UNEMPLOYMENT INSURANCE

CLAIMANT HANDBOOK

dol.georgia.gov

How To Ensure Timely and Accurate Unemployment

Insurance (UI) Benet Payments

Be Honest

lntentionally withholding or providing misleading, inaccurate information on a claim for UI benets

is considered fraud, which is punishable by law. When ling a claim for UI benets, make sure all

the information you provide is accurate.

Register as a Job Seeker

AII individuals requesting unemployment benets must register for Employment Services with

WorkSource Georgia at worksourcegaportal.com to be eligible to collect UI benets. The services

offered are designed to help you get back to work as soon as possible.

Actively Search for Work

For each week you request benet payments,

you must actively seek work and maintain a

record of your work search activities. Work

search activities must be performed at least

three days a week.

Do Not Refuse Suitable Work

Refusing a suitable work offer could result in a

denial or delay of your benet payments.

Report All Earnings

You must report ALL your gross earnings (before tax and other deductions) for each week

you work when ling for UI benets, including part-time or temporary work and other required

reportable income, at dol.georgia.gov.

Read the Information Provided

You are responsible for knowing and following Georgia’s UI laws and rules when ling for UI

benets. To prevent errors that may result in an overpayment, you must carefully read all the

materials sent to you and respond to requests.

AVOIDING PROBLEMS WITH YOUR

UI CLAIM

If you have additional questions about your

claim, visit dol.georgia.gov.

3

UNEMPLOYMENT INSURANCE (UI) CUSTOMER SERVICE

Monday–Friday, 8:00 a.m. – 4:00 p.m.

Call 1.877.709.8185

Equal Opportunity Employer/Program

Auxiliary aids and services are available upon request to individuals with disabilities.

INTERPRETER SERVICES

The Georgia Department of Labor (GDOL) will provide an interpreter for the hearing or voice

impaired and for those individuals with limited English prociency. Individuals with hearing or voice

impairment may contact the Georgia Relay Center at 1.866.694.5824 to access GDOL services.

Should you require assistance interpreting documents you received, you may take them to your

local career center for translation. These services are provided at no cost to you.

4

TABLE OF CONTENTS

INTRODUCTION 6

THE TOP 12 THINGS YOU SHOULD KNOW 7

HOW DO I QUALIFY? 8

Your Past Wages 8

Your Job Separation 11

Proof of Lawful Presence 12

Verication of Identifying Information 13

Your Availability to Work and Your Work Search 13

Suitable Work 14

Job Refusals 14

What Happens After I Apply For Benets? 14

CLAIM DETERMINATIONS 15

Unemployment Insurance Benet Determination 15

Claims Examiner’s Determination 17

APPEALS 17

What Happens After I File An Appeal? 18

CLAIMING YOUR WEEKLY BENEFITS 19

When to Claim Your Weekly Benets 19

Methods For Requesting Weekly Payments 20

Responding to the Certication Questions 21

Claiming Your Weekly Benets Online 22

Claiming Your Weekly Benets By Telephone 23

REPORTING YOUR WORK SEARCH 24

Acceptable Work Search Activities Include But Are Not Limited To: 24

Submitting Your Work Search Online 25

Submitting Your Work Search By Fax 25

CHECKING THE STATUS OF YOUR PAYMENTS 25

Checking Your Payment Status Online 25

Checking Your Payment Status By Telephone 25

BENEFIT PAYMENTS 26

Direct Deposit 26

Way2go Debit Mastercard® 27

Changing Your Payment Method 28

Income Tax Withholdings 28

5

Other Deductions 29

Payment Delays 30

REPORTING YOUR INCOME 31

Weekly Earnings 31

Vacation and Holiday Pay 31

Retirement Income 31

Severance, Separation Pay, Wages In Lieu Of Notice, and Dismissal Payments 31

Workers’ Compensation 31

OVERPAYMENTS 32

Non-Fraud Overpayments 32

Fraud Overpayments 33

Repayment of Overpayments 33

REPORTING UI FRAUD AND ABUSE 34

EMPLOYMENT SERVICES 35

Employment Services Registration 35

Services in the Gdol Career Centers 36

Career Center Computer Resources 37

SPECIAL PROGRAMS 37

Claimant Trainee Program 37

Reemployment Services and Eligibility Assessment (Resea) 37

Trade Adjustment Assistance 38

LEGAL REQUIREMENTS 39

Privacy 39

Disclosure of Private and Condential Information 39

Security Validation 39

Non-Discrimination 39

FREQUENTLY ASKED QUESTIONS 40

YOUR RECORDS 46

Work Search Conrmation Record 46

Conversations with Gdol Staff 46

6

INTRODUCTION

The Unemployment Insurance (UI) program provides short-term nancial assistance to eligible workers

who are unemployed or partially unemployed through no fault of their own. The purpose of the program

is to help bridge the gap between jobs by providing funds with which to purchase necessities. The intent

is to reduce the nancial burden of joblessness, while allowing individuals an opportunity to deliberately

search for employment that matches their skills, training, and prior earning capability.

In Georgia, unemployment benets are paid from a UI Trust Fund, which is fully funded by employers

who pay UI taxes. These taxes cannot be deducted from employees’ wages.

The information in this booklet is provided to help you understand the requirements of the UI program.

Please take time to read this booklet and make sure you understand its content. Do not risk

losing your benets because you do not know your rights and responsibilities.

If you worked in Georgia and now reside in another state, you may be eligible to collect Georgia

unemployment benets. This would be known as an interstate claim. Although you live in another state,

you must follow Georgia’s laws and rules related to the UI claim. You must also register for employment

services with the nearest State Workforce Agency (SWA) in the state in which you reside. Pay careful

attention to information throughout this handbook regarding interstate claims.

If you have any questions about the information in this handbook, do not hesitate to contact UI Customer

Service at 1.877.709.8185 or ask a representative at your local Georgia Department of Labor (GDOL)

career center.

The information in this handbook (and more) is available on the GDOL website at dol.georgia.gov.

Because the website is constantly updated to better serve you, use the Site Map or Search

feature to nd information quickly. When performing a search, a results page listing relevant links

will display. Select the desired link to return to the website.

TIP: Save time by selecting the Individuals tab on the website, Get Unemployment Assistance,

and then Frequently Asked Questions

7

THE TOP 12 THINGS YOU SHOULD KNOW

1. Know your rights and responsibilities, and ask for help. Read this handbook carefully to know

your rights and responsibilities. If you have questions or need additional information, visit our

website at dol.georgia.gov or contact your GDOL career center.

2. Follow the rules to avoid committing fraud. Anyone who applies for and receives unemployment

benets is legally responsible for following all unemployment laws and rules. Failure to obey the

law and follow the rules could result in penalties and criminal prosecution.

3. Accurately report the reason you lost your job. Be truthful about the reason for your job

separation.

4. Register for Employment Services. To be eligible to receive unemployment benets, you must

register for Employment Services at worksourcegaportal.com or with the State Workforce Agency

(SWA) in the state where you reside, unless you are exempt by law.

5. Be able to work, available for work and actively seeking work. In order to receive benets, you

must show you are able, available and actively seeking work each week.

6. Remember to claim or certify for your weekly benets. You must claim or certify for at least one

week of benets for a decision to be made regarding your eligibility.

7. Actively search for work and submit your Weekly Work Search Record. To receive benets,

you must show you are continually searching for suitable work each week. You are required to

make at least three new, veriable job search contacts each week; and submit a weekly record

of job search contacts for each week benets are claimed. Failure to submit your Weekly Work

Search Record may result in a denial of benets and a possible overpayment. (See REPORTING

YOUR WORK SEARCH and OVERPAYMENTS.)

8. Submitting your work search records is NOT the same as claiming or certifying for your

weekly benets. These are two different processes. You will receive a conrmation number when

you successfully submit your weekly work search record. You WILL NOT receive a conrmation

number when you claim or certify for your weekly benets.

