Report Aligned with the 11 TCFD

recommendations

LATAM Airlines Group

With the support of South Pole

Version

Publication date

Document type

1.0

August / 2024

Procedure

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

1. Context

LATAM Airlines Group S.A. (LATAM) is a multinational airline based in Santiago, Chile. Together with

its subsidiaries, in 2022 it connected 144 destinations in 22 countries and 154 destinations including

its cargo operations.

The operations of LATAM subsidiaries in Brazil, Colombia, Ecuador, and Peru reached or exceeded

figures recorded in 2019 before the pandemic in terms of capacity, while LATAM Chile's recovery has

been a little slower. In the calendar year 2022, around 25.3 million passengers were transported

within Chile, representing an increase of 44.4% over 2021. Demand increased by 41.8% in

Spanish-speaking countries, while the average occupancy was 81% with an increase of 6.2% over

2021. On the other hand, in Brazil, a total of 28.6 million passengers were transported. In the

international market, which considers regional flights and long-haul flights to three continents,

LATAM served 46 destinations in 22 countries, and in 2022 re-opened 14 routes that were

suspended due to the COVID-19 pandemic. Average service supply increased by 142.3% compared

to 2021 and average demand increased by 204.7% to 8.6 million passengers carried by the LATAM

group, with a load factor of 83%.

In response to increasing investor interest in corporate management and disclosure of climate-related

risks and opportunities, in 2023 LATAM identified and assessed its climate-related risks and

opportunities using scenario analysis. Using the outputs of this work, in this report LATAM seeks to

align its climate risk disclosure with the recommendations from the Task Force on Climate-Related

Financial Disclosures (TCFD), including as they relate to incorporating key risks and opportunities

within enterprise risk management (ERM) processes. This report (for internal use) is used as the basis

for LATAM’s summary TCFD disclosures within the annual report.

Whilst the narrative (including risk updates) in this report reflects reporting year 2023, the data in

the report is specific to reporting year 2022. The data will subsequently be updated with 2023 data

when available.

2. Scope

Given the scope of LATAM’s operations, which include over 154 destinations, for this report, LATAM

chose to focus on 56 of its main locations/airports, which are detailed in Table 1 below. These

airports were identified following the methodology described in detail in the Risk management

section.

August/ 2024

Página 2 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Table 1. Scope of airports analysed in this report

Airports

Hercilio Luz International Airport

Ministro Pistarini International Airport

Alejandro Velasco Astete International Airport

Aeroporto de São Paulo/Congonhas

Lynden Pindling International Airport

Inca Manco Capac International Airport

Aeroporto Internacional do Rio de Janeiro - Galeão

Orlando International Airport

Coronel FAP Carlos Ciriani Santa Rosa

International Airport

São Paulo-Guarulhos International Airport

Mario Pereira Lopes Airport

Ilo Airport

Silvio Pettirossi International Airport

Mexico City International Airport

Francisco Carle Airport

Santos Dumont Airport

Adolfo Suárez Madrid-Barajas Airport

Jaen Airport

Seymour Airport

Punta Cana International Airport

Cap. FAP Pedro Canga Rodriguez Airport

José Joaquín de Olmedo International Airport

Jose Maria Cordova International Airport

FAP Captain Guillermo Concha Iberico

International Airport

Mariscal Sucre International Airport

Viru Viru International Airport

FAP Captain Jose Abelardo Quiñones Gonzales

International Airport

Mariscal Lamar International Airport

Cerro Moreno International Airport

FAP Captain Carlos Martínez de Pinillos International

Airport

Francisco de Orellana Airport

El Loa Airport

Cad. FAP Guillermo del Castillo Paredes Airport

Eloy Alfaro International Airport

Diego Aracena International Airport

Coronel FAP Francisco Secada Vignetta International

Airport

San Cristobal Airport

Carriel Sur International Airport

Mayor General FAP Armando Revoredo Iglesias

Airport

Ciudad de Catamayo Airport

El Tepual Airport

Miami International Airport

El Dorado International Airport

Presidente Carlos Ibanez del Campo International

Airport

Comodoro Arturo Merino Benitez International Airport

Jorge Chavez International Airport

Joinville-Lauro Carneiro de Loyola Airport

Mataveri International Airport (Isla de Pascua Airport)

John F. Kennedy International Airport

Brasilia International Airport (Presidente

J. Kubitschek Int'l Airport)

Carrasco Gral. Cesareo L. Berisso International Airport

Salgado Filho International Airport

Gustavo Rojas Pinilla International Airport

Capitan FAP VIctor Montes Arias International Airport

Navegantes-Ministro Victor Konder

International Airport

Rodriguez Ballon International Airport

3. Alignment with the TCFD recommendations

3.1. Governance

● Board's oversight of climate-related risks and opportunities.

LATAM is presided over by two governance bodies, the Board of Directors and the Directors’

Committee. Regarding climate-related issues, the Board of Directors has appointed a Sustainability &

Strategy Committee to analyze results and make strategic decisions related to sustainability issues.

This committee is the highest authority addressing climate-related issues and progressing goals and

commitments. It reports to the Board of Directors on a quarterly basis.

The Strategy and Sustainability Committee is responsible for developing, implementing, and

reporting progress against the sustainability strategy, which is centered on the following three

strategic pillars:

August/ 2024

Página 3 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

● Shared Value (‘Valor compartido’)

● Climate Change (‘Cambio Climático’)

● Circular Economy (‘Economía Circular’)

Each of the pillars includes specific goals and objectives as well as key performance indicators (KPIs)

that involve internal and external stakeholders for their achievement. Similarly, in developing the

goals and objectives of each pillar, the United Nations Sustainable Development Goals (SDGs) were

taken into account.

● Management’s role in assessing and managing climate-related risks and opportunities.

The sustainability strategy guides LATAM’s efforts in assessing and managing sustainability and

climate-related issues. To track progress against sustainability and climate goals, a set of KPIs has

been developed and is monitored by the Sustainability, Security, and Fuel management areas. The

executives leading the initiatives related to the three strategic pillars are presented in Table 2. In

conjunction with the management areas, the executives report annually to the Board of Directors on

the progress of the sustainability strategy and key climate-related issues.

