Version-April2024

Annexures

Annexure -A

Declaration from entity, which does not have any existing bank account

(To be obtained on the letterhead of the client)

Date:

To,

The Branch Manager

HDFC Bank Limited,

Dear Sir,

We confirm that we do not have any bank accounts or any other banking relationship with any other Bank as on the date of this

declaration, and the proposed relationship with HDFC Bank would be the first banking relationship.

We understand that the bank reserves the right to block or close our account in the event the contents of the above declaration are

noticed to be factually incorrect.

For, __________ (Name of Entity)

(Name, Signature/s and Designation/s of Proprietor / All the Partners / All Designated Partners / Karta/ Authorised Signatory for

companies)

Version-April2024

Annexure B: Declaration by Company for non-availability of form 32 / DIR 12

(To be obtained on the letterhead of the client)

To,

The Branch Manager

HDFC Bank Limited,

(Branch Address)

Kind Attn: _____________

Dear Sir,

We, _______________, a company, registered under _______________ and having its registered office at _________________

(Complete office address) (hereinafter “the Company”) do hereby declare and state as under:

As on the date of this Declaration, the following are the directors of the Company:

1. ___________ 2. _______________

The Company hereby confirms that all the requisite legal formalities for appointment of the abovementioned Directors have been

complied with including filing of Form 32 / DIR 12 with the Office of Registrar of Companies.

The Company hereby confirms that the Company has applied to HDFC Bank for opening a current account (hereinafter referred to

as “Account”) and the Company has to submit various documents to HDFC Bank with respect to the application for the account. The

Company hereby states that the Company is unable to furnish to HDFC Bank a copy of Form 32 / DIR 12 filed with the Office of

Registrar of Companies with respect to the appointment / resignation of following persons on account of the same having been

misplaced / ___________________________

Shri / Smt __________________________

Shri / Smt __________________________

The bank may validate the aforesaid details through the official website of the registrar of companies. We understand that the bank

reserves the right to block or close our account in the event the contents of the above declaration are noticed to be factually

incorrect through the bank's independent validation.

Signed and Delivered by

1. ___________________________________Name, Designation & signature

For

2. ____________________________________Name, Designation & Signature

For

Place: Date:

Version-April2024

Annexure C

Declaration from customer operating out of premises of Group Company

(To be obtained on the letterhead of the client)

To,

The Branch Manager

HDFC Bank Limited

________________ (Branch Name & City)

Dear Sir/Madam,

Re: Non availability of Communication Address proof for opening the current account

With reference to our application _________________for opening a current account in the name and style of

____________________________________with your branch, I/we declare that:

❑ We are operating from the premises of __________________________at _______________________ since ___________.

For, ___________________________ (Name of Entity)

Name & Signature of Authorized Signatory

Date: ___________________

Place: ___________________

Version-April2024

Annexure -D

Declaration from Group Company

1

/ Owner for letting out premises for business

To,

The Branch Manager

HDFC Bank Limited

________________ (Branch Name & City)

Dear Sir/Madam,

Re: Business Address proof for the current account

With reference to application by M/s ___________________________ for opening a current account with your branch, I/we declare

that the said entity is operating from our / my premises at ____________________ since _____________.

We declare that the premises located at that particular address is let out for carrying out business activity in the said entity / person’s

name and we have no objection to the said entity carrying out business from our premises at this address.

For, ___________________________ (Name of Owner Entity)

Name & Signature of Director / partner / proprietor (of owner entity) / Landlord

Date: ___________________

Place: ___________________

1

Declaration from the Group Company is to be obtained on the letterhead of the Group Company.

Version-April2024

Annexure -E

Declaration for not providing 2

nd

Entity proof – Sole Proprietorship

(To be obtained on the letterhead of the client)

Date:

To,

The Branch Manager

HDFC Bank Limited,

(Branch Address)

Dear Sir,

Sub: Opening of Sole Proprietorship A/c

I Mr / Ms ___________________________________, Proprietor of the above-mentioned Firm hereby confirm that I do not have

the 2nd entity proof documents as per the RBI guidelines to open Sole Proprietorship account.

Under such circumstances, I request you to kindly open the account of my Firm, basis the following details:

Reason for not having the 2

nd

Entity proof :____________________________________

I confirm that all the details mentioned above are correct.

For,

(Name, Signature of Proprietor with Firm Stamp)

BDA / Branch Manager Approval:

_______________________________________________________________

Name and Signature of the Branch Manager with Employee Code

Date __________________________

Version-April2024

Annexure – G

Format of the certificate from CA / Cost Accountant (On the Letter head of Chartered / Cost Accountant)

Dear Branch Manager

_____________ Branch

Certificate

I, the Undersigned, am a qualified Chartered / Cost Accountant and hold a Certificate of Practice from the Institute of Chartered

Accountants of India/Institute of Cost Accountants of India and my membership no is ……………………….

