Contract Duration and the Costs of Market Transactions

∗

Alexander MacKay

Harvard University

†

May 11, 2020

Abstract

The optimal duration of a supply contract balances the costs of re-selecting a supplier

against the costs of being matched to an inefficient supplier when the contract lasts too

long. I develop a structural model of contract duration that captures this tradeoff and

provide an empirical strategy for quantifying (unobserved) transaction costs. I estimate

the model using federal supply contracts for a standardized product, where suppliers are

selected by procurement auctions. The estimated transaction costs are substantially greater

than consumer switching costs and a significant portion of total buyer costs. Counterfactuals

illustrate the importance of accounting for the duration margin.

JEL Codes: D22, D44, H57, L13, L14

Keywords: Supply Contracts, Intermediate Goods, Switching Costs, Auctions

∗

An earlier version of this paper circulated with the title “The Structure of Costs and the Duration of Supply

Relationships.” This version reflects an expanded data collection effort and a larger dataset. I am especially grateful

for the helpful comments and suggestions of Ali Hortaçsu, Brent Hickman, Casey Mulligan, Chad Syverson, and

Stephane Bonhomme. This paper has benefited from conversations with Ramon Casadesus-Masanell, Scott Komin-

ers, Maciej Kotowski, Steve Tadelis, Paola Valbonesi, Dennis Yao, and my Ph.D. classmates at the University of

Chicago, among others. I also thank seminar and conference participants at the University of Chicago, the CEPR-JIE

Conference, the Econometric Society World Congress, Northwestern (Kellogg), Harvard Business School, Carnegie

Mellon, UCLA (Anderson), Rice, the International Industrial Organization Conference, Rochester (Simon), and the

Berkeley-Paris Organizational Economics Workshop.

†

1 Introduction

When buyers select sellers, they select not only who but also how long. For the supply of

services, the duration of a buyer-seller relationship is often formalized in a contract. At the

expiration of the contract, the buyer returns to the market to re-select a supplier. The buyer

bears some costs for doing so: each time the buyer goes to market, he must identify potential

sellers, negotiate, determine the new seller, and draw up a contract (Coase, 1937, 1960). These

market transaction costs all occur before an agreement is reached.

1

As noted by Coase (1937),

a key motivation for a longer contract is to avoid these costs. Choosing a two-year contract

instead of sequential one-year contracts can cut these ex ante costs in half.

Though going to the market frequently can be costly, there are typically gains from doing so.

Consider a procurement auction that selects the efficient (lowest-cost) supplier. Over a longer

contract, the lowest-cost supplier at the beginning of the contract may not have the lowest cost

by the end. By running more frequent auctions with shorter contracts, the buyer can switch

among the lowest-cost suppliers and pay a lower price. In the absence of transaction costs, the

buyer would prefer a spot market that allocates the lowest-cost supplier in every instant.

In the exchange of intermediate goods, market transactions can be especially costly. Un-

like the retail sector, markets for intermediate goods are typically not well established. When

running a procurement auction, a buyer brings together potential sellers and administers a

mechanism to determine the winner and the price. In a sense, the buyer bears the cost of

creating his market. Each transaction typically requires market research, advertising the op-

portunity, and additional steps to ensure that the process complies with the buyer’s internal

policies. Even for standardized goods and services (e.g., raw materials, electricity, paper prod-

ucts, and accounting services), market transaction costs can be large, as exact specifications

vary among buyers. Indeed, as inputs, these products are typically sold on fixed-price, fixed-

duration contracts, rather than in spot markets.

2

Thus, we may infer that market transaction

costs are meaningful for a wide variety of goods and services.

Despite their importance, quantifying transaction costs has proven challenging, as they are

typically unobserved. To address this, I develop an empirical model where a buyer selects a

seller from an imperfectly competitive market. The buyer chooses the duration of the contract

to balance ex ante transaction costs against the benefit from selecting more efficient suppliers.

This tradeoff is intuitive and corresponds to a common real-world contracting problem. The

model also provides a novel strategy for the direct estimation of transaction costs. By revealed

1

Market transaction costs correspond to the first two categories of the taxonomy of transaction costs suggested

by Dahlman (1979): (1) search and information costs and (2) bargaining and decision costs. The third category, (3)

policing and enforcement costs, relates to the principal-agent problem and incomplete contracts, which have been

the focus of the literature on transaction costs following Williamson (1979).

2

In their seminal NBER survey, Stigler and Kindahl (1970) found that about half of the commodities in their

sample were purchased with fixed-term contracts. A more recent comprehensive survey has not been conducted

and would be welcome. Fixed-price contracts constitute over 90 percent of U.S. federal government contracts

(source: Federal Procurement Data System), and, anecdotally, remain predominant in the private sector.

1

preference, transaction costs may be identified from the duration of the contract and the price

schedule faced by the buyer. I apply the model in the context of federal procurement for

a standardized product, and I find that market transaction costs are large and economically

meaningful, comprising 10.9 percent of total buyer costs. Thus, I provide the first estimates of

transaction costs in intermediate goods markets.

3

The estimates suggest that transaction costs can be quite large. Though a detailed analysis

of what comprises these costs is limited by the available data, a rough breakdown indicates

that several components may be meaningful sources of ex ante transaction costs, including

formal due diligence procedures and the direct costs of the bidding mechanism. Further work

is needed to better understand these costs and their impacts in various settings.

The model of optimal contract duration and its main implications are presented in Section

2. One novel prediction of the model is that, in equilibrium, a longer contract would result in a

higher price. This arises from straightforward economic logic: if a longer duration would reduce

the price, the buyer would prefer it, because it would also reduce the burden of transaction

costs.

4

A price schedule that is increasing with duration is the natural result of time-varying

supply costs among suppliers, and it may arise from, e.g., capacity constraints or idiosyncratic

outside options. Therefore, the model provides an economic justification for shorter contracts.

I focus on a setting in which goods and services are standardized, there is little uncertainty,

and relationship-specific investments are negligible. Even in these straightforward economic

environments, the duration decision is non-trivial, depending on (1) the magnitude of the

transaction costs, (2) the degree of competition, and (3) the stochastic properties of the under-

lying supply costs. I present a simplified version of the model to provide some intuition about

these features. Perhaps surprisingly, the optimal duration is non-monotonic in the degree of

competition. With few suppliers, the benefit of re-selecting a supplier is small, and long-term

contracts are optimal. This benefit increases as the number of suppliers increases, leading to

short-term contracts at moderate levels of competition. With many suppliers, the buyer can

find a seller that provides a low-enough price over many periods, so long-term contracts are

once again optimal. Likewise, higher variance in supply costs could lead to longer or shorter

contracts. These ambiguous predictions help motivate a structural approach to estimation.

For an empirical application, I select a specialized setting that allows me to isolate the trade-

off described above and recover estimates of market transaction costs. I construct a unique

dataset of 1,046 contracts for building cleaning services for the U.S. federal government. Con-

sistent with the model, duration is determined ex ante by the local government agency, and, for

3

Economists studying the effects of transaction costs have primarily pursued the testable implications of these

costs, rather than their direct estimation (see, e.g., Monteverde and Teece, 1982; Walker and Weber, 1984). One

recent exception is Atalay et al. (2017), who construct a measurement of external transaction costs by examining

input flows between integrated and non-integrated firms across sectors. Likewise, the literature on contract duration

has also focused on testable implications rather than structural modeling.

4

By contrast, the prevailing wisdom in the transaction costs literature is that longer contracts tend to reduce

supply costs by solving ex post incentive problems.

2

the contracts I analyze, the government is required to go to market at the expiration of the pre-

vious contract. Importantly, building cleaning services are standardized, supply-side conditions

are stable, and relationship-specific investments are small.

