A N N U A L R E P O R T

Serving Our Members and Their Families Since 1955

BOARD OF DIRECTORS

Shirley R. Watson – Chairman

Edward G. Doster – Vice Chairman

Timothy P. Kiernan – Treasurer

John F. Adragna – Secretary

John J. Brody – Director

Denis A. Burgoyne – Director

Richard A. Rapp, Jr. – Director

Paul F. Scollan – Director

Tina M. Spy – Director

EXECUTIVE STAFF

Bret W. Sears – President/CEO

Randy J. Wiley – EVP/CFO

Craig A. Booth – VP/CIO

John McGregor – VP/Retail Delivery

Paul D. Young – VP/COO

SUPERVISORY COMMITTEE

John F. Adragna – Chairman

Elizabeth Cardone

Jerome Gaetani

Leslie Maddison

GENERAL COUNSEL

Pugatch & Nikolis

220 Mineola Blvd.

Mineola, NY 11501

631-851-1100 • islandfcu.com

Hauppauge Main Office

120 Motor Parkway

Hauppauge, NY 11788

Bellmore

2752 Sunrise Highway

Bellmore, NY 11710

Hicksville

85 East Old Country Road

Hicksville, NY 11801

Massapequa

824 Hicksville Road

Massapequa, NY 11758

Sayville

4820 Sunrise Highway

Sayville, NY 11782

Selden

920 Middle Country Road

Selden, NY 11784

Riverhead

1071 Old Country Road

Riverhead, NY 11901

Stony Brook University

Student Activities Center

Health Sciences Center

Locations

Supervisory Committee Chairman’s Message

Appointed by the Board of Directors, the Supervisory Committee

o

versees the operations and internal controls of Island Federal Credit

Union. A primary responsibility of the Committee is to ensure that

strong policies and procedures are in place to protect members’ funds.

The Supervisory Committee also ensures that Island is operating in

accordance with required financial reporting objectives established by

t

he National Credit Union Administration (NCUA), accounting principles

generally accepted in the United States of America (GAAP/USA) and

other regulatory guidance.

The Supervisory Committee, along with Island’s Internal Audit function,

coordinates periodic examinations by the NCUA, as well as an annual

audit of the credit union’s financial statements by an independent certified

public accounting (CPA) firm. The Internal Auditor also reviews certain

financial accounts and transactions to confirm the accuracy of balances

and the adequacy of internal controls.

The Supervisory Committee’s volunteer members are actively involved in

monitoring the credit union’s activities with your best interests in mind.

We are committed to ensuring your satisfaction with Island’s products and

services. In this regard, if you have any questions, concerns or comments

about your account, please contact the credit union directly. If you require

further assistance, you are welcome to contact the Supervisory Committee

at [email protected] to address your concerns and facilitate a

fair resolution.

The success of Island Federal Credit Union is supported by the dedicated

efforts of Island’s Management and Staff, as well as my fellow volunteers

who serve on the Supervisory Committee and Board of Directors. We

understand the importance of having a safe, sound place to conduct

your financial transactions. We value your membership and appreciate

that you are part of Island Federal Credit Union.

John F. Adragna

Supervisory Committee Chairman

Federally Insured by NCUA

Federally Insured by NCUA

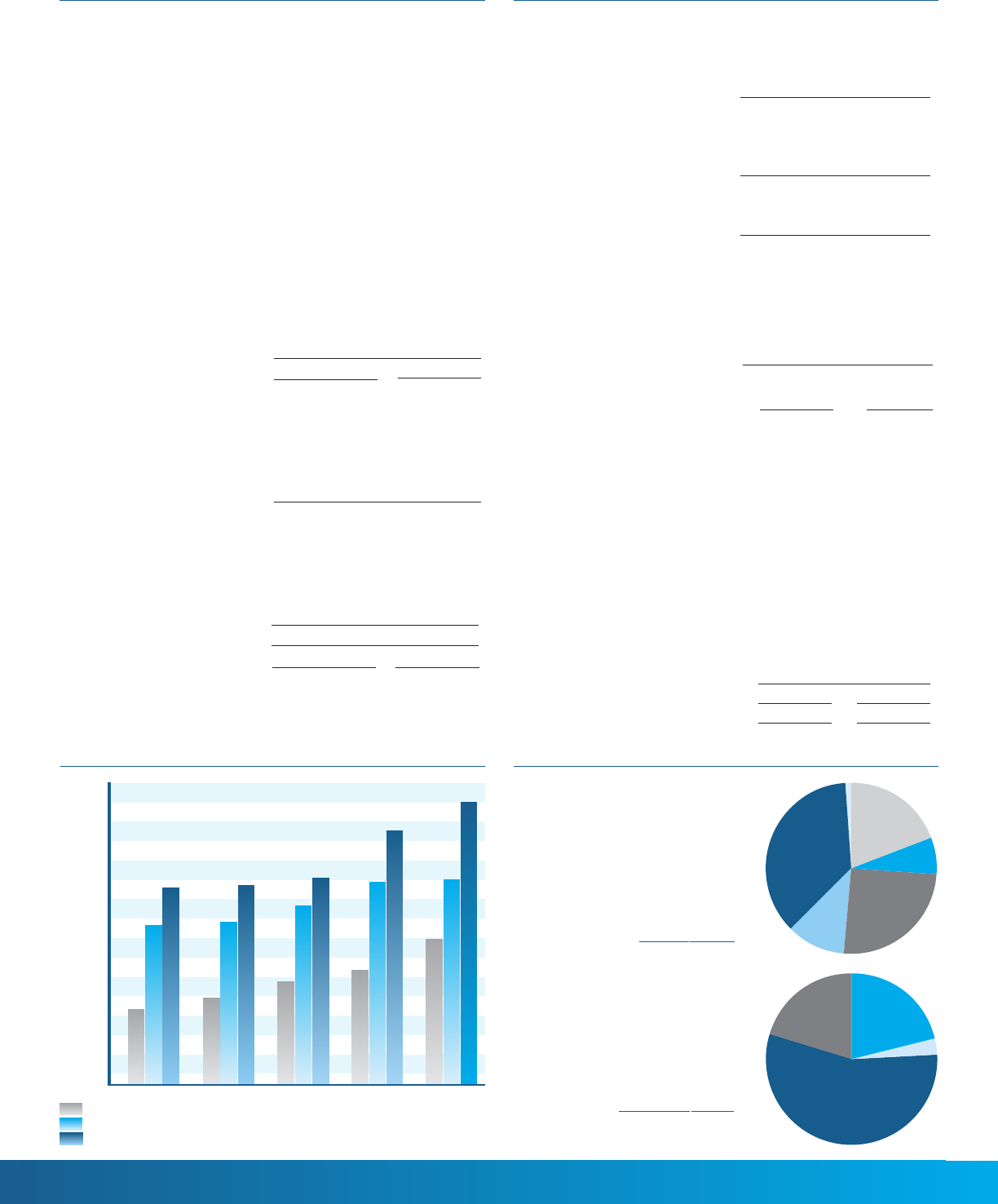

Gross Income Allocation

As of December 31, 2017

■

Dividends $ 9,054,294 23%

■

Interest On Borrowings 3,827,314 10%

■

Operating Expenses 19,068,140 49%

■

Undivided Earnings 6,795,434 18%

Total $38,745,181 100%

Chairman’s Message

The year 2017 marks 10 years since Island Federal Credit Union transitioned from a single-sponsor credit union to a

community credit union that is open to nearly all Long Islanders. When we first made this charter change, we promised

that while our field of membership would grow, Island would remain as committed to our members as we have throughout

our history. We are proud to say that we continue to uphold that promise.

While we have grown to be a $1.4 billion credit union with nearly 40,000 members, Island continues to put its members

first. We offer high quality financial products that serve you throughout a lifetime. These include savings and certificate

products with competitive rates, loans and mortgages with some of the lowest rates around and free checking with a

state-of-the-art mobile app. What truly distinguishes Island from other financial institutions is our experienced, member-

oriented staff. It is not surprising that Island was once again named by Long Island Business News as one of the ‘Best

Places to Work’ on Long Island.

Island is known in our community, not just for our premier banking services, but for being a great supporter of organizations

that make Long Island an even better place to live, work and raise a family. In 2017, we provided funding for Long Island

Cares’ Homeless Outreach program so that they could distribute healthy meals to some of our neighbors who aren’t

served by other charities. Island also provided philanthropic support to the Hope For The Warriors

®

, the John Theissen

Children’s Foundation and the Stony Brook Children’s Hospital (SBCH), among others. Of course, our largest and most

important philanthropic effort, as well as the effort that defines us, is the Island Federal Credit Union Scholarship Program

which gives out $50,000 annually to local high school seniors. Since its inception in 1992, Island has provided scholarships

to more than 290 high school seniors, totaling more than a half-million dollars.

None of these accomplishments would be possible without the support of you, our member-owners. On behalf of our

volunteer Board of Directors, Supervisory Committee, our Executives and Staff, I want to express my personal gratitude

for your membership and continued support of Island Federal Credit Union.

Shirley R. Watson

Chairman

President’s Message

We are exceptionally proud to report that once again Island Federal Credit Union had strong financial performance in 2017.

W

e experienced another record-breaking year with Assets nearing $1.4 billion, a 12% increase versus 2016. Deposits grew

to $1.0 billion, representing a 10% increase, and Loans increased to $.7 billion, also a 10% increase.

At Island, our mission is to provide an exceptional banking experience for those who live or work on Long Island. To accomplish

t

his goal, Island offers a full menu of banking products and services with rates and fees that are among the very best on

Long Island.

W

hile it is important to provide affordable banking services, Island is equally dedicated to ensuring that banking at Island

is convenient no matter where you may live, work or travel. Whether you are banking in-person with our branch staff,

accessing our state-of the-art mobile banking or calling a member representative at Island Anytime 24/7, we strive to

provide the same exceptional member service.

Finally, we are committed to adding new products and services to improve the member experience, such as these new

services added in 2017:

• The CO-OP ATM Network. When combined with the Allpoint ATM Network, Island now offers more than 75,000

surcharge-free ATMs, a total that is unsurpassed by any other local credit union.

• A new First-time Car Buying program. This program helps those just starting out their career to purchase a vehicle

and start to build credit.

• Expansion of our Mortgage offerings and educational seminars. These programs

aim to make it easier for first-time homebuyers to get the home of their dreams.

• Island Financial Services that offers investment and retirement planning,

annuities and other services for our members.

Thank you for your membership and the ongoing support of Island’s mission.

We look forward to serving you in 2018 and beyond.

Bret W. Sears

President/CEO

At December 31

2017 2016

ASSETS

Cash $ 3,586,740 3,956,615

Cash on Deposit in Other Financial Institutions 16,620,049 35,470,392

Investments:

Available-for-sale securities 604,288,930 503,877,144

FHLB Stock 14,058,600 12,185,100

Loans 692,102,866 628,408,798

Deferred loan origination expense 4,352,205 3,358,005

Allowance for loan losses (1,653,697) (1,535,586)

Premium/(Discount) Loans Purchased 1,058,756 359,288

Loans Held for Sale 927,360 –

Accrued interest income 3,539,375 2,726,035

Deposit in National Credit Union Share Insurance Fund 8,683,177 7,719,737

Property and equipment, net of accumulated

depreciation and amortization 12,183,278 12,665,716

Prepaid expenses and other assets 35,000,956 35,374,444

$ 1,394,748,595 1,244,565,688

LIABILITIES AND MEMBERS' EQUITY

Liabilities:

Members' share accounts $ 998,973,566 905,199,828

Borrowings 282,100,000 237,600,000

Accrued expenses and other liabilities 17,085,541 14,554,051

1,298,159,107 1,157,353,879

Members' Equity:

Regular reserve $ 7,551,186 7,551,186

Undivided earnings 108,779,590 101,984,156

Equity acquired in merger 307,339 307,339

Accumulated other comprehensive income (20,048,627) (22,630,872)

96,589,487 87,211,809

$ 1,394,748,595 1,244,565,688

For the Years Ended December 31

2017 2016

INTEREST INCOME

Interest on loans $ 19,673,089 16,446,692

Interest on investments 14,299,412 12,407,703

33,972,501 28,854,395

I

NTEREST EXPENSE

Dividends on share accounts 9,054,294 7,417,438

Interest on borrowed funds 3,827,314 1,734,421

12,881,607 9,151,859

Net interest income 21,090,894 19,702,536

Provision for loan losses 720,000 960,000

Net interest income after provision 20,370,894 18,742,536

for loan losses

NON-INTEREST INCOME

Fees and other operating revenues 3,891,134 3,404,562

Gain on sale of investments 1,601,546 3,227,459

Other non-operating income – –

Gain/(Loss) on disposition of Assets – –

5,492,680 6,632,021

25,863,573 25,374,557

NON-INTEREST EXPENSES

Compensation 5,482,046 5,857,228

Employee benefits 1,829,899 1,794,901

Travel & Conference 147,475 136,518

Office occupancy expenses 2,233,391 2,197,455

Office operations expenses 4,368,774 3,961,917

Educational and promotional expenses 1,830,816 1,723,590

Loan servicing expenses 2,100,034 1,570,071

Professional and outside development expenses 760,472 733,243

Corporate CU Stabilization fund assessment – –

Members' insurance 74,362 60,767

Federal supervision and examination expenses 229,900 175,135

Miscellaneous operating expenses 10,971 831,715

19,068,140 19,042,540

Net income $ 6,795,434 6,332,017

Statements of Financial Condition Statements of Income

Distribution of Shares

As of December 31, 2017

■

Shares $183,525,846 18%

■

Checking 81,127,598 8%

■

Money Market 182,889,496 18%

■

IRA 99,772,729 10%

■

Certificates 439,780,027 44%

■

All Other 11,877,870 1%

Total $998,973,566 100%

2013 2014 2015 2016 2017

Loans $ 330,540,113 $ 393,826,194 $ 484,913,825 $ 628,408,798 $ 692,102,866

Shares 765,084,825 789,392,151 857,657,443 908,199,828 998,973,566

Assets 948,038,313 977,709,673 1,094,384,818 1,244,565,688 1,394,748,595

Millions

$1,500

1,400

1,300

1,200

1,100

1,000

900

800

700

600

500

400

300

200

100

0

Total Loan, Share & Assets

Financial Overview

Gross Income Allocation

As of December 31, 2017

■

Dividends $ 9,054,294 23%

■

Interest On Borrowings 3,827,314 10%

■

Operating Expenses 19,068,140 49%

■

Undivided Earnings 6,795,434 18%

Total $38,745,181 100%

Chairman’s Message

The year 2017 marks 10 years since Island Federal Credit Union transitioned from a single-sponsor credit union to a

community credit union that is open to nearly all Long Islanders. When we first made this charter change, we promised

that while our field of membership would grow, Island would remain as committed to our members as we have throughout

our history. We are proud to say that we continue to uphold that promise.

While we have grown to be a $1.4 billion credit union with nearly 40,000 members, Island continues to put its members

first. We offer high quality financial products that serve you throughout a lifetime. These include savings and certificate

products with competitive rates, loans and mortgages with some of the lowest rates around and free checking with a

state-of-the-art mobile app. What truly distinguishes Island from other financial institutions is our experienced, member-

oriented staff. It is not surprising that Island was once again named by Long Island Business News as one of the ‘Best

Places to Work’ on Long Island.

Island is known in our community, not just for our premier banking services, but for being a great supporter of organizations

that make Long Island an even better place to live, work and raise a family. In 2017, we provided funding for Long Island

Cares’ Homeless Outreach program so that they could distribute healthy meals to some of our neighbors who aren’t

served by other charities. Island also provided philanthropic support to the Hope For The Warriors

®

, the John Theissen

Children’s Foundation and the Stony Brook Children’s Hospital (SBCH), among others. Of course, our largest and most

important philanthropic effort, as well as the effort that defines us, is the Island Federal Credit Union Scholarship Program

which gives out $50,000 annually to local high school seniors. Since its inception in 1992, Island has provided scholarships

to more than 290 high school seniors, totaling more than a half-million dollars.

None of these accomplishments would be possible without the support of you, our member-owners. On behalf of our

volunteer Board of Directors, Supervisory Committee, our Executives and Staff, I want to express my personal gratitude

for your membership and continued support of Island Federal Credit Union.

Shirley R. Watson

Chairman

President’s Message

We are exceptionally proud to report that once again Island Federal Credit Union had strong financial performance in 2017.

W

e experienced another record-breaking year with Assets nearing $1.4 billion, a 12% increase versus 2016. Deposits grew

to $1.0 billion, representing a 10% increase, and Loans increased to $.7 billion, also a 10% increase.

At Island, our mission is to provide an exceptional banking experience for those who live or work on Long Island. To accomplish

t

his goal, Island offers a full menu of banking products and services with rates and fees that are among the very best on

Long Island.

W

hile it is important to provide affordable banking services, Island is equally dedicated to ensuring that banking at Island

is convenient no matter where you may live, work or travel. Whether you are banking in-person with our branch staff,

accessing our state-of the-art mobile banking or calling a member representative at Island Anytime 24/7, we strive to

provide the same exceptional member service.

Finally, we are committed to adding new products and services to improve the member experience, such as these new

services added in 2017:

• The CO-OP ATM Network. When combined with the Allpoint ATM Network, Island now offers more than 75,000

surcharge-free ATMs, a total that is unsurpassed by any other local credit union.

• A new First-time Car Buying program. This program helps those just starting out their career to purchase a vehicle

and start to build credit.

• Expansion of our Mortgage offerings and educational seminars. These programs

aim to make it easier for first-time homebuyers to get the home of their dreams.

• Island Financial Services that offers investment and retirement planning,

annuities and other services for our members.

Thank you for your membership and the ongoing support of Island’s mission.

We look forward to serving you in 2018 and beyond.

Bret W. Sears

President/CEO

At December 31

2017 2016

ASSETS

Cash $ 3,586,740 3,956,615

Cash on Deposit in Other Financial Institutions 16,620,049 35,470,392

Investments:

Available-for-sale securities 604,288,930 503,877,144

FHLB Stock 14,058,600 12,185,100

Loans 692,102,866 628,408,798

Deferred loan origination expense 4,352,205 3,358,005

Allowance for loan losses (1,653,697) (1,535,586)

Premium/(Discount) Loans Purchased 1,058,756 359,288

Loans Held for Sale 927,360 –

Accrued interest income 3,539,375 2,726,035

Deposit in National Credit Union Share Insurance Fund 8,683,177 7,719,737

Property and equipment, net of accumulated

depreciation and amortization 12,183,278 12,665,716

Prepaid expenses and other assets 35,000,956 35,374,444

$ 1,394,748,595 1,244,565,688

LIABILITIES AND MEMBERS' EQUITY

Liabilities:

Members' share accounts $ 998,973,566 905,199,828

Borrowings 282,100,000 237,600,000

Accrued expenses and other liabilities 17,085,541 14,554,051

1,298,159,107 1,157,353,879

Members' Equity:

Regular reserve $ 7,551,186 7,551,186

Undivided earnings 108,779,590 101,984,156

Equity acquired in merger 307,339 307,339

Accumulated other comprehensive income (20,048,627) (22,630,872)

96,589,487 87,211,809

$ 1,394,748,595 1,244,565,688

For the Years Ended December 31

2017 2016

INTEREST INCOME

Interest on loans $ 19,673,089 16,446,692

Interest on investments 14,299,412 12,407,703

33,972,501 28,854,395

I

NTEREST EXPENSE

Dividends on share accounts 9,054,294 7,417,438

Interest on borrowed funds 3,827,314 1,734,421

12,881,607 9,151,859

Net interest income 21,090,894 19,702,536

Provision for loan losses 720,000 960,000

Net interest income after provision 20,370,894 18,742,536

for loan losses

NON-INTEREST INCOME

Fees and other operating revenues 3,891,134 3,404,562

Gain on sale of investments 1,601,546 3,227,459

Other non-operating income – –

Gain/(Loss) on disposition of Assets – –

5,492,680 6,632,021

25,863,573 25,374,557

NON-INTEREST EXPENSES

Compensation 5,482,046 5,857,228

Employee benefits 1,829,899 1,794,901

Travel & Conference 147,475 136,518

Office occupancy expenses 2,233,391 2,197,455

Office operations expenses 4,368,774 3,961,917

Educational and promotional expenses 1,830,816 1,723,590

Loan servicing expenses 2,100,034 1,570,071

Professional and outside development expenses 760,472 733,243

Corporate CU Stabilization fund assessment – –

Members' insurance 74,362 60,767

Federal supervision and examination expenses 229,900 175,135

Miscellaneous operating expenses 10,971 831,715

19,068,140 19,042,540

Net income $ 6,795,434 6,332,017

Statements of Financial Condition Statements of Income

Distribution of Shares

As of December 31, 2017

■

Shares $183,525,846 18%

■

Checking 81,127,598 8%

■

Money Market 182,889,496 18%

■

IRA 99,772,729 10%

■

Certificates 439,780,027 44%

■

All Other 11,877,870 1%

Total $998,973,566 100%

2013 2014 2015 2016 2017

Loans $ 330,540,113 $ 393,826,194 $ 484,913,825 $ 628,408,798 $ 692,102,866

Shares 765,084,825 789,392,151 857,657,443 908,199,828 998,973,566

Assets 948,038,313 977,709,673 1,094,384,818 1,244,565,688 1,394,748,595

Millions

$1,500

1,400

1,300

1,200

1,100

1,000

900

800

700

600

500

400

300

200

100

0

Total Loan, Share & Assets

Financial Overview

A N N U A L R E P O R T

Serving Our Members and Their Families Since 1955

BOARD OF DIRECTORS

Shirley R. Watson – Chairman

Edward G. Doster – Vice Chairman

Timothy P. Kiernan – Treasurer

John F. Adragna – Secretary

John J. Brody – Director

Denis A. Burgoyne – Director

Richard A. Rapp, Jr. – Director

Paul F. Scollan – Director

Tina M. Spy – Director

EXECUTIVE STAFF

Bret W. Sears – President/CEO

Randy J. Wiley – EVP/CFO

Craig A. Booth – VP/CIO

John McGregor – VP/Retail Delivery

Paul D. Young – VP/COO

SUPERVISORY COMMITTEE

John F. Adragna – Chairman

Elizabeth Cardone

Jerome Gaetani

Leslie Maddison

GENERAL COUNSEL

Pugatch & Nikolis

220 Mineola Blvd.

Mineola, NY 11501

631-851-1100 • islandfcu.com

Hauppauge Main Office

120 Motor Parkway

Hauppauge, NY 11788

Bellmore

2752 Sunrise Highway

Bellmore, NY 11710

Hicksville

85 East Old Country Road

Hicksville, NY 11801

Massapequa

824 Hicksville Road

Massapequa, NY 11758

Sayville

4820 Sunrise Highway

Sayville, NY 11782

Selden

920 Middle Country Road

Selden, NY 11784

Riverhead

1071 Old Country Road

Riverhead, NY 11901

Stony Brook University

Student Activities Center

Health Sciences Center

Locations

Supervisory Committee Chairman’s Message

Appointed by the Board of Directors, the Supervisory Committee

o

versees the operations and internal controls of Island Federal Credit

Union. A primary responsibility of the Committee is to ensure that

strong policies and procedures are in place to protect members’ funds.

The Supervisory Committee also ensures that Island is operating in

accordance with required financial reporting objectives established by

t

he National Credit Union Administration (NCUA), accounting principles

generally accepted in the United States of America (GAAP/USA) and

other regulatory guidance.

The Supervisory Committee, along with Island’s Internal Audit function,

coordinates periodic examinations by the NCUA, as well as an annual

audit of the credit union’s financial statements by an independent certified

public accounting (CPA) firm. The Internal Auditor also reviews certain

financial accounts and transactions to confirm the accuracy of balances

and the adequacy of internal controls.

The Supervisory Committee’s volunteer members are actively involved in

monitoring the credit union’s activities with your best interests in mind.

We are committed to ensuring your satisfaction with Island’s products and

services. In this regard, if you have any questions, concerns or comments

about your account, please contact the credit union directly. If you require

further assistance, you are welcome to contact the Supervisory Committee

at [email protected] to address your concerns and facilitate a

fair resolution.

The success of Island Federal Credit Union is supported by the dedicated

efforts of Island’s Management and Staff, as well as my fellow volunteers

who serve on the Supervisory Committee and Board of Directors. We

understand the importance of having a safe, sound place to conduct

your financial transactions. We value your membership and appreciate

that you are part of Island Federal Credit Union.

John F. Adragna

Supervisory Committee Chairman

Federally Insured by NCUA

Federally Insured by NCUA