costs if things don’t go as plannned?

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

What needs to happen

before onboarding?

Onboarding is just one part of your customer’s

journey, but it is an important one. Here’s an

example of what a new customer’s journey

might look like for your rm:

In larger practices with established teams

for each function, onboarding represents

the handover from sales to ongoing

client services, and ensures that the

bookkeeper and any other relevant team

members are well equipped to do an

excellent job.

For smaller organizations and one-person

operations, onboarding is often done

by the same person that looks after

sales and client services. Whilst it can

be tempting to take a casual or ad hoc

approach to onboarding in a smaller

rm, using a well-documented approach

will make it much easier to bring on

new team members and clients as you

expand.

However, regardless of the size of your

business, there’s another important

consideration to keep in mind: you need

to know exactly who you’re serving.

Marketing Sales

Onboarding

Referrals

Client services

C

U

S

T

O

M

E

R

J

O

U

R

N

E

Y

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

In ecommerce, it is often said that the ‘riches are in the niches’, and this holds

true for bookkeepers just as much as any other industry.

The best bookkeeping rms (and their onboarding processes) are laser focused on the needs of

their ideal customer. If you’re trying to cater to everyone, you will end up diluting your focus.

With this in mind, it’s better to focus on a small group of clients that you can be the best in the world

at serving. In other words, it’s better to be a big sh in a small pond. You can always jump into a

larger stream or lake at a later stage by widening your scope or serving new niches.

Benets of focusing on

a specic niche

Consequences of not

narrowing down your niche

Pricing

Processes

Talent

Competition

Risk

Scalability

Value for money

A need for exibility tends to favor

hourly rates and ad hoc arrangements

over xed price, repeatable, value based

oerings.

There’s a limit to how much

standardization is achievable when your

rm serves a wide variety of clients.

Sta are required to be more

dynamic and experienced to meet

the wide range of client needs.

Harder to scale up because the

needs and preferences of each

customer or segment are dierent.

High levels of competition as you’re up

against every other generalist bookkeeper.

There are a wider range of things that

can go wrong.

It can be more expensive for

customers as productivity gains from

standardization and automation aren’t

always captured. If they are, this often

results in less income for the practice.

Focusing on the needs of a narrow

customer base allows you to provide xed

price, value based oerings. Productivity

gains are retained by your practice in the

form of higher prot margins.

More opportunities to rene your

processes and tech stack for the specic

needs of your niche.

By investing in robust processes and

systems, there’s less reliance on senior

sta to be involved in day-to-day client

services.

Easier to scale up because there’s a

narrower set of client requirements which

can be heavily optimized. Less room for

scope creep.

Opportunity to dominate your niche while

other bookkeepers focus on their niches.

More opportunities to mitigate risk as

there’s a narrower scope of business

operations.

Fixed pricing packages are based on

providing the specic services that your

clients need. This means that clients

receive more value for every dollar spent

while having more predictability over

their nances.

Who is your ideal customer?

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

How to dene your ideal customer

Demographics Pyschographics Behaviours

Location, industry,

revenue, number of

employees, sales channels,

role of the key contact

person, and other

quantitative metrics.

Are based in Canada or

the United States, sell

exclusively on Amazon

marketplace, and generate

$1-5m in revenue.

Preferences, expected level

of service, attitudes and

beliefs, growth ambitions,

price sensitivity, and other

qualitative factors.

Want a hands-o, fully

managed bookkeeping

service, don’t mind paying

a bit extra for accuracy

and service, and have high

growth ambitions.

Responsiveness, ling

frequency for sales tax,

how fast they pay invoices,

the apps they are using,

and other activity based

factors.

Are fast to respond to

queries and either use

Xero or are willing to move

to Xero when they come

onboard.

For example, an ecommerce bookkeeping company might want to target sellers that:

It’s best to be as specic as possible when dening your ideal customer. You can always expand your

scope if necessary, and you’ll always have the discretion to take on clients that don’t t your criteria on

a case-by-case basis.

Rather, it allows you to optimize the way you operate to be the best t for your ideal client. At the end

of the day, who you onboard as a customer is over to you.

Here are three ways to segment your audience:

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

This helps to ensure that your new

customers are an ideal t for your

standardized onboarding process and

ongoing services. It also helps with capacity

planning by creating a pipeline of leads for

nurturing and onboarding in the future.

It can be tempting to think about

onboarding as a time-bound process

(e.g: 1 month to onboard the client).

This can be helpful for planning

cashows and allocating resources, but

it doesn’t always reect reality and may

lead to rushing some components of

onboarding.

“However, many best-in-class rms focus

on making their onboarding process task-

based, as opposed to timeline-based. Of

course, the onboarding process shouldn’t

drag on, but there also shouldn’t be

pressure to rush through it.”

– Hubdoc

In the onboarding checklist worksheet,

we have left a blank column named

‘duration’ where you can add an

estimated timeframe for each task,

based on your business setup.

What is a sales funnel, and what does it

have to do with onboarding new clients?

In the diagram at the top of ‘what needs to happen

before onboarding’, we illustrated the customer journey

as potential accounts move from marketing to sales, to

onboarding and into ongoing client services.

In this way, the growth activities that you put in place to

generate leads and acquire new clients are not separate

from the customer experience that people receive once

they sign up. Rather, they all function as part of a wider

intake process:

• A sales funnel is a way of looking at the stages

that leads go through to become customers (and

eventually raving fans that refer new leads), to

ensure that you focus on the right activities at each

stage of the relationship.

• Thinking about your customer’s journey through

this lens helps to ensure that you ask the right

questions: who is my ideal customer, how far

through the buying process are they, and what do

they need right now to move forward?

• By taking this into account when designing your

onboarding process, you can work backwards to

ensure that the sales and marketing activities you

undertake are focused on targeting your niche, and

align with what you oer.

Set up your sales funnel

Marketing & SEO Resources

For Accountants

Learn more

How long does

onboarding take?

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

In the sections below, you’ll nd a list of the steps to onboard

new ecommerce bookkeeping clients.

How to use this onboarding checklist

This process is broken down into four main sections:

To use this checklist:

1. Pre-onboarding - this stage involves setting initial expectations and signing

the contract.

2. Onboarding - this is where the vast majority of the onboarding work

happens.

3. Post-onboarding - the nal stage involves handover to the ongoing

bookkeeper and looking for ways to improve the onboarding experience.

4. Bonus resources - these assets are designed to provide further context

and information around parts of the onboarding process. They are also

linked to in the relevant descriptions for onboarding steps.

1. Read through the descriptions below in conjunction with our worksheet.

2. Download or make a copy of the worksheet.

3. Add or remove any processes relevant to your business needs.

4. Allocate the tasks to the relevant people on your team and assign an

estimated timeframe to each item.

5. When the work is complete, you can use this checklist to review the work

and ensure that everything was done properly.

6. After each new client onboarding, review how it went and make any

necessary changes to improve your process for next time.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Pre-onboarding

CLICK HERE TO VIEW

Before signing the contract

CHECK

1. Set expectations about your document signing system (at a high level)

Document signing systems (such as Ignition) are great for streamlining the process of

contract execution. To ensure that your new client is comfortable with the process,

it’s important to give them an overview of what to expect. When signing with Ignition,

there’s an option for clients to enter their payment information before signing the

contract. If you use this functionality, explaining the process to customers helps to

avoid unpleasant surprises.

2. Set expectations about your onboarding process (at a high level)

Bookkeeper-client relationships are typically long term arrangements and there’s

a signicant amount of information required to do the job. To give your new client

visibility over the onboarding process, it’s a good idea to briey explain what needs

to happen at each stage. This can be done via a call or meeting, or using a templated

email or brochure.

3. Share a teaser about the extra value they will receive from working with

you (ebooks, checklists, etc.)

Your new client hasn’t signed the contract yet. Getting them excited about all the

extra value they will enjoy from working with you is one way of helping to ensure that

as many people at this stage convert into paying clients as possible.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

4. Tell them about your awesome team, at a high level

While this isn’t the time for a teamwide meet and greet or detailed introductions,

sharing a brief overview of the people that your new client will be working with helps

to humanize the relationship. The goal here is to make your client feel like they’re in

safe hands who have the skills to do a great job.

5. Remind them of the BIG problem that your team will solve

What’s the pain point that your customer is facing? They are choosing to work with

you, to solve this problem. Reminding them of the key pain points identied during

your discovery call, the time it takes to solve them, and how you’re reducing the

client’s involvement will help to reinforce the value you’re bringing to the table.

1. Share the document signing link or les that need a signature

If you’re using Ignition, the document signing functionality is integrated with your

proposal software, so you won’t need to worry about using another system for this

purpose.

2. Set expectations for what will come next, once they sign the contract

What will happen next, once your new customer has signed the contract? Helping

them to better understand the onboarding process enhances the customer

experience and reduces the likelihood of churn. By aligning the expectations of your

customer with the way your company works helps to ensure buy-in at each stage of

the journey.

3. Remind them of the BIG problem that your team will solve

Briey mentioning the outcome that your new customer can expect to receive from

hiring you will help to get them excited about your service. This can be as simple as

thanking them for signing the contract and mentioning that once onboarded, they’ll

be free to focus on growing their business while having nancials they can rely on (or

whatever the key client pain points are that you’re solving).

4. Get them excited to be working with you

Before moving onto the nuts and bolts of the onboarding process, it’s important that

your client feels like they have made the right decision. After all, they are trusting you

with the nances of their business. If they aren’t excited yet, you may want to nd out

if they have any concerns that need to be addressed.

At signing

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Onboarding

CLICK HERE TO VIEW

Initiate welcome email sequence

Internal setup processes - stage 1

CHECK

1. Add new client to your CRM system

Once your new client has signed the contract, there are a range of actions that need

to take place behind the scenes to get them setup. While you are doing these things,

it can be helpful to send them an automated series of emails sharing important

things they need to know. Check out ‘Bonus #1’ for a list of ideas for email topics to

cover in the sequence.

2. Check that they have been added to the correct email ow

If you’ve delegated the job of adding new clients to your CRM system to a VA or

onboarding assistant, have a look to make sure that they’re in the right list and are

receiving the correct emails.

1. Inform your team about the new client

Letting your team know that you’ve got a new client serves a few purposes. It helps to

build camaraderie by celebrating wins, keeps people in sync of upcoming priorities,

and helps with capacity planning. If you use Slack or a similar app for workplace

conversations, then share the message in here. If not, a quick email to your team is

suitable.

Add page link

1

2

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

2. Assign the right internal team to new client (onboarding specialist &

bookkeeper)

By assigning your internal team as early on in the process as possible, it allows people

to plan their workows accordingly, and have a clear understanding of upcoming

priorities. Later in the onboarding process, your internal team will meet to discuss any

key considerations; at this stage, simply informing the people involved is enough.

3. Send out welcome email with next steps (if not included in the email

sequence)

If you’re using an automated sequence of emails (step 1.1), you might not need to send

a separate welcome email. Either way, it’s important that your client feels welcomed and

that they receive all of the relevant information required. In this welcome email, one of

the key actions is getting them to book in their rst onboarding meeting. Pro tip: to get

the best outcomes, keep your email short, to the point, and with only one call to action.

4. Book in the rst onboarding meeting

There are a range of handy tools for booking onboarding meetings. You may want to set

this up manually, or simplify scheduling with an booking app such as Calendly.

5. Set up your new client’s le structure in your le storage system (e.g:

Google Drive)

Having a standardized client le structure makes it easy for your team to nd the right

information when they need it. Consider creating a templated le system that you can

copy and paste for each new client. If you’re using Google Workspace, Shared Drives are

a great way of collaborating on document storage with customers.

6. Send the client onboarding questionnaire to gain access to the right logins

and information

Rather than manually asking your client for each item of information, try using an

onboarding form or questionnaire to capture all of the relevant details at the same time.

Apps like Google Forms and TypeForm can help here. Or you can use an editable PDF if

that ts better with your systems. Have a look at ‘Bonus #2’ for a list of questions and

information to gather using this form.

7. Save a copy of your client’s signed contract in a secure place for future

reference

If you use Ignition, this will be done for you. If you’re using a manual signing process,

make sure to le the contract in a safe place (ideally in cloud storage).

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

8. Send the rst invoice to your client or process their credit card based on the

agreed details

If you’re using Ignition, you can congure the app so that users are required to provide

credit card details before they can sign the contract. This will remove the need to send a

separate invoice and wait for your client to pay.

