HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

HOME SURAKSHA PLUS POLICY WORDING

PREAMBLE

WHEREAS the Policyholder named in the Schedule has applied to HDFC ERGO General

Insurance Company Limited (hereinafter called “the Company”) for the insurance herein

contained, the Company agrees subject to:

1. any proposal or other information supplied by or on behalf of the Insured Person:

a) disclosing all facts and circumstances known to the Insured Person that are material

to the assessment of the risks insured hereby, and

b) forming the basis of this insurance, and

2. the Insured having paid and the Company having received the premium on or before the

due date thereof

to grant such insurance to the Insured subject to the terms, conditions, provisions and

exclusions set out in this Policy or as contained in any endorsement that may be issued.

GENERAL CONDITIONS APPLICABLE

STANDARD TERMS AND CONDITIONS APPLICABLE

1. Age Limit

To be eligible to be covered under the Policy or get any benefits under the Policy, the

Insured should have attained the age of at least 20 years and shall not have

completed the age of 50 years on the date of commencement or renewal of the Policy

Period as applicable to such Insured.

2. Incontestability and Duty of Disclosure

THIS POLICY SHALL BE VOIDABLE AT THE OPTION OF THE COMPANY IN THE

EVENT OF MIS- REPRESENTATION, MIS-DESCRIPTION OR NON-

DISCLOSURE OF ANY MATERIAL PARTICULAR BY THE INSURED, IN THE

PROPOSAL FORM, PERSONAL STATEMENT, DECLARATION AND

CONNECTED DOCUMENTS, OR ANY MATERIAL INFORMATION HAVING BEEN

WITHHELD. ANY PERSON WHO, KNOWINGLY AND WITH INTENT TO DEFRAUD

THE INSURANCE COMPANY OR OTHER PERSONS, FILES A PROPOSAL FOR

INSURANCE CONTAINING ANY FALSE INFORMATION, OR A CLAIM BEING

FRAUDULENT OR ANY FRAUDULENT MEANS OR DEVICES BEING USED BY

THE INSURED OR ANY ONE ACTING ON HIS BEHALF TO OBTAIN ANY

BENEFIT UNDER THIS POLICY/ OR CONCEALS FOR THE PURPOSE OF

MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO,

COMMITS A FRAUDULENT INSURANCE ACT WHICH WILL RENDER THE

POLICY VOIDABLE AT THE INSURANCE COMPANY’S SOLE DISCRETION AND

RESULT IN A DENIAL OF INSURANCE BENEFITS OF A CLAIM IS IN ANY

RESPECT FRAUDULENT, OR IF ANY FRAUDULENT OR FALSE PLAN,

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

SPECIFICATION, ESTIMATE, DEED, BOOK, ACCOUNT ENTRY, VOUCHER,

INVOICE OR OTHER DOCUMENT, PROOF OR EXPLANATION IS PRODUCED,

OR ANY FRAUDULENT MEANS OR DEVICES ARE USED BY THE INSURED,

POLICYHOLDER, BENEFICIARY, CLAIMANT OR BY ANYONE ACTING ON

THEIR BEHALF TO OBTAIN ANY BENEFIT UNDER THIS POLICY, OR IF ANY

FALSE STATUTORY DECLARATION IS MADE OR USED IN SUPPORT

THEREOF, OR IF LOSS IS OCCASIONED BY OR THROUGH THE

PROCUREMENT OR WITH THE KNOWLEDGE OR CONNIVANCE OF THE

INSURED, POLICYHOLDER, BENEFICIARY, CLAIMANT OR OTHER PERSON,

THEN ALL BENEFITS UNDER THIS POLICY ARE FORFEITED.

3. Observance of terms and conditions

The due observance and fulfillment of the terms, conditions and endorsement of this

Policy in so far as they relate to anything to be done or complied with by the Insured,

shall be a condition precedent to any liability of the Company to make any payment

under this Policy.

4. Records to be maintained

The Insured shall keep an accurate record containing all relevant particulars and shall

allow the Company to inspect such record. The Insured shall within one month after

the expiry of each period of insurance furnish such information as the Company may

require.

5. No constructive Notice

Any of the circumstances in relation to these conditions coming to the knowledge of

any official of the Company shall not be construed as notice to or be held to bind or

prejudicially affect the Company notwithstanding subsequent acceptance of any

premium.

6. Notice of charge etc.

The Company shall not be bound to notice or be affected by any notice of any trust,

charge, lien, assignment or other dealing with or relating to this Policy but the receipt

of the Insured or his legal personal representative shall in all cases be an effectual

discharge to the Company.

7. Special Provisions

Any special provisions subject to which this Policy has been entered into and

endorsed in the Policy or in any separate instrument shall be deemed to be part of

this Policy and shall have effect accordingly.

8. Governing Law

The construction, interpretation and meaning of the provisions of the Policy shall be

determined in accordance with Indian Law.

9. Entire Contract

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

The Policy constitutes the complete contract of insurance. No change or alteration in

this Policy shall be valid or effective unless approved in writing by the Company,

which approval shall be evidenced by an endorsement on the Policy.

10. Territorial limits

This Policy covers insured events arising during the Policy Period only. The

Company's liability to make any payment shall be to make payment within India and

in Indian Rupees only.

11. Electronic Transactions

The Insured agrees to adhere to and comply with all such terms and conditions as the

Company may prescribe from time to time, and hereby agrees and confirms that all

transactions effected by or through facilities for conducting remote transactions

including the Internet, World Wide Web, electronic data interchange, call centers,

teleservice operations (whether voice, video, data or combination thereof) or by

means of electronic, computer, automated machines network or through other means

of telecommunication, established by or on behalf of the Company, for and in respect

of the Policy or its terms, or the Company's other products and services, shall

constitute legally binding and valid transactions when done in adherence to and in

compliance with the Company's terms and conditions for such facilities, as may be

prescribed from time to time

12. Right to inspect

If required by the Company, an agent/representative of the Company including a loss

assessor or a Surveyor appointed on that behalf shall in case of any loss or any

circumstances that have given rise to the claim to the Insured be permitted at all

reasonable times to examine into the circumstances of such loss. The Insured shall

on being required so to do by the Company produce all books of accounts, receipts,

documents relating to or containing entries relating to the loss or such circumstance

in his possession and furnish copies of or extracts from such of them as may be

required by the Company so far as they relate to such claims or will in any way assist

the Company to ascertain the correctness thereof or the liability of the Company

under the Policy.

13. Fraudulent claims

If any claim is in any respect fraudulent, or if any false statement, or declaration is

made or used in support thereof, or if any fraudulent means or devices are used by

the Insured, or anyone acting on his behalf to obtain any benefit under this Policy, or

if a claim is made and rejected and no court action or suit is commenced within

twelve months after such rejection or, in case of arbitration taking place as provided

therein, within twelve (12) calendar months after the Arbitrator or Arbitrators have

made their award, all benefits under this Policy shall be forfeited.

