1

PRESS RELEASE

Full Year 2020 results

Technicolor exceeds its 2020 guidance and remains on track to meet its 2022

guidance

Paris (France), 11 March 2021 –

Technicolor (Euronext Paris: TCH; OTCQX: TCLRY) is today

announcing its results for the full year 2020.

Richard Moat, Chief Executive Officer of Technicolor, stated:

“Technicolor has re-engineered its operations, balance sheet and global footprint and has exceeded its

guidance for 2020. Connected Home beat the targets originally set before the crisis began, but

Production Services and DVD Services were hit by the halting of activity in the film industry, and

associated cinema closures. However, overall the Group showed good resiliency in the face of the

pandemic. During 2020, significant structural changes were implemented across all divisions, which saw

a more than €165 million reduction in our cost base, combined with further investment to improve our

efficiency. In particular, Production Services strengthened its capacity to serve its clients through state

of the art technologies and artistic expertise. Despite persistent uncertainty relating to the pandemic, we

are looking to the future with confidence, and will continue to execute our transformation program to

deliver improved operational and financial performance. In consequence, the Group issuing guidance

towards strong figures for 2021, and is maintaining previously issued 2022 guidance.”

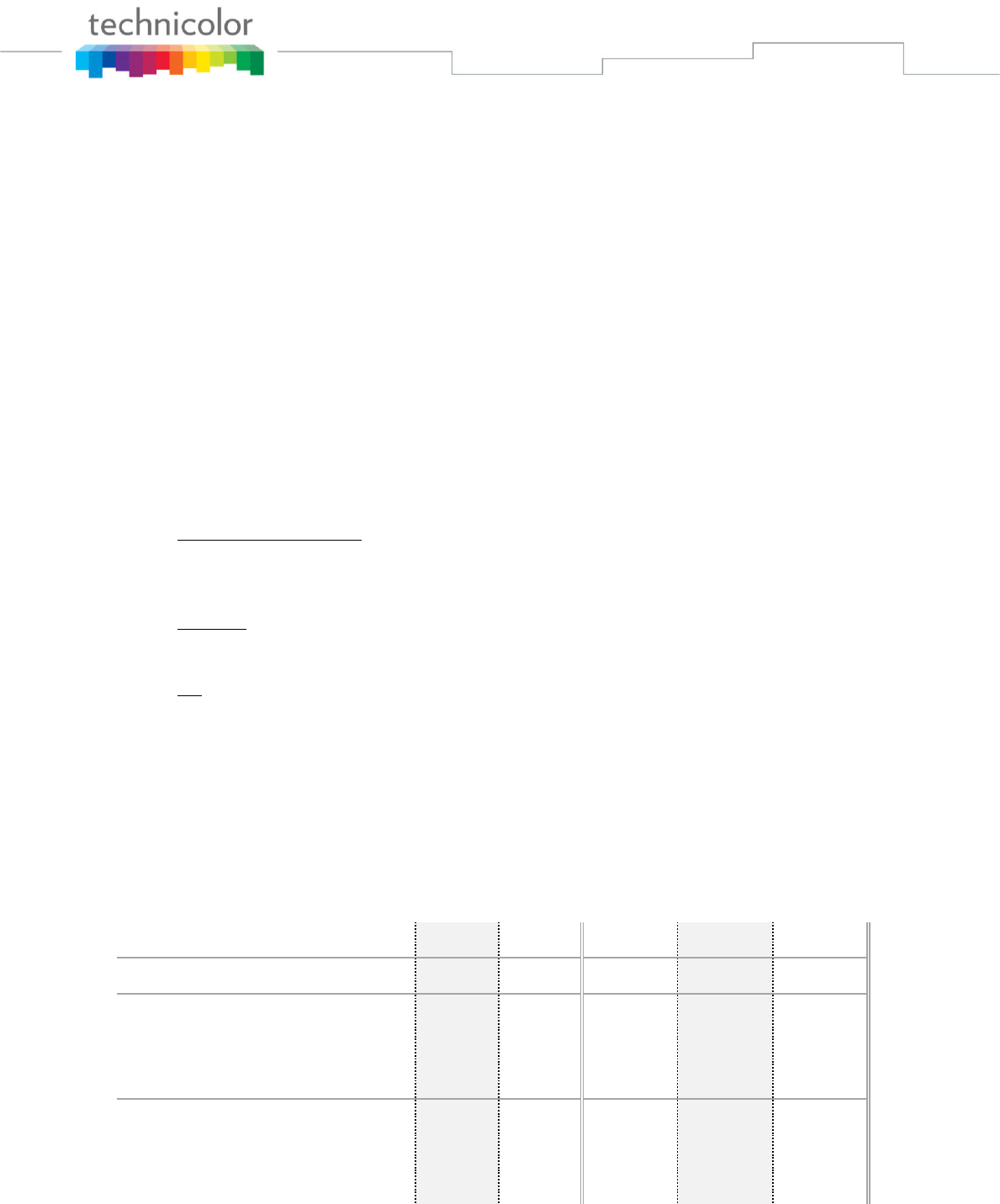

Full year 2020 results and forward outlook – key highlights:

Second Half

Full Year

In € million

2019

2020

At

current

rate

At

constant

rate

2019

2020

At

current

rate

At

constant

rate

Revenues from continuing

operations

2,036

1,573

(22.7)%

(17.9)%

3,800

3,006

(20.9)%

(18.5)%

Adjusted EBITDA from

continuing operations

222

115

(48.3)%

(44.9)%

324

167

(48.5)%

(46.0)%

As a % of revenues

10.9%

7.3%

8.5%

5.6%

Adjusted EBITA from continuing

operations

87

11

(86.9)%

(85.8)%

42

(56)

ns

ns

Free Cash Flow from continuing

operations before Tax &

Financial

202

118

(41.5)%

(44.6)%

(8)

(124)

ns

ns

In 2020 Technicolor successfully achieved a major balance sheet financial restructuring, and the

implementation of a significant business transformation:

o Liquidity as at December 31, 2020 of €432 million, consisting of €330 million cash on

balance sheet and €102 million of fully undrawn committed credit lines;

o Nominal net debt as at December 31, 2020 reduced by €340 million following the

completion of the financial restructuring, with a net debt to adjusted EBITDA (including

op. leases) ratio of 5.37;

o Significant momentum established in improving operations, profitability and cash

generation, ultimately creating value for all stakeholders;

2

o Management team renewed, and their incentives realigned to value creation for the

company in the short and medium term.

As a result, and despite the successive waves of the pandemic crisis which were not anticipated

at the time of the financial restructuring, Full Year 2020 results are ahead of previously

communicated guidance:

o EBITDA of €167 million (including IFRS 16), is better than expected and has more than

doubled from €53 million in the first half to €115 million in the second half;

o Permanent cost savings of €171 million;

o 2020 EBITA of €(56) million, better than the €(64) million expected;

o Continuing free cash flow (before financial results and tax) of €(124) million in line with

guidance, showing a strong improvement in the second half with an inflow of €118 million

despite absorbing around €(90) million of supplier payment term reductions.

