2 021

JOINT REPORT

ON MULTILATERAL

DEVELOPMENT

BANKS’

CLIMATE

FINANCE

OCTOBER 2022

This report was written by a group of multilateral development banks (MDBs),

composed of the African Development Bank (AfDB), the Asian Development

Bank (ADB), the Asian Infrastructure Investment Bank (AIIB), the Council of

Europe Development Bank (CEB), the European Bank for Reconstruction

and Development (EBRD), the European Investment Bank (EIB), the Inter-

American Development Bank Group (IDBG), the Islamic Development Bank

(IsDB), the New Development Bank (NDB) and the World Bank Group (WBG).

The findings, interpretations and conclusions expressed in this work do not

necessarily reflect the official views of the multilateral development banks’

boards of executive directors or the governments they represent.

JOINT REPORT ON MULTILATERAL

DEVELOPMENT BANKS’

CLIMATE

FINANCE

2 021

iv Abbreviations and acronyms

v Preface

vii Executive summary

1 1. OVERVIEW OF MDB METHODOLOGIES FOR TRACKING CLIMATE FINANCE

1 1.1. Finance for adaptation to climate change

1 1.2. Finance for the mitigation of climate change

3 1.3. Methodology for climate co-finance

5 2. MDB CLIMATE FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2021

5 2.1. Total MDB climate finance

6 2.1.1. MDB climate finance by type of recipient or borrower

7 2.1.2. MDB climate finance by type of instrument

8 2.1.3. MDB climate finance by region

8 2.2. MDB adaptation finance

12 2.3. MDB mitigation finance

16 2.4. Climate co-finance

19 3. MDB CLIMATE FINANCE IN HIGH-INCOME ECONOMIES, 2021

19 3.1. Total MDB climate finance

20 3.1.1. MDB climate finance by type of recipient or borrower

21 3.1.2. MDB climate finance by type of instrument

22 3.1.3. MDB climate finance by region

22 3.2. MDB adaptation finance

26 3.3. MDB mitigation finance

29 3.4. Climate co-finance

31 ANNEX A. Further detailed analysis of total MDB climate finance data, 2021

45 ANNEX B. Geographical coverage of the report, 2021

57 ANNEX C. Methodologies and definitions

CONTENTS

ADB Asian Development Bank

AfDB African Development Bank

AIIB Asian Infrastructure Investment Bank

CCF Climate co-finance

CEB Council of Europe Development Bank

CIF Climate Investment Funds

CO

2

Carbon dioxide

EBRD European Bank for Reconstruction and Development

EIB European Investment Bank

EU European Union

€ Euro

FY Fiscal year

GEF Global Environment Facility

GCF Green Climate Fund

GHG Greenhouse gas

IDB Inter-American Development Bank

IDBG Inter-American Development Bank Group, composed of the IDB, IDB Lab and IDB Invest

IDB Invest The private sector arm of the IDBG

IDB Lab The innovation laboratory of the IDBG

IDFC International Development Finance Club

IFC International Finance Corporation

IsDB Islamic Development Bank

MDBs Multilateral development banks

MIGA Multilateral Investment Guarantee Agency

NAMAs Nationally Appropriate Mitigation Actions

NDCs Nationally Determined Contributions

NDB New Development Bank

UNFCCC United Nations Framework Convention on Climate Change

$ United States dollar

WB World Bank, composed of the International Bank for Reconstruction and Development (IBRD), and the

International Development Association (IDA)

WBG World Bank Group, composed of the WB, IFC and MIGA

ABBREVIATIONS AND ACRONYMS

The Joint Report on Multilateral Development Banks’ Climate Finance

is an annual collaborative effort to publish multilateral development

bank climate finance figures, together with a clear explanation of the

methodologies for tracking this finance. This joint report, alongside the

banks’ publication of climate finance statistics in their respective corporate

media, is intended to track progress in relation to their climate finance

targets such as those announced at COP21 and the greater ambition

pledged for the post-2020 period.

Since the first Joint Report on Multilateral Development Banks’ Climate Finance, which covered

climate finance for 2011, figures reported for climate finance have been based on a joint MDB

climate finance tracking and reporting methodology. This methodology has been gradually updated

as and when need arose, in particular in light of experience and global dynamics in this space.

From the 2014 edition onwards, the methodology has included reporting on climate co-finance

alongside MDB climate finance. The first eight editions of the report provided climate finance data

on a group of emerging and developing economies.

A detailed breakdown is provided throughout the report, differentiating between climate finance

going to low- and middle-income economies and high-income economies. This edition of the report

presents the multilateral development banks’ climate finance commitments data in two separate

chapters based on the economies where these banks operate; the first with data for low- and

middle-income economies, and the second for high-income economies.

In 2015, the multilateral development banks and the International Development Finance Club (IDFC)

agreed on a set of common principles for finance to mitigate climate change and an initial set

of common principles for finance to support adaptation to climate change. Their intention was

to take a common approach to tracking reporting on climate finance. In December 2019, the

multilateral development banks

1

and members of the IDFC published the joint Framework and

Principles for Climate Resilience Metrics in Financing Operations, setting out the core concepts and

characteristics of climate resilience metrics alongside a high-level framework for such metrics in

financing operations.

The multilateral development banks also conducted a review of the joint methodology for

tracking adaptation finance over the 2021-2022 period. This review aims to take stock of recent

developments in the field of adaptation finance, the MDBs’ efforts to support climate adaptation

and resilience through a wide range of sectors beyond traditional infrastructure, and the increasing

diversity of financial conditions that are used to support adaptation and resilience. This review

complements ongoing efforts by the multilateral development banks to enhance the robustness

and transparency of climate finance tracking and reporting, and support climate action, in line

with the objectives of the Paris Agreement. Building on the review, the Climate Change Adaptation

Working Group has commenced an update of the tracking methodology for climate adaptation to

reflect the evolving understanding of adaptation and the advancements in the fields of adaptation

finance. The working group aims to complete the methodology update during 2022.

The Climate Change Mitigation Working Group finalised its review of the tracking methodology for

climate mitigation finance and commenced tracking using the new methodology on 1 January 2021

for the AfDB, ADB, AIIB, EBRD, EIB, IDBG, IsDB and NDB and on 1 July 2021 for the WBG to

coincide with the institutions’ new fiscal years. The new version of the methodology published on

18 October 2021 includes a more granular breakdown of types of eligible activity, clear criteria that

must be met and additional guidance to facilitate the application of these criteria.

1 The AfDB, ADB, AIIB, EBRD, EIB, IDBG and IsDB.

PREFACE

PREFACE |

v

The multilateral development banks will continue to improve their tracking and reporting of climate

finance as part

2

of their commitments to ensure consistent financial flows to the countries’ long-

term, low-carbon and climate-resilient development pathways, as established in Article 2.1(c) of

the Paris Agreement.

The multilateral development banks announced their climate action targets for 2025 at the UN

Secretary General’s Climate Action Summit in New York in September 2019. This resulted in an

expected collective total of $50 billion for low-income and middle-income economies, and at

least $65 billion of climate finance globally, with an expected doubling in adaptation finance to

$18 billion, and private mobilisation of $40 billion. In 2021, the MDBs already surpassed these

collective expectations on climate finance — both for low- and middle-income economies and

globally. They also notably increased adaptation finance to over $19 billion. The table in Annex C.6

summarises post-2020 MDB climate commitments.

The banks presented updates on their work to align with the Paris Agreement at COP25 in

December 2019 and COP26 in November 2021. This included the key principles and criteria of

their approach, as well as some draft methodological guidance on how to operationalise it (the

MDB Paris Alignment Framework).

3, 4

Financial flows presented in this report are based on

methodologies that are separated and distinct from the MDB Paris Alignment Framework. The

multilateral development banks will develop their own operational methodologies to implement the

MDB “Paris Alignment Framework” and will set up processes to ensure that activities they report as

climate finance are those that are consistent with the goals of the Paris Agreement.

This 2021 edition of the Joint Report on Multilateral Development Banks’ Climate Finance was

prepared by the European Investment Bank together with the following partners: the African

Development Bank, the Asian Development Bank, the Asian Infrastructure Investment Bank, the

Council of Europe Development Bank, the European Bank for Reconstruction and Development, the

Inter-American Development Bank Group, the Islamic Development Bank, the New Development

Bank and the World Bank Group.

October 2022

2 Accelerated contribution to the transition through climate finance” – Building Block 3 of MDBs’ joint framework: https://www.eib.org/en/

press/all/2018-320-multilateral-development-banks-announce-joint-framework-for-aligning-their-activities-with-the-goals-of-the-paris-

agreement. Multilateral Development Banks announce joint framework for aligning their activities with the goals of the Paris Agreement

(eib.org).

3 Multinational development banks present their Paris Alignment approach (ebrd.com)

4 Progress Report: Multilateral Development Banks Working Together for Paris Alignment (eib.org)

Download this report at:

www.eib.org/mdbs-climate-finance

Download the infographic summary at:

www.eib.org/mdbs-climate-finance-infographics

vi | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

This 11

th

edition of the Joint Report on Multilateral Development Banks’

Climate Finance is an overview of climate finance committed in 2021 by

the African Development Bank (AfDB), the Asian Development Bank (ADB),

the Asian Infrastructure Investment Bank (AIIB), the European Bank for

Reconstruction and Development (EBRD), the European Investment Bank

(EIB), the Inter-American Development Bank Group (IDBG), the Islamic

Development Bank (IsDB) and the World Bank Group (WBG). This year’s

report also summarises information on climate finance tracking from the

New Development Bank (NDB) and the Council of Europe Development

Bank (CEB), presented separately from the joint figures.

5

NDB and CEB

climate finance commitments are not yet included in the total MDB climate

finance reported in this year’s edition.

As in previous years, the data and statistics presented in this year’s report result from the

uniform application of the methodologies developed jointly by the multilateral development

banks for their annual commitments. In this report, the term “MDB climate finance” refers to the

financial resources (from own accounts and MDB-managed external resources) committed by the

multilateral development banks to their operations, and components thereof, directed to activities

that mitigate climate change and/or support adaptation to climate change. The term “climate co-

finance” refers to the volume of financial resources invested by other public and private external

parties alongside the multilateral development banks for climate change mitigation and adaptation

activities. The banks have reported jointly on climate finance since the first edition in 2012, which

reported figures for 2011, and have added joint reporting on climate co-finance since the 2015

edition. Starting with the 2019 report, for the purpose of greater transparency and consistency,

the multilateral development banks agreed to start reporting on all economies where these banks

operate, while maintaining the report’s focus on low-and middle-income economies. This change

allowed for a clear breakdown by country income level.

The MDB climate finance commitments are presented in two main groups: 1) low-income and

middle-income economies, a grouping that includes low, lower-middle and upper-middle income

economies; and 2) high-income economies. These data sets are presented in two separate

chapters in this year’s report. The multilateral development banks endeavoured to attribute

climate finance in the category of global, multi-regional and regional projects to specific income

groups. The economies are categorised by income grouping in accordance with the World Bank’s

classification dated June 2021 (see Table B.1). More detailed analysis, and data that cannot easily

be split by income level such as climate finance for SIDS, are provided in an Annex A and Annex B.

LOW- AND MIDDLE-INCOME ECONOMIES

In 2021, $50.666 billion was for low-income and middle-income economies. $33.055 billion, or

65%, of this total was for climate change mitigation finance and $17.611 billion or 35% was for

climate change adaptation finance.

In 2021, the multilateral development banks reported $41.123 billion of their climate finance for

public recipients and $10.456 billion for private recipients in low-and middle-income economies.

The report also shows that MDB climate finance investments in low-and middle-income economies

are supported by a total of $43.603 billion in climate co-finance, with 66% in mitigation activities

and 34% in adaptation activities. 70% of climate co-finance in low- and middle-income economies

came from public sources and 30% from private sources.

5 See pages 10 and 11 for data on NDB and CEB climate finance commitments.

EXECUTIVE SUMMARY

Executive summary |

vii

HIGH-INCOME ECONOMIES

In 2021, $31.051 billion was for high-income economies. $29.475 billion, or 95%, of this total was

for climate change mitigation finance and $1.576 billion, or 5%, was for climate change adaptation

finance.

In 2021, the multilateral development banks reported $19.185 billion of climate finance for public

recipients and $11.866 billion for private recipients in high-income economies.

The report also shows that MDB climate finance investments in high-income economies are

supported by a total of $56.701 billion of climate co-finance, with 99% in mitigation activities and

1% for adaptation activities. 50% of climate co-finance in high-income economies came from public

sources and 50% from private sources.

CLIMATE FINANCE DETAIL

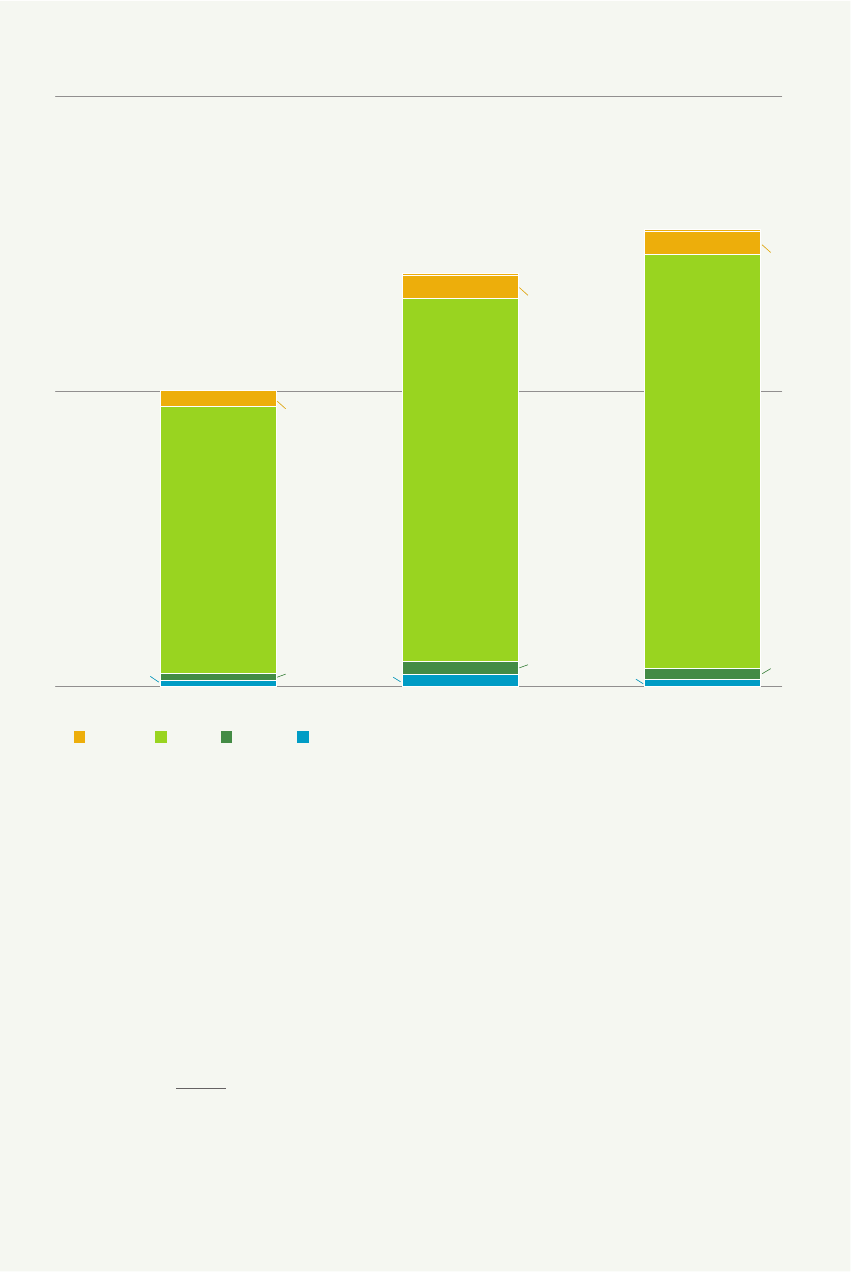

Figure 1a presents MDB climate finance commitments reported for 2019-2021 for low- and

middle-income economies where the multilateral development banks operate, while Figure 1b

shows MDB climate finance commitments reported for the same period for high-income economies

where the banks operate.

