DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-1

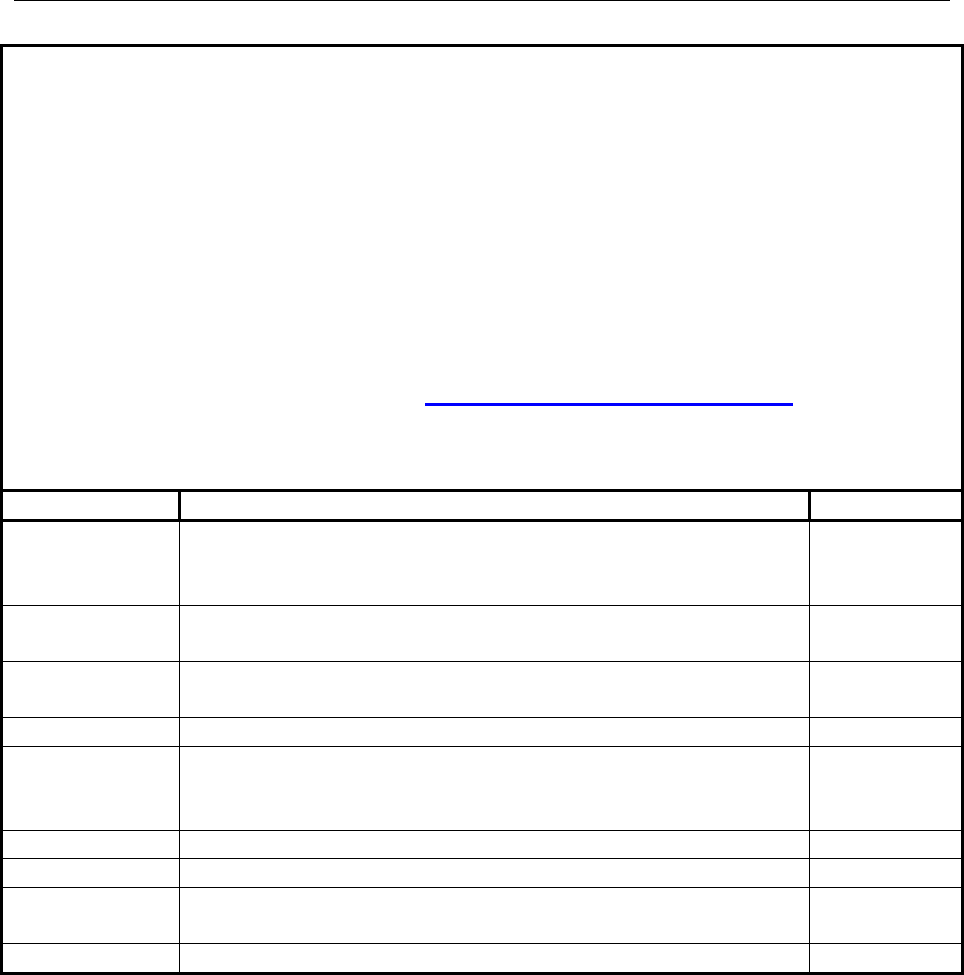

VOLUME 4, CHAPTER 3: “RECEIVABLES”

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated March 2021 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

2.0

Revised existing definitions for clarification and accuracy.

Moved a portion of the definition for the Write-off Receivable

to paragraph 4.7 for clarification.

Revision

3.1

Added additional guidance to clarify the Accounts Receivable

recognition.

Addition

3.3

Removed “Sales of Goods and Services” because the

paragraph was repetitive.

Deletion

4.4

Added additional guidance for clarification.

Addition

4.6

Added calculation methodologies for intragovernmental and

public allowance for uncollectible accounts.

Clarified public allowance calculation methodology.

Revision

4.7

Revised Tax and Write-off guidance.

Revision

5.2

Revised information for clarification and accuracy.

Revision

5.3

Added additional guidance reference to clarify the

reimbursable USSGL.

Addition

Table 3-1

Added a note defining the columns represented in the table.

Addition

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-2

Table of Contents

VOLUME 4, CHAPTER 3: “RECEIVABLES” ........................................................................... 1

1.0 GENERAL......................................................................................................................... 4

1.1 Purpose ................................................................................................................. 4

1.2 Authoritative Guidance ........................................................................................ 4

*2.0 DEFINITIONS ............................................................................................................... 5

2.1 Accounts Receivable ............................................................................................ 5

2.2 Accounts Receivable Office ................................................................................. 6

2.3 Allowance for Loss on Accounts Receivable ...................................................... 6

2.4 Current (Non-Delinquent) Receivables ................................................................ 6

2.5 Close-Out (Applies to Public Debt Only) ............................................................ 6

2.6 Currently Not Collectible ..................................................................................... 7

2.7 Debt ...................................................................................................................... 7

2.8 Debt Collection Office ......................................................................................... 7

2.9 Delinquent Receivables ........................................................................................ 7

2.10 Direct Cost ............................................................................................................ 8

2.11 Due Process .......................................................................................................... 8

2.12 Indirect Cost ......................................................................................................... 8

2.13 Intragovernmental Receivables ............................................................................ 8

2.14 Non-Current Non-Delinquent Receivables .......................................................... 8

2.15 Non- Delinquent Receivables ............................................................................... 8

2.16 Public/Non-Federal Receivables .......................................................................... 8

2.17 Rescheduled Receivables ..................................................................................... 9

2.18 DFAS Enterprise Solutions and Standards Vendor Pay Tax Office .................... 9

2.19 Trading Partners ................................................................................................... 9

2.20 Treasury Report on Receivables .......................................................................... 9

2.21 Terminate Collection Action ................................................................................ 9

2.22 Write-off of Receivables ...................................................................................... 9

3.0 RECEIVABLES POLICY ............................................................................................... 10

Recording ........................................................................................................... 10

Advance Payments ............................................................................................. 10

*3.1

3.2

3.3

Collection of Receivables .................................................................................. 11

3.4 Allowance Account and Aging .......................................................................... 12

3.5 Interest Penalties, and Administrative Receivable ............................................. 12

3.6 Payment Application .......................................................................................... 12

3.7 General Ledger Accounting ............................................................................... 12

3.8 Internal Controls ................................................................................................. 13

3.9 Erroneous, Invalid, and Unsubstantiated Accounts Receivables ....................... 13

3.10 Canceled Appropriations .................................................................................... 14

3.11 Nonappropriated Fund Instrumentalities Receivables ....................................... 14

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-3

3.12 Foreign Military Sales Receivables .................................................................... 14

3.13 Non-FMS Foreign Government Receivables ..................................................... 14

3.14 Retention of Documentation .............................................................................. 15

3.15 Undistributed Collection Balances ..................................................................... 15

4.0 PUBLIC RECEIVABLES ............................................................................................... 15

4.1 General ............................................................................................................... 15

4.2 Debt Collection Policies ..................................................................................... 16

4.3 Receivables from the Sale of Goods and Services to the Public ........................ 16

*4.4 Refunds Receivable ............................................................................................ 16

4.5 Collection Actions .............................................................................................. 18

*4.6 Establishment of Allowance for Loss on Accounts Receivable ........................ 19

*4.7 Write-off and Close-Out of Public Accounts Receivable .................................. 20

5.0 INTRAGOVERNMENTAL RECEIVABLES................................................................ 22

5.1 Receivables Due From Federal Entities ............................................................. 22

*5.2 Sales of Goods and Services .............................................................................. 22

*5.3 DoD Performing Entity Responsibilities............................................................ 22

5.4 DoD Ordering Agency Responsibilities ............................................................. 24

5.5 Management of Collection Actions .................................................................... 24

5.6 Non-Interfund Dispute Process .......................................................................... 25

6.0 REPORTING RECEIVABLES DUE FROM THE PUBLIC ......................................... 29

7.0 REPORTING RECEIVABLES IN DOD FINANCIAL STATEMENTS ...................... 29

7.1 Reported Accounts Receivable Quarterly .......................................................... 29

7.2 Gross Accounts Receivable Balances ................................................................ 29

7.3 Eliminating Intragovernmental Consolidated Quarterly Financial Statements .. 29

8.0 CREDITING AND ACCOUNTING FOR DISPUTED COLLECTIONS UNDER THE

CONTRACT DISPUTES ACT OF 1978 .................................................................................. 29

8.1 Crediting Collections.......................................................................................... 29

8.2 Accounting for Collections in Dispute ............................................................... 30

*Table 3-1. Aged Delinquent Accounts Receivable Groups .................................................... 32

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-4

CHAPTER 3

RECEIVABLES

1.0 GENERAL

1.1 Purpose

This chapter prescribes policy for the recognition, recording, and reporting of public and

federal (hereafter referred to as intragovernmental) accounts receivable.