The Group’s businesses demonstrated operating resilience to the Covid-19 crisis. Nonetheless,

revenue generation in some of our activities has been significantly impaired as a result of

sanitary restrictions around the world:

o Production Services activities were significantly impacted by the pandemic, with

revenues down 41% at constant rate year-on-year due to the halting of live action

shooting at the end of the first quarter. The decline in Film and Episodic Visual Effects and

Post Production was, however, partially mitigated by increased demand in Animation, and

resilience in Advertising which achieved the same EBITDA as in 2019 despite lower revenues.

o Connected Home delivered a strong year with a standout performance in North America,

exceeding the original targets set before the pandemic and maintaining its market

leadership. Adjusted EBITDA grew 46.7% at constant rate, as a result, EBITDA margin

expanded from 4.0% to 6.2%, highlighting the positive impact of the cost restructuring

measures. 2020 EBITA of €41 million was almost twice 2019 EBITA of €23 million.

o DVD Services performed well in a difficult environment. 2020 EBITA reached break-even

compared to a loss of €(6) million in 2019, illustrating the positive impact of successful

contract renewals and aggressive transformation actions. This was achieved despite a

decrease in revenue of (19)% at constant rate year-on-year, impacted by the lack of new film

releases following theaters closures, but partly compensated by resilient back catalog demand.

While uncertainty linked to the pandemic remains, the Group is focused on continuing the

execution of its transformation program, which has gained significant momentum in 2020. 2021

and 2022 will be years of substantial financial improvement. Taking into account the impact of

foreign exchange fluctuations and the change in Group perimeter as a result of the sale of Post

Production

1

, the Group is today adapting its 2022 guidance, and providing 2021 guidance of:

o Revenues from continuing operations stable vs. 2020;

o Adjusted EBITDA

2

of around €270 million (incl. IFRS 16), a very significant improvement

from €167 million achieved in 2020;

o Adjusted EBITA of around €60 million;

o Continuing free cash flow (before financial results and tax) at around breakeven;

o Net debt to EBITDA covenant ratio should reduce to below 4X level at 2021 year end.

1

In 2022, the cumulated impacts of foreign exchange fluctuations and change in Group perimeter as a result of the sale of Post

Production are €(40) million on Adjusted EBITDA and €(23) million on Adjusted EBITA.

2

“Adjusted EBITDA” corresponds to the profit (loss) from continuing operations before tax and net financial income (expense),

net of other income (expense), depreciation and amortization (including impact of provision for risks, litigation and warranties).

3

Full Year 2020 key indicators from continuing operations

• Revenues of €3,006 million were down (18.5)% at constant rate, including a decrease in Production

Services of (41)%, primarily driven by lower revenue in Film & Episodic Visual Effects, and lower

volumes in DVD Services (19)%. Connected Home showed resiliency with a reduction of only (8)%

thanks to the buoyant activity in North America (+16%), mitigating a lower performance from Eurasia.

• In 2020, the Group realized €171 million of cost savings, in line with its target.

• Adjusted EBITDA of €167 million was down 46% at constant rate. This reflects operational and

financial improvements across all activities, particularly in Connected Home, a decline in Film &

Episodic Visual Effects mainly driven by cessation of live action shooting, and lower business

volumes in DVD Services. EBITDA during the second half more than doubled versus the first half

reflecting a strong profitability increase in DVD Services and Production Services (primarily due to

cost restructuring actions).

• Adjusted EBITA of €(56) million was lower by €(98) million at current rate, as a result of the EBITDA

decrease mitigated by lower depreciation & amortisation and reserves.

• Non-current assets impairment charge of €75 million mainly related to DVD services goodwill

impairment due to revised Covid-related assumptions.

• Restructuring costs accounted for €(100) million at current rate, including €(33) million in DVD

Services, mainly resulting from optimization of distribution sites, €(27) million in Production Services

on cost streamlining actions, €(31) million in Connected Home pursuant to the three-year

transformation plan, and €(9) million for Corporate and Other.

• Free cash flow

3

(before financial results and tax) from continuing operations of €(124) million was

lower by €(116) million, despite a significant improvement in Connected Home operational

performance, and the ongoing implementation of our cost transformation program. Following entry

into the Accelerated Financial Safeguard procedure, a faster than expected reduction of payment

terms was requested by suppliers, which led to €(35) million of payments being advanced from 2021

to 2020.

• Net debt at nominal value amounts to €897 million, and IFRS net debt amounts to €812 million. The

difference mainly relates to the mark-to-market debt valuation on issuance, and will be reversed

through non-cash interest charges over the life of the debt.

Outlook

• Film & Episodic VFX activities are seeing a significant improvement in the forward pipeline, and

demand for Connected Home broadband products remain high, despite the extended lockdowns

affecting the Group’s trading environment.

• DVD Services and Advertising revenues are expected to take longer to recover.

• Component supply constraints are also expected to affect Connected Home activities. To address

this, Technicolor has already engaged in commercial discussions in order to pass surcharges through

to customers.

3

Free cash flow defined as: Adj. EBITDA – (net capex + restructuring cash expenses + change in pension reserves + change in

working capital and other assets & liabilities + cash impact of other non-current result).

4

• In Production Services, the work secured for 2021 is in line with the strong level of activity in 2019.

Production Services has been awarded several new major projects, already securing 75%+ of its

expected 2021 sales pipeline for Film & Episodic Visual Effects and Animation & Games. Confirmed

projects for 2021 include Disney’s live-action adaptations of The Little Mermaid and Pinocchio, and

its recently announced The Lion King prequel.

• The Group will continue to improve efficiency and productivity throughout the period, and is now

targeting a total of €325 million in run-rate cost savings by 2022, an increase of €25 million compared

to the previous announcement, despite a challenging context.

• The Group’s ambition to normalize working capital dynamics by 2022 will be achieved as early as the

end of the first quarter of 2021, without significant impact on the Group’s liquidity needs.

• Technicolor will continue to significantly improve its EBITDA, EBITA and FCF in 2021 and 2022 and,

following the recent change in perimeter (sale of Post Production) and the change in forex

assumptions, 2021 guidance and updated 2022 guidance areas follows:

o In 2021:

▪ Revenues from continuing operations stable vs. 2020;

▪ Adjusted EBITDA of around €270 million;

▪ Adjusted EBITA of around €60 million;

▪ Continuing FCF before financial results and tax at around breakeven;

▪ Net debt to EBITDA covenant ratio below 4X level at year end.

o In 2022:

▪ Adjusted EBITDA of €385 million;

▪ Adjusted EBITA of €180 million;

▪ Continuing FCF before financial results and tax at around €230 million.