$ billion

2019 2020 2021

AfDB

ADB

ADB* AIIB EBRD EIB IDBG IsDB WBG

0

20

40

60

Figure 1a. MDBs’ climate finance commitments in low- and middle-income economies, 2019-21 (in $ billion)

18.4

4.4

3.6

3.9

7.1

3.6

41.5

0.5

21.3

3.2

2.5

5.3

2.3

38.0

0.3

28.0

4.8

3.4

4.8

2.7

(3.9

2.4

50.7

0.7

0.9)

2.1

1.1

4.8

viii | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

$ billion

2019 2020 2021

EBRD EIB IDBG WBG

0

20

40

Figure 1b. MDB climate finance commitments in high-income economies, 2019-21 (in $ billion)

18.1

20.1

0.5

1.1

0.4

24.6

28.0

28.1

31.1

0.9

1.6

0.8

0.7

1.6

0.5

20202019 2021

Notes for Figures 1a. and 1b:

1. Starting in 2021, the reporting of ADB’s climate finance will be based on commitments or signatures and not on approvals. This

is in accordance with the decision made in 2017 to measure and report ADB’s corporate performance based on commitments

through 2030.

(*) For ADB, external resources under management (ERUM) includes ADB-administered financial resources from financing

partners, including AIIB. ADB administers financing from AIIB for several projects, some of which have components that contribute

to climate finance. For 2021, ADB reports climate adaptation finance of $20 million and climate mitigation finance of $893 million

from ADB-administered financing from AIIB. To avoid double counting, these amounts are excluded from the total MDB amounts

for 2021 as AIIB reports climate finance for the same projects as a share of their financing under own resources.

2. IDBG’s figures have included all climate finance for public and private borrowers or beneficiaries in all 26 IDBG borrowing member

countries, via its three operational windows — IDB, IDB Invest and IDB Lab — on the basis of approval by the respective boards of

executive directors. From 2020 onward, for IDB Invest only, the figures refer to total commitments of long-term finance, in an effort

to more accurately reflect actual investments as well as the mobilisation of private sector players. In 2021, IDBG climate finance

consisted of: $4.5 billion through IDB; $1.1 billion through IDB Invest; and $23 million through IDB Lab.

3. The IsDB reported climate finance commitment excludes operations of IsDB Group members including the Islamic Corporation for

the Development of the Private Sector (ICD), the International Islamic Trade Finance Corporation (ITFC) and the Islamic Corporation

for Insurance of Investment and Export Credit (ICIEC).

4. EIB 2019-21 climate finance commitments include some EU economies in addition to those previously included by the EIB, EBRD

and WBG. Please see Annex B for details of geographical coverage in past editions of the joint report.

5. WBG climate finance resources (including own-account and managed external resources) for IFC, MIGA and the World Bank were

$4.097 billion (including $76 million of managed external resources), $1.348 billion and $23.035 billion (including $1.829 billion

of managed external resources), respectively, for the fiscal year 2021, which covers the period from 1 July 2020 to 30 June 2021.

IFC’s total commitments of own-account long-term finance in the fiscal year 2021 were $12.474 billion and IFC reached a level of

32% on long-term finance own-account climate commitments. For MIGA, total commitments on its own account in the fiscal year

2021 were $5.2 billion and climate finance reached 26%. WB total commitments on its own account were $66.55 billion and its

share of climate-related financing reached 32%.

6. The EBRD and EIB climate finance figures in this chart are based on the annual average European Central Bank rate. For 2021 the

exchange rate used is €1 = $1.1827.

7. Numbers in the tables and figures in this report may not add up to the totals shown, due to rounding.

Executive summary |

ix

The multilateral development banks apply two distinct methodologies — with fundamentally

different approaches — to tracking climate change adaptation finance (or “adaptation finance”)

and to climate change mitigation finance (or “mitigation finance”). Both methodologies, however,

track and report climate finance in a granular manner. In other words, the climate finance reported

covers only those components and/or sub-components or elements or proportions of projects that

directly contribute to or promote adaptation and/or mitigation.

The multilateral development banks estimate adaptation finance using the joint MDB methodology

for tracking climate change adaptation finance, which involves a three-step approach. This

methodology is based on a context- and location-specific, granular and conservative approach and

captures the amounts associated with activities directly linked to vulnerability to address climate

change. The banks try as far as possible to differentiate between their usual development finance

and finance provided with an explicit intent to reduce vulnerability to climate change. In July 2015,

the multilateral development banks and the IDFC agreed an initial set of Common Principles for

Climate Adaptation Finance Tracking.

6

The organisations continue to harmonise their approaches

to tracking adaptation finance. As mentioned above, the multilateral development banks have

commenced an update of the tracking methodology for climate adaptation to be completed during

2022. Climate change adaptation finance in 2021 totalled $19.187 billion, of which 92% was

directed at low- and middle-income economies.

The multilateral development banks’ methodologies for tracking climate mitigation finance align

with the Common Principles for Climate Change Mitigation Finance Tracking

7

that the MDBs and

the IDFC jointly agreed and first published in March 2015. At COP24 in 2018 they announced a

plan to work jointly to review and strengthen the Common Principles for Climate Mitigation Finance

Tracking. Mitigation finance is estimated in accordance with the joint MDB methodology for

tracking climate mitigation finance, which is based on a list of activities in sectors and sub-sectors

that reduce greenhouse gas emissions and are compatible with low-emission development. In

2020, the banks finalised their review of the methodology for tracking mitigation climate finance,

and commenced tracking using the new methodology on 1 January 2021 for the AfDB, ADB, AIIB,

EBRD, EIB, IDBG, IsDB and NDB and on 1 July 2021 for the WBG, to coincide with each institution’s

new fiscal year. The new version of the methodology includes a more granular breakdown of types

of eligible activity, clear criteria that must be met and additional guidance to help interpretation.

Climate change mitigation finance in 2021 totalled $62.530 billion, of which 53% was directed at

low- and middle-income economies.

In addition to reporting on mitigation and adaptation finance, some multilateral development banks

report on volumes of climate finance that have dual, simultaneous benefits: reducing greenhouse

gas emissions and promoting adaptation to climate change. In 2021, the AIIB, EBRD and IDBG

reported a total of $762 million for dual-benefit projects. See Annex C.4 for further climate finance

statistics and examples of such projects. Given the relatively small volumes of dual-benefit

climate finance and in order to simplify data presentation, the tables and graphs throughout this

report present data by mitigation or adaptation finance, as indicated by the reporting multilateral

development banks.

Climate co-finance including private finance mobilisation:

Climate co-finance committed during 2021 in low-and middle-income economies was $43.603 billion,

with 66% going to mitigation investments and 34% to adaptation investments. 70% of this climate co-

finance was from public sources and 30% was mobilised from private sources.

6 The Common Principles for Climate Change Adaptation Finance Tracking are set out in Annex C.2: https://www.afdb.org/fileadmin/uploads/

afdb/Documents/Generic-Documents/Common_Principles_for_Climate_Change_Adaptation_Finance_Tracking_-_Version_1__02_

July__2015.pdf

7 The Common Principles for Climate Mitigation Finance Tracking are set out in Annex C.3: https://www.eib.org/attachments/documents/

mdb_idfc_mitigation_common_principles_en.pdf

x | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

For high-income economies the climate co-finance committed during 2021 was $56.071 billion,

with 99% going to mitigation investments and 1% to adaptation investments. 50% of this climate

co-finance was from public sources and 50% was mobilised from private sources.

Annex A provides additional information on MDB total climate finance aggregated across all their

countries of operation.

The New Development Bank and Council of Europe Development Bank´s climate finance

information:

The New Development Bank (NDB) applied the joint MDB methodologies for tracking climate

mitigation and adaptation finance to projects funded from its own account in 2021, including

sovereign and non-sovereign operations.

In 2021, NDB committed a total of $509 million in climate finance, all of which was dedicated

to climate mitigation activities in middle-income countries. Climate finance accounted for about

26% of NDB’s total approved financing excluding the COVID-19 emergency programme loans. On

a separate note, NDB approved about $3.1 billion in emergency assistance in 2021 to facilitate

countries’ efforts to respond to and recover from the pandemic.

