Deep tech innovation in

smart connected technologies

A comparative analysis of SMEs in Europe and the United States

April 2022

2

Foreword

The Fourth Industrial Revolution (4IR) has triggered sweeping transformations in value

creation and consumer behaviour. A constellation of disruptive technologies – such as the

internet of things, cloud computing, big data, 5G communication and, of course, artificial

intelligence – is paving the way for a new, data-driven economy. The world is already filled

with billions of smart devices that can all collect and share data in real time and make

autonomous decisions. In terms of value creation, the boom in 4IR technologies is expected

to contribute over two trillion euros to the EU economy by the end of this decade.

With this report, the European Investment Bank (EIB) and European Patent Oce (EPO) are

teaming up for the first time to oer key insights into the small businesses driving innovation

in 4IR technologies. This partnership stems from a shared awareness of the crucial part such

businesses play in Europe's future prosperity. It also draws on our respective experiences of

the unique challenges facing businesses seeking to bring new technologies to market and

how to address them.

Patent protection is vital for the small and medium-sized enterprises (SMEs) that invest in

innovation. Patents enable enterprises and individuals to reap the rewards of their creativity

and hard work. As the patent oce for Europe, the EPO provides high-quality patents to

protect innovations in up to 44 member states (including all EU member states). It is also

positioned at the cutting edge of technical progress, with millions of patent documents

classified across a wide variety of fields. But patent protection is not just for large

multinational corporations. Applicants at the EPO range from teams of scientists

collaborating in university spin-os to sole inventors with brilliant ideas. European patents

also help small deep tech businesses to raise funding, set up collaborations, and

eventually scale up in Europe and beyond.

Favourable financing conditions are another vital precondition for firms developing

4IR technologies to flourish. The European Investment Bank Group, composed of both the

European Investment Bank (EIB) and the European Investment Fund (EIF), is the largest

multilateral financial institution in the world. In 2021, the EIB Group made available almost

EUR 95 billion worldwide. Almost half the Group’s financing, EUR 45 billion, went to SMEs.

At the same time, the EIB Group has intensified financing for innovation. Last year, EUR

20.7 billion of the EIB Group’s financing went to support innovation, including investment in

digitalisation and cutting-edge technologies. From start-ups, to scale-ups, to well established

firms, the EIB Group supports innovation and growth via funding for lending and guarantees

for banks to target SMEs, direct finance and guarantees to innovative companies, seed capital,

business angels and venture capital support, as well as venture debt.

Our study draws attention to SMEs that are developing new 4IR technology in Europe. It

provides data-driven analysis of the specific challenges they are facing compared to other

SMEs in Europe and in the US. 4IR SMEs have strong potential to unlock growth and deliver

added value. In the global race to digital transformation, it is paramount that both investors

and decision-makers recognise their potential.

Debora Revoltella Yann Ménière

Chief Economist EIB Chief Economist EPO

3

About the report

The purpose of this study is to provide a comprehensive inventory and analysis of small

and medium-sized enterprises that invest in the development of new technologies linked to

the Fourth Industrial Revolution (4IR) in the EU27. The study quantifies and analyses the

contribution made by these small businesses to the European Union's performance in

4IR innovation over the past decade. By benchmarking these companies against similar

4IR businesses in the US and other European countries, it aims to inform policymakers,

private decision-makers and investors of the specific challenges of growing 4IR deep tech

businesses in Europe.

About the European Investment Bank Economics Department

The mission of the EIB Economics Department is to provide economic analyses and studies

to support the Bank in its operations and in defining its positioning, strategy and policy. The

department, a team of 40 economists, is headed by Director Debora Revoltella.

www.eib.org/economics

About the European Patent Oce

The European Patent Oce was created in 1977. As the executive arm of the European Patent

Organisation, it is responsible for examining European patent applications and granting

European patents, which can be validated in up to 44 countries in Europe and beyond. As the

patent oce for Europe, the EPO is committed to supporting innovation, competitiveness

and economic growth across Europe by delivering high-quality products and services and

playing a leading role in international co-operation on patent matters. The EPO is also one

of the world's main providers of patent information. As such, it is uniquely placed to observe

the early emergence of technologies and follow their development over time. The analyses

presented in this study are a result of this monitoring.

4

Table of contents

Foreword 2

List of tables and figures 6

List of abbreviations 8

List of countries 8

Executive summary 9

Key findings 10

1. Introduction 15

2. 4IR patenting and the contribution of SMEs 22

3. Innovation and business profiles of 4IR SMEs 33

Case study: From the garage to the securities exchange 40

4. Market and IP positions 42

Case study: Broad patent protection paves the way to commercialisation 51

5. Investment activities 53

Case study: Strong patent position attracts major investment for growing SME 61

6. Financial profile and structural barriers 63

6.1 Funding 4IR SMEs 64

6.2 Structural barriers 67

Case study: From the lab to the market with a solid licensing strategy 69

6

List of tables and figures

Tables

Table 1.1 Overview of core technology fields 20

Table 1.2 Overview of enabling technology fields 20

Table 1.3 Overview of technology fields in application domains 21

Table 2.1 Top 4IR clusters in the EU27, 2010-2018 30

Table 3.1 Business models and deployment areas 39

Table A 2.1 Breakdown of the fieldwork outcome 83

Table A 2.2 Weights: global (adjustment between Europe and the US) 84

Table A 2.3 EIBIS at a glance 84

Table A 3.1 4IR-based indicators: country comparison 85

Figures

Figure E.1 Share of 4IR IPFs contributed by SMEs (average of years 2010-2018) 10

Figure E.2 Size and age of 4IR SMEs 11

Figure E.3 Share of investment related to 4IR technologies (in %) 12

Figure E.4 Geographical markets of 4IR SMEs in EU27 13

Figure E.5 Major obstacles of 4IR SMEs 14

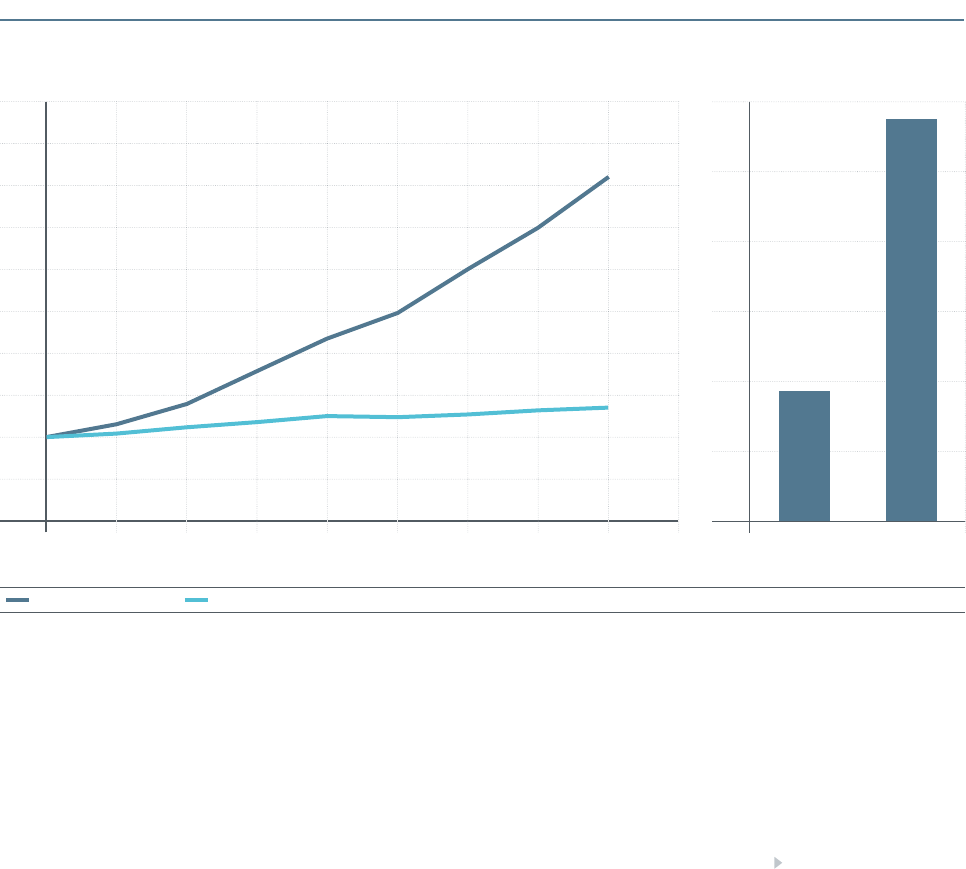

Figure 1.1 Global growth of IPFs in 4IR technologies versus all technologies and

the proportion they make up of all technologies (in %), 2010-2018 16

Figure 1.2 Top ten applicants in 4IR technologies (as a proportion of 4IR IPFs) 17

Figure 2.1 Number of 4IR IPFs by year and country/region, and their revealed

technology advantage (RTA) in 4IR technologies, 2010-2018 23

Figure 2.2 Contribution of SMEs to national 4IR IPFs, 2010-2018 25

Figure 2.3 Geographic origins of the 4IR SMEs 26

Figure 2.4 Number of 4IR IPFs originating from SMEs per million inhabitants and

specialisation (RTA) in 4IR technologies in selected countries 27

Figure 2.5 Proportion of 4IR IPFs originating from SMEs and specialisation (RTA) in

4IR technologies in selected countries 28

Figure 2.6 Location of 4IR SMEs in Europe 29

Figure 2.7 4IR activities and proportion of the population with strong digital skills 31

Figure 2.8 4IR activities and quality of digital infrastructure 32

Figure 3.1 Size and age of the 4IR SMEs 34

Figure 3.2 4IR innovation profile of European SMEs 35

Figure 3.3 Presence of core and enabling 4IR technologies in SMEs' patent portfolios 36

Figure 3.4 Implementation of 4IR technologies (proportion of firms in %) 37

Figure 3.5 Business models 38

Figure 4.1 Geographical markets for 4IR technologies 43

Figure 4.2 Scope of international patent protection 44

Figure 4.3 Market position of 4IR SMEs 45

Figure 4.4 Eect of 4IR technologies (net balance), by market position 46

Figure 4.5 Protection of intellectual assets 47

Figure 4.6 Average number of 4IR IPFs 48

Figure 4.7 Relevance of IP strategy for investors 49

Figure 4.8 Use of IP as collateral 50

Figure 5.1 Median investment intensity, in EUR 54

Figure 5.2 Proportion of investment related to 4IR technologies (in %) 55

Figure 5.3 Perceived investment gaps related to 4IR technologies 56

7

Figure 5.4 Investment outlook 57

Figure 5.5 Investment outlook, by past investment 58

Figure 5.6 Impact of the COVID-19 crisis on firms' turnover 59

Figure 5.7 Impact of the COVID-19 crisis on firms' innovation activities 60

Figure 5.8 Impact of the COVID-19 crisis on firms' innovation plans 60

Figure 6.1.1 Number of firms with and without funding, and proportion of firms

with formal funding 64

Figure 6.1.2 Funding received by funding stage, funding amount in thousand USD

(median) 65

Figure 6.1.3 4IR SMEs receiving funding, by investor type 66

Figure 6.2.1 Obstacles 67

Figure 6.2.2 Obstacles by size and age 68

Figure 6.2.3 Dierence between firms that feel they underinvested and others 68

Figure 7.1.1 Acquired start-ups, comparison to benchmark 72

Figure 7.1.2 Origin of the acquiring companies 73

Figure 7.2.1 Companies with IPO, comparison to benchmark 74

Figure 7.2.2 Location of the stock exchange for the IPO 74

Figure 8.1 Policy support 4IR SMEs considered most useful (in %) 77

8

List of countries

AT Austria

BE Belgium

CH Switzerland

CN People's Republic of China

DE Germany

DK Denmark

ES Spain

EU European Union

FI Finland

FR France

IE Ireland

IT Italy

JP Japan

KR Republic of Korea

NL Netherlands

NO Norway

PL Poland

SE Sweden

UK United Kingdom

US United States of America

List of abbreviations

4IR Fourth Industrial Revolution

AI Artificial intelligence

CAGR Compound annual growth rate

CATI Computer-assisted telephone interviews

CAWI Computer-assisted web interviews

EISMEA EU's Executive Agency for Small and Medium-sized Enterprises

EIB European Investment Bank

EIBIS EIB Investment Survey

EPC European Contracting States

(member states of the European Patent Organisation)

EPO European Patent Oce

EU27 The 27 European Union countries

GDP Gross domestic product

ICT Information and communication technologies

IoT Internet of Things

IP Intellectual property

IPFs International patent families

IPO Initial public oering

PROs Public research organisations

R&D Research and development

RTA Revealed technology advantage

SMEs Small and medium-sized enterprises

VC Venture capital

9

Back to contents

Executive summary

In recent years, the Fourth Industrial Revolution (4IR) has

massively accelerated the process of digital transformation.

Technologies such as the Internet of Things (IoT), cloud

computing, 5G and artificial intelligence (AI) are already

altering the way we live, work and interact. By paving the

way for a data-driven economy, they are disrupting many

European industries. As one of the six headline priorities

of the EU Commission's 2020 Work Programme, its digital

strategy is designed to keep Europe on a par with the

rapid pace of 4IR innovation observed in the US and Asia.

By enabling “a vibrant community of innovative and

fast-growing start-ups and small businesses to access finance

and to expand”, it specifically aims to foster the emergence

of new European players in the global race to digital

transformation.

Aim of the study

This study seeks to guide policymakers, industry and

the public in this endeavour by providing a comprehensive

inventory and analysis of SMEs that have been developing

4IR technology over the past decade. It focuses on deep

tech SMEs that have actively patented 4IR technologies,

as opposed to the larger population of small businesses

that are simply implementing and making use of such

technologies. By benchmarking these companies against

their counterparts in the US and other European countries,

the study provides insight into the specific challenges

of growing deep tech businesses in Europe for

decision-makers in the public and private sectors, as

well as investors.

10

Back to contents

– Relative to their size, smaller EU countries like Finland,

Sweden, Ireland and Denmark are outperforming

other EU member states and even the US. The

particularly high concentration of 4IR SMEs in Finland

and Sweden denotes the existence of strong local

ecosystems, including world-class 4IR companies.

Outside the EU, Switzerland and Norway have a

relatively high concentration of 4IR SMEs.

– In the EU27, over 2 600 European SMEs generated

3 181 international patent families (IPFs

1

) related to

4IR technologies between 2010 and 2018, contributing

10% of the EU's 4IR patenting in that period. Despite

the overall lower proportion of SMEs in the US economy,

there are about twice as many SMEs with 4IR IPFs in the

US. They contributed 16% of US 4IR patenting in the same

period and have significantly larger 4IR patent portfolios

on average.

– Within the EU, Germany (570), France (400) and Italy (273)

have the largest number of 4IR SMEs – most of which

are, in fact, concentrated in a limited number of regions

(such as the greater Munich and Paris areas). Outside the

EU, the UK has the largest number of 4IR SMEs (950).

1 Each international patent family (IPF) covers a single invention and includes

patent applications filed and published at several patent oces. It is a reliable

proxy for inventive activity because it provides a degree of control for patent

quality by only representing inventions for which the inventor considers the value

sucient to seek protection internationally. The patent data presented in this

report refer to IPFs.

EU US

Figure E1

Share of 4IR IPFs contributed by SMEs (average of years 2010-2018)

% %

Source: Crunchbase and Orbis, authors' calculation.

Key findings

There are twice as many SMEs with an international

portfolio of 4IR patents in the US than in the EU27,

adding to the overall leadership of the US in advanced

digital technologies.

11

Back to contents

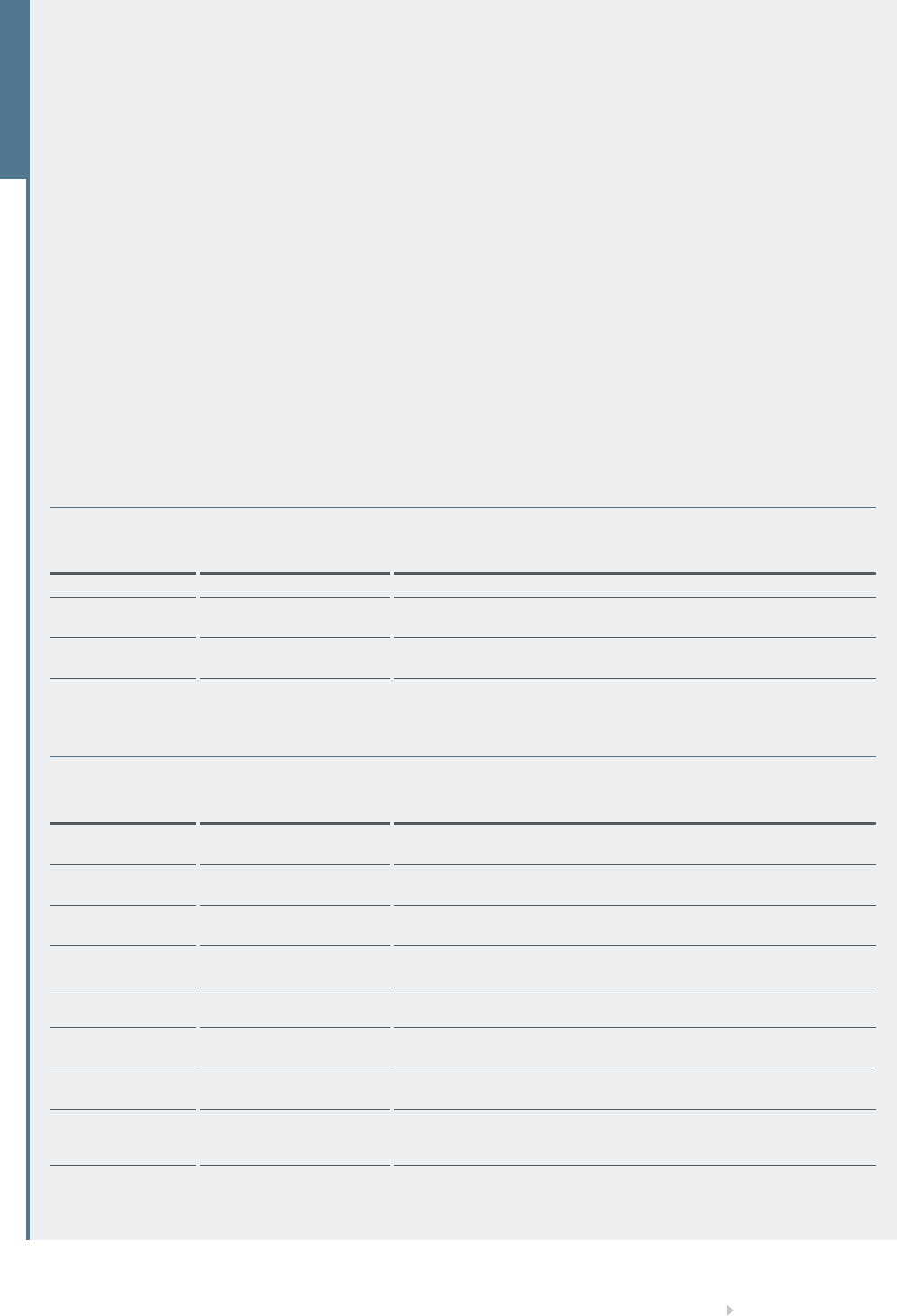

%

%

%

%

Although 80% of EU 4IR SMEs have 50 employees or less,

only 41% have been operating for ten years or less, in line

with the long development cycles typically observed in

deep tech. US 4IR SMEs have a similar age/size distribution

but tend to focus more on core hardware, software and

connectivity technologies.

– Almost 60% of EU 4IR SMEs plan to invest more in

4IR-related innovation in the future, while almost

25% regard their current investment as insucient.

However, the current COVID-19 pandemic has had a

negative impact on the turnover of more than half of

EU 4IR SMEs.

– Over 90% of the EU's 4IR SMEs have already

implemented their 4IR technologies in products and

services or in their own business, with applications

spanning the healthcare, transport and cleantech

sectors, as well as data analytics. In addition, 4IR SMEs

are more likely (44%) to be involved in manufacturing

hardware products (developing, building and selling

physical devices) than other SMEs.

– More than a third of the EU27 and US SMEs have filed

patent applications related to data mining and

exploration. The patents filed by US 4IR SMEs are also

frequently related to core hardware, software and

communication technologies. 4IR SMEs in Finland and

Sweden likewise stand out with an even stronger focus

on core hardware and communication technologies.

Small (1-50 employees) Large (51-250 employees) Young (10 years or less) Old (older than 10 years)

Source: Orbis and Crunchbase, authors' calculation.

Figure E2

Size and age of 4IR SMEs

12

Back to contents

EU 4IR SMEs show a higher investment intensity than other

EU SMEs, with up to 70% of total investment targeted at

4IR innovations among young 4IR SMEs.

– However, the proportion of these 4IR start-ups

reporting formal funding sources is higher in the US (68%)

than in the EU (59%). In addition, more EU27-based 4IR

start-ups rely on public funding.

– Almost half of all 4IR SMEs (49%) consider patents as

very important to secure financing and a large majority

(80%) report that IP strategy was of relevance to their

investors.

– About 70% of total investment by young 4IR SMEs in the

US and EU was specifically targeted at 4IR innovation.

For 4IR firms operating for more than 10 years, this

proportion drops to less than 50% in the EU27 and less

than 60% in the US.

– On average, the subgroup of 4IR SMEs from the US and

Europe listed on Crunchbase, one of the largest start-up

repositories, received significantly higher funding than

a benchmark group of SMEs, especially during the build

and growth stages.

Figure E3

Share of investment related to 4IR technologies (in %)

Share of Ivestment (in %)

%

%

%

%

%

%

%

%

EU US EU US

Young Old

%

%

%

%

Source: 4IR survey.

Base: Firms that invested in innovation (excluding don't know / refused responses).

13

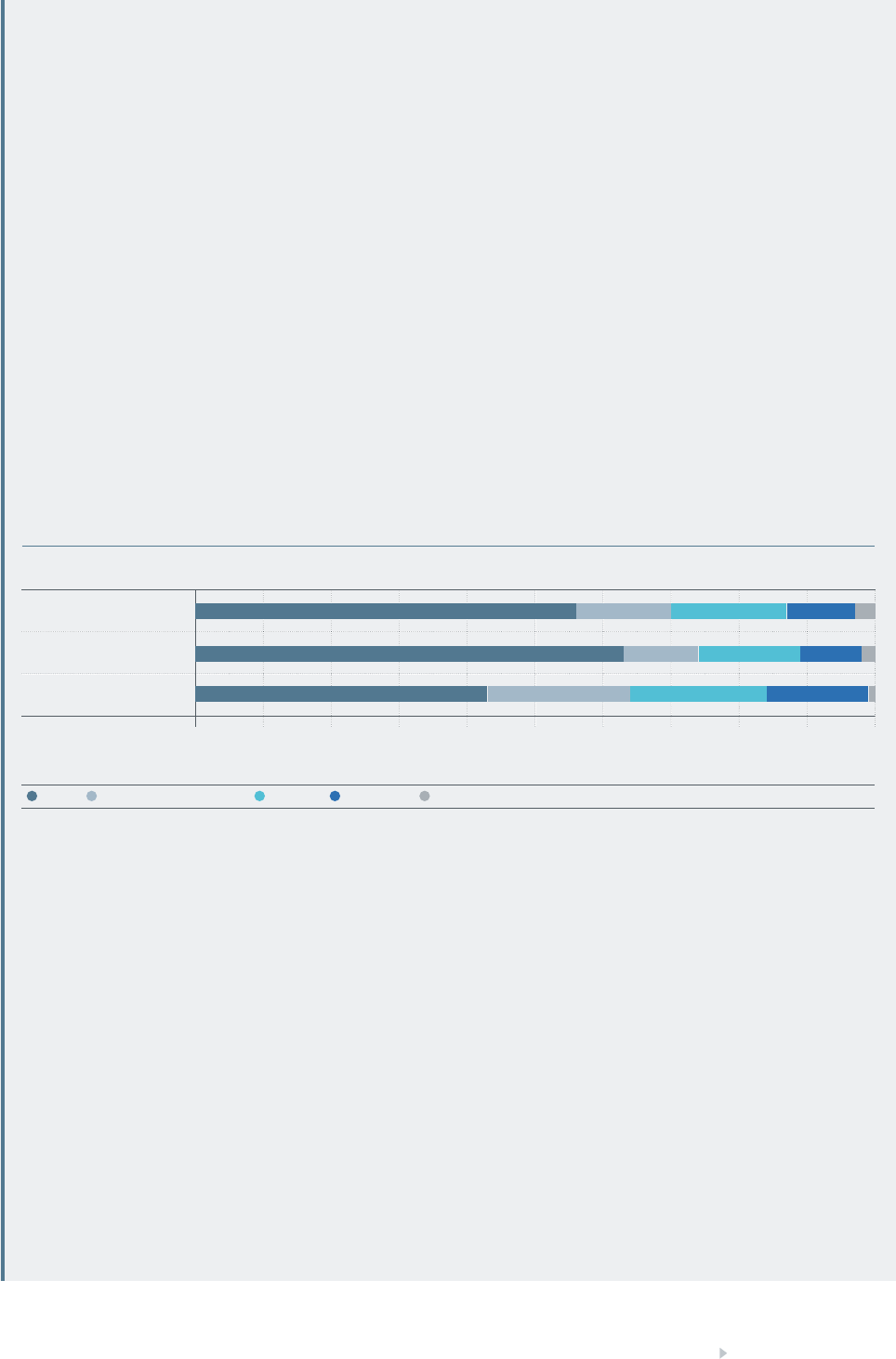

Back to contents

More than every second 4IR SME in the EU sees its future

primary market in Europe.

– European 4IR SMEs listed on Crunchbase are almost

twice as likely to be acquired than a benchmark group

of European SMEs (15% vs 8%), and more than every

third EU 4IR SME is acquired by a US company.

– Currently, 32% of EU SMEs are still focused primarily

on operations in their home country. However, their

growth plans tend to be targeted towards the European

market (57%), as also reflected in the geographical scope

of their patent portfolios. By contrast, US 4IR SMEs cite

the entire US domestic market as a priority for both

current and future growth, as well as for patent filings.

– While only about one in ten US SMEs sees their future

primary market in Europe, more European firms regard

the US as their future primary market (24% of EU27). In

particular, the EU27 SMEs considered to be dominant

players in their market report more frequently that they

expect the US to be a future primary market (38%).

Current primary market Future primary market

Home country Europe US Other

Source: 4IR survey.

Base: 4IR innovators in 4IR survey (excluding don't know / refused / no obstacle responses).

Note: Europe is defined as all EPC member states, including the EU27, the UK, Switzerland, Norway and other countries.

Figure E4

Geographical markets of 4IR SMEs in EU27

%

%

%

%

%

%

%

%

14

Back to contents

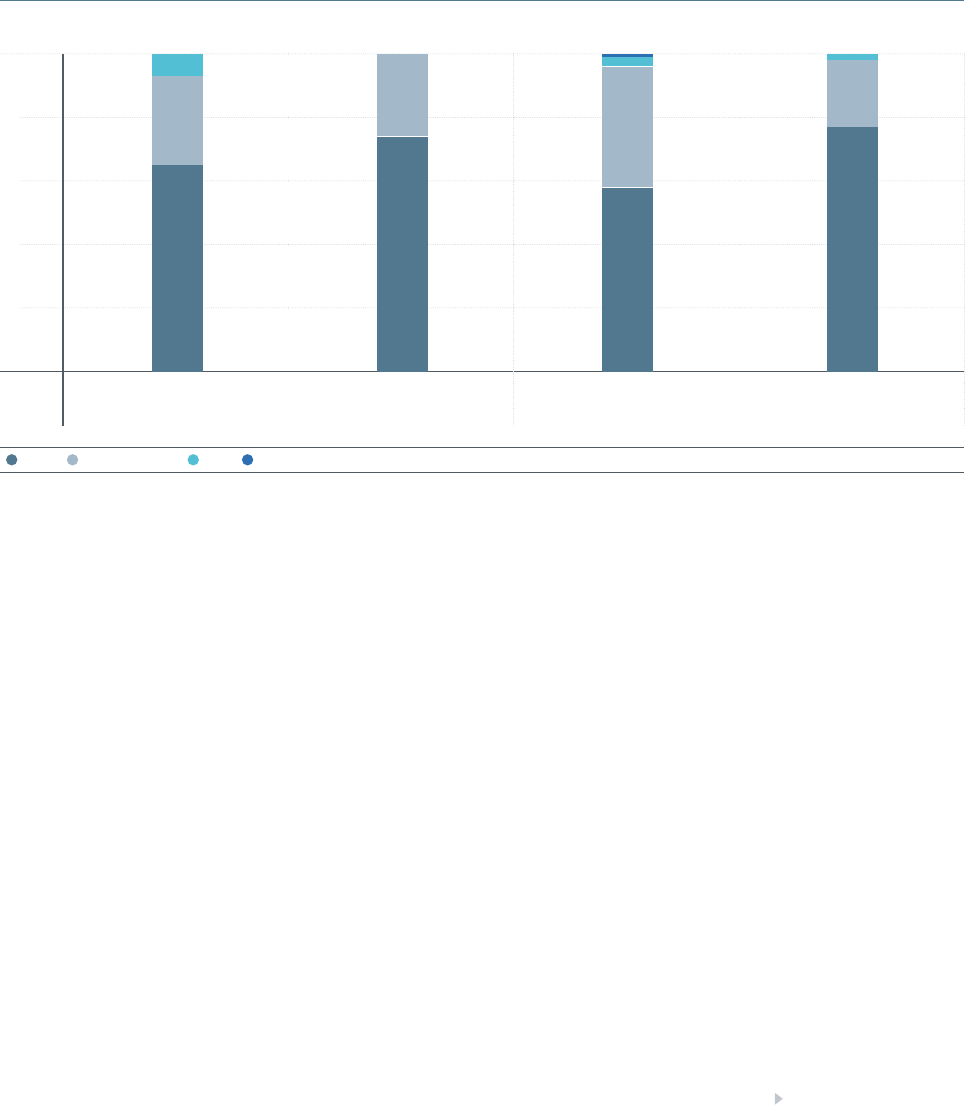

A large proportion of 4IR SMEs in both the EU and US cite

the availability of finance (73% and 77% respectively) and

the availability of sta with the required technical skills

(73% and 76% respectively) as business barriers.

– The most cited policy support that would encourage

SMEs to further introduce or develop 4IR technologies

is the availability of finance (54% of the youngest and

smallest firms indicate that this is the most helpful

support).

– Compared with other categories of SMEs, 4IR SMEs also

report the availability of finance more frequently as a

major issue. By contrast, the lack of technical skills and

other obstacles are less likely to be deemed a severe

issue by 4IR SMEs than by other SMEs.

– More than half of US and EU 4IR SMEs complain about

the availability of government support, although EU

4IR SMEs are liable to consider this to be a major

obstacle to their activities.

Policy perspective

– Fostering the 4IR innovations of small businesses,

together with digital skills and infrastructure, should

be a policy priority to ensure Europe's competitiveness

in advanced digital technologies.

– The creation of the Unitary Patent will support the

growth of 4IR SMEs in Europe by helping them secure

patent protection in a larger number of national

markets.

– Direct policies (such as targeted grants or early-stage

deployment policies) provide a tool to foster innovation

in technologies that have not yet become cost-eective.

– Access to adequate growth funding remains insucient

to enable scale-up and thereby develop more global

4IR leaders. Further development of the European

start-up ecosystem is needed to enable larger funding

rounds (in particular for the later stages) and make

listing start-ups on European stock markets an

attractive option.

Figure E5

Major obstacles of 4IR SMEs

Share of firms (in %)

%

%

%

%

%

%

EU US EU US

Availability of finance Availability of staff with the required technical skills

Major EU Major US Major EIBIS EU Major EIBIS US

Source: 4IR survey, EIBIS (2021).

Base: 4IR innovators in 4IR survey, SMEs in EIBIS (excluding don't know / refused / no obstacle responses).

%

%

%

%

16

Back to contents

1. Introduction

In recent years, the Fourth Industrial Revolution (4IR) has

been driving the digital transformation. Characterised by a

combination of technologies that blurs the lines between

the physical and digital spheres, it is altering the way we live,

work and interact, and has already disrupted many industries.

According to a 2020 study by the European Commission,

over 29 billion devices will be connected to Internet

Protocol networks across the globe by 2023, most of which

will be creating data in real time. Once combined with other

technologies, such as artificial intelligence (AI), big data,

advanced robotics, the Internet of Things (IoT), cloud

computing or 3D printing, they enable the automation of

entire business processes, including repetitive intellectual

tasks previously performed by humans. It is estimated that

the cumulative additional GDP contribution of these new

digital technologies could amount to EUR 2.2 trillion in the

EU alone by 2030, a 14.1% increase from 2017.

This revolution is primarily driven by innovation in

technology, as illustrated by the impressive growth of

worldwide patent applications in this field (EPO, 2020). The

pace of international patenting related to smart connected

objects accelerated strongly during the last decade, with an

average annual growth rate in patenting close to 20% from

2010 to 2018, compared with 12.8% between 2000 and 2009.

The annual increase in international patent families (IPFs)

2

for 4IR technologies has been nearly five times greater than

the growth of IPFs in all fields since 2010 (4.2%). As a

result, smart connected objects accounted for more than

11.5% of all patenting activity worldwide in 2018 (with

nearly 40 000 new IPFs in 2018 alone), pervading most

sectors of the economy (Figure 1.1).

2 Each international patent family (IPF) covers a single invention and includes

patent applications filed and published at several patent oces. It is a reliable

proxy for inventive activity because it provides a degree of control for patent

quality by only representing inventions for which the inventor considers the value

sucient to seek protection internationally. The patent data presented in this

report refer to IPFs.

Figure 1.1

Global growth of IPFs in 4IR technologies versus all technologies and the proportion they make up of all technologies (in %),

2010-2018

%

%

%

%

%

%

%

%

%

Earliest publication year

%

%

%

%

%

%

.%

.%

IPFs in 4IR technologies IPFs in all technologies

Source: EPO, authors' calculation

17

Back to contents

Leading innovators in these technologies are already shaping

the data-driven economy for the years to come. Meanwhile,

others may struggle or even disappear in the wake of 4IR

disruptions. Despite being a significant contributor to 4IR

innovation (with about 15% of 4IR IPFs between 2010 and

2018), the EU27 lacks specialisation in the field. It also has

few of the major digital companies that have been driving

4IR transformations thus far (Figure 1.2). The top ten 4IR

applicants in the period 2010-2018 (together accounting for

nearly a quarter of all IPFs) include only two European

companies (Ericsson and Nokia), compared with four firms

in the US (Qualcomm, Intel, Microsoft and Apple). Besides

ensuring that its established industries successfully seize the

opportunities oered by 4IR technologies, one of the EU's

key challenges is therefore to foster the rapid emergence

of new, innovative players that can strengthen Europe's

position in the global race to digital transformation.

Against this backdrop, the European digital strategy aims

to "enable a vibrant community of innovative and

fast-growing start-ups and small businesses to access

finance and to expand".

3

This objective is particularly

relevant for the deep tech SMEs that are developing

patentable 4IR technology. While deep tech innovators

typically have strong disruptive potential, they face specific

issues such as higher development costs and market and

technological risks. Most recently, these challenges have

been compounded by the COVID-19 pandemic, underlining

the need for appropriate measures to support the funding

and growth of 4IR SMEs in Europe.

3 See "Factsheet: Shaping Europe's Digital Future", European Union 2020.

Figure 1.2

Top ten applicants in 4IR technologies (as a proportion of 4IR IPFs)

Samsung [KR] Qualcomm [US] Huawei [CN] Nokia [FI] Apple [US]Ericsson [SE]

LG [KR]

Sony [JP]

Intel [US] Microsoft [US]

Source: EPO, authors' calculation.

.%

.% .% .% .%

.% .% .% .% .%

18

Back to contents

About this study

The purpose of this study is to provide a comprehensive

inventory and analysis of SMEs that invest in the

development of new 4IR technologies in the EU27. The

study quantifies and analyses the contribution made by

these small businesses to the EU's performance in 4IR

innovation over the past decade. By benchmarking these

companies against similar 4IR businesses in the US and other

European countries, it aims to inform policymakers, private

decision-makers and investors about the specific challenges

of growing deep tech businesses within Europe.

Strict emphasis is placed on SMEs that have been actively

patenting 4IR technologies, as opposed to the larger

population of small businesses that are simply implementing

and applying the technologies. These deep tech SMEs

typically rely on recombining existing technologies or

leveraging emerging technologies rooted in science and

advanced engineering that oer significant advances over

those currently in use. As a result, they also often face higher

upfront R&D investment and a longer transition period from

research to actual industry applications. Patent protection

is instrumental in securing the legal exclusivity needed to

develop and bring new technology to market.

The study documents the distribution and profiles of

European 4IR SMEs across EU27 countries and benchmarks

them against their counterparts in the US – historically,

the leading country in the field – as well as other European

countries that are not part of the EU27. To this end, it

exploits a holistic set of indicators spanning the business

and IP strategies, development trajectories, funding and

financial performance of the SMEs. Throughout the analysis,

particular attention is paid to the SMEs' plans to grow and

commercialise 4IR technologies, and to the factors impacting

their ability to fulfil those plans. Furthermore, 4IR SMEs are

compared with the SMEs interviewed in the EIB Investment

Survey (EIBIS), highlighting the obstacles they face compared

with their peers.

19

Back to contents

Methodology

The analysis is based on the systematic identification of

small businesses in Europe and the US that have been filing

international patent applications for inventions related to

4IR technologies. The identification of 4IR inventions in

patent data is based on expert searches by EPO examiners

focusing on all types of inventions relevant to smart

connected objects. The focus on international patent

families (IPFs, i.e. inventions for which patent protection

has been sought in at least two distinct jurisdictions)

ensures that the selection of SMEs is based on inventions

with a confirmed potential for commercialisation on an

international scale. It also enables sound comparisons

between populations of SMEs with 4IR patenting activities

in dierent countries.

BOX 1

For the purpose of the analysis, data on 4IR patents were

matched to company data from the ORBIS and Crunchbase

databases (see Box 3 and Annex 1 for more information)

in order to retrieve employment and financial data. The

matched dataset of 10 126 companies was also used as

a source sample to carry out a survey of 4IR SMEs in

Europe (including member states of the European Patent

Convention that are not part of the EU) and the US

(see Box 3 and Annex 1). Some 625 firms provided complete

interviews. All selected firms have fewer than 250 employees.

The aim of the interview was to ask firms about their

business activities and markets, as well as what hampers

their growth. Results from this survey form the basis of

the report and are complemented where relevant by those

directly derived by analysing the source dataset of matched

patent-company data.

Outline

The report contains nine sections. It first looks at where

SMEs stand in terms of deep tech innovation and reviews

their business profiles. Then it elaborates on the 4IR SMEs'

market and IP position, and investment activities. Next, the

report shows the investment activities and funding profiles

of 4IR SMEs, concluding with policy recommendations.

About patents and patent information

Patents are exclusive rights for inventions that are new

and innovative. High-quality patents are assets for

inventors because they can help attract investment,

secure licensing deals and provide market exclusivity.

Patents are not secret. In exchange for these exclusive

rights, all patent applications are published, revealing

the technical details of the inventions in them.

Patent databases therefore contain the latest technical

information, much of which cannot be found in any other

source and is freely available for independent research

purposes. The EPO's free Espacenet database contains

more than 120 million patent documents from around

the world and comes with a machine translation tool

in 32 languages. This patent information provides early

indications of technological developments that are bound

to transform the economy, revealing how innovation is

driving the Fourth Industrial Revolution.

20

Back to contents

BOX 2

Technologies for the Fourth Industrial Revolution (4IR)

The second sector encompasses enabling technologies

that build upon and complement the core technologies.

These enabling technologies can be used for multiple

applications. They have been subdivided into eight

technology fields (Table 1.2).

The third sector, application domains, encompasses the

final applications of 4IR technologies in various parts of

the economy. It has been broken down into eight dierent

technology application fields (Table 1.3).

4IR inventions can be relevant to one or more technology

fields within one or more technology sectors, combining

features of several 4IR technologies and forming a bridge

technology between dierent 4IR building blocks.

4IR technologies comprise inventions that are related

to smart connected devices and combine computing,

connectivity and data exchange. These 4IR inventions

are further divided into three main sectors, namely "core

technologies", "enabling technologies" and "application

domains", each of which is subdivided into several

technology fields.

The first sector, core technologies, corresponds to the

basic building blocks upon which the technologies of

4IR are built. It consists of inventions that directly

contribute to the three established fields of information

and communication technologies (ICT) inherited from the

previous industrial revolution: IT hardware, software and

connectivity. The table gives a short definition of these

core technology fields.

Table 1.1

Overview of core technology fields

Field Definition Examples

IT hardware Basic hardware technologies Sensors, advanced memories, processors, adaptive displays, smart instruments

Software Basic software technologies Intelligent cloud storage and computing structures, adaptive databases, mobile

operating systems, virtualisation and blockchain technologies

Connectivity Basic connectivity systems Network protocols for massively connected devices, adaptive wireless data

systems for short-range and long-range ommunication

Table 1.2

Overview of enabling technology fields

Field Definition Examples

Data management Technological means to

create value from data

Diagnostic and analytical systems for massive data, prediction and forecasting

techniques, monitoring functions, planning and control systems

User interfaces Enabling the display and

input of information

Virtual reality, augmented reality, speech recognition and synthesis

Core AI Enabling machine

understanding

Machine learning, neural networks, statistical and rule-based systems,

AI platforms

Geo-positioning Enabling the determination

of the position of objects

Enhanced geo-location and satellite navigation, device to device relative and

absolute positioning

Power supply Enabling intelligent power

handling

Automated generation, situation-aware charging systems, shared power

transmission and storage objectives, smart power-saving management

Data security Enabling the security of data Adaptive security systems for devices, services and data transmission

Safety Enabling safety or physical

objects

Intelligent safety systems for theft and failure prevention

Three-dimensional

support systems

Enabling the realisation of

physical or simulated

D systems

D printers and scanners for parts manufacture, automated D design and

simulation, D user interfaces

21

Back to contents

Table 1.3

Overview of technology fields in application domains

Field Definition Examples

Consumer goods Applications pertaining

to the individual

Personal health monitoring devices, smart wearables, smart entertainment and

sport devices, smart toys and textiles

Home Applications for the home

environment

Smart homes, alarm systems, intelligent lighting and heating, consumer

robotics, climate control systems

Vehicles Applications for moving

vehicles

Autonomous driving, vehicle fleet navigation devices

Services Applications for business

enterprise

Intelligent retail, payment and loyalty systems, smart offices

Industrial Applications for industrial

manufacture

Smart factories, intelligent robotics, energy saving

Infrastructure Applications for

infrastructure

Intelligent energy distribution networks, intelligent transport networks,

intelligent lighting and heating systems

Healthcare Applications for healthcare Intelligent healthcare systems, robotic surgery, smart diagnosis

Agriculture Applications for agriculture Climate monitoring systems, greenhouse automation, smart crop and cattle

management, smart farming

23

Back to contents

2. 4IR patenting and the contribution of

SMEs

Between 2010 and 2018, almost 200 000 4IR inventions

were submitted for international patent protection globally.

In 2018, they represented more than one tenth of IPFs in all

technologies (see Figure 1.1 above). The US was the strongest

contributor with 31% of all 4IR IPFs, followed by Japan (18%)

and Europe (15% for the EU27 and 19% for the 38 EPC countries).

R. Korea (12%) and P.R. China (11%) have been catching up

quickly over the last decade.

Of the top five innovation centres, Europe has the lowest

specialisation in 4IR technologies over the period 2010-2018

(Figure 2.1). The US shows the highest specialisation with a

revealed technology advantage (RTA)

4

value of 1.5, meaning

that its proportion of 4IR technologies is 50% higher than its

contribution to IPFs in technologies overall.

4 The revealed technology advantage (RTA) index indicates a country's specialisation

in terms of 4IR technology innovation relative to its overall innovation capacity. It

is defined as the proportion of IPFs a country has in a particular field of technology

divided by the proportion of IPFs a country has in all fields of technology. An RTA

above one reflects a country's specialisation in a given technology.

Figure 2.1

Number of 4IR IPFs by year and country/region, and their revealed technology advantage (RTA) in 4IR technologies, 2010-2018

US Europe (EPC) JP CN KR EU27

Source: EPO, authors' calculation.

Note: The right panel shows the average RTA for the period 2010-2018.

,%

,%

US

Europe (EPC)

EU

JP

KR

CN

.

.

.

.

.

.

Earliest publication year

24

Back to contents

BOX 3

Methodology and data sources

5

Orbis is Bureau van Dijk's flagship company database,

providing information on close to 400 million listed and

unlisted companies and entities worldwide, of which

68 million are in North America and 122 million in Europe.

It contains detailed financial information and extensive

corporate ownership structures. Data are collected from

more than 170 providers around the world, treated,

appended and standardised to make them more

comprehensive and comparable. The version used for

this study was downloaded in January 2021. Where

information was available, the European definition was

applied to identify SMEs

6

, otherwise the 250-employee

threshold was used. Manual checks were performed as

necessary. Companies that have been operating for over

50 years were not considered.

Crunchbase is a commercial database of innovative

start-ups and scale-ups maintained by US company

Crunchbase Inc. The data are sourced through two main

channels: a large network of global investment firms

and direct contributions from executives, entrepreneurs

and investors who update and revise the company

profile pages. The database version used for this study

(downloaded in March 2021) lists more than 13 800

dierent firms operating in the 37 countries covered in

this study. For every company, the database reports both

the foundation year and the date on which the firm first

registered on Crunchbase. Crunchbase is increasingly

being used by the venture capital industry as a data

source. Where information was available, the European

definition was applied to identify SMEs, otherwise the

250-employee threshold was used. Manual checks were

performed as necessary. Companies that have been

operating for over 50 years were not considered.

5 More detailed information can be found in Annexes 1-3.

6 See https://ec.europa.eu/growth/smes/sme-definition_en.

The 4IR survey

The main goal of the survey was to collect information on

small and medium-sized enterprises (SMEs) in Europe and

the US that are developing and/or applying technology

in the 4IR category. To achieve this, the population was

regarded as comprising all SMEs identified as applicants of

an international patent family in the 4IR category in recent

years. Finally, N=625 complete interviews were held with

the target population between June and October 2021.

The interviews, N=455 companies from Europe and N=170

companies from the US, were conducted using mixed

methods, namely computer-assisted telephone and web

interviews. For the analysis, 27 interviews (14 in Europe

and 13 in the US) were discarded as the firms had not

carried out any development work in 4IR technologies

over the past three years.

EIBIS

The EIB carries out an annual survey of firms in the EU27,

UK and US with the aim of monitoring investment and

investment finance activities, while at the same time

capturing potential obstacles to investment. The survey

covers approximately 12 500 companies across the EU and

the UK every year, with just over 800 firms in the US for

the last three waves. It is administered by telephone (in

the local language) and takes an average of 20 minutes.

The first wave of the survey took place in 2016 and the

survey completed its sixth wave in 2021, with interviews

being held between April and July 2021. The results of

the latest wave are used as comparison benchmarks.

25

Back to contents

During the same period 2010-2018, over 2 600 SMEs located

in member states of the EU contributed 3 117 IPFs related

to 4IR technologies, representing 10% of the EU total

(Figure 2.2). Their patenting activities increased rapidly, at

a compound average growth rate (CAGR) of 17% during

this period.

7

7 The CAGR is the rate of return that would be required for an investment to grow from

its beginning balance to its final one. See above note for the EU definition of SMEs.

In comparison, the US is home to twice as many 4IR SMEs as

the EU27, with a total of 6 157 4IR SMEs. This is remarkable

since, overall, fewer SMEs are based in the US than in the EU

(see EIB, 2021). US 4IR SMEs contributed 16% to their country's

total innovation output in 4IR technologies between 2010

and 2018; this figure is also significantly higher than their

EU27 counterparts and adds to the overall US leadership in

4IR technologies. However, the number of 4IR IPFs from SMEs

rose less dynamically than in Europe, with a CAGR of 15%. As

a result, the contribution of SMEs to national 4IR patenting

decreased in the US from 17% in 2010 to 13% in 2018, while

increasing from 9% in 2010 to 11% in 2018 in the EU.

Figure 2.2

Contribution of SMEs to national 4IR IPFs, 2010-2018

Proportion of 4IR IPFs contributed by SMEs (average of years 2010-2018)

EU US

% %

Number of 4IR IPFs contributed by SMEs

EU27 Other Europe US

Source: Crunchbase and Orbis, authors' calculation.

Base: 10 126 4IR SMEs and 14 350 4IR IPFs with earliest publication year between 2010 and 2018.

26

Back to contents

Most EU-based 4IR SMEs are located in the three largest

member states, Germany (570), France (400) and Italy (273)

(Figure 2.3). Scandinavian countries also have a significant

number of 4IR SMEs, especially Finland (271) and Sweden

(240). Poland is the only Eastern European country in the top

15, with 31 4IR SMEs. In non-EU European countries, SMEs

contributed 1 458 IPFs, largely due to the performance of

companies in the UK, Switzerland and Norway. The UK in

particular has by far the largest number of 4IR SMEs, almost

950. With 254 and 117 4IR SMEs respectively, Switzerland and

Norway have comparable numbers to Sweden and Denmark.

Figure 2.3

Geographic origins of the 4IR SMEs

UK

DE

FR

IT

FI

CH

SE

NL

ES

NO

DK

BE

AT

IE

EU27 Other Europe US

Source: Crunchbase and Orbis, authors’ calculation

Note: Only countries with at least 100 SMEs are shown in the right panel.

27

Back to contents

Figure 2.4 provides further insight into the links between

the 4IR specialisation of selected countries in 4IR patenting

(RTA) and the number of 4IR SME patents per capita in those

countries. It suggests a positive correlation between both

indicators, with countries that show overall excellence

in 4IR technologies also demonstrating stronger SME

performance in 4IR innovation. A few EU countries, namely

Finland, Sweden and Ireland, clearly stand out in this respect,

with Sweden and Finland even outperforming the US. By

contrast, larger countries such as Germany or France exhibit

both a lack of 4IR specialisation and relatively low SME

impact in 4IR patenting.

Figure 2.4

Number of 4IR IPFs originating from SMEs per million inhabitants and specialisation (RTA) in 4IR technologies in

selected countries

Number of IR SME patents per million inhabitants

. . .

RTA in IR technologies (-)

Source: Orbis and Crunchbase, authors` calculation.

Population data for 2020 were retrieved from the World Bank.

CH

NO

DK

AT

BE

DE

ES

IT

PL

UK

NL

IE

US

SE

FI

Europe (EPC)

EU

FR

28

Back to contents

Figure 2.5 in turn compares the countries' specialisation in

4IR patenting with the proportion of their 4IR IPFs contributed

by SMEs. It shows that SME contribution to overall 4IR

patenting is actually lower in countries that are highly

specialised in 4IR technologies – such as Finland and Sweden

– although the correlation is lower than in Figure 2.4 above.

This is due to the significant contribution to 4IR patenting in

these countries of other parties in the innovation ecosystem,

such as large companies or universities. For instance, Finland

and Sweden are the only two EU countries to host some of

the top ten 4IR applicants globally,

8

like the US. These large

companies contribute to the strength of local innovation

ecosystems reducing the proportion of 4IR patents

contributed by SMEs. The same pattern applies to the US,

where large companies and SMEs both contribute to the

country's specialisation in 4IR technology. In contrast, small

countries like Switzerland, Norway and Denmark reveal a

relative lack of specialisation in 4IR technologies, despite the

strong performance of local SMEs (Figure 2.4). This is likely

due to the low contribution of large companies to 4IR

patenting, as evidenced by the very high proportion of

4IR SME patenting in those countries (Figure 2.5).

8 Namely Nokia in Finland and Ericsson in Sweden, see Figure 1.2.

Proportion of IR patents originating from SMEs (-)

%

%

%

%

%

%

%

%

%

. . .

RTA in IR technologies (-)

Source: Orbis and Crunchbase, authors' calculation.

Population data for 2020 were retrieved from the World Bank.

NO

CH

AT

IT

ES

BE

UK

IE

DK

FR

Europe (EPC)

EU

DE

NL

US

SE

FI

Figure 2.5

Proportion of 4IR IPFs originating from SMEs and specialisation (RTA) in 4IR technologies in selected countries

29

Back to contents

As illustrated in Figure 2.6, along with larger companies

and research institutions, 4IR SMEs tend to congregate in

regional clusters that provide a large pool of technical and

entrepreneurial specialists, investors and business partners.

The most important clusters are shown in Table 2.1, together

with further information on their respective leading

4IR companies, research institutions and technology

specialisation. Besides Sweden (Stockholm and Malmö

regions) and Finland (Helsinki region), two main EU clusters

are located in Germany (around Munich and Stuttgart), one

in France (Paris), and one in the Netherlands (Eindhoven).

The greater London area also appears as a major 4IR cluster

outside the EU.

Figure 2.6

Location of 4IR SMEs in Europe

Source: Crunchbase and Orbis, authors' calculation.

30

Back to contents

Table 2.1

Top 4IR clusters in the EU27, 2010-2018

Cluster

(country)

Global proportion

of 4IR IPFs (CAGR)

RTA* > 1.5 Top 4IR applicants**

(% of 4IR IPFs)

Proportion of IPFs from

research institutions

Top research

institution

London (UK) .%

(.%)

Core AI Sony (%) .% University of

London

Eindhoven (NL) .%

(.%)

Core AI,

D systems,

healthcare,

agriculture

Philips (%),

Signify (%)

.% Eindhoven

University of

Technology

Munich (DE) .%

(.%)

Position

determination,

data security,

D systems,

vehicles

Siemens (%),

Volkswagen group (%),

BMW (%)

.% Fraunhofer

Stockholm (SE) .%

(.%)

Connectivity,

power supply,

agriculture

Ericsson (%),

Volkswagen group (%)

.%*** Fraunhofer***

Paris (FR) .%

(.%)

Data security,

safety,

vehicles,

infrastructure

Nokia (%),

Valeo (%)

.% CEA

Stuttgart (DE) .%

(.%)

Data management,

geo-positioning,

vehicles,

industrial

Robert Bosch (%),

Nokia (%),

SAP (%)

.% Karlsruhe

Institute of

Technology

Helsinki (FI) .%

(.%)

Connectivity,

power supply,

data security

Nokia (%),

Ericsson (%)

.% Valtion

Teknillinen

Tutkimuskeskus

Malmö (DK/SE) .%

(.%)

Power supply Sony (%),

Ericsson (%))

.%*** Danmarks Tekniske

Universitet

Source: EPO (2020)

*

The RTAs in each 4IR sector and field are calculated as the proportion of an innovation centre's IPFs in that sector or field, divided by the proportion of the same innovation

centre's IPFs in all 4IR technologies.

**

The top three corporate applicants in each cluster are shown in this column, provided they contributed more than 5% of the cluster's 4IR IPFs. Their respective proportions of IPFs

in the cluster are also reported.

***

Due to the system of professors' privilege in Sweden, most IPFs originating from academic inventors are attributed to the individual inventors and not to the research institutions

that employ them. Such IPFs are not included in the proportion of IPFs originating from universities and PROs. This explains why a non-Swedish organisation (Fraunhofer) appears

as the top research institution in Stockholm according to our data.

31

Back to contents

The availability of people with digital skills may foster

innovation in 4IR. Firms operating in countries where a

greater proportion of the population have above-average

digital skills tend to have a higher RTA in 4IR (Figure 2.7)

and more 4IR SMEs per capita. Reaping the benefits of

digitalisation will require improvements in education

and vocational training.

Figure 2.7

4IR activities and proportion of the population with strong digital skills

RTA in IR technologies (-)

.

.

% % % % % %

Proportion of the population with above-average digital skills (in %)

Number of IR SMEs per million inhabitants

Number of IR SMEs per million inhabitants RTA in IR technologies (-)

Source: Orbis and Crunchbase, authors' calculation. Digital skills data were retrieved from Eurostat.

FI

FI

SE

IE

CH

SE

PL

FR

ES

IT

FR

BE

ES

NL

NO

DK

UK

NL

NO

UK

CH

DK

DE

AT

DE

AT

PL

IE

BE

IT

32

Back to contents

Digital infrastructure plays a critical role in supporting 4IR

SMEs. Firms operating in countries with low average latency

(a proxy for good internet connection) tend to have more

4IR SMEs per capita (Figure 2.8). This indicates that many

EU regions have the potential to unlock investment in the

supporting 4IR SMEs by ensuring wider access to faster

broadband. However, broadband connection and RTA do

not appear to be linked, possibly due to regional variations

in the speed of internet connections in larger countries.

Figure 2.8

4IR activities and quality of digital infrastructure

RTA in IR technologies (-)

.

.

Average latency (in ms)

Number of IR SMEs per million inhabitants

FI

FI

SE

SE

CH

NL

NO

DK

CH NO

NL

BE

BE

AT

AT

PL

DE

DE

PL

UK

ES

UK

ES

IT

FR

FR IT

IE

IE

DK

Number of IR SMEs per million inhabitants RTA in IR technologies (-)

Source: Orbis and Crunchbase, authors' calculation. Average latency data was retrieved from European Data Journalism Network (2021).

34

Back to contents

3. Innovation and business profiles of

4IR SMEs

4IR SMEs in the EU27 are mostly small businesses: combining

information from Orbis and Crunchbase reveals that four

out of five have fewer than 50 employees and over 40% have

fewer than ten. However, they are not necessarily young

companies, which is consistent with the long development

cycles typically observed in deep tech. Only 41% of 4IR SMEs

in the EU27 have been operating for under ten years, while

a significant proportion (23%) have been in business for over

twenty years. A similar pattern of size and age distribution

can be observed for 4IR SMEs in the US, with a slightly higher

proportion of companies over 50 employees (21%) and

operating for over ten years (60%)

9

.

9 Cross-tabulation of 4IR SMEs by age and size shows that there is merely a weak

correlation between the two dimensions. Although only 3.2% of EU firms are

relatively young and large, with more than 50 employees, the majority of

EU 4IR SMEs have been operating for at least ten years and are relatively small.

The distribution of US 4IR start-ups is similar, where 42.7% have been operating

for over ten years but have a relatively small workforce. Compared with the EU27

and the US, other European countries have a larger proportion of companies

that are young and small, namely 42.3%.

Figure 3.1

Size and age of the 4IR SMEs

Number of employees

%

%

%

%

%

- - - -

Age

%

%

%

%

%

- - - - +

EU27 Other Europe US

Source: Orbis and Crunchbase, authors' calculation.

35

Back to contents

Results from interviews with firms (hereafter referred to as

the 4IR survey) provide further insight into their market and

technology profiles (Figure 3.2). The industry areas in which

4IR SMEs are planning to deploy (or are already deploying)

4IR technologies are highly diverse (Figure 3.1, right panel).

The main target area for EU27 4IR SMEs is the biotech and

healthcare industry, cited by nearly one in three SMEs.

However, other important target areas include data

analytics and software development (19%), transport (19%)

and cleantech (11%). In comparison, only a modest proportion

of 4IR SMEs are targeting less tech-intensive sectors such as

e-commerce (3%), security (2%) and fintech (2%). Although

the deployment profiles of European and US 4IR SMEs are

very similar, EU27 respondents are more likely to target the

transport sector than US respondents.

4IR SMEs tend to develop and deploy the same types

of technologies in all sectors, however. Comparable

proportions of the 4IR SMEs in the EU27, with 69% and 64%

respectively, indicate that they have made technological

developments in the areas of the Internet of Things and data

management (including data analytics and AI). Automation

of devices was also mentioned by 44% and 3D-systems

technologies by 24%. These development profiles are

remarkably similar among US and European 4IR SMEs.

Figure 3.2

4IR innovation profile of European SMEs

Focus of deployment efforts

Biotech and healthcare

Transport

Data and analytics and

software development

Cleantech

Automation

Other

E-commerce and

marketing

Security

Fintech

% % % % %

Proportion of firms (in %)

Focus of development efforts

Internet of Things

Data management,

big data analytics,

AI

Automation of

devices

D printing or

other D systems

% % % % %

Proportion of firms (in %)

EU27 Other Europe US

Source: 4IR survey.

Base: 4IR innovators in the 4IR survey (excluding don't know / refused / no obstacle responses).

36

Back to contents

A detailed analysis of the 4IR SMEs' patent portfolios from

the 4IR survey provides further information on the type of

technology that they are developing (Figure 3.3). More than a

third of the EU27 and US SMEs have filed patent applications

related to data mining and exploration, which encompasses

all technologies, including AI, that aim to exploit data from

the creation, processing and analysis thereof to feedback

execution

10

. These technologies, which are also one of the

main drivers of 4IR patenting overall

11

, oer particularly

interesting opportunities for SMEs due to their lower capital

requirements and wide spectrum of applications in a variety

of sectors (see Figure 3.1 above).

10 The field of data management is pivotal in deriving value from the massive amount

of data collected by connected objects. It encompasses all technologies aiming to

exploit data, from the creation, processing and analysis thereof to feedback

execution. It can be subdivided into four distinct categories, namely monitoring

functions (generating data typically by means of sensors), analytics and diagnosis

(based on the generated data), planning and control (e.g. automated control

systems for enterprises, vehicles or factories), and prediction and forecasting

(e.g. wind speed forecasting for electric energy production or business forecasting

and optimisation).

11 With about 28% of all 4IR IPFs at the global level in 2018.

About a quarter of the EU27 SMEs have also patented in

the core fields of connectivity (26%) and IT hardware (20%),

including sensors. Together with enabling technologies such

as user interfaces (12%) and position determination (11%),

these two technology fields form the basis of the Internet of

Things. However, an even larger proportion of US SMEs have

been filing patents relating to core 4IR technologies, even

more so in the case of software, which is represented in the

patent portfolios of 18% of the US companies, compared

with 10% of the EU27 companies. Likewise, 4IR SMEs in

Finland and Sweden display a stronger focus on core

hardware (24% and 25% respectively) and connectivity

(34% and 30% respectively). This reflects the pattern more

generally observed in patenting at the country level, where

the US, as well as Sweden and Finland, show a specialisation

in core 4IR technologies (EPO, 2020).

Figure 3.3

Presence of core and enabling 4IR technologies in SMEs' patent portfolios

Core

Connectivity

IT hardware

Software

Enabling

Data mining and exploitation

User interface

Position determination

Safety

Data security

D systems

Core AI

Power supply

% % % % %

EU27 US

Source: Orbis and Crunchbase, authors' calculation.

37

Back to contents

Over 90% of SMEs based in the EU27 (86% for US-based

SMEs) claim in the interviews to have already implemented

the respective 4IR technology

12

(Figure 3.4). Almost

three-quarters (72%) of the 4IR SMEs in the EU27 reported

implementation in products or services as well as in their

own business. Another 13% implemented the technology

exclusively in products and services sold, while the technology

was used only internally at an additional 6%. Interestingly,

younger companies (operating for under ten years) were

more likely to implement their 4IR technologies in products,

services and their own business than mature companies

(78% vs 68%).

13

12 This proportion is remarkably high compared with available evidence on the

commercialisation of patented inventions by SMEs in other sectors. In fact, a prior

EPO survey (EPO, 2019) found that European SMEs that had filed patent applications

with the EPO had managed to commercialise about two-thirds of the corresponding

inventions.

13 Although EU27 and US 4IR SMEs are comparable when it comes to implementing

deep tech technologies, there are dierences when focusing more broadly on

the non-financial corporate sector. For instance, 47% of US respondents have

already implemented the Internet of Things (IoT) in their business, compared

with 29% of EU respondents (EIBIS 2021).

Figure 3.4

Implementation of 4IR technologies (proportion of firms in %)

EU

US

% % % % % % % % % % %

Implemented in both Implemented in products and services only Implemented in own business only Not implemented

Source: 4IR survey.

Base: All firms (excluding don't know / refused / no obstacle responses).

38

Back to contents

4IR technologies can support companies' business models

in dierent ways (Figure 3.5). In the EU27, 43% of 4IR SMEs

are involved in hardware manufacturing

14

(i.e. developing,

building and selling physical products). Another 25% create

and sell intellectual property (IP), such as software, analysis,

pharmaceuticals or biotechnology, while 23% provide other

paid services. Only a very small proportion of the SMEs

surveyed operate network platforms used for online trading

or other types of interaction.

Medium-sized companies with more than 50 employees

report a larger proportion of activities related to

manufacturing, while smaller companies are apt to

concentrate on providing services and creating and selling

IP (61% of larger SMEs and 39% of smaller SMEs focus on

manufacturing). In general, 4IR SMEs tend to favour

manufacturing business models compared with other

SMEs, as shown in a recent EIB start-up survey (EIB, 2019).

14 In comparison, the proportion of EU27 start-ups focusing on manufacturing is

only 23%.

Figure 3.5

Business models

Develop, build and sell physical things

Develop and sell intellectual property,

for example software, analysis,

pharmaceuticals or biotechnology

Provide services to customers for

which you charge

Operate a network platform on which

participants can, for example, buy, sell

or share things or build relationships

Other

% % % % % %

Proportion of firms (in %)

EU27 US

Source: 4IR survey.

Base: 4IR innovators in the 4IR survey (excluding don't know / refused / no obstacle responses).

39

Back to contents

The design of the survey makes it possible to analyse the

business models used by 4IR SMEs in their main deployment

sectors, as shown in Table 3.1. In biotech and healthcare,

and transport, over 40% of the companies develop and

make physical products. By contrast, the business models

of companies active in data analytics and software

development show a stronger focus on development

and the sale or licensing of intellectual property.

Biotech and

healthcare

Data analytics

and software

development

Cleantech Transport

Develop, build and sell physical things % % % %

Develop and sell intellectual property, for example software, analysis,

pharmaceuticals or biotechnology

% % % %

Provide services to customers for which you charge % % % %

Operate a network platform on which participants can, for example,

buy, sell or share things or build relationships

% % % %

Other % % % %

Source: 4IR survey.

Base: 4IR innovators in the 4IR survey (excluding don't know / refused / no obstacle responses).

Table 3.1

Business models and deployment areas

41

Back to contents

Tobii continually expanded its patent portfolio, enabling

it to attract investors, diversify its products, and refine its

technology. As a result, the start-up from Sweden became

a listed company that dominates its niche.

Neurodegenerative conditions often mean a cruel fate.

People who are otherwise healthy with active minds

may be unable to express themselves through speech or

movement, leaving them trapped in their bodies. Thankfully,

rapid technological advancements give those living with

conditions such as cerebral palsy or severe paralysis greater

independence. Tobii continually expanded its patent portfolio,

enabling it to attract investors, diversify its products, and

refine its technology. As a result, the start-up from Sweden

became a listed company that dominates its niche.

John Elvesjö and Mårten Skogö (European Inventor Award

2015, SMEs, finalists) invented a revolutionary eye-tracking

system that recognises the position and gaze point of the

pupils and interprets this information in real time. Together

with their team at Tobii, they explored uses for their system,

ranging from interaction with speech-generating

programmes to clinical diagnosis and gaming.

Improving lives in the blink of an eye

At just 24 years old, Elvesjö made a ground-breaking

discovery during a lab experiment. He was working with

optical sensors designed to track the movements of fruit

pulp particles in solution and, peering closely at the vessel,

noticed that the sensors detected his own eye movements.

He realised the potential of his observation and began

working on an eye-tracking device.

The device employs several near-infrared light

micro-projectors – optical scanners placed on a screen

display. Sensors register and track the reflections of the

infrared light from the user's eyes to follow their gaze,

where it lands and how it moves. Proprietary software

incorporating special algorithms then interprets these

eye movements in real time.

An ever-growing number of fields now use eye-tracking.

Gamers control the on-screen action with unprecedented

realism and researchers see the world through the eyes of

their subjects. Marketeers observe how consumers behave

online and in-store, while clinicians use new tools to identify

tell-tale signs of ocular disease and mental or neural disorders.

Crucially, the invention facilitates touchless human-machine

interaction and enables people to control computers with

eye movements. For those living with a neurological

condition or recovering from a debilitating injury, this

enables mobility and improves communication. It empowers

people to gain independence and live fuller personal and

professional lives. Current assistive technologies can

generate speech, connect to devices or to the web, and

allow users to write, draw or create music.

Visionary

Tobii was founded by John Elvesjö, Mårten Skogö and Henrik

Eskilsson in 2001. The company's iterative development

approach required a robust patent portfolio and regular

investment. Between 2007 and 2012, venture capitalist firms

invested EUR 41 million over several rounds. These funds

supported R&D and allowed Tobii to explore new avenues

for its eye-tracking devices. It received an additional

EUR 13 million in 2014 to finance expansion plans and

strategic acquisitions.

Thanks to its market success, the start-up grew quickly and

surpassed its status as an SME. Today, the company has split

and both Tobii and its subsidiary (Tobii Dynavox) are listed

on Stockholm's NASDAQ. The company now employs some

600 people in 14 oces worldwide and reported revenue of

almost EUR 60 million (SEK 616 million) in 2021.

The company cites innovation as a vital part of its business

model and commands an extensive intellectual property

portfolio. This includes rights to protect the design, control

and readout of image sensor data; physical integration

techniques, calibration methods and system layouts; as well

as algorithms and methods to implement eye-tracking. Their

patent portfolio extends to industry-specific use cases in

areas such as automotive, biometrics, gaming, consumer

engagement measurement and wearables. To date, Tobii

holds 26 granted European patents, highlighting their

consistent focus on intellectual property over two decades.

43

Back to contents

4. Market and IP positions

While the previous chapter focused on the technological

profiles and innovation strategies of 4IR SMEs, this chapter

provides insight into their sales markets and structure.

Information from the 4IR survey is complemented by an

analysis of patent protection strategies of 4IR SMEs and

their role in supporting their business developments.

Figure 4.1 documents the reference geographical markets

of 4IR SMEs. At present, almost every second 4IR SME in

the EU27 primarily targets the European market in their

commercialisation eorts. Nevertheless, 32% regard their

home country as their core market and 9% primarily target

the US. Looking ahead to the next five years, only 6% of

SMEs in the EU27 would still consider their national market

as their main market. Instead, 4IR SMEs in the EU27 are

focusing their growth plans on the European market

(from 52% to 57%) or the US (from 9% to 24%).

In comparison, virtually no US 4IR SMEs focus their sales

activities exclusively on their home state and 87% of all US

4IR SMEs regard the whole US as their primary market. Only

a very small proportion of US companies have their main

operations in Europe (7%) or in any market outside the US.

Over the next five years, the US will remain the primary

market for 79% of US 4IR SMEs. However, the proportion

of companies intending to primarily target the European

market may increase to 13%. Other markets are likely to

remain peripheral for US 4IR SMEs.

It is worth stressing that more European firms see their

future primary market in the US (24% of EU27 and 35% of

Other Europe SMEs) than vice versa. Only 13% of US SMEs

regard Europe as their future primary market. Moreover,

SMEs in the EU27 claiming to be dominant players in their

markets are more likely to see the US as a future primary

market (38%).

4IR SMEs from the UK, Switzerland and Norway have a

similar market distribution to their EU counterparts.

Although their primary focus is, and will remain, on the

European market, a large proportion of these 4IR SMEs

(35%) – especially UK-based firms – will target the US market.

Overall, only less than 6% of European 4IR SMEs would

consider China as their main sales market in the future.

Figure 4.1

Geographical markets for 4IR technologies

Future primary market Current primary market

Source: 4IR survey.

Base: 4IR innovators in the 4IR survey (excluding don't know / refused / no obstacle responses).

Note: Europe is defined as all EPC member states, including the EU27, the UK, Switzerland, Norway and other countries.

EU

Home

country/state

Europe

US

China

Other

countries

Worldwide

% % %

Proportion of firms (in %)

Other Europe (UK, CH, NO)

Home

country/state

Europe

US

China

Other

countries

Worldwide

% % %

Proportion of firms (in %)

US

Home

country/state

Europe

US

China

Other

countries

Worldwide

% % %

Proportion of firms (in %)

44

Back to contents

The countries in which companies seek patent protection

for their inventions also provide information on the

importance of the dierent markets for commercialisation.

Almost 95% of European 4IR SMEs seek protection in

Europe, followed by the US (73%), with China (36%), Japan

(25%) and R. Korea (13%) quite some distance behind. In

turn, US 4IR SMEs try to protect 91% of their 4IR inventions

in their home market, 64% in Europe, 34% in China,

31% in Japan and 18% in R. Korea. These patent protection

strategies reveal the strong integration of the European and

US markets, as well as their importance for 4IR technology

commercialisation. However, European SMEs seek to protect

a larger proportion of their 4IR inventions in the US (73%)

than vice versa (63% of US SMEs protect their invention in

the EU). This is in line with the survey results, which showed

the greater significance of the US market for European 4IR

SMEs than vice versa (see Figure 4.1 above). Interestingly, the

results apply both to young and mature, as well as smaller

and larger SMEs.

Figure 4.2

Scope of international patent protection

Europe

EU

US

P.R. China

Japan

R. Korea

% % % % % % % % % % %

EU27 Other Europe US

Source: Orbis and Crunchbase, authors' calculation.

Note: The following criteria have been applied to make the results comparable: (a) filtering for patent families with the earliest filing date before 2019 to avoid the issue

of the entry into regional/national phase coming from PCT applications; (b) removing all patent families featuring a unique PCT application, since they had not entered a

regional/national phase at the time of data retrieval.

45

Back to contents

Although a large proportion of the EU's 4IR SMEs are small