2022 Annual Report

Our Vision is to protect and empower people to live their digital

lives safely

Our Mission is to build a comprehensive and easy-to-use integrated

portfolio that prevents, detects and responds to cyber threats and

cybercrimes in today’s digital world

Dear Investors,

Fiscal year 2022 was a year of great progress towards our long-term objectives.

NortonLifeLock’s double-digit non-GAAP revenue growth was the result of an ambitious

team working to build and sustain a great business. Together, we continued our

relentless focus on execution to achieve our long-term vision.

Expansion and Value Creation

:HFRPSOHWHGDVWURQJ¿VFDO\HDUZLWKDUHFRUG

billion in non-GAAP revenue and grew our non-GAAP

revenue over 10% year-over-year. This was our third

consecutive year of bookings growth and customer

expansion. Our top-line growth was supported by strong

SUR¿WDELOLW\:HGHOLYHUHGQRQ*$$3RSHUDWLQJSUR¿W

PDUJLQRIDQGQRQ*$$3(36JUHZRYHUWR

for the year.

We meaningfully scaled our business globally and delivered

an international revenue growth of 16%, while maintaining

an industry-leading direct customer retention rate above

DQGGLUHFWFXVWRPHUPRQWKO\$538RI:HSXW

RXUFXVWRPHUV¿UVWLQHYHU\WKLQJZHGR:HKDYHLPSURYHG

our overall customer satisfaction in the last 12 months and

increased our Net Promoter Score to over 45.

900K+

FY22

Year in review

6XFFHVVIXO¿UVW\HDUSURJUHVV

towards long-term objectives

14M+

10+ 16%

23% $8.90

85%+ 45+

Net New Customers

(600K Direct + Indirect*)

*Mobile & Employee

%HQH¿WVRQO\

Norton 360

Members

New Products &

Features Launched

International

Revenue Growth

Partners

Revenue Growth

$538

Direct customer

retention rate

Net Promoter

Score

*5HYHQXHRSHUDWLQJPDUJLQ(36DQGIUHHFDVKÀRZ

SUHVHQWHGDUHQRQ*$$33OHDVHUHIHUWRWKH³8VHRI

Non-GAAP Financial Information” section for reconciliation.

(600KDitIdit*)

Mb

10%

53%

$1.75

$968M

Revenue* $2.8B Op. Margin*

+22% Growth

Free Cash Flow

*

Growth EPS*

:HDOVRJHQHUDWHGQHDUO\ELOOLRQLQIUHHFDVK

ÀRZLQ¿VFDO\HDUDQGZHUHWXUQHG

cash to shareholders in the form of

regular dividends of approximately

PLOOLRQ$WWKHHQGRI¿VFDO

year 2022, we had

DSSUR[LPDWHO\ELOOLRQ

remaining in the share buyback

program, as we did not deploy any

buybacks due to the pending

acquisition of Avast.

Fiscal year 2022 was an

important year for us, as it

delivered great progress

WRZDUGVRXUWKUHHWR¿YH

year long-term objectives,

RQHRIZKLFKLVGHOLYHULQJLQQRQ*$$3(36

We are proud of what our team has accomplished

and look forward to continuing our path to make

Cyber Safety available to everyone.

A Disruptor in Cyber Safety

Our continuous investments in product innovation

and go-to-market activities accelerated our Cyber

Safety footprint globally.

NortonLifeLock has one of the largest consumer

Cyber Safety platforms in the world, empowering

nearly 80 million users in more than 150

countries. Our full portfolio provides protection

across three Cyber Safety categories in multiple

channels and geographies, including security,

identity protection, and online privacy.

Aiming for simplicity and peace of mind for

consumers, we created the Norton 360

technology platform to bring software and

service capabilities into a comprehensive and

easy-to-use integrated platform. Launched less

than three years ago, we now have over 14 million

members in more than 50 countries

worldwide, trusting us to help protect

them. We are expanding our

comprehensive integrated Cyber

Safety platform and complementing

this by offering adjacent trust-based

digital solutions.

We believe Cyber Safety will continue to be

an evolving and growing market, fueled by the

increase in activities online for the years ahead.

The digitization of the world and the overlap

between the physical and digital world is growing

at a fast pace and is here to stay. New

technologies, smart devices, digital identities and

an increasingly more connected world means

consumers will encounter a range of new Cyber

Safety challenges, even more complicated than

before, increasing the risk to their digital lives.

Committed to Innovation

Our business is built around consumers. We are

committed to our innovation and research and

development efforts to help ensure we continue

to address their needs. Fiscal year 2022 was

an important year as our

complete product offering

became more relevant

globally and our customers’

needs broadened.

We accelerated the pace

of product innovation and

introduced more than 10

new products and features

LQWKH¿VFDO\HDULQFOXGLQJH[WHQGLQJRXUSURGXFW

line to incremental privacy and identity solutions.

Additionally, we increased our

Nearly

$1 billion

LQIUHHFDVKÀRZ

Great progress

towards our

WKUHHWR¿YH\HDU

long-term objectives

We accelerated

the pace of product

innovation and

introduced more

than 10 new

products and

features.

international reach by expanding our new and

existing products into new countries.

Trusted Brand for Consumers

We are a trusted brand for consumers. We have

deployed a multi-brand strategy, supported by

marketing dollars towards a combination of digital

and traditional media – with the intention of driving

brand awareness and consideration, to increase

brand trust and loyalty. Moving forward, we will

continue to seek to balance these investments

through different channels and craft impactful

storytelling to make Cyber Safety more relatable to

consumers’ day-to-day activities.

Growing Our Customer Base

and the Value We Deliver

We have multiple go-to-market channels globally

to reach new customers, including

direct-to-consumer, indirect partnerships and

freemium. Our global customer universe is

FRPSULVHGRIDSSUR[LPDWHO\PLOOLRQXVHUV

Total direct customers

are now over 23.5

million, with nearly

600,000 net new

customers added

year-over-year. Our

direct customer base

also has reached a

50% international mix

as we continue to focus

on making our product

offering available

around the world. Our indirect partnerships

business delivered a record 23% revenue growth

as a result of adding new customers and signing

up new accounts in our telco, mobile, and

HPSOR\HHEHQH¿WVFKDQQHOV2XUPRELOHDQG

HPSOR\HHEHQH¿WVFKDQQHOVDORQHDGGHGURXJKO\

QHWQHZFXVWRPHUVLQ¿VFDO\HDU

and both of these indirect channels grew double

digits in customer count each quarter in the year.

Our customers recognize the value we provide,

which is supported by our strong direct customer

UHWHQWLRQUDWHRIRYHUDQGRXULPSURYHPHQWLQ

$5382XUGLUHFWPRQWKO\$538LQFUHDVHG

sequentially each quarter in the year, and we

H[LWHG¿VFDO\HDUZLWKDQDQQXDO$538RI

%XWZHVWLOOKDYHDUXQZD\WRLQFUHDVH$538

and to educate more of our customer cohorts on

the need for more comprehensive cyber

protection. We believe that incrementally, the

value and comprehensive protection from our

1RUWRQSODWIRUPZLOOFRQWLQXHWREHDQ$538

expansion opportunity for us. The majority of our

platform members are subscribed to the lower

tiers of Norton 360. As the need for higher level of

protection continues to grow, we will look to drive

PRUH$538E\VHOOLQJKLJKHUYDOXHRUXSVHOOLQJ

higher tiers of the platform.

,Q¿VFDO\HDUZHZLOOFRQWLQXHWRIRFXVRQ

EXLOGLQJDGLYHUVL¿HGDQGPXOWLFKDQQHO

environment, including direct acquisition,

PDUNHWLQJSDUWQHUVKLSVHPSOR\HHEHQH¿WV

retail/e-tail, OEMs, service providers, and new

SDWKZD\VHVWDEOLVKHGLQ¿VFDO\HDUVXFKDV

the freemium channel.

Environmental, Social and

Governance (ESG) is Core to Our

Business Strategy

NortonLifeLock’s commitment to ESG is a critical

anchor of the Company’s mission and operating

philosophy. Our focus in this area helps us earn

trust from our users,

23.5 million

direct customers

80 million users

employees, and shareholders. As such, ESG

topics are core to our business strategy. Setting

strategic, achievable, and business-aligned

ESG objectives help to guide our work and

improves our company performance. We align our

REMHFWLYHVZLWKWKHFRPSDQ\¶V¿QDQFLDOJRDOVDQG

focus on the unique positive social and

environmental impacts that our business model

can have on the world. We bring together our

team, expertise, and powerful technology to build

a safe, inclusive, and sustainable future for people,

their personal information, and the digital world.

Driving the Transformation of

Consumer Cyber Safety

We believe we are well positioned for the future

and to drive the transformation of consumer Cyber

Safety. As we move our business forward with a

UREXVWEDODQFHVKHHWDQGVWURQJFDVKÀRZ

generation ability, we remain intensely focused on

achieving our long-term objectives while

maximizing long-term shareholder value.

We are still in the early days of our growth

WUDQVIRUPDWLRQ3URGXFWLQQRYDWLRQGLYHUVL¿HG

go-to-market channels, a multi-brand strategy

and customer insights and satisfaction are key

priorities and critical components of our

strategy to scale up the best Cyber Safety

platform for people everywhere.

We have an experienced leadership bench,

combined with multiple growth levers and a strong

SUR¿WDELOLW\SUR¿OH:HDUHGLVFLSOLQHG¿QDQFLDO

stewards, especially when it comes to capital

allocation and usage. We remain committed to

consistent operational execution and long-term

value creation for all shareholders.

We look forward to writing the next chapter and we

will continue our pursuit to realize our vision and

achieve the three ambitious long-term goals we set

out a year ago:

• Double Net Promoter Score to world-class,

greater than 70;

• Double customers to 100 million, and;

• Double non-GAAP EPS to $3 with double-digit

revenue growth potential

We know we have a lot of work ahead. While we

recognize that geo-political events and macro-level

headwinds can create bumps along our journey, our

EXVLQHVVDQG¿QDQFLDOVWDQGLQJDUHUHVLOLHQWDQGZH

know that consumers will continue to need

comprehensive protection for their digital lives.

It is a privilege to lead this company towards our

vision of protecting and empowering people to live

their digital lives safely.

Sincerely,

Vincent, Natalie, and the NortonLifeLock team

We want Cyber Safety to have the biggest

reach – to make Cyber Safety mainstream.

Forward-Looking Statements

This letter contains statements which may be considered forward-looking within the meaning of the

86IHGHUDOVHFXULWLHVODZV,QVRPHFDVHV\RXFDQLGHQWLI\WKHVHIRUZDUGORRNLQJVWDWHPHQWVE\WKH

use of terms such as “expect,” “will,” “continue,” or similar expressions, and variations or negatives of

these words, but the absence of these words does not mean that a statement is not forward-looking. All

statements other than statements of historical fact are statements that could be deemed forward-looking

VWDWHPHQWVLQFOXGLQJEXWQRWOLPLWHGWRRXUJURZWKVWUDWHJLHVDQGWUDQVIRUPDWLRQRXU¿QDQFLDOWDUJHWV

statements relating to consumers and customers and market trends, our ESG initiatives and any other

statements of expectation or belief; and any statements of assumptions underlying any of the foregoing.

These statements are subject to known and unknown risks, uncertain ties and other factors that may

cause our actual results, levels of activity, performance or achievements to differ materially from results

expressed or implied in this supplemental information. Such risk factors include, but are not limited

to, those related to: the consummation of the Avast transaction; the current and future impact of the

&29,'SDQGHPLFRQWKH&RPSDQ\¶VEXVLQHVVDQGLQGXVWU\LQÀDWLRQDU\SUHVVXUHVDSURORQJHG

HFRQRPLFGRZQWXUQRUUHFHVVLRQUHWHQWLRQRIH[HFXWLYHOHDGHUVKLSWHDPPHPEHUVGLI¿FXOWLHVLQ

LPSURYLQJVDOHVDQGSURGXFWGHYHORSPHQWGXULQJOHDGHUVKLSWUDQVLWLRQVGLI¿FXOWLHVLQH[HFXWLQJWKH

operating model for the consumer Cyber Safety business; lower than anticipated returns from the

&RPSDQ\¶VLQYHVWPHQWVLQGLUHFWFXVWRPHUDFTXLVLWLRQGLI¿FXOWLHVDQGGHOD\VLQUHGXFLQJUXQUDWH

expenses and monetizing underutilized assets; general business and economic conditions; matters

DULVLQJRXWRIRXUFRPSOHWHG$XGLW&RPPLWWHHLQYHVWLJDWLRQDQGFRPSOHWHG866HFXULWLHVDQG([FKDQJH

&RPPLVVLRQLQYHVWLJDWLRQÀXFWXDWLRQVDQGYRODWLOLW\LQ1RUWRQ/LIH/RFN¶VVWRFNSULFHWKHDELOLW\RI

NortonLifeLock to successfully execute strategic plans; the ability to maintain customer and partner

UHODWLRQVKLSVWKHDELOLW\RI1RUWRQ/LIH/RFNWRDFKLHYHLWVFRVWDQGRSHUDWLQJHI¿FLHQF\JRDOVWKH

DQWLFLSDWHGJURZWKRIFHUWDLQPDUNHWVHJPHQWV1RUWRQ/LIH/RFN¶VVDOHVDQGEXVLQHVVVWUDWHJ\ÀXFWXDWLRQV

in tax rates and foreign currency exchange rates; tax legislation and judicial or administrative

interpretation of new tax regulations; the timing and market acceptance of new product releases and

upgrades; and the successful development of new products and the degree to which these products gain

market acceptance. Additional information concerning these and other risk factors is contained in the Risk

Factors sections of NortonLifeLock’s most recent reports on Form 10-K and Form 10-Q. NortonLifeLock

assumes no obligation, and does not intend, to update these forward-looking statements as a result of

future events or developments.

8VHRI1RQ*$$3)LQDQFLDO,QIRUPDWLRQ

This letter includes the non-GAAP measures of revenue, operating margin, and earnings per share, which

are adjusted from results based on GAAP and exclude certain expenses, gains and losses. We also

SURYLGHWKHQRQ*$$3PHWULFIUHHFDVKÀRZZKLFKLVGH¿QHGDVFDVKÀRZVIURPRSHUDWLQJDFWLYLWLHVOHVV

SXUFKDVHVRISURSHUW\DQGHTXLSPHQW7KHVHQRQ*$$3¿QDQFLDOPHDVXUHVDUHSURYLGHGWRHQKDQFHWKH

XVHU¶VXQGHUVWDQGLQJRIRXUSDVW¿QDQFLDOSHUIRUPDQFHDQGRXUSURVSHFWVIRUWKHIXWXUH2XU

PDQDJHPHQWWHDPXVHVWKHVHQRQ*$$3¿QDQFLDOPHDVXUHVLQDVVHVVLQJ1RUWRQ/LIH/RFN¶VSHUIRUPDQFH

DVZHOODVLQSODQQLQJDQGIRUHFDVWLQJIXWXUHSHULRGV7KHVHQRQ*$$3¿QDQFLDOPHDVXUHVDUHQRW

computed according to GAAP and the methods we use to compute them may differ from the methods

XVHGE\RWKHUFRPSDQLHV1RQ*$$3¿QDQFLDOPHDVXUHVDUHVXSSOHPHQWDOVKRXOGQRWEHFRQVLGHUHGD

VXEVWLWXWHIRU¿QDQFLDOLQIRUPDWLRQSUHVHQWHGLQDFFRUGDQFHZLWK*$$3DQGVKRXOGEHUHDGRQO\LQFRQ-

MXQFWLRQZLWKRXUFRQVROLGDWHG¿QDQFLDOVWDWHPHQWVSUHSDUHGLQDFFRUGDQFHZLWK*$$3

NORTONLIFELOCK INC.

Reconciliation of Selected GAAP Measures to Non-GAAP Measures (1) (2)

8QDXGLWHGLQPLOOLRQVH[FHSWSHUVKDUHDPRXQWV

&#

%& !%& !

% &( # # $"

0/53"$5-*"#*-*5*&4'"*37"-6&"%+645.&/5

50$,#"4&%$0.1&/4"5*0/

.035*;"5*0/0'*/5"/(*#-&"44&54

&4536$563*/("/%05)&3$0454

$26*4*5*0/"/%*/5&(3"5*0/$0454

*5*("5*0/4&55-&.&/5$)"3(&4

5)&3<<

% &( # # $" $#

% &( # " & #

% &( # " & # $#

% &( # '!$+

63$)"4&40'1301&35:"/%&26*1.&/5

& '!$+$#

( # $"

%+645.&/5450*/$0.&'30.$0/5*/6*/(01&3"5*0/4

0/53"$5-*"#*-*5*&4'"*37"-6&"%+645.&/5

50$,#"4&%$0.1&/4"5*0/

.035*;"5*0/0'*/5"/(*#-&"44&54

&4536$563*/("/%05)&3$0454

$26*4*5*0/"/%*/5&(3"5*0/$0454

*5*("5*0/4&55-&.&/5$)"3(&4

5)&3

0/$"4)*/5&3&45&91&/4&

044("*/0/&95*/(6*4).&/50'%

"*/0/4"-&0'1301&35*&4

05"-"%+645.&/5450*/$0.&'30.$0/5*/6*/(

01&3"5*0/4#&'03&*/$0.&5"9&4

%+645.&/5501307*4*0/'03*/$0.&5"9&4

05"-"%+645.&/550$0/5*/6*/(01&3"5*0/4/&50'5"9&4

*4$0/5*/6&%01&3"5*0/4 <

( # $" $#

NORTONLIFELOCK INC.

Reconciliation of Selected GAAP Measures to Non-GAAP Measures (1) (2) (continued)

8QDXGLWHGLQPLOOLRQVH[FHSWSHUVKDUHDPRXQWV

&#

%& ! %& !

!)( # ( # $" % &'&

%+645.&/5450%*-65&%/&5*/$0.&1&34)"3&

0/53"$5-*"#*-*5*&4'"*37"-6&"%+645.&/5

50$,#"4&%$0.1&/4"5*0/

.035*;"5*0/0'*/5"/(*#-&"44&54

&4536$563*/("/%05)&3$0454

$26*4*5*0/"/%*/5&(3"5*0/$0454

*5*("5*0/4&55-&.&/5$)"3(&4

5)&3

0/$"4)*/5&3&45&91&/4&

044("*/

0/&95*/(6*4).&/50'%

"*/0/4"-&0'1301&35*&4

05"-"%+645.&/5450*/$0.&'30.$0/5*/6*/(01&3"5*0/4

#&'03&*/$0.&5"9&4

%+645.&/5501307*4*0/'03*/$0.&5"9&4

05"-"%+645.&/550$0/5*/6*/(01&3"5*0/4/&50'5"9&4

*4$0/5*/6&%01&3"5*0/4 <

!)( # ( # $" % &'& $#

!)( + ( * & '& '$)('(# #

!)(+ (* & '& '$)('(# #$#

#$-*, - (..$)($(&/ -()(' -/, -)(!$(($&' -/, -, -/**& ' (.&(-#)/&(). )(-$ ,

-/-.$./. !),!$(($&$(!),'.$)(*, - (. $(),( 1$.#

')/(.-'3()./ .),)/($("

NORTONLIFELOCK INC.

Revenues and Consumer Cyber Safety Metrics

(in millions, except per user data)

) " ( &#"

%"

$%

$%

%"

"

&7&/6&4

0/53"$5-*"#*-*5*&4'"*37"-6&"%+645.&/5

&7&/6&40/

9$-6%&'03&*(/&9$)"/(&*.1"$5

<

0/45"/5$633&/$:"%+645&%3&7&/6&4

0/

#" &(! % + % '+ '%&

!&3&(6-"3-:.0/*503"/6.#&30'.&53*$4*/03%&350.&"463&063$633&/51&3'03."/$&"/%&45*."5&063'6563&

1&3'03."/$&63.&53*$4.":#&$"-$6-"5&%*/"."//&3%*''&3&/55)"/4*.*-"3.&53*$464&%#:05)&3$0.1"/*&4

)&'0--08*/(5"#-&46.."3*;&44611-&.&/5"-,&:1&3'03."/$&.&53*$4'0306340-65*0/4

%"

$% $%

*3&$5$6450.&33&7&/6&4

"35/&33&7&/6&4

7&3"(&%*3&$5$6450.&3$06/5

*3&$5$6450.&3$06/5"526"35&3&/%

*3&$5"7&3"(&3&7&/6&1&364&3

&5&/5*0/3"5&

+*0. 0(&&(&0&"/#&.2(1"!'1/0)"*0.",."/"*0/0%"-1.0".(52&.!"#".."!."2"*1"%&. 10)+.0&60&+*." +$*&6"!!1.&*$

0%"-1.0".

( 1(0"!1/&*$5".$+#+."&$*"4 %*$".0"/

"!"#&*"!&." 0 1/0+)".."2"*1"//."2"*1"/#.+)/("/+#+1. +*/1)"./+(10&+*/0+!&." 0 1/0+)"./3%& %3"!"#&*"/

0&2",&!1/"./3%+%2"!&." 0&((&*$."(0&+*/%&,3&0%1/00%""*!+#0%".",+.0"!,".&+!""4 (1!"1/"./+*#.""0.&(/*!

,.+)+0&+*/*!1/"./3%+%2"&*!&." 0(5,1. %/"!+1.,.+!1 0+./".2& "/0%.+1$%,.0*"./1*("///1 %1/"./ +*2".0+.."*"3

0%"&./1/ .&,0&+*/!&." 0(53&0%1/+./&$*1,#+.,&!)")"./%&,0%.+1$%+1.3"/0+."&." 0 1/0+)".."2"*1"/&*#&/ (5"./

*!"4 (1!"/ )&((&+**! )&((&+*."/," 0&2"(5."!1 0&+*+#."2"*1"#.+) +*0. 0(&&(&05,1. %/"

+1*0&*$!'1/0)"*03%& %3/." +$*&6"!&*0%"#+1.0%-1.0".+##&/ (""(&"2"0%0"(&)&*0&*$0%"&), 0+#0%&/

!'1/0)"*0&),.+2"/0%" +),.&(&05+#."2"*1"/"03""*,".&+!/*!!&0&+*(0%+1$%0%"!'1/0)"*0)+1*0/3&((*"2"."

." +$*&6"!&*+1.#&** &(/00")"*0/3"!+*+0"4," 00%" -1&/&0&+*/0+##" 00%"#101."."*"3(.0"/+#."2"*1"/

"4 (1!"!50%"!'1/0)"*0/

.+)0&)"0+0&)"3"1,!0"+1.)"0%+!+(+$5!1"0+ %*$"/&*0%"1/&*"//*#&/ (5".0%"2".$"!&." 0 1/0+)".

+1*0 ( 1(0&+*3/."#&*"!,.&).&(50+,.+.0"#+. -1&/&0&+*/0%0%,,"*!1.&*$-1.0"./1 %/2&.3%& %3/ -1&."!

&**1.5%"#1((5".2".$"!&." 0 1/0+)". +1*0&/ ( 1(0"!/*2".$" .+//0%"-1.0"./

%"2".$"!&." 0 1/0+)". +1*0#+.0%"#+1.0%#&/ (-1.0".+##&/ (5".3/,.+.0"!0+&* (1!")&((&+* 1/0+)"./

#.+)0%"2&. -1&/&0&+*

&/ ( 1(0"!/"/0&)0"!!&." 0 1/0+)".."2"*1"/#+.0%",".&+!!&2&!"!50%"2".$"!&." 0 1/0+)". +1*0#+.0%"

/)",".&+!"4,."//"!/)+*0%(5#&$1."")+*&0+." 1/"&0%"(,/1/1*!"./0*!0%".0"03%& %3".")+*"0&6&*$

+1. +*/1)". 1/0+)"./"

**1(."0"*0&+*.0"&/!"#&*"!/0%"*1)".+#!&." 0 1/0+)"./3%+%2")+."0%*+*"5".0"*1."/+#0%""*!+#0%"

)+/0." "*0(5 +),("0"!#&/ (,".&+!!&2&!"!50%"0+0(*1)".+#!&." 0 1/0+)".//+#0%""*!+#0%",".&+!#.+)+*"5".$+

")+*&0+.**1(."0"*0&+*.0"0+"2(10"0%""##" 0&2"*"//+#+1./0.0"$&"/0+&),.+2"."*"3(/+#/1/ .&,0&+*/

60 E. Rio Salado Parkway, Suite 1000

Tempe, Arizona 85281

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

to be held on:

September 13, 2022

9:00 a.m. Pacific Time

Dear Stockholder:

You are cordially invited to attend our 2022 Annual Meeting of Stockholders (the Annual Meeting), which will be held at 9:00 a.m.

(Pacific Time) on Tuesday, September 13, 2022. This year’s meeting will again be completely virtual and conducted via live webcast.

You will be able to attend the Annual Meeting online and submit your questions prior to or during the meeting by visiting

www.virtualshareholdermeeting.com/NLOK2022. You will also be able to vote your shares electronically at the Annual Meeting. Hosting

a virtual meeting enables increased stockholder attendance and participation since stockholders can participate from any location around

the world. In addition, the online format will allow us to communicate more effectively with you via a pre-meeting forum that you can

enter by visiting www.virtualshareholdermeeting.com/NLOK2022 and submit questions in advance of the Annual Meeting.

For your convenience, we are also pleased to offer a re-playable webcast of the Annual Meeting at investor.nortonlifelock.com.Weare

holding the Annual Meeting for the following purposes, which are more fully described in the proxy statement:

1. To elect the eight nominees named in the proxy statement to NortonLifeLock’s Board of Directors;

2. To ratify the appointment of KPMG LLP as NortonLifeLock’s independent registered public accounting firm for the 2023 fiscal

year;

3. To hold an advisory vote to approve executive compensation;

4. To approve the amendment of NortonLifeLock’s 2013 Equity Incentive Plan;

5. To consider and vote on a stockholder proposal described in the proxy statement, if properly presented at the Annual Meeting; and

6. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement

thereof.

We are fur nishing proxy materials to our stockholders primarily via the internet to expedite stockholders’ receipt of proxy materials,

lower the cost of the Annual Meeting and help conserve natural resources. On or about August 3, 2022, we expect to send to our

stockholders (other than those who previously requested electronic or paper delivery), a Notice of Internet Availability of Proxy Materia ls

containing instructions on how to access our proxy materials, including our proxy statement and our annual report, and how to vote

through the internet or by telephone.

Only stockholders of record as of the close of business on July 18, 2022 are entitled to notice of, and vote at, the Annual Meeting or

any postponement or adjournment thereof. A list of stockholders entitled to vote will be available for inspection a t our offices for ten days

prior to the Annual Meeting, as well as online during the Annual Meeting. If you would like to view this stockholder list, please contact

Investor Relations at (650) 527-8000.

Your vote is very important. Whether or not you plan to virtually attend the Annual Meeting, please vote at your earliest convenience

by following the instructions in the Notice of Internet Availability of Proxy Ma terials or in the proxy card you received in the mail. You may

revoke your proxy at any time before it is voted. Please refer to the “2022 Annual Meeting of Stockholders Meeting Information” section

of the proxy statement for additional information.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Bryan Ko

BRYAN KO

Chief Legal Officer and Secretary

Tempe, Arizona

August 3, 2022

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on September 13,

2022: The proxy statement and NortonLifeLock’s Form 10-K for the 2022 fiscal year are available at http://investor.nortonlifelock.com/

financials/annual-reports/default.aspx

(This page has been left blank intentionally.)

TABLE OF CONTENTS

Page

PROXY SUMMARY ...................................................................... 1

CORPORATE GOVERNANCE .............................................................. 7

Corporate Governance Guidelines .......................................................... 7

Code of Conduct and Code of Ethics ........................................................ 7

Insider Trading, Hedging and Pledging Policies ................................................. 7

Stock Ownership Guidelines .............................................................. 7

Stockholder Outreach and Engagement ...................................................... 8

Majority Vote Standard and Director Resignation Policy ........................................... 8

Proxy Access ......................................................................... 8

Board Leadership Structure ............................................................... 8

Board Independence ................................................................... 9

Change in Director Occupation ............................................................ 9

Board and Committee Effectiveness ........................................................ 10

Board’s Role in Risk Oversight ............................................................ 10

Board’s Role in COVID-19 Response ........................................................ 11

Board’s Role in Oversight of Company Strategy ................................................ 11

Board’s Role in Oversight of Human Capital Management ........................................ 11

Outside Advisors ...................................................................... 12

Board Structure and Meetings ............................................................. 12

Executive Sessions ..................................................................... 12

Succession Planning ................................................................... 13

Attendance of Board Members at Annual Meetings ............................................. 13

THE BOARD AND ITS COMMITTEES ........................................................ 14

Audit Committee ....................................................................... 14

Compensation and Leadership Development Committee .......................................... 15

Nominating and Governance Committee ..................................................... 16

Technology and Cybersecurity Committee .................................................... 17

DIRECTOR NOMINATIONS AND COMMUNICATION WITH DIRECTORS .............................. 18

Criteria for Nomination to the Board ......................................................... 18

Process for Identifying and Evaluating Nominees ............................................... 18

Stockholder Proposals for Nominees ........................................................ 19

Contacting the Board of Directors .......................................................... 19

Human Capital Management .............................................................. 20

Environmental, Social and Governance (ESG) ................................................. 21

PROPOSAL NO. 1 ELECTION OF DIRECTORS ................................................. 23

Nominees for Director ................................................................... 23

Board Diversity Matrix as of July 18, 2022 .................................................... 28

Summary of Director Qualifications and Experience ............................................. 28

Director Compensation .................................................................. 29

Fiscal 2022 Director Compensation ......................................................... 30

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM ................................................................... 32

Principal Accountant Fees and Services ...................................................... 32

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered

Public Accounting Firm ................................................................ 32

i

Page

PROPOSAL NO. 3 ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION ...................... 33

PROPOSAL NO. 4 AMENDMENT OF THE 2013 EQUITY INCENTIVE PLAN ............................ 34

Background of Amendment ............................................................... 34

Plan History .......................................................................... 34

Promotion of Compensation Governance Best Practices ......................................... 35

Summary of our 2013 Equity Incentive Plan, as Amended ........................................ 36

Summary of Federal Income Tax Consequences of Awards Granted under the 2013 Equity Incentive Plan, as

Amended .......................................................................... 38

ERISA Information ..................................................................... 39

Accounting Treatment ................................................................... 39

New Plan Benefits ..................................................................... 40

Equity Compensation Plan Information ...................................................... 41

PROPOSAL NO. 5 STOCKHOLDER PROPOSAL ON TERMINATION PAY ............................. 42

Resolution Proposed by Stockholder ........................................................ 42

Our Board of Directors’ Statement in Opposition to Proposal No. 5 .................................. 43

OUR EXECUTIVE OFFICERS .............................................................. 46

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT .................... 47

Five Percent Owners of Common Stock ...................................................... 47

Security Ownership of Executive Officers and Directors .......................................... 47

EXECUTIVE COMPENSATION AND RELATED INFORMATION ..................................... 49

Compensation Discussion & Analysis (CD&A) ................................................. 49

Compensation Committee Interlocks and Insider Participation ...................................... 71

Compensation Committee Report .......................................................... 71

Executive Compensation Tables ........................................................... 72

CEOPayRatio........................................................................ 78

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS ...................................... 80

Related-Person Transactions Policy and Procedure ............................................. 80

Certain Related Person Transactions ........................................................ 80

REPORT OF THE AUDIT COMMITTEE ....................................................... 81

INFORMATION ABOUT SOLICITATION AND VOTING ............................................ 82

ABOUT THE ANNUAL MEETING ........................................................... 82

ADDITIONAL INFORMATION .............................................................. 86

Stockholder Proposals for the 2023 Annual Meeting ............................................. 86

Available Information ................................................................... 86

Householding — Stockholders Sharing the Same Last Name and Address ............................ 86

OTHER MATTERS ...................................................................... 87

Note About Forward-Looking Statements ..................................................... 87

Information Referenced in This Proxy Statement ............................................... 87

ANNEXA—Reconciliation of Non-GAAP Financial Measures and Explanation of Key Performance

Indicators ........................................................................... 88

ANNEX B — NortonLifeLock 2013 Equity Incentive Plan, as Amended .............................. 90

ii

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all

of the information that you should consider, and you should read the entire proxy statement carefully before voting.

2022 Annual Meeting of Stockholders Information

Date and Time: Tuesday, September 13, 2022 at 9:00 a.m. Pacific Time

Location: Meeting live via the internet by visiting www.virtualshareholdermeeting.com/NLOK2022

Record Date: July 18, 2022

Admission: To participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/NLOK2022.You

will need the 16-digit control number included on your Notice of Internet Availability of Proxy

Materials, on your proxy card or on the instructions that accompanied your proxy materials. If your

shares are held in an account with a brokerage firm, bank or other nominee, then you may not

vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the

organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Voting Matters

Proposals

Board

Recommendation

Page Number for

Additional

Information

1. Election of Directors FOR 23

2. Ratification of Independent Registered Public Accounting Firm FOR 32

3. Advisory Vote to Approve Executive Compensation FOR 33

4. Amendment of the 2013 Equity Incentive Plan FOR 34

5. Stockholder Proposal on Termination Pay AGAINST 42

Our Director Nominees

Director

Since

Committee Memberships*

Other

Public

Boards**Name Age Occupation Independent Diversity AC CC NGC Tech

Susan P. Barsamian 63 2019 Director

WD 2

Eric K. Brandt 60 2020 Director

3

Frank E. Dangeard 64 2007 Managing Partner, Harcourt

2

Nora M. Denzel 59 2019 Director

W 3

Peter A. Feld 43 2018

Managing Member and Head of

Research, Starboard Value LP

2

Emily Heath 48 2021 Director

WD 0

Vincent Pilette 50 2019 Chief Executive Officer 0

Sher rese M. Smith 50 2021 Managing Partner, Paul Hastings

WD 1

AC = Audit Committee CC = Compensation and Leadership Development Committee NGC = Nominating and Governance Committee

Tech = Technology and Cybersecurity Committee W = Woman D = Underrepresented Community (Ethnic Diversity and/or LGBTQ+)

= Member = Chair

* Reflects our Board and committee composition following the Annual Meeting.

** Reflects membership on boards of companies publicly traded in the U.S.

1

8

Director

Nominees

88%

Independent

(all but CEO)

50%

Diverse

7

New Directors

Since 2016

<5 Years

Average Director

Tenure

Sound Corporate Governance Practices

Separate Independent Chair and CEO Majority Voting for Directors

Board Committees Consist Entirely of

Independent Directors

Director Resignation Policy

All Current Directors Attended at least 75% of

Meetings Held

Stockholder Ability to Call Special Meetings

(15% threshold)

Independent Directors Meet Regularly in

Executive Session

Stockholder Ability to Act by Written Consent

Director Age Limit of 72 Proxy Access Subject to Standard Eligibility

Requirements

Annual Board and Committee Self-Evaluations Robust Cybersecurity Program

Risk Oversight by Full Board and Committees Comprehensive ESG program and Board

oversight of ESG

Annual Election of All Directors Extensive Stockholder Outreach/Engagement

Program

Director Overboarding Limits No Dual-Class or Multi-Class Stock

FY22 Executive Compensation at a Glance

Fiscal year 2022 (FY22) marked our second full year as a stand-alone pure consumer Cyber Safety company, which

brought with it new challenges as well as opportunities. Our Compensation and Leadership Development Committee

(Compensation Committee) of our Board of Directors (Board) once again a pproved an executive compensation

program that was intended to drive enterprise value creation for NortonLifeLock and our stockholders and reward

actual performance. In addition, our FY22 compensation program took into account the critical retention concerns that

we faced due to top 100 leaders being aggressively approached and recruited by other companies in the highly

competitive talent market in which we compete, which concerns were exacerbated by our increased retention needs

stemming from our proposed acquisition of Avast.

2

Our Executive Compensation Program Continues to Reflect Best Governance Practices

Our Compensation Committee designed our FY22 compensation program to be consistent with leading corporate

governance and executive compensation practices:

WhatWeDo

At risk pay

The majority of pay for our CEO and other NEOs is at risk and/or performance-based.

Link to results

Our short-term incentive compensation is linked directly to our financial results and may be modified

by individual performance, except in the case of our CEO, whose compensation is entirely based on

company performance. A significant portion of our long-term incentive compensation is linked

directly to multi-year financial results or relative total shareholder return (TSR).

Predetermined goals

We reward performance that meets our short and long-term predetermined goals.

Capped payouts

We cap payouts under our incentive plans to discourage excessive or inappropriate risk taking by our

NEOs.

Peer group

We have a relevant peer group and reevaluate the peer group annually.

Ownership guidelines

We have robust stock ownership guidelines for our executive officers and directors.

Clawback policy

We have a comprehensive “clawback” policy, applicable to all performance-based compensation

granted to our executive officers.

Double-trigger acceleration

We only provide for “double-trigger” change-in-control payments and benefits for our executive

officers.

Capped severance

We do not provide for any potential cash severance payments that exceed more than 1x our

executive officers’ base salary and target bonus, and we maintain a policy requiring stockholder

approval of any cash severance benefits exceeding 2.99 times the sum of an executive officer’s base

salary plus target bonus.

Independent consultant

Our Compensation Committee retains an independent compensation consultant.

Say-on-pay

We hold an annual advisory vote on named executive officer compensation.

Stockholder engagement

We seek feedback on executive compensation through stockholder engagement.

Minimum vesting

We require one-year minimum vesting on all stock award grants to employees, with very limited

exceptions.

What We Don’t Do

No performance, no pay

We do not pay performance-based cash or equity awards for unsatisfied perfor mance goals.

No minimum payouts

Our compensation plans do not have minimum guaranteed payout levels.

No automatic increases

We do not provide for automatic salary increases or equity award grants in offer letters or

employment agreements.

No short sales, hedging

With very limited exceptions, we do not permit short-sales, hedging or pledging of our stock.

No golden parachutes

We do not provide “golden parachute” excise tax gross-ups.

No excessive severance

We do not provide excessive severance payments.

No SERPs

We do not provide executive pension plans or SERPs.

No excessive perks

We do not provide excessive perquisites.

No repricing

We do not permit the repricing or cash-out of stock options or stock a ppreciation rights without

stockholder approval.

No unvested dividends

We do not permit the payment of dividend or dividend equivalents on unvested equity awards.

3

Compensation Components

Our FY22 compensation philosophy is reflected in the following key elements of executive compensation: (i) base

salary, (ii) short-term annual cash incentive awards and (iii) long-term equity incentive awards.

FY22 Component

Form of

Compensation Performance Period Metrics and Performance Criteria Details

Base Salary Cash Annual NEO base salary changes reviewed

annually by CEO (or Board for CEO

changes).

Page 56

Executive Annual

Incentive Plan

Cash Annual Bookings with non-GAAP operating

income as a threshold goal.

Page 57

Annual Equity

Incentive Awards

Performance-

based Restricted

Stock Unit (PRU)

Vests at the end of

a three-year

period

50% of PRUs vest in full at end of FY24

based on achievement of our 3-year

relative TSR versus the Nasdaq

Composite Index.

50% of PRUs vest in full at end of FY24

based on achievement of compound

annual growth ra te (CAGR) for revenue

measured over a multi-year period.

Page 59

Restricted Stock

Unit (RSU)

Vests annually

over three years

Service and time-based vesting. Page 62

Value Creation

Program (VCP)

Equity Incentive

Awards for Top

100 Leaders

(Excluding CEO

for FY22)

Performance-

based Restricted

Stock Unit (PRU);

75% of Total VCP

Award

Vests at the end of

a four-year period

Vests in full at end of FY26 based on

achievement of certain challenging

share price appreciation targets, ranging

from $35 to $50 per share, over the

performance period, subject to

performance gates related to our

relative TSR versus the Nasdaq

Composite Index.

Page 62

Restricted Stock

Unit (RSU); 25%

of Total VCP

Award

Cliff Vests at the

end of vesting

period

Service and time-based cliff vesting on

December 1, 2023.

Page 64

4

Pay for Performance Alignment

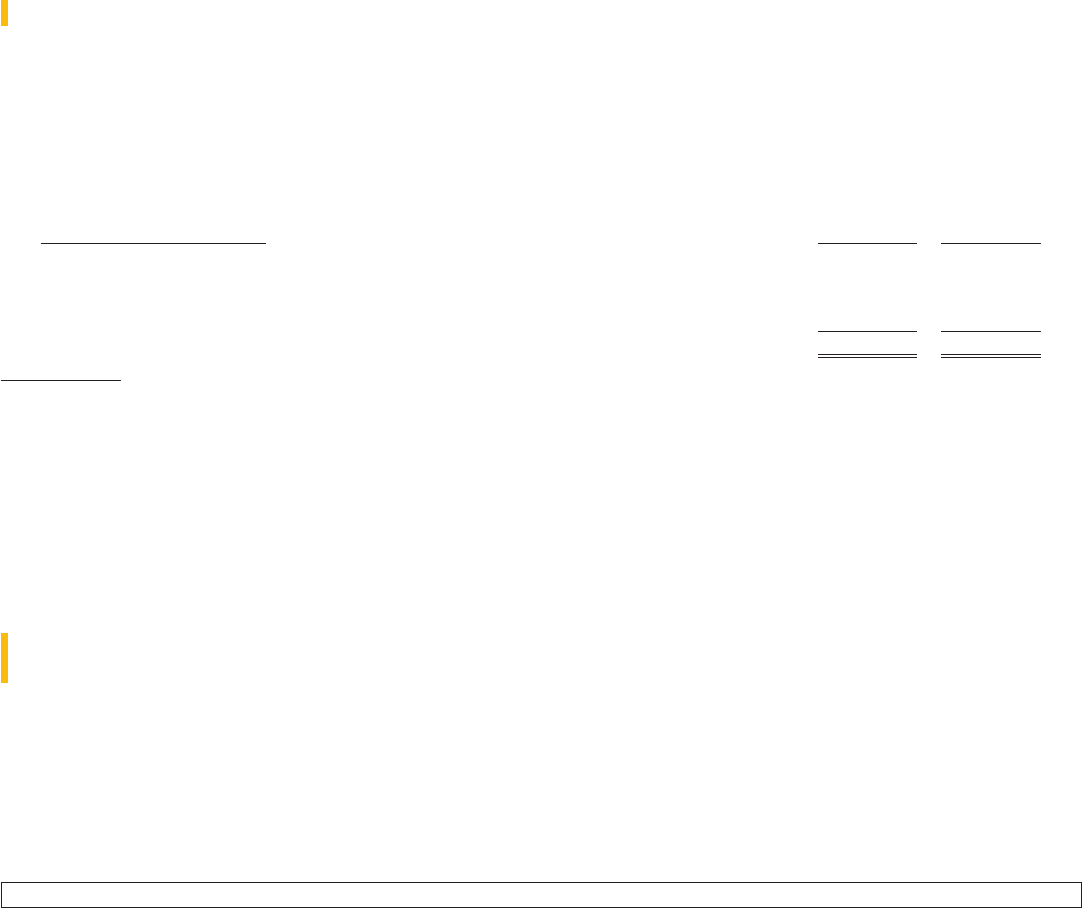

FY22 validated our long-term strategy and we showed good progress in our transformation journey with accelerated

pace of product innovation, global expansion, and a relentless focus on customer experience as we saw all our key

financial metrics increase, as reflected in the table below.

Operating Margin

(Non-GAAP, total company)

Operating Margin

(GAAP)

FY21 FY22

50%

53%

Cash Flow from

Operations

(in millions; GAAP)

FY21 FY22

$706

$974

Free Cash Flow

(in millions; Non-GAAP)

FY21 FY22

$712

$968

FY21 FY22

35%

36%

EPS

(Non-GAAP)

FY21 FY22

$1.44

$1.75

FY22

$1.41

EPS

(GAAP)

FY21

$0.92

Net Revenues

(in millions; GAAP)

FY21 FY22

$2,551

$2,796

We also saw our key performance metrics remain stable year over year.

Retention Rate

(Unit Based)

FY21 FY22

85% 85%

ARPU

(Monthly)

FY21 FY22

$9 $9

Direct Customer

Count

(in millions)

FY21 FY22

23.0

23.5

FY21 FY22

8%

8%

Bookings Growth

(Pro-forma, constant currency)

We also saw our stock price increase from $21.42 to $26.94 in FY22, prior to reflecting any adjustments for dividends.

We believe that the compensation received by our NEOs for FY22 reflects our performance and accomplishments

this past year as well as the rigor of our performance goals. Further, as discussed elsewhere in this proxy statement,

we have undertaken a number of strategic actions to drive our long-term business objectives.

5

Component Metric

(1)

Achievement (as

a percentage of target) Funding

FY22 Executive

Annual Incentive Plan

(EAIP)

FY22 non-GAAP operating income

threshold goal

113.1% Threshold Goal

Achieved

FY22 Bookings 100.3% 105%

FY22 Performance-

based Restricted

Stock Units

(2)

50% based on 3-year total shareholder

return (TSR) relative to the Nasdaq

Composite Index

NA NA

50% based on CAGR for revenue NA NA

FY21 Performance-

based Restricted

Stock Units

(2)

50% based on 3-year TSR relative to the

Nasdaq Composite Index

NA NA

50% based on CAGR for revenue NA NA

FY20 Performance-

based Restricted

Stock Units

(2)

3-year TSR relative to the S&P 500 193.06% NA

Value Creation

Program (VCP)

Performance-based

Restricted Stock

Units

(3)

Share price appreciation targets, subject

to applicable TSR gates relative to the

Nasdaq Composite Index, measured

over a 4-year period

0% to date 0% to date

(1)

Please see discussion in the CD&A section of this proxy statement below for more detail regarding how these metrics are calculated.

(2)

Achievement certified by the Compensation Committee at end of three-year period.

(3)

Achievement certified by the Compensation Committee at end of four-year period.

Meeting Information

We provide information about NortonLifeLock Inc.’s 2022 Annual Meeting of Stockholder s (the Annual Meeting),

voting and additional information starting on page 82.

6

CORPORATE GOVERNANCE

NortonLifeLock Inc. (NortonLifeLock or the Company) is strongly committed to good cor porate governance practices.

These practices provide an important framework within which our Board of Directors (the Board) and management can

pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our Corporate Governance Guidelines generally specify the rights and responsibilities of NortonLifeLock’s Board,

management and stockholders, and detail the rules and procedures for making decisions on corporate affairs. In general,

the stockholders elect the Board and vote on certain extraordinar y matters. The Board is responsible for the general

governance of NortonLifeLock, including selection and oversight of key management, and management is responsible

for running our day-to-day operations.

Our Corporate Governance Guidelines are available on the Investor Relations section of our website, which is located at

investor.nortonlifelock.com, by clicking on “Company Charters” under “Corporate Governance.” The Corporate Governance

Guidelines are reviewed a t least annually by our Nominating and Governance Committee, and c hanges are recommended

to our Board for approval as appropriate. Our Board represents the interests of the stockholder s in perpetuating a

successful business and optimizing sustainable long-term stockholder value. The Board is responsible for ensuring that

NortonLifeLock is managed in a manner that is designed to serve those interests.

Code of Conduct and Code of Ethics

We have adopted a code of conduct that applies to all of our Board members, officers and employees. We have also

adopted a code of ethics for our Chief Executive Officer and senior financial officers, including our principal financial officer

and principal accounting officer. Our Code of Conduct and Financial Code of Ethics are posted on the Investor Relations

section of our website located at investor.nortonlifelock.com, by clicking on “Company Charters” under “Corporate

Governance.” Any amendments or waivers of our Code of Conduct and Financial Code of Ethics pertaining to a member

of our Board or one of our executive officers will be disclosed on our website a t the above-referenced address.

Insider Trading, Hedging and Pledging Policies

With limited exceptions for pre-existing arrangements, our Insider Trading Policy prohibits all directors and employees,

including executive officers, from short-selling NortonLifeLock stock or engaging in transactions involving NortonLifeLock

stock-based derivative securities, including, but not limited to, trading in NortonLifeLock-based option contracts or engaging

in other hedging transactions (for example, buying and/or writing puts and ca lls, equity swaps, collars, exchange funds,

transacting in straddles and the like; however, holding and exercising options or other derivative securities granted under

NortonLifeLock’s stock option or equity incentive plans is not prohibited by this policy.) Our policy also prohibits pledging

NortonLifeLock stock as collateral for a loan or holding company securities in a margin account. Waivers may be granted with

respect to arrangements that were in existence before becoming a director or employee. Since our settlement with

Starboard Value LP in September 2018, we have agreed to waive these requirements with respect to certain forward

contracts held by Starboard on a limited basis.

In addition, our Insider Trading Policy prohibits our directors, officers, employees and contractors from purchasing or

selling NortonLifeLock securities while in possession of material, nonpublic information. It also requires that our Chief

Executive Officer and our Chief Financial Officer conduct any open market sales of our securities only through the use of

stock trading plans adopted pursuant to Rule 10b5-1 of the Securities Exchange Act of 1934, as amended (the Exchange

Act). Rule 10b5-1 allows insiders to sell and diversify their holdings in our stock over a designated period by adopting

prearranged stock trading plans at a time when they are not aware of material nonpublic information about us, and thereafter

sell shares of our common stock in accordance with the terms of their stock trading plans without regard to whether or

not they are in possession of material nonpublic information about NortonLifeLock at the time of the sale. All other executives

and our non-employee directors are strongly encouraged to trade using Rule 10b5-1 plans.

Stock Ownership Guidelines

Our Board adopted stock ownership guidelines to better a lign our directors’ and officers’ interests with those of our

stockholders. Details of our directors’ stock ownership guidelines are disclosed under “Summary of Director Qualifications

7

and Experience” on page 28, and details of our executive officers’ stock ownership guidelines are disclosed under “Stock

Ownership Guidelines” in the “Compensation Discussion & Analysis” section on page 66. The Compensation Committee

determines the stock ownership guidelines and the Nominating and Governance Committee monitors compliance under

such guidelines.

Stockholder Outreach and Engagement

We are committed to ongoing engagement with our stockholder s to gain valuable insight into the issues that matter

most to them and to enable NortonLifeLock to address them effectively. During 2021, we engaged with 70% of our top

20 stockholders, representing over 40% of our outstanding capital stock. In these meetings, we discussed matters such as

NortonLifeLock’s prospects, business model, corporate governance, and executive compensation programs and goal

settings and metrics. Following such discussions and after considering the voting preferences of our stockholders, we

revised our Corporate Governance Guidelines to forma lly provide that the Chair of the Board should be an independent

director separate from the Chief Executive Officer. At NortonLifeLock, we have an open line of communication with our

stockholders and investors and continue to engage them for feedback on our prog rams.

Majority Vote Standard and Director Resignation Policy

Our Bylaws and Corpora te Governance Guidelines provide for a majority voting standard for the election of directors.

Under the majority vote standard, each nominee must be elected by a majority of the votes cast with respect to such nominee

at any meeting for the election of directors at which a quorum is present. A “majority of the votes cast” means the votes

cast “for” a nominee’s election must exceed the votes cast “against” that nominee’s election. A plurality voting standard will

apply instead of the majority voting standard if: (i) a stockholder has provided us with notice of a nominee for director in

accordance with our Bylaws; and (ii) that nomination has not been withdrawn as of 10 days before we first deliver proxy

materials to stockholders.

To effectuate this policy with regard to incumbent directors, the Board will not nominate an incumbent director for re-election

unless prior to such nomination the director has agreed to promptly tender a resigna tion if such director fails to receive a

sufficient number of votes for re-election at the stockholder meeting with respect to which such nomination is made. Such

resignation will be effective upon the earlier of (i) the Board’s acceptance of such resignation or (ii) the 90th day after

certification of the election results of the meeting; provided, however, that prior to the effectiveness of such resignation,

the Board may reject such resignation and permit the director to withdraw such resignation.

If an incumbent director fails to receive the required vote for re-election, the Nominating and Governance Committee shall

act on an expedited basis to determine whether to recommend acceptance or rejection of the director’s resignation and

will submit such recommendation for prompt consideration by the Board. The Board intends to act promptly on the

Committee’s recommendation and will decide to accept or reject such resignation and publicly disclose its decision within

90 days from the date of certification of the election results. The Nominating and Governance Committee and the Board may

consider such factors they deem relevant in deciding whether to accept or reject a resignation tendered in accordance

with this policy. The Board expects a director whose resignation is under consideration to abstain from participating in any

decision regarding the resignation.

Proxy Access

Our Bylaws contain “proxy access” provisions which permit a stockholder, or a group of up to 50 stockholders, owning

continuously for at least three years a number of shares of our common stock that constitutes at least 3% of our outstanding

shares of common stock, to nominate and include in our proxy materials director nominees constituting up to the greater

of two individuals or 20% of the Board, provided that the stockholder(s) and the nominee(s) satisfy the requirements

specified in the Bylaws. Our Bylaws specifically allow funds under common management to be treated as a single

stockholder, and permit share lending with a five-day recall. They do not contain any post-meeting holding requirements,

do not have any limits on resubmission of failed nominees, and do not contain restrictions on third-party compensation.

Board Leadership Structure

As set forth in our Corporate Governance Guidelines, it is our general policy that the Chair of the Board should be an

independent director separate from the Chief Executive Officer. In the event the Chair leaves the Board or ceases to be

8

independent, the Board must appoint a new independent Chair from among the remaining independent directors within a

reasonable amount of time. Currently, the roles of Chief Executive Officer and Chair are separate. Frank Dangeard currently

serves as Chair of the Board.

The Board believes that separating the roles of Chief Executive Officer and Chair is the appropriate leadership structure

for NortonLifeLock because it results in an effective balancing of responsibilities, experience and perspectives that meets the

current corporate governance needs and over sight responsibilities of the Board. The Board also believes that this structure

allows our Chief Executive Officer to focus on executing NortonLifeLock’s strategic plan and managing NortonLifeLock’s

operations and performance, while allowing the Chair of the Board to focus on the effectiveness of the Board and independent

oversight of our senior management team.

The duties of the Chair of the Board and Chief Executive Officer are set forth in the table below:

Duties of the Chair of the Board Duties of the CEO

• Sets the agenda of Board meetings • Sets strategic direction for NortonLifeLock

• Presides over meetings of the full Board • Creates and implements NortonLifeLock’s vision and

mission

• Contributes to Board governance and Board processes • Leads the affairs of NortonLifeLock, subject to the

overall direction and supervision of the Board and its

committees and subject to such powers as reserved by

the Board and its committees

• Communicates with all director s on key issues and

concerns outside of Board meetings

• Presides over meetings of stockholder s

• Leads executive sessions of independent directors

Board Independence

It is the policy of the Board and The Nasdaq Stock Market LLC’s (Nasdaq) rules require that listed companies have a

board of directors with at least a majority of independent directors, as defined under Nasdaq’s Marketplace Rules. Currently,

each member of our Board, other than any person serving on our Board who also serves as our CEO, is an independent

director, and all standing committees of the Board are composed entirely of independent directors. The Nasdaq independence

definition includes a series of objective tests, such as that the director is not an employee of the company and has not

engaged in various types of business dea lings with the company. In addition, the Board has made a subjective determination

as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the

exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the

directors reviewed and discussed information provided by the directors and NortonLifeLock with regard to each director’s

business and other activities as they may relate to NortonLifeLock and our management. Based on this review and consistent

with our independence criteria, the Board has affirmatively determined that the following directors and director nominees

are independent: Susan P. Barsamian, Eric K. Brandt, Frank E. Dangeard, Nora M. Denzel, Peter A. Feld, Kenneth Y. Hao,

Emily Heath, and Sherrese M. Smith.

Change in Director Occupation

Our Corporate Governance Guidelines include a policy that our Board should consider whether a change in any director’s

professional responsibilities directly or indirectly impacts that person’s ability to fulfill his or her directorship obligations. To

facilitate the Board’s considera tion, all directors shall submit a resignation as a matter of course upon retirement, a

change in employer, or other significant change in their professional roles and responsibilities. Such resignation may be

accepted or rejected in the discretion of the Board.

Director Overboarding Limits

It is the policy of the Board that given the demands of the duties undertaken by directors, directors should limit their

participation to no more than five public company boards (including our Board) in order to ensure sufficient attention and

availability to NortonLifeLock’s business. In addition, a director who is currently serving as an executive officer of a publicly

traded company may serve on no more than two public company boards, excluding our Board. However, the Board

9

recognizes that the demands of such participation may vary substantially, and may deem an exception appropriate so

long as the director maintains sufficient attention and availability to fulfill the director’s duties to NortonLifeLock and complies

with NortonLifeLock’s conflict of interest policies.

Board and Committee Effectiveness

It is important to NortonLifeLock that our Board and its committees are performing effectively and in the best interests of

NortonLifeLock and its stockholders. The Nominating and Governance Committee reviews the size, composition and needs

of the Board with established criteria to ensure the Board has the appropriate skills and expertise to effectively carry out

its duties and responsibilities. In addition, an evaluation of the Board’s and its committees’ operations and performance is

conducted annually by the Nominating and Governance Committee. Changes are recommended by the Nominating and

Governance Committee for approval by the full Board as appropriate.

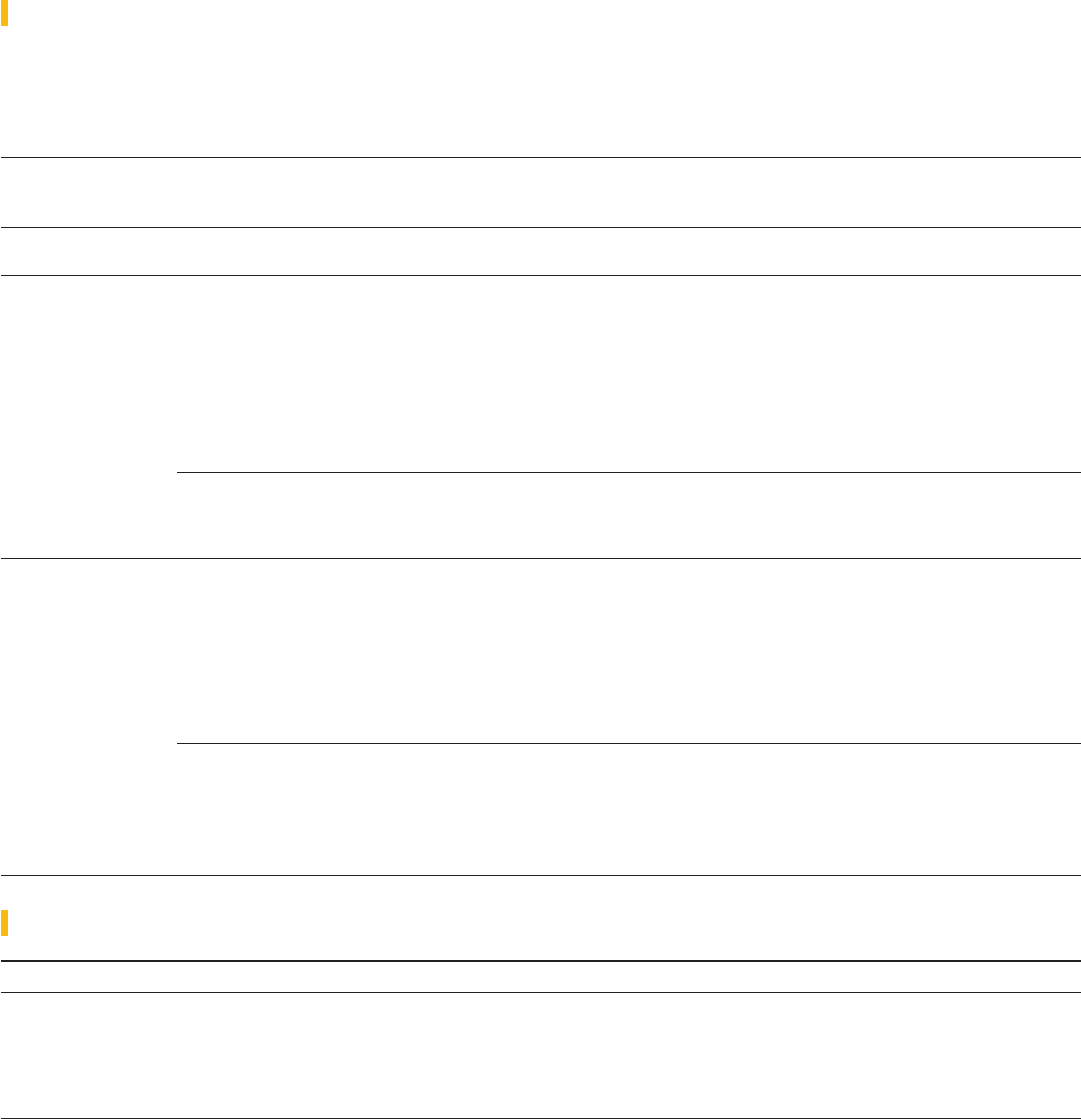

Board’s Role in Risk Oversight

The Board executes its risk management responsibility directly and through its committees.

Board of Directors

Risk Management Responsibility

Audit Committee

Compensation and

Leadership Development

Committee

Nominating and

Goverance Committee

Technology &

Cybersecurity Committee

• Oversees internal

controls and

disclosure controls.

• Oversees enterprise

risk management.

• Oversees financial

risk management

and reporting.

• Key liason with

external Auditor.

• Oversees Company’s

technology strategy,

initiatives and

investments.

• Oversees Company’s

key cybersecurity

information

technology risks.

• Oversees corporate

governance procedures

and polices.

• Oversees Board

compositions,

nomination and

evaluation.

• Oversees Company

ESG matters.

• Oversees Company

public policy and

political activities

and expenditures.

• Oversees risk

associated with

compensation policies

and practices.

• Oversees executive

development and

succession.

• Oversees Company

benefits plans and

programs.

• Oversees Company’s

human capital

Board Committees

The Board is kept abreast of its committees’ risk oversight and other activities via reports of the committee chairs to the

full Board during the Board meetings. In addition, the Board participates in regular discussions with our senior management

on many core subjects, including strategy, operations and finance, in which risk oversight is an inherent element. The

Board believes that its leadership str ucture, as described above under “Board Leadership Structure,” facilitates the Board’s

oversight of risk management because it allows the Board, with leadership from the independent, non-executive Chair

and each independent committee chair, to participate actively in the oversight of management’s actions.

10

Board’s Role in COVID-19 Response

Additionally, in connection with the ongoing COVID-19 pandemic, the Board, together with the Audit Committee, the

Compensation Committee, and management, has overseen our ef forts to mitigate financial and human capital management

risk exposures associated with the pandemic.

Key COVID-19 Actions COVID-19 Response for Colleagues in India

• Closed non-essential worker sites and implemented

travel restrictions and cancelled or shifted our

conferences and other marketing events to virtual-only.

• Vaccine reimbursement for employees and family

members in India.

• Maintain COVID-19 employee website to provide

up-to-date resources, data and education, including CDC

guidance, and benefits, ergonomic and wellness

information.

• Launched vaccination clinics in Pune and Chennai.

• Regular employee communications. • Created a social c hannel for all India team members to

share information and support one other.

• Increased our collaboration tools for remote offices. • Special 2:1 match for ActionAid India for COVID

Relief — shared with all of our NLOK community to

ensure that those who are able to, have the opportunity

to participate in giving this much needed support.

• Frequent marketing and communication of our globa l

Employee Assistance Pro gram to enable quick support

for employees and their families.

• Home isolation coverage and telemed consultations are

now included under our Health Plan.

• 100% coverage for testing, vaccinations and telemed

consultation under our US medical plans.

• Stipend to assist with remote office set up and

provisioned surplus equipment for home office

deployment.

• Social distancing measures, enhanced cleaning and

safety protocols for open sites.

Board’s Role in Oversight of Company Strategy

One of the Board’s most important responsibilities is collaborating with management to establish NortonLifeLock’s

long-term strategy and then overseeing and providing guidance to management in the execution of the articulated strategy.

Various elements of our strategy are discussed in depth at every quarterly Board meeting, with management providing

the Board with an update on performance with an update on execution against short and longer-term elements of strategy.

The Board also meets annually for a multi-day session where long-term strategy is the primary topic. While the full

Board, with leadership of the Chair, has responsibility for overseeing overall company strategy, each of our key Committees

provides input to the full Board on strategic and execution-oriented issues rela ted to their respective areas of focus. The

Board receives regular updates from the management team (including those below the executive level) regarding

NortonLifeLock’s strategy and performance to inform its perspective on progress and ensure that it can effectively perform

its oversight responsibilities.

Board’s Role in Oversight of Human Capital Management

The Board has long recognized tha t our employees are one of our most important assets and is engaged with management

on ensuring that NortonLifeLock is an employer of choice for the most talented employees in our industry. While the full

Board regularly discusses human capital management with regards to its role in overseeing our overall long-term strategy,

our Compensation Committee has responsibility for overseeing human capital management. The Compensation

Committee is tasked with overseeing specific initiatives on a regular basis.

11

Our Compensation Committee is responsible for, among other tasks:

• Overseeing compensation philosophies and incentive plans across our workforce with a focus on Executive

Compensation & Retention; and

• Monitoring talent management and organizational effectiveness on a regular basis.

Our Compensation Committee also has regular touchpoints with management on the following topics:

• Employee engagement, performance management and culture; and

• Workforce demographics including diversity, equity and inclusion strategies and representation.

Outside Advisors

The Board and its committees are free to engage independent outside financial, legal and other advisors as they deem

necessary to provide advice and counsel on various topics or issues, at NortonLifeLock’s expense, and are provided full

access to our officers and employees.

Board Structure and Meetings

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by

written consent from time to time. Agendas and topics for board and committee meetings are developed through discussions

between management and members of the Board and its committees. Information and data that are important to the

issues to be considered are distributed in advance of each meeting. Board meetings and background materials focus on

key strategic, operational, financial, governance and compliance matters applicable to us, including the following:

• Reviewing annual and longer-term strategic and business plans;

• Reviewing key product, industry and competitive issues;

• Reviewing and determining the independence of our directors;

• Reviewing and determining the qualifications of directors to serve as members of committees, including the

financial expertise of members of the Audit Committee;

• Selecting and approving director nominees;

• Selecting, evaluating and compensating the Chief Executive Officer;

• Reviewing and discussing succession planning for the senior management team, and for lower management levels

to the extent appropriate;

• Reviewing and a pproving material investments or divestitures, strategic transactions and other significant transactions

that are not in the ordinary course of business;

• Evaluating the performance of the Board;

• Overseeing our compliance with legal requirements and ethical standards; and

• Overseeing our financial results.

Executive Sessions

After each regularly scheduled Board meeting, the independent member s of our Board hold a separate closed meeting,

referred to as an “executive session.” These executive sessions are used to discuss such topics as the independent directors

deem necessary or appropriate. At least annually, the independent directors hold an executive session to evaluate the

Chief Executive Officer’s performance and compensation. Executive sessions of the Board are led by the independent, non-

executive Chair.

12

Succession Planning

Our Board recognizes the importance of effective executive leadership to NortonLifeLock’s success, and meets to discuss

executive succession planning at least annually. Our Board develops and reviews emergency and long-term succession

plans and evaluates succession candidates for the CEO and other senior leadership positions under both. The Board also

oversees management’s senior executive talent development plans, including ensuring that our succession candidates

have regular interactions with the Board.

Attendance of Board Members at Annual Meetings

We encourage our directors to attend our annual meetings of stockholders. All nine of our directors attended our 2021

Annual Meeting.

13

THE BOARD AND ITS COMMITTEES

There are four committees of the Board: the Audit Committee, the Compensation and Leadership Development Committee,

the Nominating and Governance Committee, and the Technolo gy and Cybersecurity Committee. The Board has delegated

various responsibilities and authorities to these different committees, as described below and in the committee charters.

The Board committees regularly report on their activities and actions to the full Board. Each member of the Audit Committee,

Compensation Committee, Nominating and Governance Committee and the Technology and Cybersecurity Committee

was appointed by the Board. Each of the Board committees has a written charter approved by the Board and the key

committee charters are available on our website at investor.nortonlifelock.com, by clicking on “Company Charters,” under

“Corporate Governance.”

The following table shows the proposed composition of the Board and its committees, and other information, following the

Annual Meeting. Current committee composition is provided in the text below the table.

1

Director

Since

Committee Memberships

Other

Public

Boards*Name Age Occupation Independent Diversity AC CC NGC Tech

Susan P. Barsamian 63 2019 Director

WD 2

Eric K. Brandt 60 2020 Director

3

Frank E. Dangeard 64 2007 Managing Partner, Harcourt

2

Nora M. Denzel 59 2019 Director

W 3

Peter A. Feld 43 2018 Managing Member and Head of

Research, Starboard Value LP

2

Emily Heath 48 2021 Director

WD 0

Vincent Pilette 50 2019 Chief Executive Officer

0

Sher rese M. Smith 50 2021 Managing Partner, Paul Hastings

WD 1

AC = Audit Committee CC = Compensation and Leadership Development Committee NGC = Nominating and Governance Committee

Tech = Technology and Cybersecurity Committee W = Woman D = Underrepresented Community (Ethnic Diversity and/or LGBTQ+)

= Member = Chair

* Reflects membership on boards of companies publicly traded in the U.S.

During FY22, our Board held 15 meetings, the Audit Committee held 9 meetings, the Compensation Committee held 5

meetings, the Nominating and Governance Committee held 5 meetings and the Technology and Cybersecurity Committee

held 4 meetings. During this time, no current directors attended fewer than 87% of the aggregate of the total number of

meetings held by the Board and the total number of meetings held by all committees of the Board on which such director

served during the period which such director served.

Audit Committee

Our Audit Committee is currently comprised of Mr. Brandt, who is the chair, and Memes. Denzel and Heath and Mr. Dangeard.

Our Audit Committee oversees NortonLifeLock’s accounting and financial reporting processes and the audits of our

financial statements, including oversight of our systems of internal control over financial reporting and disclosure controls

and procedures, compliance with legal and regulatory requirements, internal audit function and the appointment, retention

and compensation of our independent auditors. Its duties and responsibilities include, among other things:

• Reviewing and discussing with management NortonLifeLock’s quarterly and annual financial statements.

• Reviewing the adequacy and effectiveness of NortonLifeLock’s accounting and financial reporting processes.

1

Kenneth Y. Hao was not re-nominated by the Board.

14

• Appointing and, if necessary, terminating any registered public accounting firm engaged to render an audit report or

to perform other audit, review or attest services for NortonLifeLock.

• Reviewing and approving processes and procedures to ensure the continuing independence of NortonLifeLock’s

independent auditors.

• Reviewing the internal audit function of NortonLifeLock, including the independence and authority of its reporting

obligations and the coordina tion of NortonLifeLock’s inter nal audit function with the independent auditors.

• Reviewing NortonLifeLock’s practices with respect to risk identification, assessment, monitoring and risk

management and mitigation, including financial, privacy, operational, compliance, physical security, legal and other

key business risks.

• Reviewing NortonLifeLock’s adequacy and effectiveness of NortonLifeLock’s cyber security and information

security policies and practices.

• Reviewing NortonLifeLock’s business continuity and disaster preparedness planning.

• Reviewing any regulatory developments that could impact NortonLifeLock’s risk identification, assessment,

monitoring and risk management and mitigation.

• Reviewing NortonLifeLock’s ethics compliance program, including policies and procedures for monitoring

compliance, and the implementa tion and effectiveness of NortonLifeLock’s ethics and compliance program.

• Directing and supervising investigations into any matters within the scope of its duties.

• Retaining such outside counsel, experts and other advisors as it determines to be necessary to carry out its

responsibilities.

Our Board has unanimously determined that all Audit Committee members are independent as defined under current

Nasdaq listing standards, and at least one member has financial sophistication as required pursuant to the Nasdaq listing

standards. In addition, our Board has unanimously determined that Mr. Brandt qualifies as an “audit committee financial

expert” under U.S. Securities and Exchange Commission (SEC) rules and regulations. Designation as an “audit committee

financial expert” is an SEC disclosure requirement and does not impose any additional duties, obligations or liability on any

person so designated.

Compensation and Leadership Development Committee

Our Compensation Committee is currently comprised of Mr. Feld, who is the chair, and Memes. Barsamian and Denzel.

Our Compensation Committee oversees our compensation policies and practices so that they align with the interests of our

stockholders; encourage a focus on NortonLifeLock’s long-term success and performance; and incorporate sound

corporate governance principles. It also oversees our programs to attract, develop and retain our executive officers. Its

duties and responsibilities include, among other things: