To the Reader 1

Chapter 1: Introduction 2

Insurance Industry at a Glance 2

Chapter 2: Contribution to the National Economy 4

Employment 4

Insurance Payrolls 5

Premiums 5

Surplus Lines 6

Major Players Rankings by Line 7

Taxes 11

Comparison with Other Industries 12

Charitable Contributions 12

Contribution to GDP 13

Chapter 3: Insurers as Investors 14

Introduction 14

Property/Casualty Industry Investments 14

Life/Health Industry Investments 17

Ownership of Municipal Securities 18

Chapter 4: Defraying the Economic Costs of Disasters 19

Introduction 19

Reinsurance 21

Hurricanes 22

Tornadoes 24

Earthquakes 25

Wildfires 26

Terrorism 27

Chapter 5: Contribution to Selected Industries 29

Introduction 29

Auto Repair Industry 29

Construction Industry 30

Healthcare Industry 30

Chapter 6: Role of Credit/Mortgage Insurance 33

Credit Insurance for Short-term Trade Receivables 33

Private Mortgage Insurance 33

Credit Life/Health 34

Chapter 7: Income Replacement 36

Life Insurance Payouts 36

Disability Insurance Premiums 36

Workers Compensation Indemnity Payouts 37

Chapter 8: Contribution to State Economies 38

Employment 38

Premiums 40

Surplus Lines 50

Gross State Product 52

State Taxes 54

Insurance Companies by State 55

Catastrophes by State 57

Residual Markets 62

Captives by State 64

Incurred Losses by State 65

Insured Cars by State 73

Insured Homes by State 75

Businesses by State 76

Appendices 78

I.I.I. Resources 78

Insurance and Related Service Organizations 80

I.I.I. Member Companies 94

I.I.I. Staff 97

I.I.I. Board of Directors 98

A Firm Foundation updates at www.iii.org/firm-foundation/ 1

To The Reader

Insurance affects everything and everything affects insurance. It is generally understood that

insurance allows those who participate in the economy to produce goods and services without

the paralyzing fear that some adverse incident could leave them destitute or unable to function.

However, few people are aware of the extraordinary impact the industry has on state, local and

national economies.

To explain the ways that both property/casualty and life insurance contribute to our economy

far beyond their core function of helping to manage risk, the Insurance Information Institute

has produced a website, A Firm Foundation: How Insurance Supports the Economy

(www.iii.org/firm-foundation/), which is updated frequently. This PDF version includes the

entire contents of this unique resource.

The insurance industry is a major U.S. employer, providing some 2.3 million jobs that

encompass a wide variety of careers, from human resource administrators to public relations

managers to financial analysts.

Insurance companies also help support the economy through their investments. As part of the

financial services industry, insurers act as financial intermediaries, investing the funds they

collect for providing insurance protection. The insurance industry (property/casualty and

life/health) is a key player in the capital markets, with $7.0 trillion in financial assets in 2012,

including $1.4 trillion held by property/casualty insurers and $5.6 trillion held by life insurers,

according to data from the Federal Reserve Flow of Funds.

Insurers contributed $413 billion to the nation’s gross domestic product in 2012. Their taxes

include special levies on insurance premiums. Insurance companies, including life/health and

property/casualty companies, paid $16.7 billion in premium taxes to the 50 states in 2012. On a

per capita basis, this works out to $53 for every person living in the United States.

This publication shows the myriad ways in which insurance supports the economy. Each chart

illustrates one or more elements. Together they tell a tale that is rarely told—that insurance

helps provide the firm foundation for a functioning economy.

Robert P. Hartwig,

President

Insurance Information Institute

A Firm Foundation updates at www.iii.org/firm-foundation/ 2

Insurance Industry at a Glance

The U.S. insurance industry’s net premiums written totaled $1.1 trillion in 2012, with

premiums recorded by life/health (L/H) insurers accounting for 58 percent and

premiums by property/casualty (P/C) insurers accounting for 42 percent, according to

SNL Financial LC.

P/C insurance consists primarily of auto, home and commercial insurance. Net

premiums written for the sector totaled $456 billion in 2012.

The L/H insurance sector consists primarily of annuities and life insurance. Net

premiums written for the sector totaled $643 billion in 2012.

Health insurance is generally considered separate. The sector includes private health

insurance companies as well as government programs. P/C and L/H insurers also write

some health insurance.

There were 6,115 insurance companies in 2012, including P/C (2,660 companies),

life/annuities (913), health (806), fraternal (88), title (58), risk retention groups (272)

and other companies (1,318).

Insurance carriers and related activities accounted for $398 billion, or 2.6 percent of

U.S. gross domestic product in 2011.

The U.S. insurance industry employed 2.3 million people in 2012. Of those, 1.4 million

worked for insurance companies, including life, health and medical insurers (807,900

workers), P/C insurers (591,300 workers) and reinsurers (25,600 workers). The

remaining 912,300 people worked for insurance agencies, brokers and other insurance-

related enterprises.

Total P/C cash and invested assets were $1.4 trillion in 2012. L/H cash and invested

assets totaled $3.4 trillion in 2012. The majority of these assets were in bonds (65

percent of P/C assets and 75 percent of L/H assets).

P/C and L/H insurance companies paid $16.7 billion in premium taxes in 2012, or $53

for every person living in the United States.

P/C insurers paid out $35.0 billion in property losses related to catastrophes in 2012,

compared with $33.6 billion in 2011, according to ISO. There were 26 catastrophes in

2012, compared with 30 in 2011.

A Firm Foundation updates at www.iii.org/firm-foundation/ 4

Chapter 2: Contribution to the National Economy

Employment

CAREERS AND EMPLOYMENT

The insurance industry is a major U.S. employer, providing some 2.3 million jobs that

encompass a wide variety of careers, from human resource administrators to public relations

managers to financial analysts. Some jobs, such as claims adjusters, actuaries and insurance

underwriters, are unique to the insurance industry. For information about the many career

opportunities in the insurance industry consult the Bureau of Labor Statistics’ Career Guide to

Industries, posted on the Web at http://www.bls.gov/oco/cg/cgs028.htm

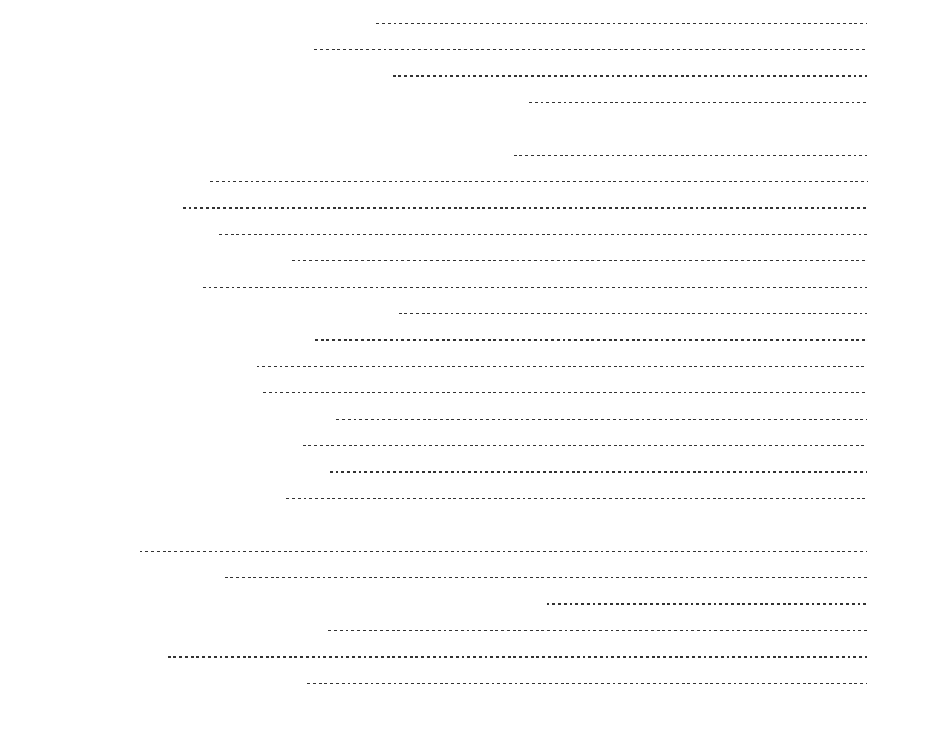

EMPLOYMENT IN INSURANCE, 2003-2012

(Annual averages, 000)

Insurance carriers

Insurance agencies, brokerages and related

services

Direct insurers (1)

Year

Life, health

and

medical

Property

/

casualty

Reinsurer

s

Total

Insurance

agencies

and brokers

Other

insurance-

related

activities (2)

Total

Total

industry

Insurance

and employee

benefit funds (3)

2003

789.0

710.0

31.0

1,530.0

628.5

208.9

837.4

2,367.4

47.1

2004

764.4

678.5

29.8

1,472.7

643.3

216.8

860.1

2,332.8

47.0

2005

761.9

639.0

28.8

1,429.7

650.1

223.5

873.6

2,303.3

46.4

2006

787.4

635.4

28.0

1,450.9

659.9

230.9

890.8

2,341.7

47.8

2007

784.0

633.2

27.0

1,444.1

675.3

234.5

909.8

2,353.9

48.6

2008

797.6

632.7

27.9

1,458.1

669.1

239.4

908.5

2,366.7

49.0

2009

799.7

619.1

27.5

1,446.3

650.8

236.0

886.7

2,333.0

49.1

2010

801.0

600.9

26.8

1,428.6

639.9

235.3

875.2

2,303.8

48.7

2011

785.9

598.3

25.6

1,409.7

646.8

243.4

890.2

2,299.9

46.9

2012

807.9

591.3

25.6

1,424.8

658.4

253.8

912.3

2,337.1

47.4

(1) Establishments primarily engaged in initially underwriting insurance policies.

(2) Includes claims adjusters, third-party administrators of insurance funds and other service personnel such as advisory and

insurance ratemaking services.

(3) Includes employees of legal entities organized to provide insurance and employee benefits exclusively for the sponsor, or its

employees or members. These employees are not included in the total for the insurance industry.

Source: U.S. Department of Labor, Bureau of Labor Statistics.

