The American Express Corporate

Account Agreement and Application Form

– Australia

S/C:

PD1Ø7ØØ2Ø1

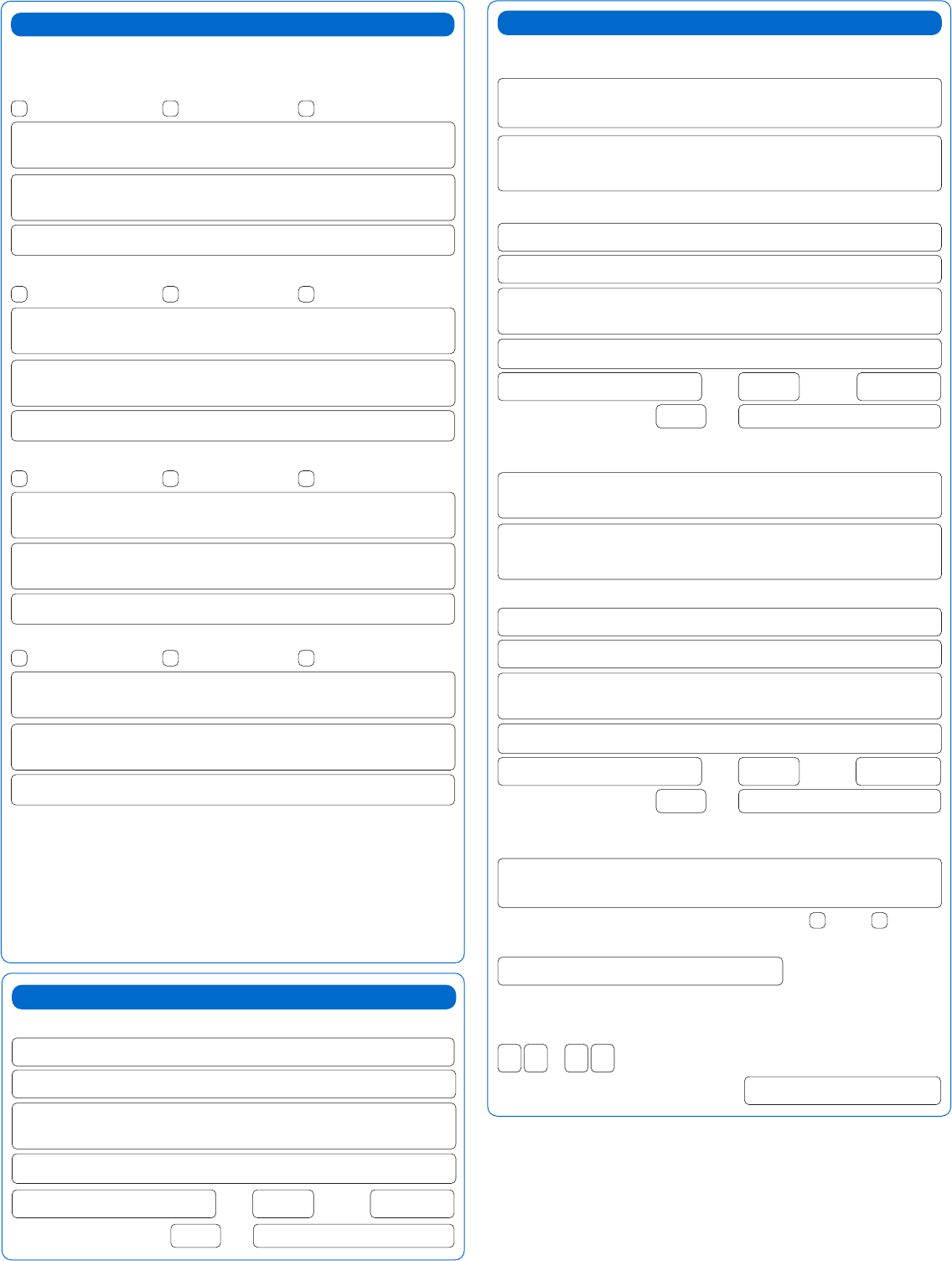

4. DIRECTORS SECTION

If Australian Proprietary Company/Registered Foreign Company/Unregistered

Foreign Company/Trustee Company list name(s) of all Directors. If more than

8 Directors, please provide on a separate Company letter head document signed

by the Decision Maker.

1. Full Name – Director 1

Residential Address – Director 1

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

2. Full Name – Director 2

Residential Address – Director 2

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Please complete the following form in conjunction with your American Express representative.

Sign it and return it to your American Express representative

All fields are MANDATORY and must be completed in black pen and BLOCK LETTERS.

Application Form P1 of 8

3. CORPORATE DETAILS

Company Name (in full, as per registered ABN Entity Name, maximum 40 characters)

Trading Name (if different to above)

Company Name to appear on Card and Reporting (maximum 24 characters)

Registered Office Address (as registered with ASIC)

City

State

Postcode

Principal Place of Business (if different from above)

City

State

Postcode

Same as Business Address

Mailing Address (if different from Address)

City

State

Postcode

Telephone Number

–

1. EXISTING CUSTOMERS

Corporate Details

Entity Name

MCA Reference

Existing American Express Customers only need to complete Section 8, Section 18

and all relevant Product sections.

2. PRODUCT TYPE

Please select the product/s you are applying for Choose liability*

American Express Corporate Card

Corporate

Combined

American Express Qantas Corporate Card

Corporate

Combined

Your Company will be enrolled into the Qantas Business Rewards Program using the

ABN listed in your application.

Your Company will receive TRIPLE Qantas Points for business, for more information

please review the TRIPLE Qantas Points for business benefit terms and conditions at

www.americanexpress.com.au/mypa.

Please select plastic colour/s

Green Gold Platinum

Corporate Purchasing Card

Corporate

Corporate Meeting Card

Corporate

Business Travel Account (BTA) Corporate

Buyer Initiated Payments (BIP) Corporate

American Express vPayment Corporate

American Express Go Corporate

* Please refer to Clause 5(a) and (b) of the attached terms and conditions for a

description of these liability types.

OR

3. CORPORATE DETAILS (CONT.)

What type of Company? Proprietary Public

What is your legal entity type?

Australian Company Co-operative*

Partnership* Incorporated Association*

Registered Foreign Company Unincorporated Association*

Unregistered Foreign Company Trustee of a Trust* – If so, please also

complete Section 7

Government Body

Other

* Note: For non-Company and Trustees, please provide certified establishing documents

(e.g. Trust deeds, Partnership agreement etc). Certifier should print their name, sign, date and

include their qualific

ation and registered number on the document.

Industry or Nature of Business

Number of Employees

Business Registration No. ABN

(please ensure your ABN No is correct and must be 11 characters)

ACN

ARBN/CO-OP/ASSOC ID/Foreign Issued ID

Country/State/Territory of establishment/incorporation

AEX9559 07/20

Application Form P2 of 8

5. BENEFICIAL OWNERS OF THE COMPANY

1

American Express Australia Limited is required by law to gather the following

information about the beneficial ownership of your Company. We will not be able

to process your application without it.

American Express Australia Limited will use the information provided to carry out

further identification and verification checks.

Please note we may need to contact you for additional information.

Parent Company name (maximum 40 characters)

Parent Company location

City

State

Postcode

If your Company is listed on a recognised Stock Exchange, please provide the

Stock Exchange name.

Please provide the details of all individual Beneficial Owners. Refer to Notes/

Definitions in Section 20.

Where beneficial ownership structure is complex, a structure diagram should be

provided on Company letterhead paper showing percentage ownership.

Beneficial Owner Role

Shareholder Senior Management (e.g. CEO, CFO) Other

1. Full Name – Beneficial Owner 1

Residential Address – Beneficial Owner 1

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Percentage of ownership (if applicable)

Beneficial Owner Role

Shareholder Senior Management (e.g. CEO, CFO) Other

2. Full Name – Beneficial Owner 2

Residential Address – Beneficial Owner 2

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Percentage of ownership (if applicable)

Beneficial Owner Role

Shareholder Senior Management (e.g. CEO, CFO) Other

3. Full Name – Beneficial Owner 3

Residential Address – Beneficial Owner 3

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Percentage of ownership (if applicable)

4. DIRECTORS SECTION (CONT.)

3. Full Name – Director 3

Residential Address – Director 3

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

4. Full Name – Director 4

Residential Address – Director 4

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

5. Full Name – Director 5

Residential Address – Director 5

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

6. Full Name – Director 6

Residential Address – Director 6

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

7. Full Name – Director 7

Residential Address – Director 7

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

8. Full Name – Director 8

Residential Address – Director 8

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

AEX9559 07/20

Application Form P3 of 8

6. OTHER ENTITY TYPES SECTION (CONT.)

Beneficial Owner Role

2. Full Name – Beneficial Owner 2

Residential Address – Beneficial Owner 2

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Beneficial Owner Role

3. Full Name – Beneficial Owner 3

Residential Address – Beneficial Owner 3

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Beneficial Owner Role

4. Full Name – Beneficial Owner 4

Residential Address – Beneficial Owner 4

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

If there are more than 4 Beneficial Owners, please provide on a separate Company

letterhead document signed by the Decision Maker.

If a Foreign Company, please confirm if the Company is registered by a foreign

registration body

YES

N0

(note this may be in addition to Australian registration)

If Yes please confirm if the Company is registered as

private

public or

other

(please specify).

Please also complete Section 5.

If Unregistered Foreign Company, state the full address of principal place of

business in its Country of formation or incorporation:

Principal Place of Business Address

Province/State

Zip/Postcode

Country

Please also complete Section 5

5. BENEFICIAL OWNERS OF THE COMPANY

1

(CONT.)

Beneficial Owner Role

Shareholder Senior Management (e.g. CEO, CFO) Other

4. Full Name – Beneficial Owner 4

Residential Address – Beneficial Owner 4

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Percentage of ownership (if applicable)

Beneficial Owner Role

Shareholder Senior Management (e.g. CEO, CFO) Other

5. Full Name – Beneficial Owner 5

Residential Address – Beneficial Owner 5

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Percentage of ownership (if applicable)

Beneficial Owner Role

Shareholder Senior Management (e.g. CEO, CFO) Other

6. Full Name – Beneficial Owner 6

Residential Address – Beneficial Owner 6

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

Percentage of ownership (if applicable)

If there are more than 6 Beneficial Owners, please provide on a separate Company

letterhead document signed by the Decision Maker.

6. OTHER ENTITY TYPES SECTION

• If Partnership, please provide the details of all individual Beneficial Owners.

Refer to Notes/Definitions in Section 20. This includes Managing Partners and

Controlling Partners.

• If Association or Co-operative, please provide the details of all individual

Beneficial Owners. Refer to Notes/Definitions in Section 20. This includes the

Chairman, Secretary, Treasurer and Public Officer.

Beneficial Owner Role

1. Full Name – Beneficial Owner 1

Residential Address – Beneficial Owner 1

City

State

Postcode

Date of birth

D D

/

M M

/

Y Y Y Y

7. TRUST SECTION

COMPLETE THIS SECTION ONLY IF THE COMPANY IS A TRUSTEE OF A TRUST

An American Express representative will contact you to collect a certified copy of the

Trust deed.

Trust Name

Type of Trust (e.g. Family, Unit, Discretionary)

Trading Name

Country where the Trust was established:

AEX9559 07/20

8. COMPANY CONTACT DETAILS

Authorised Signatory

2

(for future Application authorisation)

Full Name

Position

Mailing Address (if different from Company Address)

City

State

Postcode

Telephone Number

–

Application Form P4 of 8

7. TRUST SECTION (CONT.)

Please provide the details of all individual Beneficial Owners. Refer to Notes/Definitions

in Section 20.

Beneficial Owner Role

Beneficiary* Appointer Other

Full Name – Beneficial Owner 1

Residential Address – Beneficial Owner 1

Date of birth

D D

/

M M

/

Y Y Y Y

Beneficial Owner Role

Beneficiary* Appointer Other

Full Name – Beneficial Owner 2

Residential Address – Beneficial Owner 2

Date of birth

D D

/

M M

/

Y Y Y Y

Beneficial Owner Role

Beneficiary* Appointer Other

Full Name – Beneficial Owner 3

Residential Address – Beneficial Owner 3

Date of birth

D D

/

M M

/

Y Y Y Y

Beneficial Owner Role

Beneficiary* Appointer Other

Full Name – Beneficial Owner 4

Residential Address – Beneficial Owner 4

Date of birth

D D

/

M M

/

Y Y Y Y

If there are more than 4 Beneficial Owners, please provide on a separate Company

letterhead document signed by the Decision Maker.

REMEMBER ALSO COMPLETE ALL OF SECTION 3, SECTION 4 – DIRECTOR

DETAILS AND SECTION 5 – BENEFICIAL OWNERS FOR THE TRUSTEE COMPANY

If there is more than one Trustee please provide their name and address on a

separate page, signed by the Decision Maker.

* If the Beneficiaries are described in the Trust Deed by reference to a class, please

provide the description of each class of Beneficiary on a separate page, signed by

the Decision Maker.

8. COMPANY CONTACT DETAILS (CONT.)

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

Authorised Signatory’s Signature

✘

Date

D D

/

M M

/

Y Y Y Y

Additional Authorised Signatory

2

(recommended)

Full Name

Position

Mailing Address (if different from Company Address)

City

State

Postcode

Telephone Number

–

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

Authorised Signatory’s Signature

✘

Date

D D

/

M M

/

Y Y Y Y

Master Program Administrator

3

Full Name

Position

Mailing Address (if different from Company Address)

City

State

Postcode

Telephone Number

–

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

Do you have an existing @ Work User ID?

YES NO

If Yes, please provide your User ID

If No, please provide your day and month of birth. You will be prompted to

enter this as authentication when completing your online registration to

American Express @ Work.

D

D

/

M

M

Corporate ID

4

(please provide the CID to gain access)

AEX9559 07/20

Application Form P5 of 8

8. COMPANY CONTACT DETAILS (CONT.)

Program Administrator

5

(recommended)

Full Name

Position

Mailing Address (if different from Company Address)

City

State

Postcode

Telephone Number

–

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

9. ACCOUNT SET UP DETAILS – CORPORATE CARD PROGRAMS, CORPORATE

PURCHASING CARD AND CORPORATE MEETING CARD

(FOR BUSINESS TRAVEL ACCOUNT SET UP please go to Section 15)

Billing Method

6

Company Card Member

Payment Options

7

Company Card Member

#

Payment Method

Company Direct Debit^

Electronic Funds Transfer

#

Note payment options below are available only to Corporate Card Programs which have the

Card Member payment option ticked above.

BPAY Individual Direct Debit^ Individual Pay Online

^ A separate form will be required for Company Direct Debit and Individual Direct Debit.

How is the annual Card fee billed?

Centrally to a separate cost centre

To appear on Card Member’s statement

Note: If Annual Card Fee is to be billed separately to a cost centre, it means that the Company is

assuming Corporate Liability on the Annual Card Fees.

If annual Card fees are requested centrally, please complete Recipient details

Full Name

Position

Recipient’s Street Address

City

State

Postcode

Telephone Number

–

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

Common Anniversary Date

8

Ye s

If Yes, which month?

Nominate Ideal Date of Month for Billing Period to End

9

Billing Date

In which month does the Company’s Financial Year start?

Card Distribution Central – New Only Central – Renewal and Replacement

Central – All Cards To Card Member’s Billing Address

9. ACCOUNT SET UP DETAILS – CORPORATE CARD PROGRAMS, CORPORATE

PURCHASING CARD AND CORPORATE MEETING CARD (CONT.)

(FOR BUSINESS TRAVEL ACCOUNT SET UP please go to Section 15)

If central Card distribution is requested, please complete Recipient details

Full Name

Position

Recipient’s Mailing Address

City

State

Postcode

Telephone Number

–

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

10. AMERICAN EXPRESS vPAYMENT & AMERICAN EXPRESS GO

Billing Method

6

Company

Payment Options

7

Company

Payment Method

Company Direct Debit^

Electronic Funds Transfer

^ A separate form will be required for Company Direct Debit.

11. OTHER SERVICES – CORPORATE CARD PROGRAMS ONLY

Cash

^

^ Cash on the Card is only applicable to Corporate Card Programs and a separate application

form will be required to be completed.

Licensed Software*

##

Secure File Transfer (SFT)

10

Data Feeds

##

GL-1025 Corporate Card Data Feed

##

Daily Monthly

The GL-1025 data file contains comprehensive transactional data and facilitates the population

of your finance or expense management system to aid reconciliation. Data is provided in a

structured format on a daily or monthly basis and delivered through secure channels.

GL-1205 Card Member Listing Data Feed

##

Daily Monthly

The GL-1205 Card Member file contains details of existing Cards within the Card program and

is ideally used as a pre load file to finance, expense management, or MI system. Data is provided

in a structured format on a monthly basis and delivered through secure channels.

* Please ensure you complete the separate licensed software form.

## Fees may apply.

AEX9559 07/20

15. BUSINESS TRAVEL ACCOUNT (BTA) SET UP ONLY

To set up a Business Travel Account please complete the following

Name of your Travel Management Company (TMC)

Address of your TMC

City

State

Postcode

TMC

ABN

(Please ensure your ABN No is correct and must be 11 characters)

TMC Code

6

0

Travel Office Code

210

Air Spend Domestic AUD (per annum)

International AUD (per annum)

Total AUD (per annum)

BTA Account to be set up for the following commodity types

Tick

(3)

below to indicate the commodity type

Note: A separate BTA is required for each commodity.

Air Car Hotel

How many BTA accounts do you require?

If you have indicated above that you require more than one (1) BTA account

and the reporting information requirements or statement recipient details

differs for each BTA account, then you will be required to complete a

separate Section 15 for each BTA account. Please copy this Section 15 and

complete for each account required.

Reporting Information for Companies

1. Will the BTA be incorporated into your existing Corporate Card structure?

YES NO

2. If Yes, what is your highest level Corporate ID number?

Payment Method

3. How does your Company intend to pay the BTA?

Electronic Funds Transfer

Direct Debit

4. BTA Set-up Name (Maximum 30 characters including spaces)

5. BTA to be linked to a BCA Complete CID only if multiple

BTAs are to be linked to 1 BCA

6. CID to be linked to Corporate Card Complete only

if to be linked into existing Corporate Card structure

7. Nominate Ideal Date of Month for Billing Period to End

9

Billing Date

8. First Month of Financial Year

9. Customer Reference Fields

You can have up to four Customer Reference Fields. Please select what reference

fields you require and provide an example.

9(a). Customer Reference 1 (maximum 20 characters including spaces)

American Express Internal reporting; Customer Reference Standard.

9(b). Customer Reference 2 (maximum 20 characters including spaces)

American Express Internal reporting; Trip Requisition.

9(c). Customer Reference 3 (maximum 45 characters including spaces)

American Express Internal reporting; Customer Reference Enhanced.

9(d). Customer Reference 4 (maximum 20 characters including spaces)

American Express Internal reporting; Job Number.

Application Form P6 of 8

12. CORPORATE MEETING CARD SET UP ONLY

Agreement Start Date

D D

/

M M

/

Y Y Y Y

Accounts Requested

Plastic – Individual

Non Plastic – Individual

Non Plastic – Departmental

Licensed Software*

##

CAR (Corporate Account Reconciliation)

11

Secure File Transfer (SFT)

10

Data Feeds

##

GL-1025 Corporate Card Data Feed Daily Monthly

The GL-1025 data file contains comprehensive transactional data and facilitates the population

of your finance or expense management system to aid reconciliation. Data is provided in a

structured format on a daily or monthly basis and delivered through secure channels.

GL-1205 Card Member Listing Data Feed Daily Monthly

The GL-1205 Card Member file contains details of existing Cards within the Card program and

is ideally used as a pre load file to finance, expense management, or MI system. Data is provided

in a structured format on a monthly basis and delivered through secure channels.

* Please ensure you complete the separate licensed software form.

## Fees may apply.

13. CORPORATE PURCHASING CARD SET UP ONLY

Agreement Start Date

D D

/

M M

/

Y Y Y Y

Accounts Requested

Plastic – Individual

Non Plastic – Individual

Non Plastic – Departmental

Licensed Software*##

CAR (Corporate Account Reconciliation)

11

Secure File Transfer (SFT)

10

Data Feeds

##

GL-1025 Corporate Card Data Feed Daily Monthly

The GL-1025 data file contains comprehensive transactional data and facilitates the population

of your finance or expense management system to aid reconciliation. Data is provided in a

structured format on a daily or monthly basis and delivered through secure channels.

GL-1205 Card Member Listing Data Feed Daily Monthly

The GL-1205 Card Member file contains details of existing Cards within the Card program and

is ideally used as a pre load file to finance, expense management, or MI system. Data is provided

in a structured format on a monthly basis and delivered through secure channels.

* Please ensure you complete the separate licensed software form.

## Fees may apply.

14. BUYER INITIATED PAYMENTS (BIP) SET UP ONLY*

Agreement Start Date

D D

/

M M

/

Y Y Y Y

Accounts Requested

Non Plastic – Departmental

Licensed Software*##

CAR (Corporate Account Reconciliation)

11

Secure File Transfer (SFT)

10

Data Feeds

##

GL-1025 Corporate Card Data Feed Daily Monthly

The GL-1025 data file contains comprehensive transactional data and facilitates the population

of your finance or expense management system to aid reconciliation. Data is provided in a

structured format on a daily or monthly basis and delivered through secure channels.

GL-1205 Card Member Listing Data Feed Daily Monthly

The GL-1205 Card Member file contains details of existing Cards within the Card program and

is ideally used as a pre load file to finance, expense management, or MI system. Data is provided

in a structured format on a monthly basis and delivered through secure channels.

* Please ensure you complete the separate licensed software form.

## Fees may apply.

AEX9559 07/20

Application Form P7 of 8

15. BUSINESS TRAVEL ACCOUNT (BTA) SET UP ONLY (CONT.)

10(a). e-Data Required at Account level (additional Set-Up Forms to be completed)

Tick (3) if you require Monthly only or if you require EITHER Daily or Weekly in

addition to your Monthly file

Monthly Monthly and Daily Monthly and Weekly

10(b). Consolidated e-Data at Hierarchy levels (additional Set-Up Forms to be

completed)

Tick (3) if you require consolidated e-Data at a hierarchy level

YES

11(a). Primary Statement Recipient

Full Name

Telephone Number

Mailing Address

City

State

Postcode

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

I would like to enrol for BTA Reports

YES NO

Spend Comparison Report DHTML

Airline Usage Report DHTML

Trip Requisition Analysis DHTML

Traveller Analysis Report DHTML

Customer Reference Analysis DHTML

Top 10 Air Routings Report DHTML

Do you have an existing @ Work User ID?

YES NO

If Yes, please provide your User ID

If No, please provide your day and month of birth. You will be prompted

to enter this as authentication when completing your online registration

to American Express @ Work.

D

D

/

M

M

11(b). Additional Statement Recipient

Full Name

Telephone Number

Mailing Address

City

State

Postcode

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

I would like to enrol for BTA Reports

YES NO

Spend Comparison Report DHTML

Airline Usage Report DHTML

Trip Requisition Analysis DHTML

Traveller Analysis Report DHTML

Customer Reference Analysis DHTML

Top 10 Air Routings Report DHTML

Do you have an existing @ Work User ID?

YES NO

If Yes, please provide your User ID

If No, please provide your day and month of birth. You will be prompted

to enter this as authentication when completing your online registration

to American Express @ Work.

D

D

/

M

M

17. VERIFYING YOUR IDENTITY

American Express needs to verify your identity to comply with the Anti-Money Laundering

and Counter-Terrorism Financing Act 2006. We will attempt to electronically verify your

identity based on the details in your application and available electronic registers. However,

if this is unsuccessful, you agree that you will provide us with satisfactory documentary

evidence to allow us to verify your identity.

16. American Express OFFICE USE ONLY – BTA

SURNAME

TRAVEL ACCOUNT

SIGN

Y

FIRST

BUSINESS

PROC

6

DELIV

XXX

PROD

059

CARD DESIGN TYPE

000005

FEE

0

TEAM

6

BILL IND

C

REV

7

SCODE

PD1Ø7ØØ2Ø1

MAC

AML

E

18. AGREEMENT SIGNATURE

TO: AMERICAN EXPRESS AUSTRALIA LIMITED

The Entity named above (“You”) requests that American Express Australia Limited provide the

Corporate Payment products (“Accounts”) elected in this application. The undersigned officer

has read the attached Terms and Conditions and agrees that on your behalf you will be bound

by them and liable for charges in accordance with these Terms and Conditions.

You authorise American Express Australia Limited to contact your bankers or any other sources

and/or reports, in relation to our organisation including from, but not limited to, credit reporting

or other similar agencies for the purpose of identity verification of individuals named by us

(whether in this application or otherwise) or identified by American Express before, during or

after providing services to us to establish the chosen Accounts. You agree that a microfilmed or

other reproduction of this form may be produced by American Express as evidence of your

request to open the chosen Account(s). The undersigned warrants to American Express that

he/she is duly authorised by you to open the chosen Account(s) in the name of the above

entity in his/her capacity as (PLEASE TICK ONE):

Director, if a Company, including where Company is a Trustee

Partner, if a Partnership

Chairperson, Secretary, or Treasurer if an Association/Co-operative

Other (Please specify role):

If the Company is a Trustee, the Trustee enters into this Agreement in its own right and

as trustee of the Trust.

Full Name

Position

Company Name (maximum 40 characters)

(As per registered ABN Entity Name)

Decision Maker’s Address

12

City

State

Postcode

Telephone Number

–

We need an email address to send the Company changes to the Terms and

Conditions, servicing and marketing communications from American Express.

Business Email Address

Before you submit this form, check that you have provided true and correct

information. It is an offence under the Anti-Money Laundering and Counter-Terrorism

Financing Act 2006 to knowingly provide false, incomplete or misleading information.

Decision Maker’s Signature

12

✘

Date

D D

/

M M

/

Y Y Y Y

AEX9559 07/20

Application Form P8 of 8

American Express Australia Limited ABN 92 108 952 085

®

Registered Trademark of American Express Company.

20. NOTES/DEFINITIONS

1. Beneficial Owner – An individual with at least 25% ownership or an individual deemed

to have beneficial control of the Company. Beneficial control refers to the means of

exercising direct or indirect control including but not limited to the capacity to significantly

influence financial decisions, operating policies or the appointment/dismissal of a senior

managing official of the Company. Such control may be by means of trusts, agreements,

arrangements, understanding or practices, whether or not having legal or equitable force.

2. Authorised Signatory – An authorised signatory is authorised to approve and countersign

various agreements such as Card Applications, Corporate Cash enrolment etc, or request

changes to the Account.

3. Master Program Administrator – The central point of contact for American Express

program management within the Company and:

(i) is authorised by the Company to maintain and enquire on American Express

Account(s);

(ii) is the first point of contact if authorisation is required for certain maintenance

requests;

(iii) will oversee all other employees with permissions to transact on behalf of their Card

programs in @ Work; and

(iv) subject to the terms set out in this Agreement, will have default access and will

be authorised to approve or edit @ Work Program Management, Apply for Card,

Corporate Membership Rewards®, Corporate Online Payments and Reporting

permissions to other employees within the company.

4. Corporate ID – This is a 15 digit number that identifies all accounts within the same

cost centre.

5. Program Administrator – Additional corporate contact who is authorised by the Company

to maintain and enquire on the account. Also has access to @ Work Services.

6. Billing Method – You can choose whether the Company or the Card Member receives the

monthly Corporate Card statement

7. Payment Options – Who will be paying the monthly Corporate Card statement? Whoever

receives the monthly statement will be contacted if the Corporate Card Account becomes

overdue. Choose one option only.

8. Common Anniversary Date – Do you want all Card fees for the Company to be billed

in the same month, if so, when?

9. Ideal Date of Month for Billing Period to End – Please consult with your

American Express representative regarding which Billing Date you wish to receive your

Corporate Card statements.

10. Secure File Transfer (SFT) – A protocol used to transfer data between the Company and

American Express.

11. CAR (Corporate Account Reconciliation) – A web-based reconciliation solution that

eliminates the need for paper reconciliation.

12. Decision Maker – An individual who is responsible for initial talks with American Express,

this individual can discuss how the Company will be setup, signs the original contract and

can request changes to the recipient of any applicable rebate.

21. AMERICAN EXPRESS OFFICE USE ONLY

Sales Code

Sales Database ID

Hot Stamp ID

Salesperson’s Name

Telephone Number

–

Email Address

Existing Client LCA#

MR Client Preference No MR

CMR

CM MR

CMR and CM MR

Sales Channel CAD OBT MM – Field Sales

MM – CAT LM – Field Sales LM – ADM

GCG Multinational

Market Segment MM LM GCG MNC

Metcash Ye s No

Sales Source

1. Internal

existing relationship or client contact initiated by American Express

2. External

identified by non-American Express sales eg external sales agent,

terminal provider, etc

3. Unsolicited

telesales (inbound & outbound)

Number of Applications submitted

Date sent

D D

/

M M

/

Y Y Y Y

Date received

D D

/

M M

/

Y Y Y Y

21. AMERICAN EXPRESS OFFICE USE ONLY (CONT.)

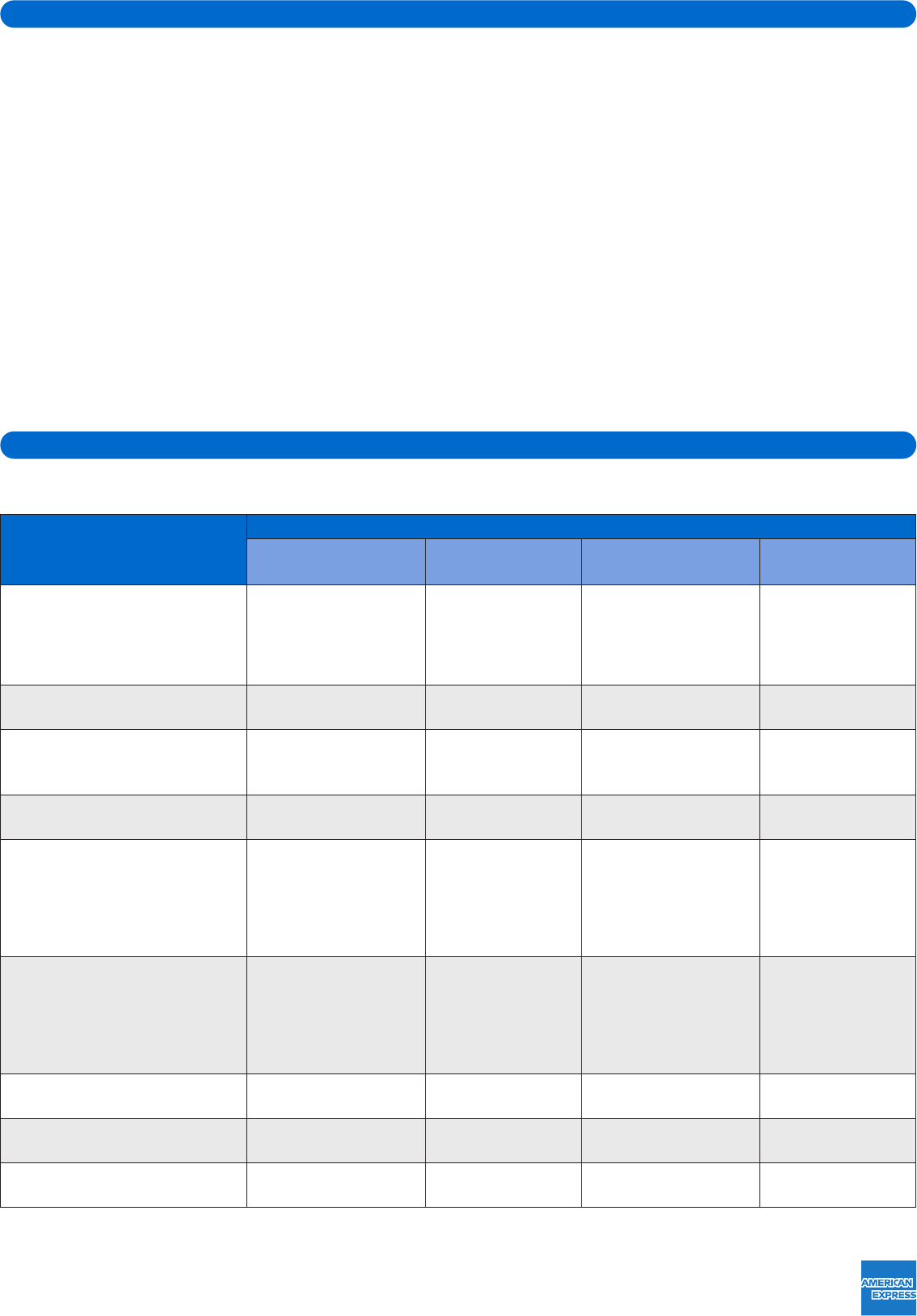

Annual Fee Scheme (Please tick all product types under the preferred product line/s.)

Product Type Non Standard Sliding Scale Fixed Amount

1. Corporate (AECC)

a. Green

$

b. Gold

$

c. Platinum

2. Cobrand

a. Green

$

b. Gold

$

c. Platinum

3. CPC

a. Plastic

$

b. Non-Plastic

$

4. CMC

a. Plastic

$

b. Non-Plastic

$

5. B

TA

6. Metcash

7. BIP

$

19. MARKETING

If you wish to opt out of marketing at a Company level please contact your

American Express Representative or call 1300 366 296.

AEX9559 07/20

Conditions P1 of 7

This Australian Global Commercial Services Agreement is between American Express

Australia Limited ABN 92 108 952 085 (“we”, ”us”, ”our” and “American Express”)

and the Company named in the attached Account Application (“you”, ”your” and “the

Company”) and governs your use of the Account(s) in Australia. This Agreement sets

out the terms and conditions under which we provide American Express Global

Commercial Services in Australia and governs your use of the Accounts selected in

the Account Application which forms part of this Agreement.

Before you use any American Express Global Commercial Services’ product or

service, please read these conditions thoroughly. If you use any Account or Card, you

will be agreeing to these conditions and they will govern your use of the Account or

Card. If you do not wish to use the Account or Card, please notify American Express

in writing by registered mail on your letterhead signed by an authorised person, to:

American Express Australia Limited, Customer Service – Corporate Card, GPO Box

5087, Sydney NSW Australia 2001.

A: General Provisions

1. Definitions: the following definitions are used throughout this document:

‘Account(s)’: your American Express Corporate Card Account, Corporate Meeting

Card Account, Corporate Purchasing Card Account, American Express Virtual

Payment Account, as selected in the Account Application.

‘Account Application’: means the attached Account Application completed by the

Company, which forms part of this Agreement.

‘Account Limit’: a limit applicable to the Company Account or the aggregate of all

or a subset of Card Member Accounts, being the maximum amount that can be

outstanding at any time.

‘Affiliate’: any entity that controls, is controlled by, or is under common control with

the relevant party, including its subsidiaries.

‘Agreement’: these Terms and Conditions, as distinct from the separate Card

Member terms and conditions that are agreed separately and independently

between Card Members and us.

‘American Express Go facility’ or ‘Amex Go facility’: a facility which allows

authorised employees and non-employees of Company to receive and use

Virtual Account Numbers from Company via the proprietary American Express

mobile app “Amex Go” (“Amex Go app”).

‘American Express vPayment Facilitator’: means the third party chosen by the

Company, American Express or nominated by the Company’s Travel Management

Company (“TMC”), being either Troovo Technologies Pty Ltd, Coupa Software Inc.

and/or Conferma Limited, to act as the third party’s agent to facilitate its

American Express vPayment or BTA with Virtual Payments transaction.

‘American Express vPayment facility’ or ‘Amex vPayment facility’: a facility that

enables Company to make payments to Merchants via specific use Virtual

Account Numbers.

‘American Express Virtual Payment Account’ or ‘Virtual Payment Account’:

an account that enables the Company (including its designated employees and

non-emplo

yees) or, in the case of BTA with Virtual Payments, its designated

TMC, to make payments to Merchants via specific use Virtual Account Numbers

through one or all of the following: an Amex Go facility, an Amex vPayment

facility or a BTA with Virtual Payments facility.

‘App Users’: In the case of an Amex Go facility, this term means an individual who

is authorised by you to access company funds via the Amex Go app, Amex Go

virtual Card information and incur Charges on your Amex Go facility.

‘BTA with Virtual Payments’ or ‘BTA’: a Virtual Account Number enabled facility

that allows the Company to centralise Charges booked through its designated

TMC and be billed monthly for those Charges by American Express.

‘Buyer Initiated Payments’ or ‘BIP’: shall mean the electronic payment service solution

for our customers that enable them to make payments to their suppliers.

‘Card Member’: an individual to whom a Corporate Card, Corporate Meeting Card,

Corporate Purchasing Card, or Virtual Account Number is issued to you at your

request. The Card Member is an individual authorised by you to incur Charges on

an Account, whether by use of a Card or otherwise. In the case of a BTA, this term

includes an account user authorised by you to make travel reservations and

thereby incur Charges on an Account. In the case of an American Express Virtual

Payment Account, this term includes an account user authorised by you to request

and receive Virtual Account Numbers and thereby incur Charges on an Account.

‘Card Member Account’: means the Account established by us for a Card Member

for the purpose of executing and recording Charges.

‘Card Member Agreement’: the agreement between us and the Card Member

governing use of a Card and liability for charges.

‘Card’: any Card, whether plastic, non-plastic or, a Virtual Account Number issued

under this Agreement or on any Account.

‘Charge’: all amounts billed to an Account, regardless of whether a charge form or

other charge authorisation is signed, including purchases of goods and services,

cash advances, late payment charges and any other fees or charges.

‘Code’: any PIN, telephone codes or online passwords approved by us to be used

on your Account.

‘Commercial Card Services’: any or all of the Accounts or services provided by us

under this Agreement.

‘Company’ means the legal entity described in the Corporate Details in part 2 of the

Account Application (whether an Australian Company, Partnership, Registered

Foreign Company, Unregistered Foreign Company, Government Body,

Co-Operative, Incorporated Association, Unincorporated Association or Trustee).

‘Corporate Card’: an American Express Corporate Card issued on your Account.

‘Designated Employee’: a Master Program Administrator, Program Administrator,

Card Member or person designated by you as your point of contact for

Corporate Card Services or Program(s).

‘Items for Resale’: goods and services purchased using your Card or Account and

used by the Company for the purpose of resale.

‘Master Program Administrator’: a person notified to us by the Company as its

main administrator for the Program.

American Express Global Commercial Services Agreement in Australia – Company

AEX9559 07/20

‘Merchant’: a Company, firm or other organisation accepting American Express

Cards as a means of payment for goods and/or services.

‘Online Service’: any internet-based service that we make available to the Company.

‘Program’: the American Express Global Commercial Services’ services provided to

Card Members and the Company under this Agreement and the Card Member

terms and conditions.

‘Program Administrator’: a person notified to us by the Company as an additional

administrator for the Program.

‘Recurring Charges’: means when you authorise a Merchant to submit Charges

to a Card repeatedly or at regular intervals.

‘ROC’: a record of charge that evidences the purchase price of any Charge.

‘Statement’: a record of Card or Account transactions, account balance and other

relevant account information for a specified period.

‘Unauthorised Charges’: are Charges that did not benefit either you or the Card

Member and which were incurred by someone who was not the Card Member

and who had no actual, implied, or apparent authority to use the Card or Account.

‘Virtual Account Number’: a virtual account number that is issued by American

Express to or on behalf of a Company or TMC for use as payment for goods and/

or services at a Merchant.

2. Establishment of Accounts and Card Issuance

(a) We will establish and operate the Account(s) in your name and, if applicable,

issue Cards on your Account(s) bearing your name and those of any Designated

Employees and/or Card Members.

(b) We reserve the right to:

(i) require each prospective Card Member to complete our application for the

Card or Account, including providing any identification or other information

required to comply with local laws;

(ii) carry out credit checks and request financial information and other

information periodically from banks, credit reference agencies and other

sources in relation to you and/or any Card Members. These agencies may

retain records of such checks, including information regarding the conduct

of your Account and payment history, which may be used (subject to

applicable law) by us and other firms and organisations in making credit

decisions about you or the Card Member, including for preventing fraud

or tracing debtors; and

(iii) decline to issue, renew or replace a Card or Account to any person; cancel

or suspend the use of a Card or Account at any time either generally or in

relation to a particular transaction.

(c) Further, in the case of a Combined Liability Corporate Card Account, we may

insist upon a minimum income for Card Members in accordance with our usual

risk management criteria.

(d) We shall renew and replace Cards, subject to 2(b) above, until you or the Card

Member directs otherwise.

(e) You are solely responsible for selecting and notifying us of the names of persons

to whom you request we issue Cards and establish Card Member Accounts. We

may deem any applicant referred to us by a Designated Employee as approved

by you to hold and use a Card.

(f) We will provide to you upon request, any Card Member application forms or Card

Member Agreement then in effect. We reserve the right at our sole discretion to

change Card Member application forms and Card Member Agreements at any

time and to establish additional or different requirements for internet-based

Card Member applications, and we will notify you accordingly.

(g) You must ensure that current Card Member application forms and procedures

prescribed by us are used and that current Card Member Agreements are provided

to and retained by each applicant upon completion of the Card Member application

form and in any event in good time before the Card is provided to the Card Member.

3. Use of the Card and/or Account

(a) You may only use a Card in accordance with this Agreement and within the

validity dates shown on its face.

(b) Subject to Section E, you must not give any Card or Account numbers to others

or allow them to use either for Charges, identification or any other purpose.

(c) Subject to Section E, the Card Member is the only person entitled to use the

Card bearing his or her name and the corresponding Card Member Account.

You must ensure each Card Member takes reasonable measures to stop anyone

els

e using the Card and/or Account and that each Card Member takes proper

care to keep the Card safe and all Card and Account details secret.

(d) To protect any Codes approved by us to be used on your Account, please make

best endeavours to ensure that any Card Members:

(i) memorise the Code;

(ii) destroy our communication informing them of the Code (if applicable);

(iii) do not write the Code on the Card;

(iv) do not keep a record of the Code with or near the Card or Account details;

(v) do not tell the Code to anyone;

(vi) if they select a Code, do not choose a Code that can easily be associated

with them such as their name, date of birth or telephone number; and

(vii) take care to prevent anyone else seeing the Code when entering it into

an Automatic Teller Machine (ATM) or other electronic device.

(e) You must designate an individual as the Program Administrator to manage each

Account that you establish with us.

(f) You must not return any goods, tickets or services obtained with a Card or

Account for a cash refund, but you may return them to a Merchant for credit

to the Card or Account, if that Merchant agrees or is obliged to do so.

(g) You shall not obtain a credit to a Card or Account for any reason other than

as a refund for goods or services previously purchased.

(h) You must not use any Card or Account if you do not honestly expect to be able

to pay your Account in full on receipt of your monthly statement.

(i) You must cease using any Card or Account and notify us immediately if an

application is filed for the Company’s winding-up, or if the Company passes a

resolution for its liquidation or has a liquidator, administrator and/or receiver

appointed to it or over any of its assets.

(j) You acknowledge and agree that we have the right to refuse authorisation for

any Charge without cause or prior notice, and that we shall not be liable to you

or anyone else for any loss or damage resulting in such refusal.

(k) You may not use a Card or Account for any unlawful purpose, including the

purchase of goods or services prohibited by the laws of Australia or any country

where the Card or Account is used or where goods or services are provided.

(l) You may not use your Card for amounts that do not represent bona fide sales

of goods or services, e.g. purchases at Merchants that are owned by you (or

your family members) or employees or any other person contrived for cash

flow purposes.

(m) You agree to provide us with all information available to you concerning the

whereabouts of a Card Member and his or her address and to co-operate with us

in any investigation concerning the use of the Card or Account, or collection of

Charges from Card Members. This provision will continue in force after the Card

is cancelled and/or this Agreement terminated.

(n)

Although the Card Member uses the Card, the Card remains our property at

all times.

(o) Subject to restrictions set out in this Agreement or the Card Member

Agreement, you shall instruct the Card Member to use the Card or Account for

your business use, i.e. to pay Merchants for goods and/or services for travel and

entertainment in relation to your business or for use or consumption in the

course of conducting your business (and not for re-sale) and in accordance with

your policies and procedures.

(p) As a special concession, where you have a Corporate Card Account, we may

allow the Card or Account to be used for the purchase of Items for Resale

provided that:

(i) you indicate in the Account Application your intention to use your Card or

Account to purchase Items for Resale or you otherwise notify us of that

intention in writing; and

(ii) you will be solely liable for all Charges related to Items for Resale, as set out

in Liability below; and

(iii) you agree that we may request that you sign an additional agreement.

(q) The Express Cash Service, where applicable, allows Card Members to withdraw

cash from ATMs’ displaying the American Express logo. If a Card Member enrols

in our Express Cash Service, participation may be governed by a separate

agreement with the Card Member, but at all times you will be liable for such

Charges regardless of the liability type elected by you in the Account Application.

4. Payment

(a) You agree to pay all Charges shown on each monthly Account statement on receipt,

but not later than the due date as set out in the monthly statement. Each monthly

statement of Charges shall be deemed to have been received by you or the Card

Member (depending on the billing system in place) upon the date of the actual

receipt or the seventh day following its dispatch by us. In the event of your non-

receipt of our monthly statement you shall be liable to make payment of the

Charges within 21 days of incurring the Charge or earlier if requested by us. Failure

to pay on time and in full is a material breach of this Agreement.

(b) If you have a Corporate Purchasing Card Account or an American Express Virtual

Payment Account, you agree to pay all Charges shown on each monthly Account

statement by direct debit or eftpos no later than 14 days after the date of the

statement. In the case of Corporate Meeting Card, you agree to pay all Charges

shown on each monthly Account statement by direct debit or eftpos no later

than 21 days after the date of the statement.

(c) Payments will be credited to the relevant Account or Card Member Account

when received, cleared and processed. The time for payments to reach us for

clearing and processing depends on the payment method, system and provider

used to make payment to us. You must allow sufficient time for us to receive,

clear and process payments by the due date taking into account weekends and

public holidays, when we and/or your or our payment service provider may not

be open for business.

(d) You and the Card Member agree not to deduct or withhold, without our prior

written approval, any amount shown as due on any Account statement or data

feed. You will pay us the full amount shown on the Account Statement or data

feed irrespective of whether you are or intend disputing an amount(s) contained

on your Account Statement or data feed. If you believe any Charge shown on a

statement is in error or in dispute, you may request and we may set up and

maintain for a reasonable period, a temporary credit on the Account for the

disputed Charge while we investigate the error or you seek to resolve the

dispute. Should the dispute be resolved in your favour, we shall credit the

amount(s) that were previously disputed to your Account and it will appear on

the next issue of your monthly Account Statement.

(e) We may, in our sole discretion, accept late or part payments or any payment

described as being in full or in settlement of a dispute. If we do, we shall not lose

any of our rights under this Agreement or at law, including the right to payment

in full, and it does not mean we agree to change this Agreement. We may credit

part payments to any of the outstanding Charges.

(f) You must always pay us in Australian dollars, unless we agree otherwise in writing.

(g) A certificate signed by one of our officers stating the amount that you and/or the

Card Member owes us under this Agreement is proof of such amount. A copy of

any document relating to the Account with us, or produced from data received

by us electronically from a Merchant, shall be admissible to prove the contents

of that document for any purpose.

5. Liability

(a) For a Corporate Card product, the following liability options apply (as selected by

you in the Account Application):

(i) Combined Liability: Subject to the terms of clause 5(c), the Company and

each Card Member shall be jointly and severally liable for all Charges

incurred by the Card Member; provided, however, that the Company shall

not be liable for Charges (i) incurred by the Card Member that are personal

in nature and which did not accrue a benefit to the Company for legitimate

American Express Global Commercial Services Agreement in Australia – Company

Conditions P2 of 7

business purposes or (ii) for which the Company has reimbursed the Card

Member; and

(ii) Corporate Liability: Subject to the terms of clause 5(c), the Company

shall be fully liable to American Express for all Charges incurred on such

American Express Accounts.

(b) For any BTA, CPC, Corporate Meeting Card or American Express Virtual

Payment Account product selected in the Account Application, you are liable

for all Charges incurred.

(c) You are not liable for Unauthorised Charges on any Card or Account except in

the following circumstances where:

(i) you and/or the Card Member breached the terms of your Agreement with

us (in particular the “Use of the Card and/or Account” clause);

(ii) you or the Card Member contributed to, or were in any way involved in or

benefitted from the theft, loss or misuse (including improper or fraudulent

use) of the Card or Account;

(iii) you or the Card Member have delayed notifying us as required under

“Liability” sub-clause (d), in which case you will be liable for all Unauthorised

Charges until you or the Card Member did notify us;

(iv) for BTA or American Express Virtual Payment Accounts, you or the Card

Member, your previous and current agents, American Express vPayment

Facilitators, TMCs, travel providers, hotel consolidators, car rental suppliers,

Account Users, and any previous and current employees of the

aforementioned parties contributed to, or were in any way involved in or

benefitted from the theft, loss or misuse (including improper or fraudulent

use) of the Card or Account; and/or

(v) for BTA and American Express Virtual Payment Accounts, you or the Card

Member failed to accurately reconcile your statements and/or failed to notify

us immediately of any suspected fraudulent use of any Card or Account.

By way of example, if you or the Card Member gave away your Card and/or

Codes to another person to use or otherwise acted in breach of this Agreement,

you may be liable for the resulting Unauthorised Charges.

(d) You agree to notify us if any Designated Employee and/or Card Member’s

authority to incur Charges on your behalf terminates or as soon as you become

aware or have reason to suspect that a Card is lost or stolen, someone else

learns a Code, or if a Card or Account is at risk of being misused.

(e) You are liable to pay us for all Charges incurred from the date a Card Member’s

authority to incur expenses on your behalf is terminated through to the date we

receive notification from you of that termination.

(f) You will use your best efforts to collect and destroy Cards issued to individuals

whose authority to incur Charges is terminated, who leave your employment for

any reason or whose Cards have been cancelled, or on termination of this

Agreement.

(g) You agree to instruct Card Members to submit expense reports covering Card

transactions promptly and in any event at least once a month.

(h) You agree to instruct Card Members that the Card is issued solely for authorised

purposes as permitted by your policies and procedures, and promptly report any

misuse of the Card or Account to us.

(i) Wherever your Cards or Accounts are used to purchase Items for Resale, you will

be solely liable for all such Charges irrespective of Card Member liability

otherwise described in this Agreement and even if you have not notified us

of your intention to purchase Items for Resale.

6. Account Limits

(a) We reserve the right at our sole discretion to establish Account Limits for any

Account and/or jointly in connection with other accounts or arrangements that

you or your Affiliates may have with us or our Affiliates. We may, at our sole

discretion, change any Account Limit. We will inform you prior to or

simultaneously with the establishment of, or change to, an Account Limit.

(b) You agree to regularly monitor and manage your Account, including but not

limited to implementing internal policies and procedures to control Card

Member spending, to ensure Account Limits are not exceeded.

(c) Upon request, you must promptly provide us with copies of your financial

information and other information about your business that is reasonably

necessary for us or our Affiliates to assess our financial risk and comply with

our legal obligations. We may use and share such information with our Affiliates.

(d) We may require you to provide us with security in order to avoid having an Account

Limit established or decreased, or to enable an increase to an Account Limit.

(e) For the avoidance of doubt, you and/or the Card Member remain liable for all

Charges as set out in this Agreement, including Charges incurred in excess of

the Account Limit.

7. Communications with You

(a) We may provide Statements, notices, disclosures and other communications to

you in connection with the Program (“Communications”) by post, email or online

channels where those have been selected by you.

(b) We may communicate with you through a Designated Employee, which you

accept is a valid Communication from us to you. You authorise any Designated

Employee to act on your behalf for all matters relating to this Agreement and we

are entitled to rely on any directions, consents and information received from

them. We may communicate with a Card Member through a Designated

Employee, in which case you shall ensure that communications from or to a Card

Member are forwarded immediately to us or the relevant Card Member

respectively.

(c) You must keep us currently advised of yours, any Designated Employees, and/or

Card Members names, email addresses, postal mailing addresses and phone

numbers and other contact details for delivering Communications. If we have

been unable to deliver any Communication or a Communication has been

returned after attempting to send it via an address or phone number previously

advised to us, we will consider you in material breach of this Agreement and we

may stop attempting to send Communications to you until we receive accurate

contact information.

AEX9559 07/20

(d) All electronic Communications that we provide including Statements will be deemed

to be received on the day that we send the notification by e-mail or post the

Communication online even if you do not access the Communication on that day.

(e) If you do not receive a Statement in any month, or cannot access Statements via

the Online Service you shall be liable to make payment within 21 days of

incurring the Charges or earlier if requested by us.

(f) You must inform us of any changes to other information previously provided to

us. You must give us any additional information and support documentation

relevant to the Program or any Card Member Account that we request or as

required by applicable law. We may charge an additional annual administration

fee where any billing address is outside Australia.

(g) You will be deemed to have received any notice we give you under this

Agreement seven (7) days after we send it, unless you receive it earlier.

(h) Notices required under this Agreement to be delivered to American Express shall

be delivered to the address – American Express Australia Limited, Customer

Service – Corporate Card, GPO Box 5087, Sydney NSW Australia 2001.

8. Problems with Bills or Purchases

(a) You are responsible for confirming the correctness of your monthly statement

and, if you notify us immediately of a disputed Charge we will take reasonable

steps to assist you. If a Merchant issues a credit for a Charge, we will credit the

amount to your Account on receipt. If a problem cannot be resolved immediately

then pending resolution of the problem, we may agree to place a temporary

credit on any disputed amount, but you must pay us for all other Charges. If, at

your request, we agree to charge back a seller of goods or services, you agree to

indemnify us for any claim against us based upon the rejection of the goods or

services or that charge back.

(b) Unless required by law, we are not responsible for goods or services obtained

with the Card or Account, or if any Merchant does not accept the Card. You must

raise any claim or dispute direct with the Merchant concerned. You are not

entitled to withhold payment from us because of such claim or dispute.

(c) You agree that if requested to do so you shall provide us with written

confirmation in relation to your claim of Unauthorised Charges including without

limitation, supplying any or all of the following, a statutory declaration, an

affidavit of forgery and/or a copy of an official police report. By reporting the

existence of Unauthorised Charges, you agree to allow American Express to

release any information that you have provided or which is the subject of an

investigation into the Unauthorised Charges to the police and any other

investigative or statutory authority. You also agree that when requested you shall

provide all reasonable assistance and relevant information to us and/or the

police in relation to your claim of Unauthorised Charges.

(d) You may authorise a Merchant to bill Recurring Charges to your Card or Account.

To avoid potential disruption of Recurring Charges or the provision of goods or

services, in the case of a replacement Card or cancelled Card it is always your

responsibility to contact the Merchant and provide replacement Card or Account

information or alternate payment arrangements. You and/or the Card Member

will be liable for Recurring Charges incurred on a cancelled Card or Account. To

stop Recurring Charges, you must have the right to do so by law or under your

arrangement with the Merchant and you must advise the Merchant in writing or

in another way permitted by the Merchant.

(e) If we agree to place any limits or restrictions on the type of Charges incurred on

any Card or Account, we are obliged only to use reasonable efforts to apply such

limits or restrictions and this does not affect your liability for any Charges. We are

unable to block or prevent Charges at certain Merchants, including but not limited

to Merchants who do not process Charges via electronic terminals or who have

provided us with a description of their own activities, which may be incomplete or

inaccurate. In classifying Merchants in our system or records, we are entitled to

rely on any description of their own activities provided by such Merchants.

9. Lost/stolen Cards and misuse of Accounts

(a) You must ensure that we are informed immediately by telephone at

1300 558 891 or +612 9271 8198 (or such other number advised by us to you or

t

o Card Members from time to time) if:

(i) a Card is lost or stolen;

(ii) a mobile device through which your Card may be used is lost or stolen;

(iii) a replacement Card has not been received by the Card Member;

(iv) someone else learns a Code;

(v) there is suspicion that a Card or Account is being misused or a transaction

is unauthorised; or

(vi) there is suspicion that a transaction has been processed incorrectly.

(b) You agree to cooperate with us in our efforts to control fraudulent use of any

Card or Account, including but not limited to providing us with any declarations,

affidavits and/or copies of any official police reports, as reasonably requested.

You agree that we may provide information to the relevant governmental

authorities concerning the activities of you, a Designated Employee and/or Card

Member under the Program.

10. Online Service

(a) You must ensure that access to the Online Service is restricted only to

Designated Employees whom you see fit to have access and that such persons

access the Online Service only via our web site as notified to you from time to

time, using the assigned user id and password (“Security Information”). You

must implement and exercise reasonable measures and controls to ensure that

only such persons access the Online Service.

(b) You are responsible for obtaining and maintaining your own compatible

computer system, software and communications lines required to properly

access the Online Service. We have no responsibility or liability in respect of your

software, equipment or communication line costs.

(c) If, at any time, whether before or after this Agreement comes into effect,

American Express introduces or has introduced any third party software

American Express Global Commercial Services Agreement in Australia – Company

Conditions P3 of 7

provider to the Company, the Company acknowledges and agrees that

American Express makes no representation nor warranty expressly or impliedly

as to the functionality or reliability of any software provided by that third party to

the Company, nor as to the availability, quality or duration of software support or

upgrades by the third party. Moreover, the Company acknowledges and agrees

that American Express shall not be liable at all for the quality, merchantability or

fitness for purpose of any software provided by a third party. The Company

hereby agrees that its sole recourse for any damages suffered arising from the

use of, or any aspect of the software, will be to the provider of the software

(d) The Security Information is confidential to the respective Designated Employee.

You must ensure that the Security Information is not shared with any other person

or recorded in an insecure location accessible to anyone else. We are not

responsible for any misuse of the Online Service by you, your Designated

Employee or anyone else, nor for disclosure of confidential information by us

where you have failed to maintain the security of the Security Information.

(e) We may terminate, withdraw, modify or suspend the use of the Online Service at any

time. Except where security requires it or in circumstances beyond our control, or in

the event of fraud or your breach of these terms of use for the Online Service, we will

give you prior notice of our withdrawal or suspension of the Online Service in

accordance with the “Changes to this Agreement” clause of this Agreement.

(f) Whilst we will make commercially reasonable efforts to notify you each time a

statement is posted, you are responsible for regularly retrieving your statement

for each billing period.

(g) You agree that access to the Online Service is subject to the website terms

of use as displayed on the American Express website.

11. Suspension

We may immediately suspend a Card or Account if we suspect unauthorised or

fraudulent use, or if we believe the Account or Card may not be paid in full and

on time and/or for other related reasons. In such cases, this Agreement will

continue, and you and/or the Card Member will remain responsible for all

authorised Charges incurred on the Card or Account. We may also require you

to provide us with security in order to avoid suspension of any Card or Account.

12. Charges made in Foreign Currencies

(a) For each Charge submitted to us in a currency other than Australian Dollars

(a ‘Foreign Charge’), on the day we process the Foreign Charge we will:

(i) convert it to US Dollars first (unless it was submitted to us in US Dollars);

(ii) convert the US Dollar amount into Australian Dollars; and

(iii) apply a single non-refundable currency conversion fee to the Australian

Dollar amount of the Foreign Charge.

(b) We will use exchange rates selected from customary industry sources on the

week day prior to the day we process the Foreign Charge, unless required by law

or as a matter of local custom or convention to use a specific rate (in which case

we will look to be consistent with that custom or convention). The exchange rate

we use may be higher or lower than the exchange rate available on the day you

make the Foreign Charge. Exchange rate fluctuations can be significant. The

American Express Exchange Rate is set daily between Monday and Friday,

except 1 January and 25 December. Changes in the rate will be applied

immediately and without notice to you.

(c) When making a Charge in a foreign currency you may have the choice to allow

a third party to convert the Charge into Australian Dollars at the point of sale.

You should check the third party fees and charges before completing the Charge.

If you choose this option, then that third party will:

(i) determine the exchange rate and any commission or fees payable for the

currency conversion; and

(ii) submit that Charge to us in Australian Dollars, meaning we will not convert

the Charge or apply a currency conversion fee.

(d) Any refund transactions are processed at the date of the refund and you

acknowledge that the refund amount may not be the same as the Charge. The

amount of any refund of a Charge made in foreign currency will generally differ

from the amount of the original Charge because:

(i) in most cases, the rate applied to any refund will differ from the original rate

applied to the Charge;

(ii) any currency conversion fee charged on the original purchase is not

refunded. We do not, however, charge an additional currency conversion fee

on the refunded amount; and

(iii) where third parties convert foreign currency Charges into Australian Dollars,

those third parties may also apply a different conversion rate to any refund.

13. Fees and other Charges

(a) Fees and Charges applicable to a Card or Account are described in the attached

Fee Schedule and will appear as Charges on the Card or Account.

(b) Various service related fees may be charged if you elect additional services from

us. Any such fee will be disclosed to you at the time of accepting the service.

(c) We may also charge fees to a Card or Account for services that we provide to

Card Members that are not covered in the Card Member Agreement, for example

(and by way of illustration only) fees for participating in the Membership

Rewards program.

(d) We reserve the right to make changes to the attached Fee Schedule as provided

under the clause “Changes to this Agreement”.

(e) If we receive from you a direct debit or other payment instrument which is not

honoured in full, you agree to pay us the dishonoured amount plus our

reasonable collection costs and legal fees, except as prohibited by law. The

amount payable is set out in the attached Fee Schedule.

14. Late payment charges

(a) If you do not pay your Account in full upon receipt or by the due date as set out

in the monthly statement, you are in default. Therefore, you acknowledge that we

may suspend or cancel your charge privileges, and you agree that late payment

charges may be incurred as follows:

AEX9559 07/20

(i) If you do not pay the full closing balance by the due date on your monthly

statement, the unpaid balance will be identified as an ‘Overdue’ amount.

(ii) Late payment charges will be incurred on any overdue amount which is

identified in a statement and will be billed in that statement, except for BTA

which will be billed in the next statement.

(iii) An overdue amount may include any unpaid late payment charges billed on

previous statements.

(iv) The amount payable is set out in the attached Fee Schedule.

15. Term And Termination

(a) The initial term of this Agreement starts on the date it is signed by you and,

subject to (b) and (c), shall continue in force until and unless terminated by either

party giving the other 3 months notice.

(b) Either party may terminate this Agreement or an Account immediately by notice at

any time if the other is bankrupt, insolvent or unable to pay its debts or becomes

involved in any action or process (including a voluntary process) normally

associated with insolvency, including, without limitation, receivership, liquidation or

voluntary administration, or if it ceases to carry on business in Australia.

(c) We may also terminate this Agreement or an Account immediately by notice in

the event of your material breach of this or any other agreement between us or

with any of our Affiliates, or in the event that we deem levels of fraud or credit

risk on any Card or Account to be unacceptable to us.

(d) If this Agreement is terminated for any reason, we shall suspend the Account

and all Cards. You must pay us immediately for all outstanding Charges and any

other amounts you owe us on any Card or Account or otherwise under this

Agreement, including unbilled Charges that may not be shown on the last

Statement. We will only cancel an Account after you have paid all amounts you

owe to us. All fees continue to accrue if outstanding balances exist on a

cancelled or suspended Account.

(e) You agree to indemnify us for all reasonable costs incurred in recovering or

attempting to recover Charges from you, including solicitor’s fees on a solicitor/

client basis, except as prohibited by law.

(f) We reserve the right at our sole discretion to cancel or suspend any Card or

Account in accordance with the Card Member Agreement without notice to you.

(g) You will indemnify us against all actions, proceedings, claims and demands

arising out of or in connection with any claim against us in respect of any

withdrawal or cancellation of a Card that has been requested by you.

16. Changes to this Agreement

(a) We may change the terms of this Agreement at any time by giving thirty (30)

days’ prior notice to you. We will consider you to have accepted the notified

changes if you or Card Members keep or use their Account or Card thereafter.

(b) We may change the Card Member Agreement in accordance with its terms and we

will notify you accordingly. You shall remain liable for all Charges notwithstanding

such changes in accordance with the “Liability” clause of this Agreement.

17. Confidentiality

(a) All business or professional secrets or other information disclosed or supplied

by one party to the other party must be kept confidential except as necessary

for the proper performance of the Program or as otherwise expressly provided

in this Agreement or agreed in writing between the parties.

(b) The parties shall treat this Agreement as confidential and may not disclose any

of its contents to any third party without the other party’s prior written consent,

or unless legally required by court order, applicable law, regulation or any

relevant regulatory or supervisory authority.

(c) We may name your Company as an American Express customer for public

relations and marketing purposes.