March 2019

Toolkit for Helping Youth

Select Bank Accounts

This supplement to Money Smart’s Bank Checklist provides additional

information to help you teach youth about the importance of

comparing services and fees when selecting a bank account.

MONEY SMART

Supplement for Instructors/Trainers

CONTENTS

Background ...........................................................................................................................2

Getting Started ................................................................................................................... 3

Bank Information ...............................................................................................................3

Accounts ..............................................................................................................................5

Checking Accounts .......................................................................................................6

Overdraft Programs ...................................................................................................... 9

Savings Accounts ........................................................................................................ 11

ATM Cards ................................................................................................................... 12

Debit Cards ..................................................................................................................13

Mobile/Online Banking ............................................................................................... 14

Total Monthly Costs ........................................................................................................15

Total Annual Costs ........................................................................................................... 15

Money Smart for Young People - Bank Checklist ............................................... 16

Decisions, Decisions: A Case Study ........................................................................ 17

Resources ............................................................................................................................24

Educational Resources Specic to Checking Accounts ............................................... 24

Comprehensive Financial Education Resources ...........................................................24

Account Templates and Standards ................................................................................25

Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts 1

Having a bank account is an important step in securing your nancial well-being. Bank

accounts keep your money safe from theft, loss, and re. Bank accounts help you to

access your paycheck quickly and easily. Using direct deposit, for example, means you

have quicker access to your money because funds that are electronically deposited are

available sooner than if you deposited a check. Having a banking relationship is almost

always cheaper than using other businesses to cash your check. A bank account provides

security. The Federal Deposit Insurance Corporation (FDIC) insures deposits up to the

maximum amount allowed by law. This means that the FDIC will return their money to

customers in the rare event a bank fails.

The Bank Checklist found in Money Smart provides an easy way to compare the costs

and services of accounts at up to three nancial institutions. The information included

in this supplement provides Money Smart instructors and trainers with additional

information to help individuals use the Bank Checklist to select safe, affordable accounts.

This supplement was designed particularly to empower young people to condently

enter into a banking relationship that meets their needs. It explains each item on the

checklist and important questions to ask. The Resources section provides links to

educational resources related to checking and savings accounts, nancial education, and

account templates and standards that also may be useful to instructors and trainers. A

case study and sample completed checklists are included at the end of the document.

We hope you nd this to be a helpful resource as you prepare to deliver training or

work with an individual one-on-one. While it was developed to complement the youth

curricula, the information can be helpful to people of all ages.

Background

Research shows that an individual is most likely to open a checking or savings account

for the rst time for a job-related reason. For example, a person will open their

rst account when they get their rst job or start a new job in order to deposit their

paycheck. These scenarios present a good opportunity for an individual to select an

account and start a banking relationship.

But if a person has never owned an account, how do they know which one is right for

them? If they have had an account in the past, but want to get a new one, what factors

should they consider? Should they open an account at the bank closest to their home,

school, or work? Should they ask their friends or parents where they bank? Selecting

an account can seem overwhelming because there are many factors to consider. The

material in this supplement will help customers, especially young adults, understand

and compare features and fees across several different accounts.

2 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Getting Started

Before completing the Bank Checklist, encourage your audience to think about their

day-to-day lives and how they like to handle their money. You may want to ask the

following questions:

Will you receive a xed paycheck on a regular basis or will the amount and frequency

of your income vary?

Do you prefer to pay for purchases using cash, credit cards, debit cards, paper

checks, or online?

Is it your nancial goal to set aside money regularly for savings?

What do you need or want from an account based on how you plan to handle your

money?

Bank Information

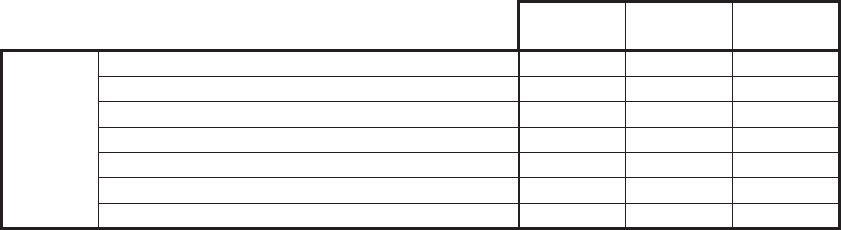

The rst section of the Bank Checklist asks your audience to think about a bank in gen-

eral, even before considering the accounts and associated fees. This section helps them

think about the range of services that they might need, as well as the convenience of

the bank’s location.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Bank

Information

Does the bank offer the services I need?

Convenient branches and ATMs?

Bank hours?

Do employees speak my language?

Is it insured by FDIC/National Credit Union Administration (NCUA)?

Does the bank have any special programs for students?

Does the bank offer the services I need?

To determine if a bank offers the services that you need, you may want to ask the

following questions:

Does the bank offer mobile or online services that allow you to check your account

balances online with a computer or phone?

Can you transfer money between your accounts? If so, how?

Can you pay your bills online with a computer or phone?

What are the costs for money orders, wire transfers, and other services?

Does the bank offer free deposits and withdrawals at a branch or ATM?

Does the bank offer direct deposit? What benets come with that?

Does the bank cash checks and accept cash deposits for the accounts you are

considering?

3

Does the bank offer a range of products you may want in the future, such as small

loans or credit cards?

Can you open both a checking and a savings account at the bank? Can you transfer

money between the accounts to help manage the balances and avoid overdraft fees,

if they apply?

Convenient branches and ATMs?

Convenience is a major factor in selecting a bank. In making your choices you can

weigh the convenience of branches and ATMs as well as any fees or costs. For example,

your questions can include:

Is there a branch or ATM near your home, school, and/or work?

Is the bank part of an ATM network that will allow you to withdraw funds free-of-

charge in convenient locations within its network?

How much does it cost to use out-of-network ATMs?

Does the account entitle you to free customer service assistance, including live

customer support in a branch, over the phone, or online?

Bank Hours?

Is the bank open when you need it to be? If not, how else can you access your account?

How can you communicate with your bank if you are unable to go into the branch while

it is open (e.g., a secure email service via the bank’s website)?

Do employees speak my language?

Does the branch have staff that can speak your preferred language? In person? On the

phone? With a TTY?

