Moving calgary

TransporTaTion + logisTics secTor profile

DeceMBer 2010

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

2

TRANSPORTATION + LOGISTICSSECTOR PROFILE

3

MOVING CALGARY

TRANSPORTATION + LOGISTICS

Calgary Economic Development has compiled this sector profile to give interested businesses

and individuals a comprehensive overview of the infrastructure and opportunities in Calgary’s

robust transportation and logistics network. This network is a cornerstone of the city’s vitality:

it gives businesses the ability to affordably and efficiently move people, products and services

by land, rail, air and, eventually, by sea; and it gives city residents and visitors alike the means

to reach and enjoy all aspects of life in and around Calgary and southern Alberta.

Major retailers like Walmart have selected Calgary as an integral part of their Western distribution

strategy. This is partly due to Alberta’s low tax regime, Calgary’s growing economy, its geographic

location, and its well developed and evolving infrastructure. This powerful combination makes

Calgary a major Canadian transportation and logistics hub of the future.

Over the last decade (2000-2010), Calgary’s population has increased by more than 300,000

people; employment in the transportation and warehousing sector supporting the city’s growth

has increased by over seven per cent and employs nearly 80,000 workers. A stream of

investment by both large and small transportation and logistics suppliers has brought the total

number of businesses in the sector to 4,200 establishments. As well, Calgary’s streets and roads

have been expanded and upgraded, the Calgary International Airport has undergone a major

expansion, and a new intermodal rail logistics park is expected to open in 2013.

Transportation and logistics are moving Calgary – and propelling one of the most dynamic

economies in North America.

For additional information, please contact:

Calgary Economic Development

731 – 1 Street SE Calgary, Alberta, Canada T2G 2G9

Phone: 403-221-7831 or toll-free: 1-888-222-5855

Fax: 403-221-7828

Email: [email protected]

www.calgaryeconomicdevelopment.com

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

4

CALGARY ECONOMIC DEVELOPMENT OVERVIEW

Calgary Economic Development (CED) is working to make Calgary the undisputed choice for people

and business.

As Calgary’s lead economic development agency, we work with businesses to facilitate growth, expedite

local, national and international business investment and trade development opportunities to promote

sustainable economic growth in the Calgary region.

Calgary is Western Canada’s business centre and has more head offices per capita than any other Canadian

city. Its key economic drivers are Financial Services, Energy, Transportation and Logistics, Information and

Communication Technology, Manufacturing, Film and Creative Industries.

CED concentrates its activities on developing these sectors; an experienced economic development

professional is dedicated to each sector. Using a hands-on approach, we are furthering the success and

growth of existing businesses, helping businesses grow their markets globally and promoting the Calgary

Region as the ideal location for business investment.

By working with business and partners proactively and collaboratively, we will be able to achieve higher

levels of success for Calgary and the surrounding region.

www.calgaryeconomicdevelopment.com

TRANSPORTATION + LOGISTICSSECTOR PROFILE

5

TABLE OF CONTENTS

CALGARY TRANSPORTATION AND LOGISTICS AT A GLANCE

COMPANIES INVESTING IN CALGARY

12

Calgary’s Advantages Drive Investment

15

Major Headquarters in Calgary

CLOSE PROXIMITY TO MARKETS

16

A Proven Location

16

A Central Location

18

Calgary’s Distribution Cost Advantage

LAND AVAILABILITY AND COSTS

20

Industrial Real Estate Market

21

Land Costs

22

City of Calgary Land Availability

23

Industrial Regions in Calgary

24 Aurora Business Park

24 Westwinds Business Park

24 Great Plains Industrial Park

24 Dufferin Industrial Park

25

Water and Wastewater Availability

LABOUR SUPPLY, SKILLS, AND WAGE RATES

27

A Workforce Strategy for Alberta’s Supply Chain Logistics Industry

28

Calgary’s Occupational Labour Supply

30

Calgary’s Educational Assets

30 The University of Calgary

32 SAIT Polytechnic

33 Mount Royal University

34 Bow Valley College

34 DeVry Institute of Technology

07

09

16

20

26

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

6

35

Labour Costs

35 Unionization and Workers’ Compensation Board Rates

36 Wage Rates

37 Calgary Wages for Key Occupations in the T&L Sector

38

Productivity

38 Productivity Alberta Program

WORLD CLASS TRANSPORTATION INFRASTRUCTURE

40

Air Transportation

41 WestJet

41 Calgary International Airport (YYC)

43 Calgary Springbank Airport (YBW)

43 International Reach

44 YYC Air Cargo Capacity & Trade Parks

46

Rail Infrastructure

46 Canadian Pacific Railway (CPR)

47 Canadian National Railroad (CN)

48

Road Infrastructure

48 The CANAMEX Trade Corridor

49 The Trans-Canada Highway

49 Coutts/Sweetgrass Border Crossing

49 Free and Secure Trade

50

Vancouver – Calgary’s Port

ORGANIZATIONS ACTIVE IN CALGARY’S TRANSPORTATION & LOGISTICS SECTOR

51 Alberta Motor Transport Association (AMTA)

51 Calgary Chamber of Commerce, Transportation & Logistics Committee

52 The Van Horne Institute (VHI)

52 Canadian Supply Chain Sector Council (CSCSC)

52 International Brotherhood of Teamsters (Teamsters)

53 Alberta Joint Learning Initiative in Logistics (JLI)

53 Western Transportation Advisory Council (WESTAC)

53 Women in Logistics

40

51

TRANSPORTATION + LOGISTICSSECTOR PROFILE

7

CALGARY TRANSPORTATION AND LOGISTICS

AT A GLANCE

Calgary’s transportation and logistics sector produces over $3.6 billion in GDP

1

and employs nearly 80,000

workers

2

at over 4,200 business establishments. The sector represents six per cent of Calgary’s total GDP

and real growth in the sector has averaged three per cent per year for the last decade.

Figure 1 Composition of Calgary’s Transportation and Logistics Sector

1

Source: Conference Board of Canada, Figures in Chained 2002 dollars.

2

Includes the total workforce in the transportation industry (NAICS 48-49) and Wholesale Trade (NAICS 41)

0

500

1000

1500

2000

2500

3000

Wholesale, Warehousing & Storage

2,632 Establishments

Truck Transportation

1,150 Establishments

Air Transportation

51 Establishments

Rail Transportation

3 Establishments

Postal and Courier

140 Establishments

Transit

66 Establishments

Transportation Support Activities

227 Establishments

Source: Canadian Business Patterns, Calgary Economic Region, December 2009

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

8

Calgary offers:

■ Excellent access to markets

Serviced by major north-south and east-west highways, two Class 1 railroads, Canada’s third busiest

international airport, and the nearby Port of Vancouver, a market of 50 million people can be reached from

Calgary within 24 hours. Direct and connecting flights from Calgary International Airport (YYC) connect Calgary

to practically every destination around the globe within 48 hours. A distribution centre situated in Calgary

can provide service to the region at a lower cost and in shorter travel time than any other city in Western

Canada. Calgary sees a large share of activity from Canada’s busiest port, with 40 per cent of imports through

Vancouver being distributed through Calgary. As it continues to grow as a major transportation hub, Calgary

enjoys a rich supply of low cost containers ready to be loaded.

■ Available & serviced land and logistics parks

The City of Calgary has nearly 12,000 hectares of industrial land supply, including over 1,600 hectares of

immediate and short-term land supply. The city is serviced by three major industrial regions comprised of

a network of industrial parks, intermodal facilities and on-airport logistics parks. Leasing rates for industrial

space in Calgary remain lower than nearby cities, and land in the larger Calgary Region offers ample space for

development at transportation nodes along major corridors. To support growth, over the 2009-2018 period, the

City of Calgary is investing $3.5 billion in Calgary’s transportation infrastructure to keep Calgary connected.

■ Highly skilled and available labour force

As Alberta’s largest city, Calgary plays a leading role in executing the workforce strategy for Alberta’s supply

chain logistics industry. Annually, over 100,000 learners benefit from educational programs offered through

the University of Calgary, SAIT Polytechnic, Mount Royal University and several other educational providers.

In partnership with the transportation and logistics industry, these institutions offer programs in international

trade management, supply chain logistics, operations management, and programs in related trades for

trucking, aircraft maintenance and rail operations. Following the growth boom in the mid-2000s, wages in

Calgary settled down close to the Canadian average, while unionization rates and Workers’ Compensation

Board premiums in Alberta are the lowest in Canada. Productivity (measured in output per hour worked)

is higher in Alberta than any other Canadian province.

■ An excellent business environment

Calgary is recognized as one of the most cost-effective places in Western North America to establish a

transportation and logistics hub. Perhaps the best evidence of Calgary’s pro-business environment is the high

level of investment transportation and logistics firms are making in Calgary. Recent investments include a

$100 million Calgary Logistics Park announced by CN Railroad and the $30 million UPS distribution centre at

Calgary International Airport. Investment is supported by Calgary’s excellent quality of life and Alberta’s low tax

rate (lowest in Canada). With 114 of Canada’s largest firms headquartered in Calgary, the city offers excellent

access to decision-makers, in particular within the energy sector.

As Canada’s fastest growing city, Calgary offers tremendous opportunities to firms across the diverse

transportation and logistics sector. We invite you to explore what Calgary can offer your business.

TRANSPORTATION + LOGISTICSSECTOR PROFILE

9

COMPANIES INVESTING IN CALGARY

Walmart, Costco, Canadian Tire, Sears, Westfair Foods, Shoppers Drug Mart, WestJet, Canadian Pacific Railway

— these are just a few names of companies selecting Calgary as the site for major investments for logistics

offices, distribution centres, and major infrastructure. Calgary has emerged as a premier hub for logistics

operations in Western Canada and to global markets. Some recent major investments are outlined below.

CN Railroad: $100 million Calgary Logistics Park

Canadian National Railroad is building a new logistics park in Calgary that offers a state-of-the-art Intermodal

yard with direct connection to CN’s network – which allows for in-park movement of containers significantly

reducing dray and handling costs. The Calgary Logistics Park will be the third logistics park operated by CN in

North America (in addition to parks in Chicago and Memphis).

The Calgary Logistics Park will be located a few minutes from two of North America’s largest highways: the

Trans-Canada Highway and the CANAMEX Corridor. It will offer direct rail connection to two west coast ports,

Vancouver and Prince Rupert, BC with superior speed to market for imports to western Canada. The park will

be located on 680 acres with total warehousing capacity of over two million square feet. The park also has

Foreign Trade Zone designation, reducing transportation miles by offering streamlined customs processes

onsite. Services include heavy container handling and in-park movement of containers.

www.cn.ca/calgarypark

UPS: $30 million Distribution Centre at Calgary International Airport’s Global Logistics Park

In 2010, UPS opened a $30 million distribution centre at Calgary International Airport. The 150,000-square-

foot facility allows local businesses to tap into global growth markets such as China, India and Mexico. The

distribution centre doubles the UPS hub’s package processing capability to deal with rapidly growing business

in Calgary, where shipment volumes have increased 60 per cent between 2003 and 2010. The hub houses

157 trucks for ground transportation to surrounding communities in addition to serving as a staging point for

aircraft. Air and ground packages are sorted at the hub, which employs 400 people at the new YYC Global

Logistics Park, located at the Calgary International Airport.

“The rise of middle classes in China and India offers great potential to businesses in the Calgary area. This facility will

provide our customers with access to those markets in a more convenient and reliable fashion than ever before.”

— Mike Tierney, President, UPS Canada

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

10

Supported by a strong infrastructure of highway, rail and air transportation, Calgary has become Western

Canada’s distribution hub for the wholesale, retail, and third-party logistics provider sectors. Investment activity

in Calgary’s transportation and logistics sector has been strong over the last several years. With 40 million

square feet of new retail space currently under construction, major retailers have already selected Calgary as

an integral part of their western retail distribution strategy.

3

Highlights

4

of recent investment in warehouse and distribution facilities in the Calgary Region include:

Table 1 Selected Recent Investment in the Calgary Region –

Distribution/ Warehouse Facilities

5

Company

Company's Products/

Services

Category

Square Foot

(thousands)

Capital

Investment ($M)

Year Lease

3E Logistics Inc. Logistics New 137 - 2010 Lease

South Wire Canada Co. Wire New 105 - 2010 Lease

CWS Logistics Ltd. Logistics New 100 - 2010 Lease

Gene Orlick Transportation Inc. Logistics New 83 - 2010 Lease

Shanahan's Building

Specialties Ltd.

Construction Materials New 79 - 2010 Lease

Culligan Water Conditioning Ltd. Plumbing Equipment New 54 - 2010 Lease

Whirlpool Appliances New 439 - 2009 Lease

Walmart Canada Foods New 400 $97 2009

Harmony Distribution Logistics New 356 - 2009 Lease

Iron Mountain Canada Records Management New 145 - 2009 Lease

Lennox Industries

Plumbing and Heating

Equipment

New 110 - 2009 Lease

Exel Canada Ltd. Logistics New 90 - 2009 Lease

WTS Distribution Logistics New 79 - 2009 Lease

Resolve Logistics Logistics New 78 - 2009 Lease

Coca-Cola Soft Drinks New 75 - 2009 Lease

Anixter Electric Wires and Cables New 55 - 2009 Lease

EBA Engineering Engineering New 50 - 2009 Lease

Federated Co-operatives Foods New - $9 2009 -

IXL Masonry Calgary Masonry Products New - $5 2009 -

Costco Wholesale distribution New 260 - 2008 -

Rona Home Improvement New 169 - 2008 Lease

UPS Package Delivery New 150 $26 2008 -

Arbonne International

Distribution

Personal Care Products New 33 - 2008 -

Sico-Canada/Akzo Nobel Paint Coating New 29 - 2008 -

3

Ibid

4

Selected investments include those in an investment in excess of $1 million, a floor area of over 20,000 sq. ft (1,858 sq. metres), or facilities employing 50 or more workers

5

List as of August, 2010

TRANSPORTATION + LOGISTICSSECTOR PROFILE

11

Source: Conway Data

Company

Company's Products/

Services

Category

Square Foot

(thousands)

Capital

Investment ($M)

Year Lease

Yokogawa Canada Inc. Energy Processing New 25 - 2008 -

AVAD, LLC Home Electronics New 21 - 2008 -

Steels Industrial Products Construction Materials New - $7 2008 -

Shoppers Drug Mart Retail distribution New - $11 2007 -

Celtic Project Services

Hazardous Materials

Storage

New - $7 2007 -

Cargill Foods Foods - - $26 2004 -

Canadian Tire

Distribution Centre

Addition

- - $14 2004 -

Grand & Toy Distribution New - $7 2004 -

Supply Chain Management /

Metrus

Distribution - $5 2004 -

FedEx Corp. Distribution New - $3 2004 -

Mhpm Project Managers Ltd. Distribution Centres New - $3 2004 -

Consolidated Fast Freight Warehousing - $2 2004 -

Quix-x Warehouse New - $2 2004 -

Canadian Tire Tire distribution New 500 - 2001 -

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

12

CALGARY’S ADVANTAGES DRIVE INVESTMENT

Calgary offers excellent multi-modal infrastructure and the fastest access to markets in Western Canada.

In 2010, the City of Calgary approved a budget of $8.5 billion for transportation infrastructure investment.

6

Alberta Transportation invested $1.9 billion for the provincial highway network, including $904 million for

continued construction of the Calgary and Edmonton ring roads. There are more than 370,000 registered

commercial vehicles in Alberta carrying goods within the province, between provinces and internationally.

Alberta’s transportation infrastructure provides access to booming markets in northern Alberta, as well as

Western Canada, the United States and offshore through the Asia-Pacific Gateway and Corridor.

Companies looking for a site for a supply chain logistics hub find that Calgary offers:

■ Access to the decision-making centre of the energy industry, Calgary has more corporate headquarters for

the energy sector than any other Canadian city.

■ The closest proximity to markets in Western Canada: a market of 50 million people is accessible by ground

transportation within 24 hours. Direct and connecting flights from Calgary International Airport (YYC) connect

Calgary to practically every destination around the globe within 48 hours.

■ Highway distribution access in all directions: Calgary is conveniently located at the intersection of the

Canamex Corridor (a “smart corridor” connecting Mexico, the U.S., Canada and Alaska) and the Trans-Canada

Highway (the world’s longest national highway, stretching east-west 7,770 kilometers (4,800 miles).

■ Access to two Class 1 Railroads (Canadian Pacific Railway and Canadian National), serving every major city

in North America.

The availability of serviced land, availability of a highly skilled labour force, and low taxes/operating costs, also

make the Calgary Region an attractive location for operations.

6

City of Calgary, Transportation Business Plans and Budgets

TRANSPORTATION + LOGISTICSSECTOR PROFILE

13

Here are a few things that companies are saying about why they invested in Calgary:

Table 2 Why Companies are Investing in Calgary – Selected Firms

Company Why they are investing in Calgary

Trucking

Mullen Group

Headquartered in Okotoks, south of Calgary, Mullen operates truckload, less-

than-truckload general freight and dry bulk hauling throughout Canada, the

U.S. and Mexico. Mullen also provides logistics, trans-load and intermodal

services in Western Canada. Mullen has annual revenues of about $1.3

billion and a total staff of 5,000 employees, of which about 500 are located

in the Calgary area.

As a supplier to the energy industry, it makes

sense to be in Calgary, one of the world’s leading

energy cities. Mullen is located in the nearby town

of Okotoks because of its close proximity to Calgary

and the low cost of land for its terminal facilities

and offices.

CF Managing Movement

CFMM (formerly Canadian Freightways) is headquartered in Calgary and

offers less-than-truckload general freight, dedicated customer-specific

transportation services, on and off-road trucking for the petroleum industry,

and full truckload van and flat-deck trailer movements. It is part of the

TransForce Group of Companies, which has total annual revenues of about

$2.0 billion. There are 2,500 employees in the overall organization, of which

250 are based in Calgary. CFMM operates terminals located in Calgary and

throughout Western Canada and the US.

Calgary is important to the company as an origin-

destination point as well as a trans-load centre for

points throughout Western Canada. Calgary offers

CFMM a central location for operations in Western

Canada. CFMM is located in a new facility in

southeast Calgary where it has good transportation

access and is close to its customers and suppliers.

Supply Chain Management

Calgary is home to one of three major operations centres for SCM. SCM

provides regional warehousing and distribution support for Walmart stores.

The Calgary operation accounts for one-third of its total business and

serves Walmart’s retail operations across Western Canada. The Calgary

facility handles centralized warehousing and distribution for an area that

extends from Vancouver to Winnipeg. There are 1,000 employees in the

SCM Calgary operation.

The availability and cost of land factor heavily for

SCM in selecting a site for a regional distribution

warehouse. SCM selected its Calgary location

because of land availability and proximity to transit

and other transportation services related to its

operation. U.S. access to the warehouse facility was

also important, as was Calgary’s population base.

3

rd

Party Logistics Providers

Unicity Integrated Logistics

Unicity is a subsidiary of Livingston International, a leading North American

provider of customs, transportation and logistics services. A third-party

logistics provider, the company offers full service logistics support for

Maytag and high-speed cross-dock product handling for other customers.

Headquartered outside the region, Unicity maintains a compliment of over

3,000 workers at over 125 boarder points, seaports and other strategic

locations across Canada and the US.

Transportation access, taxes and utility costs

all factor heavily into the company’s investment

decisions. Unicity selected its present Calgary

location because of its proximity to a rail spur,

the availability of suitable land and the needs of

its customers.

Matrix Logistics Services Ltd.

Matrix, the main logistics provider for Shoppers Drug Mart, employs 300

people in Western Canada, 95 per cent of which are situated in the Calgary

area. Calgary is the principal hub for its retail customers in Western Canada,

extending from Victoria to Winnipeg.

Proximity to markets and available labour supply

factor into Matrix’s decisions to select sites for

operations. Calgary is central to one of its biggest

markets, offers good transportation access, and is in

close proximity to its suppliers and carriers. Calgary

also offers a large workforce to meet their warehouse

needs.

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

14

Company Why they are investing in Calgary

International Freight Forwarders

Schenker of Canada Limited

Schenker of Canada is an international freight forwarder and customs broker,

offering third-party logistics support to its clients. It is the Canadian arm

of Schenker Worldwide, the world’s largest international freight forwarder,

with over 50,000 employees. Schenker’s Calgary operation offers a variety

of services related to the oil and gas industry, including project-related

international freight movements. Sixty per cent of its freight movements are

with Asia, 30 per cent are with the U.S. and 10 per cent are with Europe.

Schenker selected its present location in northeast

Calgary in order to be close to its client base and a full

range of transportation services including Calgary’s

international airport and Canada Customs.

Tim Hortons Inc.

Fast food restaurant giant, Tim Hortons, has approximately 3,100 retail

outlets across Canada and the U.S. and employs over 90,000 workers.

Calgary is home to the company’s second-largest distribution centre serving

Alberta, Saskatchewan and Manitoba.

Tim Horton’s distribution centre is located in southeast

Calgary. The company selected Calgary because of

its central location. Availability and costs of land and

utilities, as well as taxes, also factor heavily into the

company’s site selection decisions.

Retail

Sears Canada Inc.

Calgary is home to one of three national distribution centres for Sears, a

retailer of a broad range of consumer goods and services through a chain of

department stores and catalogue facilities. The Calgary distribution centre

is situated next to CP Rail’s intermodal facility and serves all of Western

Canada. The Canadian operation employs 35,000 people, 400 of which are

located in the Calgary distribution centre.

Sears situated its western distribution centre in Calgary

because of its central geographic location, combined

with a need to be close to rail. Calgary’s proximity to

markets and transportation access factored into the

decision to operate in Calgary.

Totem Building Supplies Ltd,

Totem Building Supplies is a division of the Rona home improvement

chain. Calgary serves as both the head office and distribution centre

location for Totem. The company has retail outlets in centres across

Alberta, employing 800 workers.

The availability and costs of land and labour factored

into Totem’s decisions for selecting a site for its

distribution centre operations in Calgary.

Synnex Canada Limited

A major distributor of computers, computer parts and consumer electronics,

Synnex has over 700 employees in Canada. The company selected Calgary

as its warehouse location to serve the prairie provinces.

Synnex selected Calgary because of its proximity

to markets and because of a need to be close to a

carrier hub to ensure next day service.

Wholesale

Lafarge Canada Inc.

Lafarge is headquartered in Paris, France, and has operations in some 76

countries, employs 80,000 workers worldwide, and has annual revenues

of over 20 billion Euro. Lafarge’s Calgary office serves as the headquarters

for Western North America. While Lafarge’s markets are worldwide, the

Calgary office administers manufacturing and sales throughout Western

North America.

Demand for the company’s cement, concrete

aggregates, asphalt, and other products in Western

Canada exceeds its manufacturing capacity, resulting

in a need to import product from its plants in Asia.

Calgary offers a supply of transportation providers,

such as CP Rail and Mullen Trucking, that are needed

to support the company’s batch plants located close

to major transportation arteries.

TRANSPORTATION + LOGISTICSSECTOR PROFILE

15

MAJOR HEADQUARTERS IN CALGARY

Calgary is home to corporate headquarters of 114 of the largest companies in Canada. As one of the world’s

leading energy cities, Calgary is the decisionmaking centre for Alberta’s growing energy sector. Several of these

firms have major transportation and logistics operations in Calgary.

Table 3 Major Headquarters in Calgary

Company Revenue 2009 ($M)

Largest Energy Firms Based in Calgary

Petro-Canada $27,585

Suncor Energy Inc. $25,036

Imperial Oil Limited $21,292

Husky Energy Inc. $15,074

Encana Corporation $12,681

Enbridge Inc. $12,466

Major Firms in Calgary’s Transportation and Logistics Sector

Safeway Canada Limited $6,697

Canadian Pacific Railway Limited $4,303

WestJet Airlines Ltd. $2,281

Superior Plus Corp

(propane distribution, specialty chemicals, & construction products distribution)

$2,247

UFA Co-operative Limited

(farm supply stores and petroleum and fuel outlets providing farm, ranch, home and business

products and services)

$1,604

The Forzani Group

(largest national sporting goods retailer in Canada)

$1,358

Rocky Mountain Dealerships Inc.

(independent dealer of construction and agricultural equipment)

$556

Cervus Equipment Corporation

(retailer of agricultural and construction equipment)

$377

Calgary Airport Authority $246

Source: FP 800

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

16

CLOSE PROXIMITY TO MARKETS

A Proven Location

Affordable and ideally located, Calgary is particularly well-suited for distributing agricultural, energy, and

manufactured goods to elsewhere in Canada, the United States and the world. It is a unique re- distribution

point for manufactured goods coming from outside Alberta to other North American markets. Calgary provides

ready access to the U.S. by road, rail and air. Calgary also provides access to the rapidly growing markets

in Asia by air and through its partnership with the Port of Vancouver. Calgary is seen by many companies in

Europe as a gateway to North America. Shipments from Calgary can reach most major U.S. cities by air in less

than four hours and by truck in less than 36 hours.

A Central Location

Calgary is strategically located at the heart of Western Canada. A market of over 50 million consumers can be

reached within a 24-hour travel radius from Calgary by truck. Calgary is the ideal central location for placing

a distribution centre for businesses that depend on rapid distribution of goods to Western Canada and other

major North American markets.

Figure 2 Calgary is Central to Western North America

Source: RDA Global and Google Maps

TRANSPORTATION + LOGISTICSSECTOR PROFILE

17

Table 4 Distances to Western Canada Population Centres

City Distance

2009 Population

(in thousands)

Population Growth 2001

- 2009

Calgary 0 km 1,230 26%

Edmonton 298 km 1,155 20%

Vancouver 975 km 2,328 12%

Saskatoon 623 km 257 11%

Regina 763 km 210 7%

Winnipeg 1325 km 742 8%

Total – Western Provinces N/A 10,380* 12%

Source: Statistics Canada; RDA Global analysis - total is for all of British Columbia, Alberta, Saskatchewan, and Manitoba, not just for the cities listed in this table.

Table 5 Transit Times to North American Cities

City Drive Time Flight Time

Edmonton, Alberta 3 h 45 m

Regina, Saskatchewan 8 h 1 h 11 m

Vancouver, British Columbia 11 h 1 h 15 m

Seattle, Washington 12 h 1 h 10 m

Winnipeg, Manitoba 14 h 2 h 10 m

Denver, Colorado 14 h 30 m 2 h 23 m

Salt Lake City, Utah 15 h 1 h 46 m

Thunder Bay, Ontario 21 h 2 h 50 m

San Francisco, California 22 h 2 h 44 m

Phoenix, Arizona 25 h 3 h 15 m

Chicago, Illinois 26 h 3 h 30 m

Los Angeles, California 27 h 3 h

Dallas, Texas 32 h 3 h 40 m

Toronto, Ontario 35 h 4 h 10 m

Ottawa/Gatineau, Ontario/Quebec 36 h 3 h 50 m

Montreal, Quebec 38 h 4 h

Houston, Texas 36 h 4 h 15 m

Mexico City, Mexico 47 h 7 h 20 m

Guadalajara, Mexico 45 h 6 h 45 m

Source: Statistics Canada, U.S. Census Bureau, The Calgary Advantage, Proximity One, GGA Management Consultants

Western Canada is comprised of the provinces of British Columbia, Alberta, Saskatchewan and Manitoba,

and has a population of over 10 million people in 2010, up 12 per cent from 2001. A distribution centre

located in Calgary will benefit from the closest proximity to growing markets in Western Canada.

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

18

CALGARY’S DISTRIBUTION COST ADVANTAGE

Locating a distribution centre in Calgary lowers shipping costs. Compared to other markets in Western Canada,

Calgary offers the lowest shipping costs to Western Canada and major U.S. markets.

Table 6 Benchmark Index of Shipping Costs from Cities and Towns in Western Canada

Source: UPS Worldwide Shipping Prices (www.ups.com); Shipping costs based on lowest cost to ship a 5 lb. parcel, November, 2010. Average Shipping Cost

based on selected North American shipping destinations including major U.S. destinations: New York City, Los Angeles, Chicago, Miami, Philadelphia, Dallas–Fort

Worth, Boston, Houston, Atlanta, Phoenix, Seattle, Minneapolis–Saint Paul, Denver, Portland (OR) and major Western Canada Destinations: Vancouver, Calgary,

Edmonton, Winnipeg, Abbotsford (BC), Saskatoon, and Regina.

TRANSPORTATION + LOGISTICSSECTOR PROFILE

19

In addition, Calgary-based businesses benefit from Alberta’s low tax regime. Alberta has, by far, the lowest fuel

tax of any Canadian province at only $0.19 per litre, as well as the lowest total tax bill per litre after including

federal and other taxes. Alberta also benefits from a low aircraft fuel tax of $0.15 per litre.

Table 7 Taxes per Litre by Province

Province

Gasoline Price Per Litre

(March 2010)

Gasoline Taxes Total Tax Bill

Tax Portion

of Final Price

British Columbia $ 0.707 $0.380 $0.434 38.0%

Alberta $ 0.693 $0.190 $0.234 25.3%

Saskatchewan $ 0.715 $0.250 $0.298 29.4%

Manitoba $ 0.719 $0.215 $0.262 26.7%

Ontario $ 0.707 $0.247 $0.371 34.4%

Quebec $ 0.701 $0.252 $0.375 34.8%

New Brunswick $ 0.695 $0.207 $0.324 31.8%

Nova Scotia $ 0.692 $0.255 $0.378 35.3%

Prince Edward Island $ 0.732 $0.258 $0.308 29.6%

Newfoundland and

Labrador

$ 0.731 $0.265 $0.394 35.0%

Canada $ 0.709 $0.252 $0.338 32.3%

Source: http://www.taxpayer.com/sites/default/files/GTHC_May2010.pdf

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

20

LAND AVAILABILITY AND COSTS

Industrial Real Estate Market

Calgary’s industrial real estate market offers a cost advantage for firms looking for available warehouse and

industrial space in Western Canada. As of October 2010, Calgary has the second largest inventory of industrial

real estate in Western Canada with over 115 million square feet of inventory. Industrial leasing costs in Calgary,

at $7.55 per square foot, are 11 per cent lower than Edmonton and five per cent lower than Vancouver.

Average lease and sale prices for industrial real estate in Calgary are lower than Vancouver.

Table 8 Industrial and Residential Real Estate Markets, Major Cities in Western Canada

Calgary also offers an affordable and high quality of life. The average home price in Calgary at $401,000 is

41 per cent lower than average home prices in Vancouver.

Vancouver Calgary Edmonton Winnipeg Source

Industrial Market

Availability 8.6% 5.0% 6.8% 4.2% CBRE Q3 2010

Lease ($ psf) $7.97 $7.55 $8.52 $6.18 CBRE Q3 2010

Inventory SF (millions) 170.8 115.4 96.8 76.0 CRBE Q3 2010

Asking Sale Price ($ psf) $169.00 $160.00 $125.75 $54.63 CRBE Q2 2010

Residential Market

Avg. Home Sale Price $679,381 $401,080 $325,060 $222,598 CREA (Sept 2010)

Avg. Rent 2 Bedroom Apt. $1,169 $1,090 $1,015 $835 CMHC Q3 2010

Source: RDA Global Analysis

TRANSPORTATION + LOGISTICSSECTOR PROFILE

21

LAND COSTS

Calgary’s stellar economic performance in the mid-2000s drove up land costs as demand for industrial real

estate outpaced supply. Land transactions have slowed since the peak in 2008 and prices have stabilized.

Land prices for serviced land are hovering around $750,000 per acre, whereas limited service land averages

$300,000 per acre.

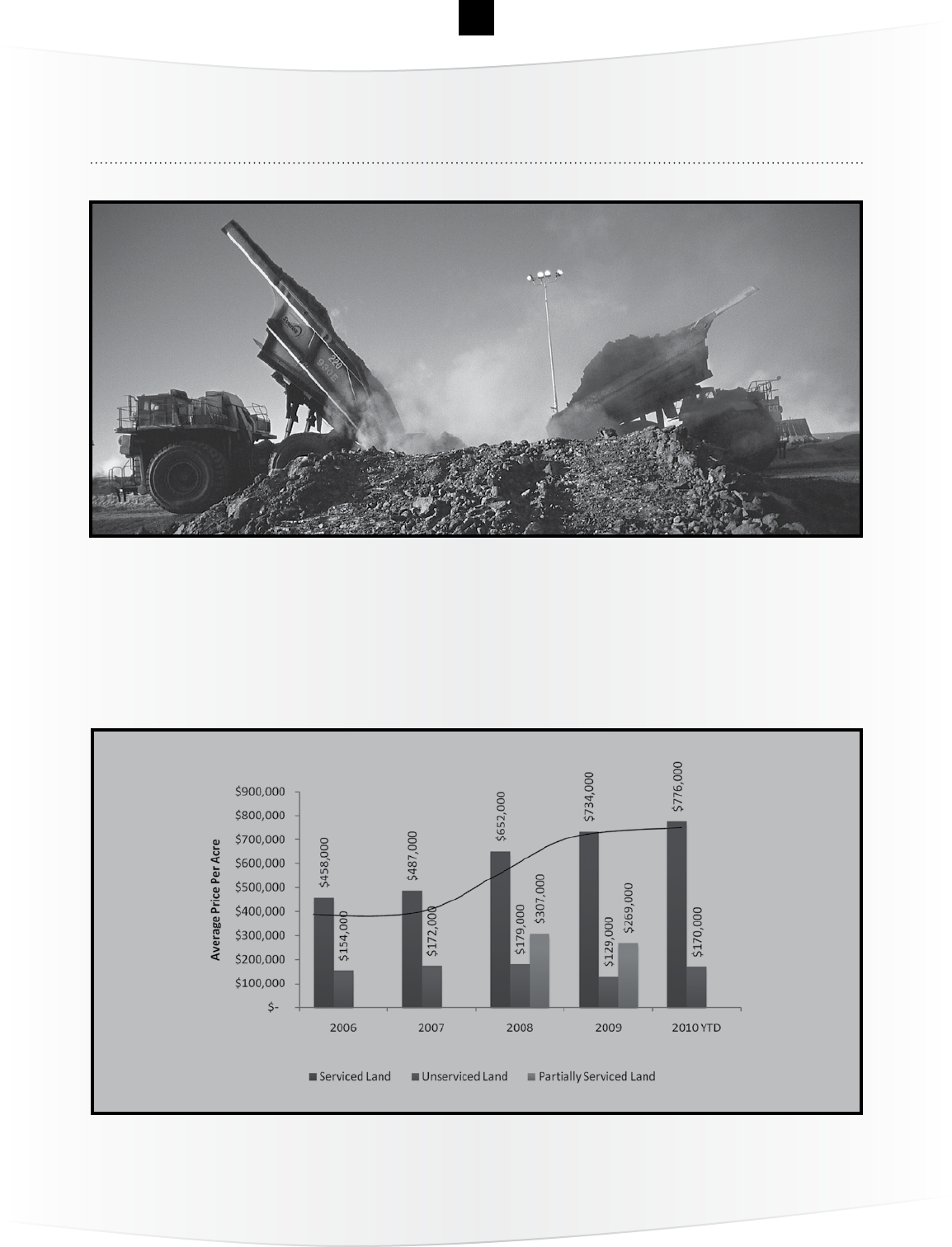

Figure 3 Average Price per Acre of Calgary Industrial Land

Source: Avison Young Calgary Industrial Market Report, Spring 2010

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

22

CITY OF CALGARY LAND AVAILABILITY

The City of Calgary offers nearly 12 thousand hectares of land supply including 907 hectares of immediate

land supply, 725 hectares of short-term land supply and 1,815 hectares of long term land supply.

Table 9 Summary of Land Area by Supply Category and Industrial Area (2007, Hectares)

* Gravel extraction lands have been removed from long term supply in Northwest Industrial Area (714 hectares)

Source: City of Calgary, Industrial Area Growth 2007

Industrial Area

Developed/

Unavailable

Immediate Land

Supply

Short Term Land

Supply

Long Term Land

Supply

Total

North/Northeast 2563 682 213 989 4447

Southeast 3905 147 512 637 5201

Central 1444 13 0 0 1456

Northwest 616 66 0 188 870*

Total 8528 907 725 1815 11974

TRANSPORTATION + LOGISTICSSECTOR PROFILE

23

INDUSTRIAL REGIONS IN CALGARY

There are three major industrial regions in Calgary: Northeast, South Central and Southeast. Within these three

major regions there are 46 individual local industrial regions. Industrial regions in Calgary are located in areas

with access to rail, road, and air transportation.

Figure 4 Map of Industrial Regions in Calgary

Source: RDA Global and Google Maps

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

24

Average leasing rates are similar across Calgary’s three main industrial regions with South Central representing slightly

higher prices per square foot. For large spaces over 75,000 square feet, lease rates per square are below $6 per

square foot.

Figure 5 Average Asking Lease Rates – Calgary Industrial Regions

Source: CRBE Calgary Industrial Market View, Q3 2010

A variety of business and industrial parks are located throughout Calgary, located in each of the three major

Calgary industrial regions. A few notable industrial parks include:

Aurora Business Park

Aurora Business Park is being developed on one of the last large lots of land that is both immediately near

Calgary International Airport and of suitable quality for a business campus. This improvement was initially

proposed in 1981, and has been undertaken in order to meet the city council’s continued strategy of

influencing traffic away from the downtown area and creating suburban employment centres so that residents

may live near where they work. The Aurora Business Campus will be completed over a 20-25 year period.

Westwinds Business Park

Westwinds Business park is located near the McKnight/Westwind C-Train Station and houses facilities for

Shaw Cable and various other businesses.

Great Plains Industrial Park

The Great Plains Industrial Park is nestled in the centre of Calgary’s southeastern industrial centre, with quick

access to Deerfoot Trail and many other industrial sites. The Great Plains Industrial Park is zoned I-G for

general light industrial use.

Dufferin Industrial Park

Located in the southeastern industrial centre on Canadian Pacific Railways lines, the Dufferin Industrial Park

is zoned for medium industrial use and will provide a good location for logistical and distribution centres that

require heavy rail use. Dufferin’s Phase 1 lots will be available in 2012.

TRANSPORTATION + LOGISTICSSECTOR PROFILE

25

WATER AND WASTEWATER AVAILABILITY

The City of Calgary water and wastewater systems provide service throughout the city’s jurisdiction and some

communities located near Calgary enjoy the advantage of being connected to the City of Calgary systems. City

of Calgary water rates are low at about 69 cents per cubic meter of water used. For effluent meter customers, a

similar rate is charged.

Table 10 City of Calgary Water Rates

Water Service Usage Rate Fees for the City of Calgary

Some of the communities surrounding Calgary that also offer water and wastewater services include:

Usage Rate ($ per cubic metre of water used) 2009 2010 2011

Usage rate per month $0.6622 $0.6881 $0.7225

■ Airdrie

■ The M.D. of Bighorn (services provided

by the Town of Canmore)

■ Black Diamond

■ Canmore

■ Chestermere (services provided by the

City of Calgary)

■ Cochrane (wastewater services provided by

the City of Calgary)

■ Crossfield

■ High River (Treated water also serves areas outside

the municipal boundaries, including Aldersyde,

Cargill, Compton Petroleum and the Saddlebrook

Industrial Park, all of which have their own water

licenses)

■ Nanton / Mosquito Creek

■ Okotoks

■ Redwood Meadows

■ Strathmore

■ Tsuu T’ina Nation (services provided by the

City of Calgary)

■ Turner Valley

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

26

LABOUR SUPPLY, SKILLS, AND WAGE RATES

Calgary has a young, dynamic workforce. With 1.2 million residents, the city has the youngest population in

Canada with an average age of 36, and has the highest net interprovincial migration in Canada. Calgarians are

confident, hard-working, entrepreneurial and well-educated.

In the last decade, Calgary has been the place where the jobs are and, it follows, that jobs attract people.

The province of Alberta experiences an average quarterly interprovincial in-migration of over 21,200 people

each quarter. Calgary experiences a net interprovincial migration of about 6,500 people per quarter. Between

2004 and 2009, an average of 8,000 temporary foreign workers entered Calgary each year. As of 2009,

Calgary was home to over 13,700 internationals who have become permanent residents.

Over the past decade, employment in Calgary has increased by an impressive 35 per cent. Growth in

employment in Calgary has outpaced all major metropolitan areas in Canada as well as all metropolitan areas

in Western Canada. As of 2009, there were nearly 700,000 workers employed in Calgary region, including

over 40,000 workers employed in Calgary’s transportation and warehousing industry and over 97,000 workers

in wholesale and retail trade.

Figure 6

Employment growth in Selected

Canadian Metro Areas, 1999 - 2009

Figure 7 Calgary Employment in

Trade and Transportation/Warehousing

Source: Statistics Canada

TRANSPORTATION + LOGISTICSSECTOR PROFILE

27

A WORKFORCE STRATEGY FOR ALBERTA’S SUPPLY

CHAIN LOGISTICS INDUSTRY

Maintaining a supply of skilled and available workers to meet the needs of the transportation and logistics

sector is a top priority for Calgary. Growth in Calgary’s supply of skilled workers is maintained by an ecosystem

of industry stakeholders and educational institutions that have developed an effective strategy to support

ongoing growth of the supply chain logistics industry workforce in Alberta. The strategy framework,

A Workforce Strategy for Alberta’s Supply Chain Logistics Industry

8

, outlines the key action plan that is being

implemented. The strategy is organized following four major themes.

INFORM

The Inform theme outlines action plans to improve access to information to support informed decision-making

on the part of employers, workers, youth entering the workforce and individuals considering employment in

this sector.

ATTRACT

The Attract theme relates to attracting workers from outside Alberta to meet some of the demand for labour in

Alberta’s supply chain logistics sector.

DEVELOP A HIGH PERFORMANCE WORKFORCE & WORK ENVIRONMENT

This theme relates to building the capacity of Alberta’s supply chain logistics workforce to support a transition

to a more value-added and knowledge-based economy. It also outlines actions to develop high performance

work environments in Alberta’s supply chain logistics sector. Examples include improving workplaces and work

arrangements, increasing capital investment and technology adoption and improving business processes.

RETAIN

The Retain theme outlines action plans to enhance the attractiveness of working in Alberta’s supply chain

logistics sector so that workers – including mature workers, immigrants, Aboriginal people and those who may

experience difficulty maintaining employment – continue to work in the industry.

8

Alberta Employment and Immigration, Supply Chain Strategy

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

28

CALGARY’S OCCUPATIONAL LABOUR SUPPLY

Calgary’s investment in education has produced a diverse and highly skilled labour force across a variety of

occupations that are critical to the growth of the transportation and logistics sector.

