G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

1

2023 G2 Software

Buyer Behavior

Report

The Value-Driven Buyer

Economic challenges drive businesses to

invest in technology—and expect fast results

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

2

With every year that passes, it’s easy to feel stunned by the disruption in every corner of the

corporate world and dwell on how easy the years prior seem. It’s been over 3 years since the

economic effects of the pandemic set in, weighing on business in every sector and geography.

And this year, governments around the world have taken major steps to curb ination while

businesses deal with the ramications of the economic upheaval.

But software continues to eat the world—unphased. In fact, G2’s latest research shows that

despite the upheaval, most businesses are increasing their software spend.

To help software vendors navigate this turbulence and nd growth on the other side, G2

surveyed over 1,700 global software buyers to understand their plans, behaviors, and attitudes.

Our research uncovered that vendors vying for a piece of that increased spend still face

signicant roadblocks. Notably, businesses facing pressures to show results are urging vendors

to not just tell them how their offerings can drive value but show them—within 6 months. Our

research uncovered 5 insights dening today’s (and tomorrow’s) software buyer and delivers

recommendations for you to move the insights into action.

Security remains an important theme, but 2023 will undoubtedly be remembered as the year AI

stormed onto the scene with the spotlight on large language models and generative AI. Simply

put, organizations are looking at how AI can save costs and support business growth—and

they’re willing to pay for it, as indicated by larger deal sizes.

The G2 team is thrilled to share our analysis to help you win, serve, and retain customers in 2023

and beyond. We hope that as you read, you identify tactics that can inform your own go-to-

market strategies and support future growth.

Chris Voce

Vice President of Market Research at G2

Cautiously optimistic

buyers expect more

value from their

software purchases.

Economic challenges are putting software buyers in a

dicult position: continue investing in tech with lower

budgets and less room for error.

3

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

Table of Contents

Foreword 2

Buyers forecast spending increases in the face of economic uncertainty 4

Sellers face challenges as buyer expectations and scrutiny grow 6

5 factors shaping the buyer over the next 12 months 9

1. Buyers see AI as foundational to their business strategy 10

2. AI will drive legal teams to be increasingly involved in software purchases 12

3. Buyers stick to processes but still succumb to timing pressure 13

4. Value, scalability, and ease are top considerations for software buyers, but priorities shift based on

company size

14

5. Solutions that work together without added complexity are key 15

Recommendations 16

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

4

Buyers forecast spending increases in

the face of economic uncertainty

Businesses are increasing their software spend in the face of broader macroeconomic concerns

as they lean into the competitive advantage of a digital strategy. Despite fears of a tech

spending pullback, G2’s 2023 Buyer Behavior study shows buyers are willing to invest in software

49%

Spending will increase

42%

Spending will remain the same

9%

Spending will decrease

BUYER SPEND OUTLOOK FOR 2023

49% of buyers say spending will increase this year (2023).

Only 9% say it will decrease:

• 77% (overall) say economic uncertainty was a factor in

the change

• 76% of those who say spending will increase say

economic uncertainty was a factor in the change

(compared to 80% of those who say spending will

decrease)

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

5

55%

Spending will increase

Executive

leaders

Percentage of respondents who

predict spending will increase

39%

Spending will remain

the same

Senior-level

employees

6%

Spending will decrease

Entry-mid

level

In 2024, 55% say spending will increase, and only 6% say it

will decrease:

• 76% say economic uncertainty is a factor in the change

• 75% of those who say spending will increase say economic

uncertainty is a factor in the change (compared to 78% of those

who say spending will decrease)

BUYER SPEND OUTLOOK FOR 2024

BUYER SPEND OUTLOOK FOR 2024 BY ROLE

There was little change in buyers’ spending

outlook from last year to this despite the

economic environment.

The outlook for software spend in 2024 is even brighter.

Even pessimistic buyers are optimistic about next year. Of those who

say spending will decrease this year, 39% say it will increase in 2024,

compared to 25% saying it will decrease (37% say it will stay the same

as this year).

Executive leaders (VPs, SVPs, C-suite) are the most optimistic

about spending in 2023 and 2024, outpacing senior-level employees

(managers, directors, high-level individual contributors) and entry and

mid-level employees.

60

58%

2%

7% 7%

38%

43%

55%

51%

50

40

30

20

10

0

Spending will

increase

Spending will

remain the same

Spending will

decrease

40%

6

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

But…sellers face

challenges as buyer

expectations and

scrutiny grow.