Is it insured by FDIC/NCUA?

The FDIC insures each depositor to at least $250,000 per insured bank if the bank fails.

The NCUA provides similar coverage at insured credit unions.

To verify whether the FDIC insures a specic bank or savings association:

Call the FDIC toll-free at 1-877-275-3342

Use FDIC’s “Bank Find” at http://research.fdic.gov/banknd/

To verify whether the NCUA insures a specic credit union:

Call the NCUA toll-free at 1-800-755-1030

Use NCUA’s “Research a Credit Union” at http://mapping.ncua.gov/

ResearchCreditUnion.aspx.

Does the bank have any special programs for students? Many banks offer accounts

geared to students that require less money to open and charge lower fees than their

other accounts. They may also offer special incentives to students. Incentives can be

4 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

appealing, but with all the information on cost and features, you can determine whether

a student account is right for you. For example, does the account provide key desired

features, such as mobile or online banking?

Does the bank provide access to its products and services for customers with

disabilities? If applicable, you may want to ask how the bank complies with the

Americans with Disabilities Act standards. Are the facilities barrier-free and are parking

spaces, ATMs, walkways, entrances and lobbies accessible to all? Are teller counters and

safe deposit vaults accessible? What assistance is offered to deaf and hard of hearing

customers? Does the bank accept relay calls for customer service requests? What

accommodations are provided for customers who are blind and for customers with

communication disorders? Are the bank’s mobile or online banking services accessible?

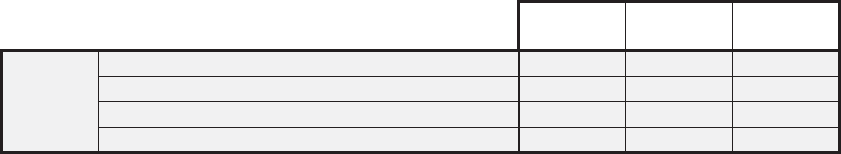

Accounts

This section of the Bank Checklist covers the requirements for opening an account at a

nancial institution and walks through the common characteristics and costs associated

with the following types of accounts and services: checking accounts, overdraft pro-

grams, savings accounts, ATM cards, debit cards, and mobile or online banking.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Accounts Requirements for opening account?

Requirements for opening an account? The requirements to open an account can vary

from bank to bank, so checking with each bank about their specic requirements is

recommended.

If you are considering opening an account at a credit union, be sure to check their

membership requirements to ensure that you are eligible to open an account with them.

Identication. At a minimum, a bank will request your name, address, date of birth,

and social security number (SSN) or Individual Taxpayer Identication Number (ITIN).

They will also need to verify you are who you say you are, often by looking at your

photo ID (such as your school ID, state-issued ID card, driver’s license, passport, Ma-

tricula Consular, or resident alien card).

Account History Reports. Banks and credit unions likely access a consumer report

from a third-party provider, such as ChexSystems, to help decide whether to open

your account. This type of report can help the nancial institution determine if you

previously had a checking account closed because you frequently overdrew your

account or bounced a lot of checks. Some banks and credit unions allow customers to

open an account even if they have had problems in the past, unless that person has

committed fraud. For example, a bank may decline to open an account for someone

who has knowingly written a check that will overdraw the account with no intention

of paying it back or has changed the payee or amount of a check for their benet.

5

Co-owner or Custodian. Some banks require customers under a certain age to have

a custodian (i.e., a parent or guardian) co-own the account. Others will allow anyone

over a certain age to open an account in their own name without a co-owner.

Checking Accounts

Having an account at a nancial institution can make it easier (and less costly) to handle

everyday nancial needs that range from paying for groceries to depositing a paycheck,

and there are many products to choose from. However, to get the one that is best for

you, it is important to understand and compare key factors including:

Limitations of your responsibility for unauthorized transactions

Differences in fees and costs

Account access, such as debit cards, checks and mobile and online banking

Overdraft and insufcient funds fees and how the bank helps you prevent

surprise costs

Checking accounts are among the most popular banking products. Checking accounts

generally offer the safety of federal deposit insurance and protections in the event

of a fraudulent withdrawal from your account. For example, your liability for an

unauthorized transaction from your checking account is generally limited to $50 if

you notify the nancial institution right away (e.g., after you lose your debit card or

notice a problem with your account). Having an account at a federally insured nancial

institution also can be helpful if you need to borrow money at some point in the future

because you will have an existing relationship with a bank.

Checking accounts can differ with respect to their features and costs, and it is

important to consider these differences when selecting an account. Fortunately,

nancial institutions that offer checking accounts are required to make standard

disclosures about those accounts that can help you comparison shop. It is important to

shop for an affordable account and to consider all of the costs and fees that may apply.

You can ask for a paper copy of each bank’s fee schedule to help you compare the costs

of different accounts you are considering.

As the name implies, a checking account typically allows you to write checks in order

to draw on the funds in your account. Most checking accounts come with debit card

access. A debit card looks like a credit card, but unlike a credit card that allows you to

borrow money, debit cards give you access to money that is in your checking account—

for example, by making a withdrawal from an ATM machine, using the debit card to

make retail purchases, or permitting you to pay bills directly from your account. For

many customers, the convenience of debit card access is an important feature in

selecting a checking account.

Some banks offer “checkless” checking accounts. These accounts work like a

traditional checking account, but you can only access funds using a debit card or

mobile phone app or through the bank’s website—not by writing paper checks. These

types of accounts can be less costly than traditional checking accounts.

6 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

For any type of checking account, understand how will be handled and whether that

differs for your debit card, check and online recurring bill payments. Some programs

allow you to overdraw the funds in your account, but they typically charge a fee for

each overdraft, and this can be costly. Also, if you authorize a utility company, lender,

or other business to obtain funds directly from your account, and do not have enough

funds in your account to cover the withdrawal, it could get expensive. If the withdrawal

exceeds your available balance, you could be charged fees by the company trying to

get paid, the bank, or both.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Checking

Accounts

Minimum opening balance?

Minimum monthly balance?

Fees?

Fee waivers available?

Number of withdrawals per month without a fee?

Earns interest?

Deposit hold times?

Minimum opening balance? The amount that you must initially deposit into an account

will vary by bank. Some accounts require a relatively low initial opening amount—for

example, $25.