I hereby certify the existence of M/S ………………………………………………………………... carrying on business from

…………………………………………………………………........................................ (address) and confirm that Mr/ Ms

………………………………………….……….................., is a sole proprietor of the said firm and his/her PAN is ………………………………….

The said firm / individual is my Client and is in the business of ………………………………………………

I am aware that the Bank is relying on this certificate as a valid proof of existence of the firm and as part of the bank’s due diligence

process for establishing the identity and existence of the firm as per the obligation laid down and as per the guidelines / regulations

issued by various Statutory / regulatory bodies on Know Your Customer and Prevention of Money Laundering and Terrorist

Financing.

…………………………………..

Chartered / Cost Accountant along with Stamp and Date

Date……………………………...

Membership No …………….....

Version-April2024

Annexure - H

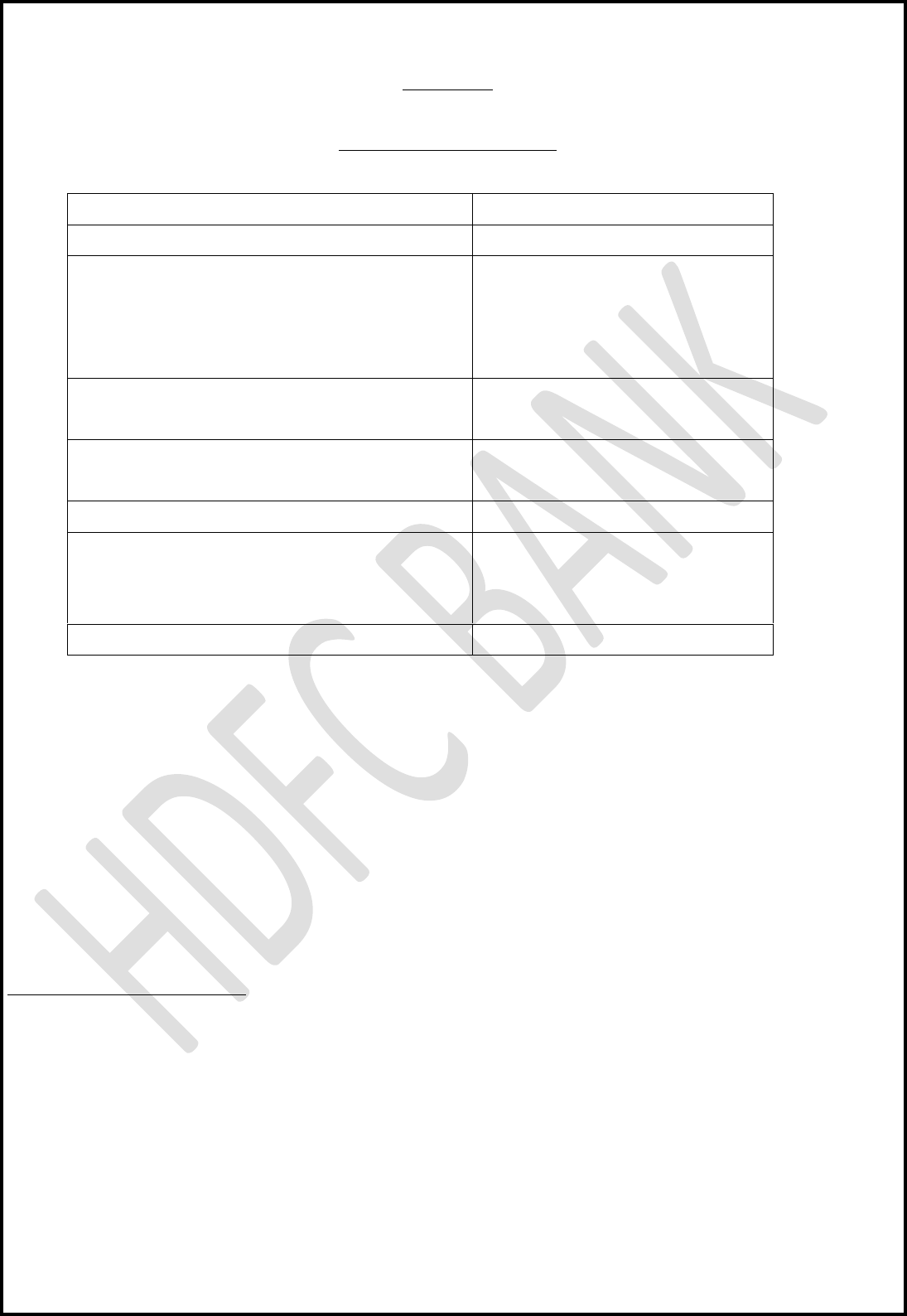

Approval / License requirement

Nature of Entity

Copy of Approval / License Issued By

NBFC (Non-banking Finance company)

Reserve Bank of India

a. Stock Broking Firm,

b. Merchant Banking Companies,

c. Venture Capital Companies

d. Sub Broker

Securities & Exchange Board of India

Insurance Companies / Companies doing business for

insurance repository

Insurance Regulatory & Development

Authority

Companies that run Collective Investment Schemes and

Mutual Funds

Securities & Exchange Board of India

Housing Finance Companies

National Housing Bank

a. Full Fledged Money changers (FFMC) 1

b. Restricted Money Changer (In case business was

started prior to July’10)

12

Reserve Bank of India

Finance (other than company): Money Lending

Central / State Government

1

In case the entity opening the account is carrying out business as a franchisee on behalf of a FFMC, following additional documents would be required:

(i) Copy of Franchisee Agreement

(ii) Letter from the FFMC (Franchisor) indicating he has appointed him as a franchisee.

