TABLE OF CONTENTS

NextEra Energy, Inc.

700 Universe Boulevard

Juno Beach, Florida 33408-0420

Notice of Annual Meeting of Shareholders

MAY 23, 2024

The 2024 Annual Meeting of Shareholders of NextEra Energy, Inc. (“NextEra Energy” or the “Company”) will be held on

Thursday, May 23, 2024, at 8:00 a.m., Mountain time, 145 Town Center Ave., Big Sky, Montana 59716 to consider and

act upon the following matters:

MEETING AGENDA BOARD RECOMMENDATION

1. Election as directors of the nominees specified in the accompanying proxy statement FOR each nominee

2. Ratification of appointment of Deloitte & Touche LLP as NextEra Energy’s

independent registered public accounting firm for 2024

FOR

3. Approval, by non-binding advisory vote, of NextEra Energy’s compensation of its

named executive officers as disclosed in the accompanying proxy statement

FOR

4.

A shareholder proposal entitled “Board Matrix” requesting a chart of individual Director

self-identified gender, race/ethnicity and skills

AGAINST

5. A shareholder proposal entitled “Climate Lobbying Report” requesting a report on the

Company’s lobbying and trade association memberships in relation to the Company’s

emissions goal

AGAINST

6.

Such other business as may properly be brought before the annual meeting or any

adjournment(s) or postponement(s) of the annual meeting

The proxy statement more fully describes these matters. NextEra Energy has not received notice of other matters that

may properly be presented at the annual meeting.

The record date for shareholders entitled to notice of, and to vote at, the annual meeting and any adjournment(s) or

postponement(s) of the annual meeting is March 26, 2024.

Admittance to the annual meeting will be limited to shareholders as of the record date or their duly appointed proxies.

For the safety of attendees, all boxes, handbags and briefcases are subject to inspection. Cameras, cell phones,

recording devices and other electronic devices are not permitted at the meeting.

NextEra Energy is pleased to deliver proxy materials electronically via the internet. Electronic delivery allows NextEra

Energy to provide you with the information you need for the annual meeting, while reducing environmental impacts and

costs.

REGARDLESS OF WHETHER YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT

YOUR PROXY OR VOTING INSTRUCTIONS PROMPTLY SO THAT YOUR SHARES CAN BE VOTED.

By order of the Board of Directors,

W. SCOTT SEELEY

Vice President, Compliance & Corporate

Secretary

Juno Beach, Florida

April 1, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO

BE HELD MAY 23, 2024

This proxy statement and the NextEra Energy 2023 annual report to shareholders are available at www.proxyvote.com.

VOLUNTARY ELECTRONIC RECEIPT

OF FUTURE PROXY MATERIALS

NextEra Energy is pleased to deliver proxy materials

electronically via the internet. Electronic delivery allows

NextEra Energy to provide you with the information you

need for the annual meeting, while reducing

environmental impacts and costs.

As one of the largest electric power and energy

infrastructure companies in North America and a

leader in the renewable energy industry, NextEra

Energy is committed to building a sustainable

energy future that is affordable, reliable and clean.

We encourage our shareholders to enroll in e-

delivery:

Online at www.proxyvote.com/NEE

Scan the QR code

TABLE OF CONTENTS

1 PROXY STATEMENT SUMMARY

3 BUSINESS AND GOVERNANCE HIGHLIGHTS

9 BUSINESS OF THE ANNUAL MEETING

9Proposal 1: Election as directors of the nominees specified in

this proxy statement

19Proposal 2: Ratification of appointment of Deloitte & Touche LLP

as NextEra Energy’s independent registered public accounting

firm for 2024

20Proposal 3: Approval, by non-binding advisory vote, of NextEra

Energy’s compensation of its named executive officers as

disclosed in this proxy statement

21Proposal 4: Shareholder proposal

23Proposal 5: Shareholder proposal

25INFORMATION ABOUT NEXTERA ENERGY AND

MANAGEMENT

25The Company’s Security Trading Policy

25Common Stock Ownership of Certain Beneficial Owners and

Management

27CORPORATE GOVERNANCE AND BOARD MATTERS

27Corporate Governance Principles & Guidelines/Code of Ethics

27Director Independence

27Board Leadership Structure

28Board Role in Risk Oversight

29Board Evaluations

29Director Meetings and Attendance

29Board Committees

31Consideration of Director Nominees

32Communications with the Board

32Website Disclosures

33Transactions with Related Persons

35 AUDIT-RELATED MATTERS

35 Audit Committee Report

36 Fees Paid to Deloitte & Touche LLP

36 Policy on Audit Committee Pre-Approval of Audit and

Non-Audit Services of Independent Registered

Public Accounting Firm

38 EXECUTIVE COMPENSATION

38 Compensation Discussion & Analysis

67 Compensation Committee Report

69 Compensation Tables

69 Table 1a: 2023 Summary Compensation Table

70 Table 1b: 2023 Supplemental “All Other

Compensation” Table

71 Table 2: 2023 Grants of Plan-Based Awards

74 Table 3: 2023 Outstanding Equity Awards at

Fiscal Year End

77 Table 4: 2023 Option Exercises and Stock

Vested

77 Table 5: Pension Benefits

79 Table 6: Nonqualified Deferred Compensation

80 Potential Payments Upon Termination or Change in

Control

86 Pay Versus Performance

88 DIRECTOR COMPENSATION

90 QUESTIONS AND ANSWERS ABOUT THE

ANNUAL MEETING

96 NO INCORPORATION BY REFERENCE

96 SHAREHOLDER ACCOUNT MAINTENANCE

A-1 APPENDIX A: RECONCILIATIONS OF NON-

GAAP TO GAAP FINANCIAL MEASURES

TABLE OF CONTENTS

Table of Contents

TABLE OF CONTENTS

Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all

the information that you should consider. You should read the entire proxy statement carefully before voting. This proxy

statement contains information related to the solicitation of proxies by the Board of Directors (the “Board”) of NextEra

Energy, Inc., a Florida corporation (“NextEra Energy,” the “Company,” “NEE,” “we,” “us” or “our”), in connection with the

2024 annual meeting of NextEra Energy’s shareholders and at any adjournment(s) or postponement(s) of the meeting.

On or about April 1, 2024, NextEra Energy began mailing this proxy statement and a Notice of Internet Availability of

Proxy Materials to shareholders.

MEETING INFORMATION

TIME AND DATE PLACE RECORD DATE

8:00 a.m., Mountain time

May 23, 2024

145 Town Center Ave., Big Sky,

Montana 59716

March 26, 2024

WEBCAST VOTING ADMISSION

The Company will provide a live

audio webcast of the annual

meeting from its website at

http://www.nexteraenergy.com.

Shareholders as of the record date are entitled

to vote. Each share of common stock, par

value $.01 per share (“common stock”), is

entitled to one vote for each director nominee

and one vote for each of the other properly

presented proposals to be voted.

An admission ticket is required to

enter the annual meeting. See

page 91 in the Questions and

Answers About the Annual

Meeting section regarding how to

obtain a ticket.

VOTING MATTERS AND BOARD RECOMMENDATIONS

PROPOSAL BOARD VOTE RECOMMENDATION PAGE REFERENCE

1.

Election of directors FOR each nominee 9

2.

Ratification of appointment of Deloitte & Touche LLP as

NextEra Energy’s independent registered public

accounting firm for 2024

FOR 19

3.

Advisory vote to approve NextEra Energy’s

compensation of its named executive officers

FOR 20

4.

Shareholder Proposal – Board Matrix

AGAINST 21

5.

Shareholder Proposal – Climate Lobbying Report

AGAINST 23

NEXTERA ENERGY 2024 PROXY STATEMENT 1

●

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

HOW TO VOTE

BY

INTERNET

BY

TELEPHONE

BY

MAIL

IN

PERSON

Go to the website

www.proxyvote.com,

24 hours a day, seven

days a week. You will

need the control number

that appears on your

proxy card or on your

Notice of Internet

Availability of Proxy

Materials (the “Notice”).

Call 1-800-690-6903,

24 hours a day, seven

days a week. You will

need the control number

that appears on your

proxy card or Notice.