9. Report any wages you earn while receiving unemployment benets. When you are receiving

unemployment benets, you must report all gross (before taxes) earnings each week, including

part- time or temporary work. All gross earnings must be reported during the week they are earned,

even if you have not received payment. Failure to accurately report income may result in an

overpayment. (See REPORTING YOUR INCOME and OVERPAYMENTS.)

10. Inform the GDOL when you return to work. As soon as you begin working, notify your GDOL

career center. Failure to do so may result in you having to repay any benets you received while

fully employed.

11. Respond timely to all requests from GDOL for information. If you fail to timely respond to

requests for information, your claim or benets may be delayed or denied.

12. Keep your personal contact information updated. If you fail to immediately notify GDOL of

a change in personal contact information, your claim, benets, or requests for appeal may be

delayed or denied. You can update your personal contact information on the GDOL website at dol.

georgia.gov. Use the search eld in the top right corner to locate and select the link for Change

Address and Contact Information.

8

HOW DO I QUALIFY?

Georgia law requires individuals to meet all of the following requirements to be paid benets:

• Sufcient insured wages

• Job separation from your last employer due to no fault of your own

• Proof of your lawful presence in the United States

• Able, available, and actively searching for suitable work. See SUITABLE WORK for more information.

YOUR PAST WAGES

To meet the wage requirement, you must have earned enough insured wages during the base period

to qualify for benets. The regular base period is the rst four of the last ve completed calendar

quarters at the time you le your claim. If your claim cannot be established using the regular base

period, the alternative base period will be used. The alternative base period is the last four completed

calendar quarters at the time you le your claim.

A calendar quarter is a three-month period. The four quarters in each year are:

1st Quarter January 1 through March 31

2nd Quarter April 1 through June 30

3rd Quarter July 1 through September 30

4th Quarter October 1 through December 31

9

The following diagram shows how the GDOL determines your regular base period.

If You File In... Your Regular Base Period Will Be...

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

4

th

Qtr

Oct

Nov

Dec

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

1

st

Qtr

Jan

Feb

Mar

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

Year Before Last

This Year

Last Year This Year

Last Year

Last Year

Last Year

10

The following diagram shows how the GDOL determines your alternative base period.

If You File In... Your Alternative Base Period Will Be...

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

1

st

Qtr

Jan

Feb

Mar

3

rd

Qtr

Jul

Aug

Sep

4

th

Qtr

Oct

Nov

Dec

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

4

th

Qtr

Oct

Nov

Dec

1

st

Qtr

Jan

Feb

Mar

2

nd

Qtr

Apr

May

June

3

rd

Qtr

Jul

Aug

Sep

Last Year This Year

Last Year This Year

Last Year This Year

Last Year

11

To meet the wage requirements:

• you must have insured wages in at least two quarters of the base period; and

• your insured wages must equal at least $1,134 in the two highest quarters in the base period; and

• your total insured wages during the base period must equal at least one and one-half times the

highest quarter of earnings.

Weekly Benet Amount (WBA) Calculation

After meeting the wage requirements, your weekly benet amount (WBA) is calculated by dividing the

two highest quarters of wages in the base period by 42.

Regular WBA Calculation

Total Wages in 2 Highest Quarters = WBA

42 (disregard cents)

If the only reason you do not qualify for benets is your total wages are not equal to one and one-

half times the highest quarter of wages, an Alternate Calculation will be used. Using the Alternate

Calculation, your weekly benet amount is calculated by dividing the highest quarter of wages by 21.

Wages must be earned in at least two quarters of the base period and total wages must be at least 40

times the weekly benet amount.

Alternate Calculation

Total Wages in Highest Quarter = WBA

21 (disregard cents)

Currently, the minimum WBA is $55 and the maximum WBA is $365. Your weekly benet amount

cannot be higher than the maximum allowed by law.

YOUR JOB SEPARATION

Your eligibility to receive benets is based on the reason you separated from your most recent

employer. Your most recent employer is dened as the last employer for whom you worked and were

separated or an employer who les a claim on your behalf.

Information will be obtained from your employer to verify your reason for job separation.

12

PROOF OF LAWFUL PRESENCE

Georgia law requires that all applicants for UI benets who are 18 years of age or older attest

they are:

• a United States citizen, or

• a legal permanent resident, or

• a non-citizen legally present in the United States.

The GDOL performs electronic verication of your lawful presence in the United States with the Georgia

Department of Driver Services (DDS). The DDS validates the identity of individuals who indicate they

have a Georgia-issued driver’s license or identication card.

The GDOL will notify you if you are required to complete an Applicant Status Afdavit attesting to your

lawful presence in the United States. If required to do so, you must execute this afdavit whether you

le your claim via the Internet on the GDOL website or in a career center. The afdavit is a one-time

requirement for U.S. citizens. However, each time a non-citizen les a claim for UI benets, Employment

Authorization Document(s) must be provided.

If completion of the afdavit is required, you must present valid government-issued picture identication

to a GDOL representative to complete the afdavit and have it notarized. If you are not a citizen of the

United States, you must also present acceptable, unexpired employment authorization document(s).

The GDOL will verify your registration status with the U. S. Department of Homeland Security. You

cannot receive benet payments until your lawful presence in the U.S. is veried.

Interstate Claimants

The afdavit is available for printing on the GDOL website. On the Home page, select the Forms and

Publications tab. The link is listed as UI Applicant Status Afdavit.

If completion of the afdavit is required, you must have it notarized (many local government agencies,

banks, and community businesses offer free notary services), and mail the original afdavit along with a

legible copy of your valid government-issued picture identication to the Interstate Unit at the following

address:

Georgia Department of Labor Interstate Claims Unit

P. O. Box 3433

Atlanta, GA 30302-3433

Phone: 877.709.8185

Fax: 404.232.3087

The afdavit must be received within ten (10) days from the date you led your claim. You must mail the

original afdavit. A faxed copy of the afdavit will not be accepted.

Failure to return the original completed, signed, and notarized Applicant Status Afdavit and a copy of

your valid government-issued picture identication within ten (10) days could result in a delay or denial

of benets.

13

VERIFICATION OF IDENTIFYING INFORMATION

When processing your claim, you will be required to verify your identity using the applicable methods

and services. If applicable, be sure to use existing login information for identity verication services

when prompted to do so. GDOL uses multiple sources to verify your identity. The name and social

security number you use on our claim must match the information on record with the Social

Security Administration (SSA). Individual Taxpayer Identication Numbers (ITIN) cannot be used

for applying for and receiving unemployment benets.

YOUR AVAILABILITY TO WORK AND YOUR WORK SEARCH

To receive benets, you must be able, available, and actively searching for work. You must show proof

that you are looking for work on a weekly basis. You are required to seek and accept all suitable work.

To meet the work availability and work search requirements, you must:

• Register for Employment Services through WorkSource Georgia, unless exempt by law.

• If you are a Georgia resident, register at worksourcegaportal.com. See Employment Services

Registration for instructions.

• If you are ling an interstate claim, register with the SWA in the state where you reside. However,

you must follow Georgia’s laws and rules regarding your availability to work, searching for work,

and reporting your work search activity.

• Be physically able to perform some type of work (even if it is not your regular eld of work).

• Be available to work and have no unreasonable restrictions that keep you from working.

• Be actively looking for suitable work each week.

• Complete veriable job search activities on three or more days each week.

• Keep a detailed record of your work search activities and submit this information to the GDOL

weekly. See REPORTING YOUR WORK SEARCH for instructions on submitting your weekly work

search report.

• Accept all referrals from the GDOL for suitable work.

• Accept all offers of suitable work from employers.

• Report any failure to seek or accept work (even if you feel the work was not suitable) to the GDOL

during the week in which it occurs.

• Report to the career center when instructed by the GDOL.

To receive benets, you must meet all availability and work search requirements each week. Your

work search record is subject to random audit by the GDOL at any time. You will be denied benets

for any week(s) you do not meet these requirements, make a false statement, or misrepresent

facts. You will be responsible for repaying benets you received during the denial period. See Fraud

Overpayments under OVERPAYMENTS.