Table 2. Executives leading the initiatives within LATAM’s strategic pillars

Strategic pillar

Internal team

Position

Climate Change

Corporate Sustainability Team Leader

Sustainability Chief

LATAM Executive Committee

LATAM Financial VP

Shared Value

Corporate Sustainability Team

Sustainability Chief

LATAM Executive Committee

Planification Senior

Manager

Circular Economy

Corporate Sustainability Team

Sustainability Chief

LATAM Executive Committee

LATAM Clients VP

Transversal through all

pillars

Corporate Sustainability Team

Sustainability Manager

Corporate Sustainability Team

Sustainability Director

At the management level, the Corporate Affairs and Sustainability Team is responsible for identifying

environmental and social risks, which are consolidated and reported to the Executive Committee and

the LATAM Risk Management Unit, who are responsible for their integration into the organization's

risk management matrix and subsequent management.

August/ 2024

Página 4 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

The results of the risk analysis guide the decision-making process on how to manage the identified

risks, led by the Sustainability and Strategy Committee of the Board of Directors, and supported by

the Audit Committee and key members within the Sustainability & Strategy, Leadership, Finance and

Clients business functions.

3.2. Strategy

● Climate-related risks and opportunities the organization has identified over the short,

medium, and long term.

LATAM's environmental performance is described in the Commitment to the Future (‘Compromiso

con el futuro’) section of the integrated report, which shows environmental performance indicators

and targets relating to the company's carbon footprint and broader resource and waste management.

These indicators and metrics are presented in Table 7. Furthermore, in 2022 LATAM began a process

to align with the TCFD recommendations in its annual reporting, continuing in 2023 and 2024 with a

climate-related risk and opportunity assessment and scenario analysis.

Based on the risk identification assessment process (described in detail in the Risk management

section), Table 3 below highlights the climate-related risks and opportunities LATAM identified

across the business in the short, medium and long term, as well as their potential impacts.

August/ 2024

Página 5 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Table 3. Summary of the climate scenario assessment for the key physical and transition risks and opportunities identified

Type of

risk

Risk

Short-term risk

rating reflecting

current/actual risk

(2025)

Change in risk under

future climate

scenarios* (2030 and

2050)

Potential impacts for LATAM Airlines Group

Physical

acute

Extreme

temperatures

Low

2030: Moderate

Extreme temperatures can result in:

Making takeoff impossible on certain runways that are too short;

Accelerating the deterioration of the tarmac over time, causing

operational disruption;

High temperatures reduce air density and, therefore, aircraft load

capacity, reducing revenues;

Extreme temperatures lead to higher office operating costs due

to increased demand for air conditioning.

Airports under a “very high” risk are projected to double by 2050

(vs 2030) from 25% to 55%. Top 3 airports with the largest

increases in annual maximum temperatures by 2050 are Adolfo

Suárez Madrid-Barajas, Mario Pereira Lopes and Viru Viru, with

an increase of over 3°C vs historical period.

2050: High

Physical

acute

Coastal

flooding**

Very Low

2030: Very Low

Riverine and coastal flooding can result in:

Inability to use access roads and transport networks surrounding

the airport, leading to service disruption and impeding

passenger access;

Disruption of air traffic and economic losses in terms of reduced

revenues from a decrease in passenger and freight traffic;

Damage to airport infrastructure such as landing lights, radar

and navigation facilities and communications networks,

increasing costs from infrastructure repairs and construction;

Flooding of airport terminals, emergency power facilities and

2050: Very Low

Physical

acute

Riverine

flooding**

Low

2030: Low

August/ 2024

Página 6 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

transport routes between terminals requiring airports to

temporarily close, leading to operational disruption and reduced

revenues from ticket fares.

For coastal flooding, projections show a higher probability for

José Joaquín de Olmedo (GYE) and Santos Dumont (SDU)

airports, with flooding exceeding 5 cm but staying below 10

cms.

Nine airports have some level of flooding projected, both for the

baseline and modeled scenarios.

Some airports projected to have floods below 5cms, between

2030 and 2050 are: Navegantes-Ministro Victor Konder (NVT),

Gustavo Rojas Pinilla (ADZ), Eloy Alfaro (MEC), Capitán Carlos

Martínez de Pinillos (TRU), Seymour (GPS), Carrasco Gral.

Cesáreo L.Berisso (MVD) y Presidente Carlos Ibáñez del Campo

(PUQ).

As for riverine flooding, 40 airports are projected to have some

flooding in a 5km radius, with 11 of them to reach above 10cms

flooding.

By 2050, the highest average of riverine flooding events is

projected for Francisco de Orellana (OCC) airport, where floods

could surpass 1.6 m, followed by Coronel Francisco Secada

Vignetta (IQT) airport, with a high of 1.4 m.

Additionally, Gustavo Rojas Pinilla (ADZ) and John F. Kennedy

(JFK) airports are projected under high risk, with a flood high of

0.7 m and 0.63 m respectively.

2050: Low

Physical

acute

Heavy rainfall

High

2030: Low

An increase in heavy rainfall events could result in:

Localised surface water flooding, leading to disruption or delays

in airline operations;

Flooding near airports, making it difficult for passengers and

workers to arrive and causing operational disruptions.

August/ 2024

Página 7 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Airports exposed to moderate and higher risk are projected to

increase from 2030 to 2050. Also, those at highest risk in 2050

are located in Galapagos Islands (Ecuador) and Junín, El Callao

and La Libertad (Peru), with other airports in the region (Chile

and mainland Ecuador) also projected to have significant

increases in the risk of heavy rainfall.

2050: Moderate

Physical

acute

Thunderstorm

s

High

2030: Moderate

An increase in the number of thunderstorms could result in:

Health and safety risks to air and ground personnel, possibly

increasing costs forms insurance and operational disruptions;

Operational disruptions due to ICAO recommendations to

suspend operations when lightning is detected within a 5km

radius.

Airports exposed to high and very high risk in 2050 are

projected to increase significantly compared to 2030. Those with

the highest risk of thunderstorms in 2050 are 2: Galapagos

Islands (Ecuador) and Junín (Peru), with other airports in the

region (Colombia and mainland Ecuador) also projected to have

significant increases in this risk.

2050: Moderate

Physical

acute

Strong

winds**

Very Low

2030: Low

An increase in strong winds could result in:

Disruptions at key hubs, which could cause disruption in

operations;

Damage airport infrastructure or even result in temporary

cessation of ground operations, increasing costs from repairs

and new infrastructure;

Impacts on aircraft takeoff, causing delays and cancellations, or

total cessation of ground operations, impacting revenues.

For all risk levels, the number of exposed airports are projected

to remain stable in 2050 compared to 2030. Those with very

high risk due to projected future annual maximum speeds are

located in New York (United States), Nassau (Bahamas), and

2050: Low

August/ 2024

Página 8 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Easter Island (Chile), followed by airports located in Montevideo

(Uruguay), Magallanes (Chile), San Andres (Colombia) and

Punta Cana (Dominican Republic) with a high risk rating. And

projections indicate that there will be no considerable increase in

the risk of strong winds in 2050 compared to 2030.

For the short-term risk, 2025, the average risk level decreases

from very high to low.

Physical

acute

Storms

(tropical

cyclones)

Moderate

2030: Very Low

Severe storms could result in:

Damages to office and airport infrastructure, increasing

operating costs from repairs or new infrastructure;

Potential impact on aircraft engine performance and

maintenance requirements due to storm damage, increasing

operational costs;

Disruption of oil and jet fuel supplies in regions where oil is

refined, increasing operational and supply costs in the fuel value

chain.

In the medium and long term, Gustavo Rojas Pinilla International

Airport at San Andres is the only site projected to have increases

in wind speed with a 50-year return period, placing it in the low

risk category, with an increase of 3% and 4.7% in the medium

and long term, respectively. Meanwhile In the short term, the

risk for this airport was also determined to be low, according to

the Saffir-Simpson scale.

For airports in New York (JFK) and Mexico City (MEX) the climate

indicator is projected to decrease. While those in Florida (MIA &

MCO), Nassau (NAS), and Punta Cana (PUJ) are projected to

have very low increases in TCV (Tropical Cyclone Velocity),

relative to the short term.

2050: Very Low

August/ 2024

Página 9 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Physical

acute

Clear-air

turbulence

Uncertain

2030: Uncertain

Increased turbulence in the air could result in:

Damage to aircraft, with possible diversions and changes in

routes, increasing operational costs and possible disruptions;

Health and safety risks to passengers and crew, causing

operational disruptions and potential reputational impacts, and

increasing costs from insurance premiums.

In the North Atlantic, models conclude that for every 1°C

increase in global temperature, moderate turbulence is projected

to increase 14% in autumn and summer, 9% in winter and

spring. This could affect flights to and from New York, where the

annual maximum temperature by 2050 is projected to increase

by nearly 2.5°C. In South America, the largest increases in

moderate turbulence are projected to occur in the March-August

period.

2050: High

Physical

acute

Wildfires

Low

2030: Low

Increases in wildfires could result in:

Reduced visibility at airports and cause changes in air routes,

possibly disrupting operations;

Health and safety risks to air and ground personnel, increasing

costs from insurance premiums;

If fires occur near airports or offices, operations are likely to be

disrupted.

The main increase in forest fires is expected to be due to a

decrease in total precipitation along with increasing

temperatures in the region - especially in the Amazon, where

the region's optimal conditions for forest fires may change from

42% today to 63% in 2050 under a 4°C increase scenario.

In South America, the annual burned area is projected (by 2050

under a 4°C scenario) to change from 0.7 Mkm2 to 2.5 Mkm2 -

mostly in the Amazon and the Cerrado region of Brazil.

The Chilean and Peruvian coastal zone, where most of LATAM's

2050: Moderate

August/ 2024

Página 10 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

airports are located, does not show major changes by 2050.

Transiti

on

opportu

nity

Ability to

transition

technologicall

y to a

low-carbon

economy

Low

2030: High

Technological advancements supporting lower-carbon aviation

could result in:

Increased profit by reducing operating costs related to fossil fuel

consumption and carbon emissions;

Reputational benefits from sustainable practices, helping to

maintain an increasingly environmentally conscious consumer

base and securing revenues;

Avoiding penalties related to environmental regulatory

non-compliance, reducing possible operational costs;

Positioning as a leader in the implementation of technological

innovations, and a potential increase in LATAM's valuation

and/or attraction of sustainable financial capital.

Aviation, highly dependent on fossil fuels, requires investment in

innovation and implementation of low-carbon technology;

however, the use of Sustainable Fuels (SAF) is the most viable

option in the medium term, at least for flights and routes of

more than 1,000 km. Likewise, there are technologies that could

be implemented on short or regional flights, but these are still in

the process of developing and depend on corporate measures

such as the renewal of aircraft or regulatory measures that

allow the supply chain to be developed and therefore deployed

in regions such as Latin America.

Results of the scenario analysis:

- 2025 [Moderate]: Efficiency and decarbonisation opportunities

for aviation have been identified and a strategy has been

mapped out in the sector for 2025 and 2030 going forward.

2050: High

August/ 2024

Página 11 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

- 2030 [High]: Sustained growth in production and availability of

SAF is expected from 2028 onwards. In addition, technological

innovations in propulsion and airframe systems could increase

aircraft efficiency by 10% and 20% in the long term. Regional

producers are expected to incentivise the use of more efficient

aircraft.

- 2050 [High]: Up to 65% CO2 reduction in aircraft operation is

expected by 2050.

Transiti

on

policy

risk

Exposure to

carbon prices

that include

the aviation

sector

Low

2030: High

Increased exposure and prices for carbon that include the

aviation sector could result in:

Increased operating costs due to the implementation of a carbon

tax on Scope 1 emissions;

Higher fuel costs due to the implementation of a carbon price

that passes through the value chain, increasing operating costs;

Increased operating costs leading to higher ticket prices,

reducing consumer demand and potentially impacting its market

share in the region in the event that other airlines are more

proactively reducing their energy and carbon footprint.

