March 10, 2015

EQUITY RESEARCH

James Schneider, Ph.D.

917.343.3149

Goldman, Sachs & Co.

S.K. Prasad Borra

917.343.7293

Goldman, Sachs & Co.

PART 2

Redefining “The Way We Pay” in the Next Decade

The Future of Finance

The way we pay is changing. The plumbing connecting

banks, merchants, networks and consumers is being

reconsidered. From Square and Stripe to Apple and Alipay,

innovators are creating new ways to transact - forcing

incumbents to adapt. Witness Millennials trading personal

data for convenience and retailers backing new networks

like MCX to reduce fees. Analytics are helping cut interbank

payment delays from days to seconds, while cryptocurrencies

like Bitcoin are emerging. All the while, shifting international

regulations are creating an uneven global landscape.

The latest in our Future of Finance series lays out where

traditional prot pools in payments are being challenged with

a focus on where we are headed in the next decade.

Goldman Sachs does and seeks to do business with companies covered in its research reports. As

a result, investors should be aware that the rm may have a conict of interest that could affect the

objectivity of this report. Investors should consider this report as only a single factor in making their

investment decision. For Reg AC certication and other important disclosures, see the Disclosure

Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US afliates are not

registered/qualied as research analysts with FINRA in the U.S.

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 2

Contents

PM Summary: Redefining “the way we pay” in the next decade 3

Thematic investment framework: Navigating payment futures 6

Key Shaping Trend #1: Technology 9

Key Shaping Trend #2: Regulation 13

Key Shaping Trend #3: Demographics 16

Key Shaping Trend #4: International 21

Connecting megatrends to payment channels 24

B2C Incumbents: An overview of today’s credit & debit ecosystem 25

B2C Payments: Mobile payments – evolution or revolution? 30

Apple Pay, Samsung Pay, and Google Wallet: Re-shaping - not disrupting - the existing credit card ecosystem 30

Payment Innovators – Working within the ecosystem to deliver value-added services 33

“Democratizing” payments and capabilities for small merchants 34

Using “big data” analytics to drive higher sales for merchants 35

Payment Disruptors – Could they disintermediate the credit/debit ecosystem? 38

ACH disruptors: Making ACH faster and easier for merchants 39

Crypto-currencies: Can Bitcoin gain broad merchant acceptance? 40

China case study: Where payment innovators are quickly gaining ground 44

C2C Payments: Convenience reshapes consumers’ payment lives 48

Faster and cheaper: Few economic victims in the “war on cash and checks” 48

The challengers: Venmo, Popmoney, and Square among the standouts in a crowded field 48

C2C Payments: International money transfer incumbents 50

International money transmitters: A large and complex market opportunity – still opportunities for new entrants 50

Mobile money transfers: making inroads among the under-banked 52

C2C Payments: International money transfer innovators & disruptors 53

Money transmitter innovators in the US and Europe 53

Cryptocurrencies: A potential value proposition for international FX 54

B2B Payments: Driving efficiency for the enterprise – A rare greenfield opportunity for the payments industry 58

Waste, fraud, and abuse: The cost penalty that corporations endure today from the use of paper checks 58

An incremental opportunity to transform the enterprise with IT in the “last bastion of paper” 62

Appendix I: Index of Emerging Payment Companies 66

Disclosure Appendix 68

Payments Financials Internet Software Management

James Schneider, Ph.D. Ryan M. Nash, CFA Heath Terry, CFA Greg Dunham, CFA Robert Boroujerdi

james.schneider@gs.com ryan.nash@gs.com heath.t[email protected]om greg.dunham@gs.com robert.boroujerdi@gs.com

S.K. Prasad Borra Eric Beardsley, CFA Debra Schwartz Frank Robinson

Jeffrey Chen Jeff Lengler, CFA Tina Sun Mark Grant

jeffrey.j.chen@gs.com jeffrey.lengler@gs.com tina.sun@gs.com mark.grant@gs.com

Jordan Fox Joon Lee

[email protected]om joon.lee@gs.com

Margarite Halaris Kevin Senet

margarite.halaris@gs.com kevin.senet@gs.com

Joe Delia

joe.delia@gs.com

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 3

PM Summary: Redefining “the way we pay” in the next decade

The level of debate around the $1.2 trillion global payments industry has never been

higher. Over the past 40 years, the payments industry has evolved into a complex

ecosystem comprised of financial institutions and intermediaries, technology vendors, and

service providers. Banks, payment networks, merchant acquirers, money transmitters, and

point-of-sale vendors all occupy unique positions in the ecosystem, and have developed

their own economic models and profit pools tied to it.

At the same time, multiple mega-trends – technological, regulatory, demographic, and

international – are converging that could potentially change or disrupt today’s payments

ecosystem. Innovations in network technology and cryptography could change the speed

and mechanics of moving money, with the UK ramping a network capable of real time (vs.

a 2-3 day time lag in the US system). Millennials have different payment habits than their

parents, with 60% regularly performing mobile financial transactions. Governments have

enacted legislation to reduce payment transaction fees such as interchange by 50% or

more in order to accelerate electronic payment adoption. And consumers around the

world have very different relationships with financial institutions than their counterparts

in the US, with 50% of the world’s population without access to formal financial services.

We examine each of these megatrends, analyze the business models of emerging players,

and look at the potential impact on the payments landscape across three channels:

Business-to-Consumer, Consumer-to-Consumer, and Business-to-Business. We also

analyze the various profit pools tied to each type of payment market, and whether

incumbents are likely to successfully adapt, or lose market share to emerging vendors.

Megatrends that are shaping the face of payments

Technology – We see four significant technologies impacting the future of payments:

(1) Faster payment networks which combine modern network technology with risk

scoring have seen adoption abroad, and could replace the US ACH network in the next

5-10 years; (2) Big data analytics which aggregate purchaser data can drive higher

sales for merchants; (3) New payment security methods help safeguard consumer

data; (4) Bitcoin and cryptocurrencies promise to change the mechanics of transactions.

Regulation – Regulation continues to play a vital role in determining the future

evolution of payments, in particular: (1) Consumer protection laws determine the level

of liability exposure for consumers, and can have a profound impact on the adoption

of payment methods by geography; (2) Compliance requirements (particularly Anti-

Money Laundering and fraud rules) have broad implications for consumer payments,

particularly money transfers; (3) Interchange rules govern the fees charged by banks.

Demographics – Multiple demographic factors are playing a role in the payment

choices people make: (1) Millennials are adopting mobile payments faster than other

age groups, but also rely more on cash, while baby boomers tend to use more credit

and electronic payments than other demographics; (2) Income also plays an important

role in consumer payment choices, with higher-income individuals skewing toward

credit and electronic payment usage, and low-income consumers using more cash.

International – Outside the US, multiple demographic, regulatory, and cultural factors

are driving very different evolution paths for payment methods. We examine the cases

of China (where online commerce is growing quickly and new services like Alipay are

gaining strong traction) and Africa (where a large under-banked population is turning

to mobile payments faster than the rest of the world).

Why read this report?

Trend #1: Technology

Faster networks

Big data analytics

Payment security

Bitcoin

Trend #2: Regulation

Consumer protection

Compliance costs

Interchange rules

Trend #3: Demographic

Generational

Income

Trend #4: International

Unbanked population

Credit vs. debit

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 4

Mapping profit pools and risks in the global payments ecosystem

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 5

Our takeaways for key payment channels: B2C, C2C, and B2B

B2C Payments:

Networks maintain a strong position, but emerging players have a fighting chance to

make inroads: Commanding $590 bn in fees globally, B2C payments is both the largest

and most widely debated market in terms of potential disruption. At the heart of B2C

payments are electronic payment networks including Visa, MasterCard, AmEx, and

UnionPay, as well as cash and checks. Electronic payments offer clear advantages to

consumers and merchants as evidenced by the rapid adoption of electronic payments

over the last 15 years. But more recently, two groups of new entrants have emerged in

the B2C payments market:

o Innovators (such as PayPal, Square, Stripe, and Cardlytics) are working within

the structure established by payment networks, providing value-added

services to merchants (such as analytics, financing, and e-commerce services).

o Disruptors (such as MCX, Seamless, Dwolla, Coinbase, and Bitpay) seek to

disintermediate payment networks in a bid to provide merchants with lower

cost electronic payments.