14

SUITABLE WORK

You must be willing to accept work under the same working conditions in which you earned the wages

used to establish your claim provided there is a reasonable expectation of obtaining that type of work.

The suitability of a job depends on the length of time you have been unemployed. As the length of your

unemployment increases, you are expected to adjust your employment expectations with respect to

earnings, working conditions, job duties, and prior training and/or experience. After ten (10) weeks of

collecting benets, you must be willing to accept an hourly wage that is at least 66% of the average

hourly wage you earned during the highest quarter of wages in the base period, in order to meet

suitable work search requirements. However, the new hourly wage must be at least the minimum wage

established by state and federal law.

Failure to apply for suitable work could result in a loss of benets and/or repayment of benets

you have already received.

JOB REFUSALS

When you are referred to suitable work by the GDOL or offered suitable work by an employer, you must

apply for the job as instructed or accept the job offer.

If you refuse to accept suitable work, you must report your refusal to the GDOL when requesting your

weekly payment. GDOL will determine if there was good cause to refuse the work. For example, you

are not required to accept work if, but not limited to:

• The position became available because of a strike.

• The job paid less than minimum wage.

• The wages were substantially less than prevailing wages for similar work in the area.

• You would be required to join a union or resign from or refrain from joining any bona de labor

organization as a condition of hire.

WHAT HAPPENS AFTER I APPLY FOR BENEFITS?

After submitting your application for UI benets, the following process will occur:

1. The GDOL reviews and processes your application. You may be contacted if additional information

is needed. You will receive an email once your claim has been processed as well as additional

instructions if necessary. Monitor your email for important information from GDOL regarding your

unemployment eligibility.

2. An Unemployment Insurance Benet Determination is mailed to you advising if you have enough

insured wages to establish a claim. This notice does not mean you are approved to receive

benets. It simply tells you what your potential weekly benet amount and number of weeks

will be if benets are allowed.

3. A notice of claim ling and request for separation information is sent to the last employer for whom

you worked and were separated.

4. You begin claiming your benets and submitting your work search record each week.

5. The GDOL reviews your claim for eligibility based on the reason for separation from your most

recent employer and your availability for work. You will be contacted ONLY IF additional information

15

is needed. You must claim at least one week of benets for the GDOL to review your claim.

6. A Claims Examiner’s Determination is mailed to you informing you if benets are allowed or denied.

7. If benet payments are allowed, payments will be released within 24–48 hours of the Claims

Examiner’s Determination being mailed to you.

If you are contacted for additional information, be sure to respond promptly. If you fail to respond

by the deadline, your benets could be delayed or denied.

If you have claimed a week of benets and have not received your written determination or a telephone

call from a Claims Examiner by the 19th day from the date your claim was led, please call UI Customer

Service immediately at 1.877.709.8185.

During times of high claims volume, this process may extend beyond the timeframe stated above.

CLAIM DETERMINATIONS

The GDOL will review your application for benets and make two determinations regarding your claim:

• Unemployment Insurance Benet Determination

• Claims Examiner’s Determination

You will receive separate determinations. The rst will tell you if you have enough insured wages to

establish a valid claim. If you have enough insured wages to establish a valid claim, you will receive a

second determination informing you if benets are approved or denied.

UNEMPLOYMENT INSURANCE BENEFIT DETERMINATION

Your Unemployment Insurance Benet Determination will show:

• Wages reported in the base period

• Potential weekly benet amount (WBA) of your claim

• Potential maximum number of weeks on your claim

• Potential maximum benet amount (MBA) that will be paid on your claim

• Seasonally adjusted unemployment rate in effect at the time your claim is led

Review the Unemployment Insurance Benet Determination carefully. If you believe the wages shown on your

determination letter are incorrect or incomplete (including those earned in other states), you may ask that your

claim be reconsidered. A request for reconsideration of wages must be submitted in writing to your

career center within 15 days of the date on the Unemployment Insurance Benet Determination.

Currently, the minimum WBA is $55 and the maximum WBA is $365. Your WBA cannot be higher than

the maximum allowed by law.

The potential number of benet weeks you may receive is determined by the date the claim is led,

the wages used to establish the claim, and the seasonally adjusted unemployment rate. The MBA is

the total amount of benets you can be paid on the claim during a benet year. The benet year is the

52-week period beginning on the Sunday of the week a new, valid claim is led regardless of the day it

is actually led.

16

For claims led from July 1 through December 31, Georgia’s seasonal adjusted UI rate for the previous

April is used. For claims led from January 1 through June 30, Georgia’s seasonal adjusted UI rate for

the previous October is used. See the Maximum Unemployment Benets chart for more information.

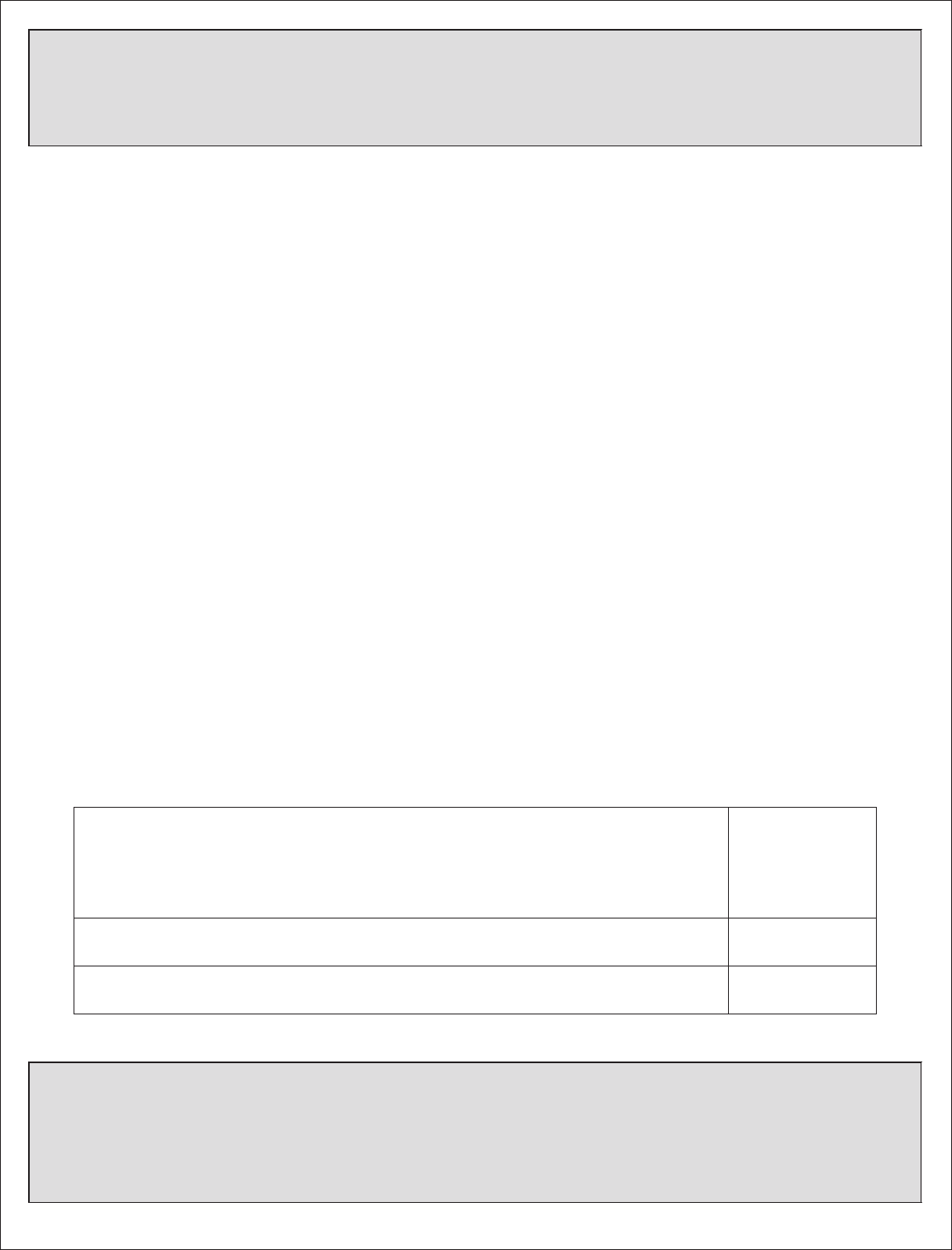

MAXIMUM UNEMPLOYMENT BENEFITS

Seasonal Adjusted UI Rate

Maximum Number of

Weeks

Maximum Benets Payable

will Equal the Lesser of:

Less than or equal to 4.5% 14 weeks

14 x (WBA) or 1/4 of Base

Period Wages

Greater than 4.5% up to 5.0% 15 weeks

15 x WBA or 1/4 of Base Period

wages

Greater than 5.0% up to 5.5% 16 weeks

16 x WBA or 1/4 of Base Period

wages

Greater than 5.5% up to 6.0% 17 weeks

17 x WBA or 1/4 of Base Period

wages

Greater than 6.0% up to 6.5% 18 weeks

18 x WBA or 1/4 of Base Period

wages

Greater than 6.5% up to 7.0% 19 weeks

19 x WBA or 1/4 of Base Period

wages

Greater than 7.0% up to 7.5% 20 weeks

20 x WBA or 1/4 of Base Period

wages

Greater than 7.5% up to 8.0% 21 weeks

21 x WBA or 1/4 of Base Period

wages

Greater than 8.0% up to 8.5% 22 weeks

22 x WBA or 1/4 of Base Period

wages

Greater than 8.5% up to 9.0% 23 weeks

23 x WBA or 1/4 of Base Period

wages

Greater than 9.0% up to 9.5% 24 weeks

24 x WBA or 1/4 of Base Period

wages

Greater than 9.5% up to 10.0% 25 weeks

25 x WBA or 1/4 of Base Period

wages

10.0% or above 26 weeks

26 x WBA or 1/4 of Base Period

wages

17

You can only receive benets for the maximum number of weeks established on your claim during the

benet year.

CLAIMS EXAMINER’S DETERMINATION

The GDOL will determine if the reason you separated from your last job and your availability for work

meet the state’s requirements to receive unemployment insurance benets. In most cases, you can

only receive unemployment insurance benets if you were separated from your last job through no fault

of your own and are meeting all eligibility requirements.

To receive benets, you must be able, available, and actively seeking work. Any issue that prevents

you from being able to work, look for work, or get to work, such as illness, the lack of child care or

transportation, could disqualify you from receiving unemployment benets.

You will receive determinations informing you whether you qualify or do not qualify to receive

unemployment benets based on your reason for job separation, your availability for work, and other

eligibility requirements in accordance with the Georgia Employment Security Law.

Claim determinations can only be changed through the appeals process. You have the right to

appeal benet and claims examiners’ determinations that deny or impact your benets. See APPEALS

for more information.

Your employer may also appeal any decisions on your claim related to your job separation or an offer

of suitable work.

The maximum benet amount and the maximum number of benet weeks established on a claim

are only valid during the benet year period for that claim. Any benets not paid during the benet

year will not carry over to a new benet year.

APPEALS

You have the right to appeal any GDOL decision that has appeal rights. You may appeal benet eligibility

determinations within 15 days of the date on the claim determination letters. If the 15th day falls on a

Saturday, Sunday, or a state holiday, the last day to le a timely appeal is the next work day.

Appeals must:

• be in writing;

• be led within 15 days of the date on the determination letter or Administrative Hearing Ofcer’s

decision;

• identify the exact determination or decision you are appealing;

• include the name of the claimant, the social security number on the determination or decision

being appealed, address, phone number (the best number to reach you), and the date on the

determination or decision;

• include the docket number if you are appealing an Administrative Hearing Ofcer’s decision; and

• explain in detail why you are appealing.

18

HOW TO SUBMIT AN APPEAL REQUEST

All appeal requests for Georgia and interstate claimants will be accepted online, by e-mail, fax, or mail

delivery. Online submission is the faster, preferred method. You may use the computers and fax

machines in the career center resource centers if needed.

If your address or other personal contact information has changed, you should immediately update your

address on the GDOL website or by calling the Appeals Tribunal at 877.709.8185 if your information

changes after submitting your appeal request

Appeals not led in accordance with these requirements may be delayed, and a request for an

administrative hearing may be denied. See the Unemployment Insurance Appeals Handbook (DOL-

424B) for complete and important information on the appeals process. You may obtain a copy of the

Unemployment Insurance Appeals Handbook (DOL- 424B) from your local career center or by doing a

search on the GDOL website at dol.georgia.gov.

Appeal hearings are scheduled in advance and routinely conducted by telephone conference.

Accommodations for people with disabilities and language translations services are available upon

request. If you require accommodations or language translation, be sure to indicate your specic

need on your appeal request. If the need for accommodations arises after submitting your appeal

(e.g., a witness requiring an interpreter), advise the Appeals Tribunal immediately by email at

[email protected] or fax at 404.232.3901 or 404.232.3902 as quickly as possible.

If you wish to le

an appeal…

You will…

Online

Go to dol.georgia.gov and select the File an Appeal link on the Homepage or on the

Individuals page. Enter the requested information then follow the on-screen instructions.

Email

Send your request to [email protected]. Your message must contain, at a minimum,

your name, the last four digits of your SSN on the determination being appealed, the date on

the determination or decision and an explanation of why you are ling an appeal. If you are

appealing a previous decision made by the Appeals Tribunal include the docket number of

that appeal decision.

Mail

Download the Appeal Request Form (DOL-423) from the GDOL website at dol.georgia.gov

under Forms and Publications. Mail the completed form to the Appeals Tribunal:

Georgia Department of Labor UI Appeals Tribunal

148 Andrew Young International Blvd. NE, Suite 525

Atlanta, GA 30303-1734

Fax

Download the Appeal Request Form (DOL-423) from the GDOL website at dol.georgia.

gov under Forms and Publications. Fax the completed form to the Appeals Tribunal at

404.232.3901 or 404.232.3902.

WHAT HAPPENS AFTER I FILE AN APPEAL?

After submitting your appeal request, the Appeals Tribunal will determine if a hearing should be

scheduled. If a hearing is warranted, the Appeals Tribunal will schedule a hearing. If a hearing is

scheduled, the Appeals Tribunal will send to you, the employer, and any interested party a Notice of

Hearing containing the time and date as well as the issues to be discussed at the hearing.

After the hearing, a decision will be mailed to all interested parties. If you disagree with the decision,

you have the right to appeal to the Board of Review.

19

Georgia Department of Labor Board of Review

148 Andrew Young International Blvd., NE, Suite 510

Atlanta, GA 30303-1734

Phone: 1.877.709.8185

Fax: 404.232.3339

Email: [email protected]

If you disagree with the decision by the Board of Review, you have the right to le a motion for

reconsideration or appeal to Superior Court in the county where you worked for the employer listed on

the claim. If you led an interstate claim and disagree with the decision by the Board of Review, you

may appeal to Fulton County Superior Court.

If a previous GDOL decision to pay you benets is reversed, you will be required to repay any

benets received during the period of time the Appeals Tribunal or Board of Review determines

you are not eligible to receive benets.

After you apply for UI benets, you must claim or certify for your benets every week you wish to

receive benet payments.

When you claim your weekly benets, you are certifying for that week you:

• Were able, available, and actively looking for work.

• Did not refuse suitable work.

• Did or did not earn wages from any work.

You may claim your weekly benets by Internet on the GDOL website or by telephone using the GDOL

Interactive Voice Response (IVR) system. The GDOL website and IVR are available 24 hours a day,

seven days a week, and can also be used to check the status of your benet payments. You may also

submit a Weekly Claim Form for UI Desk Certication (DOL-421) or Weekly UI Claim for Vocational

Trainee (DOL-460) to your local GDOL career center.

If you have problems claiming your benets, call UI Customer Service at 1.877.709.8185. UI Customer

Service hours are 8:00 a.m. to 4:00 p.m. Eastern Standard Time, Monday through Friday. Due to the

high volume of telephone calls, the wait time may be longer on Monday, Tuesday, and after a holiday.