If you received a full paper set of

materials, date and sign your proxy

card exactly as your name appears

on your proxy card and mail it in the

enclosed, postage-paid envelope. If

you received the Notice, you may

request a proxy card by following

the instructions in your Notice. Even

if you received a full paper set of

materials, you may still vote by

internet or telephone. You do not

need to mail the proxy card if you

are voting by internet or telephone.

At the annual meeting.

2 NEXTERA ENERGY 2024 PROXY STATEMENT

●

*

**

TABLE OF CONTENTS

Business and Governance Highlights

~72 GW*

in operation

~9,000 MEGAWATT (“MW”)

wind, solar and storage

origination at NextEra Energy

Resources, LLC (“NextEra

Energy Resources”)

~16,800

employees

~$177 B

in total assets

HURRICANE

RESTORATION

Florida Power & Light

Company’s (“FPL”) smart grid

technology avoided nearly

70,000 outages during

Hurricane Idalia

~71; ~9%

GAAP and adjusted

earnings per share (“EPS”)

growth compared to 2022

~20 GW

year-end backlog at NextEra

Energy Resources

~50%

below the national average

CO emissions rate

89%

improvement in NextEra

Energy overall company

safety performance since

2003

~$85-$95 B

expected capital deployment

from 2022 through 2025

56%

five-year total shareholder

return (“TSR”), outperforming

the S&P 500 Utilities Index

96%

of FPL’s transmission

structures are now concrete

or steel

Above data as of year-end 2023 if not otherwise shown.

Gigawatts (“GW”) shown includes assets operated by NextEra Energy Resources, including those owned by NextEra Energy Partners, LP

(“NEP”), as of 12/31/2023; excludes assets which have been sold to third parties but continue to be operated by NextEra Energy

Resources.

BUSINESS HIGHLIGHTS

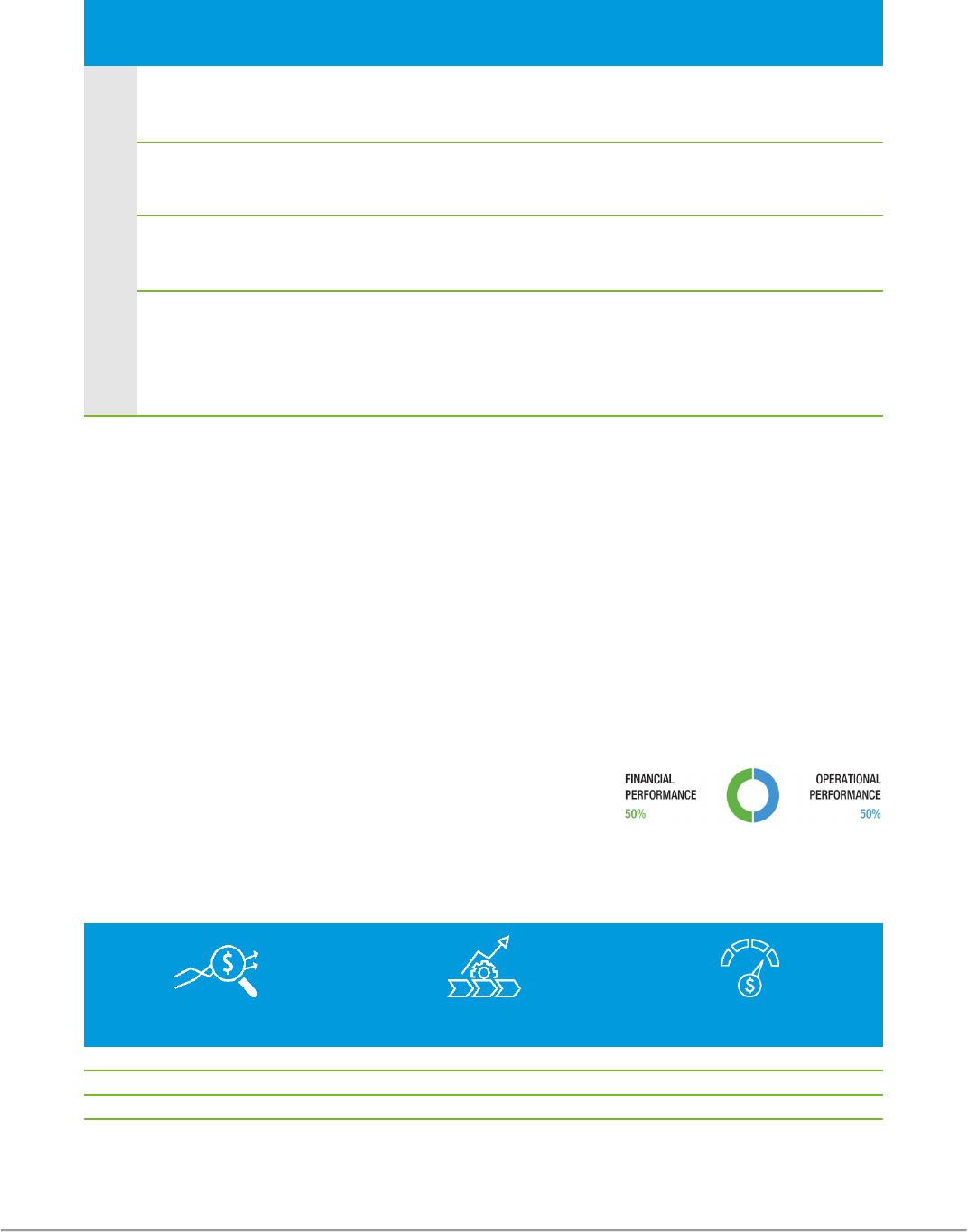

NextEra Energy’s overall operational and financial performance was superior in 2023, despite challenges in the

macroeconomic environment. NextEra Energy continued to deliver superior financial performance, on an annual and

multi-year basis.

For the full year 2023, NextEra Energy reported net income attributable to NextEra Energy on a GAAP basis of

$7.310 billion, or $3.60 per share. We achieved company-record adjusted earnings** of $6.441 billion and adjusted

EPS** of $3.17.

This measure is not a financial measure calculated in accordance with accounting principles generally accepted in the United States of

America (“GAAP”). See Appendix A to this proxy statement for a reconciliation of this non-GAAP financial measure to the most directly

comparable GAAP financial measure.

NEXTERA ENERGY 2024 PROXY STATEMENT 3

2

●

*

**

(1)

TABLE OF CONTENTS

BUSINESS AND GOVERNANCE HIGHLIGHTS

These significant accomplishments came as NextEra Energy continued to be a leader among the ten largest U.S.

utilities (based on market capitalization**) in many financial metrics, as shown below.

NEXTERA ENERGY RANK VS. TEN LARGEST U.S. UTILITIES BASED ON MARKET CAP**

METRIC RANK DETAIL

Adjusted EPS Growth* #1 3-, 5-, 7- and 10-year

Adjusted return on equity (“ROE”)* #1 1-, 3-, 5-, 7- and 10-year

This measure is not a financial measure calculated in accordance with GAAP. See Appendix A to this proxy statement for a reconciliation

of this non-GAAP financial measure to the most directly comparable GAAP financial measure. See the 2023 Financial Performance Matrix

section on page 51 for more information on how the rankings are determined.

Market capitalization is as of December 31, 2023; rankings are sourced from FactSet Research Systems Inc.

Ultimately, the Company’s financial and operational performance is reflected in the increased value of its common

stock. The chart below compares the Company’s TSR for the 10-year period ended December 31, 2023 to the TSRs of

the S&P 500 Electric Utilities Index, the S&P 500 Utilities Index, the UTY, the S&P 500 and the S&P 500 Growth Index.

NextEra Energy outperformed all of these indices over the period shown.

NEXTERA ENERGY 10-YEAR TOTAL SHAREHOLDER RETURN THROUGH 12/31/2023 VS. VARIOUS INDICES

NEXTERA ENERGY VS. INDICES 10-YEAR TSR

NextEra Energy 267

S&P 500 Electric Utilities Index, total return 146

S&P 500 Utilities Index, total return 135

UTY, total return 133

S&P 500, total return 211

S&P 500 Growth Index, total return 250

Source: FactSet Research Systems Inc.; except UTY, source: Bloomberg.