1.2 Authoritative Guidance

The accounting policy and related requirements prescribed by this chapter are in

accordance with the applicable provisions of:

1.2.1. Title 10, United States Code, sections 1095, 2201, and 3863 (10 U.S.C. §§ 1095,

2201, and 3863).

1.2.2. 22 U.S.C. § 2767.

1.2.3. 31 U.S.C. §§ 1552(a) , 1555, 3321, 3351-3558, 3711, and 3717.

1.2.4. 41 U.S.C. § 7104(a).

1.2.5. 42 U.S.C. § 2651.

1.2.6. Debt Collection Improvement Act of 1995 (DCIA).

1.2.7. Digital Accountability and Transparency Act of 2014 (DATA Act).

1.2.8. Title 31, Code of Federal Regulations, part 901.2 (31 CFR 901.1), “Aggressive

agency collection activity.”

1.2.9. 31 CFR 901.9, “Interest, penalties, and administrative costs”

1.2.10. Office of Management and Budget (OMB) Circular A-11, “Preparation,

Submission, and Execution of the Budget.”

1.2.11. OMB Circular A-129, “Policies for Federal Credit Programs and Non-Tax

Receivables.”

1.2.12. Federal Accounting Standards Advisory Board (FASAB) Statement of Federal

Financial Accounting Standards (SFFAS) 1, “Accounting for Selected Assets and Liabilities.”

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-5

1.2.13. FASAB SFFAS 7, “Accounting for Revenue and Other Financing Sources and

Concepts for Reconciling Budgetary and Financial Accounting.”

1.2.14. FASAB Technical Bulletin (TB) 2020-1 “Loss Allowance for Intragovernmental

Receivables.”

1.2.15. TFM Volume I Part 2 (I TFM 2-1500), “Description of Accounts Relating to

Financial Operations.”

1.2.16. I TFM 2-4700, “Federal Entity Reporting Requirements for the Financial Report

of the United States Government.”

1.2.17. Treasury Report on Receivables (TROR).

1.2.18. Federal Acquisition Regulation (FAR) subpart 32.6, “Contract Debts.”

1.2.19. DoD Instruction (DoDI) 1015.15, “Establishment, Management, and Control of

Nonappropriated Fund Instrumentalities and Financial Management of Supporting Resources.”

1.2.20. DoDI 5010.40, “Managers’ Internal Control Program Procedures.”

1.2.21. Government Accountability Office “Standards for Internal Control in the Federal

Government” (Green Book).

1.2.22. Defense Logistics Manual (DLM) 4000.25, “Defense Logistics Management

Standards.”

*2.0 DEFINITIONS

2.1 Accounts Receivable

Receivables arise from claims to cash or other assets against another entity. At the time

revenue is recognized and payment has not been received in advance, a receivable must be

established. Receivables include, but are not limited to, monies due for the sale of goods and services

and monies due for indebtedness. Examples of indebtedness to DoD include overdue travel

advances, Federal Employee Health Benefits paid while an employee is in a leave without pay status,

dishonored checks, fines, penalties, interest, overpayments, fees, rent, claims, damages, and any

other event resulting in a determination that a debt is owed to DoD. See Volume 16, for

comprehensive debt management policy and requirements to include administrative actions

associated with the collection and disposition of debts owed to DoD. An accounts receivable is

categorized as either an entity or non-entity accounts receivable in accordance with SFFAS 1:

2.1.1. Entity Accounts Receivable. Entity accounts receivable are amounts that a federal

entity claims for payment from other federal or non-federal entities and that the federal entity is

authorized by law to include in its obligation authority or to offset its expenditures and liabilities

upon collection.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-6

2.1.2. Non-Entity Accounts Receivables. Non-entity accounts receivable are amounts due

to be collected by DoD on behalf of the U.S. Government or other entities, and DoD is not

authorized to use. Non-entity accounts receivables are reported separately from receivables

available to DoD (entity accounts receivables). Non-entity accounts receivable include

governmental receipts and collections arising from the sovereign and regulatory powers unique to

the Federal Government, (e.g., interest, penalties, income tax receipts, customs duties, court fines,

and certain license fees). DoD accounts receivable in canceled accounts are also non-entity

receivables because collections received after an appropriation cancels are deposited in the Treasury

Account 3200, “Collections of Receivables from Canceled Accounts.” Non-entity receivables are

recorded as a receivable and a custodial liability. In addition, federal entities should not recognize

fiduciary assets, liabilities, and future cash flows in their financial statements, but only disclose

them in a note disclosure.

2.2 Accounts Receivable Office

The Accounts Receivable Office (ARO) is the office responsible for the recording and

reporting of receivables and may also be the office responsible for debt collection. In most but not

all cases, the ARO is located at Defense Finance and Accounting Service (DFAS) centers.

2.3 Allowance for Loss on Accounts Receivable

DoD must recognize an allowance for loss on accounts receivable when it is more likely

than not that DoD is not able to totally collect the receivables. The phrase “more likely than not”

means more than a 50 percent chance of loss occurrence. The allowance for loss on accounts

receivable is recorded as allowance for uncollectible accounts in the DoD consolidated and

components financial statements and notes.

2.4 Current (Non-Delinquent) Receivables

Non-delinquent receivables, i.e., debts, are categorized as current and non-current assets.

The portion of a non-delinquent debt that is scheduled to be collected in the next 12 months is

recorded as current; the portion of a non-delinquent debt scheduled for collection after 12 months

is recorded as non-current. The importance of these categories is to inform DoD and Treasury of

the expected cash flow/liquidity of the asset (i.e., current versus non-current assets).

2.5 Close-Out (Applies to Public Debt Only)

Close-out is one of two accounting classifications for writing off debt that indicate whether

or not an agency will continue debt collection efforts after write-off. The ARO, in conjunction

with the DoD Component Fund Holder, closes out a debt when it is determined that further debt

collection actions are prohibited (e.g., a debtor is released from liability in bankruptcy) or there

are no plans to take any future active or passive actions to try to collect the debt. Close-out may

occur concurrently with the write-off of an account receivable or at a later date, depending on the

collection strategy and the ultimate determination that the debt has been discharged. At close-out,

DoD may be required to report to the Internal Revenue Service (IRS) the amount of the debt as

potential income to the debtor on IRS Form 1099C, Cancellation of Debt.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-7

2.6 Currently Not Collectible

Currently Not Collectible (CNC) is one of two accounting classifications for writing off debt

that indicate whether or not an agency will continue debt collection efforts after write-off. CNC is

a category of debt that has been written off on the DoD Component’s financial statements, but cost

effective debt collection efforts will continue to be taken by the cognizant Debt Collection

Management Office (DCMO), Debt Collection Office (DCO), or Debt Management Office (DMO).

2.7 Debt

Debt is defined in 31 U.S.C. § 3701(b)(1) as any amount of funds or property that has been

determined by an appropriate official of DoD to be due to DoD by a person, organization, or entity

other than another Federal agency. See Volume 16 for additional information on debt

management.

