Understanding the U.S.

Renewable Energy Market: A

Guide for International

Investors

2022

Obafemi Elegbede, PhD

Alexander Tippett

Table of Contents

Introduction.............................................................................................................................. 3

U.S. Renewable Energy Sector Has Already Seen Strong Growth....................................................... 3

Solar And Wind Expected To Drive Future Expansion....................................................................... 5

Significant Decline In Costs.......................................................................................................... 7

Strong Government Support For Renewable Energy........................................................................ 9

Investment In Renewables Grows, Supported By Substantial Greenfield FDI......................................11

Conclusion...............................................................................................................................14

References...............................................................................................................................15

U.S. Department of Commerce | International Trade Administration 2

INTRODUCTION

The United States’ renewable energy sector, already the second largest in the world, is poised for strong

growth. Bolstered by growing demand for clean energy, falling costs, and robust incentives, renewable

energy is expected to become the leading source of electricity generation by the mid-2030s. By 2050,

renewable energy sources are projected to provide 42 percent of the United States’ electricity

compared to approximately 20 percent today.

1

Given the pace and scale of the transformation

underway, the U.S. renewable market offers a valuable opportunity for investors.

This brief explores the U.S. renewable energy landscape with a focus on the U.S. electricity sector using

data from the United States Energy Information Administration (EIA), International Renewable Energy

Agency (IRENA), International Energy Agency (IEA), Congressional Research Service (CRS) and fDi

Markets. Currently, about 60 percent of U.S. renewable energy goes to the electricity sector, while the

electricity sector overall consumes about 38 percent of total U.S. primary energy mix which includes

energy used directly in transportation, as well as industrial, residential, and commercial heating

applications.

Focusing on the five largest sources of renewable electricity generation—hydroelectric, wind, biomass,

solar and geothermal—this paper provides information on historical trends in power generation in the

United States, forecasted changes in the U.S. electricity market and their key drivers, namely declining

construction costs and government incentives, and the implications for foreign direct investment (FDI) in

the United States.

Investors interested in the opportunities present in the United States’ renewable energy sector are

invited to contact SelectUSA, the United States’ investment promotion initiative housed in the U.S.

Department of Commerce, by emailing selectusa@trade.gov or by visiting the SelectUSA website

.

THE U.S. RENEWABLE ENERGY SECTOR HAS ALREADY SEEN STRONG GROWTH

Over the past decade, renewable energy sources (renewables) have become an increasingly important

part of the United States’ energy mix. Between 2000 and 2020, overall renewable energygeneration

grew 91.2 percent, from 6.1 quadrillion British thermal units to 11.6. of energy. In 2020, about 12.2

percent of total primary U.S. energy production was generated by renewable sources.

2

Renewable energy generation in the electricity sector has also seen impressive growth. Between 2000

and 2020, utility-scale electricity generation by renewables in the United States grew approximately 120

percent, from 356 billion kilowatt-hours (kWh) in 2000 to 783 billion kWh in 2020. In 2020, renewables

generated 19.5 percent of the United States’ net electricity production.

3

In comparison, coal plants

1

U.S. Energy Information Administration, “Annual Energy Outlook 2021,” 2021,

https://www.eia.gov/outlooks/aeo/.

2

U.S. Energy Information Administration, “January 2022 Monthly Energy Review:Primary Energy Overview,”

https://www.eia.gov/totalenergy/data/monthly/.

3

U.S. Energy Information Administration, “January 2022 Monthly Energy Review: Electricity Net Generation,”

2022, https://www.eia.gov/totalenergy/data/monthly/. These figures exclude small-scale solar photovoltaic

generation. In 2020, these sources produced an additional estimated 43 billionkWhin renewable electrcity.

U.S. Department of Commerce | International Trade Administration 3

generated 19.30 percent and nuclear plants 19.7 percent. Natural gas sources currently still lead the U.S.

electricity mix, producing 1624 billion kWh of electricity in 2020 or 40.5 percent of utility-scale electricity

production (Figure 1).

Figure 1. U.S. Utility-Scale Electricity Generation by Source, 2000-2020 (billions kWh)

2500

0

500

1000

1500

2000

2000 2015 2020

Billion kWh

2005 2010

Renewables Coal Natura l Gas Nuclea r Petroleum and Other

Source: U.S. Energy Information Administration, “January 2022 Monthly Energy Review: Electricity Net Generation,” Accessed February 2022.