4 NEXTERA ENERGY 2024 PROXY STATEMENT

(1)

%

%

%

%

%

%

●

*

TABLE OF CONTENTS

BUSINESS AND GOVERNANCE HIGHLIGHTS

GOVERNANCE HIGHLIGHTS

DIRECTOR

INDEPENDENCE

BOARD

LEADERSHIP

BOARD

ACCOUNTABILITY

BOARD EVALUATION &

EFFECTIVENESS

»

10 of 11 director

nominees are

independent

» CEO is the only

non-independent

director

» All members of the

Audit Committee,

Compensation

Committee,

Finance &

Investment

Committee and

Governance &

Nominating

Committee are

independent

directors

»

Independent Lead

Director selected

by the independent

directors

» Lead Director has

strong role and

significant

governance duties,

including chairing

regularly

scheduled

executive sessions

of independent

directors

» As part of our Fall

shareholder

outreach program,

Lead Director

communicated

directly with 30.9%

of outstanding

shares

»

All directors stand for election annually and

the Board has adopted a resignation policy

for directors who fail to receive the required

vote in uncontested elections

» Simple majority voting standard for all

uncontested director elections

» Shareholders of 20% or more of the

outstanding shares may call a special

meeting

»

No shareholder rights (“poison pill”) plan

» No supermajority vote requirements in the

Company’s Articles of Incorporation

»

Annual Board and

committee self-

evaluations

» Annual independent

director evaluation

of the chairman

BOARD

REFRESHMENT &

DIVERSITY

DIRECTOR

ENGAGEMENT

CLAWBACK &

ANTI-HEDGING

POLICIES

SHARE

OWNERSHIP

PROXY

ACCESS

» Balance of new

and experienced

directors, with

tenure of director

nominees

averaging 6 years*

»

Specified

retirement age for

directors

» 36% of director

nominees are

women

» Average age of

director nominees

is 63 years*

»

18% of director

nominees are

ethnically diverse

» All current

directors attended

at least 98% of

Board and their

assigned

committee

meetings

»

Board policy limits

non-employee

director

membership on

other public

company boards

to three

» Recoupment or

clawback policy to

recover certain

executive pay

»

Policy prohibiting

short sales,

hedging and

margin accounts

» Updated clawback

policy to comply

with NYSE rules

» CEO required to

hold shares

equivalent to 7x

base salary

»

All senior

executives

required to hold

share equivalent to

3x base salary

» Directors required

to hold shares

equivalent to 7x

the cash portion of

their annual

retainer

» Available to a

shareholder, or

group of up to 20

shareholders,

owning 3% of the

Company’s

outstanding shares

for at least 3 years

»

May nominate

candidates for the

greater of 2

directorships or up

to 20% of the

membership of the

Board

As of May 23, 2024

NEXTERA ENERGY 2024 PROXY STATEMENT 5

●

»

»

»

*

TABLE OF CONTENTS

BUSINESS AND GOVERNANCE HIGHLIGHTS

SUSTAINABILITY HIGHLIGHTS

Sustainability Report

In 2023, the Company published its annual Sustainability report (the

“2023 Sustainability Report”). Highlights of the 2023 Sustainability

Report include:

» emphasis of the Company’s commitment as a clean energy leader;

continued full alignment with the Task Force on Climate-Related

Financial Disclosures (“TCFD”) framework;

disclosure of Scope 1, Scope 2 and partial Scope 3 greenhouse gas

emissions (“GHG”) as verified by an independent third party;

» a discussion of the Company’s diversity efforts; and

Board oversight of those efforts and a discussion of the sustainability strategies of the Company’s principal

subsidiaries, FPL and NextEra Energy Resources.

The 2023 Sustainability Report discusses FPL’s best-in-class value proposition of low customer bills, high reliability,

clean energy solutions and excellent customer service and NextEra Energy Resources’ continued focus on building a

diversified clean energy company with an emphasis on growing its world-leading portfolio of wind, solar and storage

projects. In addition to the ethnic breakdown of workforce and management provided in the 2023 Sustainability Report,

the Company will expand its diversity reporting this upcoming year to include diversity data related to hiring and

promotions.

The 2023 Sustainability Report details the Company’s sustainability accomplishments and goals. Included among them

are discussions of:

Emission

Reduction

The Company’s goal to

eliminate CO emissions

from its operations by

2045

61%

The Company’s CO

emissions rate in 2022

was 61% lower than the

utility industry’s 2005

average CO emissions

rate

FPL’s generation fleet is

one of the cleanest and

most efficient in the

country, saving Florida

customers more than

~$15 billion in avoided fuel

costs*

0

FPL has no coal-fired

power generation in

Florida

25% WOMEN /

41% MINORITIES

The diversity of our

employees in 2022,

including 25% women

and 41% minorities in our

workforce, with 27% and

29%, respectively, in our

management ranks

~1.2 B

Awarded, in the most

recent federal reporting

period, ~$1.2 billion in

purchase contracts to

minority- and women-

owned businesses

SUSTAINABILITY

FOCUS

The Board’s oversight

process of sustainability

issues, with a particular

focus on the sustainability

of our business

SHAREHOLDER

ENGAGEMENT

Our successful

shareholder engagement

efforts, which ensure that

the Company’s

management and the

Board better understand

shareholder priorities and

perspectives and enables

us to effectively address

the issues that matter

most to our shareholders

As of December 31, 2023.

6 NEXTERA ENERGY 2024 PROXY STATEMENT

2

2

2

●

TABLE OF CONTENTS

BUSINESS AND GOVERNANCE HIGHLIGHTS

The 2023 Sustainability Report also includes disclosure within the following established environmental reporting

frameworks:

» the Sustainability Accounting Standards Board;

» Edison Electric Institute’s ESG/Sustainability Quantitative Metrics; and

» United Nations Sustainability Development Goals.

The Company also publishes its EEO-1 reports, available at https://www.investor.nexteraenergy.com/sustainability/

sustainability- resources under Related Information.

Additionally, in 2023, the Company again participated

in the Carbon Disclosure Project (“CDP”) survey.

The Company’s 2023 Sustainability Report and CDP

survey response are available at:

Board oversight

NextEra Energy, as a renewable energy leader, has made climate-related issues core to its overall business strategy.

The entire NextEra Energy Board of Directors, led by the chairman, has oversight of climate-related risks and

opportunities, including their impacts on the Company’s strategy. The Board understands the impacts of climate related

risks on the Company’s future growth, as well as how the Company prepares its business to adapt to the effects of

climate related risks. At every scheduled board of directors meeting, the Board performs a review of the Company’s

performance against business objectives and key risks and opportunities for the Company. The Board also holds an

annual strategy session devoted to discussing, debating and validating management’s overall strategy. Oversight of

climate-related issues includes discussion of physical risks from hurricanes, climate- and emissions-related government

policies, incentives and regulations, emissions-reduction initiatives, renewable energy, trends and business plans, and

emerging clean energy technologies, among others.

The Board of Directors also has oversight of certain social topics relevant to the Company. The Board reviews the

Company’s diversity and inclusion and talent management strategy at least annually, including human capital and

diversity metrics. The Board also focuses on diversity in the Company’s talent pipeline and reviews the diversity metrics

of the Company’s internship program.

Information security

NextEra Energy’s Audit Committee receives regular reports on the key risks facing the Company from the Corporate

Risk Committee leader and also receives frequent reports from the Company’s Internal Auditor about the results of

reviews of cybersecurity and information security governance. The Board biannually receives a cybersecurity report

from the Company’s chief information officer and its vice president, IT infrastructure & cybersecurity.

Varying leading third parties periodically assess the Company’s alignment with the U.S. Department of Energy’s Cyber

Capability Maturity Model (a/k/a C2M2) standard, which is the predominate cybersecurity framework for the U.S. electric

utility industry. NextEra Energy has a comprehensive cybersecurity training program in which all employees receive

education and training on prevention of cybersecurity problems and on privacy and data protection.

Shareholder engagement

The Company engages with shareholders on a regular basis and provides information through multiple channels. We

believe our shareholder engagement efforts allow us to better understand our shareholders’ priorities and perspectives

and enable us to effectively address the issues that matter the most to our shareholders.

NEXTERA ENERGY 2024 PROXY STATEMENT 7

●

TABLE OF CONTENTS

BUSINESS AND GOVERNANCE HIGHLIGHTS

In 2023, we reached out to 73 of our 100

largest shareholders, representing

approximately 58.3% of shares

outstanding (including all top 50

shareholders), and offered to engage on

matters important to them, including

governance and compensation. We held

engagements with 22 shareholders

representing approximately 36.3% of the

Company’s shares outstanding, and

received valuable feedback on our

governance and compensation program.

Our Lead Director, Sherry S. Barrat,

participated in 8 shareholder

engagements, representing 30.9% of

shares outstanding. The feedback we

received was shared with the full Board

and has been considered in certain

enhancements we have made to our

executive compensation program and

related disclosures as described in more

detail on page 42.

8 NEXTERA ENERGY 2024 PROXY STATEMENT

●

TABLE OF CONTENTS

Business of the Annual Meeting

PROPOSAL 1: ELECTION AS DIRECTORS OF THE NOMINEES SPECIFIED IN THIS

PROXY STATEMENT

The Board is currently composed of 13 members. Two members of the Board, Sherry S. Barrat and Kenneth B. Dunn,

having reached their respective retirement ages, will retire from the Board. Upon the recommendation of the

Governance & Nominating Committee, the Board has nominated the 11 other incumbent members listed below for

election as directors at the 2024 annual meeting. Unless you specify otherwise, your proxy will be voted FOR the

election of the listed nominees. If any nominee becomes unavailable for election, which is not currently anticipated,

proxies instructing a vote for that nominee may be voted for a substitute nominee selected by the Board or, in lieu

thereof, the Board may reduce the number of directors by the number of nominees unavailable for election.

Nicole S.

Arnaboldi

James L.

Camaren

Naren K.

Gursahaney

Kirk S.

Hachigian

Maria G.

Henry

John W.

Ketchum

Amy B.

Lane

David L.

Porges

Deborah L.

“Dev”

Stahlkopf

John A.

Stall

Darryl L.

Wilson

The Board believes its current size is appropriate because it facilitates substantive discussions among Board members,

provides for sufficient staffing of Board committees and allows for contributions by directors having a broad range of

skills, expertise, industry knowledge and diversity of opinion. Directors serve until the next annual meeting of

shareholders or until their respective successors are elected and qualified.

Board refreshment and diversity

Board refreshment

The Board and the Governance & Nominating Committee engage in a continuous process of considering the mix of

skills and experience needed by the Board as a whole to discharge its responsibilities. Six of the director nominees

have a tenure of less than five years. In 2023, the Governance & Nominating Committee discussed board composition,

board refreshment and board recruiting at every committee meeting.

The Company has a director retirement policy. Generally, no person who has attained the age of 72 years by the date of

election is eligible for election as a director. However, the Board may, by unanimous action (excluding the affected

director), extend a director’s eligibility for one or two additional years, in which event the director will not be eligible for

subsequent election as a director if he or she would have attained the age of 73 or 74 by or prior to the date of the

election.

Diversity

Diversity is among the factors that the Governance & Nominating Committee considers when identifying and evaluating

potential Board nominees. NextEra Energy’s Corporate Governance Principles & Guidelines (the “Governance

Guidelines”) provide that, in identifying nominees for director, the Company seeks to achieve a mix of directors

representing a diversity of background and experience, including diversity with respect to age, gender, race, ethnicity

and specialized

NEXTERA ENERGY 2024 PROXY STATEMENT 9

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

experience. In the Board’s annual self-evaluation, it reviews the criteria for skills, experience and diversity reflected in

the Board’s membership and also reviews the Board’s process for identification, consideration, recruitment and

nomination of prospective Board members.

Maria G. Henry is a nominee for election to the Board this year who currently serves on the Board and previously has

not been elected by the Company’s shareholders. Ms. Henry was identified by the recruiting efforts of management and

the Governance & Nominating Committee members. Ms. Henry was interviewed by each of the members of the

Governance & Nominating Committee and by Mr. Ketchum. The Governance & Nominating Committee then evaluated

the qualifications, background and experience of Ms. Henry using the criteria set forth in the Governance Guidelines

discussed below, noting in particular that Ms. Henry would provide expertise beneficial to the Company in the areas of

finance, consumer facing businesses and information management and cyber-security. Following evaluation by the

Governance & Nominating Committee, Ms. Henry was interviewed by the other members of the Board and was

appointed to the Board in September 2023.

Identifying and evaluating nominees for directors

The Governance & Nominating Committee uses a variety of methods for identifying and evaluating nominees for

director. The Governance & Nominating Committee regularly assesses the appropriate size of the Board and whether

any vacancies on the Board are expected due to retirement or otherwise. Candidates may come to the attention of the

Governance & Nominating Committee through current Board members, professional search firms, shareholders or

other persons. Candidates are evaluated at regular or special meetings of the Governance & Nominating Committee

and may be considered at any time during the year. When considering candidates for the Board, the Governance &

Nominating Committee considers all nominee recommendations, including those from shareholders, in the same

manner. If any materials are provided by a shareholder in connection with the nomination of a director candidate, the

materials are provided to the Governance & Nominating Committee. The Governance & Nominating Committee also

reviews materials provided by professional search firms or other parties. In evaluating nominations, the Governance &

Nominating Committee seeks to achieve a diverse balance of knowledge, experience and capability.

Director resignation policy

Under the NextEra Energy, Inc. Amended and Restated Bylaws (the “Bylaws”), in an uncontested election, directors are

elected by a majority of the votes cast. The Board has adopted a Policy on Failure of Nominee Director(s) to Receive a

Majority Vote in an Uncontested Election (“Director Resignation Policy”), the effect of which is to require that, in any

uncontested director election, any incumbent director who is not elected by the required vote must offer to resign and

the Board will determine whether or not to accept the resignation within 90 days of the certification of the shareholder

vote. The Company will report the action taken by the Board under the Director Resignation Policy in a publicly

available forum or document. The Bylaws provide that, in a contested election, director nominees are elected by a

plurality of the votes cast.

Director qualifications

The Governance Guidelines and the Governance & Nominating Committee Charter identify Board membership

qualifications, including experience, skills and attributes, that are considered by the Governance & Nominating

Committee in recommending non-employee nominees for Board membership. In addition to the membership

qualifications identified in the Governance Guidelines, no person will be considered for Board membership who is an

employee or director of a business in significant competition with the Company or of a major or potentially major

customer, supplier, contractor, counselor or consultant of the Company, or an executive officer of a business where a

Company employee-director serves on the board of such other business.

10 NEXTERA ENERGY 2024 PROXY STATEMENT

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

The chart below provides a summary of the collective competencies of the current Board and explains why these are

important:

DIRECTOR QUALIFICATIONS COMPETENCIES AND RELEVANCE TO NEXTERA ENERGY BOARD COMPOSITION

Individuals who have served as

a public company CEO

PUBLIC COMPANY CEO EXPERIENCE

Experience serving as a CEO provides unique

perspectives to help the Board independently oversee

NextEra Energy’s CEO and management. Having this

experience also increases the Board’s understanding and

appreciation of the many facets of running a public

company, including strategic planning, financial reporting,

compliance and risk oversight.

Demonstrated expertise in

managing large, relatively

complex organizations, such as

leadership roles of a significant

company or organization

STRATEGY EXPERTISE

Our Company operates in a quickly changing industry with

new developing technologies. Having experience in

developing and implementing strategic plans helps enable

the Board to oversee and pivot in rapidly changing

environments.

OPERATIONS MANAGEMENT AND LEADERSHIP

Our Company has a strong focus on cost and customer

value, as well as innovation. Having experience with

operations assists the Board in understanding the issues

that the Company faces in achieving its industry-leading

operating and maintenance (“O&M”) initiatives and

reducing costs.

MERGERS & ACQUISITIONS EXPERIENCE

Our Company from time to time acquires and disposes of

businesses and assets. An understanding of mergers &

acquisitions helps the Board evaluate any future

transactions and any associated opportunities and risks.

Experience leading a utility,

energy company or other highly

regulated organization, such as

CEO or other leadership

position

UTILITY/REGULATED INDUSTRY LEADERSHIP

As a company in a highly regulated industry, experience in

the utility industry or another regulated industry assists the

Board in understanding the regulatory issues that the

Company faces.

ENERGY INDUSTRY LEADERSHIP

It is important that the Board understand the energy

industry and the complete energy industry value chain.

Energy industry leadership assists the Board in

understanding all aspects of the ongoing energy transition.

Financial or other risk

management expertise

FINANCIAL

Our Company’s business involves complex financial

management, capital allocation and reporting issues. An

understanding of finance and financial reporting is

valuable in order to promote effective capital allocation

and robust controls and oversight of accurate financial

reporting.

RISK MANAGEMENT

The scale, scope and complexity of our Company’s

business raises a variety of interdependent risks.

Experience in effectively identifying, prioritizing and

managing a broad spectrum of risks can help the Board

appreciate, anticipate and oversee the Company in

managing the risks that face its various businesses.

NEXTERA ENERGY 2024 PROXY STATEMENT 11

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

DIRECTOR QUALIFICATIONS COMPETENCIES AND RELEVANCE TO NEXTERA ENERGY BOARD COMPOSITION

Experience serving in senior

customer facing roles or in

industries where customer

service is strategically important

MARKETING, SALES AND CUSTOMER SERVICE

EXPERIENCE

FPL services over five million customer accounts in the

state of Florida. NextEra Energy Resources also has a

number of customer and consumer facing businesses

serving thousands of customers. Experience in

marketing, sales and customer service helps the Board

oversee FPL’s best-in-class customer value proposition

and NextEra Energy Resources’ growing consumer

facing businesses. We also have customer and

consumer facing businesses at NextEra Energy

Resources.

Experience in managing

engineering and construction

projects

ENGINEERING AND CONSTRUCTION LEADERSHIP

In 2023, the Company invested approximately $25 billion

in energy infrastructure and NextEra Energy Resources

commissioned approximately 5,025 MWs of renewable

energy projects. Board experience in engineering and

construction leadership assists the Board in its oversight

of our large-scale capital investments and on our timely

and on budget capital project execution.

Experience with information

technology and cybersecurity

INFORMATION TECHNOLOGY LEADERSHIP

Oversight of the protection of customer information and

cybersecurity is critical to providing reliable electric

service at both FPL and NextEra Energy Resources.

Board experience in information technology leadership

assists the Board in its oversight of our cybersecurity

programs.

The Board views itself as a cohesive whole consisting of members who together serve the interests of the Company

and its shareholders. The Board is comprised of directors with a mix of backgrounds, knowledge and skills that the

Board considers relevant and beneficial in fulfilling its oversight role. The chart below provides a summary of each

current individual director’s most relevant skills and gender:

Experience Arnaboldi Barrat Camaren Dunn Gursahaney Hachigian Henry Ketchum Lane Porges Stahlkopf Stall Wilson

Public Company CEO Experience X X X X X

Financial Industry Experience & Leadership X X X X X X X X X X

Strategy Expertise X X X X X X X X X X X X

Operations Management & Leadership X X X X X X X

International Experience X X X X X X X X X X

Utility / Regulated Industry Leadership X X X X X

Political / Legislative Experience X X

Energy Industry Leadership X X X X

Engineering & Construction Industry

Experience X X X X X

Nuclear Operations Leadership X X

Risk Management Leadership X X X X X X X X X X X X

Mergers & Acquisitions Experience X X X X X X X X X

Information Technology / Cyber Experience X X X X

Investor Relations Management X X X X X X

Marketing / Sales / Customer Service

Experience & Leadership X X X X X X X X

New Business Development/Development X X X X X X X X X X

Human Resources Development X X X X X X X X X X X X X

Trading/Derivatives X X X X

Gender

Female X X X X X

Male X X X X X X X X

12 NEXTERA ENERGY 2024 PROXY STATEMENT

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

Board gender and race/ethnic diversity

The Company seeks to achieve a mix of directors representing a diversity of background and experience, including

diversity with respect to age, gender, race, ethnicity and specialized experience. The charts below reflect the diversity of

the current Board members.

NEXTERA ENERGY 2024 PROXY STATEMENT 13

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

Director nominee biographies

NICOLE S. ARNABOLDI

Age 65 Independent director since 2022

Board Committees

» Audit

» Finance & Investment

Public Company Boards

» Manulife Financial Corporation

(since 2020)

Career Highlights

Ms. Arnaboldi has been a partner at Oak Hill

Capital Management since 2021. She was

previously the vice chairman of Credit Suisse

Asset Management and a managing director of

Credit Suisse Securities Corp. from 2000 to

2019. Prior to her roles at Credit Suisse,

Ms. Arnaboldi served as a managing director

of its predecessor, Donaldson Lufkin and

Jenrette, in the firm’s venture capital group

from 1985 to 1992 and then in its private equity

group, where she became a managing director

in 1996.

Qualifications

Ms. Arnaboldi has over 35 years of

leadership experience in financial

services and private equity, including her

service as vice chairman of Credit Suisse

Asset Management and as a partner of

Oak Hill Capital Management. She has a

wealth of finance and business expertise,

along with a proven track record as an

experienced leader and strategist in

investment banking and private equity for

more than three decades. Ms. Arnaboldi

holds a law degree from Harvard Law

School, a Master of Business

Administration degree from the Harvard

Business School and a Bachelor of Arts

degree from Harvard College.

JAMES L. CAMAREN

Age 69 Independent director since 2002

Board Committees

» Compensation

» Finance & Investment

Career Highlights

Mr. Camaren is a private investor. Until

May 2006, he was chairman and CEO of

Utilities, Inc. which was one of the largest

investor-owned water utilities in the United

States until March 2002 when it was acquired by

Nuon, a Dutch company, which subsequently

sold Utilities, Inc. in April 2006. He joined

Utilities, Inc. in 1987 and served successively as

vice president of business development,

executive vice president, and vice chairman,

becoming chairman and CEO in 1996.

Qualifications

Mr. Camaren has 19 years of leadership

experience with a large, regulated

investor-owned utility. During the years he

served as chairman and CEO, the utility

had customer growth at a rate that

exceeded the industry average and

acquired and integrated over 40 utilities.

In addition, Mr. Camaren has experience

in managing capital expenditures,

environmental compliance, regulatory

affairs and investor relations.

14 NEXTERA ENERGY 2024 PROXY STATEMENT

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

NAREN K. GURSAHANEY

Age 62 Independent director since 2014

Board Committees

» Audit (Chair)

» Executive

» Governance & Nominating

Public Company Boards

» Stericycle, Inc. (since 2023)

Career Highlights

Mr. Gursahaney is retired. He served as the

president and CEO, and a member of the

board of directors, of The ADT Corporation

(“ADT”), a provider of security systems and

services, from September 2012 until its

acquisition by affiliated funds of Apollo

Global Management LLC in May 2016. Prior

to ADT’s separation from Tyco International

Ltd. (“Tyco”) in September 2012,

Mr. Gursahaney served as president of

Tyco’s ADT North American Residential

business segment and was the president of

Tyco Security Solutions, then a provider of

electronic security to residential, commercial,

industrial and governmental customers and

the largest operating segment of Tyco.

Mr. Gursahaney joined Tyco in 2003 as

senior vice president of operational

excellence. He then served as president of

Tyco Engineered Products and Services and

president of Tyco Flow Control. Prior to

joining Tyco, Mr. Gursahaney was president

and CEO of GE Medical Systems Asia,

where he was responsible for the company’s

sales and services business in the Asia-

Pacific region. During his 10-year career with

GE, Mr. Gursahaney held senior leadership

roles in services, marketing and information

management.

Qualifications

Mr. Gursahaney has extensive

operations, strategic planning and

leadership experience in global

manufacturing and services businesses

serving residential, commercial, industrial

and governmental customers gained as

the CEO of a public company providing

security systems and service. He also

has extensive global operations,

information technology and service

experience gained as the president and

CEO of the Asia-Pacific division of a

medical diagnostic and imaging

manufacturer. He has an MBA from the

University of Virginia and a Bachelor of

Science in mechanical engineering from

Pennsylvania State University.

KIRK S. HACHIGIAN

Age 64 Independent director since 2013

Board Committees

» Compensation (Chair)

» Executive

» Governance & Nominating

Public Company Boards

» Allegion plc (since 2013)

» PACCAR, Inc. (since 2008)

» L3 Harris Technologies, Inc.

(since December 2023)

Career Highlights

Mr. Hachigian served as chairman of the board

of JELD-WEN Holding, Inc., a manufacturer of

windows and doors, from April 2014 until

May 2018. He also served as CEO of JELD-

WEN Holding, Inc. from April 2014 until

November 2015. He served as chairman,

president and CEO of Cooper Industries plc

(“Cooper”), a publicly held electrical equipment

and tool manufacturer, until Cooper’s acquisition

by Eaton Corporation plc in November 2012. He

was named chairman of Cooper in 2006, CEO in

2005 and president in 2004.

Qualifications

Mr. Hachigian has extensive leadership,

operations and strategic planning

experience gained through his prior

service as the chairman, CEO and

president of a global, publicly held

manufacturer of electrical equipment and

tools. He also has international leadership

and operations experience gained through

his prior service as the president and

CEO of the Asia-Pacific operations of a

lighting products manufacturer and in key

management positions in Singapore and

Mexico. In addition, Mr. Hachigian has

financial and risk oversight experience

developed through his prior service on the

audit committee of another public

company and as a prior member of the

board of the Houston branch of the

Federal Reserve Bank of Dallas. He has

an MBA in finance from the Wharton

School of Business and a Bachelor of

Science in engineering from the University

of California (Berkeley).

NEXTERA ENERGY 2024 PROXY STATEMENT 15

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

MARIA G. HENRY

Age: 57 Independent director since 2023

Board Committees

» Finance & Investment

Public Company Boards

» General Mills, Inc. (since

2016)

» NIKE, Inc. (since May 2023)

Career Highlights

Ms. Henry was chief financial officer of Kimberly-

Clark Corporation from April 2015 through

April 2022, and served as executive vice

president and senior advisor of Kimberly-Clark

Corporation from April 2022 until her retirement

in September 2022. Prior to Kimberly-Clark,

Ms. Henry was executive vice president and

chief financial officer of the Hillshire Brands

Company, formerly known as Sara Lee

Corporation, from 2012 to 2014. She was the

chief financial officer of Sara Lee’s North

American Retail and Foodservice business from

2011 to 2012. Prior to Sara Lee, Ms. Henry held

various senior leadership positions in finance

and strategy in three portfolio companies of

Clayton, Dubilier & Rice, most recently as

executive vice president and chief financial

officer of Culligan International. She also held

senior finance roles in several technology

companies and began her career at General

Electric.

Qualifications

Ms. Henry has extensive leadership

experience in finance and strategy for

large global public, private equity

controlled, and smaller entrepreneurial

companies across consumer, technology,

manufacturing and distribution industries.

She has had oversight responsibility for

finance, treasury, investor relations,

strategy, real estate and accounting. She

also has experience overseeing

information technology and risk, including

cyber risk. Ms. Henry currently serves on

the boards of directors of NIKE, Inc. and

General Mills, Inc. She holds a Bachelor

of Science degree in finance from the

University of Maryland.

JOHN W. KETCHUM

Age 53 Director since 2022

Board Committees

» Executive (Chair)

» Nuclear

Public Company Boards

» NextEra Energy Partners, LP

(since 2017)

Career Highlights

Mr. Ketchum has been president and chief

executive officer and a director of NextEra

Energy since March 2022 and chairman since

July 2022. He has also served as chairman of

NextEra Energy’s subsidiary, Florida Power &

Light Company (which has no publicly traded

stock), since February 2023. Prior to his

succession to the role of chief executive officer,

he served as president and chief executive

officer of NextEra Energy Resources, LLC

(“NextEra Energy Resources”), the Company’s

competitive energy supplier subsidiary and the

world’s largest generator of renewable energy

from the wind and sun and a world leader in

battery storage. Mr. Ketchum joined NextEra

Energy in 2002 and has a diverse business,

finance and legal background with a broad range

of experiences across key executive roles and

NextEra Energy, NextEra Energy Resources and

NextEra Energy Partners, LP (“NEP”). Mr.

Ketchum is chief executive officer and a director

of NEP, a publicly-traded growth-oriented limited

partnership formed by NextEra Energy to

acquire, manage and own contracted clean

energy projects (in which the Company owns an

underlying 52.6% interest).

Qualifications

Mr. Ketchum has a diverse business,

finance and legal background with a

broad range of experiences gained

through his key executive roles at NextEra

Energy, NextEra Energy Resources and

NEP. During his 21 years with NextEra

Energy, Mr. Ketchum has led the

execution of various strategic initiatives

across the enterprise and has been

instrumental in the expansion of the

Company’s renewable generation fleet.

While CEO of NextEra Energy Resources,

Mr. Ketchum oversaw the largest three-

year capital investment program in

NextEra Energy Resources’ history, as

well its most successful period of new

renewables origination, leading to a near

doubling of the size of the renewables

backlog during this period. In addition, he

oversaw a nearly $5 billion, three-year

capital recycling program, the largest in

NextEra Energy Resources’ history.

Mr. Ketchum holds a Master of Laws

degree in taxation and a Juris Doctor from

the University of Missouri — Kansas City

School of Law. Mr. Ketchum holds a

Bachelor of Arts degree in economics and

finance from the University of Arizona. He

also completed the Emerging CFO —

Strategic Financial Leadership Program at

Stanford University.

16 NEXTERA ENERGY 2024 PROXY STATEMENT

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

AMY B. LANE

Age 71 Independent director since 2015

Board Committees

» Executive

» Finance & Investment

» Governance & Nominating

(Chair)

Public Company Boards

» FedEx Corp. (since 2022)

» The TJX Companies, Inc.

(since 2005)

Career Highlights

Ms. Lane retired in 2002 as managing director

and group leader of the global Retailing

Investment Banking Group of Merrill Lynch &

Co., Inc. (“Merrill Lynch”), an investment banking

firm. Prior to joining Merrill Lynch in 1997, she

was a managing director at Salomon Brothers,

Inc. (“Salomon Brothers”), an investment

banking firm, where she founded and led the

retail industry investment banking unit, having

joined Salomon Brothers in 1989.

Qualifications

Ms. Lane has 26 years of leadership

experience with financial services, capital

markets, finance and accounting, capital

structure, and acquisitions and

divestitures in the financial services

industry, as well as extensive experience

in management, leadership and strategy.

Ms. Lane served as a managing director

and group leader of the global Retailing

Investment Banking Group at Merrill

Lynch from 1997 until her retirement in

2002. In that role, she led and worked on

mergers and acquisitions and equity and

debt transactions for a wide range of

major retailers. Prior to joining Merrill

Lynch, she was a managing director at

Salomon Brothers, which she joined in

1989 and where she founded and led the

retail industry investment banking unit.

Ms. Lane has an MBA from the Wharton

School of Business.

DAVID L. PORGES

Age 66 Independent director since 2020

Board Committees

» Executive

» Finance & Investment (Chair)

» Governance & Nominating

Career Highlights

Mr. Porges was a non-employee member of the

board of directors of Equitrans Midstream

Corporation (“Equitrans”) from November 2018

through December 2019 and was the chairman

of the board of Equitrans from November 2018

to July 2019. He joined EQT Corporation

(“EQT”) in 1998 as senior vice president and

chief financial officer and served as EQT’s CEO

from April 2010 to April 2011 and as CEO and

chairman from April 2011 to February 2017.

From February 2017 to March 2018, Mr. Porges

served as EQT’s executive chairman and as

chairman and interim CEO from March 2018 to

November 2018.

Qualifications

Mr. Porges has more than 20 years of

leadership, finance, operations and

mergers and acquisitions experience

gained through his prior service as CEO

and chairman of a publicly held energy

industry company, as well as his prior

service as the chief financial officer of that

energy company. Mr. Porges also has

experience with capital markets, finance

and mergers and acquisitions gained

through his prior service with an

investment bank concentrating on the

energy industry. Mr. Porges has an MBA

from Stanford University.

DEBORAH L. “DEV”

STAHLKOPF

Age 54 Independent director since 2023

Board Committees

» Audit

» Compensation

Career Highlights

Ms. Stahlkopf joined Cisco Systems, Inc.

(“Cisco”) in August 2021 as executive vice

president and chief legal officer. Prior to joining

Cisco, she held several senior roles at Microsoft

Corporation (“Microsoft”) over the course of 14

years, including corporate vice president,

general counsel and corporate secretary,

corporate, external and legal affairs from April

2018 to July 2021, vice president and deputy

general counsel from December 2015 to April

2018 and associate general counsel from

December 2010 to December 2015. Prior to

joining Microsoft, she practiced law in the Seattle

area at Perkins Coie, specializing in employment

and labor law and at Cooley Godward, LLP,

focusing on corporate and technology

transactions.

