NewMexicoHomeownerAssistanceFund

ProgramManualandTermSheets

NMHomeownerAssistanceFundManual

i

Contents

Section1‐Introduction....................................................................................................................................1

AmericanRescuePlanAct............................................................................................................................1

NewMexicoHomeownerAssistanceFund..................................................................................................1

Section2‐EligibleUseofFunds.......................................................................................................................1

ReinstatementandLossMitigation..............................................................................................................1

PaymentAssistance......................................................................................................................................2

HousingCostAssistanceTaxes.....................................................................................................................2

HousingCostAssistanceInsurance..............................................................................................................2

Section3‐Program

MarketingandOutreach..................................................................................................2

Section4‐GeneralEligibilityRequirements....................................................................................................3

COVID19Impact..........................................................................................................................................3

IncomeRequirements..................................................................................................................................3

NewMexicoResidency.................................................................................................................................5

HousingCostsandDelinquency...................................................................................................................6

ConformingLoanLimits................................................................................................................................6

Section5‐AdditionalEligibilityRequirements.................................................................................................6

ReinstatementandLossMitigation

Assistance............................................................................................6

PaymentAssistance......................................................................................................................................7

Section6‐IncomeEligibility.............................................................................................................................8

AnnualIncomeLimits...................................................................................................................................8

Section7‐RequiredDocu mentation...............................................................................................................8

HouseholdIncomeDocumentation.............................................................................................................9

ResidencyDocumentation...........................................................................................................................9

HousingCostAssistanceNeedDocumentation...........................................................................................9

ThirdPartyphoneverification....................................................................................................................10

DocumentationfromPrivateHousing

Providers.......................................................................................10

AcceptableDo cumentationforextenuatingcircumstances......................................................................10

Section8‐D uplicationofBenefits.................................................................................................................10

Section9‐ApplicationProcessingandSelection...........................................................................................10

IntakeandAssessmentProcess..................................................................................................................11

AvailabilityofApplications....................................................................................................................11

Applicationranking...................................................................................................................................11

NMHomeownerAssistanceFundManual

ii

ApplicationDate/Time...............................................................................................................................11

IncomeTargeting........................................................................................................................................12

SociallyDisadvantagedIndividuals........................................................................................................12

Appeals.......................................................................................................................................................12

Section10‐Additional ProgramGuidelinesandRequirements....................................................................12

RecertificationProcessforOngoingPaymentAssistance..........................................................................12

FalseClaims................................................................................................................................................13

ApplicantConfidentiality............................................................................................................................13

Nondiscrimination......................................................................................................................................13

ConflictofInterest......................................................................................................................................

13

ProgramGuidelinesChangesorModifications..........................................................................................13

Exhibit1–TermSheets....................................................................................................................................1

HomeownershipLoanReinstatement/LossMitigationProgram............................................................1

HomeownershipLoanPaymentAssistance.............................................................................................4

PropertyChargeDefaultResolution(Insurance).....................................................................................7

PropertyChargeDefaultResolution(Taxes)............................................................................................9

Exhibit2‐PaperApplication.............................................................................................................................1

Exhibit3‐

ProgramParticipation‐PaymentAcceptance Agreement................................................................1

Exhibit4‐VerificationofIncomeand/orReductionofHours/PayForm........................................................1

Exhibit5‐AuthorizationtoReleaseInformationtoThirdParty......................................................................1

Exhibit6–IncomeLimits..................................................................................................................................1

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 1

Section1‐Introduction

AmericanRescuePlanAct

OnJanuary21,2020,theCentersforDiseaseControlandPrevention(CDC)confirmedthefirstcaseintheUnited

StatesofacoronavirusknowncommonlyreferredtoasCOVID‐19.Thenationcontinuestofacesignificantpublic

healthandeconomicchallengesrelatedtoCOVID‐19.

The U.S. Department of the Treasury

(Treasury) Homeowner Assistance Fund (HAF) was established under

section 3206 of the American Rescue Plan Act of 2021 to mitigate financial hardships associated with the

coronaviruspandemicbyprovidingfundstoeligibleentitiesforthepurposeofpreventinghomeownermortgage

delinquencies, defaults,foreclosures,and displacements ofhomeownersexperiencingfinancialhardship

after

January21,2020,throughqualifiedexpensesrelatedtomortgage s andhousing.

TheStateofNewMexicoreceivedanallocationintheamountof$55,772,684undertheHomeownerAssistance

Fund.MFA hasbeen contracted bytheState to administerhousingcostassistanceprogra ms whichwillassist

homeownerswithhousingrelatedcosts

includingloanreinstatement,monthlypaymentassistance,homeowner

taxesandhomeownerinsurance.TheStateofNewMexicoisprovidingutilityassistancewithHAFfundingunder

aseparateprogram

1

.

NewMexicoHomeownerAssistanceFund

The New Mexico Homeowner Assistance Fund (HAF) provides housing grants to income‐eligible households

experiencingfinancialhardshipassociatedwiththeCOVID‐19healthcrisis.

Thesegrantsarehousingassistancepaymentsmadeonbehalfofincome‐eligiblehomeownersupto$20,000per

household,tomaintainhousingand/ortoreducehousingcostdelinquency

associatedwiththeCOVID‐19health

crisis.Awardamountisbasedofftheactualcostsnottoexceedthehouseholdmaximum.

HAF funds will be used for housing assistance payments on behalf of income‐eligible homeowners whose

householdshaveexperiencedfinancialhardshipassociatedwiththeCOVID‐19healthcrisis.Qualified

expenses

are for the purpose of preventing homeowner mortgage delinquencies, homeowner mortgage defaults,

homeownermortgageforeclosures,anddisplacementsofhomeownersexperiencingfinancialhardship.

Section2‐EligibleUse ofFunds

TheHAFprogramallowsforthefollowingeligibleusesoffunds.Eligibleuseoffundsincludereinstatement,loss

mitigation assistance, monthly payment assistance, delinquent property tax assistance, and delinquent

homeownerinsuranceassistanceasdescribedbelowandinthepr ogramTermSheets.

ReinstatementandLossMitigation

TheHomeownershipLoanReinstatementProgramwillprovideup$20,000perhouseholdtoreduceoreliminate

homeownershipcostdelinquencies.

HAFFundsmaybeusedtobringtheaccountfully current,withnoremainingdelinquentamounts,andtorepay

amountsadvancedbythelenderorservicerontheborrower’sbehalfforpropertycharges,

includingproperty

taxes, hazard insurance premiums, flood or wind insurance premiums, ground rents, condominium fees,

cooperativemaintenance fees,planneduni t develo pmentfees, homeowners’ association feesorutilitiesthat

theserviceradvancedtoprotectlienposition.Paymentmayalsoincludeanyreasonablyrequiredlegalfees.HAF

Fundsmaybeusedfor

apartialreinstatementifthefull reinstatementamountexceedstheho useholdmaximum.

Homeownerswhoareworkingwiththeirloanservicertocompletelossmitigationwillhavetheopportunityto

incorporateHAFintotheirdefaultresolutionasallowedbyservicerproceduresandinvestorguidelines.Funds

1

Forassistancewithutilitypayments,visitwww.renthelpnm.org.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 2

can be applied toa lump sumreinstatementorfor principal reduction. HAF funds maybeusedtoreimburse

partialclaimliensafterlossmitigation,asallowedforbyservicerandinvestorguidelines.

Assistancewillbeavailableforhouseholdswithoutaccesstolossmitigationorthathavealreadyexhaustedloss

mitigation.

HAFfundsmayalsobeusedpriortoorduringthelossmitigationprocess.

PaymentAssistance

The Homeownership Loan Payment Assistance program will provide payment assistance to homeowner

householdsstrugglingtomakemortgageorhomeownershiploanpaymentsduetofinancialhardshipassociated

withtheCoronaviruspandemic.

HousingCostAssistanceTaxes

The Property Charge Default Resolution (Taxes) program will provide up $2 0,000 per household to resolve

delinquent property taxes that threatens a homeowner’s ability to sustain ownership of the property.This

programisintendedtoassistwithpropertytaxesoutsideofahomeownershiploanescrowornotcoveredunder

theHomeownershipLoan

ReinstatementprogramorHomeownershipLoanPaymentAssistanceprogram(which

willalsopaypropertychargesassociatedwithhomeownershiploanescrows).

Eachhouseholdmayreceivefundingforuptothreeyearsofdelinquenttaxes.Fundsmayalsobeused topay

propertytaxescomingdueinthe90day s followinghouseholdapplication

approval.

HousingCostAssistanceInsurance

ThePropertyChargeDefaultResolution(Insurance)programwillprovideup$20,000perhouseholdtoresolve

propertychargedefaultthatthreatensahomeowner’sabilitytosus tainownershipoftheproperty.Thisprogram

isintendedtoassistwithpropertyinsurancechargesoutside ofahomeownershiploanescrowornotcovered

undertheHomeownership

LoanReinstatementprogramorHome ownershipLoanPaymentAssistanceprogram

(whichwillalsopaypropertychargesassociatedwithhomeownershiploanescrows).

HAFFundsmaybeusedtopaypastduepropertyinsurancepremiumsthatthreatensustainedownershipofthe

propertyandmustbebrou ghtcurrentbyprogramassistanceorresolvedconcurrently

withtheprogramdesign

elementprovidingassistance.

Each household may receive funding for up to three years for insurance premiums including force placed

insurance. Funds may also be used to pay property insurance charges coming due in the 90 days foll owing

householdapplicationapproval.

Section3‐Prog ramMarketingandOutreach

MFA will engage in outreach through partnerships with organizations that focus primarily on serving

homeownersearningincomesbelow100%ofareamedianincomeorsociallydisadvantagedindividualsandthat

havethecapacitytoengagetargetedcommunitiesinaculturallyandlinguisticallyrelevantmannertoencourage

thesubmissionofapplicationsforHAF

resourcesfromtargetedpopulations.

TheHAFoutreachandmarketingcampaignwillincludebothtraditionalmediaandgrassrootsmarketingefforts.

Thetraditiona l mediaarmofthe campaignwillserve asamechanismtospreadawarenessaroundHAFandthe

availablefunds/resourcesforNewMexicofamilies.Traditionalmediaincludes,butisnot

limitedto,broadcast

andcabletelevision,digitalmarketing,socialmedia,andpri ntadvertising(newspaper,magazine).

