UK business opportunities of moving to a low

carbon economy

FINAL REPORT

______________________________________________________________

Ricardo Energy & Environment for the Committee on Climate Change.

Tender Reference Number TH [2]/10/16

ED 10039 | Issue Number V7 | Date 15/03/2017

Ricardo in Confidence

UK business opportunities of moving to a low carbon economy I i

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Ricardo Energy & Environment

Customer:

Contact:

The Committee on Climate Change (CCC)

James Tweed, Ricardo Energy & Environment,

Gemini Building, Fermi Avenue, Harwell, Oxon,

OX11 0QR, United Kingdom.

t: +44 (0) 1235 753007

e: jam[email protected]

Ricardo-AEA Ltd is certificated to ISO9001 and

ISO14001

Customer reference:

TH [2]/10/16

Confidentiality, copyright & reproduction:

This report is the Copyright of Ricardo Energy &

EnvironmentRicardo Energy & Environment. It

has been prepared by Ricardo Energy &

Environment, a trading name of Ricardo-AEA Ltd,

under contract to the Committee on Climate

Change dated 01/12/2016. The contents of this

report may not be reproduced in whole or in part,

nor passed to any organisation or person without

the specific prior written permission of the

Commercial manager at Ricardo Energy &

Environment. Ricardo Energy & Environment

accepts no liability whatsoever to any third party

for any loss or damage arising from any

interpretation or use of the information contained

in this report, or reliance on any views expressed

therein.

Authors:

Heather Haydock, Alan McCullough, Chris

Nuttall, Louise Evans, Anna-Liisa Kaar, Eugenia

Bonifazi, Raphael Sibille, Martin Houghton

(TBR/OrtusER) and Sam Nair (TBR/OrtusER),

Approved By:

James Tweed

Date:

15 March 2017

Ricardo Energy & Environment reference:

Ref: ED10039 Draft Final Report- V7

UK business opportunities of moving to a low carbon economy I ii

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Table of contents

1 Introduction ................................................................................................................ 1

2 The timelines for the global LCE transition ............................................................. 1

2.1 Introduction ........................................................................................................................ 2

2.2 Overview of key sources ................................................................................................... 2

2.2.1 IEA Energy Technology Perspectives 2016 ............................................................. 2

2.2.2 CCC Fifth Carbon Budget Scenarios ....................................................................... 4

2.3 Phase 1: 2017 to 2030 – A more energy efficient world ................................................... 6

2.3.1 Power Generation .................................................................................................... 6

2.3.2 Transport .................................................................................................................. 6

2.3.3 Industry ..................................................................................................................... 7

2.3.4 Buildings ................................................................................................................... 8

2.3.5 Other Sectors ........................................................................................................... 8

2.4 Phase 2: 2031 to 2050 – A more resource efficient world ................................................ 8

2.4.1 Power Generation .................................................................................................... 8

2.4.2 Transport .................................................................................................................. 9

2.4.3 Industry ................................................................................................................... 10

2.4.4 Buildings ................................................................................................................. 10

2.4.5 Greenhouse gas removal technologies .................................................................. 11

2.5 Phase 3: 2051 to 2100 – A sustainable, low carbon world ............................................. 11

2.6 Timeline Analysis Conclusions ........................................................................................ 12

3 Current UK Competitive Position............................................................................ 14

3.1 Low carbon technology RD&D ........................................................................................ 14

3.2 UK strengths in low carbon innovation ............................................................................ 15

3.3 UK Export Performance .................................................................................................. 16

3.4 Current UK low carbon goods and services market ........................................................ 17

4 Global opportunities for UK Manufacturing ........................................................... 21

4.1 Approach to the quantification of market opportunity ...................................................... 21

4.2 Future global low carbon economy markets ................................................................... 21

4.2.1 Low Carbon Electricity ............................................................................................ 23

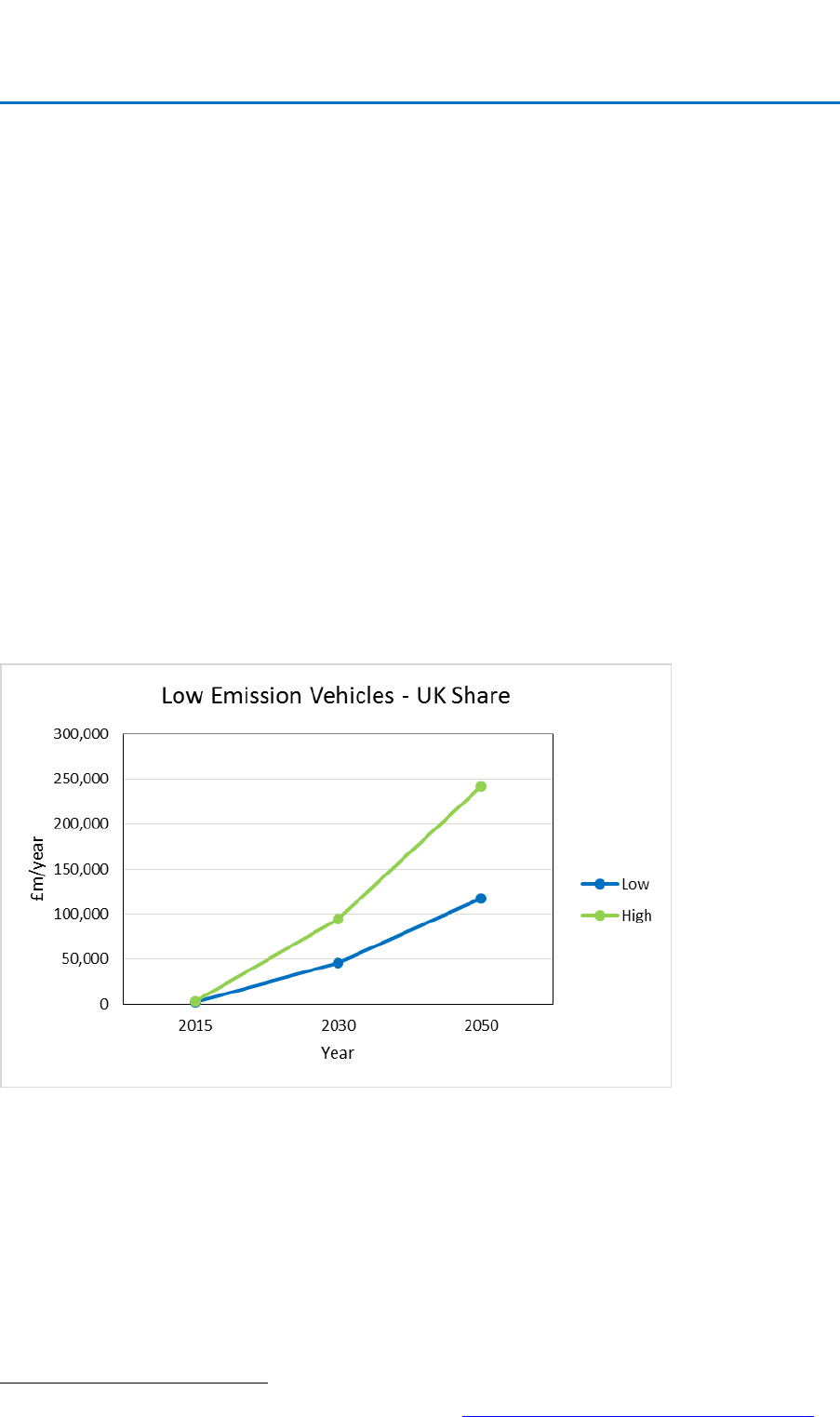

4.2.2 Low Emission Vehicles ........................................................................................... 24

4.2.3 Low Carbon Financial Services .............................................................................. 25

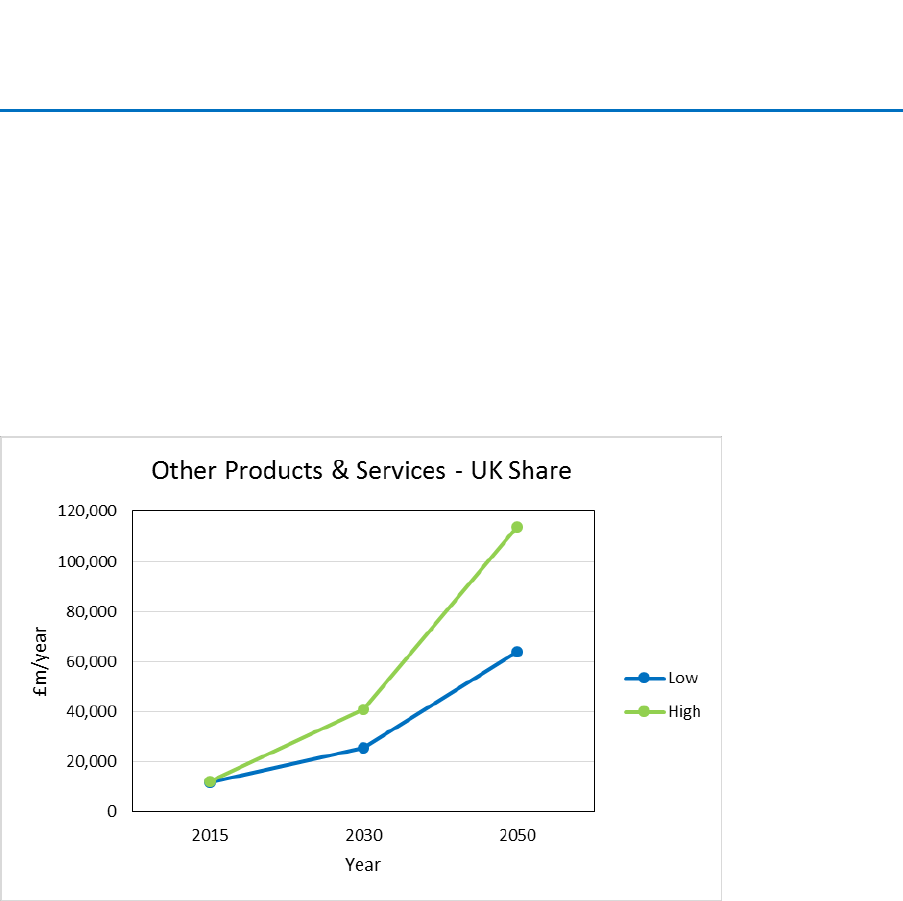

4.2.4 Other Low Carbon Products and Services ............................................................. 26

4.3 Size of the LCE opportunity for UK business .................................................................. 27

4.3.1 Low Carbon Electricity ............................................................................................ 29

4.3.2 Low Emissions Vehicles ......................................................................................... 30

4.3.3 Low carbon financial services ................................................................................ 31

4.3.4 Oher Low Carbon Products and Services .............................................................. 32

4.4 Projection of overall future market opportunities ............................................................. 33

4.5 Opportunities for UK firms to capture a greater share of future global markets ............. 34

5 Stakeholder views on opportunities, barriers and potential actions ................... 35

5.1 Introduction ...................................................................................................................... 35

5.2 Low carbon electricity ...................................................................................................... 35

5.2.1 Opportunities .......................................................................................................... 35

5.2.2 Barriers ................................................................................................................... 35

5.2.3 Actions that could be taken to increase share of global market ............................ 35

5.2.4 Other issues around capturing new market opportunities ...................................... 36

5.3 Low emission vehicles ..................................................................................................... 37

5.3.1 Opportunities .......................................................................................................... 37

5.3.2 Barriers ................................................................................................................... 37

5.3.3 Actions that could be taken to increase share of global market ............................ 38

5.4 Energy efficient products ................................................................................................. 38

5.4.1 Opportunities .......................................................................................................... 38

5.4.2 Barriers ................................................................................................................... 38

5.4.3 Actions that could be taken to increase share of global market ............................ 38

5.4.4 Other issues around capturing new market opportunities ...................................... 38

UK business opportunities of moving to a low carbon economy I iii

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

5.5 Other sectors ................................................................................................................... 39

5.5.1 Opportunities .......................................................................................................... 39

5.5.2 Barriers ................................................................................................................... 39

5.5.3 Actions that could be taken to increase share of global market ............................ 39

5.5.4 Other issues around capturing new market opportunities ...................................... 40

6 Conclusions on opportunities to increase the UK share of future global

markets .............................................................................................................................. 40

Acknowledgements .......................................................................................................... 41

Appendices

Appendix 1: Methodology for estimating current market value for UK manufacturers of low carbon goods

and services

Appendix 2: Comparison of sectors and technologies considered

Appendix 3: Data sources and assumptions for estimating the size of future global markets associated

with the low carbon economy

Appendix 4: Summary data from current analysis

UK business opportunities of moving to a low carbon economy I iv

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Executive summary

The Paris Agreement on climate change action aims to limit global warming to well below 2°C and to

pursue efforts to limit it to 1.5°C. This agreement came into force in November 2016 and requires major

reductions in greenhouse gas emissions (GHG) by 2050 and net zero global emissions in the second

half of this century. This transition will require goods such as renewable energy and energy efficient

technologies, and services such as green bonds and the recycling of batteries for electric vehicles.