Table 11 Labour Force in Calgary, Alberta, and Canada, Selected Occupations, 2006

Occupation Calgary* Alberta Canada

Total labour force 676,520 1,942,820 17,146,135

A Management occupations 74,525 187,240 1,631,725

A1 Specialist managers 22,440 47,570 423,015

B4 Clerical supervisors 3,920 9,920 93,065

B415 Supervisors, recording, distributing and scheduling occupations 1,370 3,175 26,500

B5 Clerical occupations 68,940 182,400 1,640,020

B513 Records management and filing clerks 1,770 3,735 30,075

B541 Administrative clerks 5,665 14,175 105,840

B553 Customer service, information and related clerks 7,655 18,350 205,150

B561 Mail, postal and related clerks 1,380 3,860 37,850

B562 Letter carriers 1,035 2,670 29,320

B563 Couriers, messengers and door-to-door distributors 1,360 3,115 29,825

B571 Shippers and receivers 4,945 13,215 122,715

B573 Production clerks 1,310 2,680 25,105

B574 Purchasing and inventory clerks 2,650 6,220 51,545

B575 Dispatchers and radio operators 1,200 4,105 33,955

B576 Transportation route and crew schedulers 260 570 5,240

G Sales and service occupations 152,605 438,105 4,037,725

G111 Sales representatives, wholesale trade (non-technical) 6,575 15,790 152,700

G121 Technical sales specialists, wholesale trade 3,080 7,080 56,990

G133 Retail and wholesale buyers 865 2,125 22,570

G7 Occupations in travel and accommodation, including attendants in

recreation and sport

7,645 16,770 143,595

G711 Travel counsellors 1,205 2,670 28,580

G712 Pursers and flight attendants 1,485 1,810 11,700

G713 Airline sales and service agents 1,090 1,575 12,940

G714 Ticket agents, cargo service representatives and related clerks

(except airline)

190 310 4,385

H4 Mechanics 11,470 46,025 377,035

TRANSPORTATION + LOGISTICSSECTOR PROFILE

29

H414 Railway carmen/women 175 485 3,355

H415 Aircraft mechanics and aircraft inspectors 1,035 1,895 15,690

H421 Automotive service technicians, truck and bus mechanics and

mechanical repairers

3,995 16,160 149,995

H7 Transportation equipment operators and related workers, excluding

labourers

18,675 69,775 561,365

H711 Truck drivers 8,640 42,395 304,890

H712 Bus drivers and subway and other transit operators 3,380 9,615 78,590

H714 Delivery and courier service drivers 3,550 9,415 101,700

H721 Railway and yard locomotive engineers 175 650 4,580

H722 Railway conductors and brakemen/women 160 825 5,050

H737 Air transport ramp attendants 555 835 7,695

H8 Trades helpers, construction and transportation labourers and

related occupations

15,935 48,090 402,130

H812 Material handlers 7,880 20,050 182,645

H822 Other trades helpers and labourers 500 2,335 10,320

J3 Labourers in processing, manufacturing and utilities 5,270 16,375 266,640

*Figures for Calgary include the nearby communities of Okotoks and Canmore. Source: 2006 Census, Statistics Canada, Listing by National Occupational

Classification (NOC).

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

30

CALGARY’S EDUCATIONAL ASSETS

Calgary has a highly educated population — 73 per

cent of Calgarians have attended a post-secondary

education institution and over 53 per cent have

attained a degree or certificate beyond a high school

diploma. Calgary is home to five major public post-

secondary institutions and several private colleges

including the University of Calgary (29,000 students

enrolled), Mount Royal University (13,000 students

enrolled), SAIT Polytechnic (14,000 students

enrolled), Bow Valley College and DeVry Institute of

Technology.

The University of Calgary

The University of Calgary is a comprehensive research institution that provides a dynamic setting for scholars

in 14 faculties, with over 100 academic programs and more than 30 research institutes and centres. Over

140,000 alumni have graduated from U of C during its 44 year history. There are over 29,000 students

enrolled in undergraduate, graduate and professional degree programs. The U of C has an academic staff of

nearly 1,800 professors and lecturers and a total staff of over 4,900. The university granted 5,888 degrees in

2009-2010. Notable alumni include Stephen Harper, Prime Minister of Canada. The university has consistently

been ranked in the top-ten universities in Canada by Macleans (Ranked 7th), HEEACT (Ranked 7th), U.S.

News and World Reports Top Canadian Universities (Ranked 9th), and Re$earch Infosource, Inc. (Ranked 9th).

According to the Beyond Grey Pinstripes business school ranking, University of Calgary’s Haskayne School

of Business has one of the best MBA programs, ranking 25 in the world in terms of teaching social and

environmental stewardship. In addition, Haskayne is ranked by the Financial Times (London) as having one of

the best Executive MBA programs, ranking in the top-50 in the world, and first in Canada for career progress.

In 2009-2010, the Haskayne School of Business granted 563 degrees. There are over 10,000 alumni of the

Haskayne School of Business currently residing in Calgary.

Haskayne offers programs within 18 concentrations including three degree programs related to transportation

and logistics management:

■ Students choosing a Supply Chain Management Concentration will be prepared to manage materials and

information across an entire supply chain. They will focus on issues such as transportation systems and

planning, service operations management and project management. SCMA has gained significant recognition

as organizations see tremendous advantages through collaborative management of the whole supply chain

rather than each link in the chain acting in isolation.

TRANSPORTATION + LOGISTICSSECTOR PROFILE

31

■ The International Business Concentration at the Haskayne School of Business prepares students with

the cultural, economic and linguistic background required to work effectively in the variety of environments

encountered by the international business person. International courses can serve as preparation for a career

in international business or they can serve as a basis for further education in fields such as international law.

■ Operations Management is central to any organization, overseeing all activities directly related to making

a product or providing a service. Graduates with a concentration in OPMA understand the design and

implementation of systems for planning, controlling, and continuously improving operations and can apply

analytical aids in managerial decision-making.

Many graduates of these programs go on to attain professional designations such as P.Log, CITT and CITP.

CITT (www.citt.ca)

The CITT Designation continues to be Canada’s most respected and widely held professional designation in the

supply chain and logistics field. It’s an essential tool to develop and differentiate your level of professionalism

in the industry. Senior managers in the field agree that the professionals who’ve met the requirements for the

CITT Designation have the necessary foundations for a successful career in the industry.

CITP (www.fitt.ca)

The Certified International Trade Professional is the only professional trade designation of its kind, and is

earned by completing courses and meeting standards and requirements set by FITT, Canada’s international

trade training and professional certification authority.

P.Log (www.loginstitute.ca)

The P.Log., which stands for Professional Logistician, certifies competencies in logistics and supply chain

management. The P.Log. designation provides a comprehensive approach to logistics and the supply chain.

Students learn the roles, responsibilities, tasks and competencies required by logistics managers to make

executive decisions in a global marketplace.

In addition to the degree programs at the Haskayne School of Business, the university offers a program in

Transportation Studies, which includes multidisciplinary courses in transportation systems analysis, decision

support systems for transportation planning, transportation economics, transportation policy and related courses.

University of Calgary

2500 University Drive NW

Calgary, Alberta, Canada T2N 1N4

Phone: (403) 220-5110

www.ucalgary.ca

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

32

SAIT Polytechnic

SAIT Polytechnic offers more than 70 applied degree, diploma,

and certificate programs. SAIT offers instruction to over 65,000

learners per year, including corporate training and special

programs. SAIT is internationally renowned for its quality

technical education and hands-on training. SAIT offers seven full-

time programs within its School of Transportation. These include:

■ Aircraft Maintenance Engineers Technology (AMT)

■ Aircraft Structures Technician (ACST)

■ Automotive Service Technology (AST)

■ Avionics Technology (AXT)

■ Business Administration - Automotive Management (AMG)

■ Diesel Equipment Technician (DET)

■ Railway Conductor (RRCD)

In addition, SAIT offers an apprenticeship as an Automotive Service Technician.

Rail Training Facilities

The SAIT Centre for Rail Training and Technology is a partnership with industry, including Canadian Pacific

Railway, that boasts state-of-the-art learning facilities including a locomotive simulation lab with an adjacent

simulator observation room, a mechanical lab, engineering service lab (for training in maintenance-of-way

signals and communications, bridges, and structures), as well as traditional classrooms.

Air Transit Training Facilities

SAIT’s Art Smith Aero Centre for Training and Technology is a $22 million state of the art education and training

facility, located at the Calgary International Airport. The facility is 9,848 square metres (106,0000 sq. ft.) with

11 classrooms and 13 specialty labs on two levels surrounding a 2,000- sq metre (21,528 sq. ft.) hangar with a

13-metre (43 ft) high ceiling. The centre trains highly-skilled workers in aircraft maintenance, avionics, aircraft

structures and gas turbine overhaul. This education training facility is expanding the training SAIT offers to include

heavy maintenance for large aircraft, a type of training not available at other colleges in Canada. SAIT is the first

post-secondary institution in Canada to provide a training facility which includes a hangar for large aircraft.

SAIT Polytechnic

1301 – 16 Avenue NW

Calgary, Alberta, Canada T2M OL4

Phone: (403) 284-SAIT (7248)

www.sait.ab.ca

TRANSPORTATION + LOGISTICSSECTOR PROFILE

33

Mount Royal University

Over 13,000 students are enrolled in one of more than 60 of Mount Royal’s degree, diploma, and certificate

programs. In 2008-2009 Mount Royal granted 698 degrees, diplomas, and certificates.

The university employs a staff of over 2,300 including 334 full-time instructors, 520 part-time instructors

and 490 continuing education instructors. The employment rate of Mount Royal students is 94 per cent.

The Bissett School of Business offers Bachelor of Business Administration with minor concentration in Supply

Chain Management. The program equips students with expertise in:

■ Logistics

■ Distribution

■ Strategic sourcing

■ Procurement

■ Transportation

■ Inventory management

Upon graduation from the program, students are prepared to earn the following designations:

■ Supply Chain Management Professional (SCMP) (www.pmac.ca)

■ Canadian Institute of Traffic and Transportation (CITT) (www.citt.ca)

■ Certified Professional Logistician (P.Log.) (www.loginstitute.ca)

The university also offers customized Corporate Training Services for over 50 topical areas including several

topics related to transportation and logistics such as:

■ Data Analysis for Decision Making

■ Project Management

■ Supply Chain Management

Clients within the transporation and logistics sector who participate in the Corporate Training Services classes

include Canadian Pacific Railway, WestJet, ATCO Group Ltd. and others.

Mount Royal University

4825 Richard Road SW

Calgary, Alberta, Canada T3E 6K6

Phone: (403) 440-6611

www.mtroyal.ca

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

34

Bow Valley College

Bow Valley College is a workforce preparation and development

institution from which over 4,000 students graduated in 2008-2009.

Bow Valley College provides business and management training to many

employees who support Calgary’s transportation and logistics Sector.

The college serves over 10,000 learners per year across Canada.

Bow Valley College

332 – 6 Avenue SE

Calgary, Alberta, Canada T2G 4S6

Phone: (403) 410-1400

www.bowvalleycollege.ca

DeVry Institute of Technology

DeVry Institute of Technology offers bachelor’s degree and diploma programs that combine the best of today’s

business skills with current technical applications. DeVry Calgary is the only DeVry institution in Canada and

graduated 130 students in 2008-2009. DeVry Calgary is conveniently located east of downtown Calgary near the

intersection of Memorial Drive and Barlow Trail, with easy access to the Franklin C-Train Station.

DeVry Institute of Technology Calgary

2700 – 3 Avenue SE

Calgary, Alberta, Canada T2A 7W4

Phone: (403) 235-3450

http://www.devry.ca

TRANSPORTATION + LOGISTICSSECTOR PROFILE

35

LABOUR COSTS

Unionization and Workers’ Compensation Board Rates

Alberta’s unionization rate is the lowest in Canada. The overall unionization rate in Alberta is 24.8 per cent, with

the bulk of unionized workers employed in public administration, education and health. Unionization in Alberta’s

private sector is low at 12.25 per cent. Notably, Alberta’s unionization rate is considerably lower than other

provinces in Western Canada including British Columbia (29 per cent), Saskatchewan (36 per cent),

and Manitoba (37 per cent).

The Alberta Workers’ Compensation Board (WCB) has taken major steps over the past several years to improve

operations and reduce accident claims. Alberta’s 2010 estimated rate of $1.32 per $100 of insurable earnings

is the lowest of all provinces.

Figure 9 Percentage of Workforce Covered

Under Collective Bargaining Agreements

2009, by Province

Figure 10 Workers’ Compensation Board

Premiums 2010, by Province

Source: Alberta Economic Development Facts and Figures

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

36

WAGE RATES

Within the transportation and logistics sector, wages in Calgary are similar to the Canadian average.

For transportation equipment operators, the average wage in Alberta was $22 per hour in April, 2010, slightly

above the national average of about $20 per hour. Wage rates for transportation equipment operators in

Western Canada range from a low of $18 per hour (Manitoba) to a high of $24 per hour (British Columbia).

Table 12 Median Hourly Wage for Transportation Equipment Operators by Province,

April 2010

Province Median Wage

Canada $ 19.83

Newfoundland and Labrador $ 17.00

Prince Edward Island $ 16.35

Nova Scotia $ 17.35

New Brunswick $ 17.10

Quebec $ 18.00

Ontario $ 19.00

Manitoba $ 18.00

Saskatchewan $ 20.51

Alberta $ 22.00

British Columbia $ 24.00

Source: Statistics Canada

TRANSPORTATION + LOGISTICSSECTOR PROFILE

37

CALGARY WAGES FOR KEY OCCUPATIONS

IN THE TRANSPORTATION + LOGISTICS SECTOR

Median wages for key occupations in Calgary’s transportation and logistics sector are outlined below.

Table 13 Median Wages in Calgary: Median Starting Wage and Overall Median Wage, 2009

Occupation Median Starting Wage Overall Median Wage

Clerical supervisors

Supervisors, Recording, Distributing and Scheduling Occupations $20.60 $24.81

Clerical occupations

Customs, Ship and Other Brokers $17.21 $25.30

Records Management and Filing Clerks $19.27 $26.68

Administrative Clerks $19.10 $21.35

Customer Service, Information and Related Clerks $15.00 $18.19

Couriers, Messengers and Door-to-Door Distributors $15.38 $15.38

Shippers and Receivers $14.90 $17.00

Production Clerks $20.00 $24.98

Purchasing and Inventory Clerks $19.23 $23.11

Dispatchers and Radio Operators $21.69 $27.54

Transportation Route and Crew Schedulers $19.10 $20.20

Sales and service occupations

Sales Representatives, Wholesale Trade (Non-Technical) $20.51 $26.44

Retail Salespersons and Sales Clerks $11.03 $12.65

Mechanics

Aircraft Mechanics and Aircraft Inspectors $17.50 $28.08

Automotive Service Technicians, Truck and Bus Mechanics and

Mechanical Repairers

$27.00 $31.00

Transportation equipment operators and related workers,

excluding labourers

Truck Drivers $18.00 $21.08

Bus Drivers and Subway and Other Transit Operators $21.46 $25.43

Delivery and Courier Service Drivers $17.00 $18.00

Air Transport Ramp Attendants $15.02 $16.64

Trades helpers, construction and transportation labourers and

related occupations

Railway and Motor Transport Labourers $15.00 $16.00

Labourers in processing, manufacturing and utilities

Other Labourers in Processing, Manufacturing and Utilities $14.00 $18.33

Source: Alberta Wage and Salary Survey 2009

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

38

PRODUCTIVITY

Innovation and a well-educated workforce have driven high levels of productivity in Alberta. Alberta has the highest

productivity of all Canadian provinces, with a GDP per capita of nearly $81,000. Productivity (GDP per hour

worked) in the province was $47.79 in 2008 and manufacturing productivity was $59.17.

Table 14 Measures of Productivity (2008)

Source: Alberta Economic Development

Productivity Alberta Program

9

Although Alberta has maintained high levels of productivity in terms of Gross Domestic Product (GDP), the

productivity growth rate over the past 10 years has been lower than the U.S., the rest of the provinces and

most countries in the European Union. In order to improve the state of productivity in Alberta, the government

is in the process of investigating, experimenting with and implementing various policies and initiatives to

help businesses improve their productivity and global competitiveness. Productivity Alberta is a government

Province

Total Productivity

(GDP/Hour Worked)

Manufacturing Productivity

(GDP/Hour Worked)

Total Economic Productivity

(GDP per capita)

Canada $41.01 $49.10 $48,011

Alberta $47.79 $59.17 $80,997

Newfoundland and Labrador $47.15 $24.56 $61,758

Saskatchewan $41.84 $51.86 $62,656

Ontario $41.65 $54.21 $45,440

Quebec $39.09 $45.79 $38,979

British Columbia $38.28 $42.34 $45,150

Manitoba $36.12 $36.15 $42,147

Nova Scotia $33.58 $32.88 $36,503

New Brunswick $32.23 $30.88 $36,635

Prince Edward Island $30.66 $25.96 $33,159

9

http://www.productivityalberta.ca/

TRANSPORTATION + LOGISTICSSECTOR PROFILE

39

program designed to facilitate this process by coordinating the Province’s intellectual and human resources to

meet Alberta’s productivity challenges head on. Some of Productivity Alberta’s goals include:

■ Improving awareness about the importance of productivity

■ Filling gaps in leadership and management capability

■ Improving production processes

■ Increasing investment in new equipment and technology

The strategy for improvement is focused on making Productivity Alberta the central source for the following

three core business improvement offerings.

TOOLS

One of the primary tools currently being utilized by businesses is a productivity assessment tool that allows

companies to identify areas where value is being added, uncover opportunities to eliminate waste, and connect

to other relevant tools, services, and resources. Productivity Alberta also maintains a large searchable online

inventory of programs, tools and services that are available to assist businesses in improving productivity.

SERVICES

The Productivity Improvement Services maintained by Productivity Alberta include a wide range of process

improvement services and education. A team of professional industrial engineers representing decades of

manufacturing and process experience, work with organizations all over Alberta to help realize productivity

gains. The services offered include:

■ On-site process improvement assessments

■ Value stream mapping

■ Seminars and workshops

■ Productivity Improvement Implementation

RESOURCES

Connections are available via seminars, conferences, events, and links through the website to many of the

industry organizations, post-secondary institutions, government services and programs, and global productivity

centres that exist to assist companies with improving the state of their business. Productivity Alberta is

partnered with the Government of Alberta, Calgary Economic Development, Edmonton Economic Development

Corporation, and The Association for Manufacturing Excellence.

