Presale │ March 27, 2023 fitchratings.com 1

Structured Finance

Asset-Backed Securities

U.S.A.

Avis Budget Rental Car Funding

LLC, Series 2023-3

Capital Structure

Class

Expected

Rating

Expected

Rating

Outlook

Amount

($ Mil.)

a

Minimum

CE (%)

b

Maximum

CE (%)

b

Interest

Rate (%)

Legal Final

Maturity

A

AAAsf

Stable

196,25

31.49

40.27

TBD

February 2028

B

Asf

Stable

30,00

20.46

30.64

TBD

February 2028

C

BBB–sf

Stable

23,75

11.72

23.03

TBD

February 2028

Total

250.00

a

Final note amounts will be sized to market demand.

b

Credit enhancement (CE) is dynamic and will shift with the fleet mix.

TBD – To be determined.

Fitch Ratings expects to rate the ABS notes issued by Avis Budget Rental Car Funding (AESOP)

LLC, Series 2023-3, as listed above. This is the 16th AESOP series rated by Fitch since 2017 and

the third rated in 2023. The notes are secured by a revolving pool of program and non-program

(risk) vehicles from various original equipment manufacturers (OEMs) leased to Avis Budget

Car Rental, LLC (ABCR), a wholly owned subsidiary of Avis Budget Group, Inc. (ABG), which is

not rated (NR) by Fitch. ABCR subleases the vehicles to wholly owned subsidiaries of ABCR

serving various U.S. rental and car share markets.

Key Rating Drivers

Transaction Analysis — Evolving Concentration Limits: Fitch analyzed the structural features,

including a monthly mark-to-market (MTM) vehicle value test and a minimum monthly vehicle

depreciation test, by stressing the liquidation timing, vehicle depreciation, disposition losses

and expected carrying costs of the transaction at various rating levels to determine an expected

loss level (ELL). Credit enhancement (CE) for the notes comprises subordination, letter of

credit(s) (LOC) and dynamic overcollateralization (OC), which will shift according to the fleet

mix. CE levels for each class of notes are sufficient to cover Fitch’s maximum and minimum ELL

for each class under the respective ratings.

Stable Structural Features: The 2023-3 transaction includes structural features that are

consistent with prior recent transactions. The features include OEM concentration limits, the

inclusion of medium- and heavy-duty trucks, and a different minimum depreciation rate of

nonprogram vehicles (NPVs) to account for market value and an increase to the vehicle age limit.

Beginning with the 2022-5 transaction, the used and NPV concentration limits have been

removed and the OEM concentration limit for Tesla has been increased.

Vehicle Value Risks — Stable Depreciation and Residual Realization: While previously much

more volatile, depreciation has steadied and fallen for NPVs as high demand for a limited supply

of vehicles maintains high vehicle valuation and disposition proceeds. Box trucks have limited

performance experience but were assumed to have an annual depreciation rate consistent with

the minimum required depreciation for these vehicles in the first two years of their life, which

exceeds available historical depreciation data.

Inside This Report Page

Key Rating Drivers

1

Highlights

2

Key Transaction

Parties 3

Transaction Comparisons

3

Sector Risks: Additional Perspective

4

Transaction Notes

5

Credit Analysis

5

Asset Analysis

12

Expected Rating Sensitivity

15

Transaction Structure

17

Counterparty Risk

26

Criteria Application, Model and

Data Adequacy 26

Surveillance

27

Appendix 1: Origination and

Servicing 28

Appendix 2: ESG Relevance Score

29

This presale report reflects information in Fitch

Ratings’ possession at the time that Fitch’s

expected ratings are issued. The transaction has

yet to be finalized and changes could occur. As a

result, the expected ratings disclosed in this

report do not r

eflect final ratings but are solely

based on information provided by the issuer as

of

March 27, 2023.

These expected ratings are contingent on final

documents conforming to information already

received. Ratings are not a recommendation to

buy, sell or ho

ld any security. The offering

circular

and other material should be reviewed

prior to any purchase.

The notes are being

offered and sold to qualified intermediary

buyers (QIBs), as defined by Rule 144A of the

Securities Act, or to non

-U.S. entities pursuant

to

regulations.

Fitch’s related Rating Action Commentary

issued at transaction closing will include final

ratings, which will include an assessment of any

material information that may have changed

subsequent to the publication of the presale.

Representations, Warranties and

Enforcement Mechanisms Appendix

Analysts

John Krementowski

, CFA

+1 646 582

-3576

john.krementowski@fitchratings.com

Yiming Liu

, CFA

+1 647 503

-3987

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 2

Structured Finance

Asset-Backed Securities

U.S.A.

Collateral Analysis — High Fleet Diversity and Healthy/Stable OEM Financials: AESOP’s car

and light-truck fleet is deemed diverse due to the high degree of OEM, model, segment and

geographical diversification. Concentration limits help to mitigate risks associated with OEM

defaults, declining vehicle values or vehicle recalls. Despite unprecedented rapid de-fleeting of

AESOP vehicles in the wake of the coronavirus pandemic’s impact on travel in 2020, the fleet

remains diverse albeit with a notable shift toward NPVs as auto manufacturers push the burden

of residual values onto rental car companies. Although a strong secondary vehicle market has

continued to support vehicle values, continued supply issues have constrained sales and

purchases, leading to an aging fleet.

Servicer Operational Risks — Adequate Servicer and Fleet Manager: ABCR is deemed an

adequate servicer and administrator, as evidenced by its fleet management abilities and

securitization performance to date. Fitch does not publicly rate ABCR. The company has seen

marked improvement in its rental business off the lows of 2020, with the travel and rental car

sectors improving. Avis’ latest financial results show improved rental volumes and pricing.

Additionally, the fleet has stabilized and AESOP trust performance metrics are within

expectations across depreciation, MTM tests and disposition proceeds. defi AUTO, LLC

(formerly known as Fiserv) is the backup disposition agent, while Lord Securities is the backup

administrator, and both entities have substantial experience in their respective roles.

Highlights

Effect Highlight

–

Aging Fleet Composition: Consistent with market cond

itions and other rental car platforms,

nonprogram concentrations have been increasing and currently account for roughly 99

% of

Avis’ fleet as of Dec. 31, 2022

. The fleet remains diverse from an OEM perspective but has

aged significantly due to vehicle supply constraints, with the age of the fleet of approximately

13 months as of Dec. 31, 2022, versus a historical average age of 8.1 months prior to 2020.

–

Removal of Used Vehicle Concentration Limit: The 25% concentration limit for used vehicles

has been removed beginning with the 2022-5

transaction. Used vehicle concentrations have

increased for rental car companies through the pandemic due to the lack of new vehicle supply

,

driven primarily by the semiconductor shortage. Used vehicle values have experienced

significant strength recently, although with softening recently, but are

not expected to return

to pre-pandemic levels in the near

term given the continued vehicle supply and demand

imbalances. The removal of the limit aligns with peer rental fleet ABS issuances.

Fitch has

previously included conservative assumptions for its depreciation stresses, which incorporate

potential impacts from higher concentrations of used vehicles; therefore, an additi

onal stress

was not applied with the limit removal.

–

Removal of NPV Limit: Recent series issued prior to 2022-5 included an 85% concentration

limit, with a CE step-

up schedule such that enhancement increases 0.5% should the

concentration increase to between 85% and 87.5%, and increases 1% thereafter.

Beginning

with series 2022-5, this limit has been removed, along with the step-up feature.

An additional

1% in CE has been included in the structure for NPV,

thereby offsetting the impact from the

removal of the step-up feature.

Neutral

OEM Concentration Limit Increased for Tesla: As detailed below, beginning with series 2022-

5, Tesla vehicles can now be included in the trust at up to 25% of the asset base

versus 15%

previously, and the limit may be increased to beyond 25%,

subject to a rating agency condition.

As part of this change, additional CE has been provided through a step-

up should the

concentration rise above 15% (calculated

by multiplying the excess concentration above 15%

by 10% and applying the product as the CE step-up).

+

Minimal Credit Impact from ESG: The highest level of ESG credit relevance is a score of 3,

meaning that ESG issues are credit-

neutral or have only a minimal credit impact on the

transaction, due to either their nature or the way in which they are being managed. See the

ESG Navigator in Appendix 2 for details.

The 2

5% concentration limit for Tesla vehicles did not have an impact on Fitch's rating analysis

or conclusions for this transaction; therefore, it has no impact on Fitch’s ESG Relevance Score.

Source: Fitch Ratings

Applicable Criteria

Structured Finance and Covered Bonds

Counterparty Rating Criteria (March 2023)

Global Structured Finance Rating Criteria

(

March 2023)

Global Rental Fleet ABS Rating Criteria

(July 2022)

Key Rating Drivers

(Negative/Positive/Neutral)

Rating Impact Key Rating Driver

Neutral Transaction Analysis

Neutral

Structural Features

Neutral Vehicle Value Risks

Positive Collateral Analysis

Positive

Servicer Operational Risks

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 3

Structured Finance

Asset-Backed Securities

U.S.A.

Key Transaction Parties

Transaction Counterparty Summary

Role

Counterparty

Fitch Rating

Issuer

Avis Budget Rental Car Funding (AESOP) LLC

NR

Vehicle Purchasers

AESOP Leasing L.P.

NR

AESOP Leasing Corp. II

NR

Sponsor of the SPVs

Avis Budget Group, Inc.

NR

Administrator/Lessee/

Servicer

Avis Budget Car Rental, LLC

NR

Sublessees

Avis Rent a Car System, LLC

NR

Budget Rent a Car System, LLC

NR

Zipcar, Inc.

NR

Payless Car Rental, Inc. NR

Budget Truck Rental LLC NR

Title Holder Nominees

PV Holding Corp.

NR

Quartx Fleet Management, Inc.

NR

Qualified Intermediary

AESOP Exchange Corporation

NR

Parent of Qualified Intermediary

IPX1031, LLC (Fidelity National Financial, Inc.)

NR

LOC Provider (Expected)

JPMorgan Chase Bank, N.A.

AA/F1+/Stable

Trustee/Collateral Agent

The Bank of New York Mellon Trust Company, N.A.

AA/F1+/Stable

Backup Administrator/

Managing Agent

Lord Securities Corporation

NR

Backup Disposition Agent

defi AUTO, LLC (f/k/a Fiserv Automotive Solutions, Inc.)

NR

Structuring Lead

Citigroup Global Markets Inc.

A+/F1/Stable

NR – Not rated

Source: Fitch Ratings

Transaction Comparisons

Trust AESOP AESOP HVF III

Sponsor

Avis Budget Group, Inc.

Avis Budget Group, Inc.

The Hertz Corporation

Series

2023-3

2023-1

2023-2

Cutoff Date

December 2022

September 2022

December 2022

Lessees — Sublessees

ABCR

ABCR

Hertz

Avis

Avis

Dollar

Budget

Budget

Thrifty

a

Zipcar Zipcar —

Payless

Payless

—

Budget Truck

Budget Truck

—

Avg. Age of Rental Fleet (Mos.)

a

12.8

12.8

11.2

Program Vehicles (%)

1.42

1.09

0.9

Risk Vehicles (%)

98.58

98.91

99.1

Manufacturer 1 (%)

Chrysler (20.0)

Toyota (22.5)

GM (21.6)

Manufacturer 2 (%)

Toyota (19.9)

Chrysler (16.1)

Ford (15.4)

Manufacturer 3 (%)

GM (15.6)

GM (15.4)

Tesla (14.2)

Manufacturer 4 (%)

Ford (14.3)

Ford (15.0)

Nissan (11.6)

Manufacturer 5 (%)

Kia (7.2)

Kia (8.2)

Chrysler (10.6)

Revolving Period (Years)

3.7

5

5

Amortization Period (Mos.)

6

6

6

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 4

Structured Finance

Asset-Backed Securities

U.S.A.

Trust

AESOP

AESOP

HVF III

Best Fleet Credit Enhancement (%)

Class A

31.49

31.49

39.96

Class B

20.46

20.46

30.62

Class C

11.72

11.72

22.61

Class D

N.A.

N.A.

11.05

Best Fleet Expected Losses (%)

AAAsf

18.87

18.73

25.59

AAsf

16.97

16.85

20.71

Asf

15.05

14.94

17.79

BBBsf

13.11

13.01

14.85

BBsf

11.16

11.06

11.86

Worst Fleet Credit Enhancement (%)

Class A

40.27

40.27

44.87

Class B

30.64

30.64

36.30

Class C

23.03

23.03

28.94

Class D

N.A.

N.A.

18.33

Worst Fleet Expected Losses (%)

AAAsf 36.96 36.84 38.44

AAsf 32.72 32.61 34.05

Asf 28.41 28.31 29.58

BBBsf 24.05 23.96 25.02

BBsf

19.63

19.55

20.38

Ratings

b

Class A

AAAsf

AAAsf

AAAsf

Class B

Asf

Asf

Asf

Class C

BBB–sf

BBB–sf

BBBsf

Class D

N.A.

N.A.

NRsf

a

For AESOP, the average age of the rental fleet is equal to the trailing three-month average age of the eligible fleet.

b

Ratings for AVIS transactions are expected ratings. GM – General Motors. HVF III – Hertz Vehicle Financing III LLC.

N.A. – Not available. NR – Not rated.

Source: Avis Budget Car Rental, LLC

Sector Risks: Additional Perspective

Key Sector Risks

Sector or Asset Outlook Fitch’s 2023 asset performance outlook for rental fleet ABS has been revised to deteriorating relative to 2022, reflecting

Fitch’s expectation for the moderation observed in 2022 to continue into 2023 but remain below or in line with pre-pandemic

levels. Supply constraints like semiconductor shortages have caused production shutdowns, leading to historically low

inventories, despite strong demand, which has increased secondary values and recoveries. These supply shortages, while

starting to loosen, are expected to continue to support values and overall strong rental fleet ABS performance in 2023.

Macro or Sector Risks

Fitch expects a mild recession to take hold in the U.S. in 2H2023, which will weigh on job growth and consumer demand. High

inflation will lead to a continued increase in interest rates, affecting sectors backed by consumer and real estate assets exposed

to interest rate and refinancing risk. Real income erosion will further burden households, affecting consumer spending and

businesses, especially weaker borrowers. See Fitch’s “Global Economic Outlook – March 2023.”

Relevant Research Fitch has revised its global economic forecasts to reflect its 2023 expectations. Fitch’s outlook for 2023 for structured finance is

detailed in “North America Structured Finance Outlook 2023”. Also, see Fitch’s recent special report, “

In the Auto ABS Driver’s

Seat: 2H22”. Both reports are available on Fitch’s website at www.fitchratings.com.

Source: Fitch Ratings

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 5

Structured Finance

Asset-Backed Securities

U.S.A.

Transaction Notes

AESOP ABS note proceeds fund loans from AESOP to the vehicle purchasers, who utilize the

loans to acquire vehicles to lease out to ABCR. ABCR will, in turn, sublease the vehicles to Avis

Rent a Car System, LLC (Avis), Budget Rent a Car System (Budget), Zipcar, Inc., Payless Car

Rental, Inc. (Payless) and Budget Truck Rental LLC (Budget Truck), all wholly owned subsidiaries

of ABCR serving various segments of the rental and car share markets. The vehicle purchaser

may also directly lease vehicles to Avis and Budget.

AESOP ABS notes are ultimately secured by lease payments from the lessees and sublessees,

vehicle dispositions and/or refinancing proceeds. ABCR is the servicer, administrator and

guarantor for all lease payments that flow to the vehicle purchasers and on to AESOP as

repayments of the loans. Loan payments cover all applicable AESOP costs, which include

interest, depreciation and other administrative expenses.

AESOP will issue the class A, B and C notes on the closing date. AESOP may, without consent from

the noteholders, issue class D notes, subject to conditions, which will be subordinate to class A, B

and C notes. AESOP will also issue class R notes to AESOP Leasing L.P. to comply with risk

retention rules. Class R P&I distributions will be subordinate to class A, B and C distributions.

Credit Analysis

Diversity Classification

Loss profiles within a rental fleet ABS pool can differ based on each vehicle’s OEM, segment, age

and geographic location. Diverse pools produce consistent depreciation, resulting in better loss

performance. Nondiverse pools are exposed to greater risks, including wholesale market

weakness, recalls or other issues. Additionally, a pool with a few highly correlated and/or

financially weak OEMs may be as risky as a pool with limited vehicle diversification since brand

perception can be significantly affected by a bankruptcy event.

During benign periods, the vehicles purchased through program agreements are subject to

limited market value risk, as OEMs have agreed to repurchase the vehicles at a predetermined

price. However, they are exposed to the OEM’s financial strength and its ability to make

payments to the rental fleet company (RFC) under the agreement. While Fitch’s review of the

OEM’s health and the presence of repurchase agreements are considered in determining the

diversity of the collateral pool, no direct credit is given by Fitch in the credit analysis.

Following the review of an RFC’s fleet characteristics, Fitch categorizes the fleet as either

diverse or nondiverse. Fitch considers the following in its determination of fleet diversity:

• OEM concentration;

• composition of vehicle mix, including vehicle segment, make and model; and

• geographic concentration.

Fitch deems AESOP’s fleet as a diverse pool of assets given these factors:

• Concentration limits are in place for all OEMs to ensure the OEM, make and model mix

within the fleet remain diverse.

• Pre-pandemic, the fleet had a historically consistent mix of program and risk

concentration. As of the cutoff date, risk vehicles total 98.6% of the fleet. This shift

toward NPVs is expected to remain consistent due to lower program offerings from

OEMs as manufacturers prioritize limited vehicle supply distribution to auto dealerships

over rental car companies.

• The fleet’s vehicle mix is diverse, with more than 15 different OEMs currently

represented, as well as a wide range of vehicle models.

• The fleet is spread across the U.S. and considered diverse from a geographic perspective.

• Notably, the portion of the pool expected to consist of box trucks in the future is

expected to be nondiverse and is considered separately in Fitch’s loss analysis from the

rest of the pool. These medium- and heavy-duty trucks are expected to comprise a

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 6

Structured Finance

Asset-Backed Securities

U.S.A.

limited number of models from a limited number of OEMs, with a minimum depreciation

rate of 1.67% per month and nondiverse disposition loss stresses.

Expected Loss Derivation

Fitch’s criteria for rental fleet ABS assume a hypothetical liquidation scenario in which the RFC

enters into Chapter 7 bankruptcy protection, despite Chapter 11 being the more likely scenario.

However, as Fitch’s objective is to delink the RFC from the ABS, Chapter 7 is assumed, triggering

a stay period that can last up to 60 days. No payments are expected to be made by the RFC to

the trust during this period.

Chapter 7 of the U.S. Bankruptcy Code generally implies there is no option for a reorganization or

restructuring, as would be the case under Chapter 11. Liquidation of the company’s assets is

therefore required to pay creditors. A bankruptcy of ABCR would trigger the early amortization of

the outstanding AESOP notes, which AESOP would ultimately pay with proceeds from the sale of

vehicles in the fleet. Fitch assumes the wholesale vehicle market is in a state of stress during the

bankruptcy scenario, leading to higher than expected depreciation and disposition losses.

A rental fleet ABS structure should have sufficient CE to withstand stressed expected losses

commensurate with the ratings during the assumed liquidation scenario. Fitch stresses the

following to derive stressed expected losses for each rating scenario applicable to the series:

• non-liened vehicle adjustment;

• bankruptcy/liquidation timing;

• casualty losses;

• depreciation;

• disposition losses; and

• interest and other expenses.

Fitch derives series-specific expected losses for the best and worst possible fleet mixes after

considering concentration limits. Fitch defines the best fleet as all program vehicles from

investment-grade (IG) OEMs, while the worst fleet would be the maximum concentration of box

trucks (5%) with the remainder consisting of NPVs (95%). This approach ensures expected

losses are covered by the series’ dynamic CE. Monthly required CE levels are derived based on

criteria from other NRSROs, as discussed further in the CE section. Fitch ultimately compares

best and worst fleet expected losses commensurate with the ratings against the best and worst

fleet required CE for each class of notes.

The derivation methodology and assumptions for all aspects of the expected losses are

consistent with Fitch criteria.

Non-Liened Vehicle Adjustment

Due to the administrative burden required to establish a first-priority-perfected security

interest in Nebraska, Ohio and Oklahoma, AESOP has historically included a “specified states”

concentration limit in each series of notes issued from the trust, sized to 7.50% of fleet net book

value (NBV). Although the likelihood is remote, there is a scenario in which, in the event of an

AESOP bankruptcy, the trustee’s liens on vehicles titled in the above-mentioned states may be

challenged and unavailable for repayment of the AESOP notes.

Recent issuances, beginning with 2021-2 (not rated by Fitch), have modified the concentration

limit that applied to the aforementioned states to a general “non-liened vehicle” concentration

limit, and the limit was increased to 10.00% of fleet NBV.

AESOP’s documentation currently prohibits any vehicles outside of the specified three states

from being included in fleet NBV if they lack a first-priority-perfected security interest. While

this revised concentration limit is not currently intended to be used for vehicles outside the

current three states, as has been the case historically, documentation may be amended in the

future to allow for such broadening of the limit.

A stress to the worst case fleet mix expected loss has been included to illustrate the impact of

adding non-liened vehicles to the fleet. This stress has been sized to 1.80%, which is removed

from the asset value available to the notes in the event of a fleet liquidation. The 1.80% level is

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 7

Structured Finance

Asset-Backed Securities

U.S.A.

derived from historical concentrations in the specified states and considers the remote

likelihood of the scenario.

This additional stress was not applied to the best case fleet mix, which assumes a variety of

characteristics of a hypothetical “best case” wherein all vehicles are from IG OEMs and are subject

to program agreements. An additional assumption of this best case fleet is a 0% concentration in the

states for which a first-priority-perfected security interest is not obtained.

An additional sensitivity has been added to show the hypothetical impact of increased vehicle

concentrations without a first-priority-perfected security interest outside of historical levels.

In this sensitivity, prior to applying the expected loss analysis, 5.0% of the asset base is removed

to stress for the potential concentration of non-liened vehicles in the fleet at the time of a

bankruptcy declaration. This analysis can be found on page 14of this report.

Bankruptcy/Liquidation Timing

Once an RFC files a Chapter 7 bankruptcy petition, Fitch assumes lease payments cease.

The leases are assumed to be immediately rejected by the bankruptcy trustee after the filing or

will be rejected by operation of law on the 16th day. Fitch assumes the servicer, backup servicer

or disposition agent, if applicable, will source and locate the vehicles to begin the liquidation

process subsequent to the lease rejection.

While the 60-day stay period is expected to be a fixed timeline, the actual vehicle and liquidation

time frame can vary, depending on market conditions and individual vehicle location.

Fitch assumes an additional 30-day delay past the 60-day stay period to allow the trustee to

gain control over the vehicles. Fitch expects that, once the trustee has access to the vehicles,

liquidation will occur within one month to three months due to the depth and efficiency of the

wholesale vehicle market witnessed over time, even during the stressed 2008–2009 period.

For this series, Fitch assumed timing stresses of six months for ‘AAAsf’, five months for ‘Asf’ and

4.3 months for ‘BBB–sf’. These timing periods are deemed stressful given the size of ABG’s fleet

relative to the used vehicle market and the experience of defi, the backup disposition agent.

Access to not only wholesale auctions, but also dealers, online auctions and retail disposition

channels, would provide defi with diverse and efficient ways to dispose of vehicles.

Furthermore, Fitch assumes no vehicles are sold until the final months of the timing stress for each

respective rating category, which is a stressful approach considering vehicles would typically be

liquidated more quickly than the original 30-day assumption, with recovery amounts flowing into the

trust within the first month following the 60-day bankruptcy stay period.

Casualty Losses

Casualty vehicles are defined as vehicles that are lost, stolen, destroyed or damaged, or vehicles

rejected by program agreements because the vehicle condition is in violation of repurchase

terms. The RFC is typically required to reimburse for these vehicles at NBV. The title is

transferred to the RFC upon payment, and any lien in favor of the trust is released. The RFC

typically has insurance in place that may cover all or most of the casualty losses on vehicles.

However, the RFC’s ability to make casualty payments after receipt of insurance is assumed to

be impeded because of the bankruptcy.

Therefore, Fitch assumes a full loss is taken. Fitch determines a casualty base case loss proxy derived

by utilizing the issuer’s historical casualty loss data to account for casualty losses. The casualty loss

amount is subtracted from the aggregate securitized fleet. ABG provided Fitch with historical

monthly casualty data for the fleet from January 2012 through September 2022.

Fitch is assuming a 1.00% casualty loss per month for each of the first three months based on

the provided data, consistent with the prior recent transactions and up 45 basis points (bps)

from transactions prior to 2022-1. The increase was a result of higher historical average fleet

casualty loss experienced driven by higher casualty losses in 2020, as well as consistently higher

casualty losses after peaks experienced in that year. Higher casualty losses were initially due to

the shift of rental businesses toward leisure travel as opposed to corporate travel, which tends

to experience more casualties overall. While previously expected to return to historical levels,

which had averaged 35bps–45bps per month, recent experience has ranged between 66bps

and 101bps.

Bankruptcy/L

iquidation Timing

Assumptions

Rating Category

Months

AAAsf

6.0

Asf 5.0

BBB–sf

4.3

Source: Fitch Ratings

Monthly Casualty Loss Assumptions

Rating Category

(%)

AAAsf 1.00

Asf 1.00

BBB–sf 1.00

Source: Fitch Ratings

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 8

Structured Finance

Asset-Backed Securities

U.S.A.

The three-month period includes the 60-day bankruptcy stay period plus the additional month

to locate and secure the vehicles. No further casualty losses are anticipated during the assumed

liquidation period after the initial three months since the backup disposition agent is assumed

to have secured the vehicles. Casualty losses would total 3.00% over a three-month period in all

rating scenarios.

Depreciation

Prior to the RFC bankruptcy, market value and disposition proceeds tests are expected to help

maintain parity between the fleet’s NBV and market values. However, the RFC will no longer be

expected to fulfill these test requirements upon the occurrence of a bankruptcy.

The fleet’s vehicles will continue to depreciate during the bankruptcy/liquidation period, and

noteholders will be exposed to these losses prior to their disposal. Fitch derives depreciation

assumptions for program vehicles, risk vehicles and box trucks during the bankruptcy period

until liquidation. Separate assumptions are determined for each of these types of vehicles, as

each is purchased with different capitalized costs and different residual assumptions. Program

vehicles are purchased at a higher capitalized cost but typically incur more consistent

depreciation since residual values are the responsibility of the OEM.