14. Policy Disputes

Any dispute concerning the interpretation of the terms, conditions, limitations and/or

exclusions contained herein is understood and agreed to by both the Insured and the

Company to be subject to Indian Law. Each party agrees to submit such dispute to a

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

Court of competent jurisdiction and to comply with all requirements necessary to give

such Court the jurisdiction. All matters arising hereunder shall be determined in

accordance with the law and practice of such Court.

15. Arbitration clause

If any dispute or difference shall arise as to the quantum to be paid under this Policy

(liability being otherwise admitted) such difference shall independently of all other

questions be referred to the decision of a sole arbitrator to be appointed in writing by

the parties to the dispute/difference, or if they cannot agree upon a single arbitrator

within 30 days of any party invoking arbitration, the same shall be referred to a panel

of three arbitrators, comprising of two arbitrators, one to be appointed by each of the

parties to the dispute/difference and the third arbitrator to be appointed by such two

arbitrators. Arbitration shall be conducted under and in accordance with the

provisions of the Arbitration and Conciliation Act, 1996, as amended from time to time

and for the time being in force.

It is clearly agreed and understood that no difference or dispute shall be referable to

arbitration, as hereinbefore provided, if the Company has disputed or not accepted

liability under or in respect of this Policy.

It is hereby expressly stipulated and declared that it shall be a condition precedent to

any right of action or suit upon this Policy that the award by such arbitrator/ arbitrators

of the amount of the loss or damage shall be first obtained.

16. Renewal notice

The Company shall not be bound to accept any renewal premium nor give notice that

such is due. Every renewal premium (which shall be paid and accepted in respect of

this Policy) shall be so paid and accepted upon the distinct understanding that no

alteration has taken place in the facts contained in the proposal or declaration herein

before mentioned and that nothing is known to the Insured that may result to enhance

the risk of the Company under the guarantee hereby given. No renewal receipt shall

be valid unless it is on the printed form of the Company and signed by an authorized

official of the Company.

17. Where proposal forms are not received, information obtained from the Insured

whether orally or otherwise is captured in the cover note, if issued, and / or in the

policy document. The Insured shall point out to the Company, discrepancies, if any, in

the information contained in the policy document within 15 days from policy issue

date after which information contained in the policy shall be deemed to have been

accepted as correct.

18. Notwithstanding the provisions of clause 15, any person who has a grievance against

the Company, may himself or through his legal heirs make a complaint in writing to

the Insurance Ombudsman in accordance with the procedure contained in The

Redressal of Public Grievance Rules, 1998 (Ombudsman Rules). Proviso to Rule

16(2) of the Ombudsman Rules however, limits compensation that may be awarded

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

by the Ombudsman, to the lower of compensation necessary to cover the loss

suffered by the Insured as a direct consequence of the insured peril or Rs. 20 lakhs

(Rupees Twenty Lakhs Only) inclusive of ex-gratia and other expenses. A copy of the

said Rules shall be made available by the Company upon prior written request by the

Insured. The grievance redressal procedure is attached as an annexure to this policy

wording.

19. Due Observance

The due observance and fulfillment of the terms, provisions, warranties and

conditions of and endorsements to this Policy in so far as they relate to anything to be

done or complied with by the Insured and/or the Insured’s Family shall be a condition

precedent to any liability of the Company to make any payment under this Policy.

20. The Insured Person

Should understand that if a proposal has been completed for this insurance, then all

statements and all particulars provided in such proposal, and any attachments thereto are

true, accurate and complete and are material to the Company’s decision to provide this

insurance. The Insured Person further should understand that the Company has issued

this Policy in reliance upon the truth of such statements and particulars which are

deemed to be incorporated into and constitute a part of this Policy, are the basis of this

Policy and are material to the Underwriter’s acceptance of this risk.

21. Fraud Warning Any Person Who, Knowingly And With Intent To Defraud The

Company Or Other Person, Files A Proposal For Insurance Containing Any

False Information, Or Conceals For The Purpose Of Misleading, Information

Concerning Any Fact Material Thereto, Commits A Fraudulent Insurance Act

Which Will Render The Policy Voidable At The Company’s Sole Discretion And

Result In A Denial Of Insurance Benefits.

If A Claim Is In Any Respect Fraudulent, Or If Any Fraudulent Or False Plan,

Specification, Estimate, Deed, Book, Account Entry, Voucher, Invoice Or Other

Document, Proof Or Explanation Is Produced, Or If Any Fraudulent Means Or

Devices Are Used By The Insured Person, Policyholder, Beneficiary, Claimant

Or By Anyone Acting On Their Behalf To Obtain Any Benefit Under This Policy,

Or If Any False Statutory Declaration Is Made Or Used In Support Thereof, Or If

Loss Is Occasioned By Or Through The Procurement Or With The Knowledge

Or Connivance Of The Insured Person, Policyholder, Beneficiary, Claimant Or

Other Person, Then All Benefits Under This Policy Are Forfeited.

22. Reasonable Care

The Insured and Family members shall:

Take all reasonable steps to safeguard the Contents and the Insured Premises against

any insured event;

Take all reasonable care and precautions to prevent accident, loss or damage and to act

prudently to minimize any claim arising out of an insured peril. The Insured and Family

members shall also take within their control to avert occurrence of insured peril, to protect

the subject matter of insurance.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

Ensure that any security system or aid is maintained in accordance with any maintenance

schedule or recommendations of the manufacturer or if none then as may be required,

and kept in good and effective working condition;

When the Insured Premises are left unattended ensure that all means of entry to or exit

from the Insured Premises have been properly and safely secured and any security

system or aid has been properly deployed.

23. Duties and Obligations after Occurrence of an Insured Event

It is a condition precedent to the Company's liability under this Policy that, upon the

happening of any event giving rises to or likely to give rise to a claim under this

Policy:

a) The Insured shall immediately and in any event within 15 days give written

notice of the same to the Company at the address shown in the Schedule for

this purpose, and in case of notification of an event likely to give rise to a claim

to specify the grounds for such belief; and

b) In respect of Sections 2, and any other claim under any other Section as maybe

specifically advised by the Company, immediately lodge a complaint with the

appropriate Police Authorities detailing the items lost and/or damaged and in

respect of which the Insured intends to claim, and provide a copy of that written

complaint, the First Information Report and/or Final Report to the Company.

