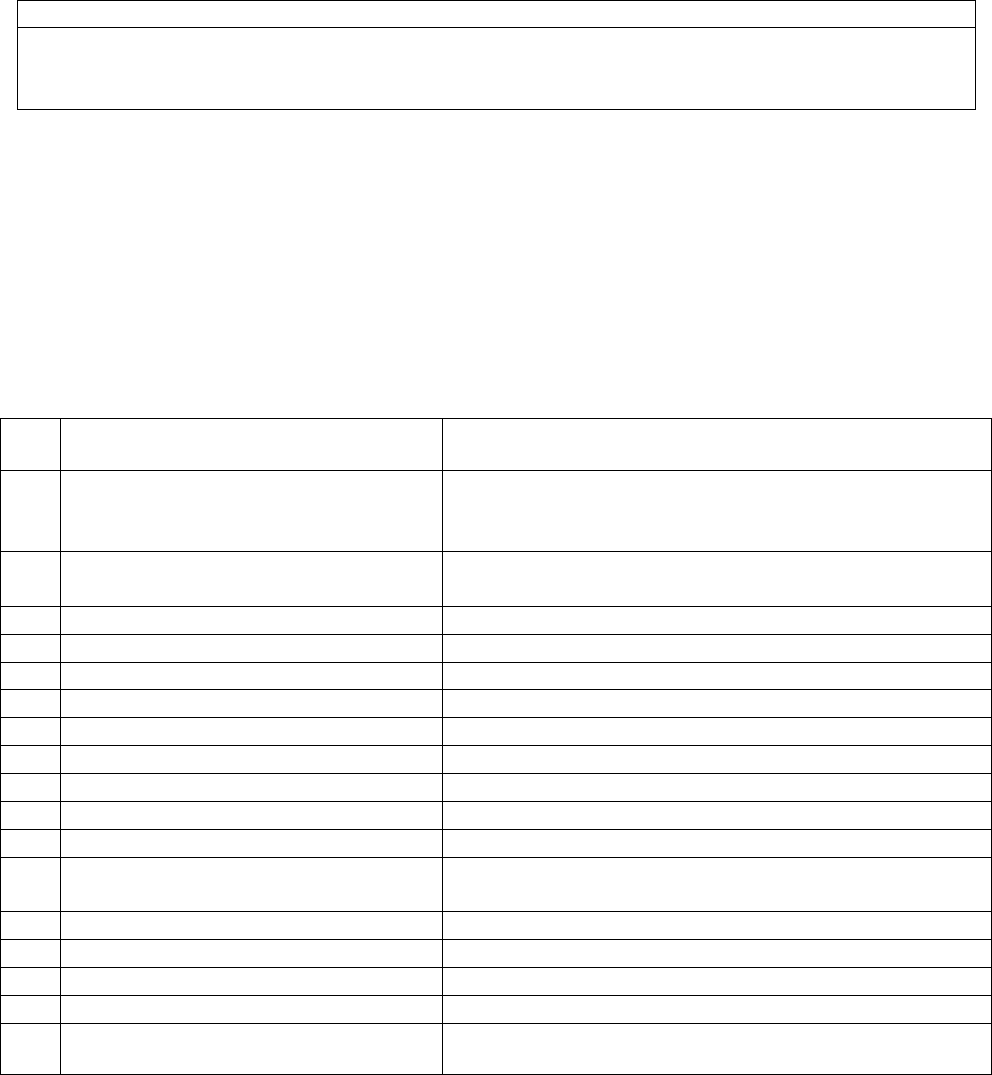

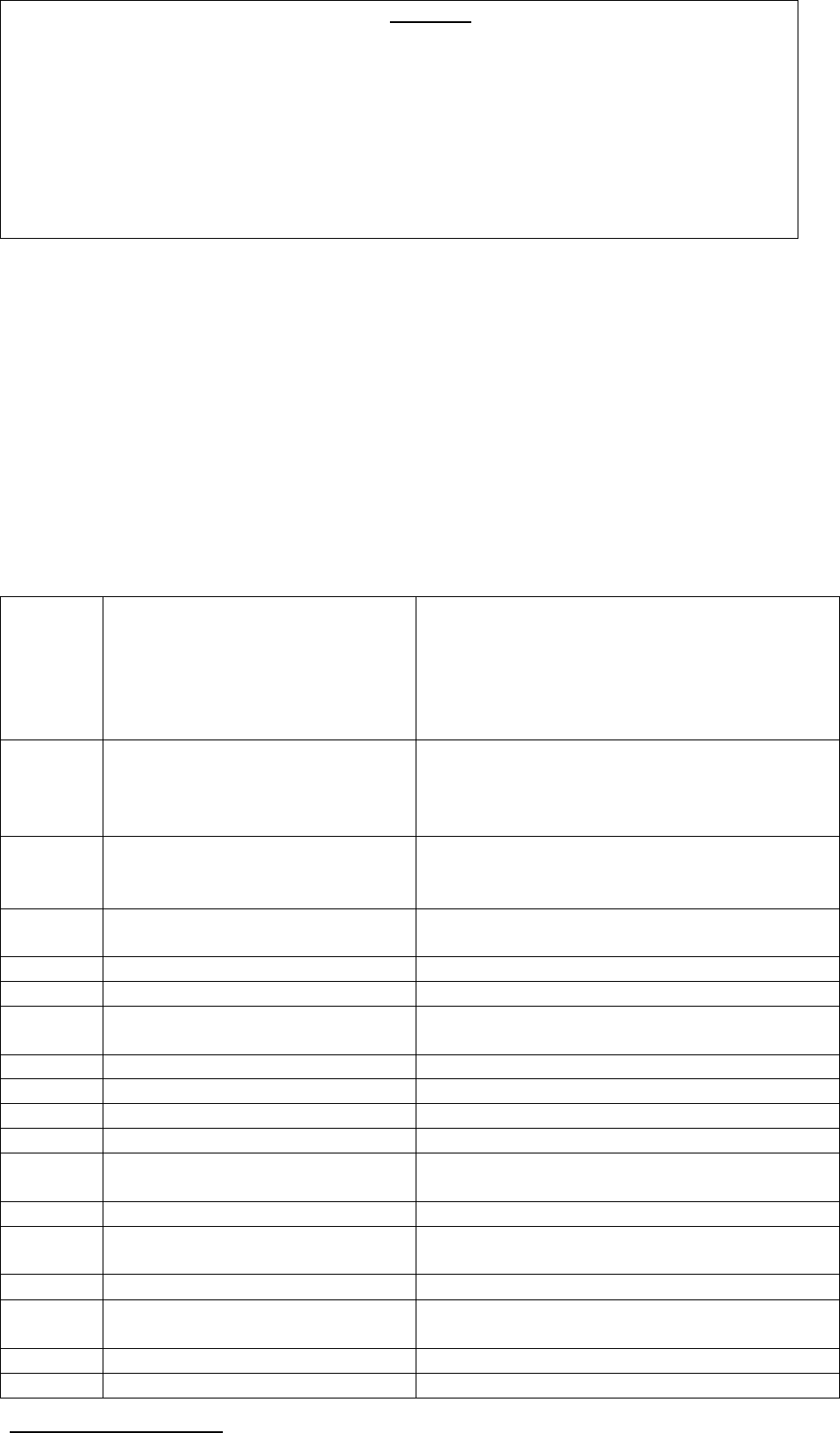

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C. S. PRASAD

CASE OF KULDEEP SINGH V/S APOLLO MUNICH HEALTH INSU. CO LTD.

COMPLAINT REF: NO: NOI-H-003-1920-0115

1.

Name & Address of the Complainant

KULDEEP SINGH

H.NO- 214 , II FLOOR , SECTOR -22

GAUTAM BUDH NAGAR

U.P.- 201301

2.

Policy No:

Type of Policy

Duration of policy/Policy period

110102/00021/AA00354313

HEALTH

3.

Name of the insured

Name of the policyholder

Kuldeep Singh

Kuldeep Singh

4.

Name of the insurer

APOLLO MUNICH HEALTH INSURANCE CO.

5.

Date of Rejection

3-07-2019

6.

Reason for rejection

Policy out of free look period

7.

Date of receipt of the Complaint

10-07-2019

8.

Nature of complaint

Repudiation for non disclosure of pre existing disease

9.

Amount of Claim

2,22,374.00

10.

Date of Partial Settlement

nil

11.

Amount of relief sought

12.

Complaint registered under

IOB rules

yes

13.

Date of hearing/place

18-12-2019/ NOIDA

14.

Representation at the hearing

a) For the Complainant

Mr. Kuldeep Singh

b) For the insurer

Dr. Mohd. Danish

15

Complaint how disposed

Award

16

Date of Award/Order

27.12.2019

17 . Brief Facts of the case : The complainant Mr. Kuldeep Singh purchased a health policy on 27-01-2016 for Rs.

5,00,000/- . He had submitted the claim papers of kidney transplant in January 2019 for settlement of the claim. The insurer

has rejected the claim on 3/07/2019 with the reason “Non disclosure and concealment of facts of previous illness of the

claimant”. On 10/07/2019 complainant has approached Ombudsman office for settlement of the claim.

18. Cause of the complaint:

A. Complainant argument : Complainant is having a policy with the insurer since January 2016. In January 2019

he got kidney transplant from AIIMS and submitted bills to the insurer. The insurer repudiated the claim stating that

his hospital treatment papers show that he is a known case of craniotomy( surgery of Brain) and neurocystcercosis (

by Larwa of tape worm of Taenia Solium Which travelled to brain ) in Year 2001. He does not have the record of

20 year old treatment. Complainant urges the operation was done 18 years back for removal of larva of tape worm in

brain and after removal of the same the problem never reoccured. He wants payment of the claim to be made by

Insurer.

B. Insurer’s argument : The policy was taken in 2016 and complainant had submitted bills for kidney transplant in

Jan 2019 for which treatment was given from last two years. In the discharge summary of AIIMS there was mention

of craniotomy and neurocysticercosis in 2001 and insurer has repudiated the claim for non disclosure of the previous

disease.

