Voltlme

u,

No.

2

The Newsletter

of

the Teachers’ Retirement Sgstem

of

Ok[aboma

Mas

2002

Retirement Plans:

Defined Benefit

vs.

Defined Contribution

Two measures prefiled before the

2002

Legislative Session began would

have made substantial changes in the

retirement program for future members.

The proposed legislation would have

created defined contribution plans for

teachers and state employees hired after

the plans were authorized and

implemented. The bills as drafted would

not have changed the retirement plan for

current members.

Neither bill was heard by the

committees assigned to examine

retirement measures.

Legislative leaders and the Office of

State Finance have agreed to fund a study

to determine the impact the proposed

changes would have on current retirement

plans and whether the new program would

better serve

future

employees and the state.

(See

DW

vs

DC

plans,

p.5)

TRS

rule change to impact

post

-

retirement employment

TRS

retirees returning to work for an Oklahoma public school

are

subject to earnings limits if they want to continue receiving their

full retirement benefits while working.

Administrative rule

OAC

71310-17-6

is being changed to

include earnings from certain corporations

in

the post

-

retirement

earnings limits.

If

a member incorporates himself or herself or works

for a corporation that supplies

servics normally provided by a school

employee, the earnings for that employment would count toward the

earnings limit.

The

TRS

Board

of

Trustees has adopted the change. Approval

by the Govemor and the Legislature is pending.

To

continue receiving

a

full

retirement benefit, a member under

age 65 and retired fewer than 36 months who returns to work in an

Oklahoma public school can earn up to

$15,000 or half the average

salary used to compute the member’s retirement benefit, whichever

is less.

A member retired at least 36 months who returns to work as an

active classroom teacher, a counselor

or a librarian in

an

Oklahoma

public school can earn up to

$25,000 and continue receiving his or

her full monthly retirement benefits.

(See

Rule

change,

p.

5)

Enron collapse won’t affect benefits

The Enron bankruptcy will not affect the Teachers’ Retirement

System’s ability to pay retirement benefits or meet other obligations.

The total

TRS loss from the Enron bankruptcy is approximately $2.1

million. While this is a large amount of money, it is less than

5/100th of

1

%

of the TRS portfolio of almost $6 billion. For every $1

,0o0

of teachers’

money invested, TRS lost 41 cents due to its investment in Enron.

TRS will participate fully

in

class action lawsuits to reclaim

as

much

as possible from this loss.