The Insured shall also take all practicable steps to enable the person accused of

such theft to be apprehended by the appropriate authorities as per law and to

recover the property stolen, and

c) the Insured shall within 15 days after the loss or damage or such further time as

the Company may allow, deliver a completed claim form in writing detailing as

particular an account as may be reasonably practicable of the loss or damage

that has occurred and an estimate of the quantum of any claim (not including

profit of any kind) along with all documentation required to support and

substantiate the amount sought from the Company. Particulars of all other

insurances, if any, shall also be furnished, and

d) The Insured shall at all the times at his own expense produce, procure and give

to the Company all such further particulars, plans, specification books, vouchers,

invoices, duplicates or copies thereof, documents, investigation reports

(internal/external), proofs and information with respect to the claim and the origin

and cause of the loss and the circumstances under which the loss or damage

occurred, and any matter touching the liability or the amount of the liability of the

Company as may be reasonably required by or on behalf of the Company

together with a declaration on oath in other legal form of the truth of the claim

and of any matters connected therewith.

No claim under this Policy shall be payable unless the terms of this condition have

been complied with

24. Contribution

If, at the time of any claim, there is, or but for the existence of this Policy, would be

any other policy of indemnity or insurance in favor of or effected by or on behalf of the

Insured applicable to such claim, then the Company shall not be liable to pay or

contribute more than its rateable proportion of any loss or damage however this does

not apply to Sections 3, 4 and 5.

25. Subrogation

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

The Insured and any claimant acting on behalf of the Insured under this Policy shall

at the expense of the Company do or concur in doing or permit to be done all such

acts and things that may be necessary or reasonably required by the Company for

the purpose of enforcing any civil or criminal rights and remedies or obtaining relief or

indemnity from other parties to which the Company shall be or would become entitled

or subrogated, upon the Company paying for or making good any loss or damage

under this Policy whether such acts and things shall be or become necessary or

required before or after the Insured's indemnification by the Company damage

however this does not apply to Sections 3, 4 and 5.

26. In no case whatsoever shall the Company be liable for any loss or damage after the

expiry of 12 months from the happening of loss or damage unless the claim is the

subject of pending action or arbitration; it being expressly agreed and declared that if

the Company shall disclaim liability for any claim here under and such claim shall not

within 12 (twelve) calendar months from the date of the disclaimer have been made

the subject matter of a suit in a court of law then the claim shall for all purposes be

deemed to have been abandoned and shall not thereafter be recoverable hereunder.

27. All insurances under this policy shall cease on expiry of seven days from the date of

fall or displacement of any building or part thereof containing the Insured Premises, or

the whole or any part of a group of buildings of which such building forms part.

Provided such a fall or displacement is not caused by insured perils, loss or damage

which is covered by this Policy, or would be covered if such building or group of

buildings were insured under this Policy.

Notwithstanding the above, the Company, subject to an express notice being given

as soon as possible but not later than seven days of any such fall or displacement,

may agree to continue the insurance subject to revised rates, terms and conditions

and confirmed in writing by the Company.

28. On the happening of loss or damage to any property insured under this Policy, the

Company may

a) Enter and take possession of the building or premises where the loss or

damage has happened to such building or premises covered under the

Policy.

b) Take the possession of or require to be delivered to it any such property

being the subject matter of loss or damage, of the Insured in the building

or on the premises at the time of the loss or damage.

c) Keep possession of any such property being the subject matter of the

loss or damage and examine, sort, arrange, remove, and otherwise deal

with the same.

d) Sell any such property being the subject matter of the loss or damage or

dispose off the same.

The powers conferred by this condition shall be exercisable by the Company at any

time until notice in writing is given by the Insured that he makes no claim under the

policy, or if any claim is made, until such claim is finally determined or withdrawn,

and the Company shall not by any act done in the exercise or purported exercise of

its powers hereunder, incur any liability to the Insured or diminish its rights to rely

upon any of the conditions of this policy in answer to any Claim.

If the insured or any person on his behalf shall not comply with requirements of the

Company or shall hinder or obstruct the Company, in the exercise of its powers

hereunder, all benefits under this policy shall be forfeited.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

The Insured shall not in any case be entitled to abandon any property insured under

this Policy after making a claim for the loss or damage thereof, whether taken

possession of by the Company or not.

29. If the Company at its option, reinstates or replaces the property damaged or

destroyed, or any part thereof, instead of paying the amount of the loss or damage, or

joins with any other Company or Insurer(s) in so doing, the Company shall not be

bound to reinstate exactly or completely but only as circumstances permit and in

reasonably sufficient manner. If the Company so elects to reinstate or replace any

lost or damaged property being the subject matter of a claim under this Policy, the

Insured shall at his own expense furnish the Company with such plans,

specifications, measurements, quantities and such other particulars as the Company

may with a view to reinstatement or replacement, require.

If in any case the Company shall be unable to reinstate or repair the property here by

insured, because of any municipal or other regulations in force affecting the alignment

of streets or the construction of buildings or otherwise, the Company shall, in every

such case, only be liable to pay such sum as would be requisite to reinstate or repair

such property if the same could lawfully be reinstated to its former condition.

30. Reinstatement Value Clause: The insurance in respect of building and contents will

be subject to the Following provision:

It is hereby declared and agreed that in the event of the building and/or any contents

insured under this Policy being lost, destroyed or damaged, the basis upon which the

amount payable under the policy is to be calculated shall be cost of replacing or

reinstating on the same site or any other site with property of the same kind or type

but not superior to or more expensive than the insured property when new as on date

of the loss, subject to the following Special Provisions and subject also to the terms

and conditions of the Policy except in so far as the same may be varied hereby.

Special Provisions:

The work of replacement or reinstatement (which may be carried out upon another

site and in any manner suitable to the requirements of the Insured subject to the

liability of the Company not being thereby increased) must be commenced and

carried out with reasonable dispatch and in any case must be completed within

twelve (12) months after the date of loss, destruction or damage or within such further

time as the Company may in writing allow, otherwise no payment beyond the amount

which would have been payable under the Policy if this Reinstatement Value Clause

had not been incorporated therein shall be made.

Until expenditure has been incurred by the Insured in replacing or reinstating the

property lost, destroyed or damaged the Company shall not be liable for any payment

in excess of the amount which would have been payable under the policy if this

Reinstatement Value Clause had not be incorporated therein.

This Reinstatement Value Clause shall be without force or effect if :

the Insured fails to intimate to the Company within six (6) months after the date of

loss, destruction or damage or such further time as the Company may in writing

allow, his intention to replace or reinstate the property lost destroyed or damaged; or

the Insured is unable or unwilling to replace or reinstate the property lost, destroyed

or damaged on the same or another site.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

31. Cancellation / Refund Of Premium

This Policy may be cancelled by or on behalf of the Company IN THE EVENT OF

MIS- REPRESENTATION, FRAUD , NON-DISCLOSURE OF ANY MATERIAL

FACTS , NON COOPERATION OR MIS-DESCRIPTION BY THE INSURED ,by

giving the Insured at least 15 days written notice and in such event the Company

shall refund to the Insured a pro-rata premium for the unexpired Policy Period. For

the avoidance of doubt, the Company shall remain liable for any claim that was made

prior to the date upon which this insurance is cancelled.