2.8 Debt Collection Office

The DCO is responsible for initial debt collection actions and serving due process. The

DCO refers to a general category of offices and includes, but is not limited to, the ARO, military

and civilian payroll offices, and other organizational elements within the DoD Components that

perform debt management/collection actions (e.g., personnel offices).

2.9 Delinquent Receivables

2.9.1. A receivable is delinquent if it has not been paid by the date specified in the DoD’s

initial written demand for payment or applicable agreement or instrument unless, other satisfactory

payment arrangements have been made. If the contract or agreement provides for a “grace” period,

DoD Components do not report the debt as delinquent until the grace period expires without

payment. In such cases, however, the original due date is used for delinquency date.

2.9.1.1. Delinquent debts are aged from the date of delinquency.

2.9.1.2. If a debtor is making payments according to the terms of a repayment plan

approved by the agency, the debt is not considered to be delinquent.

2.9.1.3. On the TROR:

2.9.1.3.1. Report each debt owed by a single debtor with multiple debts as

a separate debt.

2.9.1.3.2. Report each delinquent debt once, even if DFAS or

DoD Component tracks delinquent payments on that debt separately. For example, if the debtor

has missed two payments, and the agency keeps track of those delinquencies separately, report

them together as one debt. If any installment is delinquent more than 180 days, report the debt on

the TROR as delinquent more than 180 days.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-8

2.9.2. DoD Components must report the entire amount of each single debt as delinquent,

if any part of it has been delinquent more than 180 days and the debt has been accelerated.

2.10 Direct Cost

A direct cost includes any cost that can be identified specifically with handling cases or

accounts during the debt collection process. These costs normally include the cost of personnel,

computer equipment, supplies, postage, contract services, and administrative fees charged by the

Treasury.

2.11 Due Process

Due process is the notice of indebtedness and the opportunity provided the debtor to dispute

the indebtedness. The Fifth Amendment of the U.S. Constitution provides that no person “shall

be deprived of life, liberty, or property without due process of law...” The minimum due process

required is generally established by the statutes that authorize the use of a specified debt collection

tool or by implementing regulations. In the context of federal debt collection, see Volume 16,

Chapter 2.

2.12 Indirect Cost

Indirect cost includes costs associated with the debt collection process that benefits at least

one other activity. These costs must be accumulated only when they are expected to exceed

20 percent of the direct costs.

2.13 Intragovernmental Receivables

Intragovernmental receivables are claims of a federal entity against other federal entities.

Intragovernmental receivables are either within DoD (e.g., a Military Service) or outside DoD

(e.g., General Services Administration).

2.14 Non-Current Non-Delinquent Receivables

Non-current non-delinquent receivables are non-delinquent accounts receivables that the due

date is not within 12 months after DoD claims the receivable.

2.15 Non- Delinquent Receivables

Non-delinquent receivables are accounts receivable that have not been billed or are not due

under the contract or billing document pertaining to the receivable. This also includes rescheduled

receivables and receivables under an installment agreement.

2.16 Public/Non-Federal Receivables

Public/non-federal receivables are claims of DoD against non-federal entities. The term

“public/non-federal entities” encompasses domestic and foreign persons and organizations outside

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-9

the U.S. Government, including Nonappropriated Fund Instrumentalities (NAFIs) for purposes of

processing receivables. Examples are: salary/travel overpayments; overpayments to

contractors/vendors due to duplicate and erroneous billings; incorrectly computed invoices;

non-Foreign Military Sales (FMS) foreign government fuel purchases; contract default; amounts

due for items rejected or returned; and amounts due on payments for contractual services such as

rent, insurance, and transportation purchased, where such contracts are canceled and adjustments

are made for the unused portion.

2.17 Rescheduled Receivables

Rescheduled receivables are receivables that have been subject to rescheduling,

forbearance, re-amortization, or any other form of extending the future of the original payment(s)

or payment due dates.

2.18 DFAS Enterprise Solutions and Standards Vendor Pay Tax Office

The DFAS Enterprise Solutions and Standards (ESS) Vendor Pay Tax Office is the office

that prepares the IRS Form 1099C for reporting to the IRS on closed-out, uncollected, public

vendor, contractor, and individual debt.

2.19 Trading Partners

Trading Partners collectively refers to the requesting agency (buyer) and the providing

agency (seller) involved in intragovernmental transactions.

2.20 Treasury Report on Receivables

The TROR is a quarterly report of public receivables prepared in compliance with the

Treasury guidance. It provides a means for collecting data on the status and condition of the total

receivable portfolio from public sources. See section 6.0 for additional information.

2.21 Terminate Collection Action

Terminate Collection Action is a decision to cease active collection action on a debt, in

accordance with criteria set out in the Federal Claims Collection Standards, because such

collection action is not economically worthwhile or is otherwise inappropriate. “Termination” of

debt collection is a legal procedure, which is separate and distinct from the accounting procedure

of “write-off”. See 31 U.S.C. § 3711 on additional guidance on termination collection action for

additional guidance.

2.22 Write-off of Receivables

The write-off of a receivable is an accounting action that results in removing a public/non-

federal receivable from the DoD Component’s financial accounting records/financial statements.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-10

3.0 RECEIVABLES POLICY

*3.1 Recording

3.1.1. According to SFFAS 1, a receivable must be recognized when a federal entity

establishes a claim to cash or other assets against other entities, either based on legal provisions, such

as a payment due date, or goods or services provided. In the case that an exact amount is unknown,

a reasonable estimate must be made by the collecting entities. Disputes or litigation do not affect

the timing of receivable recognition. For additional information regarding receivable recognition,

refer to SFFAS 1.

3.1.2. A receivable must be established when payment is not received in advance or at the

time revenue is recognized. Receivables must be recorded when earned from the sale of goods

and services or when an event results in the determination that a debt is owed to DoD, i.e., in the

applicable accounting system during the month the receivable occurs. Accounting records for

receivables must be maintained so that all transactions affecting the receivables are included in the

reporting period of occurrence. There must be immediate recording of events not previously

recorded due to error or oversight. The requirements for recording and reporting errors on the

financial statements are detailed in Chapter 15.

3.1.3. DoD Components must recognize accounts receivable and unfilled orders without

an advance as valid budgetary resources when such receivables or unfilled orders are from federal

entities. Absent statutory authority, components must not recognize accounts receivable and

unfilled orders without an advance as valid budgetary resources when such receivables or unfilled

orders are from public/non-federal entities.

3.1.4. DCOs must ensure that the appropriate ARO is advised that a receivable is to be

established in the applicable accounting system. DCOs will provide the ARO with signed copies of

indebtedness notices and other appropriate documentation to support entries in the accounting

system and will provide the status of the debt which includes: beginning debt balance, collections,

adjustments, current ending balance and notice of discontinuance of collection efforts. DoD

Components must maintain the supporting documentation in the applicable accounting system. See

Volume 1, Chapter 9 for records retention.

3.2 Advance Payments

3.2.1. In general, an advance payment is required for orders from the public, including

state and local governments, except for fuel, as the sale of petroleum products to the public is

covered by fuel purchasing agreements. The order must be accompanied by an advance equivalent

to the actual or estimated cost of goods and services. If amounts are sufficient, Military

Departments may use their own appropriated fund budgetary resources to perform a reimbursable

order for a NAFI without an advance. However, they must not recognize budgetary resources for

the order until the account receivable is paid. An advance payment from foreign governments for

FMS is held and recorded in the FMS Trust Fund or investment accounts that can be drawn on to

meet the foreign government’s FMS obligations.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-11

3.2.2. The Department has statutory authority to record a budgetary resource for

non-federal orders without an advance for work performed under the provisions of

22 U.S.C. § 2767. Components must request approval from the Office of the Under Secretary of

Defense (Comptroller) (OUSD(C)) in advance of accepting the order(s) and recording the

budgetary resource. The OUSD(C) will coordinate with OMB to ensure the resulting budgetary

entries will be accepted within federal-wide accounting and reporting systems.

