Consumer Account Bill Payments and

Transfers Agreement

Last updated: 6/27/2024

This agreement with Chase is available in Spanish as a courtesy. If there is any difference in

meaning between the Spanish and English versions of this agreement or any related

documents we provide you, either now or in the future, the English version is the official

document and will prevail. Please consult with a translator if you have any questions.

We suggest you read this document carefully and print a copy for your reference. You may

refer back to it at any time by accessing the "Agreements & disclosures" tab within the

website. To print the Bill Payment and Transfers & Other Services Agreement, select File from

the menu bar and then select Print. Finally, select OK in the Print Setup box.

TABLE OF CONTENTS

General Terms

1. Payments and Transfers

1.1 General Terms Applicable to Payments and Transfers

1.2 Transfers

1.3 Payment Services

2. ADDITIONAL TERMS APPLICABLE ONLY TO PAYMENTS AND TRANSFERS FOR CONSUMER

ACCOUNTS

2.1 Your Liability for Unauthorized Transfers or Payments

2.2 Our Liability for Failure to Complete Payments and Transfers

2.3 Errors and Questions about Payments and Transfers

3. Our Guarantees

3.1 The Online and Mobile Banking Guarantee – Only for Online and Mobile Payments

and Transfers (for Consumer Deposit Accounts Only)

3.2 The Bill Pay Guarantee – for Online and Mobile Bill Payments and for Online and

Mobile Payments to a Chase Loan or Credit Account made from a Chase checking

account

4. ADDITIONAL TERMS APPLICABLE ONLY TO PAYMENTS AND TRANSFERS FOR BUSINESS

ACCOUNTS

4.1 Linking Multiple Accounts – Business and Consumer

4.2 Liability for Unauthorized Transfers or Payments for Business Deposit Accounts Only

4.3 Errors and Questions about Payments and Transfers for Business Deposit Accounts

Only

5. OTHER SERVICES

5.1 Terms Applicable to Your Use of the Real-Time Payments Service

General Terms

NOTE: If you are a Chase prepaid account holder, some products and services may not be

available to you via the Online Service.

This Bill Payment and Transfers Agreement ("Addendum") supplements the Online Service

Agreement ("Initial Agreement") to which you agreed at your initial logon to the Online

Service, and amends and becomes a part of the Initial Agreement. The terms of the Initial

Agreement are hereby ratified, affirmed and incorporated herein, and shall continue to apply

in all respects, as amended hereby. Any capitalized term used but not defined herein shall be

given the meaning ascribed thereto in the Initial Agreement. In the event of any conflict

between the terms of the Initial Agreement and this Addendum, the terms of this Addendum

shall be controlling. All references hereinafter to the term "Agreement" shall mean the Initial

Agreement as modified by this Addendum.

1. Payments and Transfers

1.1 General Terms Applicable to Payments and Transfers

You may use the Online Service to make one-time or repeating payments to companies,

merchants, individuals or Chase Loans or Credit Accounts, or to transfer funds between your

eligible accounts held by us or between an eligible account held by us and an External

Account ("Payments and Transfers"). When you use, or allow another to use, the Online

Service to send instructions to us to make payments or transfers through the Online Service

you agree to the following terms and conditions set forth in this Addendum. You agree that

you will not use this service for International ACH Transactions, which are prohibited under

this Addendum. You also agree that once a Payment or Transfer has been designated with a

status of "Sent" or "Completed", you cannot cancel that Payment or Transfer.

All of your payments and transfers made through Payment and Transfers will appear on the

statement for your respective accounts. Certain payments or transfers available through the

Online Service may be subject to terms and conditions in agreements separate from this

Addendum that apply to such other services including, but not limited to, the online wire

transfer service; payroll and tax payment services, and the Zelle® Service. Please refer to the

agreements and documentation that you receive for those services for that information.

Note: Any transfer made from any of your savings accounts by using the Online Service is a

restricted transfer subject to certain limitations. Please refer to our Deposit Account

Agreement or other terms and conditions governing your account for full details. Additionally,

External Transfers made from any line of credit account will be treated as an advance on such

line of credit, and in addition to accruing interest under the terms of your line of credit

agreement, will also be subject to all other terms and limitations on advances thereunder.

You agree to update your email address if it changes, and maintain a working email address

on your online profile at all times you use the Online Service. You agree to be bound by and

comply with such other written requirements as we may furnish to you in connection with

your deposit accounts, credit card accounts, and other products that may be accessed via

Payments and Transfers, including without limitation, your Deposit Account Agreement,

Cardmember agreement, or other terms and conditions governing your account, credit card,

mortgage, auto, installment loan, or line of credit agreements. In the event of a conflict

between the terms applicable to the Payments and Transfers section of this Addendum and

such other agreements, these Payments and Transfers terms and conditions shall control.

Note: Not all accounts are eligible for Payments and Transfers. We reserve the right to limit

eligibility to certain types of accounts and to change such eligibility from time to time. We also

reserve the right to restrict categories of recipients to whom Payments and Transfers may be

made in our sole discretion.

A. Definitions

As used in this Addendum, the following terms have the meaning set forth below.

"Business Day" refers to Monday through Friday, excluding federal holidays. For

purposes of transfers to or from Investment Accounts via Internal Transfers, "Business

Day" also excludes Good Friday.

•

"Cancelled" means when a payment or transfer will neither be processed nor sent for

any reason;

•

"Chase Loan or Credit Account" means one of our credit or loan accounts (including, but

not limited to, a mortgage, auto or student loan or credit card) held in your name that

has been added as a Payee;

•

"Current Day" refers to payments or transfers from an account held by us that are

scheduled with a present day Send On date; or the next Business Day if scheduled after

the Cutoff Time;

•

"Cutoff Time" means the time by which we must receive Instructions to have them

considered entered on that particular Business Day. See the paragraph entitled "Cutoff

Times" for additional details;

•

"Deliver By date" means the date you would like your payment or transfer delivered to

your intended recipient (i.e., your Payee or your To Account); this may or may not be the

date your payment will be posted by your Payee;

•

"Delivery Method" means the way your payment is transmitted (i.e., either electronically

or via check);

•

"Draft" means checks, or other negotiable instruments or items prepared by us or our

agents and issued pursuant to your Instructions under Bill Pay;

•

"External Account" means checking and savings accounts held by institutions other than

us and registered for External Transfers. The account holder of the External Account

must be the same individual or business entity as the account holder of the deposit or

prepaid account, or line of credit, mortgage, installment loan or auto account who is

authorized to access the Online Service;

•

"External Transfers" means the portion of Payments and Transfers that allows you to

issue Instructions to us for payments or transfers, as applicable, to or from accounts not

held by us;

•

"From Account" means an eligible account from which a transfer is being requested by

you through Payments and Transfers;

•

"Funded" means when a payment amount has been withdrawn from the available

balance or available credit of your Pay From account or when an amount to be

•

transferred has been withdrawn from (or in the case of a line of credit, charged against)

the available balance of your From Account;

"Funding Failed" means when a payment or transfer will not be delivered after multiple

unsuccessful attempts have been made to withdraw funds from the appropriate Pay

From account or From Account on consecutive Business Days or when the financial

institution holding your External Account notifies us that your attempted transfer from

your External Account could not be completed;

•

"Funds Needed" means when an Instruction made through Payments and Transfers is

not processed because the respective Pay From account or From Account had

insufficient funds or available credit to complete the transaction after an attempt to

withdraw the funds;

•

"Future Dated" means Instructions that are not scheduled to begin processing on the

current Business Day; only Business Days may be selected for Future Dated payments

and transfers;

•

"Instructions" means the information provided by you to us for a bill payment or

transfer to be delivered to the Payee, Chase Loan or Credit Account or To Account (such

as, but not limited to, Payee or To Account name, account number, and Deliver By date);

•

"Internal Transfers" means the portion of Payments and Transfers that allows you to

issue Instructions to us for payments and transfers, as applicable, between two eligible

accounts held by us;

•

"Investment Account(s)" means certain non-FDIC insured investment products and

services offered by JPMorgan Chase Bank, N.A. and its affiliates, which may include

bank-managed accounts and custody, as part of its trust and fiduciary services, as well

as brokerage and advisory accounts offered through J.P. Morgan Securities LLC;

•

“Paid” means a payment made via paper check has been completed because the check

has been presented to Chase for payment.

•

"Payee" means the merchant or other person or entity to whom you designate a

payment to be directed;

•

"Pay From account" means an eligible deposit or prepaid account you maintain with us

from which payments will be made;

•

“Payment Amount” refers to the Service Transfer Amount plus any fees payable by you

to us in conjunction with the applicable Service Transfer;

•

"Payment date" means the date you would like your payment sent, including payment

to your Chase Loan or Credit Account;

•

"Pending" means any Instruction that you have requested to be made that has not

started to process and has not been Cancelled by you;

•

“Person” means a natural person or a business, government, or nonprofit entity;•

"Primary Account" means the checking or prepaid account, if eligible, you designate for

paying any potential monthly service-fees;

•

“Processed” means an electronic payment has been sent to the payee; however, since

electronic payees do not provide us with confirmation of receipt or processing of

electronic payments, you need to contact payee directly for confirmation

•

“Real-Time Payments Service” refers to a service that allows you to send or receive

payments to other Persons;

•

"Real-Time Payments Service for Vendors and Employees" refers to a type of Real-Time

Payments Service that allows you to send payments to your vendors and/or employees,

•

but only if you have a Business Account and are enrolled in ACH Payments Services. For

clarity, Real-Time Payments Service for Vendors and Employees is a “Real-Time

Payments Service,” as defined and used herein, except as expressly referenced

separately by name in the Fees section under “Terms Applicable to Your Use of the Real-

Time Payments Service";

“Real-Time Transfer System” refers to the real-time transfer system that is accessed

through the Real-Time Payments Service;

•

“Receiver” refers to a Person that receives a payment through the Real-Time Payments

Service;

•

“Receiver Addressing Information” refers to addressing information of the Receiver,

which may include the Receiver’s account number, routing number, telephone number,

and/or email address, as applicable;

•

“Receiving Financial Institution” refers to us, when you are the Receiver, and the

Receiver’s financial institution, when you are the Sender;

•

"Recurring" or “Repeating” means automatic recurring bill payments or transfers to the

same Payee or To Account, respectively, for the same amount (or varying amount, in the

case of variable automatic bill payments) which you can authorize for transmission;

•

"Send On date" means the date we will begin the delivery process or the date we will

send a request to withdraw funds from your External Account, and begin the delivery

process. The Send On date may or may not be the date funds are withdrawn from your

Pay From account.

•

“Sender” refers to a Person that sends a payment through the Real-Time Payments

Service;

•

“Sending Financial Institution” refers to us, which you are the Sender, and means the

financial institution that holds the Sender’s account, when you are the Receiver;

•

“Sent” means the status of a Payment or Transfer where the funds have been debited

from the applicable account, but which Payment or Transfer has not yet been posted to

the account;

•

“Service Participant” refers to a financial institution that participates in the Real-Time

Payments System, which includes JPMC;

•

“Service Transfer” refers to a payment from a Sender to a Receiver through the Real-

Time Payments Service;

•

“Service Transfer Amount” refers to the amount of funds that the Sender directs the

Sending Financial Institution to transfer to the Receiver;

•

"To Account" means, the account to which a transfer is being requested by you via

Payments and Transfers Service;

•

"Transfer date" means the date we will begin the delivery process for transfers made via

the Internal Transfer Service, or the External Transfer Service, this is the date the

transfer request will be sent;

•

"Transfers" means, collectively, Internal and External Transfers.•

B. Disclosure of Account Information to Third Parties

We may disclose information to third parties about your account or the bill payments and

transfers you make:

as necessary to complete transactions.1.

in connection with the investigation of any claim you initiate.2.

to comply with government agency or court orders.3.

in accordance with your written permission.4.

as otherwise permitted by the terms of our privacy policy.5.

Our privacy policy, which includes details about our information sharing practices and your

right to opt-out of certain information sharing was provided to you when you opened your

account. It can be viewed by clicking on the "Privacy" link on any of our website pages.

C. Cutoff Times

(i) Cutoff Times to schedule Payments and Transfers are as follows in Eastern Standard Time

("ET"):

Transfers to or from Chase deposit accounts:

11:00 PM on any Business Day for Internal Transfers•

8:00 PM on any Business Day for External Transfers•

Transfers from Chase line of credit accounts:

11:59 PM any day for Internal Transfers to a Chase checking or prepaid account•

8:00 PM on any Business Day for External Transfers•

Payments to Chase mortgage loans:

7:30 PM on any Business Day for payments from a Chase checking or prepaid account•

8:00 PM on any Business Day for payments from a non-Chase checking account•

Payments to Chase commercial term lending mortgage loans:

8:00 PM ET on any Business Day for payments from a Chase checking or prepaid

account

•

8:00 PM ET on any Business Day for payments from a non-Chase checking account•

Payments to Chase home equity or personal loan or line of credit accounts:

11:59 PM on any day for payments from a Chase checking or prepaid account, with the

exception of Future Dated payments, which can be made by 11:59 PM on any Business

Day.

•

8:00 PM on any Business Day for payments from a non-Chase checking account•

Payments to Chase auto loan or lease accounts:

11:00 PM on any Business Day for payments from a Chase checking or prepaid account•

8:00 PM on any Business Day for payments from a non-Chase checking account•

Bill Payments to non-Chase accounts (excluding payments made using a Chase credit card):

For Bill Payments with a Send On date falling on a Business Day, 8:00 PM ET on that

Send On date

•

Transfers to or from Investment Accounts:

4:30 PM on any Business Day for initiating a Current Day Transfer to Investment

Accounts

•

4:15 PM on any Business Day for initiating a Current Day Transfer from Investment

Accounts

•

(ii) Cutoff Times to Cancel Payments and Transfers are as follows in Eastern Standard Time

("ET"):

Payments to a Chase home equity or personal loan or line of credit account:

8:00 PM for same day payments from a Chase deposit or prepaid account, if the

payment was scheduled prior to 8:00 PM

•

11:00 PM for same day payments from a Chase deposit or prepaid account, if the

payment was scheduled after 8:00 PM

•

8:00 PM on the Bill Payment date for Future Dated payments from a Chase deposit or

prepaid account or a non-Chase checking account

•

Payments to Chase mortgage loans:

7:30 PM on any Business Day for payments from a Chase checking or prepaid account•

8:00 PM on any Business Day for payments from a non-Chase checking account•

Payments to Chase commercial term lending mortgage loans:

8:00 PM ET on any Business Day for payments from a Chase checking or prepaid

account

•

8:00 PM ET on any Business Day for payments from a non-Chase checking account•

Payments to Chase auto loan or lease accounts:

11:00 PM on any Business Day for payments from a Chase checking or prepaid account•

8:00 PM on any Business Day for payments from a non-Chase checking account•

Bill Payments to non-Chase accounts (excluding payments made using a Chase credit card):

Automatic and future-dated Bill Payments must be canceled before 10:00 AM ET on the

day that Bill Payment is to be processed

•

For all other Bill Payments with a Send On date falling on a Business Day, 8:00 PM ET on

that Send On date

•

Transfers to or from Chase deposit accounts:

11:00 PM on any Business Day for Future Dated Internal Transfers, except as provided

below. Once you initiate a same day Internal Transfer, you have no ability to stop or

cancel such Transfer.