This transition to a low carbon economy (LCE) presents opportunities for UK businesses to supply the

goods and services required by the UK and other countries. Businesses and government can enhance

the exploitation of these global market opportunities through identification of, and investment in, the

range of areas where UK businesses have particular strengths and leading technologies.

The aim of this report is to extend the analysis of opportunities for UK business to supply global markets

for low carbon materials, goods and services that are anticipated to be required for transition to a low

carbin economy. The report consists of six sections:

Section 1 provides a brief introduction to the project

Section 2 describes the timelines for the global transition to a low carbon economy,

Section 3 considers the position of the current UK low carbon economy,

Section 4 quantifies the size of the market opportunity for UK business in 2030 and 2050

Section 5 describes the barriers to UK business capturing a larger share of the global market.

Section 6 presents conclusions.on opportunities to increase UK share of future global markets.

The work was funded by the Committee on Climate Change (CCC) and delivered by Ricardo Energy &

Environment supported by Trends Business Research and Ortus Economic Research Ltd.

To identify sectors where the UK might have “first mover advantage”, we compared the projected

timelines for the global and UK low carbon transition, as outlined in the International Energy Agency’s

(IEA) scenarios for global emissions reductions, and CCC’s scenarios and best estimates of the most

cost effective path for reaching the UK’s 2050 target of an 80% reduction in GHG emissions compared

to 1990.

A key finding of this analysis is that the UK and the EU were likely to make the transition to the low

carbon economy around 10 years ahead of the world average. We also identified three sectors

(electricity, transport and waste) where the UK is making major progress and investment in emission

reduction and these clearly offer business opportunities in the UK home market, and global export

markets. However there are also opportunities for UK business to supply goods and services in other

sectors, and a range of new technologies will be needed to complete the global transition, particularly

beyond 2050.

We also concluded that the technologies need to complete the global transition are broadly similar to

those required by the UK market, although there were some geographical variations, for example: the

UK is likely to deploy higher levels of off-shore wind and lower levels of solar PV than the global average.

The overall approach to the transition in other regions is also similar to that in the UK, and involves:

Implementing energy efficiency measures, particularly in the period up to 2030.

Deploying proven low carbon technologies. Costs for some of these will be expected to

decrease with deployment, as has been the case recently with solar photovoltaic cells.

Demonstration projects for other technologies that are close to deployment and/or require cost

reduction, in preparation for wide scale deployment, particularly between 2030 and 2050.

Investing in further research and innovation in hard-to-reduce sectors, such as aviation.

Undertaking basic research and development on novel greenhouse gas removal technologies

which are likely to be required to reach zero net emissions in the second half of the century

UK business opportunities of moving to a low carbon economy I v

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Current UK Competitive Position

Over the last 15 years, the UK has made a substantial investment in energy and low carbon technology

research, development and demonstration (RD&D). For example, the Research Councils UK (RCUK)

Energy Programme invested £839 million between 2003 and 2011, and a further £625 million is being

invested between 2012 and 2018. Innovate UK has also funded a wide range of industrial RD&D

projects, and knowledge transfer networks (KTN) in many sectors of the economy

1

that support

business seeking to develop new materials, goods and services for the low carbon economy. These

investments, and others related to the wider impact of climate change on business and society mean

that the UK is well placed to obtain a share of the growing market associated with transition to a LCE,

provided concerted action is taken by suppliers and government to ramp up export activities.

With the aid of our experts and stakeholder feedback, we have assessed whether there is a low, medium

or high potential for UK business to capture market share in each of the main segments of the UK LCE

market and identified some examples where the UK currently has particular strength, including:

Electric Vehicles

Smart Grids

Transport telematics

Energy storage

Off-shore wind

Biofuels

Solar PV

We have also identified some technologies that will need to be fully deployed by 2050, where the UK

could exploit its existing capabilities in other fields to capture a share of the global market. These

include:

Advanced materials and manufacturing, including design for reuse and waste recovery.

Low carbon chemical processes using bioprocessing, catalysts and membrane technology

In addition, there are significant opportunities for the UK services sector to establish itself as a financial

hub for green finance and gain a sizable share of the financial services associated with the estimated

capital investment of between $1.5 and $6 trillion per annum needed to deliver the global transition.

Current Size of the UK LCE Market.

We used two methods to assess the size of the UK market for low carbon goods and services in 2015,

which we estimated employed between 230 and 450 thousand people, and had a turnover of between

£42 billion and £120 billion. The first method used the provisional results of ONS’s Low Carbon and

Renewable Energy Economy Survey published in late 2016. This assessed direct employment and

turnover for the LCE sector only. The second method updated the estimates published by BIS of the

size of the LCE market in 2013. This assessed both direct and indirect employment and turnover.

Size of the LCE Market Opportunities for UK Business

Our analysis suggests that the UK low carbon economy could grow from around 2% of UK Total Output

in 2015 to up to around 8% by 2030, and around 13% by 2050. The projected compound annual growth

rate for the low carbon economy is 11% per annum between 2015 to 2030, and 4% per annum between

2030 and 2050, which is substantially higher than the OECD’s projection of average UK GDP growth

of 2.3% per annum between 2015 and 2050

2

This corresponds to a UK LCE market size of between

£210 billion and £600 billion in 2030 and between £510 billion and £1,400 billion in 2050. The levels of

UK employment associated with the LCE are between 1.0 and 2.2 million in 2030, and between 2.5 and

5.0 million in 2050.

These projections are based on an assessment of the potential size of 25 selected areas of the UK and

global LCE market in 2030 and 2050, and draw on the scenarios for technology deployment outlined in

the IEA’s Energy Technology Perspectives 2016 and technology roadmaps, the CCC’s own scenarios

and a number of estimates by market research organisations of current market size and growth rates.

These projections also include an estimate of the UK share of the global market, which is based on the

UK’s current share of global exports, and hence on the UK’s current strengths in manufacturing and

services. There is the potential to increase this share by building on UK strengths in research and

innovation and by addressing barriers to market entry and growth outlined in Section 5 of this report.

1

https://admin.ktn-uk.co.uk/app/uploads/2016/09/KTN-Annual-Report-2015_2016.pdf

2

https://data.oecd.org/gdp/gdp-long-term-forecast.htm

UK business opportunities of moving to a low carbon economy I 1

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

1 Introduction

The Paris Agreement on climate change action entered into force in November 2016, having been

ratified by the USA, China, India, Brazil, the EU and other countries. The Agreement aims to limit global

warming to well below 2°C and to pursue efforts to limit it to 1.5°C. This will require major reductions in

greenhouse gas emissions by 2050 and net zero global emissions in the second half of this century,

which in turn will drive a transition to a low carbon economy (LCE) in both developed and developing

countries. The LCE includes goods such as renewable energy and energy efficient technologies, and

services such as green bonds and the recycling of batteries for electric vehicles.

This transition to a low carbon economy presents opportunities for the UK in provision of the goods and

services required. This can be both in supplying the UK market as it makes the transition and also in

supplying global markets. Businesses and government can enhance the exploitation of these

opportunities through identification of and investment in the range of areas where the UK has particular

business strengths and leading technologies.

The CCC published a review of the UK’s research and innovation arrangements for delivering

technologies required to meet the UK’s climate change targets in 2010

3

. This report also identified

opportunities for the UK to develop new technologies and take a lead in global markets, including in

offshore wind, marine, Carbon Capture & Storage (CCS), smart grids, aviation and electric vehicle

technologies. In 2013, the CCC also reported on opportunities to create new global markets for products

from the energy-intensive sectors

4

.

The aim of this report is to update and extend the analysis of opportunities for UK business to supply

global markets for low carbon materials, goods and services that the LCE transition will create by:

Exploring the timelines around the global transition to a low carbon economy.

Quantifying the size of the global market for low carbon materials, goods and services

Identifying potential export opportunities for UK’s manufacturing and service sectors

Assessing the potential UK share of the global market in example application areas.

This will feed into an updated assessment of the opportunities that transitioning to a LCE could provide

for the UK’s manufacturing sectors, to be undertaken by CCC in early 2017.

This report comprises five sections in addition to this introduction. Section 2 describes the timelines for

the global transition to a low carbon economy, Section 3 considers the position of the current UK low

carbon economy, Section 4 quantifies the size of the market opportunity for UK business in 2030 and

2050, and Section 5 describes the opportunities and barriers to UK business capturing a larger share

of the future global market. Section 6 presents conclusions.

2 The timelines for the global LCE transition

The technologies needed to complete the global transition are boadly similar to those required by the

UK market, although there were some geographical variations, for example: the UK is likely to deploy

higher levels of off-shore wind and lower levels of solar PV than the global average.

The overall approach to the transition in other regions is also similar to that in the UK, and involves:

Implementing energy efficiency measures, particularly in the period up to 2030.

Deploying proven low carbon technologies. Costs for some of these will be expected to

decrease with deployment, as has been the case recently with solar photovoltaic cells.

Demonstration projects for other technologies that are close to deployment and/or require

cost reduction, in preparation for wide scale deployment, particularly between 2030 and

2050.

Investing in further research and innovation in hard-to-reduce sectors, such as aviation.

3

“Building a low-carbon economy – the UK’s innovation challenge ”, The Committee on Climate Change, 2010

4

“Managing competitiveness risks of low-carbon policies”, The Committee on Climate Change, 2013.

UK business opportunities of moving to a low carbon economy I 2

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Undertaking basic research and development on novel greenhouse gas removal

technologies which are likely to be required to reach zero net emissions in the second half

of the century

2.1 Introduction

This section provides an overview of the timeline for the deployment of different technologies for the

transition towards a low carbon economy, including both global and UK perspectives.

The information provided in this section is based on a number of key sources. This includes the

scenarios developed under the IEA Energy Technology Perspectives 2016

5

and the CCC’s reports on

the Fifth Carbon Budget

6

and ‘UK climate action following the Paris agreement’

7

for information related

to global and UK emission reductions respectively.

The timeline for the transition to a low carbon economy has been split into three district phases:

Phase 1: 2017 to 2030 – this aligns with the time period for the pledges made by countries as

part of the Paris Agreement

Phase 2: 2031 to 2050 – this aligns with IEA models and UK’s commitment to a reduction in

emissions of at least 80% in 2050

Phase 3: 2051 to 2100 – to align with the global objective to hold the increase in global

temperature to below 2°C and to pursue efforts to limit it to 1.5°C

For Phases 1 and 2 information is presented for the following key emissions-reduction sectors

8

; power

generation, transport, industry and buildings. For each sector the key activities/technologies are

highlighted for the respective phases. Where information is available, other emission-reduction sectors

such as agriculture, waste and F-gases are also covered. Information for Phase 3 is less detailed and

as such an overview of the key trends that can currently be expected is provided.

2.2 Overview of key sources

2.2.1 IEA Energy Technology Perspectives 2016

The International Energy Agency (IEA) Energy Technology Perspectives 2016 sets out a series of

scenarios for different levels of ambition up to 2050 – see examples in Table 1.

