★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

★

Inflation Reduction

Act (IRA) and CHIPS

Act of 2022 (CHIPS)

Pre-Filing Registration Tool

User Guide and Instructions

i

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Table of Contents

User Guide and Instructions Overview ������������������������������������������������������������������������������������������������������������������������������������������������������ 1

Introductory Note ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 1

IRA and CHIPS Credits – Pre-Filing Registration �������������������������������������������������������������������������������������������������������������������������������� 1

User Comments ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 2

Path to Monetizing an IRA/CHIPS Credit with an Elective Payment or a Transfer

Election ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 2

Registration Options ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 3

Earn the Credit ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4

Elective Payment or Transfer? �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4

Elective Payment Election ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4

Credit Transfers �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4

Pre-Filing Registration ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4

Taxpayer Privacy and Public Disclosure ��������������������������������������������������������������������������������������������������������������������������������������������������������� 5

Reporting the Credit and Making the Election on a Tax Return ������������������������������������������������������������������������������������ 5

What Forms to File ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 5

When to File ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 6

Facility-By-Facility Reporting �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 6

Reporting the Elective Payment Amount ��������������������������������������������������������������������������������������������������������������������������������������������������������������� 6

Transfer Election ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 7

Accessing the IRA/CHIPS Pre-Filing Registration Tool ������������������������������������������������������������������������������������������������� 7

Sign In or Create an ID.me Account ��������������������������������������������������������������������������������������������������������������������������������������������������������������������� 7

The Registrant’s IRS Energy Credits Online Account ������������������������������������������������������������������������������������������������������������������ 8

Registrant Authorization ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 9

Employer Identification Number of the Business ���������������������������������������������������������������������������������������������������������������������������������������� 9

Personal Information ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 10

Entity Information ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 10

Name ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 10

Address ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 10

Attestations ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 11

Options After Authorization ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 12

IRA/CHIPS Credits Dashboard �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 14

ii

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Email Notifications ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 15

2023 IRA/Chips Credit Registration ����������������������������������������������������������������������������������������������������������������������������������������������������������� 16

Before You Begin ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 16

Site Navigation ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 16

One Registration Package Per Annual Accounting Period �������������������������������������������������������������������������������������������������������������� 16

Never Use the EIN of Another Taxpayer, Even if it is a Closely Related Entity ����������������������������������������������������������� 16

How Many Registration Numbers ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 16

Error Review ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 17

Allow Time for Review ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 17

Processing Steps ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 17

Account Lock-Out While Review is "Awaiting Assignment" or "Under Review" ������������������������������������������������������� 17

Resources Before You Register ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 18

Summary ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 18

IRA/CHIPS Credits Information ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 18

Overview ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 18

General Information: Page 1 of 4 �������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 20

Date When the Registrant’s Accounting Period Ends ��������������������������������������������������������������������������������������������������������������������������� 20

EIN and Name �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 20

Parent of a Consolidated Group of Corporations �������������������������������������������������������������������������������������������������������������������������������������� 21

Registrant Type ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 22

General Information Page 2 of 4 ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 24

Registrant Address �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 24

General Information Page 3 of 4 ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 26

Banking Information ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 26

General Information Page 4 of 4 ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 27

Returns Filed ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 27

Credit Selection ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 28

Dynamic Content ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 28

IRA Credits ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 29

CHIPS Credit ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 30

Credit Summary ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 31

Facility/Property Information ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 31

General Principles ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 31

Data Entry ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 32

Questions/Data Common to Multiple Credits ������������������������������������������������������������������������������������������������������������������������������������������������ 37

Credit-Specific Information ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 45

iii

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Your Registrations �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 53

Draft Registrations ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 53

Submit for Review ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 54

Lock-Out For Revisions During Review ��������������������������������������������������������������������������������������������������������������������������������������������������������������� 55

Monitor the Status of Your Registrations ������������������������������������������������������������������������������������������������������������������������������������������������� 55

Submission Status ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 57

Registration Numbers ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 62

Amendments ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 62

One Registration Per Annual Accounting Period ��������������������������������������������������������������������������������������������������������������������������������������� 62

Amendments Allowed for Registrations Returned After Review ������������������������������������������������������������������������������������������������ 62

When to Amend ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 62

Appendix A: General Business Credit Resources �������������������������������������������������������������������������������������������������������������� 65

Appendix B: IRA/CHIPS Elective Payment and Transfer Resources �������������������������������������������������� 65

Laws and Regulations ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 65

Publications ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 65

Frequently Asked Questions ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 65

Forms ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 65

Appendix C: Worksheets ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 66

General Information Screens �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 66

IRA/CHIPS Pre-Filing Registration Tool Data Inputs Worksheet ������������������������������������������������������������������������������������������������ 66

Appendix D: Types of Returns ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ 67

1

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

User Guide and Instructions Overview

Introductory Note

Section references are to the Internal Revenue Code unless otherwise noted.

This User Guide and Instructions uses the term "taxpayer" inclusively to refer to any legal entity (business,

organization, government (including tribal governments)) that can earn one or more of the credits under

the Inflation Reduction Act of 2022 (IRA) and the CHIPS Act of 2022 (CHIPS) that can be monetized with

an elective payment or credit transfer election under section 6417 or 6418, even if the entity could never

be subject to federal income tax. Other terms used in this User Guide and Instructions include:

•

"Applicable entity" – a defined term for purposes of elective payment

•

"Eligible taxpayer" – a defined term for purposes of IRA credit transfers and elective pay under CHIPS

•

"Registrant" – the taxpayer who submits a registration request (which in the case of the parent of a

consolidated group of corporations may not always be the taxpayer that earned the credit)

IRA and CHIPS Credits – Pre-Filing Registration

IRA and CHIPS enable taxpayers to take advantage of certain manufacturing investment, clean energy

investment and production tax credits through elective pay or transfer provisions. A taxpayer who intends

to make an elective payment or credit transfer election must complete the pre-file registration process to

receive a registration number. The registration number must be included on the taxpayer’s annual return

as part of making a valid election. To facilitate this, the IRS has created a new IRA/CHIPS Pre-Filing Regis-

tration tool. This User Guide and Instructions will help registrants navigate the tool.