Minimum monthly balance? Most banks require you to keep a minimum balance

in your account throughout the monthly cycle. If you don’t maintain that minimum

amount, you may be charged a fee. Knowing when your monthly account cycle begins

and ends, and the minimum balance requirements, can help you avoid fees.

Be sure to ask how the bank calculates the minimum monthly balance. Some banks

calculate the average daily balance, while others may require you to maintain the

minimum balance at all times.

The amount of the minimum balance can vary, so it is important to shop around and

compare products. Some institutions charge relatively low fees (e.g., $5) for falling be-

low the minimum balance; others will waive those fees. If you are unsure that you will

be able to keep the minimum balance, be sure to ask about the amount of the fee for

falling below the balance. This can be an important factor in your decision. On the other

hand, if you believe that you will be able to keep the minimum balance at all times, the

fee is a less important consideration.

Fees? Before opening an account, it is important to understand all fees associated with

it and what triggers a fee. Typical fees may include:

Monthly fees for maintaining the account;

Fee for falling below the minimum monthly balance;

Inactivity fee for not making a deposit into or withdrawal from the account for the

period of time specied by the bank, such as a year;

7

Overdraft fees for spending more money than you have in the account; and

Non-sufcient funds (NSF) fees, also called a “bounced check fee,” if you write a

check when there aren’t adequate funds in your account to cover the transaction.

Many accounts designed for young people either charge no or lower fees than regular

accounts, but it is still important that you know the types of fees you may be charged,

the likely amount of those fees, especially NSF and overdraft fees, and how to avoid

them if possible.

Fee waiver available? Some banks will waive fees for customers that meet certain

conditions, such as making at least one monthly direct deposit, online bill pay, or debit

card purchase. This can be a way to save money by avoiding fees.

Check with the bank to determine whether it offers fee waivers and how to qualify for

a waiver.

Number of withdrawals per month without a fee? Be sure to ask if there is a limit on

the number of free withdrawals you can make without being charged a fee and how

much it costs for each additional withdrawal.

Most banks will not charge a fee to withdraw your funds at a branch or branded ATM.

Still, there may be fees to use ATM and debit cards at other institutions’ ATMs. Some

banks allow a certain number of free withdrawals (either in person at the bank, via

an ATM, or electronically), but will charge a fee for any withdrawals made above that

amount. (This is the case with certain savings accounts.)

Earns interest? Many banks pay interest on funds held in a checking account, but the

amount of interest will vary. The amount of interest paid is a percent of the amount of

funds in the account. In the past year, the average interest paid on checking accounts

was less than one percent—a very small amount.

If you nd a checking account product that pays a considerably higher rate of interest,

check what you must do to earn the rate. For example, a special interest rate may

require 12 or more debit card transactions each month. Be sure you are likely to meet

any requirements based on how you normally handle your money.

Deposit hold times? Each nancial institution has its own policies regarding how

quickly deposited funds will be available for withdrawal. The amount of time that a

bank holds a deposit can depend on the type of deposit and your relationship with

the bank. Banks may give immediate availability for customers who cash government

checks, payroll checks, and checks drawn on the same bank, provided you are a

customer with an established relationship at the bank. Established customers may also

have access to funds from other deposits the same day or next day.

Be sure to ask to see the bank’s Funds Availability Schedule to understand how

quickly you will be able to access your funds after you deposit a check. You can even

ask a bank employee how soon you can access funds from a check you deposited.

8 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

It’s important to understand this feature to ensure you have funds available to make

payments when you need to.

Overdraft Programs

If you want to save money on account services and stay in control of your nances,

it is important to be mindful of the balance in your bank account to ensure that you

have enough money to cover any transactions. If you don’t know the amount in your

account, you may accidentally overdraw your account and be charged fees. For

example, if you elect an “overdraft” program, you will be charged a fee for the bank to

cover the overdrawn amount. You may also be charged a fee for having “insufcient

funds” (called NSF fees) in addition to or instead of the overdraft program fee. Some

types of accounts may offer opportunities to avoid or signicantly limit these fees.

You can overdraw your account by:

Making an ATM withdrawal for more money than is in your account;

Making a Point of Sale (POS) debit card purchase (such as swipe your card at a

check-out counter) for more money than is in your account;

Writing a check for more money than is in your account; or

Authorizing a vendor, such as a phone company, to withdraw money from your

account (perhaps to pay a bill) and you don’t have adequate funds to cover the

full amount.

Here are some considerations:

ATM and Point-of-Sale (POS) Debit Card Purchases. Under federal rules, bank

customers have a choice whether to “opt-in” to an overdraft program that is offered

by a bank for overdrafts caused by ATM and everyday debit card transactions.

If you do not opt-in, the bank will decline your ATM withdrawals and debit card

transactions at POS terminals if you do not have enough money in your account

to cover the withdrawal or purchase. The bank will not charge you a fee if the

transaction is declined.

If you do opt-in to the overdraft program, the bank may honor an ATM or every-

day debit card transaction that exceeds your account balance. Expect the bank to

charge you a fee to process the transaction(s). These fees can be expensive, even

exceeding the amount of the original transaction. For example, a $5 purchase

could wind up costing you $35 or more once overdraft fees are assessed.

Checks and Other Transaction Accounts Payments. A bank can choose whether to

“pay” (cover) an overdraft caused by a paper check or other transaction (e.g., direct

bill pay). If the bank covers the transaction, expect it to charge you an overdraft fee.

Even if the bank does not cover the transaction, it may charge an NSF fee and the

merchant may also charge you a returned check fee. These fees vary, but can be very

costly (e.g., $30 or more).

9

You can avoid overdraft fees and related costs and stay in control of your account using

several strategies. The rst strategy is to decline to opt-in to the overdraft feature and

to plan only to complete transactions that are covered by your balance in the bank. The

second strategy, which can be combined with the rst one, is to keep an up-to-date

record of your account balance and the scheduled transactions to come. Something as

simple as a paper-based log or an app on a smartphone can help. You could also review

your account activity frequently online through your bank’s website. In addition, many

banks offer services that send you a text or e-mail alert when your balance falls below a

certain dollar amount.