9. Set up a recurring sales receipt or invoice for client payment

Instead of needing to remember to write up an invoice every month, why note automate

the process with a recurring bill? If you provide a retainer based service, this can easily be

done in your cloud accounting system or via Ignition.

10. Create new client in your practice management system and assign jobs and

due dates based on agreed details

As part of the onboarding process, you’ll need to create a new account in the workow

or practice management software of your choice. Many of these tools have pre-designed

templates that can be useful for onboarding. If you cannot nd a suitable template that

ts your needs, try creating your own.

11. Set up a suitable communication channel with your client (e.g: Slack)

It’s easy for discussions to get missed when you have a wide range of communication

channels that a client can reach you on. To ensure that all conversations remain in one

place (and that there’s a clear process to action requests), you’ll want to identify which

channel this is, and invite your client to collaborate.

12. Follow your new client on social media (Facebook, Instagram, LinkedIn etc.)

A simple like or follow might not sound like a big deal, but it shows that you are invested

in their success. Make sure to follow your new client using your business prole (instead

of your personal account), and consider turning on notications if you want to stay up to

date with developments in their business.

13. Add client to your email newsletter

If you send a monthly or quarterly newsletter to clients, now is the time to add them to

this list. If you’re not currently sending a regular newsletter, it’s worth considering whether

this will be a priority in the future, and what criteria need to be met (e.g: number of paying

clients) before you start investing in email marketing.

14. Add client start date or birthday to your calendar as a recurring event

The small touches are what turns a good experience into an excellent one. Add your

client’s start date or birthday to your calendar so that you never forget to celebrate

the day.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

1. Receive payment from your customer for the rst invoice

If you’re using Ignition, the rst payment will have been processed upfront when your

client signed the contract. If not, you’ll want to make sure that you receive payment before

doing much more work.

1. Review answers to the new client questionnaire and agreement to prep

for meeting

Once the new client questionnaire has been lled out, you’ll want to have a look through

the information provided and ag any areas where further details are required. This

information can be gathered at your rst onboarding meeting.

2. Meet with internal team to discuss expectations, timelines and who

is doing what

Before joining the rst meeting with your new client, you’ll want to make sure that the

people who are looking after the relationship are in sync with what needs to happen

next. During this internal team meeting, consider discussing the scope of the project, if

there are any questions and provide the opportunity to identify any potential barriers to

smooth execution.

3. Begin preliminary software setup (as required)

It’s a good idea to set up as much of the software as you can before the initial meeting,

to identify any questions that need asking and reduce the amount of work required later

in the onboarding process. The volume of work required at this stage depends on how

well your clients tech stack is currently set up, the amount of time and capacity you have

available internally, and whether you have access to the required logins.

4. Prepare for the rst meeting, compile a list of questions in addition to the

standard list if required

It’s a good idea to send an agenda a few days in advance to help your client prepare, and

ensure your workspace is clean before the meeting. Please see ‘Bonus #3’ for a standard

list of questions that can be asked alongside any other questions that have come up

during the onboarding process to date.

First payment

Internal setup processes - stage 2

3

4

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

1. Welcome the client’s representatives and introduce anyone who doesn’t yet

know each other

To start the meeting on a positive note and help everyone to feel comfortable, introduce

the people involved so they know who they’re working with.

2. Set expectations for the meeting and review the agenda

Setting expectations at the start of the meeting ensures that everyone is working towards

the same goals. Reviewing the agenda before starting provides attendees with an

opportunity to add any important items that haven’t been factored into the plan, along

with ensuring that the meeting stays on topic.

3. Review the agreement, scope of work & commitments from both parties

At this stage, you may want to talk about the potential for scope creep and that the price

will increase if work outside of the agreed commitments is requested or required. This is

especially important if you’re working on a xed retainer. But it’s also important if you’re

working on an hourly rate, to avoid surprises that may result in extra costs and potentially

unhappy customers.

4. Temperature check: how is the client feeling? What are they worried about?

Before getting into the details of the meeting, now is a good time to see how the client is

feeling. Are you on the same page? Do they have any concerns or questions?

5. Complete any required information from the new client questionnaire that

hasn’t been provided yet

Ask your standard list of questions, along with any additional questions that have arisen

through the rst two stages of internal setup processes. Make sure to take detailed notes

for future reference.

6. Gather all logs in and passwords or get set up with access to any required

apps that are needed

Collecting all of the required logins you’ll need upfront is a great way to prevent delays

and avoid unnecessary back and forth communication. You don’t have to do this - you can

rely on the client to provide the data you need. However, we have found that not having

the right logins slows down the onboarding process and takes up precious time chasing

clients for information. When asking for access to banking organizations, merchant

accounts and other logins that handle payments, ask for read-only access as much as

possible, to minimize your rm’s access to cash. Have a look at ‘Bonus #4’ for a basic list

of the logins you’ll need to ask for.

Add page link

Onboarding meeting 1

5

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

7. Discuss preferred communication methods and performance standards

It’s important to have a clear agreement on what expectations look like in practice, and

that there’s a mutually suitable communication channel. Avoid being contactable on all

channels (phone, text, email, Slack, social media etc.), and agree to how long clients can

expect to wait before receiving a response. Are you closed on the weekends or outside of

business hours, or do you have 24/7 support?

8. Review due dates for upcoming lings and timelines for work to start

Find out when the next series of tax returns and other lings are due. Make sure to

discuss expected completion dates and what factors can aect the successful delivery by

those dates. You want to know if there are any potential roadblocks that your client hasn’t

yet mentioned, and that the timelines are realistic.

9. Request a copy of their previous tax return or trial balance

This can be provided by the client’s previous bookkeeper or existing accountant. Once

received, make sure to store it in an easy-to-access place for future reference.

10. Gain government authorization to represent your new client (if applicable).

In Canada, you’ll need to get the ‘Represent a Client’ authorization signed. These

requirements vary from country to country, so use the process that applies to your

jurisdiction.

11. Discuss the next steps in the onboarding process

After the meeting, you will need to nish the setup process and congure any remaining

apps. You’ll also need to show your client how the newly setup tools work, schedule the

rst priorities for training, and introduce them to the bookkeeper or team that will be

serving them after onboarding is complete. By telling them what to expect next, your

client is more likely to be delighted with the onboarding process.

12. Keep a to-do list of future actions from the onboarding meeting

If there are items that need to be actioned outside of your standard process or things that

need to be checked or followed up on, make sure to record them during the meeting.

Add page link

Internal setup processes - stage 3

1. Send client a summary of what has been set up so far, any outstanding

to-do items and share the next steps from here

To help ensure that your client has visibility over the onboarding process and what needs

to happen next, it’s a good idea to send them a follow-up message with a summary of

your meeting notes, upcoming priorities and anything else that’s required from them.

6

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

2. Complete the set up of any apps and ensure that your team has the proper

levels of access required to do their jobs

If your client isn’t already using A2X, you’ll want to set it up now, to automate AR

reconciliation. A2X is easy to congure, but if you’d like a step-by-step process, you can

use the workow listed in ‘Bonus #5’.

3. Make sure that the government authorization requested in step 5.10 has

been led

If the application to be a representative of the client hasn’t yet been led, you will need to

follow up with your client or the relevant governing body to get this access.

4. Review the apps that have been set up and congure any nal apps that

need setting up

If you’re working in an onboarding team that includes a manager and assistant, this is

where the manager will check that the apps have been setup correctly, and that naming

conventions or other standardization mechanisms are being accurately followed. If you’re

the only person looking after onboarding, now is the time to review your work. Have a

read through ‘Bonus #6’ for an implementation checklist of what needs completing

before signo.

5. Send an introduction letter to the client’s accountant if appropriate

Depending on the level of service that your company has agreed to provide, you may

need to work with the client’s accountant to prepare tax returns and undertake other

activities. If this is the case, now is a good time to introduce yourself.

6. Complete the health check of client records (if a diagnostic review was not

done during sales)

Before transitioning into ongoing bookkeeping services, it’s important to understand the

state of your client’s records. This is critical for understanding potential risks or problems

that may arise in the future, and areas where extra work may be required. If sales channel

transactions are missing, A2X makes it easy for you to backdate and redo the books. See

‘Bonus #5’ for links to step by step guide on how to set up A2X.

7. Verify that access has been granted to government accounts and review all

accounts

Have a look at the government records that are on le. The information available can vary

from country to country. In Canada, the key accounts to consider are sales tax, payroll

liability, and corporate tax. This provides the due dates for lings, and allows you to

identify if there are any overdue lings or debts that need to be sorted out.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

1. Welcome and temperature check - how is the client feeling so far?

Before getting into the details of the meeting, nd out how the client is feeling about

the onboarding experience so far. Are they comfortable with it? Does it meet their

expectations? Do they have any concerns or questions that haven’t been answered yet?

2. Review and discuss your ndings with the client

If you discovered any issues with their accounts, discuss what you found and what’s

needed to x the problems. This is an opportunity to sell additional services such as

account clean-ups. Discuss the next steps if there’s extra work required.

3. Software setup and basic training

At this point, you only need to cover the very basics of set up. App training will be done in

another meeting. The amount of training required on a going forward basis will depend

on how tech savvy your client is, and how much experience they already have working

with your systems.

4. Get your client setup on the right communication tools

If you haven’t done so already, invite your client to Slack (or the communication tool that

you’re using) and show them how to use it.

Add page link

Onboarding meeting 2

7

CHECK

8. Verify alignment of government accounts to accounting records

Make sure that the government accounts are consistent with what’s showing in your

client’s cloud accounting system. If these records aren’t consistent, further investigation

will be needed.

9. Send a meeting link to schedule the next meeting with your client

This meeting can be organized using Calendly or a similar scheduling software. When

sending out the invitation, also consider including a high-level agenda to ensure that your

client knows what to expect.

10. Create a write up of all ndings in your review to discuss in the next

meeting

This will form the basis of your notes to discuss in the next meeting. Make sure to note

down any questions, challenges or other items that need covering.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Add page link

CHECK

5. Take your new client through how the le sharing system works

Show the client your le storage system (e.g: Google Drive), check that they have the

right access permissions and can edit items as required. Ask if there are any other team

members who will need access to this information and invite them as well.

6. Review your established systems and methods with new client

Explain what has been set up, how your practice management or workow app works,

any other relevant tools they need to know about, and naming conventions they will see

when working with you. The goal here is to get the client comfortable working with your

processes and systems.

7. Go over the key bookkeeping do’s and don’ts

This can be covered in more detail during training sessions; the purpose at this stage

is to avoid creating unnecessary work. Some of the key do’s and don’ts that need to

be discussed include not mixing business and personal accounts, learning what is a

valid business expense, and how to record receipts and paperwork. If your client has

experience running businesses or doing bookkeeping in the past, this might not be

required.

8. Receive access to the relevant payroll forms (if applicable)

If you’re looking after payroll for this client, you’ll need to receive the relevant

documentation. This may include tax forms, employee timesheets, and direct deposit

forms. Check that the information is consistent with your discussions to date and ag any

anomalies. If you are planning to switch payroll platforms, make sure to also record the

year to date employer and employee amounts.

9. Revisit timelines and due dates

Discuss what tasks are required to complete the onboarding process, and what will

happen once they are nished. Review the deadlines for upcoming work and make sure

that they are realistic. If any backwork is required from your ndings discussed in step 7.2,

you will need to factor this into the timeline.

10. Discuss the next steps and who is to do what next

Recap any required actions that have come up during the meeting, along with any other

tasks that need doing. Note down what your team needs to do, and what is still required

from the client. After the meeting, you’ll want to send a follow up email detailing the notes

taken and next steps.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

1. Send your new client a welcome gift and info package

Sending a welcome package to your clients will enhance their experience and show that

you’re invested in the relationship for the long term. In addition to providing important

information about your rm (such as a “cheat sheet” that includes contact information

for the key people), the purpose of your welcome package is to make them feel delighted

about the onboarding experience and excited about working together.

Pro tip: get creative by being thoughtful and personalizing the gift. For example, you might

want to send handwritten letter or a custom ‘hello’ video from your team, accompanied by a

hamper of locally made foods and delicacies.

2. Feature your new client on your website and social media (optional)

If you feature your new client in more than one location, consider doing these activities at

dierent stages throughout the onboarding process, to get the most exposure for your

new client.

3. Finalize the setup of any remaining apps and ensure that your team has the

correct access levels

If there are any other setup tasks that still need to be completed, now is the deadline to

get them nished before nalizing the last stage of internal setup processes.

1. Review all generic processes that are applicable to the client and save links

to the client’s workow jobs (in relevant systems)

The purpose of this task is to prepare for handing the client over to the relevant

bookkeeper or team. If you’re using the Pure Bookkeeping System, these processes are

provided as part of the subscription.

2. Create any missing or custom processes and save to the clients manual/

info pack

If there are any processes required which aren’t covered by your generic processes,

you’ll need to create and save them in an easy to access place for future use by your

bookkeeper.

Add page link

Internal setup processes - stage 4

Prepare training and processes for handover

8

9

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Add page link

CHECK

3. Review internal processes and determine whether your customer needs

any for their own use

You should have a good understanding of your client’s condence with bookkeeping and

desired level of involvement from the conversations to date. If there are processes that

will continue to be looked after by your client (for example, coding receipts), send this

documentation through for them to use.

4. Customize generic processes for client use (if applicable)

If any of the generic processes need tweaking to t the specic needs of your client, make

these changes and save the updated documents to the client’s le.

5. Create a training plan to cover o all important apps and activities they

need to know

It’s important to ensure that the training plan is prioritized based on what’s going to

make the most impact in their business. Consider where the most attention needs to be

focused rst and build your training plan around that.

6. Schedule training sessions with the client for upcoming dates in the near

future

Once you have a prioritized training plan, you’ll need to set up meetings with your client

at suitable times. Rather than batching all of the training into one session, try to spread

them out so that you can focus on one or a few key items in each meeting.

1. Decide who will be the ongoing bookkeeper for your new client

This may have been already been decided in onboarding step 4.2. If you haven’t already

appointed a bookkeeper from your team, now is the time to select the appropriate

person.

2. Schedule an internal meeting with your bookkeeper to review processes

and client details

Before introducing the bookkeeper to your new client, the onboarding manager and

bookkeeper should meet to discuss the client details and go through anything that’s

unique to this project. By covering o the generic and custom processes during this

meeting, your bookkeeper will be well equipped to do a great job.

3. Have your bookkeeper review and familiarize themselves with all ongoing

tasks in practice management system

This involves looking through the client le in your practice management system to

ensure that everything makes sense, and that they are ready to hit the ground running.

Handover to bookkeeper

10

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Post-onboarding

CLICK HERE TO VIEW

CHECK

1. Book a nal onboarding wrap up meeting with your client and bookkeeper

This is the hando point between your onboarding manager and the bookkeeper who

will be looking after the account going forward. The goals of this meeting are to build trust

with the client by introducing them to the bookkeeper and ensuring a smooth transition.

2. Complete the client hand o to your ongoing bookkeeper

If your onboarding process has been well managed up to this stage, the handover should

be a smooth transition. In this meeting, it’s a good idea to cover the responsibilities of

each person on the team, who the client can call if something goes wrong, the next steps,

and check if they have any questions or concerns.

3. Send an onboarding wrap up letter

This letter is to formally end the onboarding process and signal to the client that they’re

now all set up. By sending this letter, there is no room for confusion around where

onboarding ends and ongoing service begins.

4. Send a nal onboarding gift to the client (optional)

It’s a good idea to send the client a small gift as a way to say thanks for following the

onboarding process until the end. If you sent a personalized welcome gift in step 8.1, you

might want to consider sending them branded merchandise (cups, pens etc.) in this stage.

Onboarding wrap up

1

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

CHECK

1. Send your new client the onboarding experience review survey

It’s always worth looking for ways to improve and do an even better job at delighting

future clients. By asking newly onboarded clients for feedback on the experience, you can

identify ways to further optimize the process. Check out ‘Bonus #7’ for a list of questions

to ask.

2. Review the survey responses with onboarding specialist and team member

As a nal internal debrief, this activity involves meeting with the relevant team members

and looking for ways to do better in the future.

3. Make any appropriate changes to your system based on the feedback

Once you’ve made any changes that need actioning, you’ll want to communicate this to

your onboarding team and check in at a later stage to review how the changes are going.

Without a focus on implementation, it’s easy for improvements to get forgotten. If there’s

anyone else on the onboarding team who wasn’t involved in the project at hand, make

sure that they are kept in sync with any changes that aect their workows.

4. Start the ongoing client email campaign

If you have an ongoing client education email campaign (for example: monthly task

reminder emails, tips and tricks, education, etc.), now is when you’ll want to add your

newly onboarded client to that campaign.

Final steps

2

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Bonus 1 Welcome email sequence topic ideas

Bonus 2 Onboarding questions

Bonus 3 Questions for rst meeting

Bonus 4 Required client logins

Bonus 5 A2X setup workows

Bonus 6 Implementation checklist

Bonus 7 Onboarding review questions

Bonus 8 Sample chart of accounts – Amazon

Bonus 9 Sample chart of accounts – Shopify

BONUS SECTION

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Welcome email sequence topic ideas

– BONUS 1 –

Introductory and company emails

1

Topic Description

1 Thank you and welcome aboard The purpose of this email is to express gratitude for having your

new client come onboard, and helping them to feel like they are in

good hands.

2 Setting expectations for what's to

come next

There are quite a few steps in the onboarding process. A simple

email sharing what your new client can expect to happen next, and

in what order helps them to feel comfortable and guided along the

journey.

3 Reselling the benets of working

together

Why do clients choose to work with you? Reminding them of this

reason can help to reinforce the value that you're bringing to the

table and reassure the client that they made the right decision in

hiring your rm.

4 Whitelisting your email address It's not uncommon for emails to go to spam. Asking your new client

to whitelist your email domain as a trusted provider ensures that

they receive the messages you send.

5 Introducing your team and their

credentials

This is particularly useful in medium to large-sized practices. If the

new client is going to be interacting with multiple people throughout

the onboarding process and ongoing service, introducing these

people and any relevant members of the leadership team helps to

put a face to a name, and ensures that the new client knows where

to turn if they need help.

6 Roles and responsibilities - client,

bookkeeper, onboarding specialist

and account manager

For sellers who are new to working with an outsourced bookkeeping

rm, understanding who is responsible for what can get a bit

confusing. An easy solution is to send an email with an overview of

what each person will look after and who is accountable for what.

7 Connect with us on social media Every new client is an opportunity to gain fans on social media (and

vice versa - new fans are an opportunity to secure new clientele).