In Latin America there are no costs or mechanisms that apply

direct costs to the aviation sector, however, there are carbon

taxes that in some cases affect fuels such as jet fuel. Also, an

increase in carbon costs is expected in developing countries with

Net Zero commitments by 2050, such as Chile and Brazil, which

could increase fares and reduce demand for regional flights.

However, the uptake of SAF and low-carbon technologies are

expected to reduce the exposure of these costs in the medium to

long term.

Results of the scenario analysis:

2050: Very High

August/ 2024

Página 12 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

- 2025 [Low]: Currently, no country in Latin America has an

emissions trading system, however, Chile, Colombia and Mexico

have a tax on fossil fuels, although only in Colombia does it

apply to aviation fuels.

- 2030 [High]: A carbon price is expected to be implemented in

all Latin American countries, with an expected price of USD 90

per tCO2e by 2030, an increase of 77% compared to 2022.

- 2050 [Very high]: The regional carbon price is expected to

increase to USD 200 per tCO2e by 2050, an increase of 120%

compared to 2022 prices.

Transiti

on

market

risk

Changes in

passenger/con

sumer

behavior and

preferences

Low

2030: Low

Changes in consumer behaviours regarding aviation and air

travel could result in:

Reduction in demand for air services due to environmentally

conscious customers switching to other means of transportation,

possibly reducing revenues;

Reduction in business travel revenues, due to an increase remote

working and a substitution of business travel for virtual

meetings;

Changes in demand for certain routes as customers choose to

travel less / more locally in an effort to reduce their carbon

footprint, possibly reducing demand for long-haul vacation

travel and impacting LATAM’s strategy and destinations.

Results of the scenario analysis:

- 2025 [Low]: Around 21% of global consumers are expected to

prefer cleaner services and products.

- 2030 [Low]: A reduction in the aviation sector of 10% and

20% is expected by 2030 and 2050 respectively. Changes in the

2050: Moderate

August/ 2024

Página 13 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

way we work, live, and new technologies will also impact

demand for air services.

- 2050 [Moderate]: If SAFs cannot effectively enter into aviation,

an increase in air fares could be as high as 18% by 2050. It is

expected that in advanced economies, high-speed trains could

reduce demand for domestic flights of less than 1000 km by up

to 17%.

*For physical risks, a 4℃ scenario is used, whereas for transition risks, a 1.5℃ scenario was used. More information on the scenario analysis

methodology and approach is given in Section 2.3 below.

**For the risks of strong winds and coastal and riverine flooding, the absolute value for 2030 and 2050 was taken into account in determining

the rating (as opposed to change vs baseline used for the remaining hazards).

August/ 2024

Página 14 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Table 4. Physical risks rating

Short-term

Risk*

Unit

Unity

Very low

Low

Moderate

High

Very high

Extreme

temperatures /

Heat waves

Annual maximum

temperature

°C

<28.8

≥28.8 and <32.3

≥32.3 and <35.8

≥35.8 and <40.1

>40.1

Days over 30°C

days

0

0 - 7

7 - 78

78 - 200

>200

Heavy rainfall

rx5day

mm

<40

40 - 54

54 - 73

73 - 112

>112

Coastal/Riverine

flooding

Flooding height

m

<0.1

≥0.1 and <0.25

≥0.25 and <0.5

≥0.5 and <1.6

≥1.6

Tropical cyclones

Saffir-Simpson scale

km/hr

119-153

154-177

178-209

210-249

>250

Strong winds

Maximum wind

speeds

m/s

<16.2

16.2 - 19.3

19.3 - 21.1

21.1 - 23.4

>23.4

Thunderstorms

rx1day

mm

<21

21 - 27

27 - 37

37 - 55

>55

Medium and long-term

Risk*

Unit

Unity

Very low

Low

Moderate

High

Very high

Extreme

temperatures /

Heat waves

Changes in the

annual maximum

temperature

°C

<1

≥1 and <2

≥2 and <3

≥3 and <4

≥4

Changes in the days

over 30°C

days

<3

≥3 and <7

≥7 and <14

≥14 and <21

≥21

Heavy rainfall

Changes in rx5day

%

<2

≥2 and <5

≥5 and <15

≥15 and <25

≥25

Coastal/Riverine

flooding

Flooding height

m

<0.1

≥0.1 and <0.25

≥0.25 and <0.5

≥0.5 and <1.6

≥1.6

Tropical cyclones

Changes in the

maximum tropical

cyclone velocity

(TCV)

%

<2.5

≥2.5 and <5

≥5 and <7.5

≥7.5 and <10

≥10

Strong winds

Maximum wind

speeds

m/s

<3

3 - 6

6 - 9

9 - 12

>12

Thunderstorms

Changes in rx1day

%

<2

≥2 and <5

≥5 and <15

≥15 and <25

≥25

August/ 2024

Página 15 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Table 5. Transition risks rating

Risk

Very Low

Low

Moderate

High

Very High

Opportunity

Very Low

Low

Moderate

High

Very High

Short Term

Very little/no

importance of

climate

risk/opportunity

Little current

relevance of climate

risk/opportunity

Some significance of

climate

risk/opportunity due

to current trends

that may require

adjustments to

operations,

compliance or focus

on certain markets

High level of

significance of

climate

risk/opportunity due

to current trends

requiring substantial

changes to

operations,

compliance,

products, services or

business models

High level of

significance of

climate

risk/opportunity that

could potentially

cause

transformational

changes in

operations,

compliance,

products, services or

business models

Mid to Long Term

Very little or no

change in

risk/opportunity, e.g.

the policy, market,

technology

landscape will

remain the same as

in the baseline.

Little change in

risk/opportunity, e.g.,

policy, market,

technology

landscape will

remain similar to

baseline

Moderate changes in

risk/opportunity that

may require

adjustments to

operations,

compliance or

approach to certain

markets

Significant changes

that may require

substantial

adjustments to

operations,

compliance,

products, services or

business models.