Themediacampaignwillutilizedatatoregularlyadaptcampaignmessages,placement,andtacticstoensureit

iseffectivelyreachingtargetaudiencesandimplementingappropriatetechnologies andfindings.Theca mpaign

willoptimizetowardshighestperforming

audiencesegmentation,creativemessaging,andtacticalapproaches.

Onanongoingbasis,thecampaignwill:1)reviewapplicants'demographiccharacteristicsandareasofresidence

to determine whether applicants are representative of eligible populations and 2) employ new outreach and

marketingstrategiesasnecessary.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 3

Anon‐paidgrassrootsoutreachcampaignandcommunityengagementactionswillbevitaltacticsinprompting

applicantstostartandcompletetheHAFapplicationprocess.MFAwillcultivateandresourcetrustedmessengers

inlocal,nonprofit,andcivicorganizationstoengageandsupportapplicantsintheapplicationprocess.

Additionally,throughaseries

oftrainingsessions,thecampaignwillestablishpartnershipswithhousingagencies,

legal aid organizations, and educational organizations to utilize trusted messengers to spread awareness and

supportapplicantsinthehousingassistanceprocess.Thesetacticswillexpandthereachofthecampaign,while

concurrentlyshorteningthedistancebetweenpotential participan tsand

trustedmessengers.

While all eligible homeowners will be encouraged to apply, the campaign will leverage centralized outreach

sourceswheremanyhouseholdscanbereachedwithexistingcommunications.Thisincludesthosehomeowners

whohavemortgagesthroughexistingState,Federal,andlocalprogramsthattargetlow‐andmoderate‐income

borrowers.Thecampaignwill

providecustommaterialsfortheirspecificoutreachneeds.

All associated marketing and outreach efforts will be conducted in both English and Spanish. Some outreach

supportwillbeprovidedinlessfrequentbutpresentlanguages suchasVietnamese.

Section4‐Gene ralEligibilityRequirements

Applicant’seligibilityforthehomeownerassistanceprogramsshallbedetermineduponsubmissionofa

completedProgramApplicationwithallrequiredinformationanddocuments.Inordertogeneratean

application,householdsmustmeetthefollowingGeneralEligibilityRequirements.Eachprogramelementis

administeredindependentlyandmayhaveadditiona l programspecific eligibilitycriteria.

COVID19Impact

Tobeeligibleforassistance,eachapplicantmustattestthat theirhousehold experiencedafinancial hardship

afterJanuary21,2020associatedwiththeCOVID‐19pandemicsuchas:

a. Jobloss;

b. Jobfurlough;

c. Closureofplaceofemployment;

d. Wagereduction;

e. Reductioninself‐employmentcompensation;

f. Job

lossand/orwagereductionduetorequirementtobequarantinedbasedonadiagnosisof

COVID‐19;

g. Increasedexpenditures associatedwiththeCOVID‐19healthcrisis;or

h. Otherpertinentcircumstancesleadin gtofinancialhardship.Determinationofotherpertinent

circumstancesoffinancialhardshipwillbemadebyprogramstaff.

IncomeRequirements

Tobeeligible forassistance,eachapplicantmustprovideincomedocumentation andhaveincomesequaltoor

lessthan150%oftheareamedianincomeor100%ofthe medianincomefortheUnitedStates,whicheveris

greater.

Householdincomeeligibilityis based on thefollowing:

a. Thetotalnumberof

peopleinthehous ehold; and

b. The total amount of current annual household income as stated in the Program Application and

confirmedbysupportingdocumentation.

Annualincomemeansallamounts,monetaryornot,which:

1. Go to, or on behalf of, the family hea d or spouse (even if temporarily absent)

or to any other family

member;or

2. Areanticipatedtobereceivedfromasourceoutsidethefamilyduringthe12‐monthperiodfollowing

admissionorannualreexaminationeffectivedate;and

3. Whichareno tspecificallyexcludedbel o w.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 4

4. Annual income also means amounts derived (during the 12‐month period) from assets to which any

memberofthefamilyhasaccess.

Annualincomeincludes,butisnotlimitedto:

1. Thefullamount,beforeanypayrolldeductions,ofwagesandsalaries,overtimepay,commissions,fees,

tipsandbonuses,and

othercompensationforpersonalservices;

2. Thenetincomefromtheoperationofabusiness orprofession.Expendituresforbusinesse xpansionor

amortization of capital indebtedness shall not be used as deductions in d etermining net income. An

allowancefordepreciationofassetsusedinabusinessorprofessionmaybe

deducted, basedonstraight

linedepreciation, asprovidedinIn ternalRevenueServiceregulations.Anywithdrawalofcashorassets

from the operation of a business or profession will be included in income, except to the extent the

withdrawalisreimbursementofcashorassetsinvestedintheoperationbythefamily;

3. Interest,dividends,andothernetincomeofanykindfromrealorpersonalproperty.Expenditures for

amortization of capital indebtedness shall not be used as deductions in determining net income. Any

withdrawalof cashor assets froman investmentwillbeincluded inincome,excepttotheextent the

withdrawalisreimbursem entofcashorassetsinvestedbythefa mily.Wherethefamilyhasnetfamily

assetsinexcessof$5,000,annualincomeshallincludethegreateroftheactualincomederivedfromall

netfamilyassetsorapercentageofthevalueofsuchassetsbasedonthecurrent

passbooksavingsrate,

asdeterminedbyHUD;

4. The full amount of periodic amounts received from Social Security, annuities, insurance policies,

retirement funds, pensions, disability or death benefits, and other similar types of periodic receipts,

includingalump‐sumamountorprospectivemonthlyamounts forthedelayedstartofa

periodicamount

(exceptasprovidedinparagraph(c)(14)ofthissection);

5. Payments in lieu of earnings, such as unemployment and disability compensation, worker's

compensationandseverancepay(exceptasprovidedinparagraph(c)(3)ofthissection);

6. WelfareassistancepaymentsmadeundertheTemporaryAssistanceforNeedyFamilies(TANF)program

areincludedinannualincomeonlytotheextentsuchpayments:

a. QualifyasassistanceundertheTANFprogramdefinitionat45CFR260.31;and

b. Arenototherwiseexcludedbelow.

c. Ifthewelfareassistancepaymentincludesanamountspecificallydesignatedforshelterandutilities

thatissubje c tto

adjustmentbythewelfareassistanceagencyinaccordancewiththeactualcostof

shelterandutilities,theamountofwelfareassistanceincometobeincludedasincomeshallconsist

of:

o Theamountoftheallowanceorgrantexclusiveoftheamountspecificallydesignatedforshelter

orutilities;plus

o The

maximum amount that the welfare assistance agency could in fact allow the family for

shelter and utilities. If the family's welfare assistance is ratably reducedfrom the standard of

needbyapplyingapercentage,theamountcalculatedunderthisparagraphshallbetheamount

resultingfromoneapplicationofthe

percentage.

7. Periodic and determinable allowances , such as alimony and child support payments, and regular

contributionsorgiftsreceivedfromorganizationsorfrompersonsnotresidinginthedwelling;

8. All regular pay, special pay and allowances of a memberof the Armed Forc es (except as excluded in

number6below.

Annualincomedoesnotincludethefollowing:

1. Incomefromemployme ntofchildren(includingfosterchildren)undertheageof18years;

2. Payments received for the care of foster children or foster adults (usually persons with disabilities,

unrelatedtothetenantfamily,whoareunabletolivealone);

3.

Lump‐sum additions to family assets, such as inheritances, insurance payments (including payments

under health and accident insurance and worker's compensation), capital gains and settlement for

personalorpropertylosses(exceptasprovidedinparagraph(b)(5)ofthissection);

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 5

4. Amounts received by the family that arespecifically for, or in reimbursement of, the cost of medical

expensesforanyfamilymember;

5. Incomeofalive‐inaide,asdefinedin§5.403;

6. Thespecialpaytoafamily memberservingintheArmedForceswhoisexposed

tohostilefire;

7. AmountsreceivedundertrainingprogramsfundedbyHUD;

8. Amountsreceivedbyapersonwithadisabilitythataredisregardedforalimitedtimeforpurposesof

Supplemental SecurityIn comeeligibilityandbenefitsbecausetheyaresetasideforuseunderaPlanto

AttainSelf‐

Sufficiency(PASS);

9. Amounts received by a participant in other publicly assisted programs which are specifically for or in

reimbursement of out‐of‐pocket expenses incurred (special equipment, clothing, transportation, child

care,etc.)andwhicharemadesolelytoallowparticipationina specificprogram;(iv)Amountsreceived

underaresident

servicestipend.Aresidentservicestipendisamodestamount(nottoexceed$200per

month)receivedbyaresidentforperformingaserviceforthePHAorowner,ona part‐timebasis,that

enhancesthequalityoflifeinthedevelopment.Suchservicesmayinclude,butarenot

limitedto,fire

patrol,hallmonitoring,lawnmaintenance,residentinitiativescoordination,andservingasamemberof

thePHA'sgoverningboard.Noresidentmayreceivemorethanonesuchstipendduringthesameperiod

oftime;

10. IncrementalearningsandbenefitsresultingtoanyfamilymemberfromparticipationinqualifyingState

or local employment training programs (including training programs no t affiliated with a local

government)andtrainingofafamilymemberasresidentmanage mentstaff.Amountsexcludedbythis

provision must be received under employment training programs with clearly defi ned goals and

objectives, and are excluded only for the period during

which the family member participates in the

employmenttrainingprogram;(9)Temporary,nonrecurringorsporadicincome (includinggifts);

11. Reparation payments paid by a foreign government pursuant to claims filed under the laws of that

governmentbypersonswhowerepersecutedduringtheNaziera;

12. Earnings in excess of $480

for each full‐time student 18 years old or older (excluding the head of

householdandspouse);

13. Adoptionassistancepaymentsinexcessof$480peradoptedchild;

14. Deferred periodic amounts from supplemental security income and Social Security benefits that are

received in a lump sum a mount or in

prospective monthly amounts, or any deferred Department of

VeteransAffairsdisabilitybenefitsthatare receivedinalumpsumamount orin prospectivemonthly

amounts.

15. AmountsreceivedbythefamilyintheformofrefundsorrebatesunderStateorlocallawforproperty

taxespaidonthedwellingunit;

16. AmountspaidbyaStateagency toafamilywithamemberwho hasadevelopmentaldisability andis

livingathometooffsetthecostofservices andequipmentneededtokeepthedevelopmentallydisabled

familymemberathome;or

17. AmountsspecificallyexcludedbyanyotherFederal

statutefromconsiderationasincomeforpurposes

ofdeterminingeligibility orbenefitsunderacategory of assistanceprograms that includ esassistance

underanyprogramtowhichtheexclusionssetforthin24CFR5.609(c) apply.Anoticewillbepublished

intheFederalRegisteranddistributedtoPHAsandhousingowners

identifyingthebenefitsthatqualify

forthisexclusion.Updateswillbepublishedanddistributedwhennecessary.

Annualizationofincome:Ifitisnotfeasibletoanticipatealevelofincomeovera12‐monthperiod(e.g.,seasonal

orcyclicin come),orMFA believesthatpastincomeisthe bestavailable

indicatorofexpectedfutureincome,

MFAmay annualize theincomeanticipatedforashorterperiod,subjecttoaredeterminationattheendofthe

shorterperiod.

NewMexicoResidency

Applicantsrequestinghousingcostassistancefromthisprogrammustownandoccupyaprimaryresidencein

thesta teofNewMexico.Forhomeownerresidentsoftriballands,staffwillverifyifaHAFallocationwasmade

totheTri beorTribally Designated Housing Entityand,if not, MFAwill continue processing

theapplicationin

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 6

accordancewiththisguide.IncaseswhereanapplicantisaresidentofaTribewhichhasreceivedorwillreceive

aHAFallocation,thehomeownerwillbe requiredtoseekfunding fromtheTribeandwillnot beeligibleforthis

program.

HousingCostsandDelinquency

The applicant must be able to provide evidence of their current housing cost balance due, broken down by

month.Latefeesforanydelinquentmonthsareeligible.Exceptionsforothercontractualfeesmaybeconsidered

for certain types of housing contracts. The maximum total award amount to any applicant for all

forms of

assistancepaymentsis $20,000.Certainothercostsmaybeeligible,includingbutnotlimitedtoserviceradvances

fortaxesandinsurance,non‐escrowedhomeowner’sinsurancedues,andnon‐escrowedpropertytaxes.Funds

shouldbeappliedinaccordancewithapplicablelawand/orregulationtoachievethemaximumbenefitfor

the

applicant.Amountsreceivedby aservicerthatarelessthanafullpaymentshouldbeappliedtotheloanbalance.

ConformingLoanLimits

Atthe time oforigination, mortgages must not be more than the conforming loan limit. For purposes of this

definition,theconformingloanlimitmeansthe applicablelimitationgoverningthemaximumoriginalprincipal

obligationofamortgagesecuredbyasingle‐familyresidence,amortgagesecuredby atwo‐familyresidence,

a

mortgagesecuredbyathree‐family residence,oramortgagesecuredbyafour‐familyresidence,asdetermined

and adjusted annually under section 302(b)(2) of the Federal National Mortgage Association Charter Act (12

U.S.C. 1717(b)(2)) and section 305(a)(2) of the Federal Home Loan Mortgage Corporation Act (12 U.S.C.

1454(a)(2)).

Mortgagesgreaterthan$2,200permonthwillrequireadditionalverificationtoconfirmtheoriginal

principalbalance.

Section5‐Additio nalEligibilityRequirements

Tobeeligibleforassistanceunder eachprogramelement,applicantsmustmeettheGeneralEligibility

Requirementsandalsomeettheadditio nalprogramguidelinesandrequirementslistedbelow.

Each household will be eligible for up to $20,000 of HAF funding with respect to the applicant’s primary

residence.

If a household is requesting

assistance for multiple eligible housing costs such as property taxes or annual

homeowner’sinsurancepremiums,whetherinconjunctionwithdelinquentpaymentassistanceorseparateand

apartfromamonthlyhomeownershippaymentstructure,and/orisrequestingassistancethroughotherprogram

designelements,theperhouseholdawardshallnotexceed$20,0 00.Any

amountsawardedtoahouseholdunder

the HAF Pilot Program administered from May 18, 2021 through August 16, 2021 and/or the Homeowner

AssistanceInterimProgramfromOctober15,2021throughJanuary4,2022willbeincludedinthehousehold

maximumbenefitandthetotalbenefitshallnotexceed$20,000.

ReinstatementandLossMitigationAssistance

Tobeeligibleforreinstatementassistance,theapplicant(s) will provideaself‐attestationthatthehouseholdis

abletoresumethemonthlyhousingpaymentfollowingreceivingassistance.Reinstatementassistanceislimited

toaone‐ti mebenefitperhouseholdbutcanbeappliedincombinationtoprovidethemaxi mumbenefittothe

homeowner.

Ifahouseholdhasreceivedaone‐timebenefitthroughtheReinstatementAssistanceprogramandsubsequently

re‐defaultsandbecomesdelinquent,theywillbereferredtotheForeclosurePreventionandDefenseProgram

andwillberequiredtocompleteapprovedhousingcounselingtoreceiveanyremainin gamountsforwhichthe

householdmaybeeligible.IfthehousingcounselorrecommendsthatadditionalHAFfundsshouldbeusedto

completelossmitigation,MFAinitssolediscre tionmayawardanamountthatwasnotpreviouslyexpendedup

tothehouseholdmaximum.Homeownerswhodeclinetoworkwithahousingcounselorwillnotbe

eligiblefor

additionalreinstatementassistance.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 7

Tobeeligibleforanawardforprincipalreduction,applicantsmustbeapprovedbyandprovideevidencefrom

theirloanservicerforaprincipalreductionsolutionandbeabletoresumepaymentsfollowingassistance.For

assistancewithpartialclaimreimbursement,theapplicantorservicerwillberequiredtoprovideevidenceof

a

completedpartialclaim.

Where loss mitigation is available, HAF funds may be used to supplement other forms of loss mitigation.

Assistancewillbeavailableforhouseholdswithoutaccesstolossmitigationorthathavealreadyexhaustedloss

mitigation.HAFfundsmayalsobeusedpriortoorduringthe

lossmitigationprocess.

Applicantswhohavemorethan$20,000ofdelinquenthousingpaymentsandwhoneedadditionalassistanceto

resolve their delinquency are eligible to receive housing counseling services through a HUD certified housing

counselingagency

2

(HCA)oragencyapprovedbyaTribalgovernmentHCA.Housingcounselorscanevaluateloss

mitigationoptionsincludingreductionin the unpaid principal balance, payment deferraloptions,andoptions

offeredbyservicersthatmodifytheprincipal andinterestpayment.

Loansthatarealready in foreclosureare only eligible for a full

reinstatement. A HAF award less than thefull

reinstatementamountmaybeconsideredifadditionalfundinghasbeensecuredbytheapplicanttomeetthe

fundingshortfall.

PaymentAssistance

Householdswhomeetall eligibilityrequirementscanreceiveupassistanceupto$20,000oruptotwelve(12)

monthlypaymentsthrough themonthl y assistanceprogram.Applicantswhoareeligibleformonthlypayment

assistancearealsoeligibletoreceivefreeofchargehousingcounselingthroughaneligibleHCA.

Forhouseholdstoreceive

monthlyhousingpaymentsduewithina12‐monthperiodfollowingtheinitialdateof

approvaloftheapplication,thehouseholdmustmeetgeneraleligibilityrequirementsandmeetthefollowing

criteria:

Thehouseholdwillprovideaself‐attesta tionthatthe householdisstrugglingtosustaintheirhousing

paymentsdueto

unemployment.

Thehousehold’scontractualhomeownershiploanpa yment(s) exceed(s)40%ofthehousehol d’sgross

income.

Oneormorehouseholdmembersisunemployedandreceivingunemploymentbenefits.

Initial applications determined to be eligible for $20,000 of monthly payment assistance will be awarded the

maximumof$20,000intheinitialandonly

paymentthroughthisprogram.ApplicantswillbereferredtoanHCA

whowillbeavailabletoassisthomeownersresolveadditionaldelinquency.

MFAwillallocatefundingonafirstcome,firstservedbasis,andwillnotreservetheentirehouseholdmaximum

foreachapprovedapplication.

Ongoingmonthlyassistancewillbeavailable

asdescribedaslongasfundingisavailableandmaybeawardedfor

uptothree(3)monthsinadvanceandpaidmonthlyonaroundtheduedate.

Applicantswillberequiredtorecertifyanddocumenttheirunemploymentsta tusandhouseholdincomeevery

90daysduringthe12‐monthperiod.In

caseswheretheapplicantreturnstoworkduringtheir eligibilityperiod,

MFAwillfundfortherecertificationperiodbutnolongerbeeligibleaftertherecertificationperiodends.Tothe

extenttheCommonDataFile(CDF)isimplementedbyaservicer,theParticipantwillutilize theprocesstoverify

ongoing

lossmitigationactivityandtofacilitatemonthlypaymentassistance.

2

HUD certified housing counseling is available for all New Mexico households. More information can be found at

https://apps.hud.gov/offices/hsg/sfh/hcc/hcs.cfm.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 8

Section6‐IncomeEligibility

Whenusingtheterm“household”,MFAwillbereferringtothedefinitionof“family”asdefinedat24CFR5.403.

Ahousehold includes, butisnot limitedto,the followingregardlessofactual orperceivedsexualorientation,

genderidentity,ormaritalstatus:

1. Asingleperson,whomaybeanelderly

person,displacedperson,disabledperson,near‐elderlyperson,

oranyothersingleperson;or

2. Agroupofpersonsresidingtogether,andsuchgroupincludes,butisnotlimitedto:

a. Ahouseholdwithorwithoutchildren(achildwhoistemporarilyawayfromthehomebecause

ofplacementin

fostercareisconsideredamemberofthehousehold);

b. Anelderlyhousehold;

c. Anear‐elderlyhousehold;

d. Adisabledhousehold;

e. Adisplacedhousehold;and

f. Theremainingmemberofahousehold.