This Policy may be cancelled by the Insured at any time by giving at least 15 days

written notice to the Company. The Company will refund premium on a short period

scale as per Table below by reference to the time that cover is provided for Annual

Premium Policies. No refund of premium shall be due on cancellation if the Insured

has made any claim under this Policy.

The Company shall refund the premium as per the Company’s short period scales in

case of receipt of notice of cancellation from the Insured, provided there is no claim

under the policy for an Annual Premium Policy Only.

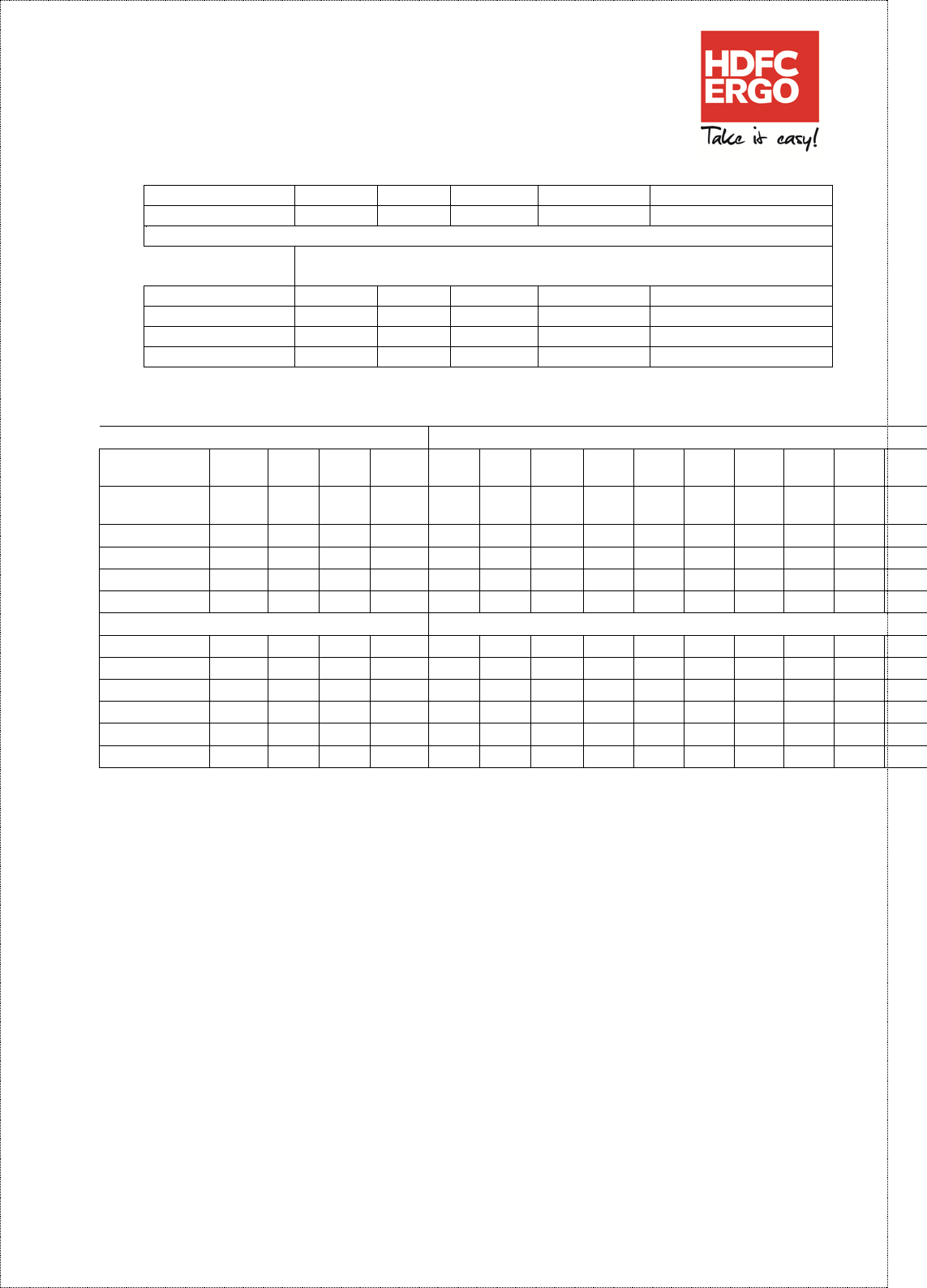

Table of Short Period Scales – Applicable to Section 1 & 2– Annual Policies Only

Period of Risk

Premium to be retained (% of the Annual

Rate).

Not exceeding 15 days

10%

Not exceeding 1 Month

15%

Not exceeding 2 Months

30%

Not exceeding 3 Months

40%

Not exceeding 4 Months

50%

Not exceeding 5 Months

60%

Not exceeding 6 Months

70%

Not exceeding 7 Months

75%

Not exceeding 8 Months

80%

Not exceeding 9 Months

85%

Exceeding 9 Months

Full Annual Premium.

Refund on Cancellations of Long-term Policy at the request of the insured may

be allowed subject to the following conditions:

1. Refund shall not be allowed if there has been a claim under the

policy.

2. If the Policy is cancelled within 3 years of inception, the premium

to be retained shall be worked out as per normal rates applicable

– that is without allowing any discount.

3. If the Policy is cancelled after 3 years of inception, the discount

slab shall be reworked for the number of years that policy was

actual in force. For this purpose faction of a year shall be

rounded to the next higher year. For example of the policy has

run for 3 years and 3 months, premium shall be retained for 4

years.

Refund Table – For Sum Insured Based on Fixed Sum Insured – Applicable to Sections

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

3-5

Loan Period

1

2

3

4

5+

Policy Period

1

2

3

4

5

Return Premium Factors

Year Of

Cancellations

% Return Premium

1

50%

67%

75%

80%

2

33%

50%

60%

3

25%

40%

4

20%

Refund Table – For Sum Insured Based on Reducing Balance – Applicable to Sections 3-5

% Return Premium

Policy

Period

2

3

4

5

5

5

5

5

5

5

5

5

5

5

Loan

Period

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Year 1

25%

45%

57%

65%

70%

73%

74%

75%

76%

77%

77%

78%

78%

78%

Year 2

11%

26%

37%

45%

49%

51%

53%

54%

55%

56%

56%

57%

57%

Year 3

6%

17%

24%

28%

31%

33%

34%

35%

36%

36%

37%

37%

year 4

4%

9%

12%

14%

15%

16%

16%

17%

17%

18%

18%

% Return Premium

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

78%

79%

79%

79%

79%

79%

79%

79%

79%

79%

79%

79%

80%

80%

80%

57%

58%

58%

58%

58%

59%

59%

59%

59%

59%

59%

59%

59%

59%

59%

37%

38%

38%

38%

38%

39%

39%

39%

39%

39%

39%

39%

39%

39%

39%

18%

18%

19%

19%

19%

19%

19%

19%

19%

19%

19%

19%

19%

20%

20%

In event of part prepayment of the Loan, no refunds of premium shall be made under

this Policy. No refunds of premium will be made under the Policy during the last year

of the Policy Period.