The growth of the renewable power sector in the United States has made it the second largest producer

of renewable electricity in the world, following only China. In total, the United States generates more

renewable electricity than Germany, Japan, and the United Kingdom combined.

4

Wind currently dominates the U.S. renewables mix, accounting for 43.2 percent of the United States’

utility-scale renewable electricity production, or 337.9 billion kWh. Hydroelectric sources were

responsible for an additional 36.43 percent of output or 285.3 billion kWh, while solar sources

contributed 11.4 percent and biomass and geothermal sources respectively produced 6.9 percent and

2.03 percent (Figure 2).

Since 2000, electricity generation by wind sources has grown exponentially at 5,941 percent, from 5.6

billion kWh to 337.9 billion kWh, while solar production has grown a staggering 17,979 percent, from

just 0.49 billion kWh to 89.1 billion kWh. This growth has transformed renewable sources from a small

section of the U.S. electricity mix into an essential element.

Hydroelectric sources like dams have been a mainstay of U.S. electricity production for decades, with

the first hydroelectric plant selling electricity opening in 1882.

5

Most current production facilities were

developed in the 1970s with federal dollars. In recent years, few additional facilities have been built in

4

International Renewable Energy Agency, “Renewable Energy Statistics 2021,” 2021, Accessed February 2022,

https://www.irena.org/Statistics.

5

U.S. Energy Information Administration, “Hydropower explained,” 2021,

https://www.eia.gov/energyexplained/hydropower/.

U.S. Department of Commerce | International Trade Administration 4

the United States due to a combination of social and environmental concerns, a limited number of prime

locations without a generator, and decreasing cost-competitiveness relative to other generator types.

6

Electricity generation via biomass is primarily produced via the combustion of waste-wood and wood-

derived fuels. In the industrial sector, many lumber and paper producers use their waste products to

generate electricity needed to operate their facilities. Other sources of biomass include municipal solid

waste and landfill gas. While a small share of utility-scale electricity generation, biomass represented 22

percent of total U.S. renewable energy consumption in 2020, because it is also used in transportation, as

well as industrial, residential, and commercial applications.

7

Geothermal generators use steam from hot water a few miles below the surface of the earth to

generate electricity. The use of geothermal production is limited by geologic conditions. As of 2020, just

seven states in the United States possessed geothermal powerplants, all located in the western half of

the country. While geothermal sources represent a small portion of overall power generation, the

United States is the global leader in geothermal electricity generation.

8

Figure 2. Utility-Scale Electricity Generation from Renewable Energy Sources by Source Type, 2000-2020

(billions kWh)

400

0

50

100

150

200

250

300

350

2000 2005 2020

Billions kWh

Wind Hydroelectric

2010 2015

Solar Biomass Geothermal

Source: U.S. Energy Information Administration, “January 2022 Monthly Energy Review: Electricity Net Generation,” Accessed February 2022.

SOLAR AND WIND EXPECTED TO DRIVE FUTURE EXPANSION

Growth in the renewables sector is expected to continue in the coming years. According to the EIA,

annual electricity generation from renewable sources is expected to exceed contributions from even

6

Emilio F. Moran, Maria Claudia Lopez, Nathan Moore, Norbert Müller, and David W. Hyndman, Proceedings of

the National Academy of Sciences of the United States of America, “Sustainable hydropower in the 21st century,”

2018, https://www.pnas.org/content/115/47/11891.

7

U.S. Energy Information Administration, “The United States consumed a record amount of renewable energy in

2020,” 2021, https://www.eia.gov/todayinenergy/detail.php?id=48396.

8

U.S. Energy Information Administration, “Ge othermal explained,” 2021,

https://www.eia.gov/energyexplained/geothermal/use-of-geothe rmal-energy.php

U.S. Department of Commerce | International Trade Administration 5

natural gas by 2050 (Figure 2).

9

This shift will be primarily driven by the addition of new renewable

sources and the retirement of older fossil fuel plants. Coal plants, most of which were built in the 1970s

and 1980s, will be steadily retired due in large part to state-level clean energy standards that mandate

reductions in carbon emissions and a changing economic landscape that has left them increasingly

uncompetitive. As of December 2021, plant owners anticipate that they will retire 28 percent of existing

coal capacity by 2035, though EIA expects that figure to grow.

