2 022

CLIMATE

FINANCE

JOINT REPORT

ON MULTILATERAL

DEVELOPMENT

BANKS’

2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

© European Investment Bank, 2023

All rights reserved.

All questions on rights and licensing should be addressed to publicat[email protected]

For further information on the EIB’s activities, please consult our website, www.eib.org.

You can also contact our info Desk, info@eib.org.

Published by the European Investment Bank.

NOVEMBER 2023

This report was written by a group of multilateral development banks (MDBs),

composed of the African Development Bank (AfDB), the Asian Development

Bank (ADB), the Asian Infrastructure Investment Bank (AIIB), the Council of

Europe Development Bank (CEB), the European Bank for Reconstruction

and Development (EBRD), the European Investment Bank (EIB), the Inter-

American Development Bank Group (IDBG), the Islamic Development Bank

(IsDB), the New Development Bank (NDB) and the World Bank Group (WBG).

The findings, interpretations and conclusions expressed in this work do not

necessarily reflect the official views of the multilateral development banks’

boards of executive directors or the governments they represent.

This November 2023 publication of the report (Version 1.1) supersedes

the earlier edition published in October 2023. Version 1.1 introduces

corrections to climate co-finance information, plus a small climate

mitigation finance adjustment.

JOINT REPORT ON MULTILATERAL

DEVELOPMENT BANKS’

CLIMATE

FINANCE

2 022

iv Abbreviations and acronyms

v Preface

viii Executive summary

1 1. OVERVIEW OF MDB METHODOLOGIES FOR TRACKING CLIMATE FINANCE

1 1.1. Finance for adaptation to climate change

2 1.2. Finance for mitigation of climate change

4 1.3. Methodology for climate co-finance

7 2. MDB CLIMATE FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2022

7 2.1. Total MDB climate finance

8 2.1.1. MDB climate finance by type of recipient or borrower

9 2.1.2. MDB climate finance by type of instrument

10 2.1.3. MDB climate finance by region

10 2.2. MDB adaptation finance

14 2.3. MDB mitigation finance

18 2.4. Climate co-finance

21 3. MDB CLIMATE FINANCE IN HIGH-INCOME ECONOMIES, 2022

21 3.1. Total MDB climate finance

22 3.1.1. MDB climate finance by type of recipient or borrower

23 3.1.2. MDB climate finance by type of instrument

24 3.1.3. MDB climate finance by region

24 3.2. MDB adaptation finance

28 3.3. MDB mitigation finance

32 3.4. Climate co-finance

35 ANNEX A. Further detailed analysis of total MDB climate finance data, 2022

53 ANNEX B. Geographical coverage of the report, 2022

65 ANNEX C. Methodologies and definitions

CONTENTS

ADB Asian Development Bank

AfDB African Development Bank

AIIB Asian Infrastructure Investment Bank

CCF Climate co-finance

CEB Council of Europe Development Bank

CIF Climate Investment Funds

CO

2

Carbon dioxide

EBRD European Bank for Reconstruction and Development

EIB European Investment Bank

EU European Union

€ Euro

FY Fiscal year

GEF Global Environment Facility

GCF Green Climate Fund

GHG Greenhouse gas

IBRD International Bank for Reconstruction and Development

IDA International Development Association

IDB Inter-American Development Bank

IDBG Inter-American Development Bank Group, composed of the IDB, IDB Lab and IDB Invest

IDB Invest The private sector arm of the IDBG

IDB Lab The innovation laboratory of the IDBG

IDFC International Development Finance Club

IFC International Finance Corporation

IsDB Islamic Development Bank

LDCs Least Developed Countries

MDBs Multilateral development banks

MIGA Multilateral Investment Guarantee Agency

NAMAs Nationally Appropriate Mitigation Actions

NDCs Nationally Determined Contributions

NDB New Development Bank

SIDS Small Island Developing States

UNFCCC United Nations Framework Convention on Climate Change

$ United States dollar

WBG World Bank Group, composed of the IDA, IBRD, IFC and MIGA

ABBREVIATIONS AND ACRONYMS

The Joint Report on Multilateral Development Banks’ Climate Finance is

an annual collaborative effort to publish Multilateral Development Banks’

(MDBs’) climate finance figures, together with a clear explanation of the

methodologies for tracking this finance as climate finance. This joint report,

alongside the banks’ publication of climate finance statistics in their

respective corporate media, is intended to track progress in relation to

their joint climate finance targets such as those announced at COP21 and

the greater ambition pledged for the post-2020 period. This year’s report

brings Council of Europe Development Bank and New Development Bank’s

climate finance fully into the MDB reporting, so that for the first time, all ten

MDBs’ climate finance is included in the aggregated data reported.

There have been several recent developments that are relevant to MDB climate finance. The

Independent Review of MDBs’ Capital Adequacy Frameworks

1

, published in July 2022, analyses

how MDBs can use public resources in the most efficient and effective way. The report presents

five key recommendations

2

to free up additional lending headroom. The independent High Level

Expert Group published a report at COP27 also calling for major increases in MDB climate finance.

COP27 also produced the Sharm El Sheik Implementation Plan. Prior to COP27, the Bridgetown

Initiative, championed by Prime Minister Mottley of Barbados in September 2022, called on

global leaders to reform the global financial architecture in response to multiple global crises.

With additional momentum from COP27, to further accelerate climate action and sustainable

development, President Macron of France co-hosted with Prime Minister Mottley a Summit for a

new Global Financing Pact in June 2023, which called on MDBs to step up ambitions to address

global challenges and achieve SDGs. The MDBs’ transparent joint reporting on their climate finance

can provide useful data to inform the international discussions.

Since the first Joint Report on Multilateral Development Banks’ Climate Finance, which covered

climate finance for 2011, figures reported for climate finance have been based on a joint MDB

climate finance tracking and reporting methodology. This methodology has been gradually updated

as and when the need arose, particularly in light of experience and global developments in this

space. The first eight editions of the report provided climate finance data on a group of emerging

and developing economies which included low- and middle-income as well as some high-income

countries. From 2019 onwards, the MDBs’ annual report included data for all countries of

operation of the MDBs, with data split by country-income level to improve transparency and with

a focus on low- and middle-income economies. In addition, responding to user requests for a

more comprehensive breakdown, a new Annex with additional details on climate finance in Least

Developed Countries and Small Island Developing States is added to this year’s report.

Some important methodological changes have occurred since last year’s report: the original,

smaller group of MDBs had already in 2011 developed a harmonised climate finance tracking

methodology and published it in their first joint reports. In 2015, the MDBs and the International

Development Finance Club (IDFC

3

) worked together to agree on a set of common principles for

finance to mitigate climate change and an initial set of common principles for finance to support

adaptation to climate change. The intention was for a wider group of public banks to take a

common approach to track and report on climate finance. The MDBs and IDFC published a new

version of the Common Principles for Climate Change Mitigation Finance Tracking in October 2021,

which includes a more granular breakdown of types of eligible activity, clear criteria that must be

1 https://www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_it/rapporti_finanziari_internazionali/rapporti_finanziari_

internazionali/CAF-Review-Report.pdf

2 The five recommendations include re-evaluating MDB risk limits, recognising the benefits of callable capital, expanding the use of financial

innovations, enhancing dialogue with credit rating agencies, and promoting greater transparency regarding MDB credit performance.

3 www.idfc.org

PREFACE

Preface |

v

met and additional guidance to facilitate the application of these criteria. In this year’s report, all

MDBs in the current group of ten MDBs have applied this updated methodology for determining

2022 climate change mitigation finance.

In 2022, the MDBs worked to update their joint methodology for tracking adaptation finance. This

update was agreed by all MDBs and launched at COP27: it reflects the evolving understanding

of adaptation and the advancements in the field of adaptation finance in recent years. The

2022 methodology complements ongoing efforts by the MDBs to enhance the robustness and

transparency of climate finance tracking and reporting and support climate action, in line with the

objectives of the Paris Agreement, and will be adopted from 2023 onwards. This year’s report, as it

covers 2022 finance, still reports using the old methodology.

The MDBs will continue to improve their tracking and reporting of climate finance as an important

part

4

of their overall commitments to ensure that financial flows are consistent with a pathway to

low greenhouse gas emissions and climate-resilient development, as established in Article 2.1(c)

of the Paris Agreement. In particular, MDBs continue to work closely with IDFC on improving climate

finance tracking, and MDBs and IDFC are now working to update the common principles for climate

adaptation and mitigation finance tracking, aiming to share them later in 2023.