Todeterminehouseholdincomeforallapplicants,MFAwillusetheannualincomedefinitionasdefinedby

HUD

at24CFR5.609(commonlyreferredtoasPart5).MFAwillusethePart5methodtocalculatetheannualincome

byprojectingtheprevailingrateofincomeofthehouseholdforthenext12‐monthperiodasmeasuredfromthe

datethatMFAperformstheincomedetermination.

AnnualIncomeLimits

Theincomelimitsforthisprogramarelimitedtoincomesequaltoorlessthan150%oftheareamedianincome

or100%ofthemedianincomefortheUnitedStates,whicheverisgreater.

TheSecretaryofHousingandUrbanDevelopmentdetermineseachofthesein come calculations.

100%ofthemedianincomefortheUnitedStatesmeansthemedianincomeoftheUnitedStates(FY2021

$79,900), as published by HUD for purposes of the HAF.

https://www.huduser.gov/portal/datasets/il/il21/HUD‐sec236‐2021.pdf

150%oftheareamedianincomeforahouseholdmeansthreetimestheincomelimitforvery‐lowincome

families,

fortherelevanthouseholdsize,aspublishedbyHUDinaccordancewith42U.S.C.1437a(b)(2)for

purposes of the HAF. https://www.huduser.gov/portal/datasets/il/il21/State‐Incomelimits‐Report‐

FY21.pdf

BreakdownbyState/County/HouseholdSize

https://www.huduser.gov/portal/datasets/il/il2021/select_Geography_haf.odn

Section7‐RequiredDocumentation

All applicants must complete the program application online or in paper format. Applicants must supply all

requireddocumentationto verifyprogrameligibility,householdincome andneedforhousing costassistance.

Documentationto confirmpayeeandamount willalso berequired.Eligible applicants whodonotprovide all

requireddocumentationwithinthe

requiredtimeframesmaynotbeawardedassistance.

Householdmemberinformationmustinclude,at aminimum,thefollowing:

Fullnamesanddatesofbirthofallhouseholdmemberslivingintheresidence

Householdcontactinformation

Householdincomeinformation

HouseholdCOVID‐19impactattestation

Owner

occupiedprimaryresidenceinNewMexico

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 9

Socialsecuritynumber(SSN)oftheborrower,allco‐borrowersandallhouseholdmemberswithsocial

securitynumbersalreadyassigned

3

.

Signature/e‐signatureoftheheadofhouseholdwhomustbeage18oroverand/orallborrowersand

co‐borrowers, certifying that the information provided related to household composition, annual

householdincome, financialhardshipa ssociated with COVID‐19andneed for assistance withhousing

costsiscorrect.

Applicantswill

beaskedtoprovidedemographic dataonthegender,raceandethnicityofall householdmembers

forreporting purposesonly.Demographicinformationwillbeusedinaggregateandisstrictlyconfidential.The

applicantdecisiontoprovideornottoprovidedemographicinformationdoesnotimpactapplicationapproval.

HouseholdIncomeDocumentation

Currentprooffromallsourcesofhouseholdincomeincludingbutnotlimitedto:

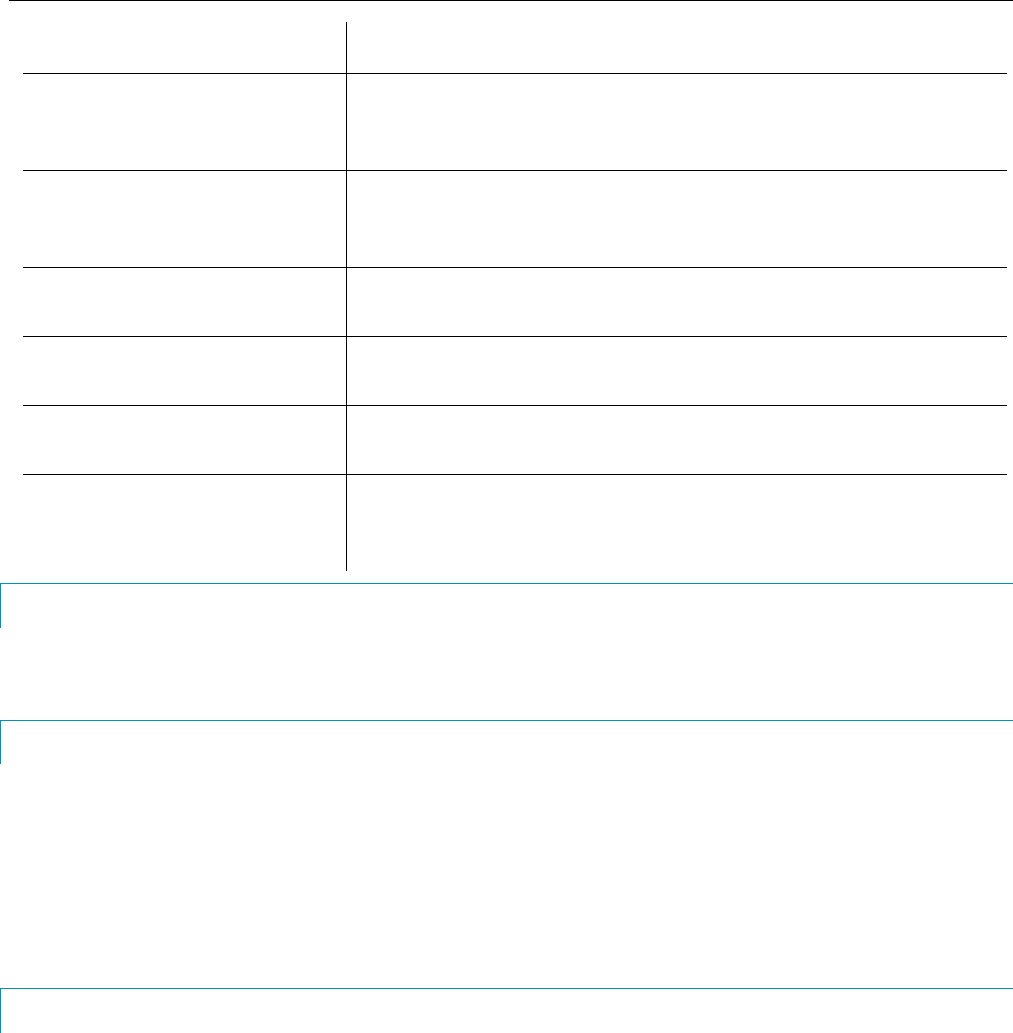

IncomeSource AcceptableDocumentation

Employmentwages

Threecurrentpaycheckstubsor

Employer‐signed formor letter confirming

wagesor

Verification of Income or Reduction of

Hours/Payform

Self‐employment

Profitand loss statement(s)for the three most

recentmonthsor

Mostrecentyearstaxreturn/filing

Net rentalincome,income from interest bearing

assets,royalty income, interest fromestatesand

trusts

Mostrecentstatement

Social Security, pensions, retirement, annuities,

disability,deathbenefits

Currentbenefitsletter

Unemploymentinsurance, worker’s

compensation,severancecompensatio n

Payment history reflecting gross benefit

amount,deductionsandrecentpayments

Any public assistance (General Assistance or

TANF) payments from state or local income

supportoffice

Currentbenefitsletter

Childsupport,familysupport,alimony

Currentbenefitsletter

Armedforcespay

Twocurrentstatements

Ifneeded,theVerificationofIncomeand/orReductionofHours/PayisExhibit2.

ResidencyDocumentation

VerificationthattheresidenceislocatedwithinthestateofNewMexicowillbemadebyprogramstaff.

HousingCostAssistanceNeedDocumentation

Applicantsmustprovidedocumentationandverificationforhousingcostsasitappliestotheirhousingsituation:

3

In order to ensure that household size is accurately captured in the application, program staff will have discretion to

overridethisrequirement.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 10

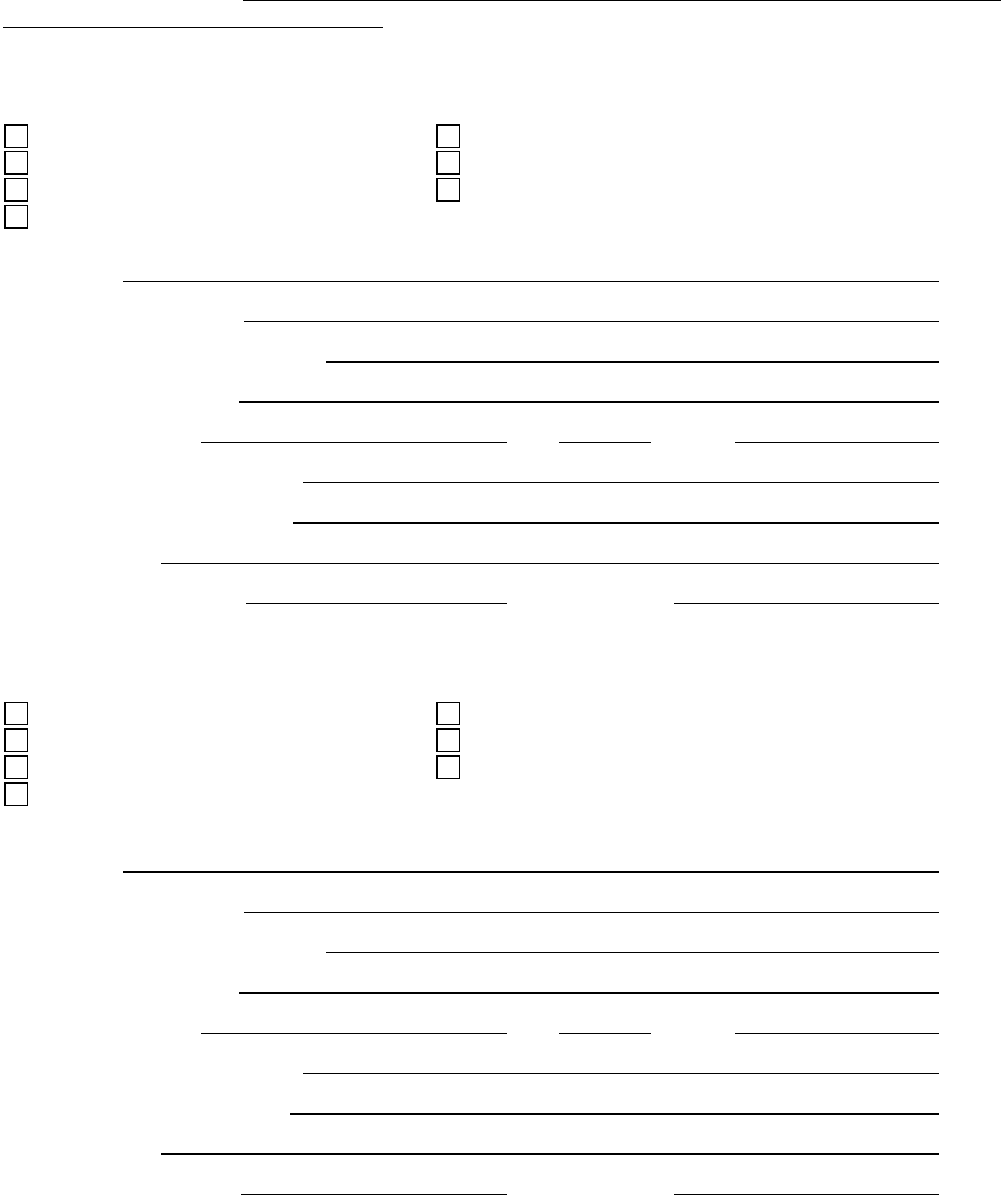

AssistanceType RequiredDocumentation

Mortgage/homeownership loan

assistance

Evidenceoftotalbalancedue,brokendownbymonth:

Currentunredactedloanstatem ent;or

Currentunredactedpast‐duenoticefromservicer

Realestatecontractassistance

Evidenceoftotalbalancedue,brokendownbymonth:

Currentescrowpaymentstatement;or

Balanceduenotice

Mobile or manufactured home

loanassistance

Evidenceoftotalbalancedue,brokendownbymonth:

Currentmobileormanufacturedhomeloanstatement;

Mobileormanufacturedlandloan

assistance

Evidenceoftotalbalancedue,brokendownbymonth:

Currentmobileormanufacturedhomeloanstatement

Propertytaxes

Evidenceoftotalbalancedue:

Currentpropertytaxbill

Homeowner’sinsurance

Evidenceoftotalbalancedue:

Accountledger;or

Currentnoticeofpaymentamountandbalancedue

ThirdPartyphoneverification

During the application review process, the reviewer shall have the discretion to collect or verify housing cost

assistance information through third party phone verification. Any verification made by reviewer must be

documentedintheactivitylog.

DocumentationfromPrivateHousingProviders

Followinginitialreviewofapplicationswhereaprivatecontractisinplace,thecontractualsellerwillberequired

toprovidethefollowing:

1. ProgramParticipation‐PaymentAcceptanceform completedbytheseller

2. W‐9formcompletedbytheseller

3. Proofofpurchaseagreementorcontract

Ifassistanceisawarded

andtheW9formreceivedisverifiedbyanindividualtaxidentificationnumber(ITIN),

thesellerwillbeprovidedwithanIRS1099formattheendoftheyearfortaxreportingpurposes.

AcceptableDocumentationforextenuatingcircumstances

Atthediscretion of the assigned program management staff, the following documentati onmaybe accepted:

W2s or other wage statements, IRS Form 1099s, tax filings, depository institution statements demonstrating

regularincome,oranattestationfromanemployer.

Section8‐DuplicationofBe nefits

AllapplicantsshallcertifyontheProgramApplicationunderpenaltyofperjuryandunderthelawsoftheState

of New Mexico, that they are not able to receive, have not received other federal or non‐federal benefits or

assistanceforthesamehousingcostsforthesameperiodoftime

forwhichassistanceisbeingrequested,and

thatiftheydoreceivesuchaduplicationofbenefits,theywillrepayduplicatedfundstoMFA.

Section9‐ApplicationProcessingandSelection

Thissectiondescribestheprocessinwhichapplicationswillbeaccepted,selectedforreviewandreviewed.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 11

IntakeandAssessmentProcess

Fundingislimited.Applicationswillbefundedinorderofdateandtimeofreceipt.Applicantsareencouragedto

usetheinformationandsampleformspostedathttps://housingnm.org/homeowners/homeowner‐assistance ‐

fundasresourcestosubmitcompleteapplications.Failuretoprovidealleligibilitydocumentationmayresultin

denial.

Program staff will review applications and begin providing res ponses as soon as possible. If a submitte d

applicationdoes notcontaincomplete documentationtoconfirmeligibility,theapplicantshallbenotifiedand

given10calendar days afterthe date of the first notification by emailor the date of the letter

to submit the

information.Applicantswhofailtorespondwithinten(10)calendardaysshallbedeniedassistance.However,

exceptionsmaybemade atMFA’sdiscretion.Applicantswho aredenieddue tofailure torespond withinten

(10)calendardaysmayreapplyiffundsareavailable.

Applicationdocumentsshallnot

bereturned.Applicantsarecau tionednottosubmitoriginaldocumentsandto

onlysubmitcopies.

AvailabilityofApplications

Application submissions will be accepted in two formats: online electronic submission and paper submission.

Online applications may be submitte d at: https://housingnm.org/homeowners/homeowner‐assistance‐fund.

Paperapplicationsmaybemailed,hand‐delivered,faxedoremailedtothefollowingaddressesandfaxnumber:

NewMexicoMortgageFinanceAuthority

3444

th

StSW

Albuquerque,NM87102

NewMexicoMortgageFinanceAuthority

Attn:NewMexicoHomeownerAssistanceFun d

505‐242‐2766

COVIDAssistanceGeneralInbox

Applicationsmaybesubmittedbeginni ng at8:00AMonFebruary28,2022throughapublicannounce ment of

programclosure.Allsupportingdocum entationtoconfirmand

verifyeligibilitymustaccompanytheapplication

forallsubmissionmethods.Torequestapaperapplicationbemaileddirectlytoyoupleasecontact:(505)308‐

4206or866‐488‐0498.Alternatively,paperapplicationsareavailablefordownloadonMFA’swebsite.

Applicationranking

Allapplicationssubmittedwithintheapplicationwindowwillberankedaccordingtothecriterialistedbelow.If

sufficientfundsareavailable,alleligibleapplicationswillbefunded,regardlessofranking.

ApplicationDate/Time

Therankingcriterionforallapplica tionsisthedateandtimeofsubmission.Dateandtimeofsubmissionofan

applicationforassistance throughtheonlinesystemwillbeloggedelectronically.Paperapplicationssubmitted

bymailwillbeloggedaccordingtothepostmarkdate,withatimestampof8:00am.

Ifthepostmarkdateisprior

tothestartoftheapplicationwindow,theapplicationwillbeloggedaccordingtothefirstdateoftheapplication

window,with atimestampof8:00am.Ifthe applicationissubmittedin ‐personatadrop offlocation,thedate

andtime

ofsubmissionwillberecordedonthepaperapplicationandloggedaccordingly.Ifapaperapplication

isfaxed,theapplicationwillbeloggedaccordingtothedateandtimethefaxwasreceived.Ifapaperapplication

ise‐mailed,theapplicationwillbeloggedaccordingtothedateandtime

thee‐mailwasreceived.A pplications

will be ranked by order of submission. If an application is incomplete, applicants will be notified and given a

minimum of ten calendar days tosubmit missing documentation as described above in Section7. During this

window,theapplicantwillmaintain theirapplicationdate/time

ranking.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 12

IncomeTargeting

Notlessthan60%ofamountsmadeavailabletoeachHAFparticipantmustbeusedforqualifiedexpensesthat

assisthomeownershavingincomesequaltoorlessthan100%oftheareamedianincomeorequaltoorlessthan

100% of the median income for the United States, whichever is

greater. Any amount not made available to

homeowners that meet this income‐targeting requirement must be prioritized for assistance to socially

disadvantagedindividuals,withfundsremainin gaftersuchprioritizationbeingmadeavailableforothereligible

homeowners.

SociallyDisadvantagedIndividuals

1. memberofagroupthathasbeen subjectedtoracialorethnicprejudiceorculturalbiaswithin

Americansociety;

2. residentofamajority ‐minorityCensustract;

3. individualwithlimitedEnglishproficiency;

4. residentofaU.S.territory,Indianreservation,orHawaiianHomeLands;or

5. individualwholives

inapersistent‐povertycounty,meaninganycountythathashad20%ormoreofits

populationlivinginpovertyoverthepast30yearsasmeasuredbythethreemostrecentdecennial

censuses.

Inaddition,anindividualmaybedeterminedtobeasociallydisadvantagedindividualinaccordancewitha

processdevelopedbyaHAFparticipantfordeterminingwhetherahomeownerisasociallydisadvantaged

individualinaccordancewithapplicablelaw,whichmayreasonablyrelyonself‐attestations.

Appeals

Applicants may appealdenialsmade basedon applicant eligibility. If theapplication was denied forfailure to

provide all eligibility documenta tion, the applicant has seven (7) calendar days of the date of the application

deniallettertoprovidethemissingdocumentation. Afterwhichtime,theapplicantmustreapply.Appealsmust

be

mailed to the assistant director ofassetmanagementat 344 FourthStreet,Albuquerque, NM 87102 or e‐

mailedto[email protected]withinseven(7)calendardaysofthedateoftheapplicationdenial

letter.However,exceptionsmaybemadeatMFA’sdiscretion.Thewrittenappealmuststatethe reason(s)why

the appli cant believes the application denial was in error and must include any additional documentation

necessarytosupporttheapplicant’sassertionofsame.Theappealwillbereviewedbytheassistantdirectorof

asset

managementoradesignatedprogramstaffmemberotherthanthereviewerwhoissuedthedenial.The

decisionregardingtheappealwillbeissuedinwritingandshallbefinal.

Section10‐AdditionalProg ramGuidelinesandRequirements

RecertificationProcessforOngoingPaymentAssistance

Tobeeligibleforpaymentassistance,thehouseholdmustmeetthefollowingcriteria:

provideupdatedhouseholdin comedocumentationforallhouseholdmembers;

provideevidenceofthetotalbalancedue;

provide a self‐attestation that the household is struggling to sustain their housing payments due to

unemployment;

have

contractualhomeownershiploanpayment(s)exceed(s)40%ofthehousehold’sgrossincome;and

haveoneormorehouseholdmembersisunemployedandreceivingunemploymentbenefitsandbeable

toprovidecurrentunemplo ymentincomedocumentation.