10

Renewables, along with natural gas, are

positioned to replace them due to their cost-effectiveness and limited emissions.

By 2050, renewable sources are expected to supply 42 percent of the United States’ electricity, or 2,258

kWh, while natural gas will supply 36 percent and nuclear and coal will provide 11 percent each.

Moreover, the EIA expects approximately 60 percent of new electrical capacity added during this period

to come from renewables while roughly 40 percent will come from natural gas.

11

Figure 3. Electricity Generation by Source, 2010 to 2050 (billions kWh)

0

500

1000

1500

2000

2500

2010 2015 2020 2045 2050

Billions kWh

2025 2030 2035 2040

Na tura l gas Renewables Nuclea r Petroleum and other Coal

Source: U.S. Energy Information Administration, Annual Energy Outlook 2021, Accessed September 15, 2021,

https://www.eia.gov/outlooks/aeo/.

While wind and hydroelectric sources are leading sources as of 2022, solar is projected to lead 2050’s

renewable mix. By 2050, solar is expected to produce 47 percent of electricity generated from

renewable energy or 1,070 kWh. Wind is expected to come next at 34 percent of renewable output,

followed by hydropower at 13 percent, and geothermal at 2 percent (Figure 2).

Figure 4. Renewable Electricity Generation by Source, 2010 to 2050 (billions kWh)

9

U.S. Energy Information Administration, “Annual Energy Outlook 2021,” 2021,

https://www.eia.gov/outlooks/aeo/.

10

U.S. Energy Information Administration, “Of the operating U.S. coal-fired power plants, 28% plan to retire by

2035,” 2021 https://www.eia.gov/todayinenergy/detail.php?id=50658.

11

U.S. Energy Information Administration, “Annual Energy Outlook 2021,” 2021,

https://www.eia.gov/outlooks/aeo/.

U.S. Department of Commerce | International Trade Administration 6

Billions kWh

1200

1000

800

600

400

200

0

Solar Wind

2025 2030 2035 2040 2045 2050

Geothermal Hydroelectric Other

2010 2015 2020

Source: U.S. Energy Information Administration, Annual Energy Outlook 2021, Accessed September 15, 2021,

