1

2

3 UNITED STATES

4 SECURITIES AND EXCHANGE COMMISSION

5 Washington, D.C. 20549

6 FORM 10-K

7

8 (Mark One)

9

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

10 Commission file number 001-40289

11 Coinbase Global, Inc.

12 (Exact name of registrant as specified in its charter)

13

Delaware 46-4707224

(State or other jurisdiction of incorporation or organization)

(I.R.S. Employer Identification No.)

Not Applicable

(1)

Not Applicable

(1)

(Address of principal executive offices) (Zip Code)

14 Not Applicable

(1)

15 Registrant's telephone number, including area code

16

17 Not Applicable

18 (Former name, former address and former fiscal year, if changed since last report)

19 Securities registered pursuant to Section 12(b) of the Act:

20

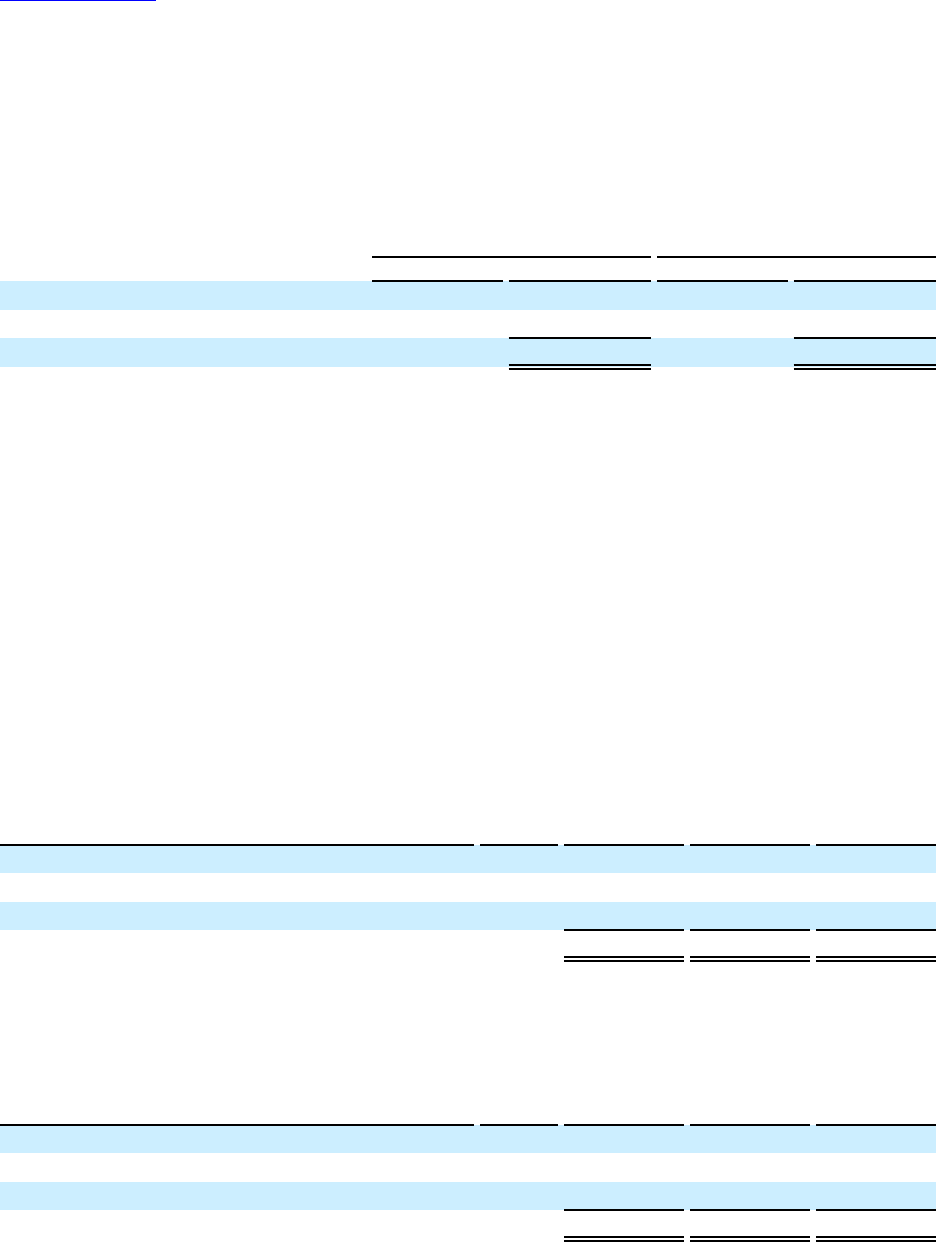

Title of each class Trading Symbol(s) Name of each exchange on which registered

Class A common stock, $0.00001 par value per share COIN The Nasdaq Stock Market LLC

21 Securities registered pursuant to Section 12(g) of the Act: None

22 Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

23 Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

24 Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

25 preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the

26 past 90 days. Yes ☒ No ☐

27 Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

28 S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

29 Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

30 growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of

31 the Exchange Act.

32

Large accelerated filer

☒

Accelerated filer

☐

Non-accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

33 If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

34 financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

35 Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over

36 financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7 262(b)) by the registered public accounting firm that prepared or issued its audit

37 report. ☒

38 If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect

39 the correction of an error to previously issued financial statements. ☐

(1)

We are a remote-first company. Accordingly, we do not maintain a headquarters. For purposes of compliance with applicable requirements of the Securities Act of 1933, as amended,

and the Securities Exchange Act of 1934, as amended, stockholder communications required to be sent to our principal executive offices may be directed to the email address:

[email protected], or to our agent for service of process at Corporation Service Company, 251 Little Falls Drive, Wilmington, Delaware 19808.

40 Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any

41 of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

42 Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

43 The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant on June 30, 2023, the last business day of the registrant’s

44 most recently completed second fiscal quarter, was $12.0 billion based on the closing sales price of the registrant’s Class A common stock as reported on Nasdaq

45 Global Select Market on that date.

46 As of February 8, 2024, the number of shares of the registrant's Class A common stock outstanding was 195,531,120 and the number of shares of the registrant's

47 Class B common stock outstanding was 46,744,055.

48

49 DOCUMENTS INCORPORATED BY REFERENCE

50 Portions of the registrant’s definitive proxy statement for its 2024 Annual Meeting of Stockholders, or Proxy Statement, to be filed within 120 days after the end of

51 the fiscal year covered by this Annual Report on Form 10-K, are incorporated by reference in Part III. Except with respect to information specifically incorporated by

52 reference in this Annual Report, the Proxy Statement shall not be deemed to be filed as part hereof.

