UIS INFORMATION PAPER NO. 14 AUGUST 2013

EMERGING MARKETS AND THE DIGITALIZATION

OF THE FILM INDUSTRY

An analysis of the 2012 UIS International

Survey of Feature Film Statistics

UNESCO

The constitution of the United Nations Educational, Scientific and Cultural Organization (UNESCO) was adopted by

20 countries at the London Conference in November 1945 and entered into effect on 4 November 1946. The

Organization currently has 195 Member States and 8 Associate Members.

The main objective of UNESCO is to contribute to peace and security in the world by promoting collaboration among

nations through education, science, culture and communication in order to foster universal respect for justice, the rule

of law, and the human rights and fundamental freedoms that are affirmed for the peoples of the world, without

distinction of race, sex, language or religion, by the Charter of the United Nations.

To fulfil its mandate, UNESCO performs five principal functions: 1) prospective studies on education, science, culture

and communication for tomorrow's world; 2) the advancement, transfer and sharing of knowledge through research,

training and teaching activities; 3) standard-setting actions for the preparation and adoption of internal instruments

and statutory recommendations; 4) expertise through technical co-operation to Member States for their development

policies and projects; and 5) the exchange of specialized information.

UNESCO is headquartered in Paris, France.

UNESCO Institute for Statistics

The UNESCO Institute for Statistics (UIS) is the statistical office of UNESCO and is the UN depository for global

statistics in the fields of education, science and technology, culture and communication.

The UIS was established in 1999. It was created to improve UNESCO's statistical programme and to develop and

deliver the timely, accurate and policy-relevant statistics needed in today’s increasingly complex and rapidly changing

social, political and economic environments.

The UIS is based in Montreal, Canada.

Published in 2013 by:

UNESCO Institute for Statistics

P.O. Box 6128, Succursale Centre-Ville

Montreal, Quebec H3C 3J7

Canada

Tel: +1 514-343-6880

Email: [email protected]

http://www.uis.unesco.org

ISBN 978-92-9189-136-8

Ref: UIS/2013/CUL/TD/06

© UNESCO-UIS 2013

The authors are responsible for the choice and presentation of the facts contained in this report and for the opinions expressed

therein which are not necessarily those of UNESCO and do not commit the Organization.

The designations employed and the presentation of material throughout this publication do not imply the expression of any opinion

whatsoever on the part of UNESCO concerning the legal status of any country, territory, city or area or of its authorities or

concerning the delimitation of its frontiers or boundaries.

- iii -

Acknowledgements

This paper was written by Mr Roque González, film studies researcher, Universidad de Buenos

Aires and Universidad Nacional de La Plata. The report was edited and finalised by Ms Lydia

Deloumeaux and Mr José Pessoa of the Culture Statistics Unit, UNESCO Institute for Statistics

(UIS).

- iv -

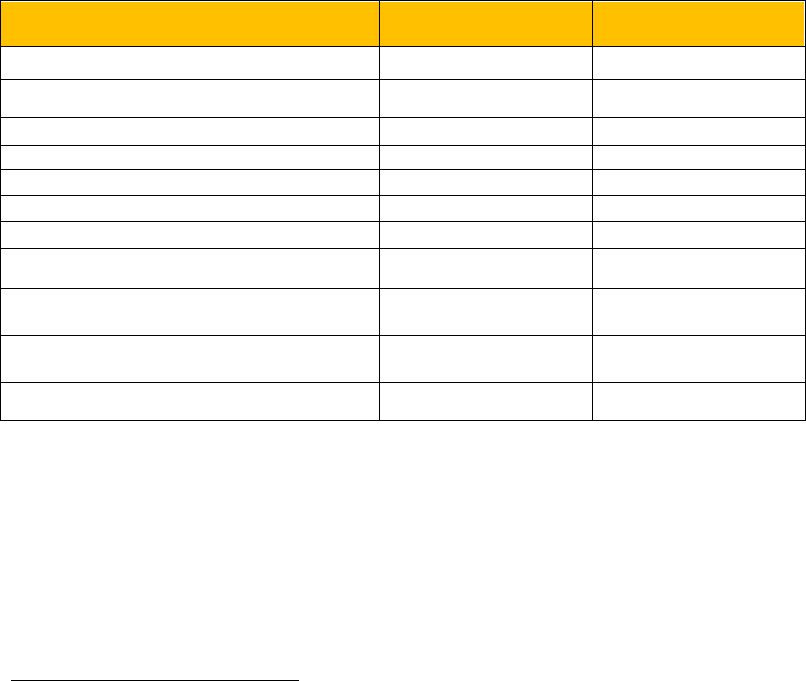

Table of contents

Page

Aclknowledgements ................................................................................................................... iii

Introduction ................................................................................................................................. 6

1. Films on top ....................................................................................................................... 6

2. Production........................................................................................................................ 10

2.1 Feature film production ......................................................................................... 10

2.2 National film support ............................................................................................. 14

3. Market share (exhibition and consumption) ...................................................................... 15

3.1 Exhibition .............................................................................................................. 15

3.2 BRIC countries: The emerging market .................................................................. 18

3.3 Consumption: The link between film attendance and availability of screens ......... 19

4. Digitization ....................................................................................................................... 24

5. Case studies .................................................................................................................... 25

5.1 China: The future leader of the film market? ......................................................... 25

5.2 Latin America: Evolution and characteristics of the cinema industry .................... .28

Conclusions .............................................................................................................................. 34

References ............................................................................................................................... 36

Appendix ................................................................................................................................... 37

List of maps

Map 1. Concentration of film production, 2011 ................................................................................... 12

List of boxes

Box 1. Film production in video format .............................................................................................. 13

List of figures

Figure 1. Contrasting trends between global admissions and box office, 2005-2011 ........................... 15

Figure 2. Frequency of attendance by screen per 100,000 inhabitants aged 5 to 79 years old, 2011 . 20

Figure 3. Distribution of cinemas by number of screens, 2011 ............................................................. 23

Figure 4. Number of digital screens, 2007-2011 ................................................................................... 24

Figure 5. Annual growth rate in box office revenue in China and USA, 2005-2011 (base year 2005).. 26

Figure 6. Annual growth rate in admissions in China and USA, 2005-2011 (base year 2005) ............. 26

Figure 7. Projected box office revenue in China and USA (in millions US$), 2011-2025 ..................... 27

Figure 8. Number of feature films produced in Latin America, 2005-2011 ............................................ 29

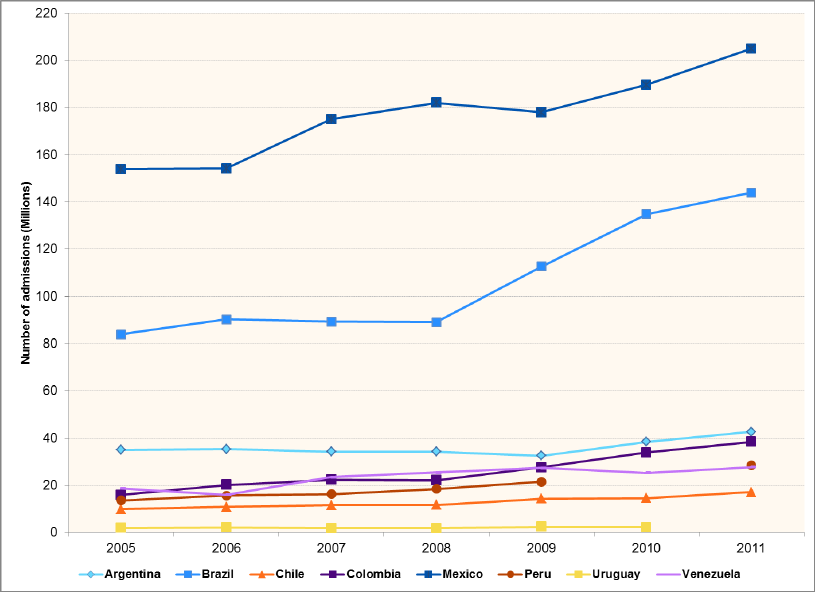

Figure 9. Number of admissions in Latin America, 2005-2011.............................................................. 30