https://www.eia.gov/outlooks/aeo/

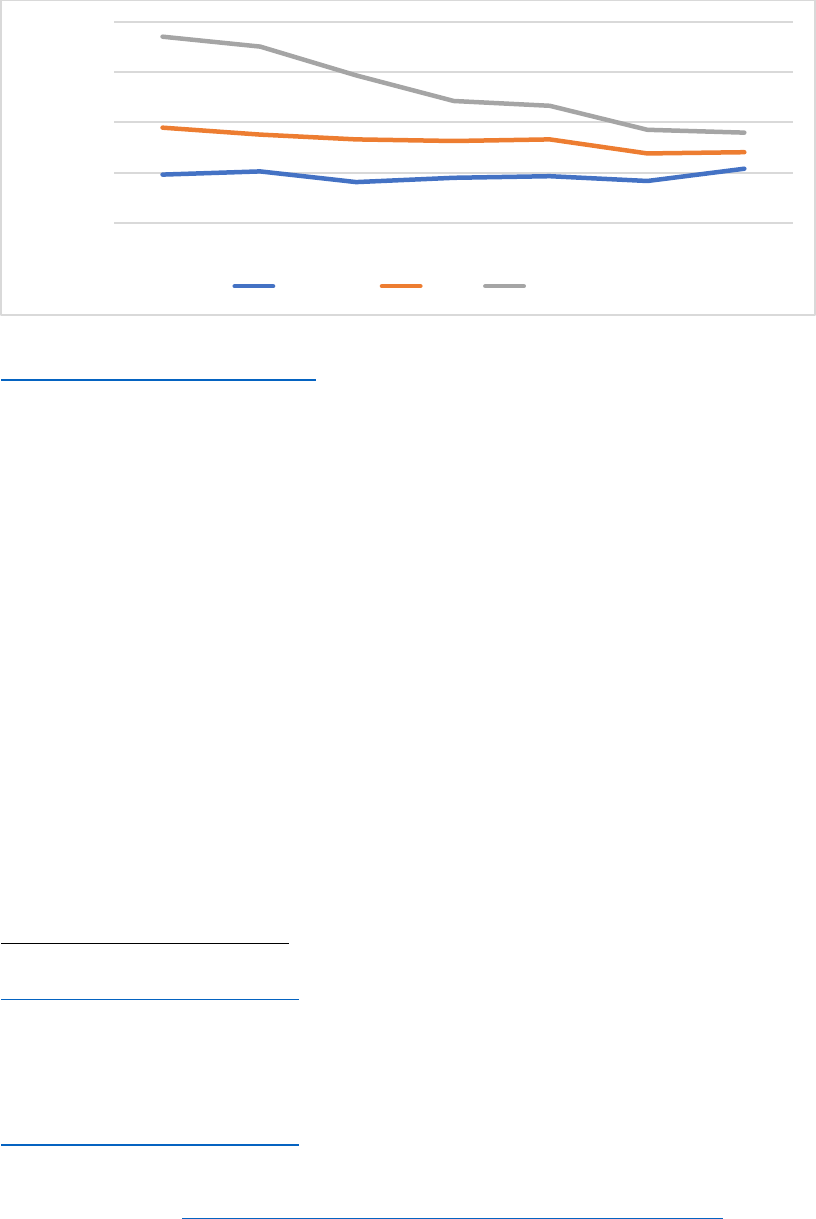

SIGNIFICANTDECLINE IN COSTS

One of the fundamental drivers behind the growth of renewable electricity generation has been the

sharp decline of construction costs associated with solar and wind projects.

While construction costs can vary significantly based on region and on the specific technology deployed,

installation costs for utility-scale energy projects have declined sharply in recent years. At the end of

2019, the average construction cost for onshore wind turbines was $1,391 per kilowatt, down 26.6

percent since 2013. Similarly, the average construction cost for solar generators in 2019 was $1,796 per

kilowatt, 51.5 percent less than in 2013.

12

Currently, natural gas remains the most competitive power source in terms of construction cost. As of

2019, average construction costs associated with natural gas plants rested at $1,078 per kilowatt (Figure

3).

12

U.S. Energy Information Administration, “Construction Cost Data for Electric Generators Installed,” 2021,

https://www.eia.gov/electricity/generatorcosts/.

U.S. Department of Commerce | International Trade Administration 7

Figure 5. Average Construction Costs for Electric Generators by Source, 2013 – 2019, (Dollars per kW)

Dollars per kW

4,000

3,000

2,000

1,000

0

2015

Natural gas

2016 2017 2018 2019

Wind Sol ar PV

2013 2014

Source: U.S. Energy Information Administration, Construction Cost Data for Electric Generators Installed, Accessed February 7, 2022,

https://www.eia.gov/electr icity/generatorcosts/

The EIA, however, expects that average national overnight construction costs for solar to be lower than

those of natural gas by 2050, with wind also seeing significant declines as well.

13

By 2050, the EIA’s

standard reference case expects overnight construction costs for wind to reach $918.36 dollars per

kilowatt, $655.97 for combined cycle multi shaft natural gas plants, and $640 for solar photovoltaic

plants with axis tracking.

14,

Initial construction costs, however, are only one element of the costs associated with running a power

plant. Over its lifetime, a plant incurs a variety of operating costs while generating revenue. The

levelized cost of electricity (LCOE) represents the installed capital and operating costs associated with a

power plant over its lifetime. The levelized avoided cost of electricity (LACE) represents the revenues

available to that power plant over the same period and their relative value to the power grid. A project

is more economically viable when it has a higher ratio of LACE to LCOE.

15

In their 2021 Outlook, the EIA forecasts that solar sources will, on average, begin outperforming natural

gas and other sources in these terms by 2026 (Figure 6).

By that point, wind is alsoexpected to

outperform nuclear and coal, delivering more value over its lifetime relative to the cost of investment

and maintenance. While natural gas is expected to remain a significant part of the United States’

13

U.S. Energy Information Administration, “Annual Energy Outlook 2021,” 2021,

https://www.eia.gov/outlooks/aeo/.