At the UN Secretary General’s Climate Action Summit in New York in September 2019, the MDBs

made a high-level statement on their joint climate actions looking forward to 2025. This included

delivering an expected collective total of $50 billion climate finance for low-income and middle-

income economies, at least $65 billion of climate finance globally, with an expected doubling in

adaptation finance to $18 billion; and private mobilisation of $40 billion. In 2022 the MDBs

surpassed these collective expectations on climate finance — both for low- and middle-income

economies and globally. They also notably increased adaptation finance to over $25 billion in all

economies in which the MDBs operate. The table in Annex C.6. summarises individual post-2020

MDBs’ climate commitments.

The MDBs presented updates on their work to align their finance flows with the Paris Agreement in

November 2022

5

. The multilateral development banks have all set their own timelines to implement

the MDB Paris Alignment Framework

6

whilst working together on joint tools and approaches, and

some MDBs have already put in place approaches for all Six Building Blocks

7

. Financial flows

presented in this report are based on climate finance methodologies that are separate and distinct

from the MDB Paris Alignment Framework, although all climate finance should also be Paris-

aligned, within the time frame set by each MDB for implementation.

As well as continuing to work on climate finance tracking and on further aspects of their Paris

Alignment Six Building Block framework, MDBs intend to work together on improving assessment

and reporting climate outcomes and climate impacts of their financing. Many MDBs work actively

with the IFI working group on greenhouse gas (GHG) accounting where harmonised GHG reporting

methodologies are developed, and several MDBs have worked together on impact reporting for

Green Bonds and on climate-resilience metrics since 2019 when MDBs and members of the

IDFC published the joint Framework and Principles for Climate Resilience Metrics in Financing

Operations, setting out the core concepts and characteristics of climate resilience metrics

alongside a high-level framework for such metrics in financing operations. MDBs' climate

outcomes and climate impacts work is therefore not new but now warrants increased focus, taking

account also of recent developments in financial markets’ reporting.

4 “Accelerated contribution to the transition through climate finance” — Building Block 3 of MDBs’ joint framework: Multilateral Development

Banks announce joint framework for aligning their activities with the goals of the Paris Agreement (eib.org)

5 Progress Report: Multilateral Development Banks Working Together for Paris Alignment (eib.org)

6 MDBs agree how to align new financial flows with the Paris Agreement goals (eib.org)

7 The six building blocks are: (i) alignment with mitigation goals, (ii) adaptation and climate-resilient operations, (iii) accelerated contribution

to the transition through climate finance, (iv) engagement and policy development support, (v) reporting, and (vi) alignment of internal

activities. As part of this ongoing work, the MDBs published in June 2023 their joint methodological principles for alignment of new

financing with the goals of the Paris Agreement. This includes methodological guidance on how to implement the new operations aspects

of Building Blocks 1 and 2 of MDBs’ joint PA framework, for different types of financing instruments.

vi | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

This edition of the Joint Report on Multilateral Development Banks’ 2022 Climate Finance was

prepared by the European Investment Bank together with partners the African Development Bank,

the Asian Development Bank, the Asian Infrastructure Investment Bank, the Council of Europe

Development Bank, the European Bank for Reconstruction and Development, the Inter-American

Development Bank Group, the Islamic Development Bank, the New Development Bank and the

World Bank Group.

This new version of the report replaces

November 2023

Download this report at:

www.eib.org/2022-joint-report-on-mdbs-climate-finance

Download the infographic summary at:

www.eib.org/2022-joint-report-on-mdbs-climate-finance-infographic

Preface |

vii

This 12

th

edition of the Joint Report on Multilateral Development Banks’

Climate Finance is an overview of climate finance committed in 2022

by the African Development Bank (AfDB), the Asian Development Bank

(ADB), the Asian Infrastructure Investment Bank (AIIB), the Council of

Europe Development Bank (CEB), the European Bank for Reconstruction

and Development (EBRD), the European Investment Bank (EIB), the Inter-

American Development Bank Group (IDBG), the Islamic Development Bank

(IsDB), the New Development Bank (NDB) and the World Bank Group (WBG).

As in previous years, the data and statistics presented in this year’s report result from the

application of the harmonised methodologies developed jointly by the multilateral development

banks (MDBs) for their annual commitments. In this report, the term “MDB climate finance” refers

to the financial resources (from own accounts and MDB-managed external resources) committed

by the MDBs to operations, and components thereof, directed to activities that mitigate climate

change and/or support adaptation to climate change. The term “climate co-finance” refers to the

volume of financial resources invested by other public and private external parties alongside the

MDBs for climate change mitigation and adaptation activities. The MDBs have reported jointly on

climate finance since the first edition in 2012, which reported figures for 2011, and have added

joint reporting on climate co-finance since the 2015 edition. Starting with the 2019 report, for the

purpose of greater transparency and consistency the multilateral development banks agreed to

start reporting on all economies where these banks operate, while maintaining the report’s focus

on low- and middle-income economies

8

. This change allowed for a clear breakdown by country

income level.

The MDB climate finance commitments are presented in this report in two main groups: (1) low-

income and middle-income economies, a grouping that includes low, lower-middle and upper-

middle income economies, and (2) high-income economies. These data sets are presented in two

separate chapters in this and last year’s report. The MDBs endeavoured to attribute any climate

finance falling within the category of global, multi-regional and regional projects to specific income

groups. The economies are categorised by income group in accordance with the World Bank

Group’s classification dated June 2022 (see Tables B.1 and B.2). This version of the report also

provides further analysis on the MDBs' climate finance in LDCs and SIDS in Annex A.5.

LOW- AND MIDDLE-INCOME ECONOMIES

In 2022, $60.9 billion was for low-income and middle-income economies. $38.2 billion, or 63%

of this total, was for climate change mitigation finance and $22.7 billion or 37% was for climate

change adaptation finance.

In 2022, MDBs reported $48.7 billion of their climate finance for public recipients and $12.3 billion

for private recipients in low- and -middle income economies.

The report also shows that MDB climate finance investments in low-and-middle income economies

are supported by a total of $ 46.3 billion climate co-finance, with 58% in mitigation activities and

42% in adaptation activities. 67% of climate co-finance in low-and middle-income economies came

from public sources and 33% from private sources.

HIGH-INCOME ECONOMIES

In 2022, $38.8 billion was allocated for high-income economies. $36.3 billion, or 94% of this total,

was for climate change mitigation finance and $2.5 billion or 6% was for climate change adaptation

finance.

8 Before 2019, the joint MDB report covered climate finance for developing and emerging economies.

EXECUTIVE SUMMARY

viii | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

In 2022, the multilateral development banks reported $20.0 billion of their climate finance for

public recipients and $18.8 billion for private recipients in high-income economies.

The report also shows that MDB climate finance investments high income economies are

supported by a total of $ 71.3 billion climate co-finance, with 80% in mitigation activities and 20%

for adaptation activities. 45 % of climate co-finance in high-income economies came from public

sources and 55% from private sources.

Figure 1a presents MDB climate finance commitments reported for 2019-2022 for low- and

middle-income economies where the MDBs operate, while Figure 1b shows MDB climate finance

commitments reported for the same period for high-income economies where the banks operate.

$ billion

2019 2020 2021 2022

AfDB

ADB

ADB CEBAIIB

0

20

40

60

Figure 1a. MDBs’ climate finance commitments in low- and middle-income economies, 2019-22 (in $ billion)

18.4

4.4

3.6

3.9

7.1

3.6

41.5

0.5

21.3

3.2

2.5

5.3

2.3

38.0

0.3

28.0

4.8

3.4

4.8

2.7

3.9

2.4

50.7

3.7

7.1

2.3

4.3

4.2

5.9

1.1

31.7

60.9

0.7

(0.9)

2.1

1.1

0.5

0.3

4.8

EBRD

EIB IDBG IsDB NDB WBG

Executive summary |

ix

$ billion

AIIB CEB EBRD EIB IDBG WBG

0

20

40

Figure 1b. MDBs’ climate finance commitments in high- income economies, 2019-22 (in $ billion)

18.1

20.1

0.5

1.1

0.4

24.6

28.0

28.1

31.1

32.9

2.5

38.8

0.9

1.6

0.8

0.7

1.6

0.6

0.1

0.1

0.1

1.3

0.5

1.4

20202019 2021 2022

Notes for Figures 1a and 1b:

1. Starting in 2021, the reporting of ADB’s climate finance is based on commitments or signatures and not on approvals. This is in accordance

with the decision made in 2017 to measure and report ADB’s corporate performance based on commitments up to 2030.

For ADB, External Resources under Management (ERUM) includes ADB-administered financial resources from financing partners, including

AIIB. ADB administers financing from AIIB for several projects, some of which have components that contribute to climate finance.

For 2022, ADB reports climate adaptation finance of $7 million and climate mitigation finance of $7 million from ADB-administered

financing from AIIB. To avoid double counting, these amounts are excluded from the total MDB amounts for 2022 as AIIB reports climate

finance for the same projects as a share of its financing under own resources.

The project under this situation belongs to the category of public recipient in the East Asia and the Pacific region; it is a grant and is

implemented under the category of “Agriculture, forestry, land use and fisheries” and “Other agricultural and ecological resources”. A similar

situation occurred in 2021, when $0.9 billion of ADB climate finance was excluded from the total MDB amounts to avoid double counting.

2. IDBG’s figures have included all climate finance for public and private borrowers or beneficiaries in all 26 IDBG borrowing member countries,

via its three operational windows — IDB, IDB Invest and IDB Lab — on the basis of approval by the respective Boards of Executive Directors.

From 2020 onward, for IDB Invest only, the figures refer to total commitments of long-term finance, in an effort to more accurately reflect

actual investments as well as the mobilisation of private-sector actors. In 2022, IDBG climate finance consisted of: $5.9 billion through IDB;

$1.3 billion through IDB Invest; and $24 million through IDB Lab.

3. The IsDB-reported climate finance commitment excludes operations of some IsDB Group members, namely the Islamic Corporation for

the Development of the Private Sector (ICD), the International Islamic Trade Finance Corporation (ITFC) and the Islamic Corporation for the

Insurance of Investment and Export Credit (ICIEC).

4. EIB 2019-22 climate finance commitments shown here include all EIB countries of operation, including all EU economies, whereas only

some EU economies’ climate finance commitments are made by the EIB; EBRD and WBG were included in 2018 and earlier MDB reports.

Please see Annex B for details of specific geographical coverage in past editions of the Joint Report.

5. WBG climate finance resources (including own-account and managed external resources) for IFC, MIGA and the IDA and IBRD were $4.5

billion (including $103 million of managed external resources), $1.1 billion and $27.4 billion (including $1.3 billion of managed external

resources), respectively, for the fiscal year (FY) 2022, which covers the period from 1 July 2021 to 30 June 2022. IFC’s total commitments

of own-account long-term finance in FY22 were $12.6 billion and IFC reached a level of 35% on long-term finance own-account climate

commitments. For MIGA, total investments guaranteed in FY22 amounted to $4.1 billion and climate finance reached 28%. IDA and IBRD

total own-account commitments were $70.8 billion and the share of its climate-related financing reached 37%.

6. CEB, EBRD and EIB climate finance figures in this chart are based on the annual average European Central Bank rate. For 2022 the

exchange rate used is €1 = $1.053.

7. Numbers in the tables and figures in this report may not add up to the totals shown, due to rounding.

8. CEB and NDB 2022 climate finance data have been presented in Figures 1a and 1b for the first time, as they did not report their climate

finance data in previous reports together with the climate finance data from the other MDBs.

a. Presenting climate finance data separately from the joint figure, the CEB committed a total of $621 million in climate finance in 2021.

b. Presenting climate finance data separately from the joint figure, the NDB committed a total of $816 million in 2020, and a total of $509

million in climate finance in 2021.

9. The numbers on the top of the columns show the totals for each year, in $ billion

x | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

The multilateral development banks apply two distinct methodologies — with fundamentally

different approaches — to tracking climate change adaptation finance (or “adaptation finance”)

and climate change mitigation finance (or “mitigation finance”). Both methodologies, however,

track and report climate finance in a granular manner. In other words, the climate finance reported

covers only those components and/or sub-components or elements or proportions of projects that

directly contribute to or promote adaptation and/or mitigation.

The multilateral development banks estimate adaptation finance using the joint MDB methodology

for tracking climate change adaptation finance, which involves a three-step approach. This

methodology is based on a context- and location-specific, granular and conservative approach

and captures the amounts associated with activities directly linked to vulnerability to address

climate change. The banks try as far as possible to differentiate between their usual development

finance and finance provided with an explicit intent to reduce vulnerability to climate change. This

methodology has been updated using a new joint methodology in October 2022

9

. In July 2015

the multilateral development banks and the IDFC agreed an initial set of Common Principles for

Climate Adaptation Finance Tracking

10

. The organisations continue to harmonise their approaches

to tracking adaptation finance. Climate change adaptation finance in 2022 totalled $25.2 billion, of

which 90% was directed at low- and middle-income economies.

The multilateral development banks’ methodologies for tracking climate change mitigation finance

align with the Common Principles for Climate Change Mitigation Finance Tracking

11

that the MDBs

and the IDFC jointly agreed and first published in March 2015. At COP24 in 2018 they announced a

plan to work jointly to review and strengthen the Common Principles for Climate Change Mitigation

Finance Tracking. Mitigation finance is estimated in accordance with the joint MDB methodology

for tracking climate change mitigation finance, which is based on a list of activities in sectors

and sub-sectors that reduce greenhouse gas emissions and are compatible with low-emission

development. In 2020, the banks finalised their review of the methodology for tracking climate

change mitigation finance and commenced tracking using the new methodology on 1 January

2021 for AfDB, ADB, AIIB, CEB, EBRD, EIB, IDBG, IsDB and NDB and on 1 July 2021 for the WBG,

to coincide with each institution’s new fiscal year. The new version of the methodology includes a

more granular breakdown of types of eligible activity, clear criteria that must be met and additional

guidance to help interpretation. Climate change mitigation finance in 2022 totalled $74.2 billion, of

which 51% was directed at low- and middle-income economies.

In addition to reporting on mitigation and adaptation finance, some multilateral development

banks report on volumes of climate finance that have dual, simultaneous benefits: reducing

greenhouse gas emissions and promoting adaptation to climate change. In 2022, AIIB, EBRD, IDBG

and IsDB reported a total of $2 759 million for dual-benefit projects. See Annex C.4 for further

climate finance statistics and examples of such projects. Given the relatively small volumes of

“dual-benefit” climate finance and in order to simplify data presentation, the tables and graphs

throughout this report present data by mitigation or adaptation finance, as indicated by the

reporting multilateral development banks.

Annex A provides additional information on MDB total climate finance aggregated across all their

countries of operation.

9 Joint Methodology For Tracking Climate Change Adaptation Finance https://www.eib.org/attachments/lucalli/20220242_mdbs_joint_

methodology_climate_finance_en.pdf

10 The Common Principles for Climate Change Adaptation Finance Tracking are set out in Annex C.2: https://www.afdb.org/fileadmin/uploads/

afdb/Documents/Generic-Documents/Common_Principles_for_Climate_Change_Adaptation_Finance_Tracking_-_Version_1__02_

July__2015.pdf

11 The Common Principles for Climate Mitigation Finance Tracking are set out in Annex C.3: https://www.eib.org/attachments/documents/

mdb_idfc_mitigation_common_principles_en.pdf

Executive summary |

xi

OVERVIEW OF MDB METHODOLOGIES FOR TRACKING

CLIMATE FINANCE

1

The tracking of MDB climate finance is based on the harmonised principles and jointly agreed

methodologies for tracking climate change adaptation and mitigation finance detailed respectively in

Annex C.2 and Annex C.3 of this report. In this publication, the term “MDB climate finance” refers to

the amounts committed by the multilateral development banks to financing climate change mitigation

and adaptation activities in the projects they undertake. See Annex B for details of the 2022 report’s

geographic coverage, and that of past editions.

MDB climate finance includes commitments from the multilateral development banks´ own accounts,

and from external resources channelled through and managed by the banks. Climate co-finance

includes the amount of financial resources contributed by external resources alongside MDB climate

finance. These may include entities from both the private (commercial) and public (non-commercial)

sectors.

1.1 FINANCE FOR ADAPTATION TO CLIMATE CHANGE

Climate change adaptation aims to reduce the risks or vulnerabilities posed by climate change

and increase climate resilience. Identification of climate change adaptation finance is the result

of a three-step process and thus, for a project to be counted either fully or partially towards MDB

adaptation finance, it must:

a. Set out the project’s context of vulnerability to climate change.

b. Make an explicit statement of intent to address this vulnerability as part of the project.

c. Articulate a clear and direct link between the vulnerability and the specific project activities.