We believe there is real demand among merchants for many of the services offered by

Innovators, and think the technologies being explored by several Disruptors promise

to lower cost of payment acceptance. However, banks and payment networks have

built a powerful market position, reinforced by tangible benefits for consumers. In the

US, credit cards come with attractive rewards programs, allowing consumers to garner

benefits based on their spending pooled across all merchants, not just one. US

consumer credit and banking regulations also provide powerful protections for

consumers (such as zero liability in case of fraud and the ability to dispute payments

for unsatisfactory products) – protections unmatched by competitive payment methods.

Importantly, incumbent payment networks are innovating. From enabling mobile

payment systems like Apple Pay, Google Wallet, and Samsung Pay to developing

merchant analytics platforms like MasterCard Advisors and Visa Transaction Advisors,

payment networks are evolving their offerings to make them more competitive with

emerging players. We see the networks’ strong market position continuing for the

foreseeable future, so long as they remain nimble and innovative. However, we see the

opportunity for emerging players to make inroads – particularly outside the US and in

emerging markets where regulatory and cultural dynamics differ.

Given multiple factors, including potential changes in regulation as well as inroads

made by emerging vendors, we see potential risk of up to $84 billion or 14% of global

industry revenue.

Our analysis suggests:

1. The greatest benefit could accrue to non-traditional lenders (such as Lending Club

and others) if they capture substantial share of the credit card debt service market

from banks.

2. Consumers could capture substantial benefits in the form of lower overdraft and

other account service fees from new real-time bank payment networks, and from

lower rates charged by non-traditional lenders.

3. Merchants could also benefit from lower interchange rates if governments

legislate lower fees in other countries as has already been done in the US, the EU,

and Australia.

4. Finally, emerging players could gain market share (such as Square, MCX, Dwolla, and

Seamless) if they penetrate under-served markets like micro-merchants and compete

effectively against traditional merchant acquirers and networks.

B2C payments:

$590 bn globally in

revenue and fees

of which:

$84 billion (14%) is

potentially at risk

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 6

Thematic investment framework: Navigating payment futures

Exhibit 1: Our thematic investment framework for evaluating payment futures

Theme Emerging Trend

Public company

winners

Notable private

companies

At risk

Technology

Faster payment networks promise

to reduce the time required to move

money in US accounts to seconds,

from 2-3 days currently

Fiserv and FIS provide

“plumbing” to

connect banks to the

system

Dwolla is selling

real-time transfer

systems to banks

Retail banks may

see lower

overdraft and

late fees

Big Data allows merchants to drive

increased sales by combining

analytics and marketing

MasterCard and Visa

are starting to provide

analytics solutions to

merchants

Cardlytics, APT,

ShopKeep, and

Womply provide

analytics solutions

to merchants

Payment security techniques help

reduce payment fraud and merchant

losses

Verifone and Ingenico

outfit merchants with

more secure point-of-

sale solutions

Square, Revel,

ShopKeep are

providing EMV-

based point-of-sale

solutions for SMBs

Bitcoin and cryptocurrencies allow

for the de-centralized transfer of

assets without a central clearing

authority

Large merchants

benefit from lower

payment costs

Coinbase, Bitpay,

and Ripple Labs are

among the key

emerging vendors

Western Union,

Moneygram,

Xoom could see

share loss

Regulation

Consumer protections help insulate

consumers from fraudulent charges

and identity theft

Visa, MasterCard &

banks retain more

business given

consumer-friendly

rules

Payment interchange fees are

moving lower in many countries

driven by legislation

Large merchants

benefit from lower

payment costs

Banks, AmEx see

reduced fees

Visa, MasterCard

may see reduced

spreads

Anti-money laundering rules help

protect against illegal funds transfer

and fraud

Smaller-scale money

transmitters like

Xoom are subject to

less regulation

WorldRemit,

TransferWise, and

Currency Fair could

gain share

Western Union

and banks could

see higher

compliance costs

Demographics

Millennials adopt mobile payments

faster

Visa, MasterCard,

Popmoney (Fiserv)

benefit from mobile

p

a

y

ment ado

p

tion

Square provides

easy-to-use mobile

solutions; Stripe

p

rocesses online

Young adults are the most under-

banked age group

MPesa (Vodafone and

Safaricom) provide

mobile money

services for unbanked

International

50% of the world’s population is

unbanked

MPesa (Vodafone and

Safaricom) provide

mobile money

services for unbanked

Western Union

and others see

lower fees from

account transfer

Many emerging market cultures

prefer debit over credit

Banks see

reduced fees;

Visa, MasterCard

may see reduced

spreads

Source: Goldman Sachs Global Investment Research.

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 7

C2C Payments:

We see the potential for significant disruption ahead: Today, consumer-to-consumer

(C2C) payments represent an estimated $30 billion in fee revenue, mainly driven by

international money remittance. We believe C2C payments are most likely to see

significant disruption over the next 10 years for several reasons:

o Incumbent technologies for C2C payments (such as checks and ACH transfers)

are generally weak, and have been unresponsive to consumer needs due to

the lack of economic incentives for incumbent service providers like banks.

o Most consumers have a simple dual mandate for C2C payments – high speed

and low cost – which can be served by applying a mix of modern network

technology and smart analytics to drive faster, more efficient payments.

o There are relatively few barriers to entry for new players in the market.

Venmo, Popmoney, ClearExchange, Square Cash, and Dwolla make it easier to transfer

money between individuals by applying mobile technology. Making transfers faster

will require systematic changes to the system (known as ACH) operated by the US

Federal Reserve and banks. A US modernization initiative is still in the early stages, but

other countries such as the UK have already adopted systems for real-time money

transfer. Few – if any – domestic C2C services charge explicit fees (they are embedded

in standard consumer banking fees) – and thus there is no profit pool to disrupt.

However, there is a significant profit pool in international C2C payments and cross-

border remittance. New online approaches (like Xoom) plus new technology

approaches (like Bitcoin, TransferWise, and Ripple Labs) have the opportunity to

disrupt traditional in-person money transfer services provided by Western Union and

many large banks.

Given both the pricing pressure we see from traditional money transmitters, and the

potential for innovators to streamline the international money transfer industry with

new technology approaches, we see about $6 billion or 20% of industry C2C revenue

at risk over time, with benefits likely accruing to both innovative service providers (in

the form of market share gains) and consumers (due to lower fees) in the long run.

B2B Payments:

A rare greenfield opportunity for payments innovation: We believe B2B payments is a

large and exciting greenfield opportunity for the industry over the next 10 years. Today,

50% of the payments processed between businesses in the US are paper checks.

Enterprises around the world bear an estimated $550 bn in direct costs and

inefficiencies tied to the manual handling, processing, and reconciliation of corporate

payments. By digitizing the payment process, enterprises can reduce both their

processing costs and headcount tied to manual reconciliation of payments and receipts.

Moreover, digitization can help reduce systemic waste, fraud, and abuse – such as

vendors overbilling their customers. Relative to consumer-facing payments, B2B

electronic payments are still in their infancy – mainly due to the slow adoption of IT

systems among small- and medium-sized businesses worldwide. However, a number

of vendors are beginning to gain market traction as electronic B2B payments take hold.

New electronic payment methods called “virtual cards” offered by companies like

WEX and FleetCor target verticals like healthcare, construction, and hospitality, which

suffer from high levels of inefficiency.

We see the opportunity for businesses worldwide to reduce their total overhead costs

tied to B2B payments by $74 billion over time, with up to $17 billion of revenue

opportunity for emerging B2B payment vendors such WEX and FleetCor, and an

estimated $57 billion in net cost savings for companies worldwide.

C2C payments:

$30 billion globally in

revenue and fees

of which:

$6 billion (20%) is

potentially at risk

B2B payments:

$550 bn in costs for

companies globally

of which:

$17 billion is the

incremental revenue

opportunity for

payments companies

$57 billion is the cost

savings that

companies could

achieve

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 8

Did you know...?