A Firm Foundation updates at www.iii.org/firm-foundation/ 5

Insurance Payrolls

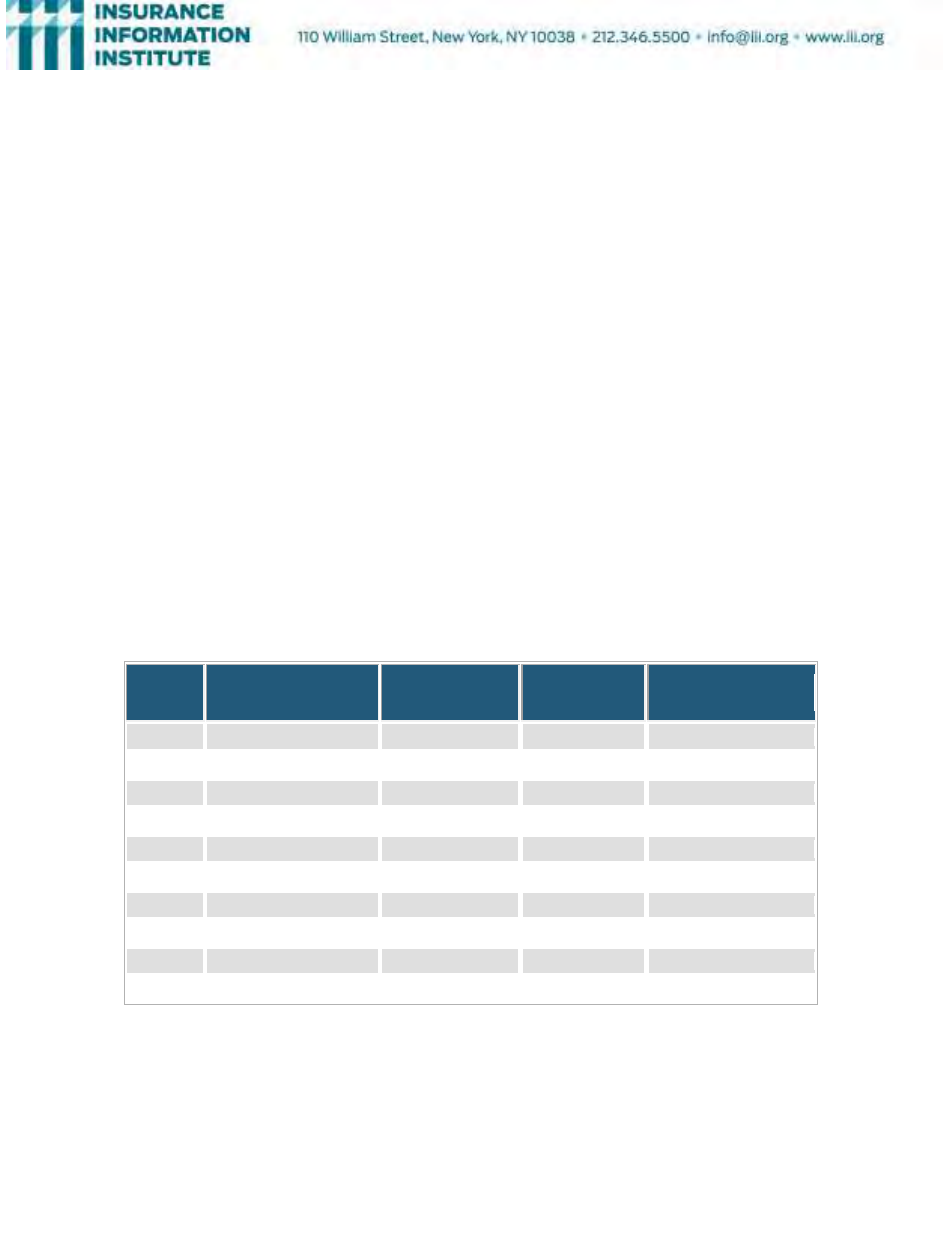

INSURANCE CARRIERS AND RELATED ACTIVITIES COMPENSATION, 2008-2012

Year

Annual payroll ($ billions)

2008

$192.6

2009

185.9

2010

191.6

2011

203.9

2012

214.1

Source: U.S. Department of Commerce, Bureau of Economic Analysis.

Premiums

NET PREMIUMS WRITTEN, PROPERTY/CASUALTY AND LIFE/HEALTH

There are three main insurance sectors. Property/casualty (P/C) consists mainly of auto, home

and commercial insurance. Life/health (L/H) consists mainly of life insurance and annuity

products. P/C and L/H net premiums written rose by 3.3 percent and 3.7 percent, respectively,

in 2012. The third sector, health insurance, is offered by private health insurance companies,

and to a lesser degree by L/H and P/C insurers.

U.S. PROPERTY/CASUALTY AND LIFE/HEALTH INSURANCE PREMIUMS, 2012 (1)

(1) Property/casualty: net premiums written, excludes state funds; life/health: premiums, annuity considerations (fees for annuity

contracts) and deposit-type funds.

Source: SNL Financial LC.

A Firm Foundation updates at www.iii.org/firm-foundation/ 6

PROPERTY/CASUALTY AND LIFE/HEALTH INSURANCE NET PREMIUMS WRITTEN, 2003-2012

($000)

Year

Property/

casualty (1)

Life/

health (2)

Total

2003

$407,226,782

$477,752,340

$884,979,122

2004

425,465,344

507,250,884

932,716,228

2005

422,448,746

520,220,499

942,669,245

2006

447,803,993

575,030,988

1,022,834,981

2007

446,180,660

609,348,564

1,055,529,224

2008

440,320,183

622,120,472

1,062,440,655

2009

423,528,077

506,664,912

930,192,989

2010

425,878,773

577,614,191

1,003,492,964

2011

441,562,154

619,522,960

1,061,085,114

2012

456,116,738

642,602,989

1,098,719,727

Percent change, 2003-2012

12.0%

34.5%

24.2%

(1) Net premiums written, excludes state funds.

(2) Premiums, annuity considerations (fees for annuity contracts) and deposit-type funds for life/health insurance companies.

Source: SNL Financial LC.

Surplus Lines

The surplus lines market, a group of highly specialized insurers exists to provide coverage that is

not available through licensed insurers in the standard insurance market. Each state has surplus

lines regulations and each surplus lines company is overseen for solvency by its home state. The

role of surplus lines in the commercial market has increased over the years. In 2011, surplus

lines accounted for 14.6 percent of the U.S. commercial lines market, up from 9.5 percent in

2001 and 5.2 percent in 1991, according to a September, 2012 A.M. Best report.

GROSS SURPLUS LINES PREMIUMS WRITTEN, 2008-2012

($ billions)

Source: 2010 to 2012 premiums from Business Insurance, September 23, 2013; earlier premiums from other issues.

A Firm Foundation updates at www.iii.org/firm-foundation/ 7

TOP TEN U.S.-BASED SURPLUS LINES INSURANCE COMPANIES BY NONADMITTED DIRECT

PREMIUMS WRITTEN, 2012

Rank

Company/Parent

Nonadmitted direct premiums

1

Lexington Insurance Co. (American International Group lnc.)

$4,285,026,291

2

Scottsdale Insurance Co. (Nationwide Mutual Insurance Co.)

1,253,440,156

3

Steadfast Insurance Co. (Zurich Insurance Co. Ltd.)

1,058,976,202

4

Chartis Specialty Insurance Co. (American International Group lnc.)

809,392,168

5

Columbia Casualty Co. (CNA Financial Corp.)

782,097,439

6

Landmark American Insurance Co. (Alleghany Corp.)

589,564,231

7

Nautilus Insurance Co. (W.R. Berkley Corp.)

489,902,728

8

Westchester Surplus Lines Insurance Co. (Ace Ltd.)

454,599,457

9

Arch Specialty Insurance Co. (Arch Capital Group Ltd.)

448,902,049 (1)

10

Illinois Union Insurance Co. (Ace Ltd.)

448,009,429 (1)

(1) Company statement filed with the National Association of Insurance Commissioners.

Source: Business Insurance, September 23, 2012.

