2011 WIND

TECHNOLOGIES

MARKET REPORT

AUGUST 2012

NOTICE

This report was prepared as an account of work sponsored by an agency of the United States government.

Neither the United States government nor any agency thereof, nor any of their employees, makes any warranty,

express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of

any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately

owned rights. Reference herein to any specific commercial product, process, or service by trade name,

trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation,

or favoring by the United States government or any agency thereof. The views and opinions of authors

expressed herein do not necessarily state or reflect those of the United States government or any agency thereof.

Available electronically at

http://www.osti.gov/bridge

Available for a processing fee to U.S. Department of Energy

and its contractors, in paper, from:

U.S. Department of Energy

Office of Scientific and Technical Information

P.O. Box 62

Oak Ridge, TN 37831-0062

phone: 865.576.8401

fax: 865.576.5728

email:

mailto:reports@adonis.osti.gov

Available for sale to the public, in paper, from:

U.S. Department of Commerce

National Technical Information Service

5285 Port Royal Road

Springfield, VA 22161

phone: 800.553.6847

fax: 703.605.6900

email:

[email protected]world.gov

online ordering: http://www.ntis.gov/help/ordermethods.aspx

This publication received minimal editorial review at NREL

Printed on paper containing at least 50% wastepaper, including 10% post consumer waste.

2011 Wind Technologies Market Report

i

2011 Wind Technologies Market Report

Primary authors

Ryan Wiser, Lawrence Berkeley National Laboratory

Mark Bolinger, Lawrence Berkeley National Laboratory

With contributions from

Galen Barbose, Naïm Darghouth, Ben Hoen, Andrew Mills (Berkeley Lab)

Kevin Porter, Michael Buckley, Sari Fink (Exeter Associates)

Frank Oteri, Suzanne Tegen (National Renewable Energy Laboratory)

Table of Contents

Acknowledgments ......................................................................................................................... i

List of Acronyms ........................................................................................................................... ii

Executive Summary .................................................................................................................... iii

1. Introduction ............................................................................................................................... 1

2. Installation Trends ................................................................................................................... 3

3. Industry Trends ...................................................................................................................... 14

4. Cost Trends ............................................................................................................................ 32

5. Performance Trends .............................................................................................................. 41

6. Wind Power Price Trends ..................................................................................................... 48

7. Policy and Market Drivers .................................................................................................... 57

8. Future Outlook ........................................................................................................................ 69

Appendix: Sources of Data Presented in this Report .......................................................... 72

References .................................................................................................................................. 76

Acknowledgments

For their support of this ongoing report series, the authors thank the entire U.S. Department of Energy (DOE) Wind

& Water Power Program team, and in particular Patrick Gilman and Mark Higgins. For reviewing elements of this

report or providing key input, we also acknowledge: J. Charles Smith (Utility Variable-Generation Integration

Group); Erik Ela, Eric Lantz, and KC Hallett (National Renewable Energy Laboratory, NREL); Michael Goggin,

Liz Salerno, and Emily Williams (American Wind Energy Association); Thomas Carr (Western Governors’

Association); Ed DeMeo (Renewable Energy Consulting Services, Inc.); Patrick Gilman, Cash Fitzpatrick, and Liz

Hartman (DOE); Alice Orrell (Pacific Northwest National Laboratory, PNNL); Jim Walker (enXco); Matt McCabe

(Clear Wind); Andrew David (US International Trade Commission); Charlie Bloch and Bruce Hamilton (Navigant

Consulting); Steve Clemmer (Union of Concerned Scientists); Chris Namovicz (Energy Information

Administration); and David Drescher (Exelon Generation). Thanks to the American Wind Energy Association for

the use of their database of wind power projects. We also thank Amy Grace (Bloomberg New Energy Finance) for

the use of Bloomberg NEF’s graphic on domestic wind turbine nacelle assembly capacity; Charlie Bloch and Bruce

Hamilton (Navigant Consulting) for assistance with the section on offshore wind; Donna Heimiller and Billy

Roberts (NREL) for assistance with the wind project and wind manufacturing maps; and Kathleen O’Dell (NREL)

for assistance with layout, formatting, and production. Berkeley Lab’s contributions to this report were funded by

the Wind & Water Power Program, Office of Energy Efficiency and Renewable Energy of the U.S. Department of

Energy under Contract No. DE-AC02-05CH11231. The authors are solely responsible for any omissions or errors

contained herein.

2011 Wind Technologies Market Report

ii

List of Acronyms

AWEA American Wind Energy Association

BPA Bonneville Power Administration

CAISO California Independent System Operator

CCGT combined cycle gas turbine

COD commercial operation date

CREZ competitive renewable energy zone

DOE U.S. Department of Energy

EIA Energy Information Administration

ERCOT Electric Reliability Council of Texas

FERC Federal Energy Regulatory Commission

GE General Electric Corporation

GW gigawatt

IOU investor-owned utility

IPP independent power producer

ISO independent system operator

ISO-NE New England Independent System Operator

ITC investment tax credit

kW kilowatt

kWh kilowatt-hour

MISO Midwest Independent System Operator

MW megawatt

MWh megawatt-hour

NERC North American Electric Reliability Corporation

NREL National Renewable Energy Laboratory

NYISO New York Independent System Operator

OEM original equipment manufacturer

O&M operations and maintenance

PJM PJM Interconnection

POU publicly owned utility

PPA power purchase agreement

PTC Production Tax Credit

PUC public utility commission

REC renewable energy certificate

RFI request for information

RPS renewables portfolio standard

RTO regional transmission organization

SPP Southwest Power Pool

WAPA Western Area Power Administration

2011 Wind Technologies Market Report

iii

Executive Summary

The U.S. wind power industry is facing uncertain times. With 2011 capacity additions having

risen from 2010 levels and with a further sizable increase expected in 2012, there are – on the

surface – grounds for optimism. Key factors driving growth in 2011 included continued state

and federal incentives for wind energy, recent improvements in the cost and performance of

wind power technology, and the need to meet an end-of-year construction start deadline in order

to qualify for the Section 1603 Treasury grant program. At the same time, the currently-slated

expiration of key federal tax incentives for wind energy at the end of 2012 – in concert with

continued low natural gas prices and modest electricity demand growth – threatens to

dramatically slow new builds in 2013.

Key findings from this year’s “Wind Technologies Market Report” include:

• Wind Power Additions Increased in 2011, with Roughly 6.8 GW of New Capacity

Added in the United States and $14 Billion Invested. Wind power installations in 2011

were 31% higher than in 2010, but still well below the levels seen in 2008 and 2009.

Cumulative wind power capacity grew by 16% in 2011, bringing the total to nearly 47 GW.

• Wind Power Comprised 32% of U.S. Electric Generating Capacity Additions in 2011.

This is up from 25% in 2010, but below its historic peak of 42-43% in 2008 and 2009. In

2011, for the sixth time in the past seven years, wind power was the second-largest new

resource (behind natural gas) added to the U.S. electrical grid in terms of gross capacity.

• The United States Remained the Second Largest Market in Annual and Cumulative

Wind Power Capacity Additions, but Was Well Behind the Market Leaders in Wind

Energy Penetration. After leading the world in annual wind power capacity additions from

2005 through 2008, the U.S. has now – for three years – been second to China, comprising

roughly 16% of global installed capacity in 2011, up slightly from 13% in 2010, but down

substantially from 26-30% from 2007 through 2009. In terms of cumulative capacity, the

U.S. also remained the second leading market, with nearly 20% of total global wind power

capacity. A number of countries are beginning to achieve relatively high levels of wind

energy penetration in their electricity grids: end-of-2011 wind power capacity is estimated to

supply the equivalent of roughly 29% of Denmark’s electricity demand, 19% of Portugal’s,

19% of Spain’s, 18% of Ireland’s, and 11% of Germany’s. In the United States, the

cumulative wind power capacity installed at the end of 2011 is estimated, in an average year,

to equate to roughly 3.3% of the nation’s electricity demand.

• California Added More New Wind Power Capacity than Any Other State, While Six

States Are Estimated to Exceed 10% Wind Energy Penetration. With 921 MW added,

California led the 29 other states in which new large-scale wind turbines were installed in

2011, ending Texas’ six-year reign (Texas fell to ninth place in 2011). Other states with

more than 500 MW added in 2011 included Illinois, Iowa, Minnesota, Oklahoma, and

Colorado. On a cumulative basis, Texas remained the clear leader. Notably, the wind power

capacity installed in South Dakota and Iowa as of the end of 2011 is estimated, in an average

year, to supply approximately 22% and 20%, respectively, of all in-state electricity

generation. Four other states are also estimated to exceed 10% penetration by this metric:

Minnesota, North Dakota, Colorado, and Oregon.

2011 Wind Technologies Market Report

iv

• No Offshore Turbines Have Been Commissioned in the United States, but Offshore

Project and Policy Developments Continued in 2011. At the end of 2011, global offshore

wind power capacity stood at roughly 4,000 MW, with the vast majority located in Europe.

To date, no offshore projects have been installed in the United States. Nonetheless,

significant strides have been made recently in the federal arena, through both the Department

of the Interior's responsibilities with regard to regulatory approvals and the Department of

Energy's investments in offshore wind R&D. Interest exists in developing offshore wind

energy in several parts of the country – e.g., Navigant finds that ten projects totaling 3,800

MW are somewhat more advanced in the development process. Of these, two have signed

power purchase agreements (a third offshore wind PPA was recently canceled).