The MDB methodology for tracking climate change adaptation finance follows a context- and

location-specific, conservative and granular approach. It tracks MDB financing only for those

components and/or sub-components or elements or proportions of projects that directly contribute

to or promote adaptation. It is important to note the following:

a. The adaptation finance reported might not capture certain activities that may contribute

significantly to resilience but cannot always be tracked in quantitative terms (for example,

operational procedures that support adaptation to climate change) or might not be associated

with costs (such as siting assets outside flood-prone areas).

b. Climate adaptation finance, as defined by the methodology, is not intended to capture the value

of an entire project or investment that may increase resilience as a result of specific adaptation

activities that take place as part of the project.

c. The adaptation finance reported captures financial support for actions aimed at, among others,

averting, minimising, and addressing the risk associated with the adverse effects of climate

change, including extreme weather events and slow onset events. It includes support for

anticipatory actions needed to increase preparedness, reduce climate vulnerability, and adapt to

the experienced and anticipated impacts of climate change, as well as financing of post-disaster

recovery and reconstruction needed in the aftermath of climate shocks.

d. This report is based on the MDBs’ methodology for tracking adaptation finance as described in

Annex C.2. In November 2022, the MDBs released the updated Joint Methodology for Tracking

Adaptation Finance

12

. The updated methodology reflects the evolving understanding of change

adaptation and resilience activities, and the advances made in the fields of adaptation finance.

The MDBs started to apply the updated adaptation finance tracking methodology to their 2023

commitments, which will be reported in the joint MDBs climate finance report to be published in

2024.

12 https://www.eib.org/en/publications/20220242-mdbs-joint-methodology-for-tracking-climate-change-adaptation-finance

Overview of MDB methodologies for tracking climate finance |

1

1.2 FINANCE FOR THE MITIGATION OF CLIMATE CHANGE

Climate change mitigation reduces, avoids, limits or sequesters greenhouse gas emissions to

mitigate climate change. However, not all activities that reduce greenhouse gas emissions are

eligible to be counted towards MDB mitigation finance, which is calculated based on a list of

activities that are compatible with low-emission pathways.

Within the MDB/IDFC “Common Principles for Climate Mitigation Finance Tracking”

13

methodology,

an activity can be classified as climate change mitigation where the activity, by avoiding or

reducing greenhouse gas emissions or increasing their sequestration, contributes substantially

to the stabilisation of GHG concentrations in the atmosphere at a level that prevents dangerous

anthropogenic interference with the climate system consistent with the long-term temperature

goal of the Paris Agreement.

The common principles recognise that a substantial contribution to climate change mitigation can

involve the following three categories of climate change mitigation activities:

1. Negative or very low-emission activities, which result in negative, zero or very low greenhouse gas

emissions and are fully consistent with the long-term temperature goal of the Paris Agreement, for

example carbon sequestration in land use or some forms of renewable energy.

2. Transitional activities, which are still part of greenhouse gas emissions-emissive systems, but are

important for and contribute to the transition towards a climate-neutral economy, such as energy

efficiency improvement in manufacturing that directly or indirectly uses fossil fuels.

3. Enabling activities, which are instrumental in enabling other activities to make a substantial

contribution to climate change mitigation such as manufacture of very low-emission technologies.

Annex C.3 contains an excerpt of the mitigation methodology (with the full description being

available within the MDB/IDFC "Common Principles for Climate Change Mitigation Tracking”).

There are fundamental differences between the tracking methodologies for climate change

adaptation activities and those for mitigation activities. For mitigation activities, a one-tonne

reduction in carbon dioxide (CO

2

) emissions has the same impact regardless of where the activities

take place. It is therefore possible to define lists of typical activities that are deemed to support

the path to low-carbon development. However, adaptation activities are project- and location-

specific, and they respond to specific climate vulnerabilities. Therefore, unlike mitigation activities,

it is not possible to produce a standalone “list of adaptation activities” that can be used under all

circumstances.

When comparing climate finance data, it is important to understand the differences and

similarities. Table 1a summarises the key points in this regard. Annexes C.2 and C.3 contain

examples of the adaptation and mitigation methodologies’ application in various sectors and

project types. Box 1 provides information on an update to the methodology for tracking adaptation

finance, agreed by all MDBs and launched at COP27. This updated version of the methodology has

not been used for the preparation of this 2022 report, but will be used for 2023 reporting.

13 mdb_idfc_mitigation_common_principles_en.pdf (eib.org)

2 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Table 1a. Comparison of methodologies for tracking adaptation and mitigation finance

CLIMATE CHANGE ACTIVITY

Item Adaptation Mitigation

General scope of

qualifying activity

The activity is typically a component or element

of a project, and in certain circumstances

an entire project, contributing to resilience

(including socioeconomic resilience) or

adaptation to climate change.

This is typically a project (or component thereof)

that avoids, reduces or sequesters greenhouse

gas emissions, or promotes efforts to achieve

these goals.

Basis for tracking Adaptation finance tracking is incremental

(component-based); it only takes into account

those activities that specifically address

vulnerability to climate change. Eligible

components are usually parts of a larger

project, for example, water-saving equipment

that is part of a larger capital expenditure

investment in an area vulnerable to increased

risk of drought.

Mitigation finance tracking is either project- or

component-based.

Project-based: If the whole project is considered

to be a mitigation activity, for example, a typical

renewable energy project or a project dedicated

to improving the energy efficiency of an existing

facility, then 100% of the project investment

is considered to be mitigation finance, where

applicable criteria are met.

Component-based: Within a project, if only

a component of that project is a mitigation

activity, such as installation of energy-efficient

equipment that is part of a larger capital

expenditure investment, then the respective

fraction of the project is considered to be

mitigation finance.

Granular approach

to finance tracking

The adaptation finance methodology is

intended to capture only the value of those

activities within the project that are aimed at

addressing specific climate vulnerabilities. It is

not intended to capture the value of the entire

project that is made more climate-resilient as a

result of specific adaptation activities within the

project.

A granular approach is used. Climate finance

methodology is intended to capture only the

value of the project or its components that

substantially contribute to climate change

mitigation, demonstrated using applicable

metrics (such as emission or energy intensity)

subject to the requirements specified in the

eligible list of activities.

Scale of impact Local, regional, national or global Global

Indicator(s) to

quantify and

compare project

outcomes

Multiple (project- and context-specific) indicators

are needed; the intended outcomes depend on

the nature of the project.

Ultimately, the impact of all mitigation projects

can be assessed on the basis of their direct

greenhouse gas emissions reductions (such as

implementation of energy-efficient equipment

in a building) or indirect greenhouse gas

emission reductions (such as the manufacture

of electric vehicles helping to reduce emissions

through substitution of internal combustion

engine vehicles in the market).

Qualification for

climate finance

Qualification is based on a three-step assessment

process, taking into account the climate change

vulnerability context and the specific project

intent to reduce climate vulnerabilities.

Qualification is based on a list of eligible

activities with associated screening criteria

that serve to assess qualification for climate

mitigation finance. Overarching criteria also

apply. See Annex C.3 for further details.

Climate finance

tracking

Following the three-step assessment process,

a share of those project components that

are clearly and directly linked to the climate

vulnerability context and contribute to climate

change resilience is classified as climate

change adaptation finance.

Financing of the eligible project activities is

classified as climate change mitigation finance

where associated criteria are met.

Overview of MDB methodologies for tracking climate finance |

3

Box 1. Updated joint MDB methodology for tracking adaptation finance

Between 2021 and 2022, the MDBs carried out a review of the joint MDB methodology for tracking adaptation

finance. The review built on collective experiences of applying the methodology over the preceding decade. It aimed

to better characterise adaptation activities for the purpose of tracking adaptation finance and provide guidance on the

application of the joint methodology in a broader range of financing instruments.

The outcome was an update to the methodology

14

that reflected the evolving understanding of adaptation and climate

resilience and advances made in the fields of adaptation finance. These developments include the following:

a. Adaptation is no longer viewed purely as an add-on to development investments, but rather as an imperative for

putting development on the path to resilience. As a result, adaptation support has expanded from traditional

infrastructure sectors to a wider range of sectors, such as education, health, social protection, financial services,

and research and innovation for adaptation solutions.

b. Financing modalities supporting adaptation have broadened from typical investment loans and programmes to

other financial instruments, including policy-based loans, working capital and credit lines.

c. Relevant advances concerning green and sustainable finance have emerged in recent years, notably the

EU taxonomy for sustainable finance and impact reporting for green bonds, introducing new concepts and

approaches for better defining, reporting and monitoring adaptation activities, including private investment in

adaptation.