14

Prices in USD as of year-end 2020.The standard reference case assumes the continuation of current laws and

regulations. The low renewables cost case developed by the EIA, however, which assumes higher learning rates for

renewable installation, anticipates both wind and solar plants will have significantly lower capital costs than

natural gas by 2050. U.S. Energy Information Administration, “Annual Energy Outlook 2021,” 2021,

https://www.eia.gov/outlooks/aeo/

.

15

U.S. Energy Information Administration, “Levelized Costs of New Generation Resources in the Annual Energy

Outlook 2021,” 2021, https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf.

U.S. Department of Commerce | International Trade Administration 8

electrical grid, renewable electricity production will become increasingly economically attractive going

forward.

Figure 6. Estimated Average LACE-to-LCOE Ratios by Source, 2026

Solar Photovoltaic

Natural gas combined cycle

Wind

Nuclea r

Coal

0 0.2 0.4 0.6 0.8 1

Rati o of National Average LACE to Nati onal Average LCOE

Source: U.S. Energy Information Administration, U.S. Energy Information Administration, Levelized Costs of New Generation Resources in the

Annual Energy Outlook 2021, Accessed February 3, 2022, https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf.

These dynamics have already helped shape planned power projects. For instance, of the 46.1 new

gigawatts of production expected to come online in 2022, 46 percent or 21.5 gigawatts are expected to

come from solar sources while an additional 17 percent or 7.6 gigawatts will come from wind. New

natural gas projects represented 21 percent or 9.6 gigawatts.

16

STRONG GOVERNMENT SUPPORT FOR RENEWABLE ENERGY

Another key factor driving the growth of renewable energy in the United States, both in the electricity

sector and elsewhere, has been the variety of support and incentives offered by federal, state, and local

governments.

While the EIA expects that some of the largest benefits will soon be wound down, federal tax credits for

production and investment have helped bolster the cost-competitiveness of wind and solar projects and

will continue to support investment in the near term.

17

In total, tax-related support for renewable

energy reached an estimated $11.7 billion in 2017 and $8.4 billion in 2018.

18

Companies without existing

16

U.S. Energy Information Administration, “Solar power will account for nearly half of new U.S. electric generating

capacity in 2022,” 2022, https://www.eia.gov/todayinenergy/detail.php?id=50818.

17

Ibid.

18

Congressional Research Service, “The Value of Energy Tax Incentives for Different Types of Energy Resources,”

2019, https://sgp.fas.org/crs/misc/R44852.pdf.

U.S. Department of Commerce | International Trade Administration

1.2

9

U.S. tax liabilities can still take advantage of these benefits via “tax equity” financing, where firms trade

federal tax credits for various forms of capital financing.

Grant and loan programs have also been provided by several federal agencies, including the U.S.

Department of Agriculture, the U.S. Department of Energy, and the U.S. Department of the Interior.

According to the International Energy Agency (IEA), the United States dedicated roughly $8.8 billion

dollars towards energy research, development, and demonstration in 2020—the single largest amount

spent by an IEA member state and more the combined national expenditures of Japan, France,

Germany, and the United Kingdom.

19

New efforts by the federal government are likely to further expand the market for renewables. The

recently passed Infrastructure Investment and Jobs Act, for instance, commits $65 billion towards

modernizing the U.S. energy grid to enable greater uptake of renewable electricity nationwide.

20

The

Biden-Harris Administration has also set out ambitious goals for the federal government and its

partners, mandating that the federal government achieve 100 percent carbon pollution-free electricity

use by 2030 and net-zero emissions from federal procurement by 2050.

21

These goals have been

accompanied by efforts by the Administration to improve permitting and regulatory processes for

renewable energy projects and investments in U.S. supply chains and manufacturing.

22

Many state and local governments also offer incentives and other forms of support for renewable

energy projects. These range from traditional tax credits to state and local “green banks” that can help

provide financing support for renewable energy projects. More than thirty states also possess

renewable portfolio standards or similar legislation that mandates a certain percentage of electricity

come from renewable sources, further bolstering demand for renewable power.

23

19

International Energy Age nc y, “Energy Technology RD&D Budgets: Overview,” 2021,

https://www.iea.org/reports/energy-technology-rdd-budgets-ove rview.