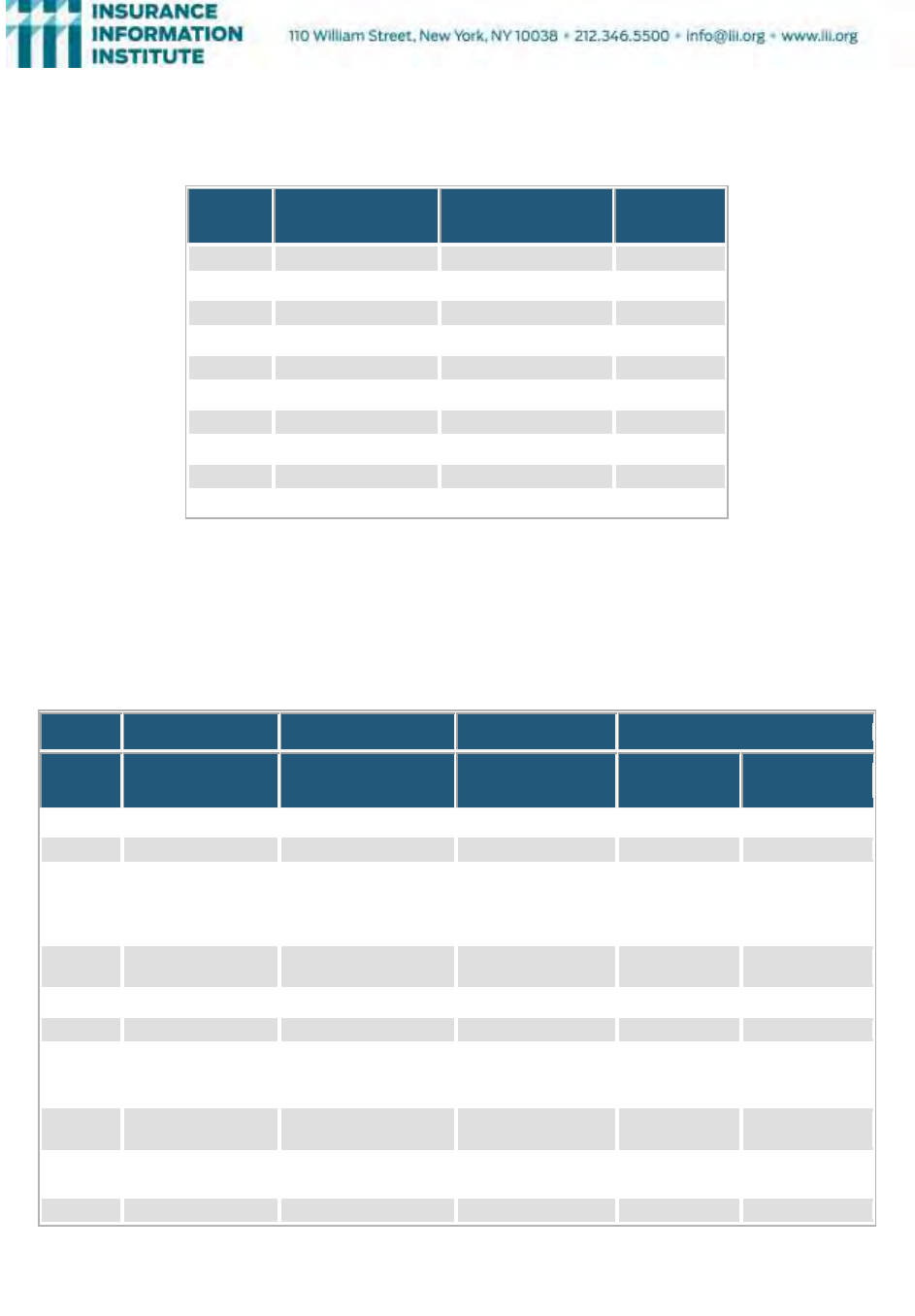

Major Players -- Rankings by Line

As employers, taxpayers and investors, insurance companies play a major role in the U.S.

economy, contributing $404.6 billion to the gross domestic product in 2010. The charts below

identify some of the leading players in this vital sector.

TOP TEN WRITERS OF PROPERTY/CASUALTY INSURANCE BY DIRECT PREMIUMS WRITTEN,

2012

($000)

Rank

Group

Direct premiums written (1)

Market share (2)

1

State Farm Mutual Automobile Insurance

$53,654,237

10.3%

2

Liberty Mutual

28,297,511

5.4

3

Allstate Corp.

26,652,040

5.1

4

American International Group

23,596,418

4.5

5

Travelers Companies Inc.

22,695,958

4.3

6

Berkshire Hathaway Inc.

20,236,495

3.9

7

Farmers Insurance Group of Companies (3)

18,311,402

3.5

8

Nationwide Mutual Group

17,042,933

3.3

9

Progressive Corp.

16,559,746

3.2

10

USAA Insurance Group

13,286,274

2.5

(1) Before reinsurance transactions, includes state funds.

(2) Based on U.S. total, includes territories.

(3) Data for Farmers Insurance Group of Companies and Zurich Financial Group (which owns Farmers' management company) are

reported separately by SNL Financial.

Source: SNL Financial LC.

A Firm Foundation updates at www.iii.org/firm-foundation/ 8

TOP TEN WRITERS OF LIFE INSURANCE/ANNUITIES BY DIRECT PREMIUMS WRITTEN, 2012

($000)

Rank

Group

Direct premiums written (1)

Market share

1

MetLife Inc.

$102,321,495

16.6%

2

Prudential Financial Inc.

85,852,775

13.9

3

Jackson National Life Group

24,206,886

3.9

4

New York Life Insurance Group

24,010,473

3.9

5

ING Groep N.V.

23,513,207

3.8

6

Lincoln National Corp.

21,004,314

3.4

7

Manulife Financial Corp.

20,965,672

3.4

8

Massachusetts Mutual Life Insurance Co.

20,751,732

3.4

9

AEGON NV

19,695,559

3.2

10

Principal Financial Group Inc.

18,336,972

3.0

(1) Includes life insurance, annuity considerations, deposit-type contract funds and other considerations; excludes accident and

health insurance from life/health insurers. Before reinsurance transactions.

(2) Based on U.S. total, includes territories.

Source: SNL Financial LC.

TOP TEN WRITERS OF HOMEOWNERS INSURANCE BY DIRECT PREMIUMS WRITTEN, 2012

($000)

Rank

Group

Direct premiums written (1)

Market share

1

State Farm Mutual Automobile Insurance

$16,299,379

20.7%

2

Allstate Corp.

7,166,931

9.1

3

Farmers Insurance Group of Companies (3)

4,823,694

6.1

4

Liberty Mutual

4,628,086

5.9

5

USAA Insurance Group

3,856,394

4.9

6

Travelers Companies Inc.

3,450,478

4.4

7

Nationwide Mutual Group

2,945,058

3.7

8

Chubb Corp.

1,877,340

2.4

9

Citizens Property Insurance Corp.

1,637,389

2.1

10

American Family Mutual

1,584,681

2.0

(1) Before reinsurance transactions, includes state funds.

(2) Based on U.S. total, includes territories.

(3) Data for Farmers Insurance Group of Companies and Zurich Financial Group (which owns Farmers' management company) are

reported separately by SNL Financial LC.

Source: SNL Financial LC.

TOP TEN WRITERS OF PRIVATE PASSENGER AUTO INSURANCE BY DIRECT PREMIUMS

WRITTEN, 2012

($000)

Rank

Group

Direct premiums written (1)

Market share

1

State Farm Mutual Automobile Insurance

$32,101,907

18.4%

2

Allstate Corp.

17,478,055

10.0

3

Berkshire Hathaway Inc.

16,748,872

9.6

A Firm Foundation updates at www.iii.org/firm-foundation/ 9

Rank

Group

Direct premiums written (1)

Market share

4

Progressive Corp.

14,438,111

8.3

5

Farmers Insurance Group of Companies (3)

10,279,070

5.9

6

USAA Insurance Group

8,447,461

4.8

7

Liberty Mutual

8,263,737

4.7

8

Nationwide Mutual Group

7,136,179

4.1

9

Travelers Companies Inc.

3,393,014

1.9

10

American Family Mutual

3,300,454

1.9

(1) Before reinsurance transactions, includes state funds.

(2) Based on U.S. total, includes territories.

(3) Data for Farmers Insurance Group of Companies and Zurich Financial Group (which owns Farmers' management company) are

reported separately by SNL Financial LC.

Source: SNL Financial LC.

TOP TEN WRITERS OF COMMERCIAL AUTO INSURANCE BY DIRECT PREMIUMS WRITTEN, 2012

($000)

Rank

Group

Direct premiums written (1)

Market share

1

Travelers Companies Inc.

$2,001,805

8.0%

2

Progressive Corp.

1,732,227

6.9

3

Liberty Mutual

1,550,125

6.2

4

Nationwide Mutual Group

1,355,638

5.4

5

Zurich Insurance Group Ltd. (3)

1,195,441

4.8

6

American International Group

993,727

4.0

7

Old Republic International Corp.

809,595

3.2

8

Hartford Financial Services

557,904

2.2

9

Auto-Owners Insurance Co.

542,623

2.2

10

W. R. Berkley Corp.

473,687

1.9

(1) Before reinsurance transactions, excluding state funds.

(2) Based on U.S. total including territories.

(3) Data for Farmers Group and Zurich Financial Group (which owns Farmers’ management company) are reported separately by

SNL Financial.

Source: SNL Financial LC.

TOP TEN WRITERS OF COMMERCIAL LINES INSURANCE BY DIRECT PREMIUMS WRITTEN, 2012

($000)

Rank

Group

Direct premiums written (1)

Market share

1

American International Group

$18,217,418

7.1%

2

Travelers Companies Inc.

15,683,525

6.1

3

Liberty Mutual

15,313,721

5.9

4

Zurich Insurance Group Ltd. (3)

10,206,436

4.0

5

ACE Ltd.

8,294,989

3.2

6

CNA Financial Corp.

8,011,222

3.1

7

Chubb Corp.

7,265,146

2.8

8

Hartford Financial Services

7,260,797

2.8

9

Nationwide Mutual Group

6,637,002

2.6

10

QBE Insurance Group Ltd.

4,704,492

1.8

A Firm Foundation updates at www.iii.org/firm-foundation/ 10

(1) Before reinsurance transactions, includes state funds.

(2) Based on U.S. total, includes territories.

(3) Data for Farmers Insurance Group of Companies and Zurich Financial Group (which owns Farmers' management company) are

reported separately by SNL Financial LC.

Source: SNL Financial LC.

TOP TEN WRITERS OF WORKERS COMPENSATION INSURANCE BY DIRECT PREMIUMS

WRITTEN, 2012

($000)

Rank

Group

Direct premiums written (1)

Market share

1

Liberty Mutual

$4,179,078

8.7%

2

Travelers Companies Inc.

3,801,993

7.9

3

Hartford Financial Services

3,286,686

6.8

4

American International Group

2,952,157

6.1

5

Zurich Insurance Group Ltd. (3)

2,409,805

5.0

6

State Insurance Fund Workers' Comp.

1,943,838

4.0

7

Berkshire Hathaway Inc.

1,256,635

2.6

8

Old Republic International Corp.

1,110,916

2.3

9

Chubb Corp.

1,049,479

2.2

10

AmTrust Financial Services

995,575

2.1

(1) Before reinsurance transactions, includes some state funds.

(2) Based on U.S. total, includes territories.

(3) Data for Farmers Insurance Group of Companies and Zurich Financial Group (which owns Farmers' management company) are

reported separately by SNL Financial LC.

Source: SNL Financial LC.

TOP TEN WRITERS OF EARTHQUAKE INSURANCE BY DIRECT PREMIUMS WRITTEN, 2012

($000)

Rank

Group

Direct premiums written (1)

Market share

1

California Earthquake Authority

$566,664

19.9%

2

State Farm Mutual Automobile Insurance

231,877

8.1

3

Zurich Insurance Group Ltd. (3)

193,214

6.8

4

American International Group

183,585

6.5

5

Travelers Companies Inc.

137,800

4.8

6

GeoVera Insurance Holdings Ltd.

121,021

4.3

7

AXIS Capital Holdings Ltd.

102,776

3.6

8

Liberty Mutual

93,982

3.3

9

ACE Ltd.

78,917

2.8

10

Swiss Re Ltd.

65,725

2.3

(1) Before reinsurance transactions, includes state funds.