Drastic changes that

require significant

changes to

operations,

compliance,

products, services or

business models

Very little or no

Little additional

Moderate costs will

Material costs will

Serious operational

August/ 2024

Página 16 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

additional costs will

be incurred over and

above current

impacts.

costs will be

incurred over and

above current

impacts.

occur related to

measures/actions

such as: investments

in new technologies,

energy efficiency

measures or

emission offsets.

be incurred with

direct impacts on the

finances.

or financial

dificulties arise with

significant costs with

a direct impact on

the finances.

August/ 2024

Página 17 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

● Impact of climate-related risks and opportunities on the organization’s businesses,

strategy, and financial planning.

As the aviation sector is highly exposed to physical and transition climate-related risks and

opportunities, direct and indirect impacts could adversely impact LATAM’s business and operations.

Changes in the climate patterns around the routes can impact and limit operations, affecting critical

infrastructure (airports), destinations, and communities in key geographies, and reducing the revenue

of the group and subsidiaries. Likewise, from the transition risk perspective, LATAM’s operations are

affected by local, national, and international regulations, which may require, among other things,

action to be taken in relation to the carbon footprint of the company and enhanced resource and

waste management. Mismanagement in all these aspects could have a detrimental effect on the

group's business and could require LATAM to implement mitigation measures in its operations, fleet,

routes, and destinations.

Environmental and social risks are identified and consolidated by the Corporate Affairs and

Sustainability Team and subsequently reported to the Risk Management Unit to be included in the

group's general risk matrix. Climate-related risks have been identified through this process and

included in the corporate risk management process. No other social and environmental risks relevant

to the operation were identified.

The sustainability team has a Business Plan, which includes the financial projections associated with

the development of the sustainability strategy.

● Resilience of the organization’s strategy, taking into consideration different

climate-related scenarios including a 2°C or lower scenario.

In 2024, LATAM will start to integrate the findings of the scenario analysis with respect to both

physical and transition risks and opportunities into the business strategy and financial planning,

enabling the enhancement and/or development of mitigation and/or adaptation actions that ensure

LATAM builds resilience to the risks identified, and can capitalize on any climate-related

opportunities.

Likewise, in the short- to medium-term, LATAM intends to update its sustainability strategy in order

to reflect material climate-related risks and opportunities that have been identified through the

TCFD-aligned scenario analysis. This may include strengthening LATAM’s climate-related risk

assessment and management processes; identifying and integrating additional climate-related

metrics and targets specific to material climate change risks and opportunities identified; and

expanding on LATAM’s efficiency and conservation and restoration initiatives.

August/ 2024

Página 18 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

3.3. Risk Management

● Organization’s processes for identifying and assessing climate-related risks.

LATAM’s uses several parallel systems and processes to help identify and assess climate-related

risks, including: 1) LATAM’s Integrated Safety Management System, which incorporates the Safety,

Security, Health, Safety and Environment (HSE) and the Emergency Response Plan, and includes a

process to periodically review and identify new/emerging risks. 2) LATAM’s monitoring systems used

in alignment with International Air Transport Association Environmental Assessment (IEnvA)

certification, whereby environmental (including climate) impacts are mapped as part of the risk

identification process; and 3) the identification, assessment and prioritization of climate-related risks

as identified in the TCFD-aligned climate risk and opportunity analysis undertaken in 2023.

The TCFD-aligned analysis of climate change risks and opportunities offers the most granular view of

LATAM’s exposure to climate risks, and the risk identification and assessment process (using scenario

analysis) is therefore described in more detail in this section.

The scenario analysis was performed in two stages. In the first stage, a baseline and scoping exercise

was undertaken with the objective of identifying a full list of potential climate change risks and

opportunities for LATAM, from which priority risks and opportunities would be explored in more

detail using scenario analysis (stage 2). In order to fully and holistically understand the

climate-related risks for LATAM, for the first stage, a set of meetings were held for each country

where LATAM has home markets (Brazil, Chile, Colombia, Ecuador and Perú). The objective was to

understand, from different perspectives within the company, the climate-related risks, based on the

unique understanding of each countries team, and taking into account their areas of expertise and

past knowledge in regards to past climate-related events. For each meeting, a key member of the

following teams participated:

● Sustainability

● Public Affairs

● Airports

● Ground / air operations

● Commercial / sales

This ‘long-list’ of climate risks and opportunities was developed by identifying all of the possible

climate-related transition and physical risks and opportunities that LATAM may be exposed to, and

assessing (at a high level) LATAM’s vulnerability to these. To support this assessment, several

sources of information were reviewed, including scientific literature, sectoral reports, competitors’

disclosures, and input from LATAM stakeholders, to map a comprehensive list of potential risks and

opportunities.

August/ 2024

Página 19 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

More than 20 physical risks and 30 transition risks and opportunities were identified in this initial

baseline and scoping phase, and the most relevant and potentially material ones were highlighted

and rated according to LATAM’s vulnerability as well as the expected level of change under the

climate change scenarios in question (+1.5℃ and +4℃ for transition and physical risks, respectively).

The top prioritized risks and opportunities were discussed during a prioritization session with a

cross-section of LATAM stakeholders, who were able to provide a comprehensive perspective on the

potential impacts of the identified risks on LATAM's business strategy. Following this, a final list of

twelve priority risks and opportunities was agreed on for further assessment during the scenario

analysis.

In the second stage, scenario analysis was used to assess the prioritized risks and opportunities

across two climate scenarios and three time horizons. The time horizons considered for physical

climate risks were 2025 (short term/baseline), 2030 (medium term) and 2050 (long term), as

changes for physical climate changes are expected to materialize more strongly during the next

decades, especially from the middle to the end of the century. Similarly, the time horizons assessed

for the transition risk assessment were 2025 (short term/baseline), 2030 (medium term) and 2050

(long term), with a greater focus on the near-to-medium term, as there can be more uncertainty in

both the evolution of both the business and operations, and climate and energy-related policies

under certain climate scenarios, beyond 2030.

Transition risks and opportunities

The analysis of the transition risks and opportunities considered climate-related risks and

opportunities across four main areas: current regulation / emerging regulation and legal risk,

technology risk, market risk, and reputational risk. The geographical areas in scope were South

America, North America, Europe, and global.

Physical risks

The analysis of physical climate change risks considered two categories of risks: acute and chronic.

Acute physical risks refer to event-driven changes, for example, extreme weather such as cyclones,

floods, and landslides, whereas chronic physical risks reflect longer-term shifts in climate patterns,

for example, an increase in the frequency of droughts. The geographical locations considered for this

analysis were the countries with key sites, routes, or hubs for LATAM’s operations: Argentina, Brazil,

Ecuador, Colombia, Peru, Bolivia, Uruguay, Paraguay, Dominican Republic, The Bahamas, United

States, Chile, Mexico, and Spain

The climate scenarios that were used as a basis for the analysis are presented in Table 6.

August/ 2024

Página 20 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Table 6. Scenarios assessed during the climate risk assessment

Type of

scenario

Scenario

Temperature

change by

2100

Description

Selection of

scenarios

Physical

risks

SSP5-8.5

+4℃ (3.3–

5.7℃)

This represents a

‘worst-case’ warming

scenario, with global

mean temperature

increases of >4℃ by the

end of the century

compared to preindustrial

levels bringing significant

changes to climate and

weather patterns

The IPCC’s

SSP5-8.5 scenario

was considered in

the analysis, as it

aligns with TCFD's

recommendations

by representing an

extreme (‘worst

case’) future in the

spectrum of

potential futures

Transition

risks

1.5℃-aligne

d

1.5℃

This represents a

‘best-case’ climate

change scenario where

stringent climate policies

and carbon pricing limit

global temperature

increases to ~1.5℃ to

1.7℃ by end-century.

The International Energy

Agency’s Net Zero

Emissions by 2050 (NZE)

is used as the main

scenario, with

information from regional

scenarios used where

NZE scenario information

is not available

This scenario is

based on the IEA

scenarios, which

are in line with the

TCFD

recommendations,

as well as being

well-known and

widely used, and

represents a ‘rapid

low-carbon

transition scenario’

with significant

policy/legal,

market, technology

and reputational

changes

Based on the scenario projections, risks and opportunities were rated as very high, high, moderate,

low, very low, or uncertain, with definition of the rating varying depending on the timeframe in

question:

August/ 2024

Página 21 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

● Short-term / baseline (2025): The rating assigned for the short-term/baseline (2025) time

horizon represents the absolute rating of the risk, which considers its current criticality and

relevance for LATAM’s operations.

● Medium- and long-term (2030 and 2050): The rating assigned to the medium (2030) and

long-term (2050) time horizons represents the magnitude of change in the risk / opportunity

under the scenario in question compared to the baseline (2025).

● Organization’s processes for managing climate-related risks.

As of 2022, LATAM has undertaken several initiatives to manage climate-related risks and enhance

the sustainability and environmental performance of the group. In particular, the following initiatives

help us to manage some of the climate change transition risks assessed above: the monitoring of

environmental measures concerning the GHG footprint, the use and implementation of sustainable

aviation fuels (SAFs), and improving circularity in the use of resources.

● Processes for identifying, assessing, and managing climate-related risks are integrated

into the organization’s overall risk management.

LATAM has already identified climate-related risks and opportunities, specifically linked to the air

transport industry; however, non-climate-related risks are already integrated into the company's

general risk management after being consolidated by the Corporate Affairs and Sustainability Team.

The Risk Management Unit is reviewing the assessment of the climate-related risks and

opportunities and is planning to include (as required) the results and findings of the identified

climate-related risks and opportunities in LATAM’s general risk management system.

From 2024 onwards LATAM intends to carry out an annual process to identify, assess, prioritize, and

integrate climate-related risks as part of the Integrated Safety Management System. The general

process for risk management is outlined in the section above.

3.4. Metrics and targets

● Metrics used by the organization to assess climate-related risks and opportunities in line

with its strategy and risk management process.

Within the sections ‘Commitment with the future’ and the sub-sections ‘climate change and

environmental management’, and ‘eco-efficiency’ in our integrated report, LATAM discloses

climate-related metrics and targets to measure and monitor material risks, and has initiated corporate

programs to improve the use of resources and reduce its carbon footprint. Data related to the GHG

emissions broken down by Scope can be found in the ‘Metrics & targets’ section of this document,

with additional climate-related metrics currently being tracked presented in Table 7.

August/ 2024

Página 22 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Table 7. Overview of LATAM’s key climate-related metrics

Metric

Overview

2020

2021

2022

Emissions

intensity

Emissions intensity in the total

operation

Measured in kg CO

2

e/100 RTK

(Revenue tonne-kilometer)

Tracked since 2013

76.87

80.76

101.80

Emissions

intensity

Emissions intensity in the air

operations

Measured in kg CO

2

e/100 RTK

(Revenue tonne-kilometer)

Tracked since 2013

76.31

80.55

76.67

Energy intensity

Energy intensity from ground and

air operations

Measured in MWh/RTK (Revenue

tonne-kilometer)

Tracked since 2013

1.4

2.2

1.7

Atmospheric

(non-CO

2

) GHG

emissions

Produced emissions of NO

x

Measured in tonnes

Tracked since 2013

19,207

22,184

33,198

Atmospheric

(non-CO

2

) GHG

emissions

Produced emissions of SO

x

Measured in tonnes

Tracked since 2013

851

983

1,470

Internal energy

consumption

(non-renewable)

Total fuels and electricity from

non-renewable sources

Measured in Terajoules (TJ)

Tracked since 2013

76,970.35

88,993.70

134,251.7

2

Internal energy

consumption

(renewable)

Ethanol and electricity from

renewable sources

Measured in TJ

Tracked since 2016

77,076.18

89,112.08

134,436.7

1

Water

withdrawn

Water withdrawn from municipal

networks

Measured in m

3

Tracked since 2013

82,480

98,846

85,656

Waste

Total waste (hazardous and

6,583

28,803

37,990

August/ 2024

Página 23 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

management

non-hazardous)

Measured in tonnes

Tracked since 2013

● Scope 1, Scope 2, and if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the

related risks.

Measuring the carbon footprint of LATAM Airlines Group S.A.'s operations is a key part of the group's

sustainability strategy, and since 2012 the group has been accounting for emissions in accordance

with the ISO 14064 standard and the Greenhouse Gas Protocol framework. The descriptions of

emissions sources included in each Scope are outlined in Table 8, and the results of the GHG

accounting for 2022, and the prior three reporting years, are disclosed in Table 9.

Table 8. Description of each GHG emissions scope

Scope

Description

Scope 1

Emissions directly generated from sources owned or controlled by LATAM

Scope 2

Emissions generated by the generation of purchased electricity

Scope 3

Emissions indirectly generated as a result of the activities of the company

from sources that the company does not own or control

August/ 2024

Página 24 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Table 9. LATAM’s GHG emissions for 2019–2022 divided by scope, in tonnes of CO

2

equivalent

Scope

Sub-category

2019

2020

2021

2022

Scope 1

Direct

emissions

12,149,72

5

5,614,368

6,497,576

9,780,288

Scope 2

Indirect

emissions

18,423

16,355

14,549

7,150

Scope 3

(total)

Other indirect

emissions

218,174

24,827

2,446

3,198,317

Scope 3

Category 1

(Purchased

goods and

services)

N/A

N/A

N/A

1,100,644

Scope 3

Category 2

(Capital goods)

N/A

N/A

N/A

N/A

Scope 3

Category 3

(Fuel & energy

related

activities)

(passengers)

N/A

N/A

N/A

1,836,131

Scope 3

Category 3

(Fuel- and

energy-related

activities)

(cargo)

N/A

N/A

N/A

194,578

Scope 3

Category 4

(Upstream

transportation

and

distribution)

N/A

N/A

N/A

37,637

Scope 3

Category 5

(Waste

generated in

operations)

N/A

N/A

N/A

2,091

Scope 3

Category 6

N/A

N/A

N/A

14,582

August/ 2024

Página 25 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

(Business

travel)

Scope 3

Category 7

(Employee

commuting)

N/A

N/A

N/A

12,364

Scope 3

Category 9

(Downstream

transportation

and

distribution)

N/A

N/A

N/A

N/A

Total (Scope

1, 2 &3)

N/A

12,386,32

3

5,655,551

6,514,570

12,985,755

Emissions

compensated

(LATAM)

N/A

N/A

N/A

N/A

572,782

Emissions

compensated

(clients)

N/A

N/A

N/A

N/A

33,184

According to the group's GHG inventory, the company has seen a 20% decrease in Scope 1

emissions compared to the base year of 2019, reaching 9,780,288 tonnes of CO2 equivalent in 2022,

in addition to reporting an amount of compensated emissions of around 572,782 thousand tonnes of

CO2 equivalent, through carbon credits. Likewise, by 2022 the emissions inventory reported a total

of 12,985,755 uncompensated emissions, of which Scope 1 accounts for 75.3%, Scope 2 for 0.1%,

and Scope 3 for 24.6% of the total.

Post-pandemic (2022), an increase in Scope 1 net emissions was observed due to the recovery of

operations in all countries. However, emissions intensity in air operations was reduced by 4.8%

compared to 2021, demonstrating the effectiveness of activities to improve operational efficiency

including under the Fuel Efficiency framework, LATAM's Fuel Efficiency program, initiatives

implemented included the optimization of routes and flight plans, implementation of Descent Profile

Optimization (DPO), and rationalization of the use of the auxiliary engine.

For the year 2022, as part of the process of continuous improvement in the calculation of the GHG

footprint, the granularity of Scope 3 accounting was increased, incorporating five new categories in

all countries, throughout the value chain. There are a total of seven categories included in the Scope

3 footprint: indirect emissions from land transportation related to operations (employees, suppliers,

August/ 2024

Página 26 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

and waste), air travel (in other companies) of employees in work activities, purchase of goods and

services, capital goods, emissions related to fuel and energy (cargo and passengers), waste

generated in the operation, and emissions generated by indirect transportation (performed by an

external supplier). In previous years (2019 to 2021), only indirect emissions from ground

transportation related to operations (employees, suppliers, and waste) and air travel (in other

companies) of employees in work activities, respectively, were considered for this scope. Scope 3

categories 8 to 12 are excluded as they are not applicable to LATAM, except for operations in Brazil

where category 9 (downstream transport and distribution) applies. However, categories 13 to 15, as

part of the company's continuous improvement process, are expected to be reviewed for their

eventual applicability.

● Targets used by the organization to manage climate-related risks and opportunities and

performance against targets.

LATAM’s climate objectives are currently focused on reducing the carbon and waste footprint, and

improving energy and fuel efficiency across all LATAM operations. LATAM has therefore established

the following climate-related targets:

● Achieve carbon neutrality in air and land operations by 2050

● Be zero waste to landfill by 2027

● Reduce by 95% the use of single-use plastics across all LATAM operations by 2023

LATAM has also begun to implement water saving initiatives, starting with a communication

campaign for the saving and efficient use of resources (including corporate buildings and

maintenance).

4. Annexes

4.1. Detailed images/maps of physical risks

For the physical risk levels described in this Annex, the medium term refers to the year 2030 and the

long term to 2050.

August/ 2024

Página 27 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

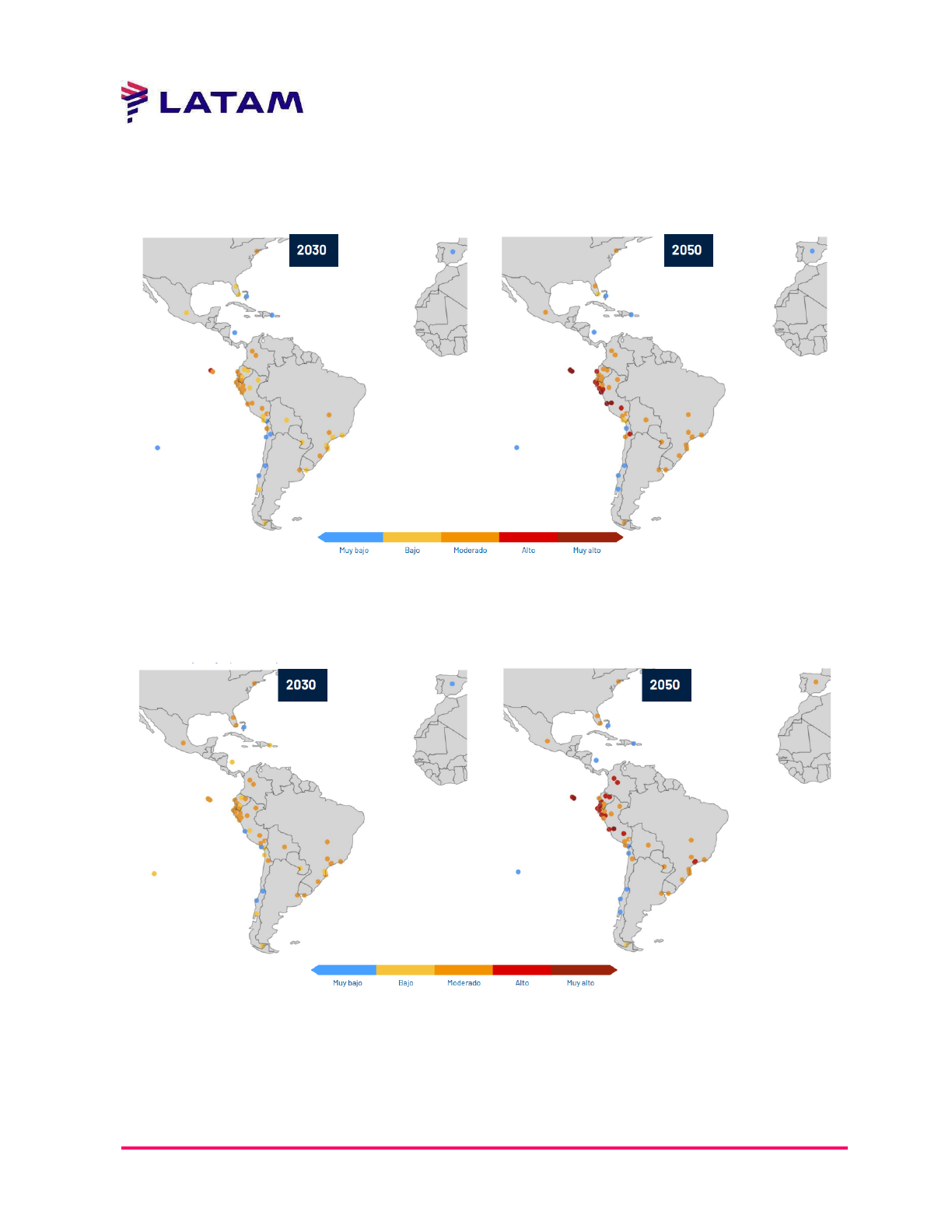

Risk Level - Maximum Temperatures

Comparison of maximum temperature indicator risk levels at LATAM Airlines' main airports for

medium and long term, under a high emissions scenario.

Risk Level - Days exceeding 30°C

Comparison of risk levels of the indicator of number of days exceeding 30°C at LATAM Airlines' main

airports for the medium and long term, under a high emissions scenario.

August/ 2024

Página 28 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Risk Level - Coastal flood height

Comparison of the average coastal flooding height at LATAM Airlines' main airports for the medium

and long term, under a high emissions scenario.

Risk Level - Riverine flood height

Comparison of average riverine flood heights at LATAM Airlines' main airports for the medium and

long term, under a high emissions scenario.

August/ 2024

Página 29 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Risk Level - rx5day

Comparison of the risk levels of the five consecutive days with the highest rainfall at LATAM Airlines'

main airports for the medium and long term, under a high emissions scenario.

Risk Level - rx1day

Comparison of annual maximum rainfall risk levels at LATAM Airlines' main airports for the medium

and long term, under a high emissions scenario.

August/ 2024

Página 30 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Risk Level - Annual maximum speeds

Comparison of risk levels of annual maximum speeds at LATAM Airlines' main airports for the

medium and long term, under a high emissions scenario.

Risk Level - Tropical cyclone velocity (TCV)

Comparison of risk levels of maximum tropical cyclone velocities at LATAM Airlines' main airports for

the medium and long term, under a high-emission scenario.

August/ 2024

Página 31 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

4.2. Detailed results of physical scenarios by airport

2030: Extreme Temperatures / Heat Waves

Changes in annual maximum temperature

August/ 2024

Página 32 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

2050: Extreme Temperatures / Heat Waves

Changes in annual maximum temperature

August/ 2024

Página 33 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

2030: Extreme Temperatures / Heat Waves

Changes in the number of days exceeding 30°C

2050: Extreme Temperatures / Heat Waves

Changes in the number of days exceeding 30°C

August/ 2024

Página 34 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Coastal Flooding

Flood height (m)

August/ 2024

Página 35 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Riverine Flooding

Flood height (m)

August/ 2024

Página 36 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

2030: Heavy rainfall

Relative changes in rx5day (%)

2050: Heavy rainfall

Relative changes in rx5day (%)

August/ 2024

Página 37 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

2030: Thunderstorms

Relative changes in rx1day (%)

August/ 2024

Página 38 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

2050: Thunderstorms

Relative changes in rx1day (%)

August/ 2024

Página 39 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

2030: Strong winds

Annual maximum wind speed

August/ 2024

Página 40 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

2050: Strong winds

Annual maximum wind speed

August/ 2024

Página 41 de 42

Title

Report Aligned with the 11 TCFD recommendations

Version

1.0

Tropical cyclones

Change in tropical cyclone speed

August/ 2024

Página 42 de 42