19. Reason for Registration of Complaint:

Repudiation of claim for non disclosure of previous health problem.

20. Following documents were placed for perusal:

1. Complaint letter.

2. medical treatment papers

3. SCN

21. Observation and conclusion :

Both the parties appeared for personal hearing and reiterated their submissions. The complainant Mr. Kuldeep Singh

had kidney problem from last two years and he got the kidney transplant in January 2019 from AIIMS, and

submitted the claim papers of that treatment to the insurer which have been rejected on account of the fact that the

insured had brain surgery in 2001 for removal of tape worm and he did not disclose it in the proposal form The

complainant stated that he never had any problem related to this after the operation and he did not preserve the

papers of treatment.

I have examined the documents exhibited as evidence and oral submissions made by both the parties, it is noticed

that removal of tape worm from brain by operation was done 18 years back and there is no nexus of between tape

worm larwa removal and the kidney transplant. Hence the insurer is directed to release the claim to the complainant

and reinstate the policy cover excluding pre- existing disease.

AWARD

Taking into account the facts and circumstances of the case and the submissions made by

both the parties during the course of hearing, the Insurance company is directed to settle

the claim as per the conditions of the policy , and reinstate the policy cover excluding the

pre-existing disease.

The complaint is treated as closed accordingly.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 27.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

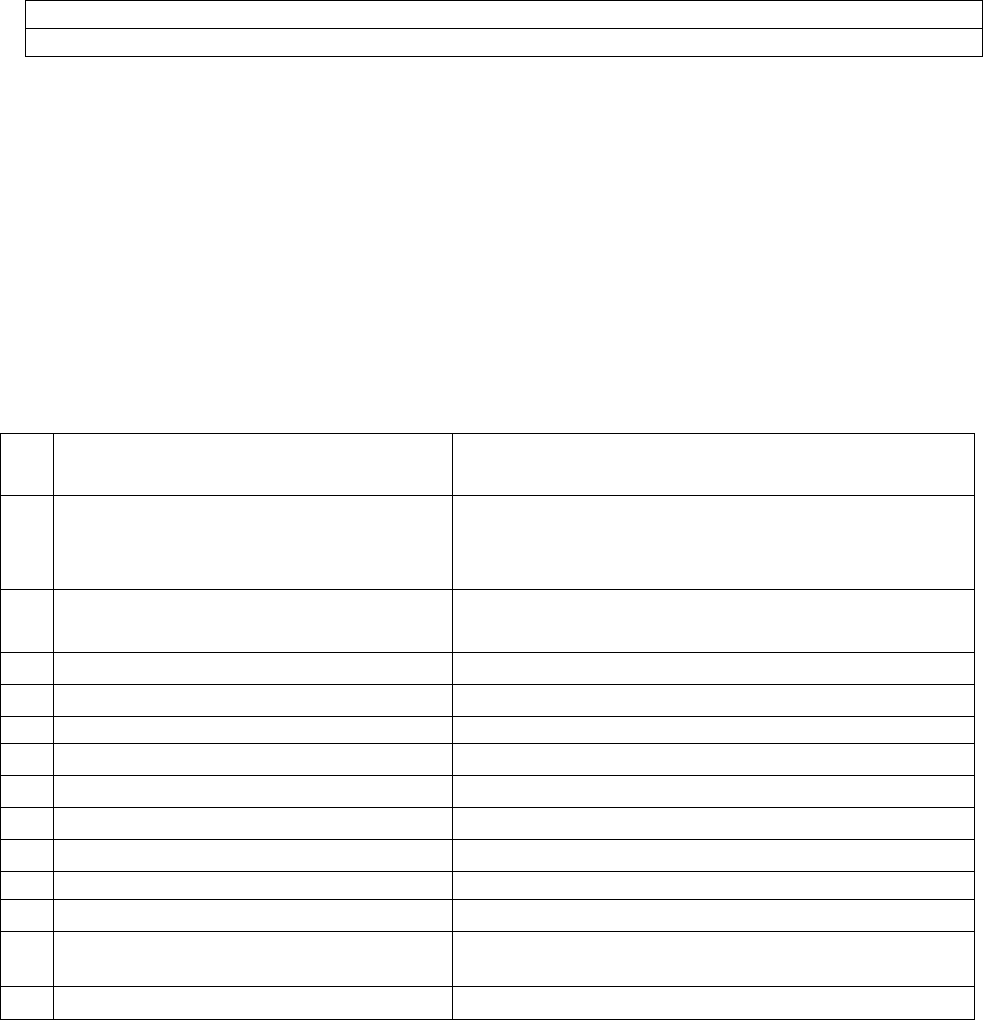

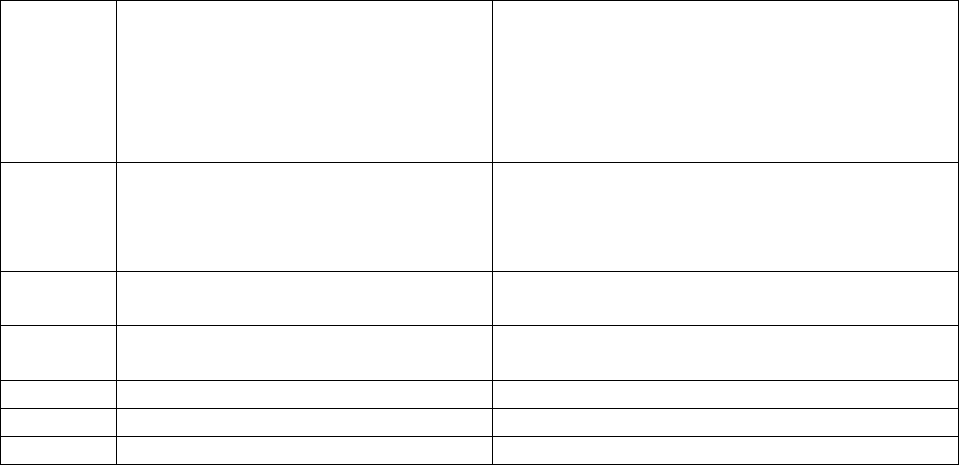

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C. S. PRASAD

CASE OF RAKESH KOHLI V/S APOLLO MUNICH HEALTH INSU. CO LTD.

COMPLAINT REF: NO: NOI-H-003-1920-0114

AWARD NO:

1.

Name & Address of the Complainant

RAKESH KOHLI

A-51 , SECTOR-2 NOIDA

U.P.- 201301

2.

Policy No:

Type of Policy

Duration of policy/Policy period

515732201903

HEALTH

12-05-2018

3.

Name of the insured

Name of the policyholder

Rakesh Kohli

Rakesh Kohli

4.

Name of the insurer

Apollo Munich Health Insurance Co.

5.

Date of Rejection

13-02-2019

6.

Reason for rejection

Repudiation for non disclosure of pre existing disease

7.

Date of receipt of the Complaint

13-05-2019

8.

Nature of complaint

repudiation

9.

Amount of Claim

75708.00

10.

Date of Partial Settlement

Nil

11.

Amount of relief sought

Settlement of medical Bill and reinstatement of policy

12.

Complaint registered under

IOB rules

Yes

13.

Date of hearing/place

18-12-2019/ NOIDA

14.

Representation at the hearing

c) For the Complainant

Mr. Rakesh Kohli

d) For the insurer

Dr. Mohd. Danish

15

Complaint how disposed

Award

16

Date of Award/Order

30.12.2019

17 . Brief Facts of the case :

The policy holder had Health policy from Oriental insurance since 2010. One insurance broker approached the

complainant and advised him to port his policy to Apollo Munich and a new policy was issued to the complainant by

porting the health policy of Oriental Insurance Company in May 2018. On 29-08-2018 the assured was admitted to Noida

Medical Center Hospital and discharged on 31-08-2018. He submitted the bills for settlement of the claim . The insurer

rejected the claim for non disclosure of material facts . On 13-05-2019, complainant has approached Ombudsman Office

for settlement of the claim.

18. Cause of the complaint:

A. Complainant argument :

The complainant was under medical cover of a Health policy with Oriental Insurance company since 2010. One

Insurance broker advised him to port his policy to Apollo Munich Health policy and complainant got his policy

ported. All previous insurance policy papers were given to the broker with premium for new policy. He was

hospitalized for treatment on 28 to 31 August in Noida Medical Center hospital. He submitted his claim to the

insurer. The insurer had rejected the claim stating that The complainant was treated for tongue cancer in April 2013.

As per porting form submitted by complainant the policy details is given for three years only. Complainant has

stated he had given all papers since inception of policy and he did not had any health problem in last three years.

He has also submitted the certificate of doctor of treating hospital that in August 2018 the complainant got seizure

all of sudden. He wants his claim to be paid.

B. Insurer’s argument :

The complainant had purchased the policy on 12-05-2018. He submitted his claim for hospitalization from 29 to 31

August 2018. From treatment papers and discharge summary, it was revealed that the complainant was operated for

cancer of tongue in 2013. As per porting form of policy from Oriental Insurance to Apollo Munich, the details of 3

years policy was mentioned. There was no claim during in three years. The operation in 2013 is before the period

mentioned in the policy so this comes under the clause of non disclosure of materiel facts. Hence the insurer has

rejected the claim

19. Reason for Registration of Complaint:

Repudiation of claim for non disclosure of previous health problem.

20. Following documents were placed for perusal:

1. Complaint letter.

2. Medical treatment papers

3. SCN

21. Observation and conclusion -

Both the parties appeared for personal hearing and reiterated their submissions. The complainant Mr. Rakesh Kohli

was insured with Oriental Insurance company since 2009. An agent of Apollo Munich approached the complainant

for porting his policy to Apollo Munich Insurance. The assured gave all papers related to the existing policy. The

assured was hospitalized for treatment from 29

th

to 31st August 2018 for sudden onset of seizure due to neuro

problem. The insurer has rejected the claim stating that the insured had history of Carcinoma of Palate in 2013. In

the policy porting available with the insurer showing details of previous 3 years , which means assured was insured

with previous insurer for three years only. Hence as per insurer , history of Ca palate in 2013 is a non disclosure of

old disease and insurer has rejected the claim. The complainant stated that no form was signed by him at the time of

porting . He had given only a cheque of premium amount to the agent. The claim in the year 2013 was paid to the

complainant by the Oriental Insurance company.

