Accident & Health

Medicare Supplement Insurance Underwriting Guide

NGAH-MEDSUPP-UW-GUIDE 1/2021

For agent use only. Not for distribution to consumers.

National General Accident and Health markets products underwritten by National Health Insurance Company, Integon National Insurance Company, and Integon Indemnity Corporation.

NGAH-MEDSUPP-UW-GUIDE 1/2021 2

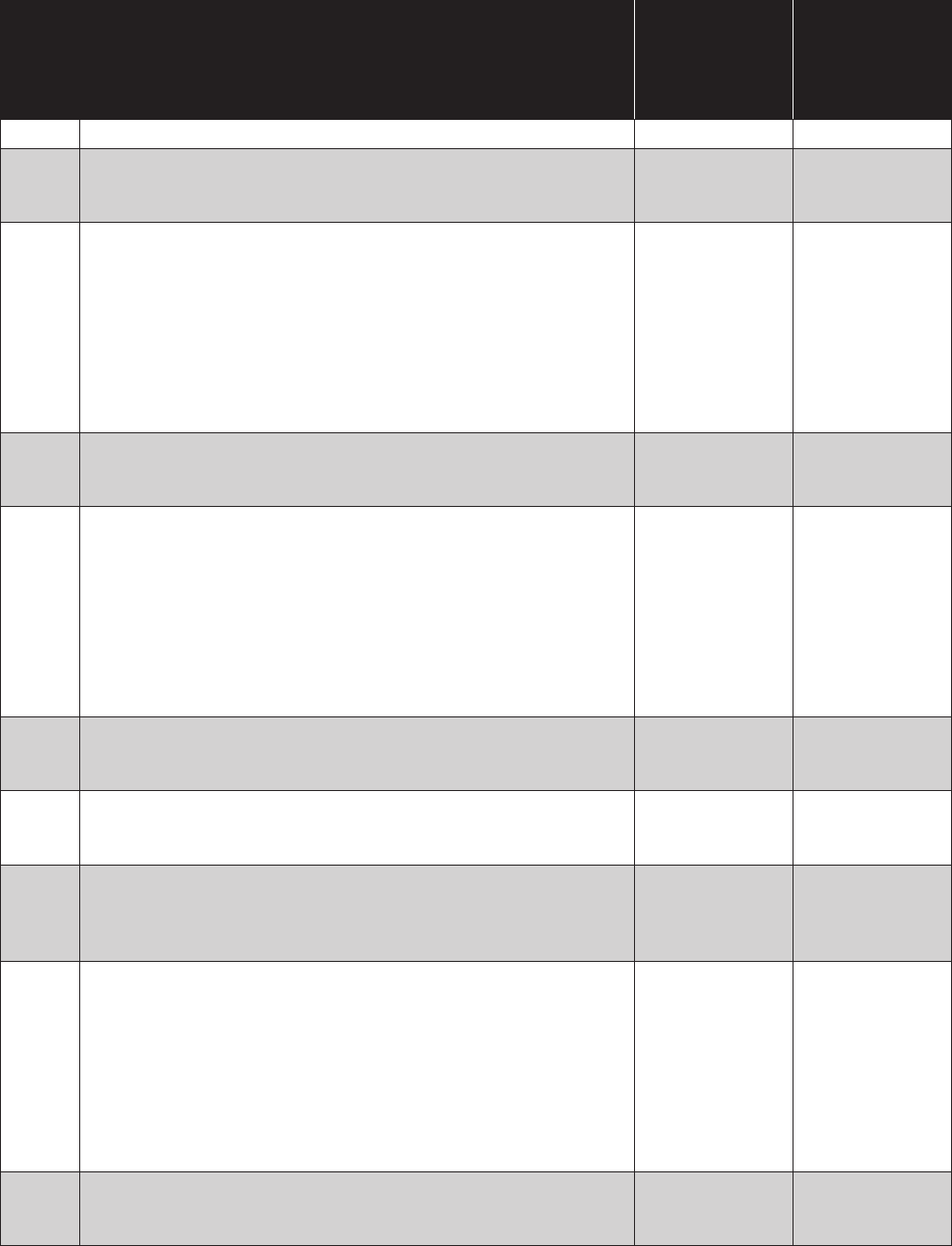

Table of Contents

Contacts ................................................................................................................................ 3

Hours of Operation ................................................................................................................ 3

Introduction ........................................................................................................................... 4

New Business Guidelines ...................................................................................................... 4

Eligibility Requirements ......................................................................................................... 4

Replacements ........................................................................................................................ 4

Open Enrollment Guidelines .................................................................................................. 5

Guaranteed Issue Guidelines ................................................................................................. 6

State Specific Guaranteed Issue Guidelines ......................................................................... 8

Medicare Advantage (MA) Guidelines ................................................................................. 15

Enrollment Guidelines ......................................................................................................... 15

Submitting the Application ................................................................................................... 16

Premium Payment ............................................................................................................... 18

Required Forms ................................................................................................................... 18

Agent Responsibilities ......................................................................................................... 19

Underwriting Concepts ....................................................................................................... 19

Underwriting Appeals .......................................................................................................... 20

Reinstatements ................................................................................................................... 20

Underwriting Guidelines ...................................................................................................... 21

Drug List Information ........................................................................................................... 24

NGAH-MEDSUPP-UW-GUIDE 1/2021 3

Contacts

Mailing & Contact Information for New Business and Delivery Receipts

New Business - Paper Applications

National General Accident & Health

PO Box 95464

Cleveland, OH 44101

Email (scanned applications): [email protected]

Phone: 888-966-2345

Hours of Operation: 7:00 AM to 4:00 PM CST

Underwriting/Home Office

National General Accident & Health

ATTN: Medicare Supplement Underwriting Department

1515 North Rivercenter Drive, Suite 135

Milwaukee, WI 53212

Email: [email protected]

Phone: 833-870-6133

Fax: 888-344-3232

Hours of Operation: 7:00 AM to 4:00 PM CST

Claims

National General

PO Box 17110

Winston-Salem, NC 27116

Phone: 833-976-2628

Hours of Operation: 7:00 AM to 4:00 PM CST

Policy Admin –

Policies issued prior to 1/1/2021

National General

PO Box 17110

Winston-Salem, NC 27116

Phone: 833-976-2628

Hours of Operation: 7:00 AM to 4:00 PM CST

Policy Admin –

Policies issued on or after 1/1/2021

National General Accident & Health

PO Box 1070

Winston-Salem, NC 27102-1070

Email: MemberSer[email protected]

Phone: 888-966-2345

Hours of Operation: 7:00 AM to 4:00 PM CST

General Correspondence

National General Accident & Health

PO Box 1070

Winston-Salem, NC 27102-1070

Email: MemberSer[email protected]

Phone: 888-966-2345

Hours of Operation: 7:00 AM to 4:00 PM CST

Agent Enrollment Portal:

EnrollNatGen.com

Agency Services Contracting or Product Training:

Phone: 833-408-5392

Hours of Operation: 8:00 AM to 4:00 PM CST

NGAH-MEDSUPP-UW-GUIDE 1/2021 4

Introduction

Thank you for partnering with National General Accident & Health for Individual Medicare Supplement

insurance. This document has been designed to help you understand the underwriting process and

guidelines used by National General Accident & Health when reviewing applications. This guide contains

a general overview of current medical underwriting guidelines and is subject to change at any time.

New Business Guidelines

Eligibility Requirements

Applicants are eligible to apply for Medicare

Supplement insurance if they:

• Are covered under Medicare Part A & B.

• Are 65 years of age or older.

• Are Medicare eligible due to disability in a

state requiring under age 65 coverage.

• Reside in any of the following states: AK, AL,

AR, AZ, CA, CO, DC, DE, FL, GA, IA, ID, IL,

IN, KS, KY, LA, MD, MI, MN, MO, MS, MT,

NC, ND, NE, NJ, NM, NV, OH, OK, OR, PA,

SC, SD, TN, TX, UT, VA, WI, WV, WY

New Business Guidelines

Applications must be submitted and received at

the home office within 30 days of the application

signature date. Once we receive the application,

it will be processed in the order in which it

was received. If there are any errors on the

application, you will be notified as they are found

and corrections will be requested. Any errors will

need to be fixed before a policy can be issued.

Effective Date

All applications must contain a requested

effective date. Effective dates must be after the

signature date of the application and is available

on the 1st through the 31st of the month.

The effective date is required when submitting an

application and must be equal to or greater than

the Medicare part B effective date, and after the

signature date of the application.

Open Enrollment:

• An application may be submitted up to 6

months prior to and 6 months following

the first day of the month of the applicant’s

65th birthday or up to 6 months prior to and

6 months following the date the applicant

becomes eligible for Medicare Part B. And;

• The coverage effective date must be on

or after the first day of the month of the

applicant’s 65th birthday.

Guaranteed Issue: An applicant applying under

guaranteed issue rights may request an effective

date up to 60 days beyond the application date.

Underwritten: An applicant applying outside of

open enrollment may request an effective date up

to 60 days beyond the application date.

Plan Selection: Refer to the state specific

application for availability.

Replacements

A replacement takes place when an applicant

is terminating existing Medicare Supplement or

Medicare Advantage insurance and replacing it

with new Medicare Supplement insurance.

National General Accident & Health requires a

fully completed application when applying for a

replacement policy; all replacements involving

Medicare Supplement, Medicare Select or

Medicare Advantage insurance MUST include a

completed Replacement Notice.

MACRA

The Medicare Access and CHIP Reauthorization Act

of 2015 (MACRA) is a Federal law that was passed

on April 16th, 2015. This law changed the available

Medicare supplement plans for those who become

newly eligible for Medicare on or after January 1,

2020. MACRA requires that Medicare supplement

plans that cover the Medicare Part B deductible cannot

be available to those who become newly eligible

for Medicare on or after January 1, 2020. Those

who become newly eligible for Medicare on or after

January 1, 2020 may not be issued a policy for Plans

C, F, or HDF. However, these plans may be available to

anyone eligible on or before December 31, 2019.

NGAH-MEDSUPP-UW-GUIDE 1/2021 5

Open Enrollment Guidelines

Applicants who purchase Medicare Supplement insurance during an Open Enrollment period are not

required to provide any health history information.

An Open Enrollment period is available for applicants who are:

• Within 6 months of turning age 65 and enrolling in Medicare Part B.

• Within 6 months of first enrolling in Medicare Part B.

• Now age 65, previously qualified for Medicare due to disability and enrolled in Medicare Part B, now

eligible for a second enrollment period.

During this period, National General Accident & Health cannot deny insurance coverage, place

conditions on a policy or charge a higher premium due to past medical conditions.

Open Enrollment Guidelines for Applicants Under Age 65

Some states require that Medicare Supplement Open Enrollment be offered to individuals under age

65 due to disability. Refer to the chart below for details on availability. If a state is not listed, applicants

under age 65 are not accepted in that state.

Under

65 Open

Enrollment

Plans: Medicare eligible on 01/01/2020 or after

(Post MACRA)

Plans: Medicare eligible before

01/01/2020 (Pre MACRA)

A B C D F G HDG K L M N A B C D F HDF G N

CA, CO, DE, FL,

GA, ID, IL, KS,

LA, MS, MO ,

MT, OR, SD, TN

√ √ √ √ √ √ √ √

PA

√ √ √ √ √ √ √ √ √ √

KY

√ √ √ √ √ √

NC

√ √ √

AR, MD, OK, TX

√ √

MI

√ √ √

NJ

√ √ √

NJ exception: Applicant must be age 50-64 as of the policy effective date to apply

KY: Application must be underwritten

Under 65 Open

Enrollment

Medicare eligible on 01/01/2020 or after

(Post MACRA)

Medicare eligible before 01/01/2020

(Pre MACRA)

Plans Basic

Extended

Basic

High

Deductible

Co-Pay Basic

Extended

Basic

High

Deductible

Co-Pay

MN

√ √ √ √ √ √ √ √

Optional Riders

Medicare Part A

Deductible

√ √

Medicare Part B

Excess Charges

√ √

Preventative Care

√ √

Medicare Part B

Deductible

√

MN: Applicant must be within 6 months of their Medicare Part B enrollment

NGAH-MEDSUPP-UW-GUIDE 1/2021 6

Under 65 Open

Enrollment

Medicare eligible on 01/01/2020 or after

(Post MACRA)

Medicare eligible before 01/01/2020

(Pre MACRA)

Plans Basic Basic

WI

√ √

Optional Riders

Medicare Part A

Deductible

√ √

Medicare Part B

Excess Charges

√ √

Home Heatlh Care

√ √

Foreign Travel Emergency

√ √

Medicare Part B

Deductible

√

Guaranteed Issue Guidelines

Medicare Supplement insurance has guidelines in place that allow qualified applicants to enroll in

certain plans without being medically underwritten.

An applicant who is age 65 or older may be eligible for guaranteed issue of Medicare Supplement

insurance upon the occurrence of certain events that cause the applicant to lose their existing

insurance coverage.

Certain documentation is required to be submitted for applicant’s applying for guaranteed issue.

Coverage will not be issued as guaranteed issue until the required documents are received.

Guaranteed issue rules and circumstances are complicated and can be difficult to comprehend.

Guaranteed issue scenarios and plan selection may also vary from state to state. Please reference the

guaranteed issue section of the application for state specific variations or contact our Underwriting

Department for assistance when submitting guaranteed issue business. The information below is a

summary to help you begin in identifying the federal and state guaranteed issue rules, but does

not represent the complete wording of the mandate.

To assist you in understanding the rules, we have provided a chart outlining the guaranteed issue

events and what type of proof needs to be submitted with the application when your client is applying

for guaranteed issue. Refer to the following tables regarding Federal Guidelines and State

Specific Guidelines for Guaranteed Issue.

Guaranteed issue proof should be sent to [email protected] and we strongly encourage it be

sent in an encrypted format. Indicate the following in body of email: applicant name, date of birth, and

residence ZIP code.

NGAH-MEDSUPP-UW-GUIDE 1/2021 7

Federal Guaranteed Issue Guidelines

Federal Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule Required Documentation

The applicant enrolled in a Medicare

Advantage plan, Medicare Select plan or

in a program of All-Inclusive Care of the

Elderly (PACE) and the plan is terminated, is

no longer providing service in their area or

the applicant moved out of the area.

If the previous carrier terminated or

discontinued the plan:

• Letter from prior carrier that contains

reason for the discontinuation/

termination and the term date.

The applicant moved out of the provider’s

service area:

• Termination letter from prior carrier

showing termination date and

verification of address change.

A

G

N (CA, MO only)

A

C (MI, NJ only)

F

HDF (High Deductible F)

N (CA, MO only)

The applicant enrolled under an employee

welfare benefit plan that provides benefits

that supplement Medicare (such as COBRA,

retiree, etc.) and that plan terminates or

ceases to provide all such supplement

benefits.

Submit a notice of termination or

explanation of benefits for a claim denied

due to a termination, and:

If the applicant had a retiree plan, submit

one of the following:

1. Termination letter showing it is a

retiree plan;

2. Benefit booklet pages showing it is a

retiree plan; or

3. Explanation of benefits showing

Medicare paid primary.

If the applicant had a COBRA plan, submit

an election notice or COBRA bill.

If the applicant had a group plan secondary

to Medicare, submit an explanation of

benefits showing Medicare paid primary.

A

G

A

C (MI, NJ only)

F

HDF (High Deductible F)

Medicare Supplement insurance terminated

because the insurer became insolvent or

bankrupt.

Letter from provider or Insurance

Commissioner showing termination date.

A

G

N (CA, MO, OR only)

A

C (MI, NJ only)

HDF (High Deductible F)

N (CA, MO, OR only)

The Medicare Supplement, Medicare

Advantage or PACE insurer violated a

material provision of the policy or the

agent materially misrepresented the plan’s

provisions in marketing the plan.