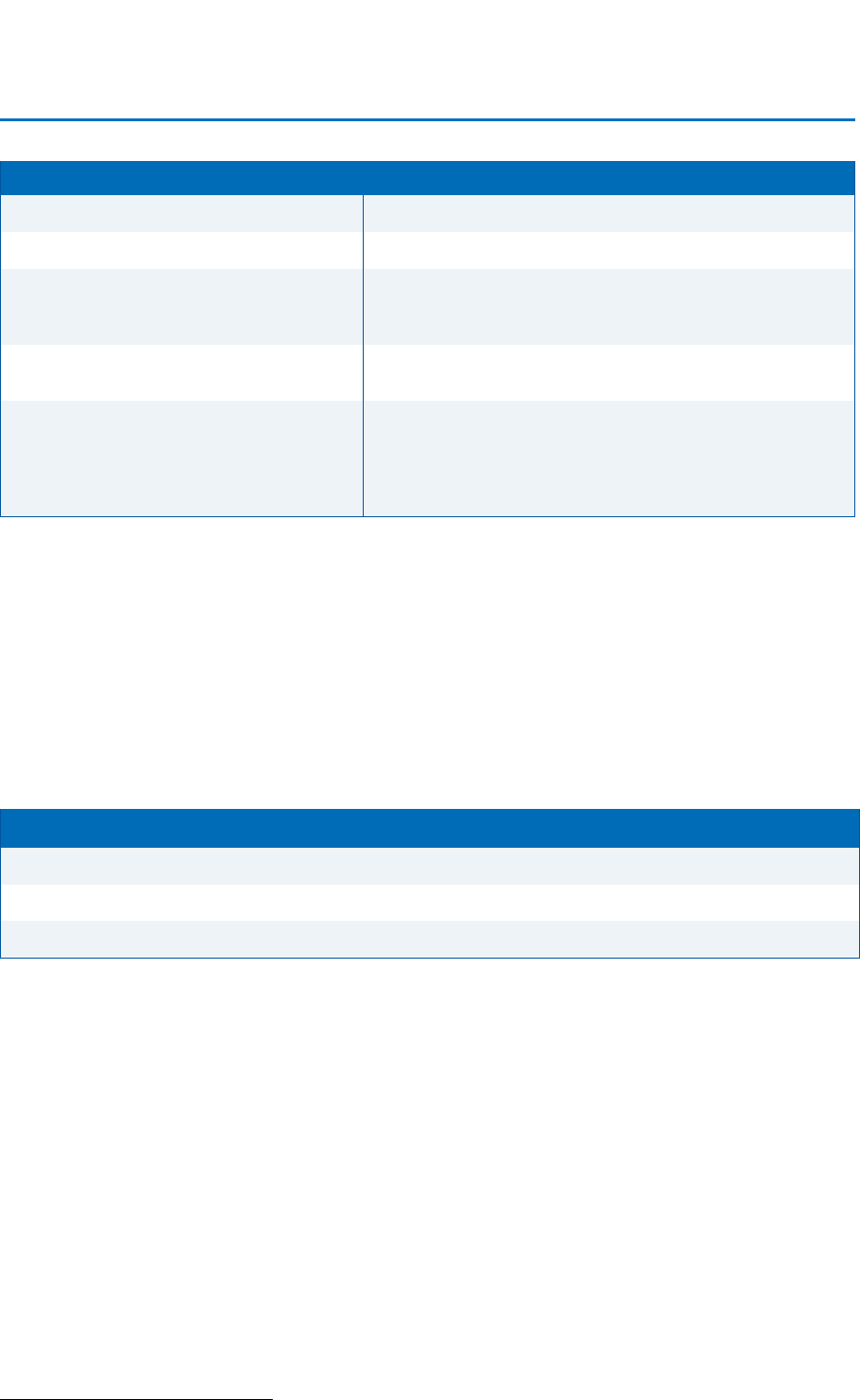

Table 1: Summary of IEA Energy Technology Perspective 2DS and 6DS Scenarios 2016

9

Scenario

Description

2°C

Scenario

(2DS)

2DS lays out an energy system deployment pathway and an emissions trajectory

consistent with at least a 50% chance of limiting the average global temperature

increase to 2°C. The reductions in carbon dioxide emissions envisaged under the 2DS

scenario go considerably beyond the Nationally Determined Contributions (NDCs) set

out in the Paris Agreement

10

.

6°C

Scenario

(6DS

6DS is largely an extension of current trends and is used as the baseline against

which to determine the additional investment in energy efficiency measures and

renewable energy deployment that will be required by 2050.

5

IEA (2016) Energy Technology Perspectives 2016 - Towards Sustainable Urban Energy Systems

6

Committee on Climate Change (2015) The Fifth Carbon Budget – The next step towards a low-carbon economy

7

Committee on Climate Change (2016) UK climate action following the Paris Agreement

8

This report is about business opportunities arising from transition to a low carbon economy. Later sections will refer to sectors based on analysis

by the Office of National Statistics and in this work of the low carbon economy in the UK. Power generation, later termed low carbon electricity,

and transport, are common to the two breakdowns. Other emissions-reduction sectors do not match 1:1 with low carbon economy sectors. As an

example some areas of opportunity such as low carbon finance and adaptation are not included in the emission-reduction sectors.

9

http://www.iea.org/publications/scenariosandprojections/

10

https://www.iea.org/publications/freepublications/publication/ECCE2016.pdf

UK business opportunities of moving to a low carbon economy I 3

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

The IEA Energy Technology Perspectives provides a consistent approach at a global level at which

different scenarios can be compared against each other. Further details about the Energy Technology

Perspectives model approach and the assumptions used are detailed on the IEA website

11

.

The difference between the scenarios can be compared to identify the reduction in emissions for

different sectors. Table 2 summarises the percentage contribution to reduction in emissions between

the 6DS and 2DS for the period 2015-2050 by sector.

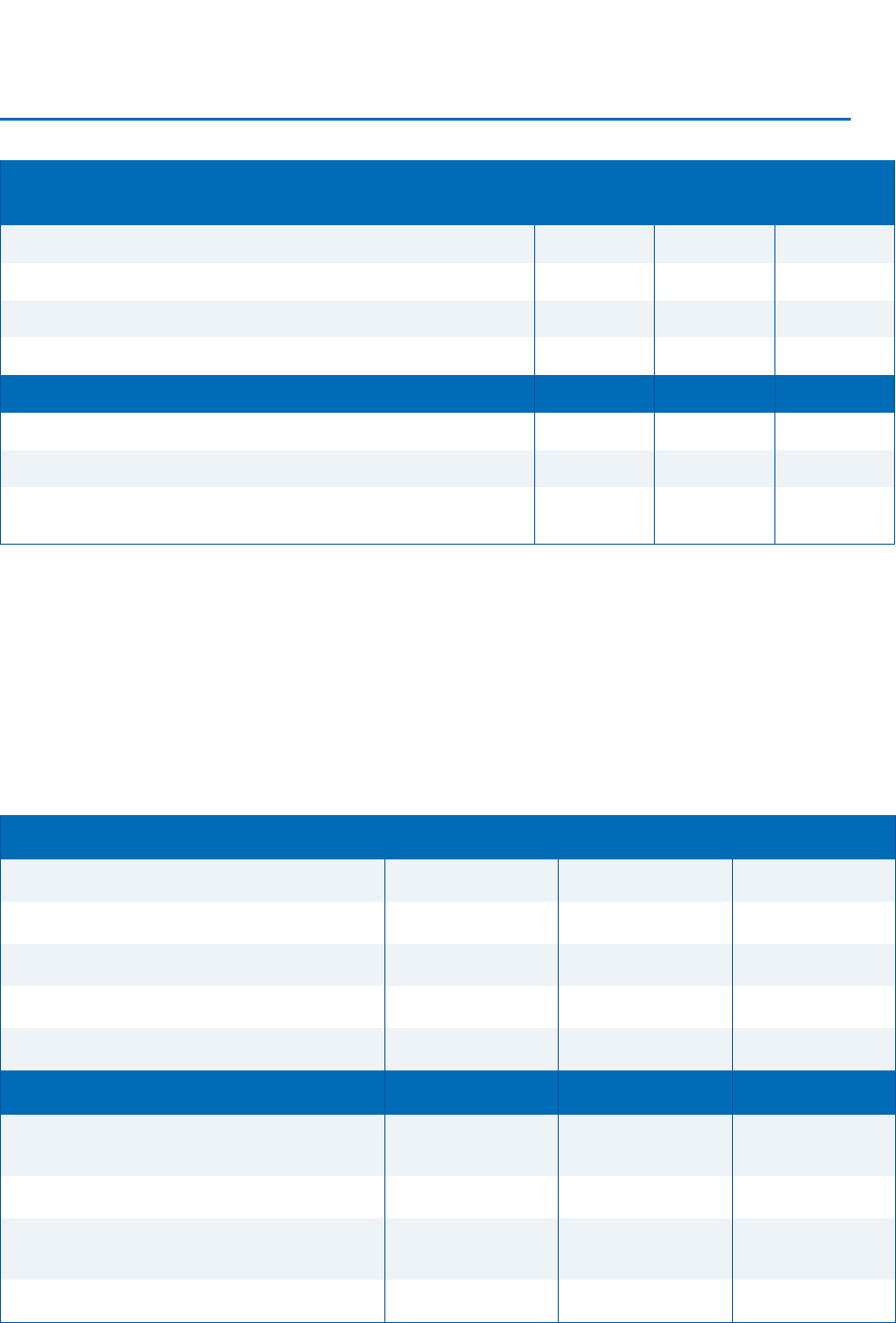

Table 2: Percentage contributions by sector to reductions at 2030 and 2050 in energy related CO

2

and

Green House Gas (GHG) emissions between 6DS and 2DS scenarios

12

Sector

2030

2050

Agriculture

0

0

Commercial

5

6

Residential

8

7

Transport

16

19

Industry

26

21

Other transformation

5

7

Power

39

39

The information presented in Table 2 indicates the following key global trends over the 2015-2050

period with respect to relative energy related global reductions in CO2 and Green House Gas (GHG)

emissions:

The largest relative contributor to emissions reductions in 2030 and 2050 is the power

generation sector, which was responsible for 47% of global energy related emissions in 2014

13

;

The transport and industry sectors, which were responsible for 43% of global energy related

emissions in 2014, also make major contributions to emissions reduction in 2030 and 2050;

All other sectors contribute about 20% of emissions reductions in 2030 and 2050

Sectors that will make the largest contribution to global emissions reductions in 2030 and 2050 are

power generation, transport and industry. These are prime candidates for significant business

opportunities arising from the low carbon transition.

The IEA scenarios also illustrate the relative time of the low carbon transition in different regions of the

world. Figure 1 presents relative projected changes in emissions from 2011 levels for the world and

major regions and countries.

11

http://www.iea.org/etp/etpmodel/ and http://www.iea.org/etp/etpmodel/assumptions/

12

http://www.iea.org/etp/explore/

13

http://www.iea.org/publications/freepublications/publication/CO2-emissions-from-fuel-combustion-highlights-2016.html

UK business opportunities of moving to a low carbon economy I 4

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Figure 1: Emissions with time compared to 2011 figures for some major countries/ regions compared with

the overall projection for the world

Source: International Energy Agency, Energy Technology Perspectives 2016 - www.iea.org/etp2016

The UK (which is included in the projections for EU in Figure 1) and USA are projected to make the

transition about 10 years earlier than the world average.

For countries, including the UK, that make the low carbon transition earliest, there may be

opportunities to supply technology, products and services to countries that make the transition later.