Invite your client to connect with you on social media and turn

notications on to ensure that they receive the content you're

publishing.

8 What are the next steps? This email should be sent near the end of the onboarding process,

to provide visibility over what happens next.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 1 –

Value-added and educational emails

2

Topic Description

1 Common accounting terminology From COGS to nexus, there's no shortage of jargon in the

bookkeeping industry. An email outlining what these dierent

terms mean helps to get you and your client speaking the same

language. Better yet, link to a blog about accounting terminology

on your website!

2 Understanding your nancial

reports

This isn't the time for in-depth education on nancial analysis.

However, an email sharing the basics of what an income

statement, balance sheet and cashow forecast are used for can

be helpful for clients who don't know much about accounting.

3 Software tips and tricks What are the easiest ways to save time or money, or nd the

information you need when using your accounting app stack?

This is a good place to start your thinking when sharing software

tips and tricks. There's no limit to the amount of detail you can go

into here, so it really depends on how much you want to share via

email (versus reading blogs or scheduling in-person training).

4 Bookkeeping best practices In this email, you can include information about a few things that

your client can do to improve accuracy, save time and make your

job easier. Examples include separating business and personal

transactions, making sure to always get receipts for expenses,

and keeping an eye on sales volumes per state to know when

nexus has been triggered.

5 Links to software tutorials It can be helpful to provide links to tutorials on your software

providers websites where the client can go to learn more about

the tools they are using.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 1 –

Notes: things to keep in mind when crafting your email campaign

3

Topic Description

1 Email marketing best practises Here are some tips to keep in mind when writing marketing emails:

• Keep the topic of each email tightly focused around a specic

topic instead of covering multiple dierent things in one

message.

• Make sure that you only have one call to action (CTA) button

per email.

• Schedule the emails to be sent during work hours of your

client’s timezone. Also consider sending the bulk of the emails

around the middle of the week (Tuesday - Thursday), as this is

when business people are the most engaged.

• Imagine you’re the person reading the email and ensure that it

feels good to read from the user’s perspective.

• Maintain consistency around fonts, font sizes, colours and

other visual elements between your emails, website, social

media channels and other properties.

2 Sending order of the emails The email topic ideas listed above aren't in any specic order.

When crafting your own email sequence, you'll want to consider

which order of communications is going to be the best t for your

clientele and onboarding process.

3 Plan your automated and human

emails so they don't overlap

One of the risks of sending automated marketing emails alongside

emails written by humans is that the team members messaging

your client might not know what is going to be sent in the next

email, and when it's scheduned to be sent. If a client receives

multiple (potentially contradicting or repetitive) emails on the same

day, it can create a negative experience. With this in mind, you'll

want to plan when emails will be sent to ensure the customer

receives a seamless experience.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Onboarding questions

to ask new clients

– BONUS 2 –

Business information

1

Topic Description

1 Legal business name This is the ocial name that the business is registered under.

2 Company or incorporation number This is the incorporation number that accompanies the company

name.

3 DBA name DBA refers to 'doing business as', which is also referred to as

'trading as' or 'T/A'. If the legal and trading names of your client's

business diers, you'll want to know both names for future

reference.

4 Primary contact name Who is the main contact person for the relationship with your

rm? In smaller companies, this will be the owner or CEO. In larger

organizations, this may be the CFO, accounts manager, or other

manager who looks after their ecommerce channel(s).

5 Primary contact email This is the email address for your primary contact person.

6 Primary contact phone number This is the phone number for your primary contact person, in case

you need to reach them urgently.

7 Contact details for any other

relevant people

If you are going to have multiple contact people (e.g: an admin

person and the business owner), you'll want to collect this

information now.

8 Website URL This is the address of their website.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 2 –

Business details (additional items and attachments)

2

Topic Description

1 Organization chart If your client has an organization chart, this will help you to

understand who's who on their end. An organization chart outlines

who looks after which responsibilities or areas of the company,

and who they report to.

2 Business plan Whilst it's not essential to have this information on hand for day-

to-day operations, knowing where your clients are heading helps

you to provide sound advice and ensure that the actions you're

taking are helping them to move towards their goals.

3 Current budget and forecasts Does your client maintain a cashow or sales forecast, an inventory

forecast, or budgets for upcoming spending? If so, you'll want to

review these documents as part of the onboarding process.

4 Current KPIs By knowing the key performance indicators that your client is

tracking and measuring success based on, you can have a better

understanding of their growth ambitions and what metrics impact

their success. This also helps to ensure that your services are

aligned to their future goals.

5 BOD minutes This involves getting your client’s board of directors meeting

minutes.

6 Proof of identity (primary contact

person)

A passport, drivers license or other form of ocial documentation

will help you to verify that who you're doing business with is

legitimately who they claim to be.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 2 –

Articles of incorporation and statements

3

Topic Description

1 FEIN This is also known as the Federal Employer Identication Number

(FEIN) or Employer Identication Number (EIN). It is issued to

entities that do business in the United States, and works in the

same way as a social security number does for individuals.

2 S-Corp letter (or equivalent letter) This letter conrms that the company has been incorporated, and

the date when it was incorporated. The letter you receive will vary

depending on your client's legal structure and country or state of

incorporation.

3 State tax registration letters When a business registers for sales tax in a state, they receive a

conrmation letter that includes their tax ID number and other

relevant information.

4 Most recent tax returns These are the returns that your client's accountant most recently

led with the country's tax department. When you receive access

to represent them, make sure to conrm that these returns are

consistent with what's on the department's records.

5 Most recent nancial statements If your new client can provide a copy of their latest nancial

statements, this will help when reviewing their accounts and

looking for potential anomalies and things that need remedying. It

will also help to understand their xed assets and overall nancial

position.

6 Most recent trial balance By reviewing the trial balance, you can get a quick overview of how

tidy the accounts are at a glance. The totals in the debit and credit

columns should match.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 2 –

Accountant’s information

4

Topic Description

1 Previous bookkeeper (if

applicable)

If your client has switched from a dierent bookkeeper to work

with you, you'll want to nd out who this is, in case you need to

ask questions about past work in their accounts. If your client was

doing the books in-house, it's a good idea to nd out who was

looking after it, so that you can quickly remedy any issues if they

arise.

2 Name of accounting rm This is the name of the accounting rm that your client is working

with. As part of the onboarding process, you'll want to send an

introductory letter to the client's accountant to let them know that

you have been appointed as their bookkeeper.