50% of the world population is still

unbanked, and over 25% of the US

population is either unbanked or under-

banked. (Page 21)

80% of Bitcoin

volume is

exchanged into

and out of

Chinese yuan.

(Page 12)

Nearly 1 in 10 of all payments in

China are made using Alipay.

(Page 46)

Nearly 50% of

payments by US

businesses are still

made with paper

checks. (Page 58)

UNBANKED POPULATION

Less than 1% of consumer

transactions in Germany

are made with credit cards.

(Page 23)

GLOBAL DIVIDE: CREDIT VS. DEBIT

4,000

X

FASTER

INNOVATION IN EMERGING MARKETS

INNOVATORS GAINING GROUND IN CHINA

PAPERLESS SHIFT

BITCOIN HAS MOMENTUM IN CHINA

MILLENNIALS

Millennials in the US

use more cash –in

40% of transactions –

than any other age

group. (Page 17)

13 million

MOBILE PAYMENTS

Kenya has more mobile payments users

than any other country. (Page 52)

BABY BOOMERS

“Big box” merchants in

the US command over

50% of all purchase volume,

but pay just 10% of payment

processing fees. (Page 34)

BIG BOX / SMALL MERCHANT PAYMENTS DIVIDE

50

%

PAY

A bank account holder

in Nigeria can move

money to another

account in seconds, but

in the US this takes up

to 3 days. (Page 10)

2.5bn+

1

元

40

%

US consumers over

65 use credit cards

more than any other

group, 33% of the

time. (Page 16)

50

%

10%

1

<

%

10

80%

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 9

Key Shaping Trend #1: Technology

As in many industries, technology is rapidly evolving both at the core and the edge of

payments. We briefly examine four salient technology changes – faster network

technology, big data analytics, payment security, and Bitcoin – and assess the likely

impact of these technologies on the future of payments.

Technology Trend #1: Faster payment networks

What’s wrong with ACH, the current interbank payments network in the US? The

system which connects banks to each other and the US Federal Reserve is known as the

Automated Clearinghouse or ACH. Overseen by National Automated Clearinghouse

Association (NACHA), the ACH system links depository institutions together. During the

day, credit and debit transactions are forwarded between member banks on the network,

and these transactions are accumulated and settled in a batch process at the end of each

day. The ACH operator calculates the net debit and credits for each member bank, and each

bank’s reserve account is adjusted by an appropriate amount at the US Federal Reserve,

which acts as the settlement agent for member banks. In 2012, the ACH network processed

more than 22 bn transactions with a total value of $39 tn.

Currently, ACH network rules mandate that credit transactions settle between banks in two

business days, with debit transactions settling the next business day. However, it may take

up to three days for funds sent from one customer’s bank to be available for use by a

customer of another bank. Despite the fact that the ACH network has been in operation for

over 40 years, the long settlement times experienced by customers are not only technology

related, and can occur due to: (1) the large number of small financial institutions in the US

connected to the network; (2) procedures and policies instituted by banks to mitigate risk

and fraud; (3) regulatory measures mandated by the government (including Know Your

Customer and Anti-Money Laundering provisions) designed to prevent illegal activity.

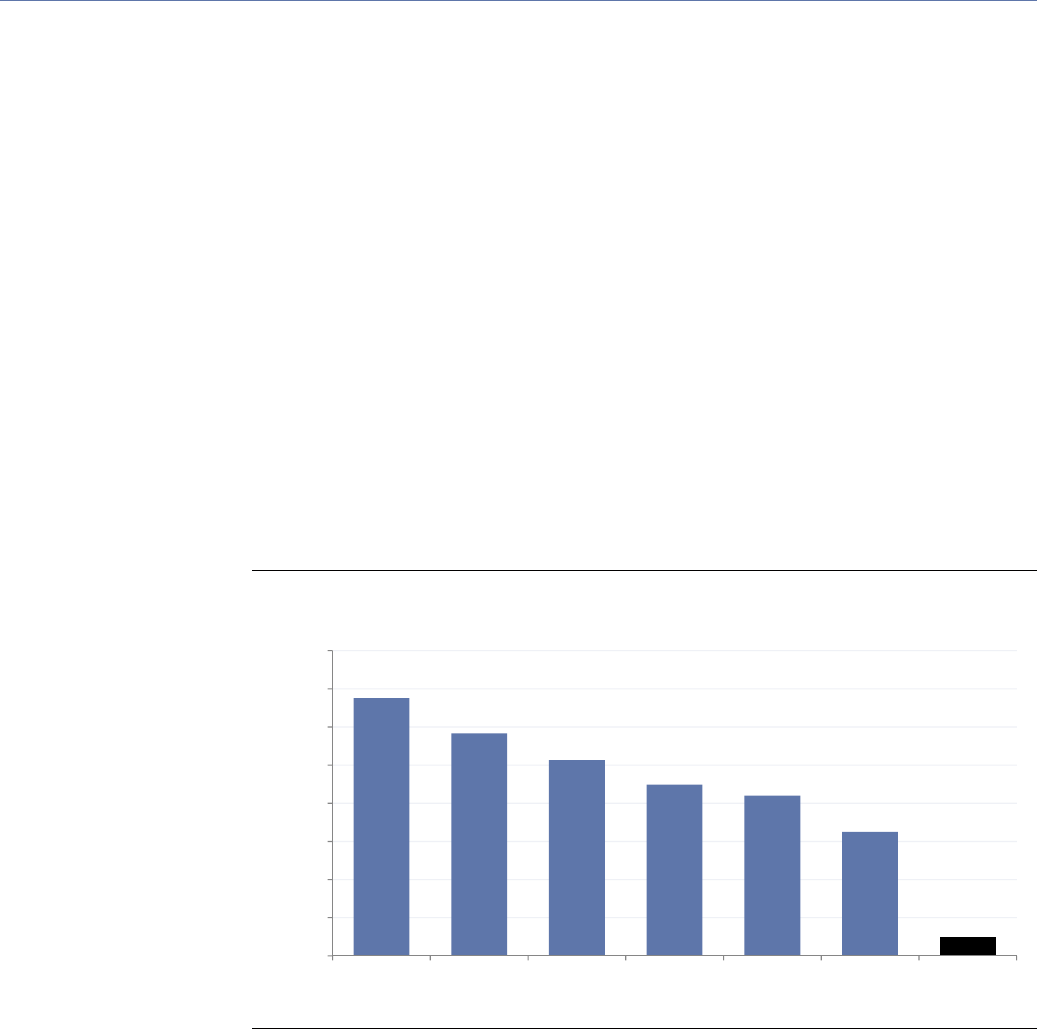

Exhibit 2: Next-generation national payment networks use updated technology plus risk-scoring algorithms to transfer

money between consumers and business in seconds or minutes, compared to 2 - 3 days currently

Source: Goldman Sachs Global Investment Research.

Customer

Customer

bank

Chase, BofA, Wells Fargo,

Barclays, etc.

NextGen ACH

Service

Faster Payments

Merchant

Real-time

Merchant’s bank

is credited

Bank validates

the transaction

details

Bank

confirms the

payment and

reflects the

balance

Within minutes

Real-time Real-time

Merchant charges customer

Real-time

Merchant

bank

Chase, BofA, Wells Fargo,

Barclays, etc.

Customer

instructs bank

to make

payment

Bank

verifies the

authenticity

of the

transaction

Faster Payments

Service verifies

funds are

sufficient

Customer bank

is debited

FIS and Fiserv provide

technology solutions

to small banks that

connect them to

payment processing

networks like ACH

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 10

New payments networks are driving nearly instant flow of funds between banks. By

using a mix of updated network technology – and more importantly, sophisticated risk-

scoring and analytics techniques – several countries have begun to transform their

interbank payment systems to provide for near-real-time (within minutes) transfers

between banks. Notably, the UK’s Faster Payments Service (FPS) began operations in 2008

and cleared over GBP 770 bn of transactions in 2013. Singapore, Poland, and Nigeria have

also established similar systems at a smaller scale. The US Federal Reserve is currently

developing a roadmap for payment system modernization in the US. Although still in the

consultation phase, we believe this process is likely to lead to the adoption of a more

modern, near-real-time system for electronic funds transfer between US banks. Given the

very large scale and complexity of the US banking system as well as our discussions with

industry participants, we believe that such a system could be implemented in the US in a 5-

10 year timeframe. In addition to providing greater convenience for consumers, we believe

it could significantly reduce late and overdraft fees currently levied by banks.

