©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 1 of 124

Chargeback

Timeframes and

Reason Codes

USER GUIDE

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 2 of 124

DISCLAIMER

The compilations, summaries and other information contained herein or any document attached

hereto is intended as general guidelines and does not take into account individual client

circumstances, objectives or needs and is not intended as a recommendation of a particular

product or strategy to particular clients and any recipient shall make its own independent

decision. While we strive to make sure this information is accurate, Chase does not warrant the

completeness, timeliness, or suitability of this information for your specific needs. In addition, the

compilations, summaries and information contained within this document do not substitute for

the Payment Brand Rules, which are part of your contract with Chase.

This downloadable document and the information provided herein may not be copied, published,

or used, in whole or in part, for any purpose other than expressly authorized by

Chase. Paymentech, LLC, Chase Paymentech Solutions, LLC and Chase Paymentech Europe

Limited, respectively trading as Chase, Chase Paymentech and J.P. Morgan are subsidiaries of

JPMorgan Chase & Co.= (JPMC). Chase Paymentech Europe Limited is regulated by the

Central Bank of Ireland. Registered Office: JP Morgan House, 1 George’s Dock, I.F.S.C., Dublin

1, D01 W213, Ireland. Registered in Ireland with the CRO under. No. 474128. Directors:

Catherine Moore (UK), Carin Bryans, Michael Passilla (U.S.), Dara Quinn, Steve Beasty (US).

© 2018 JPMorgan Chase & Co. All rights reserved.

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 3 of 124

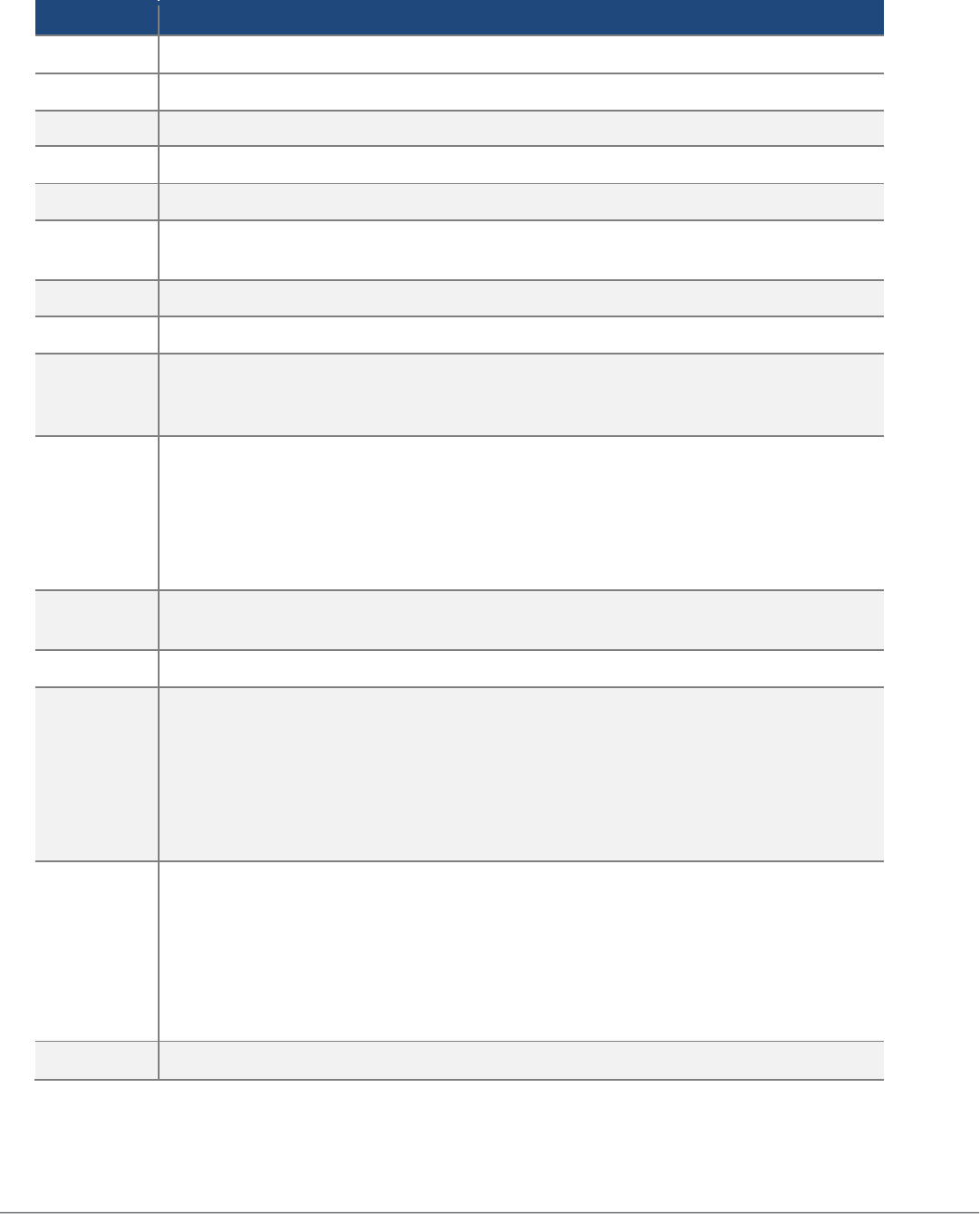

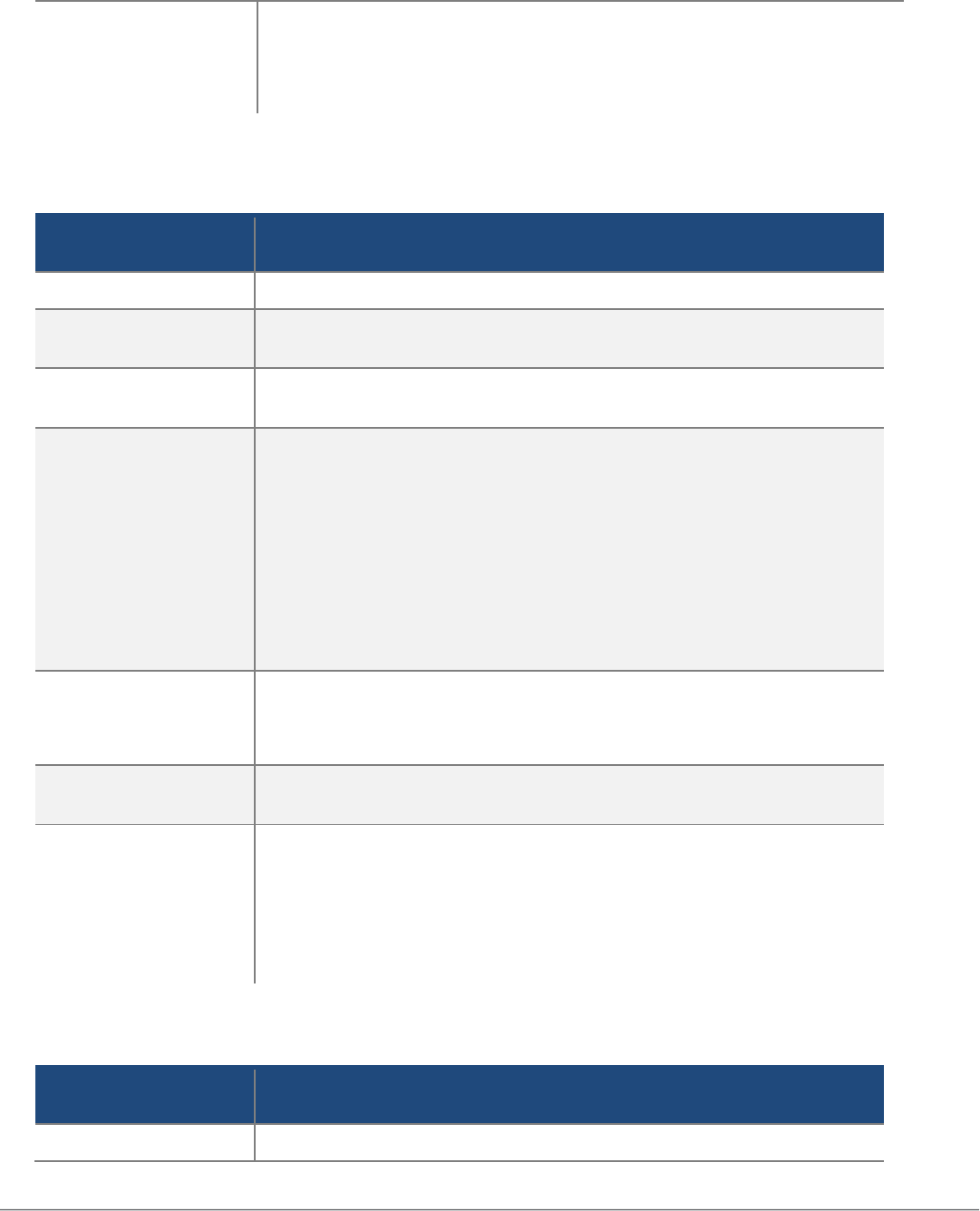

REVISION HISTORY

Date

Description

9/20/2021

Multiple updates made to bring this guide up to date

06/01/19

Updates to timeframe for MasterCard Reason Code 34 (from 120 days to 90).

8/7/18

Updates to Debit Chargeback Reason Codes.

2/12/18

Changes to Visa information for VCR Pgs.

12/19/16

Corrected document formatting for MasterCard Reason Code 37.

10/10/16

Updated: Added Merchant Required Documentation sections to each reason

code table. Removed Revolution Card section and retired reason codes.

04/04/16

Added American Express Chargeback and Retrieval Reason Codes.

02/10/16

Added Debit Chargeback Reason Codes.

11/03/15

Updated these MasterCard Chargeback Codes: 08, 12, 31, 34, 42, 53, 55, 59,

60, 70, 71. Updated these Visa Chargeback Codes: 30, 62, 85. Updated these

Discover Chargeback Codes: U05, U06.

10/23/14

Discover Retrieval Reason Codes — Removed Code 02. Updated Visa

Chargeback Code 83. Updated these MasterCard Chargeback Codes: 08, 12,

55. Updated these Discover Chargeback Codes: RG, RM, U01, U02. Added

these Discover Chargeback Codes: 05, PM. Removed Visa Chargeback Code

60. Removed these Discover Chargeback Codes: AL, CA, IC, IS, NC, SV, U03,

UNR.

10/21/14

Updated Chargeback Time Frames: Added Reason Code 05; Addendum

Reason Code PM; Changed TF time frame from 120 days to 540 days.

04/09/14

Discover: DC, U02.

04/20/13

Visa and MC Retrieval Codes — removed retired codes MC Reason Code 37

— Updated Special Notes. Visa Chargeback Codes — removed retired codes.

Code 81 — Updated Special Notes. Code 83 — Updated Re-presentment

Rights Code 96 — Deleted, Retired in Oct. 2012. Discover Chargeback Codes

— removed retired codes Updated these Discover Codes: AP, AW, CD, CR,

DP, NR, RG, RM, RN2, U02. Added information about Discover Chargeback

funding. Reformatted manual to new manual format.

04/13/13

Updated Acquirer Time Frames MasterCard Time Frames Chart: Deleted

Retired Code 35; Deleted Retired Code 57 & 62; Updated Code 60 Time frame.

Visa Time Frames Chart: Deleted Retired Code 96. Discover Time Frames

Chart: Deleted Retired Code AL & SV. Updated Time Frames for all Discover

codes: Deleted Retired Codes U02, U03, U11, U12, U18, U21, U23, U28, U31,

U38, U99. Deleted UK Maestro/Solo section as these are now combined with

MasterCard codes. Updated to new Client Manual Format.

11/02/12

Updated Discover Codes.

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 4 of 124

3/13/12

MasterCard: Removed code 01. Added Reason Codes 70 & 71. Visa: Updated

codes: 30, 41, & 53. Updated codes: 60, 76, 78, 85, & 86. Wording updated for

consistency on codes 62, 70, 71, 72, 73, 74, 75, 77, & 78.

07/11/11

Removed MasterCard Reason Code 01. Updated the Issuer Documents for

MasterCard Codes: 37, 40, 63, 70, 71. Updated Merchant Rights for these

MasterCard Codes: 37, 63.

03/09/11

Updated Issuer Required Documentation Required for VISA Codes: 53, 57, 62,

72, 80, 81, 85.

07/19/10

Added two new MasterCard Reason Codes: Reason Code 70 Chip Liability

Shift; Reason Code 71 Chip/PIN Liability Shift.

06/25/10

Per Bank Card Regulation Updates: Updated MasterCard Codes: 08, 31, 55,

59. Per Bank Card Regulation Updates: Updated MasterCard Codes: 08; 55;

59; Updated UK Maestro Code 29.

06/23/10

Updated PayPal Reason Codes

01/20/10

Adjusted timeframe to deposit for Reason Code 74

12/31/09

Visa Reason Code 79 deleted. Visa Reason Codes 57, 75, 77, 80-83 and 85 —

Timeframe to initiate chargebacks changes. Discover Reason Code CD —

Special Note added. Special Note added for processing rules for JCB USD

transactions. BML Reason Code A3 description changed to Merchant Non-

Compliance. Deleted Revolution Card Reason Code 96. Diners Codes deleted

— unnecessary as Discover codes are used now. PayPal updated with

Representment Time Frames. Maestro updated with Representment Time

Frames. Revision History Added.

05/22/09

Added Discover Retrieval Reason Codes including MasterCard and Visa IIAS

Healthcare Retrieval Codes 27 and 43. Added Chargeback Reason Codes for

Discover and 72 for Visa.

04/08/09

Manual created.

TABLE OF CONTENTS

DISCLAIMER .............................................................................................................................. 2

REVISION HISTORY .................................................................................................................. 3

Table of Contents ....................................................................................................................... 4

INTRODUCTION ........................................................................................................................ 5

RETRIEVAL REASON CODES .................................................................................................. 6

MASTERCARD CHARGEBACK TIME FRAMES ...................................................................... 10

MASTERCARD CHARGEBACK REASON CODES ................................................................. 12

VISA CHARGEBACK TIME FRAMES ...................................................................................... 33

VISA CHARGEBACK REASON CODES .................................................................................. 36

DISCOVER CHARGEBACK TIME FRAMES ............................................................................ 65

DISCOVER CHARGEBACK REASON CODES ........................................................................ 67

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 5 of 124

AMERICAN EXPRESS CHARGEBACK TIME FRAMES .......................................................... 87

AMERICAN EXPRESS CHARGEBACK REASON CODES ...................................................... 90

DEBIT CHARGEBACK REASON CODES .............................................................................. 108

JCB TIME FRAMES ............................................................................................................... 118

JCB CHARGEBACK REASON CODES.................................................................................. 119

122 ......................................................................................................................................... 122

Merchant Services CHARGEBACK REASON CODES ........................................................... 123

INTRODUCTION

A chargeback is the reversal of sale transaction. They can occur when a customer refuses to

accept responsibility for a charge on their credit card, or the issuing bank doesn’t receive an

authorization approval code, for example.

The payment brands have established time frames within which issuers and acquirers must act

or respond. Time frames vary by the payment brand, type of chargeback (technical or customer

dispute), and by the reason code associated with the chargeback.

Acquirer Time Frames

The payment brands must receive our response, “representment” of the transaction details, by

the 45

th

calendar day since the chargeback was initiated. To meet that deadline, we must

receive “recourse requests” by the due date indicated on the Online Chargeback Management

System screen, or your chargeback paperwork. This is the 39

th

calendar day from the day the

chargeback was initiated. The Return by Date is set to give us sufficient time to process the

recourse request and represent the chargeback within the 45-day time frame.

As a result of the Visa Claims Resolution (VCR) initiative occurring April 13,

2018, Visa must

receive our response, “Dispute Response” for Collaboration disputes or a pre-arbitration for

Allocation disputes by the 30

th

calendar day after the initiation of the Visa dispute. To meet that

deadline, we must receive “recourse requests” by the due date indicated on the Online

Chargeback Management System screen, or your chargeback paperwork. For Collaboration

disputes, this is the 24

th

calendar day from the day the chargeback was initiated. For Allocation

disputes, this is the 18

th

calendar day from the date the dispute was initiated. The Return by

Date is set to give us sufficient time to process the recourse request and represent the

chargeback within the Visa deadlines.

Time Frames by Chargeback Type and Reason Code

The Time Frame charts in this guide indicate the reason codes, allowable time frames for

chargeback processing and type of chargeback. We also included the reason code descriptions

and an indication of when the allowable time frame begins.

Information for each reason code may include:

• Reason code number

• Reason code description

• Timeframe for initiation

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 6 of 124

• Type of chargeback

• Dispute description

• Special notes (if any)

• Required issuer documentation

• Re-presentment rights/Client • Pre-arbitration rights/Client

RETRIEVAL REASON CODES

A retrieval request is an issuer’s request for a transaction receipt, which could include the

original printing, a paper copy or fax, or a digital version (such as a scanned copy).

To fulfill a retrieval request, we (the acquirer) must provide the documentation described below

depending on the “Fulfillment Types,” within 30 days of our receipt of the retrieval request.

A fulfillment must:

• Be legible enough for the Cardholder to read or for the Issuer to identify the Account Number

or Token

• Include the unique 12-digit identifier assigned by VisaNet to a request for a Transaction

Receipt copy

• For a US Domestic Transaction, include a unique 9-digit control number assigned by the

Issuer to identify the source of the request

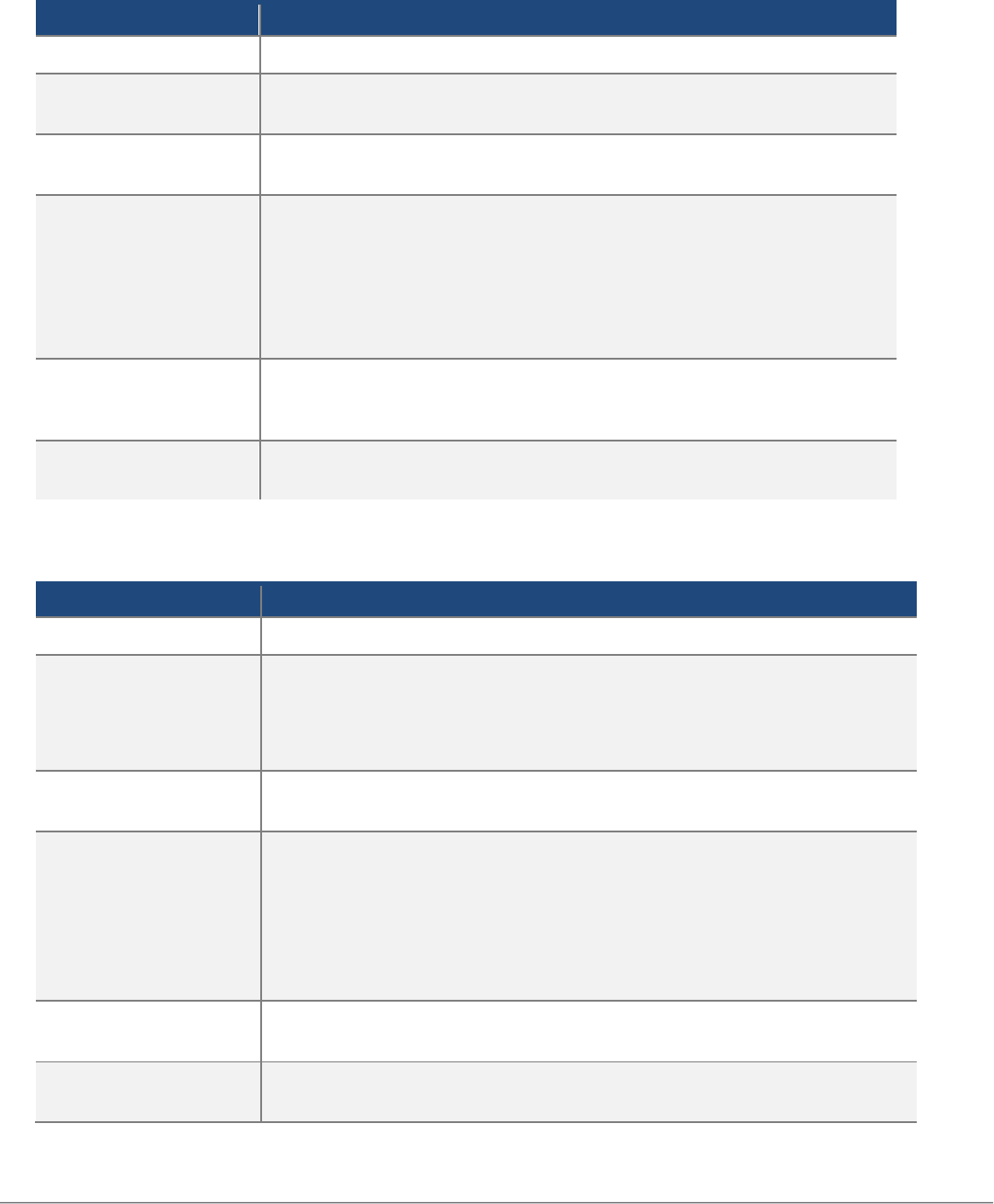

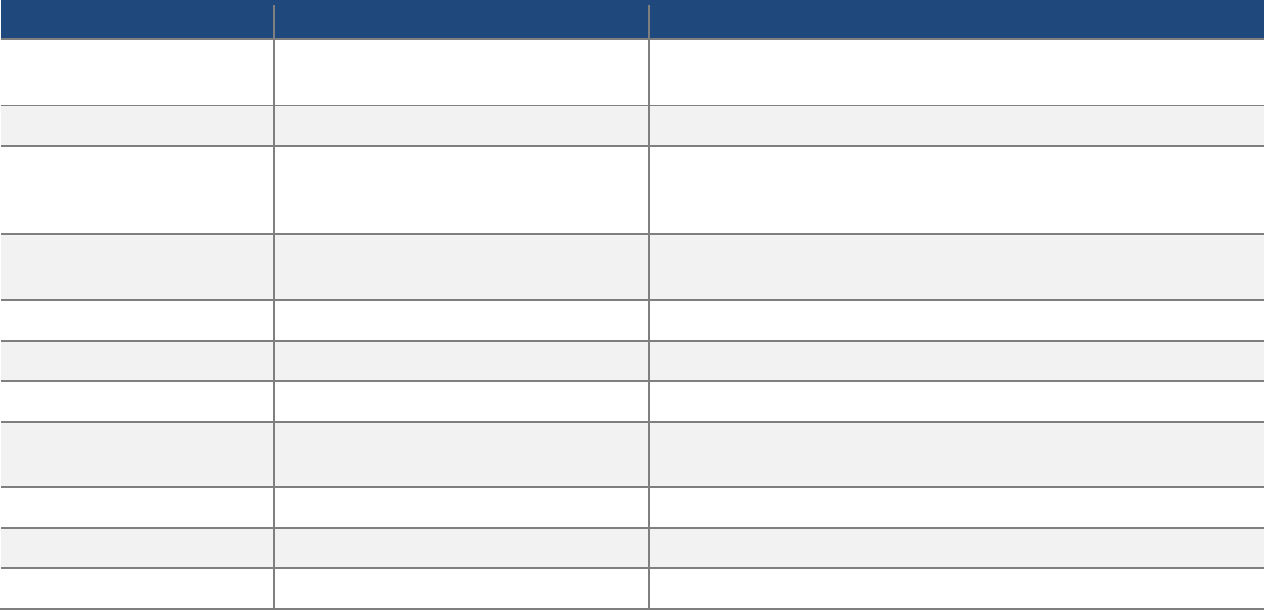

Fulfillment Types

TRANSACTION TYPE

DESCRIPTION

Face-to-Face

Environment

Transaction

The Merchant or Acquirer copy of the Transaction Receipt bearing

the signature that was used to verify the Cardholder

T&E Transaction

All of the following:

• A copy of the Transaction Receipt or a Substitute Transaction

Receipt

• Card Imprint, if available

• Cardholder signature, if available

• T&E Document, if applicable

Preauthorized Health

Care Transaction

In the U.S. Region, a copy of the Order Form

Card Not Present

Provide proof of AVS response, an itemized bill with bill-to and

ship-to addresses and proof of delivery

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 7 of 124

Credit Transaction

• For a Transaction involving a Member in the Visa Europe

Territory, a log indicating that the Credit Transaction has been

processed to the Card Account Number

• For a Transaction not involving a Member in the Visa Europe

Territory, a log indicating that the Credit Transaction has been

processed for the same Cardholder

In the event that a merchant does not respond to a ticket retrieval request within 21 days to allow

processing time, a chargeback may result and it cannot be represented.

Visa and MasterCard

VISA CODE

MASTERCARD CODE

DESCRIPTION

N/A

05

Cardholder does not agree with amount billed

27

43

IIAS Healthcare Retrieval Request

N/A

21

Cardholder does not recognize transaction (merchant

name, city, state or date)

N/A

22

Chip transaction request

N/A

23

Cardholder needs for personal records (tax record or

business expense)

28

N/A

Cardholder request for copy with signature

30

N/A

Cardholder request due to dispute

33

41

Fraud analysis request/fraud investigation

34

N/A

Legal process request

N/A

42

Potential chargeback/compliance

Discover

CODE

DESCRIPTION

01

Transaction Document Request

03

Transaction Document Request Due to Cardholder Dispute

04

Transaction Document Request for Fraud Analysis

05

Good Faith Investigation

American Express

CODE

DESCRIPTION

04

The Card Member requests delivery of goods / services ordered but not

received. Please provide the service, ship the goods, or provide Proof of

Delivery or proof of services rendered.

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 8 of 124

21

The Card Member claims the goods / services were cancelled / expired or the

Card Member has been unsuccessful in an attempt to cancel the goods /

services. Please issue Credit, or provide a copy of your cancellation policy or

contract signed by the Card Member and discontinue future billings.

24

The Card Member claims the goods received are damaged or defective and

requests return authorization. If a return is not permitted, please provide a

copy of your return or refund policy.

59

The Card Member requests repair or replacement of damaged or defective

goods received. Please provide return instructions and make the appropriate

repairs, or provide a copy of your return/replacement policy and explain why

the goods cannot be repaired/replaced.

61

The Card Member claims the referenced Credit should have been submitted

as a Charge. Please submit the Charge or provide an explanation of why

Credit was issued.

62

The Card Member claims the referenced Charge should have been submitted

as a Credit. Please issue Credit, or provide support and itemization for the

Charge and an explanation of why Credit is not due.

63

The Card Member requests replacement for goods or services that were not

as described by your Establishment, or Credit for the goods or services as the

Card Member is dissatisfied with the quality.

127

The Card Member claims to not recognize the Charge. Please provide support

and itemization. In addition, if the Charge relates to shipped goods, please

include Proof of Delivery with the full delivery address. If this documentation is

not available, please issue Credit.

147

The Card Member claims the Charge will be paid by their insurance company.

Please provide a copy of the following documentation: itemized rental

agreement, itemized repair bill, and acknowledgement of responsibility signed

by the Card Member.

154

The Card Member claims the goods / services were cancelled and /or refused.

Please issue Credit or provide Proof of Delivery, proof that the Card Member

was made aware of your cancellation policy and an explanation why Credit is

not due.

155

The Card Member has requested Credit for goods / services that were not

received from your Establishment. Please issue Credit or provide Proof of

Delivery, or a copy of the signed purchase agreement indicating the

cancellation policy and an explanation of why Credit is not due.

158

The Card Member has requested Credit for goods that were returned to your

Establishment. Please issue Credit or explain why Credit is not due along with

a copy of your return policy.

169

The Card Member has requested Credit for a Charge you submitted in an

invalid currency. Please issue Credit or explain why Credit is not due.

USER GUIDE | CHARGEBACK REASON CODES

06/2019 | REF-CHG-001 ©2018 Paymentech, LLC (“Chase”). All Rights Reserved. Page 9 of 124

170

The Card Member requests Credit for a cancelled lodging reservation or a

Credit for a Card Deposit was not received by the Card Member. Please issue

Credit or provide a copy of your cancellation policy and explain why Credit is

not due.

173

Duplicate Processing

175

Credit Not Processed

176

CNP – Does Not Recognize

177

Unauthorized Charge

193

Fraudulent Transaction

680

Transaction Amount Differs

684

Paid by Other Means

691

Requesting Trans Support

693

Req. Info Loss/Theft/Damage Trans

S02

Response Accepted, Will Not Debit

S03

Support received.

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 11 of 123 USER GUIDE | CHARGEBACK REASON CODES

USER GUIDE | CHARGEBACK REASON CODES

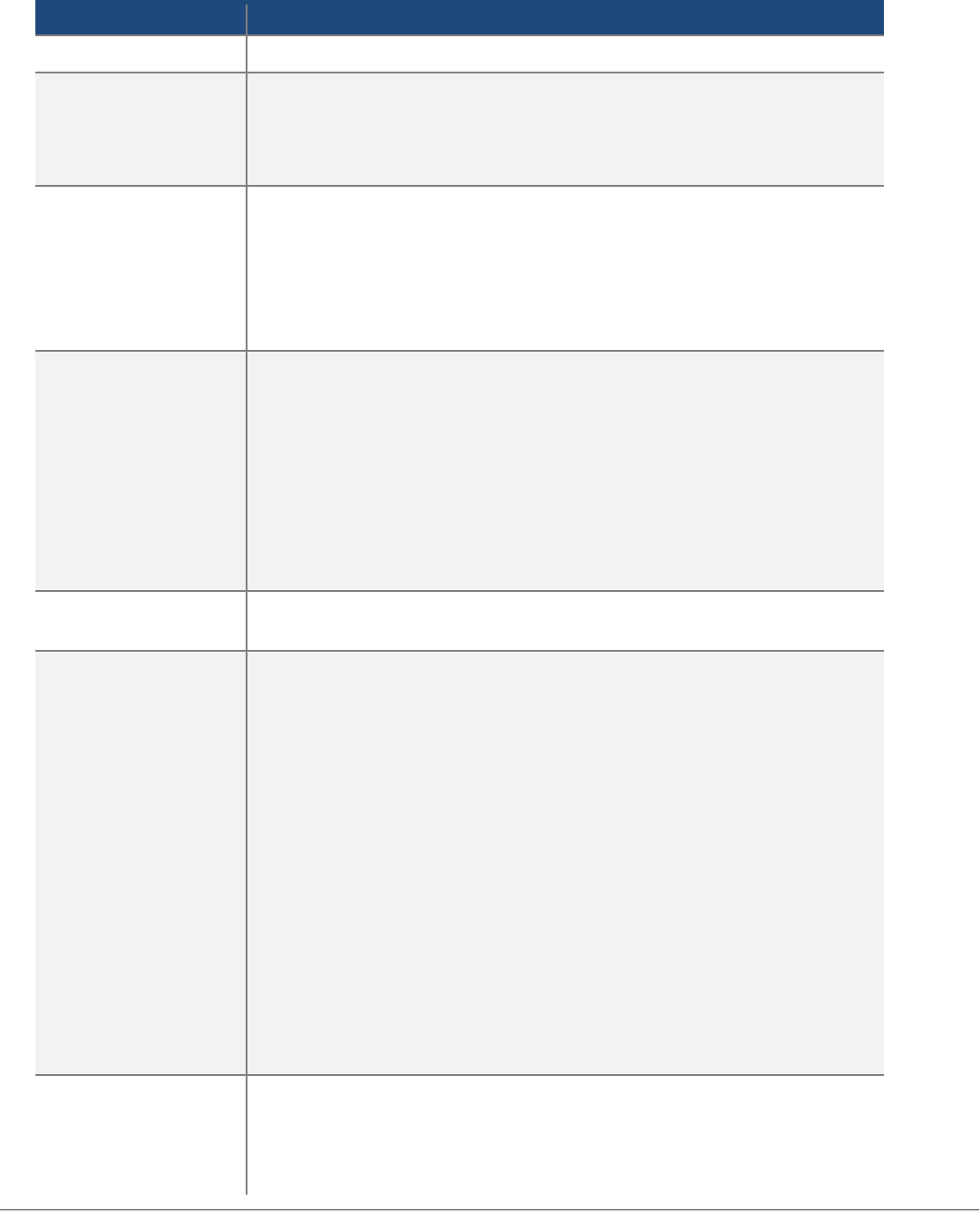

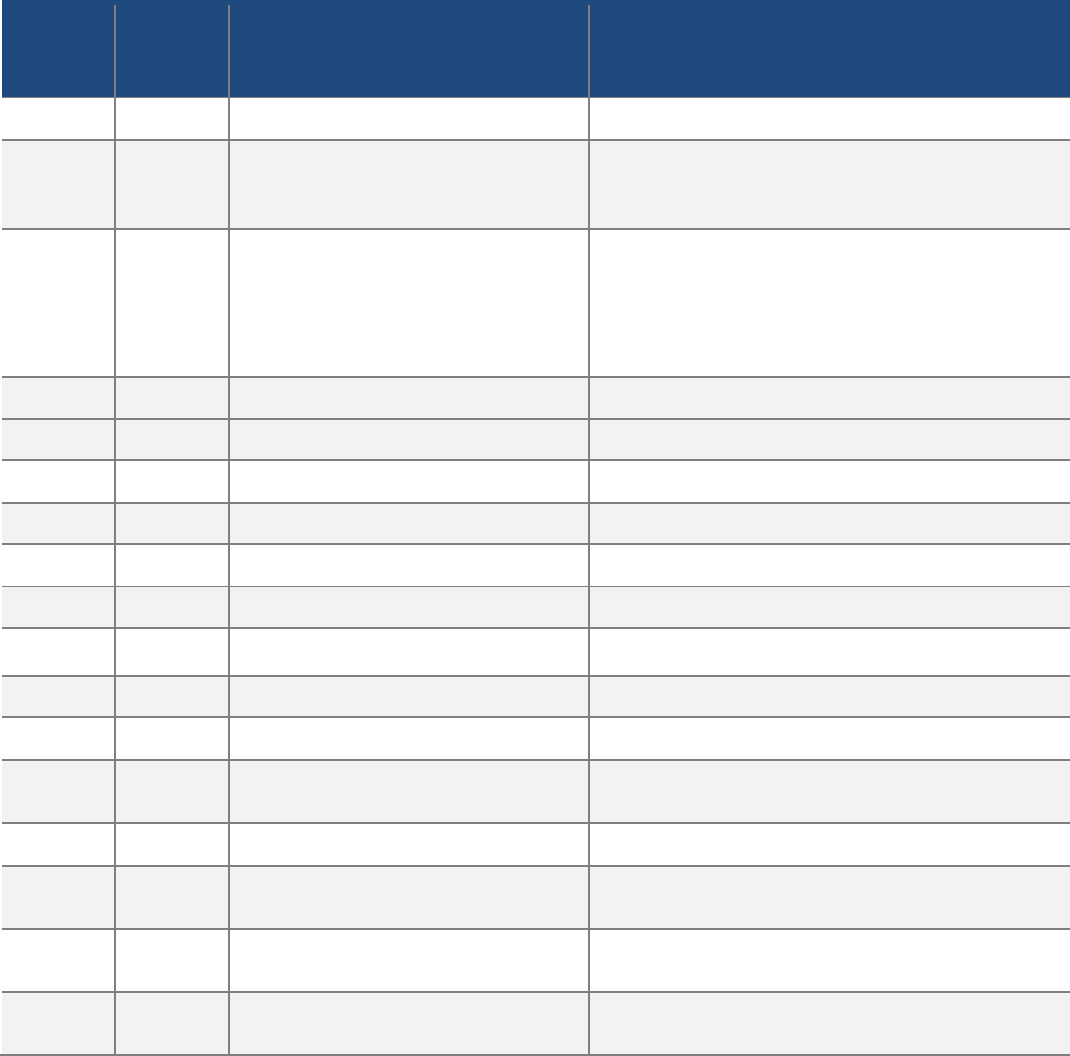

MASTERCARD CHARGEBACK TIME FRAMES

REASON

CODE

CHARGEBACK

TYPE

1

DESCRIPTION

TIME FRAME

07

T

Warning Bulletin File

90 calendar days from the transaction date

08

T

Requested/Required Authorization Not Obtained

90 calendar days from the transaction date

12

T

Account Number Not on File

90 calendar days from the transaction date

31

C

Transaction Amount Differs

90 calendar days from the transaction date

34

T or C

Point of Interaction

90 calendar days from the transaction date

37

C

No Cardholder Authorization

120 calendar days from the transaction date

41

C

Cancelled Recurring Transaction

120 calendar days from the transaction date

42

C

Late Presentment

120 calendar days from the transaction date

46

T

Correct Currency Code Not Provided

120 calendar days from the transaction date

49

T

Questionable Client Activity

120 calendar days from either the transaction

date or the global Security Bulletin date

50

C

Credit Posted as a Purchase

120 calendar days from the transaction date

53

C

Not As Described

120 calendar days from the transaction date

or 120 calendar days from the receipt date of

delayed delivery of merchandise or services

54

C

Cardholder Dispute — Not Elsewhere Classified

120 calendar days from the transaction date

or 60 calendar days from the issuer’s receipt

date of first cardholder notification of the

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 11 of 123 USER GUIDE | CHARGEBACK REASON CODES

55

C

Goods or Services Not Provided

120 calendar days from the expected date of

delivery

59

C

No-Show, Addendum, or ATM Dispute

120 calendar days from the transaction date

60

C

Credit Not Processed

70

C

Chip Liability Shift

71

C

Chip/PIN Liability Shift

1

T = Technical; C = Customer Dispute

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 12 of 124

MASTERCARD CHARGEBACK REASON CODES

If you’re using the Online Chargeback Management System, you will find the chargeback

reason codes on both the Level 1 and 2 screens. These codes are established by the payment

brands to categorize the incoming chargeback requests by reason. The codes also appear on

financial reporting associated with chargebacks.

CODE

DESCRIPTION

07

Warning Bulletin File

08

Requested/Required Authorization Not Obtained

12

Account Number Not On File Obtained

31

Transaction Amount Differs

34

Duplicate Processing

37

No Cardholder Authorization

41

Cancelled Recurring Transaction

42

Late Presentment

46

Correct Currency Code Not Provided

49

Questionable Merchant Activity

53

Not As Described

54

Cardholder Dispute — Not Elsewhere Classified

55

Goods or Services Not Provided

59

No-Show, Addendum, or ATM Dispute

60

Credit Not Processed

70

Chip Liability Shift

71

Chip/PIN Liability Shift

REASON CODE 07

WARNING BULLETIN FILE

Chargeback Type

Technical

Dispute Description

The account number was present in the Warning Bulletin File on the

date of the transaction and no authorization was obtained

Timeframe to Initiate

Chargeback

90 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• Follow in-house procedures

• If credit was previously issued, contact our Chargeback

Department; otherwise, accept the chargeback and follow inhouse

collection procedures

Issuer Required

Documentation

None

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 13 of 124

Merchant Required

Documentation

None

Special Notes

• Authorizations are valid for only 30 days

• Issuer has the right to assess a US $25 handling fee when the

chargeback is initiated

• If we represent the chargeback with a valid authorization, the

business is credited US $50.

REASON CODE 08

REQUESTED/REQUIRED AUTHORIZATION NOT OBTAINED

Chargeback Type

Technical

Dispute Description

Authorization was either requested or required, but was not obtained

Timeframe to Initiate

Chargeback

90 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• Follow in-house procedures

• If credit was previously issued, contact the Chargeback

Department; otherwise, accept the chargeback and follow

inhouse collection procedures

• Representment rights exist if the following conditions apply:

• The business can prove that the cardholder initiated the

authorization request; for example, the first transaction was

declined due to an error with the expiration date, and the

cardholder provides the correct expiration date in a second

transaction.

Issuer Required

Documentation

None

Merchant Required

Documentation

• Provide logs showing authorization obtained

• Retail: Provide signed sales slip

• Card Not Present: Provide an itemized bill with bill-to and ship-to

addresses and cardholder’s name, description of goods

Special Notes

• Authorizations are valid for only 30 days

• Issuer has right to assess US $25 handling fee when the

chargeback is initiated

• If we represent the chargeback with a valid authorization, the

business is credited US $50.

REASON CODE 12

ACCOUNT NUMBER NOT ON FILE OBTAINED

Chargeback Type

Technical

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 14 of 124

Dispute Description

A transaction was processed using an account number that is not

listed in the Issuer’s customer database

Timeframe to Initiate

Chargeback

90 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the chargeback and follow your in-house

collection procedures

• Representment rights exist if the following conditions apply:

• The business can prove that the cardholder initiated the

authorization request; for example, the first transaction was

declined due to an error with the expiration date, and the

cardholder provides the correct expiration date in a second

transaction.