3 Primary contact's name at

accounting rm

This is the name of the person who they work with at the

accounting rm.

4 Primary contact's email at

accounting rm

This is the email address of the person who they work with at the

accounting rm.

5 Primary contact's phone number

at accounting rm

This is the phone number of the person who they work with at the

accounting rm.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 2 –

Tax information

5

Topic Description

1 Federal and state or province tax

ID numbers

To look after your client's sales tax returns, you'll need to know

their tax ID numbers. You can combine this question with point 3.3

(providing state tax registration letters) to prevent the client from

needing to send over the same information twice.

2 Previous quarterly and year-end

payroll tax returns

This will help you to understand what they have spent in payroll

taxes in previous periods, to ensure that the payroll your team

submits is consistent with the overall trend.

3 Current year's payroll tax returns

(if applicable)

If there have been any payroll tax returns led during this nancial

year, ask your client to send them through.

4 Previous year's and year to date

sales tax returns

It's important that you have information on hand about past sales

tax returns, so that you can easily refer back to them without

needing to ask the client for more information. If they have been

using a tax ling app, it may be easier for your client to provide

access to the app instead.

5 Recent tax correspondence Ask your client for copies of any recent sales tax, payroll tax,

income tax, or other correspondence. In particular, you'll want to

be looking for letters that detail new tax rates that will apply going

forward, to ensure that you apply them accordingly.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 2 –

Payroll information

6

Topic Description

1 List of employees and their rates This list should include the employee's name, hours worked each

week, and their hourly rate or annual salary.

2 List of contractors and relevant

details

This list should include all of the contractors that work for the

client's business, their billing terms and any other relevant details.

3 List of employees with the ability

to claim expense reimbursements

If your client allows employees to pay for items and claim the

expenses for reimbursement later, you'll need to know this

information to eciently process payroll. Make sure to nd out

what the spending limits are, if there are any restrictions on what

they can purchase, and who is responsible for approving claims

before they are paid.

4 List of employee commission rates

(if applicable)

If your client oers a commission incentive to sta that bring in

business, you'll want to know the details of this programme to

ensure that they are paid accordingly.

5 HSA and 401(k) contribution plan

details and remittance instructions

(or equivalent)

You'll want to know the details of any employee benets plans and

any specic instructions that need to be followed when scheduling

payments.

6 Company retirement plan and

other benets documents

It can be helpful to receive the documentation around these

benets plans before they are needed. This way, if you're unsure

about something, your bookkeeper or account manager can

review the documentation to see if they can nd the answer before

reaching out to your client.

7 W-9 forms (or equivalent) If your client works with contractors, you'll need to see their W-9

forms (or equivalent for your country).

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 2 –

Payroll information

7

Topic Description

1 Depreciation and amortization

schedules

Does your client have any xed assets that need to be depreciated

or amortized? If so, you'll need to know the rates and details.

2 Inventory reports (or access to the

inventory system)

What inventory is your client holding? Ask them to send through

an inventory report (or access to their inventory system) to ensure

that your team has the information they need.

3 Company insurance information By knowing what insurance policies your client has, you'll be able

to know when insurance payments need to be accounted for

throughout the year.

4 Loan details Does your client have any long term loans or short term debts

such as credit cards and supplier accounts? Ask them to nd out,

so that you can make sure they are properly recorded and paid on

time.

5 Sales tax exemption certicates (if

applicable)

Are some supplies exempt from sales tax? If so, you'll need to see

proof of the exemption certicates.

6 Company logo le or media kit By having your client's logo on hand, you can add it to reports

in their accounting system, feature them on your website and

prepare other marketing communications (such as social media

posts).

7 Signed engagement letter or

terms of service (if applicable)

If your client hasn't already signed the engagement letter, this

should be a top priority. You may also want to consider asking

your client to agree to other legal policies if applicable.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 2 –

Notes: things to keep in mind when requesting client information

8

Topic Description

1 Streamline this process by using

an online form

There are a range of ways to collect this information without

needing to rely on manual paperwork or ddly editable PDFs.

If you use a CRM system, you should be able to set up an

information collection form with this app. If this isn't possible,

you can try Google Forms or Typeform for a visually appealing

experience.

2 Consider asking for less

information on multiple occasions

It can be overwhelming for a client to be asked so many

questions at once. This is partly why we recommend setting clear

expectations upfront - it helps to avoid surprises. However, if

you feel that it would be better to split the information gathering

over a number of interactions, consider creating a few dierent

questionnaires that can be sent at dierent stages of your

onboarding process.

3 Adapt this list to suit the specic

needs of your business

Every rm has a dierent set of needs to t their internal

processes and the types of client they serve. This is by no means

an exhausive list. We recommend that you remove any questions

that don't apply to you, add any extra questions that we haven't

covered, and set up the questionnaire in your app of choice.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Standard questions to ask in the

rst onboarding meeting

– BONUS 3 –

Standard questions

1

Topic Description

1 Have you ever been audited? If so,

what were the outcomes of the

audit?

If your client has been audited by tax authorities in the past (or if

they're currently being audited), you'll want to know when, why,

and any associated consequences or outcomes.

2 Which apps are you currently using

for each area of your ecommerce

back-oce?

Later on in this meeting, you will need to collect all of the relevant

logins. If you haven't asked for a list of the accounts and apps that

your customer uses in the onboarding questionnaire, now is the

time to ask.

3 How do you currently handle your

accounts reconciliation process?

If your client is already using an accounting system, this work might

have been done by another bookkeeping practice, a manager or VA,

or the owner.

4 How do you currently handle

your other nancial management

processes?

It's important to understand how your client's nances have been

managed until now. The key areas to ask about are paying bills,

managing payroll, sales tax, and any other processes.

5 Which countries are you currently

operating and liable for paying

taxes in?

Having a presence in multiple countries creates added bookkeeping

and accounting complexities. If this hasn't been discussed yet,

make sure to ask if your client is trading in other areas that need to

be accounted for.

6 Do you have any plans to enter

new countries or tax jurisdictions

in the next 12 months?

If your client is planning on entering new regions with dierent tax

laws in the coming year, you'll want to know about this, as it will

impact the bookkeeper's role.

7 Do you have any plans to make

signicant changes to your stang,

equity or debt structures in the

next 12 months?