Upon making any refund of premium under this Policy in accordance with the terms

and conditions hereof in respect of the Insured, the cover in respect of the Insured

shall forthwith terminate and the Company shall not be liable hereunder.

Notwithstanding anything contained herein or otherwise, no refunds of premium shall

be made in respect of the Insured where any claim has been admitted by the

Company or has been lodged with the Company.

32. Payments

The Company shall be duly discharged of its obligations under this Policy and the

Insured shall hold the Company harmless, upon making the payment of the claim to

the Insured or his nominee/ legal heirs as the case may be.

33. Notices

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

Any notice, direction or instruction given under this Insured shall be in writing and

delivered by hand, post, or facsimile to:

In case of the Insured, at the address specified in the Schedule.

In case of the Company at:

HDFC ERGO General Insurance Company Limited

6

th

Floor, Leela Business Park,

Andheri Kurla Road

Andheri (East), Mumbai – 400 059, India

Tel.: 91 22 66383600. Fax: 91 22 66383699

Notice and instructions will be deemed served 7 days after posting or immediately

upon receipt in the case of hand delivery, facsimile or e-mail.

34. Customer Service

If at any time the Insured requires any clarification or assistance, the Insured may

contact the offices of the Company at the address specified, during normal business

hours.

35. Grievances

In case the Insured is aggrieved in any way, the Insured may contact the Company at

the specified address above, during normal business hours.

36. Other Conditions

At any time during the Policy Period the Company shall be entitled to inspect any or all

records of the Insured that may be relevant to this Policy. The Company shall also have

the right of interaction with any and or all those agencies or agents of the Insured as may

be relevant for examination/verification of the data/documents in connection with the

process and disposal of any claims under this Policy. The Insured shall provide reasonable

support to the Company in this regard.

If so required by the Company, the Insured will have to submit to a medical examination by

the Company’s nominated Doctor or undergo diagnostic or other medical tests as often as

the Company considers necessary, in its sole discretion.

37. Loadings

We may apply a risk loading on the premium payable (based upon the declarations made

in the proposal form and the health status of the persons proposed for insurance). The

maximum risk loading applicable for an individual shall not exceed above 100% per

diagnosis / medical condition and an overall risk loading of over 150% per person. These

loadings are applied from Commencement Date of the Policy including subsequent

renewal(s) with Us or on the receipt of the request of increase in Sum Insured (for the

increased Sum Insured).

We will inform You about the applicable risk loading through a counter offer letter. You

need to revert to Us with consent and additional premium (if any), within 15 days of the

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

issuance of such counter offer letter. In case, you neither accept the counter offer nor

revert to Us within 15 days, We shall cancel Your application and refund the premium paid

within next 7 days.

Please note that We will issue Policy only after getting Your consent.

38. Free Look Period

You have a period of 15 days from the date of receipt of the Policy document to review the

terms and conditions of this Policy. If You have any objections to any of the terms and

conditions, You have the option of cancelling the Policy stating the reasons for cancellation

and You will be refunded the premium paid by You after adjusting the amounts spent on

any medical check-up, stamp duty charges and proportionate risk premium. You can

cancel Your Policy only if You have not made any claims under the Policy. All Your rights

under this Policy will immediately stand extinguished on the free look cancellation of the

Policy. Free look provision is not applicable and available at the time of renewal of the

Policy.

In case of any claim being admissible and payable upto the full sum insured ,the

policy will cease to exist. Incase where only partial sum insured is paid under any

of the sections then the policy will still exist on the balance sum insured

GENERAL DEFINITIONS APPLICABLE

For the purposes of this Policy, the following words shall have the meanings as set forth

below:

1. Accident or Accidental means a sudden, unforeseen and involuntary event caused

by external, visible and violent means

2. Bank means a banking company which transacts the business of banking in India or

abroad

3. Beneficiary: In case of death of the Insured Person, the Beneficiary means, unless

stipulated otherwise by the Insured Person, the surviving Spouse or immediate blood

relative of the Insured Person, mentally capable and not divorced, followed by the

children recognized or adopted followed by the Insured Person’s legal heirs. For all

other benefits, the Beneficiary means the Insured Person himself unless stipulated

otherwise.

4. Building means structure (above plinth and foundation excluding land) of standard

construction unless specifically mentioned. It shall include connected utilities, sanitary

fittings, fixtures and fittings therein belonging to the Insured and for which he is

accountable.

5. Burglary means any theft following upon actual forcible and violent visible entry or /

and unauthorized entry to or exit from the Insured Premises with the intent to steal

Contents there from.

6. Civil War means armed opposition, whether declared or not, between two or more

parties belonging to the same country where the opposing parties are of different

ethnic, religious or ideological groups. Included in the definition: armed rebellion,

revolution, sedition, insurrection, Coup d' Etat, and the consequences of Martial law.

7. Company means HDFC ERGO General Insurance Company Limited.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

8. Compensation means Sum Insured, Total Sum Insured or percentage of the Sum

Insured, as appropriate.

9. Confirmation means Confirmation of Availability of Insurance issued by the

Company to the insured confirming that the Insured is entitled to insurance coverage

under this Policy.

10. Contents means the household goods and other personal possessions owned by the

Insured or his/her Family or for which they are responsible located inside the Insured

Premises such as electronic equipment, household appliances, and goods such as

furniture, kitchen utensils, fixtures, fittings and interior decorations. Personal effects

such as clothes and other articles of personal nature to be worn used or carried but

excluding money but may include jewelry and valuables.

11. Deductible or Excess is a cost-sharing requirement under a health insurance policy

that provides that the Insurer will not be liable for a specified rupee amount in case of

indemnity policies and for a specified number of days/hours in case of hospital cash

policies which will apply before any benefits are payable by the insurer. A deductible

does not reduce the sum insured.

12. Dependent Child means an unmarried dependent child ordinarily residing with the

Insured Person between the ages of three (3) months and up to and including the age

of twenty one (21) years, or up to and including the age of twenty - three (23) years if

in full time education at an accredited tertiary institution at the time of the Date of

Loss, including legally adopted and step-children, of an Insured Person or the Spouse

of an Insured Person.