Productivity Alberta

5th floor, Commerce Place, 10155 - 102 Street NW, Edmonton, AB T5J 4L6

Tel: +1 780 427 6648

Fax: +1 780 422 2091

E-mail productivity.alberta@gov.ab.ca

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

40

WORLD CLASS TRANSPORTATION INFRASTRUCTURE

Air Transportation

Calgary is home to Canada’s third-busiest airport, Calgary International Airport (YYC) and Canada’s 12th

busiest airport, Calgary Springbank Airport (YBW), the relief airport for YYC. It is also home to Canada’s

second-largest airline carrier, Westjet, and is a growing hub for international air logistics, for firms like UPS.

Table 15 Total Aircraft Movements, 2009

Source: Statistics Canada

Airport Total Aircraft Movements National Rank

Top 5 National Airports

Toronto/Lester B Pearson International 407,724 1

Vancouver International 313,984 2

Calgary International 233,145 3

Montréal/Pierre Elliott Trudeau International 211,999 4

Montréal/St-Hubert 199,045 5

Other Major Western Canada Airports

Victoria International 166,615 8

Calgary/Springbank 143,523 12

Winnipeg/James Armstrong Richardson International 134,242 13

Edmonton International 126,775 15

Winnipeg/St. Andrews 109,756 18

Saskatoon/John G. Diefenbaker International 93,083 22

Edmonton City Centre 71,620 26

Edmonton/Villeneuve 64,792 29

Regina International 64,111 30

Fort McMurray 62,231 31

Vancouver Harbour 54,741 32

Yellowknife 52,367 33

TRANSPORTATION + LOGISTICSSECTOR PROFILE

41

WestJet

Source: WestJet Route Map

WestJet was founded in Calgary in 1996, where it still maintains its headquarters and central hub of operations.

Since its beginnings, the company has expanded rapidly to employ over 7,800 “WestJetters”, fly an average

of 419 flights daily with a fleet of 91 aircraft, and produce 2009 passenger revenues in excess of $2 billion.

The company was structured around the low cost carrier models pioneered by Southwest Airlines and Morris Air.

As a primary air carrier at Calgary International Airport and the second largest domestic carrier in Canada

(next to Air Canada), WestJet provides flights to over 70 locations in 13 countries and direct flights to

39 destinations from Calgary. WestJet’s share of the domestic airline market has increased from seven

per cent in 2000 up to 38 per cent in 2009.

Calgary International Airport (YYC)

“Over the last decade YYC has solidly established itself as a major transportation and logistics hub in North America,

making it a strategic location where cargo and passenger airlines can develop a strong link with their customers in

Western Canada and around the globe.”

– Stephan Poirier, Vice President and Chief Commercial Officer , YYC

The Calgary International Airport is one of the fastest growing cargo airports in Canada and enjoys a strategic

location in Western Canada providing a single hub location that specializes in receiving, transferring, storing,

and distributing air, rail and highway cargo both domestically and internationally. As Canada’s third-busiest

airport with over 233,000 annual aircraft movements, Calgary International Airport (YYC) is an important

component of the Canadian civil air transportation system. YYC has the highest number of passengers per

capita of any airport in Canada. It is the fourth-busiest airport for international flights to and from Canada and

cargo can be shipped from Calgary International Airport to anywhere in the world within 48 hours.

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

42

Table 16 Calgary International Airport Key Stats

Source: Calgary Airport Authority

The Calgary Airport Authority operates facilities with a replacement value of approximately $1.5 billion.

Two major projects dominate the Calgary Airport Authority infrastructure investment program for 2010-2014.

Combined, these two investments total over $1.8 billion and illustrate Calgary’s commitment to responsible

investing. Both projects will be completed by 2014-2015. They include:

1. A fourth Runway System for YYC ($500 million):

■ 4,267 m (14,000 ft.)

■ Parallel to existing runway (16R/34L)

■ Code ‘F’ capable (A380)

■ Noise contour and electronic zoning protection in place

■ In-service 2014

2. International Facilities Terminal & Apron at YYC ($1.3 billion):

■ Expanding Alberta’s premier international gateway

■ Dedicated International/Transborder Concourse

■ 120,000 square metres

■ 20 aircraft gates

■ In-service 2015

Facility Information Calgary International Airport (YYC)

Total Land Area 2,081 hectares

Terminal Building 158,000 sq. metres

Loading Bridges 32

Runways

Three Runways*: 16-34 3,864 m; 10-28

2,438 m; and 07-25 1,890 m

Business Volumes

Enplaned and Deplaned Passangers 12.2 million

Commercial Aircraft Movements 196,000

Cargo Tonnage 134,000 million tonnes

Commercial Land Under Lease 316 hectares

Third Party Industrial Space 409,000 sq. metres

TRANSPORTATION + LOGISTICSSECTOR PROFILE

43

Calgary Springbank Airport (YBW)

Springbank is Canada’s 12th busiest airport with over 143,000 annual aircraft movements. Operated and

maintained by the Calgary Airport Authority, the Springbank Airport is a Canada Customs-designated airport

of entry located 10 kilometres west of Calgary just off the Trans-Canada Highway in the Municipal District of

Rocky View No. 44. It occupies about 420 hectares (1,040 acres) and is the gateway to the Canadian Rockies

and conveniently close to the towns of Cochrane and Bragg Creek.

Rated by Transportation Canada as a Local Commercial (Satellite) Sub Class V airport, Springbank Airport is a

reliever to the Calgary International Airport. It is also a base for private and commercial light aircraft operations

including pilot training, charter services and recreational flying. Airport tenants provide onsite services for fuel

sales, flight training, aircraft maintenance, aircraft parking and hangar storage.

Activities at Springbank Airport include:

■ Light jet traffic (restricted to “Chapter 3” jets, which have newer generation engines that are quieter than

those on older jets)

■ Private and corporate aviation (for both fixed and rotary wing)

■ Aircraft Maintenance

■ Fixed Base Operations

■ Flight Training – for both fixed wing (airplanes) and rotary wing (helicopters)

Calgary Springbank Airport operates two runways: 07-25 (1,043 m) and 16-34 (1,524 m). The Springbank

master plan calls for development of a third runway as early as 2019.

The majority of the aviation activity at the airport is associated with flight training, which accounts for about

80 per cent of total aircraft movements at Springbank Airport. Calgary’s favourable economic climate has led

to a significant increase in recreational flying at the airport and the Calgary Airport Authority has developed

a 10-year master plan to expand and upgrade the airport’s facilities and services to serve a wider segment of

the aviation sector.

In terms of overall general aviation runway capacity in the Calgary region, there is a healthy surplus. A 2006

regional airport study suggests that, exclusive of Calgary International Airport, there is an estimated capacity of

970,000 annual aircraft movements given the current number of airports and associated runways. The current

surplus is estimated to be in the range of 725,000.

International Reach

Calgary International Airport is Canada’s 4th busiest airport for international flights with over 47,000

international flights annually. This includes over 7,000 international flights to locations other than the United

States. This includes regular direct-flight service to Japan, China, The United Kingdom, Germany, France,

the Netherlands, Ireland, Mexico, Cuba, Morocco, Jordan, and others globally.

MOVING CALGARYCALGARY ECONOMIC DEVELOPMENT

44

Table 17 Total International Aircraft Movements, August 2009 – August 2010

Source: Statistics Canada

YYC Air Cargo Capacity & Trade Parks

In addition to a modern terminal, Calgary International Airport has award-winning, first-class cargo facilities

and services for any needs, including a premier livestock handling facility, on-airport refrigeration facilities,

and 24/7 operations with no curfew.

Air cargo tonnage more than doubled at YYC from 66,000 tonnes in 1999 to a peak of 134,000 tonnes in

2007

11

. Today, YYC generates more than $6 billion of annual economic activity, accounting for approximately

10 per cent of Calgary’s gross domestic product. More than 15,000 people work on airport land.

Five trade parks on airport land promote and support economic development and enhance businesses’ ability

to reach over 50 million people within one day’s travel by truck. Calgary is the only Canadian city with 24/7 air

cargo services to Asia and Europe. While air cargo facilities have expanded considerably to meet demand,

the airport continues to have the land, resources, and commitment to add facilities as business grows.

11

Cargo tonnage declined to about 111,000 tonnes in 2009 during the global recessionary period

Airport

Total International

Flights

Trans-Boarder

(Canada-U.S.)

All Other

International

Canada Total 594,469 464,944 129,525

Top Five International Airports

1. Toronto/Lester B Pearson International 224,541 173,318 51,223

2. Montréal/Pierre Elliott Trudeau International 93,331 69,035 24,296

3. Vancouver International 72,042 54,596 17,446

4. Calgary International 47,756 40,661 7,095

5. Ottawa/Macdonald-Cartier International 26,177 23,233 2,944