20

The White House, Office of the Press Secretary, “FACT SHEET: The Bipartisan Infrastructure Deal Boosts Clean

Ener gy Jobs, Strengthens Resilie nce , and A dvances Environmental Justice,” 2021,

https://www.whitehouse.gov/briefing-room/statements-releases/2021/11/08/fact-sheet-the-bipartisan-

infrastructure-deal-boosts-clean-energy-jobs-strengthens-resilience-and-advances-environmental-justice/.

21

The White House, Office of the Press Secretary, “FACT SHEET: President Biden Signs Executive Order Catalyzing

America’s Clean Energy Economy Through Federal Sustainability,” 2021, https://www.whitehouse.gov/briefing-

room/statements-releases/2021/12/08/fact-sheet-president-bide n-signs-executive-order-catalyzing-americas-

clean-energy-economy-through-federal-sustainability/.

22

The White House, Office of the Press Secretary, “FACT SHEET: Biden-Harris Administration Races to Deploy Clean

Energy that Creates Jobs and Lowers Costs,” 2021, https://www.whitehouse.gov/briefing-room/statements-

releases/2022/01/12/fact-sheet-biden-harr is-administration-races-to-deploy-clean-energy-that-creates-jobs-and-

lowers-costs/?utm_source=link.

23

Congressional Research Service, “A Brief History of U.S. Electricity Portfolio Standard Proposals,” 2021,

https://crsreports.congress.gov/product/pdf/IF/IF11316.

U.S. Department of Commerce | International Trade Administration 10

Several no-cost online tools exist to help investors navigate government incentives and programs that

may be available in the U.S., including the Federal Programs and Incentives Database and SelectUSA’s

dataset of publicly listed U.S. state business incentives.

For public programs specifically related to renewable energy, the Database of State Incentives for

Renewables & Efficiency (DSIRE) is a comprehensive source of information on existing government and

utility requirements and incentives for renewable energy projects.

Many other non-public incentives, however, exist at the state and sub-state level. These incentives are

best investigated through direct conversations with U.S. state economic development organizations.

INVESTMENT IN RENEWABLES GROWS, SUPPORTED BY SUBSTANTIAL GREENFIELD FDI

The potential of the renewable energy sector in the United States, combined with traditional U.S.

strengths like a flexible workforce, robust intellectual property protections, and deep capital markets,

has helped draw investors’ interest. Between 2010 and 2019, annual investment in renewable energy in

the United States grew from $29.4 billion to more than $55.4 billion (Figure 8).

This inflow is justified in part by the strong performance of U.S. renewables firms relative to traditional

firms in the energy sector. An analysis by the IEA and Imperial College London’s Centre for Climate

Finance & Investment found that, over the past decade, large publicly listed renewable energy firms in

the United States have consistently delivered higher total returns than firms with a portfolio dominated

by fossil fuels.

24

Figure 7. Annual Investment in the U.S. Renewable Energy Market, 2010 to 2019

Estimated Capital Investment,

Billions of USD

60

50

40

30

20

10

0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Solar Wind Other Total Annual Investment

Source: Bloomberg NEF, UN Environment.

24

International Energy Agency & Imperial College Business School Centre for Climate Finance & Investment,

“Energy Investing: Exploring Risk and Return in the Capital Markets,” 2020. https://www.iea.org/reports/energy-

investing-exploring-risk-and-return-in-the-capital-markets

U.S. Department of Commerce | International Trade Administration 11

Foreign investors have also recognized the United States’ potential and have helped contribute to the

growth in renewable sectors. According to data collected by fDi Markets, the United States was the

number one global destination in terms of number of announced renewable energy projects between

2011 and 2021, attracting 428 new greenfield FDI projects during this period (Figure 8).

In terms of capital commitment during this period, the United States was the second biggest market for

renewable energy, attracting an estimated capital commitment of $83.1 billion. It was only surpassed by

the United Kingdom, which received an estimated $108.8 billion in investment across 291 projects. In

comparison, China was the 18th largest market in terms of announced projects, receiving just 56

between 2011 and 2021. These announced projects represented an estimated $7.5 billion in

investment, placing China 23rd in the global rankings behind Romania, Pakistan, and Nigeria.