Agent Misrepresentation:

• Letter from the carrier showing

termination date and reason.

Leaving an MA Plan:

• Letter from CMS acknowledging

misrepresentation.

Leaving a Medicare Supplement:

• Letter from the DOI acknowledging

misrepresentation and disenrollment.

A

G

N (CA, MO, OR only)

A

C (MI, NJ only)

F

HDF (High Deductible F)

N (CA, MO, OR only)

NGAH-MEDSUPP-UW-GUIDE 1/2021 8

Federal Guaranteed Issue Guidelines (continued)

Federal Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule Required Documentation

The applicant terminated their National

General Accident & Health Medicare

Supplement insurance, enrolled in a

Medicare Advantage plan, and then

voluntarily disenrolled within the first 12

months of enrolling.

Note: the applicant may enroll in the

National General Accident & Health

Medicare Supplement plan they were

previously on.

Letter from the prior Medicare Advantage

carrier showing termination date.

A

G

N (CA, MO, OR only)

A

C (MI, NJ only)

F

HDF (High Deductible F)

N (CA, MO, OR only)

The applicant joined a Medicare Advantage

or PACE plan when they were first eligible

for Medicare and disenrolled within the first

12 months

Letter from prior carrier showing

termination date.

A

G

N

A

C (MI, NJ only)

F

HDF (High Deductible F)

N

Enrolled in a Medicare Part D plan during

the initial Part D enrollment period while

enrolled under a Medicare Supplement

policy that covers outpatient prescription

drugs and terminates the Medicare

Supplement policy.

Letter from prior carrier showing

termination date.

A

G

N (CA, MO only)

A

C (MI, NJ only)

F

HDF (High Deductible F)

N (CA, MO only)

Other guarantee issue rights available

under State law - refer to chart below

Letter from prior carrier showing

termination date.

A

G

N

A

C (MI, NJ only)

F

HDF

G (CA* only)

N

*CA: If birthday rule, can select only the same plan as currently in force or one with lesser benefits.

State Specific Guaranteed Issue Guidelines

State Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule

OR Birthday rule - can select the same plan as currently in force or one with lesser

benefits.

A

G

N

A

F

HDF (High Deductible F)

G

N

NGAH-MEDSUPP-UW-GUIDE 1/2021 9

State Specific Guaranteed Issue Guidelines (continued)

State Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule

CA Birthday rule - can select the same plan as currently in force or one with lesser

benefits.

A

G

N

A

F

HDF (High Deductible F)

G

N

CO Currently enrolled in both Medicare and Medicaid, loses eligibility for health

benefits under Title XIX of SS Act (Medicaid)

A

G

A

F

HDF (High Deductible F)

KS Loses eligibility for health benefits under title XIX of the SS Act (Medicaid) A

G

N

A

F

HDF (High Deductible F)

N

MO Terminates Medicare supp coverage within 30 days of the annual policy

anniversary - can select the same plan as currently in force.

A

G

N

A

F

HDF (High Deductible F)

G

N

NC Eligible for Medicare Part B due to disability before the age of 65 and

enrolled in Medicare Advantage plan which is terminated due to cancellation,

nonrenewal or disenrollment from the plan

A A

CA Enrolled in Medicare Advantage and premiums or copayments increase by

15% or more, benefits are reduced or provider contract terminated

A

G

N

A

F

HDF (High Deductible F)

N

NE Enrolled in a Medicare Advantage plan and the organization’s certification or

plan is terminated. Refer to the mandate for specific criteria

A

G

A

F

HDF (High Deductible F)

CO Enrolled in a Medicare Advantage plan and the organization’s certification or

plan is terminated. Refer to the mandate for additional criteria

A

G

A

F

HDF (High Deductible F)

NC Enrolled in Medicare Advantage plan, enrolled with a Program of all-Inclusive

Care for the Elderly, and the organization’s certification or plan is terminated.

Refer to the mandate for additional criteria

A

G

A

F

HDF (High Deductible F)

OR Enrolled in Medicare Advantage plan, the individual is 65 year of age or

older and enrolled with a Program of all-Inclusive Care for the Elderly and the

organization’s certification or plan is terminated. Refer to the mandate for

additional criteria

A

G

N

A

F

HDF (High Deductible F)

N

NC Enrolled in Medicare Part D while enrolled under a Medicare Supplement

policy that covers outpatient prescription drugs and terminates the Medicare

supplement policy

A

G

A

F

HDF (High Deductible F)

OR Enrolled in Medicare Part D while enrolled under a Medicare Supplement

policy that covers outpatient prescription drugs and terminates the Medicare

supplement policy

A

G

N

A

F

HDF (High Deductible F)

N

NGAH-MEDSUPP-UW-GUIDE 1/2021 10

State Specific Guaranteed Issue Guidelines (continued)

State Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule

CO Enrolled in Medicare Part D while enrolled under a medicare Supplement

policy that covers outpatient prescription drugs and terminates the Medicare

supplement policy

A

G

A

F

HDF (High Deductible F)

WI Enrolled in Medicare Part D while enrolled under a medicare Supplement

policy that covers outpatient prescription drugs and terminates the Medicare

supplement policy

Basic plan +

riders:

Part A Deductible,

Part B Excess

Charges, Home

Health Care, Foreign

Travel Emergency,

Part B Copayment

Basic plan +

riders:

Part A Deductible,

Part B Deductible,

Part B Excess

Charges, Home

Health Care, Foreign

Travel Emergency,

Part B Copayment

KY Enrolled in a Medicare risk contract, healthcare prepayment plan, cost contract

or Medicare Select plan and the organization’s certification is terminated

A

G

A

F

HDF (High Deductible F)

MN Enrolled in a Medicare Supplement policy and coverage discontinues due to

insolvency, or other involuntary termination of coverage

Basic, Extended

Basic, High

Deductible, Copay

Plans + riders:

Part A Deductible,

Part B Excess

Charges,

Preventative Care

Basic, Extended

Basic, High

Deductible, Copay

Plans + riders:

Part A Deductible,

Part B Deductible,

Part B Excess

Charges,

Preventative Care

NC Enrolled in a Medicare Supplement policy and coverage discontinues due to

insolvency, substantial violation of a material policy provision, or material

misrepresentation

A

G

A

F

HDF (High Deductible F)

MT Enrolled in a Medicare Supplement policy and coverage discontinues due to

insolvency, substantial violation of a material policy provision, or material

misrepresentation, or the agent materially misrepresented the policy

A

G

A

F

HDF (High Deductible F)

NC Enrolled under a Medicare Supplement policy, terminates and enrolls for first

time in Medicare Advantage, etc. Then terminates coverage within 12 months

of enrollment. Eligible for same plan that was terminated. If not available, can

select alternate plan.

A

G

A

F

HDF (High Deductible F)

MN Enrolled under a Medicare Supplement policy, terminates and enrolls for first

time in Medicare Advantage, etc. Then terminates coverage within 12 months

of enrollment

Basic, Extended

Basic, High

Deductible, Copay

Plans + riders:

Part A Deductible,

Part B Excess

Charges,

Preventative Care

Basic, Extended

Basic, High

Deductible, Copay

Plans + riders:

Part A Deductible,

Part B Deductible,

Part B Excess

Charges,

Preventative Care

SD Enrolled under an employee welfare benefit plan or an employer based health

insurance plan and the coverage under the plan terminates for that person

A

G

A

F

HDF (High Deductible F)

NGAH-MEDSUPP-UW-GUIDE 1/2021 11

State Specific Guaranteed Issue Guidelines (continued)

State Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule

IN Enrolled under an employee welfare benefit plan that either (1) provides health

benefits supplementing Medicare; and the plan terminates or reduces benefits;

or (2) is primary to Medicare and the plan terminates; or ceases to provide

health benefits

A

G

A

F

HDF (High Deductible F)

CO Enrolled under an employee welfare benefit plan that either (1) provides health

benefits supplementing Medicare; and the plan terminates or reduces benefits;

or (2) is primary to Medicare and the plan terminates; or ceases to provide

health benefits

A

G

A

F

HDF (High Deductible F)

IL Enrolled under an employee welfare benefit plan that either (1) supplements

Medicare; and the plan terminates or reduces benefits; or (2) is primary to

Medicare and the plan terminates or ceases to provide health benefits because

the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

OH Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

TX Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

CA Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare, and the plan terminates or reduces benefits

including Medicare part B 20% coinsurance for services

A

G

N

A

F

HDF (High Deductible F)

N

NC Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare, and the plan terminates or reduces benefits

A

G

A

F

HDF (High Deductible F)

AK Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

WI Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

Basic plan +

riders:

Part A Deductible,

Part B Excess

Charges, Home

Health Care, Foreign

Travel Emergency,

Part B Copayment

Basic plan +

riders:

Part A Deductible,

Part B Deductible,

Part B Excess

Charges, Home

Health Care, Foreign

Travel Emergency,

Part B Copayment

MO Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare, and the plan terminates or reduces benefits, or the

individual leaves the plan

A

G

N

A

F

HDF (High Deductible F)

N

NE Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare, and the plan terminates or reduces benefits; or

enrolled due to current employment providing benefits secondary to Medicare

and individual loses eligibility for coverage

A

G

A

F

HDF (High Deductible F)

NGAH-MEDSUPP-UW-GUIDE 1/2021 12

State Specific Guaranteed Issue Guidelines (continued)

State Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule

LA Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary/secondary to Medicare, and the plan

terminates or reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

PA Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

NJ Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

AR Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

MT Enrolled under an employee welfare benefit plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

A

F

HDF (High Deductible F)

OR Enrolled under an employee welfare benefit plan, an individual, conversion, or

portability health benefit plan, or state Medicaid plan providing health benefits

supplementing Medicare or is primary to Medicare, and the plan terminates or

reduces benefits, or the individual leaves the plan

A

G

N

A

F

HDF (High Deductible F)

N

TN Enrolled under Title XIX of the SS Act (Medicaid) and enrollment involuntarily

ceases after the individual is 65 and eligible/enrolled in Medicare Part B

A

G

N

A

F

HDF (High Deductible F)

N

MT Eligible for benefits under Medicare Part A and B by reason of disability A

G

N

A

F

HDF (High Deductible F)

N

MD Under 65 and qualified for Medicare due to a disability A A

WI Eligible for benefits under Medicare Parts A and B and covered under the

medical assistance program and then loses eligibility in the medical assistance

program

Basic plan +

riders:

Part A Deductible,

Part B Excess

Charges, Home

Health Care, Foreign

Travel Emergency,

Part B Copayment

Basic plan +

riders:

Part A Deductible,

Part B Deductible,

Part B Excess

Charges, Home

Health Care, Foreign

Travel Emergency,

Part B Copayment

TX Loses eligibility for health benefits under Title XIX of the SS Act (Medicaid) A

G

A

F

HDF (High Deductible F)

WY Postponed enrollment in Medicare Part B until after 65 because working and

enrolled in a group health insurance plan

A

G

A

F

HDF (High Deductible F)

NGAH-MEDSUPP-UW-GUIDE 1/2021 13

Guaranteed Issue Guidelines (continued)

State Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule

UT Involuntarily terminated from health benefits from Title XIX of the SS Act

(Medicaid)

A

G

N

A

F

HDF (High Deductible F)

N

SD Age 65, enrolled in a Medicare risk contract, or similar organization and the

plan is terminated

A

G

A

F

HDF (High Deductible F)

NC Age 65, enrolled in a Medicare risk contract, or similar organization and the

plan is terminated

A

G

A

F

HDF (High Deductible F)

PA Eligible for Part A and enrolled in Part B, if eligible, enrolls in a Medicare

Advantage then disenrolls within 12 months

A

G

A

F

HDF (High Deductible F)

OH Eligible for Part A at 65, enrolls in a Medicare Advantage then disenrolls

within 12 months

A

G

A

F

HDF (High Deductible F)

MD Eligible for Part A at 65, enrolls in a Medicare Advantage then disenrolls

within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

SD Age 65, enrolled in a Medicare Advantage plan and the organization’s

certification or plan is terminated

A

G

A

F

HDF (High Deductible F)

NC Eligible for Part A at 65, enrolls in a Medicare Advantage then disenrolls

within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

CO Eligible for Part A, enrolls in a Medicare Advantage then disenrolls within 12

months

A

G

A

F

HDF (High Deductible F)

OR Eligible for Part A, enrolls in a Medicare Advantage then disenrolls within 12

months

A

G

N

A

F

HDF (High Deductible F)

N

OK Eligible for Part A at 65, enrolls in a Medicare Advantage then disenrolls

within 12 months; or under 65, eligible for Medicare part B, enrolls in

Medicare Advantage and disenrolls within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

IA Enrolled in Medicare Part B, enrolls in a Medicare Advantage and disenrolls

within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

KS Enrolled in Medicare Part B, enrolls in a Medicare Advantage and disenrolls

within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

NGAH-MEDSUPP-UW-GUIDE 1/2021 14

Guaranteed Issue Guidelines (continued)

State Guidelines

Plans: Medicare

eligible on

01/01/2020 or

after

(Post MACRA)

Plans: Medicare

eligible before

01/01/2020

(Pre MACRA)

Rule

IL Enrolled in Medicare Part B, enrolls in a Medicare Advantage and disenrolls

within 12 months

A

G

A

F

HDF (High Deductible F)

IN Enrolled in Medicare Part B, enrolls in a Medicare Advantage and disenrolls

within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

MT Eligible for Medicare Part A and B, enrolled in qualified medicare beneficiary

Program and no longer qualifies due to income or eligibility

A

G

N

A

F

HDF (High Deductible F)

N

MN Eligible for Part A, enrolls in a Medicare Advantage then disenrolls within 12

months

Basic, Extended

Basic, High

Deductible, Copay

Plans + riders:

Part A Deductible,

Part B Excess

Charges,

Preventative Care

Basic, Extended

Basic, High

Deductible, Copay

Plans + riders:

Part A Deductible,

Part B Deductible,

Part B Excess

Charges,

Preventative Care

ID Eligible for Part A, enrolls in a Medicare Advantage then disenrolls within 12

months

A

G

N

A

F

HDF (High Deductible F)

N

AK Enrolled in Medicare part B at age 65 or older, enrolls in a Medicare Advantage

and disenrolls within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

LA Enrolled in Medicare part B, enrolls in a Medicare Advantage and disenrolls

within 12 months

A

G

N

A

F

HDF (High Deductible F)

N

TX Enrolled in Medicare part B at age 65 or older, enrolls in a Medicare Advantage

and disenrolls within 12 months

A

G

A

F

HDF (High Deductible F)

NGAH-MEDSUPP-UW-GUIDE 1/2021 15

Medicare Advantage (MA) Guidelines

Medicare Advantage Disenrollment

If applying for Medicare Supplement insurance, there are certain requirements that must be met when

the applicant is disenrolling from a Medicare Advantage plan. Underwriting cannot issue a policy unless

the specified requirements are met. Refer to the following guidelines to determine what requirements

must be satisfied.

Disenrolling during AEP/MADP Disenrolling outside of AEP/MADP

• Complete Medicare and Insurance information section on the

application

• Complete a replacement form (NRN-2017)

• Complete Medicare and Insurance information section on the

application

• Provide the home office with a copy of the applicant’s MA

disenrollment notice

• Complete a replacement form (NRN-2017)

National General Accident & Health is not able to issue a policy until the applicant’s disenrollment letter

has been received in the home office; it must be received within 30 days of the application or the policy

will be canceled.

For any further questions regarding MA disenrollment eligibility, contact the State Health Insurance

Assistance Program (SHIP) office or call 1-800-Medicare, as each situation presents its own unique set

of circumstances.

Enrollment Guidelines

Premium

When calculating the premium, utilize the outline of coverage. Age is calculated based on the

requested policy effective date. Premium is calculated based on the application date.

Risk Classes

There are two separate underwriting risk classes: Preferred and Standard. Each risk class has a

separate premium rate. See table below.

Preferred Standard

Qualify for Coverage; Qualify for Coverage;

Fall Within Preferred HT/WT Standards Fall Outside of Preferred HT/WT Standards

AND AND/OR

No Tobacco or Nicotine Use* Use Tobacco or Nicotine Products*

*Use of tobacco or nicotine in any form is considered tobacco use (examples: nicotine patch or gum,

electronic cigarettes). This rate can be applied for applicants during open enrollment or for those who

qualify for guarantee issue in certain states.

NGAH-MEDSUPP-UW-GUIDE 1/2021 16

Standard rates DO NOT apply during Open Enrollment or guaranteed issue in the following

states:

Arkansas, California, Colorado, District of Columbia, Illinois, Iowa, Kentucky, Louisiana, Michigan, North

Carolina, North Dakota, New Jersey, New Mexico, Ohio, Pennsylvania, Tennessee, Utah, Virginia, and

Wisconsin.

Policy Discount

National General Accident & Health offers a discount for individuals that meet the necessary

qualifications. See the chart below for details.

States Discount

AK, AL, AR, AZ, CA, CO, DE, DC,

GA, IA, LA, KS, KY, MD, MI, MO,

MS, MT, NC, ND, NM, NE, NV,

OH, OR, SC, SD, TN, TX, UT, VA,

WI, WV, WY

A 7 % discount is available to applicants who for the past 12 months have resided with at least

one, but no more than three, other adults who are age 50 or older. If living with another adult who

is their legal spouse, domestic partner, or in a Civil Union Partnership we will waive the one-year

requirement.

IL, NJ, OK, A 7% discount is available to applicants who for the past 12 months have resided with at least one

but no more than three, other adults who are age 50 or older and also have an active National General

Accident & Health Medicare Supplement insurance policy. If living with another adult who is the legal

spouse, domestic partner, or in a Civil Union Partnership, we will waive the one-year requirement.

PA A 7% household discount is available if the applicant is at least 65 at the time of the requested

effective date and meets the following criteria: married and residing with their spouse; or, must have

resided for the past 12 months in the same household with an individual who has either been issued

or is applying for a National Health Insurance Company policy.

ID, MN No discount available

FL 3% discount is available to applicants if they reside with their spouse who owns or is issued a

Medicare Supplement policy written by National Health Insurance Company.

IN A 7% discount is available to applicants whose spouse have or are applying for National General

Accident & Health Medicare Supplement insurance.

A 7% discount must be applied for applicants who qualify for Open Enrollment and Guarantee Issue.

Submitting the Application

National General Accident & Health offers two methods for submitting and completing applications:

• Web Application

• Paper Application

Each application has its own guidelines to follow when submitting for coverage.

Web Application (i.e. Electronic Application or eApp)

The Web Application is a digital form to be filled out and submitted through the agent portal.

NGAH-MEDSUPP-UW-GUIDE 1/2021 17

In order to complete an application using the Web Application Process:

1. Pre-qualify the applicant based on the Medical Questions (not required if the applicant is applying

under Open Enrollment or Guaranteed Issue).

2. Review the application with the applicant; you MUST read the required statements in the Disclosure

Section. If the client has not been read these statements, the application cannot be submitted.

3. Log on to the agent portal at EnrollNatGen.com

4. Begin the application on the “Quick Quote” screen. Complete the application in full.

5. Once you have completed the application you will have the option to select the signature option:

a. eSignature

b. Voice Signature

6. Once the application has been completed, you will be notified of the decision via email.

For fully underwritten applications, an underwriter will be assigned to the case and may contact your

applicant to complete the medical risk assessment if necessary.

Once the application has been completed, you will be notified of the decision via email or you may

contact the Underwriting Department for a point-of-sale decision.

Paper Application

To submit an application using the Paper Application Process:

1. Pre-qualify the applicant based on the Health Information questions on the application. (Not

required if the applicant is applying under Open Enrollment or Guaranteed Issue).

2. Complete the entire application.

3. Complete the Health Information Authorization – (N-HHA-MS).

4. If the applicant is replacing coverage: complete the Replacement Notice (NRN- 2017).

5. If the applicant is applying during Guaranteed Issue: Complete the Definition of Eligible Person for

Guaranteed Issue form (GI-MS).

Additional state specific form requirements: KY Comparison Statement*, IL Policy Checklist*, FL Certification, OH Agent Medicare

Supplement Insurance Solicitation Disclosure, LA Your Rights Regarding the Release and Use of Genetic Information**

*required if replacing coverage

**must be provided at point of sale, but signature is not required

Once the application has been completed, you can mail the application and initial premium to:

National General Accident and Health

PO Box 95464

Cleveland, OH 44101

Initial premium via Electronic Funds Transfer should also be sent to the address listed above.

The completed application can also be emailed to National General Accident & Health Medicare

Supplement Department at [email protected]

Any application dated outside 30 days from the date the application is received at the National General

Accident & Health home office will be returned.

In order to accelerate the application process, verify that the application has been completed in full. Try

to be as detailed as possible when filling out an application. This will assist in expediting the process.

Producer Checklist for Paper Applications

F Application is completely filled out.

F All Medical Questions have been answered

(only required if application is underwritten).

F Disclosure, Acknowledgements, and Agreement

signed and dated.

F Agent statement completed, signed, and dated.

F HIPAA statement (N-HHA-MS) signed and dated.

F Replacement Notice (NRN- 2017) completed

and signed (if necessary).

F Definition of Eligible Person for Guaranteed

Issue (GI-MS) completed (if necessary).

F State Specific Forms (if applicable).

NGAH-MEDSUPP-UW-GUIDE 1/2021 18

Application Signatures

All applications require a valid signatures in order to be processed.

Web/Applications

• Web Applications require eSignatures or Voice

Signature. (Only a wet signature is accepted

in CA)

• POA signatures are not accepted on Web

Applications.

Paper Applications

• All Paper Applications require the applicant’s

physical signature.

• POA signatures can be accepted only for OE/

GI cases.

Premium Payment

National General Accident & Health offers two forms of payment for premium charges:

Each form of payment has its own guidelines.

• Bank Draft. • Direct Bill.

Credit card payments will not be accepted.

Bank Draft

Bank draft is available for all forms of applications and is the only option available when completing a

Web Application. The payments will be set up to automatically draft from the applicant’s bank account.

Payments can be set up to be made:

• Monthly.

• Quarterly.

• Semi-annually.

• Annually.

The Draft Date can be up to the day prior to the policy effective date. The recurring draft payment will

be taken on the same day each month. If this day does not exist in a month, payment will be drafted on

the next business day.

Direct Bill

Direct bill is available for Paper Applications. We will process all checks as EFT (Electronic Funds

Transfer) with the bank. Cash, post-dated checks, money orders, traveler’s checks, agent checks and

agency checks will not be accepted. Unless required by law or regulation, checks from a third-party

payer (such as a foundation or other non-profit) will not be accepted. In some circumstances, checks

from a family member or business associate can be accepted.

When completing an application using the Web Application process, the applicant must set up their

payments to be automatically drafted from their account. If they wish to have their subsequent

payments to be billed to them directly, they are able to do so by contacting National General Accident

& Health. Direct bill payments can be set up:

• Quarterly. • Semi-annually. • Annually.

Required Forms

Each application method has different requirements for forms that need to be submitted to the home

office:

Web Application: For most states, the forms are built into the Web Application and submitted

electronically.

Paper Application: Refer to Paper Application section in this document.

NGAH-MEDSUPP-UW-GUIDE 1/2021 19

Agent Responsibilities

This section does not cover all of the agent’s responsibilities. Refer to other sections of the

Underwriting Guidelines, the agent contract, and other materials provided.

The Health Insurance Portability and Accountability Act (HIPAA) established requirements and

restrictions pertaining to the use and disclosure of Protected Health Information. Please familiarize

yourself with both National General Accident & Health’s HIPAA Policy and Privacy Policy. Your

adherence to federal and state laws and regulations that provide privacy protections is mandatory.

The applicant will not be familiar with the underwriting process. Therefore, it is important for you to

read the application and forms to the applicant. You can also ask the applicant to read the application

and forms themselves and explain anything that he/she does not understand.

Things That Can Delay the Application Process

• Licensing and appointment issues.

• Missing information on the application.

• Submitting an expired application; application must be received within 30 days of signature date.

• Premium shortage.

• Poor quality copies.

Tips for Completing the Application

• Ask each question exactly as written.

• Complete the application legibly and in black or blue ink, if submitting a Paper Application.

• Have the applicant initial and date any correction or mistake.

• If completing a Web Application, prepare the applicant for the Web Application process.

• The primary residence address is the physical address where the applicant lives. A post office box

should not be used for the primary residence address. The applicant can also provide an optional

mailing address which can be a post office box.

Underwriting Concepts

We review applications in the order in which they are received. Once an application has been

received and logged into the Underwriting Department, an underwriter is assigned to the case and

the application is reviewed. The underwriter will do their best to process the application with the

information provided but additional information may be required in order complete the application

process.

Applicant must sign to certify the health questions will be answered to the best of the applicant’s

memory, and also to acknowledge that the applicant’s misrepresentation could result in a denial of

benefits and/or rescission of the policy. Information from claims activity, or other sources could lead to

a file review and inquiry to consider if misrepresentations were made at the time of the application.

Medical Underwriting

Medical underwriting is the process of reviewing the medical history of applicants and comparing that

information with established guidelines in order to assess the risk associated with providing insurance

to that applicant.

NGAH-MEDSUPP-UW-GUIDE 1/2021 20

National General Accident & Health’s underwriting guidelines take into consideration many different

factors, including but not limited to the following:

• Height and weight.

• Current and past medical conditions.

• Diagnosis and prognosis.

• Use of prescription drugs.

• Follow-up required.

• Chronic nature of the disease.

National General Accident & Health collects pharmaceutical information on underwritten Medicare

Supplement applications. In order to obtain the pharmaceutical information as requested, all

underwritten applications must be submitted with a signed HIPAA Privacy form (N-HHA-MS).

Prescription information disclosed on the application will be compared to the additional pharmaceutical

information obtained in the underwriting process.

The decision to issue coverage will be made by underwriting based on a review of the application and

any additional information received.

Underwriting Appeals

In the event of an adverse decision, the application could be eligible for reconsideration.

Reconsiderations are case specific and should be carefully considered. Agents disputing a decline or

rate up are welcome to submit information from the applicant’s physician that disputes the reason for

the adverse decision.

Information received from the doctor’s letter must be current (dated within 30 days of the date of the

decline letter) and must be specific to the health condition related to the adverse decision. National

General Accident & Health reserves the right to request up to three years of medical records to

resolve any disputes. Random excerpts from the applicant’s medical records will not be accepted. Any

expenses to retrieve a doctor’s letter or medical records must be covered by the applicant.

Reconsiderations

In the event of an adverse decision, reconsiderations can be offered case by case if the underwriter

feels the passage of time might lead to a favorable underwriting outcome. Generally at least one year

is needed before the applicant can reapply.

Reinstatements

When Medicare Supplement insurance lapses and it is within 31 days of the last paid to date,

coverage may be automatically reinstated by submitting all outstanding premiums without meeting any

underwriting requirements.

Reinstatements are subject to claims review and may require a phone interview and prescription

history check.

Reinstatements submitted 90 or more days from the date the policy lapsed will not be accepted; after

90 days from the lapse date, a new application must be submitted.

When Medicare Supplement insurance lapses and it is not within 31 days of the last paid to date, the

client will need to apply for a reinstatement of coverage where all underwriting requirements must be

met before the policy can be reinstated.

Internal Replacement (Conversions):

Insured individuals requesting to modify benefits under their existing Medicare Supplement insurance

policy 90 days after their initial approval or insured individuals requesting to modify their rate class from

Standard to Preferred, will be required to submit a new application through underwriting. Follow the

Paper Application instructions (a new application fee will also be charged).

NGAH-MEDSUPP-UW-GUIDE 1/2021 21

The internal replacement process is subject to underwriting which requires a prescription history

check, claims history review, and telephone interview (if required). There are no Guarantee Issue

options available for internal replacements. Once approved, the benefit change will take effect on the

first renewal date following the application date. If the conversion is declined, the existing coverage will

remain as is.

Underwriting Guidelines

The purpose of our Underwriting Department is to assess and evaluate the degree of risk associated

with offering insurance to an applicant and make an informed decision based on the information

received. Applications may be underwritten up until the time the policy goes into effect.

If the applicant has a change in health after the application was signed but before the policy goes into

effect, the applicant is required to disclose the change in health. This new information will be factored

into the underwriting decision to approve or decline the application.

The main sources of underwriting information are:

• Application

• Prescription Report

• Telephone Interview

Applies to All States EXCEPT CA, OR, VA

If any of the following conditions or situations have applied to the applicant

within the time frames indicated, the application will be declined.

Note: This list is not all inclusive

WITHIN THE PAST 10 YEARS

Acquired Immune Deficiency

Syndrome (AIDS)

Cardiomyopathy Emphysema, COPD or other

Chronic Pulmonary/Respiratory

Disorder (see Underwriting

Pulmonary Disorders section)*

Renal Failure

AIDS Related Complex (ARC) Chronic Hepatitis B Enlarged Heart Schizophrenia

ALS (Amyotrophic Lateral

Sclerosis)

Cirrhosis Myasthenia Gravis

Alzheimer’s Disease Congestive Heart Failure Organ Transplant

Bipolar or Personality Disorder Diabetes with Neuropathy or

Retinopathy or Uncontrolled

Diabetes (see Underwriting

Diabetes section)**

Parkinson’s Disease

WITHIN THE PAST 2 YEARS

Alcoholism or Drug Abuse Enzyme Disorders Leukemia Peripheral Vascular Disease

Amputation Caused by Disease Epilepsy Major Depression Scleroderma

Carotid Artery Disease Heart Attack Melanoma Stroke or Transient Ischemic

Attack (TIA)

Crohn’s Disease Heart Rhythm Disorders Mental or Nervous Disorder

requiring psychiatric hospital-

ization

Systemic Lupus

Coronary Artery Disease Heart Valve Surgery Muscular Dystrophy

Crippling or Disabling Arthritis Hodgkin’s Disease or other

Lymphoma

Multiple Sclerosis

Deep Vein Thrombosis Internal Cancer Osteoporosis with one or more

fractures or treated by injection/

infusion

NGAH-MEDSUPP-UW-GUIDE 1/2021 22

Applies to All States EXCEPT CA, OR, VA

If any of the following conditions or situations have applied to the applicant

within the time frames indicated, the application will be declined.

Note: This list is not all inclusive

CURRENTLY

Implantable Cardiac Device Surgery, Medical Tests, Treatment or Therapy That Has Not Been

Performed

Oxygen Therapy Surgery May Be Required Within Next 12 Months for Cataracts

Rheumatoid Arthritis

Applies to States of CA, OR, VA

If any of the following conditions or situations have applied to the applicant

within the time frames indicated, the application will be declined.

Note: This list is not all inclusive

WITHIN THE PAST 10 YEARS

Acquired Immune Deficiency

Syndrome (AIDS)

Cardiomyopathy Human Immunodeficiency Virus

(HIV) Infection

Parkinson’s Disease

AIDS Related Complex (ARC) Cognitive or Brain disorder Multiple Sclerosis Renal Failure

ALS (Amyotrophic Lateral

Sclerosis)

Dementia Muscular Dystrophy Scleroderma

Alzheimer’s Disease Diabetes with Neuropathy or

Retinopathy or Uncontrolled

Diabetes (see Underwriting

Diabetes section)**

Myasthenia Gravis Systemic Lupus

Amputation Caused by Disease Emphysema, COPD or other

Chronic Pulmonary/Respiratory

Disorder (see Underwriting

Pulmonary Disorders section)*

Organ Transplant

WITHIN THE PAST 2 YEARS

Alcoholism or Drug Abuse Congestive Heart Failure Heart Attack Melanoma

Bipolar or Personality Disorder Coronary Artery Disease Heart Rhythm Disorders Mental or Nervous Disorder

requiring psychiatric hospital-

ization

Carotid Artery Disease Crippling or Disabling Arthritis Heart Valve Surgery Osteoporosis with one or more

fractures or treated by injection/

infusion

Chronic Kidney Disease Includ-

ing End Stage Renal Disease

Deep Vein Thrombosis Hodgkin’s Disease or other

Lymphoma

Peripheral Vascular Disease

Crohn’s Disease Enlarged Heart Internal Cancer Rheumatoid Arthritis

Chronic Hepatitis B Enzyme Disorders Leukemia Schizophrenia

Cirrhosis Epilepsy Major Depression Stroke or Transient Ischemic

Attack (TIA)

CURRENTLY

Implantable Cardiac Device Surgery, Medical Tests, Treatment or Therapy That Has Not Been

Performed

Oxygen Therapy Surgery May Be Required Within Next 12 Months for Cataracts

NGAH-MEDSUPP-UW-GUIDE 1/2021 23

Underwriting Diabetes*

An applicant who has diabetes without current complications of neuropathy, retinopathy, nephropathy

or skin ulcers and without any current or past history of coronary artery disease, carotid artery disease

or peripheral artery disease could be insurable.

Some applications will ask about A1C, also called hemoglobin A1C, glycosylated hemoglobin or HbA1c,

which is a common blood test used to diagnose both type 1 and type 2 diabetes. A1C is also used

on an ongoing basis to gauge how well the patient is managing the diabetes condition. It reflects the

average blood sugar level for the past two to three months. If the applicant remembers A1C levels

before the most recent one, ask the applicant to provide the levels and approximate dates in Section F

under Additional Comments.

The use of insulin as a treatment, and the number of units of insulin being taken at the time of the

application, is not a determining factor for insurability all by itself. If the applicant is significantly

overweight and/or has certain conditions, such as heart disorder or lung disease, the risk is generally

uninsurable. The underwriter will consider all of the information in the application as well as information

from other sources.

Underwriting Pulmonary/Respiratory Disorders**

An applicant who has emphysema, COPD, or any other chronic pulmonary (respiratory; lung) disorder

other than mild asthma is uninsurable. An applicant who has asthma, and required treatment in an

emergency room or hospital within the past 2 years will be considered uninsurable. If the applicant’s

pulmonary disorder has requires treatment with supplemental oxygen, or the applicant has been

advised that oxygen will be required, the risk is uninsurable.

Build Table

Applications will be declined for applicants whose weight is below the Preferred minimum or above the Standard maximum.

Height Preferred weight Standard weight Height Preferred weight Standard weight

4 ft 2 ins 66-125 126-143 5 ft 10 ins 129-244 245-279

4 ft 3 ins 69-130 131-148 5 ft 11 ins 133-251 252-287

4 ft 4 ins 72-135 136-154 6 ft 137-259 260-295

4 ft 5 ins 74-140 141-160 6 ft 1 in 141-266 267-304

4 ft 6 ins 77-146 147-166 6 ft 2 ins 145-273 274-312

4 ft 7 ins 80-151 152-173 6 ft 3 ins 149-281 282-321

4 ft 8 ins 83-157 158-179 6 ft 4 ins 152-288 289-329

4 ft 9 ins 86-162 163-185 6 ft 5 ins 157-296 297-338

4 ft 10 ins 89-168 169-192 6 ft 6 ins 161-303 304-347

4 ft 11 ins 92-174 175-199 6 ft 7 ins 165-311 312-356

5 ft 95-180 181-205 6 ft 8 ins 169-319 320-365

5 ft 1 in 98-186 187-212 6 ft 9 ins 173-327 328-374

5 ft 2 ins 102-192 193-219 6 ft 10 ins 177-335 336-383

5 ft 3 ins 105-198 199-226 6 ft 11 ins 182-343 344-392

5 ft 4 ins 108-204 205-234 7 ft 186-352 353-402

5 ft 5 ins 112-211 212-241 7 ft 1 in 191-360 361-412

5 ft 6 ins 115-217 218-248 7 ft 2 ins 195-369 370-421

5 ft 7 ins 119-224 225-256 7 ft 3 ins 200-377 378-431

5 ft 8 ins 122-231 232-264 7 ft 4 ins 204-386 387-441

5 ft 9 ins 126-238 239-271

NGAH-MEDSUPP-UW-GUIDE 1/2021 24

Drug List Information

Drug list information is provided to assist agents in the application process. This is a list of the most

commonly prescribed medications for declinable conditions. Applicants may be unaware of a condition

listed on the application, but prescribed medication may indicate the condition exists and therefore

make the applicant not eligible for coverage with the company.

Uninsurable Medications:

Below is a partial list of uninsurable medications. Please contact underwriting if you are unsure about a

medication that does not appear in the list below.

If the medication is on the list below but is being prescribed for a condition not listed below or is being

prescribed in an “off-label” situation, the condition may or may not be insurable. However, if the “off-

label” condition being treated is on the list of uninsurable health conditions, the risk is not insurable. If

the situation is not clear, it is best to contact underwriting in advance of filling out an application.

Generic Brands Used for

abacavir Ziagen HIV

abarelix Plenaxis cancer

abciximab ReoPro heart disorder

acamprosate Campral alcohol abuse

adalimumab Humira rheumatoid arthritis

AL-721 AL-721 AIDS, HIV

albuterol/ipratropium DuoNeb, Combivent Respimat COPD

alemtuzumab Campath, Lemtrada multiple sclerosis, leukemia

alteplase Activase heart disorder, stroke

altretamine Hexalen cancer

amantadine Endantadine, Symmetrel, Symadine Parkinson's

ambrisentan Letairis pulmonary hypertension

amiodarone Cordarone, Pacerone, Nexterone heart disorder

anakinra Kineret rheumatoid arthritis

anastrozole Arimidex cancer

apomorphine Apokyn, Uprima Parkinson's

aripripazole Abilify, Aristada schizophrenia

asparaginase Elspar leukemia

atazanavir Reyataz HIV

auranofin Ridaura rheumatoid arthritis

aurothioglucose Solganal rheumatoid arthritis

aurothiomalate Myochrysine, Aurolate severe arthritis

azathioprine Imuran, Azasan rheumatoid arthritis, kidney transplant

BCG TheraCyx, Tice BCG bladder cancer

becaplermin Regranex diabetic neuropathy

benztropine Cogentin Parkinson's

bevacizumab Avastin cancer

bicalutamide Casodex prostate cancer

biperiden hydrochloride Akineton Parkinson's

NGAH-MEDSUPP-UW-GUIDE 1/2021 25

Generic Brands Used for

bleomycin Blenoxane cancer

bromocriptine Cycloset, Parlodel Parkinson's

busulfan Myleran, Busulfex cancer

capecitabine Xeloda cancer

carbidopa Lodosyn Parkinson's

carbidopa/levodopa Sinemet, Rytary, Duopa, Atamet, Carbilev,

Parcopa

Parkinson's

carboplatin Paraplatin cancer

chlorambucil Leukeran cancer, kidney disease, rheumatoid

arthritis Activase heart disorder, stroke

chlorotrianisene Tace cancer

chlorpromazine Thorazine schizophrenia, psychosis

cilostazol Pletal peripheral vascular disease

cinacalcet Sensipar hyperparathyroidism due to cancer or kidney

disease

cisplatin Platinol cancer

cladribine Leustatin leukemia

clopidogrel Plavix cardiovascular

clozapine Clozaril, FazaClo, Versacloz schizophrenia

cyclophosphamide Cytoxan, Neosar cancer, rheumatoid arthritis, lupus

cycloserine Seromycin tuberculosis

cyclosporine Neoral, Sandimmune, Gengraf organ transplant, cancer, severe arthritis

dalteparin Fragmin cardiovascular, cancer

dantrolene Dantrium, Ryanodex, Revonto multiple sclerosis

darunavir Prezista AIDS, HIV

delavirdine Rescriptor AIDS, HIV

didanosine Videx, ddl AIDS, HIV

dipyridamole Persantine cardiovascular

dipyridamole/aspirin Aggrenox stroke, TIA

disulfiram Antabuse alcohol abuse

donepezil Aricept dementia

doxorubicin Adriamycin, Caelyx, Rubex cancer

dronabinol Marinol, THC cancer

efavirenz Sustiva AIDS, HIV

emtricitabine Atripla AIDS, HIV

emtricitabine Emtriva, Coviracil AIDS, HIV

emtricitabine/tenofovir Truvada HIV

enfuvirtide Fuzeon AIDS, HIV

enoxaparin Lovenox peripheral vascular disease

entacapone Comtan Parkinson's

entacapone/levodopa/carbidopa Stalevo Parkinson's

epoetin alfa Epogen, Procrit, Eprex chronic kidney disease

eptifibatide Integrilin heart disorder

ergoloid mesylates Hydergine dementia

NGAH-MEDSUPP-UW-GUIDE 1/2021 26

Generic Brands Used for

estramustine Emcyt cancer

etanercept Enbrel severe arthritis

ethinyl estradiol Estinyl cancer

ethopropazine Parsidol Parkinson's

etoposide VePesid, Toposar, Etopophos cancer

exemestane Aromasin cancer

filgrastim Neupogen, Granix, Zarxio cancer

flecainide Tambocor heart disorder

fluorourcil Adrucil cancer

fluphenazine Modecate, Prolixin, Moditen, Permitil psychosis

flutamide Euflex, Eulexin cancer

fondaparinux Arixtra vascular disease

fosamprenavir Lexiva HIV

foscarnet sodium Foscavir AIDS, HIV

fulvestrant Faslodex cancer

galantamine Razadyne, Reminyl dementia

glatiramer Copaxone, Glatopa multiple sclerosis

gold sodium thiomalate Myochrysine, Aurolate severe arthritis

goserelin Zoladex cancer

haloperidol Haldol, Peridol psychosis

heparin Calcilean, Calciparine, Hepalean, Liquaemin cardiovascular

hydroxyurea Hydrea, Droxia cancer

imatinib Gleevec cancer

indinavir Crixivan, IDV AIDS, HIV

infliximab Remicade rheumatoid arthritis

insulin > 50 units per day many brands diabetes mellitus

interferon many brands AIDS, HIV, cancer, multiple sclerosis,

hepatitis Antabuse alcohol abuse

interferon alfa-2a Roferon-A AIDS, HIV, cancer

interferon beta 1a Avonex, Rebif multiple sclerosis

interferon beta 1b Betaseron, Extavia multiple sclerosis

ipratropium Atrovent COPD

isoniazid Hyzyd, INH, Laniazid, Nydrazid, Rimifon,

Tubizid

tuberculosis

lamivudine Combivir, 3TC, Epivir AIDS

lamivudine/zidovudine/abacavir Trizivir HIV

letrozole Femara cancer

leucovorin Wellcovorin cancer

leuprolide Lupron, Eligard cancer

levamisole hydrochloride Ergamisol cancer

levodopa Larodopa, Dopar, L-Dopa Parkinson's

lomustine Gleostine, CCNU cancer

lopinavir Kaletra HIV

loxapine Loxitane schizophrenia

NGAH-MEDSUPP-UW-GUIDE 1/2021 27

Generic Brands Used for

maraviroc Selzentry HIV

medroxyprogesterone acetate Depo-Provera, Provera, Amen, Curretab,

Cycrin

cancer

megestrol Megace cancer

melphalan Alkeran cancer

memantine Namenda dementia

methadone Methadose, Dolophine severe pain

methotrexate Trexall, Rheumatrex, Rasuvo, Otrexup severe arthritis, cancer

mitomycin Mutamycin cancer

mitoxantrone Novantrone multiple sclerosis, cancer

morphine Contin, Avinza, Depodur, Duramorph,

Infumorph, Astramorph, Kadian, Oramorph,

Rapi-Ject, Roxanol

severe pain

mycophenolate CellCept, Myfortic myasthenia gravis, organ transplant

naltrexone ReVia, Vivitrol, Depade opioid or alcohol detox

natalizumab Tysabri multiple sclerosis

nebulizer device respiratory / pulmonary disorders

nelfinavir Viracept AIDS, HIV

neostigmine Prostigmin, Bloxiverz Myasthenia Gravis

nesiritide Natrecor congestive heart disorder failure

nevirapine Viramune AIDS, HIV

nilutamide Nilandron cancer

nitroglycerine glyceryl trinitrate, Nitrol, Nitro Bid, Tridil,

NTG

heart disorder

nitroglycerine transdermal NitroDur, Minitran, Deponit, Nitrocine heart disorder

olanzapine Zyprexa schizophrenia

ondansetron Zofran cancer

oxygen Respiratory / pulmonary disorder

paliperidone Invega schizophrenia

penicillamine Cuprimine, Depen rheumatoid arthritis, disease of liver or

kidneys

pergolide mesylate Permax Parkinson's

perphenazine Trilafon schizophrenia

pimozide Orap schizophrenia

pramipexole Mirapex Parkinson's

procainamide Procanbid, Pronestyl heart disorder

prochlorperazine Compazine psychosis

procyclidine Kemadrin Parkinson's

pyridostigmine Mestinon, Regonol Myasthenia Gravis

quetiapine Seroquel schizophrenia

quinidine Quinaglute, Quinidex heart disorder

rasagiline Azilect Parkinson's

riluzole Rilutek ALS - amyotrophic lateral sclerosis

risperidone Risperdal schizophrenia, psychosis

ritonavir Norvir AIDS, HIV

NGAH-MEDSUPP-UW-GUIDE 1/2021 28

Generic Brands Used for

rituximab Rituxan non-Hodgkin lymphoma

rivaroxaban Xarelto cardiovascular

rivastigmine Exelon dementia

ropinirole Requip Parkinson's

rotigotine Neupro Parkinson's

saquinavir Invirase, Fortovase AIDS, HIV

selegiline Carbex, Eldepryl, Zelapar Parkinson's

sotalol Betapace, Sorine, Sotylize heart disorder

stavudine Zerit, d4T AIDS, HIV

streptozocin Zanosar cancer

tacrine Cognex dementia

tacrolimus Prograf, Hecoria, Astagraf, Envarsus myasthenia gravis, organ transplant

tamoxifen Soltamox cancer

tenofovir Viread AIDS, HIV

testolactone Teslac cancer

thioridazine Mellaril psychosis, dementia

thiotepa Tespa, Thioplex cancer

thiothixene Navane psychosis

ticlopidine Ticlid cardiovascular

tiotropium Spiriva COPD

tipranavir Aptivus AIDS, HIV

tirofiban Aggrastat heart disorder, kidney

tolcapone Tasmar Parkinson's

toremifene Fareston cancer

trastuzumab Herceptin cancer

treprosinil Tyvaso, Remodulin, Orenitram pulmonary hypertension

trifluoperazine Stelazine schizophrenia, psychosis

trihexyphenidyl Artane, Trihex Parkinson's

triptorelin Trelstar cancer

valganiciclovir Valcyte cytomegalovirus disease, HIV

vincristine Oncovin, Vincasar cancer

warfarin Coumadin, Jantoven cardiovascular

zalcitabine Hivid, ddC AIDS, HIV

zidovudine AZT, ZDV, Retrovir AIDS, HIV, hepatitis

ziprasidone Geodon schizophrenia, psychosis

zoledronic acid Reclast, Zometa hypercalcemia caused by cancer

Any questions concerning medications should be directed to the Underwriting Department.