Issuer Required

Documentation

None

Merchant Required

Documentation

• Provide logs showing authorization obtained

• Retail Provide signed sales slip

• Card Not Present: Provide an itemized bill with bill-to and ship-to

addresses and cardholder’s name, description of goods

Special Notes

• Authorizations are valid for only 30 days

• Retail: Provide a sales slip

REASON CODE 31

TRANSACTION AMOUNT DIFFERS

Chargeback Type

Cardholder Dispute

Dispute Description

Cardholder paid for the purchase using an alternate payment method

The amount of the transaction processed was not the amount the

cardholder agreed to

Timeframe to Initiate

Chargeback

90 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• Provide proof the transaction that was processed using an

alternate payment method was for a separate purchase

• This chargeback may be represented if it can be proven that the

transaction amount is correct

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the chargeback and follow your in-house

collection procedures

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 15 of 124

Issuer Required

Documentation

• A cardholder letter

• Email

• Fax or Expedited Billing Dispute

• Forms or exhibits showing the amount agreed upon by cardholder

• Proof that an unreasonable amount was charged

Merchant Required

Documentation

• Retail: Provide a signed sales slip

• Card Not Present: Provide an itemized bill proving charge is

correct

• Merchant explanation and documentation

Special Notes

• The chargeback amount is restricted to the difference between the

amount that was processed and the amount the cardholder

agreed to

REASON CODE 34

POINT OF INTERACTION ERROR

Chargeback Type

Cardholder or Technical Dispute

Dispute Description

The merchant charges the customer more than once for the same

purchase on the same day

Timeframe to Initiate

Chargeback

90 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• This chargeback may be represented if the merchant can prove

that each transaction is for a separate purchase

• If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit;

otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

• Cash receipts

• Statements from other credit cards

• The 23-digit Acquirer Reference Number, if the same

• MasterCard was billed or detail showing a completed funds

transfer

Merchant Required

Documentation

• Retail: Provide signed sales slips for each transaction indicated in

the issuer documentation

• Card Not Present: Provide proof of each transaction indicated in

the issuer documentation

Special Notes

• If our transaction database contains two or more transactions on

the same day and for the same amount, the chargeback will be

sent to the merchant for review

• This Reason code was formally referred to as Duplicate

Processing

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 16 of 124

REASON CODE

37

NO CARDHOLDER AUTHORIZATION

Chargeback Type

Cardholder Dispute

Dispute Description

The cardholder is claiming he/she never authorized nor participated in the

transaction

Timeframe to

Initiate Chargeback

120 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• Card Not Present: This chargeback may be represented if:

• The Address Verification Service (AVS) response was an I1 or I3

and the merchandise was shipped to the AVS address.

• Verification that transaction was properly processed using

MasterCard SecureCode

• Compelling information available

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

• Expedited Billing Dispute Resolution Process Form stating the Issuer

has:

• Closed the cardholder’s account

• Blocked the account on its host

• Listed the account number on the MasterCard Account File with a

“capture card” response until the card expiration

• Reported the transaction to SAFE (System to Avoid Fraud

Effectively)

Merchant Required

Documentation

• Retail: Provide signed sales slip

• Card Not Present: Provide proof of AVS response, an itemized bill

with bill-to and ship-to addresses and proof of delivery

• Provide compelling information; see Special Notes below

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 17 of 124

Special Notes

• Address Verification (AVS) operates in the U.S. and the UK

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 18 of 124

• MasterCard SecureCode offers chargeback protection for fraud if the

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 19 of 124

transaction is properly processed using MasterCard SecureCode

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 20 of 124

• Cardholder was present and the card stripe was magnetically read,

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 21 of 124

we will represent the chargeback as being invalid. The Issuer will still

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 22 of 124

have compliance rights available if the business failed to provide a

copy of the sales receipt when requested.

• Compelling Evidence – MasterCard will accept compelling evidence

for representment. This includes, but is not limited to:

• Evidence such as photographs or emails to prove the person

received the merchandise or service. For download of digital goods,

the IP address, email address, description of goods, date and time

goods were downloaded and/or proof the merchant’s website was

accessed for services after the transaction date.

• Passenger transport — evidence the ticket was received at

cardholder’s billing address, boarding pass was scanned at the gate,

details of frequent flyer miles claimed, additional incidental

transactions purchased (such as baggage fees, seat upgrades,

alcohol, etc.)

• Previous undisputed transaction — provide evidence that the

information provided is the same as that from a previous undisputed

transaction

• Evidence that the transaction was completed by a member of the

Cardholder’s household

• For a Transaction conducted by a digital goods Merchant assigned

MCC 5815 (Digital Goods –Media, Books, Movies, Music), 5816

(Games), 5817(Applications [Excludes Games]) or 5818 (Digital

Goods Large Digital Goods Merchants), all of the following:

• Evidence that the Merchant has been successfully registered into

and continues to participate in the Visa Digital Commerce Program

• Evidence that the Merchant is the owner of the operating system for

the subject electronic device

• Evidence that the account set up on the Merchant's website or

application was accessed by the Cardholder and has been

successfully verified by the Merchant before or on the Transaction

Date

• Evidence that the disputed Transaction used the same device and

Card as any previous Transactions that were not disputed

• Proof that the device ID number, IP address and geographic

location, and name of device (if available) are linked to the

Cardholder profile on record at the Merchant

• Description of the merchandise or services and the date and time

goods were purchased and successfully downloaded

• Customer name linked to the customer profile on record at the

Merchant

• Evidence that the customer password was reentered on the

Merchant's website or application at the time of purchase

• Evidence that the Merchant validated the Card when the Cardholder

first linked the Card to the customer profile on record at the

Merchant

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 23 of 124

REASON CODE 41

CANCELLED RECURRING TRANSACTION

Chargeback Type

Cardholder Dispute

Dispute Description

Situation 1: A cardholder attempted to notify the merchant that he/she

wished to cancel the recurring transaction on the credit card indicated

Situation 2: The Issuer had previously charged back another

transaction

Timeframe to Initiate

Chargeback

120 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• MasterCard recognizes proof of proper disclosure of the terms and

conditions (T&Cs) for ecommerce transactions.

• If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit;

otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

• Situation 1: A cardholder letter, email, fax, Expedited Billing

Dispute form and/or equivalent substitute forms or exhibits

specifying the particular dispute situation

• Situation 2: None — An Issuer message containing the date and

Acquirer’s Reference Number of the previously charged back

transaction is acceptable

Merchant Required

Documentation

• Businesses must provide proof that the customer accepted the

terms and conditions by showing documentation that either a

check box was checked or a click to “submit” button indicates

acceptance

• Terms and conditions must be in the sequence of final pages

before check out and cannot be a separate link

• For a recurring transaction, the terms and conditions must be clear

and different from the general terms and conditions.

Special Notes

Once a chargeback is received for this reason, you must obtain a new

method of payment from the cardholder; you cannot reprocess a

transaction using the same card number.

REASON CODE 42

LATE PRESENTMENT

Chargeback Type

Technical

Dispute Description

• Card Not Present: Transaction was processed more than 30 days

from the authorization date

• Retail: 7 days

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 24 of 124

Timeframe to Initiate

Chargeback

90 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• The chargeback may be represented, if there is proof that

processing occurred within the proper timeframe

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

None

Merchant Required

Documentation

• Retail: Provide a signed sales slip

• Card Not Present: Provide an itemized bill proving charge is

correct

• Merchant explanation and documentation

Special Notes

REASON CODE 46

CORRECT CURRENCY CODE NOT PROVIDED

Chargeback Type

Technical

Dispute Description

The proper currency code was not provided when depositing the

transaction

Timeframe to Initiate

Chargeback

90 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• None

• If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit;

otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

A cardholder letter, email, message or completed Dispute Resolution Form-Point-of-

Interaction (POI) Errors describing the cardholder’s complaint in sufficient

detail to enable all parties to understand the dispute

Merchant Required

Documentation

Documentation proving the correct currency was provided or

specified.

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 25 of 124

Special Notes

• The acquirer is prohibited from using the second presentment to

argue the validity of the cardholder’s claim regarding the selection

of or non-agreement to the currency.

• The contents of the transaction receipt are considered only in

determining whether point-of-interface (POI) currency conversion

has occurred on a transaction. They neither prove nor disprove

the cardholder’s agreement to the conversion.

• If the chargeback is valid and if the full amount was charged back,

the acquirer should process the transaction as a First

Presentment in the currency in which goods/services were priced

or in the currency that was dispensed.

•

REASON CODE 49

QUESTIONABLE MERCHANT ACTIVITY

Chargeback Type

Technical

Dispute Description

The merchant was listed on the MasterCard Global Security Bulletin

at the time the transaction occurred

Timeframe to Initiate

Chargeback

120 calendar days from either the date of the transaction or the

Global Security Bulletin date

Representment

Rights/ Merchant

Action

• None

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

None

Merchant Required

Documentation

None

Special Notes

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 26 of 124

REASON CODE 53

CARDHOLDER DISPUTE

Chargeback Type

Cardholder Dispute

Dispute Description

• Goods or Services did not conform to their description

• Goods arrived broken or could not be used in the fashion they

were intended for and the cardholder attempted to resolve the

dispute with the merchant prior to initiating the chargeback

Timeframe to Initiate

Chargeback

• 120 calendar days from the date of transaction

• 120 calendar days from the receipt date of delayed delivery of

merchandise or services with a maximum of 540 days from the

settlement date for issues of interruption of ongoing services

• 120 days from the date of merchandise replacement, if

replacement was provided

Representment

Rights/ Merchant

Action

• Card Not Present: Provide proof that the deficiency leading to the

dispute has been rectified address the specific dispute which may

include cancellation, non-receipt

• Retail: Provide a sales slip contains information to prove the

merchandise or services were as described

• If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit;

otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

A cardholder letter, email, fax, Expedited Billing Dispute form and/or

equivalent substitute forms or exhibits

Merchant Required

Documentation

• Proof the chargeback was invalid

• Card Not Present: Provide proof that the cardholder’s claims has

been rectified, address the specific dispute which may include

cancellation, non-receipt, or quality of goods. Ensure every aspect

of the cardholders dispute is addressed

• Retail: Provide a sales slip/contract/terms and conditions that

contain information to prove the merchandise or services were as

described

• Businesses must provide proof that the customer accepted the

terms and conditions by showing documentation that either a

check box was checked or a click to “submit” button indicates

acceptance

• Terms and conditions must be in the sequence of final pages

before check out and cannot be a separate link

• For a recurring transaction the terms and conditions must be clear

and different from the general terms and conditions.