If there are major company changes on the horizon, this will aect

the way that accounts are managed. By knowing this in advance

of the events taking place, you can make sure to be prepared for

when they do.

8 Is there any information relevant

to your accounts and bookkeeping

that wasn't covered in the

onboarding questionnaire?

This gives your client the opportunity to provide any further

information that you haven't yet asked for, or which might need to

be added to your onboarding questions in the future.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Required client logins to complete

onboarding

– BONUS 4 –

Sales channels

Accounting and back-oce apps

1

2

Platform Further information

1 Shopify Send a collaborator invite to your client to gain access to their

Shopify store(s). Pro tip: set up a Shopify Partner account so that you

can access all of your client's stores in one place.

2 Amazon Have your client invite you to their Amazon Seller Central account.

3 eBay, Etsy, Walmart and any other

relevant sales channels

If your client is selling on other sales channels, make sure that you

get access to these accounts during the onboarding process.

Platform Further information

1 Cloud accounting software (e.g:

Xero)

If your client is using cloud accounting software, now is the time to

get access to their accounts. Depending on the app stack that your

practice uses, you might need to transition them over to a dierent

platform. Either way, you'll need to gain access to their accounts

rst.

2 Inventory management system

(e.g: Cin7)

You’ll need access if your client uses an inventory management

system. If they aren't using an inventory tool, make sure to discuss

how they are currently managing inventory. Sometimes, smaller

sellers will use the inbuilt stock functionality on Shopify or their

accounting system, or record the details in a spreadsheet. This is

not ideal for businesses that are looking to scale, so you'll need

to nd out what plans they have on the horizon for inventory

management if this is the case.

3 Inventory forcasting tool (e.g:

Inventory Planner)

Some sellers use automated tools like StockTrim and Inventory

Planner to forecast their upcoming demand and orders based on

sales data. If your client is doing this, it's worth having a look at their

tool, to understand their inventory purchasing patterns.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 4 –

Platform Further information

4 AR automation app (e.g: A2X) A2X automates the process of reconciling settlement payouts

using the accrual accounting method. Find out more at www.

a2xaccounting.com.

5 Expense management tool (e.g:

Expensify)

Find out how your client is currently managing the process for

recording, reimbursing and reconciling expenses. If they are using

an app to help automate this process, make sure to gain access.

6 Sales tax app (e.g: Avalara) Sales tax is a complex beast. Apps like Avalara, Taxjar and Taxify

help to make it easier. If you're managing sales tax calculation and

returns for your client, you will need access to the app they are

using.

7 Document capture app (e.g:

Hubdoc)

If your client uses Hubdoc or a similar app for capturing and

recording documents, and automating the related bookkeeping

workows, now is the time to gain access.

8 Cloud storage platform (e.g: Google

Drive)

During the working relationship, you will be producing a wide

range of documents such as nancial reports, trial balances and

potentially cashow forecasts. It's important that you have a secure

and easily accessible place in the cloud to store this information. If

your client is using a cloud storage app, you can utilize their tool.

Otherwise, it's a good idea to set them up with a specic shared

drive or folder in your system and share client access to it.

9 Payroll app (e.g: Gusto) If you are managing payroll on behalf of your client, you'll need

to access their payroll apps. The most popular tools used can

vary from country to country, so if they employ sta in multiple

jurisdictions, make sure to ask if there is more one tool that you'll

need access to.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

– BONUS 4 –

Payment related apps

3

Topic Description

1 Ecommerce store payment

gateways (e.g: Stripe, Square,

Paypal etc.)

Some sales channels (such as Amazon) will manage payments on

behalf of the seller. Others (such as Shopify) give sellers the choice

of how they want to accept payment. If your client uses external

payment gateways to process sales, make sure to gain access to

them. This way, if any of the numbers relating to revenue in the

accounting system don't quite make sense, you can look through

the payment gateways and review the audit trail before needing to

contact your client.

2 Buy now pay later apps (e.g:

Afterpay, Klarna, Sezzle etc.)

BNPL schemes have grown in recent years to become very

popular, especially for consumer goods. If your client uses BNPL to

get sales across the line, you'll need to gain access to the services

they are using.

3 Banking access with the right

permissions (if required)

If your contract also includes preparing bills for payment

authorization, you'll need non-signing access to your client's bank

accounts.

4

Bill payment app (e.g: bill.com) Apps like bill.com help to streamline the process of managing

accounts payable. If this is within the scope of your work,

remember to ask your client for access.

3 Any other apps or tools that aect

the books

As a nal question, remember to ask your client if there are any

other apps or tools that haven't been discussed, which will have an

impact on their accounts. If there are further apps, then make sure

to gain access to them.

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

A2X setup workows

– BONUS 5 –

Overview

More helpful guides and resources

Platform-specic setup guides

The process for setting up A2X varies slightly

depending on the sales channel(s) you are

working with. We have compiled a list of links

to A2X support resources below, where you

can nd step-by-step instructions to set up and

congure A2X. For more information about

how to use A2X and tutorials related to specic

use cases, please visit the support center.

If you need guidance along the way, you can

reach our customer support team using this

email: [email protected]

Or if you’re thinking about becoming an A2X

partner, use the following link to apply:

support.a2xaccounting.com

Become an A2X partner

A2X accounting and bookkeeping partner resources

A2X accounting 101 resources

Video setup tutorials

A2X conguration tips

A2X frequently asked questions

A2X COGS and inventory support

A2X support for Xero users

A2X support for Quickbooks users

A2X support for Sage users

THE ESSENTIAL ECOMMERCE BOOKKEEPING CLIENT ONBOARDING CHECKLIST

Implementation review checklist

– BONUS 6 –

Step Area of business Task Status

1 Accounts payable 1. Run the accounts payable report and verify that all outstanding

amounts are accurate.

2 Accounts receivable 1. Run the accounts receivable report and verify that all outstanding

amounts are accurate.

3 Alignment journal 1. Review last year’s led tax return and ensure that the books

match.

4 Assets 1. Create an ‘asset register’ and save it in your client details folder.

2. Check that invoices for assets purchased since the last tax return

have been added to the client details folder.

5 Bank accounts 1. Reconcile all bank accounts.

2. Review any old, uncleared transactions and correct them

accordingly.

6 Chart of accounts 1. Align your client’s chart of accounts with the standard format that