INTERNATIONAL

INVESTMENT

POSITION

A Guide to Data Sources

INTERNATIONAL MONETARY FUND

Citation

International Monetary Fund. Statistics Department.

International Investment Position: A Guide to Data Sources.

Washington, D.C., October 2002.

(Second printing 2004)

INTERNATIONAL

INVESTMENT

POSITION

A Guide to Data Sources

INTERNATIONAL MONETARY FUND

2002

Preface

The International Investment Position: A Guide to Data Sources has been prepared to assist

national compilers in the development of international investment position statistics.

Recent financial crises have underscored the importance of timely information on countries’

external asset and liability positions as an important indicator of external vulnerability. The

International Investment Position (IIP), which is the recognized framework for the

presentation of a country’s stock of external assets and liabilities, was formally introduced in

the fifth edition of the Balance of Payments Manual in 1993.

The primary audience for this guide is those countries not currently producing an IIP

statement as well as those producing partial IIP statements. The major focus of the guide is to

give practical advice on existing data sources that could readily be used to build an IIP

statement within a relatively short time. It is, however, our hope that the guide will provide a

useful source of reference to all countries compiling IIP statements.

The guide was prepared by Ms. Beatrice Timmerman, formerly an economist in the Fund’s

Statistics Department, and Ms. Colleen Cardillo an economist in the Statistics Department.

Carol S. Carson

Director

Statistics Department

Contents

I. Introduction..........................................................................................................................3

II. Conceptual Framework for IIP Statistics.............................................................................4

A. Coverage and Concepts.............................................................................................4

B. Classification.............................................................................................................7

III. Data Sources For IIP Statistics.......................................................................................... 11

A. Existing Domestic Data Sources.............................................................................11

Banks’ external assets and liabilities ...............................................................12

Monetary authorities’ external assets and liabilities........................................15

General government external debt ...................................................................19

Balance of payments financial flows ...............................................................21

Financial statements of enterprises ..................................................................25

Approvals of foreign investment .....................................................................27

Financial press .................................................................................................28

B. Existing Foreign Data Sources................................................................................28

International banking statistics ........................................................................28

Coordinated Portfolio Investment Survey .......................................................30

Joint BIS-IMF-OECD-World Bank statistics on external debt .......................31

Partner country data .........................................................................................34

C. Existing Sources by Type of Investment.................................................................36

D. Surveys of External Financial Assets and Liabilities..............................................42

Enterprise surveys............................................................................................42

Portfolio investment surveys............................................................................44

IV. Other Compilation Aspects of IIP Statistics...................................................................... 45

A. Institutional Setting.................................................................................................45

B. Dissemination of IIP Statistics ................................................................................46

V. Summing Up...................................................................................................................... 47

Appendices

I. International Investment Postion: Standard Components .................................................48

II. International Investment Postion Methodology for SDDS: List of Prompt Points ...........54

Bibliography............................................................................................................................ 58

- 3 -

I. INTRODUCTION

1. Both the balance of payments and the international investment position (IIP) provide

useful information for assessing a country’s economic relations with the rest of the world.

2. The balance of payments shows transactions between residents and nonresidents of

an economy—that is, external transactions—during a specific period. Transactions in

financial assets and liabilities are recorded in the financial account of the balance of

payments.

3. The IIP is a statistical statement that shows an economy’s stock of external financial

assets and liabilities at a particular point. This stock is the result of past external transactions

measured according to current market values (current market prices and exchange rates) and

other factors (for example, write-offs or reclassifications) at a specific point.

4. The conceptual framework for the IIP was introduced in the fifth edition of the

International Monetary Fund’s Balance of Payments Manual (BPM5) in 1993. It reflected the

increased interest in data on levels of, or positions in, foreign investment, inclusive of

external debt. While many member countries have implemented the recommendations of the

BPM5 for balance of payments statistics, implementation of the recommendations for

compiling the IIP framework has advanced at a slower pace.

5. Against this background, this paper aims to give practical guidance on IIP

compilation to those countries that are not yet compiling IIP data or that are producing only

partial IIP statements. This approach originates from a recognition that additional guidance

might be useful to supplement available documents, which contain both the concepts

underlying IIP statistics and the more practical aspects of compiling such statistical

statements.

1

These include the following:

• Balance of Payments Manual, Fifth Edition, 1993 (BPM5)

• Balance of Payments Textbook (Textbook)

• Balance of Payments Compilation Guide (Compilation Guide)

• Financial Derivatives, A Supplement to the Fifth Edition (1993) of the Balance of

Payments Manual

• External Debt Statistics: Guide For Compilers and Users, 2003

2

(External Debt

Guide).

6. Specifically, the paper is tailored to give practical advice on how a country might

improve the availability of external position data in a relatively short time. The goal is to use

1

See Bibliography for details.

2

See http://www.imf.org/external/pubs/ft/eds/Eng/Guide/index.htm. References to the External Debt

Guide are based on the June 2003 final edition.

- 4 -

available data, which could readily provide substantial information. This would be the first

phase in developing IIP statistics. A subsequent phase, not discussed in detail in this paper,

would involve developing survey/reporting systems for compiling comprehensive IIP

statements.

7. Following this introduction, the paper comprises four sections. The first summarizes

the conceptual and other methodological guidelines of the IIP framework, using extensive

cross-references to the existing international methodological guidelines.

8. The second section discusses the existing data sources in the following broad areas—

domestic sources and foreign sources. Summary tables reorganize the existing data sources to

show how they feed the main IIP accounts. This section also presents potential sources that

compilers could use to develop IIP surveys in the subsequent phase.

9. The third section discusses the institutional environment in which IIP statistics are

produced, along with various aspects of disseminating these statistics. Finally, the fourth

section presents a brief summing up.

10. This paper draws on the international guidelines for external macroeconomic statistics

set out in the BPM5, the External Debt Guide, the Monetary and Financial Statistics Manual,

2000 (MFSM), the Government Finance Statistics Manual, 2001(GFSM), and the System of

National Accounts 1993 (1993 SNA). In addition, the paper uses technical assistance mission

reports of the Fund’s Statistics Department, as well as countries’ publications on sources and

methods for compiling balance of payments and IIP statistics.

II. CONCEPTUAL FRAMEWORK FOR IIP STATISTICS

11. To assess the suitability of data sources for compiling IIP statements, it is essential to

understand what exactly requires measuring. This section summarizes the main concepts and

definitions underlying the IIP set forth in BPM5 and other statistical methodological

manuals. For a more in-depth discussion of the conceptual framework, see the paper’s

citations to the appropriate reference documents.

12. Section II.A generally outlines the coverage, as well as the concepts—residence,

valuation, and the time of recording—of the IIP statistics. Section II.B explains the

classification of financial assets and liabilities in the IIP according to standard components

recommended in BPM5.

A. Coverage and Concepts

13. The international investment position, compiled at the end of a specific period such as

year-end, is the balance sheet of the stock of external financial assets and liabilities. The

items that compose financial assets and liabilities are financial claims on and liabilities to

nonresidents, equity assets and liabilities, financial derivative instruments, monetary gold,

and SDRs.

- 5 -

14. The net international investment position (the stock of external assets less the stock of

external liabilities) shows the difference between what an economy owns in relation to what

it owes. The net IIP, combined with the stock of an economy’s nonfinancial assets, composes

the net worth of that economy.

3

15. The concepts guiding the compilation of IIP statistics are broadly the same as those

for balance of payments and are also consistent with those for other macroeconomic

statistics. The following summarizes the concepts—residence, valuation, and time of

recording—that are relevant for IIP purposes, with reference to further detail if needed.