Special Notes

• For merchandise disputes, the cardholder may recover shipping

and handling charges

• This code may be used in cases of pricing disputes

• This reason code was formerly referred to “as Not As Described”

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 27 of 124

REASON CODE 54

CARDHOLDER DISPUTE — NOT ELSEWHERE CLASSIFIED

Chargeback Type

Cardholder Dispute

Dispute Description

• The issuing bank claims the cardholder has asserted a dispute

authorized by federal, state or local law and no other chargeback

right exists

• The cardholder claims to have attempted to resolve the dispute

with the merchant

Timeframe to Initiate

Chargeback

• 120 calendar days from the date of the transaction

• 60 calendar days from the issuer’s receipt date of the first

cardholder letter about the dispute

Representment

Rights/ Merchant

Action

• Provide a rebuttal addressing the cardholder dispute

• If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit;

otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

• A cardholder letter, email, fax, questionnaire, Expedited Billing

Dispute and/or equivalent substitute forms or exhibits

• Documentation to show calculation of the chargeback amount

• Verification of the remaining unpaid balance of the credit card

• Issuer’s written certification, signed by the manager or other

authorized member, identifying the specific regulation or law under

which the chargeback right was exercised and indicating that all

requirements under that regulation or law were met

Merchant Required

Documentation

• The chargeback was invalid

• Card Not Present: Provide proof that the cardholder’s claims has

been rectified, address the specific dispute which may include

cancellation, non-receipt, or quality of goods. Ensure every aspect

of the cardholders dispute is addressed

• Retail: Provide a sales slip/contract/terms and conditions that

contain information to prove the merchandise or services were as

described

• Businesses must provide proof that the customer accepted the

terms and conditions by showing documentation that either a

check box was checked or a click to “submit” button indicates

acceptance

• Terms and conditions must be in the sequence of final pages

before check out and cannot be a separate link

• For a recurring transaction the terms and conditions must be clear

and different from the general terms and conditions.

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 28 of 124

Special Notes

• The original transaction amount must exceed US $50

• Retail: The purchase must be in the same state as, or within 100

miles of, the cardholder’s billing address

• The Issuer is required to wait 15 days from a merchandise return

to initiate the chargeback if the chargeback timeframe being used

would be exceeded

REASON CODE 55

GOODS OR SERVICES NOT PROVIDED

(RETIRED EFFECTIVE 10/16/15)

Chargeback Type

Cardholder Dispute

Dispute Description

• The merchant was either unwilling or unable to provide services

• The cardholder states he/she did not receive the merchandise that

was ordered

Timeframe to Initiate

Chargeback

120 calendar days from the expected date of delivery

Representment

Rights/ Merchant

Action

• Provide proof that services have been rendered/merchandise

received

Issuer Required

Documentation

A cardholder letter, email, fax, form and/or equivalent substitute forms

or exhibits

Merchant Required

Documentation

• Documentation to prove that the Cardholder or an authorized

person received the merchandise or services at the agreed

location or by the agreed date

• Examples: Signed proof of delivery to shipping address, signed

pick up slips or job completion certification

• For an Airline Transaction, evidence showing that the name is

included in the manifest for the departed flight and it matches the

name provided on the purchased itinerary

Special Notes

Proof of delivery must be dated after the date of the cardholder’s letter

• We can represent the chargeback even if the date is before the

cardholder’s letter, but if another chargeback is initiated, it will be

Returned to Merchant with no further representment rights

• Issuer has the right to chargeback an ecommerce transaction that

was never completed, but for which a cardholder’s account has

been debited. For example, the cardholder thought the first

transaction was never completed, so they made another attempt

and their card is debited more than once.

REASON CODE 59

NO-SHOW, ADDENDUM, OR ATM DISPUTE

Chargeback Type

Cardholder Dispute

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 29 of 124

Dispute Description

• Cardholder is disputing a no-show hotel charge

• Cardholder is disputing any subsequent transactions representing

an addendum to any valid transactions

Timeframe to Initiate

Chargeback

120 calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• Provide proof the transaction was not a hotel no-show charge

• If a business has no record of a cancellation from the cardholder

• If there was proper disclosure given on at the time the reservation

was made that there would be a no-show fee if reservation was

not cancelled before 6 p.m. local time on the day of the

reservation period

• Provide proof that the charge was not for an addendum to a

previously valid transaction

Issuer Required

Documentation

Cardholder letter, email, fax, questionnaire, Expedited Billing Dispute

and/or equivalent substitute forms or exhibits

Merchant Required

Documentation

• Signed folio/sales slip showing was not a no show charge or an

addendum to a previously valid transaction

• Businesses must provide proof that the customer accepted the

terms and conditions by showing documentation that either a

check box was checked or a click to “submit” button indicates

acceptance

• Terms and conditions must be in the sequence of final pages

before check out and cannot be a separate link

• The acquirer can provide documentation verifying the

disbursement of funds to the cardholder.

Special Notes

REASON CODE 60

CREDIT NOT PROCESSED

Chargeback Type

Cardholder Dispute

Dispute Description

Merchant did not process a refund for:

• Credit voucher or

• Returned merchandise or

• Cancelled service

Timeframe to Initiate

Chargeback

120 calendar days beginning the date service was cancelled or

merchandise was returned

Representment

Rights/ Merchant

Action

Notify us if you have no record of having received the returned

merchandise from the cardholder or if you refused to accept the

returned merchandise

Issuer Required

Documentation

A cardholder letter, email, fax, questionnaire, Expedited Billing

Dispute and/or equivalent substitute forms or exhibits

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 30 of 124

Merchant Required

Documentation

• Documentation showing the date the credit was processed to the

cardholder’s account, and the reference number of that

transaction.

• The returned merchandise was not received by the business;

provide assertion that the merchandise was not received on

company letterhead or on the Chargeback Document

• Businesses must provide proof that the customer accepted the

cancelation terms and conditions by showing documentation that

either a check box was checked or a click to “submit” button

indicates acceptance

• Terms and conditions must be in the sequence of final pages

before check out and cannot be a separate link

Special Notes

REASON CODE 70

CHIP LIABILITY SHIFT

Chargeback Type

Cardholder Dispute

Dispute Description

• Cardholder has a chip-enabled MasterCard and claims he/she

never authorized or participated in the transaction.

• This is for retail transactions only and in all regions.

Timeframe to Initiate

Chargeback

120 Calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• For non-EMV supported (chip) POS/terminal, there are no

representment rights, unless a refund has been issued

• EMV supported (chip) POS/terminal a transaction with a chip card.

The chargeback can be represented if the full unaltered magnetic

stripe data was read and transmitted with a valid authorization. In

this case the chargeback would be represented on your behalf

• EMV supported (chip) POS/terminal and transaction with a chip

card. The chargeback can be represented if a valid transaction

was manually keyed and transmitted with the authorization. In this

case the chargeback would represented on your behalf

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the chargeback and follow your in-house

collection procedures

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 31 of 124

Issuer Required

Documentation

Expedited Billing Dispute Resolution Process Form stating the Issuer

has:

• Closed the cardholder’s account

• Blocked the account on its host

• Listed the account number on the MasterCard Account File with a

“capture card” response until the card expiration

• Reported the transaction to System to Avoid Fraud Effectively

(SAFE)

Merchant Required

Documentation

None

Special Notes

REASON CODE 71

CHIP/PIN LIABILITY SHIFT

Chargeback Type

Cardholder Dispute

Dispute Description

A fraudulent transaction resulted from the use of a hybrid PIN

preferring card at a magnetic strip-reading-only terminal (whether PIN

capable or not) or at a hybrid not equipped with a PIN pad capable (at

a minimum) of checking the PIN offline.

Timeframe to Initiate

Chargeback

120 Calendar days from the date of the transaction

Representment

Rights/ Merchant

Action

• For NON-EMV supported (chip) POS/terminal, there are no

representment rights, unless a refund has been issued

• EMV supported (chip) POS/terminal a transaction with a chip card.

The chargeback can be represented if the full unaltered magnetic

stripe data was read and transmitted with a valid authorization. In

this case the chargeback would be represented on your behalf

• EMV supported (chip) POS/terminal and transaction with a chip

card. The chargeback can be represented if a valid transaction

was manually keyed and transmitted with the authorization. In this

case the chargeback would represent on your behalf

• If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit;

otherwise accept the chargeback and follow your in-house

collection procedures

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 32 of 124

Issuer Required

Documentation

Expedited Billing Dispute Resolution Process Form stating the Issuer

has:

• Closed the cardholder’s account

• Blocked the account on its host

• Listed the account number on the MasterCard Account File with a

“capture card” response until the card expiration

• Reported the transaction to System to Avoid Fraud Effectively

(SAFE)

Merchant Required

Documentation

None

Special Notes

• This is for retail transactions only in all regions

•

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 35 of 123

USER GUIDE | CHARGEBACK REASON CODES

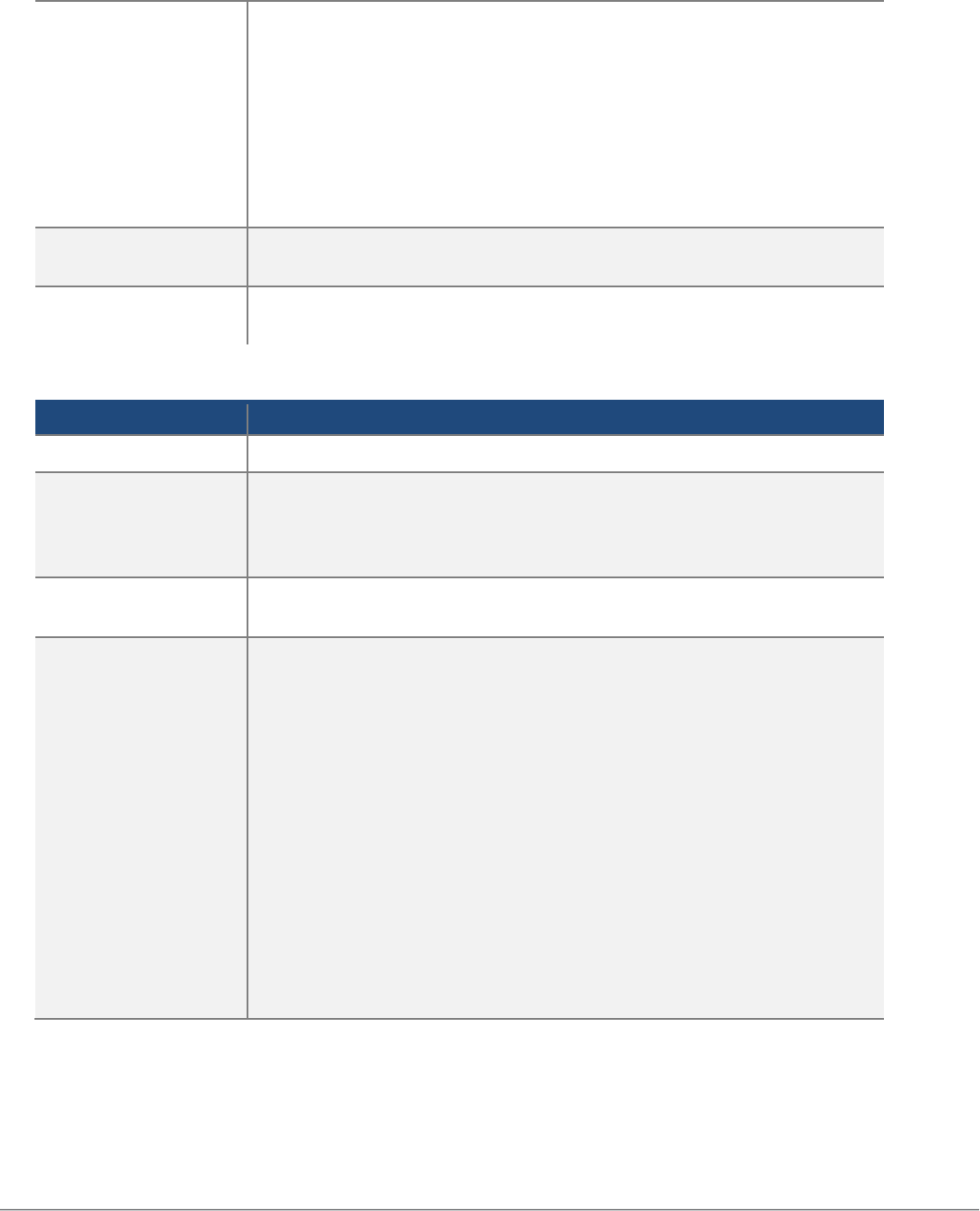

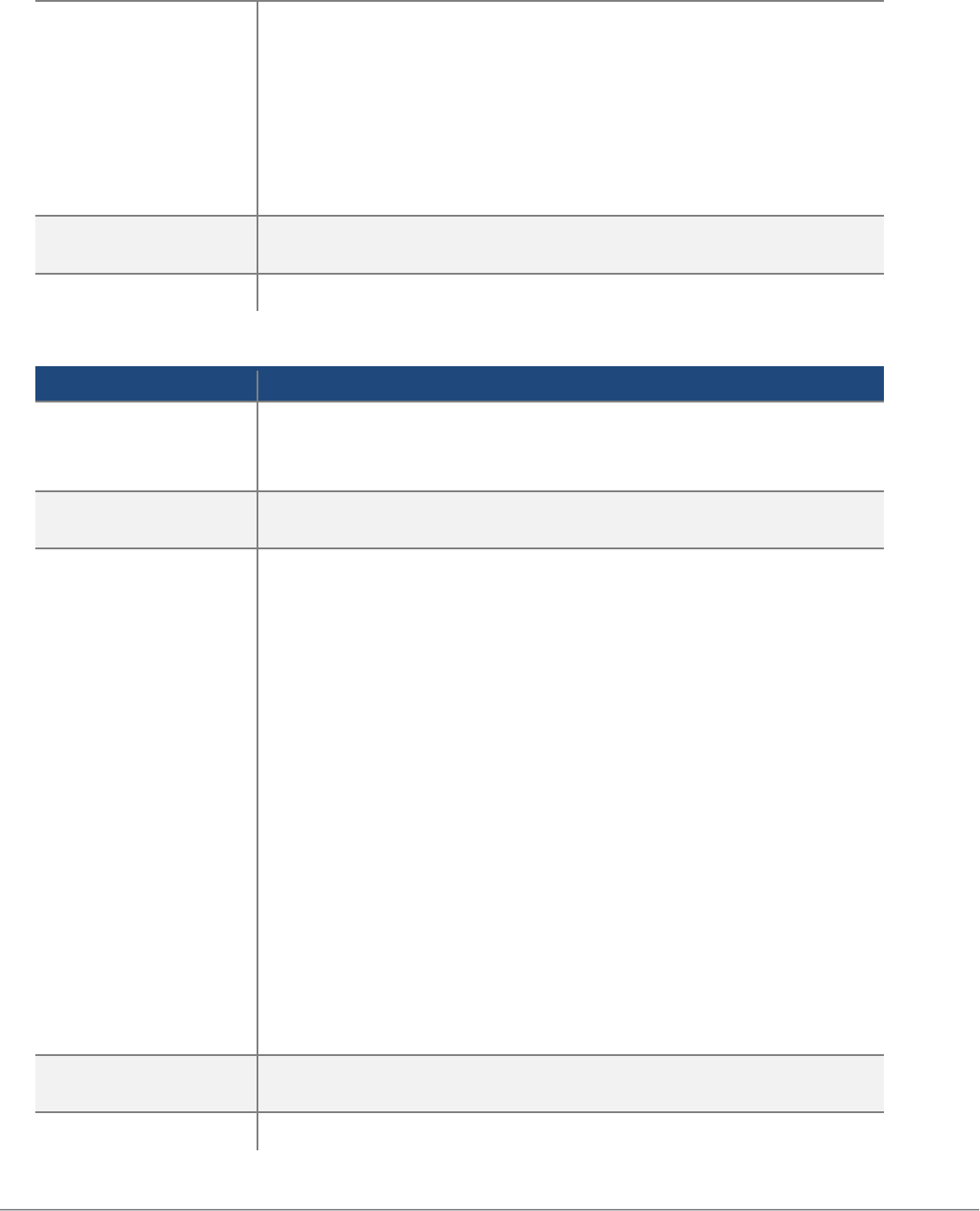

VISA CHARGEBACK TIME FRAMES

All time frames apply to both domestic and international chargeback transactions unless otherwise noted.

REASON

CODE

CHARGE

BACK

TYPE

2

DESCRIPTION

TIME FRAME

10.1

T

EMV Liability Shift Counterfeit Fraud

120 calendar days from the date of the transaction

10.2

T

EMV Liability Shift Non-Counterfeit Fraud

120 calendar days from the date of the transaction

10.3

C

Other Fraud - Card Present Environment

120 calendar days from the date of the transaction

10.4

C

Other Fraud – Card-Absent Present

120 calendar days from the date of the transaction

10.5

T

Visa Fraud Monitoring Program

120 calendar days from the date of the identification by the

Client Fraud Performance Program

11.1

T

Card Recovery Bulletin

75 calendar days from the transaction date

11.2

T

Declined Authorization

11.3

T

No Authorization

12.1

T

Late Presentment

120 calendar days from the transaction date

12.2

T

Incorrect Transaction Code

12.3

T

Incorrect Currency

12.4

T or C

Incorrect Account Number

12.5

T

Incorrect Amount

12.6.1

T or C

Duplicate Processing

12.6.2

C

Paid by Other Means

12.7

T

Invalid Data

75 Calendar days from the transaction date

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 35 of 123

13.1

C

Merchandise/Services Not Received

120 calendar days from the transaction processing date or 120

days from the last date the cardholder expected to receive the

merchandise or services

13.2

C

Canceled Recurring Transaction

120 calendar days from the date of transaction or 120 days after

the cardholder received the merchandise or services not to

exceed 540calendar days from the transaction processing date

13.3

C

Not As Described or Defective

Merchandise/Services

120 calendar days from the date of transaction or must wait 15

days from the date merchandise was returned

2

T = Technical; C = Customer Dispute

REASON

CODE

CHARGE

BACK

TYPE

2

DESCRIPTION

TIME FRAME

13.4

C

Counterfeit Merchandise

120 calendar days from the date of transaction, the expected date of delivery or the

date the cardholder was first made aware that the merchandise was counterfeit.

13.5

C

Misrepresentation

120 calendar days from either:

• The transaction date of transaction

• The date the cardholder received the merchandise or services not to

exceed 540 days from the transaction processing date

• The date the cardholder was first made aware that the merchandise was

misrepresented.

• 60 calendar days from the date the issuer received notice from CH

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 35 of 123

13.6

C

Credit Not Processed

120 calendar days from the transaction date or date of credit receipt or date of CH

(cardholder) letter if credit receipt is unavailable or date issuer received CH letter if

both credit receipt and CH are unavailable or undated

13.7

C

Cancelled

Merchandise/Services

120 calendar days from the transaction date or the date the cardholder expected to

receive the merchandise or services not to exceed 540 days from the transaction

processing date

13.8

C

Original Credit

Transaction Not

Accepted

120 calendar days from the Original Credit transaction processing date

13.9

C

Non-Receipt of Cash or

Load Transaction Value

120 calendar days from the date of transaction

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 36 of 124

VISA CHARGEBACK REASON CODES

If you’re using the Online Chargeback Management System, you will find the chargeback

reason codes on both the Level 1 and 2 screens. These codes are established by the payment

brands to categorize the incoming chargeback requests by reason. The codes also appear on

financial reporting associated with chargebacks.

CODE

DESCRIPTION

10.1

EMV Liability Shift Counterfeit Fraud

10.2

EMV Liability Shift Non-Counterfeit Fraud

10.3

Other Fraud – Card Present Environment

10.4

Other Fraud – Card-Absent Present Environment

10.5

Visa Fraud Monitoring Program

11.1

Card Recovery Bulletin

11.2

Declined Authorization

11.3

No Authorization

12.1

Late Presentment

12.2

Incorrect Transaction code

12.3

Incorrect Currency

12.4

Incorrect Account Number

12.5

Incorrect Amount

12.6.1

Duplicate Processing

12.6.2

Paid by Other Means

12.7

Invalid Data

13.1

Merchandise/Services Not Received

13.2

Cancelled Recurring

13.3

Not as Described or Defective Merchandise/Services

13.4

Counterfeit Merchandise

13.5

Misrepresentation

13.6

Credit Not Processed

13.7

Cancelled Merchandise/Services

13.8

Original Credit Transaction Not Accepted

13.9

Non-Receipt of Cash or Load Transaction Value

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 37 of 124

REASON CODE 10.1

EMV Liability Shift Counterfeit Fraud

Chargeback Type

Cardholder Dispute

Dispute Description

• The cardholder claims he/she did not authorize, nor participate in,

the transaction and the card was in their possession at the time

of the transaction

• The transaction was the result of counterfeit magnetic stripe fraud

and the full unaltered contents of the stripe were not transmitted

and not authorized by the Issuer

Timeframe to Initiate

Chargeback

• 120 calendar days from the date of the transaction

Challenge

Rights(Prearbitration)/

Merchant

Action

• For non-EMV supported (chip) POS/terminal, there are no rights

to challenge the dispute, unless a refund has been issued. EMV

supported (chip) POS/terminal a transaction with a chip card. The

dispute can be challenged if the full unaltered magnetic stripe

data was read and transmitted with a valid authorization; in this

case, the dispute would be represented on your behalf.