This User Guide and Instructions includes general information and instructions on the following topics:

•

Path to monetizing an IRA/CHIPS Credit with an elective payment or a transfer election (note that CHIPS

only allows for an elective payment election)

•

Accessing the IRA/CHIPS Pre-Filing Registration tool

•

Creating one or more Clean Energy Online accounts

•

Information about the pre-filing registration process, including:

◦

IRA/CHIPS Credits dashboard and basics of navigating within the tool

◦

Email notifications

◦

Collection of information at the taxpayer/entity level

◦

Collection of information regarding facilities/properties for specific credits

◦

Information entry (including a limited bulk data upload capability)

◦

Registration submission case review statuses

◦

Registration numbers

◦

Registration amendments

This User Guide and Instructions is not a legal or technical guide for:

•

Understanding general business credits, including computing and reporting credits on a tax return

•

Earning an IRA/CHIPS credit

•

Qualifying for bonus credit amounts

2

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

•

Determining how many separate facilities/properties to register

•

Filing the annual return where the credits will be reported

•

Making an effective credit transfer

See Appendices A and B for resources on irs.gov that address these issues.

User Comments

The IRS welcomes comments regarding users’ experiences with this new process and technology. Please

send comments to irs.elective.payment.or.transfer[email protected]. Note that this email address

accepts comments only and is not a forum to obtain assistance with use of the tool.

Path to Monetizing an IRA/CHIPS Credit with an Elective Payment

or a Transfer Election

The IRA clean energy credits and the CHIPS credit are general business credits under section 38. Elective

payment under section 6417 or section 48D(d) and the transfer election under section 6418 create alter-

native ways for applicable entities and eligible taxpayers who have earned one of the IRA clean energy or

the CHIPS credits to get the benefit of the credit even if the taxpayer cannot use the credit to offset tax

liability. This section of the User Guide and Instructions provides a brief overview of the steps a taxpayer

must take to monetize one or more of these credits with the elective payment or transfer elections.

•

IRA Credits

◦

Elective Pay: Elective pay allows applicable entities (as defined), including tax-exempt and

governmental entities (such as a local government) that would otherwise be unable to claim these

credits because they do not owe federal income tax, to benefit from some clean energy tax credits

by treating the amount of the credit as a payment of tax. With elective pay, an applicable entity that

qualifies for a clean energy credit can notify the IRS of its intent to claim the credit and file an annual

tax return to claim elective pay for the full value of the credit. The IRS would then pay the applicable

entity the value of the credit.

◦

Transfer Election: A transfer election allows an eligible taxpayer that qualifies for a clean energy tax

credit but is not eligible to use elective pay to transfer all or a portion of the credit to a third-party buyer

in exchange for cash. The buyer and seller would negotiate and agree to the terms and pricing.

•

CHIPS – Elective Pay: The Advanced Manufacturing Investment Credit, established by the Creating

Helpful Incentives to Produce Semiconductors (CHIPS) Act of 2022, incentivises the manufacture of

semiconductors and semiconductor manufacturing equipment within the United States. The CHIPS

credit is available to taxpayers that meet certain eligibility requirements. Eligible taxpayers can choose to

receive the credit as an elective payment. Like elective pay for the IRA credits, an eligible taxpayer that

earns the CHIPS advanced manufacturing credit must notify the IRS of its intent to claim the credit and

file an annual tax return to claim elective pay for the full value of the credit. The IRS would then pay the

eligible taxpayer the value of the credit, which can be refunded as an overpayment of tax if the payment

of tax exceeds the amount properly due from the taxpayer.

Fact sheets, FAQs, and more information related to elective payment and a transfer election can be found

at IRS.gov/ElectivePay.

Completing pre-filing registration and filing a tax return are both required for elective payment elections

and transfer elections. This section of the User Guide and Instructions provides a brief overview of the

steps a taxpayer must take to monetize one or more of these credits with the elective payment election or

transfer of the credit.

3

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Registration Options

Note: The information in Table 1 will be updated as needed when final regulations under sections 6417,

6418 and 48D are issued.

Table 1: Entity types and the type of registrations available to them

Registrant type Credit Provision (by reference to the applicable Code provision)

30C 45 45Q 45U 45V 45W 45X 45Y 45Z 48 48C 48E 48D

Organization exempt from tax under

Subtitle A described in section 501(a)

P P P P P P P P P P P P P

Government of any U.S. territory or a

political subdivision thereof (including an

agency or instrumentality)

P P P P P P P P P P P P N/A

Any State, the District of Columbia, or

political subdivision thereof (including an

agency or instrumentality)

P P P P P P P P P P P P N/A

An Indian tribal government or a

subdivision thereof (including an agency

or instrumentality)

P P P P P P P P P P P P N/A

Any Alaska Native Corporation (as defined

in section 3 of the Alaska Native Claims

Settlement Act, 43 U.S.C. 1602(m))

P P P P P N/A P P P P P P P

The Tennessee Valley Authority P P P P P P P P P P P P N/A

Rural electric cooperative* P P P P P N/A P P P P P P P

S Corp T T P/T T P/T N/A P/T T T T T T P

C Corp T T P/T T P/T N/A P/T T T T T T P

Partnership T T P/T T P/T N/A P/T T T T T T P

REIT T T P/T T P/T N/A P/T T T T T T P

Sole proprietor T T P/T T P/T N/A P/T T T T T T P

Trust T T P/T T P/T N/A P/T T T T T T P

Other subchapter F entities (such as

section 521, 526, 527, 528, 529, 529A

and 530 orgs)**

T T P/T T P/T N/A P/T T T T T T P

Section 664 (charitable remainder

trusts), 408(e) (IRAs) and various similar

tax-advantaged savings accounts not

included in subchapter F**

T T P/T T P/T N/A P/T T T T T T P

** For purposes of pre-filing registration, a rural electric cooperative that is an organization described in section 501(c)(12) should identify as an "Organization

exempt from tax under Subtitle A described in section 501(a)."

** These entities do not have their own entity type indicator on the IRA/CHIPS Pre-Filing Registration tool. These filers will choose "Trust" or "Other corporation."

"P" means that the registrant type identified in the left column can request a registration number for an elective payment election with respect to the credit

in the top row. "T" means that the registrant type identified in the left column can request a registration number for a transfer election with respect to the

credit in the top row. "N/A" indicates that the registrant type in the left column is unable to make either election for the credit listed in the top row.

4

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Earn the Credit

An essential step in monetizing an IRA clean energy or CHIPS credit is earning the credit. That is, make

a tax credit investment or undertake tax credit production activities to earn a credit that qualifies for the

elective payment election under section 6417 or 48D(d) or can be transferred under section 6418. Credits

that may qualify for an elective payment election under section 6417 are "applicable credits" and those

that may qualify for a transfer election under section 6418 are "eligible credits." For more information

about the credits and how to earn them, see Appendix A – General Business Credit Resources.

Elective Payment or Transfer?

Determine whether the taxpayer can monetize the credits earned with an elective payment election or

by making an election to transfer the credit. Refer to the resources in Appendix B – IRA/CHIPS Elective

Payment and Transfer Resources for detailed information on those matters.

Elective Payment Election

A taxpayer that can and wants to make an elective payment election for one or more IRA clean energy

credits under section 6417 or the CHIPS credit under section 48D(d) must register the intention to make

an elective payment election and receive a registration number. Sections 1.48D-6T and 1.6417-5T.

A taxpayer making the elective payment election is treated as having made a payment against tax

imposed by Subtitle A of the Internal Revenue Code at the later of the due date of the tax return (without

extension), or when the return is timely filed (with extensions). See the resources in Appendix B – IRA/

CHIPS Elective Payment and Transfer Resources for more detailed information. A taxpayer that does not

file an annual income tax return (such as a government entity) will use Form 990-T, Exempt Organization

Business Income Tax Return (and proxy tax under section 6033(e)).

If the elective payment election amount, together with other tax payments and refundable credits,

exceeds the taxpayer’s income tax liability, the taxpayer is treated as having made an overpayment of tax,

which can be refunded or credited to estimated tax for the next tax year.

Credit Transfers

A taxpayer that can and wants to transfer IRA clean energy credits must register the intention to transfer

the credits and receive a registration number. Section 1.6418-4T. The taxpayer also must find an unrelated

transferee taxpayer who wishes to purchase the credit(s) for cash consideration. Section 6418. Proposed

regulations under section 6418 published in the Federal Register on June 21, 2023 provide proposed

rules related to the transfer of credits, such as providing the transferee taxpayer with documentation that

satisfies the Minimum Required Documentation under proposed section 1.6418-2(b)(5)(iv).

Pre-Filing Registration

Register the intention(s) to make an elective payment or a transfer election. Pre-filing registration is

required for an effective elective payment or transfer election. The election must be made on a timely filed

return. This User Guide and Instructions focuses on the pre-filing registration process. Detailed informa-

tion about the credits, how they are computed and reported is available in IRS forms, form instructions

and other resources. See Appendix B – IRA/CHIPS Elective Payment and Transfer Resources.

Complete and submit the pre-filing registration request no earlier than the beginning of the tax year in

which the taxpayer will earn the credit it wishes to monetize with an elective payment election or transfer

election. This is the earliest date for pre-filing registration because the facility/property that will generate

the credit (either as an investment or as a production facility) must have been placed in service before the

taxpayer can register it for an elective payment or transfer election.

5

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Even though registration is not possible prior to the beginning of the tax year in which the credit will be

earned, the IRS recommends that taxpayers register as soon as reasonably practicable during the tax

year. The current recommendation is to submit the pre-filing registration at least 120 days prior to when

the organization or entity plans to file its tax return. This should allow time for IRS review, and for the

taxpayer to respond if the IRS requires additional information before issuing the registration numbers.

A registration submission can be amended after a prior submission has been processed by the IRS and

returned. See "Submission Status"

Other important considerations:

•

The IRS intends to review and process registration submissions through the IRA/CHIPS Pre-Filing

Registration tool in the order it receives them. A registrant cannot request expedited handling.

•

If the registrant chooses to make additional pre-filing registration submissions for different facilities/

properties, the registrant must wait until the most recent pre-filing registration submission is processed

by the IRS and returned.

•

IRS may consider a registrant’s tax period ending date when managing the pre-filing registration

caseload.

•

The IRS will work to issue a registration number even where the registration submission is made close

in time before the registrant’s filing deadline. In such cases, the registrant should anticipate that the

tax return on which the elective payment or transfer election is made may undergo heightened scrutiny

to mitigate the risk of fraud and duplication that pre-filing registration is intended to address before a

payment is issued.

Taxpayer Privacy and Public Disclosure

Information provided for Energy Credits Online – IRA/CHIPS Pre-Filing Registration is taxpayer information

protected from public disclosure under section 6103. Accordingly, information collected in the IRA/CHIPS

Pre-Filing Registration tool will not be shared with any person outside the IRS who is not authorized to

receive it (either by virtue of their status with respect to the taxpayer, or as the holder of a valid power of

attorney). See the Instructions for Form 990-T for information about public disclosure of Form 990-T when

filed by an organization exempt from tax under section 501(c)(3).

Reporting the Credit and Making the Election on a Tax Return

What Forms to File

Both the elective payment election and the transfer election are made on an annual tax return. A taxpayer

that has an annual tax return filing obligation will make the elective payment or transfer election on their

annual tax return.

Taxpayers that do not have an annual tax return filing obligation should refer to FAQs 20 through 23 at

Elective Pay and Transferability Frequently Asked Questions: Elective Pay for information about which

annual tax return form to use

To make an elective payment or credit transfer election, the annual tax return must include:

•

All relevant source credit forms (the form used to compute and report the credit), showing computation

of each credit. See Table 2 for a chart of the source credit forms used for each credit, and

•

Form 3800, General Business Credits, showing how each business credit is carried to the annual tax

return. Form 3800 will also associate each registration number with the credit computation to which it

relates.

6

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

When to File

Both the elective payment election and the transfer election must be made on a timely filed return

(including extensions). This is the case for all taxpayers making an elective payment or transfer election. A

taxpayer with an annual filing requirement needing an extension of the time to file their annual return will

use existing forms and procedures to request an extension.

Form 8868, Application for Automatic Extension of Time to File an Exempt Organization Return has not

yet been revised to allow government entities (including tribal governments) to request an extension of

the time to file. Therefore, these government entities will, in the first year of implementation, receive an

automatic, paperless, 6-month extension for the due date of their tax return. It is unnecessary for them to

request an extension.

Refer to the instructions for the annual tax return on which the elective payment or transfer election will

be reported for information about the due date for the return. The regular due date for Form 990-T filed

by an exempt organization is the 15th day of the 5th month after the end of the tax year. For calendar year

taxpayers, that due date is May 15. The automatic paperless extension extends the due date by 6 months

(or for a calendar year taxpayer, extends the due date from May 15 to November 15). FAQs 20 through 23

at Elective Pay and Transferability Frequently Asked Questions: Elective Pay provide information about

the filing due date for taxpayers that do not have an annual return filing requirement.

The regular (not extended) filing date is the earliest date that the elective payment amount can be

disbursed. See FAQ 25 at Elective Pay and Transferability Frequently Asked Questions: Elective Pay.

Facility-By-Facility Reporting

Reporting on a facility/property basis will determine the number of registrations numbers the registrant will

need. Refer to the instructions for each source credit form. Pre-filing registration review will not consider

whether the facility-by-facility rules have been applied correctly. The registrant is responsible for knowing

how many registration numbers will be needed and how to describe the facility/property associated with

each registration number.

Note: In general, omission of a registration number from the taxpayer’s return for any reason will cause an

elective payment or transfer election to be treated as ineffective. This rule is applied on a facility/property

basis and credit-by-by credit basis.

Reporting the Elective Payment Amount

A taxpayer that has taxable income may apply some portion (or all) of the IRA/CHIPS credit(s) earned

as a non-refundable business credit. The amount of IRA/CHIPS credits remaining unused (which for

tax exempt taxpayers may be the entire credit amount) is reported on the "Elective payment election

amount" line on the tax return. For example, the elective payment election lines are found on the following

commonly used forms at the lines shown:

•

Form 1120, Schedule J, Part II, line 22,

•

Form 1120-S, line 24d,

•

Form 1065, line 29,

•

Form 990-T, Part III, line 6g.

Refer to the instructions for Form 3800, and the instructions for the appropriate tax return form for more

information about claiming general business credits (including clean energy credits) when making an

elective payment election.

7

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Transfer Election

In addition to computing and reporting credits earned on the annual tax return, a taxpayer that is

monetizing one or more credits by transferring the credit to an unrelated transferee taxpayer must make

any necessary adjustments to credits reported on Form 3800 to account for credits used and credits

transferred. Refer to the instructions for Form 3800, and the instructions for the appropriate tax return

form for more information. See FAQs 4 and 5 at Elective Pay and Transferability Frequently Asked

Questions: Transferability for information about making and documenting a credit transfer.

Accessing the IRA/CHIPS Pre-Filing Registration Tool

You will be able to find the IRA/CHIPS Pre-Filing Registration tool at www.irs.gov/eptregister.

Sign In or Create an ID.me Account

The IRS uses ID.me, a technology provider, to provide identity verification and sign-in services. If you have

an ID.me account, just sign in. Don’t create a new ID.me account for the registrant. If you’re a new user,

have your photo identification ready. Verify your personal identity – not your business or entity information

– with ID.me.

Note: ID.me has its own help site and assists taxpayers having difficulty creating an ID.me account. See

the Frequently Asked Questions at the links on the ID.me page for more information. Please do not call an

IRS customer account service telephone number for help with ID.me.

Figure 1: Sign-In or Create a New Account

8

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

The Registrant’s IRS Energy Credits Online Account

A person who wishes to access Energy Credits Online on behalf of a taxpayer must authorize an IRS

Energy Credits Online account by selecting "Start Authorization". Sole proprietorship businesses currently

register using the IRS Business Online Account access and functionality.

The first time authorized users navigate from the ID.me login, they will see the landing page shown in

Figure 2, where the Energy Credits Online account for the taxpayer will be authorized.

From the landing page shown in Figure 2, select "Start Authorization."

Figure 2: Clean Energy Online

9

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Registrant Authorization

An authorized user accessing Energy Credits Online for the first time on behalf of registrant must go

through the authorization steps shown in Figure 3 through Figure 6.

Note: On-screen options may vary from the illustrations shown in Figure 3 through Figure 6, depending

upon the registrant’s circumstances.

Employer Identification Number of the Business

Authorizing access for a registrant begins with its unique Employer Identification Number.

Caution: Every taxpayer that will use the IRA/CHIPS Pre-Filing Registration tool MUST have its own employer

identification number unless it is an entity disregarded for income tax purposes. No registrant should ever use

the EIN of another taxpayer, even temporarily! See Publication 1635, Understanding Your EIN.

If the entity is a subsidiary of a business entity, or is a legal entity wholly owned by a business entity,

exempt organization, government entity or instrumentality of the government entity, the entity may need to

apply for an employer identification number if it doesn’t already have one.

If you are unsure whether your entity may already have a taxpayer identification number, you (or another

person authorized to act on behalf of the entity) can contact the IRS customer service telephone line for

the specific type of organization. See Telephone Assistance.

If the taxpayer needs to get an employer identification number, you should not continue the registrant

authorization process. Leave this page and go to Apply for an Employer Identification Number (EIN)

Online. Return to the IRA/CHIPS Pre-Filing Registration tool only after the taxpayer has its EIN.

Enter the EIN of the taxpayer you wish to authorize. See Figure 3

Figure 3: Authorizing a Clean Energy Business Account – Step 1

10

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Personal Information

The next step to authorize an entity is to provide your personal name and address as they appeared on

your latest personal income tax return. See Figure 4.

Figure 4: Authorizing a Clean Energy Business Account – Step 2

Entity Information

Next you must provide identifying information about the taxpayer for which you are creating an Energy

Credits Online Account. See the data fields shown in Figure 5.

Name

Enter the name of the taxpayer as it appears on any return(s) it may have filed with the IRS, including, for

example, its most recent annual tax or information return, employment tax returns, or excise tax returns. If

the taxpayer is new, or it isn’t required to file any annual or periodic returns, enter the name as it appears

on the written acknowledgment provided by the IRS when the taxpayer obtained its EIN.

Address

Enter the address associated with the taxpayer. As with the taxpayer’s name, this will be the address

shown on a recently filed return.

Note: You cannot change the legal name of the taxpayer or its address through this authorization process.

The information you provide should be consistent with information in our records.

11

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Figure 5: Authorizing a Clean Energy Business Account – Step 3

Attestations

Complete the authorization process by making the attestations shown in Figure 6.

Figure 6: Authorizing a Clean Energy Business Account – Step 4

You will have an opportunity to review the information you provided on the preceding screens before you

submit the authorization.

Review the information you provided carefully before clicking "Submit." Information you provided will be

compared to information in IRS records. Errors may cause your attempt to authorize a business to fail.

After three unsuccessful attempts to authorize a business, you will not be able to try again for 24 hours.

12

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Options After Authorization

Once you authorize an Energy Credits Online Account for at least one taxpayer, accessing the IRA/CHIPS

Pre-Filing Registration tool will take you directly to your account(s) landing page. See examples in

Figure 7 (the page you see will reflect the entity you represent). From this landing page, you can authorize

additional taxpayers by clicking on "Add clean energy business account."

Figure 7: Business Online Accounts Landing Page

Note: You must create a separate account for each taxpayer for which you are authorized to act and that

needs to register its intention to monetize any IRA/CHIPS Credits with an elective payment election or a

transfer election.

To navigate to a specific tool within Clean Energy, click on the tile for an authorized entity. Doing so will

take you to the IRS Clean Energy landing page. See Figure 8.

13

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Figure 8: Clean Energy Online

14

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

IRA/CHIPS Credits Dashboard

Select "Get Started" within the area shown on Figure 8 titled, "Clean Energy and Semiconductor

Manufacturers" to access the "IRA/CHIPS Credits" prefiling registration dashboard shown in Figure 9,

below.

Figure 9: IRA/CHIPS Credit Dashboard

The panels shown in Figure 9 will be discussed in the following order:

•

Email Notifications

•

2023 IRA/Chips Credit Registration

•

Your Registrations

15

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Email Notifications

The IRS will share information about the status of the registrant’s pre-file registration packages exclusively

through the IRA/CHIPS Pre-Filing Registration tool. The IRS can notify you by email that the status of a

registration package has changed only if you affirmatively opt in to receive email communications.

You are not required to opt in to receiving email notifications. However, if you choose not to opt in to

receive email notifications, you will be responsible to return to the IRA/CHIPS Pre-Filing Registration tool

from time to time to monitor the status of the registration packages.

Figure 10: Email Notifications

When you opt in to receive email notifications, you will receive an email informing you any time the status

of your registration submission changes. See "Submission Status"

The email message will be from [email protected]. If you opt in to email notifications, you

may want to adjust settings in your email account to avoid notifications being captured in a spam folder.

Messages will be sent to the email connected to your ID.me account. You cannot add recipients ("cc"

recipients) or change your email address through the IRA/CHIPS Pre-Filing Registration tool. To change

the email where notices are received, you will need to change the email account associated with your

ID.me account.

The email message you receive will not provide specific information about the change in status. That infor-

mation will be accessed from the IRA/CHIPS Pre-Filing Registration tool. The email message will merely

inform you of one of the types of changes in status described in "Submission Status."

Refer to information in the section of this User Guide and Instructions titled, "Your Registrations," for infor-

mation about the different review statuses and what they signify for your pre-filing registration.

16

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

2023 IRA/Chips Credit Registration

Before You Begin

Site Navigation

At the bottom of each page where you can input information or make a selection, navigation buttons

shown in Figure 11 allow you to move forward (if all required fields have entries in the correct format), go

back (to view or edit), or save your progress so that you can leave the IRA/CHIPS Pre-Filing Registration

tool and return to complete the registration fields in as many sessions as you need.

Figure 11: Navigation Buttons

One Registration Package Per Annual Accounting Period

Each registrant can have only one registration package for an annual accounting period (taxable year).

The registration package can relate to as many different elective payment or transfer elections as the

registrant is eligible to make for the annual accounting period.

Once a registration package has been submitted for review, you will not be able to make any changes

until review is completed and the registration submission is returned. Detailed information about the return

of a registration submission after manual review is in the section of this User Guide and Instructions titled

"Submit for Review."

Never Use the EIN of Another Taxpayer, Even if it is a Closely Related Entity

Each taxpayer that will file a return to make an elective payment election or a transfer election must have

its own EIN. The IRS can process only one tax return (including superseding or amended returns) for each

EIN. Two separate taxpayers can never file their respective returns using the same EIN.

•

The IRS may decline to issue a registration number if information included in the registration package

indicates the registrant may be using another taxpayer’s EIN.

•

For parent corporations and subsidiaries that are members of a consolidated group of corporations (as

defined in regulations section 1.1502-1), see "Parent of a consolidated group of corporations."

•

For owners of an entity that is disregarded for federal income tax purposes (such as a single member

limited liability company), see information about disregarded entities in the section titled, "EIN and Name."

How Many Registration Numbers

The number of registration numbers a taxpayer needs to request through the pre-filing registration process

for facility-by-facility reporting will depend on how the credits must be computed and reported on the

source credit form (see Table 2) and Form 3800.

Before you begin to complete the registration package for a taxpayer, refer to the instructions for each

applicable source credit form and the instructions for Form 3800. The credit forms corresponding to each

credit for which an election may be registered through the IRA/CHIPS Pre-Filing Registration tool are

shown in Table 2 – Source Credit Forms.

17

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Table 2: Source Credit Forms

Source Credit Forms

(30C) Alternative Fuel

Refueling Property Credit

Form 8911

(45) Renewable Electricity

Production Credit

Form 8835

(45Q) Carbon Oxide

Sequestration Credit

Form 8933

(45U Zero Emission Nuclear

Power Production Credit

Form 7213

(45V) Clean Hydrogen

Production Credit

Form 7210

(45W) Qualified Commercial

Clean Vehicles Credit

Form 8936

Form 8936 (Sch A)

(45Z) Clean Fuel Production

Credit

Form 8835 (future revision)

(45X) Advanced

Manufacturing Production

Credit

Form 7207

(45Y) Clean Electricity

Production Credit

Form 7211 (pending)

(48) Energy Credit

Form 3468

(48C) Qualifying Advanced Energy Project Credit

(48E) Clean Electricity Investment Credit (future form revision)

(48D (CHIPS)) Advanced Manufacturing Investment Credit

Error Review

The IRA/CHIPS Credits Pre-Filing Registration tool can identify certain errors immediately. When they occur,

a message will pop up describing the error(s) that must be corrected in order to proceed with registration.

Other general information errors may cause a submission to be returned without being transmitted for

review. This can happen if information you provided is inconsistent with information in our records. Please

review the information you entered and make any necessary corrections. If the information you provided

appears correct, resubmit the information.

Allow Time for Review

In general, you should submit your pre-filing registration no earlier than the beginning of the taxable period

in which you will earn the credit, but early enough to allow time for your registrations to be processed.

Currently, IRS recommends at least 120 days before the due date for the return on which the credits will

be reported.

Processing Steps

Clicking "Submit" after you have provided entries in all required data fields will cause the request for regis-

tration numbers to move to the review process.

Account Lock-Out While Review is "Awaiting Assignment" or "Under Review"

As soon as you click "Submit" on the registration package, your registrations will be closed for any additions,

updates or amendments until review is complete. However, you will be able to amend your previous submis-

sion when review is complete and your registration submission is returned. See "Amendments."

The IRA/CHIPS Pre-Filing Registration tool includes certain mandatory information fields to help you

prepare a complete registration package. However, the IRA/CHIPS Pre-Filing Registration tool cannot

discern whether you intend to register one or more than one facility/property for a particular credit.

Similarly, the IRA/CHIPS Pre-Filing Registration tool cannot recognize that you intended to register the

taxpayer for more credits than the credits already selected.

18

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Resources Before You Register

The elective payment and transfer elections under the IRA and the elective payment election under the

CHIPS Act apply to specific general business credits. This User Guide and Instructions assumes famil-

iarity with general business credits such as:

•

The difference between an investment tax credit and a production tax credit. The IRA/CHIPS credits

include provisions relating to both types of credits. To register successfully, you need to know which

credits the taxpayer can and wishes to monetize, especially when the taxpayer may have the option to

monetize an investment tax credit or a production tax credit based upon a single investment/activity.

•

How to earn each type of credit.

•

How to compute and report each type of credit on the registrant’s tax return.

See Appendix A – General Business Credit Resources for a list of resources for credit-specific information.

Also assumed is a basic understanding of the credits to which elective payment and transfer elections

apply under the IRA and CHIPS Act and:

•

Which return to use to make an elective payment or transfer election

•

How to compute and report the credits on the tax return (credit-specific forms, Form 3800)

•

How to effect the transfer of an IRA clean energy credit.

See Appendix B – IRA/CHIPS Elective Payment and Transfer Resources for resources on the specific

subject of monetization of certain credits through elective payment or transfer elections under IRA and

CHIPS legislation.

Summary

Submit the registration package as soon as reasonably practicable. If you anticipate the need to update or

amend a registration package, allow time for review and return of the submission before making updates

or amendments.

For example, a taxpayer may reasonably anticipate that it will earn production tax credits at certain facil-

ities already placed in service and has made certain other tax credit investments. If the taxpayer also

contemplates additional investments or may place an additional production facility in service later in the

year, that taxpayer could submit an early registration package (e.g., only a few months into the annual

tax period) for the projects/facilities already placed in service. After that registration package is fully

processed, that taxpayer could update its registrations with additional facilities or properties placed in

service nearer the end of its tax year.

IRA/CHIPS Credits Information

Overview

The pre-filing registration information collected by the IRA/CHIPS Pre-Filing Registration tool falls into two

broad categories:

•

General (entity) information

•

Credit-specific information

19

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

General Information

All registrants must complete the general information section. General information includes:

•

Tax period of the election

•

EIN

•

Information about subsidiaries included in a consolidated group of corporations

•

Name

•

Address

•

Type of entity

•

Bank account information

•

Types of returns filed

Credit-Specific Information

Information required from each registrant will vary depending upon the number and type of credits the

registrant wishes to monetize with an elective payment or transfer election. The information you provide

will determine the credits and types of election available.

The IRA/CHIPS Pre-Filing Registration tool is dynamic. Depending upon information you provide, options

available to the registrant will be present. You generally will not see options not available to the registrant.

Common Questions

Certain questions are common to several credits, such as the physical location of a facility/property. This

User Guide and Instructions groups common questions together with an information bar showing the

credits to which the information relates. See "Questions Common to Multiple Credits."

Credit Specific Questions

Instructions for questions unique to a specific credit are grouped under the heading for that credit.

On the 2023 IRA/CHIPS Registration dashboard, select "Register" in the dashboard panel shown below.

Figure 12: Start Pre-Filing Registration

When you select "Register," the IRA/CHIPS Pre-Filing Registration tool will take you to the first of four

Registration Information pages.

20

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

General Information: Page 1 of 4

Date When the Registrant’s Accounting Period Ends

Figure 13: Tax Period of Your Election

Use the drop-down menu to select the ending month for the annual tax period in which each credit being

registered is earned. This should match the fiscal year ending date shown on the registrant’s last filed

return. If new to filing an annual tax return, this date should be the same as the fiscal year end month

used on the first annual tax return. For example, if a registrant keeps its books and records on a non-cal-

endar year that ends on June 30 and will use that date as the fiscal year end on its first annual tax return,

select "June" from the drop-down menu. Use the drop-down menu to identify the year in which the

annual accounting period ends for the taxable period for which the registrant wishes to make an elective

payment or transfer election.

If the registrant changes its fiscal year end (such as by filing a short-year return), you must amend the

registration before the registrant files its return. See "Amendments."

More information on Accounting Periods can be found in Publication 538, Accounting Periods and

Methods.

EIN and Name

Figure 14: EIN and Name

21

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Enter the EIN and the name of the taxpayer that is registering facilities for which it will make an elective

payment or transfer election on its annual tax return.

When the registrant is the parent of a consolidated group of corporations, the parent’s EIN and name will be

entered in these fields. Additional information about subsidiaries is captured as credit-specific information.

When the business that earns the credit is a single member limited liability company (LLC) or other entity

that is disregarded for federal income tax purposes, the information entered in these fields will depend upon

the ownership of the entity for federal income tax purposes. See Table 3 – Disregarded Entities

Table 3: Disregarded Entities

Ownership Return where credit will be reported EIN and name to use

A natural person (or married couple) Owner’s Form 1040, Schedule C Disregarded entity’s EIN and name

A grantor trust Grantor’s Form 1040, Schedule C Disregarded entity’s EIN and name

A business, exempt organization or

governmental entity

Form 1120 series, Form 1065, Form

990-T, Form 1041

EIN and name of the entity filing the tax

return

See Publication 1635, Understanding Your EIN for more information about when an entity needs its own

EIN. See Publication 3402, Taxation of Limited Liability Companies for information on the classification

of a limited liability company for federal income tax purposes.

Parent of a Consolidated Group of Corporations

Figure 15: Parent of a Consolidated Group

Answer, "Yes," to the question if the entity is:

•

A corporation (including an Alaska Native Corporation) that files Form 1120 on a consolidated basis for

itself and one or more subsidiary corporations.

•

A nonprofit corporation exempt under section 501(c)(3) that files Form 990-T on a consolidated basis

with one or more title-holding companies exempt under section 501(c)(2) and one or more credits for

which it wishes to make an elective payment election will be earned by a title-holding company.

The parent of a consolidated group of corporations will register on behalf of itself and will act as agent for

subsidiaries included in the group. See regulations section 1.1502-77. When entering credit-specific infor-

mation, the parent corporation will provide the subsidiary name and EIN for each facility or property being

registered that is owned by the subsidiary.

Note: See information for an Alaska Native Corporation that is the parent of a consolidated group of

corporations that includes subsidiaries that are not Alaska Native Corporations in the description of regis-

trant types below Figure 16.

22

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Registrant Type

The Registrant Type you select determines whether the taxpayer can register to make an elective payment

or transfer election (or whether either option may be available for certain credits). See the brief descrip-

tions of the registrant types below.

Figure 16: Registrant Type

•

Organization exempt from the tax imposed by subtitle A by reason of section 501(a) of the Code.

An organization exempt from the tax imposed by subtitle A by reason of section 501(a), including an

organization described in a subparagraph of section 501(c), in section 501(d), and in section 401(a).

Note: For purposes of pre-filing registration, an organization exempt under section 501(a) should select

this registrant type regardless of entity form (corporation, trust, limited liability company or other unincor-

porated association) under state or local law.

•

Government of any U.S. territory or a political subdivision thereof (including an agency or

instrumentality). An entity exempt from the tax imposed by subtitle A because of the income exclusion

under section 115(2).

•

State, the District of Columbia, or political subdivision thereof (including any agency or

instrumentality: This is generally what cities, counties, townships, etc.

•

Indian tribal government or a subdivision thereof (including an agency or instrumentality). The

governing body of an American Indian or Alaska Native entity, including tribe, band, nation, pueblo,

village, community, component band, or component reservation on the list of Federally Recognized

Indian Tribes.

•

Alaska Native Corporation (excluding an Alaska Native Settlement Trust). A state-law corporation

formed under section 3 of the Alaska Native Claims Settlement Act, 43 U.S.C. 1602(m).

23

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Note: When registrant type is "Alaska Native Corporation," an additional question field will appear if

the registrant has indicated above that it is the parent of a consolidated group of corporations. The

additional field will ask whether the consolidated group includes any subsidiaries which are not Alaska

Native Corporations. A "yes" response here will allow the corporate parent to register for transfer

elections for its non-Alaska Native Corporation subsidiaries.

•

Tennessee Valley Authority. The public corporation creased pursuant to the Tennessee Valley Authority

Act, P.L. 108-447 (16 U.S.C. 831 – 831ee).

•

Rural electric cooperative. Any corporation operating on a cooperative basis which is engaged in

furnishing electric energy to persons in rural areas.

Note: For purposes of pre-filing registration, a rural electric cooperative described in section 501(c)(12)

should select the above-described registrant type for organizations exempt under section 501(a).

•

Partnership. A limited partnership, syndicate, group, pool, joint venture, or other unincorporated

organization, through or by which any business, financial operation, or venture is carried on, that isn't,

within the meaning of regulations under section 7701, a corporation, trust, estate, or sole proprietorship,

and files a Form 1065.

•

S Corporation. A corporation within the meaning of Section 1361(a) that elects to pass corporate

income, losses, deductions, and credits through to its shareholders for federal tax purposes, and files a

Form 1120-S.

•

C Corporation. A legal entity separate from its owners, made up of individuals, groups, or other

corporations, that has the power to conduct business and to own property, assets, and liabilities, and

which is subject to federal income tax under the provisions of subchapter C of the Internal Revenue Code.

•

Real Estate Investment Trust. A legal entity separate from its owners, made up of individuals, groups, or

other corporations, that has the power to conduct business and to own property, assets, and liabilities.

•

Sole Proprietorship. Business owned by an individual directly or through an entity, such as a grantor

trust or single member limited liability company, that is not taxed as a separate entity but is in substance

disregarded for federal income tax purposes.

Note: This registrant type applies only if the qualifying property or facility is owned by an individual

directly (and not indirectly through ownership of an interest in a separate business entity such as a

corporation, partnership, or a limited liability company, treated as a partnership or corporation for federal

income tax purposes).

•

Trust. Any arrangement for which the purpose is to vest trustees responsibility for the protection and

conservation of property for beneficiaries, and that is not properly classified as a grantor trust, sole

proprietorship, partnership, corporation, or does not receive special treatment under the Code (such as, a

REMIC).

Note: This registrant type excludes: (i) any trust exempt from federal income tax under section 501(a),

which should select the above-described registrant type for organization exempt under section 501(a); and

(ii) any revocable trust, which should select the above-described registrant type for sole proprietorship.

•

Other. Any other qualifying registrant type.

Note: When "Other" is chosen, a text field will open where the registrant should briefly identify the type

of organization it is.

24

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

General Information Page 2 of 4

Registrant Address

Choose the registrant's type of address – Domestic or foreign.

Depending upon the choice you make, a different address format will open. See Figure 17.

You should use the address that was used on the registrant’s last annual return or last employment

tax return. If the registrant is not required to file an annual return, use the address provided when the

registrant received its EIN, or that the registrant provided to the IRS on Form 8822-B, Change of Address

or Responsible Party – Business.

Note: You cannot make a change of address through the IRA/CHIPS Pre-Filing Registration tool. If you

need to change the registrant’s address in IRS records, see Address Changes

25

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Figure 17: Registrant Address

26

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

General Information Page 3 of 4

Banking Information

For program integrity purposes, you must provide information for a bank account associated with the

registrant’s name and EIN.

Figure 18: Banking Information

27

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

General Information Page 4 of 4

Returns Filed

Information about any types of returns the registrant has filed with the IRS in the previous two years is

used to help verify the registrant’s identity. See Appendix D – Types of Returns for a complete list of forms

in each return type.

Check all that apply. If "Other" is checked, a text field will open where you should provide relevant form

number(s).

If "None" is selected, use the text field to explain how the organization has no previous filing requirements

(including employment tax returns).

Figure 19: Types of Returns Filed

28

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Credit Selection

After you complete the General Information fields, you can progress to the Credit Selection module.

Figure 20: Credit Selection

Dynamic Content

The credits that appear when you reach this point in the pre-filing registration process will be limited to the

credits for which the registrant can make an election.

The full roster of potentially available credits is shown in Figure 21 (IRA) and Figure 22 (CHIPS).

To move forward from the Credit Selection page, you must select at least one credit.

29

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

IRA Credits

The panels below show the complete list of IRA credits. The roster of credits that will appear for each

taxpayer will depend on responses provided in the General Information section.

Figure 21: IRA Credits

Note: The section 45Y, Clean Energy Production Credit, section 45Z, Clean Fuel Production Credit and

section 48E, Clean Energy Investment Credit will not be included for pre-filing registration until after

December 31, 2024.

30

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

CHIPS Credit

The CHIPS credit is not a clean energy credit. However, section 48D(d) includes an elective payment

election. A taxpayer that wishes to monetize the CHIPS credit with an elective payment must register the

intention to do so.

The CHIPS credit is subject to a unique qualification that does not apply to the IRA Credits. If you choose

the section 48D Advanced Manufacturing Investment Credit, additional fields will open where you must

attest that the registrant is an eligible taxpayer before you can continue. See Figure 23 – CHIPS Credit

Attestation.

Figure 22: CHIPS Credit

Figure 23: CHIPS Credit Attestation

31

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Credit Summary

Before moving to the Facility/Property Information module, you will have an opportunity to view a

summary of the credit selections. See, Figure 24 – Credit Selection Review, which shows an example

in which the registrant selected three credits (section 48D, CHIPS Credit; section 30C, Alternative Fuel

Refueling Property Credit; and section 45, Renewable Electricity Production Credit).

Figure 24: Credit Selection Review (example)

Facility/Property Information

General Principles

The information collected for each credit is based on the requirements to qualify for the credit.

Registration Not a Determination of the Amount or Validity of a Credit

The purpose of pre-filing registration is to "[prevent] duplication, fraud, improper payments, or excessive

payments" as described in sections 48D(d)(2)(E), 6417(d)(5) and 6418(g)(1).

Issuance of a registration number does not mean that the registrant has been determined to qualify for a

credit of any specific amount. In addition to registering the intent to monetize one of the credits listed in

Figure 21 or Figure 22, each taxpayer must meet other requirements to make a valid election, including

reporting the credit on the applicable source credit form (see Table 2 – Source Credit Forms), completing

Form 3800 and attaching those forms to a timely filed tax return.

32

IRA/CHIPS Pre-Filing Registration Tool User Guide and Instructions

Data Entry

The registrant will need a separate pre-filing registration number for each facility/property. The number

of registration numbers will depend upon the number of source credit forms necessary to compute and

report the credit. See "How Many Registration Numbers?" Facility/property information can be added for

certain credits by way of a spreadsheet file (bulk upload) or manually (one facility/property at a time). Bulk

upload offers some convenience. However, for the current version of the IRA/CHIPS Pre-Filing Registra-

tion tool, bulk upload has limitations that must be considered. They are described in the "Bulk Upload"

section.

Manual Entry

Entries for each credit can be made manually by entering facility/property information required for a

complete submission field by field.

The IRS anticipates that manual entry will be adequate for the following credits:

•

Section 45Q, Carbon Oxide Sequestration Credit

•

Section 45U, Zero Emission Nuclear Power Production Credit

•

Section 45V, Clean Hydrogen Production Credit

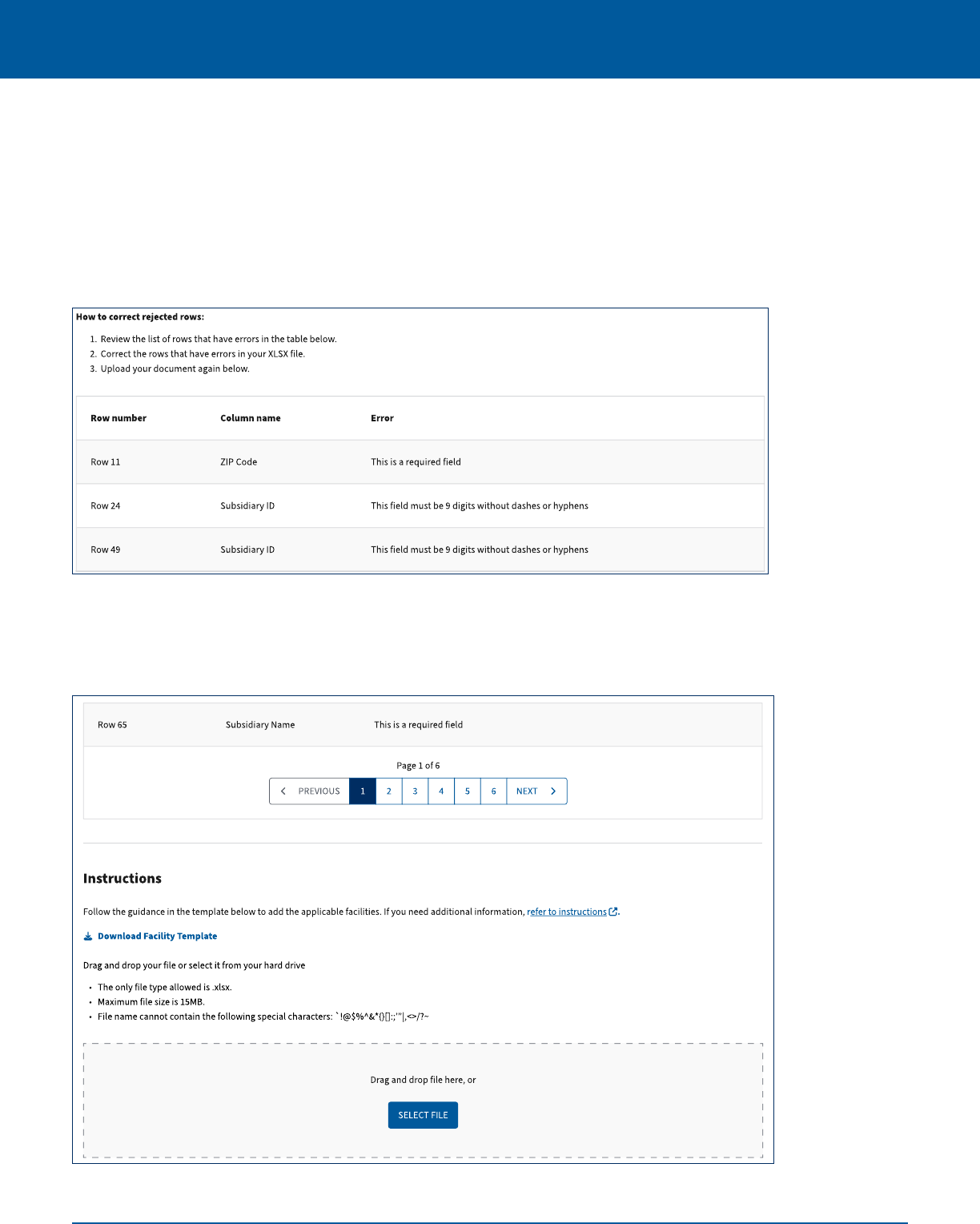

•