1.3 METHODOLOGY FOR CLIMATE CO-FINANCE

Since 2015 the multilateral development banks have been reporting on climate co-finance (CCF)

flows in line with the harmonised definitions and indicators that had been established to estimate

them. Tracking of climate co-finance aims to estimate the volume of financial resources invested by

public and private external parties alongside multilateral development banks financing for climate

mitigation and adaptation activities.

This approach presents sources of climate co-finance in the following categories: (i) other

multilateral development banks; (ii) IDFC member institutions, including bilateral and multilateral

members; (iii) other international public entities such as donor governments; (iv) contributions from

other domestic public entities such as recipient country governments (for example, financing by

local counterparts); and (v) all private entities (defined as those with at least 50% of their shares

held privately), split into private direct mobilisation and private indirect mobilisation. This level of

granularity enables multilateral development banks to present an increasingly nuanced picture of

co-finance flows used for climate change interventions.

In April 2017 the multilateral development banks published a reference guide (From Billions to

Trillions: Transforming Development Finance)

15

to explain how they calculate and jointly report private

investment mobilisation beyond climate finance. The purpose of the methodology is to recognise and

measure the private capital mobilised in MDB project activities. The guide outlines the banks´ joint

commitment to mobilising increased investment from the private sector and institutional investors.

Total financing of climate activity includes climate co-finance, that is, the amount of financial

resources that external entities contribute. The multilateral development banks are implementing

the definitions and recommendations of the MDB Taskforce on Private Investment Mobilisation for

tracking the private share of climate co-finance. This methodology focuses on assessing the private

finance mobilised by an MDB, on a project-by-project basis, such as private direct mobilisation and

private indirect mobilisation

16

. The 2022 Joint Report on MDBs’ Climate Finance follows the agreed

terminology

17

and Chapters 2.4, 3.4 and Annex A.4 show two different elements of private finance

mobilisation: “private direct mobilisation” and “private indirect mobilisation”. Put together, these two

forms of mobilisation represent the private share of climate co-finance.

14 Joint methodology for tracking climate change adaptation finance (eib.org)

15 http://documents.worldbank.org/curated/en/495061492543870701/pdf/114403-WP-PUBLIC-cedvp-14p-JointMDBReportingonPriva

teInvestmentMobilizationMethodologyReferenceGuide.pdf

16 http://documents.worldbank.org/curated/en/495061492543870701/pdf/114403-WP-PUBLIC-cedvp-14p-JointMDBReportingonPriva

teInvestmentMobilizationMethodologyReferenceGuide.pdf

17 See Annex C.1 for definitions of “private direct mobilisation”, “private indirect mobilisation” and “public direct mobilisation”.

4 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Private indirect

mobilisation

Private direct

mobilisation

Public co-financeExternal

resources

managed

by MDB

MDB own account

Total private mobilisation

MDB climate finance

Figure 2. Total activity financing, by type of finance

Overview of MDB methodologies for tracking climate finance |

5

6 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

2.1 MDB CLIMATE FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES

In 2022, multilateral development banks committed $60.7 billion to low-income and middle-

income economies, thus surpassing the annual expectation of $50 billion set in the joint MDB High

Level Statement of 2019. Of the $60.9 billion of climate finance committed to low-income and

middle-income economies, $57.9 billion was from the MDBs’ own account and $3.0 billion was in

external resources channelled through MDBs. Mitigation finance committed to low- and middle-

income economies totalled $38.2 billion, or 63%, while adaptation finance totalled $22.7 billion,

or 37%.

Sources of MDB climate finance are split between the multilateral development banks’ own

accounts and the external resources channelled through and managed by them. External

resources include trust-funded operations, such as those funded by bilateral agencies and

dedicated climate finance funds such as the Climate Investment Funds (CIF), the Green Climate

Fund (GCF) and climate-related funds under the Global Environment Facility (GEF), EU blending

facilities and others. As bilateral reporting may already cover some external resources, those

managed by the MDBs are presented separately from the multilateral development banks’ own

accounts.

Table 2. MDB climate finance in low- and middle-income economies, 2022 (in $ million)

AfDB ADB AIIB CEB EBRD EIB IDBG IsDB NDB WBG Total

Own account 3 151 6 721 2 311 295 3 949 4 097 5 556 1 050 466 30 334 57 931

MDB-managed

external

resources

500 385 - - 340 67 373 - - 1 333 2 985*

MDB climate

finance

3 651 7 107 2 311 295 4 289 4 165 5 930 1 050 466 31 666

60 916*

Notes:

1. “MDB climate finance” refers to the sum of climate finance from the MDBs’ own accounts and MDB-managed external resources.

2. For IsDB, the reported commitment excludes operations of IsDB Group members including the Islamic Corporation for the Development

of the Private Sector (ICD), the International Islamic Trade Finance Corporation (ITFC) and the Islamic Corporation for the Insurance of

Investment and Export Credit (ICIEC).

3. (*) See footnote 1 for Figures 1a and 1b.

Table 3. MDB climate finance by scope in low- and middle-income economies, 2022 (in $ million)

MDB Adaptation finance Mitigation finance MDB climate finance

AfDB 2 276 1 375 3 651

ADB 2 829 4 277 7 107

AIIB 423 1 889 2 311

CEB 211 84 295

EBRD 300 3 989 4 289

EIB 431 3 734 4 165

IDBG 2 045 3 885 5,930

IsDB 571 479 1 050

NDB 0 466 466

WBG 13 640 18 027 31 666

Total 22 718* 38 198* 60 916*

Notes:

1. In certain cases, MDBs finance activities that have simultaneous benefits for mitigation and adaptation. The 2022 figure of

$2 354 million of climate finance with dual benefits in low- and middle-income economies is presented under the subheading of

mitigation or adaptation finance (based on the most relevant elements of the project) to simplify reporting (See Annex C.4). The AIIB

reported $127 million, the EBRD reported $106 million, the IDBG reported $1 792 million, and the IsDB reported $329 million as dual-

benefit projects. Note that the IDBG and the IsDB split dual-benefit finance equally between adaptation and mitigation categories, while

the AIIB and the EBRD allocate all dual-benefit activities to adaptation finance. See Annex C.4 for further details.

2. (*) See footnote 1 for Figures 1a and 1b.

MDB CLIMATE FINANCE IN LOW- AND

MIDDLE-INCOME ECONOMIES, 2022

2

MDB climate finance in low- and middle-income economies, 2022 |

7

2.1.1 MDB CLIMATE FINANCE BY TYPE OF RECIPIENT OR BORROWER IN LOW- AND

MIDDLE-INCOME ECONOMIES

The multilateral development banks report on the nature of first recipients or borrowers of their

climate finance (those to which finance will flow directly from the MDBs), differentiating between

public and private recipients or borrowers. Total commitment varies significantly between the

MDBs’ own accounts and MDB-managed external resources, as Table 4 illustrates. Table 5 shows

the split by type of recipient or borrower for the banks’ own accounts and for MDB-managed

external resources.

Table 4. MDB climate finance by source of funds and by type of recipient or borrower in low- and middle-income

economies, 2022 (in $ million)

Type of recipient or borrower MDB own account MDB-managed external resources

Public recipient/borrower 46 146 2 491*

Private recipient/borrower 11 785 495

Total 57 931 2 985*

(*) See footnote 1 for Figures 1a and 1b.

Table 5. MDB climate finance by type of recipient or borrower in low- and middle-income economies, 2022

(in $ million)

MDB

Private Public

AfDB 777 2 874

ADB 547 6 560

AIIB 648 1 664

CEB - 295

EBRD 2 707 1 581

EIB 1 440 2 724

IDBG 1 266 4 664

IsDB - 1 050

NDB - 466

WBG 4 894 26 773

Total 12 279 48 637*

(*) See footnote 1 for Figures 1a and 1b.