You can also avoid both overdraft and NSF fees by opening and using a “checkless”

checking account or a bank-offered prepaid card that does not permit overdrafts or

charge fees for insufcient funds.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Overdraft

Programs

Low balance alerts offered?

Overdraft fees?

Link to a savings account to cover overdrafts?

Opt-out options?

Low-balance alerts offered? Will the bank let you know via text message or email

if your account falls below a particular balance so you can reduce the risk of being

charged a fee for overdrawing your account?

Overdraft fees? Overdraft fees vary, but they can be high (e.g., $30 or more per

overdraft). You have the choice about whether you “opt in” to the overdraft program as

described above. If you expect to have a low balance from time to time, it is important

to nd out more information about overdraft fees: Under what circumstances can you

be charged an overdraft fee? How much is the fee? Is there any way to waive the fee?

And remember: You can avoid overdraft fees either by keeping careful track of your

available balance or by choosing and using an account that does not give you the

ability to withdraw more than your available balance, such as a “checkless” checking

account.

Link to a savings account to cover overdrafts? You can also avoid overdraft fees if your

bank allows you to link your checking account to your savings account. If so, funds from

your savings account will be used to cover an overdraft from your checking account.

Ask your bank if there is a fee to transfer funds between accounts (i.e., a transfer fee).

The transfer fee may be considerably lower than an overdraft fee.

Opt-out options? Can you opt out of potentially incurring an overdraft fee for checks or

other transactions that are not covered under the overdraft opt-in rule discussed above?

10 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Savings Accounts

A savings account is one of the simplest types of bank accounts available to

consumers, allowing them to store cash securely and potentially earn interest on the

money. While checking accounts are designed for you to use to pay bills and make

everyday purchases, savings accounts are designed to encourage savings, typically by

paying a higher interest rate than a checking account and allowing no more than six

withdrawals per month.

Checking and savings accounts have some similarities as well. For example, a savings

account is likely to have minimum opening and monthly balance requirements and may

involve fees.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Savings

accounts

Minimum opening balance?

Minimum monthly balance?

Annual percentage yield (APY)?

Fees?

Fee waivers available?

Withdrawal limits per month?

Services available?

Minimum opening balance? The amount that you must initially deposit into an account

will vary by bank. Some accounts require a relatively low initial opening amount—for

example, $25.

Minimum monthly balance? Most banks require you to keep a minimum balance

in your account throughout the monthly cycle. If you don’t maintain that minimum

amount, you may be charged a fee. Knowing when your monthly account cycle begins

and ends, and the minimum balance requirements, can help you avoid fees.

To understand the minimum monthly balance requirements, conrm how the bank

calculates it. Some banks calculate the average daily balance, while others may require

you to maintain the minimum balance at all times.

The amount of the minimum balance can vary, so your costs might be reduced if you

shop around and compare products. Some institutions charge relatively low fees (e.g.,

$5) for falling below the minimum balance; others will waive those fees. If you are

unsure that you will be able to keep the minimum balance, ask about the size of the

fee for falling below the balance. This can be an important factor in your decision. On

the other hand, if you believe that you will be able to keep the minimum balance at all

times, the fee can be a less important consideration.

Annual percentage yield (APY)? The higher the APY, the more money you’ll earn on

funds held in your savings account.

11

Fees? Before opening an account, you can do research to understand all fees

associated with it and what triggers a fee. (An example of how to review and calculate

account fees is included at the end of the Bank Checklist.)

Typical fees include:

Monthly fees for maintaining the account;

Fee for falling below the minimum monthly balance; and

Inactivity fee.

Many accounts designed for young people either charge no or lower fees than regular

accounts, but it is still important that you know the types of fees you may be charged,

the likely amount of those fees, and how to avoid them if possible.

Fee waivers available? Some banks will waive fees for customers that meet certain

conditions, such as making at least one monthly direct deposit, online bill pay, or debit

card purchase. This can be a way to save money by avoiding fees.

Check with the bank to determine whether it offers fee waivers and what you must do

in order to qualify for a waiver.

Withdrawal limits per month? Unlike checking accounts, savings accounts are not set

up for frequent withdrawals. Be sure to nd out from your bank how many withdrawals

you can make each month without paying a fee.

Services available? Are there any additional services provided to savers, such as free-

or low-cost notary services and bank checks?

ATM Cards

An ATM card looks like a credit card, but it can only be used to make deposits and

withdrawals at an automated teller machine (ATM). The ATM card is linked to a

customer’s savings or checking account and withdrawals are deducted directly from

the linked account.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

ATM Cards

Fees?

Fee waivers available?

Location/number of ATMs?

Fees? Generally, a bank will allow you to withdraw funds at their own ATMs free of

charge. A bank may also be part of a larger, no-fee ATM network, and will allow free and

unrestricted use of in-network ATMs. If you use an ATM outside of the bank’s network

(a “foreign ATM”), however, you may be charged a fee. Banks’ policies regarding ATMs

vary, so comparing bank ATM fees, in-network locations and restrictions can help you

nd the bank that works best for you and your circumstances.

12 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Fee waivers available? You can nd out if your bank charges fees for ATM use, and

under what circumstances, if any, your bank waives part or all of those fees.

Location/number of ATMs? When shopping for a bank, the number and location of

the bank’s ATMs can affect your access and costs. Is there a machine near your home,

work, or school? Will you be able to conveniently use an in-network ATM? If there are

no in-network machines near you, will you have to pay a fee to use an out-of-network

ATM? Consider whether the bank’s ATMs allow you to make deposits or if they only

allow you to withdraw cash.

Debit Cards

A debit card, also known as a bank or check card, can be used instead of cash to make

purchases using the funds in your bank account. Some retailers allow you to get cash

back when you make a purchase using a debit card. In many cases, debit cards can be

used to access or deposit funds at an ATM machine.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Debit cards

Fees?

Fee waivers available?

Rebates or bonuses for use?

Location/number of ATMs?

Debit card transactions requirements or limits?

Fees? Does the bank charge you a fee when you use a debit card? How much is the fee?

Is the fee charged per transaction?

Fee waivers available? If your bank charges a fee for debit card use, under what circum-

stances, if any, will your bank waive part or all of those fees?

