INSTRUCTIONS

Page 1

GARNISHMENT PROCEDURES

FOR LITIGANTS NOT REPRESENTED BY AN ATTORNEY

EARNINGS GARNISHMENT

EARNINGS GARNISHMENT: You must fill out your forms before filing with the Clerk of the District

Court. Information you will need includes case title, case number, names and addresses of all parties

(including the employer), and amount of judgment or balance due. You will need to fill out the Request

for Garnishment (Form #1) and the Order of Garnishment (Form #2) and bring or mail them to the clerk’s

office. It may be helpful to refer to the list of terms at the end of this document.

File with the Clerk of the District Court:

Form #1 Request for Garnishment (1 copy)

Form #2 Order of Garnishment (2 copies)

Form #3 Answer of Garnishee (1 copy)

Form #4 Instructions to Garnishee (1 copy)

Form #5 Written Explanation of Garnishee’s

Computation of Earnings Withheld (1 copy)

Form #6 Affidavit of Written Explanation of

Garnishee’s Computation of Earnings

Withheld (1 copy)

When you file your Request for Garnishment, you will be required to pay a Judicial Branch Surcharge of

$12.50 to the Clerk of the District Court. The Clerk of the District Court will issue the garnishment

papers to whomever you indicated on your Request for Garnishment (usually the Sheriff). The Sheriff

requires a $10.00 fee to serve the papers. The person delivering the papers to the garnishee (employer)

must file a return with the Clerk of the District Court showing when and how the garnishee received the

papers. The Clerk of the District Court will send a copy of the Order of Garnishment to you showing

service.

When you receive the Order of Garnishment showing that the garnishee was served, you must

mail by first class mail to the Judgment Debtor the following document:

Form #7 Notice to Judgment Debtor and Request for Hearing

You should receive the completed “Answer of Garnishee” from the employer within 15 days following

the end of each month. The garnishee may indicate the following:

1. Judgment Debtor is not employed by garnishee

2. Judgment Debtor’s employment has terminated

If this happens, you must file with the Clerk of the District Court:

Form #8 Release of Garnishment

Garnishee shall return to you the “Answer of Garnishee” stating the amount of money withheld. The

monthly “Answer of Garnishee” and any money will be sent to you (not to the Clerk of the District

Court).

INSTRUCTIONS

Page 2

√ If you have questions about the computation of earnings. You will need to file the original with the

Clerk of the District Court:

Form # 9 Request for Written Explanation of Garnishee’s Computation

of Earnings Withheld

This garnishment will remain in effect until the judgment is paid or until the Judgment Debtor is

no longer employed by the garnishee.

YOU MUST KEEP AN ACCOUNTING OF MONEY RECEIVED, INTEREST ACCRUED, AND

BALANCE DUE. The court may require you to reproduce your record in the event that an objection is

filed to the garnishment or Answer of Garnishee. A sample record of payment form is attached for your

convenience. (Form #10)

Once the judgment has been paid, you are required to file with the Clerk of the District Court:

Form #8 Release of Garnishment

Form #11 Satisfaction of Judgment

You must also mail copies of Form # 8 to the garnishee and judgment debtor and Form # 11 to

the judgment debtor.

FORM PACKET ATTACHED: The first set of forms is provided by the Court for your use. Please

make copies to file with the Court and keep the originals for future use. Any additional copies will cost

.25¢ per page.

Form #1 Request for Garnishment

Form #2 Order of Garnishment

Form #3 Answer of Garnishee

Form #4 Instructions to Garnishee

Form #5 Written Explanation of Garnishee’s Computation of Earnings

Withheld

Form #6 Affidavit of Written Explanation of Garnishee’s Computation

of Earnings Withheld

Form #7 Notice to Judgment Debtor and Request for Hearing

Form #8 Release of Garnishment

Form #9 Request for Written Explanation of Garnishee’s Computation

of Earnings Withheld

Form #10 Record of Payments

Form #11 Satisfaction of Judgment

Updated forms are available at http://www.kansasjudicialcouncil.org/home.shtml

INSTRUCTIONS

Page 3

TERMS:

Judgment Creditor - person to whom money is owed

Judgment Debtor - person who owes money

Litigant - person who is participating in a legal action

Clerk - Clerk of the District Court

Garnishee - employer of person who owes you money

NOTE: The District Court Clerk’s Office is PROHIBITED BY

LAW from giving ANY legal advice.

FORM #1

Page 1

In The District Court of ________ County, Kansas

_________________________________________________, )

(Judgment Creditor name) Judgment Creditor,) Case No. _____________

_________________________________________________, )

Pursuant to Chapter 61 of

Kansas Statutes Annotated

Type of Service Requested: ___________________ by _____________________

REQUEST FOR GARNISHMENT

(To Attach Earnings)

The judgment creditor requests that the court issue an Order of Garnishment (To Attach Earnings) for the

judgment debtor listed below in the amount of the judgment(s) shown below:

Case No

Judgment Debtor Name,

Address

Garnishee’s Name and

Address

Judg Amount *

$

The purpose of the Garnishment is _____________________.

* The judgment amount is the current balance due and may also include costs, fees, interest and any other

items included in the judgment.

I hold a good faith belief that the party to be served with this garnishment order has, or will have, assets

of the judgment debtor(s).

Dated: _________________, _______.

________________________________

Judgment Creditor Signature

This is a communication from a debt collector. This is an attempt to collect a debt and any information

obtained will be used for that purpose

FORM #2

Page 1

In The District Court of ________ County, Kansas

_________________________________________________, )

(Judgment Creditor name) Judgment Creditor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

v. ) Case No. _____________

)

_________________________________________________, )

(Judgment Debtor) Judgment Debtor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

_________________________________________________, )

(Judgment Debtor) )

)

v. )

_________________________________________________, )

(Garnishee name) Garnishee.)

)

_________________________________________________, )

(Garnishee’s Address) )

_________________________________________________, )

)

__________________________________________________)

Pursuant to Chapter 61 of

Kansas Statutes Annotated

ORDER OF GARNISHMENT

(To Attach Earnings)

To the above-named Garnishee:

The amount of the unsatisfied balance under this judgment, as of the date this Order is

issued, is: $________________________________.

FORM #2

Page 2

Complete the attached Answer under penalty of perjury as set forth in the instructions. The

attached Instructions to Garnishee are incorporated by reference. You are ordered as a garnishee

to follow the attached instructions as if they were set forth in this Order.

This order of garnishment has the effect of attaching the nonexempt portion of the judgment

debtor’s earnings for all pay periods which end while the order is in effect. The order takes

effect the day it is served on you. This order of garnishment is a continuing order and remains in

effect until the judgment against the judgment debtor has been paid or the garnishment is

released, whichever occurs sooner.

This order also constitutes an order of the court directing the garnishee to pay to the judgment

creditor all earnings which are to be withheld under this order. You are ordered to withhold and

pay the earnings in accordance with the attached instructions.

If you fail to comply with the terms of this order and the attached instructions, the judgment

creditor may file a motion for judgment against you for the amount of judgment against the

judgment debtor or such other amount as the court shall order, including the expenses and

attorney fees of the judgment creditor. If you fail to make payment of funds as required under

this order and the attached instructions, the judgment creditor may file a motion for judgment

against you for contempt or such amount as the court shall order, including the expenses and

attorney fees of the judgment creditor.

Dated this _____ day of _______________, _____.

____________________________Deputy

Clerk of the District Court

This is a communication from a debt collector. This is an attempt to collect a debt and any information

obtained will be used for that purpose.

RETURN ON SERVICE OF GARNISHMENT ORDER

I hereby certify that I have served this garnishment order in the following manner:

(1) Personal Service. By delivering a copy of the garnishment order along with two copies of the answer

form to each of the following persons on the dates indicated:

____________________________________ ________________________, ______

____________________________________ ________________________, ______

(Name) (Date)

(2) Agent Service. By delivering a copy of the garnishment order along with two copies of the answer

form to each of the following agents authorized by appointment or by law to receive service of

process on the dates indicated:

____________________________________ ________________________, ______

____________________________________ ________________________, ______

(Name) (Date)

FORM #2

Page 3

(3) Service by Return Receipt Delivery. By causing to be delivered on the _____ day of

_______________, ______, a copy of the garnishment order along with two copies of the answer

form by return receipt delivery to each of the following persons at the following

address:___________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

with such delivery made by the following person or entity: _________________________________.

Attached hereto is a copy of the return receipt evidencing such delivery.

(4) Return Receipt Delivery Refused. By mailing on the _____ day of _______________, _____, a copy

of the garnishment order along with two copies of the answer form to each of the following persons

at the following address:_____________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

(5) Mail Service. By mailing on the _____ day of _______________, ______, a copy of the garnishment

order, along with two copies of the answer form by first class mail to each of the following persons at

the following addresses:__________________________________________

_________________________________________________________________________________

___________________________________________________________________________

(6) Telefacsimile communication. By faxing on the _____ day of _______________, _____, at _______

o’clock __.m., a copy of the garnishment order, along with two copies of the answer form, to the

following persons:________________________________________________________________

Number of transmitting machine: _____________________

Number of receiving machine: _______________________

(7) Internet electronic mail. By e-mailing on the _____ day of _______________, _____, at ____

o’clock _.m., a copy of the garnishment order, along with a copy of the answer form, to the following

persons at the following e-mail addresses:_______________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

Transmitting person’s e-mail address: __________________________

(8) No Service. The following persons were not served:

_________________________________________________________________________________

Pursuant to K.S.A. 53-601, as amended, I declare under the penalty of perjury that the foregoing is true

and correct.

EXECUTED on __________________, ______.

_______________________________

Signature, Sheriff or Process Server

FORM #3

Page 1

In The District Court of ________ County, Kansas

_________________________________________________, )

(Judgment Creditor name) Judgment Creditor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

v. ) Case No. _____________

)

_________________________________________________, )

(Judgment Debtor) Judgment Debtor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

_________________________________________________, )

(Judgment Debtor) )

)

v. )

_________________________________________________, )

(Garnishee name) Garnishee.)

)

_________________________________________________, )

(Garnishee’s Address) )

_________________________________________________, )

)

__________________________________________________)

Pursuant to Chapter 61 of

Kansas Statutes Annotated

ANSWER OF GARNISHEE

(To Attach Earnings)

To the above-named Garnishee:

1. If the judgment debtor (employee) was never employed by you or terminated employment before

the first day of the prior month for which this answer is made, complete the following section and

sign and date the answer at the bottom and send to the judgment creditor(s) and judgment debtor as

instructed below.

FORM #3

Page 2

The Judgment debtor (employee):

___ terminated employment on _________________________

(date)

check one

___ was never employed.

2. If the above paragraph does not apply you must complete the rest of the Answer Form.

3. Read carefully the attached Instructions to Garnishee.

4. You must complete this answer within 14 days following the date the initial garnishment order is

served on you. Only one answer needs to be completed under this garnishment for each judgment

debtor and you may duplicate the completed answer in any manner you desire for distribution to

the judgment creditor(s) and judgment debtor.

5. This answer covers all pay periods which end within 14 days following the date the garnishment

order is served on you. Indicate the pay periods covered under this answer:

start date: _____________________________

end date: _____________________________

6. The normal pay period for employee is (designate one):

weekly _____ every two weeks _____ semi-monthly _____ monthly _____

7. Total gross earnings due for the pay period or periods covered by this answer are:

$_____________

8. Amounts required by law to be withheld for the pay period or periods covered are:

(1) Federal FICA (social security tax and medicare tax…………………….$_____________

(2) Federal income tax ........................................................................................ $_____________

(3) State income tax ............................................................................................ $_____________

(4) Railroad Retirement Tax ............................................................................... $_____________

TOTAL DEDUCTIONS ...................................................................................... $_____________

(Deduct only those items listed above)

9. Disposable earnings for the pay period or periods covered are: ............................ $_____________

(7 minus 8)

See the attached Instructions to Garnishee to determine amount of disposable earnings to be

withheld.

10. I am subtracting from the disposable earnings in 9 pursuant to an income withholding order for

support the amount of ............................................................................................ $_____________

11. I am subtracting from the disposable earnings in 9 pursuant to a lien which has priority over

garnishments under the law the following amount: type of lien ______________

............................................................................................................................. $_____________

12. In accordance with the instructions accompanying this answer form, I have determined that the

amount which may be paid to employee is ............................................................ $_____________

FORM #3

Page 3

13. I am holding from the amount in 12 an administrative fee in the amount of ........ $_____________

See attached Instructions to Garnishee for amount of the administrative fee that can be retained.

14. After paying to the employee the amount stated in 12 less the administrative fee in 13, and

deducting any amount shown in 10 and 11, I am holding the remainder of the employee's

disposable earnings in the amount of .................................................................... $_____________

15. If I do not receive an objection to this Answer within 14 days after I deliver it to all parties entitled

to a copy, I will promptly pay the amount held in 14 to the following judgment creditors, unless I

receive prior to such payment an order of the court to the contrary:

Case No. Name Address Amount

A.___________ _______________ _____________________ $____________

_____________________

_____________________

B.___________ _______________ _____________________ $____________

_____________________

_____________________

C.___________ _______________ _____________________ $____________

_____________________

_____________________

D.___________ _______________ _____________________ $____________

_____________________

_____________________

I will continue to withhold earnings as long as the garnishment order remains in effect. As the

earnings are withheld, I will promptly pay thereafter the earnings as they are withheld to the

judgment creditors entitled thereto, unless I receive prior to such payment an order of the court to

the contrary.

Judgment Debtor Name & Address: ___________________

___________________

___________________

___________________

If more space is needed, attach separate sheet.

Pursuant to K.S.A. 53-601, as amended, I declare under the penalty of perjury that the foregoing is true

and correct.

EXECUTED on ___________________, _________.

_______________________________

Garnishee

FORM #3

Page 4

THIS COMPLETED ANSWER OF GARNISHEE MUST BE SENT TO ALL OF THE

JUDGMENT CREDITORS LISTED ABOVE AND TO THE JUDGMENT DEBTOR. DO NOT

SEND TO CLERK OF THE DISTRICT COURT.

FORM #4

Page 1

INSTRUCTIONS TO GARNISHEE

(To Attach Earnings - Chapter 61)

Effective July 1, 2010

Attached to these instructions is the Answer form and a form entitled Written Explanation of

Garnishee’s Computation of Earnings Withheld (called hereafter “Written Explanation form”).

You must complete the attached Answer form within 14 days following the date the initial order of

garnishment is served on you. You only need to complete one Answer form for this garnishment.

You should complete the attached Written Explanation form for each payroll period which comes due

after the garnishment order is served on you. The garnishment order served upon you is a continuing

order and shall remain in effect until the judgment against the judgment debtor has been paid or the

garnishment is released, whichever occurs sooner. As long as the garnishment order remains in effect,

you must continue to withhold money from the wages of the judgment debtor in accordance with these

instructions and the garnishment order. Each time you do payroll for the judgment debtor, complete the

attached Written Explanation form for the pay period covered by the payroll, and retain a copy of the

form with your normal payroll records. You do not need to furnish a copy of the Written Explanation

form unless you are requested to do so.

More than one order of garnishment may be served on you against the same judgment debtor. If more

than one order is served on you, you need only complete one Written Explanation form for each pay

period, and retain the original with your normal payroll records.

The Answer form and Written Explanation form are provided for your convenience in furnishing the

required information. They are designed so that you may prepare these forms in conjunction with the

preparation of your payroll. If you do not choose to use the attached forms, the forms you use must

contain at least the same information contained on the attached forms and your answer must be signed

under penalty of perjury. If you are requested to furnish a written explanation of your computation, you

must sign your explanation under penalty of perjury.

Here are the instructions to complete the attached forms:

1. Earnings are defined as compensation for personal services, whether called wages, salary,

commission, bonus or otherwise.

1. Answer Form. Complete the Answer form for all pay periods which end within 14 days

following the date the initial order of garnishment is served on you.

2. Written Explanation Form. Complete the Written Explanation form for each pay period which

ends after the garnishment order is served on you. You should complete the form as you do

your normal payroll for the judgment debtor for each pay period.

2. If the order of garnishment states at the top of the order that it is issued for the purpose of enforcing

(1) an order of any court of bankruptcy under chapter XIII of the federal bankruptcy act or (2) a

debt due for any state or federal tax, you must retain in your possession until further order of the

court all of the disposable earnings for all pay periods ending during the month. If this paragraph

applies, sign and date the form at the bottom and send a copy to all judgment creditors who have a

garnishment in effect on the date you sign the form.

FORM #4

Page 2

3. If the order of garnishment states at the top of the order that it is issued for the purpose of enforcing

an order of any court for child support or spousal support, you must retain in your possession until

further order of the court 50% of the disposable earnings for all pay periods ending during the

month, or such greater percentage as may be indicated in paragraph D in the table below in

paragraph 7. If this paragraph applies, sign and date the form at the bottom and send a copy to all

judgment creditors who have a garnishment in effect at the end of the month and to the judgment

debtor.

4. If paragraphs 2 or 3 do not apply, continue to paragraph 5.

5. If you are withholding money from the judgment debtor=s earnings under an income withholding

order, complete paragraph 10 of the form.

6. If you are withholding money from the judgment debtor=s earnings under any other lien which has

priority over garnishments under the law, complete paragraph 11 of the form.

7. Compute the amount of earnings which may be withheld from the earnings of the judgment debtor

(your employee) and complete paragraphs 12, 13 and 14 of the Answer form in accordance with

the following table:

DISPOSABLE EARNINGS TABLE

Employee paid weekly

Disposable Earnings: Withhold:

Less than 217.51 $0.00

$217.51 to 290.00 all over $217.50

$290.01 and over 25% of total

disposable earnings

Employee paid every two weeks

Disposable Earnings: Withhold:

Less than 435.01 $0.00

$435.01 to 580.00 all over $435.00

$580.01 and over 25% of total

disposable earnings

Employee paid semimonthly (twice per month)

Disposable earnings: Withhold:

Less than 471.26 $0.00

$471.26 to 628.33 all over $471.25

$628.34 and over 25% of total

disposable earnings

Employee paid monthly

Disposable earnings: Withhold:

Less than 942.51 $0.00

$942.51 to 1256.67 all over $942.50

$1256.68 and over 25% of total

disposable earnings

NOTE: The numbers used in this paragraph are illustrative only and must be adjusted to

comply with K.S.A. 60-2310.

A. SUPPORT ORDERS. If the person seeking the garnishment for court ordered support desires

to garnish more than 50% of disposable earnings, that person may request in writing to the

clerk of the court to check one of the below applicable percentages:

FORM #4

Page 3

55% Employee also supports a spouse or dependent child not covered by this support

order and payments are 12 weeks overdue.

60% Employee does not support a spouse or dependent child and payments are not 12

weeks overdue.

65% Employee does not support a spouse or dependent child and payments are 12 weeks

overdue.

Any disposable earnings remaining after payment of the above amounts shall be retained until

further order of the court.

B. ADMINISTRATIVE FEE: From income due the employee, you may withhold and retain to

defray your costs an administrative fee of $10 for each pay period for which income is

withheld, not to exceed $20 for each 30-day period for which income is withheld, whichever

is less. Such administrative fee shall be in addition to the amount required to be withheld

under the order for garnishment. If the addition of this fee causes the total amount withheld to

exceed the amount you are to withhold pursuant to the instructions above, the fee shall be

deducted from the amount withheld.8. Complete paragraph 15 by listing the case number,

name and address for all judgment creditors who have a garnishment in effect against the

judgment debtor on the date you complete the attached forms. Compute the amount to be

paid to each judgment creditor. For example, if there is only one judgment creditor, pay all

to that one; if there are two judgment creditors, pay each one-half (½); if there are three

judgment creditors, pay each one-third (1/3); etc. This allocation should be followed even if

some or all of the garnishments were in effect for less than the entire pay period.

8. Answer Form and Written Explanation Form.

A. Answer Form. Sign and date the Answer form under penalty of perjury on the line provided

at the bottom of the form and deliver a copy to all judgment creditors listed in 15 and to the

judgment debtor. You may deliver a copy by regular mail, fax transmission, electronic mail,

personal delivery, or any other reliable delivery method. If you do not receive an objection to

the Answer within 14 days after you have delivered it, promptly pay the earnings withheld as

indicated on the Answer to all judgment creditors designated on the Answer in the amount

due each creditor as indicated on the Answer, unless you receive prior to such payment an

order of the court to the contrary.

B. Written Explanation Form. Complete the form for each pay period for the judgment debtor

as you do your normal payroll. Retain the original of the form with your normal payroll

records. You do not need to furnish this form to anyone unless requested to do so. If

requested to furnish a copy of this form, make a copy from the original to furnish in response

to the request. As long as the garnishment order is in effect, continue to pay the earnings

withheld as they are withheld, to the judgment creditors indicated on the form, unless you

receive prior to such payment an order of the court to the contrary.

FORM #5

Page 1

In The District Court of ________ County, Kansas

________________________________________

Judgment Creditor Name

vs Case No.

________________________________________

Judgment Debtor

________________________________________

Garnishee:

________________________________________

Garnishee Address

________________________________________

Garnishee County

________________________________________

Garnishee fax / phone number

_________________________________________

Garnishee e-mail address

WRITTEN EXPLANATION OF

GARNISHEE’S COMPUTATION OF EARNINGS WITHHELD

(Chapter 61)

1. If the judgment debtor (employee) terminated employment before the first day of the payroll period

for which this form is made, complete the following section and sign and date the form at the

bottom.

The Judgment debtor (employee) terminated employment on _________________________

(date)

2. If the above paragraph does not apply you must complete the rest of this form.

3. Read carefully the attached Instructions to Garnishee.

FORM #5

Page 2

4. You must complete this form for each payroll period for the judgment debtor that ends while the

garnishment order remains in effect. Only one form needs to be completed for each payroll period

for the judgment debtor.

5. This Written Explanation form covers the following pay period:

start date: _____________________

end date: _____________________

6. The normal pay period for employee is (designate one):

weekly _____ every two weeks _____ semi-monthly _____ monthly _____

7. Total gross earnings due for the pay period covered by this form are: $_____________

8. Amounts required by law to be withheld for the pay period or periods covered are:

(1) Federal social security tax ............................................................................. $_____________

(2) Federal income tax ........................................................................................ $_____________

(3) State income tax ............................................................................................ $_____________

(4) Railroad Retirement Tax ............................................................................... $_____________

TOTAL DEDUCTIONS ...................................................................................... $_____________

(Deduct only those items listed above)

9. Disposable earnings for the pay period or periods covered are: ............................ $_____________

(7 minus 8)

See the attached Instructions to Garnishee to determine amount of disposable earnings to be

withheld.

10. I am subtracting from the disposable earnings in 9 pursuant to an income withholding order for

support the amount of ............................................................................................ $_____________

11. I am subtracting from the disposable earnings in 9 pursuant to a lien which has priority over

garnishments under the law the following amount: type of lien ______________

............................................................................................................................. $_____________

12. In accordance with the instructions accompanying this answer form, I have determined that the

amount which may be paid to employee is ............................................................ $_____________

13. I am holding from the amount in 12 an administrative fee in the amount of ........ $_____________

See attached Instructions to Garnishee for amount of the administrative fee that can be retained.

14. After paying to the employee the amount stated in 12 less the administrative fee in 13, and

deducting any amount shown in 10 and 11, I am holding the remainder of the employee's

disposable earnings in the amount of .................................................................... $_____________

FORM #5

Page 3

15. If I do not receive an objection to this Answer within 14 days after I deliver it to all parties entitled

to a copy, I will promptly pay the amount held in 14 to the following judgment creditors, unless I

receive prior to such payment an order of the court to the contrary:

Case No. Name Address Amount

A.___________ _______________ _____________________ $____________

_____________________

_____________________

B.___________ _______________ _____________________ $____________

_____________________

_____________________

C.___________ _______________ _____________________ $____________

_____________________

_____________________

D.___________ _______________ _____________________ $____________

_____________________

_____________________

I will continue to withhold earnings as long as the garnishment order remains in effect. As the

earnings are withheld, I will promptly pay thereafter the earnings as they are withheld to the

judgment creditors entitled thereto, unless I receive prior to such payment an order of the court to

the contrary.

Judgment Debtor Name & Address: ___________________

___________________

___________________

___________________

If more space is needed, attach separate sheet.

Pursuant to K.S.A. 53-601, as amended, I declare under the penalty of perjury that the foregoing is true

and correct.

EXECUTED on ___________________, _________.

_______________________________

Garnishee

RETAIN THE ORIGINAL OF THIS FORM WITH YOUR NORMAL PAYROLL RECORDS.

YOU DO NOT NEED TO FURNISH A COPY OF THIS FORM TO ANY PARTY UNLESS

REQUESTED TO DO SO. IF REQUESTED TO FURNISH A COPY OF THIS FORM, MAKE A

COPY OF THE ORIGINAL AND SEND THE COPY, ALONG WITH THE AFFIDAVIT, IN

RESPONSE TO THE REQUEST.

FORM #6

Page 1

In The District Court of ________ County, Kansas

______________________________

Judgment Creditor

vs. Case No. ______

______________________________

Judgment Debtor

______________________________

Judgment Debtor address

______________________________

______________________________

Garnishee

______________________________

Garnishee’s address

______________________________

Garnishee’s county

______________________________

{Garnishee’s fax phone number (if known)}

_______________________________

{Garnishee’s e-mail address (if known)}

Pursuant to Chapter 61 of

Kansas Statutes Annotated

Type of Service Requested: ___________________ by _____________________

AFFIDAVIT OF WRITTEN EXPLANATION

OF GARNISHEE’S COMPUTATION OF EARNINGS WITHHELD

_______________________________, of lawful age, hereby declares the following:

1. This Affidavit is made on behalf of the above named Garnishee.

FORM #6

Page 2

2. Attached hereto are the computations of the earnings withheld under the garnishment in

effect hereunder for the following pay periods:

start date: _________________________

end date: _________________________

I declare under penalty of perjury that the foregoing is true and correct.

Dated this _____ day of ____________________, _________.

Signature: __________________________________________

Printed Name: __________________________________________

THIS FORM SHALL BE SUBMITTED TO ALL PARTIES AND THE COURT WITHIN

14 DAYS AFTER THE REQUEST FOR THIS IS SERVED UPON YOU.

FORM #7

Page 1

In The District Court of ________ County, Kansas

_________________________________________________, )

(Judgment Creditor name) Judgment Creditor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

v. ) Case No. _____________

)

_________________________________________________, )

(Judgment Debtor) Judgment Debtor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

_________________________________________________, )

(Judgment Debtor) )

)

v. )

_________________________________________________, )

(Garnishee name) Garnishee.)

)

_________________________________________________, )

(Garnishee’s Address) )

_________________________________________________, )

)

__________________________________________________)

Pursuant to Chapter 61 of

Kansas Statutes Annotated

TO BE DELIVERED BY THE JUDGMENT CREDITOR TO THE JUDGMENT DEBTOR IN

ANY REASONABLE MANNER IMMEDIATELY FOLLOWING SERVICE OF THE

GARNISHMENT ORDER ON THE GARNISHEE.

NOTICE TO JUDGMENT DEBTOR

(earnings garnishment)

FORM #7

Page 2

You are hereby notified that the court has issued an order in the above case in favor of (name and address

of judgment creditor) _________________________________________________________________,

the judgment creditor in this proceeding, directing that some of your personal earnings, now in the

possession of your employer, be used to satisfy some of your debt to the judgment creditor instead of

being paid to you. This order was issued to enforce the judgment obtained by the judgment creditor

against you in this case on ___________________, _______.

This order, called a garnishment order, requires your employer to withhold a certain amount from your

earnings each pay period until your debt to the judgment creditor is satisfied or the order is released by

the judgment creditor or set aside by the court.

The laws of Kansas and the United States provide that you have a right to be paid a certain amount of

your personal earnings regardless of the claims of your creditors. In general, this amount is 75% of your

earnings after federal and state taxes, social security, and any other deductions required by law are taken

out. If the debt is for child support or the support of any other person, the protected amount is less,

ranging from 35% to 50%. In addition, if your earnings are less than 30 times the federal minimum

hourly wage for each week in the pay period, all of your earnings should be paid to you.

On each normal payday you should receive a paycheck for the amount your employer calculates you are

entitled to receive by law. Your employer should furnish you with a written explanation of how the

amount of your paycheck was calculated with the check.

If you believe that too much of your earnings have been withheld from your paycheck, you may request a

hearing before this court.

If you were unable to work at your regular job for two weeks or more because you or a member of your

family were sick, your earnings may not be garnished for two months after recovery from such illness.

You do not need to ask for a hearing to assert this right if it applies to you. All you need to do is to file an

affidavit with the court setting out the facts about the illness and your inability to work. If the

garnishment order is not released after you file this affidavit, you may ask for a hearing.

In order to request a hearing, you should fill out the form at the bottom of this notice and obtain from the

clerk of the court or the court a date and time for the hearing, and file the form with the clerk of the court

at (address of court). Immediately after the request for hearing is filed, you shall hand deliver a copy of

the request for hearing to the judgment creditor or judgment creditor's attorney, if judgment creditor is

represented by an attorney, or mail a copy of the request for hearing to the judgment creditor or judgment

creditor's attorney, if judgment creditor is represented by an attorney, by first-class mail at the judgment

creditor's, or judgment creditor's attorney's, last known address. You should ask for this hearing as soon

as possible, but no later than 10 days after this notice is served on you.

If you ask for a hearing, the court will hold a hearing within 10 days from the date it receives your

request. At the hearing, you should present any evidence you have in support of your position. The

burden is on you to prove that some or all of your property subject to the garnishment is exempt. You

may wish to consult an attorney to represent you at this hearing.

FORM #7

Page 3

Case No. __________________

_________________________________

(Name and address of court)

REQUEST FOR HEARING

I request a hearing to dispute the judgment creditor's garnishment of my earnings because

_____________________________________________________________________________________

(reason)

___________________________________________ _______________________________________

Name of Judgment debtor Signature of Judgment debtor

___________________________________________ _______________________________________

Address Date

_____________________________________________________________________________________

City, State, Zip Code

_______________________________________

Telephone No.

THIS PART SHALL BE COMPLETED BY CLERK OF THE DISTRICT COURT:

The hearing requested shall be held on the _______(day) day of _______(month), _______(year), at

_______(time) o'clock _______(am or pm).

CERTIFICATE OF SERVICE

I delivered a copy of the above request for hearing to the judgment creditor or judgment creditor's

attorney, if the judgment creditor is represented by an attorney, by hand-delivery or first-class mail in the

following manner and at the following address, on the date shown below:

_______________________________________________________

(name of judgment creditor or judgment creditor's attorney

_______________________________________________________

_______________________________________________________

(address of judgment creditor or judgment creditor's attorney)

_______________________________________________________

(manner delivered--hand-delivery or first-class mail)

_______________________________________________________

(date delivered)

______________________________________

Signature of Judgment Debtor

FORM #8

Page 1

In The District Court of ________ County, Kansas

_________________________________________________, )

(Judgment Creditor name) Judgment Creditor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

v. ) Case No. _____________

)

_________________________________________________, )

(Judgment Debtor) Judgment Debtor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

_________________________________________________, )

(Judgment Debtor) )

)

v. )

_________________________________________________, )

(Garnishee name) Garnishee.)

)

_________________________________________________, )

(Garnishee’s Address) )

_________________________________________________, )

)

__________________________________________________)

Pursuant to Chapter 61 of

Kansas Statutes Annotated

RELEASE OF GARNISHMENT

The judgment creditor hereby releases the garnishment order issued on or about

_______________________________________________ in this action.

___________________________________

Signature

FORM #9

Page 1

In The District Court of ______ County, Kansas

_____________________________

Judgment Creditor

vs. Case No. ______

_____________________________

Judgment Debtor

_____________________________

Address

_____________________________

______________________________

Garnishee

______________________________

Address

______________________________

______________________________

{Garnishee’s fax phone number (if known)}

______________________________

{Garnishee’s e-mail address (if known)}

Pursuant to Chapter 61 of

Kansas Statutes Annotated

Type of Service Requested: ___________________ by _____________________

REQUEST FOR WRITTEN EXPLANATION

OF GARNISHEE’S COMPUTATION OF EARNINGS WITHHELD

To the above-named Garnishee:

The Judgment Creditor requests that you provide a written explanation of your computations of

the earnings withheld under the garnishment in effect hereunder for the following pay periods:

start date: _________________________

end date: _________________________

FORM #9

Page 2

You shall submit the written explanation by affidavit to all parties and the court within 14 days

after this request is served upon you. Attached is an affidavit form that you may use in

complying with this Request.

Dated this _____ day of _______________, _____.

________________________________

Judgment Creditor or Attorney Signature

SC#

{If applicable, include the following:

This is a communication from a debt collector. This is an attempt to collect a debt and any

information obtained will be used for that purpose.}

RETURN ON SERVICE OF REQUEST FOR WRITTEN EXPLANATION

I hereby certify that I have served this Request for Written Explanation of Garnishee’s

Computation of Earnings Withheld in the following manner:

(1) Personal Service. By delivering a copy of the garnishment order along with two copies of

the answer form to each of the following persons on the dates indicated:

___________________ _______________, ______

___________________ _______________, ______

(Name) (Date)

(2) Agent Service. By delivering a copy of the garnishment order along with two copies of

the answer form to each of the following agents authorized by appointment or by law to

receive service of process on the dates indicated:

___________________ _______________, ______

___________________ _______________, ______

(Name) (Date)

(3) Service by Return Receipt Delivery. By causing to be delivered on the _____ day of

_______________, ______, a copy of the garnishment order along with two copies of the

answer form by return receipt delivery to each of the following persons at the following

address:__________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

with such delivery made by the following person or entity:

_______________________________

Attached hereto is a copy of the return receipt evidencing such delivery.

FORM #9

Page 3

(4) Return Receipt Delivery Refused. By mailing on the _____ day of _______________,

_____, a copy of the garnishment order along with two copies of the answer form to each

of the following persons at the following address:

(5) Mail Service. By mailing on the _____ day of _______________, ______, a copy of the

garnishment order, along with two copies of the answer form by first class mail to each of

the following persons at the following addresses:_________________________________

_________________________________________________________________________

_________________________________________________________________________

(6) Telefacsimile communication. By faxing on the _____ day of _______________, _____,

at ____ o’clock _.m., a copy of the garnishment order, along with two copies of the answer

form, to the following persons:________________________________________________

Number of transmitting machine: _____________________

Number of receiving machine: ______________________

(7) Internet electronic mail. By e-mailing on the _____ day of _______________, _____, at

____ o’clock _.m., a copy of the garnishment order, along with a copy of the answer form,

to the following persons at the following e-mail addresses:__________________________

_________________________________________________________________________

_________________________________________________________________________

Transmitting person’s e-mail address: __________________________

(8) No Service. The following persons were not served:

_________________________________________________________________________

Pursuant to K.S.A. 53-601, as amended, I declare under the penalty of perjury that the foregoing

is true and correct.

EXECUTED on __________________, ______.

_______________________________

Signature, Sheriff or Process Server

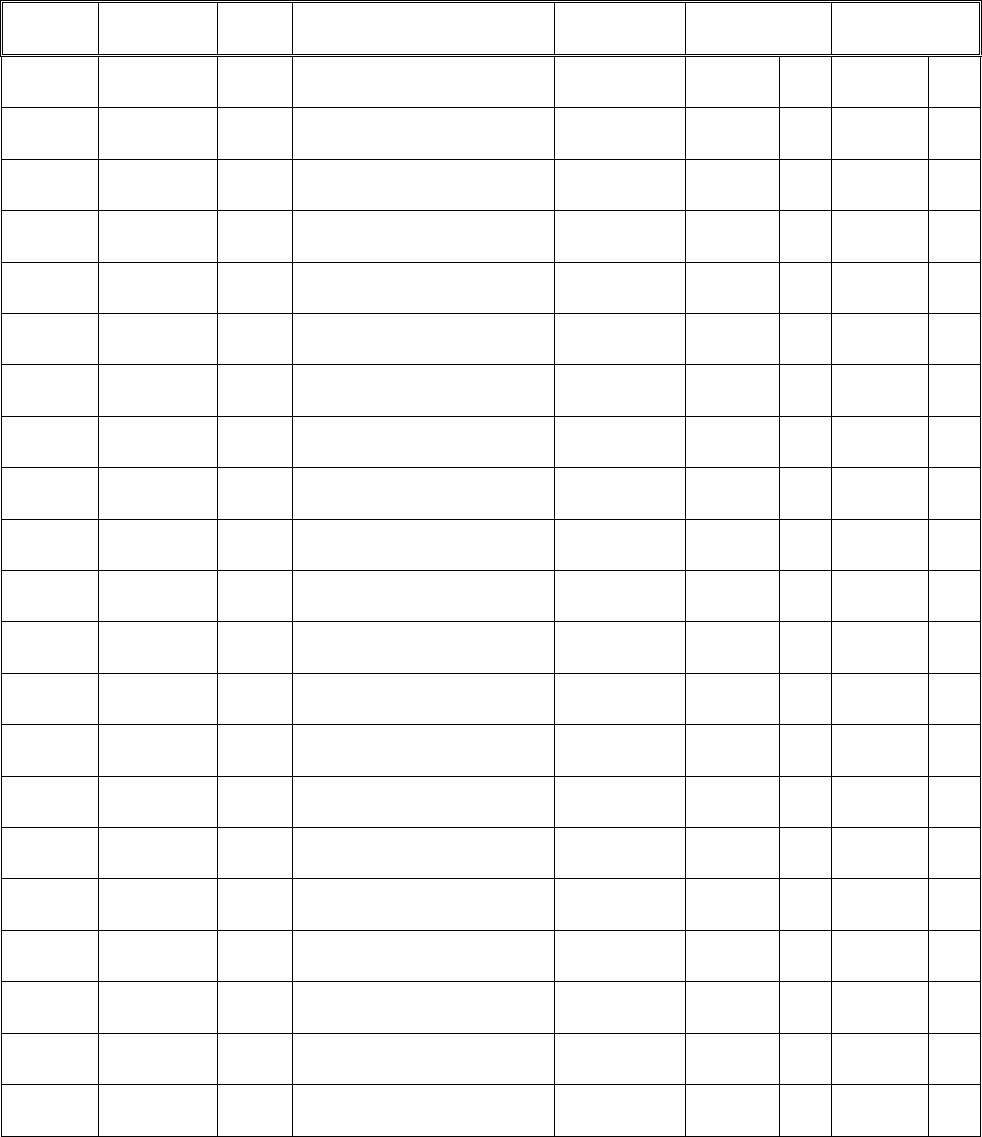

FORM #10

Page 1

DATE

CASE NO.

REC’D

BY

RECEIVED FROM

RECEIPT NO.

CHECK NO.

REC’D

BALANCE DUE

FORM #11

Page 1

In The District Court of ________ County, Kansas

_________________________________________________, )

(Judgment Creditor name) Judgment Creditor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

v. ) Case No. _____________

)

_________________________________________________, )

(Judgment Debtor) Judgment Debtor,)

)

_________________________________________________, )

(Address) )

_________________________________________________, )

)

_________________________________________________, )

(Judgment Debtor) )

__________________________________________________)

Pursuant to Chapter 61 of

Kansas Statutes Annotated

SATISFACTION OF JUDGMENT

The judgment in this matter is hereby fully satisfied as to the following Judgment Debtor(s):

____________________________________________________________________________________.

___________________________________

Signature of Judgment Creditor