(iii) Franchisor declaration given to RBI about franchisee.

(iv) RBI License in the name of FFMC

Note: The Reserve Bank has since discontinued the Scheme of Restricted Money Changers (RMCs). However, certain RMCs functioning within 10 kms

from the borders of Pakistan and Bangladesh have been specifically permitted by the Reserve Bank for the time being to continue their operations.

RMCs and franchisees of AD Category –I Banks / ADs Category – II / FFMCs functioning within 10 kms from the borders of Pakistan and Bangladesh

may also sell the currency of the bordering country, with the prior approval of the Regional offices concerned of the Reserve Bank. Other franchises of

AD Category –I Banks / ADs Category – II / FFMCs cannot sell foreign currency.

Version-April2024

Annexure I - BENEFICIAL OWNER DECLARATION

FOR Company/Partnership/LLP/AOP/BOI/Trust/Societies

(To be obtained on the letterhead of the Entity)

Please fill the Form in BLOCK LETTERS ONLY. All fields marked "*" are MANDATORY.

Please ensure that all mandatory fields have been filled correctly, as per instructions given on last page.

*Date of declaration: __/__/____ (DD/MM/YYYY)

*Entity type: Company LLP Partnership Trust

AOP (Association of Person) BOI (Body of Individuals)/Society

Whether Company is listed* No Yes.

If yes, Name of Stock Exchange: _____________________________________________________________

Country of Stock exchange (if other than India): ___________________________________________________

(Section I, II and III not to be filled)

Entity Name: ______________________________________________________________________________

Section I: We declare that no individual person holds Controlling ownership/Control** in the captioned

Company/Firm/LLP/AOP/BOI/Society above the RBI prescribed threshold limit. Below are the details of Natural Person who holds the

position of Senior Managing Official

1

Name of Senior Managing

Official*

Please paste

photograph of

Individual Beneficial

Owner here

Date of Birth*

Designation*

PAN *

Address*

2

Name of Senior Managing

Official*

Please paste

photograph of

Individual Beneficial

Owner here

Date of Birth*

Designation*

PAN*

Address*

Version-April2024

Section II: I/We the undersigned hereby declare the below details of beneficial owners holding Controlling ownership** in the

captioned Company/LLP/Firm/AOP/BOI /Trust/Society as per the RBI prescribed threshold limit

Whether Company (for which form is submitted) is Subsidiary of listed Company

(details of Listed entity to be mentioned in table below)

If yes, Name of Stock Exchange: ____________________________________________________________

Country of Stock exchange (if other than India): ___________________________________________________

(For Trusts: Pls provide details of Author/Settlor/Grantor/Protector (if any) and all trustees and beneficiaries with 10 % or more

beneficial interest in the Trust and any other natural person exercising ultimate effective control over the trust through a chain of

control or ownership.)

1

Name of Beneficiary/ Shareholder / Partner/

Author/Settlor/Grantor/ Protector (if any)/

Trustee/ any other controlling person*

Please paste

photograph of

Individual Beneficial

Owner here

Date of Birth /Date of Incorporation*

Beneficial Owner Type*:

(Mention if trustee,

beneficiary / author/ settlor/ grantor/

Protector (if any) or Designation In case of

Companies)

Individual- PAN No

Non Individual- PAN /CIN Number*

Address *

% of Ownership/Capital /Profits *

(If Author/Settlor/ Grantor/Protector (if any)/Trustee in a

Trust, then please mention 0%)

2

Name of Beneficiary/ Shareholder / Partner/

Author/Settlor/Grantor/Trustee/Protector (if

any)/ any other controlling person *

Please paste

photograph of

Individual Beneficial

Owner here

Date of Birth /Date of Incorporation*

Beneficial Owner Type:

(Mention if trustee,

beneficiary / author/ settlor/ grantor

/Protector (if any) or Designation In case of

Companies)*

Individual- PAN

Non Individual- PAN /CIN Number*

Address *

% of Ownership/Capital /Profits *

(If Author/Settlor/Grantor/Protector (if any)/Trustee in a

Trust, then please mention 0%)

Version-April2024

Section III: Applicable only if there is/are non-individual Beneficial owner(s) holding Controlling** ownership/

Control as declared in Sec II.

The following individual person(s), directly or indirectly, holds Controlling** ownership/ Control in the above captioned

Company/Firm/LLP/AOP/BOI/Trust/Society.