Rebates or bonuses for use? Some banks and merchants offer rebates and bonuses if

you use your debit card for certain transactions or at certain places of business. These

types of incentives can be appealing, but can sometimes cost you more in the end, so

ask yourself if the offer, and the purchase, is right for you.

Location/number of ATMs? Can you use your debit card at an ATM? If so, are there

ATMs in convenient locations?

Debit card transactions requirements or limits? Ask if there is a daily maximum on the

amount of money you can take out of your account using a debit card.

13

Mobile/Online Banking

More and more banks are offering mobile or online banking services. Online banking

refers to using a computer to access the bank’s website to perform transactions, such as

reviewing account balances, paying bills, or transferring funds between accounts. Mobile

banking services refers to performing these same account transactions using a smart-

phone or tablet computer to access the account via the bank’s app. These services allow

customers to access their accounts 24 hours a day from almost any location.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Mobile/

online

banking

Is it available?

Transaction types and limits?

Fees?

Fee waivers available?

Online bill pay?

Other Information?

Is it available? If mobile or online banking services interest you, ask if they are avail-

able. If you don’t have easy access to a brick and mortar bank branch, mobile or online

banking will allow you to make transactions and check balances from your phone or

computer.

Transaction types and limits? The mobile or online services offered will vary from bank

to bank. At some banks, you may be able to move money between accounts or pay

your bills this way. You also may be able to use your smartphone to pay for goods and

services at a point of sale or to transfer money from your account to someone else’s.

In some cases, you can use your smartphone to take a photo of a check and deposit it

electronically into your account.

Fees? Does the bank charge fees for its mobile or online services? If so, how much?

Fee waivers available? If your bank charges a fee for mobile or online services, nd

out under what circumstances, if any, your bank will waive part or all of those fees. For

example, some banks do not charge for direct deposit or bill pay transactions.

Online bill pay? Does the bank allow you to pay your bills online (e.g., utility bills, credit

card bills, phone bills)? If so, is there a fee? Typically, there is not.

Other Information

There are a number of additional banking services that may be important to you. Before

opening an account, you can nd out if a particular bank offers those services and at

what cost. For example:

Does the bank offer low-cost money orders? For example, the U.S. Postal Service

offers money orders to send up to $1000 for fees ranging from $1.20 - $1.60.

14 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Does the bank offer international wire transfers at a competitive price (e.g., $5.00 -

$20.00 depending on the country)?

Does the bank alert you when, for example, a large transaction posts to your account

or when your balance drops below a specic amount?

Does the bank offer credit-building products, such as secured credit cards or

personal loans?

Does the bank offer free monthly statements (including paper copies)?

Total Monthly Costs

Once you have identied all of the costs and fees associated with a particular bank

product, it is time to add up the estimated monthly costs of the account(s) using the

Bank Checklist. Include any standard monthly fees, as well as any fees that you expect

to incur based on how you plan to use the account (such as fees for using ATMs that

are not in the bank’s network).

Compare the total monthly costs to your monthly income and consider how these costs

might impact your monthly budget.

Total Annual Costs

Multiply the total monthly costs by 12 to determine what your annual costs are likely to

be for each account. A few dollars’ difference on a monthly basis may seem small, but

added up over the course of the year, these costs can become signicant.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Total Monthly Costs

Total Annual Costs

15

Money Smart for Young People - Bank Checklist

Bank Checklist

*If the nancial institution is a credit union, be sure you are eligible to join.

Bank Name/

Account Type

_________

Bank Name/

Account Type

_________

Bank Name/

Account Type

__________

Bank

Information

Does the bank offer the services I need?

Convenient branches and ATMs?

Bank hours?

Do employees speak my language?

Is it insured by FDIC/National Credit Union Administration (NCUA)?

Does the bank have any special programs for students?

Accounts Requirements for opening account?

Checking

Accounts

Minimum opening balance?

Minimum monthly balance?

Fees?

Fee waivers available?

Number of withdrawals per month without a fee?

Earns interest?

Deposit hold times?

Overdraft

Programs

Low balance alerts offered?

Overdraft fees?

Link to a savings account to cover overdrafts?

Opt-out options?

Savings

accounts

Minimum opening balance?

Minimum monthly balance?

Annual percentage yield (APY)?

Fees?

Fee waivers available?

Withdrawal limits per month?

Services available?

ATM Cards

Fees?

Fee waivers available?

Location/number of ATMs?

Debit cards

Fees?

Fee waivers available?

Rebates or bonuses for use?

Location/number of ATMs?

Debit card transactions requirements or limits?

Mobile/

online

banking

Is it available?

Transaction types and limits?

Fees?

Fee waivers available?

Online bill pay?

Other Information?

Total Monthly Costs

Total Annual Costs

16 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Decisions, Decisions: A Case Study

Getting Started: Damita and Darien, 16-year old twins, have been offered their rst

summer jobs. Damita will work at Benny’s Big Burger and Darien got a job at a local

swimming pool as a lifeguard. As a condition of employment, Darien must have his

earnings deposited directly to a checking or savings account. Damita will receive a

physical check.

Each twin’s net, or take-home, pay will be $1,000 per month. Damita wants to save to

attend culinary school when she graduates high school next year. Darien plans to pay for

soccer lessons during the summer, but would like to build a small savings fund. Damita’s

goal is to save $800 each month and spend $200. Darien’s soccer lessons will cost $500

each month. He wants to save $200 and use the remaining $300 as spending money.

Bank Information: Before starting their jobs, the twins begin their search for a nancial

institution. They remembered their math teacher showing them the Bank Checklist

from the FDIC’s Money Smart curriculum and decided to use it. They research nearby

banks and credit unions. Before an institution goes on their checklist, they make sure

that the bank or credit union provides the basic services they want. Both Damita and

Darien have smartphones and are especially interested in mobile or online banking, so

they rule out any institution that does not offer these services.

Although their preference is to bank online and via their smartphones, they make sure

that they will have convenient access to branches and bank ATMs. Damita and Darien

agree that paying fees to access their money at out-of-network (i.e., ATMs not in their

bank’s network) ATMs is something to avoid!

After looking at the locations, hours, and ATMs of local banks and credit unions, the

twins decide to review Hometown Bank, MyTown Bank, and Bank of OurTown on their

checklist. They work together to complete the checklist.

The banks being reviewed offer student accounts that require lower opening and

minimum monthly balances, and charge lower monthly maintenance fees. In addition

to lower balances and fees, Hometown Bank offers special incentives for their student

savings accounts.

Account Information. The twins learn that the banks will allow them to open savings

accounts in their own name without a co-owner. A custodian (i.e., a parent or guardian)

is required to open a checking account at Hometown Bank and MyTown Bank, while

the Bank of OurTown allows anyone over the age of 14 to open a checking account in

his/her own name. Damita and Darien both have ID cards issued by their local school

district, which satises the identication requirements of each institution.

Damita plans to deposit the full amount of her paycheck into a savings account and take

out a small amount using an ATM. She thinks a savings account will meet her needs.

Darien wants to explore both types of accounts.

17

Checking Account. The Hometown Bank and MyTown Bank require a $5 minimum

deposit to open a checking account and Bank of OurTown requires $1. The minimum

balance requirement for the Hometown Bank and MyTown Bank is also $5 and their

monthly fee for not maintaining the minimum balance is $10. Bank of OurTown’s

monthly minimum requirement is higher at $25, and has a $20 maintenance fee. Bank

of OurTown’s fee can be waived if there is at least one direct deposit made each month.

Since Darien’s payroll checks will be deposited directly to his account, he is certain that

he’ll never have to pay a fee. Damita reminds him that this is a summer job and he might

not be able to rely on the fee waiver after the summer. Since Damita plans to open a

savings account only, she needn’t worry.

All three institutions allow unlimited withdrawals from their checking accounts, and

pay interest. Bank of OurTown’s rate is slightly higher. The deposit hold times are three

days for Hometown Bank and MyTown Bank. At Bank of OurTown, payroll deposits are

immediately available and other deposits are subject to a three-day hold.

Overdraft Programs. As the twins complete the overdraft section of the Bank Checklist,

they see the importance of maintaining up-to-date account records. Hometown Bank’s

overdraft fee is $33 and MyTown Bank’s is $30. Bank of OurTown charges $28. They look

at each institution’s “opt-in” (coverage of debit card and ATM transactions when funds in

account fall short for a fee) program. Since Darien is leaning toward a checking account

with a debit card, he quickly decides that he will not opt-in when he learns that anytime

he swipes his card, the charge will be honored if he has insufcient funds to cover the

charge and he will be assessed an NSF fee.

If they write a check for more money than is in their account, the bank is likely to charge

an NSF fee. And, they may be charged a “bounced check” fee from the payee for whom

they wrote the check. To manage their accounts, they decide that they will take advantage

of the low-balance text alerts and the ability to transfer money between their individual

savings and checking accounts offered at each institution.

Savings. Damita and Darien nd that they can open a savings account with a minimum

deposit of $10 at Hometown Bank, and $5 at MyTown Bank, and that Bank of OurTown

does not have a required minimum opening balance. Damita is interested in learning

more about Hometown Bank’s youth savings accounts, which offers an initial deposit

match of up to $25 and another $50 when the balance reaches $100. After all, she has

$35 saved from gifts. If she chooses this account, she will have $60 and be well on her

way to getting another $50. She sees the money growing already! The minimum monthly

balances are also low: $10 at Hometown Bank, $5 at MyTown Bank, and $0 at Bank of

OurTown. Hometown Bank’s interest rate is higher than the other two at .50% APY. Each

institution charges $5 if the account balance drops below the stated minimum.

ATM, Debit Cards, and Mobile or online Banking. Free in-network ATMs are easily

accessible for all three institutions. The fees for out-of-network ATMs range from $2 to

$4 per transaction and cannot be waived. No-fee debit cards are also available from all

three institutions. If the twins use their debit cards at a merchant, they can get cash back

without incurring a fee, and avoid going to an ATM. Each nancial institution caps debit

card transactions at $200 per day for student accounts.

18 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Since Damita and Darien only include nancial institutions that offer mobile or online

banking on their Bank Checklist, all three institutions offer online bill payment, mobile

check deposits, and the ability to check balances for no fees. Being able to take a picture

of her check and deposit it into her account is especially important to Damita. She

doesn’t want to spend her Saturday morning going to a bank to deposit a check.

Making a Choice Based on Best and Worst Case Scenarios. After they complete the Bank

Checklist, the twins add up the “best-case” monthly and annual costs of maintaining

both a checking and savings account at each of the institutions. Assuming they always

meet the minimum balance requirements and use only in-network ATMs, they will be

able to take advantage of each of the bank’s savings and checking accounts for free.

Damita and Darien also understand that sometimes the unexpected happens, so they

look at some “worst-case” scenarios before they make their nal selections. They include

all monthly fees and two out-of-network (used an ATM not in the bank’s network) ATMs

fees each month. The fees increase to as much as $360 per year. Then, they decide to add

two NSF fees to their review.

Annual Cost

Hometown

Bank

MyTown

Bank

Bank of

OurTown

No Fees – Best Case (See page 22.) $0 $0 $0

Monthly Fees (See page 23.) $180 $180 $264

Monthly Fees incurred and with 2 monthly out-

of-network ATM fees (See page 24.)

$252 $228 $360

Monthly Fees with 2 NSF and 2 monthly out-of-

network fees (See page 25.)

$318 $288 $416

After looking at the best- and worst-case scenarios, the twins realize two things. First,

shopping for a nancial relationship is personal. There is no one-size-ts-all account.

Second, by calculating several scenarios—from the best-case to the worst-case—they

have a better appreciation of how their choices, such as using an out-of-network ATM

and maintaining accurate records, affect the cost to maintain an account.

Damita decides that opening a savings account at Hometown Bank is ideal. She will

deposit her check via mobile deposit and keep a careful watch on the number of

withdrawals each month. She is condent that she’ll be able to stay within the bank’s

guidelines which reect the federal regulation that allows no more than six monthly

withdrawals from a savings account. And, the offer of $75 in matching funds is too good

to pass up.

Darien decides that he will open both a checking and savings account at Bank of

OurTown. Now that he has a good understanding of the fees, he will be very careful

to avoid them. He will have his payroll deposited to the checking account and transfer

funds to his savings account online immediately after he is paid to be sure he makes his

savings goal. Tracking balances will be important and he will use the mobile app to help

avoid fees.