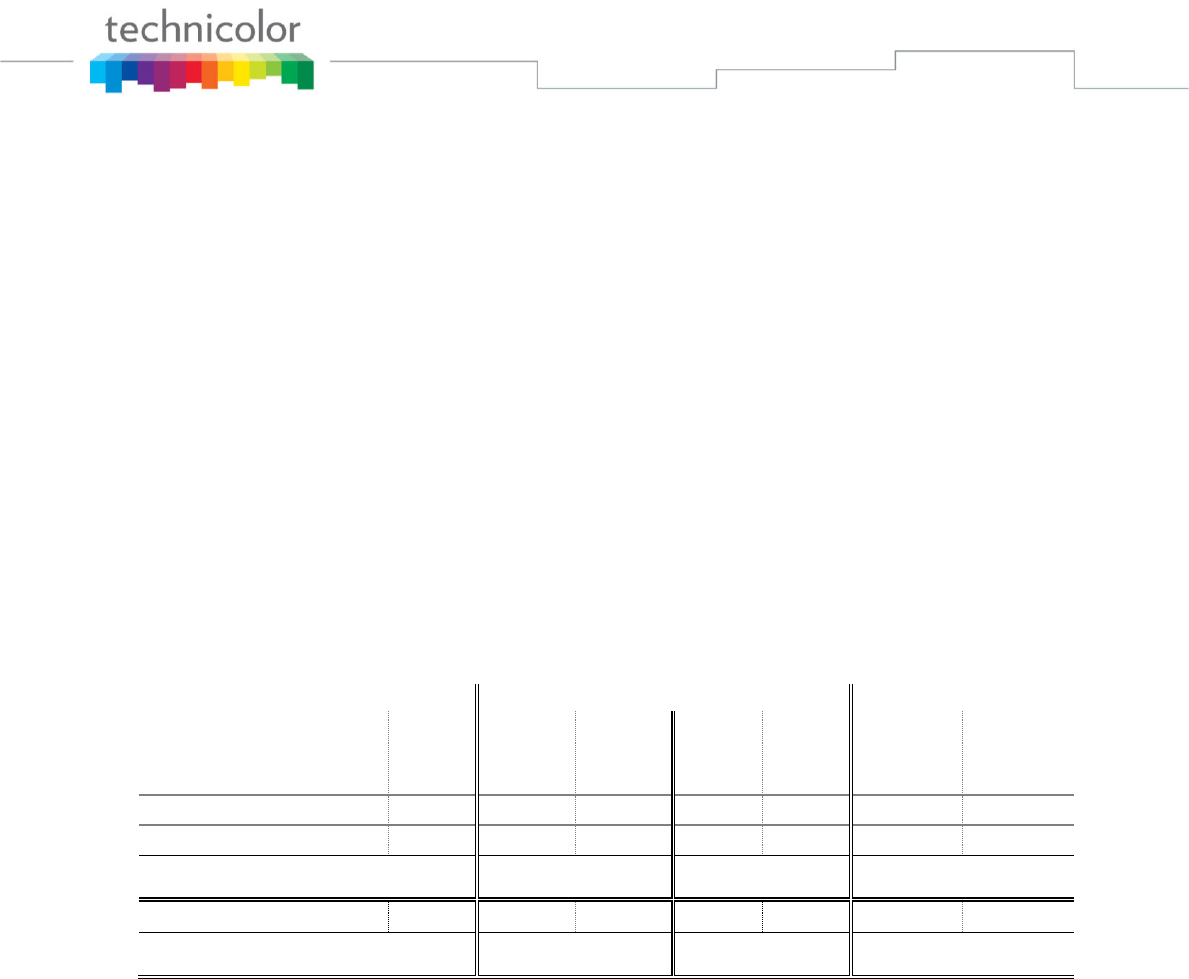

Continuing Operations – post IFRS 16

€ million, FYE Dec post IFRS-16

2020e

2021e

2022e

Adjusted EBITDA from continuing operations

167

270

385

Adjusted EBITA from continuing operations

(56)

60

180

Continuing FCF

before financial results and tax

(124)

c.0

230

• The 2021 and 2022 objectives are calculated assuming constant exchange rates.

• In 2022, the cumulated impacts of foreign exchange fluctuations and change in Group perimeter as

a result of the sale of Post Production are €(40) million on Adjusted EBITDA and €(23) million on

Adjusted EBITA.

Perimeter Change

• Technicolor announced on January 14, 2021 the disposal of its Post Production business (part of

Production Services) for €30 million. Closing is expected during the first half of 2021. The sale of

5

Post Production simplifies Production Services’ portfolio of activities, and allows management to

increasingly focus on Production Services’ remaining core CGI activities.

Management update in 2020

• As communicated during Technicolor’s third quarter results, Christian Roberton was promoted to

become President of the Production Services business division.

• As also previously communicated, David Holliday was appointed President of the DVD Services

division.

Board composition

• As previously announced, the Board of Directors has appointed as Board Observers:

o Bain Capital Credit, represented by Gauthier Reymondier, Managing Director,

European Portfolio Manager at Bain Capital Credit based in London; and

o Angelo, Gordon & Co represented by Julien Farre, Managing Director at Angelo Gordon

in London.

6

Segment Review – Full Year 2020 Results Highlights

• Production Services revenues amounted to €513 million in 2020, down (41.4)% at constant rate

and (42.5)% at current rate year-on-year, driven mainly by pandemic-related impacts on production

in Hollywood and around the world. The revenue decline was partially mitigated by double-digit

revenue growth at Mikros Animation and the launch of MPC Episodic in early 2020.

• Adjusted EBITDA amounted to €18 million, down €(144) million year-on-year at constant rate.

Costs were aggressively reduced to offset the €(370) million at constant rate revenue decline in a

high margin segment. This negative evolution also impacted Adjusted EBITA compared to the prior

year, partially mitigated by lower cloud render costs. Advertising EBITA, despite a sharp drop in its

revenues linked to the pandemic, reached the same level as in 2019, showing the positive impact

of its transformation activities on its margin.

2021 so far seems to be witnessing a restart of activity in the VFX market. The work already secured

for 2021 is in line with our more successful years, pre-pandemic, as the expanding demand for

streaming content matches or exceeds the continuing robust tentpole market. Production Services

has been awarded numerous new projects, securing more than 75% of its expected 2021 sales

pipeline for Film & Episodic Visual Effects, and is in negotiations for several more. Confirmed

projects for 2021 include Disney’s live-action adaptations of ‘The Little Mermaid’ and ‘Pinocchio’,

and their recently announced ‘The Lion King’ prequel. Focus has been placed on achieving

framework agreements with the major Hollywood studios and significant streaming players, bringing

more predictability of revenues in the coming years, and establishing a presence in locations such

as Berlin so that we can service the need for development of local content.

• Management and strategic changes

o Technicolor recently announced the appointment of Christian Roberton as President of the

Production Services Business Division. His focus on technology, quality and creativity,

combined with cost efficiency, rigorous management and client orientation, will drive Production

Services to operate as a customer-focused, technology-driven and highly profitable global

studio.

o Christian has immediately implemented management changes, with the aim of bringing forward

creativity, business acumen, and efficiency skills within his executive committee. Josh Mandel

has become CEO of The Mill, and Andrea Miloro recently joined the Group to lead the Mikros

Animation brand. Our portfolio is being refocused on value-added VFX services, and Post

Production activities are no longer aligned with our strategic repositioning. As a consequence,

Second Half

Change HtH

Full Year

Change YoY

Production

Services

2019

2020

Reported

At

constant

rate

2019

2020

Reported

At constant

rate

In € million

Revenues

465

234

(49.6)%

(47.0)%

893

513

(42.5)%

(41.4)%

Adj. EBITDA

84

16

(80.9)%

(79.5)%

164

18

(88.8)%

(88.0)%

As a % of

revenues

+18.1%

+6.9%

+18.3%

+3.6%

Adj. EBITA

9

(27)

ns

ns

28

(78)

ns

ns

As a % of

revenues

+2.0%

(11.5)%

+3.1%

(15.3)%

7

Technicolor announced on January 14, that Streamland Media had agreed to purchase the

Technicolor Post business for €30 million. The sale, which is subject to customary closing

conditions, is expected to close during the first half of 2021.

o This move strengthens Technicolor’s ability to focus on and expand its flagship creative studios

(The Mill, MPC, Mr. X and Mikros Animation) specializing in CGI (including VFX and Animation),

which is in increasing demand across film, TV, advertising, gaming and live events.

• Successful transformation

To drive the transformation of Production Services into an efficient creative production platform through

a relentless focus on improving profitability and streamlining operations, the following actions have been

launched:

o Harmonization of technology infrastructure to eliminate inefficiencies from previously siloed

operations (e.g. optimizing storage and render farms across our data centers and brands);

o Centralization of R&D efforts to ensure more efficient use of resources (e.g. real time production

technology that will impact and benefit all Production Services businesses);

o Integration of our substantial talent pool in India under a “One India” model to service all brands,

optimize utilization, and generate efficiencies of scale. This transformation program will continue

throughout 2021.

• Business Highlights

o Film & Episodic Visual Effects: revenues were significantly lower year-on-year, mainly due to

the impact of the pandemic on live action film shoots and shifting release dates.

▪ VFX teams worked on approximately 25 theatrical films from the major studios,

including 2020 releases like The Call of the Wild (Fox), The New Mutants (Fox),

and Monster Hunter (Constantin Film/Sony); and highly anticipated 2021

releases like Cruella (Disney), Ghostbusters: Afterlife (Sony), Godzilla vs. Kong

(Legendary/Warner Bros.), Snake Eyes (Paramount), Top Gun: Maverick

(Paramount), and West Side Story (Amblin/Fox).

▪ And over 40 Episodic and/or Non-Theatrical (i.e. Streaming/OTT) projects,

including The Alienist: Angel of Darkness (Paramount/TNT), Da 5 Bloods

(Netflix), The Old Guard (Netflix), Raised by Wolves (Scott Free

Productions/HBO Max), and WandaVision (Marvel/Disney+).

▪ During the year, MPC Film won the Oscar

®

and BAFTA awards for visual effects

for its work on Sam Mendes’ 1917 (Universal); and Mr. X won an Emmy Award

for Outstanding Special Visual Effects in a Supporting Role for its work

on Vikings (MGM/History).

o Advertising: revenues were lower compared to the prior year due to the impact of Covid-19 on

client spend and live action production shoots, particularly during the second quarter.

▪ Technicolor’s Advertising businesses continued to receive numerous industry

accolades in 2020 - MPC won VFX Company of the Year at the Ad Age

Creativity Awards and two VES (Visual Effects Society) Awards for Hennessy

‘The Seven Worlds’, while The Mill was awarded Creative Production Agency

of the Year by More About Advertising.

▪ Other notable projects during the year include the Dua Lipa ‘Hallucinate’ music

video, Jeep ‘Groundhog Day’, Walmart ‘Famous Visitors’, Burberry ‘Festive’,

Chanel ‘N°5. Être Ce Qui Va Arriver’, PlayStation ‘The Last of Us Part II’, Lexus

8

International ‘Electrified’, EA Sports ‘FIFA 21’ reveal trailer, Epic Games ‘Unreal

For All Creators’, and HBO ‘Lovecraft Country: Sanctum’ - a three-part social

VR experience for the highly acclaimed series.

▪ At this year’s Super Bowl LV, The Mill and MPC worked on over 20

commercials, including those for Bud Light, Doritos, Michelob, Paramount,

Robinhood, Squarespace, Tide, and Uber Eats.

o Animation & Games: revenues were slightly higher versus prior year.

▪ Mikros delivered Paramount’s The SpongeBob Movie: Sponge on the Run in

2020, and is currently in production on three features, including Spin Master’s

PAW Patrol: The Movie and Paramount’s The Tiger’s Apprentice.

▪ In episodic animation, Technicolor continues to work on multiple projects for

clients including Disney, DreamWorks Animation, France Télévisions, M6,

Nickelodeon, TF1, and Wild Canary.

▪ Technicolor Games during the year completed its work on several AAA titles

like FIFA 21 (EA), NHL 21 (EA), Assassin’s Creed Valhalla (Ubisoft), Destiny 2

(Bungie), NBA 2K21 (2K), Call of Duty: Black Ops Cold War (Activision), and

Immortals Fenyx Rising (Ubisoft).

o Post Production: lower revenues compared to the prior year, driven primarily by the pandemic’s

impact on productions.

▪ Selected highlight feature film projects during 2020 include Minions: The Rise

of Gru (Illumination/Universal), The SpongeBob Movie: Sponge on the Run

(Paramount), West Side Story (Amblin/Fox), Borat Subsequent Moviefilm

(Amazon), and The Witches (HBO Max).

▪ Selected highlight episodic projects include Bridgerton (Netflix), His Dark

Materials (HBO/BBC), Gentleman Jack (HBO/BBC), Perry Mason (HBO),

American Gods (Starz), This Is Us (Fox/NBC), and The Good Lord Bird

(Showtime).

• Covid-19 situation update

o Following the major U.S. studios reaching an agreement in September with all the key

Hollywood unions, production activity began to accelerate during the fourth quarter of 2020.

Furthermore, a number of countries like Canada, France and the U.K. have launched and/or

extended pandemic-related support programs including wage subsidies and production

insurance/indemnity schemes that provide pandemic-related coverage.

o There continue to be production stoppages/delays as the latest waves of the pandemic

temporarily restrict production activity or limit international travel for talent and

crew. Nevertheless, as vaccinations continue to roll out globally, the industry is optimistic about

a steady return to normalcy during the back half of 2021.

o Overall, Production Services continues to observe an increasing level of bidding activity for

projects, particularly for streaming/OTT distribution in addition to large tentpole films targeting

to ramp-up production once Covid-19 vaccine distribution has reached a critical mass later in

the current year.

###

9

Second Half

Change HtH

Full Year

Change YoY

Connected

Home

2019

2020

Reported

At constant

rate

2019

2020

Reported

At constant

rate

In € million

Revenues

1,029

924

(10.2)%

(3.3)%

1,983

1,764

(11.0)%

(7.6)%

Adj. EBITDA

54

56

+3.7%

+13.8%

79

110

+39.5%

+46.7%

As a % of revenues

+5.2%

+6.0%

+4.0%

+6.2%

Adj. EBITA

40

21

(48.7)%

(41.2)%

23

41

+75.8%

+91.8%

As a % of revenues

+3.9%

+2.2%

+1.2%

+2.3%

• Connected Home revenues totaled €1,764 million in 2020, down (7.6)% year-on-year at constant

rate and (11.0)% at current rate. The division experienced demand slowdown and supply constraints

in Eurasia and Latin America, which were partially offset by increased demand from the North

American cable division. The division is maintaining its market leadership in the Broadband segment

and in the video Android based segment.

The division successfully completed the bulk of the transformation plan launched in 2018. Selective

investments in key customers, and a platform-based products approach focused on broadband and

Android TV segments, combined with strategic partnerships with key suppliers and aggressive

investment in process re-engineering, have generated a significant increase in the productivity and

competitiveness of Connected Home in the market place. Connected Home has improved its

margins and its market share over the last years, despite facing many market, industry and global

challenges.

We anticipate that, overall, demand will remain strong throughout 2021. However, the Covid global

pandemic has created distortions in our industry. World logistics were severely disrupted in recent

months, and they will remain difficult for some time to come. The semiconductor crisis which started

in the second half of 2020 will continue to impact 2021 supply. Connected Home will continue to

work with its partners and customers to minimize supply disruptions. Connected Home has been

awarded the next generation DOCSIS gateway for the leading cable operator in the US which will

reinforce our leading position with the top 6 cable operators in the US, and our global leadership in

the broadband segment in the coming years.

• Adjusted EBITDA amounted to €110 million in 2020, or 6.2% of revenue, up €37 million at constant

rate primarily linked to cost reduction initiatives implemented in 2020. Adjusted EBITA of €41 million

increased by €21 million compared to the prior year at constant rate. This positive evolution in

profitability is the result of the significant transformation plan launched 2 years ago.

• Business highlights

o North America: Revenues remained strong, driven by increased demand from cable customers

for upgrades to higher power broadband to support pandemic related remote work and

education activities. We expect this trend to continue into 2021 as customers plan for continued

CPE upgrades, as well as seeking to ensure supply continuity and manage anticipated supply

concerns due to Covid-related demand surges from other industries competing for

semiconductor supply.

o Latin America: The difficult macroeconomic situation in the region continued to drive demand

down, particularly in Brazil, due to Covid as well as buying power impacts resulting from currency

devaluation stemming from the drop in oil prices.

o Europe, Middle East & Africa: Sales were flat in the second half year-on-year, with strong growth

in the broadband segment (+20%) compensating for the decline in the market for video set top

10

boxes. Android TV remained stable year over year, with additional service providers adopting

this technology in the region and associated new wins. Logistics between Asia and Europe and

the first stages of the Brexit implementation have generated backlogs additional to the one

generated by the semiconductor market situation.

o Asia Pacific: Sales were highly impacted by lockdowns in the main countries served, with slow

recovery, mainly India and Australia, combined with semiconductor supply constraints. Video

demand remained weak over the period, while broadband started to recover with strong

projections for 2021. Android TV demonstrated strong growth (+25%) with a solid trend in the

Indian market.

The division continues to focus on selective investments in key customers, platform-based products and

partnerships that will lead to improved margins over the year.

Limited supply coupled with high demand for semiconductors is creating potential cost increases and

production constraints which could delay sales during the first half 2021. To address this, Technicolor

has engaged in commercial discussions in order to pass surcharges through to customers.

• Revenue Breakdown for Connected Home (at current rate)

Second Half

Full Year

In € million

2019

2020

% Change(*)

2019

2020

% Change (*)

Total revenues

1,029

924

(3.3)%

1,983

1,764

(7.6)%

By region

North America

467

515

+16.9%

865

980

+15.9%

Europe, Middle East and Africa

193

182

(0.3)%

453

336

(24.3)%

Latin America

145

95

(19.0)%

307

206

(22.7)%

Asia-Pacific

224

132

(38.0)%

357

242

(30.5)%

By product

Video

455

375

(10.9)%

830

693

(12.5)%

Broadband

575

549

+2.5%

1,152

1,071

(4.1)%

(*) Change at constant rate

• Covid-19 situation update

Connected Home has remained fully operational throughout the Covid crisis due to the early adoption

of a remote work model that successfully moved half of all employees off site to ensure key engineering

facilities remained safe and open.

The Covid-19 impact is now limited for its Asian-based manufacturing, but is still affecting capacity in

Latin America for manufacturing and back-end operations.

###

Second Half

Change HtH

Full Year

Change YoY

DVD Services

2019

2020

Reported

At

constant

rate

2019

2020

Reported

At constant

rate

In € million

Revenues

508

404

(20.5)%

(17.3)%

882

706

(20.0)%

(18.6)%

Adj. EBITDA

69

52

(24.8)%

(23.1)%

81

54

(33.6)%

(32.3)%

As a % of

revenues

+13.6%

+12.9%

+9.1%

+7.6%

Adj. EBITA

24

29

+20.9%

+19.0%

(6)

(0)

+95.0%

+94.1%

As a % of

revenues

+4.7%

+7.2%

(0.7)%

(0.0)%

• DVD Services revenues totaled €706 million in 2020, down (18.6)% at constant rate and (20.0)%

at current rate compared to 2019, due predominately to lower replication & packaging disc volumes

11

across all formats, and lower distribution activity as a result of the negative impact of Covid-19,

which exacerbated the structural decline trend. Total combined replication volumes reached 817.1

million discs in 2020, down (22.9)% year-on-year. However, this reduction was much lower than

originally anticipated as demand for back catalog grew to compensate somewhat for loss of revenue

from new film releases.