5

This suggests that abstracting away

from other contracting concerns may be reasonable, and it allows me to focus on identifying

the direct (Coasian) costs of going to the market.

For context, each year the federal government manages over one million contracts that have

an annual value of less than $1 million. These constitute 97 percent of all federal contracts

and are disproportionally made with fixed-price, fixed-duration contracts through competitive

procedures.

6

In prices, the estimation sample is roughly comparable to these contracts and

closely resembles the full set of building cleaning contracts. The data are presented in Section

3, along with descriptive regressions that are used to motivate the structural model. I verify a

core prediction of the model: in the data, longer contracts are more expensive. Therefore, time-

varying supply costs appear to outweigh potential supplier-side benefits from a longer contract

(e.g., learning), which are likely small in this setting.

Section 4 presents the specific modeling assumptions and parameterizations used to take

the model to data. Consistent with the empirical setting, the model takes three stages: (1)

the buyer’s duration decision, (2) a participation decision by suppliers, and (3) a first-price

auction. Thus, compared to a standard auction model with endogenous entry, the model also

incorporates a strategic decision by the buyer (duration). As in Krasnokutskaya (2011), I allow

for unobserved heterogeneity across auctions. I show that the joint distribution of private costs

and unobserved heterogeneity are identified when only the winning bid and the number of

bidders are observed, thus extending identification to data that are more broadly available.

7

Intuitively, variation in the number of bids shifts the distribution of the private component in a

known way, while the distribution of auction-specific heterogeneity is unaffected.

Section 5 presents the model estimates. The median estimated transaction cost is $10,400,

representing a meaningful portion of total buyer costs. Though providing a detailed breakdown

of these costs lies beyond the scope of the paper—in part due to the fact that they are not di-

rectly observed—I provide some discussion of what comprises these costs using supplementary

data. In magnitude, the estimates are roughly comparable to back-of-the-envelope calculations

of the labor costs of procurement specialists. Further, I find that these costs are correlated with

5

Ex post incentive problems, which are a large focus of the contract literature, are not a first-order concern here.

Contracts have detailed specifications, performance is observable, and contracts are rarely canceled. I discuss this

further in Section 3.2. Hyytinen et al. (2018), who study cleaning contracts in Sweden, make similar observations

and also assume complete contracts. As is common in the auction literature, Hyytinen et al. (2018) do not analyze

the duration margin.

6

Source: Federal Procurement Data System.

7

Previous approaches relied on observing either multiple bids per auction (Krasnokutskaya, 2011; Hu et al.,

2013) or a reservation price (Roberts, 2013). Aradillas-López et al. (2013) exploit variation in the number bids for

second-price auctions, though the identification results of their paper are limited to constructing bounds on surplus.

Concurrent work by Quint (2015) exploits variation in the number of bidders in a model with additively separa-

ble unobserved heterogeneity. That identification strategy does not translate to the more common multiplicative

structure examined here.

3

other observables in ways that align with our intuition. For example, the costs are positively

correlated with the complexity of the facility: contracts for medical buildings have much higher

transaction costs than those for offices.

In Section 6, I provide two counterfactual exercises to illustrate the impact of the dura-

tion margin, which is generally not accounted for in empirical studies of procurement or other

business-to-business settings. First, I consider the value to the buyer of the strategic ability

to change the duration of the contract. Instead of optimizing for each contract, I consider an

alternative policy where all contracts are issued with a standard duration. Mandating more fre-

quent transactions could be costly. For instance, issuing only one-year contracts would increase

total costs by 37 percent. Of standard contracts with full-year durations, the four-year standard

term has the lowest impact, increasing total costs by 1.4 percent. Therefore, a poorly chosen

standard could substantially increase costs, but an informed standard may have modest effects.

As a second counterfactual, I demonstrate the impact of endogenous contracts on the esti-

mation of welfare effects. To illustrate the importance of this margin, I consider the effects on

cost pass-through. When buyers can adjust duration, the pass-through of supply costs to prices

is reduced by 10 percent, compared to a world in which duration is held fixed. Thus, appropri-

ately modeling contract duration can change the interpretation of observed price changes and

the estimation of welfare effects. Further, transaction costs may be a sizable portion of total

costs and should be accounted for in addition to any price effects.

8

A novel contribution of this paper is an empirical model of optimal contract duration. To

the best of my knowledge, this is the first model to illustrate a general cost of longer contracts,

which arises from suboptimal buyer-seller matching over time. The previous literature on con-

tract duration has focused on ex post coordination problems, primarily through costly rene-

gotiation (Masten and Crocker, 1985) and relationship-specific investments (Joskow, 1987).

Recent empirical work on these features (e.g., Decarolis, 2014; Bajari et al., 2014) focuses on

one-time projects and therefore does not model repeated demand. As discussed above, I ab-

stract away from such ex post incentive problems and focus on “recurrent spot contracting,”

in the terminology of Williamson (1979). For commodities and simple products, finding the

lowest-cost supplier is often more important than whether buyer and seller incentives are prop-

erly aligned. I am also able to test for and abstract away from incumbency advantage, which

is often a concern in settings with repeated contracts (see, e.g., Greenstein, 1993). My work is

complementary to models with these features.

9

8

Carlton and Keating (2015) emphasize the role of transaction costs in welfare analysis when the affected vari-

able is not simply the price level, through the effect on a firm’s ability to implement nonlinear pricing.

9

The tradeoff in this paper between transaction costs and price is closely related to the models of contract

duration of Dye (1985) and Gray (1978), who take the stochastic price process as given. An innovation of this

paper is to use tools of industrial organization to model primitives of the price process and explore its implications.

The contract duration decision is also theoretically linked to a simultaneous bundling problem, where the contract

bundles demand over time. In the bundling literature, Zhou (2017) and Palfrey (1983) provide the most closely

related analogues. Compared to Zhou (2017) and Palfrey (1983), I allow for intermediate degrees of bundling and

introduce transaction costs. I demonstrate that the smaller variance induced by bundling reduces total surplus when

4

A related empirical literature measures switching costs in consumer markets (e.g., Dubé

et al., 2010; Handel, 2013; Honka, 2014; Luco, 2019). These studies also use a revealed-

preference approach to recover switching costs, using a different identification strategy that

is made possible by the economic environment. Conceptually, switching costs in consumer

markets can be inferred from posted prices,

10

whereas contract prices for intermediate goods

are idiosyncratic to the buyer-seller match. Additionally, the switching costs literature tends

to take supply costs as exogenous, whereas variation in supply costs is a key factor in the

decision to switch suppliers in my setting. As one might expect, I find that transaction costs in

intermediate goods markets are substantially higher than consumer switching costs.

11

The theoretical and empirical analysis of the costs of market transactions has typically been

cast in light of the decision to vertically integrate (for a summary, see Lafontaine and Slade,

2007). Through integration, buyers and sellers can avoid the costs of going to the market, in

addition to realizing other benefits. Supply contracts provide an intermediate option, lying be-

tween arms-length transactions and vertical integration. As noted by Coase (1960), conditions

that favor longer contracts are also likely to favor vertical integration. Thus, the mechanisms

studied in this paper may also be relevant for the analysis of vertical integration.

2 Model

Consider a buyer that demands a good or service for many periods. In the model I introduce, the

buyer chooses the duration of the contract, balancing the per-period payment to suppliers with

the market transaction costs realized at the beginning of each contract. I provide a numerical

example to illustrate this key tradeoff. A central empirical implication of the model is that it

may be applied to recover unobserved transaction costs. The model does not capture every

real-world consideration, but its representation of a key contracting tradeoff provides the basis

for an empirical investigation into the magnitudes of transaction costs.

2.1 The Buyer’s Problem

A risk-neutral buyer has inelastic demand for a good or service over many (infinite) future

periods. The buyer selects a single seller and can commit to buy from that seller for multiple

periods with a contract. The buyer announces the duration of the contract (T ) in advance of

there are no transaction costs. Relatedly, Salinger (1995), Bakos and Brynjolfsson (1999), Cantillon and Pesendorfer

(2006) note that bundling affects prices by reducing the variance of average valuations.

10

See, for example, Dubé et al. (2010) for orange juice and margarine or Elzinga and Mills (1998) for wholesale

cigarettes. The wholesale market in the analysis of Elzinga and Mills (1998) mirrors a consumer market in that

pricing, though nonlinear, is uniformly applied.

11

A key feature of consumer markets is an inability to contract on future prices, leading to models that weigh an

“investing” effect versus a “harvesting” effect (Klemperer, 1995; Rhodes, 2014; Cabral, 2016). When buyers and

sellers agree on future prices, as in this paper, these effects are competed away.

5

implementing a market mechanism, which is used to select the seller and determine price. Each

time the buyer uses the mechanism, it costs the buyer δ.

The game proceeds in three stages. First, the buyer determines duration T after observing

characteristics of the service x, market conditions m, and the mechanism cost. Second, N

suppliers decide to participate in the market mechanism after observing (T, x, m). Contract

characteristics (T, x) affect the per-period supply costs, while market conditions affect entry

costs (through outside options). Third, a supplier is selected with a per-period stochastic price

P (N, T, x, m), where the price distribution may depend on the duration of the contract and the

number of sellers.

Let P denote the ex ante expected price conditional on (T, x, m), so that P (T, x, m) =

P

N

n=1

(E[P (n, T, x, m)] · Pr(N = n|T, x, m)). The buyer expects market conditions and mech-

anism costs to remain the same in future periods. With this assumption, we use P (T ) in the

exposition below as shorthand, suppressing (x, m).

The value function for the buyer in period τ who has not yet chosen a seller can be expressed

as

V (τ) = min

T

δ +

T

X

k=1

β

k−1

P (T) + β

T

V (τ + T ). (1)

After incurring the cost to determine the seller and the price (δ), the buyer pays P(T ) for T

periods and returns to the decision problem in period τ +T . The buyer discounts future periods

at rate β.

For an optimal T , it must be that, for any other duration S:

δ +

T

X

l=1

β

T −1

P (T) + β

T

V (τ + T ) ≤ δ +

S

X

l=1

β

S−1

P (S) + β

S

V (τ + S). (2)

We can expand each side of the equation by iterating forward to period τ + T · S. As the buyer

expects market conditions to persist, the problem is stationary. If T is optimal in period τ, the

buyer expects T to be optimal at the expiration of a contract in a future period, e.g., in period

τ + T . Plugging in a sequence of contracts of duration T and S, we obtain

S

X

l=1

β

T (l−1)

δ +

T

X

k=1

β

k−1

P (T)

!

+ β

T ·S

V (τ + T · S) (3)

≤

T

X

l=1

β

S(l−1)

δ +

S

X

k=1

β

k−1

P (S)

!

+ β

T ·S

V (τ + T · S).

That is, the buyer may pay a per-period price of P (T) while running the market mechanism S

times in S · T periods, or a per-period price of P (S) while running the mechanism T times over

the same horizon.

6

Rearranging,

12

we obtain the optimality condition

P (T) − P (S) ≤

δ

P

S

k=1

β

k−1

−

δ

P

T

k=1

β

k−1

. (4)

This formulation has straightforward interpretation. The left-hand side is the per-period savings

by choosing contract S instead of T . The right-hand side is the increase in amortized transaction

costs from choosing S instead of T . Thus, at the optimal contract, potential savings in the per-

period price by selecting a different (shorter) duration are less than increased transaction costs

from using the market mechanism more frequently.

Given realizations for contract and market characteristics x and m, the optimal duration,

T

∗

, is therefore given by

T

∗

= arg min

T ∈T

P (T, x, m) +

δ

P

T

k=1

β

k−1

, (5)

where T is the set of allowable durations. Intuitively, this expression shows that the buyer’s

objective is to minimize the sum of the per-period supply price and amortized transaction costs.

The optimality condition generates two fundamental results, which we express as our first

propositions:

Proposition 1. If the optimal contract is not the maximum allowable duration (i.e., an interior

solution exits), then the expected per-period price is increasing with the duration of the contract

Proposition 2. If an interior solution exits, then the optimal duration is increasing with transac-

tion costs.

Proof. See Appendix A.

The second proposition is intuitive, and it helps motivate the empirical approach of using

variation in contract duration to recover transaction costs. The first proposition is a direct

result of having ex ante costs for the market mechanism. The buyer can always reduce these

(amortized) costs by choosing a longer contract. Therefore, if the buyer chooses something

other than the maximum duration, it must be that the buyer expects the marginal increase in

the per-period price to offset the decline in transaction costs. As illustrated below, the per-

period price will be increasing when suppliers have idiosyncratic variation in supply costs.

This variation causes the low-cost supplier changes over time and provides a benefit of shorter

contracts.

12

The substitutions δ =

P

T

k=1

β

k−1

δ

P

T

k=1

β

k−1

on the left-hand side and δ =

P

S

k=1

β

k−1

δ

P

S

k=1

β

k−1

on the right-

hand side allow us to factor out the common aggregate discount factor

P

T S

k=1

β

k−1

=

P

S

l=1

β

T (l−1)

P

T

k=1

β

k−1

=

P

T

l=1

β

S(l−1)

P

S

k=1

β

k−1

and simplify.

7

2.2 Illustrative Example

To illustrate the key tradeoff of this model and its implications, consider a stylized example.

Suppose there are N symmetric suppliers in the market, and the set of suppliers stays the same

in every period. The buyer can only issue single-period or two-period contracts. Under these

conditions, the buyer only has to consider the effects of his decision over the next two periods.

Thus, the analysis of the infinite-horizon problem in this example is equivalent to that of a

two-period problem, and I describe it as such for clarity.

Suppliers are risk-neutral and participate in an auction to win the contract. Every supplier

participates in the auction (entry is exogenous). Thus, the mechanism is efficient. The per-

period cost to each supplier is the random variable c. The distribution of c is stable across

periods, but the realizations for each supplier may vary over time. When the buyer issues single-

period contracts, the per-period cost of the winning supplier is c

1:N

, which is the minimum of N

draws of c. When the buyer issues a two-period contract, the average per-period costs for each

supplier is the average of two draws, ˜c =

1

2

(c

(1)

+ c

(2)

), and the cost to the winning supplier is

˜c

1:N

.

This brings us to a key feature about costs in the model:

Remark 1 By changing the duration of the contract, the buyer changes the effective per-period

cost structure faced by suppliers.

As long as the per-period costs c are not perfectly correlated across periods, ˜c 6= c and V ar(˜c) <

V ar(c). As suppliers’ bids will reflect the average cost over the duration of the contract, the

distribution of per-period costs changes with contract duration. When the distribution of supply

costs is stable over time, this serves to reduce the variance of cost draws. The cost of a longer

contract is that the low-cost supplier may not be selected in each period. In the absence of

transaction costs, short-term contracts would be optimal.

Risk-neutrality and symmetry generate the standard auction result that the expected win-

ning bid is equal to the second-order statistic from the cost draws. Thus, the buyer-optimal

contract solves

min{2E[c

2:N

] + 2δ

| {z }

short-term

, 2E[˜c

2:N

] + δ

| {z }

long-term

} (6)

The buyer will pick the long-term contract if the increase in expected supply costs is less than

the reduction in (amortized) transaction costs, i.e., if

E[˜c

2:N

] − E[c

2:N

] <

δ

2

. (7)

This condition mirrors the optimality condition in equation (4).