8 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

2.1.2 MDB CLIMATE FINANCE BY TYPE OF INSTRUMENT IN LOW- AND MIDDLE-

INCOME ECONOMIES

For the eighth consecutive year, the multilateral development banks reported climate finance

by the types of financial instrument (see Annex C.5 for definitions). They reported that 61% of

climate finance for low- and middle-income economies was committed through investment loans,

followed by policy-based financing (14%) and grants (10%). Illustrative examples of various type of

instrument are presented in tables in Annex C.5.

Table 6. MDB climate finance by type of instrument in low- and middle-income economies, 2022 (in $ million)

Instrument type Climate finance

Equity 1 008

Grant 6 078*

Guarantee 1 766

Investment loan 37 102

Line of credit 2 839

Policy-based financing 8 427

Results-based financing 2 105

Other instruments 1 591

Total 60 916*

Notes:

1. Annex C.5 defines the various type of instrument.

2. Other instruments include advisory services and bonds. Some MDBs report eligible bonds under the category of investment loans.

3. (*) See footnote 1 for Figures 1a and 1b.

Equity $1 008 million

Grant $6 078* million

Guarantee $1 766 million

Investment loan $37 102 million

Line of credit $2 839 million

Policy-based financing $8 427 million

Results-based financing $2 105 million

Other instruments $1 591 million

TOTAL CLIMATE FINANCE BY INSTRUMENT

$60 916* million

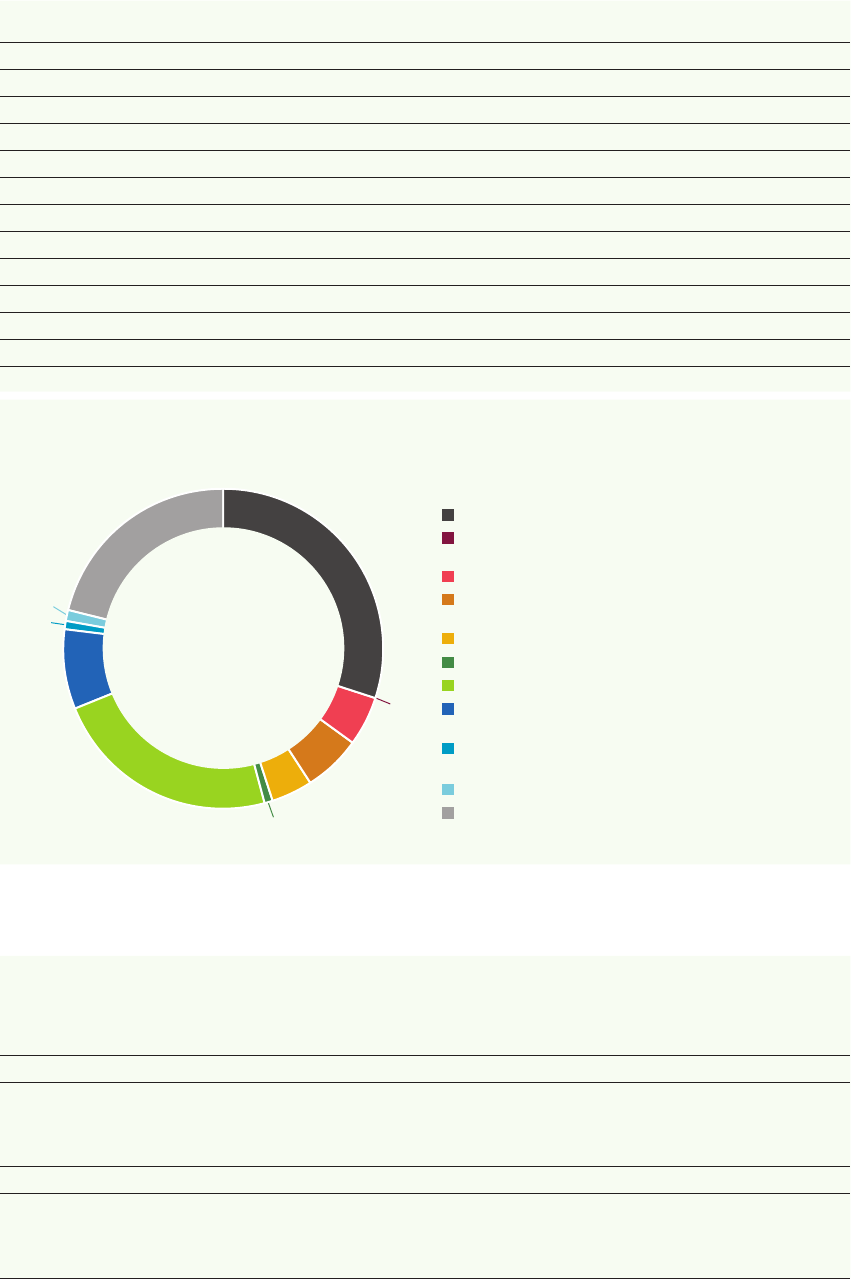

Figure 3. MDB climate finance by type of instrument in low- and middle-income economies, 2022 (in $ million)

5%

2%

2%

3%

61%

10%

14%

3%

TOTAL

$60 916* million

(*) See footnote 1 for Figures 1a and 1b.

MDB climate finance in low- and middle-income economies, 2022 |

9

2.1.3 MDB CLIMATE FINANCE BY REGION IN LOW- AND MIDDLE-INCOME

ECONOMIES

Multilateral development banks’ climate finance commitments grouped by region

18

.

Table 7. MDB climate finance by region in low- and middle-income economies, 2022 (in $ million)

Region

Climate finance

Central Asia 2 628

East Asia and the Pacific 9 846*

Europe: European Union 330

Europe: Non-European Union 4 826

Latin America and the Caribbean 12 917

Middle East and North Africa 4 715

South Asia 7 471

Sub-Saharan Africa 16 334

Multi-regional 1 848

Total 60 916*

(*) See footnote 1 for Figures 1a and 1b.

Central Asia $2 628 million

East Asia and the Pacific $9 846* million

Europe: European Union $330 million

Europe: Non-European Union $4 826 million

Latin America and the Caribbean $12 917 million

Middle East and North Africa $4 715 million

South Asia $7 471 million

Sub-Saharan Africa $16 334 million

Multi-regional $1 848 million

TOTAL CLIMATE FINANCE BY REGION

$60 916* million

Figure 4. MDB climate finance by region in low- and middle-income economies, 2022 (in $ million)

1%

3%

4%

8%

12%

21%

8%

16%

27%

TOTAL

$60 916* million

(*) See footnote 1 for Figures 1a and 1b.

2.2 MDB ADAPTATION FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2022

In 2022 a total of $25.2 billion was committed for climate change adaptation finance, with

$22.7 billion, or 90%, committed to low- and middle-income economies, thus surpassing their

expected collective delivery of increasing adaptation finance to $18 billion, set in the joint MDB

High Level Statement of 2019. The data reported correspond to the incremental costs of project

components, sub-components, or elements, or proportions of projects, which are considered to

be inputs to an adaptation process and are intended to reduce vulnerability to climate change and

build resilience to it.

18 See Tables B.1 and B.2 for regional groupings.

10 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Table 8 presents the 2022 adaptation figures by bank for low- and middle-income economies,

with a breakdown of climate adaptation finance committed by the multilateral development banks

from their own accounts and from MDB-managed external resources in low- and middle-income

economies.

Table 8. MDB adaptation finance by MDB according to source of funds in low- and middle-income economies,

2022 (in $ million)

AfDB ADB AIIB CEB EBRD EIB IDBG IsDB NDB WBG Total

MDB own

account

1 993 2 726 423 211 252 424 1 997 571 - 12 878 21 473

MDB-managed

external

resources

282 103 - - 48 7 48 - - 762 1 245*

Total 2 276 2 829 423 211 300 443 2,045 571 - 13,640 22 718*

(*) See footnote 1 for Figures 1a and 1b.

Table 9 shows a breakdown by type of recipient or borrower.

Table 9. MDB adaptation finance by MDB and by type of recipient or borrower in low- and middle-income economies,

2022 (in $ million)

MDB Private Public

AfDB 261 2 015

ADB 89 2 74 0

AIIB 5 418

CEB - 211

EBRD 145 155

EIB 211 220

IDBG 118 1 927

IsDB - 571

NDB - -

WBG 128 13 512

Total

956 21 762*

(*) See footnote 1 for Figures 1a and 1b.

Table 10 breaks down MDB adaptation finance by type of instrument. The multilateral development

banks reported that the majority (62%) of adaptation finance for low- and middle-income

economies was committed through investment loans, followed by grants (16%) and policy-based

financing (13%).

Table 10. MDB adaptation finance by MDB and by type of instrument in low- and middle-income economies, 2022

(in $ million)

Instrument type Adaptation finance

Equity 7

Grant 3 539*

Guarantee 289

Investment loan 14 091

Line of credit 767

Policy-based financing 3 032

Results-based financing 804

Other instruments 188

Total 22 718*

(*) See footnote 1 for Figures 1a and 1b.

MDB climate finance in low- and middle-income economies, 2022 |

11

Equity $7 million

Grant $3 539* million

Guarantee $289 million

Investment loan $14 091 million

Line of credit $767 million

Policy-based financing $3 032 million

Results-based financing $804 million

Other instruments $188 million

TOTAL CLIMATE FINANCE BY INSTRUMENT

$22 718* million

Figure 5. MDB adaptation finance by MDB and by type of instrument in low- and middle-income economies,

2022 (in $ million)

3%

1%

2%

1%

62%

15%

13%

3%

TOTAL

$22 718* million

(*) See footnote 1 for Figures 1a and 1b.

Table 11 shows total adaptation finance by region. The largest proportions of adaptation finance in

low- and middle-income economies were in the following regions: Sub-Saharan Africa, South Asia,

and Latin America and the Caribbean.

Table 11. MDB adaptation finance by region in low- and middle-income economies, 2022 (in $ million)

Region Adaptation finance

Central Asia 812

East Asia and the Pacific 2 718*

Europe: European Union 3

Europe: Non-European Union 1 049

Latin America and the Caribbean 3 635

Middle East and North Africa 1 805

South Asia 3 884

Sub-Saharan Africa 8 659

Multi-regional 154

Total 22 718*

(*) See footnote 1 for Figures 1a and 1b.

Central Asia $812 million

East Asia and the Pacific $2 718* million

Europe: European Union $3 million

Europe: Non-European Union $1 049 million

Latin America and the Caribbean $3 635 million

Middle East and North Africa $1 805 million

South Asia $3 884 million

Sub-Saharan Africa $8 659 million

Multi-regional $154 million

TOTAL ADAPTATION FINANCE BY REGION

$22 718* million

Figure 6. MDB adaptation finance by region in low- and middle-income economies, 2022 (in $ million)

0%

1%

3%

16%

5%

8%

17%

12%

38%

TOTAL

$22 718* million

(*) See footnote 1 for Figures 1a and 1b.

12 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Table 12 reports MDB adaptation finance by sector, with 30% in energy, transport and other built

environment and infrastructure, followed by cross-cutting operations with 17%, and 15% in water

and wastewater systems.

Table 12. MDB adaptation finance by sector in low- and middle-income economies, 2022 (in $ million)

Sector group Adaptation finance

Coastal and riverine infrastructure 306

Crop and food production 2 894

Cross-cutting sectors 3 839

Energy, transport, and other built environment and infrastructure 6 847

Financial services 1 575

Industry, manufacturing and trade 29

Information and communications technology 138

Institutional capacity support or technical assistance 2 205

Other agricultural and ecological resources 1 540*

Water and wastewater systems 3 344

Total 22 718*

(*) See footnote 1 for Figures 1a and 1b.

Coastal and riverine infrastructure $306 million

Crop and food production $2 894 million

Cross-cutting sectors $3 839 million

Energy, transport,and other built environment

and infrastructure $6 847 million

Financial services $1 575 million

Industry, manufacturing and trade $29 million

Information and communications

technology $138 million

Institutional capacity support or

technical assistance $2 205 million

Other agricultural and ecological resources

$1 540* million

Water and wastewater systems $3 344 million

TOTAL ADAPTATION FINANCE BY SECTOR

$ 22 718* million

Figure 7. MDB adaptation finance by sector in low- and middle-income economies, 2022 (in $ million)

0%

1%

1%

7%

16%

30%

15%

7%

13%

10%

TOTAL

$ 22 718* million

(*) See footnote 1 for Figures 1a and 1b.

MDB climate finance in low- and middle-income economies, 2022 |

13

Adaptation finance by region, for low- and middle-income economies, with a further breakdown by

sector, is presented in Table 13.

Table 13. MDB adaptation finance by sector and region in low- and middle-income economies, 2022 (in $ million)

Central

Asia

East Asia

and the

Pacific

Europe:

European

Union

Europe:

Non-

European

Union

Latin

America

and the

Caribbean

Middle

East and

North

Africa

South

Asia

Sub-

Saharan

Africa

Multi-

regional

Total

Coastal

and riverine

infrastructure

1 54 - - 102 16 54 74 5 306

Crop and food

production

119 46 - 89 99 622 288 1 534 97 2 894

Cross-cutting

sectors

78 1 058 - 67 589 211 748 1 077 12 3 839

Energy,

transport, and

other built

environment and

infrastructure

156 751 3 517 695 134 2 301 2 264 27 6 847

Financial

services

3 131 - 0 283 252 89 815 3 1 575

Industry,

manufacturing

and trade

0 - - 12 9 - 7 - - 29

Information and

communications

technology

3 9 - 38 3 - 26 59 0 138

Institutional

capacity support

or technical

assistance

11 52 - 225 954 89 128 743 3 2 217

Other

agricultural

and ecological

resources

209 388* - 23 228 42 32 616 3 1 540*

Water and

wastewater

systems

232 230 - 77 672 439 212 1 478 4 3 344

Total 812 2 718* 3 1 049 3 635 1 805 3 884 8 659 154 22 718*

(*) See footnote 1 for Figures 1a and 1b.

2.3 MDB MITIGATION FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2022

In 2022, the multilateral development banks reported a total of $74.5 billion in financial

commitments for the mitigation of climate change, with $38.2 billion, or 51%, committed to low-

income and middle-income economies. Data reported correspond to the financing of mitigation

projects or of those components, sub-components, elements, or proportions of projects that

provide mitigation benefits (rather than reporting the entire project cost).

Table 14 provides a breakdown of climate mitigation finance committed by the multilateral

development banks during 2022 from MDB own-account and external resources in low- and

middle-income economies.

14 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Table 14. MDB mitigation finance by MDB, according to source of funds in low- and middle-income economies,

2022 (in $ million)

AfDB ADB AIIB CEB EBRD EIB IDBG IsDB NDB WBG Total

MDB own

account

1 157 3 995 1 889 84 3 697 3 674 3 560 479 466 17 456 36 458

MDB-managed

external

resources

217 282 - - 292 60 325 - - 570 1 740*

Total 1 375 4 277 1 889 84 3 989 3 734 3 885 479 466 18 027 38 198*

(*) See footnote 1 for Figures 1a and 1b.

Table 15 shows a breakdown by type of recipient or borrower.

Table 15. MDB mitigation finance by MDB and by type of recipient or borrower in low- and middle-income

economies, 2022 (in $ million)

MDB Private Public

AfDB 516 859

ADB 458 3 819

AIIB 643 1 246

CEB - 84

EBRD 2 563 1 426

EIB 1 229 2 505

IDBG 1 148 2 737

IsDB - 479

NDB - 466

WBG 4 766 13 261

Total

11 323 26 875*

(*) See footnote 1 for Figures 1a and 1b.

Table 16 breaks down MDB mitigation finance by type of instrument. The multilateral development

banks reported that 60% of total mitigation finance for low- and middle-income economies was

committed through investment loans, followed by policy-based financing, with a share of 14%.

Table 16. MDB mitigation finance by type of instrument in low- and middle-income economies, 2022 (in $ million)

Instrument type Mitigation finance

Equity 1 001

Grant 2 539*

Guarantee 1 477

Investment loan 23 011

Line of credit 2 072

Policy-based financing 5 395

Results-based financing 1 301

Other instruments 1 399

Total

38 198*

(*) See footnote 1 for Figures 1a and 1b.

MDB climate finance in low- and middle-income economies, 2022 |

15

Equity $1 001 million

Grant $2 539* million

Guarantee $1 477 million

Investment loan $23 011 million

Line of credit $2 072 million

Policy-based financing $5 395 million

Results-based financing $1 301 million

Other instruments $1 399 million

TOTAL MITIGATION FINANCE BY TYPE OF INSTRUMENT

$38 198* million

Figure 8. MDB mitigation finance by type of instrument in low- and middle-income economies, 2022 (in $ million)

4%

3%

7%

60%

4%

5%

14%

3%

TOTAL

$38 198* million

(*) See footnote 1 for Figures 1a and 1b.

