V I C T O R I A

Auditor-General

of Victoria

SPECIAL REPORT No. 54

VICTORIA’S

GAMING INDUSTRY

An insight into the

role of the regulator

Ordered by the Legislative Assembly to be printed

VICTORIAN GOVERNMENT PRINTER

No. 3 - Session 1998 1998

ISSN 818 5565

ISBN 0 7306 9297 3

March 1998

The President

The Speaker

Parliament House

Melbourne Vic. 3002

Sir

Under the provisions of section 16 of the Audit Act 1994, I transmit the Auditor-General's

Special Report No. 54, "Victoria’s Gaming Industry: An insight into the role of the

regulator”.

Yours faithfully

C.A. BARAGWANATH

Auditor-General

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

•••••••v

Contents

Foreword vii

PART 1 EXECUTIVE SUMMARY _____________________________________ 1

Overall audit conclusion 3

Summary of major audit findings 9

PART 2 OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING

IN VICTORIA ______________________________________________ 15

Introduction 17

Role and responsibilities of the Victorian Casino and Gaming Authority 17

PART 3 CONDUCT OF THE AUDIT ___________________________________ 27

Audit objective 29

Audit scope 29

Specialist assistance 30

Impetus for the audit 30

Assistance provided to audit 31

PART 4 LICENSING OF GAMBLING INDUSTRY PARTICIPANTS ___________ 33

Overview 35

The importance of licensing in Victoria’s legislative framework for gambling 39

Action necessary by Authority to strengthen its licensing methodology 42

Investigation into an approved manufacturer and supplier of gaming machines 48

Importance of bona fide structures in place for clubs granted a venue operator’s

licence 48

Risk-based approach to licensing of special employees 52

Licensing fees and cost recovery 54

PART 5 MONITORING OF GAMBLING OPERATIONS AND

PLAYER INFORMATION____________________________________ 55

Overview 57

Monitoring of the conduct of gambling 59

PART 6 CASINO SUPERVISION _____________________________________ 83

Overview 85

Introduction 86

Ensuring that gaming in the casino is conducted honestly 90

Exclusion of persons from the casino 95

Controls in place to prevent the laundering of money 96

Casino-related crime 97

Daily verification of casino revenue 97

Continuing focus on improving effectiveness of casino supervision 99

Controlled contracts between the casino operator and other parties 101

Triennial review of casino operator and licence 102

Monitoring of conditions relating to casino licence holder 104

CONTENTS

••••••••••••••••••••••••••••••••••••••••••••••••

vi

•••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

PART 7 RESEARCH INTO THE SOCIAL IMPACT OF GAMBLING___________ 109

Overview 111

Introduction 112

Outline of additional research expenditure undertaken to 31 December 1997 113

The Authority’s strategic approach to research 116

Using the results of research 118

Appropriateness of the Authority having responsibility for research 126

PART 8 OTHER MATTERS__________________________________________ 129

Overview 131

The Authority’s approach to performance measurement and reporting 131

National Competition Policy reviews of legislation 134

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

•••••••vii

Foreword

From time-to-time, the work of an Auditor-General focuses on the activities of an

industry regulator.

This Report documents the results of a performance audit of the Victorian Casino

and Gaming Authority. The audit examined the manner in which the Authority

has discharged its regulatory responsibilities dealing with the State’s gaming

industry.

Since the introduction of electronic gaming machines and the establishment of a

casino adjacent to the business centre of Melbourne, the gaming industry has

experienced significant growth, a factor which has reinforced the importance of

the regulatory function of the Authority. In this regard, the Authority’s work is

the principal avenue through which Parliament, government and the public can

have confidence that gaming activities are conducted honestly, and are free from

criminal influence and exploitation.

The key conclusion reached in the Report is that an effective regulator is

overseeing the day-to-day workings of a major Victorian industry. This

conclusion reflects the overall professionalism and competence exhibited by the

Authority in managing its vital regulatory role.

The Authority is currently well advanced in addressing weaknesses in its

licensing procedures identified during the audit. It now needs to direct attention

to those issues raised in this Report concerning the limited level of information

currently available to players of electronic gaming machines. These issues point

to the desirability of a Players’ Charter for the industry. Such a charter could

complement the industry’s voluntary codes of practice and articulate the whole

range of information deemed as essential to players.

A positive response by the Authority to the above matters would enable it to

achieve greater effectiveness in its role as the industry’s regulator and in

maintaining public confidence in the conduct of gaming within the State.

C.A. BARAGWANATH

Auditor-General

•••••••1

Part 1

Executive

summary

Special Report No. 54 -Victoria’s Gaming Industry: An insight into the role of the regulator

••••••••3

Part 1.1

Overall audit conclusion

1.1.1

The role of a regulator in any industry is central to the maintenance of public

confidence in the integrity and fairness of activities within the particular industry. This

situation is directly applicable to the regulatory functions of the Victorian Casino and

Gaming Authority within the State’s gambling industry.

1.1.2

In Victoria, the Authority has the major and challenging task of ensuring that

gambling activities are conducted honestly and remain free from criminal influence and

exploitation.

1.1.3

The importance of the Authority’s work has been reinforced by the marked

expansion of the gambling industry in the period since 1992-93 following the

introduction of electronic gaming machines within Victoria and the establishment of a

casino adjacent to the business centre of Melbourne. As an illustration, aggregate net

revenue (after payment of player prizes) from electronic gaming machines outside the

casino reached $1.4 billion in 1996-97 and on present indications is likely to be higher in

the current financial year. The manner in which the Authority has discharged its

regulatory responsibilities having regard to these contemporary characteristics of the

industry has been the principal focus of attention during this performance audit.

1.1.4

In this Report, audit is pleased to acknowledge the professionalism and

competence exhibited by the Authority in managing its demanding regulatory role. It is

an organisation which is continually directing attention to the achievement of quality

improvement in its operations. This continuous improvement focus was particularly

evident to audit when evaluating the Authority’s past strategic response to the rapid

expansion of the industry and identifying its plans to address the future consequences of

such swift growth.

EXECUTIVE SUMMARY

•••••••••••••••••••••••••••••••••••••••••••••••••

4 ••••••••

Special Report No. 54 -Victoria’s Gaming Industry: An insight into the role of the regulator

1.1.5

The audit examination did disclose some specific shortcomings in the

methodology followed by the Authority’s licensing staff over the years since 1992-93

when assessing applications for a gaming venue operator’s licence and for the granting

of approval to manufacturers or suppliers of gaming machines to be placed on its official

Roll of Recognised Manufacturers and Suppliers. The procedures which have been used

for investigating an applicant’s associates as well as business associates of both

applicants and any identified associates of applicants were considered by audit to be

particularly deficient.

1.1.6

To its credit, the Authority has been progressively developing new

guidelines for its licensing staff with an initial focus on licence applications to operate a

gaming venue. Part of this process has involved the seeking of legal advice, legislative

change and a major restructure of staffing positions within the Authority’s Licensing and

Compliance Branch. Audit has stressed that until the new procedures have been formally

endorsed and are fully operational, the members of the Authority cannot be completely

satisfied that all licensing decisions are soundly based and consistent with the

organisation’s statutory aim of ensuring the gambling industry is free from criminal

influence and exploitation.

1.1.7

Currently, it is questionable whether the level of fees payable for a venue

operator’s licence or for approval to manufacture or supply gaming machines bears any

direct relationship to the potential commercial value of such licence or application. The

Authority should move to address this matter.

1.1.8

The legislation requires that only gaming systems, equipment and software

approved by the Authority may be utilised within the industry. Drawing on specialist

assistance, audit assessed the adequacy of the Authority’s technical standards governing

systems and equipment and of testing against the standards of systems and equipment

submitted for approval by parties within the industry. The matters addressed by audit in

this area were generally very technical and, in parts, highly sensitive from both

commercial and security viewpoints.

1.1.9

The overall conclusion reached by audit was that the standards developed by

the Authority are comprehensive in coverage and have been instrumental in assisting the

Authority in the establishment of technical integrity in the conduct of gambling

activities. Audit also found the testing laboratories utilised by the Authority are

performing their contracted tasks in a conscientious and professional manner and, at

present, the testing process is working well.

1.1.10

Nevertheless, some important areas for further enhancing the effectiveness

of the standards and testing procedures were identified during the audit. These areas

cover components integral to game software within electronic gaming machines such as

random number generators which fulfil the vital functions of determining and

controlling the randomness of game outcomes, i.e. both winning and losing

combinations.

EXECUTIVE SUMMARY

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

•••••••5

1.1.11

In addition, audit considered there is definite scope for the Authority to

widen its regulatory purview, encompassing both its standards and testing functions,

dealing with application of the concept of player fairness to electronic gaming

machines. From the perspective of the playing public, this concept is vital to maintaining

public confidence in the industry.

1.1.12

For most forms of gambling, information on winning chances and other

relevant data is usually made available to patrons or can be readily acquired by patrons.

For electronic gaming machines, the relevant information, while mathematically

determined, resides electronically and thus, out of sight to players, within game

software. This Report raises several issues concerning player fairness and argues that

players of gaming machines have a “right to know” a range of basic information and

that this right is of such significance that it warrants urgent assessment by the Authority.

1.1.13

This matter also points to the desirability of the formulation of a Players’

Charter which could complement the industry’s voluntary codes of conduct and

articulate the whole gamut of information deemed as essential to players in order that

their position in terms of fairness is totally assured. As the industry’s regulator striving

in its corporate vision for “A fair and crime free gambling industry which optimises the

benefits for Victorians”, the Authority should drive the development and dissemination

within the industry of such a charter.

1.1.14

The Report explains at some length the Authority’s ongoing monitoring and

inspection of the operation of approved gaming systems and equipment within gaming

venues (Part 5) and of the conduct of gaming at the casino (Part 6). In both these areas,

the Authority’s vital regulatory functions are soundly managed. Also, audit is pleased to

commend the sophistication and advanced nature of the central monitoring and control

systems established by the State’s 2 gaming operators. In addition, it is appropriate to

recognise that the technology in place at the casino to support surveillance of gaming

activities is, without doubt, highly advanced.

1.1.15

In terms of gaming operations at the casino, the Report summarises a

number of matters including the various breaches of game rules and procedures and the

extent of patron disputes which have been identified since June 1994 up to 31 December

1997. While each breach and patron dispute can be serious in their own right, audit

considers the extent of such incidents, relative to the extent of daily activity at the

casino, does not give rise to concern that gaming in the casino has been conducted to

date other than in an honest manner.

1.1.16

Finally, the Report identifies that the Authority has overseen in recent years

an extensive range of research activity into the social impact of gambling. The collective

results of this research were an important source of information for the Government in

reaching its decision in December 1997 to retain the cap of 27 500 electronic gaming

machines in Victoria until the year 2000. The Authority is also carefully refining its

performance measurement and reporting framework to further drive its management

improvement process and service its accountability obligations to Parliament and the

Government.

EXECUTIVE SUMMARY

•••••••••••••••••••••••••••••••••••••••••••••••••

6 ••••••••

Special Report No. 54 -Victoria’s Gaming Industry: An insight into the role of the regulator

1.1.17

In summary, based on the results of this performance audit, the Parliament,

Government and community can be confident that an effective regulator is continually

overseeing the day-to-day workings of the State’s major gaming industry.

RESPONSE by Director of Gaming and Betting, Victorian Casino and Gaming

Authority

The staff of the Victorian Auditor-General’s Office have conducted this audit in a very

professional and open manner. Their preparedness to consult and communicate was

very much appreciated by me and my staff.

The Authority welcomes audit’s conclusion that

“... the Parliament and community can be confident that an effective regulator is

continually overseeing the day-to-day workings of the State’s major gambling

industry”.

The Authority is pleased that audit has acknowledged “... the professionalism and

competence exhibited by the Authority in managing its demanding regulatory role”,

and recognises the Authority’s commitment to continually improving its operations.

The Authority notes that audit has concluded that the Authority’s vital regulatory

functions are well managed with regard to the ongoing monitoring and inspection

of the operation of approved gaming systems and equipment within gaming venues

and the conduct of gaming at the casino.

The Authority concurs with audit’s conclusion that the extent of breaches and

complaints relative to the daily activities at the casino does not give rise to concern

that gaming in the casino has been conducted other than in an honest manner.

Audit has concluded that procedures used for investigating an applicant’s associates

as well as business associates of the applicant and any identified associates of the

applicant were considered to be particularly deficient (para. 1.1.5). While

acknowledging that the Authority has been progressively developing new guidelines

and procedures for its licensing staff, audit has concluded that, until the new

procedures have been formally endorsed and are fully operational, the Authority

cannot be completely satisfied that all licensing decisions are soundly based and

consistent with the statutory aim of ensuring that the gambling industry is free from

criminal influence and exploitation (para. 1.1.6).

The Authority does not accept this conclusion. Deficiencies claimed by audit pose

no risk to the effectiveness of the licensing process.

Management reports to the Authority on the key indicators covering the legislative

criteria underlying the investigation of each application for a venue operator’s

licence. Current processes involved in carrying out investigations and inquiries into

each application preclude the Authority relying on the judgment of licensing staff.

The Authority assesses each application submitted to it to ensure that all relevant

issues have been investigated and, where considered necessary, seeks clarification

on particular issues from management of the Authority or outside legal counsel.

The Authority is satisfied that all licensing decisions are soundly based and

consistent with its statutory obligations.

Licensing is carried out by the Authority at the point of entry to the gaming industry

to ensure that only suitable persons are permitted to participate. Subsequent

control and monitoring is carried out by the Authority through a rigorous

compliance and enforcement regime.

EXECUTIVE SUMMARY

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

•••••••7

After more than 5 years of gaming in which participants have been licensed, there

has not been one substantiated case of criminal influence or exploitation having

entered the gaming industry.

Audit questions whether the level of fees payable for a venue operator’s licence or for

approval to manufacture or supply gaming machines bears any direct relationship to

the potential commercial value of such a licence or approval. Audit recommends that

the Authority should move to address this matter (para. 1.1.7).

Government agencies are required to set fees on the basis of cost recovery. If any

other basis for setting a fee is used (e.g. assessed commercial value) so that revenue

is derived, then it is considered to be charging a tax not a fee. Before such a tax is

set, enabling legislation must contain a specific power to impose the tax. An

appropriate amendment to the Gaming Machine Control Act 1991 would be

necessary to charge fees related to the assessed commercial value of a licence or

approval. As such, this would be a policy issue for government.

Audit considers that there is definite scope for the Authority to widen its regulatory

purview, encompassing both its standards and testing functions, dealing with

application of the concept of player fairness (para. 1.1.11). Audit argues that players

of gaming have a “right to know” a range of basic information and that it warrants

urgent consideration by the Authority (para. 1.1.12). Audit also sees the desirability

of a “Players’ Charter” with the Authority driving the development and dissemination

within the industry of such a charter (para. 1.1.13)

The Authority considers that there is merit in audit’s comments regarding the

provision to players of information about approximate winning chances. The issues

raised are beyond the scope of current legislation with regard to return to player

which, under the Gaming Machine Control Act 1991, requires that each venue (not

each machine) returns a minimum of 87 per cent of bets to players each calendar

year.

The Authority’s technical standards addressing player fairness augment current

legislative requirements and are consistent with the endorsed “National Standards

for Gaming Machines”. For the Authority to widen its regulatory purview, as

suggested by audit, may require amendment to the Act. If so, this would be a policy

issue for government. However, the Authority will consider audit’s comments,

consult with those gaming regulators that have endorsed the National Standards for

Gaming Machines and the gaming industry in general, and make its views known

to the Minister for Gaming in due course.

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

•••••••9

Part 1.2

Summary of major audit findings

LICENSING OF GAMBLING INDUSTRY PARTICIPANTS Page 33

There have been significant shortcomings in the Victorian Casino and Gaming Authority’s

licensing methodology utilised by its staff in investigating licence and approval

applications since the introduction in 1992-93 of electronic gaming machines.

Paras 4.22 to 4.26 and para 4.35

The procedures of the Authority dealing with applications for a gaming venue operator’s

licence, or for approval to manufacture or supply gaming machines, were particularly

deficient in investigating an applicant’s associates as well as business associates of both the

applicant and any identified associates of the applicant.

Para. 4.35

The Authority has been progressively developing new procedural guidelines for the

assessment of licence applications with an initial focus on applications to operate a gaming

venue.

Paras 4.27 to 4.34

The Authority has completed its investigation into the suitability of the associates of an

approved manufacturer and supplier of gaming machines and intends to raise some matters

with various associates of the approved manufacturer and supplier.

Paras 4.37 to 4.39

Although no investigative activity had occurred in earlier years, the Authority commenced

investigations during 1997 into structures established by 4 clubs which had been granted a

venue operator’s licence, with one investigation completed at the date of audit.

Paras 4.50 to 4.56

EXECUTIVE SUMMARY

•••••••••••••••••••••••••••••••••••••••••••••••••

10 •••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

LICENSING OF GAMBLING INDUSTRY PARTICIPANTS

- continued

Page 33

A combination of the careful scrutiny exercised by the Liquor Licensing Commission when

assessing applications for club liquor licences and subsequent investigations by the

Authority, as deemed necessary, should minimise the risk of clubs attempting to utilise

artificial structures to unfairly take advantage of the lower tax rate applicable to clubs.

Paras 4.40 to 4.57

In a positive initiative, the Authority has introduced a risk-based approach to the licensing

of particular categories of employees within the gaming industry.

Paras 4.58 to 4.70

It is questionable whether the level of fees payable for a venue operator’s licence, or for

approval to manufacture or supply gaming machines, bears any direct correlation to the

potential commercial value of such licence or application.

Paras 4.71 to 4.77

MONITORING OF

GAMBLING OPERATIONS AND PLAYER INFORMATION Page 55

The standards developed by the Authority for testing and evaluation of gaming systems and

equipment are comprehensive in coverage and have been instrumental in assisting the

Authority in the establishment of technical integrity in the conduct of gambling activities

within the State.

Paras 5.14 to 5.25

The Authority’s contracted testing laboratories are performing their tasks in a conscientious

and professional manner and at present, the testing process is working well.

Para. 5.26

Several issues identified by audit concerning the limited level of information currently

available to players of electronic gaming machines point to a need for the Authority to

widen its official regulatory approach to the concept of player fairness.

Paras 5.28 to 5.36

The Authority should drive the development and dissemination within the industry of a

Players’ Charter which articulates the whole range of information deemed as essential to

players in order that their position in terms of fairness is totally assured.

Para. 5.37

Scope exists for the Authority to further enhance the effectiveness of its standards and

testing processes in several important technical areas integral to game software within

electronic gaming machines.

Paras 5.38 to 5.47

The Authority’s monitoring and inspectorial activities relating to approved gaming systems

and operations are soundly managed.

Paras 5.51 to 5.81

EXECUTIVE SUMMARY

••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

•••••••11

MONITORING OF

GAMBLING OPERATIONS AND PLAYER INFORMATION

- continued

Page 55

The significance of the level of cash flows transacted through gaming venues is illustrated

by the fact that, for 1996-97, net revenue after player prizes totalled in excess of

$1.4 billion.

Paras 5.82 to 5.83

For virtually the whole of the 5

1

/

2

year period to 31 December 1997, weekly net revenue

derived from gaming venues at any point in time has been greater than the equivalent figure

in respect of all previous weeks.

Paras 5.84 to 5.86

The Authority has pro-actively moved to address the problem of poor accounting practices

within some gaming venues.

Paras 5.87 to 5.93

The Authority has played a lead role to date in the development of a proposed national

approach to the already major ramifications emerging for governments from interactive

gambling.

Paras 5.97 to 5.102

CASINO SUPERVISION Page 83

The collective efforts of several parties, namely, members of the Authority, the Authority’s

Director of Casino Surveillance, casino inspectors appointed by that Director, members of

the Victoria Police Casino Crime Unit and the casino operator through the casino

surveillance staff, contribute to ensuring that gaming in the casino is conducted honestly.

Paras 6.18 to 6.44

It is appropriate to recognise that the technology in place at the casino to support security

and surveillance activities is highly advanced.

Para. 6.40

The extent of occurrence to date of patron disputes and identified breaches of game rules

and procedures at the casino, relative to the magnitude of daily activity, does not give rise

to concern that gaming in the casino has been conducted other than in an honest manner.

Paras 6.45 to 6.48

At 31 December 1997, 375 exclusion orders were in force at the casino, including 65

self-initiated by individuals.

Paras 6.49 to 6.54

Given the difficulties associated with supervision and monitoring of exclusion orders, it is

clear that the various parties have discharged their responsibilities in this area in a diligent

manner.

Paras 6.55 to 6.58

To date, no incidents of money laundering at the casino have been reported to the Authority

by Victoria Police.

Paras 6.59 to 6.65

EXECUTIVE SUMMARY

•••••••••••••••••••••••••••••••••••••••••••••••••

12 •••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

CASINO SUPERVISION

- continued

Page 83

• •

The Authority has moved in a positive way to address weaknesses in its investigative

practices relating to controlled contracts at the casino.

Paras 6.81 to 6.89

The Authority has acted in relation to an identified breach of a condition of the Casino

Agreement (which underpins the casino licence) concerning the licence holder’s debt-to-

equity ratio.

Paras 6.98 to 6.108

At the date of audit, the Authority was considering the circumstances relating to a potential

breach of a condition within the Casino Agreement requiring it to be notified of certain

lease arrangements entered into by the licence holder.

Paras 6.109 to 6.112

RESEARCH INTO THE SOCIAL IMPACT OF GAMBLING Page 109

The aggregate research expenditure up to 31 December 1997 of $1 353 600 from the

Community Support Fund into the social impact of gambling represents 0.8 per cent of

total expenditure from the Fund to that date.

Paras 7.13 to 7.15

The Authority has overseen in recent years an extensive range of research activity into the

social impact of gambling and has consulted periodically with key external bodies to

receive input on suggested research topics.

Paras 7.16 to 7.23

If the Authority’s baseline database is to satisfy the basic purpose of assisting the Authority

to answer fundamental gambling-related questions, it will be important that the database is

progressively updated from both current research material and relevant data as it becomes

available from future research projects.

Paras 7.24 to 7.29

In December 1997, the Authority released the findings of a research project which analysed

and evaluated the results of all past projects and identified the specific impacts of gaming

in Victoria.

Paras 7.30 to 7.36

While recognising the advanced nature of the Authority’s research relative to international

experience, the December 1997 summary research report also drew attention to some

issues which need to be addressed by the Authority in order for it to enhance the

effectiveness of its overall research function.

Paras 7.37 to 7.38

EXECUTIVE SUMMARY

••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

•••••••13

RESEARCH INTO THE SOCIAL IMPACT OF GAMBLING

- continued

Page 109

Late in 1997, the Government determined to retain the cap of 27 500 electronic gaming

machines in hotels and clubs, a decision based principally on the outcomes from the

Authority’s research into the social impact of gambling.

Paras 7.39 to 7.43

The Authority expects the quantum of applications submitted to it for approval to vary,

upward and downward, the number of approved gaming machines at venues to continue to

increase as gaming operators negotiate with venue operators on the renewal of contractual

arrangements.

Paras 7.44 to 7.54

OTHER MATTERS Page 129

The Authority is currently moving in a positive manner to progressively refine its initial

work associated with the development of a performance measurement and reporting

framework.

Paras 8.4 to 8.18

In directing attention to the formulation of effectiveness measures, the Authority should

establish mechanisms such as periodic surveys for assessing the level of satisfaction of key

stakeholders, including members of the public, with the regulatory functions undertaken by

it.

Paras 8.16 to 8.17

Reviews under the National Competition Policy of 2 of the 9 pieces of legislation relating

to the State’s gambling industry have been finalised and the resultant reports are currently

under consideration by the Government.

Paras 8.19 to 8.22

•••••••15

Part 2

Outline of the

regulatory

framework for

gambling in Victoria

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••17

INTRODUCTION

2.1

In 1990, the then Government embarked on a policy direction which

involved expansion of the range of gambling activities available to the Victorian public.

The Government’s action in this area involved the introduction of electronic gaming

machines and the establishment of a casino close to the business centre of Melbourne.

As part of this policy direction, gaming operations involving electronic gaming

machines in hotels and clubs began in 1992-93 and a casino (operating initially from a

temporary site) opened in Melbourne in June 1994. The casino moved to a permanent

site in May 1997.

2.2

The regulatory framework initially established by the Government for its

expanded gambling industry comprised 2 regulatory bodies, the Victorian Gaming

Commission and the Victorian Casino Control Authority, operating under separate

statutes.

2.3

In September 1993, the current Government commissioned a review of

electronic gaming machines in Victoria. The review’s terms of reference included a

requirement that particular regard be given to the need for effectiveness and efficiency

in the regulatory and managerial framework governing the introduction and operation of

electronic gaming machines. The review’s recommendations conveyed to the

Government in an April 1994 report stressed the importance of having one Minister

responsible for all aspects of gambling and identified the scope to amalgamate the

Victorian Gaming Commission and the Victorian Casino Control Authority.

2.4

The Government subsequently determined to form a single regulatory

organisation covering all gambling activities in Victoria and falling within the

responsibility of one Minister. In this regard, in June 1994, the Victorian Gaming

Commission and the Victorian Casino Control Authority were formally dissolved under

the Gaming and Betting Act 1994 and the Victorian Casino and Gaming Authority was

created under this legislation as the new monitoring and controlling body for gaming,

wagering and other forms of gambling in Victoria.

ROLE AND RESPONSIBILITIES

OF THE VICTORIAN CASINO AND GAMING AUTHORITY

2.5

The Victorian Casino and Gaming Authority is an independent statutory

body, currently comprising a Chairperson, Deputy Chairperson and not more than 8

members, which reports to the Minister for Gaming. It is a requirement of the Gaming

and Betting Act 1994 that one of the members of the Authority be a member of Victoria

Police nominated by the Chief Commissioner of Police. Members of the Authority,

including the Chairperson, are appointed by the Governor-in-Council on the

recommendation of the Minister.

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

18 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

2.6

The regulatory responsibilities of the Authority are very wide ranging and

are derived from the various Acts listed below:

•

Casino Control Act 1991;

•

Casino (Management Agreement) Act 1993;

•

Club Keno Act 1993;

•

Gaming and Betting Act 1994;

•

Gaming Machine Control Act 1991;

•

Lotteries Gaming and Betting Act 1966;

•

Racing Act 1958;

•

Tattersall Consultations Act 1958; and

•

TT-Line Gaming Act 1993 (legislation governing gaming on the trans-Tasman

shipping line).

2.7

A multiplicity of gambling activities, some of which have substantially

expanded in recent years, fall within the regulatory obligations of the Authority

including:

•

electronic gaming machines;

•

casino gaming;

•

horse and greyhound wagering;

•

sports betting;

•

lotteries;

•

instant scratch tickets;

•

club keno;

•

lucky envelopes (involving automated machines);

•

bingo;

•

raffles; and

•

trade promotions (competitions or other games conducted by a trade or business to

promote the sale of its products or services).

2.8

The Authority’s stated corporate vision, as documented in its 1997-98

corporate plan, is “A fair and crime free gambling industry which optimises the benefits

for Victorians”. Its mission is “To be at the forefront of effective regulation of the

gambling industry”.

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••19

2.9

The statutory objectives of the Authority are set out in the various pieces

of legislation referred to in the above paragraph. Because of some overlap in references

to these objectives within the various statutes, the Authority has developed a

consolidated strategic statement, as presented below, of its principal legislative

objectives:

• ensure that gambling activities regulated by the Authority are conducted honestly

and remain free from criminal influence and exploitation;

• ensure that regulation is efficient and effective;

• act as a source of advice to the Minister on gambling issues and ensure that the

Government's policy on gambling is implemented;

• conduct research into, and advise the Minister on, the social impact of gambling;

and

• promote tourism, employment and economic development generally in the State.

2.10

As pointed out in the Auditor-General’s Special Report No. 40, tabled in

the Parliament in May 1996, dealing with a performance audit of the Community

Support Fund, the Authority advised during that audit that it had determined not to have

a direct role in matters relating to:

• increasing the size of the gambling market;

• increasing employment through the gambling industry;

• increasing revenue to the Government from gambling; or

• promotion of the gambling industry.

2.11

In essence, the Authority indicated to audit that it does not participate in

promotion of the industry as it viewed such activities to be in conflict with its regulatory

role.

2.12

The Authority's Business Plan for 1996-97 addressed some fundamental

issues in a manner which provided an understanding of how the Authority perceived its

role and function. In particular, the plan documented the Authority’s rationale for

regulation of the State’s gambling industry as necessary to:

• prevent any criminal or unsuitable people from becoming involved in the industry;

• ensure public confidence in the industry;

• ensure government receives all revenue due to it from approved gambling

activities; and

• protect patrons of approved gambling activities from unfair or unreasonable

treatment.

2.13

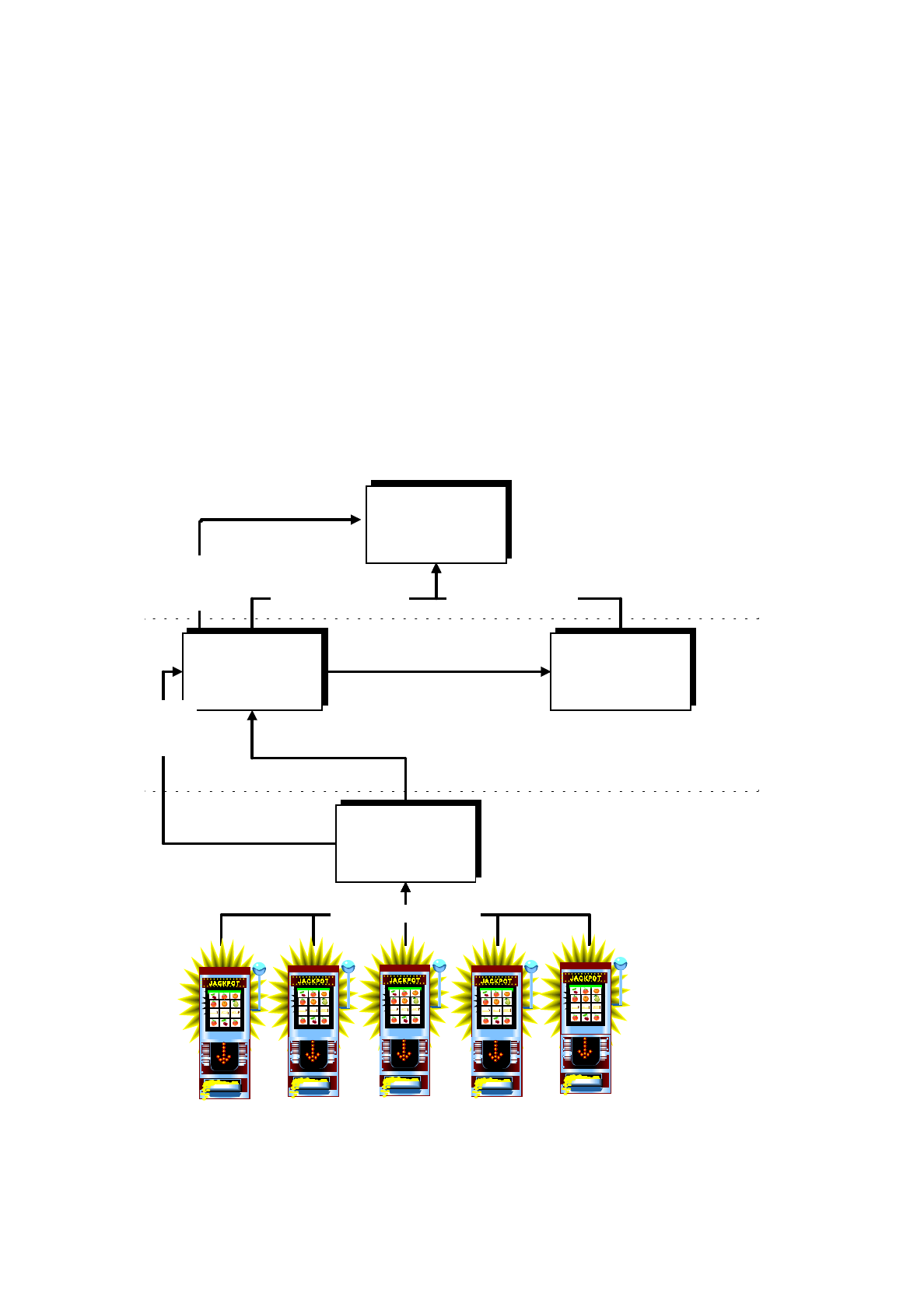

A diagrammatic representation of the Authority’s key statutory

responsibilities is shown in Chart 2A.

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

20 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

CHART 2A

OUTLINE OF PRINCIPAL STATUTORY RESPONSIBILITIES

OF THE AUTHORITY

Licensing of:

. Casino operator

. Gaming operators

. Venue operators

. Gaming equipment

manufacturers

. Employees

. Technicians

. Bingo centres

Free

from criminal

influence and

explotiation

B

INDUSTRY

PARTICIPANTS

. Gaming machines

. Casino games

. Betting & wagering

. Lotteries

. Club Keno

. Lucky envelopes

. Bingo

. Trade promotions

. Raffles

Conducted

fairly and

honestly

B

GAMBLING

Investigate

Inspect

Evaluate

Monitor

Control

Audit verification

processes for

electronic monitoring

systems

Fully

accounted

for and

distributed

B

TAX REVENUE

Victorian Casino

and Gaming Authority

LEGISLATION

. Client and

stakeholder

consultation

. Research Strategy

Plan

. Focused research

program

. Policy development

. Communication

of findin

g

s

Social and

economic

impact

B

GAMBLING

Research

Source

: Chart compiled by Victorian Auditor-General’s Office.

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••21

Statutory positions of

Director of Gaming and Betting and Director of Casino Surveillance

2.14

The members of the Authority are assisted in meeting their collective

responsibilities by the occupants of 2 independent statutory positions, the Director of

Gaming and Betting and the Director of Casino Surveillance. The occupants of these 2

statutory positions are appointed by the Governor-in-Council on the recommendation of

the Minister for Gaming.

2.15

The 2 Directors are primarily responsible to the members of the Authority

for managing, in their respective areas, the various tasks and functions necessary for

achievement of the Authority’s statutory objectives in regulating the State’s gambling

industry.

2.16

In addition, each Director has specific legislative authority to undertake

particular tasks, such as the appointment of inspectorial staff, independent of members

of the Authority. Both Directors can be called upon to provide advice to the Minister on

relevant matters without reference to the members of the Authority. Furthermore,

managerial and administrative staff working for the Authority are employed under the

provisions of the Public Sector Management Act 1992 and are regarded by the members

of the Authority as employees of the related Department, namely, the Department of

Treasury and Finance.

Quasi-judicial role of members of the Authority

2.17

It is also important to recognise that members of the Authority are obligated

under the legislation to consider and reach final determination on appeals lodged by

external parties against decisions of either Director. In such circumstances, the members

of the Authority advised audit that they assume a quasi-judicial role and must therefore

always be seen to be at arms-length from, or have no direct responsibility for, those

decisions of Directors which are subject to appeal. Notwithstanding the need to be

distanced from individual decisions, the members of the Authority have the overall

responsibility to satisfy themselves that the procedures followed by Directors are

appropriate and consistent with the Authority’s legislative objectives.

2.18

In view of the factors outlined in the preceding paragraphs, organisational

references to the Authority within this Report can involve decisions or actions of the

members of the Authority and/or those of the 2 Directors with the latter category not

necessarily falling within the direct responsibility of the members. Relevant information

is provided, as necessary, to explain the nature of such references.

2.19

Because of the statutory status of the 2 Directors within the gambling

industry’s regulatory framework and the overall significance of their roles, some

specific information dealing with the responsibilities of each statutory position is

presented in the succeeding paragraphs.

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

22 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

Director of Gaming and Betting

2.20

The statutory functions of the Director of Gaming and Betting are set out in

several Acts and include to:

• investigate compliance with relevant legislation, regulations, betting rules,

licences and permits;

• ensure the conduct of specified gambling activities is supervised;

• detect offences committed in, or in relation to, specified gambling activities;

• receive and investigate complaints from patrons concerning the conduct of

gambling;

• investigate the suitability of applicants for licences, permits and approvals; and

• report generally to, and assist the members of, the Authority regarding the

operation of various Acts.

2.21

As mentioned earlier, the Director of Gaming and Betting is also required to

provide advice, from time-to-time, to the Minister. In addition, the occupant of the

position reports to the Secretary of the Department of Treasury and Finance in relation

to the management of staff and budgetary matters.

Director of Casino Surveillance

2.22

The statutory responsibilities of the Director of Casino Surveillance are set

out in the Casino Control Act 1991 and require the occupant of the position to, inter

alia:

• supervise directly the operation of casinos and the conduct of gaming and betting

within them;

• make recommendations to the Authority concerning the games that may be played

in casinos and the rules of such games;

• detect offences committed in, or in relation to, casinos;

• receive and investigate complaints from casino customers concerning the conduct

of gaming or betting in the casino;

• appoint, supervise, direct and control inspectors;

• make recommendations to the Authority concerning systems of internal controls,

and administrative and accounting procedures for casinos;

• ensure that taxes, charges and levies payable under this Act are paid; and

• report generally to, and assist, the Authority regarding the operation of casinos.

2.23

While most of the legislative terms refer in the plural to casinos, the

functions of the Director to date have concerned the one casino operated in the State

since June 1994.

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••23

Some key features of the industry

2.24

The most significant developments impacting on the Authority’s regulatory

functions have occurred in the years since 1992-93. This period has seen the marked

expansion of the gambling industry involving the introduction of electronic gaming

machines and the establishment of a casino adjacent to the business centre of

Melbourne.

2.25

Key features of the Government’s policy direction to date dealing with these

specific segments of the gambling industry and which form part of the industry’s

legislative framework, include:

Electronic gaming machines other than at the Melbourne casino

• The maximum number of gaming machines permitted in the State to be available

for gaming in licensed venues is currently 27 500, with this figure subject to next

review in the year 2000;

• The issue of gaming operator licences to 2 operators, TABCORP Holdings

Limited and Tattersall’s (both licences expire in 2012) with each party permitted

to operate 50 per cent of the maximum permissible number of gaming machines

available for gaming in the State;

• The issue of venue operator licences to approved hotels and licensed clubs to

operate as gaming venues;

• The number of gaming machines placed in approved venues is equally distributed

between hotels and licensed clubs;

• Gaming machines placed in approved venues are purchased by the 2 gaming

operators, remain in the ownership of the operators and can be moved between

venues under commercial decisions of the operators;

• The maximum permissible number of gaming machines available for gaming in

any licensed venue is 105 machines, with a limit of 100 machines within the

restricted (i.e. designated) gaming area of the venue;

• The proportion of gaming machines to be located outside the Melbourne

metropolitan area is not less than 20 per cent; and

• Specific arrangements in place which provide for the allocation, in designated

proportions, of net revenue derived from gaming machines (i.e. after deduction of

players’ winnings) to government revenue, gaming operators, venue operators and

a special trust fund, the Community Support Fund (used for special research into

gambling and for specified community purposes).

The Melbourne casino

• The issue, following a competitive tendering process, of a casino licence in

November 1993, covering an initial period of 40 years, to Crown Limited;

• A current maximum of 350 gaming tables, e.g. roulette and poker, and of 2 500

electronic gaming machines permitted to be available for gaming within the

casino;

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

24 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

• Inclusion wthin the management agreement relating to the casino of the following

special provisions:

• no other casino is permitted to operate anywhere in the State before

November 1999 or within a radius of 150 kilometres from the Melbourne

casino before November 2005;

• the total number of gaming machines permitted to be used in the State prior

to November 2005 is limited to 45 000 (as explained above, the current limit

is 27 500); and

• the maximum number of gaming machines permitted to be used in any

approved venue located within a radius of 100 kilometres of the Melbourne

Casino must remain at 105 until November 2005.

• The application of lower taxation rates to revenue derived from specially

categorised high stake gamblers;

• Deduction of a 1 per cent Community Benefit Levy from all gaming net revenue

for payment to a special trust fund, the Hospitals and Charities Fund; and

• Provision for an investigation by the Authority, at least every 3 years, into the

suitability of the casino operator to continue to hold the licence and whether it is

in the public interest that the casino licence continue in force.

2.26

As pointed out in an earlier paragraph, the Authority acts as a key source of

advice to the Minister on gambling issues and, as part of its regulatory role, is required

to ensure that the Government’s policy on gambling is implemented. As such, the above

key features of the Government’s policy direction in respect of the industry constitute an

integral part of this element of the Authority’s responsibilities.

Significance of the Authority’s regulatory functions

2.27

A clear characteristic of the State’s gambling industry for several years now

has been a continuing expansion, as reflected in relevant financial data, in the extent of

public participation in the industry. This expansion has been particularly evident in the

public’s use of electronic gaming machines in gaming venues across the State (since

their introduction in 1992) and in the annual revenue of the Melbourne casino.

2.28

Some of the indicators of this industry expansion are presented below:

• The total number of licensed gaming machine venues had reached 558 at

31 December 1997, made up of 299 clubs and 259 hotels;

• A progressive rise in the number of gaming machines approved for installation in

licensed venues (12 970 machines at 30 June 1993 increasing to 26 570 at

31 December 1997, and comprising 13 738 in hotels and 12 832 in clubs);

• Marked escalation in the total net revenue (after deduction of players’ winnings)

derived from gaming machines moving from $673 million in respect of 1993-94

(the end of the second full year of gaming machine operations) to $1.4 billion for

1996-97; and

• A continuing upward trend in the level of funds paid into the Community Support

Fund and available for distribution for research and designated community

purposes (rising from $12.9 million for 1992-93 to $81.1 million for 1996-97).

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••25

Tattersall’s gaming venue:

The Celtic Club in Melbourne.

(Reproduced with the permission of Tattersall’s)

2.29

The impact of the above factors is clearly manifested in the significant

growth in taxation revenue derived by the Government from gambling activities in the

period since 1991-92. In this regard, revenue from gambling activities has become the

fourth most significant revenue source to the Government, with payroll tax, taxes on

property and franchise fees now the only categories generating higher levels of revenue

than gambling taxes. Table 2B illustrates the growth in taxation revenue from gambling

since 1991-92.

TABLE 2B

GAMBLING TAXATION DERIVED BY GOVERNMENT,

1991-92 TO 1996-97

($million)

Source 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97

Electronic gaming

machines 0.2 94.9 258.8 384.0 509.1 625.7

Lotteries 300.2 290.2 286.1 296.6 297.9 274.4

Racing 191.6 198.4 201.7 144.1 122.0 121.2

Melbourne casino Nil Nil Nil 67.8 110.4 128.2

Other 21.2 16.8 14.2 15.2 11.9 7.9

Total 513.2 600.3 760.8 907.7 1 051.3 1 157.4

Source

: Government financial statistics obtained from the Department of Treasury and Finance.

OUTLINE OF THE REGULATORY FRAMEWORK FOR GAMBLING IN VICTORIA

•••••••••••••••••••••••••••••••••••••••••••••••••

26 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

2.30

The increase of $644 million (125 per cent) in the Government’s aggregate

gambling taxation revenue over the 5 year period to 1996-97, as shown in Table 2A, is

entirely due to the escalating levels of taxation derived from electronic gaming

machines and the Melbourne casino, with the most significant contribution emanating

from gaming machines.

2.31

Clearly, the current magnitude of the gambling industry and its financial

significance to the State reinforce the absolute importance of the regulatory role of the

Authority.

•••••••27

Part 3

Conduct

of the audit

CONDUCT OF THE AUDIT

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••29

AUDIT OBJECTIVE

3.1

The overall objective of this performance audit was to evaluate the

effectiveness of the Victorian Casino and Gaming Authority in achieving its statutory

objectives in its capacity as the Government’s official regulatory body for the State’s

gambling industry. Specifically, the audit was aimed at determining and evaluating the

extent to which the Authority is:

• ensuring that gambling operations are conducted honestly and that the

management and operation of approved gambling activities remain free from

criminal influence and exploitation;

• acting as a source of advice to the Minister on gambling issues and ensuring that

the Government’s policy on gambling is implemented;

• funding research into, and advising the Minister on, the social impact of gambling;

and

• promoting tourism, employment and economic development generally in the State

through the administration of the various Acts associated with its regulatory

responsibilities.

3.2

In the pursuit of this objective, audit sought to give recognition to any

continuous improvement initiatives taken by the Authority to enhance the quality and

effectiveness of its regulatory role.

AUDIT SCOPE

3.3

While the audit dealt with the strategies and operating procedures adopted

by the Authority in the pursuit of its statutory objectives identified under the State’s

gambling legislation, emphasis was directed to the regulatory activities of the Authority

in respect of the industry’s 2 prime growth segments, namely, electronic gaming

machines and the Melbourne casino.

3.4

Having regard to these 2 industry segments, the scope of the audit included

examination of procedures followed by the Authority for the following key aspects of its

regulatory responsibilities:

• licensing and ongoing monitoring of industry participants;

• monitoring, supervising and controlling the manner in which gambling is

conducted in the State;

• ensuring fairness to players and patrons of the various forms of gambling;

• verifying gambling taxation revenue due to the State;

• undertaking research into the social impact of gambling; and

• generally, overseeing the implementation of the Government’s policy on

gambling.

CONDUCT OF THE AUDIT

•••••••••••••••••••••••••••••••••••••••••••••••••

30 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

3.5

In addition, the audit included an assessment of the Authority’s strategic

management practices dealing with corporate governance, particularly in terms of:

• corporate and business planning;

• the formulation by the Authority of performance measures and targets for

evaluating the effectiveness of its regulatory tasks; and

• the soundness of procedures in place for progressive monitoring of actual

performance against targets and the reporting of related information to the

Parliament and the community.

3.6

The scope of the audit did not include the initial granting of licences to the

State’s 2 gaming operators and the holder of the casino licence.

3.7

The audit was performed in accordance with Australian Auditing Standards

applicable to performance audits and, accordingly, included such tests and other

procedures necessary in the circumstances.

SPECIALIST ASSISTANCE

3.8

Specialist assistance was provided to the audit team by the following

representatives of the Department of Computer Science, Monash University:

• Dr Graham Farr;

• Professor Chris Wallace;

• Dr Rod Worley; and

• Dr David Dowe.

3.9

This assistance related to an examination of the Authority’s technical and

functional standards for gaming systems and equipment, and evaluation of the testing

strategies employed by the Authority’s contracted testing laboratories. The specialists

were requested to place emphasis on software issues associated with electronic gaming

machines, on mathematical factors pertaining to player returns and on the integrity of

game software generally.

IMPETUS FOR THE AUDIT

3.10

The principal impetus for this performance audit was derived from the huge

expansion in recent years in the gambling industry, especially in relation to the major

growth area of electronic gaming machines.

3.11

The industry’s expansion has served to reinforce the critical importance of

complete public confidence at all times in the conduct of gambling and in the integrity

and effectiveness of the manner in which the Authority discharges its statutory

responsibilities as the industry’s regulator.

CONDUCT OF THE AUDIT

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••31

3.12

An independent assessment under a performance audit of the Authority’s

regulatory role was seen, having regard to the magnitude of the industry’s growth, to be

a relevant and suitable exercise by the Auditor-General on behalf of the Parliament and

community.

3.13

The undertaking of a performance audit in the subject area also accorded the

opportunity to update material previously reported to the Parliament in relation to

expenditure from the Community Support Fund on research into the social impact of

gambling. The management of such research is an important responsibility of the

Authority and comment on this aspect of the Authority’s work up to February 1996 was

incorporated in the Auditor-General’s Special Report No. 40 “The Community Support

Fund: A significant community asset” which was tabled in the Parliament in May 1996.

3.14

Finally, the decision to undertake a performance audit dealing with the

Authority’s regulatory role within the State’s gambling industry was endorsed by the

Parliament’s Public Accounts and Estimates Committee following consultation with the

Committee by the Auditor-General on annual performance audit planning, as required

by the Audit Act 1994.

ASSISTANCE PROVIDED TO AUDIT

3.15

The current Director of Gaming and Betting (and the predecessor occupant

of the position), the Director of Casino Surveillance, Branch Managers and other staff of

the Authority provided significant support and assistance to audit. All representatives of

the Authority responded in a highly professional and co-operative manner to the many

requests made of them for information and discussion during the course of the

performance audit.

3.16

Appreciation is also extended to the Authority’s 2 contracted testing

laboratories, to venue operators and staff at venues visited by audit, members of the

Victoria Police Gaming and Vice Squad, and the Registrar of the Liquor Licensing

Commission for their helpful assistance.

3.17

Audit wishes to acknowledge the contribution that the above assistance and

co-operation made to the preparation of material included in this Report.

•••••••33

Part 4

Licensing of

gambling industry

participants

LICENSING OF GAMBLING INDUSTRY PARTICIPANTS

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••35

OVERVIEW

4.1

A key responsibility of the Victorian Casino and Gaming Authority in its

legislative role as regulator of the gambling industry is to ensure the management and

operation of approved gambling activities remain free from criminal influence and

exploitation. This responsibility reinforces the importance of the Authority having in

place sound procedures for assessing licence and other applications submitted by

prospective entrants to the gambling industry and for its ongoing monitoring of

licensed or approved participants.

4.2

The audit examination disclosed some specific shortcomings in the Authority’s

licensing methodology followed by its licensing staff over the years since the

introduction in 1992-93 of electronic gaming machines within the State. These

shortcomings involved the absence of interpretative guidance to staff on key criteria

specified in the legislation as requiring attention in considering a licence application, a

general lack of critical evidential matter on files to support licensing decisions and the

practice of the Authority not to pro-actively monitor the circumstances of licensees,

especially in terms of possible changes in their relationships with other parties, during

the period of a licence term. Audit considered the procedures of the Authority dealing

with applications for a gaming venue operator’s licence or for approval to manufacture

or supply gaming machines were particularly deficient in investigating an applicant’s

associates as well as business associates of both the applicant and any identified

associates of the applicant.

4.3

To its credit, the Authority has been progressively developing new procedural

guidelines for the assessment of licence applications with an initial focus on licence

applications to operate a gaming venue. Part of this process has involved the seeking of

legal advice, legislative change and a major restructure of staffing positions within the

Authority’s Licensing and Compliance Branch. It has also introduced, in conjunction

with Victoria Police, a risk-based approach for the licensing of employees within the

industry.

4.4

Audit has stressed to the Authority the importance of timely introduction of its

revised licensing methodology. Until the new procedures are fully operational, the

members of the Authority cannot be completely satisfied that all licensing decisions are

soundly based and are consistent with the organisation’s statutory aim of ensuring the

gambling industry is free from criminal influence and exploitation.

4.5

Finally, it is questionable whether the level of fees payable for a venue

operator’s licence or for approval to manufacture or supply gaming machines bears any

direct correlation to the potential commercial value of such licence or approval. The

Authority should move to address this matter.

LICENSING OF GAMBLING INDUSTRY PARTICIPANTS

•••••••••••••••••••••••••••••••••••••••••••••••••

36 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

RESPONSE by Director of Gaming and Betting, Victorian Casino and Gaming

Authority

OVERVIEW

4.2 Audit makes comments regarding a number of shortcomings it believes is

evident in the Authority's licensing methodology. These matters are addressed in the

responses to paras. 4.22, 4.23 and 4.35.

4.5 Audit questions whether the level of fees payable for a venue operator’s licence

or for approval to manufacture or supply gaming machines bears any direct

correlation to the potential commercial value of such a licence or approval and

recommends the Authority address this matter. This matter is addressed in the

response to para. 1.1.7 of the Overall Audit Conclusion.

THE IMPORTANCE OF LICENSING IN VICTORIA’S LEGISLATIVE

FRAMEWORK FOR GAMBLING

4.13 Audit refers to the Authority’s quasi-judicial role in determining appeals

against the decisions of the Director and states that the Authority “... must therefore

always be seen to be at arms-length from ... the statutory decisions made by the 2

Directors ...”

The Authority is, in fact and appearance, at arms-length from the statutory

decisions made by the 2 Directors.

ACTION NECESSARY BY AUTHORITY TO STRENGTHEN ITS LICENSING

METHODOLOGY

4.22 Audit identifies 3 areas where it believes there have been shortcomings in

licensing methodology, being:

•

methodology not containing official interpretation of key evaluative criteria;

•

the focus of the methodology being directed more to physical movement of

paperwork rather than factors influencing the judgement of licensing staff; and

•

no provision within the methodology for pro-active monitoring of relevant

aspects of licensees’ circumstances and those of other industry participants

such as manufacturers and suppliers of gaming machines.

The matters of methodology not containing official interpretation of key evaluative

criteria is addressed in the response to para. 4.23. The matter of pro-active

monitoring of relevant aspects of licensees’ circumstances and those of other

industry participants is addressed in the response to para. 4.35.

The Authority does not accept audit’s view that the focus of the methodology has

been directed more to physical movement of paperwork rather than factors

influencing the judgement of licensing staff. The procedures manual was

developed with the assistance of the Australian Quality Council and was developed

deliberately to focus on the decision-making processes rather than the paperwork.

4.23 Audit states that in the absence of an official interpretation by the Authority,

very little supplementary information was available to guide judgements and

decisions of the licensing staff in ensuring the requirements of the legislation were

adequately and consistently implemented. Audit states that as a consequence of this,

licensing officers have found it necessary to exercise a significant amount of

discretion in assessing the suitability or otherwise of licensing applicants which, over

the years, has created the risk that performance of the Authority’s licensing functions

may not always have been directly in line with the legislative requirements.

LICENSING OF GAMBLING INDUSTRY PARTICIPANTS

•••••••••••••••••••••••••••••••••••••••••••••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

••••••37

The Authority does not agree that there is a lack of fully documented policies and

procedures in the licensing process and also rejects that there is material risk of

exposure to inconsistency or that decisions have been made which are not always

directly in line with legislative requirements. The Authority notes that audit has not

demonstrated that this “material risk” has led to any unsuitable persons being

licensed.

Documents and procedures currently used by licensing staff are sufficient to enable

them to process licence applications in a consistent and uniform manner. Each

licensing officer has a copy of relevant Acts which contain the objectives of the

legislation and definition of key matters to be taken into account in licensing. In

addition, each licensing officer has a procedures manual which sets out the

licensing procedures and an overall description of the licensing process. If, after

consulting these documents, licensing officers are unsure of what to do, they are

encouraged and required to consult their supervisor, who may seek legal or other

advice if necessary.

SOME SPECIFIC DEFICIENCIES ARISING FROM THE INADEQUATE

LICENSING METHODOLOGY

4.35 Audit reports that its examination identified some specific deficiencies in the

Authority’s licensing procedures which it felt were primarily attributable to the less

than comprehensive coverage of key concepts within the Authority’s licensing

methodology.

The Authority again notes that audit has not demonstrated that this has led to any

unsuitable persons being licensed.

Audit also states that the overall lack of adequate documentation of the licensing

process has led to senior management and ultimately the members of the Authority

and the Directors of Gaming and Betting and Casino Surveillance relying totally on

the judgement of licensing staff.

The Authority does not accept that it or management is at risk of relying totally on

the judgement of licensing officers. Documentation used by licensing officers is

sufficient to cover most cases to ensure a consistency and uniformity in processing

applications.

In those cases where an application presents matters not covered within this

documentation, legal advice is sought before proceeding. In addition, every

application requiring determination by the Authority is reviewed by supervisors

including the Manager, Licensing and Compliance, the Manager, Legal and

Legislation, and the Director of Gaming and Betting before being submitted. With

respect to the assessment of casino special employees, officers are required to refer

all applications having criminal offences detected to the Director of Casino

Surveillance for determination.

It is also the Authority’s policy that any issue which may impact on the suitability

of applicants is brought to its attention. In addition, the Manager, Licensing and

Compliance, is available at all meetings of the Authority to answer questions on

particular applications and assist the Authority as required.

Audit states that in a significant number of instances, licensing staff of the Authority

failed to establish whether particular parties identified during investigations fell

within the legislative categories of either an associate or business associate of an

applicant. Audit states as an example a supplier who borrowed $3.7 million from an

external party and implies that the provider of the finance should have been

considered to be an associate.

LICENSING OF GAMBLING INDUSTRY PARTICIPANTS

•••••••••••••••••••••••••••••••••••••••••••••••••

38 ••••••

Special Report No. 54 - Victoria’s Gaming Industry: An insight into the role of the regulator

The Authority rejects the assertion that licensing staff failed to establish whether

particular parties identified during investigations fell within the legislative

categories of either an associate of an applicant or had a business association with

an applicant or associate of an applicant. The definition of “associate” in the

Gaming Machine Control Act 1991 requires, in addition to a financial

involvement, that such a person or entity should “... by virtue of that (financial)

interest ... (be) able or will be able to exercise a significant influence over or with

respect to the management or operation of that gaming machine business”.

In the case referred to by audit, it was determined at the time of application that the

provider of the $3.7 million had a relevant financial interest, but that this interest

would not enable the company to exercise a significant influence over, or with

respect to, the management of the gaming machine business. As such, it was

determined at the time, that the provider of the finance was not an associate, as

defined by the Act, of the applicant.

Audit has observed that it has been past practice of the Authority to place almost total

reliance on licensees and approval holders to meet their legislative obligations in

ensuring that the Authority is advised of all relevant changes in their circumstances.

While licensees and approval holders have a responsibility to advise the Authority

of changes, the Licensing and Compliance Branch now has ongoing monitoring

strategies in place including audits of the associates of a sample of venues and a

highly effective covert surveillance unit which visits every venue throughout the

State at least once, and usually more often, every year. As part of this surveillance,

investigators monitor parties with apparent interest in the venue to ensure they are

approved to have such an interest. In addition, as each venue operator’s licence

requires renewal after 5 years, this means on average, 20 per cent of venues will

have their associates freshly identified and checked for probity each year as part of

this renewal process.

4.56 Audit has stated that it has recommended to the Authority that it consider

whether a specific venue (not named in the Report, but identified to the Authority

during the review) should be assessed under section 136A to determine which rate of

tax should be applied.

The venue in question has recently been assessed as part of the renewal of its venue

operator’s licence. The corporate structure of the club has been amended and is

now considerably different to that reported by audit and as such there are now no

reasons to review whether a different tax rate should be applied.

LICENSING FEES AND COST RECOVERY

4.77 Audit has stated that the Authority should move to establish a closer

correlation between applications fees for venue operator licences and approvals to