WHEN TO CLAIM YOUR WEEKLY BENEFITS

You must wait until the current benet week has ended to claim benets for that week. You have

up to two weeks to claim your benets. An unemployment benet week begins on Sunday and ends

the following Saturday at midnight. If you are a claimant trainee, your unemployment benet week

begins on Saturday and ends on Friday at midnight.

Continue to request weekly payments and submit your Weekly Work Search Record throughout the

appeal process, and report or respond to the Department if instructed to do so. If the appeal decision

is in your favor, you will receive payment for every week you are eligible, properly requested payment,

and have submitted your weekly work search records.

CLAIMING YOUR WEEKLY BENEFITS

20

Failure to claim a week of benets on time will result in you being considered “ineligible to

receive benets” for that week. You will not receive a benet payment for any week in which you

are ineligible.

METHODS FOR REQUESTING WEEKLY PAYMENTS

REQUESTING WEEKLY PAYMENTS ONLINE

You must have a password to request weekly payments online. Your password is initially established

when you led your unemployment insurance claim. You may change your password anytime by going

to your MyUI page and select Create/Forgot Password and/or PIN.

REQUESTING WEEKLY PAYMENTS BY TELEPHONE

To request your weekly benets by telephone using Interactive Voice Response (IVR), you must use

your 4-digit Personal Identication Number (PIN) that you established at the time you led your claim.

If you have not already created a GDOL PIN, you may do so the rst time you claim weekly benets by

telephone. See CLAIMING YOUR WEEKLY BENEFITS BY TELEPHONE for instructions on creating

your PIN. You do not have to select a week to create a PIN.

If you claim your weekly benets using the Weekly Claim Form for UI Desk Certication (DOL-421) or

Weekly UI Claim for Vocational Trainee (DOL-460), a GDOL PIN is not required.

GDOL recommends not using a PIN that is easily guessed such as the last four digits of the SSN,

telephone number or sequential numbers, etc.

For example, using the calendar below, you could claim benets for the benet week ending on Saturday,

September 7 between 12:01 a.m. on September 8 until 12:00 a.m. on September 21.

September

SUN MON TUE WED THU FRI SAT

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

29 30

Enter your GDOL password and/or PIN carefully. If you enter this information incorrectly three times

in a row, your account will be locked. You can either regain access by resetting your credentials

online by going to dol.georgia.gov and select Unemployment Claim Account Management, or call

1.877.709.8185 or visit your local career center. Only you should know your password/PIN. You are

responsible for improper or fraudulent activity using your password/PIN. If another person knows your

password/PIN, visit dol.georgia.gov and select Unemployment Claim Account Management to reset it.

Your password/PIN is your signature and must be kept condential in order to guard against identity

theft and protect your privacy.

21

Social security, vacation pay (if totally separated), separation pay, jury duty income, and pay for

weekend military reserve duty are NOT considered earnings and do NOT have to be reported when

claiming your weekly benets.

RESPONDING TO THE CERTIFICATION QUESTIONS

When claiming your weekly benets, you will be asked the following questions to certify you are meeting

the eligibility requirements of the law for the week you are claiming benets:

• Were you able, available, and actively seeking work this week?

• Did you refuse any work offered this week?

• Did you work or earn any wages this week?

• If yes, what were your gross earnings (before taxes)? (See REPORTING INCOME)

• Are you still working?

• If no, did the job you worked end because there was no work for you to perform this week?

Here are some important things to remember when claiming benets:

1. Make sure your answers are truthful. Reporting false information on your UI claim is against

the law and may result in repayment of benets and criminal prosecution. If the GDOL discovers

you did not answer truthfully, you will be responsible for repaying any benets you received for

weeks in which you were not eligible.

2. Make sure your answers are entered correctly. If you make a mistake and cannot re-enter the

correct information, contact your career center immediately.

3. Make sure you report any wages during the week they are earned, even if you have not

actually been paid for the work. Report the amount you earned before taxes and other

deductions. Be sure to have this information available before you begin the process of claiming

your benets.

After you answer all questions, the system will tell you if your weekly certication was accepted and

if it will be processed. Acceptance of your entries does not guarantee you will receive a benet

payment. If your weekly certication was not accepted or cannot be processed, contact your

GDOL career center immediately.

22

If you have already been determined to be eligible to receive benets and have successfully

claimed a week of benets, please allow 24-48 hours for the funds to be credited to your account or

debit card.

When a state holiday falls on a business day, your benet payment will be delayed. See PAYMENT

DELAYS in the BENEFIT PAYMENTS section for a list of state holidays.

CLAIMING YOUR WEEKLY BENEFITS ONLINE

To claim your weekly benets online, you will need your GDOL password. Be sure all browser and

toolbar pop-up blockers are set to allow pop-ups to use this service.

Follow these steps to claim your weekly benets online:

1. Go to the GDOL website at dol.georgia.gov.

2. On the Home page, select Claim Weekly UI Benets Payments under Online Services. A

Certication Access page will open.

3. Select the week for which you are claiming benets.

4. Enter your social security number and password.

5. Select Submit. The Certication Entry page will appear with a list of questions.

If you want to change your entries before submitting them to the system, select Clear Entries.

6. On the Certication Entry page, answer each of the following questions:

• Were you able, available, and actively seeking work this week? (Yes/No)

• Did you refuse any work offered this week? (Yes/No)

• Did you work or earn any wages this week? (Yes/No)

If so, what were your gross earnings (before taxes)? If you earned wages during the week for which

you are claiming benets, enter the amount you earned before taxes and other deductions in

dollars and cents. If you earned $1,000 or more during a week, enter $999.99.

Wages must be reported for the week they were earned, even if you have not actually been paid.

• Are you still working? (Yes/No)

If you answer No, then answer the following question.

• Did the job you worked end because there was no work for you to perform this week? (Yes/No)

7. Review your answers to make sure they are correct. You may change any response(s) by

returning to the answer you wish to change and making the desired changes before clicking I

Agree.

8. Read the Certication Statement at the bottom of the screen, and select I Agree to submit your

weekly claim.

23

9. After selecting I Agree, the system will display a message at the top of the screen that states

either “Your entries have been accepted and your certication will be processed the next working

day” or “Your entry has been received, but cannot be processed.” If your weekly certication is

not accepted or cannot be processed, contact your career center immediately.

CLAIMING YOUR WEEKLY BENEFITS BY TELEPHONE

To claim your weekly benets by telephone, you will need your 4-digit PIN and a touchtone telephone.

Follow these steps to claim your weekly benets by telephone using the GDOL IVR System:

1. Dial the toll free number 1.866.598.4164.

(An option is available to hear the instructions in Spanish.)

2. Listen carefully and follow all instructions.

3. If you have already set up a GDOL PIN, go to step 5. If you do not have a PIN, go to step 4 to

create one.

4. Create a GDOL PIN by selecting Option 2 and following the instructions.

5. Select Option 3 (Request Payments) to claim your benets.

6. Answer each of the following questions by pressing 1 for Yes or 9 for No.

• Were you able, available, and actively seeking work?

• Did you refuse any work offered?

• Did you work or earn any wages during the week?

If you earned wages during the week for which you are claiming benets, you will be

asked to enter the amount you earned before taxes and other deductions. Wages must be

reported for the week they were earned, even if you have not actually been paid.

Enter dollar and cents. If you earn $1,000.00 or more during a week, enter $999.99.

EXAMPLES:

If you earned $110.50, then press 11050. If you earned $29.50, then press 2950.

If you earned $1,035.00, then press 99999.

7. After you answer all questions, the IVR will repeat your answers for conrmation. Listen carefully

to make sure you entered your responses correctly.

8. Press 1 for Yes or 9 for No to conrm your answers.

If you realize you made an error, press 9 for No. The system will ask you the questions

again. If you hang up before conrming your answers, your weekly certication will not

be completed.

24

9. After conrming answers, you will be advised if the weekly claim was processed or if you need

to contact your career center.