Table 17 shows total mitigation finance by region. The largest proportions of mitigation finance in

low- and middle- income economies were in the following regions: Latin America and the Caribbean

(24%), Sub-Saharan Africa (20%), and East Asia and the Pacific (19%).

Table 17. MDB mitigation finance by region in low- and middle-income economies, 2022 (in $ million)

Region Mitigation finance

Central Asia 1 816

East Asia and the Pacific 7 128*

Europe: European Union 327

Europe: Non-European Union 3 777

Latin America and the Caribbean 9 282

Middle East and North Africa 2 910

South Asia 3 587

Sub-Saharan Africa 7 675

Multi-regional 1 689

Total

38 198*

Notes:(*) See footnote 1 for Figures 1a and 1b.

Central Asia $1 816 million

East Asia and the Pacific $7 128* million

Europe: European Union $327 million

Europe: Non-European Union $3 777 million

Latin America and the Caribbean $9 282 million

Middle East and North Africa $2 910 million

South Asia $3 587 million

Sub-Saharan Africa $7 675 million

Multi-regional $1 689 million

TOTAL MITIGATION FINANCE BY REGION

$38 198* million

Figure 9. MDB mitigation finance by region in low- and middle-income economies, 2022 (in $ million)

4%

5%

1%

9%

10%

24%

8%

19%

20%

TOTAL

$38 198* million

(*) See footnote 1 for Figures 1a and 1b.

16 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Table 18 reports the multilateral development banks’ mitigation finance in low- and middle-income

economies by sector with 31% in energy, followed by 23% in transport.

Table 18. MDB mitigation finance by sector in low- and middle-income economies, 2022 (in $ million)

Region Mitigation finance

Energy 11 904

Mining and metal production for climate action -

Manufacturing 1 948

Agriculture, forestry, land use and fisheries 2 296*

Water supply and wastewater 1 418

Solid waste management 572

Transpor t 8 650

Buildings, public installations and end-use energy efficiency 3 009

Information and communications technology (ICT) and digital technologies 239

Research, development and innovation 121

Cross-sectoral activities 8 041

Total 38 198*

(*) See footnote 1 for Figures 1a and 1b.

Energy $11 904 million

Mining and metal production for

climate action $- million

Manufacturing $1 948 million

Agriculture, forestry, land use

and fisheries $2 296* million

Water supply and wastewater $1 418 million

Solid waste management $572 million

Transport $8 650 million

Buildings, public installations and

end-use energy efficiency $3 009 million

Information and communications technology

(ICT) and digital technologies $239 million

Research, development and innovation $121 million

Cross-sectoral activities $8 041 million

TOTAL MITIGATION FINANCE BY SECTOR

$38 198* million

0%

1%

Figure 10. MDB mitigation finance by sector in low- and middle-income economies, 2022 (in $ million)

1%

1%

31%

8%

6%

4%

21%

5%

23%

TOTAL

$38 198* million

(*) See footnote 1 for Figures 1a and 1b.

Mitigation finance by region, with further breakdown by sectors, is presented in Table 19.

Table 19. MDB mitigation finance by sector and by region in low- and middle-income economies, 2022 (in $ million)

Central

Asia

East Asia

and the

Pacific

Europe:

European

Union

Europe:

Non-

European

Union

Latin

America

and the

Caribbean

Middle

East and

North

Africa

South

Asia

Sub-

Saharan

Africa

Multi-

regional

Total

Energy 888 1 407 8 1 178 2 302 74 9 1 271 3 243 8 57 11 904

Mining

and metal

production for

climate action

- - - - - - - - - -

Manufacturing 74 253 - 617 434 244 15 154 149 1 948

Agriculture,

forestry,

land use and

fisheries

228 673* - 60 441 90 66 681 58 2 296*

MDB climate finance in low- and middle-income economies, 2022 |

17

Central

Asia

East Asia

and the

Pacific

Europe:

European

Union

Europe:

Non-

European

Union

Latin

America

and the

Caribbean

Middle

East and

North

Africa

South

Asia

Sub-

Saharan

Africa

Multi-

regional

Total

Water supply

and waste-

water

33 261 - 32 514 115 175 287 0 1 417

Solid waste

management

78 272 - 29 119 24 1 24 24 572

Transpor t 145 2 642 295 1 004 1 367 1 027 1 123 1 006 42 8 650

Buildings,

public

installations

and end-

use energy

efficiency

163 275 23 262 583 473 332 604 293 3 009

Information

and communi-

cations tech-

nology (ICT)

and digital

technologies

- 39 - 19 40 - 39 66 34 238

Research,

development

and innovation

- 2 2 - 51 1 8 39 18 121

Cross-sectoral

activities

207 1 296 - 574 3 430 188 557 1 571 218 8 041

Total 1 816 7 128* 327 3 777 9 282 2 910 3 587 7 675 1 689 38 198*

(*) See footnote 1 for Figures 1a and 1b.

2.4 CLIMATE CO-FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2022

The multilateral development banks’ climate co-finance is based on their harmonised definitions

which can be consulted in Section 1.3.

Table 21 shows 2022 climate co-finance flows as reported by each institution, segmented by

the source of co-financing. These CCF figures are the best estimate of resource flows based on

information available at the time of board approval and/or commitment to each project. In some

cases, two or more banks jointly finance a project, which results in some overlap between the

gross co-finance figures reported by the different organisations. Table 20 shows climate co-finance

flows by adaptation and mitigation for low- and middle-income economies. In order to avoid double

counting, the last column of Tables 21 and 22 nets out potentially double-counted co-financing by

considering only the proportion of co-financing for every project that features co-financing from

another MDB.

In the reference guide, the multilateral development banks emphasise the differences in how

various financial instruments, including guarantees, are tracked and reported. By mitigating the

political and commercial risks of private and publicly owned investments, guarantees can facilitate

access to capital for climate finance activities. This can enhance the mobilisation of resources for a

specific project or in support of specific government policies.

For consistency with the agreed MDB methodology on tracking and reporting mobilised private

capital, the tracking and reporting of guarantees as detailed in this report assumes: (i) a distinction

18 | 2022 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

in tracking and reporting between “commercial guarantees” and “non-commercial guarantees”

19

;

and (ii) causality between the guarantee and the underlying investment covered (in other words,

in the absence of the guarantee, the underlying investment would be unlikely to occur). For this

reason, gross exposure from the guarantee issuance and the underlying investment may be

reported separately under the banks’ own account and private co-finance, while best efforts are

made to minimise double counting.

Table 21 reflects the 2022 CCF flows, including the direct and indirect mobilisation attributed to

guarantees. The guarantee exposure of each MDB has been shown as “own account” in Tables 2,

22, 27 and 48.

Table 20. Climate co-finance flows by MDB and by thematic focus in low- and middle-income economies, 2022

(in $ million)

AfDB ADB AIIB CEB EBRD EIB IDBG IsDB NDB WBG

Total

climate

co-

finance

Adjustment

for multiple

MDB

financing

Mitigation

finance

1 406 4 075 2 231 181 4 376 5 729 2 447 1 163 2 114

7 550 32 553 27 717

Adaptation

finance

2 582 4 297 1 648 53 396 1 836 1 793 110 -

8 435 21 993 20 336

Total

3 988 8 372 3 879 234 4 772 7 564 4 240 1 273 2 114

15 986

54 546 48 053

Table 21. Climate co-finance flows by MDB and by source in low- and middle-income economies, 2022 (in $ million)

AfDB ADB AIIB CEB EBRD EIB IDBG IsDB NDB

WBG

Total

climate

co-

finance

Adjustment

for multiple

MDB

financing

Public direct

mobilisation

2 122 80 - - 35 145 - -

6 639

7 021

7 021

Public co-finance

Other MDBs

1 307 934 1 985 - 1 736 1 260 484 181 -

875

8 762

8 762

IDFC

members

421 476 260 - 100 460 304 - -

200

2 221

1 830

Other

international,

public

865 153 17 - 15 400 27 1 091 -

1 077

3 646

3 060

Other

domestic,

public

539 6 175 1 087 234 348 2 039 320 - 1 032

352

12 126

10 235

Total private mobilisation

Private

direct

mobilisation

- 187 - - 257 46 1 321 - -

2 654

4 466

4 466

Private

indirect

mobilisation

854 325 450 - 2 316 3 324 1 639 - 1 082

4 189