Qualifications

Ms. Stahlkopf has extensive experience in

legal strategy, including key issues

including intellectual property, privacy and

security, internet governance, cross-

border data issues, geopolitical matters,

and public policy priorities. She also has

extensive experience in labor and

employment law. She received her law

degree from the University of Arizona, a

Master of Arts degree in Philosophy from

Duke University, and undergraduate

degrees in English and philosophy from

the University of Washington.

NEXTERA ENERGY 2024 PROXY STATEMENT 17

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

JOHN A. STALL

Age 69 Independent director since 2022

Board Committees

» Audit

» Nuclear (Chair)

Career Highlights

Mr. Stall retired from NextEra Energy in 2010,

where he served in numerous nuclear leadership

roles. He served as president of NextEra

Energy’s nuclear division from 2009 to 2010, as

senior vice president and chief nuclear officer

from 2001 to 2009, as vice president, nuclear

engineering from 2000 to 2001 and vice

president of NextEra Energy’s St. Lucie nuclear

generating station from 1996 to 2000. He also

served in leadership roles at Dominion Energy,

Inc.’s North Anna nuclear generating station from

1977 until 1996.

Qualifications

Mr. Stall has substantial nuclear expertise,

operations and engineering experience

and leadership experience. He has over

40 years of experience in nuclear

generation through his career at both

Dominion Energy, Inc. and NextEra

Energy. He previously held a senior

reactor operator license issued by the

Nuclear Regulatory Commission and is a

previously licensed professional engineer

in the Commonwealth of Virginia. He

served as the chair of an independent

nuclear safety advisory committee for a

publicly-traded electric utility that operates

multiple nuclear generating units. He

served as a member of the Institute of

Nuclear Power Operations National

Academy of Nuclear Training Accrediting

Board from 2008 to 2019. Mr. Stall

graduated from the University of Florida

and holds a Bachelor of Science degree

in nuclear engineering. He received his

MBA from Virginia Commonwealth

University.

DARRYL L. WILSON

Age 60 Independent director since 2018

Board Committees

» Audit

» Compensation

Public Company Boards

» Eaton Corporation plc (since

2021)

» Primerica, Inc. (since

February 2024)

Career Highlights

Mr. Wilson was vice president, commercial of

GE Power, a business of GE, from June 2017

until his retirement in December 2017. From

January 2016 to June 2017, he was vice

president & chief commercial officer of GE

Energy Connections and, from January 2013 to

January 2016, he was vice president & chief

commercial officer of GE Distributed Power.

From July 2008 to January 2013, he was

president & CEO of GE Aeroderivative Products.

Prior roles also include president & CEO of GE

Consumer Products, Europe Middle-east, Africa

and India, based in Budapest, Hungary and

London, England. He also served as president &

CEO of GE Consumer and Industrial, Asia-

Pacific and India based in Shanghai, China.

Additionally, Mr. Wilson spent 6 years in

progressive executive leader roles with British

Petroleum — North America in business

operations and regional fuel and lubricant

distribution management positions.

Qualifications

Mr. Wilson has extensive leadership and

international experience in business

operations, commercial management,

global manufacturing, mergers and

acquisitions and services as a result of his

senior leadership roles for a global

manufacturer and service provider of

power generation, power electronics,

distribution, motors, power management,

appliances and lighting products.

Mr. Wilson has finance and financial

markets experience as former chairman of

the board of directors, Houston Branch —

Dallas Federal Reserve Bank and serving

on the audit and investment committees

on other public and non-profit boards.

Mr. Wilson received an MBA in Marketing

from Indiana University and a Bachelor of

Arts in business administration from

Baldwin Wallace College.

Unless you specify otherwise in your voting instructions, your proxy will be voted FOR election of each of the nominees.

The Board unanimously recommends a vote FOR the election of all nominees.

18 NEXTERA ENERGY 2024 PROXY STATEMENT

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF DELOITTE & TOUCHE LLP AS

NEXTERA ENERGY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

2024

The Audit Committee appoints the Company’s independent registered public accounting firm. It has appointed Deloitte

& Touche LLP (“Deloitte & Touche”) as the independent registered public accounting firm for the fiscal year ending

December 31, 2024 to audit the accounts of the Company and its subsidiaries, as well as to provide its opinion on the

effectiveness of the Company’s internal controls over financial reporting. The members of the Audit Committee and the

Board believe that the continued retention of Deloitte & Touche as the Company’s independent registered public

accounting firm is in the best interests of the Company and its shareholders.

Although ratification is not required, the Board is submitting the selection of Deloitte & Touche to shareholders as a

matter of good corporate practice. If shareholders do not ratify the appointment, the appointment will be reconsidered

by the Audit Committee, although the Audit Committee may nonetheless decide to continue the retention of Deloitte &

Touche as NextEra Energy’s independent registered public accounting firm for 2024. Even if the appointment is ratified,

the Audit Committee in its discretion may terminate the service of Deloitte & Touche at any time during the year if it

determines that the appointment of a different independent registered public accounting firm would be in the best

interests of NextEra Energy and its shareholders. Additional information on audit-related matters may be found on

page 35 of this proxy statement.

Representatives of Deloitte & Touche are expected to be present at the annual meeting and will have an opportunity to

make a statement and respond to appropriate questions from shareholders at the meeting.

Unless you specify otherwise in your voting instructions, your proxy will be voted FOR ratification of appointment of

Deloitte & Touche as NextEra Energy’s independent registered public accounting firm for 2024.

The Board unanimously recommends a vote FOR ratification of appointment of Deloitte &

Touche LLP as NextEra Energy’s independent registered public accounting firm for 2024.

NEXTERA ENERGY 2024 PROXY STATEMENT 19

●

(1)

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

PROPOSAL 3: APPROVAL, BY NON-BINDING ADVISORY VOTE, OF NEXTERA

ENERGY’S COMPENSATION OF ITS NAMED EXECUTIVE OFFICERS AS DISCLOSED

IN THIS PROXY STATEMENT

The Company is asking shareholders to cast an advisory vote on the compensation of the Company’s named executive

officers (“NEOs”), which is commonly called a “say-on-pay” vote, pursuant to section 14A of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Although this vote is not binding, it will provide information to the

Compensation Committee regarding investor sentiment about the Company’s executive compensation philosophy,

policies and practices, which the Compensation Committee will be able to consider when making future determinations

regarding NEO compensation. The Company plans to give shareholders the opportunity to cast an advisory vote on this

matter annually. Following the vote on this proposal, the next opportunity will occur in connection with the Company’s

2025 annual meeting.

The Company asks shareholders to approve this proposal by approving the following non-binding resolution:

“RESOLVED, that the shareholders of NextEra Energy, Inc. approve, on an advisory basis, the compensation

paid to the Company’s NEOs, as disclosed in this proxy statement for the 2024 annual meeting of shareholders,

including the Compensation Discussion & Analysis section, the compensation tables and the accompanying

narrative discussion, pursuant to the compensation disclosure rules of the Securities and Exchange Commission

(Item 402 of Regulation S-K).”

The fundamental objective of NextEra Energy’s executive compensation program is to motivate and reward actions that

will increase shareholder value, particularly over the longer term. The Compensation Committee believes the

Company’s executive compensation program reflects a strong pay-for-performance philosophy and is well-aligned with

the short-term and long-term interests of shareholders and other important Company stakeholders, including customers

and employees. A significant portion of each NEO’s total compensation opportunity is performance-based and carries

both upside and downside potential.

The Executive Compensation section of this proxy statement, beginning on page 38, provides a detailed discussion of

the Company’s compensation program for its NEOs. The discussion reflects our Fall 2023 shareholder outreach

program and that NextEra Energy’s compensation program achieves its objectives of incentivizing operational

excellence and provides long-term value for shareholders. For example, the chart below compares the Company’s TSR

for the 10-year period ended December 31, 2023 to the TSRs of the S&P 500 Electric Utilities Index, the S&P 500

Utilities Index, the UTY, the S&P 500 and the S&P 500 Growth Index. NextEra Energy outperformed all of these indices

over the period shown.

NEXTERA ENERGY TOTAL SHAREHOLDER RETURN THROUGH 12/31/2023 VS. VARIOUS INDICES

NEXTERA ENERGY VS. INDICES 10-YEAR TSR

NextEra Energy 267

S&P 500 Electric Utilities Index, total return 146

S&P 500 Utilities Index, total return 135

UTY, total return 133

S&P 500, total return 211

S&P 500 Growth Index, total return 250

Source: FactSet Research Systems Inc.

Unless you specify otherwise in your voting instructions, your proxy will be voted FOR approval, by non-binding

advisory vote, of NextEra Energy’s compensation of its NEOs as disclosed in this proxy statement.

The Board unanimously recommends a vote FOR approval, by non-binding advisory vote, of

NextEra Energy’s compensation of its named executive officers, as disclosed in this proxy

statement.

20 NEXTERA ENERGY 2024 PROXY STATEMENT

(1)

%

%

%

%

%

%

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

PROPOSAL 4: SHAREHOLDER PROPOSAL

The Company has been notified that a shareholder of the Company intends to present a proposal for consideration at

the annual meeting. In accordance with Securities and Exchange Commission (“SEC”) regulations, the text of the

shareholder proposal and supporting statement appears exactly as received by the Company. The shareholder

proposal may contain assertions about the Company or other matters that the Company believes are incorrect, but the

Company has not attempted to refute all of those assertions. All statements contained in the shareholder proposal and

supporting statement are the sole responsibility of the proponent. The Company disclaims responsibility for the content

of the proposal and the supporting statement.

The names of co-filing proponents, if any, and address and stock ownership of the proponent will be furnished upon

receipt by the Corporate Secretary of an oral or written request for that information.

Proposal 4 — Board Matrix

The New York City Employees’ Retirement System has notified the Company that they intend to present the following

proposal for consideration at the annual meeting.

RESOLVED: Shareholders of NextEra Energy, Inc. (“NextEra”) request that its Board of Directors (the “Board”) disclose

in NextEra’s annual proxy statement each director/nominee’s self-identified gender and race/ethnicity, as well as the

defined skills and attributes that are most relevant considering the Company’s overall business, long-term strategy, and

risks, particularly with respect to climate change. The requested information shall be presented in matrix format and

shall not include any attributes the Board identifies as minimum qualifications for all director candidates (the “Board

Matrix”).

SUPPORTING STATEMENT

Investors believe a diverse board — in terms of relevant skills, gender, and race/ethnicity — is an indicator of a well-

functioning board. Among other benefits, diverse boards can better manage risk by avoiding groupthink. NextEra’s

Board sets the tone from the top and disclosure of a Board Matrix would signal to NextEra’s employees, customers,

suppliers, and investors that the directors themselves are practicing diversity and inclusion in NextEra’s boardroom.

We resubmitted this proposal in 2023, and it received 49% support. NextEra’s current disclosures, however, continue to

hinder investors in determining the comparative strengths of individual directors and their self-identified race/ethnicity.

Carbon-based sources account for roughly half of NextEra’s generating capacity, underscoring the need for a climate-

competent Board to oversee NextEra’s transition to a low carbon economy.

Many institutional investors prioritize board diversity in their proxy voting guidelines and engagement initiatives.

Significant resources must be spent by investors to ascertain director information from ambiguous, aggregate company

disclosures or they must rely on data providers, which also draws from the same, imprecise sources. Even when

photographs are provided, investors and data providers may be unable to appropriately determine the race or ethnicity

of directors. As a result, it can be unnecessarily challenging for investors to fulfill their fiduciary duties and vote

according to their own proxy voting guidelines.

A Board Matrix would enable investors to make better informed proxy voting decisions by providing them with

consistent, comparable and accurate data concerning NextEra’s directors in a structured, decision-useful format. Such

information would enable investors to: (1) assess how well-suited individual director nominees are for NextEra in light of

its long-term business strategy and risks, including the overall mix of director attributes and skills; (2) identify any gaps

in skills or attributes; and (3) make meaningful, year-over-year comparisons of the Board’s composition; and

(4) ascertain the self-identified gender, race/ethnicity, skills and attributes of any particular director who has assumed

leadership roles on the board/committees, as well as his/her/their tenure. We would also encourage companies to

disclose, in aggregate, the number of any self-identified LGBTQ+ director(s).

The proposal neither prevents nor discourages NextEra from disclosing any other data or information that the Board

believes relevant.

Your peers, such as Exelon Corporation, Honeywell International Inc., and Consolidated Edison have published a Board

Matrix with individualized director data. Their matrices also use EEO-1 categories for disclosing the diversity of

individual directors, which allows for consistent and comparable data.

We urge shareholders to vote FOR this proposal.

NEXTERA ENERGY 2024 PROXY STATEMENT 21

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

The Board unanimously recommends a vote AGAINST the foregoing proposal for the

following reasons:

The Board believes that adopting the shareholder proposal would not be in the best interests of the Company or its

shareholders because the Board has included a matrix, by individual Board member, of each director’s gender and

skills and attributes that are most relevant to the Company’s overall business strategy.

Since NextEra Energy has supplemented its disclosure about Board members skills and

attributes, the proposal is duplicative of the skills and gender matrix published in this proxy

statement.

The Board agrees that a diversity of skills and attributes is a key quality of a well-functioning board and is important

information for shareholders. Diverse Board skills and attributes ensure appropriate Board oversight. As such, the

Company provides detailed information regarding the Board in its proxy statement and on its website. In this proxy

statement, the Company has enhanced its disclosure of Board member skills and gender in a matrix format by current

individual director.

The Board has complied with the proposal’s most important request. Supporting this proposal will not result in any

substantial increase in information about individual directors.

The Board acts as a collective body, representing the interests of all shareholders. While individual directors leverage

their experience and knowledge, Board decisions and perspectives reflect the collective wisdom of the group. The

breadth of our disclosures, including the enhancements mentioned above, emphasize the collective strength of our

Board and meaningfully addresses the key requests of the proposal.

Unless you specify otherwise in your voting instructions, your proxy will be voted AGAINST Proposal 4.

For the above reasons, the Board unanimously recommends a vote AGAINST this proposal.

22 NEXTERA ENERGY 2024 PROXY STATEMENT

●

TABLE OF CONTENTS

BUSINESS OF THE ANNUAL MEETING

PROPOSAL 5: SHAREHOLDER PROPOSAL

The Company has been notified that a shareholder of the Company intends to present a proposal for consideration at

the annual meeting. In accordance with Securities and Exchange Commission (“SEC”) regulations, the text of the

shareholder proposal and supporting statement appears exactly as received by the Company. The shareholder

proposal may contain assertions about the Company or other matters that the Company believes are incorrect, but the

Company has not attempted to refute all of those assertions. All statements contained in the shareholder proposal and

supporting statement are the sole responsibility of the proponent. The Company disclaims responsibility for the content

of the proposal and the supporting statement.

The names of co-filing proponents, if any, and address and stock ownership of the proponent will be furnished upon

receipt by the Corporate Secretary of an oral or written request for that information.

Proposal 5 — Climate Lobbying Report

CCLA Investment Management Limited has notified the Company that they intend to present the following proposal for

consideration at the annual meeting.

WHEREAS: The United Nations Framework Convention on Climate Change states that greenhouse gas emissions

must decline by 45 percent from 2010 levels by 2030 to limit global warming to 1.5 degrees Celsius. If that goal is not

met, even more rapid reductions, at greater cost, will be required to compensate for the slow start on the path to global

net zero emissions .

Even with the recent passage of the Inflation Reduction Act, critical gaps remain between Nationally Determined

Contributions set by the US government and the actions required to prevent the worst effects of climate change.

Domestically and internationally, companies have an important and constructive role to play in enabling policymakers to

close these gaps. Corporate lobbying that is inconsistent with the Paris Agreement presents increasingly material risks

to companies and their shareholders, as delays in emissions reductions undermine political stability, damage

infrastructure, impair access to finance and insurance, and exacerbate health risks and costs. Further, companies face

increasing reputational risks from consumers, investors, and other stakeholders if they appear to delay or block effective

climate policy. Of particular concern are trade associations and other politically active organizations that say they speak

for business but too often present forceful obstacles to addressing the climate crisis.

The latest Climate Action 100+ benchmark indicates that NextEra Energy, Inc’s (“NextEra”) Real Zero by 2045 goal and