By Jared Swanson, jared.swanson@house.mn

Property Tax 101:

Property Tax Variation

by Property Type

July 2022

Causes of property tax variation between property types

The primary cause of variation in property tax burdens is Minnesota’s classified property tax

system. In a classified system, each class of property is assigned one or more class rates. The

property’s taxable market value is multiplied by the class rate(s) to determine the property’s

tax base, known as its net tax capacity.

Besides the class rates, variations in tax by type of property also occur because the state

general tax and school district operating referendum levies apply to some types of property but

not to others. School district operating referendum levies are levied on a separate tax base

known as referendum market value, which is not classified and excludes certain agricultural and

seasonal recreational property. The state general tax only applies to

commercial/industrial/public utility property and seasonal recreational property.

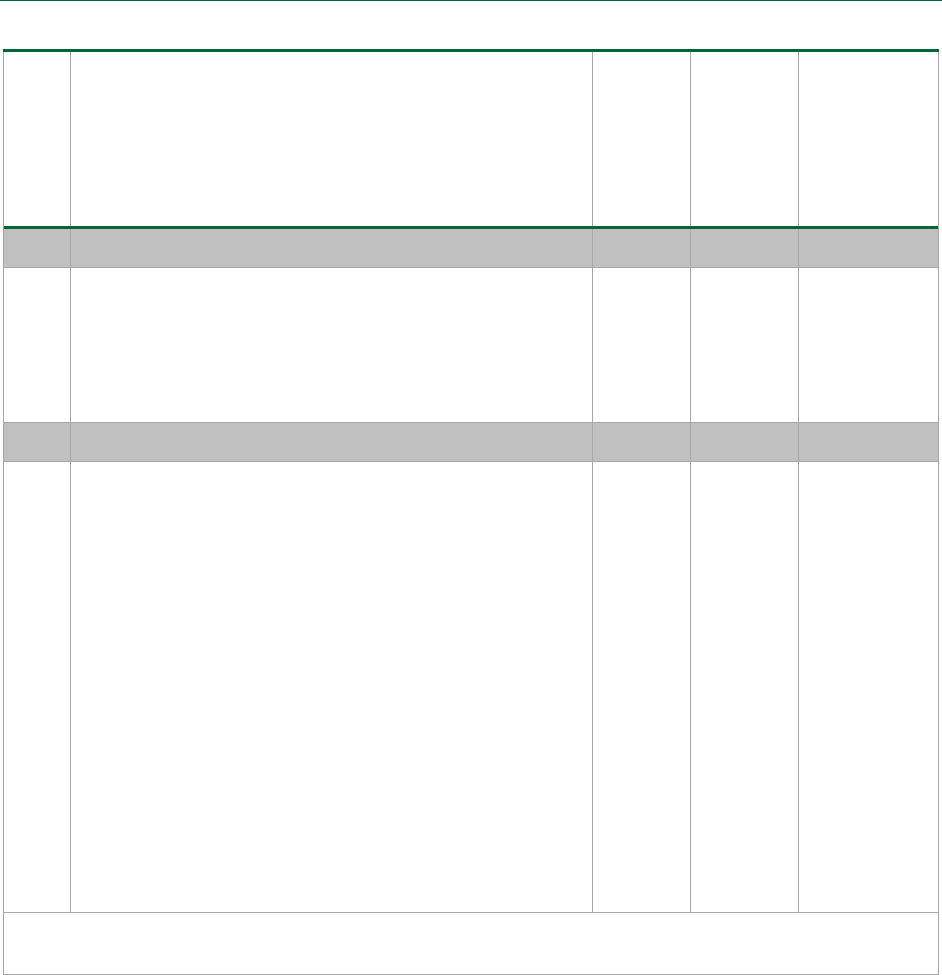

Class Rates Schedule for Taxes Payable in 2023

Class Property Type (major property types only)

Class

Rate

Subject

to State

Tax?

Subject to

School

Operating

Referendum

Levies?