I have examined the documents exhibited as evidence and oral submissions made by both the parties, I find that the

insured did not sign the porting forms as signature on the form is prima- facie, different from the signature done at

the court attendance . The alleged non disclosure can not be attributed to him and it would also be unfair to make

him bear its consequences. The claim payment details of Ca palate were available with Oriental insurance and the

same was to be checked by the insurer while porting the policy. Insured is not at fault. This fact is admitted by the

insurer. Hence, the insurer is directed to pay the claim of the complainant and renew the policy with exclusion of

pre existing disease.

AWARD

Taking into account the facts and circumstances of the case and the submissions made by

both the parties during the course of hearing, the Insurance company is directed to pay the

claim amount to the complainant and reinstate the policy number 515732201903 by

excluding pre existing disease.

The complaint is treated as closed accordingly.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 30.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C. S. PRASAD

CASE OF AMIT SRIVASTAVA V/S APOLLO MUNICH HEALTH INSU. CO LTD.

COMPLAINT REF: NO: NOI-H-003-1920-0135

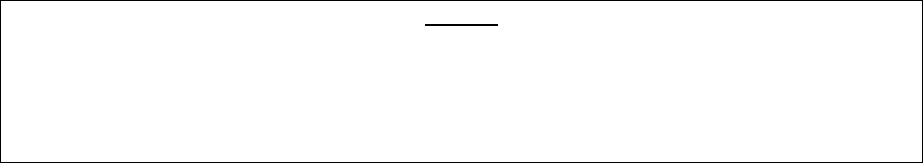

1.

Name & Address of the Complainant

AMIT SRIVASTAVA

FLAT NO- 304 , LILY TOWER , DIVINE

MEADOWS APTT. SECTOR- 108

GAUTAM BUDH NAGAR

U.P.- 201304

2.

Policy No:

Type of Policy

Duration of policy/Policy period

`110100/11121/AA00904629

HEALTH

3.

Name of the insured

Name of the policyholder

Ritu Aali Srivastava

Amit Srivastava

4.

Name of the insurer

APOLLO MUNICH HEALTH INSURANCE CO.

5.

Date of Rejection

3-07-2019

6.

Reason for rejection

Non disclosure of pre existing disease

7.

Date of receipt of the Complaint

30-07-2019

8.

Nature of complaint

Repudiation

9.

Amount of Claim

2,63,294.00

10.

Date of Partial Settlement

Nil

11.

Amount of relief sought

12.

Complaint registered under

IOB rules

Yes

13.

Date of hearing/place

18-12-2019/ NOIDA

14.

Representation at the hearing

e) For the Complainant

Mr. Amit Srivasatva

f) For the insurer

Dr. Mohd. Danish

15

Complaint how disposed

Award

16

Date of Award/Order

31.12.2019

17 . Brief Facts of the case :

The complainant Mr. Amit Srivastava purchased a health insurance policy on 7-09-2018 for Rs. 5,00,000/- for him and his

wife Mrs. Ritu Aali Srivastava. He had submitted the claim papers of Mrs. Ritu who was hospitalized on 9-02-2019, for

settlement of the claim. The insurer has rejected the claim on 15-05-2019, with the reason “Non disclosure of the disease

Rheumatoid Arthritis while taking the policy”. On 30/07/2019 complainant has approached Ombudsman Office for

settlement of the claim.

18. Cause of the complaint:

A. Complainant argument :

The Complainant purchased this policy on 7-09-2018. On 09-02-2019, the complainant’s wife Mrs. Ritu Aali

Srivastava was taken to Jaypee Hospital with the complaint of drowsiness. The doctor in emergency ward,

informed them that drowsiness is due to deficiency of sodium & potassium. She was admitted in the Hospital. She

was given treatment there for 10 days for drowsiness and anemia. On 21-02-2019, she died of Septic Shock. Insurer

rejected the claim, with the reason of non disclosure of pre-insurance existing disease rheumatoid Arthritis .The

complainant has enclosed the doctors certificate that assured died of septic shock not Arthritis. He has also

submitted that patient was not having active rheumatoid Arthritis , duration of this illness was only 3-4 days. The

complainant wants payment of the claim by Insurer.

B. Insurer’s argument :

The policy was purchased by the complainant on 7-09-2018. Insured Mrs. Ritu was admitted in hospital on 9-02-

2019. On reviewing the treatment papers of assured Mrs. Ritu, it was observed that she was admitted with the

complaint of drowsiness. In discharge summary it is mentioned that patient was the known case of HTN from last 12

Years. She was also suffering from rheumatoid Arthritis since 2015 and was on medicines. The complainant did not

disclose the pre existing disease rheumatoid Arthritis, which is one of the cause of death. Hence, claim is not

payable by the insurer.

19. Reason for Registration of Complaint:

Repudiation of claim for non disclosure of previous health problem.

20. Following documents were placed for perusal:

1. Complaint letter.

2. Medical treatment papers

3. SCN

21. Observation and conclusion :

Both the parties appeared for personal hearing and reiterated their submissions. It is observed by reviewing the

discharge summary of Jaypee Hospital, where she was admitted with the problem of drowsiness and generalized

weakness, that she was diagnosed refractory nonconvusive epilepticus and Severe Septic shock. It was also

mentioned that hypertension and rheumatoid arthritis were comorbid illnesses. The complainant has produced the

certificate dated 17-05-2019 from the treating Doctor, that Life assured died of septic shock. The Rheumatoid

Arthritis was not the cause of death.

I have examined the documents exhibited as evidence and oral submissions made by both the parties. The certificate

by the treating Doctor of Jaypee Hospital, produced by the complainant clearly proves that the assured died of Septic

shock . The insurer’s decision to repudiate the claim because the insured did not disclose the previous existing

disease , Rheumatoid Arthritis is incorrect and unreasonable. Hence, claim is payable to the complainant.

AWARD

Taking into account the facts and circumstances of the case and the submissions made by

both the parties during the course of hearing, the death of life assured was not due to

Rheumatic Arthritis, but it was due to septic shock . Hence, the Insurance company is

directed to pay the claim amount Rs. 2,63,294/- to the complainant.

The complaint is treated as closed accordingly.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 31.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES, 2017

OMBUDSMAN – SH. C.S. PRASAD

CASE OF SH. SAMIR AGARWAL V/S BAJAJ ALLIANZ GENERAL INSURANCE CO. LTD.

COMPLAINT REF. NO. : NOI-H- 005-1920-0124

1.

Name & Address of the Complainant

Sh. Samir Agarwal

B-5, Sector-27,

Noida, U.P.201301

2.

Policy No:

Type of Policy

Duration of policy/Policy period

Sum Insured

OG-18-1105-8416-00000058

Extra Care Health Insurance Policy

12.06.2017 to 11.06.2018

Rs.15,00,000/-

3.

Name of the insured

Name of the policyholder

Ms. Monica Agarwal, Spouse

Sh. Samir Agarwal

4.

Name of the insurer

Bajaj Allianz General Ins. Co. Ltd.

5.

Date of Repudiation

14.12.2017

6.

Reason for repudiation

Non disclosure of PED

7.

Date of receipt of the Complaint

24.06.2019

8.

Nature of complaint

Repudiation of claim

9.

Amount of Claim

N.A.

10.

Date of Partial Settlement

NA

11.

Amount of relief sought

Sum Insured Rs.15,00,000/- + 24% interest

Rs.7,20,000/- + harassment Rs.1,00,000/- +

Rs.1,00,000/- penalty Total Rs.24,20,000/- as per

Annex VI A

12.

Complaint registered under

Rule no: of IOB rules, 2017

13 (1)(b)

13.

Date of hearing/place

13.11.2019 / NOIDA

14.

Representation at the hearing

g) For the Complainant

Sh. Samir Agarwal

h) For the insurer

Sh. Angee Sharma, Dy. Manager

15

Complaint how disposed

Award

16

Date of Award/Order

12.12.2019

17) Brief Facts of the Case : Sh. Samir Agarwal had taken a Extra Care Health Insurance Policy No.OG-18-1105-

8416-00000058 for the period from 12.06.2017 to 11.06.2018, Sum Insured of Rs.15,00,000/-. Claim of wife of

the Complainant was rejected by the Insurance Company. Aggrieved, he requested the insurer including its GRO

to reconsider the claim but failed to get any relief. Thereafter, he preferred a complaint to this office for

resolution of his grievance.

18) Cause of Complaint:

a) Complainant’s argument : The Complainant stated that he had taken Extra Care Health Insurance Policy

No.OG-18-1105-8416-00000058 for the period from 12.06.2017 to 11.06.2018 for the Sum Insured of

Rs.15,00,000/- from Bajaj Allianz General Ins. Co. Ltd. by paying the premium of Rs.9,459/-. He was already

having Health policy with the National Insurance Co. for Sum Insured of Rs.5,00,000/- and the policy given by

the Bajaj Allianz was over and above the existing policy of NIC.

During the year 2009, his wife got admitted to Bombay Hospital and Medical Research Centre where she was

diagnosed with the Spinocerebellar Ataxia (It is one of the group of disorders characterizes by slowly

progressive in coordination of gait and is often associated with poor coordination of hands, speech and eye

movement) and Acoustic Neuroma (It is a non-cancerous growth that develops on eight cranial nerve, also

known as Vestibulocochlear Nerve, it connects the inner ear with brain and has two different parts. One part is

involved in transmitting sound and other send balance information from the inner ear to brain). She was

operated for acoustic neuroma

On 04.11.2016, almost after 7 year, his wife was admitted to Max Hospital Delhi after the complaint of

Aspiration Pneumonia with type 1 respiratory failure and she was discharged on 13.11.2016. Claim of this

hospitalization in Max Hospital Delhi for Rs.1,20,000/- was given by the NIC.

Again on 30.12.2016, his wife was admitted to Kailash Hospital, Noida upon the same complaint of aspiration

pneumonia and severe breathlessness and was discharged after being in stable condition.

The complainant’s wife was again admitted on 22.02.2017 in Kailash hospital for the same problem i.e.

pneumonitis with sepsis and was discharged on 25.02.2017 whereupon the Bajaj paid the hospital bill amounting

to Rs.1,87,954/- only in September 2017 as the total Sum Insured of NIC was exhausted.

On 23.07.2017, his wife was suffering from acute loose motions with nausea and high fever and immediately had

to be taken to Kailash Hospital. After understanding the seriousness of the condition, the complainant preferred

to take her to Sir Ganga Ram Hospital which is better equipped than the Kailash Hospital in well equipped

ambulance on 25.07.2017 and discharged on 06.09.2017. The bill for the hospitalization in Kailash Hospital for

23.07.2017 to 25.07.2017 was paid by the NIC.

After exhausting the Sum Insured of NIC in the year 2017, the claim of Rs.14,01,747/- after deducting

Rs.5,00,000/- as per policy terms and conditions was filed with the Bajaj, though, the total bill amount for

admission in Sir Ganga Ram Hospital, Delhi was for Rs.19,01,747/-. The Bajaj Allianz were informed about the

admission on 28.09.2017. Thereafter, the Bajaj kept on asking for documents and bills and proofs which were

supplied to them within the time frame.

On 14.12.2017, the Bajaj repudiated his claim on ground that the verification of claim documents reveal that his

wife was suffering from Spinocerebellar Ataxia since 2009 which was pre-existing to the policy and has not been

disclosed on the proposal form.

b) Insurers’ argument: The Insurance Company stated in their SCN that it was found that the complainant’s

patient was admitted to Sir Ganga Ram Hospital, New Delhi on 25.07.2017 with a diagnosis or perforative

peritonitis s/p PEG tube re-insertion in a follow up case of Spinocerebellar ataxia and the insured was discharged

on 06.09.2017. The insured was also admitted prior to this treatment with Kailash Hospital, Noida on

30.12.2016 and was discharged on 25.01.2017. The case summary on the discharge summary for the said

treatment record explicitly confirms that the insured namely Monica Aggarwal was suffering from

spinocerebellar ataxia since 2009.

Although the Health Policy was held by the complainant since 2013 with the Bajaj but the illness

Spinocerebellar ataxia is a pre-existing disease to the policy starting with Bajaj which has not been disclosed in

the proposal form submitted at the time of taking the policy. The complainant had taken a policy from them in

the year 2013 and was aware of the pre-existing disease but the complainant deliberately chose not to mention

and misrepresented the same in the proposal form submitted to the Insurer.

On the history of illness and non disclosure of the same in the proposal form at the time of taking the policy, the

claim for the treatment of the insured was duly repudiated under the terms and conditions no.13 of the policy.

19) Reason for Registration of Complaint:- Rejection of Mediclaim.

20) The following documents were placed for perusal.

a) SCN.

b) Annexure VI A

c) Complaint copy

d) Discharge summary.

21) Observations and Conclusion :-

Both the parties appeared for personal hearing and reiterated their submissions. The Complainant stated that

the Insurance Company had paid his claim for the same disease in 2017 because the amount was less. But

when, her wife was again hospitalized for the same disease and the hospital bill was huge, the Insurance

Company rejected his claim. The Insurance Company stated that the insured namely Monica Aggarwal was

suffering from spinocerebellar ataxia since 2009 and though, the Health Policy was held by the complainant

since 2013 with the Bajaj, the illness Spinocerebellar ataxia is a pre-existing disease to the policy starting with

Bajaj which has not been disclosed in the proposal form submitted at the time of taking the policy.

I have closely examined the documents exhibited and oral submissions made by both the parties during

personal hearing. The insurer has repudiated the claim of the complainant in December 2017 on the ground of

PED i.e. Spinocerebellar Ataxia to the policy.

The facts of the case in chronological order are given in the preceding pages which have not been assailed by

the insurer. It is observed that the complainant’s wife Ms. Monica Aggarwal was admitted in Max Hospital on

04.11.2016 and discharged on 13.11.2016. The Discharge summary of this hospital clearly mentions “Patient is

known case of Spinocerebellar ataxia and operated for Acoustic Neuroma under follow up of Neurologist for

last 7 years”.

Subsequently, the patient Ms. Monica Aggarwal was admitted in Kailash Hospital on 30.12.2016 and

discharged on 25.01.2017. The Discharge summary again mentions that the patient “ Monica Aggarwal age 51

year Female, operated for CP angle Tumour (Acoustic Neuroma) in 2019 in Mumbai with Spinocerebellar

Ataxia, unable to walk since 2009, unable to speak since 4-6 months and swallowing disorder. Presented with

severe breathlessness, Aspiration Pneumonia”.

Again the discharge summary of Kailash Hospital for Ms. Aggarwal Hospitalization from 22.02.2017 to

25.02.2017 clearly underlines the fact that she suffered from Spinocerebellar Ataxia and had a past history of

Acoustic Neuroma (Operated). The same illness is mentioned in the Discharge summary of Kailash Hospital

for the hospitalisation of Ms. Aggarwal from 23.07.2017 to 25.07.2017.

Notwithstanding the plethora of evidence about the pre-existing disease of Ms. Aggarwal, the insurer has

chosen to repudiate the claim on the basis of Sir Ganga Ram Hospital Discharge summary (for hospitalisation

from 25.07.2017-06.09.2017). Does it say anything new? No. It says

“Diagnosis: Perforative peritonitis s/p PEG tube re-insertion in a follow up case of Spinocerebellar Ataxia”

“History: 52 yrs. Old female with diagnosis of Spinocerebellar Ataxia status surgery for Acoustic Neuroma

restricted to bed on percuteneous gastronomy developed fever with loose stools. She was evaluated at Kailash

Hospital with diagnosis of Intra Abdominal Abscess ( Perforation) now admitted for further management”.

To conclude, the insurer was fully aware of the medical conditions of Ms, Monica Aggarwal as every details

were mentioned in several Discharge certificates of different hospitals. In fact, they had paid the claim of the

complainant amounting to Rs. 1,87,954/- in September 2017. Therefore, it is not understood as to why they

have invoked the issue of PED this time to repudiate the claim in just 2 months in December 2017. This office

is inclined to agree with the claimant that this was done because the claim amount is much more than the one

paid by them in September 2017. The repudiation order of the insurer is arbitrary, totally unjustified, and is set

aside. Hence, the insurance company is directed to settle the entire claim excluding the deductions as per

policy terms and conditions to the complainant.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 12.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

AWARD

Taking into account the facts and circumstances of the case and the submissions made

by both the parties during the course of hearing, the Insurance Company is directed to

settle the entire claim excluding deductions as per policy’s terms and conditions to the

Complainant.

The complaint is treated as disposed off accordingly.

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. & UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES, 2017

OMBUDSMAN – SH. C.S. PRASAD

CASE OF SH. TANMAY SHARMA V/S HDFC ERGO General Insurance Co. Ltd.

COMPLAINT REF. NO.: NOI-H-018-1920-0061

1.

Name & Address of the Complainant

Sh.Tanmay Sharma

S/O Sh.Shiv Prasad Sharma

503,Ganpati Dham,Mathura Road Agra,

Sikander Fatehpur,Agra,

U.P.282007.

Phone No.09871586754

2.

Policy No:

Type of Policy

Duration of policy/Policy period

S.I.

2825202227852400000

Health Suraksha Policy

03.06.2018 to 02.06.2019

Rs.7,50,000/-

3.

Name of the insured

Name of the policyholder

Sh.Tanmay Sharma

Sh.Tanmay Sharma

4.

Name of the insurer

HDFC ERGO General Insurance Co. Ltd.

5.

Date of Repudiation/Partial Settlement

N.A.

6.

Reason for repudiation/Partial Settlement

N.A.

7.

Date of receipt of the Complaint

06.06.2019

8.

Nature of complaint

Policy cancelled due to non-disclosure of PED

9.

Amount of Claim

N.A.

10.

Date of Partial Settlement

N.A.

11.

Amount of relief sought

N.A.

12.

Complaint registered under

Rule no. of IOB rules,2017

13(1)f

13.

Date of hearing/place

13.11.2019 / NOIDA

14.

Representation at the hearing

i) For the Complainant

Tanmay Sharma, Self

j) For the insurer

Shweta Pokhriyal, AM-Legal

15

Complaint how disposed

Award

16

Date of Award/Order

11.12.2019

17) Brief Facts of the Case:-. Sh.Tanmay Sharma, the Complainant had taken Health Suraksha Policy

No.2825202227852400000 from HDFC Ergo for the period from 03.06.2018 to 02.06.2019 for the S.I. of

Rs.7,50,000/-. His policy was cancelled at the time of renewal due to non disclosure of Pre Existing Disease.

Aggrieved, he requested the Insurer including its GRO to reconsider the renewal of his policy but failed to

get any relief. Thereafter, he preferred a complaint to this office for resolution of his grievance.

18) Cause of Complaint:

a) Complainant’s argument : The Complainant stated in his complaint that he got his Insurance Policy

no.218301/48/2018/035 from The Oriental Insurance Co. Ltd.. In this policy, a PED of Ca Rectum was

clearly mentioned, but at the time of porting this policy to HDFC policy number 2825202227852400000,

they did not mention his PED. The complainant said that he was not asked to fill any proposal form and

the agent told him that all the details would be taken from the previous policy. But in 2019, when the

complainant was renewing the policy, he noticed that PED was not mentioned in his policy and when he

asked the customer care team, they told him that it is a fraud done by him and they are cancelling his

policy. The complainant raised grievance but he got in the reply that his policy stands cancelled due to

non disclosure of facts, but the complainant's question is that he had disclosed everything and he provided

the Oriental policy at the time of portability, so how he has not disclosed all the facts. The complainant

further stated that his policy is claim free for the last 3 years and now the Insurer is cancelling the policy

because of their mistake and even denying coverage to his family who were also a part of this family

floater policy.

b) Insurers’ argument: The insurer stated in their SCN that in the month of June, 2018, the complainant

approached the Company for porting his health insurance policy from The Oriental Insurance Co.Ltd.to

HDFC Ergo and submitted a copy of his previous policy bearing no.218301/48/2018/035 along with the

proposal form. The complainant did not disclose about the pre-existing disease (PED) while porting the

policy to HDFC Ergo. Accordingly, relying upon the representations and details mentioned in the

proposal form and the previous insurance policy, the company issued the policy vide Policy

No.2825202227852400000. The complainant claims that the proposer's PED (Ca Rectum) was disclosed

in the previous policy with The Oriental Insurance, the copy of the policy submitted by the complainant

states "N/A” against the PED column. On receipt of renewal request from the complainant, the Company

renewed the above mentioned policy vide Policy bearing No.2825202227852401000 effective from

03.06.2019 to 02.06.2020. It was only, at the time of renewal of the policy, when the complainant chose

to disclose the proposer's PED. The complainant's act of disclosing the PED, at the time of renewal, lend

to "Non-disclosure of material facts” and therefore the Company was constrained to cancel the policy and

refund the premium. It may also be mentioned that, had the complainant disclosed the PED at the time of

porting the policy to HDFC Ergo, the company would have declined to issue the policy. The complainant

concealed material facts during the term of the first ported policy with HDFC Ergo in June, 2018 and

continued to enjoy the benefits under the said policy. By concealing the material facts, the complainant

has breached the terms and conditions and therefore the renewal policy was cancelled as per condition

no.10 r (ii) ab initio and the total premium amount of Rs.15,976/- was refunded by the Company.

19) Reason for Registration of Complaint:- Policy cancelled due to non-disclosure of PED

20) The following documents were placed for perusal.

a) Policy with terms and conditions.

b) Complaint copy

c) SCN

d) Annex VI A

21) Observations and Conclusion :-

Both the parties appeared for personal hearing and reiterated their submissions. The Insurance Company

reiterated that the Insured had approached the insurer in the month of June, 2018 to port his 2 years old policy

of The Oriental Insurance Company Ltd.. At the time of porting the policy, he did not disclose his PED (Ca

Rectum) to the Insurance Company. Accordingly, relying upon the representations and details mentioned in

the proposal form and the previous insurance policy, the company issued the policy. On the other hand, the

Complainant reiterated that PED of Ca Rectum was clearly mentioned in his policy of The Oriental Insurance

Co. Ltd.., but at the time of porting this policy to HDFC, they did not mention his PED. The complainant

said that at the time of renewing the policy, he noticed that PED was not mentioned in his policy and when he

asked the customer care team, they told him that it was a fraud done by him and they are cancelling his

policy. The complainant stated that he had disclosed everything and he provided the Oriental policy at the

time of portability. The complainant further stated that his policy is claim free for the last 3 years. The

Insurer is cancelling the policy because of their own mistake and even denying coverage to his family who

were also a part of this family floater policy.

The Insurance Company stated that the proposer's PED (Ca Rectum) was not disclosed in the copy of the

policy submitted by the complainant to them. The policy states "N/A” against the PED column. On receipt

of renewal request from the complainant, the Company renewed the policy. After the renewal, the

complainant chose to disclose the proposer's PED. The complainant's act of disclosing the PED, at the time

of renewal, warrants to "Non-disclosure of material facts” and therefore the Company was constrained to

cancel the policy and refund the premium. It may also be mentioned that, had the complainant disclosed the

PED at the time of porting the policy to HDFC Ergo, the company would have declined to issue the policy.

I have examined the documents exhibited and oral submissions made by both the parties. It is observed that

the Complainant himself pointed out the discrepancy in the policy regarding his PED. During the course of

hearing on 13.11.2019, the insurer requested for time to verify the previous policies from the Oriental

Insurance Co. Ltd. which was acceded to.

On 09.12.2019, we received the mail from the Insurer wherein they have clarified that they have re-verified

the documents as filed by the customer. During re-verification of documents, it was found by the Insurer that

the previous year policy schedule as provided by the customer did not disclose the PED. At the time of

hearing, it was directed to the HDFC Ergo that they would verify the previous policies from the previous

Insurer i.e. The Oriental Insurance Company but HDFC Ergo has failed to do the same. The copy of the

policy of Oriental Insurance Company, submitted by the HDFC Ergo does not have the signature and seal of

Oriental Insurance Company whereas the copy of the same policy submitted by the complainant bears the

seal and signature of the Oriental Insurance Co. and the mention of PED also. Hence, insurer’s decision to

cancel the policy is not justified and is set aside. The Insurer is directed to restore the policy with continuity

benefits.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 11.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C. S. PRASAD

CASE OF RANJITA KRISHNA V/S MAX BUPA HEALTH INSU. CO LTD.

COMPLAINT REF: NO: NOI-H-003-1920-0136

1.

Name & Address of the Complainant

RANJITA KRISHNA

104-C , SUPER MIG FLATS

EXPRESS WAY APARTMENTS , SECTOR -93

NOIDA U.P.-201304

AWARD

Taking into account the facts and the submissions made by the insurer during the course

of hearing, the insurer is directed to restore the policy with continuity benefits.

The complaint is treated as disposed off accordingly.

2.

Policy No:

Type of Policy

Duration of policy/Policy period

30537024201802

HEALTH

3.

Name of the insured

Name of the policyholder

Ranjita Krishna

Sushila Krishna

4.

Name of the insurer

MAX BUPA HEALTH INSURANCE CO.

5.

Date of Rejection

18-03-2019

6.

Reason for rejection

Repudiation for non disclosure of pre existing disease

7.

Date of receipt of the Complaint

3-07-2019

8.

Nature of complaint

Reudiation

9.

Amount of Claim

56700.00

10.

Date of Partial Settlement

Nil

11.

Amount of relief sought

Settlement of medical Bill and reinstatement of policy

12.

Complaint registered under

IOB rules

Yes

13.

Date of hearing/place

18-12-2019/ NOIDA

14.

Representation at the hearing

k) For the Complainant

Ms. Ranjita Krishna

l) For the insurer

Mr. Bhuwan Bhaskar

15

Complaint how disposed

Award

16

Date of Award/Order

30.12.2019

17 . Brief Facts of the case :

The policy holder Sushila Krishna purchased a health policy on 16-06-2016 for Rs. 30,00,000/ for herself and her

three daughters. On 16/02/2019 Ranjita was taken to hospital with complaint of pain in abdomen on and off. She

was admitted to hospital , and on the same day she was operated for cholelithiasis, and after post operative care,

she was discharged on 17-02-2019. The complainant submitted the Bill for payment but the insurer rejected the

claim stating the assured is known case of Diabetis and colloid nodule since 2015. The complainant has approached

Ombudsman Office on 3-07-2019 for settlement of claim.

18. Cause of the complaint:

A. Complainant’s argument :The complainant says that she was covered for insurance since June 2016. The

complainant went to AIIMS on 18-12-2018 for abdomen pain and was diagnosedwith 10 mm stone in her gall

bladder. She got herself admitted in Yatharth Hospital on 16 February 2019 for Gall Bladder removal and after

operation she was discharged on 17 February 2019. The investigating officer of Max Bupa stated in his report that

complainant was suffering from Diabetes Mellitus II and colloid Nodule since 2015. The insurance policy is

maintained by policy holder since 2016. The Insurer rejected the claim stating that the pre existing disease was not

disclosed to the insurer .The complainant says she did not have such disease in 2015 . Hence she wants payment of

the claim.

B. Insurer’s argument : Policy was running since 2016 . The complainant had submitted a bill for her treatment in

Yatharth Hospital from 16/02/2019 to 17/02/2019 for cholecystectomy. While reviewing the treatment papers it was

observed that Complainant went to AIIMS on 18/12/2018 for problem of abdomen pain related to Gall bladder. At

that time it was revealed that complainant was suffering from DM II and colloid nodule since 2015 . On the basis on

non disclosures of material facts, the claim was rejected by the insurer.

19. Reason for Registration of Complaint:

Repudiation of claim for non disclosure of previous health problem.

20. Following documents were placed for perusal:

1. Complaint letter.

2. Medical treatment papers

3. SCN

21. Observation and conclusion :

Both the parties appeared for personal hearing and reiterated their submissions. The complainant, Ms Ranjita

Krishna was admitted to Yatharth Hospital on 16-02-2019. When claim was submitted to the insurer, they had

rejected the claim stating that treatment papers of AIIMS of 18-12-2018 show that the complainant was suffering

from DM II and colloid Nodule since 2015 and policy was purchased in 2016. On reviewing again it was clear that

period of DM II was after two years of policy issued to assured. The insured reviewed the case again and

confirmed that a mistake was done on their part. The insurer agreed to release the payment and to reinstate the

policy.

The insurer is directed to release the claim amount under request No 405460 and reinstate the policy as agreed

during th hearing on 18-12-2019.

AWARD

Taking into account the facts and circumstances of the case and the submissions made by

both the parties during the course of hearing, the Insurance company is directed to pay the

claim amount to the complainant and reinstate the policy number 30537024201802..

The complaint is disposed accordingly.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 30.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C. S. PRASAD

CASE OF NEERAJ PRAKASH V/S MAX BUPA HEALTH INS. CO LTD.

COMPLAINT REF: NO: NOI-H-003-1920-0134

1.

Name & Address of the Complainant

NEERAJ PRAKASH

FLAT NO-114, PATRAK AR PARISAR, SECOTR-5

VASUNDHARA GHAZIABAD

U.P.-201012

2.

Policy No:

Type of Policy

Duration of policy/Policy period

515732201903

HEALTH

3.

Name of the insured

Name of the policyholder

Divyansh Srivastava

Angika Kumari

4.

Name of the insurer

MAX BUPA HEALTH INSURANCE CO.

5.

Date of Rejection

5-09-2019

6.

Reason for rejection

Repudiation for non disclosure of pre existing disease

7.

Date of receipt of the Complaint

13-09-2019

8.

Nature of complaint

Repudiation

9.

Amount of Claim

46870.00

10.

Date of Partial Settlement

Nil

11.

Amount of relief sought

Settlement of claim and reinstatement of policy

12.

Complaint registered under

IOB rules

Yes

13.

Date of hearing/place

18-12-2019/ NOIDA

14.

Representation at the hearing

m) For the Complainant

Mr. Neeraj Prakash

n) For the insurer

Mr. Bhuwas Bhaskar

15

Complaint how disposed

Award

16

Date of Award/Order

30.12.2019

17 . Brief Facts of the case : The policy holder Angika Kumari purchased health policy in March 2016 for Rs.

5,00,000/ for herself and her husband Mr. Neeraj Prakash. Their son “Divyansh ” was born on 28/11/2016 and they

got him added in their policy in year 2018-19. Their son was patient of down’s syndrome since birth but it was not

recorded in the policy. On 21-04-2019 Divyansh fell ill and was taken to hospital and was admitted with problem of

bilateral pneumonia. He was discharged after 4 days in stable condition on 25-04-2019. The Complainant submitted

papers to the insurer for settlement of claim but insurer has rejected the claim for non disclosure of material facts.

On 15-07-2019, complainant has approached Ombudsman Office for settlement of the claim.

18. Cause of the complaint:

A. Complainant argument : Complainant got added the name of their son “Divyansh” ( born on 28-11-2016) in

their old running policy with Max Bupa in year 2018-19. The child was suffering with down’s syndrome since birth.

Complainant says that they had given papers of Divyansh health problem to the agent but insurer says that no such

paper was submitted by insured. On 21-04-2019 Divyansh was admitted to hospital with problem of bilateral

pneumonia and complainant has submitted certificate from treating Doctor that pneumonia does not have any

connection to the old health problem. The Insurer rejected the claim stating that the pre existing disease down’s

syndrome was not disclosed to the insurer. The complainant wants payment of the claim.

B. Insurer’s argument : Policy was running since 2016 and the name of policy holder’s son Divyansh was added

to the policy in 2018. The insurer says that the complainant had willfully not disclosed the existing medical

condition of their child while including him in the subject policy. The cashless facility was denied by the insurer on

the basis of adverse medical condition down’s syndrome. The grievance cell also rejected the claim as this is a major

problem which was to be disclosed earlier.

19. Reason for Registration of Complaint:

Repudiation of claim for non disclosure of previous health problem.

20. Following documents were placed for perusal:

1. Complaint letter.

2. Medical treatment papers

3. SCN

21. Observation and conclusion :

Both the parties appeared for personal hearing and reiterated their submissions. The complainant Mr. Neeraj Prakash

stated the name of their son Divyansh was included in their pre-existing in the 2018-19. The papers of down’s

syndrome disease of their son were given to the agent. As per insurer no such paper was submitted by the agent.

During the hearing the insured submitted the e-mail dated 26-03-2018, the date of renewal of policy, sent to the

agent M D Sharma, giving him details of his son’s condition. The conversation between M D Sharma and the

complainant , brought by the complainant was also heard during the hearing , by which it is clear that the

complainant had given papers to the agent and the agent had forwarded the same to the insurer.

I have examined the documents exhibited as evidence and oral submissions made by both the parties. It is clear that

the papers of insured’s disease were given to the agent , who has been giving service to their policy since 2016.

The complainant is advised to submit the claim reimbursement papers to the insurer within a week . The insurer

shall settle the claim and review the cancellation of policy favorably.

AWARD

Taking into account the facts and circumstances of the case and the submissions made by both the parties

during the course of hearing, the Insurance company is directed to pay the claim amount to the complainant

and consider to reinstate the policy number 30515732201903.

The complaint is treated as closed accordingly.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 30.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C. S. PRASAD

CASE OF VARUN BANSAL V/S MAX BUPA HEALTH INSU. CO LTD.

COMPLAINT REF: NO: NOI-H-003-1920-0136

1.

Name & Address of the Complainant

VARUN BANSAL

271/6 THAPAR NAGAR

NEAR ARYA SAMAJ MANDIR , MEERUT

U.P. - 250002

2.

Policy No:

Type of Policy

Duration of policy/Policy period

30106392201806

HEALTH

12-06-2012

3.

Name of the insured

Name of the policyholder

Ajay Kumar

Ajay Kumar

4.

Name of the insurer

MAX BUPA HEALTH INSURANCE CO.

5.

Date of Rejection

10-09-2019

6.

Reason for rejection

Repudiation for non disclosure of pre existing disease

7.

Date of receipt of the Complaint

23-09-2019

8.

Nature of complaint

Repudiation

9.

Amount of Claim

10,00,000/-

10.

Date of Partial Settlement

Nil

11.

Amount of relief sought

10,33,084/-

12.

Complaint registered under

IOB rules

Yes

13.

Date of hearing/place

18-12-2019/ NOIDA

14.

Representation at the hearing

o) For the Complainant

Mr. Varun Bansal

p) For the insurer

Mr. Bhuwan Bhaskar

15

Complaint how disposed

Award

16

Date of Award/Order

31.12.2019

17 . Brief Facts of the case : The complainant’s father, late Sh. Ajay Kumar had purchased the health policy from Max

Bupa Health Insurance Company on 12-06-2012, with insurance cover of Rs. 25 lacs, annual premium Rs. 77983/- for him

and his wife. He had maintained the policy by regular payment of premium. Mr. Ajay Kumar was admitted to Medanta

Hospital for installation of ICD-D instrument in September 2018. He had submitted his treatment Bill of Medanta Hospital

to Insurance company for settlement of the claim. The insurer has rejected the claim stating that Mr. Ajay Kumar was

suffering from HTN and CAD from last 8-10 years. The Complainant says that there was no such medical history of HTN

and CAD 8-10 years back. The complainant has approached the Ombudsman Office on 23-8-2019 for settlement of the

claim.

18. Cause of the complaint:

A. Complainant’s argument :

The complainant urged that his father, the policy holder Mr. Ajay Kumar had this policy with Max Bupa Insurance

Company since 2012. In September 2018, the assured suffered from chest pain sweating and weakness. He was

admitted to Jaswant Rai Hospital, Meerut, and after treatment for 3 days he was discharged. The Insurer settled the

claim and paid Rs. 45,000/- to the insured. After 4 days of discharge, he had a major health problem and was

referred to Medanta Hospital. Mr. Ajay Kumar was admitted to hospital of 28

th

September and after installation of

AICD device, discharged on 3

rd

October2018. The cost of this instrument was around 10 lacs. This time the claim

was rejected by the insurer stating that the assured had HTN and CAD for the last 8-10 years. The complainant has

alleged that the claim of Rs. 45,000/- was paid by insurer for heart related problem but for payment of Bill above

Rs. 10 lacs the insurer is giving false excuses. The claim is pending from last one year. The complainant informed

that the assured Mr. Ajay Kumar expired on 12-06-2019.

B. Insurer’s argument :

Insurer has stated in their SCN that assured Mr. Ajay Kumar was under medical cover with Max Bupa Company

since June 2012 for Rs. 25 lacs . The complainant had submitted the Bill for treatment of Mr. Ajay Kumar from 28-

09-2018 to 3-10-2018 and the insurer has rejected the claim stating that assured was suffering from HTN for 8-10

Years, CAD for 11 Years. The insurer has attached the report of Prakash Neuroroly Center which is showing HT

since 8-10 Years. Insurer has also submitted papers of his Visit to Center for sight where HTN is shown since 8-10

Years. The insurer has rejected the claim for non disclosure of HTN and CAD before purchasing policy.

19. Reason for Registration of Complaint:

Repudiation of claim for non disclosure of previous health problem.

20. Following documents were placed for perusal:

1. Complaint letter.

2. Medical treatment papers

3. SCN

21. Observation and conclusion :

Both the parties appeared for personal hearing and reiterated their submissions. The policy was purchased by the life

assured in the year 2012. In September 2018, the assured was admitted to Medanta Hospial for installation of Pace

maker for his heart problem. The insurer has rejected the claim, stating that they have found that he was suffering

from HTN and CAD since last 8-10 years. The complainant has urged that the claim of Rs. 45,000/- for the heart

problem was released to him for 4 days treatment in Jaswant Rai Hospital in September 2018.. After discharge from

Jaswant Rai Hospital the heart problem was aggravated and the pace maker was installed in Medanta Hospital to

resolve the heart problem .

The Policy has run for more than 6 years and exact period of inception of HTN and also treatment papers related to

HTN have not been adduced as proof that assured was having disease before purchasing the policy. On the other

hand the complainant has submitted the certificate of the Doctor treating the assured that the treatment of MI was

started in September 2016. Thus the insurer’s contention that the assured was suffering from CAD is not proved.

Moreover, the insurer was fully aware of the assured’s heart problem which is proved by the fact that they had paid

him claim of Rs. 45,000/- only in September 2019. Repudiation is set aside as being arbitrary.

AWARD

Taking into account the facts and circumstances of the case and the submissions made by

both the parties during the course of hearing, the repudiation of the claim could not be

justified and is set aside, The Insurance company is directed to pay the claim amount Rs.

10,33,084/- to the complainant.

The complaint is treated as closed accordingly.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 31.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C. S. PRASAD

CASE OF RUCHI TAILONG V/S MAX BUPA HEALTH INSU. CO LTD.

COMPLAINT REF: NO: NOI-H-003-1920-0178

1.

Name & Address of the Complainant

RUCHI TELANG

H NO-1522 PARK VIEW APARTMENT

SECTOR -29 NOIDA U.P.- 201301

2.

Policy No:

Type of Policy

Duration of policy/Policy period

0198061380

HEALTH

14-03-2012

3.