19

Bank Checklist - Best Case Scenario

1

*If the nancial institution is a credit union, be sure you are eligible to join.

Bank Name/ Account

Type

Hometown Bank

Bank Name/ Account

Type

MyTown Bank

Bank Name/ Account

Type

Bank of Our Town

Bank

Information

Does the bank offer the services I need? Yes Yes Yes

Convenient branches and ATMs? Good Excellent Excellent

Bank hours? 8-5 (Sat 9-1) 9-6 9-5

Do employees speak my language? Yes Yes Yes

Is it insured by FDIC/National Credit Union Administration (NCUA)? Yes Yes Yes

Does the bank have any special programs for students? Yes Yes Yes

Accounts Requirements for opening account? Custodial Custodial Non-Custodial

Checking

Accounts

Minimum opening balance? 5 5 1

Minimum monthly balance? 5 5 25

Fees? 10 10 20

Fee waivers available? Yes No Yes

Number of withdrawals per month without a fee? Unlimited Unlimited Unlimited

Earns interest? .10% .10% .30%

Deposit hold times? 3 days 3 days

Payroll – 0 days

Other – 3 days

Overdraft

Programs

Low balance alerts offered? Yes Yes Yes

Overdraft fees? 33 30 28

Link to a savings account to cover overdrafts? Yes Yes Yes

Opt-out options? Yes Yes Yes

Savings

accounts

Minimum opening balance? 10 5 0

Minimum monthly balance? 10 5 0

Annual percentage yield (APY)? .50% .10% .10%

Fees? $5 $5 $2

Fee waivers available? Yes Yes Yes

Withdrawal limits per month? 6 6 6

Services available? Yes Yes Yes

ATM Cards

Fees? $0/$3 $0/$2 $0/$4

Fee waivers available? Yes Yes Yes

Location/number of ATMs? Good

Excellent Excellent

Debit cards

Fees? None None None

Fee waivers available? NA NA NA

Rebates or bonuses for use? Limited Limited Limited

Location/number of ATMs? Good Excellent Excellent

Debit card transactions requirements or limits? $200 Daily $200 Daily $200 Daily

Mobile/

online

banking

Is it available? Yes Yes Yes

Transaction types and limits? Mobile Deposit Mobile Deposit None

Fees? None None None

Fee waivers available? NA NA NA

Online bill pay? Yes Yes Yes

Other Information? $25/$50 match

Total Monthly Costs 0 0 0

Total Annual Costs 0 0 0

1

Fees are stated on a monthly basis

20 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Bank Checklist - Monthly Fees Scenario

*If the nancial institution is a credit union, be sure you are eligible to join.

Bank Name/

Account Type

Hometown Bank

Bank Name/

Account Type

MyTown Bank

Bank Name/

Account Type

Bank of Our Town

Bank

Information

Does the bank offer the services I need? Yes Yes Yes

Convenient branches and ATMs? Good Excellent Excellent

Bank hours? 8-5 (Sat 9-1) 9-6 9-5

Do employees speak my language? Yes Yes Yes

Is it insured by FDIC/National Credit Union Administration (NCUA)? Yes Yes Yes

Does the bank have any special programs for students? Yes Yes Yes

Accounts Requirements for opening account? Custodial Custodial Non-Custodial

Checking

Accounts

Minimum opening balance? 5 5 1

Minimum monthly balance? 5 5 25

Fees? 10 10 20

Fee waivers available? Yes No Yes

Number of withdrawals per month without a fee? Unlimited Unlimited Unlimited

Earns interest? .10% .10% .30%

Deposit hold times? 3 days 3 days

Payroll – 0 days

Other – 3 days

Overdraft

Programs

Low balance alerts offered? Yes Yes Yes

Overdraft fees? 33 30 28

Link to a savings account to cover overdrafts? Yes Yes Yes

Opt-out options? Yes Yes Yes

Savings

accounts

Minimum opening balance? 10 5 0

Minimum monthly balance? 10 5 0

Annual percentage yield (APY)? .50% .10% .10%

Fees? $5 $5 $2

Fee waivers available? Yes Yes Yes

Withdrawal limits per month? 6 6 6

Services available? Yes Yes Yes

ATM Cards

Fees? $0/$3 $0/$2 $0/$4

Fee waivers available? Yes Yes Yes

Location/number of ATMs? Good Excellent

Excellent

Debit cards

Fees? None None None

Fee waivers available? NA NA NA

Rebates or bonuses for use? Limited Limited Limited

Location/number of ATMs? Good Excellent Excellent

Debit card transactions requirements or limits? $200 Daily $200 Daily $200 Daily

Mobile/

online

banking

Is it available? Yes Yes Yes

Transaction types and limits? Mobile Deposit Mobile Deposit None

Fees? None None None

Fee waivers available? NA NA NA

Online bill pay? Yes Yes Yes

Other Information? $25/$50 match

Total Monthly Costs 15 15 22

Total Annual Costs 180 180 264

21

Bank Checklist - Monthly Fees with ATM Charges Scenario

*If the nancial institution is a credit union, be sure you are eligible to join.