Residence

16. For IIP statistics, the concept of residence implies that only those assets and liabilities

of residents that represent claims on or liabilities to nonresidents are recorded. The

distinction between residents and nonresidents is closely related to the delineation between

the compiling economy and the rest of the world.

17. Residents of an economy are institutional units—such as households, corporations,

government—that have a center of economic interest in the economy in question. These units

engage and intend to engage

4

in economic activities on a significant scale from some location

(dwelling, place of production, or other premises) within the economic territory of the

country. This means within the geographic territory administered by a government.

5

18. Nonresidents of an economy are defined residually as the institutional units that are

not residents of the economy.

Valuation of external assets and liabilities

19. In principle, all asset and liability positions constituting a country’s international

investment position should be measured at market prices. This concept assumes that such

positions are continuously and regularly revalued—for example, by reference to actual

market prices for financial assets such as shares and bonds.

3

International Monetary Fund, Balance of Payments Manual, Fifth Edition (BPM5),1993,

paras. 461-462.

4

A one-year period is suggested as a guideline but not as an inflexible rule.

5

For a more detailed description of residence see Bank for International Settlements, Commonwealth

Secretariat, Eurostat, IMF, Organisation for Economic Co-operation and Development, Paris Club

Secretariat, UN Conference on Trade and Development, and World Bank, 2003, External Debt

Statistics: Guide for Compilers and Users, paras. 2.13–2.21.

- 6 -

20. The market price measurement

6

cannot always be implemented, especially if financial

instruments are not traded in the market.

21. Cash items (currency and transferable deposits that can be redeemed on demand at

the nominal values) have only one value that could be assigned for any purpose, so this value

could be regarded as the actual market price.

22. Nonmarketable financial items, which are primarily loans in one form or another, are

valued at the nominal values. However, a secondary market occasionally arises for these

items and in these markets these instruments are often traded at substantial discounts from

nominal values. When such market prices are available then the market price of the

instrument should be used as the basis for valuation. For example, loans to some heavily

debt-burdened countries are often traded in secondary markets.

23. Balance sheet (or book) value is often the only valuation available or reported for

direct investment.

7

That value might be assigned on the basis of original cost, a more recent

revaluation, or current value. (The use of current value would accord with the market price

principle.) When direct investment enterprises are listed on stock exchanges, the listed prices

should be used as the market values of shares in those enterprises.

Time of recording

24. The international investment position presents data related to a country’s external

financial conditions as of a specific point (such as year-end). The time of recording of the

financial items that constitute the position is governed by the principle of accrual

accounting. Claims and liabilities arise when there is a change in ownership between

residents and nonresidents, as evidenced by transactions where financial assets have been

created, transformed, exchanged, transferred, or extinguished. When a change in ownership

is not obvious, the change is considered to have occurred at (or is proxied by) the time the

parties to the transaction record it in their books or accounts.

8

6

For a more detailed description of valuation, see External Debt Guide, paras. 2.31–2.49. A

discussion of valuation methods for portfolio investment assets can also be found in the International

Monetary Fund’s Coordinated Portfolio Investment Survey Guide (Second Edition), 3.33–3.42.

7

See BPM5, para. 467 and External Debt Guide, para. 2.49 for more detail.

8

For a more detailed description of time of recording, see External Debt Guide, paras. 2.22–2.30

and Box 2.1, “The Choice of a Recording Basis: The Case for Accrual Accounting.”

- 7 -

B. Classification

25. A classification scheme’s goal is to group different types of financial assets and

liabilities into analytically useful components. It thus enables a structured presentation of the

external assets and liabilities of an economy. The classifications discussed here are financial

assets and liabilities and functional types of investment.

Financial assets and liabilities

26. The primary dimension for classification in the IIP is by financial assets and

liabilities.

27. Most financial assets

9

are financial claims. Financial claims and obligations arise out

of contractual relationships entered into when one institutional unit provides funds to the

other. A financial claim is an asset that entitles its owner, the creditor, to receive a payment,

or series of payments, from the debtor, in certain circumstances specified in the contract

between them. The claim is extinguished when the debtor discharges the liability, paying a

sum agreed to in the contract. In addition, the creditor may receive a series of interest

payments, that is, property income. Financial claims are represented by financial instruments

such as cash and deposits, loans, advances and other credits, and securities such as bills and

bonds.

28. Financial assets that are not financial claims are monetary gold, SDRs allocated by

the IMF, shares in corporations, and financial derivatives. Monetary gold and SDRs are

treated as financial assets even though their holders do not have claims over other designated

units. Shares are treated as financial assets even though their holders do not have a fixed or

predetermined monetary claim on the corporation. Derivatives are treated as financial assets

by convention.

29. For convenience, the term “financial asset” may be used to cover both financial assets

and liabilities, except when the context requires liabilities to be referred to explicitly.

30. Further, the IIP includes some nonfinancial assets whose ownership is construed by

convention as ownership of financial assets (claims). Compilers will find a detailed

discussion of this topic in para. 316 of the BPM5.

31. In the IIP, the external financial claims and other external financial assets are

classified as assets when the holders are residents. They are classified as liabilities when the

issuers are residents.

10

9

For a more detailed description of assets, see Eurostat, IMF, Organisation for Economic

Co-operation and Development, UN, and World Bank, System of National Accounts, 1993,

paras. 10.2-10.14.

10

With the exception of direct investment as explained in the next section.

- 8 -

Functional types of investment

32. In a second level of classification, the various financial instruments that make up the

financial assets and liabilities are grouped according to the intent of the resident holders/

issuers of the financial instruments. That is, they are grouped according to the functional

type of investment—direct investment, portfolio investment, financial derivatives, other

investment, and reserve assets (for assets only). Table 1 gives an overview of the main

components. Appendix I presents the full list of standard components.