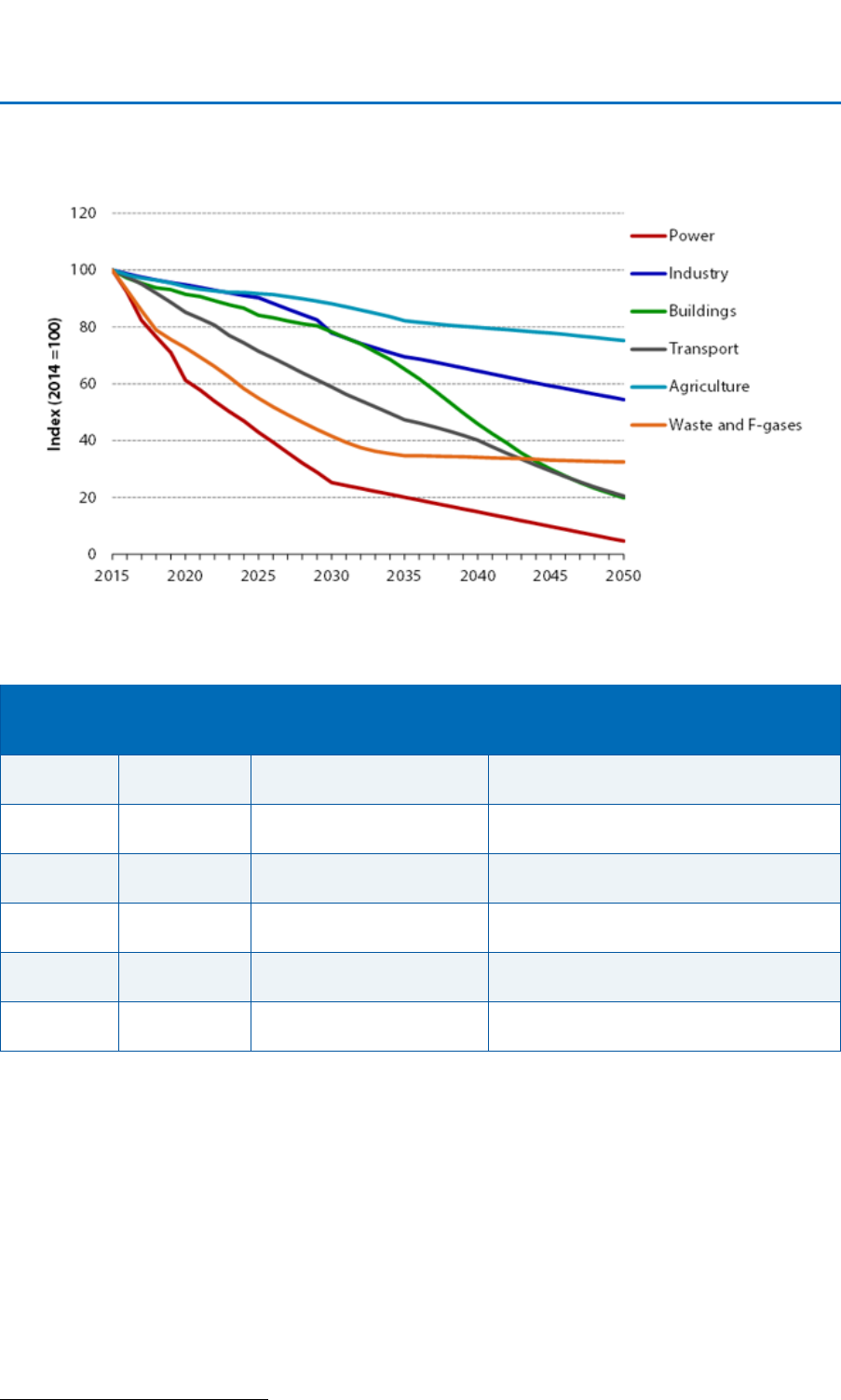

2.2.2 CCC Fifth Carbon Budget Scenarios

To understand in which sectors the UK might have “first mover advantage”, we examined the analysis

in support of CCC’s Fifth Carbon Budget

14

15

, which provides estimates of carbon emissions and

reductions for a number of scenarios across the power, transport, industry, agriculture, waste and F-

Gas emission-reduction sectors for the period 2014-2050 (see Figure 2). We explored CCC’s Central

Scenario, which represents the CCC’s best estimate of the cost effective path for reaching the UK’s

2050 target of at least an 80% reduction in emissions of greenhouse gases compared to 1990.

14

Committee on Climate Change (2015) The Fifth Carbon Budget – The next step towards a low-carbon economy

15

Committee on Climate Change (2015) Sectoral scenarios for the Fifth Carbon Budget – Technical Report

UK business opportunities of moving to a low carbon economy I 5

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Figure 2: Central scenario emissions paths to 2050

16

Projected reductions of emissions by time and sector are summarised in Table 3.

Table 3: Summary of UK projected emissions reductions by time and sector

Sector

% UK CO

2

Emissions in

2014

2015 – 2030

2030-2050

Power

23 %

Very significant reduction

in emissions (about 75%)

Further reduction in emissions at a

slower rate (about a further 20%)

Transport

23 %

Significant reduction in

emissions (about 45%)

Further significant reduction in

emissions (about another 35%

Waste and

F-gases

7 %

Major reduction in

emissions (about 60%)

Relatively low further reduction by 2035,

then flattens off (about another 5%)

Buildings

16 %

Modest reduction in

emissions (about 25%)

Significant reduction in emissions

(about another 55%)

Industry

21 %

Modest reduction in

emissions (about 25%)

Modest reduction in emissions (about

another 20%)

Agriculture

9 %

Relatively low reduction in

emissions (about 15%)

Relatively low reduction in emissions

(about another 10%)

The progression with time reflects the relative ease of and effort in addressing emissions in the

sectors. A major early focus is the power sector with almost complete elimination of emissions

projected by 2050 through the deployment of renewable electricity, nuclear or CCS technologies.

Progress in emissions reductions from transport is projected to be relatively linear to 2050 through the

progressive deployment of battery electric, hybrid plug in electric and fuel cell electric vehicles, and by

shifting car journeys to low and no carbon alternatives e.g. public transport, cycling and walking.

In the waste sector and F-gas sector, a rapid reduction in emissions is envisaged prior to 2030 due to

reductions in emissions from landfill, and leaks from refrigeration and air conditioning equipment.

In the other sectors, a modest or low rate of reduction is anticipated between 2015 and 2050, except

in the buildings sector, where the more significant emissions reduction is anticipated from 2030 to

2050 through increased energy efficiency and the use of low carbon space heating technologies.

16

Source – Figure 1.14 from Committee on Climate Change (2015) Sectoral scenarios for the Fifth Carbon Budget – Technical Report

UK business opportunities of moving to a low carbon economy I 6

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Sectors where UK is making major progress and investment in emissions reductions, clearly offer

opportunities in the home market and also offer opportunities for supply to global markets

2.3 Phase 1: 2017 to 2030 – A more energy efficient world

2.3.1 Power Generation

Key technologies globally include solar PV, on-shore wind, hydro and nuclear

Key technologies within the UK will include renewables including offshore wind,

nuclear, CCS and bioenergy

The initial deployment of less mature technologies will be required

To reduce the carbon intensity of power generation at a global level up to 2030 key technologies

identified by the IEA will include onshore wind, solar PV, and hydro, with increasing importance of

nuclear, as shown in Figure 3.

The position in the UK will be similar, increasing the share of low carbon generation through a range of

different mixes of technologies such as renewables including offshore wind, nuclear and plants with

carbon, capture and storage fitted. Bioenergy is also identified as having an important role, but is limited

by sustainable supply. The implementation of technologies such as offshore wind and CCS during this

period will be important for the UK to meet 2050 targets. Reduced support from UK Government for

CCS Research, Development and Demonstration (RD&D) could impact the deployment of this

technology.

Other technologies will start to be deployed, but this will increase post 2030, and are covered in phase

2 below. The deployment of less mature technologies will be important to enable these to become lower

cost options in future phases in order to meet 2050 targets.

Figure 3: Global deployment rates for low carbon power technologies in the 2DS

17

2.3.2 Transport

Energy efficiency improvements in conventional internal combustion engines and use

of biofuels

Ongoing electrification of vehicles

17

Source – Figure 1.8 from IEA (2016) Energy Technology Perspectives 2016 - Towards Sustainable Urban Energy Systems

UK business opportunities of moving to a low carbon economy I 7

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Technologies to improve efficiency of different transport modes such as materials

substitution to reduce weight, advanced lubricants and advanced aerodynamics

To meet the IEA 2DS requires a number of changes in the transport sector across all modes of transport.

In this phase improvements in conventional internal combustion engines will continue to be important

in improving energy efficiency. This will be complemented by replacement of fossil liquid fuels with

biofuels – initially in trucking and aviation and by electrification of passenger vehicles, with 2 and 3

wheel vehicles and light freight phased in rapidly – in particular in OECD countries, China and India.

Electric vehicles could include battery electric vehicles (BEVs), Plug in Hybrid Electric Vehicles (PHEVs)

and Fuel Cell Electric Vehicles (FCEVs), which include fuel cell systems and hydrogen storage, though

the FCEV stock is expected to remain marginal in this phase.

Possible technologies for public buses include overhead energy supply, batteries and supercapacitors

together with inductive charging and contact based systems and battery swapping concepts. The use

of hydrogen buses up to 2030 is also included as part of the UK’s Fifth Carbon Budget central scenario.

Hybridisation of trucks is anticipated to start slowly in this phase and increase in the next phase. The

aviation sector, in addition to initial deployment of biofuels, will also need continued deployment of

energy efficient technologies.

At the sub-system level it is anticipated that the phase to 2030 will see deployment of technologies to

improve energy efficiency of road transport. These may include: material substitution to reduce weight,

low rolling resistance tyres, advanced lubricants, advanced aerodynamics, exhaust heat recovery,

powertrains with low energy consumption per unit load (this could include hybridisation and

electrification).

Similarly, for rail transport, deployment is anticipated of technologies to improve energy efficiency of

trains, for example material substitution to reduce weight, improved aerodynamics, designs allowing

higher capacity, powertrains with low energy consumption per unit load (mainly electric motors).

In addition to vehicle technologies, the phase to 2030 is also expected to exhibit development of

information and communication technologies for travel demand management. This includes: providing

information for car sharing and bike rental systems, car-pooling users and public transport; and

automatic identification and data capture to enable real time variable congestion charging and regulate

access to segments of the road network.

2.3.3 Industry

Deployment of energy efficiency measures within industrial sectors

Use of low carbon fuels and feedstock and increased recovery of excess energy

CCS identified as key technology within the UK

For the IEA 2DS emission requirements industrial energy consumption needs to be decoupled from the

increasing demand for materials. Under the 2DS industrial energy use will increase slightly through to

2050, but CO

2

emissions will peak in 2020. This requires a reduction in the carbon intensity of energy

used in industrial sectors.

In the short term (up to 2020) this change is primarily driven by energy efficiency (Best Available

Technology deployment), with energy efficiency measures varying between sectors and processes.

The use of low carbon fuels and feedstocks and increased recovery of excess energy will also be

important. This includes the electrification of industrial processes to meet 2DS requirements.

Similar action has been identified for the UK with emission reductions driven by technologies covering

better energy management and process control, the use of more energy efficient plant and equipment,

waste heat recovery and use of bioenergy in space and process heat. CCS is again identified as a key

technology, with CCS cluster developments enabling its use in key industry sectors, including iron and

steel and chemicals. Depending on technological developments, hydrogen could also be used as an

alternative to CCS. As noted above, the reduced support from UK Government for CCS RD&D could

impact the deployment of this technology

UK business opportunities of moving to a low carbon economy I 8

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

More innovative low carbon processes may start to be deployed from 2020, but this will be more

predominant post 2030, and are detailed in phase 2 below.

2.3.4 Buildings

Reduce heating and cooling energy demands in buildings, both retrofit and for new

build

Components/controls to improve the energy efficient building e.g. lighting, appliances

Use of heat pumps to provide heat for homes and businesses

There are a range of technologies and options identified for limiting emissions from buildings. The IEA

scenarios place an important focus on reducing heating and cooling energy demands from urban

buildings in order to achieve targets. The IEA identifies near term action (through to 2025), with a focus

on the following, much of which will need to be promoted through relevant policies/targets:

Driving uptake in deep energy renovations of existing buildings

Promote and strive for near zero energy buildings in new construction

Promoting high performance building envelopes – air sealing, insulation, highly insulating

windows and cool roofs.

Increasing the promotion and use of solar thermal and heat pump technology for space heating

and cooling and condensing boilers for gas heating/hot water.

Promotion of heat pump water heaters

Promotion of solid state lighting and other innovative designs while phase out traditional

incandescent and halogen bulbs

Promote efficient appliances and cooking technologies

The UK scenarios cover similar areas including the use of heat pumps and heat networks, the

continuing implementation of insulation, and increased use of heating controls and energy efficient

lighting and appliances within buildings. The CCC scenarios also highlights low carbon heat could be

provided through hybrid heat pumps, or adding hydrogen to the gas grid. There are currently

technological and acceptance issues limiting the implementation of these technologies.

2.3.5 Other Sectors

The IEA scenarios do not focus on Agriculture, Waste and F-gases, but the following is identified from

the UK’s Fifth Carbon Budget scenario:

Agriculture: Emissions could be reduced through a range of measures, for example the reduction of

N

2

O though improved fertiliser use, livestock measures to reduce methane, waste and manure

management, e.g. anaerobic digestion, and improvements in machinery fuel efficiency.

Waste and F-Gases: Under the Fifth Carbon Budget, the improvements in these sectors relate to the

full diversion of biodegradable waste streams from landfill and the replacement of f-gases by low carbon

alternatives in uses such as refrigeration and air conditioning.

2.4 Phase 2: 2031 to 2050 – A more resource efficient world

This phase will build on the work, and foundations provided in earlier years, as well as developments

in new areas. Given the timeframes and uncertainties around technological developments and uptake,

information on the key technologies during this phase is less certain.

However, there are a number of key aspects included in the 5

th

Carbon Budget and IEA 2DS scenarios

that provide an indication of what is expected or required during the period 2030 – 2050 to meet future

targets, such as the UK’s target in 2050 or the IEA 2DS.

2.4.1 Power Generation

Key low carbon technologies are solar PV, onshore wind and hydro

Use of other low carbon generation technologies such as offshore wind will increase

UK business opportunities of moving to a low carbon economy I 9

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Other solutions relevant to electricity generation and distribution increase in

deployment, such as smart urban (or city) energy networks.

The IEA 2DS indicates that beyond 2030, the amount of electricity generated by onshore wind, solar

PV, hydro and nuclear continues to increase. However other low carbon power technologies, including

biomass, geothermal, ocean, offshore wind, solar thermal electricity and fossil fuels with CCS, also

increase as the level of renewables increases to 64% of electricity generation.

This is also reflected in the UKs Fifth Carbon Budget scenarios, which expects the decarbonisation of

the power sector will continue in order to provide low carbon electricity, as electricity consumption

increases due to electrification in transport, heat and other applications. CCS also plays an important

part in these scenarios, although alternative routes to decarbonisation such as higher levels of

renewables or nuclear are also considered.

In addition to changes in generation through the deployment of low carbon technologies, the IEA

identifies other solutions are also relevant to electricity generation and its distribution. These include:

District Heating & Cooling networks

Energy from Waste technologies (role of this is identified as modest in IEA report)

Energy recovery at wastewater treatment plants

Use of excess heat from industrial processes through thermal networks

Smarter urban energy networks

Smarter distribution grids

Advanced metering infrastructure

Such technologies may have started to come on-line in the previous phase, but their deployment will

increase throughout this second phase.

2.4.2 Transport

Increased electrification of vehicles, including heavy duty transport

FCEVs – main use for hydrogen in fuel cells

More high speed rail

Stronger uptake of alternative / low carbon fuels, for example biofuels and methane

The IEA highlights that the following trends can be expected during the period 2030-2050:

Annual sales of EVs rising from 28% of light duty vehicles in 2030 to 69% in 2050.

Increased share of FCEVs in this phase – through deployment of FCEVs among light duty

vehicles

Increased electrification of heavy duty transport.

Development of more high speed rail (HSR) to provide an alternative to intra-continental air

travel particularly in non-OECD countries

Expect a stronger uptake of alternative fuels vehicles and low carbon fuels in the longer term.

This aligns with the UKs Fifth Carbon Budget, which expects surface transport to have reached near

full decarbonisation by 2050 through a continuation of technologies implemented in Phase 1. This

includes for example the increasing market uptake of electric vehicles and potential increased uptake

of other technologies such as hydrogen instead of battery electric vehicles

18

.

18

The Fifth carbon Budget includes an alternative scenario in the transport sector which involves the widespread uptake of hydrogen

technologies, rather than battery electric vehicles.

UK business opportunities of moving to a low carbon economy I 10

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

2.4.3 Industry

Increased deployment of innovative low carbon process technologies, including

integration of CCS into industrial processes

Emission reductions through recycling solutions

The IEA identifies that over the period, 2030-2050, other measures will need to contribute to achieve

the target. This includes using innovative low carbon process technologies (i.e. those not yet

demonstrated, but could become commercially available by 2050), many of which require the integration

of CCS into industrial processes. Examples include the use of CCS in cement kilns, the use of smelt

reduction or direct reduced iron technology in steel making, inert anode technology in aluminium

production and chemical production from biomass based process routes.

In the longer term recycling solutions will also account for emission reductions, primarily in iron and

steel and aluminium sectors, but also plastic recycling to alleviate the demand for primary chemicals.

The UKs Fifth Carbon Budget is consistent with the IEA, in that it identifies CCS will continue be a key

technology to meets targets at least cost, particularly as it will help reduce emission across heavy

industry.

2.4.4 Buildings

Continuing improvements in energy efficiency e.g. lighting and appliances

Use of highly insulated, integrated building envelopes

Integrated heating and cooling solutions with net-zero emissions

Solar solutions – including solar cooling technologies and solar thermal systems

Potential use of hydrogen from natural gas to provide low carbon heat

Building on the implementation of technologies and solutions in Phase 1, the IEA identified the following

examples of what can be expected to be implemented up to 2050, alongside greater enforcement of

near zero energy building standards in new construction:

Deep energy renovations of buildings, including implementation of energy efficiency measures,

such as the use of energy efficient technologies and building envelope improvements.

Energy efficient technology solutions include as advanced lighting e.g. LEDs – continued

deployment in OECD countries and particular focus on other countries, water heating

technologies e.g. instantaneous condensing gas water heaters, heap pump water heaters,

solar thermal systems to provide high proportion of annual water heating load, low cost solar

cooling technologies

Advanced building envelope materials e.g. insulations, windows, including highly insulated,

integrated building envelopes

Reduce cooling and heating demands through improved insulation, use of reflective surfaces

low-emissivity glass windows, solar control, exterior shading, reflective roadways and

pavements, improved doors, air sealing and distribution systems and energy or heat recovery

equipment.

Building design considerations for new construction including orientation, shape, profile,

materials, technology choices, passive ventilation and solar heating contributions,

Geothermal technologies as part of new constructions utilising local natural water resources

Integration of energy efficient building and district energy

Overall, a similar rate of investment in energy saving measures is expected in phases 1 and 2, but 2.5

times the level of savings that needs to realised in phase 2 (2030-2050) compared with phase 1.

The UK’s Fifth Carbon Budget also highlights the potential use of hydrogen produced from natural gas

(with CCS) as an alternative means of providing low carbon heat. This includes converting parts of the

UK business opportunities of moving to a low carbon economy I 11

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

gas grid to hydrogen use, together with the use of hydrogen boilers to provide heat for residential,

commercial and public buildings.

2.4.5 Greenhouse gas removal technologies

In addition, the CCC report ‘UK climate action following the Paris agreement’

19

includes some further

indications of the potential trends that could be increasingly relevant for this phase in order to meet the

UK’s 2050 target.

Greenhouse Gas Removal Technologies (GGR) are already included as part of the scenario to 2050 in

terms of bioenergy with carbon capture and storage, afforestation and wood in construction, with the

removal of up to 67 MtCO2/year from these options.

2.5 Phase 3: 2051 to 2100 – A sustainable, low carbon world

Continued deployment of low carbon technologies from earlier phases, though

deployment rates may now be declining

Focus on hard to decarbonise sectors such as aviation, agriculture and parts of the

industry

Refined fuel demand decrease due to electrification and/or switch to hydrogen

Potential for geoengineering and other greenhouse gas removal technologies

Information beyond 2050 on the types of technologies that will be implemented is limited, and tends to

relate to higher level trends rather than sector specific actions due to the uncertainty of what will happen

in this phase. While the ETP 2016 2DS and the UK’s Fifth carbon Budget do not give any information

for the period beyond 2050, the CCC report ‘UK climate action following the Paris agreement’

20

highlights the following in relation to continued savings beyond 2050:

Continued deployment of low-carbon measures to replace high carbon stock e.g. vehicles

power generators, heating systems

Continued displacement of fossil fuelled engines by electric and hydrogen vehicles. In addition,

motorcycles, construction vehicles and aircraft support vehicles could be fully decarbonised.

Increased use of heat pumps, district heating and low carbon hydrogen in buildings to reduce

emission. Potential for a more rapid move away from gas for heating, should it become

uneconomical to maintain the gas grid.

After 2050 refining output and refining emissions will continue to reduce as transport and

heating are electrified or switched to hydrogen, lessening the demand for refined fuels.

In addition, beyond 2050 there will be a need to focus on sectors where emissions are still expected to

remain. This includes aviation, agriculture and parts of industry.

Within the aviation sector some further emission reductions could be possible through

improvements in fuel efficiency and take up of biofuels, however further reductions would

require further options. This could include for example; advanced low carbon fuels, alternative

propulsion methods e.g. LNG, hydrogen, nuclear, solar, hybrid planes, greater shifts away from

aviation to alternatives by consumers

Emissions from agriculture will be mainly from livestock and fertilisation of soils. Emissions

could potentially be reduced beyond 2050, for example through increased diet change, food

waste reduction, breakthroughs in genetically modified livestock, novel crops and precision

livestock farming.

It is envisaged that remaining emissions from industry will be primarily from fuel combustion,

process emissions and residual CCS emissions from manufacturing (such as iron & steel, food

& drink), water management and construction sectors. Further electrification or the use of

hydrogen may be possible to reduce fuel combustion emissions. Process and CCS emissions

19

Committee on Climate Change (2016) UK climate action following the Paris Agreement

20

Committee on Climate Change (2016) UK climate action following the Paris Agreement

UK business opportunities of moving to a low carbon economy I 12

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

will be more difficult to decarbonise. The sector may be able to reduce emission through less

carbon intensive products and increased reuse of products and materials.

The report also covers Geoengineering options in order to help achieve targets, including spraying

reflective particles into the upper atmosphere, enhancing the reflectivity of clouds by spraying particles,

and enhancing the reflectivity of land surfaces. However, there is a larger degree of uncertainty

regarding such approaches and further exploration of these options would be required. Greenhouse

Gas Removal, which is already included in Phase 2, would also have a potential role in this phase, as

other options of greenhouse gas removal as developed.

Other sources do provide scenarios with some information on the period 2050-2100. The recent report

‘Bending the Curve’, published by the University of California

21

identifies a series of clusters for moving

towards a low carbon economy:

Science Solutions Cluster

Societal Transformation Solutions Cluster

Governance Solutions Cluster

Market- and Regulations-Based Solutions Cluster

Technology-Based Solutions Cluster

Natural and Managed Ecosystem Solutions Cluster

This highlights the wider activities in addition to technology based solutions that need to be considered.

For the technology based cluster, the report indicates the various solutions, if fully implemented, could

reduce global warming by as much as 1.5 degrees Celsius by 2100. Therefore, solutions identified

would continue to be implemented beyond 2050. This includes technologies such as photovoltaics,

wind turbines, battery and hydrogen fuel cell electric light-duty vehicles and more efficient end-use

devices, together with innovations for the complete electrification of energy and transport systems and

improvements to building efficiency.

2.6 Timeline Analysis Conclusions

This section has identified the key technologies likely to be required to move towards a low carbon

economy, based on the IEA’s ETP 2016 and the UK’s Fifth carbon Budget scenarios.

The overall approach to transition to a low carbon economy is:

Implement known and developing energy efficiency measures

Deploy technologies that have been developed and are known. Costs for some of these will be

expected to decrease with deployment, as has been the case recently with solar photovoltaic

cells

Demonstrate other technologies that are close to deployment

This leaves hard-to-reduce sectors, such as aviation, where further innovation is likely to be

required

Greenhouse gas reduction technologies may be required to reach zero net emissions in the

second half of the century

The expected deployment of technologies in the UK and globally is broadly similar. There are some

obvious differences based on geography – offshore wind is likely to provide a higher proportion

electricity for UK than globally and solar PV a lower proportion.

Clearly there is a range of technologies that can be implemented, and also a degree of uncertainty in

terms of when they will be deployed in reality. However key trends for each phase have been

identified and are in Table 4 below.