13. Dwelling means insured’s private residence as stated in the schedule, which is used,

is occupied mainly for domestic purposes by the insured and/or insured family and/or

insured’s domestic staff whether owned by the insured or insured’s family otherwise.

14. Doctor means a person who holds a degree of a recognized medical institute and is

registered by Medical Council of India or of the respective States of India, if so

required and acting within the scope of the license of registration granted to him/her.

The definition would include Physician, Specialist, Anesthetist and Surgeon and

specifically excludes doctors / practitioners in non-allopathic fields.

15. EMI or EMI Amount

1

means and includes the amount of monthly payment required

to repay the principal amount of Loan and Interest by the Insured as set forth in the

amortization chart referred to in the loan agreement (or any amendments thereto)

between the Bank/Financial Institution and the Insured prior to the date of occurrence

of the Insured Event under this Policy. For the purpose of avoidance of doubt, it is

clarified that any monthly payments that are overdue and unpaid by the Insured prior

to the occurrence of the Insured Event will not be considered for the purpose of this

Policy and shall be deemed as paid by the Insured.

16. Financial Institution shall have the same meaning assigned to the term under

section 45 I of the Reserve Bank of India Act, 1934 and shall include a Non Banking

Financial Company as defined under section 45 I of the Reserve Bank of India Act,

1934

1

EMI refers to the EMI or Pre EMI on the loan or the Sum Insured, whichever is lower, on the date of the

Insured Event.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

17. Fees mean only “tuition fees” payable only on reimbursement basis (on production

of original fee receipt), upto the amount stated in the Policy schedule, the limit

being for 24 months to the surviving Dependent Child of the Insured Person who

must be in full time education at an accredited educational institution, and only upto

2 children are eligible. This would be a one time payment.

18. Foreign War means armed opposition, whether declared or not between two

countries

19. Illness means a sickness or a disease or pathological condition leading to the

impairment o f normal physiological function which manifests itself during the Policy

Period and requires medical treatment

20. Injury means accidental physical bodily harm excluding illness or disease solely and

directly caused by external, violent and visible and evident means which is verified

and certified by a Medical Practitioner.

21. Insured means the Individual(s) whose name(s) are specifically appearing as such in

Section 1 of the Schedule to this Policy. For the purpose of avoidance of doubt it is

clarified that the heirs, executors, administrators, successors or legal representatives

of the Insured may present a claim on behalf of the Insured to the Company.

22. Insured Event means any event specifically mentioned as covered under this Policy.

23. Insured Premises means the premises specified in the Schedule where the Insured

resides so long as the use of the same is restricted to solely domestic purposes.

24. Jewelry means articles of precious stones, gold, silver or other precious metals

specified as such in the Schedule.

25. Kutcha Construction means buildings having walls and / or roofs of wooden planks

thatched leaves, grass, bamboo, plastic, cloth, asphalt, canvass, tarpaulin, or the like.

26. Loan means the sum of money lent at interest or otherwise to the Insured by any

Bank/Financial Institution as identified by the Loan Account Number referred to in

section 1 of this policy

27. Nominee means the person(s) nominated by the Insured to receive the insurance

benefits under this Policy payable on the death of the Insured. For the purpose of

avoidance of doubt it is clarified that if the Insured is a minor, his guardian shall

appoint the Nominee.

28. Policy Period means the period commencing from Policy start date and hour as

specified in the Schedule and terminating at midnight on the Policy end date as

specified in of the Schedule to this Policy.

29. Period of Insurance means the period commencing from the policy start date of the

first Major Medical Illness & Procedures policy with the Company, under which the

Insured is covered, subject to the Insured continuously renewing such Major Medical

Illness & Procedures policy with the Company without any break and terminating at

midnight on the Policy end date as specified in the Schedule to this Policy. No benefit

shall accrue to the Insured on account of the Period of Insurance unless the dates are

evidenced in writing against the caption of “Period of Insurance” of this Policy. For the

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

purpose of avoidance of doubt it is clarified that if no dates are evidenced in writing

against the caption “Period of Insurance” as mentioned above, then the Period of

Insurance shall mean the Policy Period.

30. Permanent Total Disablement means disablement, as the result of a Bodily Injury,

which:

a) continues for a period of twelve (12) consecutive months, and

b) is confirmed as total, continuous and permanent by a Physician after the twelve (12)

consecutive months, and

c) entirely prevents an Insured Person from engaging in or giving attention to gainful

occupation of any and every kind for the remainder of his/her life.

31. Physical Separation means as regards the hand actual separation at or above the

wrists, and as regards the foot means actual separation at or above the ankle.

32. Physician means a person currently legally licensed and registered to practice

medicine in the jurisdiction of loss, other than

a) An Insured Person under this Policy;

b) An Immediate Family of the Insured Person. For purposes of this definition only,

the term Immediate Family Member shall not be limited to natural persons

resident in the same country as the Insured Person.

33. Policy means the Policy booklet, the Schedule, any Extension and applicable

endorsements under the Policy. The Policy contains details of the extent of cover

available to the Insured, the exclusions under the cover and the terms and conditions

of the issue of the Policy

34. Policyholder means the entity or person named as such in the Schedule

35. Public Authority means any governmental, quasi-governmental organization or any

statutory body or duly authorized organization with the power to enforce laws, exact

obedience, and command, determine or judge.

36. Principal Outstanding means the principal amount of the Loan outstanding as on

the date of occurrence of Insured Event less the portion of principal component

included in the EMIs payable but not paid from the date of the loan agreement till the

date of the Insured Event/s. For the purpose of avoidance of doubt, it is clarified that

any EMIs that are overdue and unpaid to the Bank prior to the occurrence of the

Insured Event will not be considered for the purpose of this Policy and shall be

deemed as paid by the Insured.

37. Professional Sports means a sport, which would remunerate a player in excess of

50% of his or her annual income as a means of their livelihood.

38. Pre-Existing means Any Condition, ailment or injury or related condition(s) for which

you had signs or symptoms, and / or were diagnosed, and / or received medical

advice / treatment, within 48 months prior to your first policy with us.

Exclusion: Benefits will not be available for any condition(s) as defined in the policy,

until 48 months of continuous coverage have elapsed, since inception of the first

policy with us.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

39. Reinstatement Value means the cost of replacing or reinstating on the same site,

property of the same kind or type but not superior to or more extensive than the

insured property when new.

40. Schedule means this schedule and parts thereof, and any other annexure(s)

appended, attached and / or forming part of this Policy.

41. Specific Definitions for all Table B of Benefits

1) Limb means the hand above the wrist joint or foot above the ankle joint.

2) Loss of Hearing means the total and irrecoverable Loss of Hearing.

3) Loss of Mastication means the total and irrecoverable loss of ability to chew food.