Householdsareeligibleforongoingassistanceuptoa12‐monthperiodfollowingtheinitialdate

ofapprovalof

theapplicationortheprogrammaximumof$20,000whichevercomesfirst.Thetotalprogramawardwillinclude

fundsreceiv ed inthePilotprogram, the Interimprogramandany fundingawardsin thisprogram.The award

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 13

amountis basedoff theapplicant’sactualeligiblecostsandthemaximumawardof$20,000willnotbepaid on

theinitialpaymentifactualcostsareverifiedlessthantheprogrammaximum.

Applicants will be required to provide recertification documentation every 90 days while receiving assistance

whichwillincludea

currentmortgagestatement,currenthouseholdincomedocumen tation, anddocumen tation

ofcurrentunemploymentstatus.

Eligibilitytoapplyforpaymentassistancedoesnotguaranteeapproval.Recertificationrequestsareprocessed

intheorderreceivedandarefundedintheorderreceiveddependingontheav ailabilityoffu nding.

FalseClaims

Applicants shall certify on the Program Application that the information provided on this form is subject to

verificationbyMFA,the Department ofFinanceandAdministra tion (DFA)or the Treasuryatanytime, orany

employeeofMFA,DFA,orTreasurymaybesubjecttopenaltiesforunauthorizeddisclosuresorimproper

useof

information collected based on the consent form. Use of the information collected based on this verification

form is restricted to the purposes cited above. Any person who knowingly or willingly requests, obtains or

disclosesanyinformationunderfalsepretensesconcerninganapplicantorparticipantmayresultinlegal

action.

Anyapplicantorparticipantaffectedbynegligentdisclosureofinformationmaybringcivilactionfordamages,

andseekotherrelief,asmaybeappropriate.

ApplicantConfidentiality

EmployeesandagentsofMFAwillnotdiscloseanyapplicant’spersonalconfi dentialinformationaspartofthe

program, with the following exception: only MFA’s complianc e officer may provide such information to

authorizedrepresentatives ofprogramsprovidingsimilarassistance,attheirrequestandwhensuchrequestis

made with the express purpose

of preventing or correcting any duplication of benefits. All confidential

informationofapplicantswillbekeptinalockedsecuredstoragefacilityorpasswordprotectedelectronicfiles

andunavailabletopersonsoutsideoftheprogram.Atalltimes,MFAwillabidebyallrequirementsstatedwithin

thePrivacy Actof

1974asamended.IfMFAreceivesarequestfo rpublic recordsrelatedtotheprogram,only

non‐confidentialinformation,asverifiedbyMFA,willbeprovided.

Nondiscrimination

TheNewMexicoHomeownerAssistanceFundshallbeimplementedconsistentwithMFA’scommitmenttostate

andfederalequalopportunitylaws.Nopersonshallbeexcludedfromparticipationin,deniedthebenefitof,or

besubjectedtodiscriminationunderanyprogramoractivityfundedinwholeorinpartwithHAFprogram

funds

on the basis of their disability, familial status, national origin, race, color, religion, sex, spousal affiliation,

ancestry,sexualorientationorgenderidentity.

MFA will provide reasonable accommodations and/ or modifications or provide language assistance to

individuals requesting such assistance to benefit fr om the services provided by the New Mexico

Homeowner

AssistanceFund.

ConflictofInterest

Nomember,managementoremployeeshalltakeanyofficialactwhichmaydirectlyorindirectlybenefithis/her

ora familymember'spositionorfinancialinterests.Programstaffmustreportconflictsofinteresttotheassistant

directorandteamleadofassetmanagemen t.Theprogramstaffmemberwillberecusedfrominvolvement

on

thefileprocessing.

ProgramGuidelinesChangesorModifications

Minor changes to these New Mexico Homeowner Assistance Fund Program Manual involving administrative

procedures or accommodations to adapt to uniq ue applicant situations or to regulatory changes may be

performedwiththeapprovaltheassistantdirectorofassetmanagement.Anymajorchangestoprogrampolicies

orproceduresmustbeapprovedbythe

executivedirectorofMFA.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 14

Federalregulatoryrequire mentsfortheHAFprogramsarenotsubject tomodificationorrevision,exceptwhen

Treasuryissuesguidancesupersedingpriorregulatoryrequirements.

NMHomeownerAssistanceFundManual

HAFProgramGuide(3/22) 1

Exhibit1–Term Sheets

(attached)

03/2022 1

HomeownershipLoanReinstatement/Loss MitigationProgram

NewMexicoHomeownerAssistanceFund–HomeownershipLoanReinstatement/LossMitigationProgram

Criteria

ProgramTerms

Briefdescription TheHomeownershipLoanReinstatement/LossMitigationProgramwillprovideup$20,000perhouseholdtoeliminatedelinquencies,reinstateahomeownershiploan,

including the current month (delinquency plus one month) and/or provide funds which will assist hom eowners achieve housing cost affordability through principal

reductionorpost‐lossmitigationlienextinguishment .

HAFFunds may

beusedtobringthe accountfullycurrent, withnoremainingdelinquentamounts,andto repayamounts advancedby the lenderorserviceronthe

borrower’s behalf for property charges, including property taxes, hazard insurance premiums, flood or wind insurance premiums, ground rents, condominium fees,

cooperativemaintenancefees,plannedunit

developmentfees,homeowners ’associationfeesorutilitiesthattheserviceradvancedtoprotectlien position.Payment

mayalso includeanyreasonablyrequiredlegalfees.HAFFundsmaybeusedforapartialreinstateme ntifthefullreinstatementamountexceedsthehouseholdmaximum.

Homeownerhouseholds whoareworkingwiththeirhomeownershiploan

servicertocomplete lossmitigationwillhavetheopportunitytoincorporateHAFintotheir

defaultresolutionasallowedbyservicerproceduresandinvestorguidelines.Servicersshouldinformthehomeowne r householdswhoareindefaultoftheavailability

of the funds and should encourage homeowner households to apply for funding to

assist with lump sum reinstatement or for principal reduction through the loss

mitigationprocess.HAFfundsmaybeusedtoreimbursepartialcl aimliensafterlossmitigation,asallowedforbyservicerandinvestorguidelines.

Assistancewillbeavailableforhouseholdswithoutaccesstolossmitigationorthathavealreadyexhausted

lossmitigation.HAFfundsmayalsobeusedpriortoorduring

thelossmitigationprocess.TotheextenttheCommonDataFile(CDF)isimplementedbyaservicer,theParticipantwillutilizetheprocesstoverifyongoinglossmitigation

activityandtofacilitateassistance.

Maximum

amountof

assistanceper

homeowner

Eachhouseholdwillbeeligibleforupto$20,000ofHAFfundingtobeusedonlyforthehomeowner’sprimaryresidence.

Ifa householdisrequestingassistanceformul tipleeligiblehousing costssuchaspropertytaxesorannualhomeowner’sinsurancepremiums,whetherinconjunction

withdelinquentpaymentassistanceorseparateand

apartfromamonthlyhomeownershippaymentstructure,and/orisrequestingassistancethroughotherprogram

designelements(withtheexceptionoftheutilityassistanceprogramdesignelement),theperhouseholdawardshallnotexceed$20,000.Utilityassistancehasaseparate

03/2022 2

household maximum and is excluded from the $2 0,000 household maximum benefit av ailable for the pilot, homeownership loan reinstatement/loss mitigation,

homeownershiploanpayment, propertycharge(insurance)defaultresolutionandpropertycharge(taxes)defaultresolutionprogramdesignelements.

Homeowner

eligibility

criteriaand

documentation

requirements

Households are eligible to receive loan reinstatement/loss mitigation assistance if they (1) attest that they experienced a financial hardship after Jan uary 21, 2020

associatedwiththeCOVID‐19healthcrisis,(2)provideincomedocumentationandhaveincomesequaltoorlessthan150%oftheareamedianincomeor100%

ofthe

medianincomefortheUnitedStates,whicheve r is greater,and(3)currentlyownandoccupyaprimaryresidenceinNewMexico.

Tobeeligibleforreinstatementand/orlossmitigationassistance,theapplicant(s)willprovideaself‐attestationthatthehouseholdisabletoresumethemonthlyhousing

payment

followingreceivingassistance.Assistanceislimitedtoaone‐timebenefitperhous ehold butcanbeappliedincombination toprovidethemaximumbenefitto

thehomeowner.

Tobeeligibleforanawardforprincipalreduction, applicantsmustbeworkingwiththeirloanservicerindependentlyorwiththeassistanceofa

housingcounselorto

exploreavailableloss mi tigationandbe approved by their loan servicerfor a principal reduction solutionand be able to resume paymentsfollowingassistance. For

assistancewithpartialclaimreimbursement, theapplicantorservicerwillberequiredtoprovide evidenceofacompletedpartialclaim.

Whereloss

mitigationisavailable,HAFfundsmaybeusedtosupplementotherformsoflossmitigation.Assistancewillbeavailableforhouseholds withoutaccessto

lossmitigationorthathavealreadyexhaustedlossmitigation.HAFfundsmayalsobeusedpriortoorduringthelossmitigationprocess.

Indicatedocumentationrequirementslisted

here:

Documentationrequirementsincludealegallyissuedformofidentification,docume ntsneededtoverifyhouseholdincome,anddocumentationneededtoverifythe

reinstatementamountsuchasacurrenthomeownershiploanstatementorreinstatementquote,orotherevidenceofhousingcostdelinquencyand/orapartialclaim.

Insomeinstances,evidenceof

avalidlossmitigationofferfromaloanservicermayberequiredtoevidenceprincipalreductionamounts.

TotheextenttheCommonData File(CDF)isimpleme nted byaserv icer,theParticipantwillutilizetheprocesstoverifyreinstatement/lossmitigationamountsthrough

theservicer.

Loaneligibility

criteriaspecific

totheprogram

Forreinstatementandprincipalreduction,theloanmustbedelinquentbyatleastonepayment,includinganypaymentsduringaforbearanceperiod,or,inthecaseof

areversemortgage,hasoutstandingpropertychargeswhetherindefaultorinarepaymentplan.Apaymentwillbeconsidereddelinquentone(1)day

followingthedue

date.

Eligibleloansincludeamortgage,deedoftrust,orotherconsensualsecurityinterestonaprincipalresidenceandhomeownerswithconsensualcontractualagreements

onaprincipalresidencesuchasrealestatecontracts,lease‐purchasecontracts,mobile/manufacturedhomeloans,chattelloansand/orlandcontr acts.

03/2022 3

Eligiblepropertiesincludesingle‐familyresidentialproperties,condominiumsandtownhomes,manufacturedhomespermanentlyaffixedtorealpropertyandtaxedas

realestate,andmobilehomesnotpermanentlyaffixedtorealproperty.

HomeEquityLineofCredit(HELOC)loansareineligible.

Form of

assistance

Assistancewillbestructuredasanon‐recoursegrant.AssistanceisnotrequiredtoberepaidandtheParticipantwillnotcollectorissuetaxableincomedocumentation

suchasW‐9or1099forms,exceptincaseswherethefundsarebepaiddirectlytoanindividuallienholderwithoutanLLC

orLLC.Thismayincludeprivatelienholdersof

homeownershipcontracts,leasetoowncontracts,manufacturedhomeland/lotcontracts,etc.Privatecontractlienholderswillberequiredtooptintotheprogramand

providetheirsocialsecuritynumberortaxpayeridentificationnumber.

Payment

requirements

MFAwilldisburseHAFassistancedirectlyviacheckorelectronicfundstransfertothehomeownershiploanlender/servicer,landcontractholder,manufactured/mobile

homelender,and/orotherhousingproviderasappropriate.

03/2022 4

HomeownershipLoanPaymentAssistance

NewMexicoHomeownerAssistanceFund–HomeownershipLoanPaymentAssistance

Criteria

ProgramTerms

Briefdescription The Homeownership Loan Payment Assistance program design element will provide payment assistance to homeowner households unable to make mortgage or

homeownershiploanpaymentsduetofinancialhardshipassociatedwiththeCOVID‐19healthcrisis.

HAFfundsmaybeusedtoreduceahomeowner’smortgage/homeownershiploanpaymentsformonthlyhousingpaymentsdue

withina12‐monthperiodfollowingthe

initialdateofapprovalof theapplication.TheParticipantwillallocatefundingonafirstcome,firstservedbasis,andwillnotreservetheentirehouseholdmaximumfor

eachapprovedapplication.Ongoingmonthlyassistancewillbeavailableasdescribedaslongasfunding

isavailable.

Wherelossmitigationisavailable,HAFfundsmaybeusedtosupplementlossmitigation.Assistancewillbeavailableforhouseholdswithoutaccesstolossmitigationor

thathave already exhaustedlossmitigation. HAF funds may alsobe used prior to orduring the loss mitigation process.Totheextent

theCo mmon Data File (CDF) is

implementedbyaservicer,theParticipantwillutilizetheprocesstoverifyongoinglossmitigationactivityandtofacilitatemonthlypaymentassistance.

Maximumamount

ofassistanceper

homeowner

Eachhouseholdwillbeeligibleforupto$20,000ofHAFfunding,tobeusedonlyforthehomeownerhousehold’sprimaryresidence.

Ifahouseholdisrequestingassistanceformultipleeligiblehousingcostssuchaspropertytaxesorannualhomeowner’sinsurancepremiums,whetherinconjunctionwith

delinquentpaymentassistance orseparate

andapartfromamonthlyhomeownershippaymentstructure,and/orisrequestingassistancethroughotherprogramdesign

elements (with the exceptionof the utility assistance program design element),the per household award shall not exceed $20,000. Utility assistance has a separate

household maximum and is excluded from the $20,000 household maximum

benefit available for the pilot, hom eownership loan reinstatement/loss mitigation,

homeownershiploanpayment, propertycharge(insurance)defaultresolutionandpropertycharge(taxes)defaultresolutionprogramdesignelements.

03/2022 5

Homeowner

eligibilitycriteria

anddocumentation

requirements

Homeowner households are eligible to receive assistance underthe mortgage payment assistance program design element if they (1) attest that they experienced a

financialhardshipafterJanuary21,2020associatedwiththeCOVID‐19healthcrisis,(2)provideincomedocumentationandhaveincomesequaltoorlessthan150%of

theareamedianincomeor100%ofthemedianincomefortheUnitedStates,whicheverisgreater,and(3)currentlyownandoccupyaprimaryresidenceinNewMexico.

Wherelossmitigationisavailable,HAFfundsmaybeusedtosupplementlossmitigation.Assistancewillbeavailableforhouseholdswithout

accesstolossmitigationor

thathavealreadyexhaustedlossmitigation.HAFfundsmayalsobeusedpriortoorduringthelossmitigationprocess.

Inorder forhomeowner households toreceive monthlyhousing payments duewithina12‐monthperiodfollowing the initialdate ofapproval oftheapplication, the

householdmustalsomeetthefollowingcriteria:

Thehouseholdwillprovideaself‐attestationthatthehouseholdisstrugglingtosustaintheirhousingpaymentsduetoune mploymentorzeroincome.

Thehousehold’scontractualhomeownershiploanpa yment(s) exceed(s)40%ofthehousehold’s grossincome,ifany.

Oneormorehouseholdmembers

isunemployedandreceivingunemploymentbenefits.

Indicatedocumentationrequirements:

Documentationrequirementsincludealegallyissuedformofidentification,documentsneededtoverifyhouseholdincome,anddocumentationneededtoverifypast

due amounts, if applicable, and/or the contractual monthly payment such as a homeownership loan statement or other evidence of housing cost

delinquency.

Documentationevidencingunemployment,suchasunemploymentbenefitsoraffidavitofzeroincome.Documentationmayberequiredtorecertifyincomeandeligibility

statuseverythree(3)monthsofassistance.

Loaneligibility

criteriaspecificto

theprogram

Delinquentbyatleastonepayment,includinganypaymentsduringaforbearanceperiod.Apaymentwillbeconsidereddelinquentone(1)dayfollowingtheduedate.

Eligibleloansincludethosewithamortgage,deedoftrust,orotherconsensualsecurityinterestonaprincipalresidenceandhomeownerswithconsensualcontractual

agreements

onaprincipalresidencesuchasrealestatecontracts,lease‐purchasecontracts,mobile/manufacturedhomeloans,chattelloansand/orlandcontracts.

Eligibleproperties includesingle‐familyresidentialproperties,condominiumsandtownhomes, manufacturedhomespermanentlyaffixedtorealpropertyandtaxedas

realestate,andmobilehomesnotpermanentlyaffixedtoreal

property.

HomeEquityLineofCredit(HELOC)loansareineligible.

FormofAssistance Assistancewillbestructuredasanon‐recoursegrant.AssistanceisnotrequiredtoberepaidandtheParticipantwillnotcollectorissuetaxableincomedocumentation

suchas W‐9or1099forms,exceptincasewherethefundsarebepaid directl y toanindividuallienholderwithoutanLLC

orLLC.Thismayincludeprivatelienholdersof

homeownershipcontracts,leasetoowncontracts,manufactured homeland/lotcontracts,etc.Privatecontractlienholderswillberequiredtooptintotheprogramand

providetheirsocialsecuritynumberortaxpayeridentificationnumber.

03/2022 6

Payment

requirements

MFAwilldisburseHAFassistancedirectlyviacheckorelectronicfundstransfertothemortgagelender/servicer,landcontractholder,manufactured/mobilehomelender

and/orotherhousingproviderasappropriate.

03/2022 7

PropertyCharge De faultResolution(Insurance)

NewMexicoHomeownerAssistanceFund–PropertyChargeDefaultResolution(Insurance)

Criteria

ProgramTerms

Briefdescription ThePropertyChargeDefaultResolution(Insurance)programdesignelementwillprovideup$20,000perhouseholdtoresolveanypropertychargedefaultthatthreatens

ahomeowner’sability tosustainownershipoftheproperty.Thisprogramdesignelementisintendedtoassistwithpropertychargesoutsideofahomeownershiploan

escrowornot

coveredundertheHomeownershipLoanreinstatement/lossmitigationorHomeownershipLoanPaymentAssistanceprogramdesignelements(whichwill

alsopaypropertychargesassociatedwithhomeownershiploanescrows).

HAF Funds may be used to pay past due property insurancepremiums that threaten sustained ownership of the property and must be brought current

by program

assistanceorresolvedconcurrentlywiththeprogramdesignelementprovidingassistance.

Eachhouseh old mayreceive fundingforuptothree yearsforinsurancepremiums includingforceplacedinsurance. Fundsmayalsobeused topay propertycharges

comingdueinthe90daysfollowinghouseholdapplicationapproval.

Maximumamountof

assistanceper

homeowner

Eachhouseholdwillbeeligibleforupto$20,000ofHAFfundingwithr especttotheapplicant’sprimaryresidence.Eachhouseholdmayreceivefundingforuptothree

yearsofpremiums,includingforceplacedinsurance.Fundsmayalsobeusedtopaypropertychargescomingdueinthe90daysfollowing

householdapplicationapproval.

Ifahouseholdisrequestingassistanceformultipleeligiblehousingcostssuchaspropertytaxesorannualhomeowner’sinsurancepremiums,whetherinconjunctionwith

delinquentpaymentassistanceorseparateandapartfromamonthlyhomeownershippaymentstructure,and/orisrequestingassistancethroughotherprogramdesign

elements (with

the exception of the utility assistance program design element),the per household awardshall not exceed $20,000.Utility assistance has a separate

household maximum and is excluded from the $20,000 household maximum benefit available for the pilot, homeownership loan reinstatement/loss mitiga tion,

homeownershiploanpayment, propertycharge(insurance)defaultresolutionandproperty

charge(taxes)defaultresolutionprogramdesignelements.

03/2022 8

Homeowner eligibility

criteria and

documentation

requirements

HomeownerhouseholdsareeligibletoreceivepropertychargeassistanceundertheNMHAFifthey(1)attestthattheyexperiencedafinancialhardshipafterJanuary21,

2020associatedwiththeCOVID‐19healthcrisis,(2)provideincomedocumentationandhaveincomesequaltoorlessthan150%oftheareamedian

incomeor100%of

themedianincomefortheUnitedStates,whicheverisgreater,and(3)currentlyownandoccupyaprimaryresidenceinNewMexico.