• Seek quick returns on their investments. Vendors

are on the hook to show quick value. Of respondents

who anticipate software spending to increase

in 2024, the necessity to realize an ROI within 6

months is the most important consideration during

the purchase process. The urgency to quickly

demonstrate ROI is even greater in APAC as shorter

contract lengths increase the pressure to show value

within 6 months of purchase.

Though businesses will spend more

than ever, sellers will face headwinds

as buyers:

1 year

1 year

1 year

6 months or less

6 months or less

6 months or less

APAC

EMEA

NORTH AMERICA

AVERAGE CONTRACT LENGTH BY REGION

2+ years

2+ years

2+ years

47% 34%

24%

23%

13%

11%

9%

56%

60%

7

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

• Struggle to balance speed and security. The disconnect between

buyers’ recognition of the importance of addressing security and

privacy concerns and their behavior continues to be an issue.

Overwhelmingly, 88% of respondents cite “needed to move quickly

to deliver results from software so didn’t have time” as the main

reason for leaving IT and InfoSec teams out of the software

purchasing decision.

Additionally, even with 86% requiring a security assessment

prior to software purchase, more than half (54% of respondents)

admit to buying software that has not been approved or vetted for

security by their organization’s IT or InfoSec team. All of this can

lead to purchase delays and needless customer churn.

86% of buyers require a security

assessment prior to purchase,

but only 24% involve a security

stakeholder during the research

phase of the buying process.

14% leave it until implementation.

8

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

• Favor the incumbent. Buyers prefer to work with sellers whose products they

already use. 83% of buyers prefer buying products from the same vendor

instead of switching vendors. This is because using multiple vendors to build a

tech stack offers buyers a chance to explore best-of-breed solutions but adds

complexity. It requires managing more contracts and potentially complicates

integration—and 82% of buyers say it’s important for the software they buy to

integrate with tools they already have.

HAVE YOU EVER PURCHASED SOFTWARE AT WORK

THAT HAS NOT BEEN APPROVED OR VETTED BY

YOUR IT OR INFOSEC TEAM?

WHAT PROMPTED YOU TO PURCHASE SOFTWARE

THAT WAS NOT APPROVED OR VETTED BY YOUR IT/

INFOSEC TEAM?

54%

Yes

88%

Needed to move quickly

to deliver results

12%

We don’t have a clear

process for this

2%

I don’t know

44%

No

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

9

5 factors

shaping the buyer over the next 12 months.

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

10

Hype around generative AI has spurred a genuine frenzy of businesses looking

to secure a competitive advantage. In fact, 81% of respondents say that it is

important or very important that the software they purchase moving forward has

AI functionality—and less than 5% say AI functionality is not important at all.

Buyers trust AI-powered solutions—78% trust or trust strongly the accuracy and

reliability of AI-powered solutions. This built-in level of trust is a competitive

advantage for any AI-powered product.

78% trust the accuracy and reliability of AI-powered solutions.

81% of buyers say it’s important that the software they purchase has AI.

AI buyers are...

• More willing to spend. Companies are willing to spend on AI despite economic

uncertainty, and often because of it. 59% of AI buyers anticipate spending in

2024 will increase—10 percentage points higher than overall.

• Involved in bigger deals. 84% are typically involved in deals larger than $50,000

compared to 75% for non-AI buyers. 72% are typically involved in deals larger

than $100,000 compared to 60% for non-AI buyers.

• Often eschewing IT. 55% have purchased shadow IT. Circumventing established

IT and InfoSec vetting processes, particularly with complicated AI-powered

solutions that handle sensitive data, may present signicant future business

risks.

Buyers see AI as foundational

to their business strategy.

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

11

84% trust or trust strongly the reliability and accuracy of AI-powered solutions (6

points higher than overall), and 88% say it’s important or very important that the

software they purchase moving forward has AI functionality (7 points higher than

overall). AI buyers are leaning into its importance for their businesses and trusting

the technology to drive results.

Trust in AI remains high overall, but APAC buyers, in particular, are hungry for

AI-powered solutions and willing to trust them to deliver a competitive edge in a

rapidly growing market.

APAC buyers trust AI solutions’ reliability and accuracy more than their EMEA

and North American counterparts. 47% of APAC respondents trust strongly in

AI reliability and accuracy—16 percentage points higher than North American

respondents and 10 points higher than those in EMEA.

PERCENTAGES OF RESPONDENTS WHO

TRUST STRONGLY IN AI:

Unsurprisingly, AI buyers trust AI and view

it as an important part of their technology

strategy going forward.

APAC

47%

EMEA

37%

NA

31%

12

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

84% of overall respondents indicate their IT department is responsible for

conducting security or privacy assessments when evaluating software. But 40%

indicate their legal department is involved as well, and this shoots up to 55% in

EMEA countries due to its more stringent digital regulations. Over the coming year,

G2 believes legal’s role will become increasingly prevalent around the globe. This is

because generative AI solutions increase the necessity for legal involvement. Buyers

and vendors have to scrutinize how their own company’s data will be treated and the

risks associated with generative AI output.

AI will drive legal teams to

be increasingly involved in

software purchases.

APAC

38%

NA

36%

EMEA

55%

PERCENTAGE OF ENTERPRISE RESPONDENTS WHO

SAY THAT LEGAL IS RESPONSIBLE FOR CONDUCTING

SECURITY AND PRIVACY ASSESSMENTS

The department

responsible for the

buying decision.

Legal

department

IT

department

Infosec

department

PERCENTAGE OF

RESPONDENTS WHO

IDENTIFY A DEPARTMENT

AS RESPONSIBLE FOR

CONDUCTING SECURITY OR

PRIVACY ASSESSMENTS

IT Departments run security

assessments, but Legal’s

responsibility is increasing.

20%0% 40% 60% 80% 100%

84%

31%

28%

40%

13

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

A majority of companies have a set process in place for buying

software. 83% of respondents say they have an ocial buying

process, though only 67% of small businesses say they have an

ocial process.

Research is the most time-consuming aspect of the buying journey,

according to 36% of respondents, with evaluation coming in second

at 29%.

But, business pressure still drives

changes in behavior.

Of those who purchased shadow IT, medium-sized companies

(87%) and enterprises (93%) did so because they needed to move

quickly, compared to 76% of small businesses. Processes in large

companies tend to be more complicated and slower, while their

departments or business units demand faster results.

Buyers stick to processes but still

succumb to timing pressure.

RESPONDENTS SAY RESEARCH IS THE MOST TIME CONSUMING

PART OF THE BUYING JOURNEY

Research

0% 10%

15%

20%

29%

36%

30%20% 40%

Evaluation

Decision

Implementation

Respondents who say they spend the most time on a stage.

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

14

Out of a list of 14 considerations for purchasing software, the top 5 were consistent

regardless of company size. Small business buyers prioritize ease of use and ease of

implementation. Medium-sized and enterprise companies need solutions that will

be able to keep up with their growth, with both ranking scalability as the third most

important criteria.

Buyers prioritize value over cost; regardless of size, buyers are more concerned about

showing value than focusing on software costs or total cost of ownership (TCO).

Small businesses Medium-sized companies Enterprises

1

How easy the tool is to

implement

Receive ROI within 6

months

How easy the tool is to

implement

2

How easy the tool is to

use

How easy the tool is to

implement

Receive ROI within 6

months

3

Receive ROI within 6

months

Ability to scale as my my

team/company grows

Ability to scale as my

team/company grows

4

Receive ROI within 1

year

How easy the tool is to

use

Receive ROI within 1

year

5

Ability to scale as my

team/company grows

Receive ROI within 1 year

How easy the tool is to

use

6

At least weekly usage

by all users

At least weekly usage by

all users

At least weekly usage by

all users

7

Quality of customer

support

Quality of customer

support

Quality of customer

support

8

Number of features

That the tool easily

integrates with other

software we already use

That the tool easily

integrates with other

software we already use

9

That the tool easily

integrates with other

software we already

use

Number of features Number of features

10

How much the software

costs

How much the software

costs

What kind of security

does the software

provide

Value, scalability, and ease are

top considerations for software

buyers, but priorities shift based

on company size.

4

4

THE TOP 10 CONSIDERATIONS FOR PURCHASING

SOFTWARE, BY COMPANY SIZE

15

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

82% of respondents mention it is important to them that the software they

buy integrates with their existing solutions. Buyers rank ease of integration

higher than the cost of the software, the kind of security it provides, or

its TCO. Buyers prefer to work with fewer vendors (78%) and use a single

solution instead of multiple tools (84%). When multiple solutions are

required, 77% of buyers prefer to buy complementary products from the

vendors they already work with.