Technology Trend #2: Big Data - Using data to drive increased sales

Big data, when combined with loyalty programs, could deliver a sales lift of 2% - 5%

for merchants.

Big data solutions are clearly still in their infancy, but early results among

retailers are encouraging. McKinsey has noted that several of its clients in the grocery,

drugstore, and do-it-yourself retail verticals have achieved sales uplifts of up to 3% - 5%

with increased profit of 1% - 4% when using Big Data solutions. Dell reported that it

achieved incremental revenue of $200 mn in 2013, increased conversions by 30% and

increased customer satisfaction by 30% following use of Big Data applications. Applied

Predictive Technologies (APT), a provider of Big Data analytics software to the retail

industry, cites several customer case studies where retailers using big data solutions to

optimize retail space have achieved sales uplift of up to 2% with increased profit of up to

4%. We believe retailers will increasingly seek Big Data solutions to help boost sales and

customer retention.

Card-linked offers are one concrete way merchants are leveraging Big Data to drive higher

sales. Offers are tied directly a consumer’s debit or credit card (or mobile device), and

consumers shop normally with no slowdown at the register. Consumers avoid all the

hassle related to cutting and printing of paper coupons, mail-in rebates and related follow-

up. Merchants benefit from the precise targeting of customers based on purchase history

and enhancing sales and loyalty with high-value customers. Banks also see card-linked

offers as a way of enhancing customer engagement and increasing wallet share.

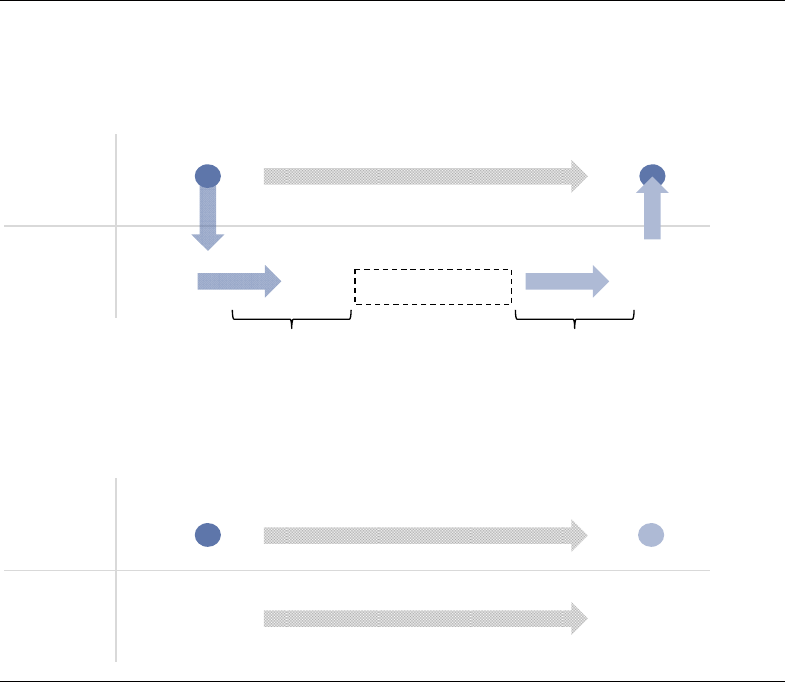

Exhibit 3: Big Data combines analytics & marketing with datasets to drive higher sales

Source: Goldman Sachs Global Investment Research.

Data

Integrated

Sales&

Marketing

BigData

Analytics

Sales

Uplift

Dwolla, FIS, and

Fiserv are providing

upgraded real-time

money transfer

capabilities to banks

Cardlytics, APT,

ShopKeep, and

Womply are equipping

merchants with

analytics

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 11

Technology Trend #3: Payment security and tokenization

Payment security has moved to a top priority for retailers following data breaches.

Cybersecurity became an extremely high-profile topic in 2013, and we believe interest has

accelerated further in 2014 following a series of high-profile consumer data breaches at

eBay, Target, Home Depot, and others. Given the magnitude of some of these breaches

and the significant erosion in consumer confidence experienced by some retailers, we

believe consumer data and transaction security has become a more prominent topic than

ever before in corporate boardrooms. What was once perceived as a “cost of doing

business” with an implementation timeline set by internal IT departments has now become

a business imperative for merchants – with security programs now closely monitored by

the C-suite.

Exhibit 4: EMV, tokenization, and encryption can enhance

payment security

Exhibit 5: Large merchants are leading EMV adoption

Percentage of merchants by category enabled with EMV

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.

We believe three complementary pieces of technology are required to provide

maximum security in the payment ecosystem: EMV (chip cards), tokenization, and

encryption.

Each of these technologies addresses a different security vulnerability: 1) EMV

or chip card technology helps prevent the use of counterfeit cards; 2) tokenization

safeguards consumer data by breaking the link between a consumer’s identity and their

financial account data; 3) encryption ensures that account data cannot be “skimmed” or

stolen at the point of sale or between points in a merchant’s data network. Although each

of these technologies is helpful independently in reducing fraud and increasing data

security, we believe all three need to operate together to ensure the highest possible level

of security.

Tokenization is vital to new mobile payment methods like Apple Pay, and is being

provided by payment networks including Visa, MasterCard, AmEx, and banks. Instead of

providing the actual cardholder’s account number to the merchant, tokenization generates

a substitute number for the purpose of the transaction which is used to communicate with

the card network and member banks. Even if tokens are lost or stolen, they are of limited

value as tokens carry defined constraints such as maximum transaction value. Tokenization

is completely transparent to the consumer – and happens entirely in the software within

the payment network. We believe the primary beneficiaries of US EMV adoption are

traditional terminal vendors like Verifone and Ingenico which enable security at the point of

sale.

EMV

Tokenization

Encryption

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2013 2014 2015 2016 2017E 2018E 2019E 2020E

SME Midmarket Nationalmerchants Overallmarket

Square, Revel

Systems, and

ShopKeep provide

secure point-of-sale

software and

hardware solutions to

merchants

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 12

Technology Trend #4: Bitcoin - the era of “pervasive cryptography”

What is Bitcoin? Bitcoin is a decentralized, peer-to-peer network that allows for the proof

and transfer of ownership without the need for a trusted third party. The unit of the

network is bitcoin (with a little “b”), or BTC, which many consider a commodity or a form

of currency. The Bitcoin network was conceived in 2008 and launched in 2009. The network

is based on a series of mathematical computations, and people around the world called

“miners” who perform sophisticated computations to generate bitcoins. The formula and

software are freely available for anyone to use. There is a finite amount of bitcoins that can

be produced and as more bitcoins are created, the mathematical computations required to

create more become increasingly difficult. Bitcoin can be traded or used to buy goods and

services. Bitcoin transactions are recorded in the “block chain” – a massive and transparent

ledger of all bitcoin transactions maintained by miners. There is no central authority that

oversees Bitcoin. Importantly, there are many other cryptocurrencies that operate similarly

to Bitcoin and are used for a specific purpose, which we detail later in the report.

Exhibit 6: About 80% of Bitcoin exchange volume is now driven by the Chinese yuan

Bitcoin trading volume breakdown by the top 3 currencies

Source: Bitcoinity.org, Goldman Sachs Global Investment Research.

How could Bitcoin change the payments landscape? Rather than using a centralized

clearing system operated by a single authority (such as the government, a federation of

banks, or a single payment network), Bitcoin and other cryptocurrencies use distributed

computing power to clear and authenticate transactions between counterparties. In the

context of business-to-consumer purchase transactions, merchants would still likely need a

“merchant acquirer” or a processor to act as a service provider to handle payments.

Without a single large entity such as a large bank or payment network acting as an

intermediary for processing transactions, competition between payment processors could

in principle be increased significantly, potentially resulting in lower processing fees.

Similarly, in consumer-to-consumer money transmission, foreign exchange fees could also

be potentially reduced.

$0.00

$200.00

$400.00

$600.00

$800.00

$1,000.00

$1,200.00

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

7/12/2010

9/12/2010

11/12/2010

1/12/2011

3/12/2011

5/12/2011

7/12/2011

9/12/2011

11/12/2011

1/12/2012

3/12/2012

5/12/2012

7/12/2012

9/12/2012

11/12/2012

1/12/2013

3/12/2013

5/12/2013

7/12/2013

9/12/2013

11/12/2013

1/12/2014

3/12/2014

5/12/2014

7/12/2014

9/12/2014

11/12/2014

Bitcoin Trading Volume

CNY USD EUR Averageprice

Coinbase operates a

regulated Bitcoin

exchange in the US

Bitpay allows

merchants to accept

Bitcoin payments

online

Ripple Labs is

creating new

protocols for cross-

border FX transfers

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 13

Key Shaping Trend #2: Regulation

Over the years in developed markets, national governments have imposed significant

restrictions on banks and their ability to issue credit and debit card products. These

regulatory trends are detailed in each of our Future of Finance reports. In many cases,

they create a competitive gap in the costs at which banks can offer financial products

relative to smaller, less regulated peers including technology and internet companies.

Regulatory Trend #1: Consumer liability and fraud protection

Credit & debit incumbents offer significant consumer protection relative to most

emerging payments methods

Consumer fraud liability: Even though banks are subject to significant regulatory costs

related to the issuance of credit and debit cards, they also provide a number of important

protections that are attractive to consumers. Most important, US banks are subject to a

number of federal lending and electronic banking rules which limit consumers’ liability for

unauthorized or fraudulent use of their account (i.e., consumer liability). In many cases,

consumers in the US and other geographies are subject to zero liability on authorized or

fraudulent transactions made without their knowledge – although this varies by country.

Chargebacks: Consumers in the US and other geographies are also afforded significant

protections against merchants who do not deliver goods as advertised, or who deliver

unsatisfactory goods to the consumer. This is called a “chargeback,” and the transaction is

typically immediately credited to a consumer’s account pending an investigation by the

card-issuing bank. Relative to most other emerging payment forms, conventional credit

and debit cards offer consumers substantial financial protections – which we believe may

make them relatively difficult to displace, especially for longstanding users.

Exhibit 7: Conventional credit and debit cards afford substantial consumer protections

relative to some emerging payment forms

Source: Company data, Goldman Sachs Global Investment Research.

Credit/Debit PayPal ACH MCX*

UnitedStates

UK N/A

Australia N/A

India N/A

China N/A

Strongconsumerprotection Weakconsumerprotection

*MCXda taisbasedonCurrentCpilotprogramrules

Note:Factorsusedtogaugerelativeconsumerprotectionincludetermsrelatedto

consumerliabilityforunauthorizedchargesandchargeback/refunds

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 14

Regulatory Trend #2: Interchange fee rules

US debit interchange caps have changed the mix of payments. As part of the Dodd-

Frank financial reform legislation in the United States, Congress regulated the interchange

fees charged by banks for consumer card transactions (see B2C Payments section). Recall

that banks – not Visa and MasterCard – collect interchange fees. However, interchange

rates can impact the types and mix of cards banks issue – and hence the consumer

transaction behavior that results. The so-called “Durbin amendment” constrained

interchange fees for debit transactions (credit interchange was left untouched). The text of

the original legislation left the Federal Reserve to set specific fee caps, and the Fed

subsequently went through several iterations of fee rules. Although these rules were

challenged in court by merchants (led by Wal-Mart) as being excessive, they were

ultimately upheld by the US Supreme Court. Most notably, the rules cut debit interchange

fees by nearly 70% – capping debit interchange fees at $0.22 + 5 bps of transaction value.

Among other things, these fee reductions led US banks to largely eliminate “debit

rewards” designed to incentivize debit card use. Over time, US banks have gradually

shifted the mix of card usage toward credit, in part through the use of rewards programs.

Next stop: EU interchange and bundling rules. Interchange fees have received similar

scrutiny by the European Commission (EC). In January 2015, the European Parliament

endorsed draft rules that would cap the debit interchange fees at a flat rate 20 bps of

transaction value or 0.05 EUR, whichever is lower. Credit transactions would be capped at a

flat rate of 30 bps. This fee cap is constant across all forms of debit and credit, including

PIN debit, signature debit, and card-not-present (CNP) transactions. The European

Parliament will vote on the draft rules when it convenes in April 2015. These provisions

would take effect six months after the legislation is passed. Perhaps more important, the

proposed rules may impose “unbundling” requirements between card brand pricing and

switching/processing that could drive share shifts in processing revenue. These rules

would take effect 12 months after the legislation is passed.

Exhibit 8: US debit volume growth slowed post Durbin...

Includes estimated volume shifted to regional debit networks

Exhibit 9: Proposed EU rules would cut rates in half

Assumes a transaction value of 30 Euro

Source: Nilson, company data, Goldman Sachs Global Investment Research.

Source: Company data, Goldman Sachs Global Investment Research.

Further interchange regulation – particularly around US credit – represents a risk.

Although there has been no recent action in the US Congress to regulate credit interchange

rates, we recognize this as a long-term potential risk for banks and payment networks.

Although the card networks do not receive any portion of interchange fees, we believe the

network fees for US credit transactions are among the highest rates for different

transaction types – and thus a reduction in US credit interchange fees could result in a

long-term degradation in overall spreads they can capture in the future.

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

USdebitvolumegrowth(YoY%)

FinancialcrisisslowedUSdebitto5%growth...

...andvolumesslowedpostDurbin,

potentially duetoseveralfactors

0.18

0.26

0.20

0.20

0.09

0.36

0.29

0.21

N/A

0.09

0.09

0.00

0.10

0.20

0.30

0.40

Spain U.K. Italy Germany France Proposal

EuroCents

Visa Mastercard

Avg.Credit Interchange:0.18

EuroCents

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 15

Regulatory Trend #3: Anti-money laundering (AML) and fraud rules

Over the past ten years, governments’ increasing focus on combating terrorism and drug

enforcement has driven significant regulatory scrutiny in the area of consumer-to-

consumer (C2C) payments, especially across international borders. Compliance with the

US Bank Secrecy Act as well as other international regulations has required that many

money transmitters enforce so-called “Know Your Customer” (KYC) protocols to ensure

proper identification and traceability for individuals moving money. These protocols have

driven regulatory burdens higher for many players in the space, most notably large banks

and established money transmitters.

Large money transmitters carry a higher regulatory burden than startups

As mentioned above, a variety of regulations on the national and state levels has driven

increased compliance costs for a variety of banks and established money transmitters. In

some cases, specific incidents involving affiliated local money transfer agents (affiliated

with Western Union) have resulted in additional ongoing regulatory and enforcement costs.

As a result, a notable “regulatory umbrella” has developed between large, established

money transmitters (such as Western Union and MoneyGram) and niche technology

startups who offer domestic or cross-border money transfer services. We estimate this

burden is as high as 4% of sales for Western Union, and below 1% for some emerging

money transfer players. As a result, we believe small-scale money transmitters may be

able to price more aggressively in the market.

Exhibit 10: Regulatory costs for larger money transmitters creates “regulatory umbrella”

below which emerging peers can offer more competitive pricing

Source: Company data, Goldman Sachs Global Investment Research.

4.0%

3.9%

1‐ 3%

0%‐ 1%

0%

1%

1%

2%

2%

3%

3%

4%

4%

5%

WesternUnion Moneygram Xoom Newentrants

Compliancecostsasapercentageofrevenue

300bpsof

incremental

pricingpower

Xoom, WorldRemit,

TransferWise,

Currency Fair, and

other emerging

remittance players are

innovating with new

approaches to money

transfer

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 16

Key Shaping Trend #3: Demographics

Perhaps even more than technology, one of the most compelling changes

impacting the payments industry is demographics. As technology evolves, so too

does the comfort level of different demographics with the latest technology –

from PCs to mobile devices such as smartphones and tablets, and from cash to

plastic to mobile payments. As consumers age, they become wealthier – and this

also impacts their spending capacity and credit worthiness. We examine some of

the potentially disruptive effects of these shifts.

Coming of Age: The story of Millennials, Gen X, and Baby Boomers

Consumers’ financial habits change as they age. As they get older, personal income grows

and personal wealth is gradually amassed – which drives differences in consumers’

interactions with banks over time. As a consumer’s relationship with a bank changes,

changes in payment preferences follow. A 2013 study of US consumers by the US Federal

Reserve yielded some surprising results. In contrast to the conventional wisdom that older

consumers use far more cash because they are not conditioned to use electronic payments,

younger consumers actually use the most cash (40% of transactions) relative to all other

age groups – and among the demographics using the largest fraction of electronic

payments is consumers ages 65 and up. Perhaps not surprisingly, consumers aged 65+ use

credit cards nearly 5X more often than ages 18-24. However, debit card usage is far greater

among consumers ages 18-34 (at 51%) relative to older consumers.

Exhibit 11: Somewhat surprisingly, consumers ages 18-24 use the most cash. Less of a

surprise is that younger consumers use more debit. Consumers ages 65+ use by far the

most credit.

Source: US Federal Reserve.

Not surprisingly, there are significant differences in adoption rates for the use of mobile

payment services by age – with over 60% of users aged 18-25 having made at least one

money-related transaction with their mobile device in the past month relative to just 13%

for consumers over 65 (as of 2Q14). However, even within age cohorts there have been

significant shifts that have occurred within just 30 months. For example, the fraction of

consumers using mobile payments methods has nearly doubled for ages 18-25 – and this

40%

31% 31%

32%

25% 25%

1%

6%

8%

7%

18%

18%

23%

23%

33%

51%

51%

48%

40%

41%

32%

2%

3%

4%

5%

2%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

18‐24 25‐34 35‐44 45‐54 55‐64 65&older

Cash Check Creditcard Debitcard Other

Venmo, Square, and

Popmoney (Fiserv)

provide mobile money

transfer services

which are popular

among Millennials

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 17

increase has been even more dramatic for other cohorts such as consumers aged 55-64,

where mobile payment usage has tripled to 21% (albeit from a low base) over that same

timeframe. This suggests to us that the adoption is technologies – even within age cohorts

– is rapidly evolving and is far from static.

Exhibit 12: Percentage of banked smartphone/tablet owners who have performed at least

one mobile money-related transaction in the past month

Source: AlixPartners.

The comfort with public availability of personal information is one area that is perhaps

driven more by generational and cultural factors than any other. A recent study of US

consumers by AlixPartners showed that about 55% of respondents under 35 were “very

comfortable” or “extremely comfortable” with sharing personal data with companies in

exchange for offers or rewards. This fraction drops significantly to 42% for ages 35-44 and

to 31% for ages 45-54. Perhaps most notably, this drop coincides with the generations

known as Millennials (born between 1980 and 2000) and Generation X (born between the

early 1960s and the early 1980s). This suggests to us that younger consumers, for reasons

beyond considerations of income, are more likely to respond to rewards and offers from

corporate advertisers or social media companies.

In terms of vendor preferences for mobile wallets and mobile payments, we believe recent

consumer survey work from Accenture yields some interesting observations. Consumers

still view credit card networks as top providers – with 72% of respondents preferring Visa,

MasterCard, or AmEx. However, emerging payment providers with scale such as PayPal

are not far behind (at 66% of respondents) – and notably are ahead of retail banks (at 59%),

large technology companies like Apple and Google (at 57%), retailers (at 52%), and wireless

carriers (at 48%).

34%

40%

30%

18%

7%

6%

28%

35%

45%

32%

18%

17%

10%

30%

46%

49%

31%

24%

15%

10%

31%

50%

44%

31%

23%

14%

10%

32%

56%

61%

43%

29%

23%

13%

41%

63%

56%

40%

27%

21%

13%

39%

0%

10%

20%

30%

40%

50%

60%

70%

18‐25 26‐34 35‐44 45‐54 55‐64 65and

above

Overall

Q42011 Q22012 Q42012 Q22013 Q42013 Q22014

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 18

Exhibit 13: Consumers under 35 display a significantly greater willingness to provide

personal data in exchange for rewards

Source: AlixPartners.

Exhibit 14: Traditional payment networks lead consumer preferences for mobile, but

PayPal and other challengers are not far behind

Source: Accenture, North America Consumer Payments Survey, 2014

Income: The wealthy, the unbanked, and the under-served

In the US, there is a notable divergence in payment preference by income group.

Even more than age, income dictates payment preferences among consumers in the US.

Data from the US Federal Reserve shows that low-income consumers use far more cash

28%

33%

25%

22%

15%

16%

23%

27%

21%

17%

9%

8%

4%

14%

0%

10%

20%

30%

40%

50%

60%

18‐25 26‐34 35‐44 45‐54 55‐64 65and

above

Overall

Verycomfortable Extremelycomfortable

55% 54%

42%

31%

23%

20%

37%

36%

48%

52%

57%

59%

66%

72%

0%

10%

20%

30%

40%

50%

60%

70%

80%

Techstart‐up

(Square)

LargeTelcos

(Verizon,

AT&T)

LargeRetailer

(BestBuy,

Walmart)

Largetech

Companies

(Apple,

Google)

RetailBank

(JPMorgan,

Bankof

America)

Emerging

Payment

Providers

(PayPal)

Payment

Networks

(Visa,

MasterCard,

AmEx)

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 19

than any other demographic, with 55% preferring cash. In part, we believe this reflects the

relatively large proportion of US consumers in this category who are unbanked or under-

banked. The preference for cash declines dramatically as income grows, to just 10% for

incomes over $200k. For many of the same reasons, there is a similar discrepancy for credit

card use, where just 5% of consumers with incomes under $25k expressed a preference for

credit cards, growing to 66% for incomes over $200k. Although debit preference is far more

stable across income groups (especially among those with moderate incomes), there is a

significant tail-off for both low-income consumers (just 31% for incomes under $25k) as

well as high-income consumers (just 15% for incomes over $200k). Among low-income

consumers, we would attribute this gap to a lack of banking services. However, among

high-income consumers, we would attribute this downshift to much higher yield consumer

incentives and rewards programs tier to credit card products vs. other payment forms.

Exhibit 15: Significant payment preference gaps exist among income levels in the US, with

low-income individuals expressing a strong preference for cash and high-income for credit

Source: US Federal Reserve.

28% of adults in the US are unbanked or under-banked.

Since the financial crisis, low-income individuals have been an increasing source of focus

for payments companies and the banking system. A 2013 FDIC survey shows that nearly

8% of adults in the US are unbanked, with no access to a retail banking account. Fully 20%

of US adults are under-banked, which is defined as individuals which have a bank account

but that rely heavily on non-traditional financial services such as payday loans and check

cashing services. When unbanked individuals were asked the reasons why they do not

have a bank account, the largest proportion – 39% - said that they do not have enough

money to maintain a bank account. 15% stated that they do not like dealing with banks as a

primary reason, and 13% cited high fees as the main reason.

55%

29%

22%

16% 16%

14%

10%

3%

2%

2%

1% 1%

4%

2%

5%

15%

24%

35%

37%

37%

66%

31%

51%

49%

46%

43% 40%

15%

6%

3% 3%

2%

3%

5%

7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Lessthan

$25

$25to$50k $50kto$75k $75kto

$100k

$100kto

$125k

$125kto

$200k

$200kplus

Cash Check Creditcard Debitcard Other

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 20

Exhibit 16: Approximately 28% of US consumers are either unbanked or under-banked

Source: FDIC.

Exhibit 17: Young adults are the most unbanked

US unbanked- by age group

Exhibit 18: Low income groups are the most unbanked

US unbanked- by income bracket

Source: FDIC.

Source: FDIC.

FullyBanked,

67.0%

Underbanked,

20.0%

Unbanked,7.7%

Statusunknown,

5.3%

15.7

12.5

9.0

7.5

5.6

3.5

0

2

4

6

8

10

12

14

16

18

15to24

years

25to34

years

35to44

years

45to54

years

55to64

years

65years

ormore

Unbanked(%)

27.7

11.4

5.1

1.7

0.5

0

5

10

15

20

25

30

Lessthan

$15,000

Between

$15,000and

$30,000

Between

$30,000and

$50,000

Between

$50,000and

$75,000

AtLeast

$75,000

Unbanked(%)

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 21

Key Shaping Trend #4: International

The US remains the global innovation leader in the technology sector, including in

payments. However, local conditions – including legacy infrastructure, regulation,

customer spending patterns, and cultural norms – will dictate the adoption of these

technologies. In emerging markets, large groups of unbanked and under-banked

individuals are driving the adoption of new technologies ahead of their counterparts

in the developed world. As a result, most payment solutions tend to be local or

regional in nature, except for a few cases like PayPal which enjoys wide acceptance in

many countries.

50% of the world population is without access to financial services

Access to a bank account is one of the most basic needs in developed markets like US and

Western Europe. However, the World Bank estimates that more than 50% of the global

population (over the age of 15) does not have access to basic financial services. In many

emerging markets, sizeable “shadow economies” exist which operate entirely on cash.

These “shadow economies” comprise legal activities – including retail sales and

employment – which are unreported or under-reported for the purposes of tax avoidance.

Exhibit 19: Africa and Asia remain the least penetrated financial services markets

Adults with an account at a formal financial institution

Source: World Bank.

.

.

81+

51 - 80

31- 50

16 - 30

0 - 15

No data

Adults with an account at a formal

financial institution (%)

MPesa (Vodafone and

Safaricom) provide

mobile money

services for the

world’s under-banked

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 22

Exhibit 20: Credit penetration remains low outside US and developed Europe

Adults with a credit card

Source: World Bank.

Exhibit 21: Africa and Asia have low debit card ownership

Adults with a formal account by debit card use

Exhibit 22: Credit dominates in the US, while debit

remains the primary method in EMEA

% of cards transactions by format

Source: World Bank.

Source: Eurostat.

Developed markets have highest adoption of electronic payments

In select economically developed markets such as the United States, Scandinavia, and the

UK, there has been a substantial shift away from paper forms of payment (cash and

checks) toward electronic payments – and in particular credit and debit cards – over the

past 20 years. However even today, we estimate that over 50% of global consumer

transactions are still conducted with paper payment methods.

The shift toward electronic payments in developed markets has been largely driven by

consumer-perceived benefits such as greater convenience relative to handling cash and

bank/merchant-financed rewards for using cards. Although the penetration of electronic

.

.

81+

51 - 80

31- 50

16 - 30

0 - 15

No data

Adults with a credit card (%)

8%

13%

5%

33%

37%

35%

61%

9%

6%

27%

8%

7%

20%

28%

1%

1%

1%

1%

1%

1%

1%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Middle‐East

&North

Africa

Sub‐Saharan

Africa

SouthAsia LatinAmerica

&Caribbean

Europe&

CentralAsia

EastAsia&

Pacific

High‐Income

Economies

Hasadebitcard Doesnothavedebitcard Adultswithanaccount

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Americas EMEA RoW

CreditCardTransactions DebitTransactions ATMtransactions

Pre‐PaidCardTransactions StoreCardTransactions ChargeCardTransactions

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 23

payments in emerging markets is still small, government-driven initiatives (for raising tax

revenue and reducing shadow economy) are accelerating the move.

We estimate that in 2014, about 30% of the growth in card-based payments came from

seven emerging markets within the top 20 largest economies by GDP, namely China, Brazil,

India, Russia, Indonesia, and Mexico. At the same time, over 50% of this growth was driven

by a mix of countries (both developed and emerging) which comprise the other 20% of

global GDP not captured by the top 20. Roughly 20% of this growth is coming from

traditional developed markets within the top 20 GDP countries.

Exhibit 23: Developed markets have high adoption of electronic payments

Transactions by payment format

Source: Eurostat.

The mix of credit and debit varies based on culture and regulation

Historical consumer spending patterns vary widely different across key geographies. While

the US is one of the biggest users of consumer credit, Europeans tend to largely use debit

for most consumer transactions.

Credit cards in the US offer more protection and less risk to consumers because funds are

not being directly withdrawn from the user’s bank account as they are with a debit card.

Along with bank- and merchant-financed rewards programs, we view these consumer

protection regulations as key reasons for the higher adoption of credit cards in the US.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

CreditCardTransactions DebitTransactions ATMtransactions Pre‐PaidCardTransactions Other

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 24

Connecting megatrends to payment channels

Although there are multiple ways to classify payments, we believe they are best

discussed in terms of commercial channels, each with its own characteristics and

participants. We identify B2C (Business to Consumer), C2C (Consumer to Consumer),

and B2B (Business to Business) as the three main payment channels based on market

participants and underlying funding mechanisms. In the context of the megatrends

we have identified (technology, regulation, and demographics), we see technology as

most actively shaping C2C payments, with regulation, demographics, and technology

impacting B2C and B2B in various ways.

B2C: Incumbents are deeply entrenched, but continue to innovate

The B2C payments market is perhaps the most difficult to predict because of the multiple

sets of competing incentives for merchants and consumers. On one hand, merchants seek

to maximize their sales while simultaneously minimizing their costs – making payments a

utility and a cost center for most. On the other hand, consumers want incentives in return

for their shopping dollar, as well maximum convenience and protection against fraud and

unauthorized charges – and these features largely explain the dominant market position

which banks and networks like Visa, MasterCard, and AmEx have in the market.

Demographics and technology are key trends that we believe could shift the B2B landscape

in the future, allowing for emerging players like Square, PayPal, and Seamless to gain

market share. However, we believe regulation is the main trend dictating the prospects of

incumbent payment providers in the long term. In the absence of significant regulatory

changes, we believe banks and networks remain well positioned in the market – especially

in light of their continued innovation with initiatives such Apple Pay.

C2C: A fast-moving market with significant disruption potential

C2C payments involve consumers directly transacting with each other using technology

infrastructure provided mainly by banks. Technology and demographics are shaping C2C

payments, with new technologies like “Instant ACH” allowing for real-time transfers

between consumer bank accounts, and mobile apps like Venmo and Square Cash being

adopted by tech-savvy Millennials for everyday transactions between friends. Disruptive

technologies provided by Dwolla promise to replace existing infrastructure to make

payments faster. Although Bitcoin and other cryptocurrencies are still in the early stages of

development, they could gain traction once clear use cases become more established.

International money transfers are the only real revenue opportunity for market disruptors

in C2C payments, with innovators like TransferWise and Bitcoin exchanges leading the way.

B2B: Slow-moving market, but a greenfield market for payments

B2B payments mainly involve businesses, and tend to move very slowly given the

significant time and cost required to change technology infrastructure. Although

technology and demographics have a very gradual impact, regulation is the biggest

potential catalyst of change in the segment. We see a significant shift from paper payments

(such as checks) to electronic formats in the long run. Integration challenges and a

shortage of IT resources for implementation are cited as key reasons for slower change in

B2B channels. As new electronic products like virtual cards come to market and as IT

Services and BPO vendors accelerate their investments in this space, adoption among

businesses should drive significant opportunities for WEX, FleetCor and various IT Services

vendors.

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 25

B2C Incumbents: An overview of today’s credit & debit ecosystem

How the four-party system works for credit and debit. In any merchant credit

transaction, the exchange of goods for payment involves the delivery of goods to the

consumer by the merchant, as well as delivery of payment to the merchant. Both activities

involve certain risks, such as product delivery risk (the merchant fails to deliver), credit risk

(the customer is unable to pay), and fraud risk (by either consumer or merchant). In the

event where the merchant itself is fraudulent or processes fraudulent transactions, the

merchant acquirer is responsible for the transaction cost. This happens most frequently

when an online merchant account is established with false documentation. If a counterfeit

physical credit card is used to make a purchase which is properly validated by the card

network, the issuing bank is liable for the amount due the merchant.

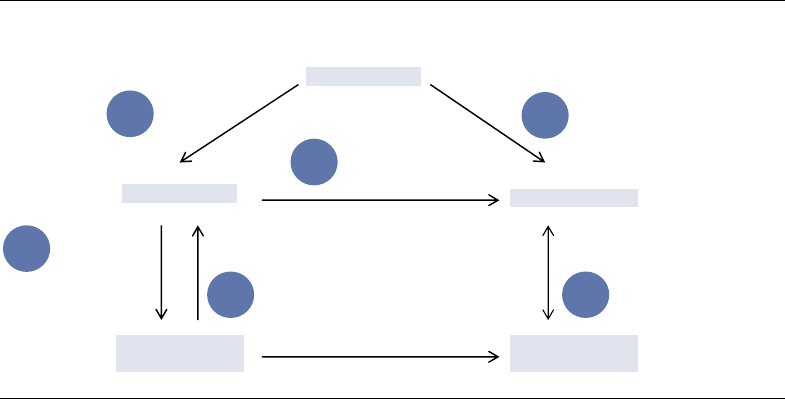

Exhibit 24: Overview of information and money flow in the four-party payment ecosystem

Information and money flow through the payments value chain

Source: Company data, Goldman Sachs Global Investment Research.

Consumer convenience and universal acceptance: keys to the early growth of the

payment networks.

The need for a system where banks can easily communicate and

process credit card transactions gave rise to credit card networks such as Visa and

MasterCard, which began as bank-owned associations facilitating authorization, clearing,

and settlement among member banks. As interstate and international travel grew, so did

the role of the credit card networks. The fact that credit card networks began as bank-

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 26

owned institutions is critical to understanding how credit cards gained such wide

acceptance among consumers and how they operate. Credit card networks operate as

associations of member banks, which “sponsor” their affiliates on the network. Merchant

acquirers are responsible for vetting the credibility of their merchant clients, and bear

ultimate financial responsibility if they behave improperly. Merchant acquirers can also use

ISOs (independent sales organizations) as a sales channel to recruit merchants. Similarly,

card issuing banks extend credit to consumers, and are financially responsible in the event

consumers are unable to pay for their purchases.

Perhaps more important, the card network associations established a number of rules

which bind merchants accepting credit cards, in order to ensure both consumer acceptance

of credit cards as a form of payment, as well as the equitable treatment of all banks that are

part of the network. Ultimately, these rules were key to the early expansion of credit card

acceptance in the United States given the convenience of using electronic payments and

the lack of additional charges for doing so (for consumers), the incremental sales (and

higher ticket rate per transaction) generated (for merchants), and fees and interest

generated from greater consumer credit balances (for issuing banks). In the US, this

system has resulted in a dramatic increase in electronic forms of payment over the past 20

years. We expect this to continue globally, with growth in electronic payments of about

13% through 2018.

Exhibit 25: US credit and debit card transactions continue to climb at high-single-digit

rates – with prepaid growing at double this rate – while checks are still in rapid decline

Number of US transactions, in billions

Source: United States Federal Reserve.

How does the credit and debit network ecosystem make money?

MDR feeds the ecosystem: The current electronic payment ecosystem is funded indirectly

through the Merchant Discount Rate (MDR), a fee embedded in the sales price of products

purchased at a retailer. The merchant discount rate encompasses all the transaction-related

fees associated with processing, settling, and clearing a transaction – and is subtracted

from the total amount paid by the consumer when payment is remitted to the merchant.

0.8

3.3

5.9

9.2

15.6

25

37.5

47

19

21.7

21.0

26.2

8.8

14.6

19.1

22.1

37.3

30.5

24.5

18.3

2003 2006 2009 2012

CAGR

2003‐12 2009‐12

Total 4.7% 4.4%

Checks ‐7.6% ‐9.2%

ACH 10.9% 5.1%

Credit card 3.7% 7.6%

Debitcard 13.0% 7.7%

Prepaidcard 30.7% 15.8%

81.4 95.2 108.1 122.8

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 27

The MDR is negotiated between a merchant acquirer and a merchant, and varies based on

the merchant’s purchase volume.

Exhibit 26: The merchant discount rate paid by merchants varies by volume

Source: Electronic Transaction Association (ETA), Goldman Sachs Global Investment Research.

The MDR is composed of the following fees:

Interchange –

Interchange typically comprises the largest portion of the MDR in a

transaction, and is intended to cover the cost of cardholder charge-offs and most

credit card fraud. At the low end, interchange ranges between a flat fee of $0.23

(for a debit transaction), and 2.95% at the high end (when a premium high-end

credit card is used). Interchange rates for various transaction and card types are

set by the card networks, although issuing banks receive the entire interchange fee

Visa and MasterCard do not receive any portion of the interchange fee.

Interchange received the greatest scrutiny of any aspect of the electronic payment

ecosystem. As part of the Dodd-Frank financial reform legislation in the US,

Congress regulated the fees charged by banks for consumer debit transactions.

Network and data processing fee –

The network fee is charged by the card

network for routing the transaction, typically 4 – 25 bps of the purchase price.

Merchant acquiring/processing fees – The processing fee is charged by the

merchant’s credit card processor for transaction handling and clearing on the

merchant side, and is typically assessed as a fixed fee (for example $0.003 - $0.10

per transaction). The acquiring fee is changed by the merchant’s acquiring bank

for handling and settling the transaction, and is intended to cover costs related to

settling transaction balances with merchants, as well as the cost of merchant fraud.

Players in the four-party system: Card networks and card issuers

The role of card networks is to seamlessly connect issuing and merchant acquiring

banks, and to securely process, route, and verify merchant transactions as quickly as

possible.

Payment network operators derive income from 1) transaction fees on purchase

volumes carrying their brand;

2) data processing fees on credit and debit transactions

routed through their network;

3) international transaction and foreign exchange fees on

cross-border transactions processed through the network:

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

0‐$100k $100k‐$250k $250k‐$500k $500k‐$1,000k Over$1,000k

MerchantDiscountRate

AnnualCardVolume

March 10, 2015 Americas: Technology

Goldman Sachs Global Investment Research 28

Visa: The largest card network, with 62% of worldwide transactions processed in

2013. Notably, Visa operates independently from Visa Europe, which operates as a

bank-owned network within Europe. Visa does not derive any transaction revenue

directly from Visa Europe, though their processing networks interoperate

seamlessly.

MasterCard: The second-largest card network with 26% of global volume,

MasterCard has significantly greater exposure to Europe (given Visa’s separation

from Visa Europe) than Visa.

UnionPay: UnionPay is a bank-owned card network based in China, the third

largest network globally. UnionPay has a reciprocal agreement with Discover that

accepts Discover at merchants in China which accept UnionPay, and accepts

UnionPay at merchants in the US and Canada which accept Discover.

Bank credit issuer & network operators derive revenue from the same sources as card

networks, as well as 1) interchange fees collected by issuing banks; 2) interest

charges on outstanding customer credit balances; 3) license fees paid by third-party

issuers of network-branded cards (for example, AMEX issued by Bank of America):

American Express: Operating as the largest card-issuing network globally, AMEX

also offers a range business and consumer financial products.

Discover: Discover offers a variety of consumer lending services (70% of sales) as

well as issuing branded credit cards (30% of sales). As noted above, Discover has a

reciprocal agreement with China’s UnionPay. Discover also has an agreement with

EBay’s PayPal to process PayPal transactions over Discover’s network.

Exhibit 27: Visa and Mastercard together held about 66%

of $20.6 trillion credit/debit transaction value in 2013...

Percentage share of global credit and debit transaction value

Exhibit 28: ...but process a far greater share of

transaction volume

Percentage share of global credit and debit transaction

volume

Source: The Nilson Report.

Source: The Nilson Report.

Players in the four-party system: merchant acquirers & processors

Merchant acquirers perform several basic functions for merchants: 1) Underwrite

merchants, allowing them to accept network-branded cards; 2) Sell or rent point-of-sale

equipment used to validate transactions; 3) Process transactions, which means facilitating

transaction authorization, clearing, and settlement. Different companies in the payment

ecosystem perform one or all of these services for merchants. In order to gain access to the

card networks, a merchant acquirer is either part a bank or sponsored by a bank. Merchant

acquirers often use ISOs (Independent Sales Organizations) to recruit new merchants.

Merchant acquiring and processing: Fixed costs dominate, so scale is critical. Processing

card transactions requires significant fixed infrastructure investment, including datacenter

Visa

46%

Mastercard

20%

UnionPay

28%

AMEX

5%

JCB

1%

DinersClub

0%

Visa