•

8:00 PM on any Business Day for External Transfers•

Transfers from Chase line of credit accounts:

11:59 PM any day for Internal Transfers to a Chase checking or prepaid account. Once

you initiate a same day Internal Transfer, you have no ability to stop or cancel such

Transfer.

•

8:00 PM on any Business Day for External Transfers•

If you wish to Cancel a Bill Payment or Transfer, you should cancel your transaction online.

All Cutoff Times referenced in this Addendum reflect the times displayed on our internal

system clocks and may not necessarily be synchronized with the internal clock displayed on

your computer or mobile device. For this reason, we suggest that you transmit any

Instructions to us sufficiently in advance of such Cutoff Times to eliminate the possibility of

missing the cutoff. If you enter Instructions after the Cutoff Time with a Send On date that is

the Current Day or next Business Day, we may initiate the Transfer process immediately,

which means the Transfer may be Funded prior to the requested Send On date.

Notwithstanding the foregoing, for Investment Accounts, Sections 1.2(B)(iv) and 1.2(C)(iv) also

apply.

D. Service Fees

Unless otherwise noted in your account agreement, we do not charge a monthly service fee

for Payments or Transfers. If we process a payment or transfer in accordance with your

Instructions that overdraws your account or exceeds your Chase credit card limit, we may

assess a fee or charge interest in accordance with the terms of your Deposit Account

Agreement, Cardmember agreement, or other applicable agreement. We are not responsible

for any payment or transfer request if there isn’t enough money in the designated Pay From

or From Account or if the payment request exceeds your credit card limit.

E. Recurring Payments and Transfers

Recurring payments and transfers that are for the same fixed amount each month will be

sent on the specified calendar day, or on the following Business Day if the regular Send On

date falls on a non-Business Day (for payments) or on the prior Business Day if the regular

Transfer date falls on a non-Business Day (for transfers). Repeating payments and transfers

will be deducted from your Pay From account or From Account, or charged to your Chase

credit card, on the Send On date or Transfer date, as applicable. In order to authorize a

Recurring payment or transfer, you agree to have means to print a copy of your authorization

for your records. If you do not have a printer, you agree to continue to authorize a Recurring

transaction on a transaction-by- transaction basis until you have means of printing a copy of

your authorization for your records.

If you wish to cancel a Recurring payment or transfer, you should cancel your transaction

online. Future Dated or Recurring Internal Transfers may be Cancelled before 11:59 p.m. ET

the Business Day before the Send On date or Transfer date. Future dated Payments to Chase

Loan or Credit Accounts may be Cancelled until the Cutoff Time on the Payment date. If you

order us to stop a Recurring payment or transfer three (3) Business Days or more before the

Send On date or Transfer date, and we do not do so, we will be liable to you for those losses

or damages as provided by law. If for any reason you cannot access the Online Service, you

may also call or write online customer service at the phone number or address set forth in

the paragraph entitled "Your Liability for Unauthorized Transfers or Payments". If you call, we

may also require you to present your request in writing within fourteen (14) days after you

call. Repeating transfers are not available for Investment transfers.

Some Chase Loan and Credit Accounts will allow you to set up automatic payments.

Automatic payments differ from Recurring payments in that automatic payments are

triggered based on the associated billing date and the payment amount may vary each

month. Terms and conditions for automatic payments to Chase Loan and Credit Accounts will

be presented to you at the time you set up the payments.

For Investment Accounts, you can establish a Recurring incoming Transfer instruction only;

outgoing Transfers must be entered individually. To cancel or modify an existing transfer

request, you must contact Investment Services at 1-800-392-5749.

1.2 Transfers

A. General Terms Applicable to Transfers

You authorize us to charge your designated From Account for all transfers of funds that you

initiate and you agree to have sufficient funds or available credit in your From Account on the

Transfer date for each such transfer you schedule. Except with regard to certain Transfers to

and from Investment Accounts, if there are insufficient available funds, including funds in any

linked account used for Overdraft Protection, (or available credit) to cover a Current Day

transfer, we will not retry the transaction and the transfer will be immediately rejected.

In the case of Future Dated transfers (excluding Autosave Transfers), if sufficient funds are

not in your account (inclusive of any funds in a linked account used for Overdraft Protection)

on the Transfer date, we will automatically try to debit your account up to two (2) more times

on each of the three (3) succeeding Business Days. For these attempts, a status of “Funds

Needed” will appear online. After the final attempt, the transfer request will be Cancelled. A

status of “Funding Failed” will appear online. We will send a message advising you of each

failed attempt to transfer from your From Account.

For Investment Accounts, you can set a future Transfer date even if there are insufficient

funds in the Investment Account. On the Transfer date, any available funds will be

transferred,even if the amount is below the requested Transfer, which will mean that the

cash balance in the Investment Account will be zero ($0). You will be notified if your available

cash balance is below your Transfer amount. If your account has a zero ($0) balance as of the

Transfer date, the Transfer will be rejected.

B. Internal Transfers

Internal Transfers can be used to transfer funds between your eligible accounts held by us, or

to make a payment from an eligible account held by us to a Chase Loan or Credit Account. To

make Internal Transfers, you must have at least two eligible accounts with us between which

you may transfer money. Notwithstanding the foregoing, the eligible accounts from which a

payment can be made to a Chase Loan or Credit Account do not include a Chase home equity

line of credit or other line of credit account. We reserve the right to determine eligibility and

to restrict categories of recipients to whom Internal Transfers may be made in our sole

discretion.

Transfer Limits: To protect your account, we place a daily dollar limit on Internal

Transfers sent to or from your eligible Chase accounts, even if your available balance is

higher than the daily limit. However, we may allow transactions that exceed your limits

or temporarily reduce your limits without notice, for security purposes. We may refuse

to process any transaction that exceeds the applicable limits or to protect the security of

your account or the transfer system. You may make Internal Transfers up to (A) your

available balance plus any amount in your overdraft protection account; or (B) your

credit limit, to the extent applicable. If you have selected a home equity line of credit

secured by Texas homestead property as your From Account, the minimum allowed

through Transfers is $4,000.00, to the extent eligible. Current Day Internal Transfer

Instructions begin to process immediately and cannot be Cancelled. If your From

Account is a Chase home equity line of credit, to the extent eligible, you may make

Internal Transfers up to a maximum amount of (A) $200,000 daily; or (B) $500,000 daily,

if you are a Private Banking customer.

1.

Transfers between eligible deposit and prepaid accounts held by us: Current Day

transfers between eligible deposit and prepaid accounts held by us that are made

before the Cutoff Time will be processed immediately and the transferred funds will be

available the same day to cover all transfers. Funds transferred to deposit or prepaid

accounts held by us and made after the Cutoff Time on the Current Day or on a non-

Business Day will be available for immediate cash withdrawal at ATMs and for online

payments and transfers; however the funds will not be available to cover other

payments such as paper checks until the next Business Day. Repeating transfers will be

paid on the same calendar day of each transfer period, or on the next Business Day if

the regular Transfer date falls on a non-Business Day. Future Dated transfers (including

Repeating transfer(s) from deposit or prepaid accounts held by us) will be deducted

from your From Account on the Transfer date.

2.

Transfers from line of credit accounts held by us: Current Day money transfers from line

of credit accounts held by us will be reflected in your account as soon as we receive the

transfer request. The minimum or maximum you will be able to withdraw via Transfers

is subject to the terms of your existing credit agreements with us. Future Dated and

Repeating transfers cannot be made from line of credit accounts with us.

3.

Transfers to or from Investment Accounts: Current Day Transfers can be made between

eligible deposit accounts or prepaid held by us and an Investment Account. NOTE: To

cancel or modify an existing transfer request, please contact Investment Services

at 1-800-392-5749.

Transfers to Investment Accounta.

4.

When Instructions are received by us at or before the Cutoff Time, funds will be

posted to, and viewable in, the Investment Account as of 5:01 PM ET on the day the

Instruction was made. These funds will be available for trading at or about 11:59

PM ET on the day they post and are viewable in the Investment Account. When

Instructions are received after the Cutoff Time, funds will be posted to, and

viewable in, the Investment Account as of 5:01 PM ET on the next Business Day

following the day the Instruction was made. These funds will be available for

trading at or about 11:59 PM ET on the day they post and are viewable in the

Investment Account. During the interim period between when the funds are

posted and are viewable and available for trading, a hold for the amount in

question will be placed on the From Account in the amount of the transfer for up

to four (4) Business days. Please note that, with Transfers to Investment

Accounts in excess of $100,000, only the first $100,000 will be immediately

available to trade.

Transfers from Investment Account

When Instructions are received at or before the Cutoff Time, funds in the

Investment Account will be immediately reduced by the amount of the Transfer

and no longer be available for withdrawal or trading. These Transfers will be

posted to, and viewable in, the To Account as of 5:01 PM ET on the day the

Instruction was made. These funds will be available in the To Account at or about

11:59 PM ET on the day they post and are viewable in the To Account. When

Instructions are received after the Cutoff Time, funds in the Investment Account

will be reduced by the amount of the transfer on the next Business Day following

the day the Instruction was made and be posted to, and viewable in, the To

Account as of 5:01 PM ET that day. The funds will be available in the To Account at

or about 11:59 PM ET on the day they post and are viewable in the To Account. For

Transfers from Investment Accounts, the Investment Account cash balance will be

immediately reduced by the amount of the Transfer and no longer be available for

withdrawal or trading, regardless of whether Instructions are received at or

before/after the Cutoff Time.

b.

Autosave Feature: You can set up automatic transfers from your checking account to

your savings account, investment account, or to other types of accounts that we may

specify from time to time.We may offer certain Autosave features which, if used by you,

give us discretion, within limits set by you, to make periodic transfers based on factors

such as your account balance and spending patterns, and you agree to regularly

monitor such transfers closely and change or cancel them as you determine necessary.

Use the Chase Mobile app or chase.com to set up, review, change or cancel your

transfers. Except as specifically set forth herein or where the law requires a different

standard, we are not liable for any errors, losses or damages in connection with any

transfer of funds or failure to transfer funds under any Autosave feature that you select,

for any reason, including system outages or defects. In particular, we will not be liable

for any interest, gains or dividends you might have earned or not earned in any account

as a result of your use of Autosave.

5.

C. External Transfers

External Transfers can be used to transfer funds between an eligible account held by us and

an External Account. To initiate External Transfers you must have at least one eligible deposit

or prepaid account, Investment Account, line of credit, mortgage, installment loan or auto

loan account with us. We reserve the right to determine eligibility and to restrict categories of

recipients to whom External Transfers may be made in our sole discretion.

Transfer Limits: To protect your account, we place a daily dollar limit on External

Transfers sent to or from your eligible Chase accounts, even if your available balance is

higher than the daily limit. However, we may allow transactions that exceed your limits

or temporarily reduce your limits without notice, for security purposes. We may refuse

to process any transaction that exceeds the applicable limits or to protect the security of

your account or the transfer system. Excluding Transfers to or from Investment

Accounts, Transfers to or from External Accounts may be made in amounts of up to the

daily maximum noted in the chart below for your applicable account segment in the

aggregate from all your combined Chase accounts, except as otherwise described in the

subsections below. To help protect you from fraud and scams, Chase dynamically

determines the limit for each External Transfer(s) based on internal Chase criteria at the

time you schedule the transfer. The maximum daily limit applicable to you will be

displayed at the time you set up the transfer and may be lower than the maximum

shown in the table below.. If your From Account is a home equity line of credit secured

by your Texas homestead, to the extent eligible, each transfer must be a minimum of

$4,000.

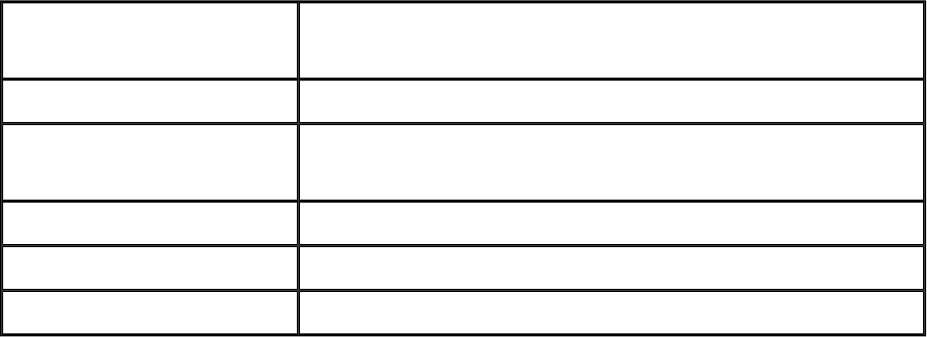

Maximum Daily Limit (all accounts in the

aggregate)

Consumer Banking

$25,000.00

Chase Sapphire

Banking

$100,000.00

Chase Private Client

$100,000.00

Private Banking

$100,000.00

Business Banking

$100,000.00

1.

If your From Account is a Chase home equity line of credit, to the extent eligible, you

may make External Transfers up to a maximum amount of (A) $200,000 daily; or (B)

$500,000 daily, if you are a Private Banking customer.

2.

Transfers between eligible deposit or prepaid deposit accounts held by us and an

External Account that we receive by the Cutoff Time on any Business Day will begin

processing on the same day. Transfers to an External Account will be deducted from

your From Account held by us on the calendar date and will usually be reflected in your

External Account on the Deliver By date. Transfers from External Accounts are subject to

the processing times of the financial institution holding your External Account.

Instructions for transfers from External Accounts that we receive by the Cutoff Time on

a Business Day will be sent to the holder of your External Account on the same day for

processing. Instructions entered via the External Transfer Service may be Cancelled until

3.

the Cutoff Time on the Send On date.

Transfers to or from Investment Accounts

Transfers to Investment Account: When Instructions are received by us at or

before the Cutoff Time, funds will be posted to, and viewable in, the Investment

Account as of 5:01 pm ET on the next Business Day after the day the Instruction

was made. These funds will be available for trading at or about 11:59 PM ET on the

day they post and are viewable in the Investment Account. When Instructions are

received after the Cutoff Time, funds will be posted to, and viewable in, the

Investment Account as of 5:01 PM ET on the second Business Day following the

day the Instruction was made. These funds will be available for trading at or about

11:59 PM ET on the day they post and are viewable in the Investment Account.

During the interim period between when the funds are posted and are viewable

and available for trading, a hold for the amount in question will be placed on the

External Account in the amount of the transfer for up to four (4) Business Days.

1.

Transfers from Investment Account: When Instructions are received at or before

the Cutoff Time, funds will be posted to, and viewable in, the External Account as

of 5:01 PM ET on the next Business Day after the day the Instruction was made.

These funds will be available in the External Account at or about 11:59 PM ET on

the day they post and are viewable in the External Account. When Instructions are

received after the Cutoff Time, funds will be posted to, and viewable in, the bank

account as of 5:01 PM ET that day. The funds will be available in the External

Account at or about 11:59 PM ET on the day they post and are viewable in the

External Account. Regardless of whether Instructions are received at or

before/after the Cutoff Time, the Investment Account cash balance will be

immediately reduced by the amount of the Transfer and no longer be

available for withdrawal or trading.

2.

4.

Transfer instructions relating to External Accounts and the transmission and issuance of

data related to such instructions shall be received pursuant to the terms of this

Agreement and the rules of the National Automated Clearing House Association

("NACHA") and the applicable automated clearing house ("Regional ACH") (collectively,

the "Rules") and you and we agree to be bound by such Rules as in effect from time to

time. In accordance with such Rules, any credit to your deposit or prepaid account held

by us, or your External Account shall be provisional until such credit has been finally

settled by us or the third party institution which holds your External Account, as the

case may be. You acknowledge that you have received notice of this requirement and of

the fact that if we do not receive final settlement for a transfer for any reason, we shall

charge back the amount of such transfer to the Transfer To or From Account (as

applicable) or any other of your accounts or claim a refund from you.We reserve the

right at any time to delay the availability of funds transferred into your deposit account

via a debit from another account pending settlement or until such time as those

transactions cannot be reversed in accordance with the Rules or applicable law.

5.

1.3 Payment Services

A. General Terms Applicable to Payments

Your responsibilities: You authorize us to remove funds from your designated Pay From

account for all payments that you initiate and you agree to have sufficient available

funds on the Send On date or Payment date for each such payment you schedule.

Please note that if you have Chase Overdraft Protection for your Pay From account,

available funds in the account that you use for overdraft protection are included in the

determination of available funds for the Service. If there are insufficient available funds

to cover a Current Day payment, we will not retry the payment and it will be

immediately rejected. If sufficient funds are not in your account to cover a Current Day

payment, we will not retry the transaction and the payment will be immediately

rejected. In the case of Future Dated payment, if sufficient funds are not in your account

on the Send On or Payment date we may reject the request, or accept the request and

process the payment for delivery (even if such payment processing causes you to

exceed your credit limit or overdraw your account). In the alternative, if sufficient

available credit or funds are not in your account on the Send On date or Payment date,

we will automatically try to debit your account up to two (2) more times on each of the

three (3) succeeding Business Days. For these attempts, a status of "Funds Needed" will

appear online. After the final attempt, the payment request will be Cancelled. A status of

"Funding Failed" will appear. We will provide updates on the status of your transaction

in real time in the Payment Activity page on Chase online or the Chase mobile

application. You agree that we may, at our option, follow your Instructions to make

payments to a Payee, even though a charge to or a debit from your Pay From account

may cause you to exceed your credit limit, or bring about or increase an overdraft. In

the event of an overdraft to your Pay From account, we may charge any other of your

accounts for the amount of the overdraft.

1.

WE ARE NOT RESPONSIBLE FOR ANY CHARGES IMPOSED, OR ANY OTHER ACTION, BY A

PAYEE RESULTING FROM A LATE PAYMENT, INCLUDING ANY APPLICABLE FINANCE

CHARGES AND/OR LATE FEES UNLESS WE CAUSE PROCESSING DELAYS THAT CAUSE

YOUR PAYMENT TO BE LATE.

2.

Further, for Bill Payments to certain eligible healthcare providers only, you authorize us

to charge your Chase credit card for any eligible Bill Payments to certain healthcare

providers that you initiate using your Chase credit card and you agree to have sufficient

available credit balance on the Send On date or Bill Payment date for each such Bill

Payment you schedule. If your Chase credit card payment is rejected for any reason, we

will not retry the Bill Payment and you will be notified of the failed attempt to charge

your Chase credit card. You agree that we may, at our option, follow your Instructions to

make Bill Payments to a named Payee, even though a charge to your Chase credit card

may cause you to exceed your credit limit. WE ARE NOT RESPONSIBLE FOR ANY OVER-

THE-CREDIT-LIMIT FEE, OR CHARGES IMPOSED OR ANY OTHER ACTION BY A PAYEE

RESULTING FROM A LATE BILLPAYMENT, INCLUDING ANY APPLICABLE FINANCE

CHARGES AND/OR LATE FEES; PROVIDED, HOWEVER, THAT IF WE CAUSE PROCESSING

DELAYS THAT CAUSE YOUR BILL PAYMENT TO BE LATE, WE WILL BE RESPONSIBLE FOR

ANY LATE FEES ONLY, IN ACCORDANCE WITH OUR BILL PAY GUARANTEE.

3.

B. Bill Payments

Bill Payment can be used to make one-time or Recurring payments to companies, merchants

or individuals you have designated as a Payee to pay bills such as rent, utilities, or car

payments (sometimes referred to as the "Bill Payment" or other trade name or trademark as

determined by us from time to time). This can include us for payments to Chase Loan or

Credit Accounts. You must have an eligible checking account, AMA, or investment account (or

Chase credit card for certain healthcare payments as provided above) with us in order to

make bill payments. The eligible accounts from which a Bill Payment can be made do not

include a Chase home equity line of credit or other line of credit account, except for Chase

credit cards. We reserve the right to determine eligibility and to restrict categories of

recipients to whom Bill Payments may be made in our sole discretion.

Description of Services: To make Bill Payments, you must maintain an eligible checking

account, AMA or investment account (or Chase credit card for certain healthcare

payments as provided above) with us and designate one of your eligible accounts with

us as your Pay From account. You may select Payees located within the United States to

pay using Bill Payment, subject to our and the Payee's approval with the following

exceptions: you agree not to use Bill Payment to pay Payees to whom you are

obligated for tax payments, payments made pursuant to court orders (including

court-ordered amounts for alimony or child support), fines, payments to loan

sharks, gambling debts or payments otherwise prohibited by law. The minimum Bill

Payment allowed is normally $.01. The default maximum total dollar amount of all

payments is $100,000.00 in the aggregate attributable to any Business Day. We may

modify this limit in our sole discretion at your request, and you acknowledge that a

modified limit may not be reflected in these Terms. To use Bill Payments you must

provide sufficient information online to us to properly identify your Payees, direct your

payment and permit the Payee to identify you as the payment source upon receipt of a

payment. You must complete all required fields with accurate information, as directed

by screen messages. By providing us with the names and account information of those

Payees to whom you wish us to direct payment, you authorize us to follow the

Instructions that we receive through Bill Payments. You further authorize us to update

or change any of your Payee information (including but not limited to changes to

account information, Payee name and mailing address) as requested or provided by

your Payee, the U.S. Post Office or pursuant to any updates or changes through other

tools and resources we may use from time to time to effectuate the Bill Payment. When

we receive a payment Instruction (for the current or a future date), we will send funds to

the Payee on your behalf, from the funds in your Pay From account or charged to your

Chase credit card. You authorize us to charge your designated Pay From account or

Chase credit card, for all payments that you authorize through the Bill Payments. We

and any agent used by us in connection with the Bill Payment Service is authorized to

prepare Drafts drawn on your Pay From account, charge your Chase credit card, and/or

electronically debit your Pay From account for the purpose of making payments. We are

authorized to accept any Draft drawn on the Pay From account on presentment and

charge the Pay From account even though it does not bear your signature where such

Draft has been issued as part of Bill Payments. Such Drafts may originate from us or any

financial institution in the United States used by us or any of our agents.

1.

Because your payment Instructions are transmitted to us on your computer or mobile

device, the payment will not be sent to your Payee with the Payee's payment stub.

2.

Payments received without the payment stub are sometimes processed at a different

location. Some Payees may take longer to post the payment to your account if the

payment stub is not included with the payment, although federal regulations may limit

certain creditors (such as credit card issuers) to a period of up to five (5) days. For this

reason, we recommend that you contact your Payees to ensure that you have the right

address and that you schedule payments in sufficient time to allow for your payment to

be sent to your Payee and the payment to be posted.