4) Loss of Sight means the total and irrecoverable Loss of Sight. This is considered to

have occurred if the degree of sight remaining after correction is 3 / 60 or less on the

Snellen Scale.

5) Loss of Speech means the total and irrecoverable Loss of Speech

42. Spouse means an Insured Person’s husband or wife who is recognized as such by

the laws of the jurisdiction in which they reside

43. Sum Insured means and denotes the amount of cover available to the Insured in the

subject to the terns and conditions of this Policy and as stated in the Table of Benefits

of Part of section 1 of the Schedule which is the maximum liability of the Company

under this Policy.

44. Scheduled Airline means any civilian aircraft operated by a civilian scheduled air

carrier holding a certificate, license or similar authorization for civilian scheduled air

carrier transport issued by the country of the aircraft’s registry, and which in

accordance therewith flies, maintains and publishes tariffs for regular passenger

service between named cities at regular and specified times, on regular or chartered

flights operated by such carrier and is flown by authorized licensed pilot.

45. Terrorism means activities against persons, organizations or property of any nature:

1) that involve the following or preparation for the following:

a) use or threat of force or violence; or

b) commission or threat of a dangerous act; or

c) commission or threat of an act that interferes with or disrupts an electronic,

communication, information or mechanical system; and

2) when one or both of the following applies:

a) the effect is to intimidate or coerce a government or the civilian population or any

segment thereof, or to disrupt any segment of the economy; or

b) It appears that the intent is to intimidate or coerce a government, or to further

political, ideological, religious, social or economic objectives or to express (or

express opposition to) a philosophy or ideology.

46. Valuables means: Jewelry Watches, clocks, photographic equipment, binoculars,

telescopes, musical instruments, mobile telephone handsets, digital diaries, electronic

calculators, palmtops.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

47. War means war, whether declared or not or any warlike activities, including use of the

military force by any sovereign nations to achieve economic, geographic,

nationalistic, political racial religious or other ends.

Overriding effect of Definitions of the Schedule

The terms and conditions contained herein and in Definitions of the Schedule shall

be deemed to form part of the Policy and shall be read as if they are specifically

incorporated herein; however in case of any inconsistency of any term and condition

with the scope of cover contained in Definitions of the Schedule, then the term(s)

and condition(s) contained herein shall be read mutatis mutandis with the scope of

cover/terms and conditions contained in Definitions of the Schedule and shall be

deemed to be modified accordingly or superseded in case of inconsistency being

irreconcilable.

GENERAL EXCLUSIONS APPLICABLE

No indemnity is available hereunder and no payment will be made by the Company

for any claim directly or indirectly caused by, based on, arising out of or howsoever

attributable to any of the following:

a) Acts of Terrorism. Loss or damage, cost or expenses of whatsoever nature

directly or indirectly caused by, resulting from or in connection with any action

taken in controlling, preventing, suppressing or in any way relating to such action

taken in respect of any act of terrorism shall be excluded, unless it is proved by

the Insured to the satisfaction of the Company that such loss or damage, cost or

expenses of whatsoever nature is not directly or indirectly caused by, resulting

from or in connection with any action taken in controlling, preventing, suppressing

or in any way relating to such action taken in respect of any act of Terrorism.

In the event any portion of this exclusion is found to be invalid or unenforceable,

the remainder shall remain in full force and effect.

b) War, war-like operations, act of foreign enemy, invasion of Indian territory or any

part thereof, hostilities (whether war be declared or not), civil war, rebellion,

revolution, insurrection, civil commotion, military or usurped power, or loot or

pillage in connection with the foregoing, seizure, capture, confiscation, arrests,

restraints and detainment by order of any governments or any other authority,

unless it is proved by the Insured to the satisfaction of the Company that such

loss or damage or contingency or cost or expenses of whatsoever nature are not

directly or indirectly caused by, resulting from or in connection with any war, war-

like operations, act of foreign enemy, invasion of Indian territory or any part

thereof, hostilities (whether war be declared or not), civil war, rebellion, revolution,

insurrection, civil commotion, military or usurped power, or loot or pillage in

connection with the foregoing, seizure, capture, confiscation, arrests, restraints

and detainment by order of any governments or any other authority.

In the event any portion of this exclusion is found to be invalid or unenforceable,

the remainder shall remain in full force and effect.

c) Directly or indirectly caused by or contributed to by or arising from ionizing

radiation or contamination by radioactivity from any nuclear fuel or from any

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

nuclear waste or from the combustion of nuclear fuel. For the purpose of this

exclusion, combustion shall include any self-sustaining process of nuclear fission

d) Directly or indirectly caused by or contributed to by or arising from nuclear

weapon materials.

e) Arising or resulting from the Insured committing any breach of the law with

criminal intent.

f) The Policy does not cover loss or damage to:

i. Cash, money in any form such as drafts, cheques, credit/debit/charge

cards, ATM cards, promissory notes, bonds, certificates, negotiable

instruments and the like.

ii. Drawings, plans, manuscripts, moulds, designs.

iii. Contact lenses and dentures.

iv. Items of historic, antique or artistic value including fine art, statues, rare

books, rare items, object d’art, rugs, rare glass and/or porcelain.

v. Items those are consumable or perishable in nature.

vi. Livestock, domestic pets, domestic animals. Loss or damage caused to or

by domestic pets, birds, vermin, insects, rodents or domestic animals shall

be excluded.

vii. Motor vehicles, pedal cycles.

viii. Excess of 20% of the total burglary Sum Insured.

ix. The Policy does not cover any damages occurring to Insured premises

located 500 feet before sea / ocean.

g) The Policy does not cover any loss or damage to Contents while they are located

inside the Insured Premises whilst the Insured Premises has remained

unoccupied by the Insured / any family member or their representative /

authorized person for 30 or more consecutive days unless the Insured notifies the

Company in writing and the Company agrees in writing to cover any loss or

damage to Contents on certain terms and conditions entirely at the discretion of

the Company.

h) The Policy does not cover loss or damage caused by discharge, seepage,

dispersal, migration or release or escape of pollutants or the cost of extracting

such pollutants. Pollutant means any solid, liquid, gaseous or thermal irritant or

contaminant or smoke, vapour, soot, fumes, acids, alkalis, chemicals and waste.

i) The Policy does not cover loss or damage caused by water or water borne

material in the ground, or by its pressure, leakage or seepage.

j) The Policy does not cover any loss or damage to business property.

k) The Policy does not cover any loss or damage due to gradually operating cause,

aging, wear and tear or deterioration, rusting, corrosion, moths, insects, mildew

and the like, rust, bacteria, dry or wet rot, or warping, air dampness, water vapour

or temperature extremes.