Fitch received and reviewed historical depreciation from both ABG and the market to determine

base rates for the analysis. ABG provided depreciation experience segmented by program, risk and

all vehicles by model year from 2008 to 2021, as well as by truck depreciation data from 2017

through 2020. The data provided were deemed adequate for the analysis. Fitch’s base depreciation

rate assumptions are 1.45%, 1.50% and 1.67% for program vehicles, risk vehicles and trucks,

respectively, based on data provided, and are consistent with pre-pandemic levels.

According to Black Book USA, the annual depreciation rate on two- to six-year-old vehicles fell by

only 2% in 2020 and showed actual gains of over 29% in 2021 due to the global microchip shortage

resulting in supply and inventory constraints, coupled with strong new and used vehicle demand.

This was in sharp contrast to the 16.8% annual depreciation in 2019. Most of the 2019 depreciation

(a 9.9% portion of the 16.8%) occurred in 4Q19, with luxury segments seeing some of the largest

drops due to higher new vehicle incentives applying downward pressure on used vehicle values. The

strength of the new and used vehicle market followed into 2021 and 2022 and continues in 2023,

despite some recent softening in used vehicle prices coming off record levels.

Depreciation Assumptions (Worst Case Fleet Scenario)

(%)

Rating Stress

AAAsf

AA+sf

AAsf

AA–sf

A+sf

Asf

A–sf

BBB+sf

BBBsf

BBB–sf

BB+sf

BBsf

Bankruptcy/Liquidation

Timing (Months)

6.00

5.75

5.50

5.33

5.17

5.00

4.83

4.67

4.50

4.33

4.17

4.00

Expected Depreciation

Program Vehicles

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

Risk Vehicles

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

Box Trucks

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

Total Depreciation

Program Vehicles

7.99

7.67

7.35

7.14

6.92

6.71

6.49

6.28

6.06

5.84

5.62

5.41

Risk Vehicles

8.26

7.93

7.60

7.38

7.16

6.93

6.71

6.49

6.26

6.04

5.81

5.59

Box Trucks

9.15

8.79

8.43

8.18

7.94

7.69

7.45

7.20

6.95

6.70

6.45

6.21

Source: Fitch Ratings

Depreciation Assumptions (Best Case Fleet Scenario)

(%)

Rating Stress

AAAsf

AA+sf

AAsf

AA–sf

A+sf

Asf

A–sf

BBB+sf

BBBsf

BBB–sf

BB+sf

BBsf

Bankruptcy/Liquidation Timing (Months)

6.00

5.75

5.50

5.33

5.17

5.00

4.83

4.67

4.50

4.33

4.17

4.00

Expected Depreciation

Program Vehicles

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

1.45

Risk Vehicles

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

1.50

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 9

Structured Finance

Asset-Backed Securities

U.S.A.

Depreciation Assumptions (Best Case Fleet Scenario)

(%)

Box Trucks

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

1.67

Total Depreciation

Program Vehicles 8.14

7.81

7.49

7.27

7.05

6.83

6.61

6.39

6.17

5.95

5.73

5.50

Risk Vehicles

8.41

8.07

7.74

7.51

7.29

7.06

6.83

6.61

6.38

6.15

5.92

5.69

Box Trucks

9.32

8.95

8.58

8.33

8.08

7.83

7.58

7.33

7.08

6.83

6.57

6.32

Source: Fitch Ratings

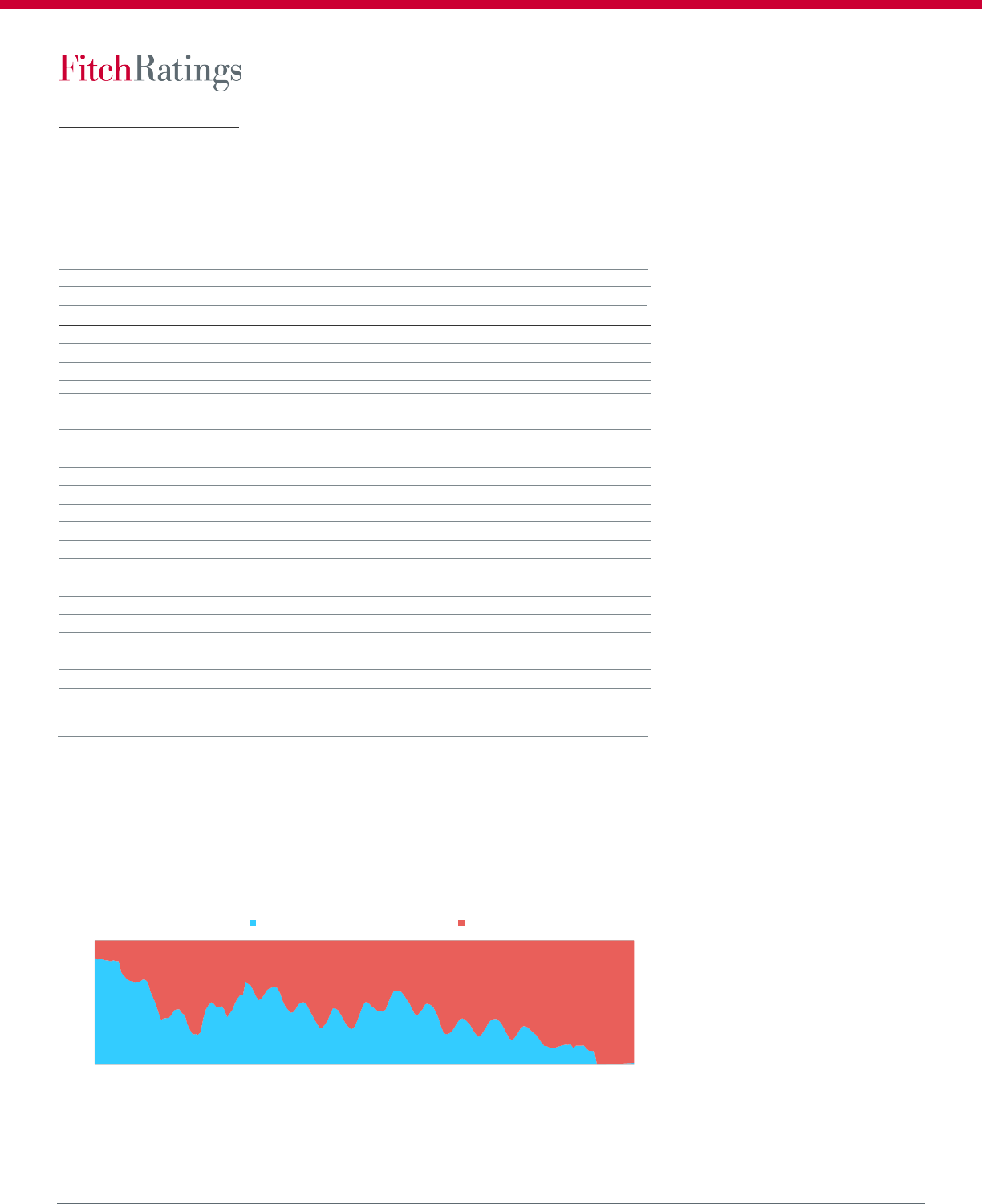

As shown below, 2020 annual vehicle depreciation rates were far below those of historical data,

coming in at just 2.0%, according to Black Book USA (BB). Depreciation in 2021 reached

historical levels, strengthening to -28.7%, driven by the aforementioned new vehicle supply

constraints, before increasing to slightly elevated levels in 2022, estimated at 22.5%. For 2023,

BB forecasts depreciation at 18.0%.

This performance remains consistent with Fitch’s base depreciation assumptions for both

AESOP’s program and risk vehicles. Fitch did not apply any additional stresses to depreciation

assumptions.

The monthly depreciation rate is multiplied by the assumed bankruptcy/liquidation timing.

When considering the derived depreciation rates, Fitch would anticipate depreciation to be

approximately 8.5% over a six-month period at the ‘AAAsf’ level. Losses from depreciation are

multiplied by the remaining pool balance after accounting for the non-liened vehicle adjustment

and casualty losses and are applied to a declining (depreciating) collateral balance, resulting in

adjusted rates of 7.99%, 8.26% and 9.15% for program vehicles, risk vehicles and box trucks,

respectively, in the worst fleet ‘AAAsf’ stress scenario.

Disposition Loss

Vehicles are expected to be liquidated by the backup disposition agent, likely through auction houses

such as Manheim or ADESA (the Auto Dealers Exchange Services of America), historically the most

efficient for large fleet dispositions. ABCR uses additional disposition channels, including direct-to-

dealer sales, retail locations and online marketplaces for third-party retailers to help maximize

liquidity by achieving the highest recovery rate on liquidated vehicles. However, these other

channels would be unavailable in a Chapter 7 bankruptcy scenario.

Liquidation proceeds are the sole payment sources under Fitch’s bankruptcy/liquidation

scenario since ABG and ABCR are no longer able to operate and rent out vehicles to produce

additional sources of funds for the trust. Vehicles sold below their respective NBV would

translate into losses for the trust. Fitch utilizes historical loss performance data provided by the

RFC and third parties to determine potential stress scenarios for each rating category.

Wholesale vehicle market data exhibiting economic pressure, the health of automobile

manufacturers, supply and demand of both new and used vehicles, fuel prices and other factors

can severely affect used vehicle values. Therefore, wholesale vehicle values of pools exhibiting

-40

-30

-20

-10

0

10

20

30

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

(%)

Source: Black Book USA

Observed Depreciation Forecast Depreciation

Black Book Annual Vehicle Depreciation Rates

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 10

Structured Finance

Asset-Backed Securities

U.S.A.

segment diversity would tend to be less sensitive to factors affecting vehicle values versus a

pool comprising a single or limited number of vehicle types.

The worst yoy aggregate price decline observed for all vehicles over the past 11 years was used

to derive Fitch’s ‘BBsf’ expected loss stress. The stress was determined to be consistent with a

‘BBsf’ rating based on Fitch’s review of the scale of wholesale vehicle value declines for all

vehicle types (11.3% peak to trough, October 2008 versus October 2007, rounded to 12%), as

well as the magnitude of the worst loss during this period compared to other historical losses,

and then scaled upward based on standard deviations observed in the historical data.

Fitch’s ‘BBsf’ loss stress is scaled upward in 4% increments for each rating category up to

‘AAAsf’, the approximate mean standard deviation of the data, to reflect higher expected losses

under each ascending rating category. This results in expected disposition losses of 24%–28%

at the ‘AAAsf’ rating level for a diverse pool and 28%–32% for a nondiverse pool. The disposition

loss amount is calculated after accounting for expected losses from depreciation, casualty

losses and the non-lien vehicle adjustment.

Fitch’s view of the macroeconomic environment, expectations of wholesale vehicle values and

the general health of the RFC and related OEMs will determine the specific loss disposition

stress to be utilized. For example, Fitch would tend to use the upper range of the disposition

stress in times of weak macroeconomic conditions or if the RFC is of particularly weak credit

quality. Conversely, if Fitch’s view of the macroeconomic environment is positive and the RFC

is in a stronger financial position, Fitch may choose to use the lower end of the range.

Fitch

Criteria Disposition Loss Ranges

(%)

BBsf

BBBsf

Asf

AAsf

AAAsf

Nondiverse

12.0–16.0

16.0–20.0

20.0–24.0

24.0–28.0

28.0–32.0

Diverse

8.0–12.0

12.0–16.0

16.0–20.0

20.0–24.0

24.0–28.0

Source: Fitch Ratings

The rental industry recovered relatively quickly from the pandemic slowdown and the financial

health of OEMs has been strong in recent years. In addition, ABG has been profitable in recent

years and has displayed a disciplined approach in many aspects of its business and strategies,

including fleet management.

Fitch utilized the lower end of the disposition loss range for risk vehicles and box trucks in

consideration of these expectations, as shown in the table above for each rating category.

Since ABG’s vehicle fleet is deemed diverse and box trucks are deemed nondiverse, the ranges

are recommended at the low end of the range as described, from 8.0% and 12.0% at ‘BBsf’ to

24.0% and 28.0% for ‘AAAsf’, respectively, consistent with the criteria.

Monthly disposition proceeds for the fleet have consistently exceeded the NBV for sold

vehicles over the past five years, with no monthly losses relative to NBV in any month.

Disposition proceeds have generally ranged from 101% to 164% of NBV since 2010.

The monthly market value tests and minimum depreciation applied to vehicles in the fleet

enable ABCR to keep NBVs in parity with ongoing market values, resulting in low disposition

losses historically and mostly gains recorded to date.

For program vehicles, Fitch looked at annual disposition data provided by ABCR by model year,

which have shown minimal losses relative to NBV since the majority of vehicles returned to

OEMs have been within terms of the program agreements. Fitch assumed 0.50% for ‘BBsf’

program disposition losses, well above annual losses observed. This assumption is increased for

each rating scenario, up to 5.00% for ‘AAAsf’.

Fitch analyzed the number of vehicles in ABG’s total fleet relative to the one-year- to two-year-

old used vehicle market, which is expected to be about 15 million vehicles at any given time, to

determine fleet size relative to the applicable wholesale market. The estimated fleet accounts

for a small percentage of used sales in any given year, ranging from 1.5% to 2.5% of the market.

Therefore, Fitch believes the market could adequately absorb the fleet in a liquidation scenario

when considering the fleet size relative to the market, in addition to the diversity of the fleet

from a make/model perspective. Additionally, defi provides reports on the fleet and disposition

202

3-3 Expected Loss

Assumptions

(%)

Best Fleet

Worst Fleet

AAAsf

18.87

36.96

AA+sf

17.92

34.85

AAsf 16.97 32.72

AA–sf

16.33

31.29

A+sf

15.69

29.85

Asf 15.05 28.41

A–sf

14.41

26.97

BBB+sf

13.76

25.51

BBBsf

13.11

24.05

BBB–sf

12.46

22.58

BB+sf

11.81

21.11

BBsf

11.16

19.63

Source: Fitch Ratings

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 11

Structured Finance

Asset-Backed Securities

U.S.A.

strategies in the event of a bankruptcy/liquidation scenario on an ongoing basis to ABG and

ABCR. As such, no further asset liquidity stresses are recommended.

Interest and Other Expenses

Interest and administrative costs are still payable on the notes during the bankruptcy/liquidation

period. Therefore, Fitch’s analysis accounts for these expenses by including them in the expected

loss assumptions. Depending on the note rating, sufficient liquidity in the form of a cash reserve or

an LOC would be expected to cover anticipated interest expenses/funding costs, servicing fees

and any other administrative expenses, up to their maximum allowed amounts, over the assumed

liquidation period.

The expected weighted average (WA) bond coupon is 6.76% per annum as a percentage of the

notes. The total interest cost as a percentage of the series receivable amount can fluctuate

based on the fleet mix, ranging from 6.22% for the best fleet to 5.48% for the worst fleet.

Aggregate servicing and other costs per annum are 0.33% of the current series receivables

amount but can fluctuate according to fleet mix since certain costs are tied to the size of the

fleet and the series balance. Expenses decrease while the required enhancement increases

when the fleet shifts toward the worst fleet mix, as the receivables pool must increase so that

CE reaches required levels. The required LOC amount for 2023-3 is expected to total 4.00% of

the notes.

Summary — Total Expected Loss Proxy

Fitch calculates total expected losses for each rating scenario by summing the following four

components over the assumed liquidation period:

• casualty losses;

• depreciation losses;

• disposition losses; and

• interest expenses and other fees.

Fitch then compares the total expected losses for each rating scenario to the amount of

required CE for each class of notes in the series to determine if expected losses are covered by

the available CE levels at all rating categories.

Note that the depreciation amount is calculated on a declining (depreciating) balance after taking

into account the non-liened vehicle adjustment, if any, and casualty losses. The disposition loss

amount is calculated after accounting for the non-liened vehicle adjustment, expected

depreciation loss and casualty loss.

Best and worst fleet expected losses commensurate with the ratings for each of the notes are

shown above in comparison to the best and worst fleet required CE for each class. Under the

‘AAAsf’ scenario, Fitch expects losses ranging from 18.87% to 36.96% for 2023-3, while

required CE for class A notes ranges from 31.49% to 40.27%, in excess of expected losses.

Best and worst fleet CE for class B notes are in excess of best and worst fleet expected losses;

the worst fleet CE of class C notes are in excess of worst fleet expected losses and the best fleet

CE for class C notes are within 74bps of best fleet expected losses. The shortfall for class C

under the best fleet CE is deemed to be acceptable due to the unlikely event that all vehicles in

the fleet would be program vehicles given the ongoing vehicle supply and demand imbalances

resulting in nearly 100% in NPVs recently.

Disposition Assumptions

(%) Program

Risk

Truck

AAAsf

5.00

24.00

28.00

AA+sf

4.44

22.00

26.00

AAsf

3.88

20.00

24.00

AA–sf

3.50

18.67

22.67

A+sf

3.13

17.33

21.33

Asf

2.75

16.00

20.00

A–sf

2.38

14.67

18.67

BBB+sf

2.00

13.33

17.33

BBBsf

1.63

12.00

16.00

BBB–sf

1.25

10.67

14.67

BB+sf

0.88

9.33

13.33

BBsf

0.50

8.00

12.00

Source: Fitch Ratings

Expected Losses v

ersus Credit Enhancement

(%)

Best Fleet Mix

Worst Fleet Mix

Class

Expected Losses

Required CE

Expected Losses

Required CE

Ratings

A

18.87

31.49

36.96

40.27

AAAsf

B 15.05

20.46

28.41

30.64

Asf

C

12.46

11.72

22.58

23.03

BBB–sf

Source: Fitch Ratings

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 12

Structured Finance

Asset-Backed Securities

U.S.A.