1

Name of Beneficiary/ Shareholder / Partner/

Author/Settlor/Grantor/Trustee/ Protector

(if any) *

Please paste

photograph of

Individual Beneficial

Owner here

Date of Birth*

Beneficial Owner Type:

(Mention if trustee,

beneficiary / author/ settlor/ grantor

Protector (if any) or Designation In case of

Companies)*

PAN*

Address *

% of Ownership/Capital /Profits *

(If Author/Settlor/ Grantor/Protector (if any) /Trustee in a

Trust, then please mention 0%)

2

Name of Beneficiary/ Shareholder / Partner/

Author/Settlor/Grantor/ Protector (if any)

Trustee*

Please paste

photograph of

Individual Beneficial

Owner here

Date of Birth*

Beneficial Owner Type:

(Mention if trustee,

beneficiary / author/ settlor/ grantor

Protector (if any) or Designation In case of

Companies)*

PAN*

Address *

% of Ownership/Capital /Profits *

(If Author/Settlor/ Grantor/Protector (if any)/Trustee in a

Trust, then please mention 0%)

__________________________________________________

(Signatures & seal as per Mode of operation)

Version-April2024

*Important Points to Note:

• Pan Number to be provided for Resident.

• If minor, then valid age proof to be provided.

• In case of Foreign National/NRI, copy of Passport to be additionally provided.

• Copy of Officially Valid Document as per prevailing KYC Circular as applicable to Individuals i.e. ID & Address

proof along with Latest Colour Photograph of beneficial owner / Senior Managing Official to be submitted.

• CIN No. to be mentioned for Companies registered under ROC. For other non-individual entities Pan No to be

mentioned.

• Address mentioned should be of Residence for Individuals and Registered Office for Non-Individuals entity.

• Date of Incorporation should be the date when entity was registered/formed.

• In case of listed Companies, no further details of beneficial owners to be obtained.

** RBI guidelines for identification of Beneficial owners

(a) Company: More than 10 % of shares or capital or profits of the company. Control shall include the right to

appoint majority of the directors or to control the management or policy decisions including by virtue of their

shareholding or management rights or shareholders agreements or voting agreements.

(b) Partnership firm/LLP: having ownership of/entitlement to more than 10 % of capital or profits of the

partnership or who exercises control through other means. “Control” shall include the right to control the

management or policy decision.

(C) BOI/Association of person/Society # : Ownership of/ entitlement to more than 15% of the property or capital

or profits.

(d ) Registered / Unregistered Trust: Author/ Settlor / Grantor/Protector (if any) and All trustees and beneficiaries

With 10% or more interest in the trust and any other natural person exercising ultimate effective control over the

trust through a chain of control or ownership

Where no natural person is identified under (a) or (b) or (C) the identity of the relevant natural person who holds

the position of senior managing official to be captured as Beneficial Owner.

# Body of Individuals: BOI includes Societies

Version-April2024

Annexure K

Declaration cum Undertaking for TDS Exemption

Date:

To,

HDFC Bank,

_____ Branch,

Mumbai - _____

Dear Sir / Madam,

I/We _______________________, having PAN ___________, Principal Officer of __________________ (‘the entity’) confirm and

undertake that: -

1. ______ is the entity formed under ________ Act.

2. The income of the said entity is unconditionally exempt under Section _____ of the Income-tax Act, 1961 and the said

entity is statutorily not required to file return of income as per Section 139 of the Income-tax Act, 1961.

3. Further, the PAN of the said entity is ___________.

Or

3. Further, as per updated provisions of Section 139A of the Income-tax Act, 1961, the said entity is not required to obtain

PAN from the Assessing Officer of the Income-tax Department. Hence, the entity does not have PAN and for that Form 60 is

enclosed.

(Kindly provide the details as mentioned in sr. no. 3 above, as the case may be).

4. I/We hereby enclose herewith documents in support of what is stated above.

5. I /We request you to accept the application form for opening of the bank account with your bank.

6. I/We request you to not deduct tax at source from the payment or credit of income by the Bank to the said entity, as being

mentioned in Circular 18/2017 issued by CBDT. Further, the said Circular is attached herewith highlighting the entry in which

the said entity is covered.

Version-April2024

7. I/We also undertake to keep the Bank informed from time to time about the changes in the facts provided above. However,

in case, if it is not provided by me/us for whatsoever reason and Bank manages on its own to incorporate such changes, I/We

will accept the changes accordingly.

8. I/We agree to indemnify and keep HDFC Bank saved and harmless against any claims, loss; damages made or suffered on

account of any misstatement / change of facts / errors of omission or commission by me/us. If the Bank is required to pay the

said tax or any interest / penalty, I/We agree to reimburse the same and the liability in this regard will be borne by me.