NDB aims to report on the details of its climate finance (for example, by region, sector and instrument)

in future editions of the joint report, as it extends the application of the joint MDB methodologies.

The Council of Europe Development Bank (CEB) is in the process of extending and adapting its

internal processes in order to fully implement the joint MDB methodology for climate finance

tracking, including the required level of granularity. In this report, the 2021 numbers for climate

mitigation and adaptation finance disclosed by CEB are based on the MDB methodology but may

be incomplete and therefore should be considered as conservative. Furthermore, only projects

financed from CEB’s own account are being tracked, including sovereign-backed financing and

non-sovereign-backed financing. No data for climate co-finance are available.

The CEB committed a total of $621 million in climate finance, representing 13% of the total volume

of financing approved in 2021 (15% excluding the emergency COVID-19 loans approved in 2021).

Mitigation finance accounted for 89% of total climate finance, representing $552.3 million, while

$68.6 million (11%) was allocated for climate change adaptation.

The CEB intends to report on the details of its climate finance commitments (for example, by region,

sector and instrument) in future editions of the joint report, as it extends its application of the joint

MDB methodologies after their review in 2021.

Executive summary |

xi

OVERVIEW OF MDB METHODOLOGIES FOR

TRACKING CLIMATE FINANCE

1

The tracking of MDB climate finance is based on the harmonised principles and jointly agreed

methodologies for tracking climate adaptation and mitigation finance detailed in Annex C.2 and

Annex C.3, respectively, of this report. In this publication, the term “MDB climate finance” refers

to the amounts committed by the multilateral development banks to financing climate change

mitigation and adaptation activities in the projects they undertake. See Annex B for details of the

2021 report’s geographic coverage, and that of past editions.

MDB climate finance includes commitments from the multilateral development banks’ own

accounts, and from external resources channelled through and managed by the banks. Climate

co-finance includes the amount of financial resources contributed by external resources alongside

MDB climate finance. These may include entities from both the private (commercial) and public

(non-commercial) sectors.

1.1 FINANCE FOR ADAPTATION TO CLIMATE CHANGE

Climate change adaptation aims to reduce the risks or vulnerabilities posed by climate change and

to increase climate resilience. Identification of climate change adaptation finance is the result of

a three-step process and thus, for a project to be counted either fully or partially towards MDB

adaptation finance, it must:

a. Set out the project’s context of vulnerability to climate change.

b. Make an explicit statement of intent to address this vulnerability as part of the project.

c. Articulate a clear and direct link between the vulnerability and the specific project activities.

The MDB methodology for tracking climate change adaptation finance follows a context- and

location-specific, conservative and granular approach. It tracks MDB financing only for those

components and/or sub-components or elements or proportions of projects that directly contribute

to or promote adaptation. It is important to note the following:

a. The adaptation finance reported might not capture certain activities that might contribute

significantly to resilience but cannot always be tracked in quantitative terms (for example,

operational procedures that support adaptation to climate change) or might not be associated

with costs (such as siting assets outside flood-prone areas).

b. Climate adaptation finance, as defined by the methodology, is not intended to capture the value

of an entire project or investment that may increase resilience as a result of specific adaptation

activities that take place as part of the project.

The joint methodology for tracking climate adaptation finance is presented in Annex C.2 of this

report.

1.2 FINANCE FOR THE MITIGATION OF CLIMATE CHANGE

Climate change mitigation reduces, avoids, limits or sequesters greenhouse gas emissions to

mitigate climate change. However, not all activities that reduce greenhouse gas emissions are

eligible to be counted towards MDB mitigation finance, which is calculated based on a list of

activities that are compatible with low-emission pathways.

Within the MDB/IDFC Common Principles for Climate Mitigation Finance Tracking

8

methodology,

an activity can be classified as climate change mitigation where the activity, by avoiding or

reducing greenhouse gas emissions or increasing their sequestration, contributes substantially

to the stabilisation of greenhouse gas concentrations in the atmosphere at a level that prevents

8 mdb_idfc_mitigation_common_principles_en.pdf (eib.org)

Overview of MDB methodologies fortracking climate finance |

1

dangerous anthropogenic interference with the climate system consistent with the long-term

temperature goal of the Paris Agreement.

The common principles recognise that a substantial contribution to climate change mitigation can

involve the following three categories of climate change mitigation activities:

1. Negative- or very-low-emission activities, which result in negative, zero or very low greenhouse gas

emissions and are fully consistent with the long-term temperature goal of the Paris Agreement, for

example carbon sequestration in land use or some forms of renewable energy.

2. Transitional activities, which are still part of greenhouse gas-emissive systems, but are important

for and contribute to the transition towards a climate-neutral economy, such as energy efficiency

improvement in manufacturing that directly or indirectly uses fossil fuels.

3. Enabling activities, which are instrumental in enabling other activities to make a substantial

contribution to climate change mitigation, such as manufacture of very-low emission technologies.

There are fundamental differences between the tracking methodologies for climate change

adaptation activities and those for mitigation activities. For mitigation activities, a 1 tonne

reduction in CO

2

emissions has the same impact regardless of where the activities take place. It

is therefore possible to define lists of typical activities that are deemed to support the path to low-

carbon development. However, adaptation activities are project- and location-specific, and they

respond to specific climate vulnerabilities. Therefore, unlike mitigation activities, it is not possible

to produce a stand-alone list of adaptation activities that can be used under all circumstances.

When comparing climate finance data, it is important to understand the differences and

similarities. Table 1 summarises the key points in this regard.

Table 1. Comparison of methodologies for tracking adaptation and mitigation finance

CLIMATE CHANGE ACTIVITY

Item Adaptation Mitigation

General scope of

qualifying activity

The activity is typically a component or element

of a project, and in certain circumstances

an entire project, contributing to resilience

(including socioeconomic resilience) or

adaptation to climate change.

This is typically a project (or component thereof)

that avoids, reduces or sequesters greenhouse

gas emissions, or promotes efforts to achieve

these goals.

Basis for tracking Adaptation finance tracking is incremental

(component-based); it only takes into account

those activities that specifically address

vulnerability to climate change. Eligible

components are usually parts of a larger

project, for example water-saving equipment

that is part of a larger capital expenditure

investment in an area vulnerable to increased

risk of drought.

Mitigation finance tracking is either project- or

component-based.

Project-based: If the whole project is considered

to be a mitigation activity, for example a typical

renewable energy project or a project dedicated

to improving the energy efficiency of an existing

facility, then 100% of the project investment

is considered to be mitigation finance, where

applicable criteria are met.

Component-based: Within a project, if only

a component of that project is a mitigation

activity, such as installation of energy efficient

equipment that is part of a larger capital

expenditure investment, then the respective

fraction of the project is considered to be

mitigation finance.

2 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

CLIMATE CHANGE ACTIVITY

Item Adaptation Mitigation

Granular approach

to finance tracking

The adaptation finance methodology intends

to capture only the value of those activities

within the project that are aimed at addressing

specific climate vulnerabilities. It is not intended

to capture the value of the entire project that is

made more climate-resilient as a consequence

of specific adaptation activities within the

project.

A granular approach is used. Climate finance

methodology intends to capture only the value of

the project or its components that substantially

contribute to climate change mitigation,

demonstrated using applicable metrics (such

as emission or energy intensity) subject to the

requirements specified in the eligible list of

activities.

Scale of impact Local, regional, national or global. Global.

Indicator(s) to

quantify and

compare project

outcomes

Multiple (project- and context-specific) indicators

are needed; the intended outcomes depend on

the nature of the project.

Ultimately, the impact of all mitigation projects

can be assessed on the basis of their direct

greenhouse gas emissions reductions (such as

implementation of energy efficient equipment

in a building) or indirect emissions reductions

(such as manufacture of electric vehicles

that enables reduction of emissions through

substitution of internal combustion engine

vehicles inthe market).

Qualification for

climate finance

Qualification is based on a three-step assessment

process, taking into account the climate change

vulnerability context and the specific project

intent to reduce climate vulnerabilities.

Qualification is based on a list of eligible

activities with associated screening criteria that

enable assessment for qualification for climate

mitigation finance. Overarching criteria also

apply.See Annex C.3 for further details.

Climate finance

tracking

Following the three-step assessment process, a

share of the project components that are clearly

and directly linked to the climate vulnerability

context and contribute to climate change

resilience is classified as climate change

adaptation finance.

Financing of the eligible project activities is

classified as climate change mitigation finance

where associated criteria are met.

Annex C.2 presents a full description of the adaptation methodology, while Annex C.3 contains an

excerpt of the mitigation methodology (with the full description being available within the MDB/

IDFC Common Principles for Climate Change Mitigation Tracking). Both annexes will contain

examples of the methodologies’ application to MDB projects in an array of sectors.

1.3 METHODOLOGY FOR CLIMATE CO-FINANCE

In 2015, the multilateral development banks began reporting on climate co-finance (CCF) flows in

line with the harmonised definitions and indicators that had been established to estimate them.

Tracking of climate co-finance aims to estimate the volume of financial resources invested by

public and private external parties alongside multilateral development banks for climate mitigation

and adaptation activities.

This approach presents sources of climate co-finance in the following categories: (i) other

multilateral development banks; (ii) IDFC member institutions, including bilateral and multilateral

members; (iii) other international public entities such as donor governments; (iv) contributions from

other domestic public entities such as recipient-country governments (for example, financing by

local counterparts); and (v) all private entities (defined as those with at least 50% of their shares

held privately), split into private direct mobilisation and private indirect mobilisation. This level of

granularity enables multilateral development banks to present an increasingly nuanced picture of

co-finance flows used for climate change interventions.

Overview of MDB methodologies fortracking climate finance |

3

In April 2017, the multilateral development banks published a reference guide (From Billions

to Trillions: Transforming Development Finance)

9

to explain how they calculate and jointly report

private investment mobilisation beyond climate finance. The purpose of the methodology is to

recognise and measure the private capital mobilised in MDB project activities. The guide outlines

the banks’ joint commitment to mobilising increased investment from the private sector and

institutional investors. Total financing of climate activity includes climate co-finance (the amount

of financial resources that external entities contribute). The multilateral development banks are

implementing the definitions and recommendations of the MDB Taskforce on Private Investment

Mobilisation for tracking the private share of climate co-finance. This methodology focuses on

assessing the private finance mobilised by an MDB, on a project-by-project basis, such as private

direct mobilisation and private indirect mobilisation.

10

The 2021 Joint Report on MDBs’ Climate

Finance follows the agreed terminology

11

and the following chapters show two different elements

of private finance mobilisation: private direct mobilisation and private indirect mobilisation. Added

together, these two forms of mobilisation represent the private share of climate co-finance.

Private direct

mobilisation

Private indirect

mobilisation

Public co-financeExternal

resources

managed

by MDB

MDB own account

Private co-financing

MDB climate finance

Figure 2. Total activity financing, by type of finance

9 http://documents.worldbank.org/curated/en/495061492543870701/pdf/114403-WP-PUBLIC-cedvp-14p-JointMDBReportingonPriva

teInvestmentMobilizationMethodologyReferenceGuide.pdf

10 http://documents.worldbank.org/curated/en/495061492543870701/pdf/114403-WP-PUBLIC-cedvp-14p-JointMDBReportingonPriva

teInvestmentMobilizationMethodologyReferenceGuide.pdf

11 See Annex C.1 for definitions of “private direct mobilisation”, “private indirect mobilisation” and “public direct mobilisation”.

4 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

MDB CLIMATE FINANCE IN LOW- AND

MIDDLE-INCOME ECONOMIES, 2021

2

2.1 MDB CLIMATE FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES

In 2021, the multilateral development banks committed $50.666 billion to low-income and middle-

income economies, thus surpassing the annual expectations of $50 billion set in the joint MDB

High Level Statement of 2019. Of the $50.666 billion of climate finance committed to low-income

and middle-income economies, $47.24 billion was from the MDBs’ own account and $3.426 billion

from external resources that were channelled through the banks. Mitigation finance committed

to low- and middle-income economies totalled $33.055 billion, or 65%, while adaptation finance

totalled $17.611 billion, or 35%.

Sources of MDB climate finance are split between the multilateral development banks’ own

accounts and the external resources channelled through and managed by them. External

resources include trust-funded operations, such as those funded by bilateral agencies and

dedicated climate finance funds such as the Climate Investment Funds (CIF), Green Climate Fund

(GCF) and climate-related funds under the Global Environment Facility (GEF), EU blending facilities

and others. As bilateral reporting may already cover some external resources, those managed by

the multilateral development banks are presented separately from their own accounts.

Table 2. MDB climate finance in low- and middle-income economies, 2021 (in $ million)

AfDB ADB AIIB EBRD EIB IDBG IsDB WBG Total

Own account 2 020 3 552 2 74 6 4 500 3 257 4 372 684 26 110 47 240

MDB-managed

external

resources

409 1 212* - 276 115 448 - 1 879 3 426*

MDB climate

finance

2 429 4 764* 2 74 6 4 777 3 371 4 819 684 27 989 50 666

Notes:

1. Numbers in the tables and figures in this report may not add up to the totals shown, due to rounding.

2. “MDB climate finance” refers to the sum of the climate finance from the multilateral development banks’ own accounts and the MDB-

managed external resources.

3. “Total MDB operations” refers to the sum of the multilateral development banks’ own accounts and MDB-managed external resources.

4. For IsDB, the reported commitment excludes operations of IsDB Group members including the Islamic Corporation for the Development

of the Private Sector (ICD), the International Islamic Trade Finance Corporation (ITFC) and the Islamic Corporation for Insurance of

Investment and Export Credit (ICIEC).

5. (*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate finance from AIIB financing

for three projects, amounting to $913 million, reported under ERUM is excluded from the MDB total amounts to avoid double

counting. Subtracting this amount from ADB’s total climate finance for low- and middle-income economies yields $3.851 billion.

(**) AIIB financing for ADB projects amounting to $1.421 billion was subtracted from total MDB operations to avoid double counting.

Table 3. MDB climate finance by scope in low- and middle-income economies, 2021 (in $ million)

MDB Adaptation finance Mitigation finance MDB climate finance

AfDB 1 549 880 2 429

ADB 1 326* 3 438* 4 764*

AIIB 651 2 096 2 74 6

EBRD 336 4 441 4 777

EIB 381 2 990 3 371

IDBG 1 688 3 131 4 819

IsDB 252 432 684

WBG 11 448 16 541 27 989

Total

17 611

33 055

50 666

MDB climate finance in low- and middle-income economies, 2021 |

5

Notes:

1. In certain cases, multilateral development banks finance activities that have simultaneous benefits for mitigation and adaptation.

The 2021 figure of $762 million of climate finance with dual benefits is presented under the sub-heading of mitigation or adaptation

finance (based on the most relevant elements of the project) to simplify reporting (See Annex C.4). The AIIB reported $68 million, the

EBRD reported $27 million and the IDBG reported $668 million as dual-benefit projects. Note that the IDBG splits dual-benefit finance

equally between adaptation and mitigation categories, while the EBRD allocates all dual-benefit activities to adaptation finance. See

Annex C.4 for further details.

2. (*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate adaptation finance ($20 million)

and climate mitigation ($893 million) finance from AIIB financing for three projects reported under ERUM is excluded from the MDB total

amounts to avoid double counting. Subtracting these amounts from ADB’s climate adaptation finance and climate mitigation finance

for low- and middle-income economies yields $1.306 billion and $2.545 billion, respectively.

2.1.1 MDB CLIMATE FINANCE BY TYPE OF RECIPIENT OR BORROWER

IN LOW- AND MIDDLE-INCOME ECONOMIES

The multilateral development banks report on the nature of first recipients or borrowers

12

of their

climate finance (those to which finance will flow directly from the MDBs), differentiating between

public and private recipients or borrowers. Total commitment varies significantly between the

banks’ own accounts and MDB-managed external resources, as Table 4 illustrates. Table 5 shows

the split by type of recipient or borrower for the banks’ own accounts and for MDB-managed

external resources.

Table 4. MDB climate finance by source of funds and by type of recipient or borrower in low- and middle-income

economies, 2021 (in $ million)

Type of recipient or borrower MDB own account MDB-managed external resources

Public recipient/borrower 37 561 2 649*

Private recipient/borrower 9 679 777

Total 47 240 3 426

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate finance from AIIB financing for three

projects reported under ERUM, amounting to $913 million, is excluded from the MDB total amounts for public recipient/borrower to

avoid double counting.

Table 5. MDB climate finance by type of recipient or borrower in low- and middle-income economies, 2021

(in $ million)

MDB

Private Public

AfDB 510 1 919

ADB 459* 4 305*

AIIB 374 2 373

EBRD 2 807 1 970

EIB 582 2 789

IDBG 833 3 986

IsDB - 684

WBG 4 891 23 098

Total 10 456 40 210

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate finance from AIIB financing for the

three projects that ADB reported under ERUM, amounting to $913 million, is excluded from the MDB total amount for public recipient/

borrower to avoid double counting. Subtracting this amount from ADB’s climate finance for public recipient/borrower in low- and middle-

income economies yields $3.392 billion.

12 See Annex C.1 for the definitions of public and private recipients or borrowers.

6 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

2.1.2 MDB CLIMATE FINANCE BY TYPE OF INSTRUMENT IN LOW- AND MIDDLE-

INCOME ECONOMIES

For the eighth consecutive year, the multilateral development banks reported climate finance by

the types of financial instrument (see Annex C.5 for definitions). They reported that 71% of climate

finance for low- and middle-income economies was committed through investment loans, followed

by grants and policy-based financing. Illustrative examples of various types of instrument are

presented in tables in Annex C.5.

Table 6. MDB climate finance by type of instrument in low- and middle-income economies, 2021 (in $ million)

Instrument type Climate finance

Equity 830

Grant 4 259

Guarantee 1 651

Investment loan 36 039*

Line of credit 171

Policy-based financing 4 000

Results-based financing 2 114

Other instruments 1 602

Total 50 666

Notes:

1. Annex C.5 defines the various types of instrument.

2. Other instruments include advisory services and bonds. Some multilateral development banks report eligible bonds under the category

of investment loans.

3. (*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources under management, climate finance

from AIIB financing for three projects reported under ERUM, amounting to $913 million, is excluded from the investment loan

amount to avoid double counting.

Equity $830 million

Grant $4 259 million

Guarantee $1 651 million

Investment loan $36 039 million

Line of credit $171 million

Policy-based financing $4 000 million

Results-based financing $2 114 million

Other instruments $1 602 million

TOTAL CLIMATE FINANCE BY INSTRUMENT

$50 666 million

Figure 3. MDB climate finance by type of instrument in low- and middle-income economies, 2021 (in $ million)

0.3%

2%

3%

3%

71%

9%

8%

4%

TOTAL

$50 666 million

MDB climate finance in low- and middle-income economies, 2021 |

7

2.1.3 MDB CLIMATE FINANCE BY REGION IN LOW- AND MIDDLE-INCOME

ECONOMIES

Multilateral development banks’ climate finance commitments are grouped by region below.

13

Table 7. MDB climate finance by region in low- and middle-income economies, 2021 (in $ million)

Region

Climate finance

Central Asia 1 929*

East Asia and the Pacific 5 960

Europe: EU 1 170

Europe: Non-EU 5 272

Latin America and the Caribbean 9 820

Middle East and North Africa 4 071

South Asia 8 159*

Sub-Saharan Africa 12 760

Multi-regional 1 524

Total 50 666

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate finance from AIIB financing for three

projects reported under ERUM, amounting to $108 million and $805 million, is excluded from the Central Asia and South Asia total

amounts, respectively, to avoid double counting.

Central Asia $1 929 million

East Asia and the Pacific $5 960 million

Europe: EU $1 170 million

Europe: Non-EU $5 272 million

Latin America and the Caribbean $9 820 million

Middle East and North Africa $4 071 million

South Asia $8 159 million

Sub-Saharan Africa $12 760 million

Multi-regional $1 524 million

TOTAL CLIMATE FINANCE BY REGION

$50 666 million

Figure 4. MDB climate finance by region in low- and middle-income economies, 2021 (in $ million)

2%

3%

4%

10%

16%

20%

8%

12%

25%

TOTAL

$50 666 million

2.2 MDB ADAPTATION FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2021

In 2021, a total of $19.187 billion was committed to climate change adaptation finance, with

$17.611 billion, or 92%, committed to low- and middle- income economies, thus surpassing the

expected collective delivery of increasing adaptation finance to $18 billion, set in the joint MDB

High Level Statement of 2019. The data reported corresponds to the incremental costs of project

components, sub-components, or elements, or proportions of projects, which are considered to

be inputs to an adaptation process and are intended to reduce vulnerability to climate change and

build resilience to it.

13 See Table B.1 for regional groupings.

8 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Table 8 presents the 2021 adaptation figures by bank for low- and middle-income economies,

with a breakdown of climate adaptation finance committed by the multilateral development banks

from their own accounts and from MDB-managed external resources in low- and middle-income

economies.

Table 8. MDB adaptation finance by MDB according to source of funds in low- and middle-income economies,

2021 (in $ million)

AfDB ADB AIIB EBRD EIB IDBG IsDB WBG Total

MDB own account 1 325 1 278 651 302 328 1 655 252 10 626 16 417

MDB-managed

external resources

224 48* - 34 54 33 - 822 1 194*

Total 1 549 1 326* 651 336 381 1 688 252 11 448 17 611*

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate adaptation finance from AIIB

financing for three projects, amounting to $20 million, reported under ERUM is excluded from the MDB total adaptation amount to avoid

double counting.

Table 9 shows a breakdown by type of recipient or borrower.

Table 9. MDB adaptation finance by MDB and by type of recipient or borrower in low- and middle-income economies,

2021 (in $ million)

MDB Private Public

AfDB 275 1 274

ADB 70 1 256*

AIIB 1 650

EBRD 54 282

EIB 45 336

IDBG 56 1 632

IsDB - 252

WBG 37 11 411

Total

538 17 073*

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate adaptation finance from AIIB

financing for three projects, amounting to $20 million, reported under ERUM is excluded from the MDB total adaptation amount to

avoid double counting. Subtracting this amount from ADB’s climate adaptation finance for public recipient borrower for low- and middle-

income economies yields $1.237 billion.

Table 10 breaks down MDB adaptation finance by the type of instrument. The multilateral

development banks reported that 63% of adaptation finance for low-and middle-income economies

was committed through investment loans, followed by grants and policy-based financing.

Table 10. MDB adaptation finance by MDB and by type of instrument in low- and middle-income economies, 2021

(in $ million)

Instrument type Adaptation finance

Equity 22

Grant 2 631

Guarantee 145

Investment loan 11 055*

Line of credit 40

Policy-based financing 1 490

Results-based financing 1 179

Other instruments 1 050

Total 17 611*

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate adaptation finance from AIIB

financing for three projects reported under ERUM, amounting to $20 million, is excluded from the investment loan amount to avoid

double counting.

MDB climate finance in low- and middle-income economies, 2021 |

9

Table 11 shows total adaptation finance by region. The largest proportions of adaptation finance in

low- and middle-income economies were in the following regions: Sub-Saharan Africa, South Asia

and Latin America and the Caribbean.

Table 11. MDB adaptation finance by region in low- and middle-income economies, 2021 (in $ million)

Region Adaptation finance

Central Asia 485*

East Asia and the Pacific 2 308

Europe: EU 98

Europe: Non-EU 542

Latin America and the Caribbean 2 984

Middle East and North Africa 1 100

South Asia 3 034*

Sub-Saharan Africa 6 847

Multi-regional 214

Total 17 611

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate adaptation finance from AIIB

financing for three projects reported under ERUM, amounting to $3 million and $17 million, is excluded from the Central Asia and South

Asia climate adaptation amounts, respectively, to avoid double counting.

Central Asia $485 million

East Asia and the Pacific $2 308 million

Europe: EU $98 million

Europe: Non-EU $542 million

Latin America and the Caribbean $2 984 million

Middle East and North Africa $1 100 million

South Asia $3 034 million

Sub-Saharan Africa $6 847 million

Multi-regional $214 million

TOTAL ADAPTATION FINANCE BY REGION

$17 611 million

Figure 5. MDB adaptation finance by region in low- and middle-income economies, 2021 (in $ million)

1%

1%

3%

17%

3%

6%

17%

13%

39%

TOTAL

$17 611 million

Table 12 reports MDB adaptation finance by sector, with 26% in energy, transport and other built

environment and infrastructure, followed by cross-cutting operations with 17%, and 15% in water

and wastewater systems.

Table 12. MDB adaptation finance by sector in low- and middle-income economies, 2021 (in $ million)

Sector group Adaptation finance

Coastal and riverine infrastructure 532

Crop and food production 1 699

Cross-cutting sectors 3 052

Energy, transport and other built environment and infrastructure 4 547*

Financial services 1 832

Industry, manufacturing and trade 32

Information and communications technology 176

Institutional capacity support or technical assistance 2 400*

10 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Sector group Adaptation finance

Other agricultural and ecological resources 675*

Water and wastewater systems 2 666*

Total 17 611

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate adaptation finance from AIIB

financing for three projects reported under ERUM, amounting to $20 million, is excluded from relevant sectors to avoid double counting.

Coastal and riverine infrastructure $532 million

Crop and food production $1 699 million

Cross-cutting sectors $3 052 million

Energy, transport and other built environment

and infrastructure $4 547 million

Financial services $1 832 million

Industry, manufacturing and trade $32 million

Information and communications technology $176 million

Institutional capacity support or

technical assistance $2 400 million

Other agricultural and ecological resources $675 million

Water and wastewater systems $2 666 million

TOTAL ADAPTATION FINANCE BY SECTOR

$17 611 million

Figure 6. MDB adaptation finance by sector in low- and middle-income economies, 2021 (in $ million)

0%

1%

3%

4%

17%

26%

15%

10%

10%

14%

TOTAL

$17 611 million

Adaptation finance by region, for low- and middle-income economies, with a further breakdown by

sector, is presented in Table 13.

Table 13. MDB adaptation finance by sector and region in low- and middle-income economies, 2021 (in $ million)

Central

Asia

East Asia

and the

Pacific

Europe:

EU

Europe:

Non-EU

Latin

America

and the

Carib-

bean

Middle

East and

North

Africa

South

Asia

Sub-

Saharan

Africa

Multi-

regional

Total

Coastal

and riverine

infrastructure

- 33 - - 79 - 164 179 76 532

Crop and food

production

42 51 - 38 60 257 270 975 7 1 699

Cross-cutting

sectors

139 568 3 36 511 247 477 1 065 5 3 052

Energy,

transport and

other built

environment and

infrastructure

210* 611 74 332 399 94 695* 2 132 1 4 547

Financial

services

1 270 - 19 193 229 399 691 32 1 832

Industry,

manufacturing

and trade

0 - - 2 - 13 - 13 4 32

Information and

communications

technology

7 - - 4 14 8 18 126 - 176

Institutional

capacity support

or technical

assistance

12 299 - 7 1 279 85 373* 314 32 2 400

MDB climate finance in low- and middle-income economies, 2021 |

11

Central

Asia

East Asia

and the

Pacific

Europe:

EU

Europe:

Non-EU

Latin

America

and the

Carib-

bean

Middle

East and

North

Africa

South

Asia

Sub-

Saharan

Africa

Multi-

regional

Total

Other

agricultural

and ecological

resources

34 37 - 40 226 6 53* 227 52 675

Water and

wastewater

systems

41 439 20 64 223 162 586* 1 126 4 2 666

Total 485 2 308 98 542 2 984 1 100 3 034 6 847 214 17 611

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate adaptation finance from AIIB

financing for three projects reported under ERUM, amounting to $3 million and $17 million, is excluded from the Central Asia and South

Asia climate adaptation amounts, respectively, to avoid double counting.

2.3 MDB MITIGATION FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2021

In 2021, the multilateral development banks reported a total of $62.530 billion in financial

commitments for the mitigation of climate change, with $33.055 billion, or 53%, committed to low-

income and middle-income economies. Data reported corresponds to the financing of mitigation

projects or of the components, sub-components, or elements, or proportions of projects that

provide mitigation benefits (rather than reporting the entire project cost).

Table 14 provides a breakdown of climate mitigation finance committed by the multilateral

development banks during 2021 from MDB own-account and external resources in low- and

middle-income economies.

Table 14. MDB mitigation finance by MDB and source of funds in low- and middle-income economies, 2021

(in $ million)

AfDB ADB AIIB EBRD EIB IDBG IsDB WBG Total

MDB own

account

695 2 274 2 096 4 198 2 929 2 716 432 15 483 30 823

MDB-managed

external

resources

185 1 164* - 243 61 415 - 1 057 2 232*

Total 880 3 438* 2 096 4 441 2 990 3 131 432 16 541 33 055*

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate mitigation finance from AIIB

financing for three projects, amounting to $893 million, reported under ERUM is excluded from the MDB total mitigation amount to avoid

double counting.

Table 15 shows a breakdown by type of recipient or borrower.

Table 15. MDB mitigation finance economies by MDB and by type of recipient or borrower in low- and middle-

income, 2021 (in $ million)

MDB Private Public

AfDB 235 645

ADB 389 3 049*

AIIB 373 1 723

EBRD 2 753 1 687

EIB 537 2 453

12 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

MDB Private Public

IDBG 777 2 354

IsDB - 432

WBG 4 854 11 687

Total

9 918 23 137*

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate mitigation finance from AIIB financing

for three projects, amounting to $893 million, reported under ERUM is excluded from the MDB total mitigation amount to avoid double

counting. Subtracting this amount from ADB’s climate adaptation finance for public recipient borrowers for low- and middle-income

economies yields $2.155 billion.

Table 16 breaks down MDB mitigation finance by type of instrument. The multilateral development

banks reported that 76% of total mitigation finance for low -and middle- income economies was

committed through investment loans, followed by policy-based financing.

Table 16. MDB mitigation finance by type of instrument in low- and middle-income economies, 2021 (in $ million)

Instrument type Mitigation finance

Equity 807

Grant 1 628

Guarantee 1 506

Investment loan 24 985*

Line of credit 131

Policy-based financing 2 510

Results-based financing 936

Other instruments 552

Total

33 055*

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate mitigation finance from AIIB

financing for three projects reported under ERUM, amounting to $893 million, is excluded from the investment loan amount to avoid

double counting.

Equity $807 million

Grant $1 628 million

Guarantee $1 506 million

Investment loan $24 985 million

Line of credit $131 million

Policy-based financing $2 510 million

Results-based financing $936 million

Other instruments $552 million

TOTAL MITIGATION FINANCE BY TYPE OF INSTRUMENT

$33 055 million

Figure 7. MDB mitigation finance by type of instrument in low- and middle-income economies, 2021 (in $ million)

3%

5%

76%

5%

8%

2%

2%

0.40%

TOTAL

$33 055 million

MDB climate finance in low- and middle-income economies, 2021 |

13

Table 17 shows total mitigation finance by region. The largest proportions of mitigation finance in

low- and middle-income economies were in the following regions: Latin America and the Caribbean,

Sub-Saharan Africa, and South Asia.

Table 17. MDB mitigation finance by region in low- and middle-income economies, 2021 (in $ million)

Region Mitigation finance

Central Asia 1 444*

East Asia and the Pacific 3 652

Europe: EU 1 073

Europe: Non-EU 4 730

Latin America and the Caribbean 6 837

Middle East and North Africa 2 970

South Asia 5 125*

Sub-Saharan Africa 5 914

Multi-regional 1 310

Total

33 055*

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate mitigation finance from AIIB financing

for three projects reported under ERUM, amounting to $105 million and $788 million, is excluded from the Central Asia and South Asia

climate mitigation amounts, respectively, to avoid double counting.

Central Asia $1 444 million

East Asia and the Pacific $3 652 million

Europe: EU $1 073 million

Europe: Non-EU $4 730 million

Latin America and the Caribbean $6 837 million

Middle East and North Africa $2 970 million

South Asia $5 125 million

Sub-Saharan Africa $5 914 million

Multi-regional $1 310 million

TOTAL MITIGATION FINANCE BY REGION

$33 055 million

Figure 8. MDB mitigation finance by region in low- and middle-income economies, 2021 (in $ million)

4%

4%

14%

3%

16%

21%

9%

11%

18%

TOTAL

$33 055 million

Table 18 reports the multilateral development banks’ mitigation finance in low- and middle-income

economies by sector with 29% in energy, followed by 21% in transport.

Table 18. MDB mitigation finance by sector in low- and middle-income economies, 2021 (in $ million)

Region Mitigation finance

Energy 9 676*

Mining and metal production for climate action 18

Manufacturing 1 649

Agriculture, forestry, land use and fisheries 2 411

Water supply and wastewater 1 278*

Solid waste management 1 447*

Transport 6 704*

Buildings, public installations and end-use energy efficiency 2 532

Information and communications technology (ICT) and digital technologies 298

14 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Research, development and innovation 30

Cross-sectoral activities 7 011

Total 33 055

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate mitigation finance from AIIB

financing for three projects reported under ERUM, amounting to $893 million, is excluded from relevant sectors to avoid double counting.

Energy $9 676 million

Mining and metal production for

climate action $18 million

Manufacturing $1 649 million

Agriculture, forestry, land use

and fisheries $2 411 million

Water supply and wastewater $1 278 million

Solid waste management $1 447 million

Transport $6 704 million

Buildings, public installations and

end-use energy efficiency $2 532 million

Information and communications technology

(ICT) and digital technologies $298 million

Research, development and innovation $30 million

Cross-sectoral activities $7 011 million

TOTAL MITIGATION FINANCE BY SECTOR

$33 055 million

0.05%

0.09%

Figure 9. MDB mitigation finance in low- and middle-income economies by sector, 2021 (in $ million)

1%

29%

8%

7%

4%

21%

4%

5%

20%

TOTAL

$33 055 million

Mitigation finance by region, with further breakdown by sectors, is presented in Table 19.

Table 19. MDB mitigation finance by sector and by region in low- and middle-income economies, 2021 (in $ million)

Central

Asia

East Asia

and the

Pacific

Europe:

EU

Europe:

Non-EU

Latin

America

and the

Carib-

bean

Middle

East and

North

Africa

South

Asia

Sub-

Saharan

Africa

Multi-

regional

Total

Energy 370 1 476 347 1 677 1 044 485 1 601* 2 386 291 9 676

Mining and

metal produc-

tion for climate

action

- - 18 - - - - - - 18

Manufacturing 52 46 8 824 68 282 88 147 134 1 649

Agriculture,

forestry, land

use and

fisheries

100 405 0 86 755 58 146 704 156 2 411

Water supply

and waste-

water

115 126 - 31 482 27 401* 80 16 1 278

Solid waste

management

19 408 - 189 120 78 3 81* 112 140 1 447

Transport 398* 426 88 1 413 617 1 726 1 454* 388 192 6 704

Buildings, pub-

lic installations

and end-use

energy effi-

ciency

83 299 496 389 581 100 227 198 159 2 532

MDB climate finance in low- and middle-income economies, 2021 |

15

Central

Asia

East Asia

and the

Pacific

Europe:

EU

Europe:

Non-EU

Latin

America

and the

Carib-

bean

Middle

East and

North

Africa

South

Asia

Sub-

Saharan

Africa

Multi-

regional

Total

Information

and communi-

cations

technology

(ICT) and

digital

technologies

- - - 6 225 - - 2 66 298

Research,

development

and innovation

3 1 - - 11 1 2 - 13 30

Cross-sectoral

activities

304 466 116 114 2 933 213 825 1 898 143 7 011

Total 1 444 3 652 1 073 4 730 6 837 2 970 5 125 5 914 1 310 33 055

(*) Considering the explanation provided in Figures 1a, 1b and 2 about ADB external resources, climate mitigation finance from AIIB financing

for three projects reported under ERUM, amounting to $105 million and $788 million, is excluded from the Central Asia and South Asia

climate mitigation amounts, respectively, to avoid double counting.

2.4 CLIMATE CO-FINANCE IN LOW- AND MIDDLE-INCOME ECONOMIES, 2021

The multilateral development banks’ climate co-finance is based on their harmonised definitions,

which can be consulted in Section 1.3.

Table 20 shows 2021 climate co-finance flows as reported by each institution, segmented by the

source of co-financing. These figures are the best estimate of resource flows based on information

available at the time of board approval and/or commitment to each project. In some cases, two

or more banks jointly finance a project, which results in some overlap between the gross co-

finance figures reported by the different organisations. Table 21 shows climate co-finance flows

by adaptation and mitigation for low- and middle-income economies. In order to avoid double

counting, the last column of Tables 21 and 22 nets out potentially double-counted co-financing

by considering only the proportion of co-financing for every project that features co-financing from

another multilateral development bank.

In the reference guide, the multilateral development banks emphasise the differences in how

various financial instruments, including guarantees, are tracked and reported. By mitigating the

political and commercial risks of private and publicly owned investments, guarantees can facilitate

access to capital for climate finance activities. This can enhance the mobilisation of resources for a

specific project or in support of specific government policies.

For consistency with the agreed MDB methodology on tracking and reporting mobilised private

capital, the tracking and reporting of guarantees as detailed in this report assumes: (i) a distinction

in tracking and reporting between commercial guarantees and non-commercial guarantees;

14

and

(ii) causality between the guarantee and the underlying investment covered (in other words, in the

absence of the guarantee, the underlying investment would be unlikely to occur). For this reason,

the gross exposure from the guarantee issuance and the underlying investment may be reported

separately under the banks’ own account and private co-finance, while the best effort is made to

minimise double counting.

14 In the context of this report, non-commercial risk guarantees are defined as insurance or guarantee instruments covering investors against

perceived political risks including, but not limited to, the risks of transfer restriction (including inconvertibility), expropriation, war and civil

disturbance, breach of contract, and failure to honour financial obligations, and may provide credit enhancement and improve ratings for

capital market transactions. Commercial or credit-risk guarantees refer to instruments covering all other risks not included above.

16 | 2021 JOINT REPORT ON MULTILATERAL DEVELOPMENT BANKS’ CLIMATE FINANCE

Table 21 reflects the 2021 climate co-finance flows, including the direct and indirect mobilisation

attributed to guarantees. The guarantee exposure of each multilateral development bank has been

shown as “own account” in Tables 2, 22, 42 and 64.

Table 20. Climate co-finance flows by MDB and by thematic focus in low- and middle-income economies, 2021

(in $ million)

AfDB ADB AIIB EBRD EIB IDBG IsDB WBG Total

climate

co-finance

Correction

for

multiple

MDB

financing

Mitigation

finance

1 935 2 785 704 8 752 6 133 2 131 5 127 8 566 36 133 28 844

Adaptation

finance

4 034 2 388 3 773 312 797 229 1 756 5 063 18 351 14 759

Total 5 969 5 173 4 477 9 063 6 929 2 360 6 883 13 629 54 484 43 603

Table 21. Climate co-finance flows by MDB and by source in low- and middle-income economies, 2021 (in $ million)

AfDB ADB AIIB EBRD EIB IDBG IsDB WBG Total

climate

co-finance

Correction

for

multiple

MDB

financing

Public direct

mobilisation

- - - - 329 435 - 4 656 5 420 5 420

Public co-finance

Other MDBs 1 913 83 2 043 2 068 1 203 - 4 067 1 158 12 536 12 536

IDFC

members

561 556 73 580 905 780 83 72 3 610 2 753

Other

international

public

234 55 3 114 717 - 2 733 943 4 799 1 485

Other

domestic

public

2 474 3 523 2 358 969 2 409 205 - 85 12 022 8 407

Total private mobilisation

Private

direct

mobilisation

- 98 - 449 55 591 - 3 421 4 614 4 614

Private

indirect

mobilisation

787 859 - 4 883 1 311 349 - 3 294 11 484 8 389

Total 5 969 5 173 4 477 9 063 6 929 2 360 6 883 13 629 54 484 43 603

MDB climate finance in low- and middle-income economies, 2021 |

17

3.1 MDB CLIMATE FINANCE IN HIGH-INCOME ECONOMIES

In 2021, the multilateral development banks committed $31.051 billion to high-income