Wik

Prom

$e

Annual Reprt-2,3

Positiwe Inwestments

-.....-

5

~unaing

Increase

SOU&

-

5

Briefb Speaking

6

Our

New Home

Our

New website

LOO^

2001

~rrmal~~

Aam*Me

2002

egisl la ti on

4

Page

2

Mag

2002

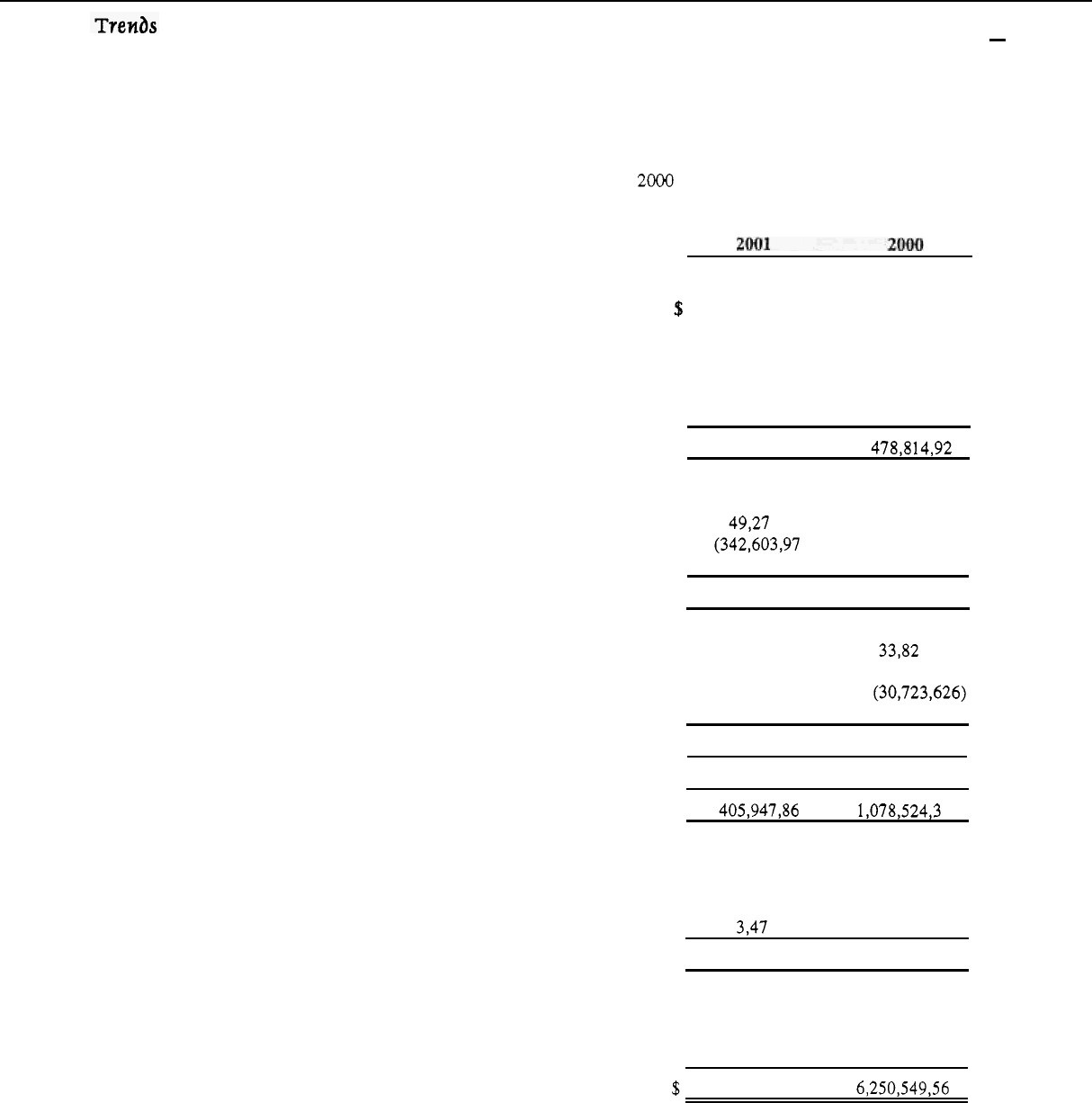

Trenbs

TEACHERS’ RETIREMENT SYSTEM

OF

OKLAHOMA

Statements of Plan Net Assets

June

30,2001

and

2000

Assets

2001

2000

Cash

Short

-

term investments

Accrued interest and dividends receivable

Contributions receivable

Receivable from state of Oklahoma

Due from brokers for securities sold

Security lending institutional daily assets fund

Long

-

term investments:

US

government securities

Corporate bonds

International bonds

Equity securities

Total long

-

term investments

Total assets

Capital assets, net

Liabilities

Benefits in process of payment

Due to brokers for securities purchased

Payable under security lending agreement

Accrued investment fees

Compensated absences

Total liabilities

Net Assets

Invested in capital assets

Net assets held in trust for pension benefits and annuity

benefits (note

6)

of electing members (a schedule of

funding progress is presented on page

45)

Total net assets

$

3,223,790

233,955,161

35,682,725

30,734,990

13,835,266

77,375,928

909,808,650

1,270,263,989

889,924,464

77,067,622

3.590.188.312

5,827,444,387

382.620

7,132,4433 17

30,777,532

338,743,201

33,153,290

24,699,745

12,83 1,212

134,537,732

73 1,866,253

1,121,322,730

607,998,748

3 12,023,596

3.915.168.380

5,956.5 13,454

400,195

7,263,522,6 14

15,976,756 42,137,486

15

1,95538

1

234,935,437

909,808,650 73 1,866,253

4,548,039

3,87 1,882

200,193 161,995

1,082,489,219 1,012,973,053

382,620

400,195

6.049.57 1,678 6,250,149,366

$

6,049,954,298 6,250,549,561

3

-

2002

TEACHERS’ RETIREMENT SYSTEM

OF

OKLAHOMA

Statements of Changes in Plan Net Assets

Years ended June 30,2001 and 2000

Additions:

Contributions:

Members

Members tax

-

shelter

Employer statutory requirement from local

school

districts

Federal matching

Dedicated tax

Total contributions

Investment income:

Interest

Dividends

Net realized and unrealized

(losses)

gains

Less

investment expenses

(Loss)

income from investing activities

Income from securities lending activities:

Securities lending income

Securities lending expenses:

Borrower rebates

Management fees

Income from securities lending activities

Net investment (loss) income

Total additions

Deductions:

Retirement, death, survivor and health benefits

Refund of member contributions and annuity

Administrative expenses

payments

Total deductions

Net (decrease) increase

Net assets:

Beginning

of

year

End of year

!$

216,752,852

5,181,802

195,988,873

7,038,250

172,749,389 130,758,712

14,406,265 12,454,200

140,925,355 132,574,886

550,015,663

478,8 14,92 1

163,139,203 140,911,589

49,27 1,990 52,506,072

(342,603,97 1) 417,582,752

(16,590,368) (13,571,552)

(

146,783,146) 597,428,861

42,929,337

33,82 1,402

(39,306,499)

(30,723.626)

(907,494)

(8

17.240)

2,715,344 2,280,536

(144,067,802) 599,709,397

405,947~36

1

1,078,524,3 18

537,308,002

500,289,049

65,763,326 61,725,419

3,47 1,796 2,964,237

606,543,124 564,978,705

(200,595,263)

5

13,545,613

6,250,549,561 5,737,003,948

!$

6,049,954,298 6,250,54936

1

Mag

2002

2002

TRS

legislation

proposes

changes

The

2002

Legislature

is

considering

a

number

of

measures

affecting

TRS. Here

is

a

summary

House

HB 2124 Retiree Health Insurance Premium Offsets

Increases amount

TRS

pays toward retiree health insurance

premium.

Principal Authors:

Stites, J. T. (H); Morgan, Mike

(S)

HB 2344 Post

-

retirement earnings limits

Allows retirees age

62

or older to earn up to

$30,000

from

public schools and still receive full retirement benefits;

clarifies that corporations or members who work as

independent contractors are subject to same post

-

retirement

earnings limits as other retirees.

Principal Authors:

Staggs, Barbara (H); Crutchfield, Johnnie

c.

(S)

HB 2368 COLA

&

Health Insurance Supplement

Increase

Provides for COLA for

TRS

retirees who retired before July

1,

2001;

increases health insurance supplement paid by

TRS.

Principal Authors:

Turner, Dale

(H);

Shurden, Frank

(S)

HB 2383 Death Benefit Reference

TRS

$5,000

Death Benefit would be deemed life insurance

proceeds for purposes of federal income tax, if approved by

IRS

.

Principal Authors:

Roan, Paul D. (H); Shurden, Frank

(S)

HB 2429

Continues appropriation to TRS for Teacher Retirement

Credit.

Principal Authors:

BOMY, Jack

(H);

Mass, Mike (H); Haney,

Enoch Kelly

(S);

Hobson, Cal

(S)

Funding for Teacher Retirement Credit

m

Trends

Senate

SB 1001

Continues appropriation to TRS for Teachers’ Retirement

Credit.

Principal Authors:

Haney, Enoch Kelly

(S);

Hobson, Cal

(S);

Bonny, Jack

(H);

Mass, Mike

(H)

Funding for Teachers’ Retirement Credit

SB 1231 COLA

Provides for COLA for TRS members retired before July

1,

2001,

and would provide for automatic COLAS in future years.

Principal Authors:

Morgan, Mike

(S);

Stites, J. T.

(H)

SB 1244 TRS Retiree Health Insurance Premium

Supplement

Increases payment by

TRS

for a retiree’s health insurance plan

administered by the State and Education Employees Group

Insurance Program.

Principal Authors:

Morgan, Mike

(S);

Stites, J. T. (H)

SB 1376 Appropriations bill

Increases TRS apportionment from state income and sales taxes.

Principal Authors:

Morgan, Mike

(S);

Stites, J. T.

(H)

SB 1378 Alternate Retirement Plan for Eligible

Employees of Participating State Institutions

of

Higher Education Act

Authorizes higher education Boards of Regents to establish

retirement plans for their employees in which employees would

participate instead

of

participating in the Teachers’ Retirement

System of Oklahoma. Such employees would be ineligible to

participate in TRS.

Principal Authors:

Morgan, Mike

(S);

Ingmire, Terry

(H)

SB 1456 Continued TRS Membership

for

Certain State

Government Employees

Allows TRS members to remain in TRS when employed by

certain state government agencies

Principal Author:

Williams, Penny

(S)

Trenbs

5

-

2002

Investments post

positive returns

TRS investment returns for the

period ending

Dec. 31, 2001, were

8.1% for the 3-month period of

October, November and December.

TRS returns ranked in the top

17%,

compared to 155 other public pension

funds.

TRS returns (and rankings) were

a negative 1.9% (47

"

) for the 1-year

period ending 12/31/01, 4.6%

(28")

for three years, 10.4% (12

"

) for five

years, and 12.7% (17

"

) for the 7-year

period.

At the end of December, 63.4%

of

TRS's investments were in stocks,

35.7% in fixed income and 0.9% in

cash.

The

TRS

portfolio continues to

be well-diversified, and the TRS

Board's asset allocation has produced

above-average returns.

Board Recommends Funding Increase

In

January. the

TRS

Board of Trustees adopted a recommendation

calling for an increase

in

state funding to be phased in over fike years.

Goal

777

asks the state to contribute the same amount statutes require

from employees and local school districts. TRS members contribute

7%

of

pay. Local school district contributions will increase

to

7.0S%

beginning

July

1.

The Board's proposal calls for the state to increase its contribution

from

3.54%

to

5.25%

of sales and income tax collections, or an equivalent

percentage of other state revenues. This increase would result in total state

contributions to be approximately

7%

of

employees' pay.

The Oklahoma Retired Educators Association and the OEA have agreed

to support the TRS plan.

TRS

needs

your

help

...

TRS is still poorly funded compared to other public pension plans.

TRS has only

5

1.4%

of assets needed to cover its future obligations.

Tell your elected representatives you want TRS to be funded

as

rapidly as possible!

Ask them to fund existing liabilities. help local schools fund their

payments to TRS, and provide extra money to cover new benefits

when granted.

Any extra money now will grow and greatly reduce future needs!

@?

G23

DB

V

S

.

DC

plans

...

promp.

1)

Current retirement programs operated by the Teachers' Retirement

System of Oklahoma and the Oklahoma Public Employees Retirement System

are

defined benefit

plans. A defined benefit plan calculates retirement benefits

based upon a formula, which is often a percentage of final average pay,

multiplied by years of service. The TRS formula is 2% times Final Average

Salary times years of service. Benefits are paid as an annuity for a member's

lifetime. The costs of a defined benefit plan are funded through a combination

of employee contributions, employer contributions and investment returns.

In a defined benefit plan, the employer assumes the investment risk, and

must make up any loss in investment earnings.

In a

defined contribution

plan, each member has an individual account

that accumulates employee contributions and/or employer contributions and

investment returns. At retirement, the retirement benefit is determined by

the account balance. Payment options often include lump sums, as well as

annuities, which are limited by the account balance at the time the annuity

is

purchased. In a defined contribution plan, the employee may self-direct all

or part of his or her investment account and assumes the risk of the investment.

Rule change ...

(from

p.

1)

A member age 65 or older

who has been retired fewer than

36

months or who returns to

Oklahoma public school

employment, but is not working

as an active classroom teacher,

a counselor or a librarian, can

earn up to half the average salary

used to compute his or her

retirement benefit.

TRS subtracts $1 from a

member's retirement benefit for

each $1

earned over the limit for

Oklahoma public school

employment.

Mag

2002

Page

6

Trends

Ma3

2002

Teachers'

Retirement Sgstem

Executive Secretarg

T0”g

C.

Beavers

Assistant Executive Secretarg

Sue

d&an

chief Investment Officer

Bif[P&ett

Secretarg

-

Treasurer

Joe

Ezzef[

Trenbs Bbitor

Jacqwehe Scott

Location:

2500

N

.

Lincofn

Bfvb.

okl&oma

citg,

okl&oma

Maifing

Abbress:

okl&m

citg

O

K

73152

http://

W

WtY.stat e.oIWL/.Okt eachers/

1

-

877

-

738

-

6365 [tokfree)

(405)

521

-

1387

P.O.

Box

53514

Trends

is

published

and issued by the Teachers’ Retirement

System

of

Oklahoma as authorized by Executive Secretary

Tommy C. Beavers. 150,ooO

copies

have been printed by the

Department

of

Central

Sewices Central Printing Division at a

cost

of

$14,255. Copies have been deposited with the

Publications Clearinghouse

of

the Oklahoma Department

of

Libraries.

Briefly Speaking.

..

We’ve

Mowed!

TRS

offices are back in the

Oliver

Hodge Education Building, at

the State Capitol Park, 2500

N.

Lincoln Blvd., Oklahoma City.

TRS

is on the

5”

floor.

Our

mailing address is still

TRS,

P.O.

Box

53524, Oklahoma City,

OK

73152.

Our

telephone numbers remain

405

-

521

-

2387 and 1-877

-

738

-

6365

(toll

-

free).

Website getting new

look

Anew look’s coming for the

TRS

website!

The website’s renovation, which

will be complete in June, will make

our site more compact and user-

friendly. Changes will include search

capabilities and a

retirement calculator.

Our website address

is:

www.okteachers.state.ok.us

We hope you’ll visit often for

updates on

TRS

activities.

2001

Annual

Report

available

The

2001

TRS

Annual Report

is now available.

The report contains the System’s financial, actuarial and investment

data

as of June 30,2001.

Copies have been mailed to every school, and single copies

are

available

to

members by written request. You can also read and copy the

Annual

Report

from the

TRS

website,

www.okteachers.state.ok.us.