1

UNITED STATES DISTRICT COURT

WESTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

UNITED STATES OF AMERICA,

Plaintiff,

vs.

ROSHELL BEATY, aka Roshell Clinton,

aka Angel Clinton, aka Angel Beaty,

MELVIN CLINTON,

DANIELLE BRANCH, aka Danielle Beaty,

CHRISTOPHER BATES,

BRIANNA RIMPSON, and

CHRISTOPHER BRANCH, INDICTMENT

Defendants.

/

The Grand Jury charges:

At all times material to this Indictment:

1. Defendant ROSHELL BEATY, aka ROSHELL CLINTON, aka ANGEL

CLINTON, aka ANGEL BEATY,³%($7<´was a resident of Benton Harbor, Michigan.

2. Defendant MELVIN CLINTON, a son of BEATY, was a resident of Benton

Harbor, Michigan.

3. Defendant DANIELLE BRANCH, aka DANIELLE BEATY, a daughter of

BEATY, was a resident of Benton Harbor, Michigan.

4. Defendant CHRISTOPHER BATES was a resident of Benton Harbor, Michigan.

5. Defendant BRIANNA RIMPSON was a resident of Benton Harbor, Michigan.

6. Defendant CHRISTOPHER BRANCH, a son of BEATY, was an intermittent

resident of Benton Harbor, Michigan until in or about December 2020, when he moved to the area

of Atlanta, Georgia

Case 1:22-cr-00151-JTN ECF No. 1, PageID.1 Filed 10/19/22 Page 1 of 46

2

7. Bank of America, Huntington National Bank, Flagstar Bank, JP Morgan Chase,

KeyBank, Wells Fargo, The Bancorp Bank, Stride Bank, and Green Dot Bank and its associated

brand banks GO2Bank and GoBank, were financial institutions that were insured by the Federal

Deposit Insurance Corporation.

8. United Federal Credit Union, Delta Community Credit Union, and Honor Credit

Union were financial institutions that were insured by the National Credit Union Administration.

PANDEMIC UNEMPLOYMENT INSURANCE BENEFITS

9. Unemployment Insurance (“UI”) is a joint state-federal program that is intended to

provide temporary financial assistance to workers who are unemployed through no fault of their

own. The federal UI trust fund finances the costs of administering unemployment insurance

programs, loans made to state unemployment insurance funds, and fifty percent of extended

benefits during periods of high unemployment. States can borrow from the federal fund if their

own reserves are insufficient. Each state administers a separate UI program, through its state

workforce agency (“SWA”), but all states follow the same guidelines established by federal law.

10. In March 2020, the United States was in the midst of the coronavirus (“Covid-19”)

pandemic, which resulted in the shutdown of numerous businesses and caused millions of

American workers to be out of work. On March 12, 2020, the President declared a national

emergency under Section 501 of the Robert T. Stafford Disaster Relief and Emergency Assistance

Act, 42 U.S. §§ 5121 et seq. (“Stafford Act”). On March 18, 2020, the President signed into law

the Families First Coronavirus Response Act, which provided additional flexibility for SWAs and

additional administrative funding to respond to the Covid-19 pandemic. The Coronavirus Aid,

Relief, and Economic Security (“CARES”) Act was signed into law on March 27, 2020. The

CARES Act expanded the ability of the states to provide unemployment insurance for many

Case 1:22-cr-00151-JTN ECF No. 1, PageID.2 Filed 10/19/22 Page 2 of 46

3

workers impacted by the Covid-19 pandemic. The CARES Act dedicated over $250 billion to give

workers more access to UI benefits during the public health emergency.

11. The CARES Act expanded UI benefits during the pandemic by (1) making those

benefits available for those who have not traditionally qualified, such as contractors, self-employed

individuals, and gig workers, and (2) substantially increasing the amount of money paid to those

who qualify for UI benefits.

12. As of April 18, 2020, the President had declared that a major disaster existed in all

States and territories under Section 401 of the Stafford Act. On August 8, 2020, to further offset

the pandemic’s impact on American workers, the President authorized the Federal Emergency

Management Agency (“FEMA”) to expend up to $44 billion from the Disaster Relief Funds for

wage payments. The President authorized the FEMA Administrator to provide grants to

participating states, territories, and the District of Columbia to administer delivery of lost wages

assistance (“LWA”) to those receiving unemployment insurance benefits.

13. Each state determines its own weekly UI benefit amount for qualifying unemployed

individuals. In the wake of the Covid-19 pandemic, several categories of federal UI benefits,

collectively “pandemic UI benefits,” supplemented each states’ traditional UI benefit amounts,

including:

Federal Pandemic Unemployment Compensation Program (“FPUC”);

Pandemic Unemployment Assistance (“PUA”);

Pandemic Emergency Unemployment Compensation (“PEUC”); and

Lost Wages

Assistance (“LWA”) program.

14. The LWA authorization allowed FEMA to provide an additional $300 per week to

claimants who were eligible for at least $100 per week in UI benefits, beginning with the

Case 1:22-cr-00151-JTN ECF No. 1, PageID.3 Filed 10/19/22 Page 3 of 46

4

unemployment week ending August 1, 2020, for a maximum of six weeks, i.e., $1,800 per

claimant.

15. In order to obtain any of the pandemic UI benefits, whether PUA, PEUC, FPUC,

or LWA, an individual had to initiate a UI claim, i.e., an application, with the SWA in their state

of prior employment. Thereafter, the claimant had to regularly certify their ongoing eligibility for

UI benefits. The overwhelming majority of claims/applications and certifications for pandemic UI

benefits were filed electronically through the SWA’s respective UI websites. In the application

process, the claimant was required to enter personal information such as their name, date of birth,

Social Security number, physical address, email address, and telephone number. A claimant also

was required to answer a series of questions that enabled the SWA to determine their eligibility

and UI benefit amount, including whether the Covid-19 pandemic had directly and adversely

affected the claimant’s employment. Once awarded pandemic UI benefits, the claimant was

required to submit electronic certifications for each week of pandemic UI benefits they claimed.

16. SWAs in states throughout the country, including Michigan, Indiana, California,

Illinois, and Arizona, accepted applications online that contained the claimant’s email address,

physical mailing address, and personally identifiable information (“PII”) including the applicant’s

name, date of birth, and Social Security number.

17. SWAs had different ways of accepting claims/applications and certifications, and

different manners of providing claimants with pandemic UI benefits.

Michigan: Michigan’s SWA accepted UI applications and certifications

online through a UI website hosted by one or more computer servers located in the Western District

of Michigan. Once approved for pandemic UI benefits, Michigan’s SWA paid them from a Chase

Bank account by: (1) making a direct deposit into a checking or savings account at a financial

Case 1:22-cr-00151-JTN ECF No. 1, PageID.4 Filed 10/19/22 Page 4 of 46

5

institution specified by the UI claimant; or (2) making a direct deposit into a dedicated account

that was used solely for the purpose of receiving UI benefits deposits, for which the claimant was

issued a UI debit card to use for purchases and/or withdrawals of their UI benefits. Prior to August

25, 2021, Bank of America maintained such bank accounts and issued corresponding “TIA”

Mastercard debit cards. Bank of America mailed UI debit cards to the address specified by each

UI claimant.

Indiana: Indiana’s SWA accepted UI applications and certifications online

through a UI website hosted by one or more computer servers located in Indiana. Once approved,

Indiana’s SWA paid pandemic UI benefits to claimants by: (1) making a direct deposit into a

checking or savings account at a financial institution specified by the UI claimant; or (2) making

a direct deposit into a dedicated bank account with KeyBank that was used solely for the purpose

of receiving UI benefits deposits, for which the claimant was issued a “Key2Benefits” Mastercard

debit card to use for purchases and/or withdrawals of their UI benefits. KeyBank mailed UI debit

cards to the address specified by each UI claimant. To verify identities of certain UI claimants,

Indiana’s SWA used a third-party online identity-authentication service, “ID.me,” with computer

servers located in Virginia.

California: California’s SWA accepted UI applications and certifications

online through a UI website hosted by one or more computer servers located in California. Once

approved, California’s SWA paid pandemic UI benefits to claimants by making a direct deposit

into a dedicated account with Bank of America that was used solely for the purpose of receiving

UI benefits deposits, for which the claimant was issued a Visa “EDD” debit card to use for

purchases and/or withdrawals of their UI benefits. Bank of America mailed UI debit cards to the

address specified by each UI claimant. To verify identities of certain UI claimants, California’s

Case 1:22-cr-00151-JTN ECF No. 1, PageID.5 Filed 10/19/22 Page 5 of 46

6

SWA used a third-party online identity-authentication service, “ID.me,” with computer servers

located in Virginia.

Illinois: Illinois’s SWA accepted applications and certifications online

through a UI website hosted by computer servers located in either Illinois or Virginia. Once

approved for pandemic UI benefits, Illinois’s SWA paid them to claimants by: (1) making a direct

deposit into a checking or savings account specified by the UI claimant; or (2) prior to December

27, 2021, making a direct deposit into a dedicated account with KeyBank that was used solely for

the purpose of receiving UI benefits deposits, for which the claimant was issued a KeyBank debit

card to use for purchases and/or withdrawals of their benefits. KeyBank mailed UI debit cards to

the address specified by each UI claimant.

Arizona: Arizona’s SWA accepted applications and certifications online

through a UI website hosted by computer servers located in California. Once approved for

pandemic UI benefits, Arizona’s SWA paid them to claimants by: (1) making a direct deposit into

a checking or savings account specified by the UI claimant; or (2) prior to September 23, 2021,

making a direct deposit into a dedicated account with Bank of America that was used solely for

the purpose of receiving UI benefits deposits, for which the claimant was issued an “EPC” debit

card to use for purchases and/or withdrawals of their benefits. Bank of America mailed UI debit

cards to the address specified by each UI claimant.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.6 Filed 10/19/22 Page 6 of 46

7

COUNT 1

(Conspiracy to Commit Wire Fraud)

18. Beginning in or about April 2020, and continuing to at least in or about December

2021, in Berrien County, in the Southern Division of the Western District of Michigan, and

elsewhere,

ROSHELL BEATY,

MELVIN CLINTON,

DANIELLE BRANCH,

CHRISTOPHER BATES,

BRIANNA RIMPSON, and

CHRISTOPHER BRANCH

knowingly combined, conspired, confederated, and agreed with each other and with other persons

known and unknown to the Grand Jury to devise a scheme and artifice to defraud and to obtain

money and property by means of false and fraudulent pretenses, representations, and promises, by

means of wire communication in interstate commerce.

Overview of the Conspiracy

19. From in or about April 2020 and continuing to at least in or about December 2021,

ROSHELL BEATY, CLINTON, DANIELLE BRANCH, BATES, RIMPSON, and

CHRISTOPHER BRANCH, and others known and unknown to the Grand Jury (collectively

“coconspirators”) engaged in a scheme and artifice to defraud and to obtain money and property

from SWAs by means of false and fraudulent pretenses, representations, and promises, by

submitting falsified and fraudulent claims/applications and certifications for pandemic UI benefits

in their own names and in the names of third parties, some of whom were victims of identity theft.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.7 Filed 10/19/22 Page 7 of 46

8

Object of the Conspiracy

20. The object of the conspiracy was for the defendants to unjustly enrich themselves

by submitting false and fraudulent claims/applications and certifications to SWAs to collect

pandemic UI benefits they were not entitled to receive.

Manner and Means

21. Among the manner and means by which the coconspirators carried out the

conspiracy were the following:

22. Coconspirators submitted various types of false and fraudulent pandemic UI

benefits claims, including (1) claims in their own names and PII to collect pandemic UI benefits

from states where the coconspirators did not live or work, and (2) claims for pandemic UI benefits

in the names of third parties, using the PII of those third parties, some of whom were victims of

identity theft.

23. Coconspirators used the IP address associated with BEATY and CLINTON’s

residence, namely 71.201.191.51, as well as other IP addresses, to electronically submit false and

fraudulent UI claims and certifications online to SWAs in multiple states including, but not limited

to, Michigan, Illinois, Indiana, California, and Arizona, providing information they knew to be

false that was material including, but not limited to:

false contact information, such as residential addresses, phone numbers, and

email addresses, for the third parties whose names and PII were used for UI claims and

certifications;

false statements respecting employment histories of the third parties whose

names and PII were used for UI claims and certifications; and

Case 1:22-cr-00151-JTN ECF No. 1, PageID.8 Filed 10/19/22 Page 8 of 46

9

false statements respecting the coconspirators’ residential addresses and

employment history or employment status, when their PII was used for UI claims and

certifications.

24. Coconspirators obtained pandemic UI benefits, in some instances, by directing

SWAs to mail debit cards containing UI benefits to mailing addresses accessible to the

coconspirators and, in other instances, by directing SWAs to electronically deposit UI benefits into

bank accounts the coconspirators controlled.

25. By submitting false and fraudulent claims and certifications online for UI benefits,

coconspirators caused SWAs to, among other things:

transmit emails that were related to the fraudulent UI benefit claims to the

email addresses provided by coconspirators;

authorize UI benefits to be provided to individuals who were ineligible for

UI benefits for a variety of reasons, including that they were deceased, incarcerated, employed, or

receiving UI benefits in another state;

cause financial institutions to mail UI debit cards, that is, debit cards linked

to the UI debit accounts in the names of UI claimants, to mailing addresses provided by

coconspirators.

cause financial institutions to deposit pandemic UI benefits into accounts,

controlled by the coconspirators, at financial institutions including Bank of America, United

Federal Credit Union, Huntington National Bank, Delta Community Credit Union, Honor Credit

Union, Flagstar Bank, JP Morgan Chase, KeyBank, Wells Fargo, The Bancorp Bank, Stride Bank,

and Green Dot Bank and its associated brand banks GO2Bank and GoBank.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.9 Filed 10/19/22 Page 9 of 46

10

26. Coconspirators submitted at least 98 false and fraudulent claims and related

certifications for pandemic UI benefits to SWAs in multiple states under the names and PII of at

least 61 different individuals, including the coconspirators’ own names and PII and the names and

PII of third parties, for which SWAs paid out more than $764,194 in UI benefits.

Fraudulent UI Claims in Coconspirators’ Own Names and PII

27. BEATY, CLINTON, DANIELLE BRANCH, BATES, RIMPSON, and

CHRISTOPHER BRANCH used their own names and PII to obtain or attempt to obtain fraudulent

pandemic UI benefits from multiple states, including, but not limited to:

28. Defendant BEATY used IP address 71.201.191.51 to file with Michigan’s SWA

electronic claims and certifications for pandemic UI benefits in her own name and PII. In response

to those claims and certifications, Michigan’s SWA paid BEATY $18,240 in pandemic UI benefits

for the 39 weeks of unemployment identified below, which were deposited into the bank account

identified below. While BEATY was receiving pandemic UI benefits from Michigan, she applied

for pandemic UI benefits from the states of Indiana and Illinois on or about the dates listed below,

based on false and fraudulent statements about her residential address, employment history, and

existing UI benefits. Indiana’s and Illinois’s SWAs denied BEATY’s UI claims.

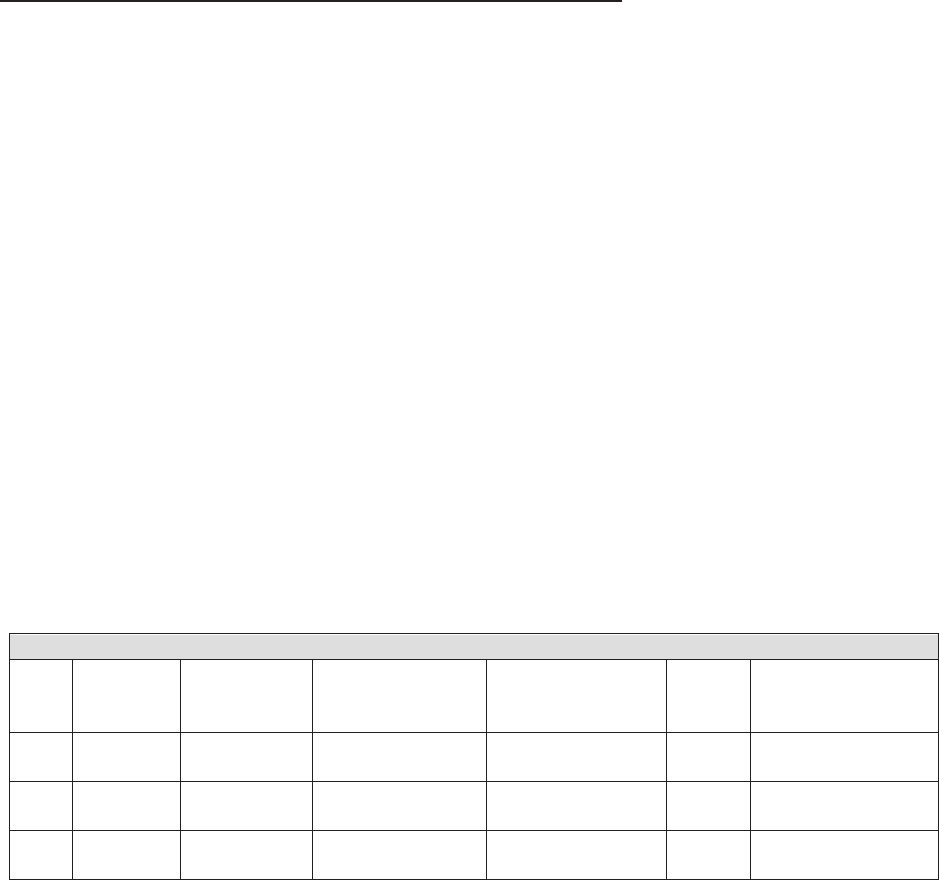

ROSHELL BEATY FRAUDULENT UI BENEFITS

State

Initial

Claim

Filed Date

IP Address

for Claim or

Certification

Residential Street

in Initial Claim

UI Benefits Paid

for Weeks Ending

Total UI

Benefits

Paid

Financial Institution

and Last Four Digits

of Account Number

MI 4/27/2020 71.201.191.51

E. May St.,

Benton Harbor, MI

March 21, 2020–

December 12, 2020

$18,240 Green Dot (2305)

IN 12/4/2020 71.201.191.51

Lancashire Ct

Indianapolis, IN

n/a n/a n/a

IL 12/13/2020 n/a

E. 85th St.

Chicago, IL

n/a n/a n/a

29. Defendant CLINTON, aided and abetted by coconspirator BEATY, used IP address

71.201.191.51 to electronically file with Michigan’s SWA claims and certifications for pandemic

Case 1:22-cr-00151-JTN ECF No. 1, PageID.10 Filed 10/19/22 Page 10 of 46

11

UI benefits. Michigan’s SWA approved CLINTON’s UI claim. While CLINTON was receiving

pandemic UI benefits from Michigan, on or about the dates listed below he applied for and

obtained pandemic UI benefits from the states of California, Indiana, and Arizona, using his own

name and PII, based on false and fraudulent statements about his residential address, employment

history, and existing UI benefits. In total, for the unemployment weeks identified below,

CLINTON obtained pandemic UI benefits in the approximate amounts listed below from SWAs

in the identified states. With respect to Arizona, CLINTON applied for and was provided $10,038

in benefits, which was deposited into CLINTON’s United Federal Credit Union (“UFCU”) account

ending in 0104; this deposit was flagged by UFCU as fraudulent and was subsequently returned to

Arizona’s SWA.

MELVIN CLINTON FRAUDULENT UI BENEFITS

State

Initial

Claim

Filed Date

IP Address

for Claim or

Certification

Residential

Street in Initial

Claim

UI Benefits

Paid for Weeks

Ending

Total UI

Benefits

Paid

Financial Institution

and Last Four Digits of

Account Number

MI 4/27/2020 71.201.191.51

E. May St.,

Benton Harbor, MI

March 21, 2020

– April 17, 2021

$16,160

United Federal Credit

Union (0104)

$2,080 Flagstar Bank (9425)

$7,680 Green Dot (4533)

CA 8/22/2020 71.201.191.51

Maplewood Ave.,

Los Angeles, CA

April 18, 2020–

August 8, 2020

$16,938 Bank of America (6917)

IN 12/2/2020 71.201.191.51

Royal Vista Ter

South Bend, IN

April 4, 2020–

June 19, 2021

$23,948 Huntington Bank (5412)

$4,939 Green Dot Bank (7575)

AZ 7/9/2020 71.201.191.51

N. 84th Ave

Phoenix, AZ

April 4, 2020–

August 22, 2022

$10,038

(returned)

United Federal Credit

Union (0104)

30. Defendant DANIELLE BRANCH, aided and abetted by coconspirator BEATY,

used IP address 71.201.191.51 to electronically file with Michigan’s SWA claims and

certifications for pandemic UI benefits. Michigan’s SWA approved DANIELLE BRANCH’s UI

claim. While DANIELLE BRANCH was receiving pandemic UI benefits from Michigan, on or

about the dates below she applied for and obtained pandemic UI benefits from the states of

California and Indiana, using her own name and PII, based on false and fraudulent statements

Case 1:22-cr-00151-JTN ECF No. 1, PageID.11 Filed 10/19/22 Page 11 of 46

12

about her residential address, employment history, and existing UI benefits. In total, for the

unemployment weeks identified below, DANIELLE BRANCH obtained pandemic UI benefits in

the approximate amounts listed below from SWAs in the identified states.

DANIELLE BRANCH FRAUDULENT UI BENEFITS

State

Initial

Claim

Filed Date

IP Address

for Claim or

Certification

Residential

Street in Initial

Claim

UI Benefits

Paid for Weeks

Ending

Total UI

Benefits

Paid

Financial Institution

and Last Four Digits of

Account Number

MI 5/3/2020 71.201.191.51

Britain Ave.,

Benton Harbor, MI

March 14, 2020

–July 17, 2021

$20,907 Honor Credit Union (2001)

$9,660 Bank of America (4309)

CA 8/15/2020 71.201.191.51

W. 76

th

St.,

Los Angeles, CA

April 4, 2020–

August 2020

$17,700 Bank of America (0577)

IN 12/4/2020 71.201.191.51

Royal Vista Ter,

South Bend, IN

May 2, 2020–

May 15, 2021

$21,665 Green Dot Bank (7311)

31. Defendant CHRISTOPHER BATES, aided and abetted by coconspirator BEATY,

used IP address 71.201.191.51 to electronically file with Michigan’s SWA claims and

certifications for pandemic UI benefits. Michigan’s SWA approved BATES’s UI claim. While

BATES was receiving pandemic UI benefits from Michigan, he used IP address 71.201.191.51 to

login to Indiana’s SWA website, specifically into a fraudulent UI account in his name and PII;

BATES used a different IP address, namely 174.255.192.33, and the same fraudulent UI account

with Indiana’s SWA, to file a false and fraudulent application for pandemic UI benefits from

Indiana, while he was receiving pandemic UI benefits from Michigan. Also while receiving

pandemic UI benefits from Michigan, Bates applied for UI benefits from Illinois. Both out-of-state

applications were based on false and fraudulent statements about BATES’s residential address,

employment history, and existing UI benefits. In total, for the unemployment weeks identified

below, BATES obtained pandemic UI benefits in the approximate amounts listed below from

SWAs in the identified states.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.12 Filed 10/19/22 Page 12 of 46

13

CHRISTOPHER BATES FRAUDULENT UI BENEFITS

State

Initial

Claim

Filed Date

IP Address

for Claim or

Certification

Residential

Street in Initial

Claim

UI Benefits Paid

for Weeks Ending

Total UI

Benefits

Paid

Financial Institution

and Last Four Digits of

Account Number

MI 4/27/2020 71.201.191.51

Union Ave.,

Benton Harbor, MI

March 21, 2020–

August 28, 2021

$34,040 Bank of America (5777)

IN 6/22/2020

174.255.192.33

71.201.191.51

Roosevelt St.,

South Bend, IN

March 15, 2020–

September 4,

2021

$24,695 JP Morgan Chase (0399)

$8,082 Huntington Bank (4078)

$449 JP Morgan Chase (1773)

IL 11/29/2020 undetermined

N. Morgan St.,

Chicago, IL

July 26, 2020–

March 27, 2021

$25,896 JP Morgan Chase (0399)

32. Defendant BRIANNA RIMPSON, aided and abetted by coconspirator BEATY,

used IP address 71.201.191.51 to electronically file with Michigan’s SWA claims and

certifications for pandemic UI benefits. Michigan’s SWA approved RIMPSON’s UI claim. While

RIMPSON was receiving pandemic UI benefits from Michigan, on or about the dates below she

applied for and obtained fraudulent pandemic UI benefits from Indiana, using her own name and

PII, based on false and fraudulent statements about her residential address, employment history,

and existing UI benefits. Also while RIMPSON was receiving benefits from Michigan, she applied

for pandemic UI benefits from Illinois, using the name “Brianna Simpson” and her actual birth

date and Social Security number, based on false and fraudulent statements about her residential

address, employment history, and UI benefits. Illinois’s SWA denied the claim. In total, for the

unemployment weeks identified below, RIMPSON obtained pandemic UI benefits in the

approximate amounts listed below from SWAs in the identified states.

BRIANNA RIMPSON FRAUDULENT UI BENEFITS

State

Initial Claim

Filed Date

IP Address of

Initial Claim

Residential Street

in Initial Claim

UI Benefits Paid for

Weeks Ending

Total UI

Benefits

Paid

Financial Institution

Account Number

Ending

MI 12/25/2020 71.201.191.51

Union Ave.,

Benton Harbor, MI

September 19, 2020

–August 28, 2021

$28,600

Bank of America (6256)

IN 12/2/2020 71.201.191.51

Royal Vista Ter,

South Bend, IN

March 28, 2020–

June 19, 2021

$27,385 Green Dot (1125)

IL 12/25/2020 undetermined

N Hamilton Ave

Chicago, IL

n/a n/a n/a

Case 1:22-cr-00151-JTN ECF No. 1, PageID.13 Filed 10/19/22 Page 13 of 46

14

33. Defendant CHISTOPHER BRANCH, aided and abetted by BEATY, used IP

address 71.201.191.51, on or about April 12, 2020, to electronically file with Michigan’s SWA

claims and certifications for pandemic UI benefits. Michigan’s SWA approved his UI claim. While

CHRISTOPHER BRANCH was receiving pandemic UI benefits from Michigan under his own

name, PII, and a residential address on E. May Street in Benton Harbor, he moved to Atlanta,

Georgia, in or about December 2020. On or about January 4, 2021, CHRISTOPHER BRANCH

began working full time for an employer in Atlanta, Georgia, earning an annual salary of

approximately $36,401. Between on or about January 4, 2021 and on or about April 10, 2021,

CHRISTOPHER BRANCH electronically filed with Michigan’s SWA 11 false and fraudulent

certifications to continue receiving pandemic UI benefits he was not entitled to receive on account

of his full-time employment. In each of the certifications, CHRISTOPHER BRANCH falsely and

fraudulently answered “No” to the question, “Did you have any earnings, even if you have not

been paid, [during the one-week certification period]?” As a result of his false and fraudulent

certifications, CHRISTOPHER BRANCH fraudulently obtained approximately $5,060 in

pandemic UI benefits from Michigan’s SWA.

Fraudulent UI Claims in Names of Third Parties and Identity Theft Victims

34. Using a variety of manner and means, defendant BEATY obtained and stored the

PII of third parties, some of whom were victims of identity theft, which BEATY used to submit

false and fraudulent claims to state SWAs for pandemic UI benefits. For example, BEATY

obtained the PII of identity-theft victim V.H. from an email CHRISTOPHER BRANCH sent to

BEATY on June 8, 2016, containing an image of a fabricated Michigan driver’s license bearing

BEATY’s photograph and the name and date of birth of V.H., which email was stored on

BEATY’s cell phone. Further, BEATY stored on her cell phone the PII of the following third

Case 1:22-cr-00151-JTN ECF No. 1, PageID.14 Filed 10/19/22 Page 14 of 46

15

parties: A.B., D.G.B., P.G., G.H., W.H., E.D.H., E.L.H. V.H., R.H., S.J., J.M., J.L., D.P., B.S.,

J.T., and N.Y.

35. One or more coconspirators, including defendant BEATY, used the names and PII

of third parties to electronically file, or assist third parties in electronically filing, false and

fraudulent claims and certifications for pandemic UI benefits with multiple state SWAs, using IP

address 71.201.191.51. Coconspirators, including defendant BEATY, assumed the identities of

third parties, purported to be those third parties, and provided materially false information on the

electronic UI claims and certifications, including false statements about the third parties’

employment histories and residential addresses.

36. One or more coconspirators, including defendant BEATY, used false and fabricated

forms of identification to support claims for pandemic UI benefits in the names of third parties,

which were uploaded to the Michigan SWA’s website using IP address 71.201.191.51. For

example, on July 15, 2020, a fabricated Michigan driver’s license bearing a picture of defendant

CHRISTOPHER BRANCH and the PII of P.G. was electronically uploaded in support of an

application for pandemic UI benefits in the name of P.G. Additionally, fabricated identification

documents bearing the PII of third parties J.H., D.D., and M.D. were electronically uploaded in

support of fraudulent claims for pandemic UI benefits.

37. One or more coconspirators, including defendant BEATY, used false and fabricated

employment records to support claims for pandemic UI benefits in the names of third parties,

which they uploaded to Michigan’s online UI website using IP address 71.201.191.51. For

example, on July 27, 2020, a fabricated “2019 Summary report” from Lyft for purported employee

P.G. was electronically uploaded in support of a fraudulent claim for pandemic UI benefits in the

name of P.G. Additionally, fabricated employment documents bearing the PII of E.L.H. and

Case 1:22-cr-00151-JTN ECF No. 1, PageID.15 Filed 10/19/22 Page 15 of 46

16

deceased individual E.J.C. were electronically uploaded in support of fraudulent claims for

pandemic UI benefits.

38. Between March 2020 and April 2021, one or more coconspirators, including

defendant BEATY, used IP address 71.201.191.51 to electronically file false and fraudulent

pandemic UI benefits claims and certifications with SWAs in the states listed below, using the

identities of the following third parties, resulting in the payment of pandemic UI benefits by state

SWAs in the total approximate amounts listed below, which were deposited into accounts in the

names of those third parties at the respective financial institutions identified below.

Third Party State

Initial Claim Filed

Date

UI Benefits

Paid

Financial Institution

A.B. California 8/9/2020 $12,606 Bank of America

D.G.B. Michigan 6/9/2020 $12,920 Bank of America

D.F.B. California 8/18/2020 $14,880 Bank of America

M.B. Michigan 4/28/2020

$7,240 Bank of America

$11,320 GO2 Bank/Green Dot

J.B. California 8/9/2020 n/a n/a

D.J.B. Michigan 6/22/2020 n/a n/a

D.D.B. California 8/18/2020 $19,200 Bank of America

J.B. California 8/31/2020 n/a n/a

L.B. California 8/31/2020 n/a n/a

K.B. Michigan 8/2/2020 n/a n/a

J.C. Michigan 7/13/2020 n/a n/a

E.C. Michigan 12/1/2020 n/a n/a

J.C. Michigan 12/1/2020 $8,520 Bank of America

J.C. California 8/17/2020 n/a n/a

D.C. Michigan 5/22/2020 $ 7,920 Bank of America

J.D. Michigan 5/20/2020 n/a n/a

M.D. Michigan 6/13/2020 $10,040 Bank of America

M.D. Michigan 5/21/2020 n/a n/a

J.D. California 8/9/2020 $14,886 Bank of America

D.D. Michigan 7/6/2020 $12,160 Stride Bank

K.F. California 8/31/2020 n/a N/A

P.G. Michigan 5/10/2020 $1,520.0 Bank of America

P.G. California 8/13/2020 $16,188 Bank of America

P.G. Indiana 11/30/2020 n/a n/a

K.G. Michigan 6/22/2020 n/a n/a

K.G. Arizona 7/9/2020 $10,038 Bank of America

V.H. Michigan 5/9/2020 $13,400 GO2 Bank/Green Dot

R.H. Michigan 7/11/2020 n/a n/a

G.H. Michigan 5/16/2020 $13,400 Bank of America

A.H. California 8/18/2020 $17,700 Bank of America

Case 1:22-cr-00151-JTN ECF No. 1, PageID.16 Filed 10/19/22 Page 16 of 46

17

Third Party State

Initial Claim Filed

Date

UI Benefits

Paid

Financial Institution

J.H. California 8/15/2020 $16,020 Bank of America

J.H. Michigan 5/7/2020 $13,080 Bank of America

T.H. Michigan 6/18/2020 n/a n/a

I.H. Michigan 7/8/2020 n/a n/a

W.H. Michigan 5/1/2020 $10,640 GO2 Bank/Green Dot

E.D.H. Arizona 9/10/2020 n/a n/a

E.D.H. Michigan 5/21/2020 $5,800 Bank of America

E.L.H. California 8/18/2020 n/a n/a

E.L.H. California 9/10/2020 n/a n/a

E.L.H. Michigan 7/7/2020 $ 760 Bank of America

A.J. Arizona 7/9/2020 $ 15,042 Bank of America

A.J. Indiana 7/8/2020 n/a n/a

A.J. Nevada 7/18/2020 n/a n/a

S.J. California 8/31/2020 n/a n/a

S.J. Michigan 4/29/2020 $1,520 Chime

T.J. California 8/17/2020 n/a n/a

Z.J. Michigan 5/20/2020 n/a n/a

K.L. California 8/15/2020 $19,200 Bank of America

J.L. Michigan 5/21/2020 $2,280 Bank of America

J.M. California 8/14/2020 $16,008 Bank of America

M.M. Arizona 7/9/2020 n/a n/a

N.M. Michigan 5/22/2020 n/a n/a

D.N. California 8/31/2020 n/a n/a

D.N. Michigan 5/3/2020 $13,560 Bank of America

D.N. Indiana n/a n/a

J.N. Michigan 7/6/2020 $9,880 Wells Fargo

S.P. California 9/2/2020 n/a n/a

D.P. Arizona 7/10/2020 n/a n/a

D.P. Michigan 4/28/2020

$15,200 Chime

$3,680 Green Dot

$3,360 Bank of America

D.P. California 8/17/2020 $ 29,100 Bank of America

D.P. Indiana 4/7/2021 $8,229 GoBank/Green Dot

D.R. California 8/6/2020 n/a n/a

R.R. California 8/31/2020 n/a n/a

J.C.S. Michigan 6/29/2020 n/a n/a

C.S. Michigan 8/31/2020 n/a n/a

K.S. California 8/6/2020 n/a n/a

B.S. California 8/19/2020 $ 17,700 Bank of America

C.S. California 8/27/2020 n/a n/a

J.S. California 8/17/2020 n/a n/a

A.T. Michigan 5/21/2020 $ 7,920 Bank of America

J.T. Michigan 4/29/2020 $ 12,480 Green Dot

Q.W. California 8/31/2020 n/a n/a

N.Y. Arizona 6/25/2020 $ 14,625 Bank of America

J.Y. Michigan 6/26/2020 n/a n/a

Case 1:22-cr-00151-JTN ECF No. 1, PageID.17 Filed 10/19/22 Page 17 of 46

18

39. After the respective state SWAs approved the fraudulent pandemic UI benefits

claims and certifications and disbursed pandemic UI benefits to checking and savings accounts in

the names of third parties, defendants BEATY and CHRISTOPHER BRANCH assumed the

identities of certain third-party UI claimants and used the corresponding UI debit cards in the

names of those third parties to make fraudulent cash withdrawals of pandemic UI benefits,

knowing that they were not entitled to those funds, from ATMs, including ATMs in Benton

Harbor, Michigan, Michigan City, Indiana, and Chicago, Illinois.

18 U.S.C. § 1349

18 U.S.C. § 1343

Case 1:22-cr-00151-JTN ECF No. 1, PageID.18 Filed 10/19/22 Page 18 of 46

19

COUNTS 2 THROUGH 29

(Wire Fraud)

40. Paragraphs 1 through 39 of this Indictment are realleged and incorporated by

reference in these Counts, as if fully set forth herein.

41. On or about the dates listed in Column C, in Berrien County, in the Southern

Division of the Western District of Michigan, and elsewhere, the defendants identified in Column

B, aiding and abetting each other, and having knowingly devised a scheme or artifice to defraud

to obtain money by means of false and fraudulent pretenses, representations, and promises, and

for the purpose of executing such scheme, transmitted and caused to be transmitted by means of

wire communication in interstate commerce the writings, signs, and signals, set forth in column

D, below, each of which constituted an execution of the fraudulent scheme:

A

Count

B

Defendant(s)

C

Date

D

Transmission

2 ROSHELL BEATY 6/23/2020

Electronic transmission of false and

fraudulent registration for pandemic UI

benefits in the name and PII of N.Y.,

from IP address 71.201.191.51 to

Arizona’s SWA

3 ROSHELL BEATY 7/8/2020

Electronic transmission of false and

fraudulent application for pandemic UI

benefits in the name and PII of A.J., from

IP address 71.201.191.51 to Indiana’s

SWA

4

ROSHELL BEATY

CHRISTOPHER BATES

7/8/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

CHRISTOPHER BATES for the week

ending March 28, 2020, from IP address

71.201.191.51 to Indiana’s SWA

5

ROSHELL BEATY

CHRISTOPHER BATES

7/8/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

CHRISTOPHER BATES for the week

ending April 25, 2020, from IP address

71.201.191.51 to Indiana’s SWA

Case 1:22-cr-00151-JTN ECF No. 1, PageID.19 Filed 10/19/22 Page 19 of 46

20

A

Count

B

Defendant(s)

C

Date

D

Transmission

6

ROSHELL BEATY

CHRISTOPHER BATES

7/8/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

CHRISTOPHER BATES for the week

ending May 9, 2020, from IP address

71.201.191.51 to Indiana’s SWA

7

ROSHELL BEATY

CHRISTOPHER BATES

7/8/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

CHRISTOPHER BATES for the week

ending July 4, 2020, from IP address

71.201.191.51 to Indiana’s SWA

8 ROSHELL BEATY 7/9/2020

Electronic transmission of false and

fraudulent registration for pandemic UI

benefits in name and PII of K.G., from IP

address 71.201.191.51 to Arizona’s SWA

9

ROSHELL BEATY

MELVIN CLINTON

7/9/2020

Electronic transmission of false and

fraudulent registration for pandemic UI

benefits in the name and PII of MELVIN

CLINTON, from IP address

71.201.191.51 to Arizona’s SWA

10 ROSHELL BEATY 8/6/2020

Electronic transmission of false and

fraudulent application for pandemic UI

benefits in name of D.R. and the PII of

J.Y., from IP address 71.201.191.51 to

California’s SWA

11 ROSHELL BEATY 8/14/2020

Electronic transmission of false and

fraudulent application for pandemic UI

benefits in name and PII of P.G., from IP

address 71.201.191.51 to California’s

SWA

12 ROSHELL BEATY 8/15/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in name and PII of K.L., from

IP address 71.201.191.51 to California’s

SWA

13

ROSHELL BEATY

CHRISTOPHER BRANCH

8/15/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in the name and PII of J.H.,

from IP address 71.201.191.51 to

California’s SWA

Case 1:22-cr-00151-JTN ECF No. 1, PageID.20 Filed 10/19/22 Page 20 of 46

21

14

ROSHELL BEATY

DANIELLE BRANCH

8/15/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in the name and PII of

DANIELLE BRANCH, from IP address

71.201.191.51 to California’s SWA

15 ROSHELL BEATY 8/17/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in the name and PII of D.P.

from IP address 71.201.191.51 to

California’s SWA

16 ROSHELL BEATY 8/18/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in the name and PII of E.L.H.,

from IP address 71.201.191.51 to

California’s SWA

17

ROSHELL BEATY

MELVIN CLINTON

8/22/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in the name and PII of

MELVIN CLINTON, from IP address

71.201.191.51 to California’s SWA

18

ROSHELL BEATY

MELVIN CLINTON

12/3/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in the name and PII of

MELVIN CLINTON, from IP address

71.201.191.51 to Indiana’s SWA

19

ROSHELL BEATY

BRIANNA RIMPSON

12/4/2020

Electronic transmission of false and

fraudulent pandemic UI benefits

application in BRIANNA RIMPSON’s

name and PII, from IP address

71.201.191.51 to Indiana’s SWA

20 ROSHELL BEATY 12/4/2020

Electronic transmission of false and

fraudulent UI benefits initial claim in

BEATY’s name and PII, from IP address

71.201.191.51 to Indiana’s SWA

21

ROSHELL BEATY

DANIELLE BRANCH

12/4/2020

Electronic transmission of false and

fraudulent UI benefits initial claim in

DANIELLE BRANCH’s name and PII,

from IP address 71.201.191.51 to

Indiana’s SWA

22

ROSHELL BEATY

CHRISTOPHER BATES

12/7/2020

Electronic transmission from IP address

71.201.191.51 to Indiana’s SWA to log in

to UI account for claimant

CHRISTOPHER BATES

Case 1:22-cr-00151-JTN ECF No. 1, PageID.21 Filed 10/19/22 Page 21 of 46

22

23

ROSHELL BEATY

BRIANNA RIMPSON

12/8/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

BRIANNA RIMPSON for the week

ending March 28, 2020, from IP address

71.201.191.51 to Indiana’s SWA

24

ROSHELL BEATY

BRIANNA RIMPSON

12/8/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

BRIANNA RIMPSON for the week

ending April 11, 2020, from IP address

71.201.191.51 to Indiana’s SWA

25

ROSHELL BEATY

BRIANNA RIMPSON

12/8/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

BRIANNA RIMPSON for the week

ending April 25, 2020, from IP address

71.201.191.51 to Indiana’s SWA

26

ROSHELL BEATY

DANIELLE BRANCH

12/9/2020

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

DANIELLE BRANCH for the week

ending May 2, 2020, from IP address

71.201.191.51 to Indiana’s SWA

27

ROSHELL BEATY

MELVIN CLINTON

2/2/2021

Electronic transmission of selfie

photograph of MELVIN CLINTON and

photographs of CLINTON’s identity

documents, from IP address

71.201.191.51 to ID.me

28

ROSHELL BEATY

BRIANNA RIMPSON

2/26/2021

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

BRIANNA RIMPSON for the week

ending December 12, 2020, from IP

address 71.201.191.51 to Indiana’s SWA

29

ROSHELL BEATY

BRIANNA RIMPSON

5/2/2021

Electronic transmission of false and

fraudulent weekly certification for

pandemic UI benefits for claimant

BRIANNA RIMPSON for the week

ending May 1, 2021, from IP address

71.201.191.51 to Indiana’s SWA

18 U.S.C. § 1343

18 U.S.C. § 2

Case 1:22-cr-00151-JTN ECF No. 1, PageID.22 Filed 10/19/22 Page 22 of 46

23

COUNTS 30 THROUGH 35

(Financial Institution Fraud)

42. Paragraphs 1 through 41 of this Indictment are realleged and incorporated by

reference in these Counts, as if fully set forth herein.

43. On or about the dates listed in Column C, in Berrien County, in the Southern

Division of the Western District of Michigan, and elsewhere,

ROSHELL BEATY,

having knowingly executed and attempted to execute a scheme or artifice to obtain any of the

moneys and funds under the custody or control of a financial institution by means of false and

fraudulent pretenses, representations, and promises, and for the purpose of executing such scheme,

committed and caused to be committed the acts identified in Column C, each of which constituted

an execution of the fraudulent scheme.

A

Count

B

Date

C

Act

30 7/19/2020

Falsely and fraudulently purporting to be individual D.N. while using

Michigan UI debit card ending in 6077, issued to D.N, to withdraw $500

at a United Federal Credit Union ATM in Benton Harbor, Michigan

31 7/24/2020

Falsely and fraudulently purporting to be individual R.H. while using

Michigan UI debit card ending in 3610, issued to R.H., to withdraw $500

at a Bank of America ATM in Benton Harbor, Michigan

32 7/24/2020

Falsely and fraudulently purporting to be individual J.C. while using

Michigan UI debit card ending in 3174, issued to J.C., to conduct a

balance inquiry at a Bank of America ATM in Benton Harbor, Michigan

33 7/24/2020

Falsely and fraudulently purporting to be individual D.C. while using

Michigan UI debit card ending in 2369, issued to D.C, to conduct a

balance inquiry at a Bank of America ATM in Benton Harbor, Michigan

34 7/24/2020

Falsely and fraudulently purporting to be individual A.T. while using

Michigan UI debit card ending in 1960, issued to A.T., to conduct a

balance inquiry at a Bank of America ATM in Benton Harbor, Michigan

35 7/24/2020

Falsely and fraudulently purporting to be individual D.B. while using

Michigan UI debit card ending in 7534, issued to D.B., to conduct a

balance inquiry at a Bank of America ATM in Benton Harbor, Michigan

18 U.S.C. § 1344

Case 1:22-cr-00151-JTN ECF No. 1, PageID.23 Filed 10/19/22 Page 23 of 46

24

COUNTS 36 THROUGH 42

(Aggravated Identity Theft)

44. Paragraphs 1 through 41 of this Indictment are realleged and incorporated by

reference in these Counts, as if fully set forth herein.

45. Between on or about the dates identified in Column B, in Berrien County, in the

Southern Division of the Western District of Michigan, and elsewhere,

ROSHELL BEATY,

during and in relation to the felony of conspiracy to commit wire fraud charged in Count One of

this Indictment, which is incorporated as if alleged herein, knowingly transferred, possessed, and

used, without lawful authority, the means of identification of other persons, namely, the means of

identification described in Column C belonging to the other persons identified in Column D,

knowing that those means of identification belonged to other actual persons.

A

Count

B

Date Range

C

Means of ID

D

Other

Person

36 5/21/2020 – 3/12/2021 name, date of birth, Social Security number D.C.

37 5/16/2020 – 9/15/2020 name, date of birth, Social Security number G.H.

38 7/7/2020 – 12/1/2020 name, date of birth, Social Security number E.L.H.

39 8/15/2020 – 9/24/2020 name, date of birth K.L.

40 8/19/2020 – 9/21/2020 name, date of birth, Social Security number B.S.

41 4/30/2020 – 12/15/2020 name, date of birth, Social Security number W.H.

42 6/26/2020-03/12/2021 Social Security number J.Y.

18 U.S.C. § 1028A(a)(1)

18 U.S.C. § 1028A(b)(2)

18 U.S.C. § 1028A(c)(5)

Case 1:22-cr-00151-JTN ECF No. 1, PageID.24 Filed 10/19/22 Page 24 of 46

25

COUNTS 43 THROUGH 44

(Aggravated Identity Theft)

46. Paragraphs 1 through 41 of this Indictment are realleged and incorporated by

reference in this Count, as if fully set forth herein.

47. Between on or about the dates identified in Column B, in Berrien County, in the

Southern Division of the Western District of Michigan, and elsewhere,

ROSHELL BEATY and

CHRISTOPHER BRANCH,

aiding and abetting each other during and in relation to the felony of conspiracy to commit wire

fraud charged in Count One of this Indictment, which is incorporated as if alleged herein,

knowingly transferred, possessed, and used, without lawful authority, the means of identification

of other persons, namely, the means of identification described in Column C belonging to the other

persons identified in Column D, knowing that those means of identification belonged to other

actual persons.

A

Count

B

Date Range

C

Means of ID

D

Other

Person

43 5/7/2020 – 12/23/2020 name, date of birth, Social Security number J.H.

44 5/10/2020 – 11/30/2020 name, date of birth, Social Security number P.G.

18 U.S.C. § 1028A(a)(1)

18 U.S.C. § 1028A(b)(2)

18 U.S.C. § 1028A(c)(5)

18 U.S.C. § 2

Case 1:22-cr-00151-JTN ECF No. 1, PageID.25 Filed 10/19/22 Page 25 of 46

26

COUNT 45

(Fraud in Connection with Emergency Benefits)

48. Paragraphs 1 through 41 of this Indictment are realleged and incorporated by

reference in this Count, as if fully set forth herein.

49. Between on or about August 8, 2020 and on or about September 17, 2020, in

Berrien County, in the Southern Division of the Western District of Michigan, and elsewhere,

ROSHELL BEATY

knowingly concealed and covered up by means of a scheme or device a material fact, which fact

BEATY knew was material, specifically BEATY concealed and covered up from Michigan’s

SWA the fact that she was not individual M.B., in whose name and PII BEATY submitted false

and fraudulent certifications to Michigan’s SWA for pandemic UI benefits, and this concealment

and covering up of a material fact by scheme or device was done in a matter involving a benefit

authorized, transmitted, transferred, disbursed, and paid by the United States or of any department

or agency thereof in connection with a major disaster declaration under section 401 of the Robert

T. Stafford Disaster Relief and Emergency Assistance Act (42 U.S.C. § 5170), namely Lost Wages

Assistance program benefits that were authorized, paid, and disbursed in connection with the

Covid-19 pandemic, an emergency declaration under section 501 of the Robert T. Stafford Disaster

Relief and Emergency Assistance Act (42 U.S.C. § 5191).

18 U.S.C. § 1040(a)(1)

Case 1:22-cr-00151-JTN ECF No. 1, PageID.26 Filed 10/19/22 Page 26 of 46

27

COUNT 46

(Fraud in Connection with Emergency Benefits)

50. Paragraphs 1 through 41 of this Indictment are realleged and incorporated by

reference in this Count, as if fully set forth herein.

51. On or about December 4, 2020, in Berrien County, in the Southern Division of the

Western District of Michigan, and elsewhere,

MELVIN CLINTON

knowingly concealed and covered up by means of a scheme or device a material fact, which fact

CLINTON knew was material, specifically CLINTON concealed and covered up from Indiana’s

SWA the fact that, at that time, CLINTON was simultaneously receiving pandemic UI benefits

from Michigan’s SWA, and this concealment and covering up of a material fact by scheme or

device was done in a matter involving a benefit authorized, transmitted, transferred, disbursed, and

paid by the United States or of any department or agency thereof in connection with a major

disaster declaration under section 401 of the Robert T. Stafford Disaster Relief and Emergency

Assistance Act (42 U.S.C. § 5170), namely Lost Wages Assistance program benefits that were

authorized, paid, and disbursed in connection with the Covid-19 pandemic, an emergency

declaration under section 501 of the Robert T. Stafford Disaster Relief and Emergency Assistance

Act (42 U.S.C. § 5191).

18 U.S.C. § 1040(a)(1)

Case 1:22-cr-00151-JTN ECF No. 1, PageID.27 Filed 10/19/22 Page 27 of 46

28

COUNT 47

(Fraud in Connection with Emergency Benefits)

52. Paragraphs 1 through 41 of this Indictment are realleged and incorporated by

reference in this Count, as if fully set forth herein.

53. Between on or about August 15, 2020 and on or about October 14, 2020

, in Berrien

County, in the Southern Division of the Western District of Michigan, and elsewhere,

DANIELLE BRANCH

knowingly concealed and covered up by means of a scheme or device a material fact, which fact

DANIELLE BRANCH knew was material, specifically DANIELLE BRANCH concealed and

covered up from California’s SWA the fact that, at that time, DANIELLE BRANCH was

simultaneously receiving pandemic UI benefits from Michigan’s SWA, and this concealment and

covering up of a material fact by scheme or device was done in a matter involving a benefit

authorized, transmitted, transferred, disbursed, and paid by the United States or of any department

or agency thereof in connection with a major disaster declaration under section 401 of the Robert

T. Stafford Disaster Relief and Emergency Assistance Act (42 U.S.C. § 5170), namely Lost Wages

Assistance program benefits that were authorized, paid, and disbursed in connection with the

Covid-19 pandemic, an emergency declaration under section 501 of the Robert T. Stafford Disaster

Relief and Emergency Assistance Act (42 U.S.C. § 5191).

18 U.S.C. § 1040(a)(1)

Case 1:22-cr-00151-JTN ECF No. 1, PageID.28 Filed 10/19/22 Page 28 of 46

29

COUNT 48

(Fraud in Connection with Emergency Benefits)

54. Paragraphs 1 through 41 of this Indictment are realleged and incorporated by

reference in this Count, as if fully set forth herein.

55. Between on or about August 8, 2020 and on or about September 14, 2020, in

Berrien County, in the Southern Division of the Western District of Michigan, and elsewhere,

CHRISTOPHER BATES

knowingly concealed and covered up by means of a scheme or device a material fact, which fact

BATES knew was material, specifically BATES concealed and covered up from Indiana’s SWA

the fact that, at that time, BATES was simultaneously receiving pandemic UI benefits from

Michigan’s SWA, and this concealment and covering up of a material fact by scheme or device

was done in a matter involving a benefit authorized, transmitted, transferred, disbursed, and paid

by the United States or of any department or agency thereof in connection with a major disaster

declaration under section 401 of the Robert T. Stafford Disaster Relief and Emergency Assistance

Act (42 U.S.C. § 5170), namely Lost Wages Assistance program benefits that were authorized,

paid, and disbursed in connection with the Covid-19 pandemic, an emergency declaration under

section 501 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act (42 U.S.C.

§ 5191).

18 U.S.C. § 1040

Case 1:22-cr-00151-JTN ECF No. 1, PageID.29 Filed 10/19/22 Page 29 of 46

30

PANDEMIC-RELATED LOANS FOR BUSINESS

At all times material to this Indictment:

56. The United States Small Business Administration (“SBA”) was an executive-

branch agency of the United States government that provided support to entrepreneurs and small

businesses. The mission of the SBA was to maintain and strengthen the nation’s economy by

enabling the establishment and viability of small businesses and by assisting in the economic

recovery of communities after disasters.

57. As part of this effort, the SBA enabled and provided for loans through banks, credit

unions, and other lenders. These loans have government-backed guarantees. The CARES Act,

which was signed into law in March 2020, established several new temporary programs and

provided for the expansion of others, including programs created and/or administered by the SBA.

Economic Injury Disaster Loan Program

58. An Economic Injury Disaster (“EID”) loan is an SBA-administered loan designed

to provide assistance to small businesses that suffer substantial economic injury as a result of a

declared disaster. An EID loan helps businesses meet necessary financial obligations that could

have been met had the disaster not occurred. It provides relief from economic injury that the

disaster caused and permits businesses to maintain a reasonable, working capital position during

the period that the disaster affected.

59. In March 2020, the CARES Act authorized the SBA to provide EID loans

nationwide to eligible small businesses to help alleviate economic injury caused by Covid-19.

60. EID loan funds are issued directly from the United States Treasury and applicants

apply through the SBA via an online portal. The EID loan application process, which uses certain

outside contracts for system support, collects information concerning the business and the

Case 1:22-cr-00151-JTN ECF No. 1, PageID.30 Filed 10/19/22 Page 30 of 46

31

businesses’ owner. In order to obtain an EID loan, a business was required to submit an application

to the SBA and provide information on its operations, such as the number of employees, gross

revenue for the 12-month period preceding the disaster, and cost of goods sold in the 12-month

period preceding the disaster. In the case of EIDLs for COVID-19 relief, the 12-month period was

that preceding January 31, 2020. Applicants electronically certify that the information provided is

accurate and are warned that any false statement or misrepresentation to the SBA or any

misapplication of loan proceeds may result in sanctions, including criminal penalties.

61. Beginning on July 11, 2020, EID loan applications were submitted directly to the

SBA through a cloud-based platform using an online application provided by Rapid Finance, a

government contractor, whose servers were located in Iowa.

62. If an EID loan application was approved, the amount of the loan was determined

based, in part, on the information provided in the application concerning the number of employees,

gross revenue, and cost of goods, as described above. Any funds under an EID loan were issued

directly by the SBA. EID loan funds were permitted to be used for payroll expenses, sick leave,

production costs, and business obligations, such as debts, rent, and mortgage payments. If the

applicant also obtained a loan under the PPP, the EID loan funds were not permitted to be used for

the same purpose as the PPP funds.

Paycheck Protection Program

63. One source of relief provided by the CARES Act was the authorization of up to

$349 billion in forgivable loans to small businesses for job retention and certain other expenses,

through a program referred to as the Paycheck Protection Program (“PPP”). In or around April

2020, Congress authorized over $300 billion in additional PPP funding.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.31 Filed 10/19/22 Page 31 of 46

32

64. In order to obtain a PPP loan, a qualifying business was required to submit a PPP

loan application, which was signed by an authorized representative of the business. The PPP loan

application required the business (through its authorized representative) to acknowledge program

rules and make certain affirmative certifications in order to be eligible to obtain the PPP loan. One

such certification required the applicant to affirm that “[t]he [PPP loan] funds w[ould] be used to

retain workers and maintain payroll or make mortgage interest payments, lease payments, and

utility payments.” The applicant (through its authorized representative) was also required to

acknowledge that “I understand that if the funds are used for unauthorized purposes, the federal

government may pursue criminal fraud charges.” In the PPP loan application, the small business

(through its authorized representative) was required to state, among other things, its: (i) average

monthly payroll expenses; and (ii) number of employees. These figures were used to calculate the

amount of money the small business was eligible to receive under the PPP. In addition, businesses

applying for a PPP loan were required to provide supporting documentation showing their business

expenses. To qualify for eligibility, businesses applying for a PPP loan needed to be in operation

as of February 15, 2020.

65. The SBA administered the PPP and had authority over all PPP loans. However,

approved lenders, including banks, credit unions, and non-bank lenders, issued the loans. A

business’s PPP loan application was received and processed, in the first instance, by a participating

lender, for assessment of the applicant’s eligibility. It was then transmitted to the SBA for review.

If a PPP loan application was approved, the participating lender funded the PPP loan using its own

monies, which the SBA guaranteed.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.32 Filed 10/19/22 Page 32 of 46

33

66. The following approved lenders participated in the PPP: Harvest Small Business

Finance LLC (“Harvest SBF”), Fountainhead Small Business Finance LLC (“Fountainhead

SBF”), and Benworth Capital Partners LLC (“Benworth Capital”).

67. Womply is a technology service provider that provides an online platform that

assists PPP lenders, including Harvest SBF, Fountainhead SBF, and Benworth Capital, in

processing PPP loan applications. Womply provided a variety of technology solutions to lenders

including the internet platform “Fast Lane,” which collected and automated PPP application data

and supporting information provided by the applicant, such as identification documents, bank

account data, and tax records. Womply used third-party computer servers, located in the states of

Virginia and Oregon, to host and store electronic data from Fast Lane.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.33 Filed 10/19/22 Page 33 of 46

34

COUNT 49

(Conspiracy to Commit Wire Fraud—EID Loan Conspiracy)

68. Paragraphs 1 through 8 and paragraphs 56 through 67 of this Indictment are

realleged and incorporated by reference in this Count, as if fully set forth herein.

69. Beginning on or about July 9, 2020, and continuing to in or about August 2020, in

Berrien County, in the Southern Division of the Western District of Michigan, and elsewhere,

ROSHELL BEATY and

MELVIN CLINTON

knowingly combined, conspired, confederated, and agreed with each other and with other persons

known and unknown to the Grand Jury to devise a scheme and artifice to defraud and to obtain

money and property by means of false and fraudulent pretenses, representations, and promises, by

means of wire communication in interstate commerce.

Object and Purpose of PPP Conspiracy

70. It was the object and purpose of the EID loan conspiracy for BEATY and

CLINTON to unjustly enrich themselves by obtaining EID loan proceeds from the SBA under

false and fraudulent pretenses, including by making false statements, and converting the EID loan

proceeds to their own personal use.

Manner and Means

71. Among the manner and means by which the BEATY and CLINTON carried out

the conspiracy were the following:

72. On or about July 9, 2020, one or more coconspirators used the internet to apply

online to the Internal Revenue Service for an Employee Identification Number, i.e., “EIN” for the

sole proprietorship “Melvin Clinton,” using Clinton’s Social Security number.

Case 1:22-cr-00151-JTN ECF No. 1, PageID.34 Filed 10/19/22 Page 34 of 46

35

73. On or about July 12, 2020, BEATY used IP address 71.201.191.51 to electronically

file with the SBA a false and fraudulent EID loan application in the name and Social Security

number of MELVIN CLINTON, as well as the EIN for CLINTON’s sole proprietorship. The

application contained false and fraudulent representations including:

that CLINTON’s business was in the “Personal Services” industry,

specifically in the category of “Hair and Nail Salon”;

that CLINTON’s business had 10 employees; and

that CLINTON’s business had gross revenues of $100,000 in the 12 months

prior to the pandemic.

74. BEATY and CLINTON used CLINTON’s United Federal Credit Union (“UFCU”)

checking account ending in 0104 as the deposit account for the fraudulent EID loan, thereby

causing the SBA to deposit $49,900 into this account of CLINTON’s.

75. BEATY and CLINTON converted to their own personal use the EID loan proceeds

that were deposited into CLINTON’s UFCU account ending in 0104 through a variety of means

including withdrawals of cash, electronic transfers of the loan proceeds to other accounts, and a

cashier’s check in the amount of $34,000 drawn on CLINTON’s account ending in 0104.

76. On or about August 1, 2020, BEATY and CLINTON used the fraudulently obtained

EID loan proceeds to purchase a 2017 Jaguar F-Pace SUV.

18 U.S.C. § 1349

18 U.S.C. § 1343

Case 1:22-cr-00151-JTN ECF No. 1, PageID.35 Filed 10/19/22 Page 35 of 46

36

COUNT 50

(Wire Fraud—EID Loan Scheme to Defraud)

77. Paragraphs 1 through 8 and paragraphs 56 through 75 of this Indictment are

realleged and incorporated by reference in this Count, as if fully set forth herein.

78. Between on or about July 9, 2020 and on or about August 1, 2020, in Berrien

County, in the Southern Division of the Western District of Michigan, and elsewhere,

ROSHELL BEATY and

MELVLIN CLINTON,

aiding and abetting each other, knowingly devised a scheme and artifice to defraud and to obtain

money, namely an EID loan from the SBA, by means of false and fraudulent pretenses,

representations, and promises.

The Wires

79. For the purpose of executing the scheme and artifice to defraud, BEATY and

CLINTON, aiding and abetting each other, transmitted and caused to be transmitted by means of

wire communication in interstate commerce the writings, signs, and signals set forth in Column B,

on the date listed in A.

A

Date

B

Transmission

7/13/2020

Electronic transmission of false and fraudulent application for EID loan in

the name and PII of MELVIN CLINTON, with electronic “Docusign”

signature of CLINTON’s name, from IP address 71.201.191.51 in Benton

Harbor, Michigan, to Rapid Finance computer servers in Iowa

18 U.S.C. § 1343

18 U.S.C. § 2

Case 1:22-cr-00151-JTN ECF No. 1, PageID.36 Filed 10/19/22 Page 36 of 46

37

COUNT 51

(Conspiracy to Commit Wire Fraud—PPP Loan Conspiracy)

80. Paragraphs 1 through 8 and 56 through 67 of this Indictment are realleged and

incorporated by reference in this Count, as if fully set forth herein.

81. Beginning in or about March 2021 and continuing to in or about May 2021, in

Berrien County, in the Southern Division of the Western District of Michigan, and elsewhere,

ROSHELL BEATY,

MELVIN CLINTON,

DANIELLE BRANCH,

CHRISTOPHER BATES, and

BRIANNA RIMPSON

knowingly combined, conspired, confederated, and agreed with each other and with other persons,

known and unknown to the Grand Jury, to devise a scheme and artifice to defraud and to obtain

money and property by means of false and fraudulent pretenses, representations, and promises, by

means of wire communication in interstate commerce.

Object and Purpose of PPP Loan Conspiracy

82. The object of the PPP conspiracy was for BEATY, CLINTON, DANIELLE

BRANCH, BATES, and RIMPSON, and others known and unknown to the Grand Jury, to unjustly

enrich themselves by obtaining PPP loan proceeds to which they were not entitled under false and

fraudulent pretenses, including by making false statements, and converting the PPP loan proceeds

to their own personal use.

Manner and Means of the PPP Loan Conspiracy

83. Among the manner and means by which the coconspirators carried out the PPP loan

conspiracy were the following:

84. BEATY electronically submitted false and fraudulent applications for PPP loans in

the names and PII of CLINTON, DANIELLE BRANCH, BATES, and RIMPSON, as well as in

Case 1:22-cr-00151-JTN ECF No. 1, PageID.37 Filed 10/19/22 Page 37 of 46

38

the names and PII of unindicted coconspirators, providing information that the coconspirators

knew to be false that was material including false statements that the applicants were sole

proprietors or independent contractors who were eligible for PPP loans, and false statements about

gross business income for each applicant.

85. One or more coconspirators, including BEATY, prepared false and fraudulent IRS

tax forms to support the purported incomes stated in the false and fraudulent PPP loan applications.

86. One or more coconspirators, including BEATY, electronically submitted fraudulent

PPP loan applications and supporting documentation, namely the false and fraudulent IRS tax

forms, to PPP lenders via wire communications in interstate commerce using the online PPP web

platform of the Womply technology company.

87. BEATY electronically submitted false and fraudulent applications for PPP loans in

the names and PII of the following third parties, on the approximate dates listed below, resulting

in the payment of PPP loans through the identified lenders, for the amounts listed below.

Loan Recipient

Application

Date

Lender

Loan

Amount

A.A.C. 3/29/21 Fountainhead SBF $20,833

A.A.C. 5/23/21 BSD Capital, dba Lendistry $20,833

A.D.C. 4/9/21 Harvest SBF $18,562

K.F. 4/27/21 n/a n/a

L.J. 4/26/21 n/a n/a

L.J. 3/30/21 Harvest SBF $19,354

A.L. 4/23/21 n/a n/a

J.L. 3/30/21 Harvest SBF $19,354

K.L.B. 4/12/21 n/a n/a

D.P. 3/27/21 n/a n/a

K.R. 4/26/21 Harvest SBF $19,770

K.R. 5/3/21 Fountainhead SBF $19,770

K.T. 4/23/21 Benworth Capital $15,208

D.W. 4/9/21 n/a n/a

N.Y. 4/2/21 n/a n/a

S.Y. 4/12/21 Benworth Capital or Harvest SBF $19,979

88. On the approximate dates listed below, one or more coconspirators, including

BEATY, used IP address 71.201.191.51 to file with Womply applications for PPP loans in the

Case 1:22-cr-00151-JTN ECF No. 1, PageID.38 Filed 10/19/22 Page 38 of 46

39

names and PII of the following defendants, which contained false statements about the defendants’

purported businesses and purported gross business profits, resulting in the payment of PPP loans

through the identified lenders, for the amounts listed below.

Defendant

Application

Date

Purported

Business

Purported Gross Business

Profits by Year

Lender

Loan

Amount

MELVIN CLINTON 4/17/2021

Independent

Contractor

$77,000 gross profits (2019) Benworth Capital $16,041

DANIELLE BRANCH 4/9/2021

Sole

Proprietor

$59,000 gross profits (2019) Harvest SBF $12,291

CHRISTOPHER BATES 4/12/2021

Sole

Proprietor

$97,270 gross profits (2020) Fountainhead SBF $20,264

BRIANNA RIMPSON 4/9/2021

Sole

Proprietor

$75,000 gross profits (2020) Fountainhead SBF $15,625

89. Coconspirator BATES applied for a second PPP loan on or about May 23, 2021,

which contained materially false and fraudulent statements respecting the nature of BATES’s

purported business and its purported gross profits, resulting in the funding to BATES of a second

PPP loan, by Harvest Small Business Finance, dba Lendistry, in the amount of $20,264.

90. To receive proceeds of the fraudulently obtained PPP loans, the coconspirators used

checking accounts belonging to and under the control of CLINTON, DANIELLE BRANCH,

BATES, and RIMPSON, as well as unindicted coconspirators, as the deposit accounts for PPP

loans, thereby causing the lenders to deposit PPP loan proceeds into these accounts.

91. CLINTON, DANIELLE BRANCH, BATES, and RIMPSON converted to their

own personal use the PPP loan proceeds that were deposited into their respective accounts.

92. One or more coconspirators, including DANIELLE BRANCH, BATES, and

RIMPSON, applied to the SBA for forgiveness of their PPP loans by submitting applications

containing materially false and fraudulent statements, thereby causing the SBA to reimburse their

respective lenders in the amount of their PPP loans, with interest.

18 U.S.C. § 1349

18 U.S.C. § 1343

Case 1:22-cr-00151-JTN ECF No. 1, PageID.39 Filed 10/19/22 Page 39 of 46

40

COUNTS 52 THROUGH 55

(Wire Fraud—PPP Loan Scheme to Defraud)

93. Paragraphs 1 through 8, 56 through 67, and 79 through 91 of this Indictment are

realleged and incorporated by reference in these Counts, as if fully set forth herein.

94. On or about the dates listed in Column C, in Berrien County, in the Southern

Division of the Western District of Michigan, and elsewhere, the defendants identified in Column

B, aiding and abetting each other, having knowingly devised a scheme or artifice to defraud to

obtain money by means of false and fraudulent pretenses, representations, and promises, and for

the purpose of executing such scheme, transmitted and caused to be transmitted by means of wire

communication in interstate commerce the writings, signs, and signals set forth in column D,

below, each of which constituted an execution of the fraudulent scheme:

A

Count

B

Defendant(s)

C

Date

D

Transmission

52

ROSHELL BEATY

MELVIN CLINTON

4/17/2021

Electronic transmission of false and

fraudulent application for PPP loan in the

name of MELVIN CLINTON, from IP

address 71.201.191.51 to Womply’s

computer server in Virginia or Oregon

53

ROSHELL BEATY

DANIELLE BRANCH

4/9/2021

Electronic transmission of false and

fraudulent application for PPP loan in the

name of DANIELLE BRANCH, from IP

address 71.201.191.51 to Womply’s

computer server in Virginia or Oregon

54

ROSHELL BEATY

CHRISTOPHER BATES

4/12/2021

Electronic transmission of false and

fraudulent application for PPP loan in the

name of CHRISTOPHER BATES, from

IP address 71.201.191.51 to Womply’s

computer server in Virginia or Oregon

55

ROSHELL BEATY

BRIANNA RIMPSON

4/9/2021

Electronic transmission of false and

fraudulent application for PPP loan in the

name of BRIANNA RIMPSON, from IP

address 71.201.191.51 to Womply’s

computer server in Virginia or Oregon

18 U.S.C. § 1343

18 U.S.C. § 2

Case 1:22-cr-00151-JTN ECF No. 1, PageID.40 Filed 10/19/22 Page 40 of 46

41

FORFEITURE ALLEGATION

(Conspiracy to Commit Wire Fraud—Pandemic UI Benefits Fraud)

The allegations contained in Count 1 (conspiracy to commit wire fraud) are hereby

realleged and incorporated by reference for the purpose of alleging forfeitures pursuant to 18

U.S.C. § 981(a)(1)(C) and 28 U.S.C. § 2461(c).

Pursuant to 18 U.S.C. § 982(a)(1)(C) and 28 U.S.C. § 2461(c), upon conviction of the

offense in violation of 18 U.S.C. §§ 1349 and 1343 set forth in Count 1 of this Indictment, the

defendants,

ROSHELL BEATY,

MELVIN CLINTON,

DANIELLE BRANCH,

CHRISTOPHER BATES,

BRIANNA RIMPSON, and

CHRISTOPHER BRANCH,

shall forfeit to the United States any property, real or personal, which constitutes or is derived,

directly or indirectly, from proceeds traceable to the violation. The property to be forfeited

includes, but is not limited to, the following:

A. MONEY JUDGMENT: A sum of money equal to at least $764,194, which

represents the proceeds obtained, directly or indirectly, from the offense charged in Count 1 of this

Indictment, including $1,905.00 seized from ROSHELL BEATY on April 28, 2021;

B. REAL PROPERTY: 566 E. May St., Benton Harbor, MI 49022, Berrien County,

being more fully described as: Lot(s) 4, BLOCK 1, F.M. MILLS EMPIRE ADDITION TO THE

CITY OF BENTON HARBOR, according the recorded plat thereof, as recorded in Liber 5 of