When it comes to contract renewals, 83% of respondents (36% strongly

agree, 47% agree) prefer buying products from the same vendor instead of

switching vendors. As for the products, 60% always conduct research and

consider new alternatives, but 45% renew without considering new options.

5

Solutions that work together without

added complexity are key.

I WOULD PREFER TO PURCHASE ONE TOOL TO SOLVE

MULTIPLE BUSINESS PROBLEMS THAN MULTIPLE TOOLS.

84%

AGREE

82%

AGREE

83%

AGREE

78%

AGREE

IT IS IMPORTANT TO ME THAT THE SOFTWARE I BUY

INTEGRATES WITH TOOLS I ALREADY HAVE.

I LIKE TO BUY COMPLEMENTARY PRODUCTS

FROM A SINGLE VENDOR I ALREADY WORK WITH.

I PREFER TO RENEW A PRODUCT THAN SWITCH TO A

NEW VENDOR.

16

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

Lead with a richer view of value

Simple ROI calculations fail to capture the full impact of a solution’s potential on a

customer’s environment. Vendors are more frequently employing business value

advisory consultants to learn about and advise on how solutions create business

value over time. More complete assessments include bottomline cost savings

or risk mitigation, topline business growth examples, and strategic growth

opportunities.

For instance, digital workspace solutions that enable remote work can lower

the bottomline. They enable device cost savings using thin clients and reduce

breaches. But they also potentially allow contact center workers to help more

customers. Buyer interest in AI opens up opportunities to communicate both

bottomline and topline value.

Use buyers’ preferred channels to earn their trust

Buyers are decreasing their reliance on salespeople and gravitating to other

trusted sources of information and self-service. The top 85% of most inuential

sources include industry experts, colleagues or professional networks, online

reviews, and other internal inuencers.

A Software company salesperson is the least inuential source in purchasing

processes at 1%, decreasing from 3% year over year (YoY). The importance of

vendor-published content has reduced from 10% to 7% YoY.

Vendors must build product awareness across communities, experts, and review

platforms. Buyers still trust software company websites and rely on them most

when making major purchasing decisions for their company, but they are slowly

reducing in importance YoY, going from 38% in 2021 to 33% in 2022, and 32% in

2023.

66% of respondents say salespeople at a software company are not generally

involved in the research phase of the purchasing process—up from 63% who said

this in 2022 and 60% in 2021.

To win, serve, and retain customers in the upcoming year, G2 believes

vendors should:

84%

Yes

No

16%

PERCENTAGE OF BUYERS WHO USE ONLINE REVIEW SITES

Recommendations

17

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

Offer self-service options across multiple channels

throughout the process

Buyers are looking for self-service options at every stage of the buying process.

Enterprise buyers, in particular, want the majority of the software purchase

process to be self service. Regionally, APAC buyers prefer self service the most:

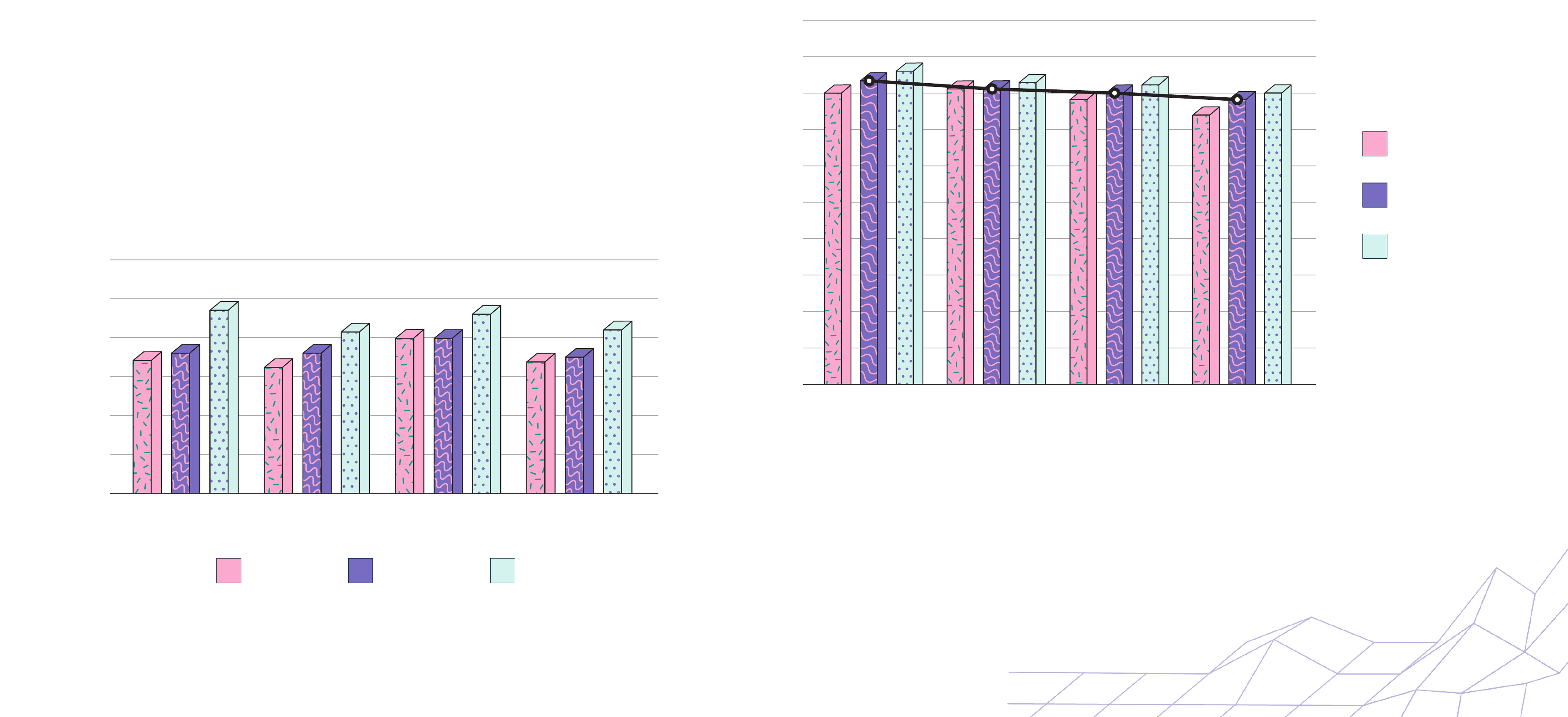

PERCENTAGE OF RESPONDENTS THAT ARE LOOKING FOR

SELF-SERVICE OPTIONS AT EVERY STAGE OF THE BUYING

PROCESS

PERCENTAGE OF RESPONDENTS WHO WANT ALL OR MOST

OF THE FOLLOWING PARTS OF THE BUYING PROCESS TO BE

SELF SERVICE

Implementation is not as cut and dry as the other stages, particularly for more

complicated pieces of software, doubly so for complex solutions that need to

integrate with an entire tech stack of different tools.

Buyers may want the majority of the implementation process to be self service

(the importance buyers attribute to ease of implementation, ranked rst among

buyer considerations across all respondents, highlights this), but just 41% of

enterprise buyers want all of the process to be self service.

Research Evaluation Decision Implementation

60

50

40

30

20

10

0

34%

34%

35%

42%

32%

40% 40%

46%

36%

41%

36%

47%

Research Evaluation Decision Implementation

100

80%

81%

78%

74%

78%

80%

80%

82%

81%

83%

83%

86%

90

80

70

60

50

40

30

20

10

0

NA

Small

business

EMEA

Medium-sized

companies

APAC

Enterprises

18

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

Buyers are ooded with contacts from salespeople every day

and may take steps to avoid even more. For example, 61% of

respondents indicate they are less likely to purchase software if the

vendor requires personal information (email address, name, etc.)

prior to releasing pricing data or product demos. This indicates

buyers want time to conduct research before entering into

discussions with sales.

ARE YOU LESS LIKELY TO PURCHASE A

SOFTWARE PRODUCT IF A VENDOR REQUIRES

YOU TO PROVIDE INFORMATION (EMAIL ADDRESS,

NAME, ETC) PRIOR TO RELEASING PRICING

INFORMATION OR PRODUCT DEMOS?

Offer multiyear deals for buyers seeking consistency

in their tech stacks

Introduce offerings to help buyers but they

may not want to talk just yet.

Multiyear deals are rare (across all respondents, only 12% say their typical contract length is 2

years or more), but there are levers to pull to entice buyers to sign longer-term contracts.