Figure 8. Number of Announced Renewable Investment Projects Generated by Greenfield FDI, by

Country, 2011 to 2021

0

50

100

150

200

250

300

350

400

450

United Sta tes Uni te d

Kingdom

Chile Spain Brazil A ust rali a M exi co

Announced Projects

Source: Financial Times, Renewable Energy Investments in Destination Markets, Accessed February 7, 2022, www.fdimarkets.com.

Solar and wind projects together captured 89 percent of the investment in renewables in the United

States, with wind projects receiving an estimated $37.6 billion and solar projects an estimated $36.6

billion. Biomass projects received the third most investment, collecting $7.9 billion over this period

(Figure 10).

Figure 9. Capital Expenditure from FDI into U.S. Renewable Energy Market, 2011 to 2021

U.S. Department of Commerce | International Trade Administration 12

37.55

36.55

7.92

1.11

0 5 10 15 20 25 30 35 40

Wind

Solar

Biomass

Other

Estimated Capital Investment, Bi llions of USD

Source: Financial Times, Renewable Energy Investments in Destination Markets, Accessed February 7, 2022, www.fdimarkets.com.

These 428 announced investments came from firms based in 26 different countries. The largest number

of announcements came from Canadian-based firms, which made 57 announcements or 13.3 percent of

the total. Other top investor countries included France and Germany, whose firms each announced 44

and 43 respectively, and Italy, whose firms announced 40 projects.

In terms of capital expenditure, Italian firms led the pack with an estimated $10.3 billion in announced

investments, followed by French and Canadian firms with $9.1 billion and $8.7 billion respectively.

Figure 10. Top Ten Sources of FDI into U.S. Renewable Energy Market, 2011 – 2021

Estimated Capital Investment, Bi llions of USD

0 2 4 6 8 10 12

Italy

France

Canada

Germany

Spain

De nma rk

United Kingdom

South Korea

Portug al

China

Source: Financial Times, Renewable Energy Investments in Destination Markets, Accessed February 7, 2022, www.fdimarkets.com.

U.S. Department of Commerce | International Trade Administration 13

Greenfield FDI in renewable energy has begun to outpace FDI in coal, oil, and gas production and their

related support activities. Beginning in 2013, announced investments in renewables consistently

exceeded those in the fossil fuel sector, only falling behind in 2019. Between 2015 and 2020, renewable

energy projects attracted an estimated $51.2 billion in greenfield investment while fossil fuel projects

attracted $30.8 billion (Figure 11).

Figure 11. Total Estimated Capital Expenditure for Energy FDI Projects in United States, 2010 – 2020

0

10

20

30

40

50

60

70

2005 - 2010 2010 - 2015 2015 - 2020

Esti mated Capital Investment, Billions of USD

Renewable Energy Coal, Oil and Gas

Source: Financial Times, Renewable Energy Investments in Destination Markets, Accessed February 7, 2022, www.fdimarkets.com.

These inflows have also proved resilient. In 2020, substantial new FDI investments in renewable energy

continued to be announced despite the start of the COVID-19 pandemic which waylaid investments in

fossil fuels and other sectors. 2020 and 2021 together saw international investors announce an

estimated $22.1 billion in U.S. renewable energy projects compared to $327.9 million in coal, oil, and

gas projects.

These FDI commitments highlight the substantial opportunities currently present in the U.S. renewables

market for overseas investors. As the pace of the green energy transition in the United States

accelerates, these opportunities are likely to grow.

CONCLUSION

As this brief illustrates, the U.S. renewable energy market presents a valuable opportunity to investors.

This sector is expected to grow by leaps and bounds in the comings years. Electricity generation from

renewable sources as a percentage of utility-scale production is expected to double by 2050, primarily

thanks to investments in increasingly cost-effective wind and solar plants. By that point, renewables are

expected to be the single largest contributor to the U.S. power grid, overtaking natural gas.

U.S. Department of Commerce | International Trade Administration 14

Due to its rapid growth—and traditional American strengths like strong intellectual property

protections, deep capital markets, and a well-trained workforce—the renewable energy sector has

already drawn in billions of dollars in foreign direct investment. As the United States continues its

transition towards a green economy, new investment opportunities will emerge. Investors interested in

positioning themselves to take advantage of these opportunities should contact SelectUSA.

The SelectUSA program conducts one-on-one client counselling and provides data and research tohelp

investors understand and navigate U.S. market. To access these resources, investors are invited to

contact SelectUSA by emailing selectusa@trade.gov or visiting the SelectUSA website

.