This simple example illustrates a second key feature of the model:

8

Remark 2 The intensity of supply-side competition, in terms of the number of participating

suppliers, affects the optimal contract by changing the per-period cost structure.

Variation in N affects the left-hand side of (7), changing the marginal effect of a longer contract

on the per-period price. This marginal effect is non-monotonic in N, so an increase in the

number of suppliers has an ambiguous effect on equilibrium contracts. Therefore, the optimal

duration may be decreasing, increasing, or U-shaped with N. I describe the intuition for this

result below along with the numerical example.

To illustrate the above features, I present a numerical example in which the per-period costs

are drawn independently over time from a beta distribution with shape parameters (0.5, 0.5).

Recall that the beta distribution has support [0, 1]. With shape parameters (1, 1) it is equivalent

to a uniform distribution, and as the shape parameters approach zero it approaches a Bernoulli

distribution.

Figure 1 illustrates how expected buyer costs vary with contract duration and the degree

of competition. Panel (a) plots the expected supply price for one-period contracts and a two-

period contract. For N = 3, the expected prices are the same, and for N > 3 the single-period

contracts always have a lower expected price. The blue line in panel (b) plots the difference

between these two lines. This difference is equivalent to the left-hand side of equation 7 and is

non-monotonic in the number of suppliers. The dashed line indicates a transaction cost of 0.20,

which is amortized by two periods. When the blue line falls above this dashed line, the increase

in the expected supply price exceeds the savings in transaction costs, and one-period contracts

are optimal. Panel (c) plots the U-shaped buyer-optimal duration as a function of N. Short-term

contracts are optimal for moderate level of competition; in this case, when N ∈ {6, ..., 21}.

This stylized example conveys a general insight from the model. For low levels of com-

petition, the benefit of switching suppliers is low, and long-term contracts are preferred. At

moderate levels of competition, there is an increased benefit of switching among suppliers

more frequently. When competition is intense, the expected costs of both long-term and short-

term contracts approach the lower bound of costs, and therefore long-term contracts, which

minimize transaction costs, are optimal.

Thus, even in a stylized example, the directional predictions of the model are empirical,

depending on particular contract or market conditions. This finding further motivates the use

of a structural approach to assess the impacts of transaction costs. The model also generates

a set of predictions related to the stochastic properties of per-period costs to suppliers. Higher

autocorrelation in supply costs will lead to longer contracts, while higher variance in per-period

supply costs can have effects in either direction. As the remainder of the paper focuses on the

structural approach, I discuss these in more detail in Appendix A.

9

Figure 1: Competition, Costs, and Contract Duration: A Numerical Example

(a) Expected Price of One-Period and Two-Period Contracts

Two−Period Contract

One−Period Contracts

0.00

0.10

0.20

0.30

0.40

0.50

5 10 15 20 25 30

Number of Suppliers

Expected Price

(b) The Marginal Cost of a Longer Contract

δ

2

= 0.1

0.00

0.05

0.10

5 10 15 20 25 30

Number of Suppliers

Change in Expected Price

(c) The Buyer-Optimal Contract

N=6 N=21

1

2

5 10 15 20 25 30

Number of Suppliers

Optimal Duration

Notes: Panel (a) plots the expected per-period costs for separate one-period contracts and

a bundled two-period contract, as a function of the number of bids. The blue line in panel

(b) is the difference between the two, which is the expected price increase to the buyer.

The dashed line in panel (b) reflects a transaction cost of 0.2 amortized over two periods,

which is the amount saved by issuing a two-period bundled contract. For values of N where

the blue line is above the dashed line (N ∈ {6, ..., 21}), short-term contracts are optimal,

as the increase in supply costs from the long-term contract is greater than the savings in

transaction costs. Panel (c) plots the buyer-optimal contract duration.

10

2.3 Identification of Transaction Costs via Revealed Preference

I now discuss the empirical strategy for recovering unobserved transaction costs. The optimality

condition for the buyer generates a contract-specific implied value for δ that rationalizes the

observed duration. Thus, by revealed preference, we can recover δ for each contract.

If a contract T is optimal, then, relative to contract S, we have the following optimality

condition, which is a re-expression of equation (4):

T

X

k=1

β

k−1

!

S

X

k=1

β

k−1

!

P (T) − P (S)

≤

T

X

k=1

β

k−1

δ −

S

X

k=1

β

k−1

δ. (8)

By comparing the optimal contract to one that is one period shorter (S = T − 1), we obtain the

inequality

δ ≥

1

β

T −1

T

X

k=1

β

k−1

!

T −1

X

k=1

β

k−1

!

P (T) − P (T − 1)

. (9)

Likewise, a comparison of of T to S = T + 1 obtains

δ ≤

1

β

T

T +1

X

k=1

β

k−1

!

T

X

k=1

β

k−1

!

P (T + 1) − P (T )

. (10)

In principle, one could generate an inequality for every element in the duration choice set T,

excluding the chosen contract. The minimum upper bound and the maximum lower bound are

sufficient bounds on δ.

The right-hand sides of the inequalities depend only on the discount rate and the expected

per-period price function. The next result follows immediately:

Proposition 3. When β and P (T) are known, bounds for contract-specific realizations of δ are

identified.

The tightness of the bounds depends on the slope of the function P (T ) and the discount rate

β. Effectively, these parameters are governed by the length of each period. Thus far, we have

used a discrete formulation where 1 unit separates each period. If the length of this unit became

infinitesimally short, then T is chosen from a continuous set and we obtain point identification

of δ. We present this as a corollary:

Corollary 1. When T is continuous (i.e., the duration of each period approaches zero), then δ is

point identified for each contract.

Proof. See Appendix A.

Even in the discrete case, the full distribution of δ can be identified from additional assump-

tions on the relationship between δ and x or m. This distribution can be used as a prior over

the bounds. Recall that P (T ) is shorthand for P(T, x, m).

11

Proposition 4. Assume that there exists a special covariate w that is an element of x or m. This

covariate meets the following two conditions: (i) δ and w are independent and (ii) P (T, x, m)

varies continuously with w. Local variation in w provides local identification of the distribution of

δ. When sufficient variation in P (T, x, m) is generated by variation in w, the distribution of δ is

identified.

Proof. Under the above conditions, the bounds (9) and (10) vary continuously with w. There-

fore, the cumulative distribution function of δ is identified.

The model provides a straightforward way to recover unobserved contract-specific trans-

action costs. A key input to this procedure is the duration-dependent function P (T, x, m).

Intuitively, observed variation in contract duration will be necessary to estimate this function

when not known a priori. I discuss the empirical strategy to estimate this object in Section 4.

2.4 Discussion

Setting

The model captures a setting in which the buyer chooses fixed-price, fixed-duration contracts.

This type of contract is quite common. They constitute the vast majority of government service

contracts, and, anecdotally, are used quite frequently in the private sector. Why might a buyer

choose this type of contract instead of allowing for options to renew or a less formal structure?

Some possible reasons are (a) to maximize the number of suppliers that bid on the next contract

and (b) to protect against favoritism by the buyer’s agent (at the expense of the buyer) through

increased transparency. I take the contract structure as given; an analysis of why fixed-duration

contracts are prevalent lies outside the scope of this paper.

The model abstracts away from ex post transaction costs that arise from the principal-agent

problem and incomplete contracts. These considerations have been studied in detail by the

transaction costs literature. The focus of this paper is on illustrating a new fundamental mech-

anism, which may be important even when ex post transaction costs are negligible or when

complete contracts are possible. In some settings, a richer model that accounts for both ex ante

and ex post transaction costs may be appropriate. Ex post transaction costs tend to suggest

longer contracts, as longer contracts can offer a greater return and better align incentives. By

contrast, the model of this paper illuminates that time-varying supply costs make longer con-

tracts more costly, providing a reason why shorter contracts may be preferred. Even with ex

post transaction costs, the per-period price should be increasing in duration at the equilibrium.