(2) Based on U.S. total, includes territories.

(3) Data for Farmers Insurance Group of Companies and Zurich Financial Group (which owns Farmers' management company) are

reported separately by SNL Financial LC.

Source: SNL Financial LC.

TOP TEN HEALTH INSURANCE GROUPS BY DIRECT PREMIUMS WRITTEN, 2012 (1)

($ billions)

A Firm Foundation updates at www.iii.org/firm-foundation/ 11

Rank

Group/company

Direct premiums written

Market share

1

WellPoint Inc.

$51.3

11.6%

2

UnitedHealth Group Inc.

49.6

11.2

3

Health Care Service Corporation

21.2

4.8

4

Aetna Inc.

20.9

4.7

5

Humana Inc.

16.6

3.7

6

Highmark Insurance Group

11.8

2.6

7

Kaiser Foundation Health Plan Inc.

10.7

2.4

8

EmblemHealth Inc.

10.0

2.3

9

Independence Blue Cross

9.6

2.2

10

Horizon Healthcare Services Inc.

9.1

2.0

(1) Based on health insurer annual statement data. Excludes health insurance data from the property/casualty and life/health annual

statements. Excludes territories.

Source: SNL Financial LC.

Taxes

The insurance industry is a major source of tax revenue on the state and federal level. In 2012

property/casualty insurers and life insurers incurred federal and foreign taxes were about $16

billion dollars. Insurance companies, including life/health and property/casualty companies,

paid $16.7 billion in premium taxes to the 50 states in 2012. On a per capita basis, this works out

to $53 for every person living in the United States.

INSURANCE INDUSTRY'S FEDERAL AND FOREIGN INCOME TAXES INCURRED, 2008-2012

($ billions)

Year

Property/casualty

Life

Total

2008

$7.7

-$0.1

$7.7

2009

8.5

10.7

19.1

2010

9.0

9.0

17.9

2011

3.0

5.1

8.1

2012

6.3

10.2

16.4

Source: SNL Financial LC.

A Firm Foundation updates at www.iii.org/firm-foundation/ 12

Comparison with Other Industries

The insurance industry employs 2.4 million people, accounting for about 25 percent of the

workforce in the U.S. financial activities sector, according to the Current Population Survey from

the U.S. Department of Labor.

EMPLOYMENT BY INDUSTRY, 2012

Industry

Employees (000)

Total, all industries

142,469

Agriculture, forestry, fishing, and hunting

2,186

Mining, quarrying, and oil and gas extraction

957

Construction

8,964

Manufacturing

14,686

Wholesale and retail trade

19,876

Transportation and utilities

7,271

Information

2,971

Financial activities

9,590

Insurance carriers and related activities

2,437

Professional and business services

16,539

Education and health services

32,350

Leisure and hospitality

13,193

Other services

7,168

Public administration

6,717

Source: Bureau of Labor Statistics, Current Population Survey (CPS).

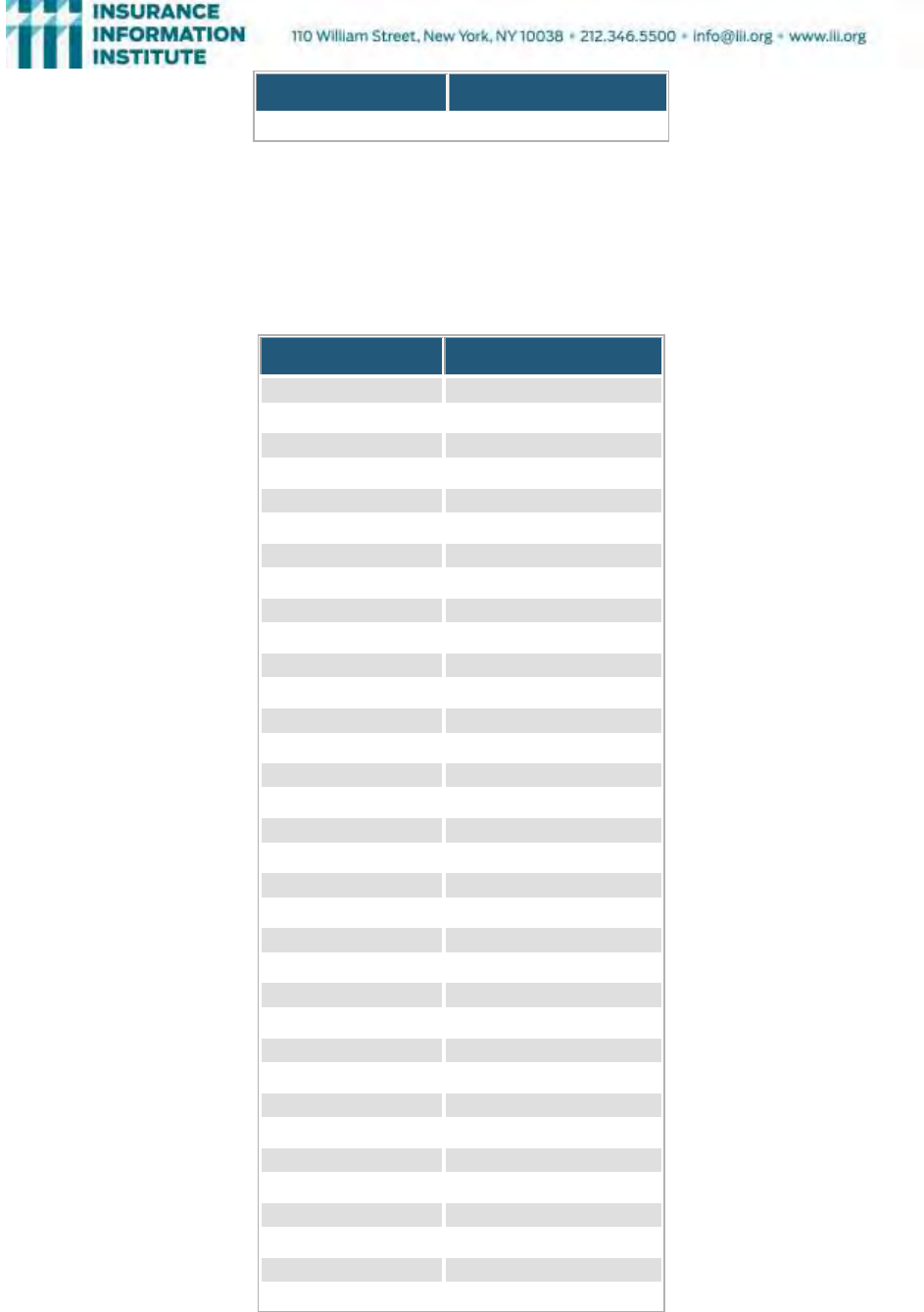

Charitable Contributions

The insurance industry is a major contributor to charitable causes. In 2010 the industry,

including insurance carriers and related firms, made $924 million in charitable contributions,

according to an analysis of corporation tax returns by the Internal Revenue Service.

The property/casualty insurance segment of the industry contributed over $500 million to

charitable causes in 2010, with the bulk of the support going to education, health and social

services, and community and economic development, according to a 2011 report by McKinsey &

Company.

Each year in October the Insurance Industry Charitable Foundation (IICF) promotes a Week of

Giving, during which insurance industry employees volunteer at community programs

throughout the country. The IICF was established in 1994 and is completely directed and funded

by the insurance industry. Since its inception, the IICF has contributed more than $18 million in

grants to charities and 155,000 volunteer hours to hundreds of community nonprofit

organizations.

For information on the insurance industry's contribution to community development see

Impact, I.I.I’s online resource highlighting the insurance industry's contributions to community

development. Information on corporate giving (including contributions by insurance

foundations) is also available from the Foundation Center.

A Firm Foundation updates at www.iii.org/firm-foundation/ 13

BREAKDOWN OF THE PROPERTY/CASUALTY INSURANCE INDUSTRY’S CHARITABLE GIVING

BY CAUSES, 2010

Source: McKinsey IICF survey, Center for Encouraging Corporate Philanthropy, Giving by Numbers 2010, McKinsey analysis.

Contribution to GDP

Gross domestic product (GDP) is the total value of all final goods and services produced in the

economy. The GDP growth rate is the primary indicator of the state of the economy.

INSURANCE SECTOR’S SHARE OF GROSS DOMESTIC PRODUCT (GDP), 2008-2012

($ billions)

Insurance carriers and related activities

Year

Total GDP

GDP

Percent of total GDP

2008

$14,720.3

$339.7

2.3%

2009

14,417.9

357.5

2.5

2010

14,958.3

364.8

2.4

2011

15,533.8

378.5

2.4

2012

16,244.6

413.1

2.5

Source: U.S. Department of Commerce, Bureau of Economic Analysis

.

A Firm Foundation updates at www.iii.org/firm-foundation/ 14

Chapter 3: Insurers as Investors

Introduction

The insurance industry (property/casualty and life/health) is a key player in the capital markets,

with $5.8 trillion in cash and invested assets in 2012, according to SNL Financial. Total P/C cash

and invested assets were $1.4 trillion in 2012, according to SNL L/H cash and invested assets

totaled $3.4 trillion in 2012. The majority of these assets were in bonds (65 percent of P/C assets

and 75 percent of L/H assets).

Insurance companies invest the premiums they collect in state and local municipal bonds,

helping to fund the building of roads, schools and other public projects. They provide businesses

with capital for research, expansions and other ventures through their investments in corporate

equities and bonds.

Because their losses are more volatile than those in the life insurance sector, property/casualty

insurers invest largely in high-quality liquid securities, which can be sold quickly to pay claims

resulting from a major hurricane, earthquake or man-made disaster such as a terrorist attack. In

2011 alone, property/casualty insurers’ holdings in municipal bonds totaled $331.0 billion. Life

insurers, whose benefit payments are more predictable, invest more heavily in corporate stocks

and corporate and foreign bonds, with holdings in these sectors of $1.4 trillion and $2.1 trillion,

respectively, in 2011, according to the Federal Reserve.

Property/Casualty Insurance Industry Investments

Cash and invested assets of property/casualty insurance companies totaled $1.38 trillion in

2012. This represents 84 percent of total assets, which were $1.64 trillion. Most of these assets

were invested in highly liquid securities (high-quality stocks and bonds, for example, rather than

real estate), which can be sold quickly to pay claims in the event of a major catastrophe.

INVESTMENTS, PROPERTY/CASUALTY INSURERS, 2010-2012 (1)

($ millions, end of year)

Amount

Percent of total

investments

Investment type

2010

2011

2012

2010

2011

2012

Bonds

$873,836

$902,508

$904,247

66.39%

67.26%

65.39%

Stocks

226,035

238,873

265,810

17.17

17.80

19.22

Preferred

17,574

11,619

11,930

1.34

0.87

0.86

Common

208,461

227,254

253,880

15.84

16.94

18.36

Mortgage loans on real estate

4,171

4,969

5,682

0.32

0.37

0.41

First liens

3,885

4,767

5,428

0.30

0.36

0.39

Other than first liens

287

202

254

0.02

0.02

0.02

Real estate

9,773

10,371

10,372

0.74

0.77

0.75

A Firm Foundation updates at www.iii.org/firm-foundation/ 15

Amount

Percent of total

investments

Investment type

2010

2011

2012

2010

2011

2012

Properties occupied by

company

8,540

8,902

8,948

0.65

0.66

0.65

Properties held for income

production

1,057

1,216

1,227

0.08

0.09

0.09

Properties held for sale

176

252

198

0.01

0.02

0.01

Cash, cash equivalent and short-

term investments

85,962

72,605

82,323

6.53

5.41

5.95

Derivatives

643

649

592

0.05

0.05

0.04

Other invested assets

102,863

104,204

108,573

7.82

7.77

7.85

Receivable for securities

4,481

1,529

960

0.34

0.11

0.07

Securities lending reinvested

collateral assets

5,285

2,628

2,324

0.40

0.20

0.17

Aggregate write-in for invested

assets

3,200

3,568

4,006

0.24

0.27

0.29

Total cash and invested assets

$1,316,192

$1,341,904

$1,382,861

100.00%

100.00%

100.00%

(1) Includes cash and net admitted assets of property/casualty insurers.

Source: SNL Financial LC.

A Firm Foundation updates at www.iii.org/firm-foundation/ 16

BONDS

Bonds in or near default (Class 6) accounted for less than 1 percent (0.18 percent) of all short-

and long-term bonds owned by insurers at the end of 2012, according to SNL Financial LC.

INVESTMENTS, PROPERTY/CASUALTY INSURERS, 2012

(1) Cash and invested net admitted assets, as of December 31, 2012.

Source: SNL Financial LC.

A Firm Foundation updates at www.iii.org/firm-foundation/ 17

Life/Health Industry Investments

The life/health insurance industry’s cash and invested assets totaled $3.4 trillion in 2012,

according to SNL Financial.

INVESTMENTS, LIFE/HEALTH INSURERS, 2010-2012 (1)

($ billions, end of year)

Amount

Percent of total investments

Investment type

2010

2011

2012

2010

2011

2012

Bonds

$2,426.5

$2,536.2

$2,547.2

75.92%

75.47%

74.77%

Stocks

77.9

78.4

77.5

2.44

2.33

2.27

Preferred stock

9.1

8.1

7.8

0.29

0.24

0.23

Common stock

68.7

70.3

69.7

2.15

2.09

2.05

Mortgage loans on real

estate

307.4

323.1

335.6

9.62

9.61

9.85

First lien real estate

mortgage loans

305.2

321.1

333.1

9.55

9.56

9.78

Real estate loans less

first liens

2.1

2.0

2.5

0.07

0.06

0.07

Real estate

19.7

20.6

21.4

0.62

0.61

0.63

Occupied properties

5.7

5.7

5.5

0.18

0.17

0.16

Income generating

properties

13.6

14.6

15.4

0.43

0.43

0.45

Properties for sale

0.3

0.3

0.5

0.01

0.01

0.02

Cash, cash equivalent

and short-term

investments

95.1

96.5

106.6

2.97

2.87

3.13

Contract loans including

premium notes

123.5

126.0

127.5

3.86

3.75

3.74

Derivatives

21.6

44.4

41.6

0.68

1.32

1.22

Other invested assets

111.4

124.0

136.6

3.48

3.69

4.01

Receivables for securities

1.8

2.1

2.1

0.06

0.06

0.06

Securities lending

reinvested collateral

assets

10.6

10.1

10.8

0.33

0.30

0.32

Write-ins for invested

assets

0.5

0.2

-0.3

0.02

0.01

-0.01

Total cash and invested

assets

$3,196.2

$3,360.5

$3,406.7

100.00%

100.00%

100.00%

(1) Includes cash and net admitted assets of life/health insurers.

Source: SNL Financial LC.

A Firm Foundation updates at www.iii.org/firm-foundation/ 18

INVESTMENTS, LIFE/HEALTH INSURERS, BOND PORTFOLIO, 2012 (1)

(1) Long-term bonds with maturity dates over one year, as of December 31, 2012.

Source: SNL Financial LC.

Ownership of Municipal Securities

Insurance companies help fund the construction of schools, roads and healthcare facilities, and

a variety of other public sector projects through their investments in municipal bonds. The

property/casualty insurance industry invested $328 billion in such bonds in 2012, and the life

insurance industry invested $131 billion, according to the Federal Reserve.

INSURANCE COMPANY HOLDINGS OF U.S. MUNICIPAL SECURITIES AND LOANS, 2008-2012

($ billions, end of year)

2008

2009

2010

2011

2012

Property/casualty

$381.9

$369.4

$348.4

$331.0

$327.6

Life

47.1

73.1

112.3

121.6

131.2

Total

$429.0

$442.5

$460.7

$452.6

$458.8

Source: Board of Governors of the Federal Reserve System, June 6, 2013.

A Firm Foundation updates at www.iii.org/firm-foundation/ 19

Chapter 4: Defraying the Economic Costs of

Disasters

Introduction

The insurance industry plays a vital role in helping individuals and businesses prepare for and

recover from the potentially devastating effects of a disaster such as a catastrophic hurricane or

storm or wildfire.

NATURAL DISASTER LOSSES IN THE UNITED STATES, 2013

Source: © 2014 Munich Re, NatCatSERVICE. As of January 2014.

CATASTROPHES IN THE UNITED STATES

Property Claim Services (PCS) defines a catastrophe as an event that causes $25 million or more

in insured property losses and affects a significant number of property/casualty policyholders and

insurers. The estimates in the following chart represent anticipated insured losses from

catastrophes on an industrywide basis, reflecting the total net insurance payment for personal

and commercial property lines of insurance covering fixed property, vehicles, boats, related-

property items, business interruption and additional living expenses. They exclude loss-

adjustment expenses. Catastrophe losses rose from $33.6 billion in 2011 to $35.0 billion in 2012,

the highest amount since the $62.3 billion recorded in 2005, the year of Hurricane Katrina.

Superstorm Sandy accounted for half of 2012 losses. While insured catastrophe losses rose in

2012, the number of catastrophes and the number of claims fell from 2011 to 2012.

A Firm Foundation updates at www.iii.org/firm-foundation/ 20

THE TEN MOST COSTLY CATASTROPHES, UNITED STATES (1)

($ millions)

Estimated insured property losses

Rank

Date

Peril

Dollars when

occurred

In 2012 dollars

(2)

1

Aug. 2005

Hurricane Katrina

$41,100

$47,424

2

Sep. 2001

Fire, explosion: World Trade

Center, Pentagon

terrorist attacks

18,779

23,883

3

Aug. 1992

Hurricane Andrew

15,500

23,349

4

Oct. 2012

Hurricane Sandy

18,750

18,750

5

Jan. 1994

Northridge, CA earthquake

12,500

18,043

6

Sep. 2008

Hurricane Ike

12,500

13,283

7

Oct. 2005

Hurricane Wilma

10,300

11,885

8

Aug. 2004

Hurricane Charley

7,475

8,912

9

Sep. 2004

Hurricane Ivan

7,110

8,476

10

Apr. 2011

Flooding, hail and wind including

the tornadoes

that struck Tuscaloosa and other

locations

7,300

7,431

(1) Property losses only. Excludes flood damage covered by the federally administered National Flood Insurance Program.

(2) Adjusted for inflation through 2012 by ISO using the GDP implicit price deflator.

Source: Property Claim Services (PCS), a division of Verisk Analytics.

ESTIMATED INSURED PROPERTY LOSSES, U.S. CATASTROPHES, 2004-2013 (1)

Year

Number of

catastrophes

Number of claims

(millions)

Dollars when occurred

($ billions)

In 2012 dollars (2)

($ billions)

2004

22

3.4

$27.5

$32.8

2005

24

4.4

62.3

71.9

2006

33

2.3

9.2

10.3

2007

23

1.2

6.7

7.3

2008

37

4.1

27.0

28.7

2009

28

2.2

10.6

11.1

2010

34

2.4

14.3

14.9

2011

30

4.9

33.6

34.2

2012

26

4.0

35.0

35.0

2013

29

1.8

12.9

NA

(1) Includes catastrophes causing insured property losses of at least $25 million in 1997 dollars and affecting a significant number of

policyholders and insurers. Excludes losses covered by the federally administered National Flood Insurance Program.

(2) Adjusted for inflation through 2012 by ISO using the GDP implicit price deflator.

NA=Data not available.

Source: Property Claim Services (PCS), a division of Verisk Analytics.

A Firm Foundation updates at www.iii.org/firm-foundation/ 21

INFLATION-ADJUSTED U.S. INSURED CATASTROPHE LOSSES BY CAUSE OF LOSS, 1993-2012

(1)

(2012 $ billions)

(1) Adjusted for inflation through 2012 by ISO using the GDP implicit price deflator. Excludes catastrophes causing direct losses less

than $25 million in 1997 dollars. Excludes flood damage covered by the federally administered National Flood Insurance Program.

(2) Includes losses from other perils that frequently accompany tornadoes such as hail, wind and thunderstorms. Excludes snow.

(3) Includes wildland fires.

(4) Includes losses from civil disorders, water damage, utility service disruptions, and any workers compensation catastrophes

generating losses in excess of PCS's threshold after adjusting for inflation.

Source: Property Claim Services (PCS), a division of Verisk Analytics.

Reinsurance

Reinsurance is insurance for insurance companies. Just as individuals and businesses buy

insurance to protect their assets, primary insurers, the companies that sell insurance to

consumers, buy reinsurance to protect their profits and solvency. Reinsurance fosters

competitive insurance markets by enabling smaller insurers to compete with larger ones. It

strengthens U.S. insurers by giving them access to global resources. Reinsurance is often sold in

layers, reaching up into the millions of dollars to protect insurance companies from possible, but

statistically highly unlikely events, such as an extraordinary number of homeowners claims as a

result of a hurricane or a large single event, such as the destruction of a high-value asset or a

massive legal judgment. As shown in the chart below, many reinsurers of U.S. risks are owned

by offshore firms.

TOP TEN U.S. PROPERTY/CASUALTY REINSURERS OF U.S. BUSINESS BY GROSS PREMIUMS

WRITTEN, 2012

($000)

Rank

Company (1)

Country of parent

company

Gross premiums

written

1

National Indemnity Company (Berkshire

Hathaway) (2)

U.S.

$7,242,437

A Firm Foundation updates at www.iii.org/firm-foundation/ 22

Rank

Company (1)

Country of parent

company

Gross premiums

written

2

QBE North America

Australia

6,568,732

3

Swiss Reinsurance America Corporation

Switzerland

4,327,392

4

Munich Re America, Corp.

Germany

4,070,596

5

Everest Reinsurance Company

Bermuda

3,456,915

6

Transatlantic Reinsurance Company/FairCo

U.S.

3,280,711

7

XL Reinsurance America

Ireland

3,070,123

8

Odyssey Reinsurance Group

Canada

2,589,229

9

Berkley Insurance Company

U.S.

1,916,915

10

Partner Reinsurance Company

Bermuda

1,226,831

(1) See Reinsurance Underwriting Report footnotes posted at http://www.reinsurance.org for list of affiliated companies included.

(2) Underwriting results exclude assumptions from affiliated General Re Group.

Source: Reinsurance Association of America.

Hurricanes

2012 AND 2013 ATLANTIC HURRICANE SEASONS

The 2012 Atlantic hurricane season witnessed 19 tropical storms, with 10 becoming hurricanes,

above the annual average of 12 storms and six hurricanes. Only four of these events made landfall

in the U.S., including Hurricane Sandy, one of the most damaging hurricanes to hit the United

States. Sandy, the 18th tropical storm of the 2012 hurricane season, made landfall as a post-

tropical storm on October 29, 2012, in New Jersey, causing extensive damage in that state as well

as to New York, Pennsylvania and Connecticut. Sandy caused 72 deaths in the U.S. and $18.75

billion in insured property losses in 15 states and the District of Columbia, not including National

Flood Insurance Program (NFIP) losses, according to Property Claim Services (PCS). This makes

it the third costliest U.S. hurricane, topped only by Hurricane Katrina in 2005 and Hurricane

Andrew in 1992. The only other significant storm to make landfall was Hurricane Isaac in August.

Isaac was a slow-moving Category 1 hurricane when it hit the Louisiana coast on August 28,

following roughly the same path as Hurricane Katrina, which caused record-breaking losses of

over $40 billion in 2005. Isaac stirred up strong winds and flooding in the Gulf, particularly in

Louisiana and Mississippi and caused five deaths in the U.S. PCS estimated that Isaac caused $1

billion in insured property damage, not including NFIP claims.

The 2013 Atlantic hurricane season produced 13 tropical storms, two of which became hurricanes.

Neither of these became major hurricanes, which is defined as a storm that reaches Category 3 or

higher. According to the National Oceanographic and Atmospheric Administration, the 2013

Hurricane Season had the fewest number of hurricanes since 1982. 2013 is expected to rank as

the sixth-least-active Atlantic hurricane season since 1950, in terms of the collective strength and

duration of named storms and hurricanes. In 2013 there were no U.S. hurricanes that met PCS’s

catastrophe threshold of at least $25 million in insured property losses. The first hurricane of the

season, Humberto, reached hurricane force on September 11, but did not make landfall. It is

topped only by 2002’s Hurricane Gustav as the latest forming first hurricane. Ingrid, the second

2013 hurricane, made landfall in Mexico on September 16. Together with Pacific Tropical Storm

Manuel, it caused massive flooding and over 40 deaths. Andrea, an Atlantic tropical storm, made

landfall in Florida on June 6 and caused one death. Losses from Andrea did not reach PCS’s

catastrophe threshold.

A Firm Foundation updates at www.iii.org/firm-foundation/ 23

THE TEN MOST COSTLY HURRICANES IN THE UNITED STATES (1)

($ millions)

Estimated insured loss (2)

Rank

Date

Location

Hurricane

Dollars when

occurred

In 2012

dollars (3)

1

Aug. 25-30, 2005

AL, FL, GA, LA, MS, TN

Hurricane Katrina

$41,100

$47,424

2

Aug. 24-26, 1992

FL, LA

Hurricane Andrew

15,500

23,349

3

Oct. 28-31, 2012

CT, DC, DE, MA, MD, ME, NC,

NH, NJ, NY, OH, PA, RI, VA,

VT, WV

Hurricane Sandy

18,750

18,750

4

Sep. 12-14, 2008

AR, IL, IN, KY, LA, MO, OH, PA,

TX

Hurricane Ike

12,500

13,283

5

Oct. 24, 2005

FL

Hurricane Wilma

10,300

11,885

6

Aug. 13-14, 2004

FL, NC, SC

Hurricane Charley

7,475

8,912

7

Sep. 15-21, 2004

AL, DE, FL, GA, LA, MD, MS,

NC, NJ, NY, OH, PA, TN, VA,

WV

Hurricane Ivan

7,110

8,476

8

Sep. 17-22, 1989

GA, NC, PR, SC, U.S. Virgin

Islands, VA

Hurricane Hugo

4,195

6,957

9

Sep. 20-26, 2005

AL, AR, FL, LA, MS, TN, TX

Hurricane Rita

5,627

6,493

10

Sep. 3-9, 2004

FL, GA, NC, NY, SC

Hurricane Frances

4,595

5,478

(1) Includes hurricanes occurring through 2012.

(2) Property coverage only. Excludes flood damage covered by the federally administered National Flood Insurance Program.

(3) Adjusted for inflation through 2012 by ISO using the GDP implicit price deflator.

Source: The Property Claim Services (PCS) unit of ISO, a Verisk Analytics company.

The following chart from the Property Claim Services (PCS) unit of ISO, a Verisk Analytics

company, ranks historic hurricanes based on their insured losses, adjusted for inflation. The chart

beneath it, from AIR Worldwide Corporation, estimates insured property losses from notable

hurricanes from past years, if they were to hit the nation again today with the same meteorological

parameters.

ESTIMATED INSURED LOSSES FOR THE TOP TEN HISTORICAL HURRICANES BASED ON

CURRENT EXPOSURES (1)

($ billions)

Rank

Date

Hurricane

Category

Insured loss

(current exposure)

1

Sep. 18, 1926

Miami Hurricane

4

$125

2

Aug. 24, 1992

Hurricane Andrew

5

57

3

Sep. 17, 1947

1947 Fort Lauderdale Hurricane

4

53

4

Sep. 17, 1928

Great Okeechobee Hurricane

5

51

5

Aug. 29, 2005

Hurricane Katrina

3 (2)

45

6

Sep. 9, 1965

Hurricane Betsy

3

45

7

Sep. 9, 1900

Galveston Hurricane of 1900

4

41

8

Sep. 10, 1960

Hurricane Donna

4

35

9

Sep. 21, 1938

The Great New England Hurricane

3

33

A Firm Foundation updates at www.iii.org/firm-foundation/ 24

Rank

Date

Hurricane

Category

Insured loss

(current exposure)

10

Sep. 15, 1950

Hurricane Easy

3

23

(1) Modeled loss to property, contents, and business interruption and additional living expenses for residential, mobile home,

commercial, and auto exposures as of December 31, 2011. Losses include demand surge.

(2) Refers to Katrina’s second landfall in Louisiana.

Source: AIR Worldwide Corporation.

Tornadoes

A tornado is a violently rotating column of air that extends from a thunderstorm and comes into

contact with the ground, according to the National Oceanic and Atmospheric Administration

(NOAA). In an average year about 1,000 tornadoes are reported nationwide, according to NOAA.

Tornado intensity is measured by the enhanced Fujita (EF) scale. The scale rates tornadoes on a

scale of 0 through 5, based on the amount and type of wind damage. It incorporates 28 different

“damage indicators,” based on damage to a wide variety of structures ranging from trees to

shopping malls.

THE FUJITA SCALE FOR TORNADOES

Original F scale (1)

Enhanced F scale (2)

Category

Damage

Wind speed (mph)

3-second

gust (mph)

F-0

Light

40-72

65-85

F-1

Moderate

73-112

86-110

F-2

Considerable

113-157

111-135

F-3

Severe

158-207

136-165

F-4

Devastating

208-260

166-200

F-5

Incredible

261-318

Over 200

(1) Original scale: wind speeds represent fastest estimated speeds over ¼ mile.

(2) Enhanced scale: wind speeds represent maximum 3-second gusts. Implemented on February 1, 2007.

Source: U.S. Department of Commerce, National Oceanic and Atmospheric Administration.

NUMBER OF TORNADOES AND RELATED DEATHS PER MONTH, 2012 (1)

(1) Excludes Puerto Rico. Excludes tornadoes crossing state lines. Counts these tornadoes as one event.

Source: U.S. Department of Commerce, Storm Prediction Center, National Weather Service.

A Firm Foundation updates at www.iii.org/firm-foundation/ 25

TORNADOES AND RELATED DEATHS IN THE UNITED STATES, 1992-2012 (1)

Year

Tornadoes

Deaths

Year

Tornadoes

Deaths

Year

Tornadoes

Deaths

1992

1,297

39

1999

1,345

94

2006

1,103

67

1993

1,173

33

2000

1,071

40

2007

1,098

81

1994

1,082

69

2001

1,216

40

2008

1,692

126

1995

1,234

30

2002

941

55

2009

1,156

21

1996

1,173

25

2003

1,376

54

2010

1,282

45

1997

1,148

67

2004

1,819

36

2011

1,691

553

1998

1,424

130

2005

1,264

38

2012 (2)

939

70

(1) Excludes Puerto Rico. Does not include tornadoes crossing state lines. Counts these tornadoes as one event.

(2) Preliminary.

Source: U.S. Department of Commerce, Storm Prediction Center, National Weather Service.

Earthquakes

The costliest U.S. earthquake, the 1994 Northridge quake, caused $15.3 billion in insured damages

when it occurred (about $24 billion in 2013 dollars). It ranks as the fifth-costliest U.S. disaster,

based on insured property losses (in 2012 dollars), topped only by Hurricane Katrina, the attacks

on the World Trade Center, Hurricane Andrew and Superstorm Sandy. Six of the costliest U.S.

quakes, based on insured losses, were in California, according to Munich Re. There were six

earthquakes in the United States in 2013 which caused only minor damage, according to Munich

Re.

THE TEN MOST COSTLY U.S. EARTHQUAKES (1)

($ millions)

Insured losses (2)

Rank

Date

Location

Overall losses

when occurred

When

occurred

In 2013

dollars (3)

Fatalities

1

Jan. 17, 1994

California: Northridge, Los

Angeles, San Fernando Valley,

Ventura, Orange

$44,000

$15,300

$24,050

61

2

Apr. 18, 1906

California: San Francisco,

Santa Rosa, San Jose

524

180

4,240 (4)

3,000

3

Oct. 17, 1989

California: Loma Prieta, Santa

Cruz, San Francisco, Oakland,

Berkeley, Silicon Valley

10,000

960

1,800

68

4

Feb. 28, 2001

Washington: Olympia, Seattle,

Tacoma; Oregon

2,000

300

395

1

5

Mar. 27-28, 1964

Alaska: Anchorage, Kodiak

Island, Seward, Valdez,

Portage, Whittier, Cordova,

Homer, Seldovia; Hawaii;

includes tsunami

540

45

340

131

6

Feb. 9, 1971

California: San Fernando

Valley, Los Angeles

553

35

200

65

7

Oct. 1, 1987

California: Los Angeles,

Whittier

360

75

155

8

8

Apr. 4, 2010

California: San Diego,

Calexico, El Centro, Los

150

100

105

NA

A Firm Foundation updates at www.iii.org/firm-foundation/ 26

Insured losses (2)

Rank

Date

Location

Overall losses

when occurred

When

occurred

In 2013

dollars (3)

Fatalities

Angeles, Imperial; Arizona:

Phoenix, Yuma

9

Sep. 3, 2000

California: Napa

80

50

68

NA

10

Jun. 28, 1992

California: San Bernardino

100

40

66

1

(1) Costliest U.S. earthquakes occurring from 1950 to 2013, based on insured losses when occurred. Includes the 1906 San

Francisco, California earthquake, for which reliable insured losses are available.

(2) Based on property losses including, if applicable, agricultural, offshore, marine, aviation and National Flood Insurance Program

losses in the United States and may differ from data shown elsewhere.

(3) Inflation-adjusted to 2013 dollars by Munich Re.

(4) Inflation-adjusted to 2013 dollars based on 1913 Bureau of Labor Statistics data (earliest year available).

NA=Data not available.

Source: © 2014 Munich Re, Geo Risks Research, NatCatSERVICE.

The previous chart ranks historic earthquakes based on their total insured property losses,

adjusted for inflation. The chart below uses a computer model to measure the estimated impact

of historical quakes according to current exposures. The analysis, conducted in 2012, is based on

AIR Worldwide's U.S. earthquake model. It makes use of the firm's property exposure database

and takes into account the current number and value of exposed properties.

ESTIMATED INSURED LOSSES FOR THE TOP TEN HISTORICAL EARTHQUAKES BASED ON

CURRENT EXPOSURES (1)

($ billions)

Rank

Date

Location

Magnitude

Insured loss

(current exposures)

1

Feb. 7, 1812

New Madrid, MO

7.7

$112

2

Apr. 18, 1906

San Francisco, CA

7.8

93

3

Aug. 31, 1886

Charleston, SC

7.3

44

4

Jun. 1, 1838

San Francisco, CA

7.4

30

5

Jan. 17, 1994

Northridge, CA

6.7

23

6

Oct. 21, 1868

Hayward, CA

7.0

23

7

Jan. 9, 1857

Fort Tejon, CA

7.9

8

8

Oct. 17, 1989

Loma Prieta, CA

6.3

7

9

Mar. 10, 1933

Long Beach, CA

6.4

5

10

Jul. 1, 1911

Calaveras, CA

6.4

4

(1) Modeled loss to property, contents, and business interruption and additional living expenses for residential, mobile home,

commercial, and auto exposures as of December 31, 2011. Losses include demand surge and fire following earthquake. Policy

conditions and earthquake insurance take-up rates are based on estimates by state insurance departments and client claims data.

Source: AIR Worldwide Corporation.

Wildfires

Fire plays an important role in the life of a forest, clearing away dead wood and undergrowth to

make way for younger trees. But for much of the last century, fire-suppression policies have

sought to extinguish wildfires as quickly as possible to preserve timber and real estate. This

approach has led to the accumulation of brush and other vegetation that is easily ignited and

A Firm Foundation updates at www.iii.org/firm-foundation/ 27

serves as fuel for wildfires. Most of the large fires with significant property damage have occurred

in California, where some of the fastest developing counties are in forest areas.

THE TEN MOST COSTLY WILDLAND FIRES IN THE UNITED STATES (1)

($ millions)

Estimated insured loss

Rank

Date

Location

Dollars when

occurred

In 2012 dollars

(2)

1

Oct. 20-21, 1991

Oakland Fire, CA

$1,700

$2,622

2

Oct. 21-24, 2007

Witch Fire, CA

1,300

1,412

3

Oct. 25-Nov. 4, 2003

Cedar Fire, CA

1,060

1,299

4

Oct. 25-Nov. 3, 2003

Old Fire, CA

975

1,195

5

Nov. 2-3, 1993

Los Angeles County Fire,

CA

375

553

6

Sep. 4-9, 2011

Bastrop County Complex

Fire, TX

530

539

7

Oct. 27-28, 1993

Orange County Fire, CA

350

516

8

Jun. 24-28, 2012

Waldo Canyon Fire, CO

450

450

9

Jun. 27-Jul. 2, 1990

Santa Barbara Fire, CA

265

423

10

Sep. 6-13, 2010

Fourmile Canyon Fire, CO

210

218

(1) Property coverage only for catastrophic wildfires. Effective January 1, 1997, Property Claim Services (PCS) defines catastrophes

as events that cause more than $25 million in insured property damage and that affect a significant number of insureds and

insurers. From 1982 to 1996, PCS used a $5 million threshold in defining catastrophes. Before 1982, PCS used a $1 million

threshold.

(2) Adjusted for inflation through 2012 by ISO using the GDP implicit price deflator.

Source: Property Claim Services (PCS), a division of Verisk Analytics.

Terrorism

A total of 2,976 people perished in the September 11, 2001 terrorist attacks in New York,

Washington and Pennsylvania, excluding the 19 hijackers. Total insured losses (including liability

losses) from the terrorist attacks on the World Trade Center in New York City and the Pentagon

are about $42.1 billion (in 2012 dollars), including property, life and liability insurance claim

costs. Loss estimates may differ from estimates calculated by other organizations. It was the worst

terrorist attack on record in terms of fatalities and insured property losses, which totaled about

$24.6 billion (in 2012 dollars). The April 15, 2013 Boston Marathon bombing, which killed three

people and injured 264, marked the first successful terrorist attack on U.S. soil since the

September 11 tragedy. As of August 2013 insurers had paid out $1.18 million in losses related to

the incident, according to an analysis by the Massachusetts Division of Insurance based on the

claims paid by the state’s top 25 insurers and the Massachusetts FAIR Plan, the state’s insurer of

last resort.

A Firm Foundation updates at www.iii.org/firm-foundation/ 28

THE TWENTY WORST TERRORIST ACTS BY INSURED PROPERTY LOSSES

(2012 $ millions)

Rank

Date

Country

Location

Event

Insured

property

loss (1)

Fatalities

1

Sep. 11, 2001

U.S.

New York,

Washington,

DC, Pennsylvania

Hijacked airliners crash into

World Trade Center and

Pentagon

$24,364 (2)

2,982

2

Apr. 24, 1993

U.K.

London

Bomb explodes near NatWest

tower in the financial district

1,176

1

3

Jun. 15, 1996

U.K.

Manchester

Irish Republican Army (IRA)

car bomb explodes near

shopping mall

966

0

4

Apr. 10, 1992

U.K.

London

Bomb explodes in financial

district

870

3

5

Feb. 26, 1993

U.S.

New York

Bomb explodes in garage of

World Trade Center

810

6

6

Jul. 24, 2001

Sri Lanka

Colombo

Rebels destroy 3 airliners, 8

military aircraft and heavily

damage 3 civilian aircraft

517

20

7

Feb. 9, 1996

U.K.

London

IRA bomb explodes in South

Key Docklands

336

2

8

Jun. 23, 1985

North Atlantic

Irish Sea

Bomb explodes on board of

an Air India Boeing 747

209

329

9

Apr. 19, 1995

U.S.

Oklahoma City, OK

Truck bomb crashes into

government building

189

166

10

Sep. 12, 1970

Jordan

Zerqa, Dawson's

Field

(disused RAF

airstrip in desert)

Hijacked Swissair DC-8, TWA

Boeing 707, BOAC VC-10

dynamited on ground

165

0

11

Sep. 6, 1970

Egypt

Cairo

Hijacked PanAm B-747

dynamited on ground

143

0

12

Apr. 11, 1992

U.K.

London

Bomb explodes in financial

district

125

0

13

Nov. 26, 2008

India

Mumbai

Attack on two hotels; Jewish

center

109

172

14

Mar. 27, 1993

Germany

Weiterstadt

Bomb attack on a newly built,

still unoccupied prison

92

0

15

Dec. 30, 2006

Spain

Madrid

Bomb explodes in car garage

at Barajas Airport

75

2

16

Dec. 21, 1988

U.K.

Lockerbie

Bomb explodes on board of a

PanAm Boeing 747

73

270

17

Jul. 25, 1983

Sri Lanka

Riot

61

0

18

Jul. 7, 2005

U.K.

London

Four bombs explode during

rush hour in a tube and bus

61

52

19

Nov. 23, 1996

Comoros

Indian Ocean

Hijacked Ethiopian Airlines

Boeing 767-260 ditched at

sea

59

127

20

Mar. 17, 1992

Argentina

Buenos Aires

Bomb attack on Israel's

embassy in Buenos Aires

49

24

(1) Includes bodily injury and aviation hull losses. Updated to 2012 dollars by the Insurance Information Institute using the U.S.

Bureau of Labor Statistics CPI Inflation Calculator.

(2) Differs from inflation-adjusted estimates made by other organizations due to the use of different deflators.

Source: Swiss Re.

A Firm Foundation updates at www.iii.org/firm-foundation/ 29

Chapter 5: Contribution to Selected Industries

Introduction

When life insurance claims are paid, funds flow into the general economy, as beneficiaries spend

the money they receive. When property/casualty insurance claims are paid, funds flow to the

industries that supply claimants with the goods and services necessary for their recovery.

Property/casualty insurers pay out billions of dollars each year to settle claims. Many of the

payments go to businesses, such as auto repair companies, that help claimants get their lives

back together after an accident, fire, windstorm or other incident that caused the injury or

property damage. Insurance claim payments support local businesses, enabling them to provide

jobs and pay taxes that support the local economy.

All industries benefit from property/casualty insurance because it pays for losses that might

otherwise have put them out of business. But certain industries derive a good portion of their

income from insurers’ claim payments. These businesses include the auto parts and repair

industries (auto insurance), the building construction and supply industries (homeowners and

commercial property insurance), health care services (auto, workers compensation and other

liability insurance coverages) and legal services.

The charts that follow provide some indication of how much insurers contribute to the economy

indirectly through some of the industries that provide these services. In addition,

property/casualty insurance claims payments reimburse victims of theft and help make up for

loss of income while people who have been injured are recuperating and businesses that have

been hit by a disaster prepare to resume operations.

Auto Repair Industry

THE INSURANCE INDUSTRY’S CONTRIBUTION TO THE AUTO REPAIR INDUSTRY

The primary recipients of auto insurance claim payments are auto repair and auto body shops

and window glass installers. Others include new and used car dealers, tire dealers and

manufacturers of the parts required for vehicle repair and restoration.

Collision and comprehensive coverages pay for damage to or theft of a policyholder's car.

Additional sums are paid by insurers to repair other vehicles damaged by the policyholder in a

crash. This money is paid under the liability portion of the policy, which also covers legal costs.

INCURRED LOSSES FOR AUTO INSURANCE, 2008-2012 (1)

($000)

2008

2009

2010

2011

2012

Private passenger

auto

Liability

$60,806,847

$63,448,211

$64,110,267

$64,310,776

$65,018,837

Physical damage

39,189,255

36,497,330

36,454,102

40,589,159

41,261,719

Commercial auto

A Firm Foundation updates at www.iii.org/firm-foundation/ 30

2008

2009

2010

2011

2012

Liability

9,956,316

9,345,288

8,798,119

9,363,647

10,513,434

Physical damage

3,498,383

3,005,162

2,911,013

3,164,880

3,250,715

Total

$113,450,801

$112,295,991

$112,273,501

$117,428,462

$120,044,705

(1) Losses occurring within a fixed period, whether or not adjusted or paid during the same period, after reinsurance transactions.

Source: SNL Financial LC.

Construction Industry

THE INSURANCE INDUSTRY’S CONTRIBUTION TO THE CONSTRUCTION INDUSTRY

The construction industry benefits from claims filed under homeowners and commercial

property insurance policies.

INCURRED LOSSES FOR HOMEOWNERS INSURANCE, 2008-2012 (1)

($000)

Year

Incurred losses

2008

$42,531,094

2009

36,903,733

2010

39,497,587

2011

50,709,943

2012

41,107,253

(1) Losses occurring within a fixed period, whether or not adjusted or paid during the same period, after reinsurance transactions.

Source: SNL Financial LC.

INCURRED LOSSES FOR COMMERCIAL INSURANCE, 2008-2012 (1)

($000)

Year

Incurred losses

2008

$141,340,999

2009

111,576,968

2010

112,727,166

2011

129,993,492

2012

126,819,159

(1) Losses occurring within a fixed period, whether or not adjusted or paid during the same period, after reinsurance transactions.

Source: SNL Financial LC.

Healthcare Industry

THE INSURANCE INDUSTRY’S CONTRIBUTION TO THE HEALTHCARE INDUSTRY

The healthcare industry is a prime recipient of claims filed under auto, workers compensation

and other liability insurance policies.

A Firm Foundation updates at www.iii.org/firm-foundation/ 31

WORKERS COMPENSATION BENEFITS, COVERAGE AND COSTS, 2010-2011

2010

2011

Percent

change

Covered workers (000)

124,454

125,833

1.1%

Covered wages ($ billions)

$5,820

$6,049

3.9

Workers compensation benefits paid ($

billions)

58.2

60.2

3.5

Medical benefits

28.6

29.9

4.5

Cash benefits

29.6

30.3

2.6

Employer costs for workers compensation ($

billions)

71.9

77.1

7.1

Source: National Academy of Social Insurance.

PRIVATE PASSENGER AUTO INSURANCE LOSSES, 2003-2012 (1)

Liability

Bodily injury (2)

Property damage (3)

Year

Claim

frequency (4)

Claim

severity

(5),(6)

Claim

frequency (4)

Claim

severity (5)

2003

1.12

$11,135

3.84

$2,558

2004

1.11

11,640

3.75

2,596

2005

1.04

12,282

3.55

2,717

2006

0.98

12,907

3.40

2,796

2007

0.90

13,361

3.46

2,847

2008

0.91

14,067

3.42

2,903

2009

0.89

13,891

3.49

2,869

2010

0.91

14,406

3.53

2,881

2011

0.92

14,848

3.56

2,958

2012

0.95

14,653

3.50

3,073

Physical damage (7)

Collision

Comprehensive (8)

Year

Claim

frequency (4)

Claim

severity (5)

Claim

frequency (4)

Claim

severity (5)

2003

5.13

$2,921

2.76

$1,324

2004

4.85

3,080

2.46

1,417

2005

5.04

3,067

2.38

1,457

2006

4.87

3,194

2.40

1,528

2007

5.20

3,109

2.48

1,524

2008

5.35

3,005

2.57

1,551

2009

5.48

2,869

2.75

1,389

2010

5.69

2,778

2.62

1,476

2011

5.75

2,861

2.79

1,490

A Firm Foundation updates at www.iii.org/firm-foundation/ 32

Liability

Bodily injury (2)

Property damage (3)

Year

Claim

frequency (4)

Claim

severity

(5),(6)

Claim

frequency (4)

Claim

severity (5)

2012

5.56

2,950

2.62

1,585

(1) For all limits combined. Data are for paid claims.

(2) Excludes Massachusetts and most states with no-fault automobile insurance laws.

(3) Excludes Massachusetts, Michigan and New Jersey.

(4) Claim frequency is claims per 100 car years. A car year is equal to 365 days of insured coverage for one vehicle.

(5) Claim severity is the size of the loss, measured by the average amount paid for each claim.

(6) Includes loss adjustment expenses.

(7) Excludes Massachusetts, Michigan and Puerto Rico. Based on coverage with a $500 deductible.

(8) Excludes wind and water losses.

Source: ISO, a Verisk Analytics company.

A Firm Foundation updates at www.iii.org/firm-foundation/ 33

Chapter 6: Role of Credit/Mortgage Insurance

Credit Insurance for Short-Term Trade Receivables

ROLE OF CREDIT/MORTGAGE INSURANCE

Specialized insurance products protect lenders and borrowers, shielding businesses such as

exporters from customer defaults and facilitating the financing of mortgages and other

transactions. These products include credit insurance for short-term receivables.

CREDIT INSURANCE FOR CUSTOMER DEFAULTS

Credit insurance protects merchants, exporters, manufacturers and other businesses that extend

credit to their customers from losses or damages resulting from the nonpayment of debts owed

them for goods and services provided in the normal course of business. Credit insurance

facilitates financing, enabling insured companies to get better credit terms from banks. The high

combined ratio from 2007 to 2010 reflects the crisis in financial markets.

CREDIT INSURANCE, 2003-2012

($000)

Year

Net premiums

written (1)

Annual percent

change

Combined

ratio (2)

Annual point

change (3)

2003

$640,580

-11.0%

92.3

-9.9 pts.

2004

806,381

25.9

96.9

4.5

2005

936,108

16.1

81.1

-15.8

2006

1,090,145

16.5

86.0

4.9

2007

1,405,444

28.9

129.3

43.4

2008

1,413,313

0.6

171.0

41.6

2009

1,224,474

-13.4

140.8

-30.2

2010

1,344,766

9.8

127.2

-13.6

2011

1,490,135

10.8

94.5

-32.7

2012

1,457,796

-2.2

91.3

-3.2

(1) After reinsurance transactions, excludes state funds.

(2) After dividends to policyholders. A drop in the combined ratio represents an improvement; an increase represents a

deterioration.

(3) Calculated from unrounded data.

Source: SNL Financial LC.

Private Mortgage Insurance

MORTGAGE GUARANTY INSURANCE

Private mortgage insurance (PMI), also known as mortgage guaranty insurance, guarantees that,

in the event of a default, the insurer will pay the mortgage lender for any loss resulting from a

property foreclosure, up to a specific amount. PMI, which is purchased by the borrower but

protects the lender, is sometimes confused with mortgage life insurance, a life insurance product

A Firm Foundation updates at www.iii.org/firm-foundation/ 34

that pays off the mortgage if the borrower dies before the loan is repaid. Banks generally require

PMI for all borrowers with down payments of less than 20 percent. The industry’s combined

ratio, a measure of profitability, deteriorated (i.e., rose) significantly in 2007 and 2008,

reflecting the economic downturn and the subsequent rise in mortgage defaults. The combined

ratio improved in 2009 and 2010 as conditions began to ease, but remains at high levels.

MORTGAGE GUARANTY INSURANCE, 2003-2012

($000)

Year

Net premiums

written (1)

Annual

percent

change

Combined ratio

(2)

Annual point

change (3)