Figure 10. Number of national first-time release films in Latin America, 2005-2011 ............................... 31

Figure 11. Number of screens in Latin America, 2005-2011 ................................................................... 33

Figure 12. Number of digital screens in DLP-DCI in Latin America, 2007-2011 ..................................... 33

- v -

List of tables

Table 1. Top 30 feature films, 2010 and 2011 ........................................................................................ 7

Table 2. Genre of the Top 30 Films, 2010 and 2011 .............................................................................. 9

Table 3. World production of feature films for theatrical release, 2005-2011 ....................................... 11

Table 4. Top 10 film producers in the world ......................................................................................... 11

Table 5. Production level by number of countries and films, 2005-2011 ............................................. 12

Table 6. Film producers in video format, 2005-2011 ............................................................................ 13

Table 7. Total number of films in all formats, 2005-2011 ..................................................................... 13

Table 8. Top 15 countries with the highest number of feature films produced for theatrical

release, by market share (admissions) and national film support (average for 2005-2011) .. 14

Table 9A. Total box office revenue for the Top 10 countries (in millions US$). 2006-2011 ................... 16

Table 9B. Evolution of box office revenue, 2006-2011 ........................................................................... 16

Table 10. World average ticket prices (in US$), 2005-2011 ................................................................... 17

Table 11. Total admissions for the Top 10 countries (in millions), 2005-2011 ....................................... 18

Table 12. Box office revenue in BRIC countries (in millions US$), 2006-2011 ...................................... 19

Table 13. Admissions in BRIC countries, 2006-2011 ............................................................................. 19

Table 14. Frequency of film attendance per capita (population aged 5 to 79 years) for the

Top 10 countries, 2005-2011 .................................................................................................. 20

Table 15. Top 5 countries with at least 10 screens per 100,000 inhabitants (population

aged 5 to 79 years), 2005-2011 ............................................................................................. 21

Table 16. Top 5 countries with the fewest screens per 100,000 inhabitants (population

aged 5 to 79 years), 2005-2011 ............................................................................................. 22

Table 17. Average market share of national first-time release films between 2005 and 2011

in Latin America, based on admissions ................................................................................. 32

- 6 -

Introduction

Feature films are one of the most popular cultural expressions worldwide, with an audience of

approximately 7.5 billion people per year. However, in recent years, the cinema sector

experienced structural changes in the production of its movies and greater diversification of its

access modes. Audiences are increasingly using a wide range of media (i.e. smartphone, tablet,

video-on-demand) to watch movies.

The digitization of movie production and their exhibition in multiplexes has been one of the

primary reasons that cinema has continued to attract audiences to theatres in many parts of the

world. At the same time, the cinema sector has had to face the impacts of the financial crisis of

2008, which slowed down growth in many sectors of the economy. What have been the impacts

of the digitization of the movie industry? Has the rate of digitization been the same worldwide?

Do cinema audiences go to movie theatres more often? What are the trends in ticket prices? Is

there still an audience for nationally-produced movies?

This report examines these and other aspects of the film industry based on the analysis of

harmonised data collected from the 2012 biennial Survey of Feature Film Statistics for the

reference years 2010 and 20011 conducted by the UNESCO Institute for Statistics (UIS). In

addition, an analysis of data from 2005 to 2011 is also presented for selected indicators to

provide insight into the current state of the cinema industry. It focuses on the impact that

increasing digitization of film production and exhibition has had on the industry. The report also

presents two case study analyses: i) a comparison of the Chinese and USA film markets; and ii)

an examination of the film sector in Latin America over the last seven years.

1. Films on top

The majority of films produced today are oriented towards mass market consumption, in

particular the youth market. Blockbusters, many based on comics and others being sequels,

supported by powerful global mass marketing that bottleneck national and non-Hollywood

cinema characterise the global cinema industry with few exceptions.

The global Top 30 list of films, as illustrated in Table 1, uses a weighted score to rank films by

popularity. It is a measure of audience preference. To create this list, the UIS

1

collects

information on the 10 most popular feature films in each country, generally using admissions

2

,

and applies a weighted score to calculate a total point count for each country.

As has been the case throughout the 2000s, in almost all countries feature films from the United

States of America (USA) (or USA coproductions in conjunction with primarily European

countries) dominated the Top 30 (see Table 1) in 2010 and 2011. Almost all of these films were

distributed by the six major Hollywood studios (with 50% of them released in 3D). Furthermore,

the number of animated releases aimed at child-youth audiences was significant, in addition to

sequels, prequels and adaptations. The rise and importance of 3D films is also evident between

2005 and 2011.

1

Refer to the UIS Data Center for a complete database:

http://www.uis.unesco.org/Culture/Pages/movie-statistics.aspx

2

Most countries measure popularity by cinema admissions, though a few use gross box office revenue.

- 7 -

However, many of the films that are ranked from No. 15 to No. 30 are typically nationally-

produced or non-USA-produced films, mostly distributed by local companies.

TABLE 1. TOP 30 FEATURE FILMS IN 2010 AND 2011

2010

rank

Title

Origin

Genre

Weighted

score

Language

3D

1

Avatar

USA/GBR

Fantasy, adventure, action

399

English

Yes

2

Harry Potter and the Deathly

Hallows: Part 1

GBR/USA

Fantasy, adventure

290

English

No

3

Shrek Forever After

USA

Animation

290

English

Yes

4

Inception

USA/GBR

Action, adventure,

mystery

284

English

No

5

Alice in Wonderland

USA

Fantasy, adventure

272

English

Yes

6

The Twilight Saga: Eclipse

USA

Fantasy, adventure

208

English

No

7

Toy Story 3

USA

Animation

184

English (Spanish)

Yes

8

Clash of the Titans

USA

Fantasy, adventure, action

104

English

Yes

9

Iron Man 2

USA

Sci-fi, adventure, action

69

English (Russian)

Yes

10

Sex and the City 2

USA

Comedy, romance, drama

68

English

No

11

Prince of Persia: The Sands of

Time

USA/GBR

Fantasy, adventure, action

61

English

No

12

Despicable Me

USA

Animation

48

English

Yes

13

How to Train Your Dragon

USA

Animation

34

English

Yes

14

Sherlock Holmes

GBR/USA/

DEU

Action, adventure, crime

34

English

No

15

Tangled

USA

Animation

33

English

Yes

16

The Chronicles of Narnia: The

Voyage of the Dawn Trader

USA/GBR

Fantasy, adventure

27

English

Yes

17

The Karate Kid

USA/CHN

Action, drama

23

English (Chinese)

No

18

Step Up 3D

USA

Romance, musical, drama

22

English

Yes

19

Robin Hood

GBR/USA

Adventure, action

21

English (French)

No

20

Salt

USA

Action, crime, mystery

20

English (Russian/

Korean)

No

21

My name is Khan

India

Drama, romance, thriller

18

Hindi/Urdu/English

No

22

Alvin and the Chipmunks: The

Squeakquel

USA

Animation

15

English

No

23

Grown Ups

USA

Comedy

14

English

No

24

The Princess and the Frog

USA

Animation

13

English (French)

No

25

Elite Squad: The Enemy Within

(Tropa de Elite 2 - O Inimigo Agora

É Outro)

Brazil

Action, drama

10

Portuguese

No

26

Five Minarets in New York (New

York'ta Bes Minare)

Turkey

Drama

10

Turkish/ English

No

27

Lapland Odyssey (Napapiirin

sankarit)

FIN/SWE/IRL

Comedy, drama, romance

10

Finnish

No

28

Le clandestin (Al Khattaf)

Morocco

Comedy

10

Arabic

No

29

Mission London

BGR/GBR/HUN/

MKD/SWE

Comedy

10

English/ Bulgarian

(Russian/ Serbian)

No

30

Women in temptation (Ženy v

pokušení)

Czech Republic

Comedy, romance

10

Czech

No

- 8 -

2011

rank

Title

Origin

Genre

Weighted

score

Language

3D

1

Harry Potter and the Deathly

Hallows: Part 2

GBR/USA

Fantasy, adventure

336

English

No

2

Pirates of the Caribbean: On

Stranger Tides

USA

Adventure, action

306

English

(Spanish)

No

3

The Smurfs

USA

Animation

167

English

Yes

4

The Twilight Saga: Breaking Dawn -

Part 1

USA

Fantasy, adventure

165

English

No

5

The Hangover Part II

USA

Comedy

154

English (Thai)

No

6

Transformers: Dark of the Moon

USA

Sci-fi, action, adventure

139

English

No

7

Rio

USA

Animation

108

English

(Portuguese)

Yes

8

Kung Fu Panda 2

USA

Animation

105

English

Yes

9

Fast Five

USA

Action, adventure

104

English

(Portuguese/

Spanish)

No

10

Cars 2

USA

Animation

101

English

(Japanese/

Italian/

French)

Yes

11

Tangled

USA

Animation

77

English

Yes

12

Puss in Boots

USA

Animation

47

English

Yes

13

Johnny English Reborn

GBR/FRA/

USA

Comedy

45

English

(Mandarin)

No

14

The King's Speech

GBR/USA

Drama

43

English

No

15

The Adventures of Tintin

USA/NZL

Animation

39

English

Yes

16

Intouchables

France

Drama

23

French

No

17

Bridesmaids

USA

Comedy, romance

21

English

No

18

Mission Impossible - Ghost Protocol

USA/UAE

Action, adventure

21

English

(Russian/

Arabic)

No

19

Sherlock Holmes II

GBR/USA/

DEU

Action, adventure

21

English

No

20

Nothing to Declare (Rien à déclarer)

France/

Belgium

Comedy

18

French

No

21

The Inbetweeners Movie

GBR

Comedy

14

English

No

22

Zookeeper

USA

Comedy

13

English

No

23

Ertkhel Shua Qalaqshi

Georgia

Action, adventure

10

Georgian

No

24

Eyyvah eyvah 2

Turkey

Comedy

10

Turkish

No

25

Fireheart: The Legend of Tadas

Blinda (Tadas Blinda. Pradzia)

Lithuania

Adventure, action, drama

10

Lithuanian/

Russian

No

26

Kokowääh

Germany

Comedy

10

German

No

27

Lao Wedding

Laos

Romance

10

Lao

No

28

Letters to Santa (Listy do M.)

Poland

Comedy, romance, drama

10

Polish

No

29

Montevideo, Bog te video

(Montevideo, God Bless You!)

Serbia

Comedy, adventure,

drama

10

Serbian

No

30

Muži v nadeji (Muzi v nadeji - Men

in hope)

Czech

Republic

Comedy

10

Czech

No

Notes: BGR: Bulgaria;`CHN: China; DEU: Germany; FIN: Finland; GBR: United Kingdom; HUN: Hungary;

IRL: Ireland; MKD: the former Yugoslav Republic of Macedonia; NZL: New Zealand;

SWE: Sweden; UAE: United Arab Emirates; USA: United States of America.

Source: UNESCO Institute for Statistics, July 2013.

- 9 -

Films from the USA distributed by Hollywood studios occupied the top positions in the Top 30 in

2010 and 2011. A total of 23 films were produced by Hollywood movie studios in 2011, while 17

of the Top 30 were of Hollywood origin in 2012. Interestingly, one-half of the titles distributed by

the Hollywood majors were shown in 3D in both years, demonstrating the emerging importance

of this type of movie.

Except for one movie (The Hangover Part II, released in 2011), Hollywood studios did not

distribute other movies rated NC-17 (no one aged 17 years and under admitted). A total of 43%

of Hollywood films in the Top 30 were rated G in 2010 (59% in 2011); the remaining films were

rated PG-13.

3

Since virtually all the top Hollywood films were targeted at child-youth audiences, there are a

significant number of animated films and action adventure movies (see Table 2). In addition,

several of these titles were in 3D (one-half of the Top 10 films were screened in this format). In

2010, 5 animated movies and 6 action adventure films were released in 3D; while in 2011,

7 animated films were shown in 3D and 1 action adventure film.

TABLE 2. GENRE OF THE TOP 30 FILMS, 2010-2011

Characteristics

2010

2011

Distributed by Hollywood studios

23 (10 G)

17 (10 G)

3D

11 (6 in Top 10)

8 (5 in Top 10)

Sequels and non-original scripts

11

15

Sequels

9 (6 in Top 10)

12 (8 in Top 10)

New versions

2

–

Adaptations

–

2

Prequels

–

1

Animation

7

7

Action adventure

Total: 14

(Hollywood: 12)

Total: 9

(Hollywood: 7)

Comedy

Total: 6

(Hollywood: 2)

Total: 11

(Hollywood: 3)

National films (non-Hollywood)

7

11

Source: UNESCO Institute for Statistics, July 2013.

3

The Motion Picture Association of America (MPAA)’s film-rating system is used in the USA and its

territories to rate a film's thematic and content suitability for certain audiences. The MPAA film ratings

are: G (General Audiences), PG (Parental Guidance Suggested), PG-13 (Parents Strongly

Cautioned), R (Restricted; i.e. films rated R are prohibited to children under 17). The film-rating system

varies all over the world, but the rates are very similar to the MPAA’s. For comparative purposes, the

MPAA’s film-rating system was used for every movie in the Top 30 lists.

- 10 -

Following a similar pattern over the last few years for Hollywood blockbusters, many of the films

in the Top 30 are non-original concepts, i.e. sequels, prequels and adaptations. Including film

adaptations (such as Tintin), new versions/remakes (such as Karate Kid) or prequels (such as

Puss in Boots), the overall number of non-original films increased from 11 in 2010 to 15 in 2011

in the Top 30 films list. Furthermore, 6 of the Top 10 movies were sequels in 2010 and 8 in 2011.

In both years, there were also two sequels and one adaptation that were non-Hollywood-

produced releases.

Comedy is another genre that stands out in the Top 30: 6 were released in 2010 and 11 in 2011.

It is interesting to note that 2 of the 6 comedies in 2010 were USA-produced; while in 2011 3 of

11 were produced in the USA. It should also be noted that comedies for all ages were among

the films that broke box office and admission records in many countries. For example, Mission

London in Bulgaria and Listy do M. in Poland broke box office records in their respective

markets.

There were other notable non-USA releases that were blockbusters, illustrating the growing

impact of non-Hollywood film globally. The Indian movie, My name is Khan (a 2010 drama), was

the highest-grossing Indian movie internationally in history. Meanwhile, the paramilitary Brazilian

drama, Elite Squad, turned into the most viewed Brazilian film internationally to date (with more

than 11 million admissions outside Brazil, breaking the record of the 1976 film Dona Flor e Seus

Dois Maridos, which sold 10.7 million tickets). Elite Squad was distributed in about 20 countries.

All films in the Top 30 were distributed by local companies (or distributors that covered two or

three neighbouring countries). The only exception was the Indian movie; My Name is Khan,

which was distributed by Fox Studios in about 30 countries worldwide.

Other non-Hollywood national films appearing in the Top 30 included the French film

Intouchables (distributed in about 50 countries worldwide), the British film The In-Betweeners

(released in about 25 territories), the French-Belgian film Rien à Déclarer (released in about 12

countries), and the Finnish film Lapland Odyssey (distributed in about 12 countries). The 12

remaining movies were released by national distributors in their respective native countries and

in 1 to 5 other territories.

In total, 7 non-Hollywood national films were released in 2010 and 11 in 2011. Of these 18 films,

11 were European, 2 were from Turkey, 1 was from India, 2 were from the rest of Asia, 1 from

Latin America, and 1 from Africa.

2. Production

2.1. Feature film production

World film production continued to grow from 2005 to 2011, with a 39% increase. During this

period, about 100 countries produced professional feature films for theatrical release, with an

average of 5,987 feature films being produced per year, as shown in Table 3. The figures also

show that there has been stagnation in the world film production since 2008, with total film

production remaining at around 6,500 releases per year over the last four years for which data

are available.

- 11 -

TABLE 3. WORLD PRODUCTION OF FEATURE FILMS FOR THEATRICAL RELEASE*,

2005-2011

2005

2006

2007

2008

2009

2010

2011

Number of feature

films produced

4,818

5,284

5,760

6,454

6,475

6,548

6,573

Number of countries

81

79

85

89

93

82

76

Note: * Professional films made with commercial exhibition as the main objective (Nigerian films are not

included).

Source: UNESCO Institute for Statistics, July 2013.

When analysed at the country level, the increase in the world film production is highly

dependent on the Top 10 producers which represent around 65% of world production, as shown

in Table 4. The countries with the highest increases in production between 2005 and 2011 were:

China (260 to 584, 124.6%), the United Kingdom (106 to 299, 182.1%) and the Republic of

Korea (87 to 206, 148.3%). Other countries with significant increases were: Germany (45.2%),

Spain (40.1%) and Italy (58.1%). Outside of the Top 10, several countries showed important

increases although the level of production was smaller, including: Brazil (42 to 100 films, 136%),

Iran (26 to 76 films, 192%), Turkey (28 to 70 films, 150%), Viet Nam (12 to 75 films, 525% in

2010), and Mexico (71 to 111 films, 56.3%). The level of production for the rest of the world

grew at a smaller rate between 2008 and 2011.

However, as seen in Table 4, the increase in film production was at a slower pace for the largest

producers (on average at about 20%). For example, the average increase in film production

between 2005 and 2011 was 21% in India, 17% in USA, 24% in Japan and 13% in France. As of

2008, some relative stagnation in growth for these countries is noticeable.

TABLE 4. TOP 10 FILM PRODUCERS IN THE WORLD

Rank

Country

2005

2006

2007

2008

2009

2010

2011

Average

increase

from

2005-2011

1

India

1,041

1,091

1,146

1,325

1,288

1,274

1,255

21%

2

USA

699

673

789

773

751

792

819

17%

3

China

260

330

411

422

475

542

584

125%

4

Japan

356

417

407

418

448

408

441

24%

5

UK

106

107

124

279

313

346

299

182%

6

France

240

203

228

240

230

261

272

13%

7

Rep. of Korea

87

110

124

113

158

152

216

148%

8

Germany

146

174

174

185

216

189

212

45%

9

Spain

142

150

172

173

186

200

199

40%

10

Italy

98

116

121

154

131

142

155

58%

World share of Top 10

65.9%

63.8%

64.2%

63.2%

64.8%

65.8%

67.7%

Source: UNESCO Institute for Statistics, April 2013.

- 12 -

Nigeria has a very high number of audiovisual productions (see Map 1) – on average releasing

966 films per year between 2005 and 2011 – but they are semi-professional/informal

productions, most of them almost artisanal with limited or no theatrical release. While 1,074

films were produced in 2010 in Nigeria, national movies sold only 117,563 tickets (26% of

market share of that year), in a country with a population of about 160 million inhabitants. For

this reason, artisanal audiovisuals from Nigeria were not included in the figures (see Box 1).

MAP 1. CONCENTRATION OF FILM PRODUCTION, 2011

Source: UNESCO Institute for Statistics, July 2013.

To better analyse the concentration of worldwide film production, Table 5 shows 90 countries

that made feature films during at least three years between 2005 and 2011, categorised by

production level.

TABLE 5. PRODUCTION LEVEL BY NUMBER OF COUNTRIES AND FILMS*, 2005-2011

Level of film production

Number of

countries**

Average annual

number of feature

films produced

Share of total

production (%)

Very high

200 and more

7

3,561

57.0

High

80-199

11

1,259

20.3

Average

20-79

26

1,014

16.3

Low

6-19

32

337

5.4

Very low

Up to 5

14

40

0.7

Total

90

6,211

Notes: * Professional films that are made with commercial exhibition as the main objective (Nigerian

films are not included).

** Countries with at least one feature film produced over at least three years between 2005 and

2011.

Source: UNESCO Institute for Statistics, July 2013 and Roque González (2012).

- 13 -

BOX 1. FILM PRODUCTION IN VIDEO FORMAT

This report focuses on films for theatrical release. Nevertheless, production in video format is also a key

component of the film industry and a factor of growth and creativity in many developing countries.

Countries which do not have the facilities and resources to produce films for theatrical release are using

video format to reach their audiences. As shown in Table 6, Nigeria – with an average production of 1,000

movies per year – is the third largest producer in terms of volume. As a result of new technology and

video production, the emergence of new film producers, such as Mauritius, has been possible. While the

country did not produce any feature films before 2009, Mauritius increased its production from 19 to 30

films between 2010 and 2011.

TABLE 6. FILM PRODUCERS IN VIDEO FORMAT, 2005-2011

Country

Total number of films produced in video format

2005

2006

2007

2008

2009

2010

2011

Average

Bhutan

31

29

30

Cambodia

41

62

35

25

28

26

13

33

Cameroon

4

7

1

3

20

*

7

Gabon

1

4

6

9

10

6

Mauritius

–

–

–

–

19

16

30

22

Nigeria

872

914

**

956

987

1,074

997

967

Notes: – = quantity nil ; * = National estimation; **= UIS estimation.

Source: UNESCO Institute for Statistics, July 2013.

Analysing all films, regardless of their format of production (theatrical release or video production)

provides an overview of the cinema sector worldwide. Table 7 shows that global film production has

increased significantly in recent times, with total production rising from 5,735 movies in 2005 to 7,442 in

2008. Production continues to grow but at a slower pace since 2008.

TABLE 7. TOTAL NUMBER OF FILMS IN ALL FORMATS, 2005-2011

Country

Total number of films produced in all formats

2005

2006

2007

2008

2009

2010

2011

Video format

917

951

988

1,060

1,156

1,079

Theatrical release

4,818

5,214

5,760

6,454

6,475

6,548

6,573

Total

5,735

6,711

7,442

7,535

7,704

7,652

Source: UNESCO Institute for Statistics, July 2013.

There were 7 countries that had “very high” annual film production (more than 200 feature films)

between 2005 and 2011, producing on average 3,561 films yearly and representing 57% of the

world’s feature films.

There were 11 countries that had a “high” level of film production (between 80 and 199 feature

films per year), producing on average 1,259 feature films annually. The very high- and high-level

groups together accounted for 78% of global film production on average over this time period,

representing the production of 4,820 films annually.

The “average” production category (between 20 and 79 feature films per year) accounted for an

average annual production of 16% of the world’s films (1,013 films on average per year). Finally,

one-half of countries were classified in the “low” or “very low” levels of film production. They

accounted for 6% of total average annual feature films produced.

- 14 -

2.2. National film support

Much of the national film industry receives direct or indirect public subsidies. Direct subsidies

can be received from national cinematographic agencies, the national film commission in charge

of financing national films, or special funds dedicated to national film production. Indirect

subsidies can take the form of screen quota or tax incentives and are directly financed by the

Lottery, like in the United Kingdom.

Table 8 shows that 12 of the Top 15 countries with the highest production and market share

have public subsidy policies and mechanisms. The main film-producing countries with a very

high or high level of production have direct financial support, in addition to a tradition of

coproductions, such as Argentina, France, Spain and the United Kingdom.

Nevertheless, the film sector does not benefit from public support in the main producer of the

world, India, and the fourth producer Japan. In the case of USA, the cinema sector receives tax

exemptions, deferred payments or accelerated amortization.

TABLE 8. TOP 15 COUNTRIES WITH THE HIGHEST NUMBER OF FEATURE FILMS

PRODUCED FOR THEATRICAL RELEASE, BY MARKET SHARE (ADMISSIONS) AND

NATIONAL FILM SUPPORT (AVERAGE FOR 2005-2011)

Average

production

(2005-2011)

Level of

production*

National film

support

1

India

1,203

Very high

No

2

USA

757

Very high

Indirect

3

China

432

Very high

Yes

4

Japan

414

Very high

No

5

Russian Federation

292

Very high

Yes

6

France

239

Very high

Yes

7

United Kingdom

225

Very high

Yes

8

Germany

185

High

Yes

9

Spain

175

High

Yes

10

Republic of Korea

137

High

Yes

11

Italy

131

High

Yes

12

Argentina

108

High

Yes

13

Mexico

94

High

Yes

14

Brazil

89

High

Yes

15

Bangladesh

88

High

Yes

Notes: * “Very high”: 200 feature films produced per year; “High”: 80-199 feature films produced per

year.

Source: UNESCO Institute for Statistics, July 2013 and Roque González (2012).

- 15 -

3. Market share (exhibition and consumption)

3.1. Exhibition

Figure 1 shows that, while admissions have slightly declined in recent years, box office has

continued to grow.

FIGURE 1. CONTRASTING TRENDS BETWEEN GLOBAL ADMISSIONS AND BOX OFFICE,

2005-2011

Source: UNESCO Institute for Statistics, July 2013.

The 27.8% increase in world box office between 2006 and 2011 was primarily a result of the

growth in the Top 10 countries, representing 70%-78% of the total. In effect, this growth was led

by China (with a spectacular increase of 517.0%) and the Russian Federation (+171.8%) (see

Tables 9A and 9B). Other major markets with strong growth in box office were: Australia (+83%)

and Japan (+54%). In contrast, the USA (the largest film market) had one of the lowest growth

rates of the Top 10, with only a 7.36% increase in the period analysed, a rate below those of

France (+20.7%) and the United Kingdom (+18.7%). The Republic of Korea was the only

country with a negative growth of 3.8%.

Other countries with important increases in their box offices over the period 2006 to 2011

include: Belarus, Romania, Ukraine and Venezuela. Several Latin American, East European

and Asian markets doubled their box office during this period. Nevertheless, the majority of

these countries represent small markets and the increase in some of them is explained by high

inflation rates, as is the case for Argentina, Belarus and Venezuela.

- 16 -

TABLE 9A. TOTAL BOX OFFICE REVENUE FOR THE TOP 10 COUNTRIES

(IN MILLIONS US$), 2006-2011

2006

2007

2008

2009

2010

2011

USA

9,488

9,632

9,635

10,610

10,580

10,186

Japan

1,745

1,685

1,885

2,202

1,347

2,766

China

329

434

607

909

1,502

2,030

France

1,475

1,559

1,586

1,789

1,745

1,780

GBR

1,402

1,878

1,723

1,772

1,526

1,665

India

1,371

1,729

1,843

1,415

1,356

1,470

Germany

1,008

1,115

1,104

1,415

1,227

1,244

Australia

616

749

793

848

1,038

1,128

Russia

408

547

799

706

1,014

1,109

Rep. of Korea

1,036

1,069

890

857

1,000

997

TOTAL Top 10

18,878

20,398

20,865

22,524

22,335

24,375

World*

25,500

26,200

27,700

29,400

31,600

32,600

% Top 10

74

78

75

77

71

75

Note: * From Focus 2013, European Audiovisual Observatory.

Source: UNESCO Institute for Statistics, July 2013.

TABLE 9B. EVOLUTION OF BOX OFFICE REVENUE, 2006-2011

Variation

2006/2011

Yearly

average

growth

Share of

World in

2011

Share of

Top 10

USA

7.36%

1.43%

31.25%

41.79%

Japan

58.51%

9.65%

8.48%

11.35%

China

517.02%

43.90%

6.23%

8.33%

France

20.68%

3.83%

5.46%

7.30%

GBR

18.76%

3.50%

5.11%

6.83%

India

7.22%

1.40%

4.51%

6.03%

Germany

23.41%

4.30%

3.82%

5.10%

Australia

83.12%

12.86%

3.46%

4.63%

Russia

171.81%

22.14%

3.40%

4.55%

Rep. of Korea

-3.76%

-0.76%

3.06%

4.09%

TOTAL Top 10

29.12%

5.24%

74.77%

World*

27.80%

5.04%

Source: UNESCO Institute for Statistics, July 2013.

- 17 -

A key factor in the world box office variation was the constant rise in the average ticket price, by

46% globally (see Table 10). Switzerland had the most expensive average ticket price in the

world over 2005-2011: US$13.55, followed by Norway (US$12.96), Sweden ($US12.07), and

Japan (US$11.96). Nine of the Top 10 countries with the highest ticket prices were from Europe.

In contrast, countries with the least expensive ticket prices included: India (the world’s least

expensive); Egypt, Niger, Senegal, Ethiopia in Africa; the Philippines, Indonesia and Laos in

Asia; Belarus in Europe; and Iran in West Asia.

TABLE 10. WORLD AVERAGE TICKET PRICES (IN US$), 2005-2011

2005

2006

2007

2008

2009

2010

2011

Average ticket price

4.76

5.21

6.02

6.30

6.35

6.53

6.95

Countries covered

55

55

59

63

60

58

52

Source: UNESCO Institute for Statistics, July 2013.

Between 2005 and 2011, China’s ticket prices increased by 253% the most of any country. It

was followed next by Morocco (180%), Belarus (148%) and Argentina (134%) over the same

period. These price increases are also a result of inflation, with Argentina and Belarus

experiencing some of highest inflation rates in the world during that time. Other countries where

ticket prices doubled include: the Philippines, Slovakia, Ukraine and Venezuela. In the Russian

Federation, box office increased by 239%, while the average ticket price grew by 86%.

In contrast, some countries showed only small increases in ticket prices between 2005 and

2011, such as Estonia, Iceland and the Republic of Korea. In fact, ticket prices in Iceland

decreased by 25%, coinciding with the beginning of the 2008 national economic crisis. The

average ticket price in Iceland declined from US$12.90 to US$9.10, and then to a low of

US$6.80 in 2009. However, there were small increases in 2010 and 2011, with ticket prices of

US$7.70 and US$8.10 respectively.

Although it may appear that ticket prices in developing countries are low, when compared with

the average income and the cost of living, ticket prices in these countries are relatively high

compared to developed countries: one trip to the movies with friends or family can represent

almost 10% of monthly income (González, 2012).

Comparing admissions and box office, it is clear that different dynamics emerge. In box office

(see Table 9A), the wealthiest countries (with a high average ticket price) and the robust

markets of emerging countries (like China and India) are prominent.

When examining the Top 10 countries by admissions for the period 2005-2011 (see Table 11),

other emerging economies are noticeable with outstanding increases in markets, such as China

(135.3%), the Russian Federation (82.5%) and Brazil (71.5%). After the Top 10 list, other

markets with notable increases (from +138% to +156%) were: Bosnia and Herzegovina,

Colombia, Lithuania, Malaysia and Romania. Nevertheless, all these countries (outside of the

Top 10) have small to medium-sized markets (from 600,000 to 7 million admissions in 2011). By

contrast, admissions were down by 5.2% in countries with larger markets (-8.1% in the Top 10),

primarily accounted by decreases in India and Japan (especially in the former – the largest

world market in terms of admissions). During the period 2005 to 2011, the share of world

admissions of the Top 10 countries varied from 82% to 85%.

- 18 -

Another reason for this decrease can be explained by the changing trends in audiovisual

consumption (Internet, mobile devices, video on demand, Over-the-Top Content, etc.) that is

radically changing the way people consume movies. As Iberoamerican expert Octavio Getino

said, “Never have people watched so many movies... but mainly not in theaters” (Getino, 2012).

TABLE 11. TOTAL ADMISSIONS FOR THE TOP 10 COUNTRIES (IN MILLIONS), 2005-2011

2005

2006

2007

2008

2009

2010

2011

Variation

India

3,770

3,997

3,290

3,251

2,917

2,706

2,940

-22.02%

USA

1,403

1,449

1,399

1,341

1,415

1,342

1,284

-8.49%

China

157

176

196

210

264

290

370

135.37%

France

176

189

178

190

201

207

217

23.42%

Mexico

154

154

175

182

178

190

205

33.06%

GBR

165

157

162

164

173

169

172

4.19%

Japan

160

165

163

160

169

174

145

-9.80%

Rep. of Korea

146

153

159

151

157

149

160

9.75%

Russian Fed.

84

92

105

118

132

156

153

82.54%

Brazil

84

90

89

89

113

135

144

71.50%

Total Top 10

6,298

6,622

5,917

5,857

5,720

5,518

5,788

-8.10%

World

7,372

7,761

7,073

7,033

6,961

6,664

6984

-5.26%

% of Top 10

85

85.33

83.66

83.28

82.16

82.16

82.80

Average: 83.65

Source: UNESCO Institute for Statistics, July 2013.

When analysing the decrease in Indian film admissions, there is no consensus about the cause.

Nevertheless, some assumptions can be made based on the important decrease in 2009. In this

year, there was a boycott by the main Indian producers refusing to release big films to pressure

exhibitors (mainly multiplex cinemas) to increase revenue-sharing. The two-month dispute (from

April to early June) concluded with a 50:50 split agreement.

Furthermore, over the last several years the exhibition market in India has changed, possibly

accounting for variations in the film market. The main change in the exhibition market is the

multiplex (Pendakur, 2012). In India, there still is a plethora of mono screens in the southern half

of the country, with an average ticket price of US$0.50. These screens are still the most popular

for Indian moviegoers. Around 1,000 multiplexes have emerged in large Indian cities, with a

ticket price of around US$3.30. These multiplexes account for most of the Indian revenues

generated for Hollywood blockbusters. Nevertheless, films from USA account for no more than

7% to 10% of the Indian box office (Ernst & Young-India Film Council, 2012). Additionally, no

Hollywood films are in the Indian Top 10 films.

3.2. BRIC countries: The emerging market

The difference between box office and admissions is even clearer when analysing BRIC

countries (Brazil, the Russian Federation, India and China). While BRIC countries accounted for

9% to 17% of world box office, the rate for admissions was impressive, between 49% and 56%:

BRIC countries accounted for one-half of global admissions (mainly, because of India) between

2006 and 2011.

At the country level, growth in China was exceptional. In 2006, China represented 13.6% of

BRIC box office, while in 2011 that percentage grew to 37.4%, surpassing the leading position

of India (see Table 12). In contrast, box office in India declined from 56.6% of the BRIC total in

- 19 -

2006 to 27% in 2011. Meanwhile, the Russian Federation and Brazil had very little growth

during this period from 17% to 20% and from 13% to 15%, respectively.

TABLE 12. BOX OFFICE REVENUE IN BRIC COUNTRIES (IN MILLIONS US$), 2006-2011

Box office

2006

2007

2008

2009

2010

2011

China

329

434

607

909

1,502

2,030

Russian Fed.

409

547

799

707

1,014

1,109

India

1,371

1,729

1843

1,415

1,356

1,470

Brazil

313

360

359

478

735

817

Total BRIC

2,422

3,070

3,608

3,509

4,607

5,426

% share in Top 10

12.83%

15.05%

17.29%

15.58%

20.63%

22.26%

% of world share

9.50%

11.72%

13.03%

11.94%

14.58%

16.64%

Source: UNESCO Institute for Statistics, July 2013 and Roque González (2011).

With regards to admissions, the situation was more stable (see Table 13). The market share of

films from India decreased in relation to the total of BRIC countries, from 91.8% in 2006 to 81.5%

in 2011. Meanwhile, China multiplied its proportion of BRIC admissions by 2.5, increasing from

4.5% to 10.3%. The Russian Federation and Brazil doubled their admissions: 2.0% for both in

2006, increasing to 4.2% and 4.0%, respectively, in 2011.

TABLE 13. ADMISSIONS IN BRIC COUNTRIES, 2006-2011

BRIC

2006

2007

2008

2009

2010

2011

India

3,997

3,290

3,251

2,917

2,706

2,940

China

176

196

210

264

290

370

Russian Fed.

92

105

118

132

156

153

Brazil

90

89

89

113

135

144

Total BRIC

4,355

3,680

3,668

3,425

3,287

3,606

% share in Top 10

65.77%

62.20%

62.62%

59.89%

59.56%

62.31%

% world share

56.12

52.03

52.15

49.21

49.32

51.64

Source: UNESCO Institute for Statistics, July 2013.

3.3. Consumption: The link between film attendance and availability of screens

The frequency of attendance varied across the world. Table 14 shows the Top 10 countries by

film attendance in 2005 and 2011. Historically, some countries maintain a high level of

attendance: Australia, Iceland, France, the Republic of Korea, Singapore, the United Kingdom

and USA.

However, there are other countries that represent important markets but have relative low

frequency of attendance and which are not in the Top 10 list (e.g. China, Japan and Germany).

India, Norway and Spain (countries appearing in the 2005 Top 10 but not in the 2011 one), still

had a high frequency of attendance in 2011: 2.66, 2.65 and 2.37, respectively.

- 20 -

TABLE 14. FREQUENCY OF ATTENDANCE PER CAPITA (POPULATION AGED 5 TO 79

YEARS) FOR THE TOP 10 COUNTRIES FOR FILM ATTENDANCE, 2005-2011

Rank

2005

2011

1

USA

5.27

Iceland

5.24

2

Iceland

5.19

USA

4.59

3

Australia

4.54

Singapore

4.56

4

Singapore

3.78

Australia

4.20

5

India

3.74

Ireland

4.06

6

Rep. of Korea

3.31

France

3.89

7

Spain

3.25

Aruba

3.81

8

France

3.23

Rep. of Korea

3.56

9

United Kingdom

3.04

United Kingdom

3.08

10

Norway

2.90

Luxembourg

2.74

Source: UNESCO Institute for Statistics, July 2013.

This situation becomes more complex when taking into account the lack of screens in many

countries and the proportion of screens in relation to the population. Figure 2 and Table 15

show the level of attendance by the number of screens per inhabitant. With a limited number of

screens per inhabitant, Brazil, Japan, Mexico and the Russian Federation witnessed impressive

growth in the film market.

FIGURE 2. FREQUENCY OF ATTENDANCE BY SCREEN PER 100,000 INHABITANTS

AGED 5 TO 79 YEARS, 2011

Source: UNESCO Institute for Statistics, July 2013.

- 21 -

Aruba and the USA stand out in Figure 2. They have the highest frequency of attendance and

screens per capita but for different reasons. Aruba has a wealthier economy mainly generated

from tourism and a small population (about 100,000 inhabitants in 2011); it has nearly 20

screens/2 theaters for 380,000 annual admissions. These humble numbers generate very high

percentages. Another Caribbean island – Saint Kitts – has a similar situation. The other outlier,

USA, is the primary film market in the world.

Singapore and the Republic of Korea have high attendance frequency but a relatively low

number of screens per capita.

Countries which have a high number of screens per capita but lower frequency of attendance

include: Malta, Spain and Sweden. It is worth noting that Spain is the 6

th

largest exhibition

market in the world (2011). This country also had an important crisis that significantly reduced

its level of admissions in recent years (127.6 million in 2005; 98.3 million in 2011).

TABLE 15. TOP 5 COUNTRIES WITH AT LEAST 10 SCREENS PER 100,000 INHABITANTS

(POPULATION AGED 5 TO 79 YEARS), 2005-2011

Country

Screens per

capita in 2005

Country

Screens per

capita in 2006

Iceland

16.88

Iceland

17.03

USA

14.34

USA

14.34

Sweden

12.03

Sweden

12.04

Spain

11.20

Ireland

10.90

Malta

11.08

Spain

10.81

Country

Screens Per

Capita in 2007

Country

Screens per

capita in 2008

Iceland

15.70

Saint Kitts and Nevis

15.30

USA

14.85

USA

14.77

Sweden

11.49

Iceland

14.75

Ireland

11.05

Ireland

11.16

Malta

10.99

Malta

10.97

Country

Screens per

capita in 2009

Country

Screens per

capita in 2010

Saint Kitts and Nevis

15.09

Aruba

21.03

USA

14.47

USA

14.28

Iceland

14.19

Iceland

13.29

Ireland

11.22

Belarus

11.30

Malta

10.95

Ireland

10.99

Country

Screens per

capita in 2011*

Aruba

20.93

USA

14.19

Ireland

11.03

Sweden

9.90

Malta

9.88

Note: * No data for Iceland for 2011, which should have been ranked in the Top 5.

Source: UNESCO Institute for Statistics, July 2013.

- 22 -

Table 16 shows that the countries that had the fewest number of screens in 2007 were almost

exclusively from Africa. Nevertheless, some countries with few screens in other regions still had

important markets, such as China, India and the Russian Federation. Latin America also

generally has a low number of screens, but two countries stood out: Bolivia (2005) and

Paraguay (2006). This is a more recent situation, because until the 1970s Latin America had

many screens distributed all over its territories (Getino, 2005).

TABLE 16. TOP 5 COUNTRIES WITH THE FEWEST SCREENS PER 100,000 INHABITANTS

(POPULATION AGED 5 TO 79 YEARS), 2005-2011

Country*

Screens per

capita in 2005

Country*

Screens per

capita in 2006

Iran

0.38

China

0.25

Romania

0.59

Tunisia

0.31

Bolivia

0.61

Iran

0.37

Russian Federation

0.81

Indonesia

0.45

India

1.04

Paraguay

0.52

Country

Screens per

capita in 2007

Country

Screens per

capita in 2008

Cameroon

0.02

Cameroon

0.02

Mozambique

0.02

Mozambique

0.02

Niger

0.03

Niger

0.03

Algeria

0.03

Burkina Faso

0.08

Palestine

0.06

Nigeria

0.08

Country

Screens per

capita in 2009

Country

Screens per

capita in 2010

Mozambique

0.02

Mali

0.02

Niger

0.03

Guinea

0.02

Algeria

0.06

Syria

0.03

Cambodia

0.06

Niger

0.03

Burkina Faso

0.08

Tanzania

0.06

Country

Screens per

capita in 2011

Mali

0.02

Guinea

0.02

Syria

0.03

Niger

0.03

Tanzania

0.06

Note: * No data for the Sub Saharan region.

Source: UNESCO Institute for Statistics, July 2013.

- 23 -

On the other hand, there are several countries which do not have any multiplexes. Nevertheless,

the countries with the most box office numbers have a higher proportion of 2 to 7 screens or

multiplex screens in comparison to single screens.

As seen in Figure 3, six countries have only monoscreens. There are also several countries

that have a significant number of theaters (100+) with single screens, including: Slovakia (89%),

Belarus (83%), Switzerland (69%), and Nordic countries like Finland (77%) and Norway (61%).

Other countries that have a large number of screens (300 to 500 in total) with a high proportion

of monoscreens include: the Czech Republic (95% monoscreens), Sweden (79%) and Poland

(73%). In 2011, France had 2,031 screens of which 58% were monoscreens.

FIGURE 3. DISTRIBUTION OF CINEMAS BY NUMBER OF SCREENS, 2011

Source: UNESCO Institute for Statistics, July 2013.

- 24 -

4. Digitization

Since 2010 (the year in which the film Avatar was released), the number of digital screens

increased exponentially, especially in developed countries. In developing countries, the rate of

digitization was lower yet still significant. Figure 4 shows the sharp rise in the number of digital

screens, increasing from 6,707 in 2005 to 55,442 in 2011. This represents an increase of 726%.

The trend is also characterised by the fact that it occurred outside the USA. In 2007, the USA

accounted for 70% of all digital screens; by 2001, the share had dropped to 46%. The greatest

growth occurred in Europe.

In the 2000s, the mainstream film industry (Hollywood and multinational companies) declared

that digitization of screens would reduce copy fees and other related costs, opening more

theaters, penetrating territories with a low level of screens, allowing national film producers and

filmmakers in developing countries to increase their market share and reinforcing cultural

diversity (De Luca, 2004, 2009) .

FIGURE 4. NUMBER OF DIGITAL SCREENS*, 2007-2011

Note: * Digital projectors included in the UIS survey until 2007 required a minimum standard of 1.3K

resolution, where the imaging device is 1,280 pixels wide by either 720 or 1,024 pixels high. Since

2008, all new digital projectors have a minimum standard of 2K resolution (2,048 x 1,080).

Source: UNESCO Institute for Statistics, July 2013.

- 25 -

Digitization is dominated by Hollywood and other major players. This concentration has

strengthened in recent years, and this having a negative impact on middle and small exhibitors

and, in some cases, national producers. The Virtual Print Fee (VPF

4

) has almost no presence in

regions like Latin America – except for a very few big players. National producers also need to

pay a “sui generis” VPF which is more expensive than the former 35mm print costs for local

producers in developing countries (González, 2011).

5. Case studies

In order to analyse specific trends in the cinema market across the world, two cases studies will

be presented: one comparing film market in the USA to that of China, and the other focusing on

the Latin American market. The first case study will demonstrate how the dynamic Chinese

market is challenging the USA as the premier film market in terms of box office. The second

case study will show that the Latin American film sector is not homogenous and is led by two

countries – Brazil and Mexico have entered into the world top market during the last decade,

while other countries of the region lack screens and have small production. Public regulation

and support of the film sector in the region have also highly influenced the structure of the Latin

American market.

5.1. China: The future leader of the film market?

Over the few last decades, the rate of economic growth of the Chinese economy has been

enormous compared to most, if not all, economies in developed countries. As a result, this

growth has been evident in the film market, where by 2012 China became the second largest

consumer of feature films in the world in terms of box office. During the same period, the USA

market has faced stagnation or experienced little increase in terms of admissions. If this trend

continues, China will surpass the USA as the world’s Number 1 film market by 2020.

The film market in China has grown four to five times faster than its GDP over the last decade

(and its GDP is one of the fastest growing in the world) and the growth in the film market has

been even more impressive. In fact, between 2005 and 2011, box office in China grew on

average by 43% per year (50% over the 2008-2011 period), while the cinema market box office

of the USA grew on average by just 2.2% annually (see Figure 5).

The difference in the number of admissions is remarkable: while admissions grew on average

by 15.6% annually in China between 2005 and 2011, in the USA market there was an annual

average decrease of -1.4% (see Figure 6). This growth occurred despite the dramatic increase

in ticket prices that occurred in China during this period. The average admission price in China

multiplied 3.5 times, an increase of 253% between 2005 and 2011, whereas the average ticket

price in the USA increased by only 23.8%.

It is worth noting that the decline in growth of the US market (both for box office and

admissions) started in 2005, that is to say, three years before the start of the global financial

crisis.

4

The Virtual Print Fee (VPF) is financial support giving by distribution companies to exhibition

companies to afford the high costs of digitization.

- 26 -

FIGURE 5. ANNUAL GROWTH RATE IN BOX OFFICE REVENUE IN CHINA AND USA,

2005-2011 (BASE YEAR 2005)

Source: UNESCO Institute for Statistics, July 2013.

FIGURE 6. ANNUAL GROWTH RATE IN ADMISSIONS IN CHINA AND USA, 2005-2011

(BASE YEAR 2005)

Source: UNESCO Institute for Statistics, July 2013.

- 27 -

One of the reasons for the sharp increase in the number of cinema admissions in China has

been the prodigious growth of its economy and the increase in the standard of living and

disposable incomes of the middle class. These newly wealthy citizens can now afford to go to

the cinema to enjoy both national and foreign movies. This growth has spurred the continual

and rapid construction of theatres: “China is building something like 10 screens a day”, said

Christopher Dodd, MPAA chairman and CEO on March 2013 (The Hollywood Reporter, 2013).

And despite the tremendous increases in average ticket prices, Chinese spectators continue to

fill theaters.

Although the number of new multiplexes has risen steadily, China is still lacking screens (as

seen in Section 3.3) in comparison to its population and market. In 2011, China had

approximately 2,000 theaters and 9,286 screens across the country – making it the second

largest national exhibition market in the world. However, this represents only one screen per

every 136,000 people. In contrast, the USA had approximately 40,000 screens in 2011, with a

population of approximately 280 million, representing one screen per every 7,000 people. China

will need to construct some 170,000 screens to reach the same level of screen density as in the

USA.

At this rate of growth in cinema theatre construction and admissions, China is expected to

surpass the USA as the Number 1 film market by 2020. Figure 7 shows that, if China’s growth

rate continues to increase regularly, although at a slower rate, over the next 15 years and if

USA’s growth remains almost stable, then China will surpass USA by 2019. In addition, China’s

box office will be 50% more than that of the USA by 2025.

FIGURE 7. PROJECTED BOX OFFICE REVENUE IN CHINA AND USA (IN MILLIONS US$),

2011-2025

Source: UNESCO Institute for Statistics, July 2013.

- 28 -

5.2. Latin America: Evolution and characteristics of the cinema industry

The Latin American film market shows contrasting situations between countries. On the one

hand, there are countries that in the last decade have more than doubled the number of screens,

admissions and/or box office (i.e. Brazil, Colombia, Mexico and Peru). Brazil entered the world

Top 10 list with the highest admissions of any Latin American country during the last decade,

while Mexico has the fifth largest number of screens in the world. On the other hand, some

countries encountered modest growth or even stagnation in the number of screens available

(i.e. Argentina and Uruguay).

A common pattern seen in the region is government support for film production. The evolution of

the film market in some countries, such as Argentina, Brazil and Mexico, is highly dependent on

public policies, which have been changing over the last 30 years.

In 2011, Latin America generated a total box office of US$1.6 billion, representing an average

ticket price of US$4.50 and the sale of 417 million tickets. Brazil and Mexico together accounted

for 65% to 75% of these totals.

Viewers in Latin America have access to about 9,756 screens. On average, there are 210

commercial releases per year. Depending on the country, between 5 and 130 national films are

produced a year, primarily as a direct result of the national support received by the governments

of the region over various decades.

Production

During the first decade of the 21

st

Century, Latin American countries produced 2,400 feature

films (see Figure 8), with growth throughout each decade (on average 350 films were produced

per year between 2005 and 2011). This is a sharp increase from the 1980s, when on average

230 films were produced annually or the 1990s with 90 films per year (Getino, 2005).

Film production in Latin America increased partly as a direct result of the public policies

developed to support the field (with the exceptions of Paraguay and a few Central American

countries). These policies have been present in most of the subcontinent since the 1930s

(mainly in Argentina, Brazil, Mexico and Peru). The subsequent decades saw further support in

the form of subsidies, tax incentives, soft loans, prizes for quality and screen quotas (there were

even state producers, state distributors and state exhibitors, mainly in Mexico from the 1940s to

1970s and in Brazil in the 1970s).

In the early 1990s, most countries in the region experienced a drastic reduction in public

support, affecting the national film sectors negatively. Nevertheless, in the late 1990s and early

2000s, there was a re-emergence of public policies favorable to the film sector, mainly in

relation to production. The three major film-producing countries, Argentina, Brazil and Mexico,

resumed their growth. During the 2000s, most Latin American countries implemented national

legislation supporting the film sector.

Argentina and Brazil returned to maximum production peaks with over 100 films produced

annually, surpassing records set in the earlier “golden years”. Mexico also increased film

production, but the country is only just reaching the number of films produced during its golden

years (between 1940 and 1980), which was also about 100 annually. Other Latin American

countries showed more modest increases in the number of films produced. Due to new national

film policies in some of these countries, they have begun regular production of films for the first

time in their history.

- 29 -

FIGURE 8. NUMBER OF FEATURE FILMS PRODUCED IN LATIN AMERICA, 2005-2011

Source: UNESCO Institute for Statistics, July 2013 and Latin American film agencies, production

companies and media (RoqueGonzalezConsulting.com).

Over the last decade, coproduction became the main method of film production in many Latin

American countries, such as Bolivia, Cuba and Uruguay. A significant inter-governmental

initiative related to film support was born within this context: the Conference of Ibero American

Film Authorities (CACI, in Spanish initials). In 1997, they created the Ibermedia Program

5

that

since has had a fundamental role in regional cinematography, with funds dedicated to

production, distribution, training and marketing. Nevertheless, production is the main focus for

Ibermedia loans. There was another regional attempt to create a similar inter-governmental

space in Southern Cone–the Specialized Meeting of Film and Audiovisual Authorities

6

(Recam,

in Spanish initials), but with no concrete outcome until now.

Within Latin America, there is an important and hidden level of semi-professional, almost

artisanal, production of feature films, especially in Bolivia, Ecuador, Peru and Venezuela. Like

“Nollywood”, these films which are not released in theatres but rather circulated via street

vendors or streaming on-line (mainly YouTube) are viewed by large audiences, with some titles

becoming popular “hits”.

5

www.programaIbermedia.com

6

www.recam.org

- 30 -

Market and consumption

The cinema market in Latin America has faced drastic changes over the last few decades. Up

until 40 years ago, national private companies dominated the Latin American film markets,

especially exhibition. Through globalization, film distribution and exhibition are now mainly

controlled by Hollywood studios and the multinational companies associated with them (Guback

1969, Getino, 1984-1987, Rey, 2005).

In Latin America, there are fewer numbers of moviegoers: the frequency of attendance in the

region is on average 0.8 movies per year per person, except in Mexico (1.7), a country that has

the fifth largest exhibition market of the world. Nevertheless, box office showed an increase of

127% during the 2000s, due mainly to the constant increase in cinema ticket price: prices

doubled during the last decade (due primarily to the cost of 3D screening which typically is at a

premium price).

Meanwhile, the number of tickets sold rose 43% on average between 2005 and 2011 (2.8 billion

admissions were sold). As such, the rise in Latin American box office was 1.6 times higher in

comparison to the increase in tickets sold. Mexico and Brazil represented 70% of the total Latin

American admissions and box office.

Growth was not homogeneous in the region. There was significant growth in Brazil, Colombia,

Mexico and Peru. Meanwhile, Chile and Venezuela saw only modest increases while Argentina

and Uruguay experienced relative stagnation (see Figure 9).

FIGURE 9. NUMBER OF ADMISSIONS IN LATIN AMERICA, 2005-2011

Source: UNESCO Institute for Statistics, July 2013 and RoqueGonzalezConsulting.com.

- 31 -

These numbers are far from the height of the cinema industry in Latin America when the

frequency of attendance varied between two to five films on average per year.

Latin American film exhibition

The presence of nationally-produced films in Latin American screens varies according to the

strength of each respective national film sector, cinematographic tradition and degree of state

support. During the last decade, the production of national films substantially increased in

Argentina, Mexico and Brazil, doubling in the first case and tripling in the remaining as shown in

Figure 10. The remaining countries showed slight increases in the number of national releases.

FIGURE 10. NATIONAL FIRST-TIME RELEASE FILMS IN LATIN AMERICA, 2005-2011

Source: UNESCO Institute for Statistics, July 2013 and Latin American film agencies, consulting

companies and media (RoqueGonzalezConsulting.com).

Table 17 shows that national movies attained over a 10% market share in terms of admissions

and box office in Argentina and Brazil, where cinematography is well developed. The remaining

countries of the region with data available had between 2% and 7% of the market share.

Latin American produced movies did not have much success within the region. The market

share for those films was between 0.02% and 1% of admissions. In rare exception, the share

reached to 2% for national hits distributed by international companies.

- 32 -

TABLE 17. AVERAGE MARKET SHARE OF NATIONAL FIRST-TIME RELEASE FILMS

BETWEEN 2005 AND 2011 IN LATIN AMERICA, BASED ON ADMISSIONS

Country

Market share (%)

Brazil

12.7

Argentina

11.0

Colombia

7.3

Mexico

6.5

Uruguay

6.0

Chile

5.6

Venezuela

4.9

Peru

2.0

Source: UNESCO Institute for Statistics, July 2013 and Latin American film agencies, consulting

companies and media (RoqueGonzalezConsulting.com).

Infrastructure and exhibition

The number of screens in Latin America grew on average by 65% in the 2000s. This percentage

was led by Mexico and to a lesser extent; Brazil and Colombia (see Figure 11). This growth

took place in a context of high geographic and class concentration, in addition to the high cost of

tickets – in Latin America just one family outing to the family represented the equivalent of 10%

of average local monthly income.

Nevertheless, Latin America still remains “under screened”, including the giant Brazil, which has

only around 2,500 screens for a population of almost 200 million inhabitants, representing only

1.1 screens per 100,000 inhabitants.

Regardless of whether one country has more or fewer screens, the geographic concentration of

the screens is extremely important in all Latin American countries. In Mexico, only 7% of cities

had a screen, and in Brazil, the second largest Latin American exhibition market, only 10% of

cities had a theater (González, 2011).

Digital screens

These patterns are especially acute in digital cinema through its flagship: 3D (the vast majority

of Latin American digital screens are 3D). In 2007, 19 screens were digitized in Latin America.

Since 2008, especially 2009, many digital screens opened in the entire region. Nevertheless,

the rate of digitization in the region remains one of the lowest in the world (22% in 2011) (see

Figure 12).