An example of a single vehicle for 2023-3, as illustrated in the table to the right, demonstrates

the impact of the six-month depreciation and disposition stresses on vehicle value for a single-

risk vehicle when considering Fitch’s stresses. Effectively, a $30,000 vehicle would experience

a 33.88% loss in this scenario.

Legal Structure

Fitch believes the AESOP legal structure provides that a bankruptcy of ABG or ABCR would not

impair the timeliness of payments on the securities. Fitch expects to receive and review legal

opinions to the effect that the AESOP assets would not be consolidated with those of ABG or

ABCR in the event of bankruptcy. Furthermore, Fitch expects to receive an opinion that the

trustee has a first-priority-perfected security interest in the vehicles leased by the vehicle

purchasers to ABCR, Avis and Budget, as well as the other sublessees.

AESOP is structured with a single operating lease under which all vehicles in the trust fall.

This master lease is considered indivisible and a singular obligation upon which ABCR and its

sublessees make monthly rental payments. The recent bankruptcy of The Hertz Corporation

saw a legal challenge of this structure in court in an attempt to segment out a portion of the

vehicles Hertz intended to liquidate. Ultimately, the motion on this issue was not heard by the

court and postponed indefinitely. However, ABCR has made clear in its documentation that the

AESOP operating lease is considered indivisible, and while it may be challenged by debtors in

bankruptcy court, that is not the intent of the structure as created, and Fitch shares this opinion

in all respects.

Asset Analysis

AESOP Fleet Mix

(As of Dec. 31, 2022)

Total Fleet OEM Concentrations

OEM

Fitch Rating

% of Fleet NBV

Toyota A+, Rating Outlook Stable 19.88

Ford

BB+, Rating Outlook Positive

14.27

Chrysler

a

BBB, Rating Outlook Stable 19.96

GM

BBB–, Rating Outlook Positive

15.64

Kia BBB+, Rating Outlook Stable 7.18

Honda

A, Rating Outlook Stable

5.85

Nissan Rating Withdrawn 5.53

Hyundai

BBB+, Rating Outlook Stable

4.05

Mitsubishi NR 1.21

Mazda

NR

1.57

Volkswagen A–, Rating Outlook Stable 1.08

Subaru

NR

1.07

Mercedes + Smart A–, Rating Outlook Stable 0.54

Other

N.A.

1.97

BMW NR 0.13

Volvo

A–, Rating Outlook Stable

0.08

Total

—

100.00

a

Rating of parent, Stellantis N.V. N.A. – Not applicable. NR – Not rated.

Source: Avis Budget Car Rental, LLC

OEM Concentrations — Diverse

The fleet as of the cutoff date is summarized in the table below by program/risk and OEM.

Chrysler replaced Toyota to be the largest OEM at 20.0% of the fleet, while Toyota and GM are

the second and third largest OEMs with 19.9% and 15.6% of the fleet’s NBV, respectively.

The concentration of the top five OEMs as a percentage of the total pool has steadily decreased

since 2005, from a fleet average of 97.4% to 76.9% through December 2022. Fitch views this

trend positively, as a less concentrated pool provides more diversification. Notably, the

concentration of GM in the fleet has decreased considerably. In 2005, GM averaged 57.6% of

AAAsf Scenario

—

Risk Vehicle Example

Initial NBV ($)

a

30,000

Lien Holiday (%)

b

1.80

Adjusted NBV After

Removal of Non-Lien

Vehicles ($) c = a * (1 – b)

29,460

Casualties (%)

d

3.00

NBV Less

Casualty Loss ($)

e = c * (1 – d)

28.576

Timing (Months)

f

6

Monthly

Depreciation (%)

g

1.50

Total

Depreciation (%)

h = (1- (1 - g)^f)

8.67

Subtotal ($)

i = e * (1 – h)

26,099

Disposition Loss (%)

j

24.00

Ending NBV ($)

k = i * (1 – j)

19,835

Total Loss ($)

l = a – k

10,165

Total Loss (%)

m = l / a

33.88

Source: Fitch Ratings

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 13

Structured Finance

Asset-Backed Securities

U.S.A.

the fleet and represented the top OEM concentration. By contrast, GM is currently the third

largest OEM; it comprises 15.6% of the fleet, as of the cutoff date.

As of the cutoff date, 79.7% of the current pool consist of vehicles manufactured by IG OEMs,

with the remaining 20.3% from non-IG OEMs. Ford is currently the pool’s largest non-IG OEM.

AESOP Fleet Mix

(As of Dec. 31, 2022)

Program — Non-Program OEM Concentrations

OEM

% of Fleet

% of Program

Program

Kia 1.00

70.26

GM

0.42

29.72

Total

1.42

100.00

Non-Program

Toyota

19.88

20.16

Ford

14.27

14.48

Chrysler

19.96

20.25

GM

15.22

15.44

Kia

6.18

6.27

Honda 5.85

5.94

Nissan

5.53

5.61

Hyundai

4.05

4.11

Other

1.97

2.00

Mazda

1.57

1.59

Mitsubishi

1.21

1.23

Volkswagen 1.08

1.10

Subaru

1.07

1.08

Mercedes + Smart

0.54

0.55

BMW

0.13

0.13

Volvo

0.08

0.08

Total

98.58

100.00

a

Rating of parent, Stellantis N.V. N.A. – Not applicable. NR – Not rated.

Source: Avis Budget Car Rental, LLC

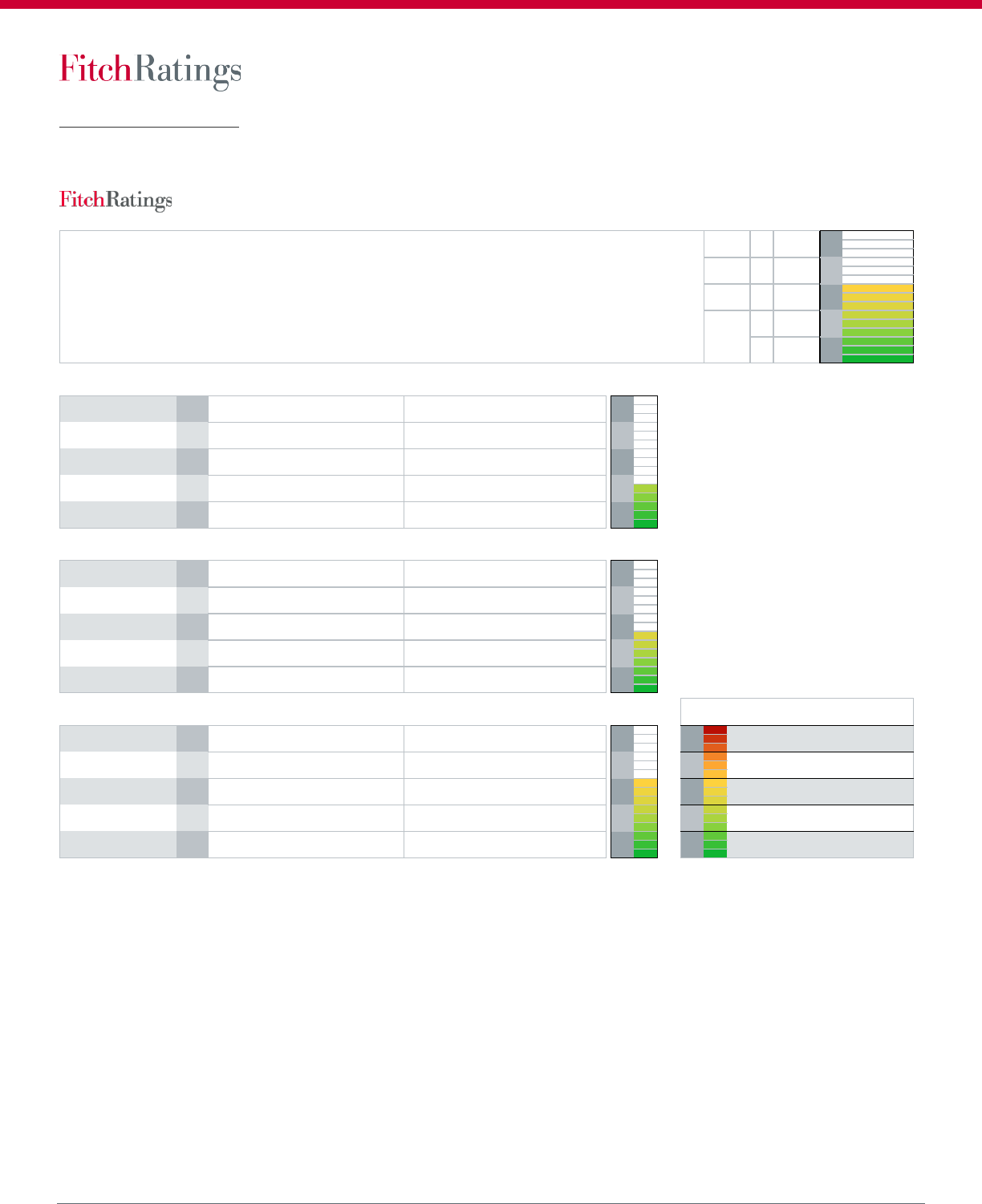

Program/Non-Program Vehicle (Risk) Mix — Weakening

The program/risk vehicle mix has shifted significantly at times but has trended toward risk

vehicles in recent years, per the chart below. Program concentrations first dipped below 50% in

November 2007, and prior to the pandemic, they fluctuated in line with seasonal trends. As of

the cutoff date, the fleet consists of mainly NPVs, at 98.58% of the fleet, while program vehicles

represent only 1.42%, compared with 15.15% as of March 2021. The following chart shows

monthly concentrations for program and risk vehicles since 2005.

Prior to the pandemic, the program/risk vehicle mix shifted according to seasonal trends, with

the program typically declining in the early winter months before increasing in the spring and

summer months. Since mid-2015, program concentrations have been below typical levels,

0

20

40

60

80

100

12/05

6/06

12/06

6/07

12/07

6/08

12/08

6/09

12/09

6/10

12/10

6/11

12/11

6/12

12/12

6/13

12/13

6/14

12/14

6/15

12/15

6/16

12/16

6/17

12/17

6/18

12/18

6/19

12/19

6/20

12/20

6/21

12/21

6/22

12/22

(%)

Historical Program vs. Risk Concentrations

Program Risk

Source: Avis Budget Car Rental, LLC

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 14

Structured Finance

Asset-Backed Securities

U.S.A.

largely due to declining OEM offerings. Kia now represents the only significant program

concentration at 1.00% of the fleet and 70.26% of total program vehicles, while GM accounts

for 0.42% and 29.72%, respectively.

ABCR’s fleet management team adjusts the mix to best fit the needs of their fleet and consumer

demand while also assessing ongoing program offerings from the OEMs. Program offerings

have continued to decrease in recent years, with additional pandemic-related factors adding to

this shift from historical levels. OEMs are hesitant to shoulder the risk of additional program

agreements’ residual values, and ABCR and other rental car companies returned many of their

pre-pandemic program vehicles during initial de-fleeting in 2020.

Fitch expects the mix to continue to fluctuate along with seasonal and market trends.

Program levels should remain low in the near term due to the low amount of vehicle supply in the

market and the limited amount of offerings to the rental car companies that have been observed.

Notably, as of the December 2022 cutoff date, used vehicles comprised 18.4% of AESOP’s total

fleet NBV. This is a marked increase from historical levels due to the continued supply

constraints for new vehicle production. As previously discussed, the 25% series-level

concentration limit was removed starting with the 2022-5 transaction.

Vehicle Models — Diverse

The top 20 models in the fleet as of December 2022 are diverse, represented by seven different

OEMs, with a balanced mix between light-duty trucks, cars and vans. These top models

represent 49.7% of the fleet, slightly down from 2023-1 and 2023-2, and 2022-3, 2022-4 and

2022-5, but similar to levels seen in 2020 and before. Of the top 20 models, 37.9% are cars;

light-duty trucks, sport-utility vehicles (SUVs) and crossover utility vehicles (CUVs) account for

51.0%; and vans make up the remaining 11.1%, compared with 32.8%, 56.6% and 10.6% in both

2023-1 and 2023-2, respectively.

Light-duty trucks have grown as a concentration within the fleet from 2017 to 2022, although

the concentration of cars recently took some shares of the fleet due to customer demand. Fitch

expects light-duty truck concentration in the fleet to remain elevated for the foreseeable

future.

Geographic Concentration — Diverse

As of the December 2022 cutoff date, the top five states represent approximately 60.3% of the

fleet, marginally up from 2023-1 and 2023-2, and slightly above prior transactions. Florida has

the top state concentration with approximately 34.1% of the fleet, with California (12.8%), New

York (4.6%), Texas (4.5%) and Colorado (4.2%) rounding out the top five.

As mentioned previously, certain specified states (Nebraska, Oklahoma and Ohio) have

historically been constrained to 7.5% of fleet NBV due to the lack of first-priority-perfected

security interests for vehicle titles in these states. Historical concentrations have remained

below this historical limit, comprising less than 4% of the fleet in recent years.

Aging — Increasing

Aging within the fleet remained consistently cyclical for the four years prior to the onset of the

pandemic. However, as new vehicle supply and demand dried up in the early days of the

pandemic, vehicle age began to increase in the overall AESOP fleet, even as it liquidated fleets

to match decreased demand. The current trailing three-month average fleet age is 12.84

months as of the December 2022 collection period, at the high end of the range since January

2020 (9.0 months–12.8 months). This average age is higher compared to early 2020 and prior,

attributable to the impact of the pandemic, and aging remains elevated, with delays in new

vehicle deliveries, due in part to the ongoing global semiconductor chip shortage, leading to

longer fleet vehicle retention.

Notably, this aging pattern is due to ABCR’s intentional fleet management. Vehicles that

previously would have been sold from the fleet earlier in their lives are now retained and used for

longer durations and strategically moved from Avis’ higher-quality rental brands to lower

economy options, right down to vehicles used for rideshare partnerships and Zipcar rentals, until

eventually, such vehicles are sold at Avis’ retail network, at auction or in the secondary market.

Light

Truck

50.6%

Car

38.2%

Van

11.2%

Source: Avis Budget Car Rental, LLC

AESOP Top 20 Models —

Segment Concentration

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 15

Structured Finance

Asset-Backed Securities

U.S.A.

Risk vehicles are held longer than program vehicles to take advantage of the depreciation curve

for dispositions. With the risk vehicle concentration in the fleet higher within the past two years,

aging has trended higher.

Expected Rating Sensitivity

Series 2023-3 - Rating Sensitivity

Class A

Class B

Class C

Original Rating

AAAsf

Asf

BBB-sf

Liquidation Timing

AAAsf

A-sf

BB-sf

Disposition AA+sf A-sf BB-sf

Combined AAsf BBB-sf Bsf

Non-Liened Vehicles

AAAsf

A-sf

BBsf

Source: Fitch Ratings

Rating Sensitivity

Liquidation Timing Stress

Fitch’s rating sensitivity analysis focuses on two scenarios involving potentially extreme market

disruptions that would force the agency to redefine its stress assumptions. The first scenario

examines the effect of moving Fitch’s bankruptcy/liquidation timing scenario to eight months

at ‘AAAsf’ with subsequent increases to each rating level.

Bankruptcy/Liquidation Timing Stress Sensitivity

(%)

Worst Fleet Mix

Best Fleet Mix

Sensitivity

Recommended

Ratings

Class

Current

Ratings

Expected

Loss

Proposed

CE

Expected

Loss

Proposed

CE

A

AAAsf

39.89

40.27

22.40

31.49

AAAsf

B

Asf

31.59

30.64

18.67

20.46

A-sf

C

BBB–sf

25.92

23.03

16.15

11.72

BB-sf

Source: Fitch Ratings

Disposition Proceeds Stress

The second scenario considers the effect of moving the disposition stresses to the higher end of

the range at each rating level for a diverse fleet for NPVs in the fleet and to the higher end of

the range for a nondiverse fleet for trucks in the fleet. For example, the ‘AAAsf’ stress levels

would move to 28% from 24% and to 32% from 28% for NPVs and trucks, respectively.

Disposition Proceeds Stress Sensitivity

(%)

Worst Fleet Mix

Best Fleet Mix

Sensitivity

Recommended

Ratings

Class

Current

Ratings

Expected

Loss

Proposed

CE

Expected

Loss

Proposed

CE

A AAAsf 40.44

40.27

18.87

31.49

AA+sf

B

Asf

31.94

30.64

15.05

20.46

A-sf

C

BBB–sf

26.15

23.03

12.46

11.72

BB–sf

Source: Fitch Ratings

Combined Stress

Finally, the last example shows the impact of both stresses on the structure. The purpose of

these stresses is to demonstrate the potential rating impact on a transaction if one or a

combination of these scenarios were to occur.

The Rating Sensitivity section provides

insight into the model

-implied

sensitivities the transaction faces when

one assumption is stressed while holding

others equal. The

modeling

process uses

the estimation and stress of these

variables to reflect asset performance in

a stressed environment. The results to

the left should only be considered as one

potential outcome, as the transaction is

exposed to multiple dynamic risk

factors. They should not be used as

indicators of possible future

performance.

No change or positive change

Negative change within same category

– 1 category change

– 2 category change

– 3 or larger category change

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 16

Structured Finance

Asset-Backed Securities

U.S.A.

Combined Stress

Sensitivity

(%)

Worst Fleet Mix

Best Fleet Mix

Sensitivity

Recommended

Ratings

Class

Current

Ratings

Expected

Loss

Proposed

CE

Expected

Loss

Proposed

CE

A

AAAsf

43.27

40.27

22.40

31.49

AAsf

B

Asf

35.01

30.64

18.67

20.46

BBB–sf

C

BBB–sf

29.38

23.03

16.15

11.72

Bsf

Source: Fitch Ratings

With a sufficient increase in either the timing of the liquidation of the fleet or disposition fees,

the class A notes could still be maintained at ‘AAAsf’. To approach non-investment-grade rating

levels or a ‘CCCsf’ rating, in addition to the combined scenario described above, depreciation

costs would need to rise to previously unseen levels for the platform, increasing to, at minimum,

two times the highest monthly depreciation levels seen for both program vehicles and NPVs at

the height of the recession.

Non-Liened Vehicle Concentration

In the event of an amendment to the base documents, the AESOP trust may be allowed to contain

a certain portion of non-liened vehicles that do not give the trustee a first-priority-perfected

security interest, and may not be available in the event of a bankruptcy of the owner of the vehicles

and early amortization of the notes. Although the likelihood of this scenario is deemed extremely

remote, to account for such a change, Fitch ran a sensitivity expected loss analysis assuming 5.00%

of the asset base becomes unavailable in the event of a bankruptcy in both the best and worst case

fleets, with the potential impact on ratings illustrated in the following table.

Non

-Liened Vehicle Sensitivity

(%)

Worst Fleet Mix

Best Fleet Mix

Sensitivity

Recommended

Ratings

Class

Current

Ratings

Expected

Loss

Proposed

CE

Expected

Loss

Proposed

CE

A

AAAsf

39.11

40.27

23.09

31.49

AAAsf

B

Asf

30.82

30.64

19.44

20.46

A–sf

C

BBB–sf

25.17

23.03

16.96

11.72

BBsf

Source: Fitch Ratings

Up Sensitivity

Overall improvement in the secondary market or lower than expected depreciation versus

historical levels may lead to positive migrations in the ratings for the transaction. However,

there is limited upgrade potential for rated rental fleet ABS notes given the revolving nature of

the structure, whereby collateral changes on a daily basis through fleet purchases and

dispositions, as well as trust concentration limits in place. Therefore, the occurrence of

upgrades is very limited at best. Additionally, fleet composition changes each day, including the

concentration of program vehicles versus NPVs (or risk vehicles), as well as OEM

brand/segment/model concentrations. Potential positive rating actions are also limited by the

current macroeconomic environment.

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 17

Structured Finance

Asset-Backed Securities

U.S.A.

Transaction Structure

Credit Enhancement

CE for each series is dynamic based on the aforementioned methodology. CE may be in the form

of subordination, OC, LOCs and/or cash reserves subject to a required liquidity amount sized to

cover at least six months of interest on the notes plus 50bps.

The fleet is categorized into different risk buckets according to the Issuer Default Ratings (IDRs)

of the vehicle OEMs for vehicles and program/risk status. IDRs are determined from non-Fitch

NRSROs. Minimum required CE for the most subordinate notes is determined based on the fleet

characteristics according to the above criteria, with varying levels of enhancement required for

each category of vehicle from Moody’s. The WA CE level will be utilized as the minimum

required CE level each month for the most subordinate notes.

The table above summarizes AESOP maximum and minimum CE levels for each series since

2017-1. For transactions pre 2022-5, the worst fleet mix, per Fitch’s methodology, occurs when

the fleet mix would change immediately to 85% risk vehicles (given the 85% limit on NPV), 5%

box trucks and 10% program vehicles from non-IG OEMs. No credit was given for the additional

CE step-up for exceeding the NPV concentration, as it was assumed this would not be available

in the event of a bankruptcy. For series 2023-3, the worst fleet mix is 95% risk vehicles and 5%

box trucks, which reflects the removal of the NPV limit for this series and the additional

permanent CE provided. The best fleet mix would be 100% program vehicles from IG OEMs.

Required CE levels and advance rates for this series are listed in the table below. AESOP will be

required to maintain assets equal to an NBV equal to the aggregate asset coverage threshold

amount for the series, determined by the required advance rate for each series. Failure to do so

will result in an amortization event. Each vehicle’s NBV for the purpose of this calculation will

be equal to the capitalized cost less aggregate depreciation charges and, in the case of risk

vehicles, the amount of any upfront incentive fees paid by the OEM.

AESOP Credit Enhancement

(%) 2023-3

2023-2

2023-1

2022-5

2022-4

2022-3

2022-1

2021-1

2020-

2

(NR)

2020-1

2019-3

2019-2

2018-2

2018-1

2017-2

2017-1

Tenor

(Years)

3.7

3

5

3

5

3

5

5

5

5

5

5

5

5

5

5

LOC Size

(% of Notes)

4.00

3.75

4.00

4.00

3.50

3.50

2.75

2.00

2.00

2.00

2.00

2.25

2.75

2.50

2.25

2.25

Best Fleet

Class A

31.49

31.36

31.49

31.43

33.41

33.35

32.27

30.92

26.41

27.40

27.40

27.47

28.12

28.38

28.31

30.70

Class B

20.46

20.34

20.46

20.39

23.66

23.58

22.98

22.22

18.83

18.83

18.83

18.78

19.27

19.37

19.33

20.27

Class C

11.72

11.62

11.72

11.64

17.32

17.24

16.63

16.43

11.51

11.51

11.51

11.54

11.79

12.16

12.13

13.11

Class D

N.A.

N.A.

N.A.

N.A.

5.61

5.52

4.89

4.83

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

Worst Fleet

Class A

40.27

40.14

40.27

40.22

38.64

38.59

37.60

35.29

33.99

35.60

35.60

35.67

36.22

35.89

36.07

38.49

Class B

30.64

30.53

30.64

30.59

29.65

29.59

29.04

27.14

27.19

27.99

27.99

27.97

28.37

27.82

28.06

29.23

Class C

23.03

22.92

23.03

22.97

23.81

23.74

23.19

21.71

20.63

21.51

21.51

21.55

21.73

21.37

21.64

22.88

Class D

N.A.

N.A.

N.A.

N.A.

13.02

12.94

12.38

10.85

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A. – Not applicable. NR – Not rated.

Source: AESOP 2023-3

Not for redistribution

Avis Budget Rental Car Funding LLC, Series 2023-3

Presale │ March 27, 2023 fitchratings.com 18

Structured Finance

Asset-Backed Securities

U.S.A.

Required Advance Rates and Credit Enhancement Levels

Vehicle Type

IG versus Non-IG

Moody’s Required CE (%)

Program

IG

12.75

Program

Non-IG

16.25

Risk

IG

28.35

Risk

Non-IG

28.35

Trucks

All

35.75

Source: Avis Budget Car Rental, LLC

The 2023-3 class A required CE are 40.27% for the worst fleet mix and 31.49% for the best fleet

mix. The required CE will, at all times, be within the maximum and minimum levels as both

AESOP’s collateral mix and OEM ratings shift. Monthly CE may be in excess of the required

amounts when considering amounts available in AESOP’s principal collection account.

Overcollateralization

OC is provided by the excess receivables when considering the assets over the outstanding note

principal balance. After closing and on each distribution date, the OC level will also include any

amounts deposited into the principal collection account. For the purposes of this analysis, the

class R notes are considered part of OC.

Historically, required AESOP series CE levels were calculated based on the total senior invested

amount for each series, which includes the series’ pro-rata share of cash and permitted

investments held in a collection account. However, for these series and future issuance, AESOP

will now use a net senior invested amount for the calculation of the enhancement amount; this

will net out these liquid assets since they do not require additional enhancement, in contrast to

trust vehicles that do. This net debt concept does not affect the level of actual enhancement

available to each series.

Letters of Credit

Liquidity is provided in the form of a cash reserve and/or an LOC expected to be sized to 4.00% of the

notes, equal to six months of interest plus a cushion of 0.50%. An amortization event will occur with

respect to the notes if the liquidity amount falls below the required amounts and such deficiency

continues for at least two business days. The LOC provider is expected to initially be JPMorgan

Chase Bank, N.A. (AA/F1+, Stable), which conforms to Fitch’s counterparty criteria for direct support

counterparties.

Should the LOC provider be downgraded below Fitch’s required rating thresholds, the

administrator must notify the trustee to draw on the LOC in an amount equal to a potential

enhancement deficiency should the transaction lose the LOC, up to the full size of the LOC and

deposit that amount in the cash collateral amount. Should the LOC provider go bankrupt or

refuse to honor a proper draw on the LOC, this will trigger a limited liquidation event where

fleet assets will be sold to pay off the principal of any series they provide the LOC for. It is

important to note that this provision can be waived with noteholder consent.