• EMV supported (chip) POS/terminal and transaction with a chip

card. The dispute can be represented if a valid transaction was

manually keyed and transmitted with the authorization; in this

case, the dispute would be represented on your behalf.

If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit; otherwise

accept the dispute and follow your in-house collection procedures

Issuer Required

Documentation

None

Merchant Required

Documentation

• Evidence of the following

• A credit or reversal was not addressed by the issuer

• The dispute is invalid

• The cardholder no longer disputes the transaction

• Compelling evidence

Special Notes

• Invalid for the following transactions

• A chip initiated transaction

• A Fallback transaction

• A mobile push payment

• An Emergency cash dispersment

•

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 38 of 124

REASON CODE 10.2

EMV LIABILITY SHIFT NON-COUNTERFEIT FRAUD

Chargeback Type

Cardholder Dispute

Dispute Description

• The cardholder claims he/she did not authorize, nor participate in,

the transaction

• The card was a pin preferring card

• One of the following

• The transaction did not take place at a chip reading device

• A chip initiated transaction took place at a chip reading device

that was not EMV pin compliant

• The transaction was chip initiated without online PIN and both

• The transaction was authorized online

• The acquirer did not transmit the full chip data in the authorization

record

Timeframe to Initiate

Chargeback

120 calendar days from the date of the transaction

Challenge

Rights(Prearbitration)/

Merchant

Action

• EMV supported (chip) POS/terminal and transaction with a chip

card. The chargeback can be represented if a valid transaction

was manually keyed and transmitted with the authorization; in

this case, the chargeback would be represented on your behalf.

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the chargeback and follow your in-house

collection procedures

Issuer Required

Documentation

Certification that the card was pin preferring and provide hierarchy

and that the cardholder denies participating in the transaction

Merchant Required

Documentation

Evidence of the following

• A credit or reversal was not addressed by the issuer

• The dispute is invalid

• The cardholder no longer disputes the transaction

Special Notes

• This is invalid for the following transactions

• ATM

• Contactless

• Visa Easy Pay

• Fallback

• Transactions that were correctly processed

• Mobile push payment

• A mobility and transport transaction

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 39 of 124

REASON CODE 10.3

OTHER FRAUD-CARD PRESENT ENVIRONMENT

Dispute Type

Cardholder Dispute

Dispute Description

A transaction was processed in a face-to-face retail environment and

the merchant did not obtain a PIN or imprint

Timeframe to Initiate

Dispute

120 calendar days from the transaction date

Challenge

Rights(Prearbitration)/

Merchant

Action

• Provide valid sales slip

• Compelling information is available

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the dispute and follow your in-house

collection procedures

REASON CODE 10.3

OTHER FRAUD-CARD PRESENT ENVIRONMENT

Issuer Required

Documentation

Certification that the cardholder denies participation in the

transaction

Merchant Required

Documentation

Evidence of the following

• A credit or reversal was not addressed by the issuer

• The dispute is invalid

• The cardholder no longer disputes the transaction

• Evidence of an imprint

• Compelling evidence

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 40 of 124

Special Notes

• Compelling Evidence — Visa accepts compelling evidence for

challenging this dispute through pre-arbitration. This includes,

but is not limited to:

• Evidence such as photographs or emails to prove the person

received the merchandise or service. For download of digital

goods, the IP address, email address, description of goods,

date and time goods were downloaded and/or proof the

merchant’s website was accessed for services after the

transaction date.

• Passenger transport — evidence the ticket was received at

cardholder’s billing address, boarding pass was scanned at

the gate, details of frequent flyer miles claimed, additional

incidental transactions purchased (such as baggage fees,

seat upgrades, alcohol, etc.)

• Previous undisputed transaction — provide evidence that the

information provided is the same as that from a previous

undisputed transaction

• Evidence that the transaction was completed by a member of

the Cardholder’s household

• For a Transaction conducted by a digital goods Merchant

assigned MCC 5815 (Digital Goods –Media, Books, Movies,

Music), 5816 (Games), 5817(Applications [Excludes Games])

or 5818 (Digital Goods Large Digital Goods Merchants), all of

the following:

• Evidence that the Merchant has been successfully registered

into and continues to participate in the Visa Digital Commerce

Program

• Evidence that the Merchant is the owner of the operating

system for the subject electronic device

• Evidence that the account set up on the Merchant's website or

application was accessed by the Cardholder and has been

successfully verified by the Merchant before or on the

Transaction Date

• Evidence that the disputed Transaction used the same device

and Card as any previous Transactions that were not disputed

• Proof that the device ID number, IP address and geographic

location, and name of device (if available) are linked to the

Cardholder profile on record at the Merchant

• Description of the merchandise or services and the date and

time goods were purchased and successfully downloaded

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 41 of 124

• Customer name linked to the customer profile on record at the

Merchant

• Evidence that the customer password was reentered on the

Merchant's website or application at the time of purchase

• Evidence that the Merchant validated the Card when the

Cardholder first linked the Card to the customer profile on

record at the Merchant

For qualifying transactions under the Visa Easy Payment Service

(VEPS) the program eliminates retrieval requests

REASON CODE 10.4

OTHER FRAUD-CARD NOT PRESENT ENVIRONMENT

Dispute Type

Cardholder Dispute

Dispute Description

• Scenario 1: Cardholder claims he/she neither authorized nor

participated in the transaction

• Scenario 2: Issuer certifies that the account number is fictitious

and an authorization was not obtained

Timeframe to Initiate

Dispute

120 calendar days from the date of the transaction

Challenge

Rights(Prearbitration)/

Merchant

Action

• This dispute may be represented if an AVS (Address Verification

Service) response of I1 or I3 was obtained

• Compelling Evidence — see Special Notes below.

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the dispute and follow your in-house

collection procedures

Issuer Required

Documentation

Certification that the cardholder denies participation in the transaction

Merchant Required

Documentation

Provide compelling information – see Special Notes below

Special Notes

• This dispute is invalid if the transaction was authenticated using

Verified by Visa

• International Only: Visa allows transaction-bundling for

transactions under MCC 4814 — Telephone Service Transaction

merchants (in other words, where the card was used to initiate a

long distance call). There is a maximum of 25 transactions

allowed, they must be under US $40 per transaction and be listed

with the Acquirer’s Reference Number on an Exhibit 2F

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 42 of 124

• Evidence such as photographs or emails to prove the person

received the merchandise or service. For download of digital

goods, the IP address, email address, description of goods, date

and time goods were downloaded and/or proof the merchant’s

website was accessed for services after the transaction date.

• Passenger transport — evidence the ticket was received at

cardholder’s billing address, boarding pass was scanned at the

gate, details of frequent flyer miles claimed, additional incidental

transactions purchased (such as baggage fees, seat upgrades,

alcohol, etc.)

• Previous undisputed transaction — provide evidence that the

information provided is the same as that from a previous

undisputed transaction

Evidence that the transaction was completed by a member of the

Cardholder’s household

• For a Transaction conducted by a digital goods Merchant

assigned MCC 5815 (Digital Goods –Media, Books, Movies,

Music), 5816 (Games), 5817(Applications [Excludes Games]) or

5818 (Digital Goods Large Digital Goods Merchants), all of the

following:

• Evidence that the Merchant has been successfully registered into

and continues to participate in the Visa Digital Commerce

Program

• Evidence that the Merchant is the owner of the operating system

for the subject electronic device

• Evidence that the account set up on the Merchant's website or

application was accessed by the Cardholder and has been

successfully verified by the Merchant before or on the Transaction

Date

• Evidence that the disputed Transaction used the same device

and Card as any previous Transactions that were not disputed

• Proof that the device ID number, IP address and geographic

location, and name of device (if available) are linked to the

Cardholder profile on record at the Merchant

• Description of the merchandise or services and the date and time

goods were purchased and successfully downloaded

• Customer name linked to the customer profile on record at the

Merchant

• Evidence that the customer password was reentered on the

Merchant's website or application at the time of purchase

• Evidence that the Merchant validated the Card when the

• Cardholder first linked the Card to the customer profile on record

at the Merchant

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 43 of 124

REASON CODE 10.5

VISA FRAUD MONITORING PROGRAM

Dispute Type

Technical

Dispute Description

Visa notified the issuer that a fraudulent transaction occurred that

appeared on the Merchant Fraud Monitoring Program

Timeframe to Initiate

Dispute

120 calendar days from the date of the identification by the Merchant

Fraud Performance Program

Challenge Rights

(Pre-arbitration)/

Merchant Action

If credit was previously issued, submit a rebuttal to the chargeback

department detailing the amount and the date of the credit; otherwise

accept the dispute and follow your in-house collection procedures

Issuer Required

Documentation

None

Merchant Required

Documentation

Evidence of the following

• A credit or reversal was not addressed by the issuer

• The dispute is invalid

• The cardholder no longer disputes the transaction

Special Notes

REASON CODE 11.1

CARD RECOVERY BULLETIN

Dispute Type

Technical – all regions except domestic

For a T&E Transaction, evidence that the Account Number was not

listed on the Card Recovery Bulletin on the following dates, as

applicable:

- For a Lodging Merchant, the check-in date

- For a Car Rental Merchant, the vehicle rental date

- For a Cruise Line, the embarkation date

Dispute Description

On the Transaction Date, the Account Number was listed in the Card

Recovery Bulletin for the Visa Region in which the Merchant Outlet is

located

Timeframe to Initiate

Dispute

75 calendar days from the date of the transaction

USER GUIDE | CHARGEBACK REASON CODES

04/2018 | ©2018 Paymentech, LLC. All Rights Reserved. Page 44 of 124

Challenge Rights

(prearbitration)/

Merchant

Action

• If the transaction was authorized through the Emergency

Payment Authorization Service

• If the transaction was completed at a Contactless only

Acceptance Device

• If credit was previously issued, submit a rebuttal to the

chargeback department detailing the amount and the date of the

credit; otherwise accept the dispute and follow your in-house

collection procedures

Issuer Required

Documentation

None

Merchant Required

Documentation

• Documentation proving the transaction was authorized through

the Emergency Payment Authorization Service

• Documentation proving the transaction was completed at a