Name of the insured

Name of the policyholder

Anurag Telang

Anurag Telang

4.

Name of the insurer

MAX BUPA HEALTH INSURANCE CO.

5.

Date of Rejection

21-03-2019

6.

Reason for rejection

Rejection for non disclosure of pre existing disease

7.

Date of receipt of the Complaint

23-09-2019

8.

Nature of complaint

rejection

9.

Amount of Claim

1,71,310.00

10.

Date of Partial Settlement

Nil

11.

Amount of relief sought

12.

Complaint registered under

IOB rules

Ys

13.

Date of hearing/place

18-12-2019/ NOIDA

14.

Representation at the hearing

q) For the Complainant

Ms. Ruchi Telang

r) For the insurer

Mr. Bhuwan Bhaskar

15

Complaint how disposed

Award

16

Date of Award/Order

31.12.2019

17 . Brief Facts of the case : The complainant Mrs. Ruchi Telang’s husband Mr. Anurag Telang had purchased this policy

on 14-03-2012, with the cover of Rs. 5,00,000/- with Max Bupa Company. Mr.The Anurag Telang was admitted to

Bhardwaj Hospital with the problem of Cerebrovascular accident and shifted by taking LAMA to Max Hospital on 14-03-

2019. There it was diagnosed that assured was suffering from malignant left MCA infract. The insurer had approved the

cashless amount of 1.98 lacs but later the insurer had denied the payment of the same. The complainant shifted the patient

to Safadarjang by taking LAMA, because they could not afford high medical expenses. The insurer had rejected the claim

for non disclosure of material fact. Now, complainant has approached Ombudsman Office for solution.

18. Cause of the complaint:

A. Complainant’s argument :

The complainant has urged that the policy was purchased in year 2012. As per complainant’s statement, the policy

was taken with declaration of DM II and HTN . Her husband suffered with CVA on 14-03-2019 and was first

admitted in Bhardwaj Hospital, and later on the same day, shifted to Max Hospital. He was diagnosed with left

MCA infract. The insurer initially approved the cashless claim of Rs. 1,98,000/- but later withdrew the permission

and asked the complainant to file the reimbursement of claim, which also was denied. The complainant submitted

that the treating doctor had clarified that in their case, the disease could happen to any person not having Diabetes

or HTN, and as such no conclusive reason can be attributed to the cause of the disease. The rejection is not justified

and she wants the settlement of the claim.

B . Insurer’s argument

The insurer has stated in their SCN that the complainant was asked to submit the treatment record from Bhardwaj

Hospital. She was also asked to submit the photograph & ID of patient, case summary , exact duration of DM and

HTN and discharge summary of CABG, and also last 5 days treatment details of the patient. As per the insurer, the

required information were not provided by the complainant. After non receipt the required information, the insurer

scrutinized the case and repudiated, stating absence of treatment papers of Bhardwaj Hospital and cause of MCA

infract. The authenticity and accomplishment of document for claim procedure not established hence claim could

not be paid.

19. Reason for Registration of Complaint:

Rejection of claim for non disclosure of previous health problem.

20. Following documents were placed for perusal:

1. Complaint letter.

2. Medical treatment papers

3. SCN

21. Observation and conclusion :

Both the parties appeared for personal hearing and reiterated their submissions. The complainant stressed that her

husband is having a health insurance policy with the respondent insurer since 14-03-2012. Her husband suffered

with CVA on 14-03-2019, and was first admitted in Bhardwaj Hospital and later on the same day shifted to Max

Hospital. He was diagnosed with left MCA infract. The insurer initially approved the cashless claim of Rs.

1,98,000/- but later withdrew the permission and asked the complainant to file the reimbursement of claim, which

also was denied. She has complained only for the payment of claim pertaining to admission of her husband in Max

Hospital form 14-03-2019 to 21-03-2019.

The insurer submitted that the cashless permission was withdrawn for the want of treatment record from Bhardwaj

Hospital. Later the reimbursement of claim was denied due to the fact that as per the policy document diseases

related to DM-II and Hypertension were permanently excluded. The insurer maintained that MCA infract was

caused due to hypertension.

I have gone through the records and observe that the complainant’s husband, while taking insurance policy, had

declared DM-II & HTN as pre existing diseases. Consequently, treatment for diseases relating to DM-II & HTN

were permanently excluded from the scope of the policy. However, it is noticed that Dr. Ashish Jaiswal has certified

vide his letter dated 7-08-2019 that MCA infract can be caused by many risk factors including DM-II & HTN.

Another certificate dated 20-03-2019 by the treating doctor, Dr. Prakash Singh has also certified that the cause of

CVA in this patient is left internal carotid artery atherosclerotic disease which is not excluded. In view of specific

evidence provided by the complainant in the form of two certificates, the decision of the insurer to repudiate the

claim is not justified. The insurance company is directed to settle the claim as per other terms and conditions of the

policy.

AWARD

Taking into account the facts and circumstances of the case and the submissions made by

both the parties during the course of hearing, the Insurance company is directed to pay the

claim amount to the complainant.

The complaint is treated as closed accordingly.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 31.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SHRI C.S. PRASAD

CASE OF MR. YATINDER SINGH CHAUHAN V/S RELIANCE GENERAL INSURANCE CO. LTD.

COMPLAINT REF: NO: NOI-H-035-1920-0167

1.

Name & Address of the Complainant

Mr. Yatinder Singh Chauhan,

Flat No. 17-A/201, Vasundhara, Ghaziabad,

UP-201012.

2.

Policy No:

Type of Policy

Duration of policy/Policy period

131691928451000018

BOI-Swasthya Bima Policy

13.03.2019 to 12.03.2020

3.

Name of the insured

Name of the policyholder

Yatinder Singh Chauhan

Yatinder Singh Chauhan

4.

Name of the insurer

Reliance General Insurance Co. Ltd.

5.

Date of Repudiation

30.07.2019

6.

Reason for repudiation

As per Policy Clause 5.1 – 2 : non disclosure of

PED.

7.

Date of receipt of the Complaint

03.09.2019

8.

Nature of complaint

Rejection of Claims

9.

Amount of Claim

Rs. 4,52,115/- (as per Annex. VI A)

10.

Date of Partial Settlement

Nil

11.

Amount of relief sought

Rs. 4,52,115/-

12.

Complaint registered under IOB rules

13 (1) (b)

13.

Date of hearing/place

27.12.2019 at Noida

14.

Representation at the hearing

s) For the Complainant

Mr. Dharvendra Singh Chauhan, Brother

t) For the insurer

Ms. Priyanka Singh, Legal Manager,

15

Complaint how disposed

Award

16

Date of Award/Order

31.12.2019

Brief Facts of the Case: This complaint is filed by Mr. Yatender Singh Chauhan against M/s Reliance General

Insurance Co. Ltd. for rejection of his hospitalization claims.

17) Cause of Complaint:

a) Complainant’s argument: The complainant stated that he was covered under health insurance policy from

Reliance General Ins. Co. Ltd. under tie-up with Bank of India for the period from 13.03.2019 to 12.03.2020. This

policy was in continuation of National Insurance Co. Ltd. – BOI National Swasthya Bima from the year 2010. This

policy was discontinued by National Insurance Co. Ltd., and accordingly the policy was ported with Reliance

General Ins. Co. He was hospitalized on 09.06.2019 on complaints of uneasiness, sweating and anxiety, at

Vasundhara Hospital, Ghaziabad. He was discharged on 10.06.2019. The total bill amount was Rs. 15,323/- which

paid by him to the hospital. Dr. Dave of Vasundhara Hospital advised him spine surgery after examining the MRI

report. Later on, he submitted the claim bill for reimbursement but the insurance company rejected the claim for

non-disclosure of PED of HTN and DM. The complainant stated that he had not been diagnosed these diseases

before issuance of policy from them. Even, he was covered under medical policy with previous insurer for the last

nine years; all pre-existing diseases would have been automatically covered. The complainant then consulted Dr.

Kalra, Spine Surgeon, of Sir Ganga Ram Hospital, who also recommended spine surgery. He was admitted in

SGRH on 03.07.2019 and was discharged on 08.07.2019. His pre-authorization request was denied, so he submitted

claim form for reimbursement of hospitalization bill with all medical documents. The insurance company rejected

this claim also on the same ground of PED. He approached this Forum for settlement of claim bills for Rs.

4,52,115/-.

b.) Insurers’ argument: The insurance company in their SCN stated that the complainant was insured with them

from 13.3.2019 to 12.3.2020. He felt some uneasiness, sweating and anxiety and went to Vasundhara Hospital on

09.06.2019. He was admitted there and was diagnosed with HT/DM/Neuropathy/Lumber spondylosis/scoliosis with

radioculopathy/to rule out CAD/Accelerated Hypertension. On perusal of claim documents of Vasundhara Hospital

it was found that the complainant was a patient of Hypertension and Diabetes which was not disclosed by him at

the time of filling in the proposal form. The claim was rejected on the ground of non-disclosure of pre-existing

diseases. The complainant was again hospitalized at Sir Ganga Ram Hospital on 03.07.2019 for surgery. He was

discharged on 08.07.2019. He sent claim another for reimbursement of hospital expenses. The insurance company

appointed investigator. As per the questionaire filled by Dr. Girjesh Rustagi, the complainant was a known case of

hypertension and DM and was on medication from last 3 years. This fact was not disclosed by the complainant in

proposal form on 13.3.2019, at the time of taking policy, the insurance company repudiated the claim and cancelled

the policy as per Clause 5.1 clause 3 of general policy terms and conditions.

18) Reason for Registration of Complaint: Repudiation of claim.