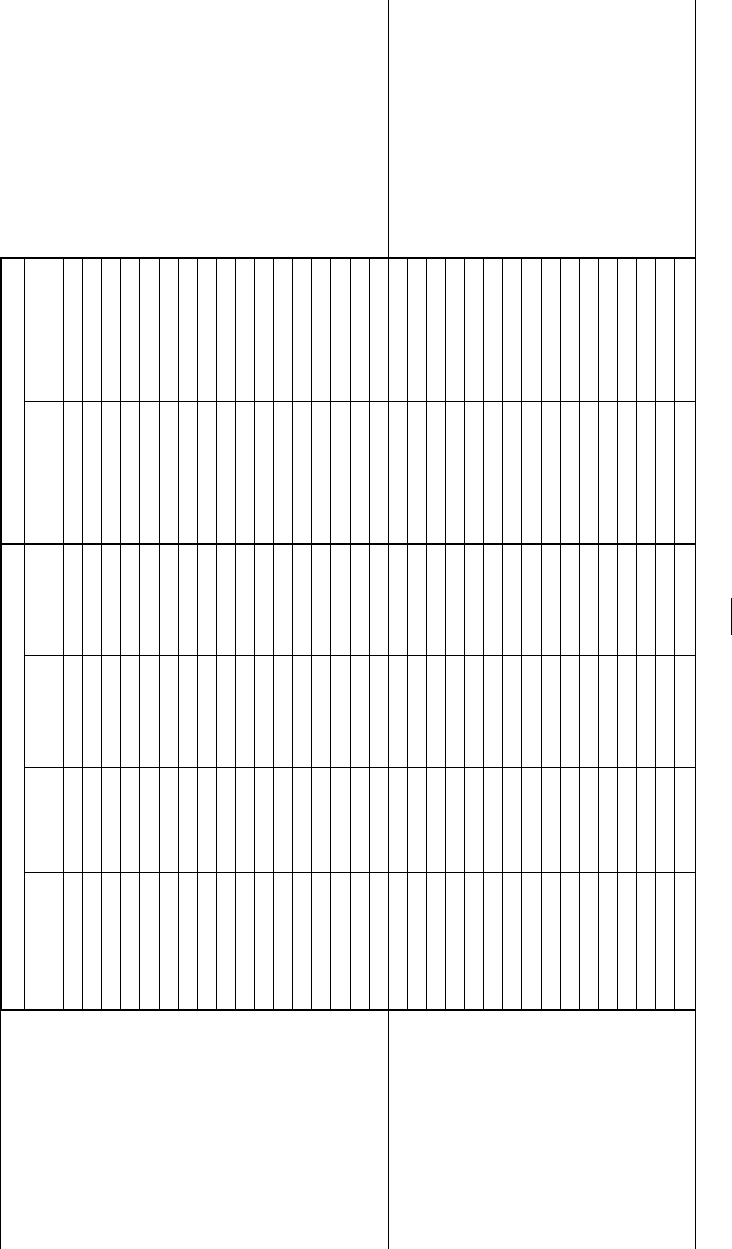

Table 1: International Investment Position: Main Components

__________________________________________________________________________

A. ASSETS

1. Direct investment abroad

1.1 Equity capital and reinvested earnings

1.1.1 Claims on affiliated enterprises

1.1.2 Liabilities to affiliated enterprises

1.2 Other capital

1.2.1 Claims on affiliated enterprises

1.2.2 Liabilities to affiliated enterprises

2. Portfolio investment

2.1 Equity securities

2.2 Debt securities

2.2.1 Bonds and notes

2.2.2 Money market instruments

3. Financial derivatives

4. Other investment

4.1 Trade credits

4.2 Loans

4.3 Currency and deposits

4.4 Other assets

5. Reserve assets

5.1 Monetary gold

5.2 SDRs

5.3 Reserve position in the Fund

5.4 Foreign exchange

5.4.1 Currency and deposits

5.4.2. Securities

5.4.3 Financial derivatives (net)

5.5 Other claims

B. L

IABILITIES

1. Direct investment in reporting economy

1.1 Equity capital and reinvested earnings

1.1.1 Claims on direct investors

1.1.2 Liabilities to direct investors

1.2 Other capital

1.2.1 Claims on direct investors

1.2.2 Liabilities to direct investors

2. Portfolio investment

2.1 Equity securities

2.2 Debt securities

2.2.1 Bonds and notes

2.2.2 Money market instruments

3. Financial derivatives

4. Other investment

4.1 Trade credits

4.2 Loans

4.3 Currency and deposits

4.4 Other liabilities

_________________________________________________________________

Direct investment

33. The first functional category, direct investment, is classified by direction of

investment–direct investment abroad and direct investment in the reporting economy. Table 1

illustrates that these direct investment components each include asset and liability instruments,

- 9 -

consistent with the presentation of the flow data in the financial account of the balance of

payments.

11

34. Direct investment abroad includes claims

12

on and liabilities to direct investment

enterprises, and direct investment in the reporting economy includes claims on and liabilities to

direct investors.

35. Within the functional category of direct investment, a distinction is made between

equity capital, including reinvested earnings, and other capital (intercompany debt).

36. Direct investment reflects the lasting interest of a resident entity in one economy—the

direct investor—in an entity resident in another economy—the direct investment enterprise.

The lasting interest implies a significant degree of influence by the investor in the management

of the enterprise. According to BPM5, a lasting interest can usually be assumed if the direct

investor has ownership of a minimum of 10 percent of the ordinary shares or voting power or

the equivalent in the direct investment enterprise.

13

37. Direct investment positions cover all financial claims and liabilities between direct

investors and direct investment enterprises (except for financial derivatives

14

and specific

exceptions for affiliated financial intermediaries

15

).

Portfolio investment

38. The portfolio investment category covers financial instruments in the form of equity

and debt securities that are usually traded (or tradable) in organized markets

16

and where the

resident holders/issuers are largely driven by consideration of portfolio diversification. Debt

securities are subdivided into bonds and notes and money-market instruments. The instruments

11

Because direct investment is classified primarily on a directional basis—abroad under the heading

Assets and in the reporting economy under the heading Liabilities—claim/liability breakdowns are

shown for the components of each, although these subitems do not strictly conform to the overall

headings of Assets and Liabilities.

12

Also includes assets that are not claims.

13

See also BPM5, chapter XVIII.

14

International Monetary Fund, Letter of Promulgation of Final Decision on Classification in the

Balance of Payments and IIP of Financial Derivatives involving Affiliated Enterprises, June 24, 2002,

sent to IMF balance of payments correspondents.

15

International Monetary Fund, Balance of Payments Statistics Newsletter, Midyear 2002, pages 12–13,

and BPM5, para. 372.

16

BPM5, para. 387.

- 10 -

are further classified by institutional resident sectors, namely, monetary authorities, general

government, banks, and other sectors.

17

Financial derivatives

39. Financial derivatives are financial instruments that are linked to another specific

financial instrument, indicator, or commodity and through which specific financial risks can be

traded in financial markets in their own right. The classification shows the subdivision by the

four institutional resident sectors. Compilers should report all financial derivatives here except

those reported under reserve assets.

18

Other investment

40. Other investment is a residual category that covers all financial instruments other than

those classified as direct investment, portfolio investment, financial derivatives, or reserve

assets. Like portfolio investment, it is primarily classified by instrument and secondarily by

sectors. The instruments include trade credits, loans, currency and deposits, and other assets

and liabilities. The sector classification is the same as for portfolio investment instruments.

Guidelines also recommend a classification by original maturity (short and long term) except

for currency and deposits, which are considered to be short-term instruments unless details are

available to make the short-/long-term attribution.

19

Reserve assets

41. Reserve assets are external assets that are readily available to and under the effective

control of monetary authorities for balance of payments or other purposes.

20

The classification

distinguishes monetary gold, SDRs, reserve position in the IMF, foreign exchange, and other

claims. The foreign exchange position is further split into currency and deposits, securities, and

financial derivatives. Within currency and deposits, a distinction is made for “held with other

monetary authorities” and “held with banks.” In addition, foreign exchange securities are

further identified by instrument—equities, bonds and notes, and money market instruments.

17

See also BPM5, chapter XIX.

18

See also International Monetary Fund’s Financial Derivatives, A Supplement to the Fifth Edition

(1993) of the Balance of Payments Manual, 2000, and Letter of Promulgation, noted previously.

19

External Debt Guide, Table 7.10.

20

See also BPM5, chapter XXI, Anne Kester’s International Reserves and Foreign Currency Liquidity,

Guidelines for a Data Template, 2001, paras. 64–74, and Financial Derivatives, pp. 26, 40, and 45.

- 11 -

III. DATA SOURCES FOR IIP STATISTICS

42. As mentioned, this guide intends to give practical guidance on how a country might

improve the availability of external-position data in a relatively short time. This could be

accomplished by using available data, which could readily provide substantial information.

43. This section therefore discusses the following existing data sources—the domestic

sources, which are often already available for other statistical systems, and foreign sources

from international organizations or administrative records. It also presents summary tables that

reorganize the existing data sources by functional type of investment (e.g., all existing sources

for direct investment).