For _________

Principal Officer of ________

(________)

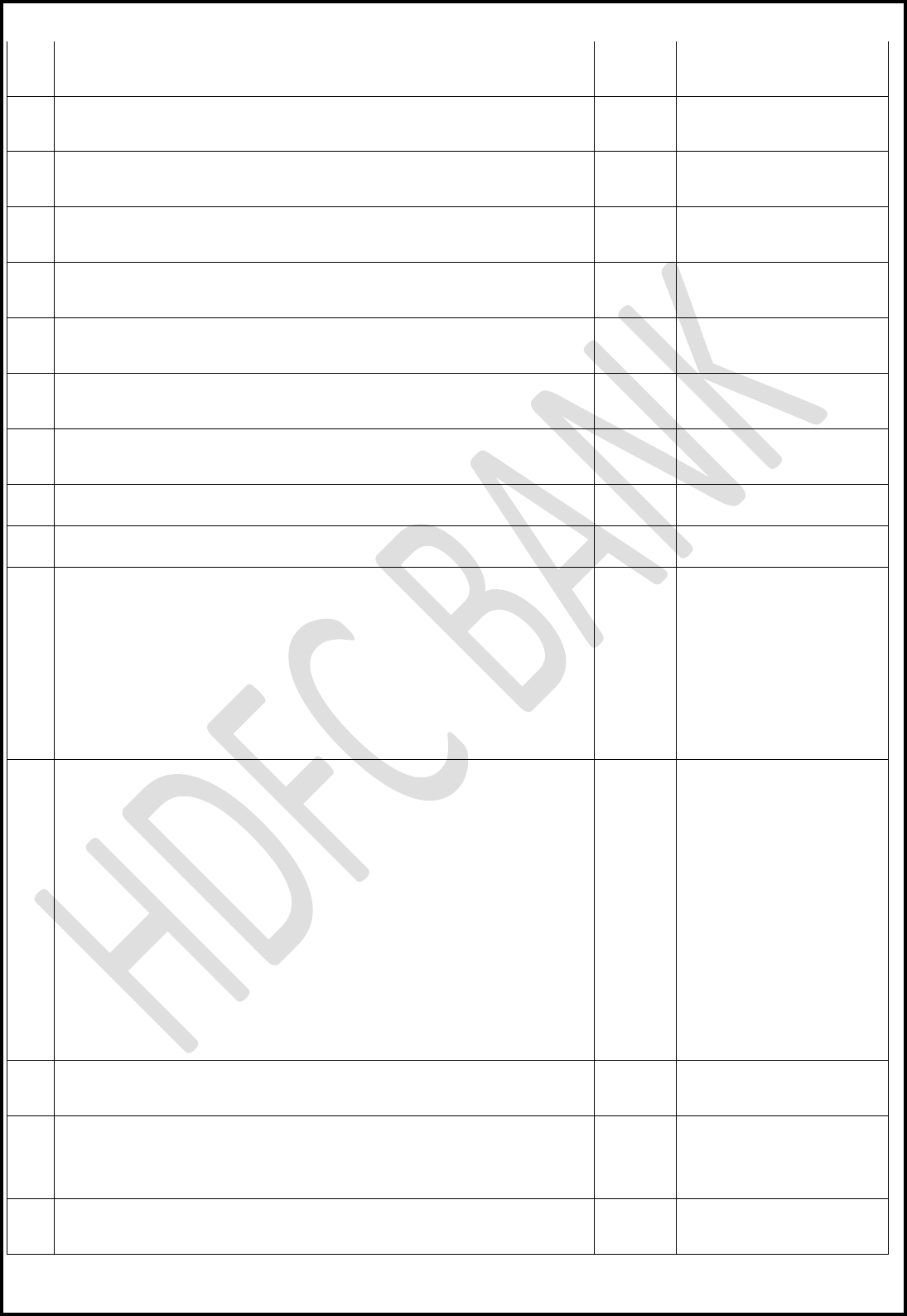

Version-April2024

Date :- _____________________ .

Entity Name :-

_________________________________________________________________________________________________

Sr No

Type of Certification

Tick against the relevant

checks

Mandatory /

Conditional

Mandatory

1

All Original documents seen and verified

Mandatory

2

Customer signed in my presence on all supporting documents

Mandatory

3.

Non DBT consent for Authorized Signatories

Mandatory

Signature ________________________________;

Date_____________________________________;

Name of Sourcing staff ______________________________________________________________

EMP Code : _____________, Branch Name _______________________, Branch Code ___________

Section 2: Certification by Branch Manager/ BDA :

Sr

No

Type of Certification

Tick

relevant

checks

Mandatory /

Conditional

1

Blacklisted MLM match carried out - Negative match

Mandatory

2

Banned Dedupe Check carried out

Mandatory

3

Customer Contactibility done on provided phone no

Mandatory

4

All PAN have been verified from site

Mandatory

5

Account Opening Documents have been verified from KYC Utility

Mandatory

6

Annexure N conducted Any bank Staff including BSO/ CSO and approved by Branch

Manager / BOM / PBA.

Mandatory

7

FATCA / CRS Annexure signed by BDA

Mandatory

8

UCIC Check done.

