2024

Insights Report

An inside look at the

future of pet nutrion

2

What’s inside:

Secon 1:

Introducon................................................................3

Secon 2:

Category growth.........................................................4

Secon 3:

Daily treang...............................................................6

Secon 4:

Health and sustainability.............................................9

Secon 5:

Human-like products and services............................12

Secon 6:

How ADM can help...................................................14

3

Introduction

Powered by evolving percepons of pet ownership across the globe, the pet

care industry is poised for connued growth in 2024. Surveys show that a

majority of owners consider their pets members of their family, and this societal

shi in perspecve is expanding across major pet-owning markets.

1

Furry family

members connue to receive preventave care, mental smulaon, and high-

quality nutrion on a daily basis—and there is no sign that modern pet parents

are slowing down.

Consumers are also showing their excitement for novel avors and mul-

sensorial experiences in their buying behaviors. Today’s pet parent is looking for

the next big thing in pet care and willing to try new products if they meet their

expectaons for quality and aordability. When you layer in a focus on health

and wellness through funconal ingredients, the pet care market is ripe for

innovaon this year.

Read on for more ADM insights that can help you achieve success in 2024.

Secon 1:

4

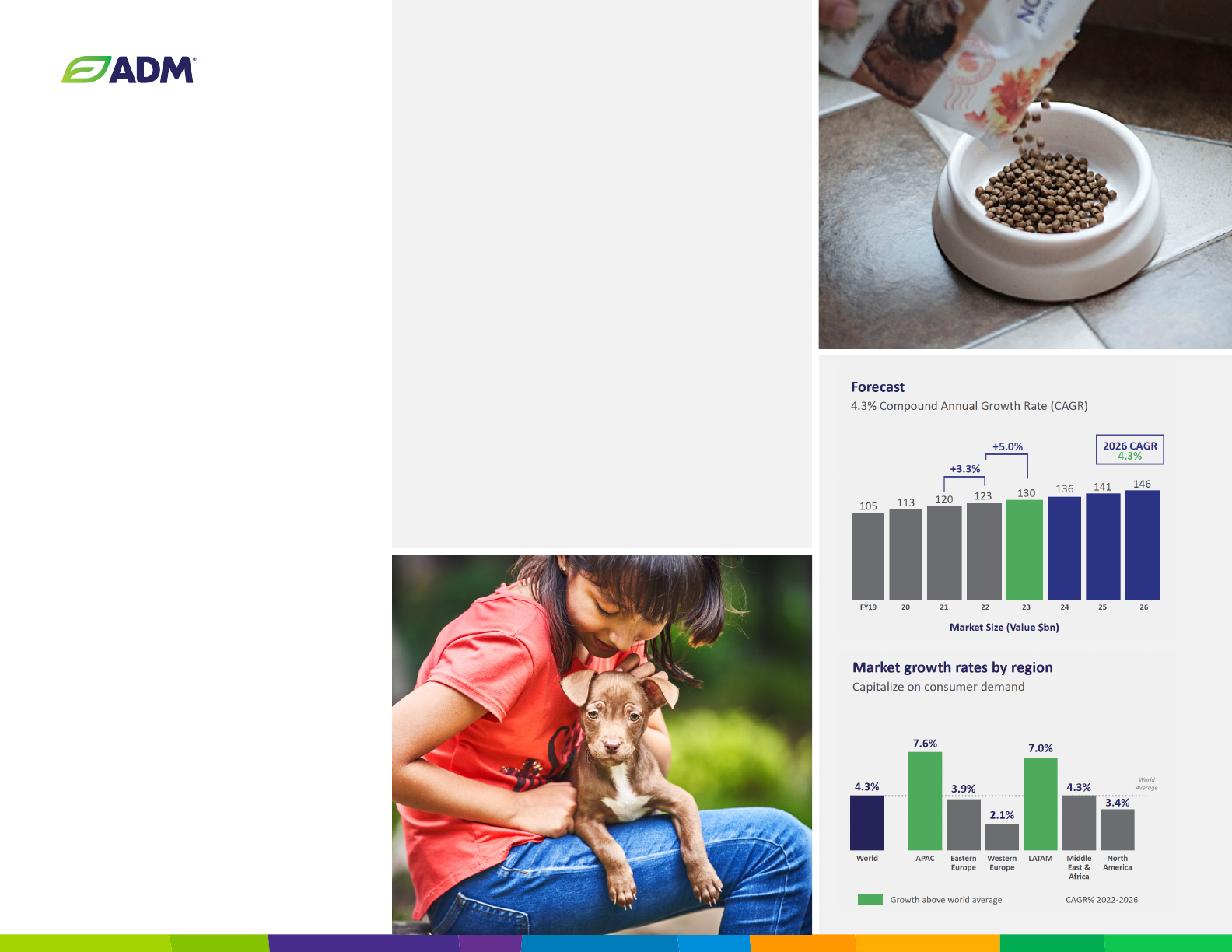

Category growth

Global humanizaon trends and increasing

pet populaons connue to drive consistent

growth across the pet care industry. The

APAC and LATAM regions are in the lead

with higher-than-average CAGR compared

to the rest of the world.

1

In 2024, pet

brands need to globalize and diversify their

oerings to remain compeve.

Secon 2:

65% of Millennials

plan to acquire a pet by

2025.

1

5

As inaon cools, consumers are sll looking for the best value in pet products,

yet premium products connue to sell, aributed partly to humanizaon

trends. Overall, the global pet care market shows strong resistance to inaon

as pet owners generally avoid making sacrices when it comes to pet health

and wellness.

1

70% of owners

consider their pets a

family member.

1

72% would not

cut pet food expense

regardless of

finances.

1

Premiumization persists

6

Daily treating

Whether it is for enrichment, training,

or nutrional benets, daily treang is

becoming commonplace across pet owners.

Many pet parents are looking for treats with

health and wellness benets to provide a

guilt-free treang experience. In fact, 85%

of pet owners say they consider proper

nutrion and supplements just as important

for their pets as they are for themselves.

4

Secon 3:

73% of pet

owners say they

still prioritize fun

items or treats for

their pets despite

rising costs.

4

63% of dog owners

and 60% of cat owners

participate in

daily treating.

2

7

Overall, the rise in funconal benets added to treats may encourage pet

owners to engage in healthy treang more frequently, raising the potenal for

future category growth. Consumers across the globe are connuing to show

strong interest in treats and supplements with 79% stang that they would

spend money on preventave care in an aempt to avoid larger vet bills.

4

From so chews to baked treats, there is connuous demand for innovaon

in treats and supplements as pet owners mirror their own health and wellness

habits to their pets. Treats that make science-backed funconal claims remain

popular in store and online.

The global pet treat and

supplement market is

forecasted to grow at an

8% CAGR through 2028.

1

US retail sales of pet

treats are forecasted

to grow 5.5% in 2024.

2

Focusing on function

8

Growth opportunities:

Innovaon in ingredients and formulaon to create

new types of healthy treats

Scienc research into acve ingredients and their

role in health and wellness

Treats that mimic indulgent human food while

providing nutrional benet to pets

Healthy training and enrichment treats that provide

pet owners a guilt-free treang experience

Focus on ingredients that boost gut health to

improve overall wellness

+

+

+

+

+

9

Health and sustainability

Given the rise in humanizaon of pets by modern pet parents, it’s no surprise

to see human-oriented buying habits reected in their pets. As the modern

consumer becomes more familiar with acve ingredients promoted on human

food labels, their desire to see these same ingredients in their pet’s food grows.

Similarly, pet brands are nding that consumers are increasingly focused on

products’ environmental impacts, from where and how ingredients are grown

to how those ingredients are processed.

Secon 4:

10

Consumers are aracted to innovaon in food and treats, especially

when ingredients are sourced from familiar health categories such

as superfoods and vegetables. These products make similar claims to

their human-product counterparts, so owners feel safe feeding their

pets a food or treat with healthy ingredients that they would willingly

consume themselves.

Human health and environmental sustainability research is oen

promoted on news outlets and social media, and pet owners are

looking to see this research reected in pet products as well. These

trends are driving high rates of innovaon in pet care products,

especially at the intersecon of health-focused and sustainable

manufacturing.

54% of pet owners

are looking for healthy

ingredients in food.

1

New pet owners are more

likely to place emphasis

on quality and premium

products.

2

Gut, brain, and heart health claims are on

the rise in new products.

2

Echoing human trends

11

When presented a choice, more consumers

are choosing sustainable and healthy

opons for themselves and their pets, and a

majority of pet owners are trying to make a

dierence on the environment through their

buying habits. It’s safe to say, pet brands are

paying aenon.

As 2024 unfolds, we expect to see an

increased focus on sustainability iniaves

from pet care brands, big and small.

42% of pet owners

prefer sustainable

packaging.

1

Pet owners are more

likely than non-pet

owners to say they

are worried about

climate change.

1

66% of pet owners

globally are worried about

climate change and try to

have a positive impact on

the environment through

their actions.

1

63% of pet owners

aged 18-34 prefer pet food

brands that limit their

environmental impact.

2

The takeaways

12

Human-like products and services

As owners connue to humanize their pets, they are spending more me

together through common acvies. This might mean bringing their pet to the

coee shop or on a trip to the home improvement store. Owners now want to

share their lifestyle with their pets, and that includes their favorite foods and

beverages. From pumpkin spice dog treats to pet-safe beer, owners are ready to

invest in excing new experiences and make long-lasng memories with their

favorite furry friend.

Secon 5:

New pet owners (<3 years)

are driving growth in unique

feeding experiences, such as

incorporating dog food toppers;

35% say they purchased sauce

or mixers in 2023.

2

13

The fun doesn’t stop with edible endeavors. Some pet shops are

now providing spas, salons, health and wellness centers, and even

swimming pools to cater to modern pet owners.

1

Workplaces are

becoming increasingly dog friendly, and a large poron of Gen Z pet

owners say they are willing to spoil their pet with birthday presents

and cake.

3

It’s safe to say that pet owners want to share their lives with

their favorite pets, and consumer spending habits reect these trends.

In 2024, the most successful pet care companies will develop lifestyle

brands on social media and diversify their products to include health

and wellness. Others may venture into products that boost a pet’s

mood, promote mental wellbeing, or regulate energy levels.

Overall, variety and innovaon will be key to capturing future market

share, so pet brands should partner only with the most capable

co-manufacturers to ensure success.

Variety and innovation

14

How ADM can help

Whether you want a reliable partner to help you develop a new product or

you’re looking for science-backed funconal ingredients, ADM has the experse

and porolio you need. Using our diverse team of formulaon sciensts and

state-of-the-art facilies, we regularly help our partners bring new products to

market. Our teams will monitor consumer trends, conduct scienc research,

and use our experse to help your pet brand succeed.

Secon 6:

140 sciensts, technicians, and employees dedicated to animal nutrion

13 Research & Development and applied research centers globally

A porolio of patented biocs with sciencally veried ecacy and stability

Signicant resources dedicated to supporng partners in the pet industry

Full integrated soluons that range from ingredients to turnkey products

+

+

+

+

+

15

ADM’s 360-degree approach includes services, customer insights, and

tailor-made soluons that enable us to help our partners move quickly from

ideas to innovaons, giving them a compeve advantage with today’s pet

parents. As a go-to partner for our customers, ADM’s pet nutrion soluons

help advance the role of foods, treats, and supplements as a way to strengthen

the bond between pets and their owners.

Insights and expertise to advance innovation

Request a consultation today

800-775-3295 | petnutri[email protected] | adm.com/petnutrion

THIS INFORMATION IS INTENDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT IMPLY ANY EXPRESS RECOMMENDATIONS FOR THE CURE, MITIGATION, TREATMENT, OR PREVENTION OF

DISEASE. CONSULT WITH A VETERINARIAN FOR THE CURE OF ALL ANIMALS DURING HEALTH CHALLENGES.

THE INFORMATION PROVIDED IN THIS DOCUMENT IS BASED ON THE CURRENT KNOWLEDGE AND EXPERIENCE OF ADM OR ITS AFFILIATED COMPANIES AND IS ONLY INTENDED TO BE RECEIVED BY

THE ADDRESSEE (THE “ADDRESSEE”). THE INFORMATION PROVIDED TO THE ADDRESSEE “AS IS” AND NO WARRANTIES, EXPRESS OR IMPLIED, ARE GIVEN OR LIABILITIES OF ANY KIND ARE ASSUMED

BY ADM OR ITS AFFILIATED COMPANIES WITH RESPECT TO SUCH INFORMATION.

1

Euromonitor: World Market for Pet Care - June 2023

2

Mintel: Pet Food US - September 2023

3

Megna, Michelle. “Pet Ownership Stascs 2024.” Forbes, 25 Jan. 2024 hps://www.forbes.com/advisor/pet-insurance/pet-ownership-stascs.

4

Morning Consult: ADM Pet Food Study - December 2023