3.2.3. Additional information regarding budgetary resources may be found in Volume 3,

Chapters 13, 14 and 15. See Volume 11B, Chapter 11 and Volume 4, Chapter 5 for Defense

Working Capital Funds’ policy on receipt of advances on orders from public/non-federal entities.

3.3. Collection of Receivables

3.3.1. The collection of receivables must be aggressively pursued for amounts due from

DoD Components, federal agencies, and the public. The due date for a receivable normally is

30 days from the date of invoice, demand letter, or notice of payment due; unless a specific due

date is established by statute, contract provision, or notice of indebtedness. Collection actions

must be initiated when payment becomes due. See Volume 16, Chapter 2 for additional

information on due process.

3.3.2. Funds must be collected in the appropriation that earned the funds, or in the case of

a refund, into the appropriation from which the excess payment was made, unless otherwise

specified by law. Examples of applicable legal provisions include, but are not limited to:

3.3.2.1. In accordance with 42 U.S.C. § 2651, amounts recovered from a liable

third-party or insurer due to a service member’s injury or disease must be credited to current

operating funds as follows:

3.3.2.1.1. Amounts recovered for hospital, medical, surgical, or dental care

and treatment will be credited to the current operating funds of the facility or activity that provided

the care and treatment.

3.3.2.1.2. Amounts recovered for loss of the service member’s duty will be

credited to current operating funds of the command, activity, or unit to which the service member

was assigned at the time of the injury or illness.

3.3.2.2. In accordance with 10 U.S.C. § 1095, collection from third parties for

medical services provided must be recorded against the year in which the collection is received

regardless of the year in which service was provided.

3.3.3. Any collections including refunds received after an appropriation cancels must be

deposited in Treasury Account 3200, "Collections of Receivables from Canceled Accounts.” See

paragraph 3.11 for additional guidance on accounts receivable and canceled appropriations.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-12

3.4 Allowance Account and Aging

3.4.1. An allowance for uncollectible accounts receivable due from the public and

intragovernmental customers must be estimated and recorded.

3.4.2. No allowance for uncollectible accounts will be recorded for non-loan interest,

penalties, and administrative charges.

3.4.3. The AROs (on behalf of the DoD Components) must age delinquent accounts

receivable within the accounting system.

3.4.4. Aging of receivables (delinquency) starts one day after the due date for both public

and intragovernmental (within and outside DoD) receivables. See Figure 3-1.

3.5 Interest Penalties, and Administrative Receivable

Interest, Penalties, and Administrative (IPA) receivables are DoD assessments added to

delinquent debts. The full amount of a delinquent debt is the sum of the principal, accrued program

interest, and any other penalties and/or administrative charges that are due and owed to the DoD.

See Volume 16, Chapter 7 for detailed IPA information.

3.5.1. Interest accrues from the first day of delinquency and is added to the outstanding

principal receivable balance within the accounting system when an amount due is not received by

the due date or other agreed upon date. Interest also must be recognized on outstanding accounts

receivable against persons and entities in accordance with provisions in 31 U.S.C. § 3717. Until

the interest payment requirement is officially waived by the DoD or the related debt is closed-out,

interest will accrue. Note that debts owed by any federal agency are exempt from interest, penalty,

and administrative charges. Interest receivables are considered non-entity receivables.

3.5.2. An interest receivable must be recorded when the interest income is earned not when

the income is received. An interest receivable must be recorded as it is earned on investments in

interest-bearing securities.

3.6 Payment Application

When a debt is paid in partial or installment payments, amounts received will be applied first

to contingency fees, second to outstanding penalties, third to administrative charges, and fourth to

interest, and lastly to principal per Federal Claims Collection Standards, 31 CFR 901.9(f).

3.7 General Ledger Accounting

Information on receivables must be developed, maintained, and reported using the United

States Standard General Ledger (USSGL) accounts depicted in Volume 1, Chapter 7. The first six

digits of the accounts receivable general ledger account must conform to the USSGL chart of

accounts. DoD requires the use of the DoD Standard Chart of Accounts (SCOA). The DoD SCOA

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-13

and accounting transactions for collections and receivables are outlined in the DoD USSGL

Transaction Library, available on the Standard Financial Information Structure (SFIS) web page.

3.8 Internal Controls

The basic standards for internal controls prescribed in DoDI 5010.40, must be adhered to in

establishing and collecting receivables.

3.8.1. Major categories of receivables must be maintained to facilitate clear and full

disclosure of accounts receivable, e.g., disclose the debtor, the amount, the age, and the type of debt.

Subsidiary records must be reconciled to the control accounts on at least a monthly basis.

3.8.2. Proper internal controls require the accurate and timely recording of transactions,

appropriate documentation and retention appropriate authorization, (i.e., executed only by persons

acting within the scope of their authority) and appropriate management.

3.8.3. Responsibilities for authorizing transactions, processing and recording them,

reviewing the transactions, and handling any related assets must be separated so that no one

individual controls all key aspects of a transaction or event (e.g., a technician responsible for

creating cash or check due transactions cannot also be responsible for collecting cash or checks),

must be maintained.

3.8.4. Each DoD Component must develop and implement internal operating procedures

and/or guidance to implement this overarching policy in a manner that ensures accurate, timely,

and relevant reporting of financial data. Internal operating procedures must include a dormant

account review quarterly (DAR-Q) for accounts receivable as described in Volume 3, Chapter 8.

Relevant records supporting financial statements must be maintained and made available during

financial statement audits.

3.9 Erroneous, Invalid, and Unsubstantiated Accounts Receivables

During the DAR-Q process, the reviewer must examine the receivables for completeness,

accuracy, and supportability. Abnormal or erroneous accounts receivable must be promptly

researched and resolved. If at any time it is determined that a debt was never owed and should not

have been classified as an accounts receivable, the accounting records must be adjusted. Return

all funds collected to the debtor for an unsubstantiated account receivable.

3.9.1. For errors detected in the year the receivable was recorded, reverse the entry. For

errors detected in subsequent fiscal years, record an entry in accordance with the requirements for

recording and reporting errors in the financial statements as detailed in Chapter 15.

3.9.2. A billing DoD Component that cannot produce the evidence necessary to establish

an accounts receivable and has not been able to obtain the voluntary repayment of the debt, the

entries that established the accounts receivable must be reversed.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-14

3.9.2.1. Evidence necessary to establish an account receivable includes, but is not

limited to, a duplicate payment voucher, contract reconciliation document, Department of Justice

litigation report, an unpaid U.S. payment voucher, or demand letter.

3.9.2.2. All erroneous, invalid, and unsubstantiated accounts receivable must be

removed from the general ledger by reversing the existing entry if recorded in current year. See

Chapter 15 if the receivable was recorded in prior years. The reversing journal entry must be

supported with all known evidence.

3.9.3. The evidence obtained from research may identify internal control failures and/or

process weakness with the recognition of accounts receivable. Any internal control failures and/or

process weaknesses must be addressed and corrected.

3.10 Canceled Appropriations

AROs must retain all outstanding receivables in the residual records even though an

appropriation cancels. When the appropriation cancels, the collection of a receivable is recorded in

Treasury miscellaneous receipt account 3200, “Collections of Receivables From Canceled

Accounts.” Appropriation cancellation does not relieve DoD of the responsibility to pursue

collection or recovery.

3.11 Nonappropriated Fund Instrumentalities Receivables

Receivables from NAFIs must be recorded as transactions from the public. They must be

included in the quarterly TROR. With the exception of individual debt, NAFI delinquent debt will

not be referred to the DMO or to Treasury for collection assistance. Refer to Volume 13, Chapter 3

for guidance on NAFI debts.

3.12 Foreign Military Sales Receivables

Receivables from the FMS Trust Fund (appropriation 97 11X8242) must be recorded as

federal transactions. Other Security Assistance receivables, e.g., the Foreign Military Financing

Program, Funds Appropriated to the President (appropriation 11(FY) 1082), must be recorded and

reported as intragovernmental receivables. The FMS delinquent accounts receivable will not be

referred to the DMO or to Treasury for collection assistance. See Volume 16, Chapter 6 for

guidance on FMS receivables.

3.13 Non-FMS Foreign Government Receivables

The ARO will initiate initial billings for non-FMS foreign government accounts receivable.

See Volume 16, Chapter 6 for additional information on non-FMS foreign government

receivables.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-15

3.14 Retention of Documentation

AROs and DCOs will maintain documentation to support actions taken on each accounts

receivable. This includes but is not limited to documents supporting:

3.14.1. Establishing the receivable.

3.14.2. Due process requirements.

3.14.3. Research and resolution of abnormal or erroneous balances.

3.14.4. Reversal of entries establishing the receivable.

3.14.5. Termination, write-off, and close-out of receivable.

3.14.6. Bankruptcy.

3.14.7. Installment payment plan.

3.15 Undistributed Collection Balances

Undistributed collection balances placed in Treasury budget clearing (suspense) accounts

F3875 and F3885 must be analyzed and reconciled monthly on the Financial Management System

Form 224, “Statement of Transactions,” to ensure all collected amounts are properly credited to

the proper appropriation and applicable accounts receivable accounts. For any suspense account,

items, or transactions more than 60 days old, investigate and document the reason why the

transaction cannot be reclassified to the correct appropriation. All differences must be cleared

within 60 days, with the exception of those suspense accounts that have been identified by Treasury

as exempt from the 60-day requirement. Refer to Chapter 2 for the required investigatory

procedures related to budget clearing account balances.

4.0 PUBLIC RECEIVABLES

4.1 General

Receivables due from the public are DoD claims (or another entity within the

Federal Government) against non-federal entities, to include public entities, domestic and foreign

persons and organizations outside the U.S. Government. Public receivables are also created from

the sales of goods or services when an advance payment is not first received or from refunds due to

the DoD. See paragraph 3.2 for more on an advance payment.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-16

4.2 Debt Collection Policies

The DoD policies for credit management and debt collection delineated in other volumes

are:

4.2.1. Policies and procedures for collection of debt from individuals are in Volume 16,

Chapter 3.

4.2.2. Policies and procedures for physical loss of funds are in Volume 5, Chapter 6.

Accounts receivable that are the result of improper payments may require loss of funds investigations

in accordance with Volume 5, Chapter 6 for improper payments.

4.2.3. Policies and procedures for salary offset to collect debts owed to the DoD by

military members or civilian employees are in Volume 7B, Chapter 28; and Volume 8, Chapter 8.

Volumes 7A, 7B, and 8 also address collection of child support, alimony, or commercial debts

from the pay of military members or civilian employees through garnishment or involuntary offset.

4.2.4. Policies and procedures for collection of commercial or contractor debt are in

Volume 16, Chapter 5. Additionally, the FAR Subpart 32.6, prescribes policies and procedures for

ascertaining and collecting contract debts, charging interest on the debts, deferring collections, and

compromising and terminating certain debts.

4.2.5. Policies for collection of debts from foreign entities are available in Volume 16,

Chapter 6.

4.3 Receivables from the Sale of Goods and Services to the Public

4.3.1. Upon receipt of a collection voucher, the ARO must record the collection in the

accounting system and include it in the monthly reports (Standard Forms 1218, 1219, and 1220,

and FMS Form 224) to Treasury. If an abnormal balance results from recording the collection, the

ARO must research and resolve the abnormal balance.

4.3.2. The ARO must refer delinquent accounts receivable for further collection action as

required by debt collection policy in Volume 16, Chapter 3.

*4.4 Refunds Receivable

Refunds to appropriations represent amounts collected from outside sources for payments

made in error, overpayments, or adjustments for previous amounts disbursed. They must be

directly related to previously recorded expenditures and are reductions to those expenditures.

There is not a separate account for refunds receivable in the USSGL. Refunds receivable are

treated as accounts receivable and DoD Components must recognize and report them in their

financial statements.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-17

4.4.1. Examples of refunds receivable include, but are not limited to the following:

4.4.1.1. Salary overpayments.

4.4.1.2. Overpayments to commercial concerns due to erroneous billings, incorrectly

computed invoices, or contract default.

4.4.1.3. Amounts due for items rejected or returned.

4.4.1.4. Amounts of recovery due on payments for contractual services, such as

rent, insurance, and transportation purchased, where such contracts are canceled and adjustments

made for the unused portion.

4.4.1.5. Amounts for advance payment of travel when the travel was canceled.

4.4.1.6. Amounts payable for “due U.S.” travel vouchers.

4.4.1.7. Amounts due from advance payments for contractual purposes.

4.4.1.8. Amounts due from employees on leave without pay for employee share of

benefits (i.e., health insurance).

4.4.2. Non-DCO activities (e.g., contracting offices, Fund Holders) must notify the DCO

that a debt exists. For contracting offices, the FAR, Part 32, Contract Financing provides the

guidance. DCOs must ensure the appropriate ARO is advised to establish a receivable in the

applicable accounting system. Such notification must be made in the same accounting cycle that the

debt is recognized.

4.4.3. Upon receipt of a collection voucher, the ARO must ensure that the collection is

recorded in the accounting system and reported to Treasury. See sections 6.0 and 7.0 for additional

guidance on reporting requirements. If an abnormal balance results from recording the collection,

then the ARO must research and resolve the abnormal balance.

4.4.4. The ARO or DCO must refer delinquent accounts receivable for further collection

action as required in subparagraphs 4.6.

4.4.5. OMB Circular A-11 addresses the proper budgetary accounting for refunds in

section 20.10. Since refunds are the repayments of excess payments, the amounts are directly

related to previous obligations incurred and outlays made against the appropriation. Refunds

received are deposited to the credit of the appropriation or fund account charged with the original

obligations.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-18

4.5 Collection Actions

Accounts receivable must be aged to allow for the management of collection actions.

4.5.1. The due date for a receivable is normally 30 days from the date of invoice, demand

letter, or notice of payment due unless a specific due date is established by statute, contract provision,

or notice of indebtedness. The initial demand for payment, invoice, or demand letter must include a

complete explanation of the debtor’s rights and responsibilities, the basis of the indebtedness, the

agency’s intention to use various collection tools to collect the debt, additional charges

(i.e., interest, penalties, and administrative charges) that may be levied, and the name, work phone

number, and address of an individual to contact within the agency to resolve the delinquency. See

Volume 16, Chapter 2 for additional information on debt notification requirements.

4.5.2. AROs or DCOs will refer valid and legally enforceable delinquent individual

out-of-service debt to the DCMO for further collection action. See Volume 16, Chapter 3 for

additional information.

4.5.3. AROs or DCOs will refer valid and legally enforceable delinquent vendor debt of

$25 ($100 if vendor does not have a Taxpayer Identification Number) or more, comprised of

principal, interest, administrative charges, and penalty, to the DMO for further collection action

no later than 60 days after the payment due date. Multiple debts to the same vendor totaling $25

or $100 or more must be consolidated and referred to the DMO as one debt package.

4.5.4. Uncollected public vendor debt of less than $25 and individual out-of-service debt

of less than $25 must be collected or written off and closed-out within 1 year of delinquency in

accordance with Volume 16, Chapter 3. These debts are not referred to DMO or DCMO for further

collection action unless mandated by public law.

4.5.5. The DCMO or DMO must refer valid and legally enforceable delinquent public

receivables over 120 days old to Treasury for further collection action in accordance with the DCIA

and the DATA Act.

4.5.5.1. Exceptions to the requirement to refer debt to Treasury include debts or

claims that: (a) are in litigation or foreclosure; (b) will be disposed of under an asset sales program

within one year after becoming eligible for sale, or later than one year if consistent with an asset

sales program (See OMB Circular A-129, section IV); (c) have been referred to a private collection

contractor for collection for a period of time approved by the Secretary of the Treasury; (d) will

be collected under internal offset, if such offset is sufficient to collect the claim within three years

after the date the debt or claim is first delinquent; (e) are foreign government debts; or (g) are

NAFI debts.

4.5.5.2. The Treasury, after due process, returns uncollected public receivables to

the sender (length of time varies based upon collection actions taken by Treasury).

4.5.5.3. Debts less than $100,000 that are referred to Treasury and later returned

due to failure to collect may be terminated for further collection action by DCMO or DMO upon

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-19

coordination with the appropriate Fund Holder. Debts of $100,000 to $500,000 that are referred

to Treasury and later returned due to failure to collect may be terminated with Treasury’s approval.

Debts of $500,000 or more must be referred to the Department of Justice for approval to terminate

collection action. See Volume 16, Chapter 2 for additional guidance regarding termination of

collection action.

4.5.5.4. DCMO or the DMO will advise the ARO when the Treasury has returned a

debt as uncollectible. The ARO will take appropriate actions to terminate collection action, write-off

the receivable, and close-out the receivable, as applicable.

*4.6 Establishment of Allowance for Loss on Accounts Receivable

4.6.1. The ARO must recognize and record its projected debt losses by setting up

allowance for uncollectible accounts on public and intragovernmental accounts receivable in the

general ledger. By accurately estimating the potential losses and putting that amount in its

allowance accounts, a reporting entity is recognizing the accounts receivable at their net realizable

value.

4.6.2. SFFAS 1 requires an allowance for estimated uncollectible receivable amounts be

recognized when it is more likely than not that the receivables will not be totally collected; the

phrase “more likely than not” means more than a 50 percent chance of loss. TB 2020-1 clarifies

that the absence of explicit guidance distinguishing between intra-governmental and

nonfederal/public entities receivables, both must be recognized in accordance with SFFAS 1

requirements. The allowance for loss on accounts receivable must be re-estimated annually and

when information indicates that the latest estimate is no longer accurate.

4.6.3. Losses due to uncollectible receivables should be measured through a systematic

methodology. The systematic methodology should be based on analysis of groups of receivables

as a whole with the option to isolate individual receivables for a separate allowance calculation.

The allowance amount calculated for individual receivables and groups of receivables will be

added together and will be the total amount for allowance for loss on accounts receivable. A

provision to increase or decrease the allowance will result in an adjustment of nonexchange

revenue, rather than a bad debt expense.

4.6.3.1. Group of Receivables. To determine the loss allowance for receivables

less than $100,000, separate the receivables into groups having similar risk characteristics.

Receivables may be grouped by each delinquent age category greater than 60 days old, by category

of debtor, by reason that gave rise to the receivable, or by geographic regions. The methodology

used to determine the percentages will be based on the history of bad debt expense from the last

three years. The determined percentages will be applied to the total amount in each category. The

OUSD(C) must approve exceptions when abnormal circumstance skews the three-year average.

4.6.3.2. Individual Receivables. Each receivable equal to or greater than $100,000

must be analyzed to determine the loss allowance. Loss estimation for each receivable will be

based on: (a) the debtor’s ability to pay, (b) the debtor’s payment record and willingness to pay,

and (c) the probable recovery of amounts from secondary sources, including liens, garnishments,

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-20

cross collections, and other applicable collection tools. DoD Components with a low number of

receivables or a large number of small dollar receivables may lower the threshold. However,

consistent methodology must be used from year to year.

4.6.4. DoD must not recognize intragovernmental allowance for uncollectible accounts up

to and including two years in delinquent age for intragovernmental receivables. After two years

and older delinquent age, DoD must recognize 100 percent allowance for uncollectible accounts.

The public allowance for uncollectible accounts is calculated:

4.6.4.1. No (0 percentage) allowance is calculated for aging categories less than 90

days.

4.6.4.2. 100 percentage allowance is calculated for public debt for aging categories

greater than two years.

4.6.4.3. Allowance for public debt for aging categories greater than 90 days and

less than 2 years are calculated by agency-specific Monthly Receivable Data (MRD) write-off

amounts divided by total Account Receivable amounts to determine the write-off percentage. The

most recent 36 months of write-off percentages are averaged to determine the allowance

percentage for 91 days to 2 years aging categories.

4.6.5. In those instances, when one DoD Component sub-allots funds to another DoD

Component, the office executing the funds will be responsible for establishing the allowance for loss

on accounts receivable. The write-off of receivables must be processed through the allowance for

uncollectible accounts.

*4.7 Write-off and Close-Out of Public Accounts Receivable

OMB Circular A-129 provide general provisions for write-off and close-out of public

accounts receivable. Write-off is mandatory for public delinquent debt that has not been collected

within two years of delinquency unless documented and justified to OMB in consultation with

Treasury. All write-offs of non-federal receivables must be made by debiting the allowance for

uncollectible account and crediting the receivable account. A direct write-off to public receivable

without recording an allowance for uncollectible is prohibited. Intergovernmental receivable

write-off is prohibited. In accordance with OMB Circular A-129, when a receivable is written-

off, it must be classified as currently not collectible (CNC) or closed-out. Receivables that are

classified as CNC must be maintained in an inactive administrative file and reported on the TROR

until the receivable is closed-out.

4.7.1. Write-off. The DCO must provide the ARO with documentation to support

write-off of the receivable (regardless of amount) and also must provide the history of all research

and debt collection efforts. When received, the ARO must immediately provide the documentation

to the Fund Holder for concurrence for write-off and notify the DCO that the request for

concurrence was sent. If the Fund Holder concurs, the ARO will write-off the debt. If the Fund

Holder non-concurs or does not respond, then the following applies:

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-21

4.7.1.1. The Fund Holder must respond within 30 days of request for a write-off. If

a response is not received within 30 days, the ARO will write-off the debt.

4.7.1.2. If non-concurring, the Fund Holder must provide the ARO with additional

written evidence to enable the collection of the debt. The ARO will only make one additional attempt

to collect (i.e., issue one additional demand letter).

4.7.1.3. If payment is not received after making one additional attempt to collect,

the ARO will write-off the debt. The ARO will notify the Fund Holder and the DCO that the debt

was written off.

4.7.2. Currently Not Collectible. Once the debt is written off, it must either be classified

as CNC or closed-out. Debts in CNC status are reported on the TROR and are still eligible for the

Treasury's cross-servicing and offset programs.

4.7.2.1. Public debt will be classified as CNC only if the following criteria are met:

4.7.2.1.1. The vendor debt or the individual out-of-service debt is $25 or

more.

4.7.2.1.2. All debt collection actions referenced in this chapter have been

pursued.

4.7.2.1.3. It is cost effective to continue collection efforts.

4.7.2.2. CNC debt must be continuously reviewed and, as required, reclassified and

closed-out.

4.7.2.3. When Treasury is able to collect on a receivable categorized as CNC and

remits funds to DoD, the ARO will reverse the write-off, reestablish the receivable, and record the

collection against the receivable.

4.7.3. Close-Out of Indebtedness. Debt write-off and close-out may occur at the same

time, or close-out may follow write-off by a substantial period of time. When it has been

determined that the debt is not collectible (e.g., returned from Treasury uncollected or further

collection action would not be economically feasible), the DCO must notify the ARO. The ARO

must notify the Fund Holder and request concurrence to close-out the debt. If the Fund Holder

non-concurs or does not reply, the following applies.

4.7.3.1. The Fund Holder must respond within 30 days of request for close-out. If

a response is not received within 30 days, then the debt must be closed-out.

4.7.3.2. If non-concurring, the Fund Holder must provide the ARO with additional

written evidence to enable the collection of the debt. The ARO will only make one additional

attempt to collect (i.e., issue one additional demand letter).

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-22

4.7.3.3. If payment is not received after procedures in subparagraphs 4.7, then the

ARO must close-out the debt and notify the Fund Holder.

4.7.3.4. Once a debt has been closed-out, it cannot be reactivated, and the Federal

Government cannot take any further administrative or legal action to collect the debt. The Federal

Government, however, can accept voluntary repayment of the debt at any time. Once the Fund

Holder has decided to close-out the debt, the ARO has primary responsibility for close-out actions.

Volume 16, Chapter 6 provide guidance regarding the FMS arrearages write-off and close-out.

4.7.4. Tax Reporting: In most cases, when an agency closes out a debt or compromises a

debt for less than the full amount owed, the debt is considered a canceled debt. DoD has a

responsibility to issue tax forms and execute IRS reporting for canceled debts that meet the IRS’s

reporting criteria. The DFAS ESS Vendor Pay Tax Office is responsible for the tax form issuance

and IRS reporting for vendor and contractor canceled debts managed in the DFAS Defense

Contractor Debt System (DCDS).

5.0 INTRAGOVERNMENTAL RECEIVABLES

5.1 Receivables Due From Federal Entities

Receivables due from DoD Components or other federal entities are intragovernmental

receivables and must be reported separately from receivables due from public entities in the

financial statements.

*5.2 Sales of Goods and Services

5.2.1. Intragovernmental materials sold or services furnished must be authorized and

documented in a support agreement between the provider (seller) and ordering entity (buyer). A

providing entity (seller) must initiate the agreed upon activity by providing the cost of materials

or performing the services to the ordering entity (buyer). The activity receiving the materials or

services (buyer) pays the providing activity. Uncollected amounts earned from reimbursable sales

are recorded as accounts receivable

5.2.2. In contrast with orders from the public/non-federal entities without an advance,

under the Economy Act DoD organizations with reimbursable authority may recognize a

budgetary resource upon acceptance of funded reimbursable orders from DoD and other federal

agencies, because customer agencies obligate their own budgetary resources (e.g., appropriations)

at the time of order placement and acceptance. DoD organizations may incur obligations to fill

such orders without requiring the customer to provide an advance payment and without burdening

their own budgetary resources.

*5.3 DoD Performing Entity Responsibilities

The performing entity (seller) must ensure that the costs incurred for completed

performance are promptly recorded as revenue and receivable and must ensure the earned revenue

amount is promptly charged and collected from the ordering entity. Refer to Chapter 9 for a

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-23

description of how titles are passed on a contractual agreement. Ensure that transactions are

recorded on a timely basis, in order for Treasury to perform intragovernmental eliminations. The

performing entity will:

5.3.1. Receive a customer’s order, which will be verified against the agreement serving as

the basis for the order, such as a DD Form 448, “Military Interdepartmental Purchase

Request” (MIPR). The amount of the order must be recorded as an unfilled customer order.

5.3.2. Reverse the unfilled customer order and record a filled customer order

(i.e., earnings) uncollected upon receiving documentation showing that goods or services were

provided. Record the receivable and charge the customer. If an abnormal balance results from

reversing the unfilled customer order, research the abnormal balance and promptly resolve the

issue.

5.3.3. Reverse the filled customer order uncollected (i.e., earnings) and record a filled

customer order collected upon receipt of a collection voucher. If an abnormal balance results from

reversing the filled customer order uncollected, research the abnormal balance and promptly resolve

the issue.

5.3.4. Ensure that collection vouchers are recorded in the accounting system and reported to

the Treasury in the accounting month the collection was received.

5.3.5. Review unearned and earned orders and determine that recorded orders are supported

with an order or contract.

5.3.6. Research any abnormal unfilled customer order balances; such balances indicate that

an order may not be recorded. Research any abnormal filled customer order uncollected balances;

such balances indicate that collections may have been incorrectly recorded. Promptly resolve these

abnormal balances.

5.3.7. For orders not filled from inventory (e.g., supply issues from materiel systems); obtain

the accounts payable transaction history. Review obligations and accrued expenditures recorded and

determine whether the accruals are supported with a reimbursable agreement or a document

evidencing that a payment is due. Unsupported obligations and accrued expenditures must be

thoroughly researched, and the necessary corrective actions taken. Copies of all reimbursable orders

must be available to ensure that all obligations and accrued expenditures are recorded correctly.

Reconcile the receivables and collections relating to the reimbursable program of the performing

activity with the accrued expenditures paid and unpaid of the same performing activity.

5.3.8. Obtain the billing transaction history from the ARO. Billing transaction histories

must be provided within 30 days. Ensure that billings are against the correct order and,

consequently, billed against the correct obligation. Request copies of documents supporting that a

payment is due; reconcile these documents with the related accounts receivable. Any discrepancies

must be resolved by adjusting the accounts receivable to the appropriate amounts.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-24

5.3.9. Upon receiving a request for supporting documentation, provide a copy of an

agreement, contract, and/or proof of performance or delivery within 30 days of request.

5.3.10. If a charge is disputed or rejected, review supporting files promptly. The

intragovernmental dispute process is outlined in paragraph 5.5.

5.3.11. Research unmatched disbursements and negative unliquidated obligations as

required by Volume 3, Chapter 11.

5.3.12. Unless authorized by law to perform non-reimbursable work, DoD performing

activities will not perform reimbursable work for another federal agency that is 90 days or more in

arrears in payment of previous reimbursable billings. This restriction can be waived by the

OUSD(C) if in the national interest to do so.

5.3.13. Refer to TFM Volume 1: Federal Agencies, Supplements, USSGL for reimbursable

USSGL transaction entries.

5.4 DoD Ordering Agency Responsibilities

5.4.1. The ordering agency must review all charges from the performing activity to ensure

that amounts due are in agreement with the reimbursable orders and are supported with a copy of the

order or contract and evidence of performance.

5.4.2. Transportation charges that cannot be matched to an accounts payable transaction, or

that cannot be charged back, must be researched and charged to the proper line of accounting (LOA)

upon completion of research.

5.4.3. If the bill is supported, but the order or obligation is not recorded in accounting

systems, then record the order or obligation immediately. Determine why the order or obligation

was not recorded. The evidence obtained from research may identify internal control failures

and/or process weaknesses. Any internal control failures and/or process weaknesses must be

addressed and corrected. Evidence from the research should be documented and maintained by

the organization.

5.5 Management of Collection Actions

Aging Accounts Receivable qualify for the collection actions. Aging (delinquency date)

starts one day after the initial due date.

5.5.1. Charges arising from transactions within the DoD and with other federal

departments and agencies must be recorded as accounts receivable in the accounting month earned.

5.5.2. Bills arising from transactions which contain a National Stock Number within the

DoD will be collected through the Military Standard Billing System interfund billing procedures

when supported by the supply and accounting systems. The provider will not accept a MIPR if

interfund can be used. Manual billing (i.e., the XP fund code) will not be used unless approved

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-25

by the Deputy Chief Financial Officer. For intragovernmental interfund disputes, follow the

dispute process outlined in DLM 4000.25.

5.5.3. For non-interfund intragovernmental (within DoD) receivables, reimbursement will

be via Defense Cash Accountability System or Intra-Government Payment and Collection (IPAC).

The buyer cannot chargeback or reject the charge (other than IPAC) unless authorized by the

dispute process as outlined in paragraph 5.6. The buyer must perform an IPAC reject within

30 days. The only valid reasons for reject/adjustment are:

5.5.3.1. Billing for more than the agreed amount.

5.5.3.2. Duplicate/erroneous billing.

5.5.3.3. Lack of supporting documentation.

5.5.3.4. MIPR has expired and/or appropriation has expired.

5.5.4. For intragovernmental (outside DoD) receivables, IPAC is the preferred method of

billing/collection.

5.5.4.1. Include the use of IPAC as the preferred method of billing/collection on

the MIPR acceptance.

5.5.4.2. Follow the intragovernmental (outside DoD) dispute process as outlined

in the paragraph 5.6 if the IPAC transaction is rejected.

5.5.5. Rejected charges must require the reestablishment of a receivable and adjustments

to an appropriation’s Fund Balance with Treasury.

5.5.6. USSGL accounting transactions for reimbursable billings and collections, and

accounts receivable corrections and adjustments are detailed in the SFIS library.

5.6 Non-Interfund Dispute Process

5.6.1. Intragovernmental Debt Within the DoD. The performer’s ARO is responsible for

managing intragovernmental debt. OUSD(C) oversees DoD dispute resolution processes to resolve

balance discrepancies between DoD reporting entities. See Volume 6B, Chapter 13, paragraph 5.4,

paragraph 5.6 for additional information on eliminations.

5.6.1.1. Intragovernmental debt cannot be referred to a debt collection activity.

5.6.1.2. The full settlement of intragovernmental accounts receivable disputed

charges must take no longer than 180 days from the date of the charge.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-26

5.6.1.3. For receivables of $2,500 or less, the buyer may accept the charge without

dispute. However, these charges may be disputed as long as the process can be justified as cost

effective.

5.6.1.4. For disputed receivables greater than $2,500:

5.6.1.4.1. The buyer will work with the seller during the first 60 days from

the date of the charge to resolve the dispute. The buyer or seller may request assistance from

DFAS. If the dispute cannot be resolved, the buyer, along with assistance from DFAS, will

assemble a dispute package and send it to the seller. At a minimum, the dispute package must

include copies of: MIPR or equivalent, MIPR acceptance or equivalent, voucher payment, bill,

correspondence, shipment or delivery evidence, and a narrative explaining the basis of the dispute.

5.6.1.4.2. During 61-90 days from the date of the charge, the seller will

review the buyer’s dispute package and will provide a written response of concurrence or

non-concurrence.

5.6.1.4.2.1. If the seller concurs, the seller will reverse the charge.

5.6.1.4.2.2. If no response is received from the seller, the buyer may

chargeback without recourse.

5.6.1.4.2.3. If the seller non-concurs, the buyer will elevate the

dispute package to their Resource Manager/Comptroller.

5.6.1.4.3. During 91-120 days from the date of the charge, the buyer’s

Resource Manager/Comptroller will contact the seller’s Resource Manager/Comptroller to resolve

the dispute. If the dispute cannot be resolved, the buyer’s Resource Manager/Comptroller will

elevate the dispute package to their Service Secretary, Combatant Command Commander, or

Defense Agency Director.

5.6.1.4.4. During 121-150 days from the date of the charge, the buyer’s

Service Secretary, Combatant Command Commander, or Defense Agency Director, will contact

the seller’s Service Secretary, Combatant Command Commander, or Defense Agency Director, to

resolve the dispute. The dispute must be resolved within 180 days.

5.6.1.5. If the resolution to the dispute is that the buyer does not have to pay the

bill, then the seller must adjust their revenue to liquidate the debt if the revision reflects current

fiscal year activity. The seller will decrease revenue and increase direct obligations and expenses.

For material receivables established in a prior year, revenue must not be decreased, rather a prior

period adjustment must be used to properly account the adjustment. See Volume 6B, Chapter 6.

For immaterial receivables established in the prior year, reduce current year revenues.

5.6.2. Intragovernmental Debt Outside DoD. Disputes between government agencies

(e.g., between the DoD and the General Services Administration) will be resolved in accordance

with I-TFM-2-4700.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-27

5.6.2.1. Dispute resolution will involve the program offices, the accounting offices,

the contracting officer, and the agency’s Chief Financial Officer (CFO), as appropriate. Disputes

will be documented in writing with clear reasons for the dispute. A memorandum of agreement will

be signed by the CFOs of each department and agency to acknowledge that department’s or agency’s

active participation in the dispute resolution process.

5.6.2.2. Trading Partners will not chargeback or reject transactions that comply with

1-TFM-2-4700. Further, new transactions will not be created to circumvent the guidance contained

therein.

5.6.2.3. Disputes are of two types:

5.6.2.3.1. Accounting treatment (e.g., advances and non-expenditure

transfers).

5.6.2.3.2. Contractual (e.g., payment, collection, and interagency

agreement).

5.6.2.4. If intragovernmental differences result from differing accounting treatment,

then the trading partners have 60 calendar days from the date that the difference is identified in

Treasury Government wide Treasury Account Symbol Adjusted Trial Balance System (GTAS) or

the date that a charge is disputed, whichever comes first, to agree on the treatment of an accounting

entry. If agreement cannot be reached within 60 calendar days, then both trading partners’ CFOs

must request that a decision be rendered by the Treasury Bureau of Fiscal Service (BFS). After

BFS has rendered a decision, the ARO must adjust their financial records as needed within five

calendar days or the end of the quarter, whichever comes first.

5.6.2.5. If intragovernmental differences result from contractual disputes, then the

trading partners have 60 calendar days from the date that the difference is identified or the date

that a charge is disputed, whichever comes first, to agree on the contractual terms. If agreement

cannot be reached, then both trading partners’ CFOs must request that a binding decision be

rendered by the CFOs Council’s Committee established for this purpose. The Committee must

render a decision within 90 calendar days of request. The trading partners will then coordinate to

ensure any necessary IPAC transaction is needed.

5.6.2.5.1. Missing indicative data on an intragovernmental transaction is

cause for a contractual dispute. Examples of indicative data include:

5.6.2.5.1.1. Order number.

5.6.2.5.1.2. Treasury Account Symbol (TAS) for both trading

partners. If multiple TAS are included on one order, specify amounts for each TAS, as appropriate.

5.6.2.5.1.3. Business Event Type Code for both trading partners.

5.6.2.5.1.4. Amount to accrue, advance, or disburse.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 3

* March 2023

3-28

5.6.2.5.1.5. Business Partner Network number for both trading

partners.

5.6.2.5.2. The buyer may establish a monetary threshold before asking for

contractual decisions; the threshold must not exceed $100,000 per order. If an amount is under the

buyer’s threshold, and the buyer elects not to pursue a dispute, then the buyer must pay the amount.

5.6.3. NAFI Billing, Collection and Dispute Processes. DoDI 1015.15, “Establishment,

Management, and Control of Nonappropriated Fund Instrumentalities and Financial Management

of Supporting Resources,” requires certain categories of NAFIs to reimburse appropriated funds

(APF) for the provision of goods and services to the NAFI.

5.6.3.1. Reimbursement Agreements. The applicable APF office will prepare a

reimbursement agreement with the NAFI. This could be in the form of a Memorandum of

Understanding or Inter-Service Support Agreement. The agreement must be signed by the

authorized representatives from APF and NAFI. At a minimum, this agreement must have:

5.6.3.1.1. Fixed price for goods and services or methodology for

determining price, e.g., utilities, or both. The agreement can be for a specific sale or for a specified

period of time.

5.6.3.1.2. Bill due date will be 30 days from date of the bill.

5.6.3.2. Due Process. If bill is not paid by due date, a demand letter will be sent to

the NAFI. The NAFI has 30 days from the date of the demand letter to provide payment or provide

reasons for non-payment. The validity of the dispute will be determined by the APF representative.

If dispute is valid, the APF representative will immediately resolve. If dispute is determined not