53

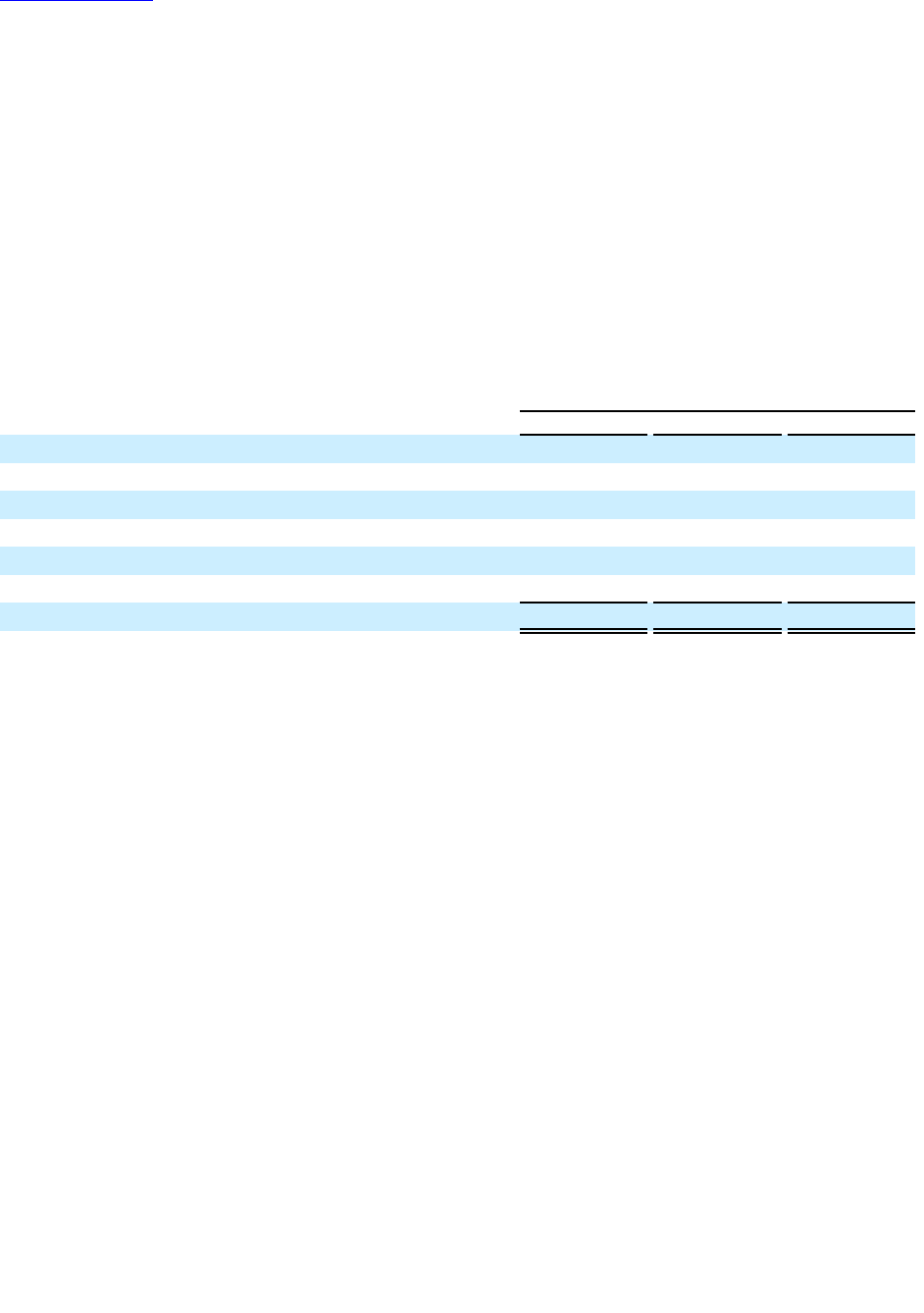

TABLE OF CONTENTS

Part I

Item 1. Business ......................................................................................................................................................

8

Item 1A. Risk Factors .............................................................................................................................................

21

Item 1B. Unresolved Staff Comments ..................................................................................................................

85

Item 1C. Cybersecurity ...........................................................................................................................................

85

Item 2. Properties ....................................................................................................................................................

87

Item 3. Legal Proceedings .....................................................................................................................................

87

Item 4. Mine Safety Disclosures ...........................................................................................................................

87

Part II ..............................................................................................................................................................................

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities ......................................................................................................................................................

88

Item 6. [Reserved] ...................................................................................................................................................

89

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations .........

90

Item 7A. Quantitative and Qualitative Disclosures About Market Risk 117

Item 8. Financial Statements and Supplementary Data ....................................................................................

120

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosures ......

185

Item 9A. Controls and Procedures .......................................................................................................................

186

Item 9B. Other Information ....................................................................................................................................

187

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections ...........................................

187

Part III .............................................................................................................................................................................

Item 10. Directors, Executive Officers and Corporate Governance ................................................................

188

Item 11. Executive Compensation ........................................................................................................................

188

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters ......................................................................................................................................................................

188

Item 13. Certain Relationships and Related Transactions, and Director Independence .............................

188

Item 14. Principal Accountant Fees and Services ..............................................................................................

188

Part IV .............................................................................................................................................................................

Item 15. Exhibit and Financial Statement Schedules ........................................................................................

188

Item 16. Form 10-K Summary ...............................................................................................................................

191

Signatures ................................................................................................................................................................

191

Page

Table of Contents

1

Glossary to the Cryptoeconomy

Throughout this Annual Report on Form 10-K, we use a number of industry terms and concepts which

are defined as follows:

• Address: An alphanumeric reference to where crypto assets can be sent or stored.

• Bitcoin: The first peer-to-peer electronic cash system of global, decentralized, scarce, digital

money as initially introduced in a white paper titled Bitcoin: A Peer-to-Peer Electronic Cash

System by Satoshi Nakamoto.

• Block: Synonymous with digital pages in a ledger. Blocks are added to an existing blockchain as

transactions occur on the network. Miners are rewarded for “mining” a new block.

• Blockchain: A cryptographically secure digital ledger that maintains a record of all transactions

that occur on the network and follows a consensus protocol for confirming new blocks to be

added to the blockchain.

• Cold storage: The storage of private keys in any fashion that is disconnected from the internet.

Common cold storage examples include offline computers, USB drives, or paper records.

• Crypto: A broad term for any cryptography-based market, system, application, or decentralized

network.

• Crypto asset or token: Any digital asset built using blockchain technology, including

cryptocurrencies, stablecoins, and security tokens.

• Cryptocurrency: Bitcoin and alternative coins, or “altcoins,” launched after the success of

Bitcoin. This category of crypto asset is designed to work as a medium of exchange, store of

value, or to power applications and excludes security tokens.

• Cryptoeconomy: A new open financial system built upon crypto.

• Dapps: Decentralized applications, or Dapps, are applications that run on a decentralized

network, typically using blockchain technology.

• DeFi: Short for Decentralized Finance. Peer-to-peer software-based network of protocols that can

be used to facilitate traditional financial services like borrowing, lending, trading derivatives,

insurance, and more through smart contracts.

• Ethereum: A decentralized global computing platform that supports smart contract transactions

and peer-to-peer applications, or “Ether,” the native crypto assets on the Ethereum network.

• Fork: A fundamental change to the software underlying a blockchain which results in two different

blockchains, the original, and the new version. In some instances, the fork results in the creation

of a new token.

• Hot wallet: A wallet that is connected to the internet, enabling it to broadcast transactions.

• Layer 1 (L1) Blockchain: The foundational blockchain that provides essential services like

recording transactions and ensuring security.

• Layer 2 (L2) Blockchain: This refers to network protocols layered on top of a L1 Blockchain. L2

Blockchains utilize the infrastructure of L1 Blockchains but offer greater flexibility in scaling,

transaction processing and improving overall network throughput.

• Miner: Individuals or entities who operate a computer or group of computers that add new

transactions to blocks, and verify blocks created by other miners. Miners collect transaction fees

and are rewarded with new tokens for their services.

2

• Mining: The process by which new blocks are created, and thus new transactions are added to

the blockchain.

• Network: The collection of all nodes that use computing power to maintain the ledger and add

new blocks to the blockchain. Most networks are decentralized, reducing the risk of a single point

of failure.

• Node: A computer or group of computers that supports the operations of a blockchain network, by

validating blocks, executing smart contracts, or storing copies of the blockchain available for other

nodes in the network to establish consensus.