21

and http://www.ccacoalition.org/en/resources/executive-summary-report-bending-curve-10-scalable-solutions-carbon-neutrality-and-climate

UK business opportunities of moving to a low carbon economy I 13

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

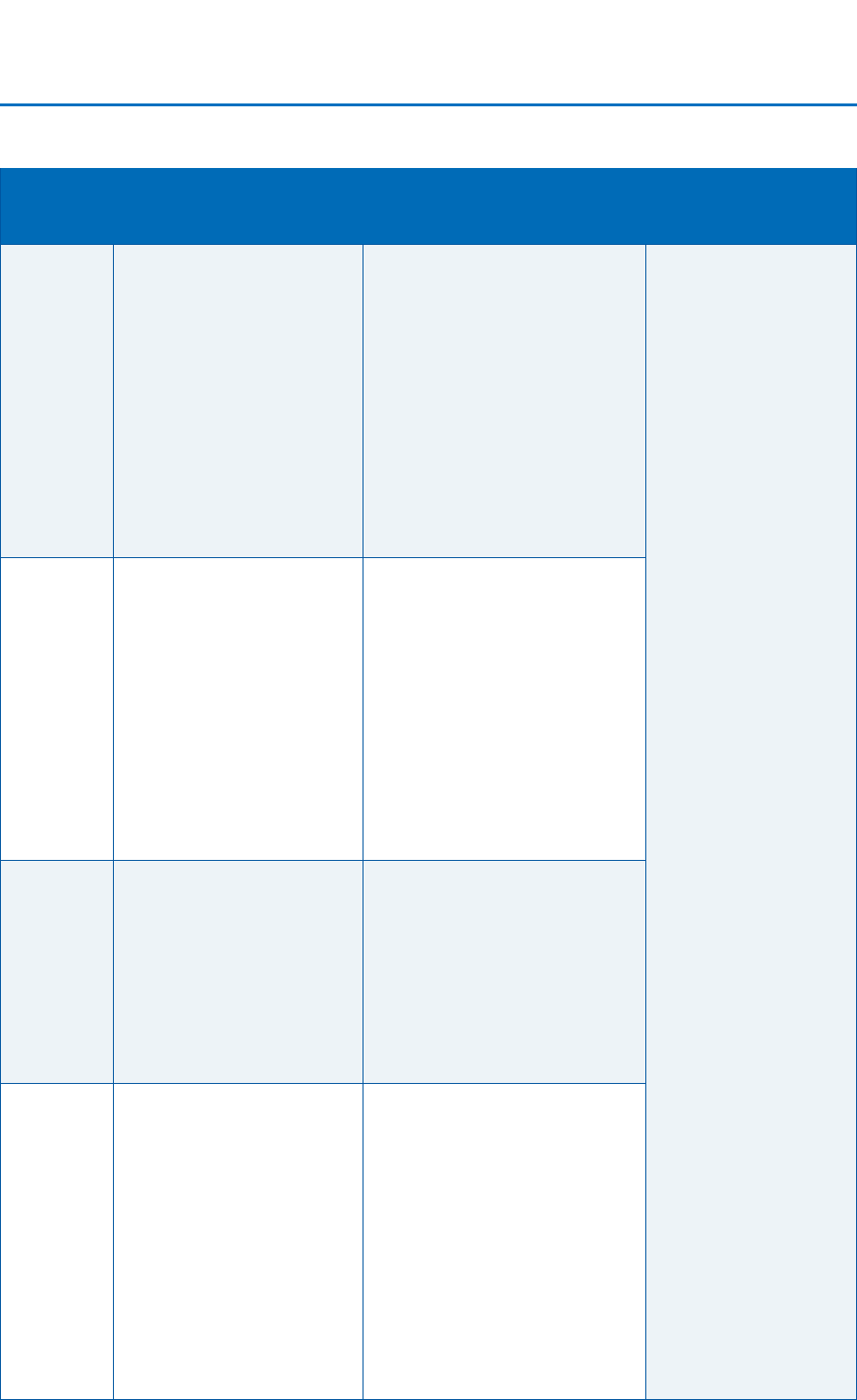

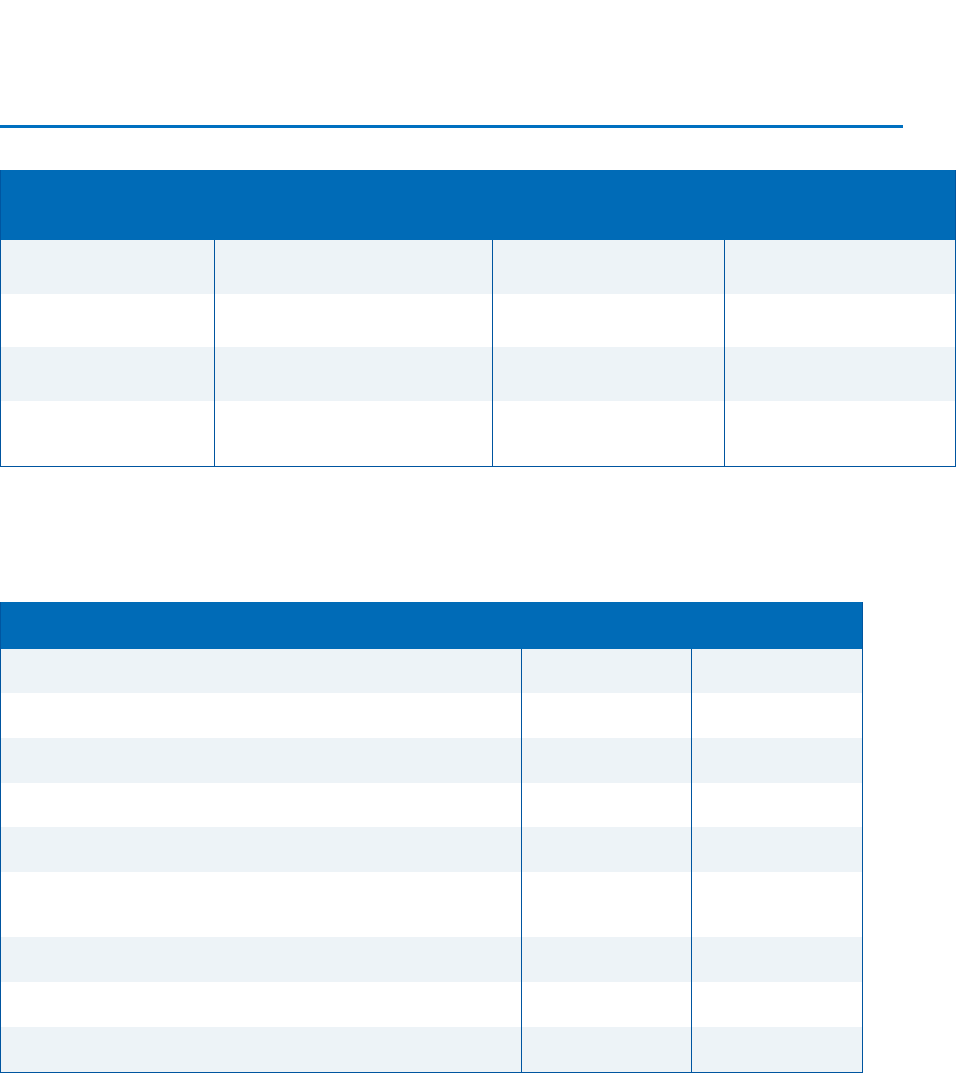

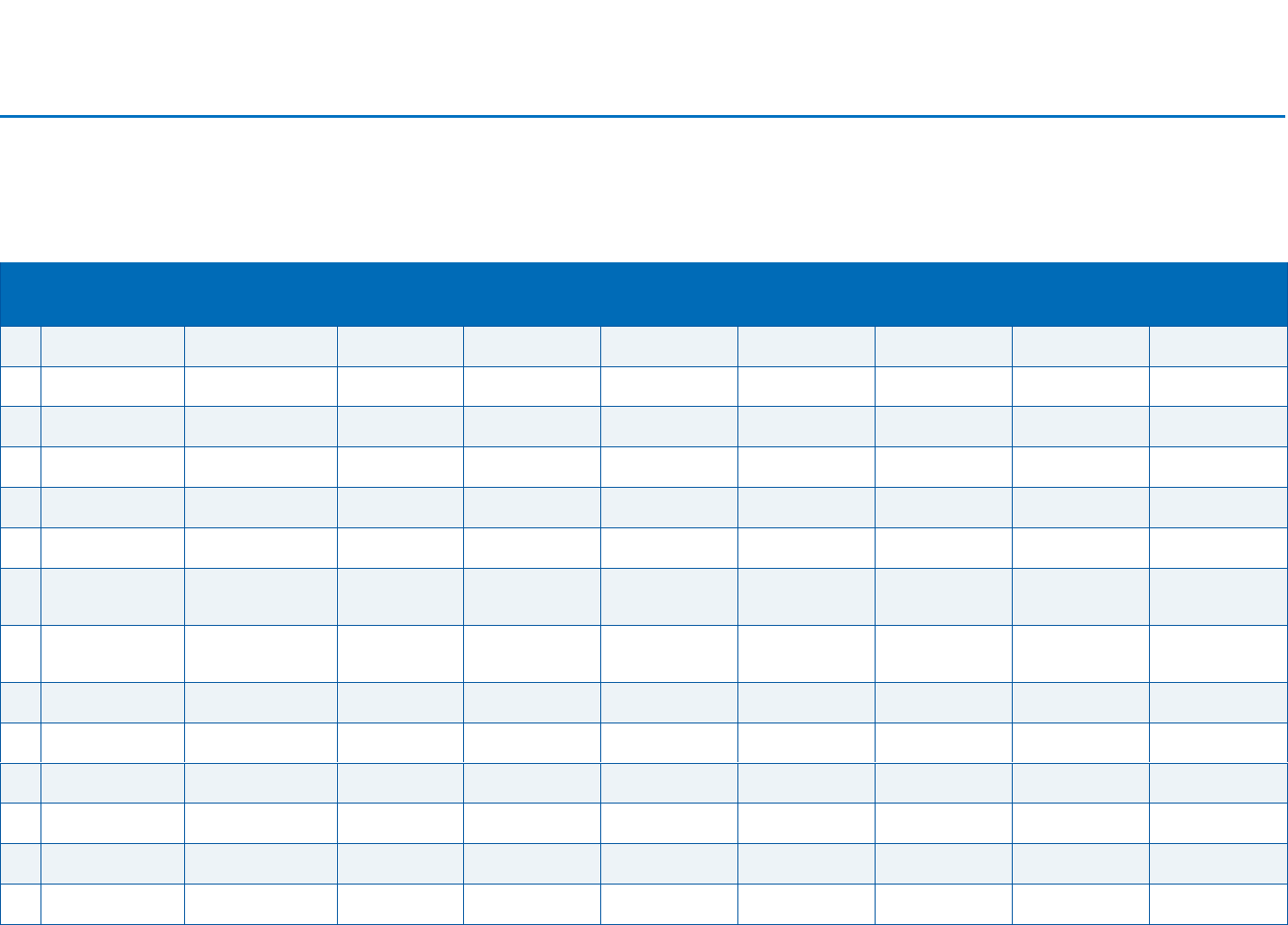

Table 4: Summary of technology requirements by emissions-reduction sector and time

Emissions-

reduction

sector

2017-2030

2030-2050

2050-2100

Power

generation

Key technologies globally

include solar PV, on-

shore wind, hydro and

nuclear

Key technologies within

the UK will include

renewables including

offshore wind, nuclear,

CCS and bioenergy

The initial deployment of

less mature technologies

will be required

Key low carbon technologies

are solar PV, onshore wind

and hydro

Deployment of other low

carbon generation

technologies such as offshore

wind will increase

Other solutions relevant to

electricity generation and

distribution increase in

deployment such as smart

urban (or city) energy

networks

Continued

deployment of low

carbon technologies

from earlier phases

though deployment

rates may be

declining

Focus on aviation,

agriculture and parts

of the industry

sectors

Refined fuel

demand decrease

due to electrification

and/or switch to

hydrogen

Potential for

geoengineering and

other greenhouse

gas removal

technologies

Transport

Energy efficiency

improvements in

conventional internal

combustion engines and

use of biofuels

Ongoing electrification of

vehicles

Technologies to improve

efficiency of different

transport modes such as

materials substitution to

reduce weight, advanced

lubricants and advanced

aerodynamics

Increased electrification of

vehicles, including heavy duty

transport

FCEVs – main use for

hydrogen in fuel cells

More high speed rail

Stronger uptake of alternative

/ low carbon fuels, for example

biofuels and methane

Industry

Deployment of energy

efficiency measures

(BAT) within industrial

sectors

Use of low carbon fuels

and feedstock and

increased recovery of

excess energy

CCS identified as key

technology within the UK

Increased deployment of

innovative low carbon process

technologies, including

integration of CCS into

industrial processes

Emission reductions through

recycling solutions

Buildings

Reduce heating and

cooling energy demands

in buildings both retrofit

and for new build

Components/ controls to

improve the energy

efficient building e.g.