Bank Name/

Account Type

Hometown Bank

Bank Name/

Account Type

MyTown Bank

Bank Name/

Account Type

Bank of Our Town

Bank

Information

Does the bank offer the services I need? Yes Yes Yes

Convenient branches and ATMs? Good Excellent Excellent

Bank hours? 8-5 (Sat 9-1) 9-6 9-5

Do employees speak my language? Yes Yes Yes

Is it insured by FDIC/National Credit Union Administration (NCUA)? Yes Yes Yes

Does the bank have any special programs for students? Yes Yes Yes

Accounts Requirements for opening account? Custodial Custodial Non-Custodial

Checking

Accounts

Minimum opening balance? 5 5 1

Minimum monthly balance? 5 5 25

Fees? 10 10 20

Fee waivers available? Yes No Yes

Number of withdrawals per month without a fee? Unlimited Unlimited Unlimited

Earns interest? .10% .10% .30%

Deposit hold times? 3 days 3 days

Payroll – 0 days

Other – 3 days

Overdraft

Programs

Low balance alerts offered? Yes Yes Yes

Overdraft fees? 33 30 28

Link to a savings account to cover overdrafts? Yes Yes Yes

Opt-out options? Yes Yes Yes

Savings

accounts

Minimum opening balance? 10 5 0

Minimum monthly balance? 10 5 0

Annual percentage yield (APY)? .50% .10% .10%

Fees? $5 $5 $2

Fee waivers available? Yes Yes Yes

Withdrawal limits per month? 6 6 6

Services available? Yes Yes Yes

ATM Cards

Fees? $0/$3 $0/$2 $0/$4

Fee waivers available? Yes Yes Yes

Location/number of ATMs? Good Excellent

Excellent

Debit cards

Fees? None None None

Fee waivers available? NA NA NA

Rebates or bonuses for use? Limited Limited Limited

Location/number of ATMs? Good Excellent Excellent

Debit card transactions requirements or limits? $200 Daily $200 Daily $200 Daily

Mobile/

online

banking

Is it available? Yes Yes Yes

Transaction types and limits? Mobile Deposit Mobile Deposit None

Fees? None None None

Fee waivers available? NA NA NA

Online bill pay? Yes Yes Yes

Other Information? $25/$50 match

Total Monthly Costs 21 19 30

Total Annual Costs 252 228 360

22 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Bank Checklist - Monthly Fees with ATM Charges Scenario

and 2 Annual NSF Charges

*If the nancial institution is a credit union, be sure you are eligible to join.

Bank Name/

Account Type

Hometown Bank

Bank Name/

Account Type

MyTown Bank

Bank Name/

Account Type

Bank of Our Town

Bank

Information

Does the bank offer the services I need? Yes Yes Yes

Convenient branches and ATMs? Good Excellent Excellent

Bank hours? 8-5 (Sat 9-1) 9-6 9-5

Do employees speak my language? Yes Yes Yes

Is it insured by FDIC/National Credit Union Administration (NCUA)? Yes Yes Yes

Does the bank have any special programs for students? Yes Yes Yes

Accounts Requirements for opening account? Custodial Custodial Non-Custodial

Checking

Accounts

Minimum opening balance? 5 5 1

Minimum monthly balance? 5 5 25

Fees? 10 10 20

Fee waivers available? Yes No Yes

Number of withdrawals per month without a fee? Unlimited Unlimited Unlimited

Earns interest? .10% .10% .30%

Deposit hold times? 3 days 3 days

Payroll – 0 days

Other – 3 days

Overdraft

Programs

Low balance alerts offered? Yes Yes Yes

Overdraft fees? 33 30 28

Link to a savings account to cover overdrafts? Yes Yes Yes

Opt-out options? Yes Yes Yes

Savings

accounts

Minimum opening balance? 10 5 0

Minimum monthly balance? 10 5 0

Annual percentage yield (APY)? .50% .10% .10%

Fees? $5 $5 $2

Fee waivers available? Yes Yes Yes

Withdrawal limits per month? 6 6 6

Services available? Yes Yes Yes

ATM Cards

Fees? $0/$3 $0/$2 $0/$4

Fee waivers available? Yes Yes Yes

Location/number of ATMs?

Good Excellent Excellent

Debit cards

Fees? None None None

Fee waivers available? NA NA NA

Rebates or bonuses for use? Limited Limited Limited

Location/number of ATMs? Good Excellent Excellent

Debit card transactions requirements or limits? $200 Daily $200 Daily $200 Daily

Mobile/

online

banking

Is it available? Yes Yes Yes

Transaction types and limits? Mobile Deposit Mobile Deposit None

Fees? None None None

Fee waivers available? NA NA NA

Online bill pay? Yes Yes Yes

Other Information? $25/$50 match

Total Monthly Costs 21 19 30

Total Annual Costs 252+66=318 228+60=288 360+56=416

23

Resources

There are a number of free resources to help consumers select and maintain safe and

low-cost accounts, including:

Educational Resources Specic to Checking Accounts

Money Smart ’s Bank Checklist provides a list of questions that a person can use

to help select an account that meets their needs. You can nd the checklist in the

Money Smart curricula and in this supplement.

CFPB’s “Consumer Guide to Selecting a Lower-Risk Account” provides tips for

nding and choosing a checking or prepaid account.

Guidance on how to avoid costly overdrafts and fees includes:

FDIC’s “Your Guide to Preventing and Managing Overdraft Fees”

FDIC Consumer News includes practical guidance on how to become a smarter, safer

user of nancial services. Articles include:

“Checking Accounts: More Questions to Ask”

“What’s the Right Account for Your Everyday Banking Needs?”

Having trouble opening or managing accounts?

“Have You Bounced Yourself Out of a Checking Account?” (from FDIC

Consumer News)

“You’ve Been Turned Down for a Checking or Savings Account. Now What?” (from

FDIC Consumer News)

“Protecting Yourself from Overdraft and Bounced-check Fees” (from the Federal

Reserve Board of Governors)

“Consumer Guide to Checking Account Denials” (from the Consumer Financial

Protection Bureau (CFPB))

Comprehensive Financial Education Resources

FDIC’s Money Smart – Educational resources to help people – from those just

starting out, just starting over, or who are somewhere in between – learn how

to create a positive banking relationship and boost their money skills. Curricula

are available for all ages and in formats to teach to others and for consumers to

complete on their own using a computer.

MyMoney.GOV – A one-stop resource for nancial education material provided by

more than 20 Federal entities. The site includes MyMoney Five, the ve key building

blocks for managing and growing your money.

24 Money Smart Supplement for Instructors/Trainers: Toolkit for Helping Youth Select Bank Accounts

Account Templates and Standards

FDIC Model Safe Accounts Template – This template provides insured institutions

with guidelines for offering cost-effective transactional and savings accounts that are

safe and affordable for consumers.

Cities for Financial Empowerment Fund (CFE) Bank On National Account Standards

– Identies critical product features for appropriate bank or credit union accounts,

making it easier for Bank On coalitions to connect consumers to accounts that meet

their needs.

CFPB’s Safe Student Account Toolkit helps colleges and universities select col-

lege-sponsored nancial accounts to meet their students’ needs.

25

www.fdic.gov/moneysmart

FDIC-019-2019