David Holliday, the newly appointed President of the DVD Services Business Division, has been

tasked with further in-depth transformation of the business, driving efficiencies across the worldwide

footprint, streamlining internal processes and centralizing cost management, while accelerating

revenue and profitability from non-disc activities.

• Adjusted EBITDA amounted to €54 million at current rate, or 7.6% of revenue, better than

expectations given stronger than anticipated disc volumes and the acceleration of cost saving

actions. The margin also includes the benefit of the positive impact from contracts renegotiated in

2019 and 2020. Lower depreciation & amortisation and renewal of contracts helped to deliver an

Adjusted EBITA at break even compared to a loss in 2019.

• Business Highlights

o Standard Definition DVD volumes were down (20)% in 2020 reflecting the lack of new release

content due to theater closures, but overall results were better than expected given the

continued aggressive studios and major retailers catalog promotional activity.

o Blu-ray

TM

volumes were down (27)% in 2020, heavily impacted by the lack of new release

content, and without as much mitigating benefit from catalog promotions.

o CD volumes were down (33)% year-on-year on a combination of expected structural declines

and Covid-19 retail impacts.

All formats showed an easing in the rate of decline in the fourth quarter with strong retail demand

activity during the holiday season, particularly in the games segment.

The Disney/Fox contract successfully closed, as did the Lionsgate contract. Paramount (PHE)

replication will expire in mid-2021 and will not be renewed; the effect of this will be mitigated by an

acceleration of DVD Services’ business transformation plans. Technicolor will continue to service

PHE for distribution services.

Second Half

Full Year

In million units

2019

2020

% Change

2019

2020

% Change

Total Combined Volumes

613.3

490.5

(20.0)%

1,059.1

817.1

(22.9)%

By Format

SD-DVD

402.6

340.1

(15.5)%

701.9

560.2

(20.2)%

Blu-ray™

181.3

129.2

(28.7)%

298.8

218.0

(27.1)%

CD

29.3

21.2

(27.6)%

58.4

38.9

(33.5)%

By Segment

Studio/Video

557.0

442.9

(20.5)%

959.4

740.6

(22.8)%

Games

20.5

21.2

+3.1%

29.7

27.5

(7.5)%

Music & Software

35.7

26.5

(25.9)%

70.0

49.0

(30.0)%

12

• Covid-19 situation update

o Theatrical new release activity was very limited in 2020 from March onwards due to the Covid-

19 outbreak, with many key title release dates pushed out into 2021, which in most cases

resulted in the home entertainment release being delayed as well, directly impacting DVD

Services revenue/volume activity.

o Most major retailers remained open during the pandemic, but the level of sales activity was

below normal, with some signs of improvement in the fourth quarter. Without new release

content, some retailers are continuing to allocate shelf space to catalog/library content

promotions, which should continue to support DVD replication volumes in 2021.

o Some production facilities experienced temporary staffing shortages, but the overall impact to

operations was low.

o The ongoing Covid-19 impact will be dependent on the extent and duration of ongoing

restrictions (driven by the rate of new Covid case growth). The specific timing and extent of the

reopening of movie theaters will impact the level of new disc release activity. DVD Services has

accelerated certain aspects of its future restructuring plans in an effort to adapt to these impacts.

###

Second Half

Change HtH

Full Year

Change YoY

Corporate &

Other

2019

2020

Reported

At

constant

rate

2019

2020

Reported

At constant

rate

In € million

Revenues

34

11

(68.1)%

(68.1)%

43

23

(45.6)%

(45.6)%

Adj. EBITDA

15

(9)

(162.4)%

(163.3)%

1

(14)

ns

ns

As a % of

revenues

+43.2%

(84.7)%

+3.5%

(61.1)%

Adj. EBITA

14

(11)

(180.5)%

(181.9)%

(2)

(18)

ns

ns

As a % of

revenues

+40.7%

(102.9)%

(5.0)%

(77.7)%

• Corporate & Other includes the Trademark Licensing business.

Corporate & Other recorded revenues of €23 million in 2020, decreasing compared to last year. In 2019,

the Group benefited from €20 million of retained patent licensing revenues versus only €5 million in

2020. Adjusted EBITDA amounted to €(14) million and Adjusted EBITA was €(18) million.

###

• Debt and leverage details

As part of the financial restructuring transaction completed in 2020, debt maturities have been extended

and new financings executed, reinforcing the Group’s liquidity.

13

In million currency

Currency

Nominal

Amount

IFRS

Amount

Type

of

rate

Nominal

rate

(1)

Repayment

Type

Final

maturity

Moodys

/ S&P

rating

New Money notes

EUR

350

363

Floati

ng

12.00%

(2)

Bullet

Jun. 30,

2024

Caa1/B

New Money Term

loans

USD

98

101

Floati

ng

12.34%

(3)

Bullet

Jun. 30,

2024

Caa1/B

Reinstated Term

Loans

EUR

453

372

Floati

ng

6.00%

(4)

Bullet

Dec. 31,

2024

Ca/CCC

Reinstated Term

Loans

USD

115

95

Floati

ng

6.03%

(5)

Bullet

Dec. 31,

2024

Ca/CCC

Subtotal

EUR

1,016

931

8.68%

Lease liabilities

(6)

Various

178

178

Fixed

7.94%

Accrued PIK Interest

EUR+USD

16

16

NA

0%

Accrued Interest

Various

16

16

NA

0%

Other Debt

Various

1

1

NA

0%

Total Gross Debt

1,227

1,142

8.34%

Cash & Cash

equivalents

Various

330

330

Total Net Debt

897

812

Covenant leverage

ratio

(7)

5.37

(1) Rates as of December 31, 2020.

(2) Cash interest of 6-month EURIBOR with a floor of 0% +6.00% and PIK interest of 6.00%.

(3) Cash interest of 6-month LIBOR with a floor of 0% +6.00% and PIK interest of 6.00%.

(4) Cash interest of 6-month EURIBOR with a floor of 0% + 3.00% and PIK interest of 3.00%.

