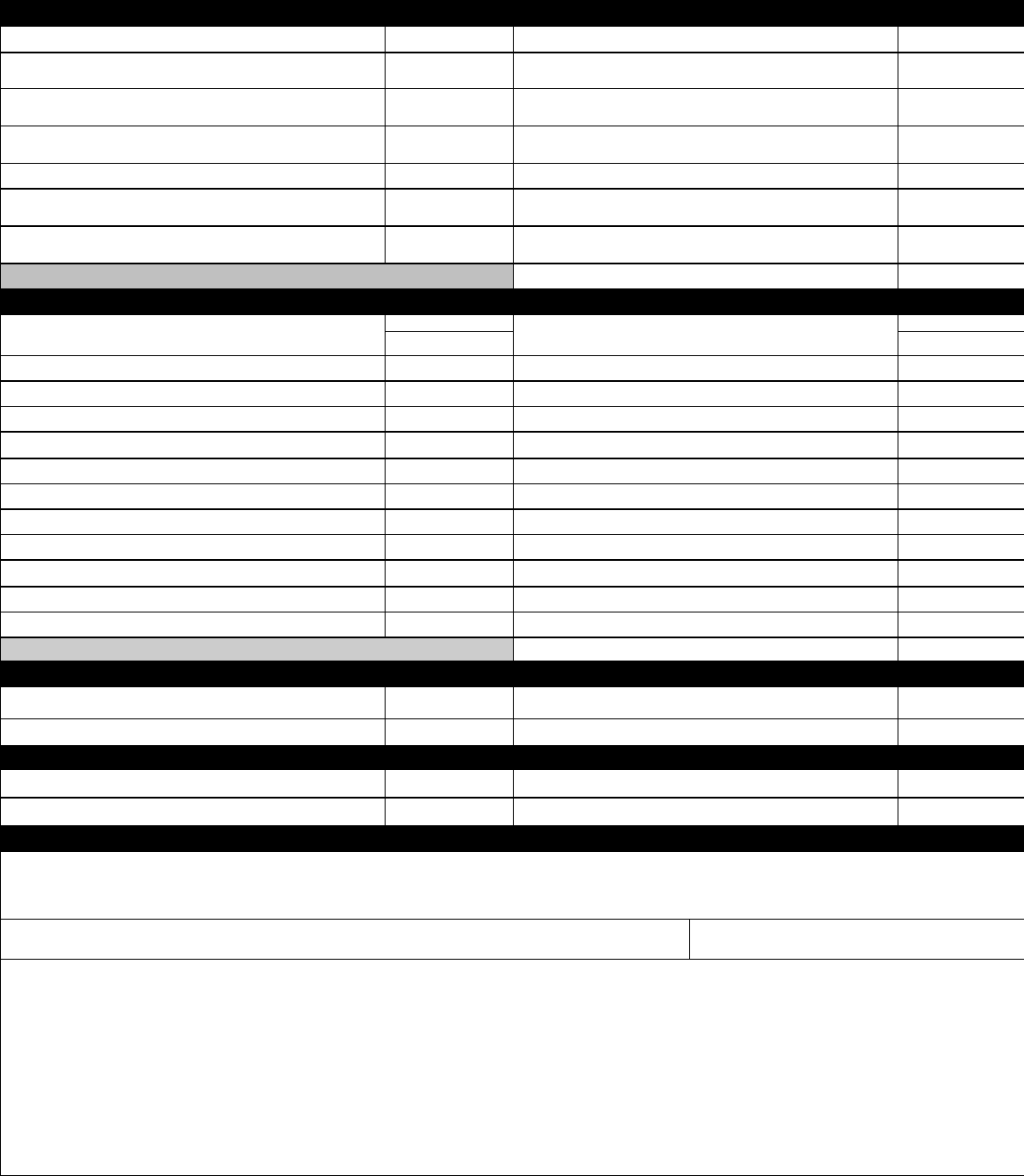

This form is available electronically. Form Approved –OMB No. 0560-0238

(See Page 2 for Privacy Act and Public Burden Statements.)

FSA-2038 U.S. DEPARTMENT OF AGRICULTURE Position 3

(08-19- 14) F arm S er vic e A genc y

FARM BUSINESS PLAN WORKSHEET

Projected/Actual Income and Expense

1. NAME

2. For Production Cycle Beginning:

Projected

20 Thru: 20

Actual

A - INCOME

1. Cr op Production and Sal es:

1A. Description

Production

1F.