Delivery Method (excluding Chase credit card Bill Payments): We remit two types of

payments on your behalf to your Payees - electronic funds transfer and paper check,

depending on your Payees determined method of receiving payments. The Delivery

Method and lead time expected for each type of payment your Payee will ordinarily

receive will be indicated on screen when your payment is scheduled.

The Delivery Method for a Payee is subject to change. If a Payee no longer accepts

electronic payments, payments to that Payee will be delivered by paper check and the

Send On Date will be changed to five (5) Business Days before the Deliver By date for all

subsequent payments and if the Payee provides us with sufficient notice, for the most

current payment. If a Payee begins accepting electronic payments, payments to that

Payee will be processed electronically and the Send On date will be changed accordingly

for all subsequent payments. In case of payment delivery errors, we will modify the

payment delivery method accordingly, i.e.,, if an electronic payment is undeliverable or

Payee cannot accept an electronic payment due to a temporary issue, the payment may

be resubmitted by check. We will notify you via e-mail if the Delivery Method indicated

for your scheduled payments changes to a slower Delivery Method, i.e., one that

increases the delivery time of your payment; otherwise, you will not be notified of

Delivery Method changes. Once an electronic payment is indicated on screen as

“Processed”, we no longer control or receive updates on the payment status and you will

need to contact your Payee for further information. Please note that, in some situations,

if a payment is scheduled to be sent electronically to a Payee who can no longer process

payments using the Delivery Method in which it was sent, then that payment may be

late and we will not be responsible for any associated late charges that might be

incurred as a result. Late payments arising from changes in your Payee's Delivery

Method are explicitly excluded from coverage of our Guarantee as we have no control

over your Payee's acceptance of or changes to a particular Delivery Method.

While it is anticipated that most transactions will be delivered by the Deliver By date, it is

understood that due to circumstances beyond our control, particularly delays due to

internal fraud review, or in handling and posting payments by slow responding

companies or financial institutions, some transactions may take a few days longer to be

credited by your Payee to your Payee account. FOR THIS REASON, YOU NEED TO SELECT

A DELIVER BY DATE WHICH IS SUFFICIENTLY IN ADVANCE OF THE ACTUAL DUE DATE

(NOT THE LATE DATE) OF YOUR PAYMENT OBLIGATION TO ENSURE THAT YOUR

PAYMENT ARRIVES ON OR BEFORE YOUR DUE DATE AND NOT AFTER THE DUE DATE OR

DURING THE GRACE PERIOD.

3.

Additional Terms Applicable to Only Variable Automatic Bill Payments: You may also set

up variable automatic bill payments for select Payees participating in the e-Bills Service.

4.

Variable automatic bill payments differ from Recurring payments in that variable

automatic payments are triggered based on the associated billing date and/or the bill

due date, as set up by you, and the payment amount may vary each month. While it is

anticipated that most variable automatic bill payments will be delivered by the Deliver

By date you set, it is understood that due to circumstances beyond our control,

particularly when your Payee is late in providing the e-Bill and/or we receive the e-Bill

too close to, on, or after the bill’s due date, WE MAY BE UNABLE TO PAY THAT BILL AND

YOU WILL HAVE TO MAKE ALTERNATIVE PAYMENT ARRANGEMENTS DIRECTLY WITH THE

PAYEE. These terms apply in addition to the other terms applicable to Recurring

payments in this Section 1.3(B), and additional terms for variable automatic bill

payments may be presented to you at the time you set up the variable automatic bill

payment.

Canceling Bill Payments: You may cancel any Pending or Funded bill payment if you do

so no later than the Cutoff Time, on the Send On Date. Funds will be returned to your

Pay From account by the following Business Day. You may not stop a bill payment after

the Cutoff Time has passed.

For Chase credit card Bill Payments only, the Cutoff Times do not apply and you may

cancel the payment any time before it is sent.

5.

C. Payments to Chase Loans or Credit Accounts

Payments to Chase Mortgage or Auto Loan or Lease Accounts:

Only Business Days may be chosen as Payment dates for Chase Loan or Credit Accounts

and Instructions must be received by us by the Cutoff Time to receive credit on that

same Business Day; Instructions received on any non-Business Day or after the Cutoff

Time on any Business Day will be processed on the next Business Day.

i.

Payments to Chase Home Equity or Personal Loan or Line of Credit Accounts:

Same day payments using a Chase deposit account made before the Cutoff Time as

stated above on any day will be credited with the date the payment is submitted. Only

Business Days may be chosen as Payment dates for Future Dated payments or

payments made using a non-Chase checking account and Instructions must be received

by us by the Cutoff Time as stated above to receive credit on that same Business Day;

Instructions received on any non-Business Day or after the Cutoff Time on any Business

Day will be processed on the next Business Day.

Payments to a Chase Loan or Credit Account from an account held by us may be made

in amounts of up to the available balance in your Pay From account (plus any available

balance in any associated overdraft protection account) per day.

ii.

Note: Payments to Chase credit card or student loan accounts have separate terms that will

be provided at the time Instructions are provided by you.

D. Bill Payments to Certain Healthcare Providers

Provided that you maintain an eligible checking account, AMA or investment account

with us and designate one of your eligible accounts with us as your Pay From account,

you may also have the option to use one of your Chase credit cards to pay certain

healthcare providers listed in our Bill Pay directory. Your Chase credit card will be shown

as one of the payment options if a healthcare provider you are trying to pay is eligible to

receive Chase credit card payments. You may be able to schedule a one-time, future-

dated, or recurring Bill Payment using a Chase credit card for certain healthcare

providers and may cancel any such payment at any time before it is sent. Sent Chase

credit card payments will be authorized immediately so you will not be able to cancel

any payment after it has been sent. These terms apply in addition to and, in the event of

conflict shall supersede, the other terms applicable to the Bill Payment Service.

For Business Accounts: Even if the dual control function has been turned on for the Bill

Payment Service, payments to healthcare providers using a Chase credit card will not be

submitted for approval.

E. Duplicate Payments

If you submit a duplicate Bill Payment request, an error message may be displayed on

our website but you may choose to bypass the message and schedule the payment. If

you submit a duplicate payment to Chase Loan or Credit Account, an error message

may be displayed and such duplicate payments may not be permitted. No error

message will be displayed for duplicate payments made through different methods and

the payments will be processed as normal.

F. Stale Dated Payments

Paper checks which may be issued to your Payees are not negotiable after the

designated period noted on the check, usually 90 days. Occasionally, paper check

payments are not cashed by your Payee within the negotiable period. When this

happens, we will notify you and credit your Pay From account. We have no liability to

you, your Payee or any other party for refusing payment on any check that remains

outstanding after the end of the negotiable period.

G. Merchant or Payee Limitation

We reserve the right to refuse to pay any Payee whom you may designate for a

payment. We will notify you promptly if we decide to refuse to pay a Payee designated

by you. This notification is not required if you attempt to pay tax or court related

payments or payments to Payees located outside the United States, each of which is

prohibited under this Agreement.

H. Terms Applicable to your use of the e-Bills Service for both Consumer and Business

Account

e-Bills is a feature of the Bill Payment Service that enables you to receive bills electronically

from participating Payees.

Electronic Communications/Payee Terms. By activating e-Bills, you agree to abide by

the terms and conditions stated in this Section to get e-Bills, and to get other related

communications electronically. By activating e-Bills, you will be required to agree to each

Payee's terms and conditions, which will also include the requirement to not to receive

paper bills. For avoidance of doubt, you understand and agree that enrollment into

eBills will terminate the provision of paper statements to you by the Payee, including

any reformatted paper statements, i.e. Braille or enlarged font, that you were receiving

from the Payee, and any accommodations or exceptions will be agreed upon and made

between you and the Payee and not Chase.

1.

Limitations. You must enroll each Payee individually in e-Bills. You also acknowledge

and agree that the right to activate and receive e-Bills for each Payee is limited to one

financial institution. If you activate e-Bills for a particular Payee through us, you will no

longer receive e-Bills for that Payee through the financial institution through which

you're currently receiving such e-Bills. Conversely, if you activate e-Bills for a particular

Payee through another financial institution, your action will effectively terminate the e-

Bills service for that Payee and you will no longer receive such e-Bills through us.

2.

Approval of e-Bills.Participating Payees establish their own criteria for reviewing

requests to receive e-Bills and have sole discretion to accept or decline your request. We

do not participate in this decision. Participating Payees generally take up to five (5)

Business Days to approve an e-Bill set-up request. By requesting that bills, statements,

or other related communications be sent to you electronically, you warrant that you

have the right, power, and authority to receive them.

3.

Individual and Joint Responsibility. Any individual borrower, account holder or

authorized user on your loan, line of credit, or account can enroll in and use e-Bills.

Regardless of the individual who enrolls in e-Bills, the terms of this Section apply to all

borrowers/account holders/authorized users, individually and jointly.

4.

Timely Delivery of e-Bills. We take no responsibility if a Payee does not provide the

necessary data to forward an e-Bill in a timely manner. If you do not receive a bill, it is

your responsibility to contact the Payee directly. We are not responsible for any late

charges or other adverse consequences. Any questions regarding your bill details

should be directed to your Payee.

5.

Cancel e-Bills. All parties have the right to cancel the service at any time. We may also

elect to discontinue delivering e-Bills for certain Payees or customers. We will notify you

if Chase or a Payee discontinues/stops e-Bills. If you request that an e-Bill be

discontinued, we generally require at least seven (7) Business Days for the Payee to

receive and process the request. Therefore, you may not receive a paper statement

from the Payee, and/or you may not receive an e-Bill through the new financial

institution through which you have activated the e-Bill service for the Payee, but

continue to receive e-Bills from us instead for one or two cycles. We also reserve the

right to terminate a Payee's participation in e-Bills at any time.

6.

Privacy. When you request e-Bills from a participating Payee you will provide certain

information such as required username and password, and you authorize us and our

third party service provider to collect and forward such information onto the Payee on

your behalf, and you appoint us and our third party service provider as your agent for

7.

the limited purpose of completing your enrollment. If you have concerns about the

future use of this information by the Payee you should contact your Payee directly.

Fees, Charges or Other Terms. Unless otherwise noted in your account agreement, we

do not charge any fees for using e-Bills. We reserve the right to change the charges,

fees, or terms for e-Bills. If we make a change, we'll provide notice to you in accordance

with terms of this Addendum. We also reserve the option, in our business judgment, to

waive, reduce, or reserve charges or fees in individual situations.

8.

Acknowledgements and Agreements.

You understand and agree that e-Bills are provided for your convenience, and

payments due continue to be your responsibility.

•

You also understand and agree that the e-Bills service and therefore the e-Bills

(and any content contained therein) may only be available in English, and not in a

foreign language, including Spanish, regardless of whether you currently receive a

Payee's bill in a foreign language, depending on the Payee. By using this service,

you agree to receive the e-Bills in English, even if you use or access Chase's

website, mobile application or Chase's other products and services in a foreign

language. You agree that Chase is not responsible for delivering the e-Bills to you

in a foreign language, and any questions regarding this issue will be directed to

your Payee.

•

You also understand and agree that the eBill summary (and any content contained

therein) is accessible via screen reader software and other Assistive Technology

(AT) as presented on any Chase digital platform. The eBill summary may include

the statement date, due date, amounts due and/or other information, and is

different from the eBill.

•

You also understand and agree that the e-Bills service and therefore the e-Bills

(and any content contained therein) may not be presented in a way which is

accessible to screen reader software or AT which are conformant to web content

accessibility guidelines (WCAG), regardless of whether you currently can access

Payee's bill online or via digital application using screen reader software or other

AT, depending on the Payee. By using this Service, you agree to receive the e-Bills

as provided, which may include an inaccessible format, even if you use or access

Chase's website, mobile application or Chase's other products and services by

using screen reader software or other AT. You agree that Chase is not responsible

for delivering the e-Bills to you in a digitally accessible format which conforms to

WCAG, and any questions regarding this issue will be directed to your Payee.

•

9.

Accuracy or Completeness. An e-Bill may or may not have all the same information as

the paper version, depending on the Payee. Chase presents the e-Bills as provided by

the Payee. Chase is not responsible for any information or communications related to

them, or for the acts or omissions of any Payee.

10.

Chase Is Not Responsible for Third Parties. We are not responsible for any aspect of

your relationships with the Payees, or for the performance or non-performance of these

third parties. We do not act as a service provider of the Payees. Transactions between

you and a Payee are governed by the Payee's terms and conditions. We do not endorse

or assume any liability for any Payee you use, and we do not have any liability for

payments, returns, refunds, chargebacks, loyalty and rewards related offers and

benefits or any disputes between you and a Payee or other third parties.

11.

2. ADDITIONAL TERMS APPLICABLE ONLY TO PAYMENTS

AND TRANSFERS FOR CONSUMER ACCOUNTS

A consumer account is one that is used primarily for personal, family or household purposes.

If you perform transactions from a home equity line of credit or other credit account, please

see your home equity line of credit or other credit documents for information about your

liability for unauthorized charges or other errors or questions relative to those accounts.

Except for online transfers covered by this Section 2, concerns about other transactions in

your Investment Account or errors on your confirmations and statements from J.P. Morgan

Securities LLC must be reported in accordance with the terms of your Brokerage Account

Agreement.

If we tell you the Delivery Method for your payment is paper check and make the payment by

paper check, the terms in this Section 2 do not apply to the payment. For information on your

rights and obligations involving erroneous paper checks (including paper checks you did not

authorize), see Section V of our Deposit Account Agreement. If we make the payment

electronically, this Section 2 will apply to the payment even if we told you the Delivery Method

for your payment is a paper check.

2.1 Your Liability for Unauthorized Transfers or Payments

If you permit other persons to use Payments and Transfers or your Password, you are

responsible for any transactions they authorize from your accounts. If you believe that your

Password has been lost or stolen or that someone has made payments, transferred or

may transfer money from your account without your permission, notify us AT ONCE, by

calling 1-877-242-7372 or writing us at Online Customer Service, P. O. Box 2558,

Houston, TX 77252-9968.

Tell us AT ONCE if you believe your Password has been lost or stolen or that an unauthorized

online transfer or payment has been made from any of your deposit or prepaid accounts.

Telephoning us is the best and fastest way of keeping your possible losses to a minimum. If

you do not do so, you could lose all the money in each of the accounts, as well as all of the

available funds in any overdraft protection account or any other credit line included among

your accounts. If you tell us within two (2) Business Days after you discover the loss or theft,

you are completely covered if someone makes a transfer or payment without your

authorization.

If you do not tell us within two (2) Business Days after you discover the loss or theft of your

Password or that an unauthorized online transfer or payment has been made from any of

your deposit or prepaid accounts, and we can prove we could have stopped someone from

making a transfer or payment without your authorization if you had told us, you could lose as

much as $500. Furthermore, if any account statement shows online transfers or payments

that you did not make, tell us AT ONCE. If you do not tell us within sixty (60) days after a

statement showing such a transfer or payment was transmitted to you, you may not get back

any money you lost after the sixty (60) days if we can prove that we could have stopped

someone from taking the money if you had told us in time.

If a good reason, such as a long trip or hospital stay, kept you from telling us, we will extend

the time periods.