l) The Policy does not cover any loss or damage due to scratches, dents, cracks,

internal misalignment, ingress of moisture and the like unless caused by an

accidental external means, inherent vice or latent defect.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

m) The Policy does not cover any loss or damage resulting from intentional acts or

gross negligence of the Insured and/or family members. Intentional act is one

whose consequences could have been foreseen by a reasonable person.

n) The Policy does not cover any loss or damage caused by failure of Insured or any

family member to use all reasonable means to prevent or limit loss / damage

before, at, or after the time of loss or damage.

o) The Policy does not cover any loss or damage to property or contents of roomers,

boarders, licensees or other tenants / sub-tenants residing in the Insured

Premises.

p) The Policy does not cover loss or damage on account of failure on the part of

Insured and Family members to take reasonable and due care as may be

expected of prudent persons.

q) Any residential property used for Commercial Purposes.

r) The Policy does not cover loss or damage caused by or attributable to:

i. Breakage or chipping of items of fragile or brittle nature unless it is directly

attributable to insured perils.

ii. Normal shrinkage, spontaneous combustion.

iii. Faulty workmanship, defective design or material

iv. Process of cleaning, maintenance, repair or dismantling.

v. The Insured Premises undergoing structural alteration, renovation or repair.

vi. Atmospheric or climatic conditions.

vii. Temporary or permanent dispossession resulting from confiscation,

requisition or destruction by order of the Government or any lawfully

constituted authority.

viii. The Policy does not cover any consequential or indirect loss or damage,

which is not the direct result of insured perils, nor does it cover

apprehended loss or damage or contractual liability of any kind.

s) Directly or indirectly caused by or contributed to by or arising out of usage,

consumption or abuse of alcohol and/or drugs. "However, this exclusion will not

apply if the insured's inebriated condition has not contributed to the cause of

accident or the insured in inebriated condition had a mere presence at the site of

accident without contributing to the cause of accident.

t) Arising out of or as a result of any act of self-destruction or self inflicted injury,

attempted suicide or suicide.

u) Any sexually transmitted diseases. Acquired Immune Deficiency Syndrome

(AIDS), AIDS related complex syndrome (ARCS) and all diseases caused by and/

or related to the HIV.

v) Any consequential or indirect loss or expenses arising out of or related to any

Insured Event.

w) Arising out of or resulting directly or indirectly due to or as a consequence of

pregnancy or treatment traceable to pregnancy and childbirth, abortion and its

consequences, tests and treatment relating to infertility and invitro fertilization.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

x) Arising out of or resulting directly or indirectly while serving in any branch of the

Military or Armed Forces of any country during war or warlike operations.

y) Arising out of or resulting directly or indirectly caused by, resulting from or in

connection with any act of terrorism regardless of any other cause or event

contributing concurrently or in any other sequence to the loss. The Policy also

excludes loss, damage, cost or expenses of whatsoever nature directly or

indirectly caused by, resulting from or in connection with any action taken in

Controlling, preventing, suppressing or in any way relating to action taken in

respect of any act of terrorism.

SECTION 1

BUILDINGS AND CONTENTS

The Company will indemnify the Insured in respect of loss of or damage to the Building and

Contents in the Insured Premises specified in the Schedule against:

a) Fire, excluding destruction or damage caused to the property insured by:

i) Its own fermentation, natural heating or spontaneous combustion.

ii) It’s undergoing any heating or drying process.

iii) Burning of property insured by order of any Public Authority

b) Lightning.

c) Explosion/implosion, excluding loss, destruction of or damage:

i) To boilers (other than domestic boilers), economizers or to other vessels,

machinery or apparatus in which steam is generated or their resulting from their

own explosion/ implosion,

ii) Caused by centrifugal forces.

d) Aircraft Damage: Loss, Destruction or damage caused by Aircraft, other aerial or

space devices and articles dropped there from excluding those caused by pressure

waves.

e) Riot, Strike, and Malicious Damage: Loss of or visible physical damage or

destruction by external violent means directly caused to the property insured but

excluding those caused by:

i) Total or partial cessation of work or the retardation or interruption or cessation of

any process or operations or omissions of any kind.

ii) Permanent or temporary dispossession resulting from confiscation,

commandeering, requisition or destruction by order of the Government or any

lawfully constituted Authority.

iii) Burglary, housebreaking, theft or any such attempt or any omission of any kind of

any person (whether or not such act is committed in the course of a disturbance

of public peace) in any malicious act.

iv) Permanent or temporary dispossession of the Insured from the building in which

the Insured Premises is situated resulting from the unlawful occupation by any

person of such building or prevention of access to the same.

f) Storm, Cyclone, Typhoon, Tempest, Hurricane, Tornado, Flood and Inundation:

Loss destruction or damage directly caused by storm, cyclone, typhoon, tempest,

hurricane, tornado, flood or inundation.

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st

Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Service Address: D-301, 3rd

Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. Customer Service No: 022 - 6234 6234 / 0120 -

6234 6234 | care@hdfcergo.com | www.hdfcergo.com. Trade Logo displayed above belongs to HDFC Ltd and ERGO International AG and used

by the Company under license. UIN: Product Name – Home Suraksha Plus Policy - IRDA/NL-HLT/HDFC-ERGOGI/P-H/V.I/258/13-14

HDFC ERGO General Insurance Company Limited

g) Impact Damage: Loss of or visible physical damage or destruction caused to the

property insured due to the impact by any Rail/Road vehicle or animal by direct

contact not belonging to or owned by:

i) the Insured or any occupier of the premises or

ii) Their employees while acting in the course of their employment.

h) Subsidence and Landslide including Road slide: Loss, destruction or damage

directly caused by Subsidence of part of the site on which the property stands or

Land slide / Road slide excluding:

i) the normal cracking, settlement or bedding down of new structures

ii) the settlement or movement of made up ground

iii) coastal or river erosion

iv) defective design or workmanship or use of defective materials

v) Demolition, construction, structural alterations or repair of any property or ground

works or excavations.

i) Bursting and/or overflowing of water tanks, apparatus and pipes.

j) Missile testing operation

k) Leakage from automatic sprinkler installations, excluding loss, destruction or

damage caused by:

i) Repairs or alterations to the buildings or premises.

i) repairs, removal or extension of the sprinkler installation

ii) Defects in construction known to the Insured.

l) Bush fire, excluding loss, destruction or damage caused by forest fire.

A. GENERAL CONDITIONS AND EXCLUSIONS APPLICABLE TO SECTION 1

General Conditions:

1. THIS POLICY shall be voidable in the event of misrepresentation, mis-description or non-

disclosure of any material particular.

2. All insurances under this policy shall cease on expiry of seven days from the date of fall

or displacement of any building or part thereof or of the whole or any part of any range of

buildings or of any structure of which such building forms part.

PROVIDED such a fall or displacement is not caused by insured perils, loss or damage

which is covered by this policy or would be covered if such building, range of buildings or