REFERENCES

Administration, U.S. Energy Information. “Annual Energy Outlook 2021,” 2021.

https://www.eia.gov/outlooks/aeo/.

———. “Construction Cost Data for Electric Generators Installed,” 2021.

https://www.eia.gov/electricity/generatorcosts/.

———. “Electricity,” 2021. https://www.eia.gov/electricity/.

———. “Geothermal explained,” 2021, https://www.eia.gov/energyexplained/geothermal/use-of-

geothermal-energy.php

———. “Hydropower explained,” 2021, https://www.eia.gov/energyexplained/hydropower/.

———. “January 2022 Monthly Energy Review: Electricity Net Generation,” 2022.

https://www.eia.gov/totalenergy/data/monthly/.

———. “Levelized Costs of New Generation Resources in the Annual Energy Outlook 2021,” 2021.

https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf.

———. “Of the operating U.S. coal-fired power plants, 28% plan to retire by 2035,” 2021

https://www.eia.gov/todayinenergy/detail.php?id=50658.

———. “Solar power will account for nearly half of new U.S. electric generating capacity in 2022,” 2022.

https://www.eia.gov/todayinenergy/detail.php?id=50818.

———. “The United States consumed a record amount of renewable energy in 2020,” 2021,

https://www.eia.gov/todayinenergy/detail.php?id=48396.

———. “Total Energy,” 2021. https://www.eia.gov/totalenergy/.

Congressional Research Service, “A Brief History of U.S. Electricity Portfolio Standard Proposals,” 2021.

https://crsreports.congress.gov/product/pdf/IF/IF11316.

———. “The Value of Energy Tax Incentives for Different Types of Energy Resources,” 2019,

https://sgp.fas.org/crs/misc/R44852.pdf.

U.S. Department of Commerce | International Trade Administration 15

Emilio F. Moran, Maria Claudia Lopez, Nathan Moore, Norbert Müller, and David W. Hyndman,

Proceedings of the National Academy of Sciences of the United States of America, “Sustainable

hydropower in the 21st century,” 2018, https://www.pnas.org/content/115/47/11891

.

International Energy Agency & Imperial College Business School Centre for Climate Finance &

Investment. “Energy Investing: Exploring Risk and Return in the Capital Markets,” 2020.

https://www.iea.org/reports/energy-investing-exploring-risk-and-return-in-the-capital-markets

International Energy Agency, “Energy Technology RD&D Budgets: Overview,” 2021.

https://www.iea.org/reports/energy-technology-rdd-budgets-overview.

The International Renewable Energy Agency, “Renewable Energy Statistics 2021,” 2021.

https://www.irena.org/Statistics.

The White House, Office of the Press Secretary. “FACT SHEET: Biden-Harris Administration Races to

Deploy Clean Energy that Creates Jobs and Lowers Costs,” 2021. https://www.whitehouse.gov/briefing-

room/statements-releases/2022/01/12/fact-sheet-biden-harris-administration-races-to-deploy-clean-

energy-that-creates-jobs-and-lowers-costs/?utm_source=link.

———. “FACT SHEET: President Biden Signs Executive Order Catalyzing America’s Clean Energy Economy

Through Federal Sustainability,” 2021. https://www.whitehouse.gov/briefing-room/statements-

releases/2021/12/08/fact-sheet-president-biden-signs-executive-order-catalyzing-americas-clean-

energy-economy-through-federal-sustainability/.

———. “FACT SHEET: The Bipartisan Infrastructure Deal Boosts Clean Energy Jobs, Strengthens

Resilience, and Advances Environmental Justice,” 2021. https://www.whitehouse.gov/briefing-

room/statements-releases/2021/11/08/fact-sheet-the-bipartisan-infrastructure-deal-boosts-clean-

energy-jobs-strengthens-resilience-and-advances-environmental-justice/.

Times, Financial. “Renewable Energy Investments in Destination Markets,” 2021. www.fdimarkets.com.

U.S. Bureau of Economic Analysis. “Direct Investment by Country and Industry,” 2020.

https://www.bea.gov/news/2021/direct-investment-country-and-industry-2020.

U.S. Department of Commerce | International Trade Administration 16