THE MOST POPULAR REASONS WHY SOMEONE WOULD SIGN A

MULTIYEAR CONTRACT:

Only 3% say nothing would sway them, they prefer yearly or monthly deals. Enterprises tend

to sign more multiyear deals, at 14% compared to 10% for medium-sized companies and 10%

for small businesses. The primary driver for larger companies to sign multiyear contracts is

discounts, but 16% of enterprise buyers look to multiyear deals for leverage to request product

enhancements and integrations.

Enterprise buyers also consistently research alternatives more than their mid-market and small

business counterparts (63% always research alternatives when a product is up for renewal).

To limit the risk of customers researching alternatives, sellers should look to secure multiyear

deals by leaning into customer feedback on product development, desired features, and

integrations.

Discounts are a common lever for securing multiyear deals. Sellers who are responsive to

customer feedback and open to product roadmap suggestions have an additional tool that may

help them secure consistent business.

5%

34%

61%

I don’t know

no

Yes

Discounts

Consistent

tech stack

Time and

resource saving

30% 24% 24%

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

19

Small businesses are less likely to have security or privacy vetting process

requirements than larger companies, but most still do. 77% of small businesses

require a security and privacy assessment when purchasing software, compared

to 86% of medium-sized businesses and 89% of enterprises.

To accommodate buyers from these verticals and company sizes,

vendors must:

1. Lead with product security credentials

2. Conduct buyer interviews to dive into their security and privacy vetting process

3. Design information or implementation according to buyer needs and resources

When it comes to selecting IT services, cost (50% consider it to have a high

inuence) and customer satisfaction (51% consider it to have a high inuence)

ratings are the most important factors that inuence selection. 49% consider

alignment with industry compliance standards (ISO, ASTM, ANSI, etc.) to be

very important in a service provider. Meeting project requirements and staying

within budget are the most important qualities in a service provider, according

to respondents.

COST AND CUSTOMER SATISFACTION RATINGS ARE

THE MOST IMPORTANT FACTORS WHILE SELECTING

SERVICES PROVIDERS

The process of software implementation is arguably as important as the product

itself. In fact, 93% of respondents say that the quality of the implementation

process has a signicant inuence on the decision to renew a software product.

Respondents prefer vendors’ implementation teams over third-party and in-

house implementation teams. 63% of respondents have used the vendor’s

implementation team, while 53% have worked with third-party implementers. In

comparison, only 37% have used in-house teams to implement software.

For those who worked with a third-party implementation provider, 33% chose

a provider based on the software vendor’s recommendation, the highest of any

options, followed by peer suggestion (25%) and third-party reviews (24%).

Help buyers navigate complex security requirements

Bridge the software implementation gap

0% 20%

51%

50%

49%

46%

40%

39%

40%

Customer satisfaction

ratings

Cost

Alignment with industry

standardizations

Domain expertise /

certifications

Geo presence (languages,

global oce locations)

The number of

projects completed

G2 SOFTWARE BUYER BEHAVIOR REPORT 2023

20

Authors

Gabriel Gheorghiu

Rachana Hasyagar

Patrick Szakiel

Chris Voce

Sarah Wallace

Designers

Jason Ortiz

Mike Puglielli

Contributors

Sinchana Mistry

Jigmee Bhutia

Shanti Nair

Nicole Zhang

Jenny Gardynski

Sara Rossio

Laura Horton

Palmer Houchins

Chris Perrine

Sarah Reks

Methodology

G2 elded an online survey among 1,704 B2B decision makers with responsibility

for, or inuence over, purchase decisions for departments, multiple departments,

operating units, or entire businesses. Respondents had job titles ranging from

individual contributor to manager, director, VP, or higher. G2 denes small

business as a company with 1-100 employees, mid-market as a company with 101-

1,000 employees, and enterprise as a company with 1,001+ employees. The survey

was elded in March 2023 and includes a global pool of respondents across North

America, EMEA, and APAC.

About G2

G2 is the world’s largest and most trusted software marketplace. More than 80

million people annually — including employees at all Fortune 500 companies —

use G2 to make smarter software decisions based on authentic peer reviews.

Thousands of software and services companies of all sizes partner with G2 to

build their reputation, manage their software spend, and grow their business —

including Salesforce, HubSpot, Zoom, and Adobe. To learn more about where you

go for software, visit www.g2.com and follow us on Twitter and LinkedIn.