Farm Use

Purchases Sales

1B.

Acres

1C.

Yield

1D.

% Share

1E.

# Units

1G.

# Units

1H.

$/Unit

1I.

Total $

1J.

# Units

1K.

$/Unit

1L.

Total $

2. Livesto ck an d Po ultry Production and S ales:

2A. Description

2B.

Purch/Raised

2C.

# Units

Purchases

2G.

Death Loss

Sales

P R

2D.

Weight

2E.

$/Unit

2F.

Total $

2H.

# Units

2I.

Weight

2J.

$/Unit

2K.

Total $

3. Dairy L ivest ock Production and S al es:

3A. Description

3B.

Purch/Raised

3C.

# Head

Purchases

3G.

Death Loss

Sales

P R

3D.

Weight

3E.

$/Unit

3F.

Total $

3H.

# Units

3I.

Weight

3J.

$/Unit

3K.

Total $

4. Milk Sales:

4A. Description

4B.

# Head

4C.

Production/Head/Year

4D.

Total Production

4E.

Price

4F.

Sales $

5. Livestock Product Sales:

5A. Description

5B.

Production

5C.

Measure

Sales

5D.

Units

5E.

$/Unit

5F.

Total $

FSA-2038 (08-19-14) Page 2 of 2

A - INCOME (Continued)

6. Ag Program Payments $ Amount 8. Custom Hire Income $ Amount

7. Crop Insurance Proceeds $ Amount 9. Other Income $ Amount

10. Total Income (Items 1 through 9)

B - EXPENSES

11. Car and Truck

$ Amount

23. Rent – Land/Animals

$ Amount

12. Chemicals

24. Repairs and Maintenance

13. Conservation

25. Seeds and Plants

14. Custom Hire

26. Supplies

15. Feed Supplement

27. Taxes – Real Estate

16. Feed, Grain and Roughage

28. Utilities

17. Fertilizers and Lime

29. Veterinary/Breeding/Medicine

18. Freight and Trucking

30. Other Expenses

19. Gas/Fuel/Oil

31. Other - Irrigation

20. Insurance

21. Labor Hired

22. Rent – Machinery/Equipment/Vehicles

32. Interest

33. Total Expenses (Items 11 through 32)

C – NON-OPERATING

34. Owner Withdrawal

(Total Family Living Expenses

and Non

-

Farm Debt Payments)

36. Non-Farm Income

35. Income Taxes

37. Non-Farm Expense

D - CAPITAL

38. Capital Sales

40. Capital Expenditures

39. Capital Contributions

41. Capital Withdrawals

E - WARNING

I certify that the information provided is true, complete, and correct to the best of my knowledge and is provided in good faith. (Warning:

Section 1001 of Title 18, United States Code, provides for criminal penalties to those who provide false statements. If any information is

found to be false or incomplete, such finding may be grounds for denial of the requested action.)

42A. SIGNATURE

42B. DATE

NOTE:

The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information

identified on this form is the Consolidated Farm and Rural Development Act, as amended (7 U.S.C. 1921 et. seq.). The informa tion will be used to determine

eligibility and feasibility for loans and loan guarantees, and servicing of loans and loan guarantees. The information collected on this form may be disclosed to

other Federal, State, and local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by

statute or regulation and/or as described in the applicable Routine Uses identified in the System of Records Notice for USDA/FSA-14, Applicant/Borrower.

Providing the requested information is voluntary. However, failure to furnish the requested information may result in a denial for loans and loan guarantees,

and servicing of loans and loan guarantees. The provisions of criminal and civil fraud, privacy, and other statutes may be applicable to the information

provided.

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of

information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0560-0238. The time required to

complete this information collection is estimated to average 1.25 hours per response, including the time for reviewing instructions, searching existing data

sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. RETURN THIS COMPLETED FORM TO

YOUR COUNTY FSA OFFICE.

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the basis of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable,

political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or

funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the address below or if you require alternative means of communication for

program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202) 720-2600 (voice and TDD). Individuals who are deaf, hard of hearing, or have speech disabilities and wish to file either an EEO or program

complaint, please contact USDA through the Federal Relay Service at (800) 877-8339 or (800) 845-6136 (in Spanish).

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to

request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter by mail to U.S. Department of Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W.,

Washington, D.C. 20250-9410, by fax (202) 690-7442 or email at [email protected]. USDA is an equal opportunity provider and employer.