2.2 Our Liability for Failure to Complete Payments and Transfers

If we do not complete a transfer or payment to or from a consumer account in the correct

amount or according to our agreement with you, we will be liable for those damages as the

law imposes in such cases. However, there are some exceptions. We will not be liable, for

example:

If, through no fault of ours, your account does not contain sufficient funds to make the

transfer or payment and the transfer or payment would exceed any credit line or any

overdraft for such account.

A.

Your operating system or software was not functioning properly at the time you

attempted to initiate such transfer or payment and it was evident to you at the time you

began the transfer or payment.

B.

Circumstances beyond our control, such as fires, floods, acts of God, power outages and

the like.

C.

The Payee or, for Payments and Transfers from an External Account, the third party

financial institution holding your account, mishandles or delays processing or posting a

payment or transfer sent by Payments and Transfers.

D.

If you have not provided us with complete and correct payment or transfer information,

including without limitation the financial institution name, address, account number,

transfer amount for a transfer or payment amount for the Payee on a payment.

E.

The list of examples set out in this paragraph is meant to illustrate circumstances under

which we would not be liable for failing to make a transfer or payment and is not intended to

list all of the circumstances where we would not be liable.

2.3 Errors and Questions about Payments and Transfers

If you think your statement is wrong, or if you need more information about a transaction

listed on it, call or write us at the telephone number or address at the end of this Addendum.

For personal accounts only, the following procedures apply: We must hear from you NO

LATER than 60 days after we sent you the FIRST statement on which the error appeared.

Please provide us with the following:

Your name and account number;•

A description of the error or the transaction you are unsure about, and why you think it

is an error or want more information; and

•

The amount of the suspected error.•

We will determine whether an error occurred within 10 Business Days after we hear from you

and will correct any error promptly. However, if we need more time, we may take up to 45

days to investigate your complaint or question. If we do this, we will credit your balance

within 10 Business Days for the amount you think is in error, so that you will have the use of

the money during the time it takes us to complete our investigation. If you opened your

account less than 30 days before the date of the suspected error, the 10-Business-Day period

is extended to 20 Business Days. If you opened your account less than 30 days before the

date of the suspected error or the transaction occurred at a point-of- sale location or outside

the U.S., the 45-day period is extended to 90 days.

If you call us, we may require that you send us your complaint or question in writing within 10

Business Days. If we do not receive it within 10 Business Days, we may not credit your

balance. We will tell you the results within three business days after completing our

investigation. If we decide that there was no error, we will send you a written explanation.

You may ask for copies of the documents that we used in our investigation.

In case of errors or questions about your electronic transfers that appear on your External

Account statements, please contact the financial institution that provided such statement to

you in accordance with the terms and conditions of your External Account.

3. Our Guarantees

3.1TheOnlineandMobileBankingGuarantee–OnlyforOnlineandMobile

Payments and Transfers (for Consumer Deposit Accounts Only)

In the event that money is removed from your consumer deposit accounts (i.e., checking or

savings) or prepaid accounts with us without your authorization through Payments and

Transfers, we will reimburse you 100% if you tell us within two Business Days of your

discovery of the unauthorized transaction. (See the paragraph entitled "Your Liability for

Unauthorized Transfers or Payments", above governing "Your Liability for Unauthorized

Transfers.") Our guarantee covers only things that are within our control. It is your

responsibility to use care when exiting the system and safely maintain your user IDs and

Passwords.

3.2 The Bill Pay Guarantee – for Online and Mobile Bill Payments and for

Online and Mobile Payments to a Chase Loan or Credit Account made from

a Chase checking account

If we ever cause processing delays of your online or mobile bill payments or online or mobile

payments to a Chase Loan or Credit Account made from a Chase checking account or Chase

credit card that result in late fees, we will cover 100% of those fees. This guarantee covers

everything within our control. Our guarantee does not cover losses, which you cause, or

payment processing delays, which are not caused by us or within our control, such as:

Your failure to make your payment request by the Cutoff Time sufficiently in advance of

the Payee's due date for the payment to arrive on time (before the grace period begins)

•

Your input errors or errors made by your Payees•

Your failure to notify us of any suspected unauthorized transaction from your Account,

or theft of your ID or Password within the time periods specified in this Agreement and

your account agreement. If you suspect any suspicious activity on your account with us,

notify us immediately at 1-877-242-7372.

•

Your failure to follow the procedures or to otherwise fail to use the Online Service in

accordance with the terms of this Agreement.

•

Your Payee's change to the Delivery Method resulting in an increase in processing time

for your payments or your Payee mishandles or delays processing or posting a

payment.

•

As a precondition to this guarantee, you agree not to enter into any agreements where

one of the purposes is to generate late payment fees. The risk of incurring and the

responsibility for paying any and all late charges or penalties shall be borne by you in

the event you do not follow the procedures or otherwise fail to use Payments and

Transfers in accordance with the terms of this Agreement.

4. ADDITIONAL TERMS APPLICABLE ONLY TO PAYMENTS

AND TRANSFERS FOR BUSINESS ACCOUNTS

4.1 Linking Multiple Accounts – Business and Consumer

You may use Chase Online for Small Business to access eligible accounts. These accounts may

include accounts of affiliated, subsidiary, or non-affiliated businesses bearing the same tax

identification number which may be added to your business subscription with the agreement

of each such business (a "Multiple-Business Subscription"). You may be permitted to link

consumer accounts to your Online Service profile provided: (i) the authorized signer on the

business account is also an authorized signer on the consumer accounts to be linked and (ii)

the consumer account information provided during linkage is accurate and can be validated.

4.2 Liability for Unauthorized Transfers or Payments for Business Deposit

Accounts Only

You are responsible for all transfers and payments that are authorized using your Online

Service Password. If you permit other persons to use the Online Service or your Password,

you are responsible for any transactions they authorize. NOTE: ACCOUNT ACCESS THROUGH

THE ONLINE SERVICE IS SEPARATE AND DISTINCT FROM YOUR EXISTING SIGNATURE

ARRANGEMENTS FOR YOUR ACCOUNTS. THEREFORE, WHEN YOU GIVE AN INDIVIDUAL THE

AUTHORITY TO ACCESS ACCOUNTS THROUGH THE ONLINE SERVICE, THAT INDIVIDUAL MAY

HAVE ACCESS TO ONE OR MORE ACCOUNTS TO WHICH THAT INDIVIDUAL WOULD NOT

OTHERWISE HAVE SIGNATURE ACCESS. YOU ASSUME THE ENTIRE RISK FOR THE

FRAUDULENT, UNAUTHORIZED OR OTHERWISE IMPROPER USE OF YOUR PASSWORD. WE

SHALL BE ENTITLED TO RELY ON THE GENUINENESS AND AUTHORITY OF ALL INSTRUCTIONS

RECEIVED BY US WHEN ACCOMPANIED BY SUCH PASSWORD, AND TO ACT ON SUCH

INSTRUCTIONS.

We are not liable to you for any errors or losses you sustain in using Online Banking except

where we fail to exercise ordinary care in processing any transaction. We are also not liable

for any failure to provide any service if the account(s) involved is no longer linked for

Payments and Transfers. Our liability in any case shall be limited to the amount of any money

improperly transferred from your Pay From account or From Account less any amount,

which, even with the exercise of ordinary care, would have been lost.

Without regard to care or lack of care of either you or us, a failure to report to us any

unauthorized transfer, payment or error from any of your accounts within sixty (60) days of

our providing or making available to you a bank statement showing such unauthorized

transfer, payment or error shall relieve us of any liability for any losses sustained after the

expiration of such sixty-day period and you shall thereafter be precluded from asserting any

such claim or error.