In order to receive assistance, the applicant(s) will provide a self‐attestation that the household is able to resume the monthly housing payment (where

applicable)

followingreceivingassistance.

Homeownerhouseholdisatleastoneinstallmentpaymentinarrearsononeormorepropertychargesincluding:

Insurance:homeowner,hazard,flood,windpremiums

Indicatedocumentationrequirements:

Documentationrequirementsincludealegallyissuedformofidentification,documentsneededtoverifyhouseholdincome,anddocumentationneededtoverifyproperty

chargedelinquency suchasaninvoiceorotherevidenceofpropertychargesd elinquency.

Loaneligibilitycriteria

specifictotheprogram

N/A

Formofassistance

Assistancewillbestructuredasanon‐recoursegrant.AssistanceisnotrequiredtoberepaidandtheParticipantwillnotcollectorissuetaxableincomedocumentation

suchasW‐9or1099forms.

Paymentrequirements

MFAwilldisburseHAFassistanceviacheckorelectronicfundstransferdirectlytotheeligibleentitytowhichthehousingcostisdue.

03/2022 9

PropertyCharge De faultResolution(Taxes)

NewMexicoHomeownerAssistanceFund–PropertyChargeDefaultResolution(Taxes)

Criteria

ProgramTerms

Briefdescription

ThePropertyChargeDefaultResolution(Taxes)programdesignelementwillprovideup$20,000perhouseholdtoresolveanypropertychargedefaultthatthreatensa

homeowner’sabilitytosustainownershipoftheproperty.Thisprogramdesignelementisintended toassistwithpropertychargesoutsideofahomeownershiploan

escrowornot

coveredundertheHomeownershipLoanreinstatement/lossmitigationorHomeownershipLoanPaymentAssistanceprogramdesignelements(whichwill

alsopaypropertychargesassociatedwithhomeownershiploanescrows).

HAFFundsmaybeusedtopaypastduepropertytaxesthatthreatensustainedownershipofthepropertyandmustbebroughtcurrentby

programassistanceorresolved

concurrentlywiththeprogramdesignelementprovidingassistance.

Eachhouse holdmay receivefunding forupto threeyears ofdelinquenttaxes.Funds mayalso beusedto paypropertychargescomingdueinthe90 daysfollowing

householdapplicationapproval.

Maximumamount

ofassistanceper

homeowner

Eachhouseholdwillbeeligibleforupto$20,000ofHAFfundingwithr especttotheapplicant’sprimaryresidence.Eachhouseholdmayreceivefundingforuptothree

yearsofdelinquenttaxes.Fundsmayalsobeused topaypropertychargescomingdueinthe90daysfollowinghouseh oldapplicationapproval.

Ifahouseholdisrequestingassistanceformultipleeligiblehousingcostssuchaspropertytaxesorannualhomeowner’sinsurancepremiums,whetherinconjunctionwith

delinquentpaymentassistanceorseparateandapartfromamonthlyhomeownershippaymentstructure,and/orisrequestingassistancethroughotherprogramdesign

elements (with the exceptionof

the utility assistance program designelement), the per household award shall not exceed $20,000.Utility assistance has a separate

household maximum and is excluded from the $20,000 household maximum benefit available for the pilot, homeownership loan reinstatement/loss mitigation,

homeownershiploanpayment, propertycharge(insurance)defaultresolutionandpropertycharge(taxes)default

resolutionprogramdesignelements.

03/2022 10

Homeowner

eligibility criteria

and

documentation

requirements

HomeownerhouseholdsareeligibletoreceivepropertychargeassistanceundertheNMHAFifthey(1)attestthattheyexperiencedafinancialhardshipafterJanuary21,

2020associatedwiththeCOVID‐19healthcrisis,(2)provideincomedocumentationandhaveincomesequaltoorlessthan150%oftheareamedian

incomeor100%of

themedianincomefortheUnitedStates,whicheverisgreater,and(3)currentlyownandoccupyaprimaryresidenceinNewMexico.

In order to receive assistance, the applicant(s) will provide a self‐attestation that the household is able to resume the monthly housing payment (where

applicable)

followingreceivingassistance.

Homeownerhouseholdisatleastoneinstallmentpaymentinarrearsononeormorepropertychargesincluding:

Propertytaxes

Indicatedocumentationrequirements:

Documentationrequirementsincludealegallyissuedformofidentification,documentsneededtoverifyhouseholdincome,anddocumentationneededtoverifyproperty

chargedelinquency suchas

ataxstatement,invoice,orotherevidenceofpropertychargesdelinquency.

Loan eligibility

criteria specific to

theprogram

N/A

Formofassistance Assistancewillbestructuredasanon‐recoursegrant.AssistanceisnotrequiredtoberepaidandtheParticipantwillnotcollectorissuetaxableincomedocumentation

suchasW‐9or1099forms.

Payment

requirements

MFAwilldisburseHAFassistanceviacheckorelectronicfundstransferdirectlytotheeligibleentitytowhichthehousingcostisdue.

NMHomeownerAssistanceFundManual

Exhibit2‐PaperApplicatio n

(Attached)

HAFApplication(03/2022) 1

NewMexicoHomeownerAssistanceProgram

PROGRAMAPPLICATION

OFFICEUSEONLY

ApplicationPostmark/DropoffDate:

ApplicationTime:

ReceivedbyInitials:

A.GENERALQUALIFICATIONSANDCONDITIONSANDDOCUMENTATIONREQUIREMENTS

I/weunderstandthefollowingqualifications,conditions,anddocumentationrequirementsforthisprogram:

TheNewMexicoHo meowner AssistanceFund provideshousingcostassistancetohouseholdsresiding in

NewMexicowhoareexperiencingfinancial hardshipassociatedwiththeCOVID‐19healthcrisisandwho

areatriskoflosingtheirhousing.

Themaximumamountofassistanceislimitedto$20,000perhousehold,basedonactualneedandprogram

eligibility.

Theformofassistanceisagrantpaiddirectlytothehousingprovider,e.g.servicer,escrowcompany,seller,

lotowner/manager,etc.

Eligible expenses that can be paid with grant funds include monthly, delinquent taxes, homeowner’s

insuranceandhousingcostpaymentsasevidencebyaconsensualhomeownershipcontractoragreement

(e.g.mortgageloan,realestatecontract,privateleasetoownagreement,manufactured/mobilehomeloan

or other documented, consensual private financing arrangements), late fees,

and reasonable escrow

advancesasevidencedbyaloanstatement.

To qualify, the total annual household income for all household members in the county in which the

applicantresidentscannotexceedthelimitslistedinExhibit6.

Toqualify,grosshousehold

4

incomewillinclude

all

incomefrom

all

personsover18yearsofageaswellas

allunearnedincomeofminors.

To qualify, the household must certify that it has experienced financial hardship since January 21, 2020

associatedwiththeCOVID‐19healthcrisis.Situationscausingfinancialhardshipinclude,butarenotlimited

to,lossofemployment,reductionofworkhours,reducedwagesandincreasedexpenses.

Toqualify,thehouseholdmustnotbereceivinghousingassistancefromanotherprogram thatcoversthe

fullcostoftheirhousingpayment.

Applicationswillbereceiveduntilfurthernotice.

Theapplicationmustbefilledoutcompletelyandincludeallrequiredsupportingdocuments.

Programstaffwillreviewapplications intheorderinwhichtheyarereceived.Ifanapplicationis complet e

butmissingallrequireddocumentstoprocessforeligibility,theapplicantwillbegiven10calendardaysto

submitthemissingdocumentation.

Programstaffdeterminestheeligibilityofapplicantstotheprogramandreservestherighttodenyrequests

inspecificinstanceswhereapplications/applicantsdonotconformtotheseorotherprogramguidelines.

4

Whenusingtheterm“household”inthemanual,MFAwillbereferringtothedefinitionof“family”asdefinedat24CFR

5.403andfurtherusedin24CFR570.3and24CFR570.483(b)(2)(ii)(B).

HAFApplication(03/2022) 2

APPLICANTCONTACTINFORMATION

FirstName:

LastName:

PropertyAddress:

City:State: ZipCode:

County:_____________________________________

PrimaryPhone:OtherPhone:

Emailaddress:

Isthispropertyaddressalsoyourmailingaddress? Yes No

PropertyType

2ormoreUnits Condo ManufacturedHomePermanentlyAffixed Mobile/ManufacturedHomeNot

PermanentlyAffixed

SingleFamilyResidence Townhome

AreyouinactiveBankruptcy?

Yes No

Ifyes,pleaseprovidethefollowinginformation:

Datefiled:Chapter:

7 13 11

Datedischarged,ifapplicable:

HOUSEHOLDCOMPOSITION

Listthenameofeachindividual livinginthehousingunit,startingwiththeheadofhousehold:

*UseNumberfromlistbelow*

No.

Name

Dateof

Birth

SocialSecurity

Number

Gender*

Ethnicity*

Race*

1

2.

3.

4.

5.

6.

7.

8.

1‐Male

2‐Female

3‐Other

4‐Prefernottosay

1‐HispanicorLatino

2‐Not Hispanic or

Latino

1‐American Indian / Alaska

Native

2‐Asian

3‐Black/AfricanAmerican

4–Native Hawaiian/Other

PacificIslander

6–White

7– I donotwishto furnish this

information.

Isyourhouseholdasingle‐headedhousehold?* Yes No Prefernottosay

IsEnglishtheprimarylanguagespokeninyourhome?

Yes No,Ifno,pleaseprovidetheprimarylanguagespoken:

*Thisinformationisstrictlyconfidentialandwillbeusedintheaggregateforfederalreportingpurposesonly.

Triballand

Areyouaresidentoftriballand?

Yes NoIfyes,pleaselistthetribe:

HAFApplication(03/2022) 3

HOUSINGINFORMATION

Providingthefollowinginformationdoesnotdisqualifyyourapplication.

Isthisloanindefault?

Yes No

Haveyoureceivedaforeclosurenotice?

Yes No

Ifyes,providethedatetheComplaintforForeclosurewasfiled:

HaveyoureceivedaNoticeofForeclosureSale?