44. In a subsequent phase, a country would also need to develop survey/reporting systems

for compiling comprehensive IIP statements. Although this paper does not discuss this phase in

detail, it does present potential sources for developing surveys specifically designed for IIP

data needs.

45. In setting out the range of data sources that countries can possibly use, this section

notes that information that can be obtained from these data sources is partly overlapping—that

is, more than one source described may provide information on any given claim or liability.

46. Further, some of the data sources may not be available in particular countries.

Compilers will, therefore, need to choose those sources that provide the most adequate data in

the country’s specific circumstances. If a country adopts a phased approach to compiling IIP

data, as this paper suggests, these choices will most probably change over time when a country

develops more appropriate sources.

47. As well, the range of data sources available is likely to change with progressive

liberalization of foreign exchange regulations from administrative and banking records towards

survey collection methods. The External Debt Guide

21

outlines the impact of the regulatory

environment on the collection techniques for external debt statistics, which is also relevant for

IIP statistics.

A. Existing Domestic Data Sources

48. The first step in identifying the various sources consists of a stocktaking exercise of

macroeconomic datasets and other sources collected by a country for other than purely

statistical purposes. These existing sources may be relevant for compiling an IIP statement.

21

See External Debt Guide, Chapter 10, paras. 10.16–10.22.

- 12 -

49. Domestic-based data that exist can be divided into those collected for economic

datasets that follow accounting and classification principles similar to the IIP and those that

serve other purposes, including administrative data.

50. This section reviews four economic datasets—banks’ external assets and liabilities,

monetary authorities external assets and liabilities, general government external debt, and

balance of payments financial flows.

51. It also reviews three nonstatistical sources—financial statements of enterprises,

approvals of foreign investment, and the financial press.

52. It examines the concepts and definitions used in the various datasets, available

breakdowns, valuation practices, frequency, timeliness, and related issues.

53. The intent is for compilers to determine whether these data are consistent with the IIP

requirements. Even after a country has developed a comprehensive data collection system for

compiling the IIP (see Section III.D), the data sources described here can still prove useful for

cross-checking purposes.

54. Major gaps of the sources covered in this section are in the area of financial derivatives

and the financial assets and liabilities of the private nonbank sector. Administrative data on the

latter may exist only if restrictive capital controls are in place, and in such cases, the

importance of the private nonbank sector’s external positions might be rather small.

Statistical sources (four economic datasets)

55. The first two—banks’ external assets and liabilities and monetary authorities’ external

assets and liabilities—are existing domestic sources for monetary statistics. The third dataset is

drawn from government finance statistics while the fourth refers to statistics of the external

sector (balance of payments).

Banks’ external assets and liabilities

56. The Monetary and Financial Statistics Manual, 2000 (MFSM) presents an

internationally accepted framework that can be used for three sectoral components of the IIP.

That is, the Sectoral Balance Sheet for Other Depository Corporations

22

can be used for the

Banking sector of the IIP. Second, the Sectoral Balance Sheet for the Central Bank can be

used to compile statistics for the Monetary Authorities sector in the IIP. Third, the Sectoral

22

Other depository corporations include commercial banks, merchant banks, savings banks, savings

and loan associations, building societies and mortgage banks, credit unions and credit cooperatives,

rural and agricultural banks, and travelers’ check companies that mainly engage in financial corporation

activities (International Monetary Fund, Monetary and Financial Statistics Manual (MFSM), 2000,

p. 18).

- 13 -

Balance Sheet for Other Financial Corporations may be used to a lesser extent as part of

“other sectors.”

23

57. This section presents the Sectoral Balance Sheet for Other Depository Corporations

(ODCs), which can be used to compile estimates for the Banking sector of the IIP. Banks are

closely regulated in almost all countries; therefore, usually extensive data on their financial

flows and positions are collected for monetary policy and banking supervision purposes. Such

data generally are also available on a very frequent (mostly monthly) and timely basis. In

principle, they could thus constitute an important source of information for IIP purposes.

58. From this same Sectoral Balance Sheet for Other Depository Corporations,

24

it is

possible for compilers to identify and select the external assets and liabilities of the banking

sector. The following table presents this information on positions vis-à-vis nonresidents as well

as the relevant corresponding IIP components.

Table 2: Reconciliation of Other Depository Corporations’ Balance Sheet Items with

International Investment Position Components

ODC’s Balance Sheet International Investment Position

Assets: claims on nonresidents

Foreign currency

Deposits (transferable and other, in national and

foreign currency)

A.4.3.3 Other investment, currency and deposits,

banks

Securities other than shares A.2.2.1.3 Portfolio investment, debt securities, bonds

and notes, banks

A.2.2.2.3 Portfolio investment, debt securities, money

market instruments, banks

Loans A.4.2.3 Other investment, loans, banks

A.4.2.3.1 Long-term

A.4.2.3.2 Short-term

Shares and other equity A.1.1.1 Direct investment abroad, equity capital and

reinvested earnings, claims on affiliated

enterprises

B.1.1.1 Direct investment in the reporting economy,

equity capital and reinvested earnings,

claims on direct investors

A.2.1.3 Portfolio investment, Equity securities,

banks

Insurance technical reserves A.4.4.3.1 Other investment, other assets, banks,

long-term

23

Other financial corporations include insurance corporations and pension funds, other financial

intermediaries, and financial auxiliaries (MFSM para. 96; see also Table 3, p. 142). Note: Liabilities in

the form of deposits are excluded, and other financial corporations may have liability positions from

insurance technical reserves.

24

MFSM, p.136.

- 14 -

Table 2 (continued)

ODC’s Balance Sheet International Investment Position

Assets: claims on nonresidents

Financial derivatives A.3.3 Financial derivatives, banks

Other accounts receivable

25

Trade credit and advances

Other

A.4.4.3. Other investment, other assets, banks

A.4.4.3.1 Long-term

A.4.4.3.2 Short-term

Liabilities to nonresidents

Deposits (excluded from broad money, transferable

and other, in national and foreign currency)

B.4.3.2 Other investment, currency and deposits,

banks

Securities other than shares (excluded from broad

money, in national and foreign currency)

B.2.2.1.3 Portfolio investment, debt securities, bonds

and notes, banks

B.2.2.2.3 Portfolio investment, debt securities, money

market instruments, banks

Loans B.4.2.3 Other investment, loans, banks

B.4.2.3.1 Long-term

B.4.2.3.2 Short-term

Financial derivatives B.3.3 Financial derivatives, banks

Other accounts payable

Trade credit and advances

Other

B.4.4.3 Other investment, other liabilities, banks

B.4.4.3.1 Long-term

B.4.4.3.2 Short-term

Shares and other equity: market value, by holding

sector (memorandum item)

B.1.1.2 Direct investment in reporting economy,

equity capital and reinvested earnings,

liabilities to direct investors

A.1.1.2 Direct investment abroad, equity capital and

reinvested earnings, liabilities to affiliated

enterprises

B.2.1.1 Portfolio investment, equity securities, banks

59. Table 2 shows that, although the sectoral balance sheet data can largely correspond

with IIP components, the differences in the classification do not allow a full reconciliation of

the two frameworks. For several items, additional information from the banks’ balance sheets

would be needed for a compiler to identify unequivocally the appropriate IIP components.

60. As outlined previously, the main criterion for classifying asset and liability components

in the IIP is the function of investment, that is, direct investment, portfolio investment,

financial derivatives, other investment, and reserve assets. Only the next levels of classification

provide an instrument and sector breakdown.

61. Sometimes the mapping of Other Depository Corporations items to the various

components of the IIP is not straightforward. For example, external assets in the form of

“shares and other equity” could be part of the bank’s direct investment in foreign corporations

(direct investment abroad), or part of their portfolio investment in equities of nonresident

corporations. To fill in the standard components of the IIP, additional data that show a further

detailed breakdown by type of investment would be necessary.

25

For a definition of other accounts receivable/payable, see MFSM, para. 179.

- 15 -

62. Careful consideration should be given to the possibility of expanding the banks’

reporting requirements to accommodate the requirements for IIP statistics. Clearly, compiling

agencies would want to avoid requesting similar information for different purposes from the

same group of reporting entities. The agencies could therefore investigate whether it is possible

to incorporate the requests for the IIP statistics in existing reporting forms for the banking

sector. For example, they could introduce some additional memorandum items or breakdowns

of the data. They could do this without impeding the objectives of the banking statistics (for

example, regarding the timeliness of the provision of the data). Since compilers usually request

data for the IIP at a lower frequency, they could include such additional reporting requirements

only in quarterly reports.

63. Alternatively, compiling agencies could investigate whether they could possibly use

approximations to attribute the positions reported in the banking statistics for specific

instruments to the IIP components of the banking sector. This approach could be considered

appropriate if the compilers envisage a separate survey later for IIP statistics and consider the

use of data from the banking statistics temporary. In that case, it might not be worthwhile to

introduce additional reporting requirements into existing surveys. In the above-mentioned

example, compiling agencies could investigate whether they could use other information, such

as that collected for supervisory purposes, to determine the appropriate functional category of

the IIP for shares and other equity assets and liabilities. (Banking supervision information

usually encompasses information on the capital ownership relations.)

64. Apart from allocating shares and other equity positions to direct investment or portfolio

investment, the additional detail required for IIP purposes concerns breakdowns for loans and

other accounts payable and receivable by long- and short-term original maturity. It also

involves distinguishing debt securities assets and liabilities by bonds and notes and money

market instruments. Such information should be available in banks’ records, and compiling

agencies could probably incorporate it in the reporting requirements for banks. If not directly

available, the IIP data for the banking sector could still be compiled at the next aggregated

level without such detail.

65. In a case where a country uses a closed international transactions reporting system

(ITRS)

26

to collect data for balance of payments statistics, compilers could also retrieve

information on the banks’ external positions from this source with enough details on the IIP

components.

Monetary authorities’ external assets and liabilities

66. The reserve assets component of the IIP should be straightforward to compile, since

data on the monetary authorities’ accounts should be readily available directly from the

monetary authorities.

26

For a detailed description of ITRS types, see International Monetary Fund’s Balance of Payments

Compilation Guide, 1995, Chapter III.

- 16 -

67. It should be borne in mind, however, that in instances where the monetary authorities

include several institutional units or where certain transactions of other units need to be taken

into account, then compiling the reserve assets component might be more complex.

68. That is, monetary authorities are defined as a functional concept encompassing the

central bank (and other institutional units such as the currency board, monetary agency, etc.)

and certain operations usually attributed to the central bank but sometimes carried out by other

government institutions or commercial banks. Such operations include issuing currency,

maintaining and managing international reserves, including those resulting from transactions

with the IMF, and operating exchange stabilization funds.

27

The data should be easily

accessible to the compiling institution, but it will entail greater coordination to gather the data

from various sources and aggregate the figures consistently.

69. The monetary authorities should also be able to provide without difficulty, besides the

official reserve assets, the information on their other external assets and their external

liabilities. Such assets may include claims on nonresidents in domestic currency and any other

external assets that do not qualify as reserve assets (for example, because they are not readily

available for balance of payments purposes). Compilers should allocate these foreign assets to

the appropriate IIP components under portfolio investment, financial derivatives, or other

investment.

70. External liabilities of monetary authorities may be in the form of debt securities (bonds

and notes, money market instruments), financial derivatives, loans, deposits, or other liabilities

and should be recorded in the appropriate components of the IIP.

71. Table 3 presents the components that need to be collected from the monetary

authorities’ accounting records for IIP reporting purposes.

27

See BPM5, para. 514.

- 17 -

Table 3: Summary of Required Information on External Asset and Liability

Positions of Monetary Authorities

External Assets External Liabilities

Portfolio investment:

2.1.1 Equity securities

2.2.1.1 Bonds and notes

2.2.2.1 Money market instruments

Portfolio investment:

2.2.1.1 Bonds and notes

2.2.2.1 Money market instruments

Financial derivatives 3.1

(not pertaining to reserves management)

Financial derivatives 3.1

(not pertaining to reserves management)

Other investment:

4.2.1.1 Long-term loans

4.2.1.2 Short-term loans

4.3.1 Currency and deposits

4.4.1.1 Other long-term assets

4.4.1.2 Other short-term assets

Other investment:

4.2.1.1 Use of Fund credit and

loans from the Fund

4.2.1.2 Other long-term loans

4.2.1.3 Short-term loans

4.3.1 Currency and deposits

4.4.1.1 Other long-term liabilities

4.4.1.2 Other short-term liabilities

Reserve assets

5.1 Monetary gold

5.2 SDRs

5.3 Reserve position in the Fund

5.4.1.1 Currency and deposits

with monetary authorities

5.4.1.2 Deposits with banks

5.4.2.1 Equities

5.4.2.2 Bonds and notes

5.4.2.3 Money market instruments

5.4.3 Financial derivatives (net)

5.5 Other claims

72. In practice, the list above of financial instruments may be shorter if, for example,

reserve management policy or other provisions prohibit the monetary authority’s investing in

certain types of assets or incurring certain liabilities.

73. Although it is preferable that the central bank directly provides the required data to the

IIP compiler, the compiler can also use the Sectoral Balance Sheet for the Central Bank, as

presented in the MFSM, as a reference. As in the case of the Sectoral Balance sheet for Other

Depository Corporations, the compiler can compare the recommended classification of those

data in the MFSM with the required information for the IIP (see Table 4).

- 18 -

Table 4: Reconciliation of Sectoral Balance Sheet Items for the Central Bank

with International Investment Position Components

Sectoral Balance Sheet for the

Central Bank

28

International Investment Position

Assets: claims on nonresidents

Monetary gold A.5.1 Reserve assets, monetary gold

SDRs A.5.2 Reserve assets, SDRs

Foreign currency A.5.4.1.1 Reserve assets, foreign exchange,

currency and deposits, with monetary

authorities

Deposits in national currency (transferable and other) A.4.3.1 Other investment, currency and deposits,

monetary authorities

Deposits in foreign currency (transferable and other) A.4.3.1. Other investment, currency and deposits,

monetary authorities

A.5.4.1 Reserve assets, foreign exchange,

currency and deposits

A.5.4.1.1 With monetary authorities

A.5.4.1.2 With banks

Securities other than shares A.2.2.1.1 Portfolio investment, debt securities,

bonds and notes, monetary authorities

A.2.2.2.1 Portfolio investment, debt securities,

money market instruments, monetary

authorities

A.5.4.2.2 Reserve assets, foreign exchange,

securities, bonds and notes

A.5.4.2.3 Reserve assets, foreign exchange,

securities, money market instruments

Loans A.4.2.1 Other investment, loans, monetary

authorities

A.4.2.1.1 Long-term

A.4.2.1.2 Short-term

Shares and other equity A.2.1.1 Portfolio investment, equity securities,

monetary authorities

A.5.4.2.1 Reserve assets, foreign exchange,

securities, equities

Insurance technical reserves A.4.4.1.1 Other investment, other assets, monetary

authorities, long-term

Financial derivatives A.3.1 Financial derivatives, monetary authorities

A.5.4.3 Part of reserve assets, foreign exchange,

financial derivatives (net)

Other accounts receivable

Trade credit and advances

Other

A.4.4.1 Other investment, other assets, monetary

Authorities

A.4.4.1.1 Long-term

A.4.4.1.2 Short-term

A.5.5 Reserve assets, other claims

28

MFSM, p. 130.

- 19 -

Liabilities to nonresidents

Currency in circulation (nonresidents’ holdings, not

separately identified in balance sheet)

Deposits (transferable and other, in national and foreign

currency)

B.4.3.1 Other investment, currency and deposits,

monetary authorities

Securities other than shares B.2.2.1.1 Portfolio investment, debt securities,

bonds and notes, monetary authorities

B.2.2.2.1 Portfolio investment, debt securities,

money market instruments, monetary

authorities

Loans B.4.2.1 Other investment, loans, monetary

Authorities

B.4.2.1.1 Use of Fund credit and loans

from the Fund

B.4.2.1.2 Other long-term

B.4.2.1.3 Short-term

Financial derivatives B.3.1 Financial derivatives, monetary authorities

A.5.4.3 Part of reserve assets, financial derivatives

(net)

Other accounts payable

Trade credit and advances

Other

B.4.4.1 Other investment, other liabilities, monetary

Authorities

B.4.4.1.1 Long-term

B.4.4.1.2 Short-term

General government external debt

74. The previous sections on existing domestic data sources have focused on two

components of a country’s external debt statement—the external debt of the banking sector and

the monetary authorities sector. This section focuses on the external debt of the general

government sector.

29

It also discusses the relationship of the external debt statement to the IIP

statement.

75. The external debt statement relates closely to the IIP. It is a subset of the liability

component of the IIP and, as such, can be derived from the IIP. Liability components of the IIP

that are not considered part of external debt include equity liabilities and financial derivative

liabilities. In the same vein, the net international investment position is not identical to the net

external debt position of an economy. A measure for net external debt would exclude from

assets and liabilities any equity instruments as well as financial derivative positions.

76. The new External Debt Guide gives detailed recommendations on how to measure,

compile, and present external debt. Because the External Debt Guide was only finalized in

29

Although this section focuses on the liability side of the government’s balance sheet, information on

the general government’s holdings of assets abroad may be available to the compiler through existing

government financial statistics.

See IMF’s Government Finance Statistics Manual, 2001 for more

information on the availability of holdings of external assets that can be attributed to the general

government sector.

- 20 -

2003, countries may not yet have implemented some of its recommendations. Nevertheless,

this guide presents the now accepted methodology for measuring and presenting external debt

statistics.

30

77. According to the External Debt Guide, the main framework for presenting data on

external debt shows external debt positions primarily broken down by the four institutional

sectors of the compiling economy—monetary authorities, general government, banks, and

other sectors.

31

The definition of these sectors is identical with that of the balance of payments

and IIP frameworks. Further breakdowns include long- and short-term maturity of the debt,

and financial instruments (money market instruments, bonds and notes, loans, trade credits,

other debt liabilities) on an original maturity basis. The External Debt Guide also presents a

memorandum table for position data on financial derivatives (assets and liabilities),

32

which

identifies data for the general government sector. Compilers can directly reconcile these

positions with the IIP components.

78. If agencies compile data on the general government’s external debt according to this

framework, they can use the data directly for the IIP statement. Table 5 illustrates the

relationship between the general government’s external debt position according to this

presentation and the relevant IIP components.

30

The previous guidance on the measurement of gross external debt was presented in External Debt:

Definition, Statistical Coverage and Methodology, 1988 (Grey Book). Although this may still represent

the conceptual basis for many of the existing external debt compilation systems, it has some major

conceptual differences that may impede the use of those data for IIP purposes.

31

The External Debt Guide, Chapter Five, recommends another presentation, which emphasizes the

role of the public sector in external borrowing (the public sector includes the general government,

monetary authorities, and those entities in the banking and other sectors that are public corporations

(para. 5.5)). However, since additional information on the public sector debt would be needed in order

to allocate it according to the institutional sector breakdown used in the IIP, this paper will not present

it.

32

External Debt Guide, Table 4.3.

- 21 -

Table 5: Relationship between General Government’s Gross External Debt and IIP

Gross External Debt Position—General

Government

IIP General Government’s Liabilities

Components

Short-term

Money market instruments B.2.2.2.2 Portfolio investment, Debt

securities, Money market

instruments, General government

Loans B.4.2.2.2 Other investment, Loans, General

government, Short-term

Trade credits B.4.1.1.2 Other investment, Trade credits,

General government, Short-term

Other debt liabilities

Arrears

Other

B.4.4.2.2 Other investment, Other liabilities,

General government, Short-term

Long-term

Bonds and notes B.2.2.1.2 Portfolio investment, Debt

securities, Bonds and notes,

General government

Loans B.4.2.2.1 Other investment, Loans,

General government, Long-term

Trade credits B.4.1.1.1 Other investment, Trade credits,

General government, Long-term

Other debt liabilities B.4.4.2.1 Other investment, Other

liabilities, General government,

Long-term

Balance of payments financial flows

79. To examine how compilers can use the financial flows in the balance of payments to

estimate the IIP, this section briefly profiles the relationship between the two statements.

80. The international investment position and the balance of payments are closely

interrelated. The balance of payments records both financial and nonfinancial transactions with

nonresidents during the period in which they occur. The IIP shows the result of previous

financial transactions with nonresidents at a specific point in time, usually at year-end.

81. The reconciliation statement (Figure 1) illustrates the relationship, explaining the

difference between IIP positions. It shows how changes that have occurred during the period

are due to financial transactions, price and exchange rate changes, and other adjustments. The

financial transactions that contributed to the change in positions are those transactions that are

recorded in the financial account of the balance of payments.

33

33

The balance of payments also includes the current and capital accounts where nonfinancial

transactions with nonresidents are recorded, e.g., trade in goods and services.

- 22 -

Figure 1: Relationship between the International Investment Position and the Balance of

Payments

Balance of Payments

C

URRENT ACCOUNT

CAPITAL ACCOUNT

Position at the

beginning of the

period

F

INANCIAL ACCOUNT

Other Changes in Position Position at the

end of the

period

Transactions Price

Changes

Exchange

Rate

Changes

Other

Adjust-

ments

International Investment Position

Assets

Direct Investment abroad

Portfolio Investment

Financial Derivatives

Other Investment

Reserve Assets

Liabilities

Direct Investment in

reporting economy

Portfolio Investment

Financial Derivatives

Other Investment

Net International

Investment

Position

Assets

Direct Investment abroad

Portfolio Investment

Financial Derivatives

Other Investment

Reserve Assets

Liabilities

Direct Investment in

reporting economy

Portfolio Investment

Financial Derivatives

Other Investment

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

√

Assets

Direct Investment abroad

Portfolio Investment

Financial Derivatives

Other Investment

Reserve Assets

Liabilities

Direct Investment in

reporting economy

Portfolio Investment

Financial Derivatives

Other Investment

Net International

Investment

Position

82. The first step in building an IIP position from financial flows is to estimate a “position

at the beginning of the period.”

83. Compilers may find it possible to use the information provided in the three preceding

sections on existing domestic sources to estimate positions for the banking sector, the general

government sector, and the monetary authorities’ sector. But what if there are no existing

sources for the position at the beginning of the period? How does a compiler establish the first

position in this case?

84. The following simple example illustrates the basic procedures. If a compiler is

attempting to estimate position data on loan assets for year-end 2001, domestic sources may

exist to determine the starting position for the banking sector, general government sector, and

- 23 -

monetary authorities’ sector.

34

For the “other sectors,” however, similar source data may not

exist to estimate the initial position.

85. In this case, the starting point could be the transactions in the financial account of the

balance of payments. For this example, it is assumed that transaction data have been available

on a loan asset for four years, 1998-2001. The initial loan, valued at 100 (unit of account), was

first recorded in the financial account in 1998.

35

The loan was valued at its nominal value;

therefore, it was not affected by price changes,

36

and there was no exchange rate change

because its value was not linked to a foreign currency. However, there was a write-down of

five units in the loan during the period, and this was considered a valuation change (other

adjustment). The position at year-end 1998 was therefore 95.

CHANGES in POSITION

Position at the

beginning of

the period

year-end

1997

Transactions Price

Changes

Exchange

Rate

Changes

Other

Adjustments

Position at the

end of the

period

year-end

1998

Assets

Other Investment

Loans

Other sectors

–

+100

–

–

-5

95

+ equals increase; – equals decrease

86. This position of 95 then becomes the “position at the beginning of the period, year-end

1998” for the next IIP statement. During 1999, there may have been a loan repayment

transaction of –10 and no other changes. The position at year-end 1999 would then be 85.

87. The above procedures are repeated for year-end 2000 and 2001. At that time, the

position data should reflect accumulated transactions and other changes that have taken place

during the four-year period.

34

See this paper’s section III.C for a summary of “Existing Sources by Type of Investment—Other

Investment, Assets, Loans.”

35

Clearly, however, if there were loans outstanding prior to the initial measurement in 1998, the

recorded flows during 1998–2001 would result in an underestimation of the position.

36

There is no secondary market.

- 24 -

88. In this manner, a position estimate for loan assets-other sectors can be made with a

view to revising this estimate in the future when more precise measurement tools, such as

enterprise surveys, are in place. It is important to include a detailed explanation of the

methodology used to derive the position with any published data.

89. The External Debt Guide, Chapter 12, Appendix, paras. 12.36–12.56 presents a

comprehensive methodology for estimating position data with transactions information. It

discusses detailed methods—from the simplest cases, such as nontraded debt instruments

whose value is linked to the unit of account,

37

to the more complex case of traded instruments,

where the effect of price changes, exchange rate effects, and other adjustments can all come

into play.

90. With an increasing volatility of prices, exchange rates, and transaction volumes during

a given period and with an increasing volume of transactions relative to stocks,

38

the effect on

the quality of estimates of using more detailed information becomes particularly important.

There is thus clearly a need to undertake position surveys from time to time, both to help

ensure the quality of position data and to help check on the reported transactions data.

91. Compilers could also consider using flows to estimate stock data when surveys of

stocks prove to be costly and burdensome for both compilers and respondents and are therefore

only undertaken with long intervals. Compilers could extrapolate results obtained from

benchmark surveys by using the information on financial flows as recorded in the balance of

payments and adjusting for price and exchange rate changes as well as other adjustments.

Countries with advanced data collection and compilation systems sometimes also choose this

method if they do not collect position data for selected components. (For example, they may

have experienced difficulties in response rates or conceptual difficulties in capturing relevant

position data via surveys.)

Nonstatistical sources (three datasets)

92. Three nonstatistical existing domestic sources are financial statements of enterprises,

approvals of foreign investment, and the financial press.

37

In this case, all the factors come into play except price and exchange rate changes.

38

The effects on the accuracy of stock estimates derived from flow data (and of flow estimates derived

from stock data) are analyzed and discussed in more detail in Effects of Volatile Asset Prices on

Balance of Payments and International Investment Position Data, Marco Committeri, IMF Working

Paper No. 00/191.

- 25 -

Financial statements of enterprises

93. Compilers can sometimes estimate the initial value of foreign direct investment (FDI)

using information in financial statements of enterprises. This data source is particularly useful

if the compiler does not yet carry out enterprise surveys.

94. Financial statements can be used as a source for estimating foreign direct investment in

the reporting economy (inward FDI) and foreign direct investment abroad (outward FDI). The

key to determining the usefulness of this data source is the level of consolidation of the

financial statements—whether they are consolidated or unconsolidated. The source of the

financial statements—external (publicly available source) or internal (source found within the

government) largely determines the level of consolidation available.

Foreign direct investment in the reporting economy

External sources

95. Generally, external sources exist for publicly traded companies in an annual report,

available in print format or on the Internet. Annual reports contain balance sheet items that can

be used to estimate foreign direct investment in an enterprise. Financial statements that are

publicly available are usually consolidated.

39

96. The following example shows how compilers can estimate inward FDI from this

source. If the nonresident direct investor owns 100 percent of the resident enterprise,

40

the

compiler can estimate FDI from the Shareholders’ Equity portion of the balance sheet (IIP

component–B.1.1.2).

Consolidated Balance Sheet

Assets Liabilities

Shareholders’ Equity (B.1.1.2)

Internal sources

97. Internal government sources may also have available financial-statement information.

Some compiling agencies collect—for their national financial statistics—the financial-

statement information for foreign-owned enterprises. Depending on the rules for data sharing

39

This means that intercompany transactions have been eliminated. As a result, it is not possible to

identify the “other capital” component of FDI from this source. A note describing this limitation needs

to be included in the methodology documentation.

40

If the nonresident direct investor owns 50 percent of the resident enterprise, then only 50 percent of

the value would be included in the FDI estimate.

- 26 -

that govern the compiling agency, it may be possible for compilers to access information on

the shareholders’ equity of the foreign-owned enterprise from this source.

98. Internal data may also be available from other government departments outside the

compiling agency. Once again, access to this information would depend on data sharing

agreements between the institutions.

99. Financial statement information collected from internal sources may be consolidated or

may be unconsolidated. If it is unconsolidated, compilers could possibly estimate “other

capital” in the form of intercompany debt. For inward FDI, Loans from parent are found in the

liability section of the balance sheet, and Loans to parent are found in the asset section.

Unconsolidated Balance Sheet – Inward FDI

Assets Liabilities

Loans to parent

41

B.1.2.1 Loans from parent B.1.2.2

Foreign direct investment abroad

External sources

100. Using financial statements to estimate foreign direct investment abroad (outward FDI)

is more complex. The compiler can use two sets of financial statements—those of the resident

direct investor and those of the nonresident direct investment enterprise.

101. Financial statements of the resident direct investor that are consolidated may not

provide enough information to calculate outward FDI from the balance sheet. However, the

Notes to the Financial Statements may yield some useful information on equity ownership in

the nonresident direct investment enterprises.

102. Another potential external source of financial statement information for outward FDI

exists when the direct investor has just acquired an existing company abroad. If the financial

statements of the acquired enterprise are publicly available, the compiler can estimate the

initial value of FDI.

Internal sources

103. If the resident direct investor makes the financial statements of the nonresident direct

investment enterprise

42

available to the compiler, this can be very useful in estimating outward

FDI. Compilers can follow the same procedures outlined above for inward FDI.

41

The resident direct investment enterprise does not own more than 10 percent of its parent company.

42

Another government department may collect this information and, once again, data sharing

agreements would need to be taken into consideration.

- 27 -

104. Internal sources may provide the unconsolidated financial statements of the resident

direct investor. If this is the case, the asset side of the balance sheet may provide information

on the Investment in foreign affiliates (equity) and Loans to foreign affiliates (other capital).

The liability side may provide information on Loans from a foreign affiliate (other capital).

Unconsolidated Balance Sheet – Outward FDI

Assets Liabilities

Investment in foreign affiliates A.1.1.1 Loans from a foreign affiliate

43

A.1.2.2

Loans to foreign affiliates A.1.2.1

105. When using financial statements to estimate FDI, compilers should note that most

balance sheets reflect book value or historical cost. In principle, BPM5 suggests that all

external assets and liabilities be measured at current market prices. In practice, however, it is

recognized that book values from the balance sheets are generally utilized to determine the

value of FDI.

44

If book value is used, compilers are also encouraged to collect data from

enterprises on a current market-value basis.

45

Also, if they use book value, they should note it

in the methodology documentation, including an explanation of the type of book value used,

such as historical cost or directors’ valuation.

106. Although financial statements may provide an early source for estimating FDI, clearly

compilers need to develop a more complete source, such as enterprise surveys.

Approvals of foreign investment

107. As was mentioned earlier, the data sources available in a specific country will depend

partly on the regulatory framework for international transactions. In some circumstances,

international capital movements are restricted. That is, external borrowing or investment is not

allowed for specific institutional units, or approval is required by an official body for external

transactions. Then a good source of information for balance of payments and IIP compilation is

the administrative records of the agency in charge of such foreign exchange controls.

108. However, this kind of data often has significant shortcomings because approval

procedures are usually not set up with macroeconomic statistical requirements in mind. Also,

significant time lags between approvals and actual investments may occur, or the approved

investment may not actually take place.

43

The foreign affiliate does not own more than 10 percent of the resident direct investor.

44

BPM5, para. 467.

45

External Debt Guide, para. 2.49.

- 28 -

109. Thus, the information on approvals can be rather limited regarding the range of

information that is needed for IIP purposes. For example, the approvals of direct investment in

an economy might capture information on new direct investment relationships—the

acquisition/establishment of equity capital—but might not capture particular items such as

intercompany debt positions, collected for the “other capital” component of direct investment.

This source is best used to identify the new investment, and compilers would need other

sources such as financial statements and enterprise surveys to measure the foreign investment.

Financial press

110. In countries where some types of investment, like foreign direct investment, play only a

minor role, compilers may find that collecting information from financial and economic media

(possibly making some additional ad-hoc inquiries) may provide initial coverage of foreign

direct investment activity. Typically, such circumstances can be found in economies that are in

an early phase of liberalizing foreign investments. However, the economies will have to take

adequate measures in time to ensure access to the necessary information when such

investments become more numerous in the process of liberalization.

111. Other economies might also use this source to identify new investments that might be

surveyed or new investments for which financial statements might be utilized.

B. Existing Foreign Data Sources

112. Section III.A described datasets that are commonly produced for domestic purposes.

This section will address data sources available from international organizations and partner

countries that can be used to close some gaps in the data collection for the IIP. The data

sources are international banking statistics, the Coordinated Portfolio Investment Survey, the

joint BIS-IMF-OECD-World Bank statistics on external debt, and partner country data.

113. Moreover, this section will discuss some estimation methods that can be used in the

absence of more adequate primary data sources to compile some of the IIP components.

Compilers can use these methods also to adjust source data that are not consistent with the

recommended conceptual framework of the IIP.

International banking statistics

46

114. The international banking statistics collected and disseminated by the Bank for

International Settlements (BIS) provide information on the international banking business

conducted in the major international banking centers that make up the BIS reporting area.

International banking business in this context is defined as comprising banks’ balance-sheet

46

A further discussion of BIS data can be found in the External Debt Guide, Chapter 17, paras. 17.3–

17.12, and in the BIS’s Guide to the international banking statistics, July 2000, which is available on

the BIS website at http://www.bis.org/publ/other.htm

.

- 29 -

assets and liabilities vis-à-vis nonresidents in any currency, plus similar assets and liabilities

vis-à-vis residents in foreign currencies. Certain of these data are relevant to the IIP.

115. There are two sets of data. The first set is based on the country of location, or residence,

of creditor banks (termed locational statistics). The second set is based on the country of

origin, or nationality, of creditor banks (termed consolidated statistics). However, the

underlying principle of the consolidated statistics is the worldwide consolidation of the

outstanding exposures of reporting banking institutions.

47

Therefore, for balance of payments

and IIP compilation, only the locational data can be a relevant data source. The data are

published in the BIS Quarterly Review and made available on the BIS website at www.bis.org.

116. The locational banking statistics provide quarterly creditor information on loans and

deposits of banks and nonbanks by country. Many compilers use the data on loans and deposits

in relation to nonbanks (BIS Quarterly Review, International Banking Statistics, Table 7B

48

) to

supplement other balance of payments and IIP data sources. The data provide information on

private nonbanks’ claims and liabilities with nonresident banks and serve to compile part of the

“other sectors” components of other investment assets and liabilities. Specifically, the table

shows amounts outstanding and estimated exchange-rate-adjusted changes of external loans

and deposits of reporting banks concerning the nonbank sector and individual countries.

117. Thus, compilers can use the outstanding amounts of loans for their country to compile

the other sector’s liabilities in loans (IIP component B.4.2.4). The BIS data do not provide a

breakdown by short- and long-term maturity of the loans, however. Similarly, compilers can

use the outstanding amounts of deposits of nonbanks for their country to compile the other

sector’s assets in the form of deposits (IIP component A.4.3.4).

118. It needs to be emphasized that the information from the BIS statistics is partial

regarding the coverage of these IIP components, since it includes only the positions of

countries participating in the BIS international banking statistics. As of August 2002,

28 countries report these data to the BIS.

119. Although the international banking statistics also give information on loans and

deposits vis-à-vis banks, compilers usually do not use these data, since national statistics

generally provide more comprehensive information on such positions.

120. Tables 14A and 14B (BIS Quarterly Review, Security Statistics

49

) can provide some

information on a country’s liabilities related to issuing international money market instruments

47

See External Debt Guide, para. 17.4.

48

Table 7B, “External loans and deposits of reporting banks vis-à-vis individual countries, vis-à-vis the

non-bank sector.”

49

“International debt securities by country of residence”—Table 14A, “Money market instruments.”

Also, Table 14B, “Bonds and notes.”

- 30 -

and international bonds and notes. It should be mentioned that since this source reports only

“international securities” (securities issued abroad by countries), it does not cover securities

issued in the domestic market that are purchased by nonresidents. In addition, it makes no

allowance for international securities purchased by residents of the debtor country. Therefore,

compilers should be cautious when using these data for IIP (and balance of payments)

purposes.

Coordinated Portfolio Investment Survey

121. The Coordinated Portfolio Investment Survey (CPIS) focuses on the geographical

distribution of portfolio assets (equity, long-term debt, and short-term debt securities) of the

participating countries. Thus, partner countries can use these data to obtain information on

their portfolio liabilities. Such information can be difficult to collect for the debtor country,

since the resident issuer of traded securities is often not in a position to identify the beneficial

owner of its securities and so may be unaware whether the creditor is a resident or

nonresident.

50

122. Under the auspices of the IMF, a CPIS was undertaken for the first time with the

reference date of December 31, 1997. Twenty-nine jurisdictions participated, including most of