If you have a problem claiming your weekly benet, call UI Customer Service at 1.877.709.8185.

Customer Service hours are 8:00 a.m. to 4:00 p.m., Monday through Friday.

Due to the volume of telephone calls received on Monday, Tuesday, or a day after a holiday, you

may experience a longer wait time to speak to a Customer Service Representative. To avoid this

possibility, you may want to call on Wednesday, Thursday or Friday, which are our least busy days.

REPORTING YOUR WORK SEARCH

You must make a good faith effort to nd another job by performing new veriable work search

activities three (3) or more days for each week you request payments to include, but is not

limited to, developing a work search plan, applying for jobs, interviewing, attending job fairs,

developing résumés, and more.

A Weekly Work Search Record must be submitted to the GDOL by computer or fax for each week you

claim unemployment benets. Your work search record is subject to random audit by the GDOL at any

time. You will be denied benets for any week(s) you do not meet these requirements, make a false

statement, or misrepresent facts. You will be responsible for repaying benets you received during the

denial period.

ACCEPTABLE WORK SEARCH ACTIVITIES INCLUDE BUT ARE NOT LIMITED

TO:

• register for employment services by visiting worksourcegaportal.com

• develop a work search plan

• develop résumé(s)

• upload résumé(s) to online job boards

• apply for jobs with employers that have (or are reasonably expected to have) job openings

• interview with employers (virtual or in-person)

• attend job fairs/networking work related events

• use online career tools or job matching systems

• follow through on all job referrals from the GDOL for suitable work

• utilize reemployment services in the GDOL Career Centers or complete similar online or self-service

activities (e.g. obtaining and using labor market and career information, participate in Reemployment

Services and Eligibility Assessment (RESEA) activities, participate in skills assessment for

occupational matching, instructional workshops or other specialized activities.

• create a personal user prole on a professional networking site

• take a civil service exam

25

CHECKING THE STATUS OF YOUR PAYMENTS

CHECKING YOUR PAYMENT STATUS ONLINE

Follow these instructions to check on the status of your weekly benet payments online:

1. Go to the GDOL website at dol.georgia.gov.

2. On the Home page, select Check MyUI Claim Status for benets paid for the current benet year

program.

CHECKING YOUR PAYMENT STATUS BY TELEPHONE

Follow these instructions to check the status of any payment, or the number of remaining benet weeks

and balance on your claim:

1. Call the IVR at 1.866.598.4164.

SUBMITTING YOUR WORK SEARCH ONLINE

The faster, preferred method is to submit your Weekly Work Search Records on the GDOL website.

Follow these instructions to submit your work search record online:

1. Go to the GDOL website at dol.georgia.gov.

2. On the Home page, select Submit Weekly Work Search under Online Services. The Weekly

Work Search Record page will appear.

3. Enter your social security number and GDOL password. Use the same GDOL password you use

for online claim services.

4. Follow the on-screen instructions.

5. Provide complete information that can be veried. Include the company name, job title, and

employer address, if available. If you apply for jobs online, enter the name of the job search

engine (e.g., Monster or Indeed.com), the Job ID #, and/or the URL or web address of the job

listing. You must enter either an employer address or URL. URLs may not display on mobile

applications. Use the full website version to view the URL.

6. You will receive a conrmation number for each successful submission of your Weekly Work

Search Record. Record the conrmation number for your records.

SUBMITTING YOUR WORK SEARCH BY FAX

A printable UI Weekly Work Search Record (DOL-2798) form may be downloaded from the Forms and

Publications tab on the GDOL website at dol.georgia.gov.

The form may also be requested from your local career center or by contacting the Customer Service

Unit at 1.877.709.8185.

26

2. Select Option 5.

3. Choose the desired option:

a. To hear the status of an individual payment, select the Payment option. If prompted to

enter a date, enter the 6-digit ending date for the benet week. For example, enter April 24,

2021 as 042421.

b. To hear the number of weeks remaining on your claim and the remaining balance of

your maximum benet amount, select the Balance option.

BENEFIT PAYMENTS

You may receive your benet payments by direct deposit or on a Georgia UI Way2Go Debit MasterCard®.

DIRECT DEPOSIT

The preferred method of payment for benets is direct deposit into your checking or savings account.

With direct deposit, if benets are approved, your payments can be in your account within three days

after you claim your weekly benets.

To establish direct deposit, you must provide your bank’s routing number and your savings or checking

account number for that bank. Do not use the routing number on a deposit slip if it is different from the

routing number on your checks. The following illustration shows you how to locate the routing number

and account number for your checking account.

If you do not request direct deposit, a Georgia UI Way2Go Debit MasterCard® account will be

established for you, and your payments will be deposited on the debit card.

Do not write any checks or schedule automatic or other withdrawals against the deposit until

you have veried the funds have been credited to your account by your bank. The GDOL is not

liable for overdraft charges you may incur.

Your Name

Your Street Address

City, State Zip

Pay to the Order of:

For:

Bank Routing Number

Account Number

Check Number (Do NOT enter)

Date

27

WAY2GO DEBIT MASTERCARD®

The Georgia UI Way2Go Debit MasterCard® program is operated by Go Program and works much like a

standard debit card. With this option, your benet payments are deposited into a separate account established

for you with Comerica Bank. You access your money by making purchases or withdrawing cash using the card.

No credit check or bank account is required. Your Georgia UI Way2Go Debit MasterCard® is accepted

everywhere MasterCard® debit cards are accepted. The Georgia UI Way2Go Debit MasterCard® is valid

for any UI claim you le for the next three years. If you le a new claim for unemployment benets during

the three-year period, you will not receive a new card, so keep it in a safe place. If you are receiving

benets when the three-year period expires, Comerica Bank will automatically issue you a new card.

Make sure the card is kept in a secure location and that you are the only person who knows the debit

card PIN. Never keep the card and PIN together.

If your card is lost or stolen or if someone learns your debit card PIN, immediately notify the

Georgia UI Way2Go Debit MasterCard® Customer Service at 1.888.929.2460 to change your PIN

and request a new card.

You will be liable for any money removed from the card if you:

• fail to report the loss of the card;

• fail to change the PIN on your debit card; or

• fail to keep the card in a safe place and the PIN private.

One free replacement card may be issued each 12-month period for lost or stolen cards.

Additional replacement cards may be purchased.

Follow these instructions to begin using your debit card:

1. Call the Georgia UI Debit MasterCard® Customer Service at 1.888.929.2460 or visit the

GoProgram website at goprogram.com to activate your debit card.

2. Check the balance on your account to verify funds are available.

A “Payment Record” form is available for your convenience in the YOUR RECORDS

section of this handbook to record each benet payment you receive.

The following services are available on the debit card at no cost to you:

• Deposit notications

• Purchases wherever MasterCard® is accepted

• Cash back with purchases

• Unlimited MoneyPass ATM

• Bank teller cash withdrawals

If your bank account information changes, be sure to update your banking information on our secure

website at dol.georgia.gov. Select the Online Services tab on the Home page, and then select UI

Benet Payment Methods under Unemployment Insurance (UI) Benets.

28

Fees may be associated with the following activities:

• Using an out-of-network ATM

• Receiving text messages on your cell phone notifying you of deposits

• Requesting a rush on a replacement card

Be sure to read the fee schedule and “Terms of Use” in your debit card packet to fully understand when

fees apply. You can also review this information on the GDOL website.

Review your account statement regularly to make sure all transactions are correct. If you believe

a transaction is incorrect, call the Georgia UI Way2Go Debit MasterCard® Customer Service at

1.888.929.2460 immediately.

CHANGING YOUR PAYMENT METHOD

You may change your method of benet payments at any time on our secure website at

dol.georgia.gov. Changes made to your account information after 6:00 p.m. ET may take up to 48

hours to become effective. Follow these instructions to change your payment method or update your

direct deposit information:

1. Go to the GDOL website at dol.georgia.gov.

2. On the Home page, select the Online Services tab, and then select UI Benet Payment

Methods under Unemployment Insurance (UI) Benets.

3. Follow the on-screen instructions.

INCOME TAX WITHHOLDINGS

Unemployment insurance is taxable income and must be reported on your federal and state

income tax returns. Federal taxes are deducted at 10 percent and state taxes at 6 percent. You

can have both or either deducted from your benets. For example, if your weekly benet amount is

$274, your federal taxes would be $27, and your state taxes would be $16.

You have two options for handling taxes on your benet payments:

• Request that the GDOL withhold state and/or federal taxes from your benet payments. Use

the Income Tax Withholding Option Update transaction available at dol.georgia.gov. Taxes will be

calculated on the gross payment for the week being paid (weekly benet amount minus any wages

you earned and any other deductions). Since withholding of income taxes is voluntary, taxes are

deducted only after any involuntary deductions are made (e.g., child support and repayment of an

overpayment).

• Make estimated tax payments to the Internal Revenue Service (IRS). If your taxable income

withholding status meets the estimated payment requirements, you may make tax payments

directly to the IRS.

At the end of January, you will receive an IRS Form 1099-G showing the total benet payments and

taxes withheld during the previous tax year, even if you repaid benets to the GDOL. If you opt out

of receiving this information electronically, the GDOL will mail an IRS Form 1099-G to you. The same

information will be provided to the IRS and the Georgia Department of Revenue.

29

You may also view and print 1099-G forms for multiple years on the GDOL website at dol.georgia.gov.

The information is updated in January each year. You will need your GDOL password to access the

information. If you do not remember your password, you may use your date of birth and last zip code

used on your claim to access the information. You do not have to submit IRS Form 1099-G with your

income tax returns.

Questions about the taxation of unemployment insurance benets, making estimated tax payments or

other tax matters should be directed to the IRS or the Georgia Department of Revenue.

OTHER DEDUCTIONS

The following payments will be deducted from your unemployment benet payments:

• Child Support: If you are required (or volunteer) to make child support payments to a court,

district attorney’s ofce, or other child support enforcement agency, a deduction from your weekly

benet payment may be required up to 50 percent of the compensable amount.

• Earnings: Report gross earnings (the amount earned before taxes and other deductions) when

claiming weekly benets, (even if it is only $1) . This includes self-employment, part-time work

or any vacation or holiday pay received (if you have a denite date of recall within 6 weeks of

the last date worked). Earnings over $50 per week for weeks ending on or after July 8, 2023 are

deducted from your weekly payment dollar for dollar. Earnings over $150 per week for weeks

ending before July 8, 2023 will be deducted from your weekly payment dollar for dollar. See

REPORTING INCOME for more information.

EXAMPLE (Weeks ending on or after July 8, 2023):

To ensure you receive your IRS Form 1099-G, be sure to update any change of your address on the

GDOL website immediately. Go to dol.georgia.gov, select the Online Services tab, and then select

the Change of Address and Contact Information under Unemployment Insurance (UI) Benets.

If you reside in Georgia, you may also report in person to your local career center.

Report all weekly earnings before taxes and other deductions to the GDOL. The GDOL will make

the appropriate deductions from your benet payment based on your gross earnings (before taxes).

Failure to report your earnings may be considered fraud and could result in a denial of benets. If an

overpayment occurs, you will be responsible for the overpayment and subject to penalties. See Fraud

Overpayments under OVERPAYMENTS.

Item

Amount

Your weekly benet amount

Gross earnings (before taxes) from part-time job

NOTE: Report your gross earnings (before taxes) when claiming

your weekly benets.

$330.00

$250.00

Amount GDOL will deduct from your benet payment

($250 – $50 = $200)

$200.00

Your benet payment before taxes ($330 - $200 = $130)

$130.00

30

Retirement Income: If you are receiving a monthly pension from an employer whose wages were used

to establish your claim or the last employer from which you were separated, your benet payment may

be reduced. You must report all retirement income. Failure to do so may be considered fraud and

could result in a denial of benets. If an overpayment occurs, you will be responsible for the

overpayment and subject to penalties. See Fraud Overpayments under OVERPAYMENTS.

• Repayment of an Overpayment: If the GDOL determines you were paid unemployment benets you

should not have received, you will be required to repay the unemployment benets. One-half of your

weekly benet payment will be deducted and applied to your overpayment. See OVERPAYMENTS

for additional information.

PAYMENT DELAYS

Your benet payments may be delayed due to:

• Your failure to respond to requests from the GDOL for additional information or for you to report to the

career center.

• Your failure to claim your weekly benets on time.

• the GDOL ofces being closed in observation of the following state holidays:

• New Year’s Day

• Martin Luther King Jr.’s Birthday

• State Holiday

• Memorial Day

• Juneteenth

• Independence Day

• Labor Day

• Columbus Day

• Veterans Day

• Thanksgiving Day

• State Holiday (observed on Friday after Thanksgiving Day)

• Washington’s Birthday (normally observed in conjunction with Christmas Day)

• Christmas Day

When a state holiday falls on a business day, your benet payment will be delayed. This includes

direct deposits into your bank account or UI debit card account.

31

REPORTING YOUR INCOME

When ling for unemployment benets, you must report all forms of income to the GDOL including weekly

earnings, retirement, severance, separation pay, wages in lieu of notice, and workers’ compensation.

Failure to report income could result in your having to repay any overpayment of benets.

WEEKLY EARNINGS

You must report all income you earn during the week to the GDOL when requesting your weekly

payments, even if you have not been paid. Report your gross earnings (the amount you earned before

taxes and other deductions).

Calculate your gross earnings by multiplying your hourly rate of pay times the number of hours worked.

The GDOL will make the necessary calculations to determine how much, if any, will be deducted from

your weekly benet payment.

VACATION AND HOLIDAY PAY

If you are still attached to your employer, you must report vacation and/or holiday pay when requesting

your weekly payments. Examples of being attached to an employer while collecting unemployment

benets include:

• You were laid off temporarily and have a denite date to return to work within six (6) weeks from

the separation date

• You are still working, but your hours have been reduced

• Your employer led a partial claim on your behalf

NOTE: If you are totally separated from your employer, you are not required to report vacation or

holiday pay.

RETIREMENT INCOME

Retirement income includes pensions or similar payments from either an employer whose wages are

used to establish your claim or the last employer from which you were separated. Report all retirement

income to the GDOL when ling your claim. If you begin receiving retirement income after ling your

claim, contact your local career center to report this income.

You will receive a Claims Examiner’s Determination from the GDOL informing you of how the retirement

income will affect your unemployment benets. Notify your career center immediately if your retirement

amount changes. Failure to report retirement income could result in an overpayment.

SEVERANCE, SEPARATION PAY, WAGES IN LIEU OF NOTICE, AND DISMISSAL

PAYMENTS

Any type of payments you received (or will receive) as a result of your separation such as, severance,

separation pay, or wages in lieu of notice must be reported to the GDOL at the time you le your claim.

If you begin receiving such income after ling your claim, contact your local career center to report this

income. Failure to report such income could result in an overpayment.

If the weekly amount of such payment(s) is more than your weekly unemployment benet amount, you

will not be eligible to receive unemployment benets for the period of time the payment(s) covers.

32

If the GDOL determines you were paid unemployment benets you should not have received, it is

considered an overpayment, and you will be required to repay the money including any income taxes

that were withheld.

There are two types of overpayments:

• Non-fraud

• Fraud

NON-FRAUD OVERPAYMENTS

An overpayment that is caused by an unintentional act is considered non-fraud. That is, you did not

intend to obtain benets to which you were not entitled. For example, you were initially allowed to

receive benets, but after an appeal by the employer, it was determined you were not eligible to receive

benets.

The penalties for non-fraud overpayments are:

• You must pay back the amount that was overpaid.

• You may be subject to other civil penalties in a court of law, and you will have to pay certain court

costs or ling fees.

If it is not conrmed by a written determination that you did not intentionally or knowingly commit

fraud, you may request a waiver application to be released from repaying the overpayment. For more

information on requesting an overpayment waiver go to the Overpayment & Waiver Information page

on our website at dol.georgia.gov. A waiver must be requested within 15 days of the release date of

the overpayment notice or the decision establishing the overpayment.

When determining if a waiver will be granted, the GDOL will consider if:

• The overpayment waiver application was submitted within 15 days of the overpayment determination

mail date; and

OVERPAYMENTS

Any income you receive at any time while collecting unemployment benets must be reported to the

GDOL immediately except social security retirement, jury duty income, and pay for weekend military

reserve duty. Vacation and holiday pay must be reported as earnings if you are considered to still be

employed. See VACATION and HOLIDAY PAY

If it is a lump sum payment, it will be divided by your average gross weekly earnings for a standard work

week to determine the number of weeks covered. You will receive a Claims Examiner’s Determination

from the GDOL informing you of how the severance, separation pay, or wages in lieu of notice will

affect your unemployment benets.

WORKERS’ COMPENSATION

You must inform the GDOL if you have applied for or are receiving workers’ compensation when ling

your claim. If you apply for or begin receiving workers’ compensation after ling your claim, contact your

local career center to report this income. You will receive a Claims Examiner’s Determination from the

GDOL informing you if the workers’ compensation will affect your unemployment benets.

33

• The overpayment was not established due to fraud (waiver rights are provided on the non-fraud

overpayment determination); and

• Benets paid were based on no fault of your own; and

• Proof is received showing that repayment of the overpayment will cause nancial hardship; or

• Recovery would be unreasonably excessive under the circumstances; or

• You can show receiving the payments resulted in giving up other government benets and is,

therefore, now in a worse nancial position than if you had not received the benets; or

• You used the money for things that were not ordinary expenses, such as, paying off a debt or

taking on a new loan.

FRAUD OVERPAYMENTS

Fraud overpayments occur when you knowingly make false statements, fail to disclose a material fact,

or misrepresent material facts to obtain or increase benets. You commit fraud anytime you intentionally

make false statements, provide false information, or withhold information for the purpose of obtaining or

increasing unemployment benets.

The penalties for fraud overpayments are:

1. You must pay back the amount that was overpaid.

2. You must pay a penalty of up to fteen (15) percent on the amount of the overpayment plus

interest of one (1) percent of the unpaid balance each month.

3. You will not be able to collect unemployment benets for the remainder of the calendar quarter in

which the fraud overpayment was established and for the next four calendar quarters through the

last Saturday of the fourth and nal calendar quarter.

4. You may be subject to other civil or criminal penalties in a court of law, and you will have to pay

certain court costs or ling fees.

REPAYMENT OF OVERPAYMENTS

If you do not repay your overpayment in full, you will be billed monthly. You must pay at least the

minimum monthly amount established for your overpayment. The minimum amount billed each month

is determined by the amount of your overpayment and the period of time allowed for overpayment to

be repaid in full.

• Electronic Funds Transfer (EFT)/Automated Clearing House (ACH) debit payments from checking

or savings accounts

• Check

• Money Order

EFT/ACH is the preferred method because your payments will be processed and posted against your

account faster. To make an EFT/ACH payment, go to the GDOL website at dol.georgia.gov, select

the Online Services tab, and then select Repayment of Overpaid Benets under Unemployment

Insurance (UI) Benets.

34

Failure to voluntarily repay the overpayment in full may result in the GDOL taking any of the following actions:

• Deducting 50 percent of future benet payments and applying them to the overpayment. This

includes overpayments established in another state.

• Intercepting your state and/or federal income tax refund and applying it to your overpayment (this

may include joint returns).

• Seeking possible legal action, including criminal prosecution, liens, levies, and/or garnishment in

small claims court or other courts of law.

When making a payment by check or money order, made payable to the Georgia Department of

Labor, please ensure the payment is submitted to the following address:

Georgia Department of Labor Overpayment Unit

P.O. Box 3433

Atlanta, Georgia 30302-3433

Please ensure the last four digits of your social security number appear on all correspondence

that you provide to the Overpayment Unit.

Unemployment insurance fraud and abuse is a crime that affects everyone. Individuals who commit

fraud are subject to penalties and/or criminal prosecution. The GDOL is committed to maintaining

the integrity of the UI program. If you think someone is committing fraud or abuse against the GDOL

UI program or someone is using your social security number to fraudulently collect unemployment

benets, it is important you let us know about it immediately.

All allegations of fraud and abuse are taken seriously. Please provide as much information as possible.

We review all tips received regardless of how much information is provided. However, the more details

you can provide when reporting unemployment fraud, the more it will help our investigation. In addition to

the name of the individual and the fraudulent activity, providing details such as their address, telephone

number, date of birth, and/or their social security number will help us better identify the person in our

claim records.

You can remain anonymous when providing such information. Due to condentiality requirements, we

are unable to inform you of the results of our investigation.

To report UI fraud, go to the GDOL website at dol.georgia.gov and select Report UI Fraud & Abuse

on the Home page under Online Services. You may report suspected cases of UI fraud, abuse, identity

theft, job refusals, and failure or refusal of pre-employment drug screening tests online or download and

print the appropriate form to mail or fax to:

Georgia Department of Labor UI Integrity Unit

148 Andrew Young International Blvd., NE. Suite 727

Atlanta, GA 30303-1732

Phone: 877.709.8185

Fax: 404.232.3445

E-mail: [email protected]

REPORTING UI FRAUD AND ABUSE

35

EMPLOYMENT SERVICES REGISTRATION

You must be actively registered for Employment Services to receive UI benets, unless exempt by

law. This includes being available for screening and referral to employers who are currently offering

employment Georgia residents are required to register for Employment Services with our partners at

the Technical College System of Georgia (TCSG) through WorkSource Georgia. Interstate claimants

must register for Employment Services with the State Workforce Agency (SWA) in the state where they

reside.

Claimants may go to dol.georgia.gov and select Register for Employment Services under Online

Services to register and get more information.

Registration requires:

• the establishment of an account, which must include your social security number; and

• creation or uploading of a complete online resume

with your WorkSource Georgia account. Please maintain your resume to ensure your most current

employment information is documented.

EMPLOYMENT SERVICES

36

SERVICES IN THE GDOL CAREER CENTERS

Helpful resources available in the GDOL career centers include:

• Computer Resource Centers: Use the computers in the resource area to explore careers, look

for a job, and complete job applications. See Career Center Computer Resources below for a

description of tools that are available on the GDOL computers.

• Copiers and Fax Machines: Use the GDOL copiers and fax machines to copy and fax documents

related to your job search.

• Library: The GDOL career center has brochures, books, and videos to help you with your job

search.

• Support Services: The GDOL can refer you to services to assist you with housing, food, childcare,

healthcare, and transportation.

• Special Programs: Additional employment services are provided to individuals who meet certain

criteria. See SPECIAL PROGRAMS to learn more.

Having trouble locating something on the GDOL website? Use the Site Map or Search feature.

37

CAREER CENTER COMPUTER RESOURCES

The computer resource areas of the GDOL’s career centers contain several job search tools including:

• Georgia Labor Market Explorer: Use the Georgia Labor Market Explorer to research occupations

and access information about labor market trends, statistics, the economy, and demographic data.

You will also nd assistance in looking for a new job and nding training or educational programs.

• O*NET OnLine: O*NET OnLine at onetonline.org provides detailed descriptions of occupations

including skills, knowledge, training, work environments, and work values. Use O*NET to learn

about careers; match your skills and interests to occupations; and nd a wealth of information on

jobs, schools, educational and training programs, and nancial aid.

• mySkills myFuture: Would you like to change careers? Visit myskillsmyfuture.org to learn how

skills you used in past jobs can build a bridge to a new career. This website also helps you compare

careers, nd training, and search for jobs.

• My Next Move: Use My Next Move at mynextmove.org to search careers that match your interest

and training.

The following special programs are available to people who meet certain criteria. To determine your

eligibility to participate in these programs, GDOL staff may need to contact you for additional information.

If a GDOL representative requests information, be sure to respond promptly. Failure to respond to all