If not, the buyer will opt for a longer contract that reduces the supply price and (both ex ante

and ex post) transaction costs.

One simplifying assumption of the model is that the market transaction costs are fixed. In

some settings, we may expect that these cost vary with the duration of the contract. Longer

12

contracts could require more market research by the buyer or additional costs of drawing up

the contract. This is not a first-order consideration for simple goods and services. The language

of the contracts in the empirical application is not duration-dependent, likely reflecting the

standardized nature of the service and stable market conditions.

Another simplification is that suppliers have perfect foresight about future costs. A more

general setup with imperfect information shares the same qualitative features of this model. For

example, consider the case in which a supplier has no information about future costs. Then the

bid for a longer-duration contract will reflect an average between the current-period realization

and the expected mean of future costs, which is the same across suppliers. Therefore, longer

contracts shrink the variance of prices across suppliers. In this scenario, there is an additional

ex post inefficiency arising from imperfect information, though fixed-price contracts eliminate

this risk to the buyer.

Efficiency

The duration of a fixed-price, fixed-duration contract is typically determined by the buyer. Thus,

the analysis of this paper focuses on buyer-optimal contracts, though the intuition translates to

efficient contracts as well. The buyer is concerned with the supply price, which shares similar

stochastic properties to supply costs in most settings. For example, in the illustrative example

above, expected supply cost and expected price are the first and second order statistics from the

cost distribution, which generate similar directional predictions. In the efficient case, supply-

side frictions such as entry costs should also be incorporated for when analyzing welfare.

Though the qualitative features of the buyer-optimal and the efficient contract are similar,

they are not identical. In Appendix B, I provide an analysis of these two outcomes, as well as

the seller-optimal contract. Contracts that are determined by market participants (buyers and

sellers) may be too long or too short, resulting in wasteful social costs. Counterintuitively, these

extra costs may increase as a market becomes more competitive. Therefore, when ex ante costs

are taken into account, highly competitive markets may be of more concern for regulators than

those that are more concentrated.

13

13

This result occurs because market participants care about price rather than cost, and the price responds more

quickly to a change in contract duration when the number of bidders is large. If we think of expected price as the

expected second-order statistic, and the cost as the first-order statistic, then we have some intuition for why this

could be true. The second-order statistic responds more strongly to a change in variance (or mean) than the first-

order statistic when the number of draws is large and the cost distribution is bounded from below. The buyer (or

seller) internalizes the duration’s effect on the second-order statistic rather than its effect on the first-order statistic.

13

3 Empirical Application: Data and Reduced-Form Analysis

3.1 Data

To estimate the costs of market transactions, I construct a dataset of 1,046 competitive contracts

for building cleaning services for the United States federal government. This market provides

a relatively clean case study to analyze the duration decision and estimate costs. For many

commodity products and services, the buyer (a government agency) is compelled to run a

sealed-bid auction for a contract of a pre-determined duration at the expiration of the previous

contract. Thus, for many federal procurement contracts, the empirical setting is aligned with

the model of the previous section. The sample period is October 2003 to May 2017.

A general empirical challenge is that procured goods and services may have heterogeneity

that is multi-dimensional and difficult to quantify. Thus, I focus on commodity-like goods and

services with standard cost structures. Indeed, products of this sort are numerous in procure-

ment and make up a significant portion of all transactions.

14

From the set of commodity-like

products, building cleaning services were chosen because they are numerous, cost factors are

easily quantified, and there is a lot of variation in contract duration. Finally, demand is inelas-

tic, as there were no significant substitutes. The market for such services is sizable; the federal

government spent $1.2 billion annually on such services. In addition, the standardized nature

of the work, along with the fact that the contracts are rarely terminated, mitigates concerns

about the impact of relationship-specific investments in this setting.

To the best of the author’s knowledge, this is the first dataset on contracts to combine

measures price, duration, and competition, which are the key outcomes of the model. To

construct this dataset, I combined detailed location, price, and vendor information maintained

in the Federal Procurement Data System (FPDS) with contract-specific documents downloaded

from the Federal Business Opportunities (FedBizOpps) website. By law, the FPDS keeps public

records of all contracts for the U.S. federal government, and its data has been used in recent

empirical work (e.g., Kang and Miller, 2017; Bhattacharya, 2018; Decarolis et al., 2018). I was

able to identify 4,119 contracts that appeared in both sources. The final sample was restricted

to competitive contracts in the United States that received more than one bid, had an annual

price of less than $1 million, and included square footage in the text of the contract documents,

which is a key cost factor. These contracts span different types of facilities and government

agencies. For additional details on the construction of the sample, see Appendix C.1.

The FPDS data is subject to measurement error. To correct for this, I collected a subsample

of 75 finalized contracts and cross-validated price, duration, and total contract value to what

was reported in FPDS. The cross-validation approach allowed me to generate accurate measures

14

For context, 97 percent of federal government contracts during the period had an annual price of under $1

million. A counter-example of the ideal setting for this sort of analysis might be a customized, large-scale computer

software system for an agency.

14

for the value of the contract. For details, see Appendix D.

I matched the contract-specific dataset with auxiliary datasets of (1) government contract-

ing expenditures at the same location in related products and (2) local labor market conditions.

Local labor market conditions include county-level unemployment from the Local Area Unem-

ployment Statistics and the number of NAICS-code level establishments in the same 3-digit ZIP

code from the County Business Patterns data.

3.2 Institutional Details

Competitive contracts are posted publicly and allow open competition from registered ven-

dors.

15

Many of these contracts are posted on the centralized web portal FedBizOpps.gov, from

which I collected the data in this analysis. On the website, a prospective supplier can view the

contract details, including contract duration and the square footage of the building, require-

ments for the job, and a list of interested suppliers. From the portal, a supplier submits a bid

to the contracting office that includes the total price over the duration of the contract. The

contracting office determines the winning supplier primarily based on the lowest price. By law,

the contracting office must justify selecting other than the lowest-price offer.

Importantly, contract duration is determined by the local contracting office and varies from

contract to contract, even within an agency. As several industry personnel described to the

author, contract duration is a balance between minimizing the administrative costs of re-

contracting and realizing lower supply costs from re-competing more frequently. Administrative

costs include market research, drafting contract specifications, ensuring compliance with poli-

cies and regulations, advertising the opportunity, administering a supplier selection mechanism,

and concluding the contract. Ex ante transaction costs and the competitive benefits of shorter

contracts are key factors for the duration decision, motivating this market as a case study.

Contracts include specifications for the tasks to be done and their frequencies. For building

cleaning, tasks include mopping, vacuuming carpets, picking up debris, dusting, and emptying

trash cans. For an example list of specifications, see Appendix C.4. Contract documents are

extensive, and multiple documents are often posted for each solicitation. The median primary

document runs 49 pages.

As mentioned previously, one motive for using this market as a case study is that ex post

incentive problems are not a significant concern, based on the nature of the service (Hyytinen

et al., 2018), conversations with contracting officers, and the data. The extensive list of contract

specifications combined with observable performance means these contracts are more or less

complete; ex post incentives might be of more concern in a different equilibrium with less

15

These contracts fall under three categories: Full and Open Competition, Full and Open Competition after the

Exclusion of Sources, and Competed Under Simplified Acquisition. 86 percent of the contracts deemed Full and

Open Competition after the Exclusion of Sources are listed as a small business set-aside. As 96 percent of the

contracts are won by small businesses (as determined by the contracting officer), I ignore this distinction for the

purposes of analysis. See Federal Acquisition Regulation (FAR) Part 5.

15

Table 1: Summary Statistics

Mean Min p25 Median p75 Max

Price (Annual, $) 43,870 1,112 7,259 13,180 26,731 976,538

Contract Value ($) 190,200 2,914 28,500 50,550 102,000 4,882,692

Duration (Years) 4.2 0.4 3.0 5.0 5.0 6.5

Square Footage 25,701 145 3,700 7,000 14,500 2,031,842

Price per Square Foot 2.91 0.16 1.32 2.01 3.14 33.02

Number of Bids 6.5 2.0 4.0 5.0 8.0 40.0

Weekly Frequency 3.5 0.1 2.0 3.0 5.0 7.0

Num. Employees (Winner) 61.5 1.0 3.0 14.0 75.0 650.0

Observations 1046

Notes: The table displays summary statistics for key variables in the contract data. Included are outcomes (price, duration,

and number of bids), as well as cost characteristics such as the number of square feet and the frequency of cleaning. The

last variable is the size of the winning firm, in terms of number of employees.

rich contracts. Service contracts under $1 million annually are rarely canceled, and the use of

fixed-price contracts limits the ability of firms to drive up costs, compared to cost-plus contracts.

In particular, building cleaning services have lower rates of terminations, change orders, and

additional work than the average federal government service contract.

16

For these contracts,

the best estimate of what the buyer pays is the initial stated value of the contract. I provide

empirical support for this in Appendix D.3, where I show that the median overrun, defined as

the difference between the total payments made and the initial value of a contract, is zero.

17

3.3 Summary Statistics

Summary statistics for the contracts are displayed in Table 1. Contracts vary in price, duration,

and the number of bids. As shown later in this section, much of the variation in price can

be captured by the square footage of the building and the weekly cleaning frequency. For the

sample, which removes contracts greater than $1 million per year, the mean annual contract

price is $43,870 and the median is $13,180. The sample contains 76 contracts with an annual

price greater than $100,000.

Overall, the estimation sample compares favorably to the broader set of cleaning contracts

in the FPDS. For fiscal years 2004 to 2016, an average of 6,366 cleaning contracts are in effect

each year. 95 percent of these have an annual value of less than $1 million. Within this subset,

the mean annual value is $70,322 and the median is $11,200. Cleaning contracts are larger in

16

On a contract-by-contract basis, these outcomes occur at higher rates for building cleaning services. However,

after correcting for the fact that building cleaning contracts last 3 to 4 times longer the typical service contract, the

comparison is reversed. In other words, other services require, on average, 3 to 4 contracts to cover the same period

as a typical building cleaning contract.

17

The initial entry for total contract value in FPDS is systematically underreported, as shown in Appendix D. Thus,

comparing total payments to the initial entry in FPDS would systematically overstate the degree of cost overruns.

16

value than the average contract. For all contracts with an annual value of less than $1 million,

the mean annual value is $35,469 and the median is $4,731. These contracts comprise 97

percent of all contracts in the relevant period, or an average of 1,004,991 each year.

One important source of variation in the analysis is in the number of bids received. The

median is 5 bids, and the maximum is 40. Thus, there is a good deal of competition for these

contracts. The variation in the number of bids will help to disentangle the effect of private costs

from unobserved heterogeneity in the structural analysis.

In the last row, the table provides the number of employees for the winning firms. The

winning firms in this dataset are typically small, with a median of 14 employees. Over 25

percent of the winning suppliers have 3 or fewer employees.

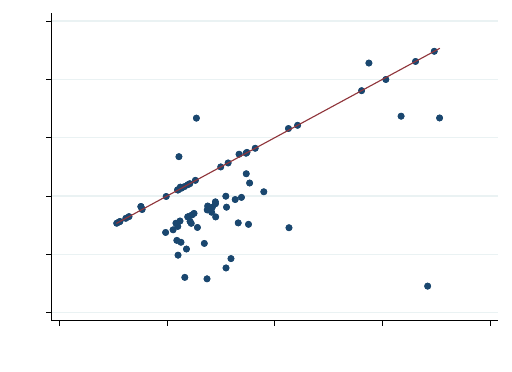

Figure 2 plots the logged values of the winning bids on the y-axis against the number of

bidders on the x-axis. The second panel displays residualized values for the (log) winning

bids. The residuals were constructed from a regression of price on duration, square footage,

cleaning frequency, baseline unemployment, and fixed effects for facility type. Even after con-

trolling for observable characteristics, there is large variation in prices for auctions with many

bidders. The pattern observed in the figure—large variation in prices with clustering at the me-

dian price, rather than the minimum—motivates the assumption of unobserved auction-specific

heterogeneity used in the model. Though much of the variation in prices can be explained by

observables, there is still residual variation that is inconsistent with an independent private

values model; the model with multiplicative common costs fits far better.

The contracts in the dataset have a good deal of variation in duration, ranging from 5

months to 6.5 years, though contracts tend to cluster at yearly increments. Figure 3 provides

a histogram of duration in three-month intervals. Empirical variation in contract duration

occurs within and across government agencies. Consistent with the model, larger facilities and

more frequent cleaning are correlated with shorter contracts, after conditioning on department

and facility type.

18

As a first-pass check that transaction costs matter, contracts issued under

the government’s simplified acquisition protocol, which reduces the ex ante transaction costs,

are 15 percent shorter than other contracts, after conditioning on square footage, cleaning

frequency, and facility type.

Notably, 53 percent of contracts are for 5 years, which is the typical maximum contract

duration imposed by federal budgeting regulations. Longer durations require the contracting

officer to request and justify an extension. The observed variation in duration, combined with

the five-year cap on contract duration, help motivate the counterfactual analysis of Section 6,

where I consider the value of the duration decision compared to standard-duration contracts.

The buildings to be cleaned for each contract are categorized into offices (694), research

facilities (111), medical facilities (61), service centers (59), visitor centers (41), airports (30),

technical facilities (19), accommodations (18), and industrial facilities (13). Offices are split

18

For summary statistics by agency, see Appendix C.3.

17

Figure 2: Price versus Number of Bids

(a) Annual Price

1.0

3.2

10.0

32.0

100.0

316.0

1000.0

10 20 30 40

Number of Bids

Annual Price ($1000, Log Scale)

(b) Residualized Annual Price

−2

−1

0

1

2

10 20 30 40

Number of Bids

Residualized Log Winning Bid

Notes: The figure plots the log annual price against the number of bids received for each

contract. There is a great deal of variation in the annual price, much of which cannot be

explained by observable variables. This is illustrated by the residualized bids in the lower

panel. The R

2

of the regression used to construct the residuals, which includes duration,

square footage, frequency, baseline unemployment, and fixed effects for facility type, is

0.74. It is notable that some of the highest and lowest prices are realized with few bidders.

18

Figure 3: Contract Duration

.1 .2 .3 .4 .5 .6

Fraction

1 2 3 4 5 6

Duration (Years)

Notes: The figure displays a histogram of contract duration in 3-month bins. Over half of

the contracts have a five-year duration, which is the maximum duration (by regulation)

without specifically requesting an extension. Contracts are clustered in yearly intervals,

though the support in between full years is relatively well-covered.

into standard offices (424) and field offices (270), which also have an auxiliary building, such

as an exercise room, a bunkhouse, or a small warehouse. Appendix C.2 provides a breakdown

by the issuing agency and by subcategory.

3.4 Descriptive Regressions

To demonstrate the fit between the model and the data and to motivate specific assumptions

made in estimation, I present descriptive regressions. Table 2 provides regressions of the log

annual price on the number of bids, duration, and controls. The first three columns display the

results from ordinary least squares (OLS) regressions. Square footage alone, as reported in the

first specification, captures 62 percent of the variation in prices.

To account for endogenous entry, I instrument for the number of bidders using time-series

and cross-sectional variation in local labor market conditions, as well as variation in the type of

bidders permitted to compete for the contract. The first instrument is the (log) ratio of county-

level unemployment relative to a 2004 baseline. This generates a time-varying county-specific

unemployment shock. The second instrument is the number of establishments for NAICS code

561720 (corresponding to building cleaning services) in the same 3-digit ZIP code.

19

It is

plausible that an increase in unemployment or the presence of more firms in the broader ge-

19

I add 1 to the raw value to use the logged value in estimation, as a few contracts have zero in the raw value.

19

Table 2: Descriptive Regressions: ln(Annual Price)

OLS-1 OLS-2 OLS-3 IV-1 IV-2

ln(Square Footage) 0.730

∗∗∗

0.658

∗∗∗

0.658

∗∗∗

0.689

∗∗∗

0.687

∗∗∗

(0.018) (0.017) (0.017) (0.024) (0.024)

Number of Bids −0.014

∗∗∗

−0.009

∗

−0.053

∗∗

−0.047

∗∗

(0.005) (0.005) (0.022) (0.022)

Duration (Years) 0.041

∗∗∗

0.032

∗∗

0.043

∗∗∗

0.033

∗∗

(0.015) (0.015) (0.016) (0.015)

ln(Weekly Frequency) 0.459

∗∗∗

0.394

∗∗∗

0.467

∗∗∗

0.407

∗∗∗

(0.039) (0.038) (0.041) (0.040)

ln(2004 Unemp.) 0.054

∗∗∗

0.037

∗∗∗

0.080

∗∗∗

0.060

∗∗∗

(0.012) (0.012) (0.019) (0.018)

High-Intensity Cleaning 0.586

∗∗∗

0.559

∗∗∗

(0.071) (0.075)

Building Type FEs X X

Observations 1046 1046 1046 1046 1046

R

2

0.62 0.71 0.74 0.69 0.73

Standard errors in parentheses

∗

p < 0.10,

∗∗

p < 0.05,

∗∗∗

p < 0.01

Notes: The table displays estimated coefficients from regressions of log annual price on auction

characteristics. The variables from specification IV-1 are included in the structural model. These

regressions show that square footage, cleaning frequency, and market characteristics explain

much of the variation in prices. Once square footage, cleaning frequency, and market character-

istics are accounted for, fixed effects for location type add little explanatory power. Specifications

IV-1 and IV-2 are two-stage least squares regressions, where the instruments for the number of

bids are monthly (log) county-level unemployment relative to 2004, the (log) number of NAICS

code 561720 establishments in the same 3-digit ZIP code in 2004, and an indicator for whether

the set-aside was for generic small businesses.

ographic area are not driven by unobservable characteristics of these contracts, yet they are

likely to generate increased entry.

A third instrument is developed from the federal government practice of “setting aside” cer-

tain contracts for firms with particular types of owners. Specialized set-asides include women-

owned and veteran-owned small businesses. As we have removed economically disadvantaged

set-asides (e.g., for Economically Disadvantaged Women-Owned Small Business) from the sam-

ple, it is plausible that the ownership type is uncorrelated with the underlying cost structure of

the participating firms. If the cost structure is independent of ownership for these firms, then

the type of set-aside is a valid instrument for price (by affecting entry). This instrument is im-

plemented as a binary variable with the value of 1 if the contract is open to all small businesses,

i.e., the set-aside does not restrict entry based on characteristics of the owner.

The last two columns report the estimated coefficients from instrument variables regres-

sions. Consistent with endogenous entry, I find a larger negative effect of the number of bidders

on price compared to the corresponding OLS specifications. In the structural model of Section

20

Table 3: Descriptive Regressions: Number of Bids

(1) (2) (3) (4)

Duration (Years) 0.104 −0.017 −0.002 −0.002

(0.104) (0.099) (0.099) (0.100)

ln(Square Footage) 0.760

∗∗∗

0.779

∗∗∗

0.834

∗∗∗

0.825

∗∗∗

(0.111) (0.106) (0.106) (0.112)

ln(Weekly Frequency) 0.487

∗

−0.081 0.009 0.137

(0.254) (0.247) (0.253) (0.257)

ln(2004 Unemp.) −0.832

∗∗∗

−0.794

∗∗∗

−0.793

∗∗∗

(0.239) (0.238) (0.238)

ln(Unemployment) 1.415

∗∗∗

1.420

∗∗∗

1.356

∗∗∗

(0.232) (0.231) (0.231)

ln(Num. Firms in Zip3) 0.241 0.257

∗

0.276

∗

(0.148) (0.148) (0.147)

Generic Set-Aside 1.134

∗∗∗

0.987

∗∗∗

(0.350) (0.361)

High-Intensity Cleaning −0.294

(0.475)

Building Type FEs X

Observations 1046 1046 1046 1046

R

2

0.06 0.16 0.17 0.19

F -statistic 22.2 32.0 25.9 14.7

Standard errors in parentheses

∗

p < 0.10,

∗∗

p < 0.05,

∗∗∗

p < 0.01

Notes: The table displays estimated coefficients from regressions of the number of

bids on auction characteristics and local labor market variables. Specification (3) is

equivalent to the first-stage regression of IV-1 in Table 2. Specification (4) includes

fixed effects for each building type.

5, I explicitly model entry to account for this endogeneity. The main motivating specification

is IV-1, which uses square footage, weekly cleaning frequency, and baseline (2004) unemploy-

ment as controls. To capture variation in the types of buildings and cleaning required, IV-1

includes an indicator for "high intensity" cleaning of airports and medical buildings. IV-2 in-

cludes indicators for all building types. The inclusion of fixed effects for all types have low in

specifications OLS-3 and IV-2 have a low per-variable impact on R

2

and do not have a substan-

tial effect on the estimated coefficients. Therefore, I omit them from the structural estimation

and proceed with the variables used in IV-1.

20

Though the linear model does not account for the offsetting effects of duration on price

and (via profits) on entry, the regressions capture a positive relationship between price and

20

Each of the three instruments, when used by itself, pushes the coefficient on number of bids more negative and

has little impact on the other coefficients. If separate indicators are estimated for medical buildings and airports,

the coefficients on the indicators are very similar and the coefficients on the other variables are unchanged.

21

duration. This reduced-form correlation is consistent with Proposition 1, which predicts that a

longer duration generates a higher per-period price. Thus, the data match a key distinguishing

feature of the model of optimal duration. In the structural estimation, I also find a positive and

significant direct relationship between duration and price.

In Table 3, I display regressions of the number of bids on auction characteristics and local

measures of unemployment. Specification (3) is equivalent to the first-stage regression in IV-1,

with an F -statistic of 25.9. All three instruments—the unemployment shock, the presence of

existing firms, and a generic set-aside—have the expected positive signs. Though current un-

employment is associated with more bids, higher baseline levels, which are used as a control,

are associated with fewer bids. I interpret the negative correlation between higher 2004 un-

employment and fewer bids as a reflection of local labor market frictions, leading to reduced

competition and higher wages.

4 Empirical Implementation

4.1 Supplier Participation, Bidding, and Equilibrium

In the general model of Section 2, the buyer decides on the contract T with knowledge of

P (T, x, m), the expected price conditional on contract and market characteristics. The buyer’s

expectation is taken over the number of bidders N and the cost realizations for these bidders.

For the empirical analysis, we separately model the participation decision that determines

Pr(N = n|T, x, m) and the market mechanism that determines E[P (n, T, x, m)|N = n]. The

model thus proceeds in three stages: the first stage reflects the buyer’s problem, the second

stage is the participation decision of suppliers, and the third stage is the market mechanism

that determines the chosen supplier and the price.

1st Stage: Duration Decision The buyer observes (x, m, δ) and sets T to minimize the ex-

pected per-period price plus the amortized transaction cost. The buyer’s objective function is:

min

T ∈T

N

X

n=1

(E[P (n, T, x, m)] · Pr(N = n|T, x, m)) +

δ

P

T

k=1

β

k−1

. (11)

2nd Stage: Participation Potential entrants observe (T, x, m), entry costs k(m) · ε, and con-

tract cost-shifters h(x). These costs are common across bidders. k(m) and h(x) are observed by

all parties (including the econometrician), but the entry shock ε is only observed by suppliers.

Bidders enter if expected profits exceed entry costs. Profits conditional on participation

depend on total contract costs C

i

· U · h(x). Thus, we make the usual assumption that cost

components are multiplicative. Bidders do not observe the private cost C

i

or the common cost

22

Figure 4: Summary of Model

Price

Contract

Duration

Number

of Bids

Transaction

Costs

Contract

Characteristics

Entry

Conditions

Notes: The figure summarizes the causal assumptions embedded in the empir-

ical model. The three sets of variables on the left: entry conditions, contract

characteristics, and transaction costs, are taken as given. Price, number of

bids, and contract duration are jointly determined in the model. Arrows indi-

cate the direction of causality.

U until after they decide to participate. In this context, U captures unobserved auction-specific

heterogeneity.

Let π

n

denote proportional profits for the n

th

marginal entrant, which depends on C

i

, the

distribution of C, and the number of participating suppliers. Total profits are π

n

· U · h(x). The

entry condition is given by

E[π

n

· U · h(x)|n, T ] − k(m) · ε > 0 ⇐⇒ N ≥ n. (12)

3rd Stage: Bidding Participating suppliers realize their private (proportional) cost C

i

and the

common cost U . They then engage in a supplier selection mechanism. For the empirical appli-

cation, we model the mechanism as a first-price auction, though the model can be generalized

to other structures.

We assume bidders are risk neutral. Therefore, in equilibrium, each bidder submits a bid of

b

i

· U · h(x), where b

i

represents the proportional bid for bidder i. The lowest proportional bid,

B, is the winning bid.

Equilibrium is characterized by the buyer choosing duration to minimize expected buyer

costs, potential suppliers entering if expected profits exceed entry costs, and participating sup-

pliers bidding optimally in the market mechanism. The model is summarized in Figure 4.

Relative to a standard auction model with entry, the model also allows for a strategic decision

by the buyer (duration).

23

4.2 Identification of Participation and Bidding

As shown in Section 2, contract-specific transaction costs are identified conditional on P (T, x, m),

using the optimality condition of the buyer. The function P (T, x, m), which captures the partic-

ipation and bidding game, is identified separately. It is identified even if T is not set optimally,

or if T is chosen from a restricted set (e.g., capped a maximum duration).

4.2.1 Identification of Supply Price

The econometrician observes the transaction price P = B · U · h(x) as well as (N, T, x, m). The

cost shocks U, ε, and C are unobserved by the buyer and the econometrician, but their distri-

butions are common knowledge. To achieve nonparametric identification, we make restrictions

on the distributions of unobservables. Assume

(i) Independence of Unobservables: C

i

, U, and ε are independent conditional on (N, T, x, m).

(ii) Mean Independence of Common Shocks: E[ε|T, x, m] = E[ε] and E[U|T, x, m] = E[U].

E[U ] is normalized to 1.

(iii) h(·) and k(·) are continuous, and the range of h(·) or k(·) has broad support. h(x

0

) and

k(m

0

) are normalized to 1 for specific values of x and m.

Importantly, we assume that U is independent of T . In the timing of the model, U is realized

after T is chosen; T depends endogenously on (x, m, δ) but not U. Under these assumptions, it

is straightforward to obtain identification of the expected proportional bid (B), the cost-shifter

functions, and relative profits:

Proposition 5. When (P, N, T, x, m) is observed, the following components of the model are

identified:

1. E[B|N, T, x, m]

2. h(x) and k(m)

3. Relative profits for N and N

0

participants:

E[π

N

|N,T ]

E[π

N

0

|N

0

,T ]

4. Relative profits for T and T

0

with N participants:

E[π

N

|N,T ]

E[π

N

|N,T

0

]

Proof. See Appendix E.

The first two components are sufficient to identify P (T, x, m) and transaction costs, without

using the auction structure for the third stage of the game. Thus, even when the underlying

selection mechanism is unknown, the model can be useful for counterfactual analysis of the

impact of duration and transaction costs.

24

4.2.2 Identification of Profits and the Joint Distribution of Costs

With additional structure on the final mechanism, seller surplus can be identified. This can be

useful in analyzing efficiency and for identification of the full joint distribution of costs. To this

end, in addition to (i)-(iii) we further assume:

(iv) Bidders are symmetric: C

i

∼ F

i

, with F

i

= F for all i.

(v) F is continuous with positive support. U ∼ G, where G has positive support.

(vi) Auctions with sequential values of N ∈ {N, ..., N } are observed, with N < N.

Proposition 6. When the supplier selection mechanism is an auction with symmetric bidders, seller

surplus is identified.

Proof. See Appendix E.

Variation in N, combined with identification of relative profits, allows for identification of seller

surplus in the auction model.

Once seller surplus (or expected profit) is identified, the distribution of ε is identified from

equation (12), using variation in h or k. Further, we can pin down properties of the private cost

distribution.

Proposition 7. The first (N − N + 2) expected order statistics of N draws from F are identified,

providing (N − N + 2) restrictions on the private cost distribution.

Proof. See Appendix E.

Intuitively, exogenous variation in N shifts the private cost component of the winning bid,

but not the common costs. Restrictions on the order statistics of F have additional power in that

they may reject many classes of flexible distributions with (N − N + 2) parameters. Because the

full set of expected order statistics approximates the quantile function when N is large, exact

nonparametric identification of F is obtained when N = 2 and N → ∞.

Corollary 2. The distribution of unobserved heterogeneity is obtained after F is identified.

Proof. By independence, we can use the characteristic function transform to write ϕ

ln W

N

(z) =

ϕ

ln B

N

(z) · ϕ

ln U

, where W

N

= B

N

· U is the observed winning bid scaled by the observables and

B

N

is the distribution of the proportional winning bid conditional on N. We can construct this

function for two different values of N. Once the characteristic function of F is obtained, either

by exact identification (N → ∞) or by flexible estimation methods, G is pinned down.

25

4.2.3 Discussion of Identification Assumptions

In my empirical setting, it is important to account for unobserved auction-specific heterogeneity.

The baseline set of assumptions map to the setting of Krasnokutskaya (2011), while allowing

for endogenous entry. Symmetry is a typical assumption in auction models of unobserved het-

erogeneity (see also, e.g., Aradillas-López et al., 2013). To relax symmetry, one could consider

alternative restrictions to pin down costs and the joint distribution of outcomes. One alternative

would be to employ supplementary data on profits for one (N, T ) pair. This would identify the

expected profit function, which could then be used to identify the joint distribution of costs.

21

Another common assumption is that bidders realize some auction-specific costs after decid-

ing to participate. This assumption may a reasonable approximation in this setting because

observables explain roughly 70 percent of the variation in prices. One could relax this as-

sumption by allowing bidders to select into the auction based on observing U beforehand. In

this case, it is straightforward to extend the identification results. Additional steps would be

required if potential bidders observed their private cost draw before deciding to participate.

These assumptions are sufficient for the nonparametric identification of the auction model.

In effect, the entry cost shifters m serve as instruments for the number of bidders. Exogenous

variation in N is then used to separately identify private costs from unobserved heterogeneity.

With no instruments, these distributions can still be separately identified. Therefore, with