• Non-fungible token or NFT: A crypto asset that is unique - as opposed to “fungible” assets like

Bitcoin and dollar bills.

• Onchain: Onchain typically refers to activities or processes that occur directly on a blockchain. It

involves transactions, smart contracts, or any other operations that are recorded and executed

within the blockchain network itself, as opposed to offchain activities that might occur outside the

blockchain system.

• Protocol: A type of algorithm or software that governs how a blockchain operates.

• Public key or private key: Each public address has a corresponding public key and private key

that are cryptographically generated. A private key allows the recipient to access any funds

belonging to the address, similar to a bank account password. A public key helps validate

transactions that are broadcasted to and from the address. Addresses are shortened versions of

public keys, which are derived from private keys.

• Security token: A crypto asset that is a security under the U.S. federal securities laws. This

includes digital forms of traditional equity or fixed income securities, or may be assets deemed to

be a security based on their characterization as an investment contract or note.

• Self-custodied Wallet: A self-custodied wallet, also known as a self-hosted wallet, is a type of

cryptocurrency wallet where the user holds the private keys, instead of a third-party.

• Smart contract: Software that digitally facilitates or enforces a rules-based agreement or terms

between transacting parties.

• Stablecoin: Crypto assets designed to minimize price volatility. A stablecoin is designed to track

the price of an underlying asset such as fiat money or an exchange-traded commodity (such as

precious metals or industrial metals), while other stablecoins utilize algorithms that are designed

to maintain a relative stable price of the asset. Stablecoins can be backed by fiat money, physical

commodities or other crypto assets.

• Staking: An energy efficient equivalent of mining. Stakers use their tokens to validate

transactions and create blocks. In exchange for this service, stakers earn a reward.

• Supported crypto assets: The crypto assets we support for trading and custody on our platform,

which include crypto assets for trading and crypto assets under custody.

For additional information regarding our key business metrics, which include Monthly Transacting

Users and Trading Volume as well as our use of Adjusted EBITDA, a non-GAAP financial measure, see

the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Key Business Metrics” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations—Non-GAAP Financial Measure” in Part II, Item 7 of this Annual Report on

Form 10-K.

3

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements contained in

this Annual Report on Form 10-K other than statements of historical fact, including statements regarding

our future operating results and financial position, our business strategy and plans, market growth, and

our objectives for future operations, are forward-looking statements. In some cases, forward-looking

statements may be identified by words such as “believe,” “may,” “will,” “estimate,” “potential,” “continue,”

“anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” or the negative of these terms or

other similar expressions.

Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited

to, statements about:

• our future financial performance, including our expectations regarding our net revenue, operating

expenses, and our ability to achieve and maintain future profitability;

• our business plan and our ability to effectively manage any growth;

• anticipated trends, growth rates, and challenges in our business, the cryptoeconomy, the price

and market capitalization of crypto assets and in the markets in which we operate;

• market acceptance of our products and services;

• beliefs and objectives for future operations;

• our ability to maintain, expand, and further penetrate our existing customer base;

• our ability to develop new products and services and grow our business in response to changing

technologies, customer demand, and competitive pressures;

• our expectations concerning relationships with third parties;

• our ability to maintain, protect, and enhance our intellectual property;

• our ability to continue to expand internationally;

• the effects of increased competition in our markets and our ability to compete effectively;

• future acquisitions of or investments in complementary companies, products, services, or

technologies and our ability to successfully integrate such companies or assets;

• our ability to stay in compliance with laws and regulations that currently apply or become

applicable to our business both in the United States and internationally given the highly evolving

and uncertain regulatory landscape;

• general macroeconomic conditions, including interest rates, inflation, instability in the global

banking system, economic downturns, and other global events, including regional wars and

conflicts and government shutdowns;

• economic and industry trends, projected growth, or trend analysis;

• trends in revenue;

• trends in operating expenses, including technology and development expenses, sales and

marketing expenses, and general and administrative expenses, and expectations regarding these

expenses as a percentage of revenue;

• our key business metrics used to evaluate our business, measure our performance, identify

trends affecting our business, and make strategic decisions; and

4

• other statements regarding our future operations, financial condition, and prospects and business

strategies.

We caution you that the foregoing list may not contain all of the forward-looking statements made in

this Annual Report on Form 10-K.

You should not rely upon forward-looking statements as predictions of future events. We have based

the forward-looking statements contained in this Annual Report on Form 10-K on our current expectations

and projections about future events and trends that we believe may affect our business, financial

condition, results of operations, and prospects. The outcome of the events described in these forward-

looking statements is subject to risks, uncertainties, and other factors, including those described in the

section titled “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K and elsewhere in this

Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing

environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict

all risks and uncertainties that could have an impact on any forward-looking statements contained in this

Annual Report on Form 10-K. We cannot assure you that the results, events, and circumstances reflected

in the forward-looking statements will be achieved or occur, and actual results, events, or circumstances

could differ materially from those described in such forward-looking statements.

Neither we nor any other person assumes responsibility for the accuracy and completeness of any of

these forward-looking statements. Moreover, the forward-looking statements made in this Annual Report

on Form 10-K relate only to events as of the date on which the statements are made. We undertake no

obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect

events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or

the occurrence of unanticipated events, except as required by law. We may not actually achieve the

plans, intentions or expectations disclosed in our forward-looking statements and you should not place

undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the

potential impact of any future acquisitions, mergers, dispositions, restructurings, joint ventures,

partnerships, or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the

relevant subject. These statements are based upon information available to us as of the date of this

Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such

statements, such information may be limited or incomplete, and our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant

information. These statements are inherently uncertain and investors are cautioned not to unduly rely

upon these statements.

5

RISK FACTORS SUMMARY

Consistent with the foregoing, our business is subject to a number of risks and uncertainties, including

those risks discussed at length below. These risks include, among others, the following, which we

consider our most material risks:

• Our operating results have and will significantly fluctuate, including due to the highly volatile

nature of crypto;

• Our total revenue is substantially dependent on the prices of crypto assets and volume of

transactions conducted on our platform. If such price or volume declines, our business, operating

results, and financial condition would be adversely affected and the price of our Class A common

stock could decline;

• Our net revenue may be concentrated in a limited number of areas. Within transaction revenue

and subscription and services revenue, a meaningful concentration is from transactions in Bitcoin

and Ethereum and stablecoin revenue in connection with USDC, respectively. If revenue from

these areas declines and is not replaced by new demand for crypto assets or other products and

services, our business, operating results, and financial condition could be adversely affected;

• We have in the past, and may in the future, enter into partnerships, collaborations, joint ventures,

or strategic alliances with third parties. If we are unsuccessful in establishing or maintaining

strategic relationships with these third parties or if these third parties fail to deliver certain

operational services, our business, operating results, and financial condition could be adversely

affected;

• Interest rate fluctuations could negatively impact us;

• The future development and growth of crypto is subject to a variety of factors that are difficult to

predict and evaluate. If crypto does not grow as we expect, our business, operating results, and

financial condition could be adversely affected;

• Cyberattacks and security breaches of our platform, or those impacting our customers or third

parties, could adversely impact our brand and reputation and our business, operating results, and

financial condition;

• We are subject to an extensive, highly-evolving and uncertain regulatory landscape and any

adverse changes to, or our failure to comply with, any laws and regulations could adversely affect

our brand, reputation, business, operating results, and financial condition;

• We operate in a highly competitive industry and we compete against unregulated or less

regulated companies and companies with greater financial and other resources, and our

business, operating results, and financial condition may be adversely affected if we are unable to

respond to our competitors effectively;

• We compete against a growing number of decentralized and noncustodial platforms and our

business may be adversely affected if we fail to compete effectively against them;

• As we continue to expand and localize our international activities, our obligations to comply with

the laws, rules, regulations, and policies of a variety of jurisdictions will increase and we may be

subject to inquiries, investigations, and enforcement actions by U.S. and non-U.S. regulators and

governmental authorities, including those related to sanctions, export control, and anti-money

laundering;

6

• We are, and may continue to be, subject to material litigation, including individual and class action

lawsuits, as well as investigations and enforcement actions by regulators and governmental

authorities. These matters are often expensive and time consuming, and, if resolved adversely,

could harm our business, financial condition, and operating results;

• If we cannot keep pace with rapid industry changes to provide new and innovative products and

services, the use of our products and services, and consequently our net revenue, could decline,

which could adversely impact our business, operating results, and financial condition;

• A particular crypto asset, product or service’s status as a “security” in any relevant jurisdiction is

subject to a high degree of uncertainty and if we are unable to properly characterize a crypto

asset or product offering, we may be subject to regulatory scrutiny, inquiries, investigations, fines,

and other penalties, which may adversely affect our business, operating results, and financial

condition;

• We currently rely on third-party service providers for certain aspects of our operations, and any

interruptions in services provided by these third parties may impair our ability to support our

customers;

• Loss of a critical banking or insurance relationship could adversely impact our business,

operating results, and financial condition;

• Any significant disruption in our products and services, in our information technology systems, or

in any of the blockchain networks we support, could result in a loss of customers or funds and

adversely impact our brand and reputation and our business, operating results, and financial

condition;

• Our failure to safeguard and manage our and our customers’ fiat currencies and crypto assets

could adversely impact our business, operating results, and financial condition; and

• The theft, loss, or destruction of private keys required to access any crypto assets held in custody

for our own account or for our customers may be irreversible. If we are unable to access our

private keys or if we experience a hack or other data loss relating to our ability to access any

crypto assets, it could cause regulatory scrutiny, reputational harm, and other losses.

7

PART I

Item 1. Business

Coinbase Overview

Our mission is to increase economic freedom in the world.

We are working to update the century-old financial system by providing a trusted platform that makes

it easy for our customers to engage with crypto assets, including trading, staking, safekeeping, spending,

and fast, free global transfers. We also provide critical infrastructure for onchain activities. Onchain

activities are interactions with the blockchain that usually take place in a broad category of blockchain-

powered technologies, including self-custody wallets, decentralized apps and services, and open

community engagement platforms.

Our Business

We offer a suite of products and services that are designed to meet the distinct needs of our three

customer groups:

• Consumers - individual retail user customers seeking to discover or trade crypto assets and

engage in onchain activities.

• Institutions - businesses that include market makers, asset managers, hedge funds, banks,

wealth platforms, registered investment advisors, payment platforms, and public and private

corporations.

• Developers - developers, creators, merchants, crypto asset issuers, organizations and financial

institutions, and other groups building decentralized protocols, applications, products, or other

services onchain.

When signing up for an account on our platform, among other requirements, consumer and

institutional customers must certify that they are at least eighteen (18) years of age (if a natural person),

agree to a user agreement, satisfy the requirements of our robust know-your-customer (“KYC”) program,

and have read our privacy policy.

Our platform serves as a trusted and compliant gateway to the onchain economy and enables our

users to engage in a wide variety of activities, including discovering, trading, staking, storing, spending,

earning, and using their crypto assets in both our own proprietary and third-party product experiences

enabled by access to decentralized applications. Our product offerings primarily include trading products

that generate transaction revenue as well as a variety of ecosystem products, many of which generate

subscription and services revenue. We describe these products below. Throughout this Annual Report on

Form 10-K, we will refer to our full suite of products and offerings as our platform or platforms.

Trading Products

Trading is the primary source of our transaction revenue, and is driven by consumer and institutional

customers.

Consumer Trading

Our platform is designed to serve a wide variety of consumers, whether they are buying their first

crypto asset or are advanced traders. We offer two trading experiences: (i) a simple trading experience for

consumers of any experience level seeking ease of use and (ii) an advanced trading experience for more

sophisticated traders. Simple trading refers to buying and selling crypto assets using the basic interface of

our platform, and includes value-added services such as fixed price quotes and recurring trades. Our

advanced trading experience offers traders access to real-time market information through interactive

8

charts, order books, a live trade history on the advanced trade view, and other trading tools.

We generate fees from consumers trading on our platform, including through volume-based

transaction fees and a spread depending on the type of trade. We also offer a subscription product for

consumers trading on our platform, which is described in more detail below.

Coinbase Prime

Through Coinbase Prime, our full-service prime brokerage platform, institutional customers can

access deep pools of liquidity across trading venues and best price execution due to our ability to route

trades through a network of connected trading venues. We offer volume-based pricing and charge a

transaction fee for executed trades.

Markets

We provide market infrastructure in the form of trading venues for customers to trade spot and

derivatives. We currently provide access to three trading venues: the Coinbase Exchange, the Coinbase

International Exchange, and the Coinbase Derivatives Exchange. These markets generate revenue by

charging a transaction fee for executed trades.

Coinbase continues to gain traction in regulated derivatives as we continue to expand our offerings.

For example, in September 2023, we secured regulatory approval from the Bermuda Monetary Authority

(the “BMA”) to enable perpetual futures for eligible non-U.S. customers through the Coinbase

International Exchange.

Ecosystem Products

We also offer a suite of products and other services that are key parts of the crypto ecosystem.

Stablecoins

As part of our effort to update the financial system, we are focused on growing the stablecoin

ecosystem. In August 2023, we entered into an updated arrangement with the issuer of USDC to (i)

support USDC, a stablecoin redeemable on a one-to-one basis for U.S. dollars; (ii) help drive long-term

success of the stablecoin ecosystem; and (iii) continue to generate revenue through means other than

transaction fees.

Staking

One of the most popular services customers often engage with is earning rewards on their crypto

assets. Certain blockchain protocols, such as Ethereum, rely on staking to validate blockchain

transactions. Network participants can designate a certain amount of their crypto assets on the network to

validate transactions and get rewarded in kind from the network. Today, staking crypto assets is a

technical challenge for most customers. Staking independently requires a participant to run their own

hardware and software and maintain close to 100% up-time.

We provide a true, onchain proof-of-stake service, which reduces the complexities of staking and

allows our customers to maintain full ownership of their crypto assets while earning staking rewards. In

return, we earn a commission on all staking rewards received. Subject to jurisdiction, we support seven

staking assets through our platform for consumers as of December 31, 2023: Cardano (ADA), Cosmos

(ATOM), Polkadot (DOT), Ethereum (ETH), MATIC (POL), Solana (SOL), and Tezos (XTZ). As of

December 31, 2023, approximately $9.4 billion worth of these assets were held on behalf of individual

consumers staked through our platform, as adjusted to USD. We also support staking of additional assets

for our institutional customers. As of December 31, 2023, over $7.4 billion worth of assets were staked by

institutional customers through Coinbase Prime, as adjusted to USD. In addition to operating our own

validator nodes to provide staking services, we utilize third-party service providers to operate validator

nodes on our customers’ behalf.

9

Because staking rewards depend on the relevant protocol and network conditions, the estimated

rewards rate for each asset made available for staking is displayed on our website and through our

platform, and is calculated by periodically consulting onchain data to determine the total amount earned

by our stakers. We only facilitate staking of a user’s crypto assets in response to a direct instruction from

that user, and they remain the property of the user while staked, and a user’s staked crypto assets remain

in our custody. According to certain protocol rules, staked crypto assets cannot be sold or transferred

while they remain staked, and we do not use or allocate users’ staked crypto assets for any other

purpose.

Custody

We offer consumer and institutional customers a variety of custodial solutions underpinning our

product offerings. For example, underpinning our Coinbase Prime product is an institutional-grade

custody platform with a highly secure cold storage solution made available both within the United States

and globally. We charge institutions a separate fee based on the total assets stored in custody on our

platform. For example, we serve as a custodian for several Bitcoin ETF issuers. In January 2024, the

Securities and Exchange Commission (the “SEC”) approved 11 spot Bitcoin ETF applications, eight of

which are partnered with Coinbase. We do not charge our consumers a separate fee to safely store their

crypto assets on our platform. We discuss our custodial practices for both institutions and consumers in

further detail below.

Coinbase One

Consumers can transact on our platform through a subscription product, Coinbase One. Consumers

pay a monthly fee in lieu of a transaction fee under a certain trading threshold and access a variety of

benefits, including priority support.

Financing

Increasingly important to institutions is the ability to have access to financing products. We offer

integrated financing products and services to select institutions that meet our credit criteria to access

liquidity for their hedging, trading, and working capital needs. Customers typically need to pre-fund their

account and maintain fiat or crypto assets on our platform in order to participate in the 24/7/365 instant

settlement crypto market. We offer trade financing whereby we lend funds to credit-eligible customers,

removing a key point of friction by allowing customers to instantly trade on credit and settle within a few

days. We also earn interest income on loans outstanding.

Coinbase Wallet

We offer a self-custody software product to consumers globally, Coinbase Wallet, which allows them

to engage and transact with the full universe of Dapps and crypto use cases without the need for a

centralized intermediary such as Coinbase. Customers can link their Coinbase account to their Coinbase

Wallet to transfer assets between the two. A benefit of Coinbase Wallet is that consumers have sole

control over their private keys and seed phrase, which are stored directly on their mobile devices or

personal storage accounts and not with a centralized exchange. If a Coinbase Wallet user loses their key

or seed phrase, then we are unable to assist in recovery.

Easier Onchain Access

We also offer certain features to facilitate onchain activities. For example, our consumer and

institutional customers can access third-party products and interact with certain Dapps using a “web3

wallet” feature that is integrated into our platform. A benefit of this feature is that the user does not need to

navigate the complexities associated with private key management on their own, and in the case of our

consumers, there is no need to download a separate wallet application. Additionally, this feature utilizes

multi-party computation technology, which means that the customer benefits from two-layered security

and Coinbase is able to assist with recovery in cases where a user loses their portion of the private key.

10

However, despite those safeguards, the user can still become permanently locked out, and the user’s

control of the feature can still be compromised, such as if the user does not secure their Coinbase

account credentials or loses their recovery passphrase.

Developer Suite

Our developer product suite includes some of our most nascent products, including Base, Coinbase

Cloud, and Coinbase Pay. Base, an Ethereum Layer 2 chain, optimizes speed and efficiency while

granting developers access to the Coinbase ecosystem. Coinbase Cloud offers crypto payment or trading

APIs, data access, and staking infrastructure, which allow developers to build crypto products faster and

to simplify how they interact with blockchains. Coinbase Pay and Coinbase Commerce allow developers

and merchants to more easily integrate crypto transactions into their products and businesses.

Trusted Crypto Platform

The failure of several prominent crypto trading venues and lending platforms, such as FTX, Celsius

Networks, Voyager, and Three Arrows Capital, in 2022 (the “2022 Events”) has impacted and may

continue to impact the broader cryptoeconomy. While the cryptoeconomy has shown signs of recovery

more recently, the full extent of the 2022 Events may not yet be known. Impacts include, but are not

limited to, the consequent and ongoing financial distress and bankruptcy of certain crypto market

participants, loss of confidence in the broader cryptoeconomy, reputational harm to crypto asset platforms

generally, increased negative publicity of the broader cryptoeconomy, heightened scrutiny by regulators

and lawmakers, and calls for increased regulation of crypto assets and crypto asset platforms. We have

had no material direct impact to our business, financial condition, customers, or counterparties from the

2022 Events; however, the 2022 Events caused a change to crypto market prices, crypto market volatility,

and customer sentiment, and each of these drivers indirectly impacted our business and our revenue

potential. We do not have any known material financial exposure to other cryptoeconomy participants that

faced insolvency and liquidity issues, experienced excessive redemptions or suspended redemptions or

withdrawals of crypto assets, allegedly mishandled customer funds, or experienced significant corporate

compliance failures in connection with the 2022 Events.

Following the 2022 Events, one of our highest priorities continues to be restoring confidence and

interest in the cryptoeconomy and increasing engagement on our platform.

We place great importance on safeguarding crypto assets, and we have policies and procedures to

help ensure the proper safeguarding of the crypto assets we hold on behalf of our customers and for our

own investment and operating purposes. When customers use our platform, their assets remain their

assets. We hold our customer assets 1:1 at all times, which means we do not lend or rehypothecate

customer assets, and do not act on customer assets or engage in fractional reserve banking with respect

to customer assets without customer consent. We safeguard crypto assets using proprietary technology

and operational processes. Crypto assets are not insured or guaranteed by any government or

government agency, however we have worked hard to safeguard our customers’ crypto assets and our

own crypto assets for investment and operational purposes with legal and operational protections.

Similarly, for customers who participate in our staking program, their staked assets remain their

assets. Staking does not affect ownership of staked assets, and customers have the same custody

relationship with us whether or not they stake. Also, when users stake their assets through Coinbase, the

rewards they earn for helping to secure the network are directly tied to the rewards returned by onchain

network protocols and marketplaces, which Coinbase passes through minus a disclosed fee. Coinbase

does not unilaterally determine what reward to pay or whether to pay a reward.

Further, we appropriately ledger, properly segregate, and maintain separate accounts for our

corporate crypto assets and customers’ crypto assets. Additionally, with respect to Coinbase entities that

provide cold storage custody services, such as Coinbase Custody Trust Company, LLC, crypto assets are

held separately in dedicated addresses and ledgered using a proprietary combination of hardware

security modules. For Coinbase entities that provide crypto trading services, such as Coinbase, Inc.,

11

crypto assets are held in an omnibus manner on the blockchain and separately recorded using a ledger

system. Additionally, as a U.S. public company, we are required to undergo annual audits and quarterly

reviews, which, among other things, require that our independent registered public accounting firm

reviews and audits our crypto reserves, internal controls, and reconciliation processes. Moreover, our

various user, custody, and client agreements clarify the applicability of Uniform Commercial Code (“UCC”)

Article 8 to custodied crypto assets. UCC Article 8 provides that financial assets held by Coinbase for its

customers are not property of Coinbase and not subject to claims of our general creditors.

Custodial Practices

We utilize both hot wallets and cold wallets in our custodial solutions. We actively manage wallet

balances and generally seek to hold no more than 2% of custodied assets in hot wallets at any given

time. Cold wallet private key materials are stored and secured at facilities within the United States and

Europe. We store the substantial majority of our own crypto asset holdings utilizing the same storage

solutions that we provide to our customers. In limited cases, we use storage solutions not offered to our

customers to store immaterial amounts of crypto held for corporate purposes outside of our core custodial

product offerings. Additionally, our Coinbase Asset Management offering utilizes both Coinbase and third

parties as custodians.

As part of our risk mitigation efforts, wallet private keys are not stored in plaintext format in any

location and the cryptographic consensus of multiple human operators is required to decrypt a private key

for both hot and cold wallets. No single individual has control of Coinbase’s wallet private keys. To the

extent a customer withdrawal requires movement of assets from a cold wallet, authority to release

proceeds from such wallet resides with a geographically distributed team of professionals, all of whom are

subject to background checks as part of the onboarding process.

We perform internal audits of the private key management process and reconciliations between

Coinbase wallets and third-party blockchain data. Coinbase, Inc. and Coinbase Custody Trust Company,

the two subsidiaries that custody the majority of crypto assets on platform, are also periodically examined

by a variety of regulators, including the New York State Department of Financial Services (“NYDFS”) and

various states in which such entities hold money transmission licenses. In the event of an insurable loss

of assets for which we file a claim, we may be expected to allow our insurance providers to inspect

custodied assets in the course of their investigation of such claim.

We do not use sub-custodians in connection with the storage of digital assets. In accordance with

applicable state money transmitter laws, we hold U.S. customers’ cash at FDIC-insured depository

institutions and in money market funds in accounts explicitly named to further demonstrate that we are

holding the funds as custodian. We believe the terms of the relevant account agreements to be

comparable to those offered to similar companies.

Other Policies and Procedures

We also have policies in place to help us govern accounting controls, including customer account

initiations and reconciliations, and to help prevent improper self-dealing and other conflicts of interest

between us and our customers on our platform. When we make investments in crypto assets, we execute

investment trades away from our platform to avoid any conflict of interest with our customers. Additionally,

Coinbase is committed to providing a fair, transparent, and equitable experience across our suite of

trading products. Crypto assets and use cases are rapidly expanding and Coinbase seeks to offer our

customers access to all assets and use cases where it is safe and legal to do so. For example, we take a

number of steps to mitigate conflicts in our digital asset listing process. We have a digital asset support

committee that is composed of senior leaders from our product, legal, compliance, finance, and

accounting departments. The digital asset support committee reviews the relevant aspects of any asset

escalated to it in connection with a listing on our platform in accordance with our digital asset support

policies and procedures that are designed to mitigate conflicts. Only the digital asset support committee

decides which of these escalated assets we can and cannot list on our platform, and it does not

12

coordinate such decisions with anyone outside of the committee. We also have policies and procedures

that require committee members to recuse themselves from asset listing decisions where a committee

member may have a conflict of interest.

Further, we carefully handle and keep customer data confidential through security and encryption as

well as policies, training, and monitoring. Moreover, we invest heavily in compliance tools. For example, in

addition to robust know-your-customer and anti-money laundering programs, we employ an industry

leading third-party trade surveillance software platform that helps us monitor and detect problematic

trading activities on our platform, as further discussed below. We have also invested in a range of

technologies that are designed to help identify and prevent harmful activity on our platform, including

fraud or account takeovers.

As we maintain, grow, and expand our product and services offerings we also must scale and

strengthen our internal controls and processes, and monitor our third-party partners’ and vendors’ ability

to similarly scale and strengthen in order for us to remain an industry leader and a trusted platform.

Additionally, we have procedures to process redemptions and withdrawals expeditiously, subject to the

terms of applicable user agreements. For additional information, see Note 10. Customer Assets and

Liabilities, of the Notes to our consolidated financial statements included in Part II, Item 8 of this Annual

Report on Form 10-K and Risk Factors—Our failure to safeguard and manage our and our customers’ fiat

currencies and crypto assets could adversely impact our business, operating results, and financial

condition and Risk Factors—Depositing and withdrawing crypto assets into and from our platform involve

risks, which could result in loss of customer assets, customer disputes and other liabilities, which could

adversely impact our business included in Part I, Item 1A of this Annual Report on Form 10-K.

Competition

The cryptoeconomy is highly innovative, rapidly evolving, and characterized by healthy competition,

experimentation, changing customer needs, frequent introductions of new products and services, and is

subject to uncertain and evolving industry and regulatory requirements. We face significant competition

from a variety of companies around the world – ranging from crypto-native companies, including

decentralized exchanges, to large traditional financial services incumbents and financial technology

providers.

Our main competition falls into the following categories:

• traditional financial technology and brokerage firms that have entered the crypto asset market in

recent years and offer overlapping features targeted at our customers;

• companies focused on the crypto asset market, some of whom adhere to local regulations and

directly compete with our platform, and others who choose to operate outside of local rules and

regulations or in jurisdictions with less stringent local rules and regulations and are potentially

able to more quickly adapt to trends, support a greater number of crypto assets, and develop new

crypto-based products and services due to a different standard of regulatory scrutiny;

• crypto-focused companies and traditional financial incumbents that offer point or siloed solutions

specifically targeted at institutional customers; and

• stablecoins, other than USDC, and fiat currencies globally.

The competitive landscape varies significantly by geography. For example, the traditional financial

services and financial technology companies we compete against are largely U.S. and European based

and operate under the same evolving regulatory landscape that we do. However, we also face

competition from companies, in particular those located outside the United States, who are subject to

significantly less stringent regulatory and compliance requirements in their local jurisdictions. Their

business models rely on being unregulated or only regulated in a small number of lower compliance

jurisdictions, while also offering their products in highly regulated jurisdictions, including the United States,

13

without necessarily complying with the relevant regulatory requirements in such jurisdictions.

Across our product portfolio, we differentiate ourselves through our cohesive ecosystem of products

and services that address the distinct needs of our customers, our full-stack technology platform purpose-

built for the cryptoeconomy, significant investments in regulatory compliance and licensure, advanced

cryptography and security expertise, and our emphasis on accessibility, trust, and ease of use. We invest

in user research, design, and experience to continuously improve the ability of our products to address

our users’ needs.

Additionally, we have continued to invest in the trust foundations of our business. We have built and

expanded the use of advanced cryptographic techniques such as multi-party computation, an innovative

approach to securing user funds, within the business. In parallel, we remain highly engaged with global

regulatory bodies and governmental agencies.

Our ability to quickly and continuously innovate to support additional blockchains, provide products

and services to our customers that are native to the cryptoeconomy, such as staking and governance,

and launch additional products and services further separates us from our competition. See the section

titled “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K for a more comprehensive

description of risks related to competition.

Human Capital

Powering the cryptoeconomy is no small task, and requires hiring, developing, and retaining the

most talented individuals who are deeply passionate about our mission to increase economic freedom

and who are excited to build new products and services.

We work incredibly hard in pursuit of ambitious goals. We signal who will thrive at Coinbase by being

transparent about our culture on our website. Our culture has and will continue to evolve but, at our core,

we prioritize the following principles:

• Clear communication

• Efficient execution

• Act like an owner

• Top talent

• Championship team

• Continuous learning

• Customer focus

• Repeatable innovation

• Positive energy

• Mission first

We are a remote-first company. We believe that allowing our employees to work in the location that

best suits them provides us access to a large talent pool and a sustained advantage in hiring and

retaining employees in the United States and worldwide.

We offer competitive, transparent compensation and unique learning. We conduct an annual market

review to ensure our compensation continues to be consistent with our competitive compensation

philosophy. We have single, transparent pay targets for the vast majority of our roles – eliminating most

compensation negotiations – and provide one-year equity grants for the vast majority of employees. We

14

have also made meaningful investments in learning and development, including offering an annual

learning stipend and in-house crypto learning curriculum.

We continuously improve our people programs and practices. We regularly monitor engagement

through quarterly pulse surveys to continuously optimize our culture, employee engagement, risk

management, and productivity. We invest in these surveys and associated action planning at the

executive level, as we believe our people and culture are key drivers of business success.

As of December 31, 2023, we had 3,416 employees.

Government Regulation

We operate globally in a complex and rapidly evolving regulatory environment and are subject to a

wide range of laws and regulations enacted by U.S. federal, state, and local and foreign governments and

regulatory authorities. The breadth of laws, rules, and regulations we are subject to include financial

services and banking, consumer protection, money transmission, stored value and prepaid access,

electronic payments, payment services, securities, commodities, derivatives, and unclaimed property, as

well as bespoke digital asset and cryptocurrency laws that have been promulgated in some jurisdictions.

These laws, rules, and regulations evolve frequently and may be modified, interpreted, and applied in an

inconsistent manner from one jurisdiction to another, and may conflict with one another. Moreover, the

complexity and evolving nature of our business and the significant uncertainty surrounding the regulation

of the cryptoeconomy, require us to exercise our judgment as to whether certain laws, rules, and

regulations apply to us, and it is possible that regulators may disagree with our conclusions. We are not

supervised by any federal banking agency, such as the Office of the Comptroller of the Currency, the

Federal Deposit Insurance Corporation, or the Federal Reserve Board. In addition, our trading platform is

not an SEC-regulated national securities exchange or alternative trading system.

Globally, we are subject to strict legal and regulatory requirements relating to the detection and

prevention of countering terrorist financing, anti-money laundering, fraud, tax evasion, and other illicit

activity, the regulation of competition, economic and trade sanctions, privacy, cybersecurity, information

security, and data protection. These descriptions are not exhaustive, and these laws, regulations, and

rules (and the interpretations thereof) frequently change and are increasing in number.

The laws and regulations to which we are subject, including those pertaining to digital assets and

crypto assets, are rapidly evolving and increasing in scope. Therefore, we monitor these areas closely

and invest significant resources in our legal, compliance, product, and engineering teams to ensure our

business practices evolve to help us comply with the current laws, regulations, and legal standards to

which we are subject, as well as to plan and prepare for changes in interpretations thereof, as well as

additional laws, regulations, and legal standards that are introduced in the future.

Anti-money laundering and counter-terrorist financing

We are subject to various anti-money laundering and counter-terrorist financing laws, including the

Bank Secrecy Act (the “BSA”) in the United States, and similar laws and regulations abroad. In the United

States, as a money services business registered with the Financial Crimes Enforcement Network

(“FinCEN”), the BSA requires us to among other things, develop, implement, and maintain a risk-based

anti-money laundering program, provide an anti-money laundering-related training program, report

suspicious activities and transactions to FinCEN, comply with certain reporting and recordkeeping

requirements, and collect and maintain information about our customers. In addition, the BSA requires us

to comply with certain customer due diligence requirements as part of our anti-money laundering

obligations, including developing risk-based policies, procedures, and internal controls reasonably

designed to verify a customer’s identity. Many states and other countries impose similar and, in some

cases, more stringent requirements related to anti-money laundering and counter-terrorist financing. Our

compliance program is designed to prevent and detect instances of money laundering, terrorist financing,

and other illicit activity on our platform. It is also designed to prohibit the use of Coinbase in sanctioned

jurisdictions, or by sanctioned persons or entities, as determined by the Office of Foreign Assets Control

15

(“OFAC”), and equivalent foreign authorities. It includes policies, procedures, reporting protocols, and

internal controls, and is designed to address legal and regulatory requirements as well as to assist us in

managing risks associated with money laundering and terrorist financing. As part of our compliance

program, we limit the use of our products and services to jurisdictions where we are legally able to offer

our products and services, and customers can only use our products and services in the specific

jurisdictions we have approved. We enforce such geographic restrictions though various onboarding and

login controls to limit a customer from accessing products or services outside of their jurisdiction-based

permissions. Additionally, we have a robust KYC program, which is a central part of our anti-money

laundering program. Our KYC program is governed by our Global KYC Policy that covers customer

onboarding, and includes customer due diligence; calculation and assessment of customer risk rating;

application of enhanced due diligence on high risk customers; and screening customers against global

sanctions lists. Following the customer onboarding process, we perform ongoing monitoring of customers

and transaction activity to ensure that potentially suspicious activity is appropriately detected, and when

appropriate, reported. Anti-money laundering regulations are constantly evolving and vary from

jurisdiction-to-jurisdiction. We continuously monitor our compliance with anti-money laundering and

counter-terrorist financing regulations and industry standards and implement policies, procedures, and

controls in light of the most current legal requirements.

For a description of the risks we may face from (i) unauthorized or impermissible customer access to

our products and services outside of jurisdictions where we have determined to make such products and

services available or (ii) an assertion of jurisdiction over our operations or the crypto assets we offer by

U.S. and foreign regulators and other government entities, see the following risk factors in the section

titled “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K: (i) “We are subject to an

extensive, highly-evolving and uncertain regulatory landscape and any adverse changes to, or our failure

to comply with, any laws and regulations could adversely affect our brand, reputation, business, operating

results, and financial condition”; (ii) “As we continue to expand and localize our international activities, our

obligations to comply with the laws, rules, regulations, and policies of a variety of jurisdictions will

increase and we may be subject to inquiries, investigations, and enforcement actions by U.S. and non-

U.S. regulators and governmental authorities, including those related to sanctions, export control, and

anti-money laundering”; and (iii) “A particular crypto asset, product or service’s status as a “security” in

any relevant jurisdiction is subject to a high degree of uncertainty and if we are unable to properly

characterize a crypto asset or product offering, we may be subject to regulatory scrutiny, inquiries,

investigations, fines, and other penalties, which may adversely affect our business, operating results, and

financial condition.”

Money transmission, stored value, and virtual currency business activity

In the United States, we have obtained licenses to operate as a money transmitter or the equivalent in

the states where such licenses or equivalent are required to conduct our business, as well as in the

District of Columbia and Puerto Rico. In addition, we have obtained a BitLicense from NYDFS. As a

licensed money transmitter and an entity subject to the BitLicense regulatory regime, we are subject to,

among other things, the BSA, restrictions and requirements with respect to the investment of customer

funds and use and safeguarding of customer funds and crypto assets, and bonding, minimum capital and

net worth requirements, prudential compliance obligations associated with customer notice and

disclosure, reporting and recordkeeping requirements applicable to the company, as well as requirements

relating to the screening of control persons and inspection and examination by state regulatory agencies.

These state licensing laws also cover matters such as regulatory approval of controlling stockholders,

directors, and senior management of the licensed entity.

Outside the United States, we have obtained licenses to provide crypto-asset custody and trading

from the German Federal Financial Supervisory Authority (BaFin). In Singapore, we hold a major payment

institution license issued by the Monetary Authority of Singapore. In Australia, we are registered as a

digital currency exchange provider with the Australian Transaction Reports and Analysis Centre. We are

also registered as a Money Services Business with the Financial Transactions and Reports Analysis

Centre of Canada. In Bermuda, we have obtained a ‘Class ‘F’ (Full) Digital Asset Business License from

16

the BMA enabling us to service consumer trading in numerous approved jurisdictions. In addition, we

have obtained Virtual Asset Service Provider (VASP) registrations in Ireland, Spain, France, Italy and the

Netherlands, through which we offer crypto custody and trading services in these countries. Under these

licenses and registrations, we are subject to a broad range of rules and regulations including in respect of

anti-money laundering, safeguarding of customer assets and funds, regulatory capital requirements, fit

and proper management, operational controls, corporate governance, customer disclosures, reporting,

and record keeping.

New York State trust company

Our subsidiary, Coinbase Custody Trust Company, LLC, operates as a New York State-chartered

limited purpose trust company, which is subject to regulation, examination, and supervision by the

NYDFS. NYDFS regulations impose various compliance requirements including, without limitation,

operational limitations related to the nature of crypto assets we can hold under custody, capital

requirements, BSA and anti-money laundering program requirements, affiliate transaction limitations, and

notice and reporting requirements.

Electronic money and payment institution

We serve our customers through Electronic Money Institutions authorized by the U.K. Financial

Conduct Authority and the Central Bank of Ireland. We comply with rules and regulations applicable to the

European e-money industry, including those related to funds safeguarding, corporate governance, anti-

money laundering, disclosure, reporting, and inspection. We are, or may be, subject to banking-related

regulations in other countries now or in the future related to our role in the financial industry.

Economic and trade sanctions

We are required to comply with economic and trade sanctions administered by the United States, the

European Union (“E.U.”), relevant E.U. member states, and other jurisdictions in which we operate.

Economic and trade sanctions programs administered by OFAC and by certain foreign jurisdictions

prohibit or restrict transactions to or from (or dealings with or involving) certain countries, regions,

governments, and in certain circumstances, specified individuals and entities such as narcotics traffickers,

terrorists, and terrorist organizations, as well as certain digital currency addresses.

Securities

In recent years, the SEC and U.S. state securities regulators have stated that certain digital assets or

digital asset products may be classified as securities under U.S. federal and state securities laws, and in

the case of the SEC, has made public statements on this topic – however, these statements are not

binding or definitive guidance, and there is currently no certainty under the SEC’s application of the

applicable legal test as to whether particular crypto assets, products, or services would be deemed

securities. Though the SEC’s Strategic Hub for Innovation and Financial Technology published a

framework for analyzing whether any given crypto asset is a security in April 2019, this framework is also

not a rule, regulation, or statement of the SEC and is not binding on the SEC. A number of enforcement

actions and regulatory proceedings have since been initiated against digital assets and digital asset

products and their developers and proponents, as well as against trading platforms that support digital

assets. Several foreign governments have also issued similar warnings cautioning that digital assets may

be deemed to be securities under the laws of their jurisdictions.

We have established policies and practices to evaluate each crypto asset we consider for listing or for

custody and are a founding member of the Crypto Rating Council, a member-owned and operated

organization whose purpose is to assess whether any given crypto assets, or whether the development,

issuance, and use of such assets, have characteristics that make them more or less likely to implicate

U.S. federal securities laws. We also evaluate all other products and services prior to launch under U.S.

federal and applicable international securities laws.

17

Commodities and derivatives

The Commodity Futures Trading Commission (“CFTC”) has stated, and CFTC enforcement actions

have confirmed, that at least some crypto assets, including Bitcoin, fall within the definition of a

“commodity” under the U.S. Commodities Exchange Act of 1936 (the “CEA”). Under the CEA, the CFTC

has broad enforcement authority to police market manipulation and fraud in spot commodity markets,

including the spot crypto markets. We are subject to such authority with respect to improper trading on

our platform. In addition, CFTC regulations and CFTC oversight and enforcement authority apply with

respect to futures, swaps, other derivative products, and certain retail leveraged commodity transactions

involving crypto assets, including the markets on which these products trade. Separately, security-based

swaps are subject to SEC regulation and oversight. In general, we seek to ensure that crypto asset

transactions on our crypto asset trading platform do not constitute futures, swaps, security-based swaps,

other derivative products, or retail leveraged commodity transactions. Given our novel business model

and uncertainty regarding the application of some of these laws and regulations, we may become subject

to regulatory scrutiny or legal challenge with respect to our compliance with these requirements. In August

2023, our subsidiary, Coinbase Financial Markets, Inc. secured regulatory approval from the National

Futures Association to operate as a futures commission merchant (“FCM”), in September 2023, Coinbase

International Exchange secured regulatory approval from the BMA to enable perpetual futures for eligible

non-U.S. customers, and in February 2022, we acquired LMX Labs, LLC, a designated contract market

(“DCM”) regulated by the CFTC which now operates as the Coinbase Derivatives Exchange, in

connection with our acquisition of FairXchange, Inc. FCMs and DCMs are subject to the rules of the

National Futures Association as well as numerous regulatory requirements, including strict capital

requirements.

Prohibitions on bribery and anti-corruption

We are subject to regulations imposed by the FCPA in the United States and similar laws in other

countries, such as the Bribery Act 2010 in the United Kingdom (the “Bribery Act”), which generally prohibit

companies and those acting on their behalf from making improper payments to foreign government

officials for the purpose of obtaining or retaining business. Some of these laws, such as the Bribery Act,

also prohibit improper payments between private entities and persons.

Privacy and protection of user data

We are subject to a number of laws, rules, directives, and regulations relating to the collection, use,

retention, security, processing, and transfer of personally identifiable information about our customers and

employees in the countries where we operate. Our business relies on the processing of personal data in

many jurisdictions and the movement of data across national borders. As a result, much of the personal

data that we process, which may include certain financial information associated with individuals, is

regulated by multiple privacy and data protection laws and, in some cases, the privacy and data

protection laws of multiple jurisdictions. In many cases, these laws apply not only to third-party

transactions, but also to transfers of information between or among us, our subsidiaries, and other parties

with which we have commercial relationships.

Consumer protection

The Federal Trade Commission (“FTC”), the Consumer Financial Protection Bureau (“CFPB”), and

other U.S. federal, state, and local and foreign regulatory agencies regulate financial products, including

money transfer services related to remittance or peer-to-peer transfers. These agencies, as well as

certain other governmental bodies, including state attorneys general, have broad consumer protection

mandates and discretion in enforcing consumer protection laws, including matters related to unfair or

deceptive, and, in the case of the CFPB, abusive acts or practices (“UDAAPs”), and they promulgate,

interpret, and enforce rules and regulations that affect our business. For example, all persons offering or

providing financial services or products to consumers in the United States, directly or indirectly, can be

subject to enforcement actions related to the prohibition of UDAAPs. The CFPB has enforcement

18

authority to prevent an entity that offers or provides consumer financial services or products or a service

provider in the United States from committing or engaging in UDAAPs or violating other federal consumer

financial laws, including the ability to engage in joint investigations with other agencies, issue subpoenas

and civil investigative demands, conduct hearings and adjudication proceedings, commence a civil action,

grant relief (e.g., limit activities or functions; rescission of contracts), and refer matters for criminal

proceedings. Recent market disruptions have led to numerous proposals among consumer protection

focused agencies including by the FTC and CFPB for changes in the regulation of the crypto industry, and

in November 2023, the CFPB proposed a rule to define a market for general-use digital consumer

payment applications, which would give the CFPB supervisory authority to examine the larger participants

of that market. New laws or regulations, or changes in enforcement of existing laws or regulations could

require us to change certain business practices related to consumer disclosures, marketing and

operational features related to payments and remittance regulations and other laws that may impact our

business.

Escheatment and unclaimed property regulations

We are subject to unclaimed property laws in the United States and in certain other jurisdictions

where we operate. These laws require us to turn over to certain government authorities the property of

others held by us that has been unclaimed for a specified period of time, including airdropped tokens and

forked crypto assets. These laws may also require us to liquidate that property prior to turning it over. We

hold property subject to unclaimed property laws; however, there is significant regulatory uncertainty with

how states and certain foreign jurisdictions treat crypto assets under unclaimed property rules.

Lending law