1 Homestead

1a Residential homestead

Up to $500,000 1.00% No Yes

Over $500,000 1.25 No Yes

2 Agricultural

2a Agricultural homestead

House, garage, & 1 acre: up to $500,000 1.00 No Yes

House, garage, & 1 acre: over $500,000 1.25 No Yes

Agricultural land & buildings

Up to $1,890,000 0.50 No No

Over $1,890,000 1.00 No No

2b Agricultural nonhomestead 1.00 No No

2c Nonhomestead rural vacant land 1.00 No No

Property Tax 101: Property Tax Variation by Property Type

Minnesota House Research Department Page 2

Class Property Type (major property types only)

Class

Rate

Subject

to State

Tax?

Subject to

School

Operating

Referendum

Levies?

3 Commercial/Industrial/Public Utility

3a Commercial/Industrial/Public Utility

Up to $150,000 1.50 Yes* Yes

Over $150,000 2.00 Yes* Yes

Electric generation attached machinery 2.00 No Yes

4 Other residential

4a Apartments (4 or more units) 1.25 No Yes

4bb Residential nonhomestead single unit:

Up to $500,000 1.00 No Yes

Over $500,000 1.25 No Yes

4b Residential nonhomestead 2-3 unit and undeveloped

land

1.25 No Yes

4c Seasonal recreational residential (noncommercial):

Up to $500,000 1.00 Yes** No

Over $500,000 1.25 Yes** No

4d Low-income apartments:

Up to $100,000 per unit 0.75 No Yes

Over $100,000 per unit 0.25 No Yes

* Subject to state general tax at commercial-industrial rate.

** Subject to state general tax at seasonal recreational rate.

Other factors that cause variation

Variations also occur because of various property tax exclusions and credits. Homesteads

benefit from the homestead market value exclusion, which provides for up to $30,400 of a

homestead’s market value to be deducted before determining the taxes payable. Other

exclusions are the disabled veterans’ exclusion and the agricultural “Green Acres” program.

Certain types of property also qualify for property tax credits that reduce the net tax on the

property. The biggest property tax credit programs are the agricultural market value credit, the

taconite homestead credit, the disparity reduction credit, and the school building bond

agricultural credit.

Local variation also occurs because tax rates are determined separately for each taxing

jurisdiction in the state, based on each jurisdiction’s levy and tax base.

Property Tax 101: Property Tax Variation by Property Type

Minnesota House Research Department Page 3

Effective tax rate

Effective tax rate is a measure of tax burden useful in making property tax comparisons. It is

defined as net tax divided by market value (i.e., tax as a percent of market value). It allows

comparison of tax burdens between properties of different values, different types, and

different locations.

Comparison of Property Taxes on Various Types of Property,

Within the Same Taxing Jurisdiction, Each with an Estimated Market Value of

$200,000

(Property taxes payable in 2023)

Property Type

Class

Rate(s)

Net Tax

Capacity

Property Tax*

Effective

Tax Rate

Gross Net

Agricultural homestead** 0.5/1.0% $1,040 $1,168 $717 0.36%

Agricultural nonhomestead 1.0 2,000 2,100 2,100 1.05

Residential homestead 1.0 1,808 2,278 2,278 1.14

Seasonal recreational residential (i.e.,

cabin)

1.0 2,000 2,400 2,400 1.20

Residential nonhomestead (1 unit) 1.0 2,000 2,480 2,480 1.24

Residential nonhomestead (2-3 units) 1.25 2,500 3,005 3,005 1.50

Apartment 1.25 2,500 3,005 3,005 1.50

Low-income apartment 0.75/0.25 1,050 1,430 1,430 0.72

Commercial/Industrial 1.5/2.0 3,250 4,193 4,193 2.10

Commercial/Industrial @

$2,000,000***

1.5/2.0 39,250 59,813 59,813 2.99

* These examples assume a total local net tax capacity tax rate of 105 percent, a total market value tax rate of

0.19 percent, a state commercial-industrial tax rate of 40 percent, and a state seasonal recreational tax rate of

15 percent.

** The agricultural homestead is assumed to consist of a house valued at $40,000 and agricultural land and

buildings valued at $160,000.

*** This property has a market value of $2,000,000 to show a typical effective tax rate on a larger

commercial/industrial property.

Minnesota House Research Department provides nonpartisan legislative, legal, and

information services to the Minnesota House of Representatives. This document

can be made available in alternative formats.

www.house.mn/hrd | 651-296-6753 | 155 State Office Building | St. Paul, MN 55155