20) The following documents were placed for perusal.

a) Complaint letter/Form VIA

b) Survey Report

c) Policy document

d) SCN

19) Observations and Conclusion: - Both the parties appeared for personal hearing on 27.12.2019 and reiterated

their submissions. The complainant’s brother stated that his brother, Mr. Yatinder Singh Chauhan, was covered

under BOI National Swasthya Bima for the past nine years. After the National Insurance had

withdrawn/terminated this policy, the Bank of India ported the policy with Reliance General Insurance

Company. His brother was hospitalized for spine surgery in Sr. Ganga Ram Hospital but the insurance company

not only denied the cashless facility but also repudiated the reimbursement claim, on the ground of non-

disclosure of HTN and DM as pre-existing disease. The insurance company reiterated that the current policy

was ported with their company, but the complainant did not disclose the material fact of pre-existing disease

that he was suffering from HTN and DM. The investigator appointed by their company, during the

hospitalization period, revealed the fact that the complainant was a known case of hypertension and DM and

was on medication from the last three years. He did not disclose the fact at the time of proposing for insurance

cover; hence they repudiated the claim as per terms and conditions of the policy.

On going through the documents exhibited and the oral submissions made by both the parties during the hearing,

it is noted that the complainant was covered under health insurance policy for the last 9 years from National

Insurance Company Ltd. This policy was withdrawn by National Insurance, so the Bank of India ported his

policy from National to Reliance General on 13.03.2019. The complainant was for the first time diagnosed with

HT and DM at Vasundhara Hospital on 09.06.2019 i.e. after the inception of policy. Secondly, the Discharge

Summary of SGRM dated 8.7.2019 does not show any past history of HT/DM, and his physical examination of

BP shows 120/80. In fact, the certificate of Dr. K.L. Kalra of SGRH also certifies that the complainant came with

c/o pain in back and neurogenic claudicatios since 1 year. He was taking self medication including painkillers

and did not consult any doctor. As per MRI Scan, he was found to have severe Stenois and was advised surgery.

Further, it is noted that the claim is for spine surgery which has nothing to do with hypertension and diabetes

which are life style diseases.

The complainant was covered in mediclaim policy for the last nine years. It has been mentioned in the Circular

issued by Health Cell, Head Office, National Insurance Co. Ltd. that: “We wish to assure policyholders that, on

migration, continuity benefits, as applicable will be extended. Similarly IRDAI portability norms shall apply in

case of change of insurer.” In this case, all his pre-existing diseases would automatically be covered under

portability clause as he was insured for the last 9 years. The insurance company has wrongly repudiated the

claim. The insurance company is directed to settle the claim as per the terms and conditions of the policy.

22. The attention of the Complainant and the Insurer is hereby invited to the following provisions of

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of Insurance Ombudsman Rules,2017, the insurer shall comply with the award within

thirty days of the receipt of the award and intimate compliance of the same to the Ombudsman.

Place: Noida. C.S. PRASAD

Dated: 31.12.2019 INSURANCE OMBUDSMAN

(WESTERN U.P. & UTTARAKHAND)

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF WESTERN U.P. AND UTTARAKHAND

UNDER INSURANCE OMBUDSMAN RULES 2017

OMBUDSMAN – SH. C.S. PRASAD

CASE OF SH. AMIT SINHA V/S RELIGARE HEALTH INSURANCE CO. LTD.

COMPLAINT REF: NO: NOI-H-037-1920-0145

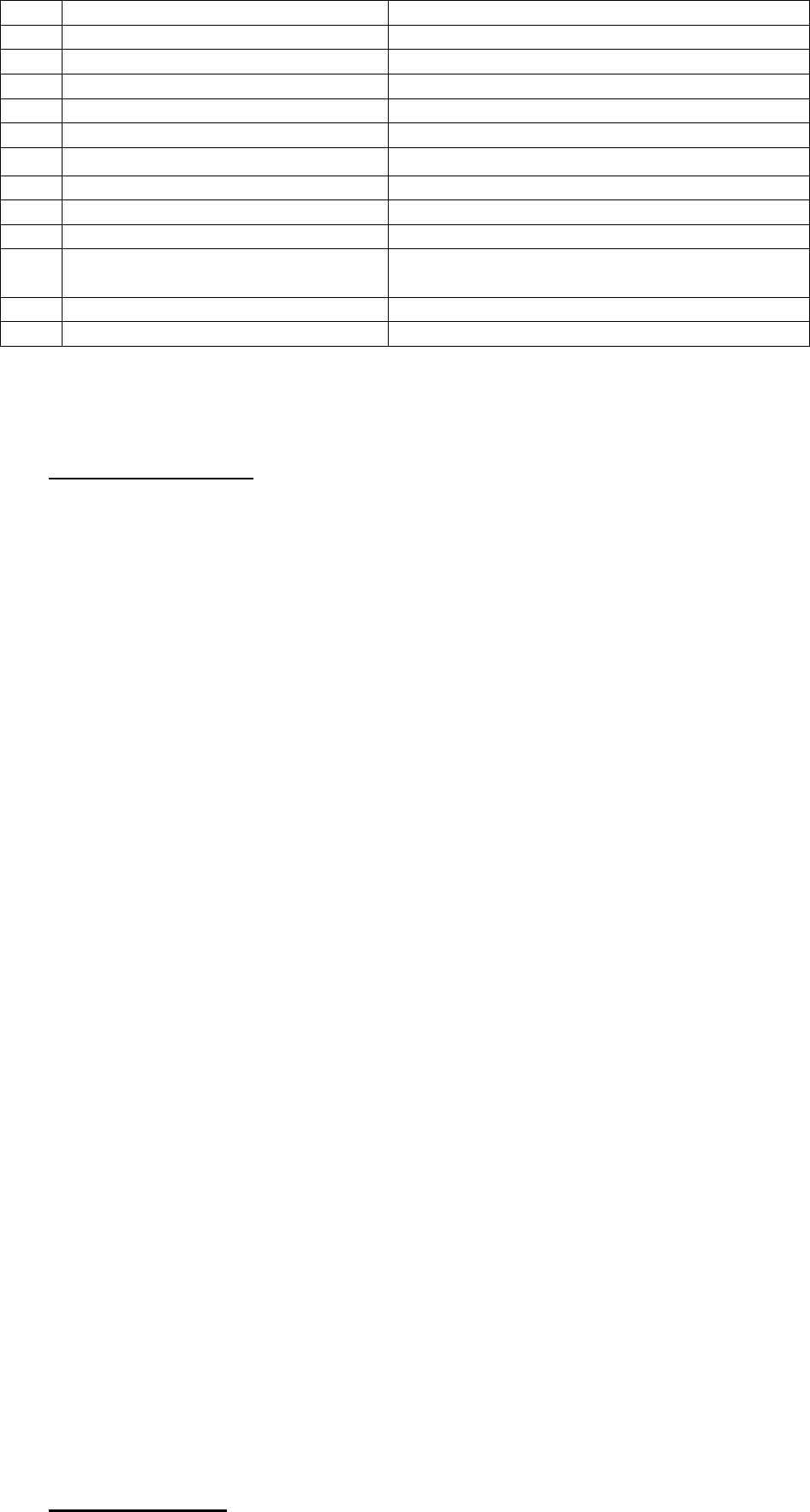

1.

Name & Address of the Complainant

Sh. Amit Sinha,

A-61, Sector-51, Opp. Parkview Apartment,

NOIDA-201301

2.

Policy No:

Type of Policy

Duration of policy/Policy period

10562856

Health

We.f. 03/05/2019 Till 02/05/2020

3.

Name of the insured

Name of the policyholder

Sh Amit Sinha

Sh. Amit Sinha

4.

Name of the insurer

Religare Health Insurance Company Limited

5.

Date of Repudiation

26/06/2019

6.

Reason for repudiation

Denial of Health Claim

7.

Date of receipt of the Complaint

29/07/2019

8.

Nature of complaint

Denial Of Health Claim

9.

Amount of Claim

124000/-

10.

Date of Partial Settlement

nil

11.

Amount of relief sought

124000/-

12.

Complaint registered under

IOB rules

YES

13.

Date of hearing/place

20.12.2019

AWARD

Taking into account the facts and circumstances of the case and the submissions made by both

the parties, the insurance company is directed to pay the claim as per the terms and

conditions of the policy.

The complaint is closed accordingly.

14.

Representation at the hearing

u) For the Complainant

Sh. Amit Sinha

v) For the insurer

Sh Pratyush Prakash

15

Complaint how disposed

Dismissed

16

Date of Award/Order

31/12/2019

17) Brief Facts of the Case : This is a complaint filed by Sh Amit Sinha against Religare Health Insurance

Co.Ltd., relating to denial of health claim under policy no. 10562856.

18)Cause of Complaint:-Denial of health claim by the insurance company.

a) Complainants argument :- The complainant had taken health insurance policy No.10562856 from the above

company wherein insurance coverage was given for sum Assured of Rs.700000/- to the complainant , his

spouse and daughter w.e.f. 30/03/2016 Till 29/03/2018 and the policy was further renewed on yearly basis till

02/05/2020. The said policy was ported from Royal Sundram Alliance Gen. Ins. Co. Ltd. The insured was

admitted on 24/06/2019 for ailment of ACUTE CALCULUS CHOLECYSTITIS in Indraprastha Apollo

Hospital, Sarita Vihar, New Delhi. But, the insurance company rejected the request for cashless

hospitalization facility and stated that “NON DISCLOSURE OF MATERIAL FACTS/PRE-EXISTING

AILMENTS AT TIME OF PROPOSAL – H/O HTN BEFORE INCEPTION OF POLICY.

.

b) Insurers’ argument:- The insurance company vide their SCN dated 04/10/2019 submitted that the insured

had taken a Health insurance policy form the Insurance company. The said policy was ported from Royal

Sundram Alliance Gen Ins. Company and further, renewed till 02/05/2020. During the continuation of the

policy, the complainant approached to insurance company to avail the cashless facility for hospitalization at

Indraprastha Apollo Hospital, New Delhi on 24/06/2019 for 2 days with complaint of Gall Stone since 30 days.

The complainant was primarily diagnosed with Gall Stone and was admitted for surgical treatment i.e.

Laparoscopic/Open Cholecystectomy. As per the attending doctor`s assessment, the complainant was the

patient of Hypertension and was under medication . As per the clinical chart initial assessment sheet of