lighting, appliances

Use of heat pumps to

provide heat for homes

and businesses

Continuing improvements in

energy efficiency e.g. lighting

and appliances

Use of highly insulated,

integrated building envelopes

Integrated heating and cooling

solutions with net-zero

emissions

Solar solutions – including

solar cooling technologies and

solar thermal systems

Potential use of hydrogen

from natural gas to provide

low carbon heat

UK business opportunities of moving to a low carbon economy I 14

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

3 Current UK Competitive Position

Used two methods to assess the size of the UK LCE in 2015

Estimated employment of 230,000 to 450,000

Estimated turnover of £42 billion to £120 billion

Broadly stable over 2013 to 2015

3.1 Low carbon technology RD&D

Over the last 15 years, the UK has made a substantial investment in energy and low carbon technology

research, development and demonstration (RD&D). For example, the Research Councils UK (RCUK)

Energy Programme invested £839 million between 2003 and 2011, and a further £625 million is being

invested between 2012 and 2018. Analysis by the programme managers at EPSRC, indicates that this

investment has been made across a wide range of technical areas, including renewable energy,

alternative fuels, low carbon transport, nuclear power, energy storage and CCS, as well as energy

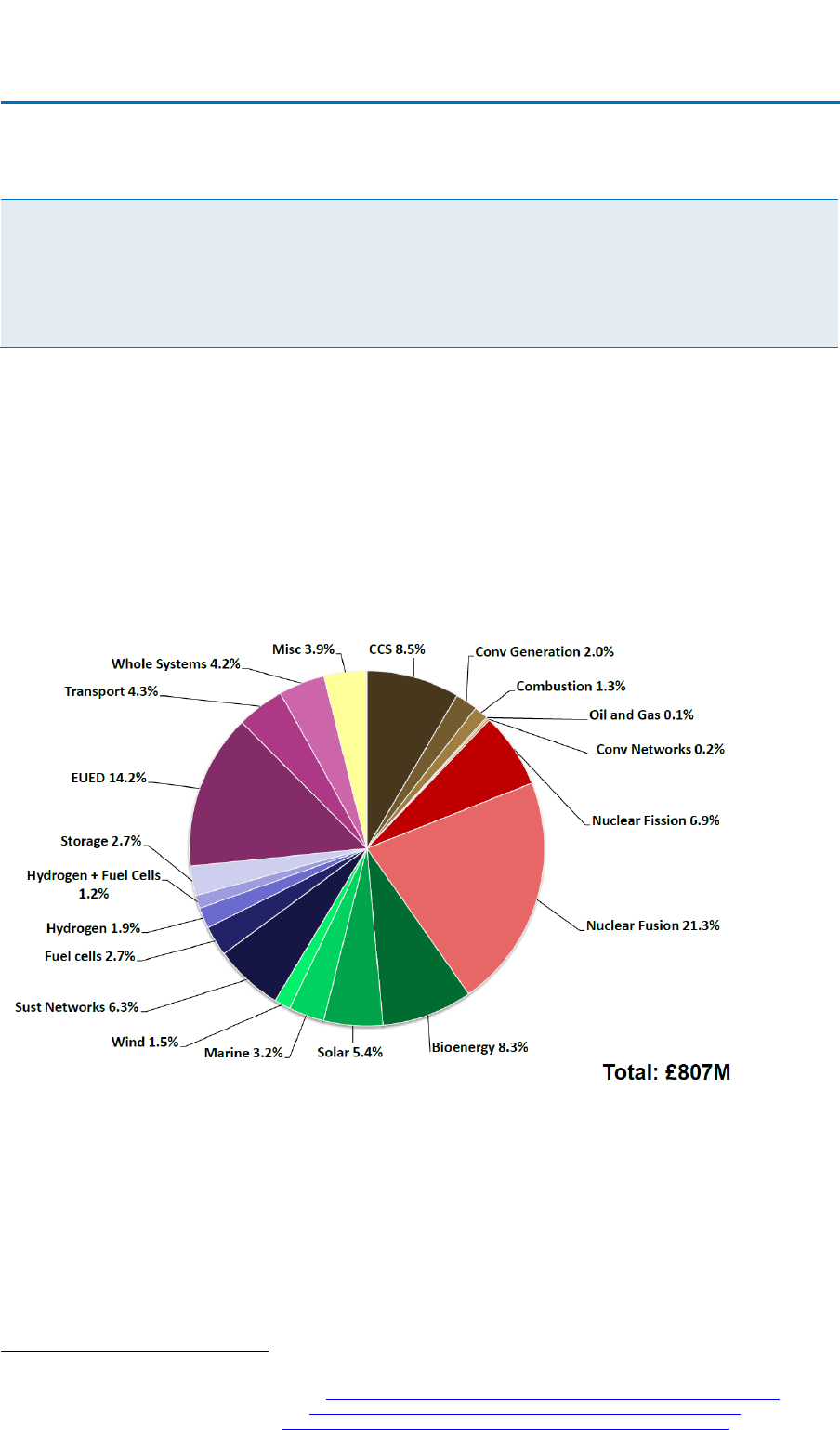

efficient electricity and heat generation, distribution and end use, as illustrated in the Figure 4 below.

Figure 4: Breakdown of Energy Programme investment up to 2014 by technology area

22

.

About one third of all RCUK research grants are made through the Supergen initiative in sustainable

power generation and supply

23

,

24

,

25

, which has provided core funding to 14 hubs undertaking basic

research on energy technologies at low state of technology readiness (TRL) since 2001, and is

continuing to support six hubs under its fourth phase of investment working on:

Alternative energy carriers (such as hydrogen),

Bioenergy,

Energy networks,

Energy storage,

22

Research Councils UK, Energy Portfolio Breakdown, EPRSC, April 2014

23

Supergen Introduction and background, RCUK 2016, http://www.rcuk.ac.uk/documents/energy/supergenintroductionbackground-pdf/

24

Supergen Draft Programme Strategy, RCUK 2016, http://www.rcuk.ac.uk/documents/energy/supergenprogrammestrategy-pdf/

25

Supergen Benchmarking report, RCUK, 2016, http://www.rcuk.ac.uk/documents/energy/supergenphase3-benchmarking-pdf/

UK business opportunities of moving to a low carbon economy I 15

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Fuel cells,

Offshore renewable energy,

The RCUK also has 10 national research centres which act as focal points for mid TRL applied

research and development in the energy technologies, including:

The UK Energy Research Centre (UKERC),

The National Centre for Energy Systems Integration (CESI),

The EPSRC Centre for Power Electronics, CCS Research Centre (UKCCSRC),

The Dynamics of Energy, Mobility and Demand (DEMAND) Centre

The Centre for Energy Epidemiology (CEE)

The Centre on Innovation and Energy Demand (CIED),

The Centre for Industrial Energy, Materials and Products (CIE-MAP),

The Interdisciplinary centre for Storage, Transformation and Upgrading of Thermal Energy (i-

STUTE).

The Centre for Sustainable Energy Use in Food Chains (CSEF).

In addition, 8 out of 11 Innovate UK catapult centres

26

are commercialising research work in energy or

supporting the development of sustainable solutions for UK manufacturing, business, and society:

The Offshore Renewable Energy Catapult,

The Energy Systems Catapult,

The Future Cities Catapult,

The Transport Systems Catapult,

The High Value Manufacturing Catapult,

The Compound Semiconductor Applications Catapult,

The Satellite Applications Catapult,

The Digital Catapult.

As part of its mission to support innovation, increased productivity and growth in UK business Innovative

UK also funds a range of industrial research, development and demonstration (RD&D) projects

27

,, and

knowledge transfer networks (KTN) in many sectors of the economy

28

that support business seeking to

develop new materials, goods and services for the low carbon economy and specialist interest groups

in emerging technology areas such as sustainability and the circular economy and energy harvesting.

These investments in research and innovation, and others related to the wider impact of climate change

on business and society (e.g. adaptation), mean that the UK is well placed to obtain a share of the

growing market for the materials, goods and services needed by the transition to a low carbon economy

provided concerted action is taken by suppliers and government to ramp up export activities

29

.

Technologies where UK is investing in research and innovation are candidates for UK opportunities

from transition to a low carbon economy.

3.2 UK strengths in low carbon innovation

During our review, we identified a substantial volume of world class research, and innovative product

designs in all of the areas that we made estimates of potential global market size (See section 4).

In many cases, the UK research has the potential to produce a new generation of low carbon products

and services, and work is under way to commercialise the results through the Catapult Centres and

Industrial Research Centres. (See Section )

26

https://catapult.org.uk/about-us/about-catapult/

27

Innovate UK, Delivery Plan 2016/17,

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/514962/CO300_Innovate_UK_Delivery_Plan_2016_2017_WEB.pdf

28

https://admin.ktn-uk.co.uk/app/uploads/2016/09/KTN-Annual-Report-2015_2016.pdf

29

https://www.carbontrust.com/media/504208/ctc829-a-must-win-capitalising-on-new-global-low-carbon-markets.pdf

UK business opportunities of moving to a low carbon economy I 16

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

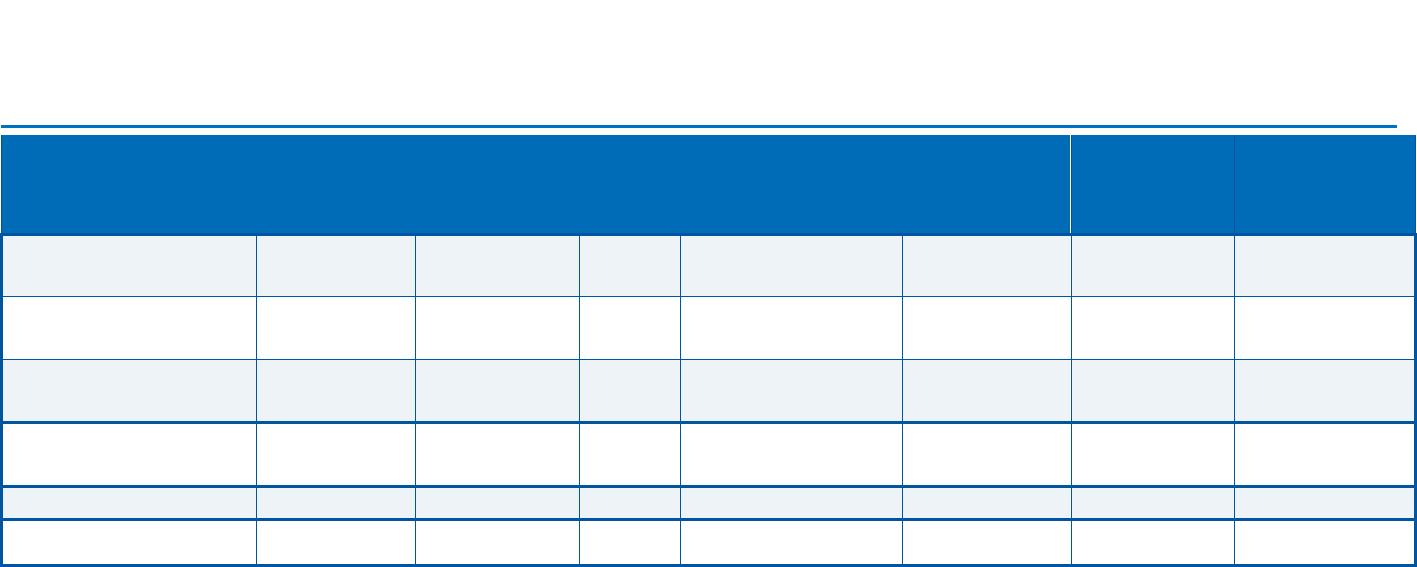

With the aid of our experts and stakeholder feedback, we have assessed whether there is a low, medium

or high potential for UK business to capture market share in each of the main segments of the UK low

carbon economy market (Table 5) and identified some examples of areas where the UK currently has

particularly strength based on an assessments of UK low carbon capabilities produced by the Foreign

& Commonwealth Office (FCO), UK Trade & Industry (UKTI) and Carbon Trust

30

and Low Carbon

Coordination Innovation Group (LCCIG)

31

.

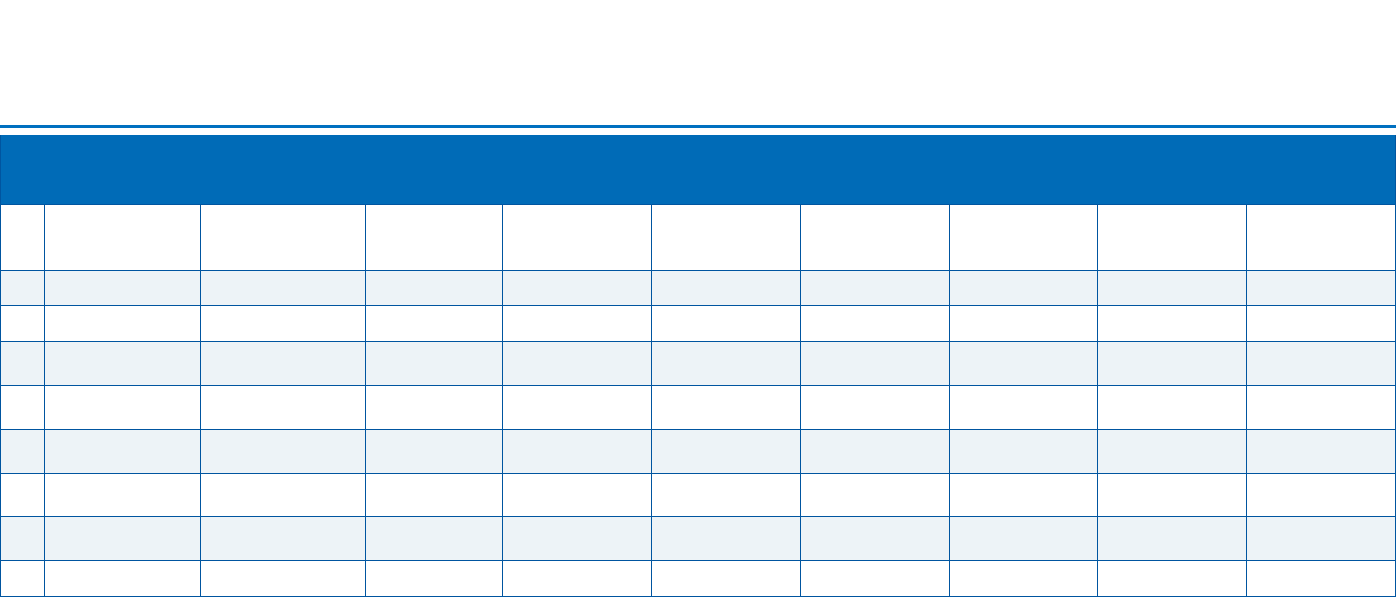

Table 5: Assessment of UK potential to capture market share and examples of current UK strengths

Low carbon economy (LCE) sector

Potential to

capture market

share

Examples of current UK strengths

Energy efficient products

Medium

Smart Grids, advanced building design,

materials and manufacturing systems

Energy from waste and biomass

Low to Medium

Biofuels, waste recycling techniques

Low carbon electricity

Medium

Off-shore wind, energy storage, solar PV

Low carbon services

High

Finance, insurance, consultancy

Low emission vehicles, infrastructure,

fuels cells and energy storage

Medium to high

Power systems & transmissions,

batteries, logistics, telematics,

Other products and services

Medium to high

Membranes, catalysts, bioprocessing

These ratings are intended as high level assessments looking at the short to medium term potential for

UK business to capture global market share by 2030. The list of example UK strengths is not exhaustive,

and there are other promising but less well known technologies that could be included from sector

strategies and sector benchmarking reports

32

by BIS and regional/country strategies

33

.

If we look over the immediate time horizon, research is underway to develop the next generation of

innovations that will be needed to enable and deliver the circular economy and on the technologies that

will enable UK society and the global economy to adapt to the impact of climate change. We expect

that many of these technologies will take advantage of the UK’s strengths in advanced manufacturing

and materials; robotic, autonomous and digital systems; and energy storage.

3.3 UK Export Performance

Analysis of global production and trade data between 2010 and 2014

34

, indicates that 75% of UK exports

(by Value) related to:

Financial services (11.6%)

Wholesale and retail products (11.5%)

Transport equipment (11.1%)

Machinery and electricity products (9%)

Chemicals and related products (8.2%)

Business services (8.1%)

Professional services (6.1%)

Metals / Metal Products (4.9%)

30

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/199886/UK_Capabilities_Report_EN.pdf

31

https://www.carbontrust.com/media/190038/tina-bioenergy-summary-report.pdf

32

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/34647/12-1207-benchmarking-uk-competitiveness-in-the-global-

economy.pdf

33

2014-17 Business Plan, Scottish Enterprise, https://www.scottish-enterprise.com/~/media/5793a121a3ff431a8453f4b0c83b8744.ashx

34

As published in the World Input-Output Database, http://www.wiod.org/home. For details of the method see: Timmer, M. P., Dietzenbacher, E.,

Los, B., Stehrer, R. and de Vries, G. J. (2015), "An Illustrated User Guide to the World Input–Output Database: the Case of Global Automotive

Production", Review of International Economics., 23: 575–605

UK business opportunities of moving to a low carbon economy I 17

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

Computer and information services (4.2%)

In 2014, UK business captured approximately 3.6% of global export market. Sectors that captured more

than this percentage of the global export market for their particular category of materials, goods services

are considered to have a comparative advantage

35

. Of these nine sector groupings listed above, six of

exceeded this threshold, whilst three (metals / metal products, chemicals and related products, and

machinery / electrical products) do not. In part, these market shares reflect the shift in UK industry

towards production of higher value added materials, goods and services, and the globalised nature of

the some manufacturing sectors. The six sectors groupings with comparative advantage are broadly

similar to the sectors identified by BIS’s benchmarking of revealed comparative advantage of in 2003

and 2008

36

, although mineral products and the food and drink sector have lost competitive position.

The results of analysis for all sector groupings are shown in Figure 5. The UK’s share of the global

export market for Low Carbon Economy related materials, goods and services might be maximised by

helping sectors that generate a significant share of UK exports to develop new products, and by

investment in sectors with future growth potential where the UK has a competitive advantage.

Figure 5: Analysis of UK Exports and UK Share of the Global Export Market by sector grouping

Markets which represent a relatively high proportion of UK exports and particularly where the UK has

a high share of global exports give areas where low carbon opportunities may start from a strong

current base.

Research and innovation investments (Section 3.1) may lead to enhancing the UK share of global

exports.

3.4 Current UK low carbon goods and services market

The current UK market for low carbon goods and services has been estimated using an established

method described in detail in Appendix 1.

A baseline for the market was set with the publication of the report ‘The size and performance of the

UK low carbon economy’ by BIS in 2015

37

. This work, which was led by TBR, set out employment,

turnover and gross value added (GVA) data for a range of sectors that made up the low carbon

economy, as of 2013.

35

http://www.rbs.com/content/dam/rbs/Documents/News/2014/08/UK%20export%20performance%20August%202014.pdf

36

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/34647/12-1207-benchmarking-uk-competitiveness-in-the-global-

economy.pdf

37

The Size and performance of the UK low carbon economy, BIS, March 2015.

UK business opportunities of moving to a low carbon economy I 18

Ricardo Energy & Environment

Ricardo in Confidence

Ref: Ricardo/ED10039 V7

The current work sought to update the BIS baseline with data for 2015. The analysis is based on the

performance of 5,600 businesses known to operate across the low carbon economy and which were in

existence in both years, viz 2013 and 2015.

Subsequent to the publication of the BIS report, ONS undertook survey work to generate its own data

for the low carbon and renewable energy economy. While there was significant commonality between

the sectors used, there were also important definitional differences such as in the way supply chain

effects were incorporated.

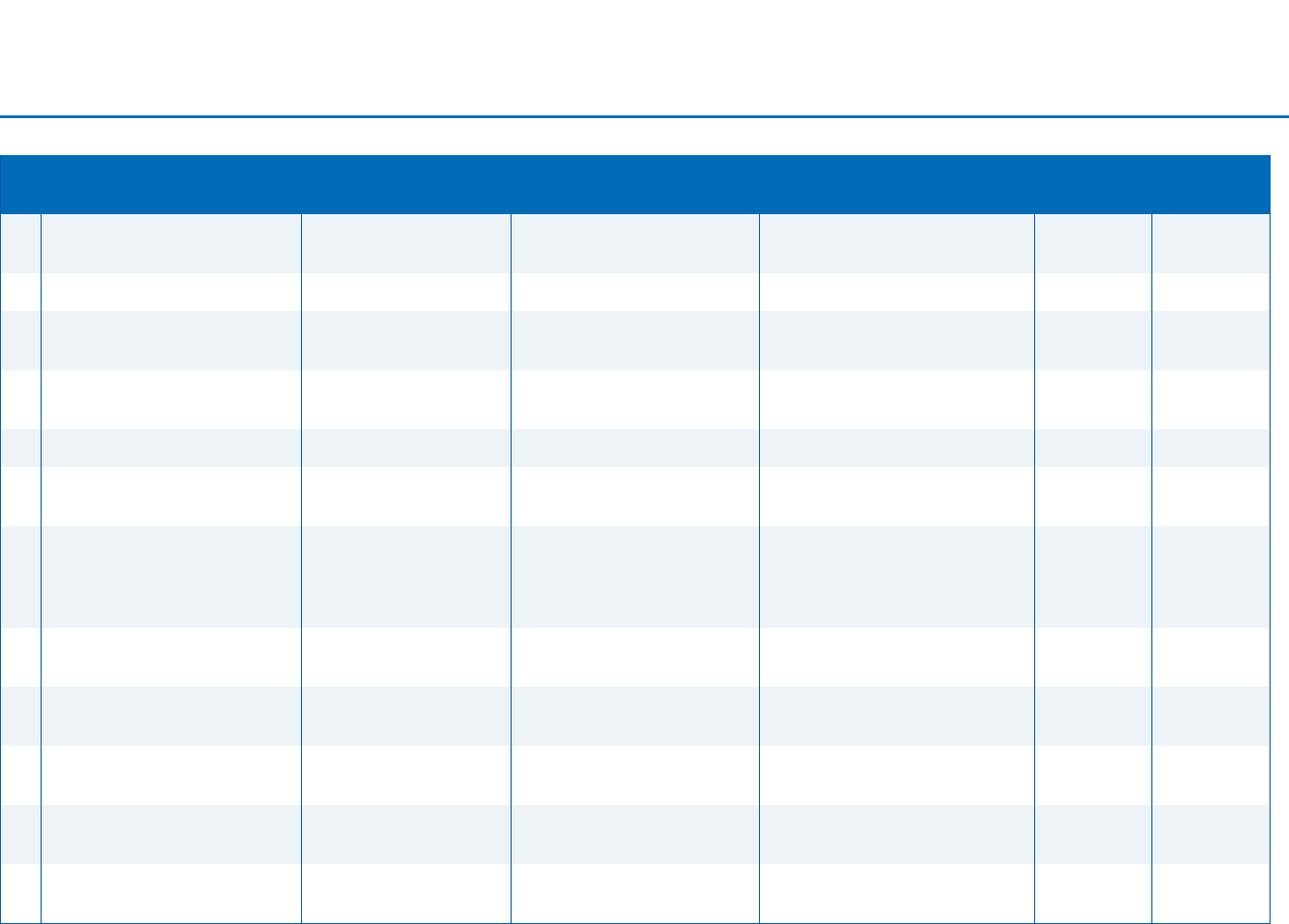

Headline data by group is presented below in Table 6 to Table 8 to show changes in employment,

turnover and GVA between 2013 and 2015.

Table 6: Low carbon employment 2013 – 2015

Sector Group

2013

2015

Change

Energy Efficient products

94,200

90,900

-3.5%

Low carbon electricity

140,800

139,400

-1.0%

Low carbon heat

32,600

30,800

-5.4%

Low carbon services

28,000

28,600

2.0%

Low emission vehicles, infrastructure, fuels cells

and energy storage