Mandatory

9

Below Online KYC Documents (not carrying physical stamp and sign of issuing authority) Verified from Site

GST

Mandatory where document is

obtained

Annexure – M – Branch Certification

Version-April2024

Shop Licence

Mandatory where document is

obtained

FSSAI Licence

Mandatory where document is

obtained

ICAI / ICSI Certificate

Mandatory where document is

obtained

Municipal Licence

Mandatory where document is

obtained

Trade Licence

Mandatory where document is

obtained

IEC Certificate

Mandatory where document is

obtained

Labour Licence

Mandatory where document is

obtained

MCA Site verification done / eMOA and eAOA verified from MCA site

Mandatory where document is

obtained

Any Other ______________________________ ( Please specify name )

Mandatory if applicable

10

Signatures Verified from System for Existing Customer

Mandatory if applicable

11

For name mismatch in KYC document v/s AOF

I have made necessary enquiries on the discrepancy observed ‘The name on the

identity / address document VS the name on the AOF’. I confirm that the individual

signing the account opening form and the individual appearing on the identity / address

document are the same individuals.

Mandatory if applicable

12

Approvals provided with form

(a) Initial IP issued through saving account Branch Manager Approval with Annexure A

or Bank statement.

(b) NIL IP (BM in D1 and above approval with Annexure A or Bank statement).

(c) Single existence proof provided for proprietorship firm (BM / CH approval with

Annexure E).

(d) CH approval for third party deed purchase, along with declaration signed by all the

partners.

(e) CH approval to override the banking clause in partnership deed.

(f) CH approval for annexure J

(h) In case of HUF, CH approval for NIL IP/ IP from Savings account

Mandatory if applicable

13

If the constitution is not mentioned on the IP cheque, confirm type of entity for

proprietorship / Partnership.

Mandatory if applicable

14

Where photograph is not clear on KYC document.

Recent Photograph needs to be affixed on the copy of KYC document and customer has

to sign across the photograph. Identity of the customer is confirmed.

Mandatory if applicable

15

Net Banking, Debit Card request received with non-individual accounts has been signed

by BDA

Mandatory if applicable

Version-April2024

16

Additional checks conducted prior to account opening of NBFCs / Chit Funds / Nidhi

Companies / Mutual Benefit Companies.

Mandatory if applicable

16A

In case the customer is an entity regulated by specific regulators Approval / license

from regulatory authority /body / Central Govt / State Govt – (Refer Annexure H).

Mandatory

16B

If RBI Licence is not submitted, check for nature of business on AOF / MOA - Alternate

business proof required.

Mandatory

17

BM / BDA Confirmation for handwritten execution date in partnership deed

BM/BDA to sight original deed and annotate mention - original documents carries the

same date/content and the handwritten part is duly authenticated by all the partners

by placing their counter signatures.

Mandatory if applicable

18

BM Confirmation required for High Annual Turnover basis Constitution.

Mandatory if applicable

19

Other Exceptions/ Certifications / Remarks to be certified by BDA (If any)

1…………………………………………………….

2…………………………………………………….

3…………………………………………………….

Mandatory if applicable

20

Approvals provided for opening of Multiple accounts

(i) Cluster Head- upto 5 accounts

(ii) Circle/ Zonal Head- for more than 5 accounts

Mandatory if applicable

Signature ________________________________;

Date_____________________________________;

Name of BM / BDA ______________________________________________________________

EMP Code : _____________, Branch Name _______________________, Branch Code ___________

Version-April2024

Annexure Q

Documents for establishing proof of existence for Sole proprietorship firms:

Category A:

a. License / registration certificate issued, in the name of the entity, by / under:

i) Municipal authorities such as Shop & Establishment certificate / Trade License,

ii) Registering authority in the name of practicing firm like Certificate of Practice issued by Institute of Chartered

Accountants of India, Institute of Cost Accountants of India and Institute of Company Secretaries of India,

iii) Indian Medical Council,

iv) Food and Drug Control Authorities,

v) IRDA (Insurance Regulatory and Development Authority),

vi) State / Central government authority,

vii) any specific Statute / Act of the government,

viii) Professional Tax / Goods and Service Tax (GST, Branch to verify active status and customer’s name from site

and attach print out along with certification)

ix) VAT / CST certificate, only in case customer is dealing in petroleum crude, high speed diesel, motor spirit

(commonly known as petrol), natural gas and aviation turbine fuel,

x) Factory registration certificate issued by any state / central government authority,

xi) RBI/SEBI,

xii) PF Commissioner - Registration certificate of recognized Provident Fund,

xiii) District Industries Center for firm registered as SSI/Micro/Medium Unit (EM Part II Acknowledgement),

xiv) Contract Labour (Regular & Abolition) Act 1970,

xv) Police department under the provisions of State Police Acts,

xvi) Director General of foreign Trade (IEC Certificate),

xvii) Weights & Measures Act, 1976 (Inspection / Verification certificate,

xviii) License to sell stock or exhibit for Sale or distribute Insecticides, under the Insecticides Rules, issued by

respective state /union government department.

b. Receipt of Intimation (Form ‘G’) issued in Maharashtra for shops and establishment in lieu of shop and establishment

certificate (for establishments having less than 10 employees)

c. Form B (Intimation Receipt) issued as per The Punjab Shops and Commercial Establishments Act can be accepted as

CAT-A Document. Alternate CAT A/ CAT B proof is mandatory which confirms constitution of entity as Proprietorship.

(Except Annexure- E and CA Letter/Certificate).

d. Receipt of Intimation (Form E) issued in Gujarat in lieu of shop and establishment certificate can be accepted as a CAT-

A Document

e. Permission Issued by respective government authority for units in SEZ (Special Economic Zone), STP (Software

Technology Park), EOU (Export Oriented Unit), EHTP (Electronic Hardware Technology Park), DTA (Domestic Tariff Area)

and EPZ (Export Processing Zone) in the name of the entity mentioning the address allotted,

Version-April2024

f. Letter/ Certificate/ NOC / permission issued by village Administrative Officer / Talati / Panchayat Head / Mukhiya /

Village Developmental officer / Block development officer or Equal Rank officer for customers in rural / village areas

and President/CEO (if document issued by Nagar Parishad/Zilla Parishad) stating the details of existence of the firm,

g. Latest & complete Income Tax Return in name of sole proprietor where firm’s income is reflected (duly authenticated

/ acknowledged by Income Tax Authorities) provided IP is through a cheque from firm’s existing account,

h. Utility bills such as electricity, water, and landline telephone bills (not be older than 3 months), in the name of the

proprietary concern provided 2

nd

document is not a CA certificate.

i. UDYAM Aadhaar Registration Certificate (only for sole prop) subject to

a. If UDYAM is submitted as only document with Annexure E to open an account, turnover of entity should be

less than 20 lakhs.

b. Document is verified through online and all details are matching and BDA to stamp and confirm that document

is verified online.

c. Mailing address to be updated as Official Address mentioned on certificate.

d. In case mailing address is different, document as per extant process to be provided.

e. Date of Incorporation is as updated on document (in case DOI is different declaration will not be acceptable

and 2nd document from CATA/ B having correct DOI to be provided).

f. We may accept URC as an existence or address proof for the units as mentioned in the certificate subject to

the online verification of same through issuing authority.

Category B:

i. Latest Professional Tax / GST Returns filed in name of firm, duly acknowledged. Profession Tax/GST Returns cannot not

be accepted along with registration certificate under respective acts e.g. Professional Tax/GST Return cannot be

accepted with Professional Tax /GST Registration Certificate),

ii. TAN Allotment Letter, in name of firm / proprietor (subject to firm’s name appearing in address) or TAN registration

details (available online),

iii. Income Tax / Wealth Tax Assessment order,

iv. 1 month bank statement not older than 3 months, in the name of firm with satisfactory operations subject to obtaining

IP cheque from the same account provided this account is maintained with a Nationalized / private / foreign bank /

Small Finance Bank or Regional Rural / Cooperative Banks (for customers in rural / village areas). This document cannot

be accompanied with ITR as Category A document. Latest property tax receipt in the name of firm issued by local

government authorities. In case, Stamp/sign of issuing Bank is not available, statement can be accepted if downloaded

in front of bank staff and annotation from respective branch staff “Statement verified by me”.

v. Certificate issued by a Chartered / Cost Accountant (as per Annexure – G) confirming existence of the firm, containing

name and address of firm along with name of the proprietor. The name of Chartered / Cost Accountant to be validated

from chartered / cost accountants’ directory. In case Certificate has been issued by Chartered Accountant, certificate

to contain UDIN number which needs to be verified by the Branch in ICAI website and attach printout of verification

carried out.

vi. Landline telephone bill, in the name of proprietor (with the word "Prop" mentioned on it) and name of firm appearing

in address,

Version-April2024

Important

1) Online printout of registration certificates / details can be accepted provided the same is verified online from relevant

website and authenticated by BDA along with signature & stamp,

2) Online registration certificates issued with a disclaimer such as, “The certificate is based on the information provided

by the occupier/employer and has not been verified” or a similar such disclaimer, can be accepted along with any other

Cat B document other than CA certificate,

3) In case of acceptance of online MeeSeva Certificate (issued in the state of Andhra Pradesh/Telangana), branch

verification through the website is mandatory.

4) Online print out of labour licence (issued in Delhi for shops and establishment) cannot be accepted as a valid proof of

existence.

Version-April2024

Undertaking for opening a Current/CC/OD Account in HDFC Bank Ltd.

To, Date: ___________________

The Branch Manager

HDFC Bank Limited, (_____________________________ Branch)

………………………………………………………………………………. …………………………………………………………(name of Individual/ Entity) with PAN ………………………….

request HDFC Bank limited to open a Current Account / Collection Account / Cash Credit (CC) Account / Overdraft (OD) Account / Escrow Account.

This is to certify that I/ we has/have;

Sr

No.