• Data from Interconnection Queues Demonstrate that an Enormous Amount of Wind

Power Capacity Is Under Consideration. At the end of 2011, there were 219 GW of wind

power capacity within the transmission interconnection queues administered by independent

system operators, regional transmission organizations, and utilities reviewed for this report.

This wind power capacity represented 45% of all generating capacity within these queues at

that time, and was 1.5 times as much capacity as the next-largest resource (natural gas). Of

note, however, is that the absolute amount of wind and coal power capacity in the sampled

interconnection queues has declined in recent years, whereas natural gas and solar capacity

has increased. Most (96%) of the wind power capacity is planned for the Midwest, PJM

Interconnection, Texas, Mountain, Northwest, Southwest Power Pool, and California regions.

Projects currently in interconnection queues are often very early in the development process,

so much of this capacity is unlikely to be built as planned; nonetheless, these data

demonstrate the continued high level of developer interest in wind power.

• Despite the Ongoing Proliferation of New Entrants, the “Big Three” Turbine Suppliers

Have Gained U.S. Market Share Since 2009. GE and Vestas both secured roughly 29% of

U.S. market share (by capacity installed) in 2011, followed by Siemens (18%), Suzlon and

Mitsubishi (both at 5%), Nordex and Clipper (both at 4%), REpower (3%), and Gamesa

(2%). There has been a notable increase in the number of wind turbine manufacturers serving

the U.S. market – those installing more than 1 MW has increased from just 5 in 2005 to 20

manufacturers in 2011. Recently, however, there is evidence of gains in the aggregate

market share of the three leading manufacturers: GE, Vestas, and Siemens. On a worldwide

basis, Chinese turbine manufacturers continue to occupy positions of prominence: four of

the top ten, and seven of the top 15, leading global suppliers of wind turbines in 2011 hail

from China. To date, that growth has been based almost entirely on sales to the Chinese

market. However, 2011 installations by Chinese and South Korean manufacturers in the U.S.

include those from Sany Electric (10 MW), Samsung (5 MW), Goldwind (4.5 MW), Hyundai

(3.3 MW), Sinovel (1.5 MW), and Unison (1.5 MW).

• Domestic Wind Turbine and Component Manufacturing Capacity Has Increased, but

Uncertainty in Future Demand Has Put the Wind Turbine Supply Chain Under Severe

Pressure. Eight of the ten wind turbine manufacturers with the largest share of the U.S.

market in 2011 had one or more manufacturing facilities in the United States at the end of

2011. In contrast, in 2004 there was only one active utility-scale wind turbine manufacturer

assembling nacelles in the United States (GE). In addition, a number of new wind turbine

and component manufacturing facilities were either announced or opened in 2011, by both

foreign and domestic firms. The American Wind Energy Association (AWEA) estimates

that the entire wind energy sector directly and indirectly employed 75,000 full-time workers

2011 Wind Technologies Market Report

v

in the United States at the end of 2011 – equal to the jobs reported in 2010 but fewer than in

2008 and 2009. Though domestic manufacturing capabilities have grown, uncertain

prospects after 2012 – due primarily to the scheduled expiration of federal incentives – are

pressuring the wind industry’s domestic supply chain as margins drop and concerns about

manufacturing overcapacity deepen, potentially setting the stage for significant layoffs. The

growth in U.S. wind turbine manufacturing capability and the drop in wind power plant

installations since 2009 led to an estimated over-capacity of U.S. turbine nacelle assembly

capability of more than 5 GW in 2011, in comparison to 4 GW of under-capacity in 2009.

Over-capacity relative to U.S. turbine demand is anticipated to be even more severe in 2013

and 2014. As a result of this over-supply, coupled with increasing competition, including

from new entrants from China and Korea, a wide range of turbine manufacturers have

reported weakened financial results, with companies throughout the U.S. wind industry’s

supply chain announcing cuts to their U.S. workforce.

• A Growing Percentage of the Equipment Used in U.S. Wind Power Projects Has Been

Sourced Domestically in Recent Years. U.S. trade data show that the United States

remained a large importer of wind power equipment in 2011, but that growth in installed

wind power capacity has outpaced the growth in imports in recent years. As a result, a

growing percentage of the equipment used in wind power projects is being sourced

domestically. When presented as a fraction of total equipment-related wind turbine costs,

domestic content is estimated to have increased significantly from 35% in 2005-2006 to 67%

in 2011. Exports of wind-powered generating sets from the United States have also

increased, rising from $15 million in 2007 to $149 million in 2011.

• The Average Nameplate Capacity, Hub Height, and Rotor Diameter of Installed Wind

Turbines Increased. The average nameplate capacity of wind turbines installed in the

United States in 2011 increased to 1.97 MW, up from 1.80 MW in 2010 and the largest

single-year increase in more than six years. Since 1998-99, average turbine nameplate

capacity has increased by 174%. Average hub heights and rotor diameters have also scaled

with time, to 81 and 89 meters, respectively, in 2011. Since 1998-99, the average turbine

hub height has increased by 45%, while the average rotor diameter has increased by 86%. In

large part, these increases have been driven by new turbines designed to serve lower-wind-

speed sites. Industry expectations as well as new turbine announcements (mostly

surrounding additional low-wind-speed turbines) suggest that significant further scaling,

especially in average rotor diameter, is anticipated in the near term.

• Project Finance Was a Mixed Bag in 2011, as Debt Terms Deteriorated While Tax

Equity Held Steady. After steady improvement in both the debt and tax equity markets

throughout 2010, progress faltered somewhat in 2011 on the debt side as the latest

Greek/European debt crisis drove a new round of retrenchment. At the same time, new

banking regulations took hold, driving considerably shorter bank loan tenors (institutional

lenders, meanwhile, continued to offer significantly longer products). In contrast to the

weakened debt market, the market for tax equity improved somewhat in 2011, with pricing

remaining fairly stable and a handful of new or returning investors entering the market. As

the number of grandfathered Section 1603 grant deals begins to taper off in 2012, however,

attrition in tax equity investors is possible, as some have indicated no interest in PTC deals.

• IPPs Remain the Dominant Owners of Wind Projects, But Utility Ownership Increased

Significantly in 2011, Largely On the Back of One Utility. Independent power producers

(IPPs) own 73% of all new wind power capacity installed in the United States in 2011, and

2011 Wind Technologies Market Report

vi

82% of the cumulative installed capacity. Utility ownership jumped to nearly 25% in 2011

(as MidAmerican Energy alone added nearly 600 MW in Iowa), up from 15% in the two

previous years, and reached 17% on a cumulative basis.

• Long-Term Contracted Sales to Utilities Remained the Most Common Off-Take

Arrangement, but Scarcity of Power Purchase Agreements and Looming PTC

Expiration Drove Continued Merchant Development. Electric utilities continued to be

the dominant purchasers (i.e., off-takers) of wind power in 2011, either owning (25%) or

buying (51%) power from 76% of the new capacity installed last year. Merchant/quasi-

merchant projects were less prevalent in 2011 than they have been in recent years,

accounting for 21% of all new capacity. With power purchase agreements (PPAs) in

relatively short supply in comparison to wind developer interest, wholesale power prices at

low levels, and a scheduled PTC expiration looming, it is likely that many of the

merchant/quasi-merchant projects built in 2011 are merchant by necessity rather than by

choice – i.e., building projects on a merchant basis may, in some cases, simply have been the

most expedient way to ensure the deployment of committed turbines in advance of the

scheduled expiration of important federal incentives. Some of these projects are, therefore,

likely still seeking long-term PPAs. On a cumulative basis, utilities own (17%) or buy (50%)

power from 66% of all wind power capacity in the United States, with merchant/quasi-

merchant projects accounting for 24% and power marketers 10%.

• With Increased Competition among Manufacturers, Wind Turbine Prices Continued to

Decline in 2011. After hitting a low of roughly $700/kW from 2000 to 2002, average wind

turbine prices increased by approximately $800/kW (>100%) through 2008, rising to an

average of more than $1,500/kW. Wind turbine prices have since dropped substantially,

despite continued technological advancements that have yielded increases in hub heights and

especially rotor diameters. A number of turbine transactions announced in 2011 had pricing

in the $1,150-$1,350/kW range and price quotes for recent transactions are reportedly in the

range of $900-$1,270/kW, depending on the technology. These price reductions, coupled

with improved turbine technology and more-favorable terms for turbine purchasers, should,

over time, exert downward pressure on total project costs and wind power prices.

• Though Slow to Reflect Declining Wind Turbine Prices, Reported Installed Project

Costs Finally Turned the Corner in 2011. Among a large sample of wind power projects

installed in 2011, the capacity-weighted average installed project cost stood at nearly

$2,100/kW, down almost $100/kW from the reported average cost in both 2009 and 2010.

Moreover, a preliminary estimate of the average installed cost among a relatively small

sample of projects that either have been or will be built in 2012 suggests that average

installed costs may decline further in 2012, continuing to follow lower turbine prices.

• Installed Costs Differ By Project Size, Turbine Size, and Region. Installed project costs

are found to exhibit some weak economies of scale, at least at the lower end of the project

and turbine size range. Texas is found to be the lowest-cost region, while California and

New England were the highest-cost regions.

• Newer Projects Appear to Show Improvements in Operations and Maintenance Costs.

Despite limited data availability, it appears that projects installed more recently have, on

average, incurred lower O&M costs than older projects in their first several years of

operation, and that O&M costs increase as projects age.

• Sample-Wide Wind Project Capacity Factors Have Generally Improved Over Time.

Boosted primarily by taller towers and larger rotor diameters (relative to nameplate capacity),

2011 Wind Technologies Market Report

vii

average sample-wide wind power project capacity factors have, in general, gradually

increased over time, from 25% in 1999 (for projects installed through 1998) to a high of

nearly 34% in 2008 (for projects installed through 2007). In 2009 and 2010, however,

sample-wide capacity factors dropped to around 30%, before 2011 brought a resurgence back

to 33% (for projects installed through 2010). The drop in 2009 and 2010 was likely due to a

combination of lackluster wind speeds throughout much of the U.S. in both 2009 and 2010 as

well as wind power curtailment (particularly severe in 2009).

• Some Stagnation in Wind Project Capacity Factor Improvement Is Evident Among

Projects Built from 2006 through 2010, Due in Part to a Build Out of Projects in

Progressively Weaker Wind Resource Areas. Focusing only on capacity factors in 2011

parsed by project vintage reveals that average capacity factors have been largely stagnant

among projects built from 2006 through 2010 (though the maximum capacity factor attained

by any individual project in 2011 increased noticeably among projects built in 2009 and

2010, and the fact that rotor scaling continued for projects built in 2011 suggests that further

increases in capacity factors are likely in 2012, all else equal). Three main drivers appear to

be behind this stagnation: the average hub height of wind power projects has only increased

by a few meters since 2006 (after growing rapidly in earlier years), the average rotor swept

area relative to turbine nameplate capacity (i.e., the inverse of “specific power”) also held

steady during much of this period (though increased considerably in both 2010 and 2011),

while the average quality of the wind resource among those projects built in each year has

deteriorated significantly since 2008. This final trend of building projects in progressively

less-energetic wind resource sites may be driven by the proliferation of low wind speed

turbine designs (see above), siting challenges (including transmission constraints), and even

policy design (the value of the Section 1603 cash grant does not depend on how energetic a

given site is).

• Regional Variations in Capacity Factor Reflect the Strength of the Wind Resource.

Based on a sub-sample of wind power projects built from 2004 through 2010, capacity-

weighted average capacity factors were the highest in the Heartland (37%) and Mountain

(36%) regions in 2011, and lowest in the East (25%) and in New England (28%). Not

surprisingly, these regional rankings are roughly consistent with the relative quality of the

wind resource in each region.

• Unlike Turbine Prices and Installed Project Costs, Cumulative, Sample-Wide Wind

Power Prices Continued to Move Higher in 2011. After having declined through 2005,

sample-wide average wind power prices have risen steadily, such that in 2011, the

cumulative sample of 271 projects totaling 20,189 MW built from 1998 through 2011 had an

average power sales price of $54/MWh. This general temporal trend of falling and then

rising prices is consistent with – but lags, due to the cumulative nature of the sample – the

turbine price and installed project cost trends (at least through 2008 and 2010, respectively)

described earlier.

• Binning Wind Power Sales Prices by Project Vintage Also Fails to Show a Price

Reversal. The capacity-weighted average 2011 sales price, based on projects in the sample

built in 2011, was roughly $74/MWh – essentially unchanged from the average among

projects built in 2010 (the spread of individual project prices is also similar among projects

built in 2010 and 2011), and more than twice the average of $32/MWh among projects built

during the low point in 2002 and 2003. Although the similarity in pricing among 2010 and

2011 projects may actually portend a peak (with lower prices likely among 2012 projects),

2011 Wind Technologies Market Report

viii

the fact that neither calendar year prices (among a cumulative sample) nor 2011 prices

(binned by project vintage) show any sort of price reversal is nevertheless surprising,

particularly given the degree to which turbine prices have dropped since 2008, along with

growing evidence of aggressive pricing in wind PPAs.

• Binning Wind Power Sales Prices by PPA Execution Date Shows Steeply Falling Prices.

An abnormally long lag between when PPAs were signed and when projects were built

appears to be largely responsible for the stubborn lack of a price reversal in 2011 when

viewed by calendar year or project vintage. Only two projects within the sample that were

built in 2011 actually signed PPAs in 2011. All other 2011 projects in the sample signed

PPAs in 2010, 2009, or even back as far as 2008 – i.e., at the height of the market for

turbines – thereby locking in prices that ended up being above market in 2011. Binning by

PPA signing date reveals that the average price peaked in 2009 and then progressively fell in

both 2010 and 2011. Among a sample of “full term” wind project PPAs signed in 2011, the

capacity-weighted average levelized PPA price is $35/MWh, down from $59/MWh for PPAs

signed in 2010 and $72/MWh for PPAs signed in 2009.

• Wind Power PPA Prices Vary Widely By Region. Texas, the Heartland, and the Mountain

regions appear to be among the lowest-price regions, on average, while California is, by far,

the highest price region. California also accounts for nearly one quarter of the 2011 project

sample, thereby disproportionately inflating the capacity-weighted average price in 2011 (as

it also did in 2010, when it made up almost 20% of the sample).

• Low Wholesale Electricity Prices Continued to Challenge the Relative Economics of

Wind Power. Average wind power prices compared favorably to wholesale electricity

prices from 2003 through 2008. Starting in 2009, however, increasing wind power prices,

combined with a sharp drop in wholesale electricity prices (driven by lower natural gas

prices), pushed wind energy to the top of (and in 2011 above) the wholesale power price

range. Although low wholesale electricity prices are, in part, attributable to the recession-

induced drop in energy demand, the ongoing development of significant shale gas deposits

has also resulted in reduced expectations for gas price increases going forward. While

comparing wind and wholesale electricity prices in this manner is not appropriate if one’s

goal is to fully account for the costs and benefits of wind energy relative to its competition,

these developments may nonetheless put the near-term comparative economic position of

wind energy at some risk absent further reductions in the price of wind power and absent

supportive policies for wind energy. That said, levelized PPA prices in the $30-$40/MWh

range (currently achievable, with the PTC, in many parts of the interior U.S.) are fully

competitive with the range of wholesale power prices seen in 2011.

• Uncertainty Reigns in Federal Incentives for Wind Energy Beyond 2012. The Recovery

Act enabled wind power projects placed in service prior to the end of 2012 to elect a 30%

investment tax credit (ITC) in lieu of the production tax credit (PTC). More importantly,

given the relative scarcity of tax equity in the immediate wake of the financial crisis, the

Recovery Act also enabled wind power projects to elect a 30% cash grant from the Treasury

in lieu of federal tax credits. More than 60% of the new wind capacity installed in 2011

elected the cash grant. However, in order to qualify for the grant, wind power projects must

have been under construction by the end of 2011, must apply for a grant by October 1, 2012,

and must be placed in service by the end of 2012. With the PTC, ITC, and bonus

depreciation all also currently scheduled to expire at the end of 2012, the wind energy sector

is currently facing serious federal policy uncertainty looking to 2013 and beyond.

2011 Wind Technologies Market Report

ix

• State Policies Play a Role in Directing the Location and Amount of Wind Power

Development, but Current Policies Cannot Support Continued Growth at the Levels

Seen in the Recent Past. From 1999 through 2011, 65% of the wind power capacity built in

the United States was located in states with renewables portfolio standards (RPS); in 2011,

this proportion was 78%. As of July 2012, mandatory RPS programs existed in 29 states and

Washington D.C., and a number of states strengthened previously established programs in

2011. However, existing RPS programs are projected to drive average annual renewable

energy additions of roughly 4-5 GW/year (not all of which will be wind) between 2012 and

2020, which is less than the amount of wind capacity added in recent years and demonstrates

the limitations of relying exclusively on state RPS programs to drive future deployment.

• Despite Progress on Overcoming Transmission Barriers, Constraints Remain.

Transmission development has continued to gain traction during recent years, with about

2,300 circuit miles of new transmission additions under construction near the end of 2011,

and with an additional 17,800 circuit miles planned through 2015. The wind industry has

identified near-term transmission projects that – if all were completed – could carry almost

45 GW of wind power capacity. In July 2011, the Federal Energy Regulatory Commission

(FERC) issued an order that requires public utility transmission providers to improve

transmission planning processes and to determine a cost allocation methodology for new

transmission facilities. States, grid operators, utilities, regional organizations, and the

Department of Energy also continue to take proactive steps to encourage transmission

investment. Finally, construction and development progress was made in 2011 on a number

of transmission projects designed, in part, to support wind power. Nonetheless, siting,

planning, and cost allocation issues remain key barriers to transmission investment, and wind

curtailment continues to be a problem in some areas.

• Integrating Wind Energy into Power Systems Is Manageable, but Not Free of Costs,

and System Operators Are Implementing Methods to Accommodate Increased

Penetration. Recent studies show that wind energy integration costs are below $12/MWh –

and often below $5/MWh – for wind power capacity penetrations of up to or even exceeding

40% of the peak load of the system in which the wind power is delivered. The increase in

balancing reserves with increased wind power penetration is projected, in most cases, to be

below 15% of the nameplate capacity of wind power, and typically considerably less than

this figure, particularly in studies that use intra-hour scheduling. Moreover, a number of

strategies that can help to ease the integration of increasing amounts of wind energy –

including the use of larger balancing areas, the use of wind forecasts, and intra-hour

scheduling – are being implemented by grid operators across the United States.

With federal tax incentives for wind energy currently slated to expire at the end of 2012, new

capacity additions in 2012 are anticipated to exceed 2011 levels and perhaps even the highs in

2009 as developers rush to commission projects. At the same time, despite the improved cost,

performance, and price of wind energy, policy uncertainty – in concert with continued low

natural gas prices, modest electricity demand growth, and the aforementioned slack in existing

state policies – threatens to dramatically slow new builds in 2013 and beyond. Forecasts for

2013 and beyond therefore span a particularly wide range, depending in large measure on

assumptions about the possible extension of federal incentives.

2011 Wind Technologies Market Report

1

1. Introduction

The U.S. wind power industry is facing uncertain times. With 2011 capacity additions having

risen from 2010 levels and with a further sizable increase expected in 2012, there are – on the

surface – grounds for optimism. At the same time, the currently-slated expiration of key federal

tax incentives for wind energy at the end of 2012 – in concert with continued low natural gas

prices and modest electricity demand growth – threatens to dramatically slow new builds in

2013, despite recent improvements in the cost and performance of wind power technology. In

combination with growing global competition within the sector, these trends have already

negatively impacted the U.S. wind power industry’s supply chain.

The wind power sector is dynamic, making it difficult to keep up with evolving trends in the

marketplace. This annual report – now in its sixth year – meets the need for timely, objective

information on the industry and its progress by providing a detailed overview of developments

and trends in the United States wind power market, with a particular focus on 2011. As with

previous editions, this report begins with an overview of key installation-related trends: trends in

wind power capacity growth; how that growth compares to other countries and generation

sources; the amount and percentage of wind energy in individual states; the status of offshore

wind power development; and the quantity of proposed wind power capacity in various

interconnection queues in the United States. Next, the report covers an array of wind power

industry trends, including: developments in turbine manufacturer market share; manufacturing

and supply-chain investments; wind turbine and component imports into and exports from the

United States; wind turbine size, hub height, and rotor diameter; project financing developments;

and trends among wind power project owners and power purchasers. The report then turns to a

discussion of wind power cost, performance, and pricing trends. In so doing, it describes trends

in wind turbine transaction prices, installed project costs, operations and maintenance expenses,

and project performance. It also reviews the prices paid for wind power in the United States, and

how those prices compare to short-term wholesale electricity prices. Next, the report examines

policy and market factors impacting the domestic wind power market, including federal and state

policy drivers, transmission issues, and grid integration. Finally, the report concludes with a

preview of possible near-term market developments.

This sixth edition of the annual report updates data presented in previous editions, while

highlighting key trends and important new developments from 2011. New to this edition is a

summary of trends in the wind resource conditions in which wind power projects have been

sited, as well as differences in how wind power sales prices are reported – including new data on

full-term power purchase agreement (PPA) prices levelized over the full contract term. The

report concentrates on larger-scale wind turbines, defined here as individual turbines that exceed

100 kW in size.

1

The U.S. wind power sector is multifaceted, however, and also includes

smaller, customer-sited wind turbines used to power residences, farms, and businesses. Data on

these latter applications are not the focus of this report, though a brief discussion on Small Wind

1

This 100 kW threshold between ‘small’ and ‘large’ wind turbines is applied starting with 2011 projects (to better

match AWEA’s historical methodology), and is justified by the fact that the U.S. tax code makes a similar

distinction. In years prior to 2011, however, different cut-offs are used to (a) better match AWEA’s reported

capacity numbers and (b) to ensure that older utility-scale wind power projects in California are not excluded from

the sample.

2011 Wind Technologies Market Report

2

Turbines is provided on page 4. Because this report has an historical focus and all wind power

projects installed in the U.S. have been land-based, its treatment of trends in the offshore wind

power sector is limited to a brief summary of recent developments. A companion report funded

by the U.S. Department of Energy that focuses exclusively on offshore wind energy will be

published later this year.

Much of the data included in this report were compiled by Berkeley Lab, and come from a

variety of sources, including the American Wind Energy Association (AWEA), the Energy

Information Administration (EIA), and the Federal Energy Regulatory Commission (FERC).

The Appendix provides a summary of the many data sources used in the report, and a list of

specific references follows the Appendix. Data on wind power capacity additions in the United

States are based largely on information provided by AWEA, though minor methodological

differences may yield slightly different numbers from AWEA (2012a) in some cases. In other

cases, the data shown here represent only a sample of actual wind power projects installed in the

United States; furthermore, the data vary in quality. As such, emphasis should be placed on

overall trends, rather than on individual data points. Finally, each section of this document

primarily focuses on historical market information, with an emphasis on 2011; with some limited

exceptions (including the final section of the report), the report does not seek to forecast future

trends.

2011 Wind Technologies Market Report

3

2. Installation Trends

Wind Power Additions Increased in 2011, with Roughly 6.8 GW of New

Capacity Added in the United States and $14 Billion Invested

The U.S. wind power market grew more rapidly in 2011 than in 2010, with 6,816 MW of new

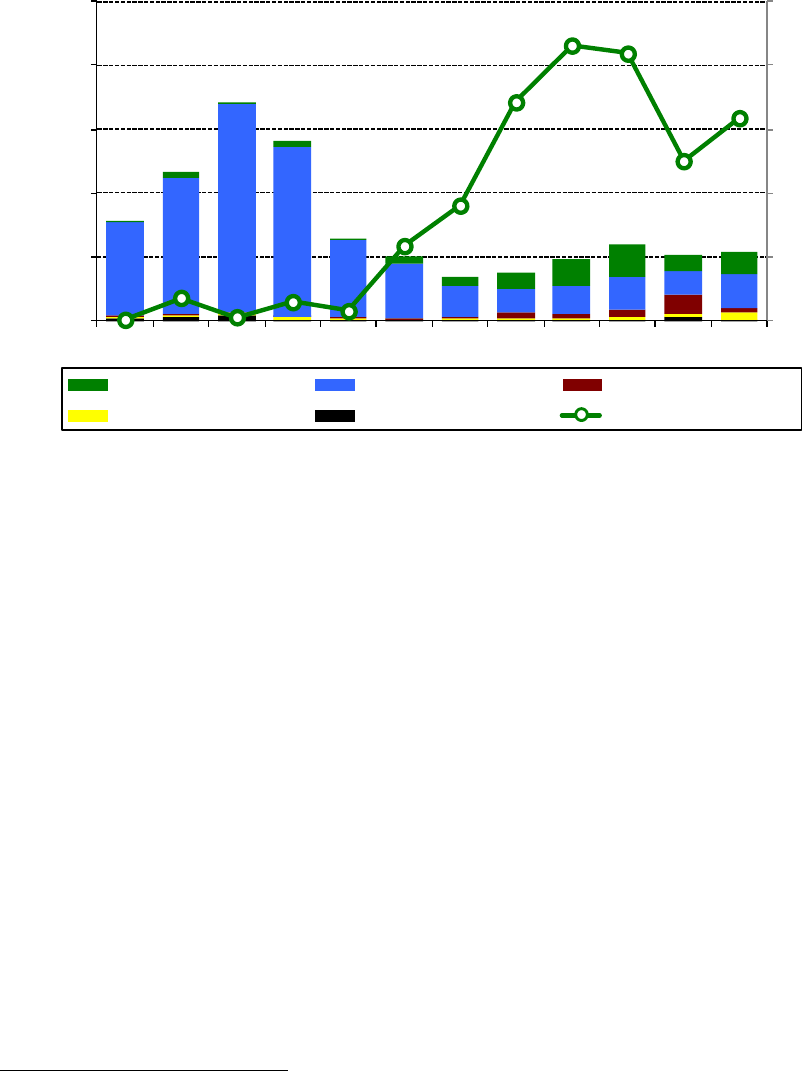

capacity added, bringing the cumulative total to nearly 47,000 MW (Figure 1).

2

This growth

translates into $14.3 billion (real 2011 dollars) invested in wind power project installation in

2011, for a cumulative investment total of $95 billion since the beginning of the 1980s.

3

Wind

power installations in 2011 were 31% higher than in 2010, but still well below the levels seen in

2008 and 2009. Cumulative wind power capacity grew by 16% in 2011.

Source: AWEA project database

Figure 1. Annual and Cumulative Growth in U.S. Wind Power Capacity

Key factors driving growth in 2011 included: continued state and federal incentives for wind

energy, recent improvements in the cost and performance of wind power technology, and the

need to meet an end-of-year construction start deadline in order to qualify for the Section 1603

Treasury grant program. With the Section 1603 grant and other federal tax incentives for wind

energy scheduled to expire at the end of 2012, new capacity additions in 2012 are anticipated to

substantially exceed 2011 levels as developers rush to commission projects. At the same time,

this scheduled expiration – in concert with continued low natural gas prices, modest electricity

demand growth, and existing state policies that are not sufficient to support continued capacity

additions at the levels witnessed in recent years – threatens to dramatically slow new builds in

2013 and beyond.

2

When reporting annual wind power capacity additions, this report focuses on gross capacity additions of large

wind turbines. The net increase in capacity each year can be somewhat lower, reflecting turbine decommissioning.

3

These investment figures are based on an extrapolation of the average project-level capital costs reported later in

this report, and do not include investments in manufacturing facilities, research & development expenditures, or

operations and maintenance (O&M) costs.

0

1

2

3

4

5

6

7

8

9

10

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

0

5

10

15

20

25

30

35

40

45

50

Annual US Capacity (left scale)

Cumulative US Capacity (right scale)

Cumulative Capacity (GW)

Annual Capacity (GW)

2011 Wind Technologies Market Report

4

Wind Power Comprised 32% of U.S. Electric Generating Capacity Additions

in 2011

Wind power has represented one of the largest new sources of electric capacity additions in the

United States in recent years. In 2011, wind power was again (for the sixth time in seven years)

the second-largest new resource added to the U.S. electrical grid in terms of gross capacity

additions, behind the 10,500 MW of new natural gas capacity.

4

New wind power projects

4

Data presented here are based on gross capacity additions, not considering retirements.

Small Wind Turbines

Small wind turbines can provide power directly to homes, farms, schools, businesses, and industrial facilities,

offsetting the need to purchase some portion of the host’s electricity from the grid; such wind turbines can also

provide power to off-grid sites. Wind turbines used in these applications are often much smaller – generally

ranging in size from a few hundred watts to 100 kW – than the larger-scale turbines that are the primary focus of

this report.

The table below summarizes sales of small wind turbines, 100 kW and less in size, into the U.S. market from

2005 through 2011. Roughly 19 MW of small wind turbines were sold in the U.S. in 2011, most of which came

from turbines manufactured by U.S. companies. These installation figures represent a 26% decline in annual

sales – in capacity terms – relative to 2010, yielding a cumulative installed capacity of small wind turbines in the

United States of 198 MW by the end of 2011 (AWEA 2012b).

Within this market segment, there has been a general trend towards larger, grid-tied systems. Sales of turbines

<1 kW in size (often used off-grid) were flat or even declined from 2006-11, averaging roughly 2-3 MW per

year. Sales of 1-10 kW turbines (often used in the grid-tied residential market), on the other hand, grew from

less than 2 MW in 2006 to more than 8 MW in 2010, before dropping to approximately 6 MW in 2011. Sales of

11-100 kW turbines (often used in the grid-tied commercial / light industrial / government market) grew from

around 3 MW in 2006 to more than 15 MW in 2010, before dropping to roughly 12 MW in 2011 (AWEA

2012b).

Year

Annual Sales of Small Wind Turbines (≤ 100 kW) into the United States

Number of Turbines

Capacity Additions

Sales Revenue

2005

4,324

3.3 MW

$11 million

2006

8,330

8.6 MW

$36 million

2007

9,102

9.7 MW

$43 million

2008

10,386

17.4 MW

$74 million

2009

9,820

20.4 MW

$91 million

2010

7,811

25.6 MW

$139 million

2011

7,303

19.0 MW

$115 million

Source: AWEA (2012b)

Sales in this sector have historically been driven – at least in part – by a variety of state incentive programs. In

addition, wind turbines equal to or under 100 kW in size are eligible for an uncapped 30% federal investment tax

credit (in place through 2016). The Section 1603 Treasury Grant Program and programs administered by the

USDA have also played a role in the recent growth of the sector. The decline in U.S. sales in 2011 is attributed

by AWEA (2012b) in part to inconsistent state incentives, with several states suspending or defunding their

small wind incentive programs in 2011, as well as the poor state of the U.S. economy.

2011 Wind Technologies Market Report

5

contributed roughly 32% of the new nameplate capacity added to the U.S. electrical grid in 2011,

compared to 25% in 2010, 42% in 2009, 43% in 2008, 34% in 2007, 18% in 2006, 12% in 2005,

and less than 4% from 2000 through 2004 (Figure 2).

0%

10%

20%

30%

40%

50%

0

20

40

60

80

100

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Total Annual Capacity Additions (GW)

Wind

Gas

Coal

Other Renewable

Other Non-Renewable

Wind (% of Total)

Wind Capacity Additions

(% of Total Annual Capacity Additions)

Source: EIA, Ventyx, AWEA, IREC, SEIA/GTM, Berkeley Lab

Figure 2. Relative Contribution of Generation Types in Annual Capacity Additions

EIA’s (2012) reference-case forecast projects that total U.S. electricity supply will need to

increase at an average pace of roughly 35 TWh (0.8%) per year from 2011 to 2035 in order to

meet demand growth. On an energy basis, the annual amount of electricity expected to be

generated by the new wind power capacity added in 2011 represents roughly 54% of this average

annual projected growth in supply. By extension, if wind power additions continued through

2035 at the same pace as in 2011, then roughly 54% of the nation’s projected increase in

electricity generation from 2011 through 2035 would be met with wind electricity. Although

future growth trends are hard to predict, it is clear that a significant portion of the country’s new

generation needs is already being met by wind energy.

The United States Remained the Second Largest Market in Annual and

Cumulative Wind Power Capacity Additions, but Was Well Behind the

Market Leaders in Wind Energy Penetration

On a worldwide basis, a record of roughly 42,000 MW of wind power capacity was added in

2011, up 6% from the additions experienced in 2010 and bringing the cumulative total to

241,000 MW (BTM 2012; Table 1).

5

In terms of cumulative capacity, the United States ended

5

Yearly and cumulative installed wind power capacity in the United States are from the present report, while global

wind power capacity comes from BTM (2012), but updated with the U.S. data presented here. Some disagreement

exists among these data sources and others, e.g., Windpower Monthly, the Global Wind Energy Council, and

AWEA.

2011 Wind Technologies Market Report

6

the year with almost 20% of total global wind power capacity, but is now a distant second to

China by this metric (Table 1).

6

Over the past 10 years, cumulative wind power capacity has

grown by an average of 27% per year in the United States, somewhat higher than the 25%

growth rate globally. Annual growth in cumulative capacity was down in 2011, however, at 16%

for the U.S. and 21% globally.

After leading the world in annual wind power capacity additions from 2005 through 2008, the

U.S. has now – for three years – been second to China (Table 1), representing roughly 16% of

global installed capacity in 2011, up slightly from 13% in 2010, but down substantially from

26% in 2009, 30% in 2008, and 27% in 2007. China now dominates global wind power

rankings, with an approximate 42% share of the global market for new wind power additions in

2011. India, Germany, and the U.K. rounded out the top five countries in 2011 for annual

capacity additions.

Table 1. International Rankings of Wind Power Capacity

Annual Capacity

(2011, MW)

Cumulative Capacity

(end of 2011, MW)

China 17,631 China 62,412

U.S. 6,816 U.S. 46,916

India 3,300 Germany 29,248

Germany 2,007 Spain 21,350

U.K. 1,293 India 16,266

Canada 1,267 U.K. 7,155

Spain 1,050 France 6,836

Italy 950 Italy 6,733

France 875 Canada 5,278

Sweden 763 Portugal 4,214

Rest of World

5,766

Rest of World

34,453

TOTAL 41,718 TOTAL 240,861

Source: BTM Consult; AWEA project database for U.S. capacity

A number of countries are beginning to achieve relatively high levels of wind energy penetration

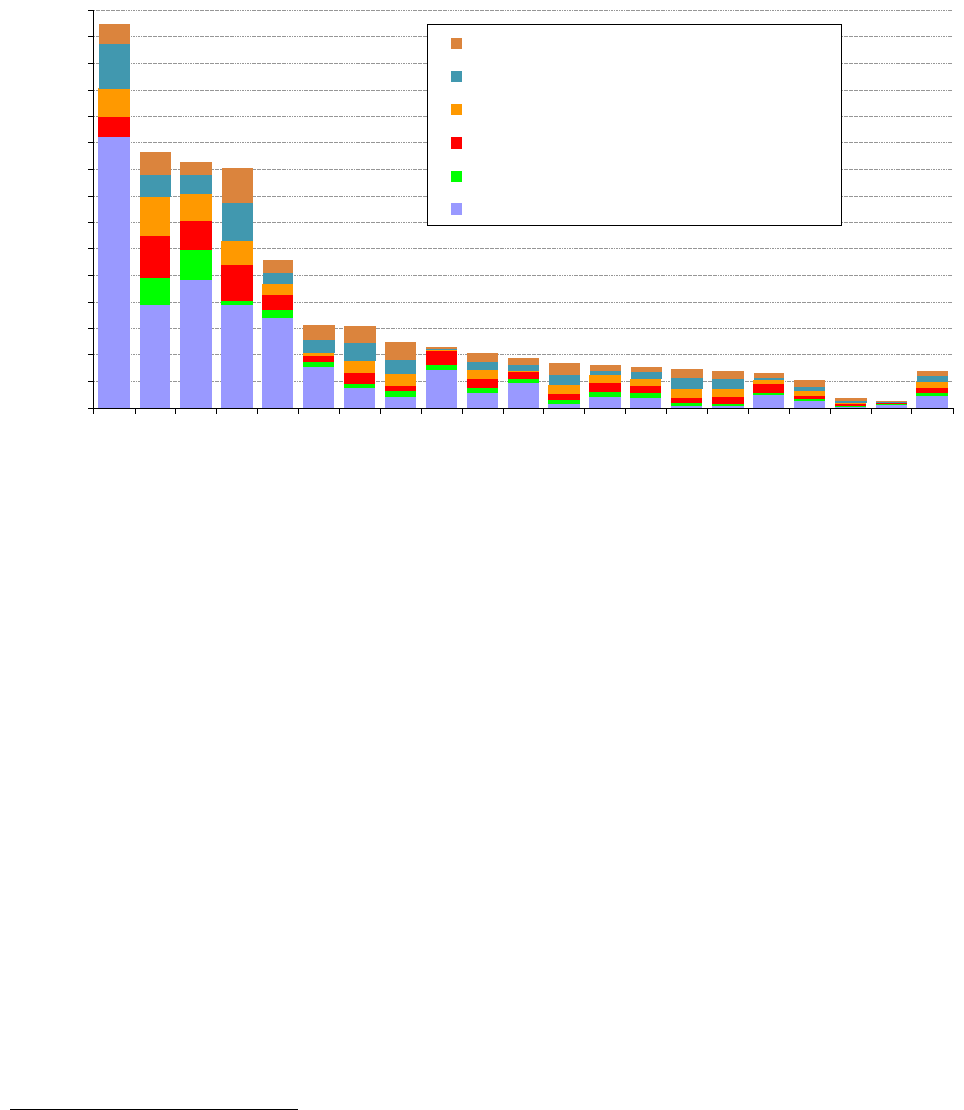

in their electricity grids. Figure 3 presents data on end-of-2011 (and end-of-2006/07/08/09/10)

installed wind power capacity, translated into projected annual electricity supply based on

assumed country-specific capacity factors, and divided by projected 2012 (and actual or

projected 2007/08/09/10/11) electricity consumption. Using this approximation for the

contribution of wind power to electricity consumption, and focusing only on the 20 countries

with the greatest cumulative installed wind power capacity, end-of-2011 installed wind power is

estimated to supply the equivalent of roughly 29% of Denmark’s electricity demand, 19% of

Portugal’s, 19% of Spain’s, 18% of Ireland’s, and 11% of Germany’s. In the United States, the

cumulative wind power capacity installed at the end of 2011 is estimated, in an average year, to

equate to roughly 3.3% of the nation’s electricity demand (up from 2.9% at the end of 2010, and

6

Wind power additions and cumulative capacity in China are from BTM (2012), and include a considerable amount

of capacity that was installed but that had not yet begun to deliver electricity by the end of 2011, due to a lack of

coordination between wind developers and transmission providers, and the lengthier time that it takes to build

transmission and interconnection facilities. All of the U.S. capacity reported here, on the other hand, was capable of

electricity delivery.

2011 Wind Technologies Market Report

7

just 0.9% at the end of 2006).

7

On a global basis, wind energy’s contribution at the end of 2011

is estimated to be 2.9%.

Source: Berkeley Lab estimates based on data from BTM Consult, EIA, and elsewhere

Figure 3. Approximate Wind Energy Penetration in the Twenty Countries with the

Greatest Installed Wind Power Capacity

California Added More New Wind Power Capacity than Any Other State,

While Six States Are Estimated to Exceed 10% Wind Energy Penetration

New large-scale

8

wind turbines were installed in 30 states in 2011. With 921 MW installed,

California added the most new wind capacity in 2011, ending Texas’ six-year reign (Texas fell to

ninth place in 2011, with 297 MW). As shown in Figure 4 and Table 2, other leading states in

terms of new capacity (each with more than 500 MW) included Illinois, Iowa, Minnesota,

Oklahoma, and Colorado. Nineteen states added more than 100 MW each in 2011.

On a cumulative basis, Texas remained the clear leader among states, with 10,394 MW installed

at the end of 2011 – more than 6,000 MW more than the next-highest state (Iowa, with 4,322

MW). In fact, Texas has more installed wind power capacity than all but five countries

(including the U.S.) worldwide. States following (distantly) Texas in cumulative installed

capacity include Iowa, California, Illinois, Minnesota, Washington, Oregon, and Oklahoma – all

with more than 2,000 MW. Twenty-nine states had more than 100 MW of wind capacity

installed as of the end of 2011, with twenty of these topping 500 MW, eight topping 2,000 MW,

7

In terms of actual 2011 deliveries, EIA reports that wind energy represented 2.9% of net electricity generation and

3.2% of national electricity consumption in the United States. These figures are below the 3.3% figure provided

above in part because 3.3% is a projection based on end-of-year 2011 wind power capacity.

8

“Large-scale” turbines are defined consistently with the rest of this report – i.e., turbines over 100 kW.

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

22%

24%

26%

28%

30%

Denmark

Portugal

Spain

Ireland

Germany

Greece

UK

Sweden

Netherlands

Italy

India

Poland

U.S.

France

China

Turkey

Australia

Canada

Brazil

Japan

TOTAL

Approximate Wind Penetration, end of 2011

Approximate Wind Penetration, end of 2010

Approximate Wind Penetration, end of 2009

Approximate Wind Penetration, end of 2008

Approximate Wind Penetration, end of 2007

Approximate Wind Penetration, end of 2006

Estimated Wind Generation as a

Proportion of Electricity Consumption

2011 Wind Technologies Market Report

8

and one (Texas) topping 10,000 MW. Although all wind power projects in the United States to

date have been installed on land, offshore development activities continued in 2011, as discussed

in the next section.

Note: Numbers within states represent cumulative installed wind capacity and, in parentheses, annual additions in 2011.

Figure 4. Location of Wind Power Development in the United States

Some states are beginning to realize relatively high levels of wind energy penetration. The right

half of Table 2 lists the top 20 states based on both actual wind electricity generation in 2011 as

well as estimated wind electricity generation from end-of-2011 wind power capacity, both

divided by total in-state electricity generation in 2011.

9

Using either method, the same four

upper Midwest states – North and South Dakota, Minnesota, and Iowa – lead the list (though in a

slightly different order). Most notably, the wind power capacity installed in South Dakota and

Iowa as of the end of 2011 is estimated, in an average year, to supply approximately 22% and

9

Wind energy penetration can either be expressed as a percentage of in-state load or in-state generation. In-state

generation is used here, primarily because wind energy (like other energy resources) is often sold across state lines,

which tends to distort penetration levels expressed as a percentage of in-state load. The actual penetration of wind

electricity generation in 2011 is based exclusively on preliminary EIA data for 2011, and matches what AWEA

provides in its U.S. Wind Industry Annual Market Report (AWEA 2012a). For the estimated penetration – which

captures the full, rather than partial, impact of new wind power capacity added in 2011 – end-of-2011 wind power

capacity is translated into estimated annual wind generation based on estimated state-specific capacity factors that

derive from the project performance data reported later in this report. The resulting state-specific wind electricity

generation estimates are then divided by preliminary EIA data on total in-state electricity generation in 2011.

2011 Wind Technologies Market Report

9

20%, respectively, of all in-state electricity generation. Four other states are also estimated to

exceed 10% penetration by this metric: Minnesota (14.9%), North Dakota (14.1%), Colorado

(10.7%), and Oregon (10.5%).

Table 2. United States Wind Power Rankings: The Top 20 States

Capacity (MW)

Percentage of In-State Generation

Annual (2011)

Cumulative (end of 2011)

Actual (2011)*

Estimated (end of 2011)**

California

921

Texas

10,394

South Dakota

22.3%

South Dakota

22.1%

Illinois

692

Iowa

4,322

Iowa

18.8%

Iowa

20.0%

Iowa

647

California

3,917

North Dakota

14.7%

Minnesota

14.9%

Minnesota

542

Illinois

2,742

Minnesota

12.7%

North Dakota

14.1%

Oklahoma

525

Minnesota

2,718

Wyoming

10.1%

Colorado

10.7%

Colorado

506

Washington

2,573

Colorado

9.2%

Oregon

10.5%

Oregon

409

Oregon

2,513

Kansas

8.2%

Idaho

9.7%

Washington

367

Oklahoma

2,007

Idaho

8.2%

Kansas

9.2%

Texas

297

Colorado

1,805

Oregon

8.2%

Oklahoma

9.1%

Idaho

265

North Dakota

1,445

Oklahoma

7.1%

Wyoming

8.8%

Michigan

213

Wyoming

1,412

Texas

6.9%

Texas

7.3%

Kansas

200

New York

1,403

New Mexico

5.4%

Maine

6.5%

Wisconsin

162

Indiana

1,340

Washington

5.3%

New Mexico

5.8%

West Virginia

134

Kansas

1,274

Maine

4.5%

Washington

5.5%

Maine

131

Pennsylvania

789

Montana

4.2%

California

4.7%

New York

129

South Dakota

784

California

4.0%

Montana

3.8%

Nebraska

125

New Mexico

750

Illinois

3.1%

Illinois

3.7%

Utah

102

Wisconsin

631

Hawaii

3.1%

Hawaii

3.7%

Ohio

102

Idaho

618

Nebraska

2.9%

Indiana

3.0%

South Dakota

75

West Virginia

564

Indiana

2.7%

Nebraska

2.9%

Rest of U.S.

274

Rest of U.S.

2,915

Rest of U.S.

0.4%

Rest of U.S.

0.5%

TOTAL

6,816

TOTAL

46,916

TOTAL

2.9%

TOTAL

3.2%

* Based on 2011 wind and total generation by state from EIA’s Electric Power Monthly.

** Based on a projection of wind electricity generation from end-of-2011 wind power capacity, divided by total in-state electricity

generation in 2011.

Source: AWEA project database, EIA, Berkeley Lab estimates

No Offshore Turbines Have Been Commissioned in the United States, but

Offshore Project and Policy Developments Continued in 2011

10

At the end of 2011, global offshore wind power capacity stood at roughly 4,000 MW (BTM

2012), with the vast majority of 2011 additions and cumulative capacity located in Europe. Just

470 MW of new offshore wind power capacity was commissioned in 2011, a two-thirds decrease

from 2010, though BTM (2012) reports that more than 1,500 MW are likely to be installed in

2012.

A companion report funded by the U.S. Department of Energy that focuses exclusively on offshore wind energy

will be published later this year, and will provide a detailed summary of the status of the offshore wind sector in the

United States.

10

2011 Wind Technologies Market Report

10

To date, no offshore projects have been installed in the United States, and the emergence of a

U.S. offshore wind power market faces both challenges and opportunities. Perhaps most

importantly, the projected near-term costs of offshore wind energy remain high. Additionally,

planning, siting, and permitting can be challenging, as demonstrated in the long history of the

Cape Wind project. At the same time, interest in developing offshore wind energy exists in

several parts of the country. Driving this interest is the proximity of offshore wind resources to

population centers, the potential for local economic development benefits, advances in

technology, and superior capacity factors (and, in some instances, peak load coincidence)

compared to the finite set of developable land-based wind power projects available in some

regions. Moreover, significant strides relating to offshore wind energy have been made recently

in the federal arena, both through the Department of the Interior's responsibilities with regards to

regulatory approvals and the Department of Energy's investments in offshore R&D.

Figure 5. Proposed Offshore Wind Power Projects in a Relatively Advanced State of

Development

Figure 5 identifies ten proposed offshore wind power projects in the United States that have been

identified by Navigant Consulting as being more-advanced in development process: generally,

this includes projects that have signed power purchase agreements, those with a partnership with

a potential power offtaker, those that are pursuing detailed surveying/permitting efforts, and

2011 Wind Technologies Market Report

11

those that are expecting to install demonstration or pilot-phase turbines in the relatively near

future. In total, these proposed projects equal 3,800 MW, and are primarily located in the

Northeast and Mid-Atlantic, though proposed projects also exist in the Great Lakes and Gulf of

Mexico. It is not certain which of these projects will ultimately come to fruition, while many

other proposed projects not listed in Figure 5 are in earlier planning phases.

Of the projects identified in Figure 5, two have signed power purchase agreements (PPAs): Cape

Wind (Massachusetts) and Deepwater Wind (Rhode Island). The nation's first offshore wind

PPA, for NRG Bluewater’s project off the coast of Delaware, was canceled by the developer in

2011.

Data from Interconnection Queues Demonstrate that an Enormous Amount

of Wind Power Capacity Is Under Consideration

One testament to the continued interest in land-based wind energy is the amount of wind power

capacity currently working its way through the major transmission interconnection queues across

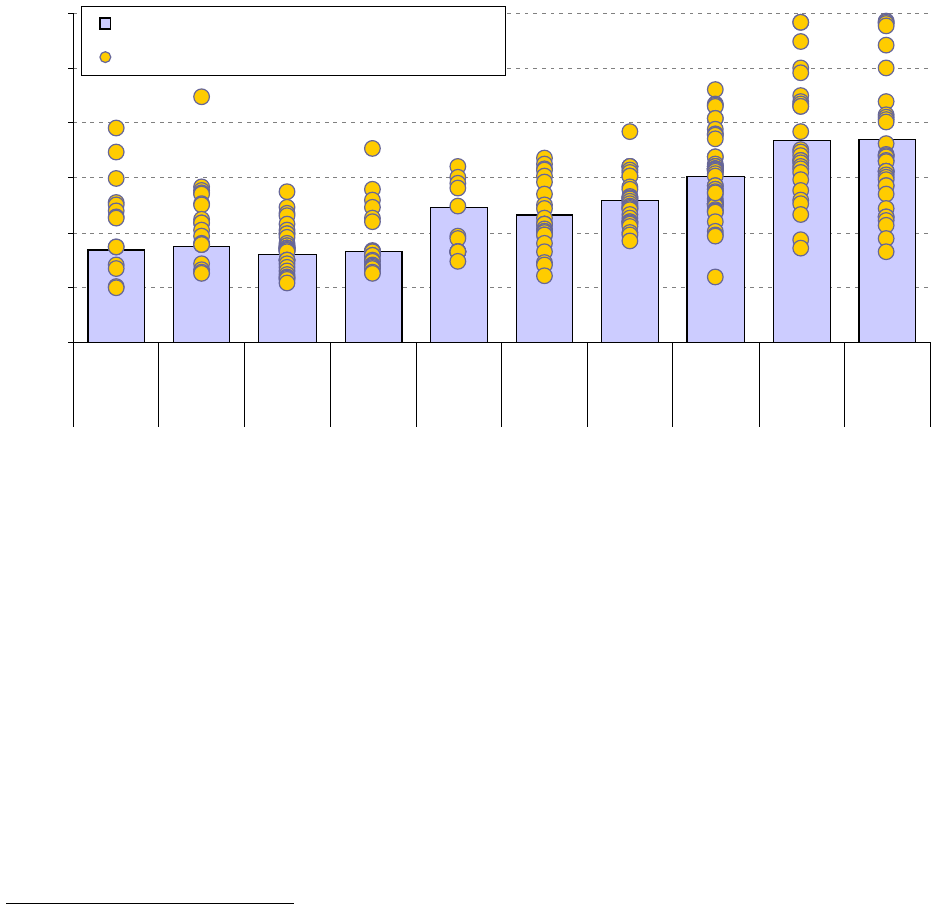

the country. Figure 6 provides this information for wind power and other resources aggregated

across 41 different interconnection queues administered by independent system operators (ISOs),

regional transmission organizations (RTOs), and utilities.

11

These data should be interpreted

with caution: though placing a project in the interconnection queue is a necessary step in project

development, being in the queue does not guarantee that a project will actually get built. In fact,

projects currently in interconnection queues are often very early in the development process. As

a result, efforts have been and are being taken by the Federal Energy Regulatory Commission

(FERC), ISOs, RTOs, and utilities to reduce the number of speculative projects that have – in

recent years – clogged these queues. One consequence of those efforts, as well as perhaps the

uncertain magnitude of the future wind market in the U.S. given the impending scheduled

expiration of federal tax incentives, is that the total amount of wind power capacity in the

nation's interconnection queues has declined in recent years.

11

The queues surveyed include PJM Interconnection (PJM), Midwest Independent System Operator (MISO), New

York ISO (NYISO), ISO-New England (ISO-NE), California ISO (CAISO), Electric Reliability Council of Texas

(ERCOT), Southwest Power Pool (SPP), Western Area Power Administration (WAPA), Bonneville Power

Administration (BPA), and 32 other individual utilities. To provide a sense of sample size and coverage, the ISOs,

RTOs, and utilities whose queues are included here have an aggregated peak demand of almost 70% of the U.S.

total. Figures 6 and 7 only include projects that were active in the queue at the end of 2011 but that had not yet been

built; suspended projects are not included.

2011 Wind Technologies Market Report

12

Source: Exeter Associates review of interconnection queues

Figure 6. Nameplate Resource Capacity in 41 Selected Interconnection Queues

Even with this important caveat, the amount of capacity in the nation’s interconnection queues

still provides at least some indication of the amount of wind power development that is in the

planning phase. At the end of 2011, even after reforms by a number of ISOs, RTOs, and utilities

to reduce the number of projects in their queues, there were 219 GW of wind power capacity

within the interconnection queues reviewed for this report – almost five times the installed wind

power capacity in the United States.

12

This 219 GW represented 45% of all generating capacity

within these selected queues at that time, and was 1.5 times as much capacity as the next-largest

resource, natural gas. In 2011, 40 GW of gross wind power capacity entered the interconnection

queues, compared to 54 GW of natural gas and 25 GW of solar; relatively little nuclear and coal

capacity entered these queues in 2011. Of note, however, is that the absolute amount of wind

and coal power in the sampled interconnection queues (considering gross additions and project

drop-outs) has declined in recent years, whereas natural gas and solar capacity has increased.

Much of this wind power capacity is planned for the Midwest, PJM Interconnection, Texas,

Mountain, Northwest, Southwest Power Pool, and California regions: wind power projects in the

interconnection queues in these regions at the end of 2011 accounted for 96% of the aggregate

219 GW of wind power in the selected queues (Figure 7). Smaller amounts of wind power

capacity were represented in the interconnection queues of the New York ISO (2.6%), ISO-New

England (1.4%), and the Southeast (0.3%).

12

As a rough benchmark, 300 GW of wind power capacity is the approximate amount of capacity required to reach

20% wind energy penetration in the United States in 2030, as estimated in DOE (2008).

0

50

100

150

200

250

Wind Natural Gas Solar Nuclear Coal Other

Nameplate Capacity (GW)

Entered queue in 2011 Total in queue at end of 2011

2011 Wind Technologies Market Report

13

Source: Exeter Associates review of interconnection queues

Figure 7. Wind Power Capacity in 41 Selected Interconnection Queues

As a measure of the near-term development pipeline, Ventyx (2012) estimates that – as of mid-

June 2012 – approximately 40 GW of wind power capacity was either under construction or in

site preparation (11 GW of the 40 GW total), in-development and permitted (14 GW of the 40

GW), or in-development with pending permit and/or regulatory applications (the remaining 15

GW of the 40 GW total). This total is similar to the 38 GW that was in the development pipeline

as of last year at approximately the same time (April 2011), indicating, potentially, that the

development pipeline remains robust despite political uncertainty at the federal level. AWEA

(2012c), meanwhile, reports 1,695 MW of wind power capacity installed in the first quarter of

2012, with another 8,900 MW under construction as of the end of March 2012.

0

5

10

15

20

25

30

35

40

45

50

MISO /

Midwest

PJM ERCOT Mountain Northwest SPP California

ISO

New York

ISO

ISO-New

England

Southeast

Nameplate Wind Power Capacity (GW)

Entered queue in 2011 Total in queue at end of 2011

2011 Wind Technologies Market Report

14

3. Industry Trends

Despite the Ongoing Proliferation of New Entrants, the “Big Three” Turbine

Suppliers Have Gained U.S. Market Share Since 2009

New U.S. wind projects built in 2011 deployed 2,006 MW of GE Wind turbines, compared to

1,969 MW of Vestas turbines, representing a roughly 29% market share for each manufacturer.

13

Following GE Wind and Vestas were Siemens (with an 18% market share), Suzlon and

Mitsubishi (both at 5%), Nordex and Clipper (both at 4%), REpower (3%),

14

and Gamesa (2%).

Other utility-scale (>100 kW) wind turbines installed in the U.S. in 2011 (and that fall into the

“Other” category in Figure 8) were manufactured by Alstom (43 MW), Sany Electric (10 MW),

Vensys (6 MW), Samsung (5 MW), Goldwind (4.5 MW), Hyundai (3.3 MW), Kenersys (2.5

MW), Northern Power Systems (2.3 MW), Sinovel (1.5 MW), Unison (1.5 MW), Nordic

Windpower (1 MW), PowerWind (0.9 MW), and Aeronautica (0.75 MW). This list of turbine

suppliers is increasingly global in nature, with manufacturers no longer hailing just from the

United States, Europe, Japan, and India, but now also from China and South Korea.

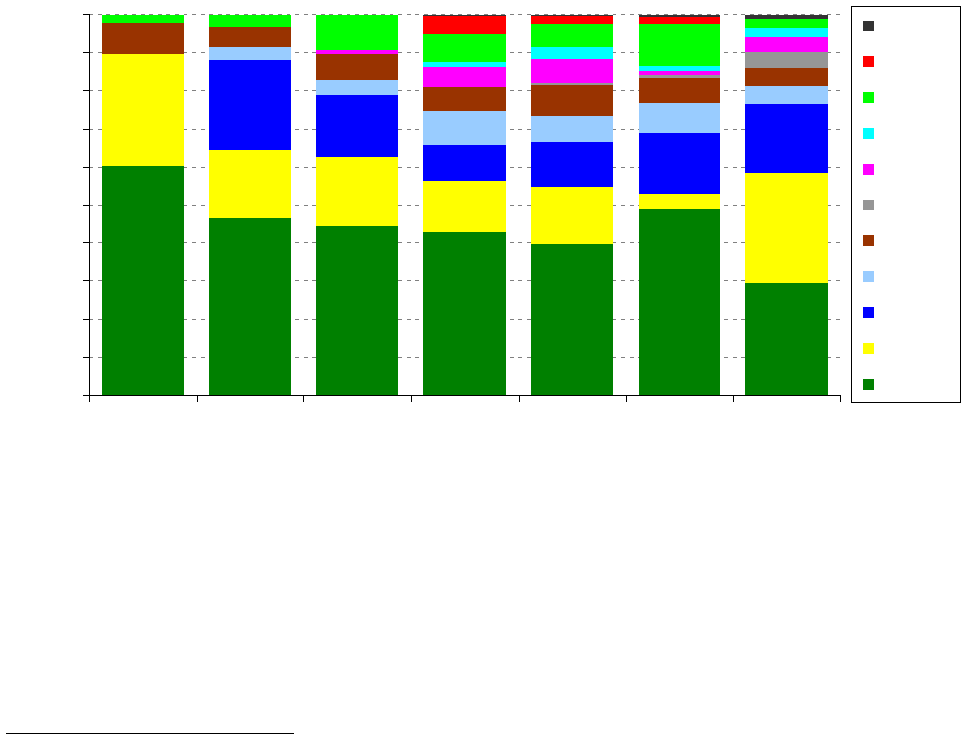

Source: AWEA project database

Figure 8. Annual U.S. Market Share of Wind Manufacturers by MW, 2005-2011

Figure 8 and Table 3 depict a notable increase in the number of wind turbine manufacturers

serving the U.S. market since 2005, when just five manufacturers (compared to twenty in 2011)

installed more than 1 MW, and just four manufacturers captured 99% of the market (compared to

the ten it took to reach 99% in 2011). Despite steady growth in the number of turbine

manufacturers serving the U.S. market over time, however, the “big three” turbine suppliers –

GE Wind, Vestas, and Siemens – have, in aggregate, actually gained market share since

2008/2009 (from 66% in both 2008 and 2009 up to 76% in 2011), reversing some of their earlier

13

Market share reported here is in MW terms, and is based on project installations in the year in question, not

turbine shipments or orders.

14

As of October 2011, REpower became a wholly owned subsidiary of Suzlon.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2005 2006 2007 2008 2009 2010 2011

Other

Acciona

Gamesa

REpower

Clipper

Nordex

Mitsubishi

Suzlon

Siemens

Vestas

GE Wind

Turbine Manufacturer U.S. Market Share

2011 Wind Technologies Market Report

15

losses through 2008. This recapture may, in part, reflect a legacy of the financial crisis (i.e., a

heightened preference among investors for projects using “bankable” turbines), coupled with

ample turbine supply (relative to demand), which reduces the need to consider less-bankable

technology.

Table 3. Annual U.S. Turbine Installation Capacity, by Manufacturer

Source: AWEA project database

Globally, U.S.-owned GE remained the third-leading supplier of turbines worldwide in 2011,

with an 8.8% market share (down from 9.3% in 2010), behind Vestas’ 12.9% and Goldwind's

9.4% (BTM 2012). No other U.S.-owned manufacturer cracked the top-15.

15

On a worldwide

basis, Chinese turbine manufacturers continue to occupy positions of prominence: four of the

top ten, and seven of the top 15, leading global suppliers of wind turbines in 2011 hail from

China.

To date, the growth of Chinese turbine manufacturers has been based almost entirely on sales to

the Chinese market. With the Chinese market beginning to show signs of cooling, however,

Chinese (and South Korean) manufacturers have begun to look abroad and penetrate the

international wind turbine market, including with limited sales into Europe and the United States.

In the United States, for example, 2011 installations by Chinese and South Korean manufacturers

included those from Sany Electric (10 MW), Samsung (5 MW), Goldwind (4.5 MW), Hyundai

(3.3 MW), Sinovel (1.5 MW), and Unison (1.5 MW). Many of these early installations have

been developed and financed by the turbine suppliers themselves, and until there is sufficient

operating experience to mitigate uncertainty over turbine quality and bankability, widespread

entry by Chinese suppliers into the U.S. market seems unlikely. Nevertheless, the historically-

dominant wind turbine suppliers in the U.S. market are likely to face growing competition from

new entrants in the coming years.

15

These statements emphasize the sale of large wind turbines. U.S. manufacturers are major players in the global

market for smaller-scale turbines (AWEA 2012b).

Manufacturer

Turbine Installations (MW)

2005

2006

2007

2008

2009

2010

2011

GE Wind

1,431

1,146

2,342

3,585

3,995

2,543

2,006

Vestas

699

439

948

1,120

1,488

221

1,969

Siemens

0

573

863

791

1,162

828

1,233

Suzlon

0

92

197

738

702

413

334

Mitsubishi

190

128

356

516

814

350

318

Nordex

0

0

3

0

63

20

288

Clipper

3

0

48

470

605

70

258

REpower

0

0

0

94

330

68

172

Gamesa

50

74

494

616

600

564

154

Acciona

0

0

0

410

204

99

0

Other

2

2

0

22

38

37

85

TOTAL

2,375

2,454

5,249

8,361

10,000

5,214

6,816

2011 Wind Technologies Market Report

16

Domestic Wind Turbine and Component Manufacturing Capacity Has

Increased, but Uncertainty in Future Demand Has Put the Wind Turbine

Supply Chain Under Severe Pressure

Faced with substantial expected growth in wind power capacity additions in 2012, but uncertain

prospects after 2012, the wind industry’s domestic supply chain faces conflicting pressures. As