(5) Cash interest of 6-month LIBOR with a floor of 0% + 2.75% and PIK interest of 3.00

(6) Of which €14 million are capital leases and €164 million is operating lease debt under IFRS 16

(7) Net debt using nominal value of financial debts divided by adjusted EBITDA, not tested as at December 31, 2020

14

Summary of consolidated results for 2020

Second Half

Full Year

In € million

2019

2020

Change

2019

2020

Change

Revenues from continuing operations

2,036

1,573

(22.7)%

3,800

3,006

(20.9)%

Change at constant currency (%)

(17.9)%

(18.5)%

o/w

Production Services

465

234

(49.6)%

893

513

(42.5)%

DVD Services

508

404

(20.5)%

882

706

(20.0)%

Connected Home

1,029

924

(10.2)%

1,983

1,764

(11.0)%

Corporate & Other

34

11

(68.1)%

43

23

(45.6)%

Adjusted EBITDA from continuing

operations

222

115

(48.3)%

324

167

(48.5)%

Change at constant currency (%)

(44.9)%

(46.0)%

As a % of revenues

+10.9%

+7.3%

(361)bps

+8.5%

+5.6%

(298)bps

o/w

Production Services

84

16

(80.9)%

164

18

(88.8)%

DVD Services

69

52

(24.8)%

81

54

(33.6)%

Connected Home

54

56

+3.7%

79

110

+39.5%

Corporate & Other

15

(9)

ns

1

(14)

ns

Adjusted EBITA from continuing

operations

87

11

(86.9)%

42

(56)

ns

Change at constant currency (%)

(85.8)%

ns

As a % of revenues

+4.3%

+0.7%

(356)bps

+1.1%

(1.9)%

(297)bps

Adjusted EBIT from continuing

operations

60

(7)

ns

(12)

(96)

ns

Change at constant currency (%)

ns

ns

As a % of revenues

+3.0%

(0.5)%

(345)bps

(0.3)%

(3.2)%

(289)bps

EBIT from continuing operations

(31)

(70)

ns

(121)

(264)

ns

Change at constant currency (%)

ns

ns

As a % of revenues

(1.5)%

(4.4)%

(292)bps

(3.2)%

(8.8)%

(561)bps

Financial result

(36)

144

-

(84)

77

-

Income tax

3

(2)

-

(3)

(5)

-

Share of profit/(loss) from associates

0

0

-

(1)

0

-

Profit/(loss) from continuing operations

(64)

72

-

(208)

(193)

-

Profit/(loss) from discontinued

operations

(26)

(14)

-

(22)

(15)

-

Net income

(90)

58

-

(230)

(207)

-

(*) Change at current rate

• Restructuring costs accounted for €(100) million at current rate, including €(27) million in Production

Services on cost streamlining actions, €(33) million in DVD Services, mainly resulting from

optimization of replication and distribution sites, €(31) million in Connected Home, pursuant to the

three-year transformation plan, and €(9) million for Corporate and Other.

• EBIT from continuing operations amounted to a loss of €(264) million in 2020.

15

• The financial result totaled €77 million in 2020 compared to €(84) million in 2019, reflecting:

o Net interest costs of €(78) million, slightly up from last year’s €(69) million, primarily due to the

interest rates on the bridge loan in place from March to July;

o Other financial income amounting to €155 million in 2020 compared to €(15) million in 2019,

mostly explained by a non-cash gain on the equity and debt initial valuations, in the application

of IFRS Standards following the financial restructuring process.

• Income tax amounted to €(5) million, compared to €(3) million in 2019.

• Group net income therefore amounted to a loss of €(207) million at current rate in 2020, compared

to the €(230) million loss in 2019.

16

Reconciliation of adjusted indicators (unaudited)

In addition to published results, and with the aim of providing a more comparable view of the evolution

of its operating performance in 2020 compared to 2019, Technicolor is presenting a set of adjusted

indicators which exclude the following items as per the statement of operations of the Group’s

consolidated financial statements:

• Net restructuring costs;

• Net impairment charges;

• Other income and expenses (other non-current items).

These adjustments, the reconciliation of which is detailed in the following table, amounted to an impact

on EBIT from continuing operations of €(168) million in 2020 compared to €(109) million in 2019

(including IFRS 16).

Full Year

In € million

2019

2020

Change(*)

EBIT from continuing operations

(121)

(264)

(144)

Restructuring charges, net

(31)

(100)

(69)

Net impairment losses on non-current operating

assets

(63)

(75)

(12)

Other income/(expense)

(15)

8

23

Adjusted EBIT from continuing operations

(12)

(96)

(84)

As a % of revenues

(0.3)%

(3.2)%

(289)bps

Depreciation and amortization (“D&A”) **

305

261

(44)

IT capacity use for rendering in Production S.

31

2

(29)

Adjusted EBITDA from continuing operations

324

167

(157)

As a % of revenues

8.5%

5.6%

(298)bps

(*) Variation at current rates

(**) including reserves (Risk, litigation and warranty reserves)

17

Free Cash Flow Reconciliation and Summarized Financial Structure (unaudited)

Technicolor defines “Free Cash Flow” as net cash from operating activities (continuing and discontinued)

plus proceeds from sales of property, plant and equipment (“PPE”) and intangible assets, minus

purchases of PPE and purchases of intangible assets including capitalization of development costs.

Full Year (IFRS)

In € million

Dec 31,

Dec 31,

2020

2019

Adjusted EBITDA from continuing operations

167

324

Changes in working capital and other assets and liabilities

(101)

(65)

IT capacity use for rendering in Production Services

(2)

(31)

Pension cash usage of the period

(30)

(26)

Restructuring provisions – cash usage of the period

(46)

(35)

Interest paid

(51)

(65)

Interest received

3

1

Income tax paid

(12)

(12)

Other items

(9)

(21)

Net operating cash generated from continuing activities

(81)

70

Purchases of property, plant and equipment (PPE)

(33)

(70)

Proceeds from sale of PPE and intangible assets

-

1

Purchases of intangible assets including capitalization

(75)

(99)

of development costs

Net operating cash used in discontinued activities

(18)

(11)

Free cash-flow

(207)

(111)

Nominal gross debt (including Lease debt)

1,227

1,302

Cash position

330

65

Net financial debt at nominal value (non IFRS)

897

1,237

IFRS adjustment

(85)

(4)

Net financial debt (IFRS)

812

1,233

• The change in working capital & other assets and liabilities was negative by €(101) million in 2020,

mostly driven by unfavorable changes in supplier payment terms at Connected Home and DVD

Services, and reduced milestone payments at Film & Episodic Visual Effects due to Covid-19.

• Cash outflow for restructuring totaled €46 million in 2020, up by €11 million year-on-year at current

rate, mainly resulting from accelerated implementation of cost savings.

• Capital expenditures amounted to €108 million, down by €61 million year-on-year at current rate,

reflecting a strict control of investment expense.

Cash position at end of 2020 was €330 million, compared to €65 million at the end of December 2019.

18

An analyst audio webcast hosted by Richard Moat, CEO and Laurent Carozzi, CFO will be held today,

11 March 2021 at 7:30pm CET.

Financial calendar

Q1 2021

May 11 2021

Annual General Meeting

May 12 2021

###

Warning: Forward Looking Statements

This press release contains certain statements that constitute "forward-looking statements", including

but not limited to statements that are predictions of or indicate future events, trends, plans or objectives,

based on certain assumptions or which do not directly relate to historical or current facts. Such forward-

looking statements are based on management's current expectations and beliefs and are subject to a

number of risks and uncertainties that could cause actual results to differ materially from the future

results expressed, forecasted or implied by such forward-looking statements. For a more complete list

and description of such risks and uncertainties, refer to Technicolor’s filings with the French Autorité des

marchés financiers

.###

Audited financial information

The auditors have performed their procedures on the consolidated financial statements. The audit report

will be issued after verification of the management report and the presentation of the format required by

the ESEF regulation on the financial statements intended to be included in the annual financial report.

###

About Technicolor:

www.technicolor.com

Technicolor shares are admitted to trading on the regulated market of Euronext Paris (TCH) and

are tradable in the form of American Depositary Receipts (ADR) in the United States on the

OTCQX market (TCLRY).

Investor Relations Media

Christophe le Mignan: +33 1 88 24 32 83 Stephanie Varlotta

Christophe.lemignan@technicolor.com Stephanie.varlotta@technicolor.com

Nathalie Feld : +33 1 53 70 94 23

19

CONSOLIDATED STATEMENT OF OPERATIONS

12 months ended December 31,

(€ in million)

2020

2019

CONTINUING OPERATIONS

Revenues

3,006

3,800

Cost of sales

(2,725)

(3,375)

Gross margin

281

425

Selling and administrative expenses

(284)

(323)

Research and development expenses

(94)

(114)

Restructuring costs

(100)

(31)

Net impairment gains (losses) on non-current operating assets

(75)

(63)

Other income (expense)

8

(15)

Earnings before Interest & Tax (EBIT) from continuing

operations

(264)

(121)

Interest income

4

1

Interest expense

(82)

(70)

Net gain on financial restructuring

158

-

Other financial income (expense)

(3)

(15)

Net financial income (expense)

77

(84)

Share of gain (loss) from associates

0

(1)

Income tax

(5)

(3)

Profit (loss) from continuing operations

(193)

(208)

DISCONTINUED OPERATIONS

Net gain (loss) from discontinued operations

(15)

(22)

Net income (loss)

(207)

(230)

Attribuable to:

- Equity holders

(207)

(230)

- Non-controlling interest

0

0

20

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(€ in million)

December

31, 2020

December 31,

2019

ASSETS

Goodwill

716

851

Intangible assets

535

632

Property, plant and equipment

140

191

Right-of-use assets

148

285

Other operating non-current assets

27

32

TOTAL OPERATING NON-CURRENT ASSETS

1,566

1,991

Non-consolidated investments

14

17

Other non-current financial assets

47

22

TOTAL FINANCIAL NON-CURRENT ASSETS

61

39

Investments in associates and joint-ventures

1

1

Deferred tax assets

45

52

TOTAL NON-CURRENT ASSETS

1,674

2,082

Inventories

195

243

Trade accounts and notes receivable

425

507

Contract assets

63

79

Other operating current assets

224

184

TOTAL OPERATING CURRENT ASSETS

907

1,013

Income tax receivable

14

36

Other financial current assets

17

13

Cash and cash equivalents

330

65

Assets classified as held for sale

76

-

TOTAL CURRENT ASSETS

1,344

1,127

TOTAL ASSETS

3,018

3,210

21

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(€ in million)

December

31, 2020

December

31, 2019

EQUITY AND LIABILITIES

Common stock (235,795,486 shares at December 31, 2020 with nominal value

of 0.01 euro per share)

2

414

Subordinated Perpetual Notes

500

500

Additional paid-in capital & reserves

126

(540)

Cumulative translation adjustment

(456)

(339)

Shareholders equity attributable to owners of the parent

173

36

Non-controlling interests

0

0

TOTAL EQUITY

173

36

Retirement benefits obligations

325

342

Provisions

33

30

Contract liabilities

2

3

Other operating non-current liabilities

21

25

TOTAL OPERATING NON-CURRENT LIABILITIES

381

400

Borrowings

948

979

Lease liabilities

122

224

Other non-current liabilities

-

1

Deferred tax liabilities

15

27

TOTAL NON-CURRENT LIABILITIES

1,466

1,631

Retirement benefits obligations

30

33

Provisions

90

70

Trade accounts and notes payable

710

825

Accrued employee expenses

142

134

Contract liabilities

41

40

Other current operating liabilities

215

302

TOTAL OPERATING CURRENT LIABILITIES

1,228

1,404

Borrowings

16

8

Lease liabilities

56

87

Income tax payable

21

41

Other current financial liabilities

2

2

Liabilities classified as held for sale

56

-

TOTAL CURRENT LIABILITIES

1,379

1,542

TOTAL LIABILITIES

2,845

3,173

TOTAL EQUITY & LIABILITIES

3,018

3,210

22

CONSOLIDATED STATEMENT OF CASH FLOWS

12 months ended

December 31,

(€ in million)

2020

2019

Net income (loss)

(207)

(230)

Income (loss) from discontinuing activities

(15)

(22)

Profit (loss) from continuing activities

(193)

(208)

Summary adjustments to reconcile profit from continuing activities to cash generated

from continuing operations

Depreciation and amortization

263

322

Impairment of assets

88

63

Net changes in provisions

16

(48)

Gain (loss) on asset disposals

(14)

17

Interest (income) and expense

78

69

Net gain on financial restructuring

(158)

-

Other items (including tax)

(2)

-

Changes in working capital and other assets and liabilities

(101)

(69)

Cash generated from continuing activities

(22)

146

Interest paid on lease debt

(19)

(21)

Interest paid

(32)

(44)

Interest received

3

1

Income tax paid

(12)

(12)

NET OPERATING CASH GENERATED FROM CONTINUING ACTIVITIES (I)

(81)

70

Acquisition of subsidiaries, associates and investments, net of cash acquired

(3)

(3)

Proceeds from sale of investments, net of cash

7

1

Purchases of property, plant and equipment (PPE)

(33)

(70)

Proceeds from sale of PPE and intangible assets

-

-

Purchases of intangible assets including capitalization of development costs

(75)

(99)

Cash collateral and security deposits granted to third parties

(35)

(6)

Cash collateral and security deposits reimbursed by third parties

1

5

NET INVESTING CASH USED IN CONTINUING ACTIVITIES (II)

(138)

(171)

Disposal of treasury shares

-

1

Increase of Capital

60

-

Proceeds from borrowings

760

1

Repayments of lease debt

(85)

(91)

Repayments of borrowings

(158)

(5)

Fees paid linked to the debt and capital operations

(60)

(1)

Other

5

4

NET FINANCING CASH USED IN CONTINUING ACTIVITIES (III)

522

(91)

NET CASH FROM DISCONTINUED ACTIVITIES (IV)

(23)

(33)

CASH AND CASH EQUIVALENTS AT THE BEGINING OF THE PERIOD

65

291

Net increase (decrease) in cash and cash equivalents (I+II+III+IV)

280

(226)

Exchange gains / (losses) on cash and cash equivalents

(16)

-

CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD

330

65