Scenarios

HDFC

Bank is

lender

HDFC

Bank has

CC / OD

Other Bank

- CC / OD

Account opening to be processed or denied

1

a) No Exposure In banking system

b) Total Banking exposure is below Rs. 5 Crores (Including / Excluding

CC / OD)

c) Exposure is ONLY with HDFC Bank Ltd. (Including / Excluding CC /

OD) (Sole Lender)

Account to be opened

2

Total Banking exposure is

Rs. 5 Crore or more and

having CC/OD account in

banking system

Yes

Yes

Yes

A) Exposure with HDFC Bank > = 10% of the aggregate exposure-

Account to be opened as per below criteria.

I/We would like to appoint HDFC Bank as designated bank to

open & maintain Current/CC/OD Account

B) Exposure with HDFC Bank < 10% of the aggregate exposure

I/We would like to open Collection Account only

Yes

No

Yes

ONLY Collection account to be opened

No

No

Yes

Note: Neither Collection nor Current account to be opened in

such scenario

3

Total Banking exposure is

Rs. 5 Crores or more but less

than Rs. 50 Cr & No CC/OD

in Banking system

Yes

No

No

Current Account to be opened

No

No

No

Only Collection account can be opened.

4

Total Banking exposure is

Rs.50 Crores or more & No

CC/OD in Banking System

Yes

No

No

I/We would like to appoint HDFC Bank as escrow managing

bank to open current account

I I/We would like to open Collection Account with HDFC Bank as

we have already appointed other lending bank as Escrow

Managing Bank.

No

No

No

Note: Neither Collection nor Current account to be opened in

such scenario

*Please fill up bank details where cash credit/ Overdraft (OD) facility is availed where overall exposure is 5 Crores or more

No.

Bank Name and Branch

Type of facility

Amount (Rs. Lacs)

1

2

Further, I/we undertake to inform the following to the Bank:

• I/We confirm that the details provided are true and correct as per my knowledge and that HDFC Bank reserve rights to reject the account

opening application in case of any discrepancies.

• We further confirm that as and when there is any change in bank exposure, I/We will inform the same to HDFC Bank. Accordingly, HDFC Bank

may take requisite action in compliance with the RBI guideline for Current Accounts by Banks - Need for Discipline

• I/We understand that the bank reserves the right to block or close our account without further notice in the event of the above information

shared subsequently found to be factually incorrect/untrue through the bank’s independent validation procedures.

• I/We hereby voluntarily give my/our consent to extract the information available in Credit Information Companies (CICs), National E-

Governance Services Ltd (NeSL) etc. to compute my/our aggregate exposure for the purpose of opening of CA/OD/CC as per RBI Guidelines.

Thanking you,

Yours faithfully, (Signature of the Individual/Karta/Authorized Signatory/Director/Proprietor/Partner/Trustee)

# “Exposure” for the purpose of these instructions shall mean sum of sanctioned fund based and non-fund-based credit facilities availed by the borrower.

# “Banking System” for the purpose of these instructions, shall include Scheduled Commercial Banks and Payments Banks only.

Version-April2024

CIBIL

Annexure 1 - 2

nd

declaration to be provided by the customer:

Date:

To,

The Branch Manager

HDFC Bank Limited,

(_____________________________ Branch)

Dear Sir,

This has reference to my application for opening Current Account with your bank.

Entity Name ___________________________________ Entity PAN __________________________________

It is observed that the below details are visible in the CIBIL Report: (Tick as applicable)

I/We hereby confirm that the below mentioned credit facilities are closed by me/us. I / we confirm to write to the lending bank

to get the above records removed from CIBIL Database.

I/We hereby confirm that the below mentioned credit facilities does NOT pertain to me / us.

I/We understand that the bank reserves the right to block or close our account in the event the contents of the above undertaking

is noticed to be factually incorrect through the bank’s independent validation procedures.

Thanking you,

Yours faithfully,

Signature with Stamp

(Signature of the Individual/Karta/Authorised Signatory/Director/Proprietor/Partner/Trustee)

No.

Type of facility

Amount (Rs. Lacs)

Bank Name

Closure Date

1

2

3

No.

Type of facility

Amount (Rs. Lacs)

1

2

3

Version-April2024

CIBIL

Annexure 2

<to be provided on company letter head with company stamp & signature of Individual/Karta/Authorized

Signatory/Director/Proprietor/Partner/Trustee) >

To,

The Manager

CIBIL TransUnion

Mumbai

Subject: Credit Information Report details

I undersigned M/s ___________________________________authorize Hdfc Bank Ltd to seek the following details from CIBIL on

the account/s reflecting in my CIBIL report on my behalf.

Personal Details of the Consumer:

Full Name:

Full Address with Pincode:

PAN Number :

Mobile / Telephone number:

Email ID:

ID Proof Type (Voter’s ID / Passport / Driver’s license/Ration Card/UID ):

ID Proof no:

Account Identifiers:

Name:

Signature:

Date: